Bridge Report:(6914)OPTEX GROUP the First Quarter of Fiscal Year December 2020

Isamu Oguni President and CEO | OPTEX GROUP (6914) |

|

Company Information

Market | TSE 1st Section |

Industry | Electric equipment (manufacturer) |

President and CEO | Isamu Oguni |

HQ Address | 4-7-5, Nionohama, Otsu, Shiga Prefecture |

Year-end | December |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥1,237 | 37,735,784shares | ¥46,679million | 6.8% | 100shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

TBD | - | TBD | - | ¥891.06 | 1.5x |

*The share price is the closing price on May 15. The number of shares outstanding was taken from the brief financial report for the first quarter of fiscal year ending December 2020. ROE and BPS are the results of the previous term. The forecast for this term is to be determined as it is difficult to make any reasonable calculations due to the effects of the novel coronavirus.

Earnings Trend

Fiscal Year | Sales | Operating profit | Ordinary profit | Net profit | EPS | DPS |

December 2016 | 31,027 | 3,015 | 3,086 | 1,809 | 54.67 | 22.50 |

December 2017 | 37,504 | 4,885 | 5,036 | 3,386 | 97.63 | 27.50 |

December 2018 | 40,113 | 4,989 | 5,038 | 3,775 | 104.85 | 30.00 |

December 2019 | 37,517 | 2,856 | 2,876 | 2,197 | 60.02 | 32.50 |

December 2020 Est. | - | - | - | - | - | - |

*The estimated values are from the company. Net profit is net profit attributed to parent shareholders. On April 1, 2018, a 2-for-1 stock split was implemented. Both EPS and DPS are revised retroactively. The forecast for this term is to be determined as it is difficult to make any reasonable calculations due to the effects of the novel coronavirus.

This Bridge Report presents OPTEX GROUP’s earnings results for the First Quarter of Fiscal Year Ending December 2020 and so on.

Table of Contents

Key Points

1. Company Overview

2. The First Quarter of Fiscal Year Ending December 2020 Earnings Results

3. Fiscal Year Ending December 2020 Earnings Forecasts

4. Measures to address changes to the market after the crisis of coronavirus passes

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The sales for the first quarter of the fiscal year ending December 2020 were 8,801 million yen, down 5.2% year on year. The delivery of parts was delayed due to the worldwide spread of the novel coronavirus causing a partial disruption in production. Due to the lockdown, movement restrictions, etc., the business activities stagnated and Europe, which is the company’s main market, took a strong hit. The sales of both the SS business and FA business went down. The sales of the domestic business were 4,058 million yen, down 1.1% year on year, while the sales of the international business were 4,743 million yen, down 8.5% year on year. Operating profit was 555 million yen, down 24.2% year on year. SG&A expenses decreased, but it wasn’t enough to offset the decrease in sales.

- The severe situation with spreading COVID-19 didn’t improve. Under the circumstances where we can’t predict the scale of infection spread or when it will come to a halt, it is difficult to make reasonable estimations of financial results, thus the company decided to state their full-year earnings forecast, the forecast for the first half of the fiscal year ending December 2020, and dividend estimation as undetermined.

- It is currently difficult to predict losses due to the novel coronavirus, and for the short term, there is no other way than to check reports for each quarter. In the short term, human casualties were significant and we would like to pay attention to how quickly the businesses in foreign markets, where social distancing regulations are stricter than Japan, will be able to recover.

- On the other hand, for the medium to long term, we would like to raise our expectations for the company to implement measures for promoting ESGs as the company has a clear story of creating value and improving business performance by providing solutions to social problems.

1. Company Overview

OPTEX GROUP Co., Ltd. is a holding company centered around OPTEX Co., Ltd. that manufactures and sells outdoor sensors (top share of 40% in the global market), automatic door sensors (30% share of the global market and 50% share of the domestic market) and environment-related products.

OPTEX GROUP holds subsidiaries including OPTEX FA CO., LTD., which deals with FA related sensing business; CCS Inc., which holds the global top share in the LED lighting business for image processing; Three Ace Co., Ltd., which specializes in the development of various systems, applications, and digital content; Optex MFG Co., Ltd., which is responsible for manufacturing Group products, RAYTEC LIMITED (UK), which has attained the largest global share (about 50 %) for supplemental lights for CCTV; and FIBER SENSYS INC. (US), which deals with optical fiber intrusion detection systems.

As of December 2019, the company had 80 business bases globally, including 26 companies overseas.

OPTEX CO., LTD. | Develops and sells sensors for various uses, such as security sensors and sensors for automatic doors |

OPTEX FA CO., LTD. | Development and sales of photoelectric sensors, image inspection systems, displacement sensors and measuring instruments |

CCS Inc. | Development, manufacturing and sales of LED lighting devices, and systems for image processing |

THREE ACE CO., LTD. | Development of various systems, applications, and digital content |

OPTEX MFG CO., LTD. | Manufactures products for the Group and provides contract manufacturing service for electronic equipment |

SICK OPTEX CO., LTD. | Development of general-purpose photoelectric sensors. A joint venture of SICK AG (Germany) and OPTEX FA CO., LTD. |

GIKEN TRASTEM CO., LTD. | Development, manufacturing and sales of people counting systems, customer traffic counting/management systems |

ZENIC INC. | Contracted development of IC and LSI for image processing, and design and sales of FA systems |

O’PAL OPTEX CO., LTD. | Management of membership sports clubs and environmental hands-on learning programs |

FIBER SENSYS INC. (US) | Development, manufacturing and sales of fiber-optic intrusion detection systems |

FARSIGHT SECURITY SERVICES LTD. (UK) | Security company providing remote video surveillance services |

RAYTEC LIMITED. (UK) | Development, manufacturing and sales of supplemental lighting for surveillance cameras |

GARDASOFT VISION LIMITED. (UK) | Development, manufacturing and sale of LED lighting controllers for machine vision |

1-1 Business Description

The Company’s business is composed of its main Sensing Solution (SS) business (security-related business and automatic door-related business), Factory Automation (FA) business (sensors for industrial machinery), Machine vision lightning (MVL) business (LED lighting device and system for image processing), “EMS business,” which was included in the SS business up until the previous term and provides contract manufacturing services for electronic equipment in China, and Other business (operation of sport clubs and development of applications and digital content).

Segment | Business Description | |

SS Business

| Security-related | Main products include various indoor and outdoor sensors, wireless security systems and LED lighting control systems, etc. For outdoor sensors, the company has the leading share in the global market. Recently, it focuses on development of the automobile detection sensor using microwave technologies. |

Automatic door-related | The company developed the world’s first automatic door sensor using infrared rays. Main products are automatic door opening/closing sensors, shutter sensors for factories, wireless touch switches, etc. | |

Others | Equipment for measuring water quality. Manufacturing/marketing of measuring instruments, Transportation safety products, Customer traffic counting/management systems, developing/marketing of image processing-related products | |

FA Business | Main products include photoelectric sensors used for quality control and automation of production lines, displacement sensors, image sensors, LED lights, etc. In Japan, these products are provided to a wide range of industries such as food or pharmaceutical for quality control of production lines. In Europe, OEM are sold broadly through its technological partner SICK AG (Germany) that has the largest share in industrial sensor market. Also, its house-brand products have been launched in Japan, Asia, and North America. | |

MVL Business

| The company has a significant world share in the LED lighting business for image processing. The company collaborates with corporations related to software and peripherals to offer “the best solution.” | |

EMS-related | Contract manufacturing services for electronic equipment, developed at a factory in China | |

Others | Operating sports clubs and development of applications and digital content. | |

1-2 Advantages: Diversified Technologies/Expertise on Sensing and Unique Sensing Algorithm

To produce stable and reliable sensors, it is essential to build on a number of elemental technologies and expertise, as well as “algorithms” to control physical changes. The company takes advantage of its technologies/expertise suitable for intended applications and its unique sensing algorithm to secure the largest share in the global market.

Noise abatement technology | ・Hardware design to minimize various noises ・Conduct a number of environmental assessments based on its own standard, and launch products that passed the assessments |

Sophisticated optical design | ・Make use of optical simulation to achieve high-density areas eliminating blind spots ・Packaging technologies to enable downsizing |

Compliant to public standards for reliability | ・Adapted and compliant to any global standards ・Adapted and compliant to industry standards and guidelines (CE marking, EN standard [TUV certified], ANSI, JIS, etc.) |

Environment friendly design | ・By identifying 15 restricted-use materials and 10 self-control materials, the company succeeded in excluding toxic substances in all products ・Compliant to RoHS directive, lead-free solder alloy ・Design to minimize the effect from CO2 when in use |

Secure & safe control | ・Adopt self-diagnosis functions in emergency or in failure to prevent system outage, and fail-safe devices for sensors ・Propose preventive maintenance measures to maintain functions |

Unique sensing algorithm | ・Unique algorithm to eliminate the impact of noise ineliminable by hardware, detect, scan and analyze only the intended events ・Various automatic correction functions to maintain performance in the field |

1-3 Corporate History

OPTEX was established in 1979 and developed the world's first automatic door sensors using infrared rays in the following year. Back then, most of the automatic doors were using pressure sensitive rubber mats, which contained sensors, and sensors using infrared rays were very innovative. The company also showed unrivaled abilities in product maintenance and implementation, and captured the top share in the automatic door sensors market in only three years since its foundation (currently, about 60% share in the domestic market). The company expanded operations and got listed on the over-the-counter market (equal to listing on JASDAQ) in 1991. Then it got listed on the second section of Tokyo Stock Exchange in 2001 and moved to its first section in 2003.

Recently, it has been working on enhancement of solutions based on image processing technologies and high-end security systems. In 2008, it acquired ZENIC INC., which specialized in contracted development of IC/LSI for image processing systems. Furthermore, it acquired FIBER SENSYS INC. (US) in 2010 and RAYTEC LIMITED (UK) in 2012, respectively. Also, CCS Inc. (6669, JASDAQ), which holds the largest market share in the world for LED lighting for image processing, was reorganized into a subsidiary in May 2016 (and became a wholly owned subsidiary in July 2018). On January 1, 2017, the company shifted to the holding company system, with the aim of advancing to next-generation management and pursuing group synergy.

1-4 ROE analysis

| FY 12/ 11 | FY 12/ 12 | FY 12/ 13 | FY 12/ 14 | FY 12/ 15 | FY 12/ 16 | FY 12/ 17 | FY 12/ 18 | FY 12/ 19 |

ROE (%) | 6.0 | 4.6 | 8.2 | 8.6 | 8.7 | 7.4 | 12.6 | 12.3 | 6.8 |

Net profit margin (%) | 5.58 | 3.99 | 6.87 | 7.39 | 7.38 | 5.83 | 9.03 | 9.41 | 5.86 |

Total asset turnover [times](x) | 0.85 | 0.91 | 0.92 | 0.89 | 0.91 | 0.91 | 0.95 | 0.95 | 0.86 |

Leverage [times](x) | 1.27 | 1.28 | 1.30 | 1.31 | 1.30 | 1.41 | 1.48 | 1.38 | 1.35 |

The company is targeting ROE being “more than 10% .” The company aims to recover it to over 10% by the final year of the medium-term management plan, which starts this term.

1-5 Efforts on ESG

The company thinks that building a trusting relationship with various stakeholders is indispensable for improving the corporate value and since it was considered necessary to disclose more ESG information, the company created a page for “ESG information” (https://www.optexgroup.co.jp/esg/stakeholder.html) on its website. Additionally, it issued the “ESG Bridge Report” through Investment Bridge Co., Ltd.

It did not only identify materiality needed for sustainable growth for the first time but also mentioned the future issues and initiatives to address them.

https://www.bridge-salon.jp/report_bridge/archives/2020/05/200512_6914.html

2. The First Quarter of Fiscal Year Ending December 2020 Earnings Results

(1) Business Results

| 1Q FY 12/19 | Ratio to sales | 1Q FY 12/20 | Ratio to sales | YoY |

Sales | 9,285 | 100.0% | 8,801 | 100.0% | -5.2% |

Gross profit | 5,054 | 54.4% | 4,767 | 54.2% | -5.7% |

SG&A | 4,321 | 46.5% | 4,212 | 47.9% | -2.5% |

Operating profit | 732 | 7.9% | 555 | 6.3% | -24.2% |

Ordinary profit | 704 | 7.6% | 604 | 6.9% | -14.2% |

Net Profit | 499 | 5.4% | 356 | 4.0% | -28.7% |

*Unit: million yen. The Net profit is the profit attributable to owners of the parent company. The same shall apply hereinafter.

Sales and profit declined

The sales were 8,801 million yen, down 5.2% year on year. The delivery of parts was delayed due to the worldwide spread of the novel coronavirus causing a partial disruption in production. Due to the lockdown, movement restrictions, etc., the business activities stagnated and Europe, which is the company’s main market, took a strong hit. The sales of both the SS business and FA business went down. The sales of the domestic business were 4,058 million yen, down 1.1% year on year, while the sales of the international business were 4,743 million yen, down 8.5% year on year. Operating profit was 555 million yen, down 24.2% year on year. SG&A expenses decreased, but it was not enough to offset the decrease in sales.

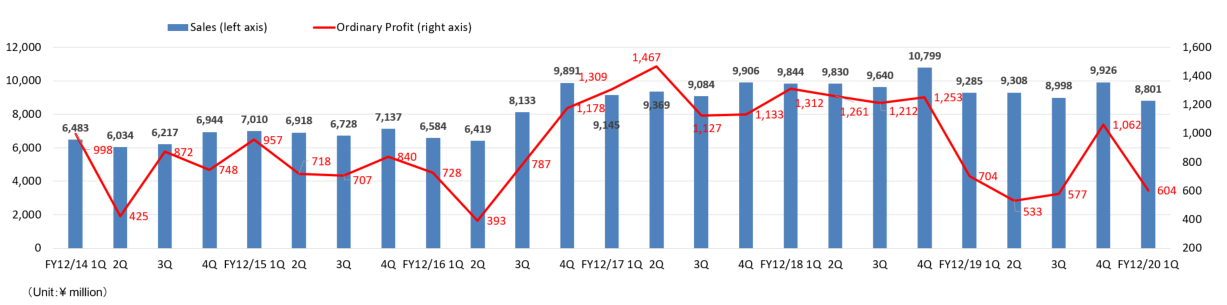

◎Trends in each quarter

◎Average exchange rate

| 1Q FY 12/19 | 1Q FY 12/20 |

USD | ¥110.20 | ¥108.92 |

EURO | ¥125.15 | ¥120.11 |

(2) Earnings by Segment

①Trends in each segment

| 1Q FY 12/19 | Ratio to sales | 1Q FY 12/20 | Ratio to sales | YoY |

SS Business | 4,989 | 53.7% | 4,695 | 53.3% | -5.9% |

FA Business | 1,755 | 18.9% | 1,562 | 17.7% | -11.0% |

MVL Business | 2,305 | 24.8% | 2,325 | 26.4% | +0.9% |

EMS Business | 115 | 1.2% | 98 | 1.1% | -14.5% |

Others | 119 | 1.3% | 119 | 1.4% | 0.0% |

Sales | 9,285 | 100.0% | 8,801 | 100.0% | -5.2% |

SS Business | 398 | 8.0% | 349 | 7.4% | -12.3% |

FA Business | 172 | 9.8% | 106 | 6.8% | -38.4% |

MVL Business | 158 | 6.9% | 152 | 6.5% | -3.8% |

EMS Business | -22 | - | -61 | - | - |

Others | -12 | - | -5 | - | - |

Adjustments | 38 | - | 14 | - | - |

Operating profit | 732 | 7.9% | 555 | 6.3% | -24.2% |

*Unit: million yen. Ratio to sales of Operating profit refers to Sales Profit margin.

②Trends in each segment and region

| 1Q FY 12/19 | Ratio to sales | 1Q FY 12/20 | Ratio to sales | YoY |

SS: Security | 3,331 | 100.0% | 3,221 | 100.0% | -3.3% |

Japan | 574 | 17.2% | 585 | 18.2% | +1.9% |

AMERICAs | 635 | 19.1% | 588 | 18.3% | -7.4% |

EMEA | 1,780 | 53.4% | 1,738 | 54.0% | -2.4% |

Asia | 342 | 10.3% | 310 | 9.6% | -9.4% |

|

|

|

|

|

|

SS: Automatic door | 1,088 | 100.0% | 1,042 | 100.0% | -4.2% |

Japan | 515 | 47.3% | 510 | 48.9% | -1.0% |

AMERICAs | 284 | 26.1% | 282 | 27.1% | -0.7% |

EMEA | 260 | 23.9% | 227 | 21.8% | -12.7% |

Asia | 29 | 2.7% | 23 | 2.2% | -20.7% |

|

|

|

|

|

|

SS: Other | 571 | 100.0% | 433 | 100.0% | -24.2% |

Japan | 534 | 93.5% | 383 | 88.5% | -28.3% |

Asia | 37 | 6.5% | 50 | 11.5% | +35.1% |

|

|

|

|

|

|

FA | 1,756 | 100.0% | 1,562 | 100.0% | -11.0% |

Japan | 839 | 47.8% | 900 | 57.6% | +7.3% |

AMERICAs | 31 | 1.8% | 23 | 1.5% | -25.8% |

EMEA | 623 | 35.5% | 366 | 23.4% | -41.3% |

Asia | 263 | 15.0% | 273 | 17.5% | +3.8% |

|

|

|

|

|

|

MVL | 2,305 | 100.0% | 2,326 | 100.0% | +0.9% |

Japan | 1,491 | 64.7% | 1,494 | 64.2% | +0.2% |

AMERICAs | 192 | 8.3% | 200 | 8.6% | +4.2% |

EMEA | 394 | 17.1% | 343 | 14.7% | -12.9% |

Asia | 228 | 9.9% | 289 | 12.4% | +26.8% |

|

|

|

|

|

|

EMS Business | 115 | 100.0% | 98 | 100.0% | -14.8% |

Japan | 31 | 27.0% | 67 | 68.4% | +116.1% |

Asia/Oceania | 84 | 73.0% | 31 | 31.6% | -63.1% |

*Unit: million yen

◎SS Business

(Security-related)

Japan:Sales increased as the sales of the outdoor security sensors for security companies and important large-scale facilities were healthy.

AMERICAs : The sale of security sensors for general housing and business offices was firm, however, sales dropped due to the sluggish sales of sensors for important large-scale facilities.

EMEA:Sales decreased as the sales of the sensors for general residence in Southern Europe region by the sales subsidiary in the U.K. were sluggish.

Asia:Sales declined due to the sluggish sales of security sensors by a Korean subsidiary that distributes the products of Optex.

(Automatic door-related)

Japan:The curtailment of opening of new shops in the retail industry affected the business, and the sales of sensors for automatic doors were sluggish and dropped.

AMERICAs :Sales of automatic door sensors to major clients in North America increased but sales decreased due to the influence of foreign exchange.

EMEA: Sales of automatic door sensors to major European customers slumped sluggishly.

◎FA Business

Japan:The sale of image sensors, etc. aimed at the food industry has been performing well and sales increased.

EMEA :Due to the production delay, the sale to OEMs was sluggish and sales decreased considerably.

Asia:Despite some stagnation of operating activities in China, the sales performance of displacement sensors etc. was firm and sales increased.

◎MVL lighting business

Japan :Amid restrictions on economic activities, the sales of 5G-related investments were the main driver for increasing sales.

AMERICAs :Sales increased thanks to orders on continued projects for the smartphone industry in North America.

EMEA :Sales decreased due to the suspension of the activities of the French subsidiary because of the novel coronavirus.

Asia:The sales for 5G-related investments expanded and led to a substantial increase in sales.

(3) Financial Conditions and Cash Flow

◎Main BS

| End of Dec.2019 | End of Mar.2020 |

| End of Dec.2019 | End of Mar.2020 |

Current Assets | 30,027 | 29,314 | Current liabilities | 8,066 | 7,956 |

Cash | 12,396 | 12,450 | Payables | 1,754 | 1,893 |

Receivables | 8,700 | 8,068 | LT Interest Bearing Liabilities | 3,368 | 3,361 |

Inventories | 7,217 | 7,101 | Noncurrent liabilities | 3,528 | 3,435 |

Noncurrent Assets | 13,939 | 13,836 | ST Interest Bearing Liabilities | 433 | 432 |

Tangible Assets | 5,792 | 5,845 | Net defined benefit liabilities | 1,248 | 1,252 |

Intangible Assets | 3,829 | 3,777 | Liabilities | 11,595 | 11,391 |

Investment, Others | 4,317 | 4,213 | Net Assets | 32,372 | 31,758 |

Total assets | 43,967 | 43,150 | Total Liabilities and Net Assets | 43,967 | 43,150 |

*Unit: million yen

Total assets were 43,150 million yen, down 817 million yen from the end of the previous term, due to the decline in accounts receivables, etc.

Total liabilities were 11,391 million yen, down 204 million yen year on year.

Net assets were 31,758 million yen, down 614 million yen year on year, due to the expansion of deficit of foreign currency translation adjustment amount.

The equity ratio remained unchanged at 73.2% compared to the end of the previous term.

(4) Topics

◎ Launched “Clean Switch,” a non-contact switch for automatic doors.

In March 2020, OPTEX Co., Ltd. released a non-contact switch “Clean Switch,” which is utilized for the doors of food factories and medical institutions as well as warehouses’ partitions and the opening and closing of shutters.

An unspecified large number of people can touch doorknobs and switches, which make it more likely for viruses and bacteria to accumulate on them. As public awareness of hygiene rises, users will appreciate the convenience of doors that can open and close without contacts such as automatic doors and non-contact switches, and its usage as a measure for managing hygiene will continue to spread.

Clean Switch is a non-contact switch that works when reached by the hand within a 10 to 50 cm distance. It can maintain its detection functionality in humid places or environments where dew is easily deposited. In addition, it provides the standard top-level water resistance functionality to allow cleaning.

Moreover, it has a ring-shaped LED operation display on the surface, whose indicator changes when the hand is close providing high visibility in addition to its appealing design, which blends well in various places, building materials, and spaces.

Expanding the non-contact switch lineup is beneficial for managing hygiene in a wide variety of places and environments including public facilities, offices, commercial facilities, food factories, and medical institutions.

◎Started sales of "Wireless Full Air Management System"

The wireless vacancy management system for parking lots that visualizes information on space availability in parking lots, “ViiK Parking System,” which was released by OPTEX Co., Ltd. in February 2020, was adopted by Lion-Shika, which runs clinics within Kanagawa Prefecture.

Most of Lion-Shika patients visit the clinic by car, which resulted in issues with dealing with many inquiries regarding space vacancies in the parking lot and the congestion from cars entering and leaving and cars waiting for open space.

The “ViiK Parking System” is a system that uses a vehicle sensor to detect the usage status in parking lots and links it to a display indicator, which allows the patients to check the availability of parking space when they are close. The vehicle detecting sensor is wireless, thanks to which no major installation work was required and it was possible to install the parking lot vacancy indicator in a short time.

The OPTEX GROUP Co., Ltd. positions the system as a major solution for the growth of the SS business for the ongoing medium-term management plan.

3. Fiscal Year Ending December 2020 Earnings Forecasts

◎Earnings Forecast

As mentioned above, due to the increasing infections with the novel coronavirus, the delivery of some parts was delayed in the first quarter of the current term, which resulted in a partial disruption in production. Additionally, the situation is still severe in Europe. For instance, sales of the security-related segment of the SS business stagnated due to the halt of operations of distributors and the sales to OEMs in the FA business decreased considerably.

Under the circumstances where we can’t predict the scale of infection spread or when it will come to a halt, it is difficult to make reasonable estimations of financial results, thus the company decided to state their full-year earnings forecast, the forecast for the first half of the fiscal year ending December 2020, and dividend estimation as undetermined.

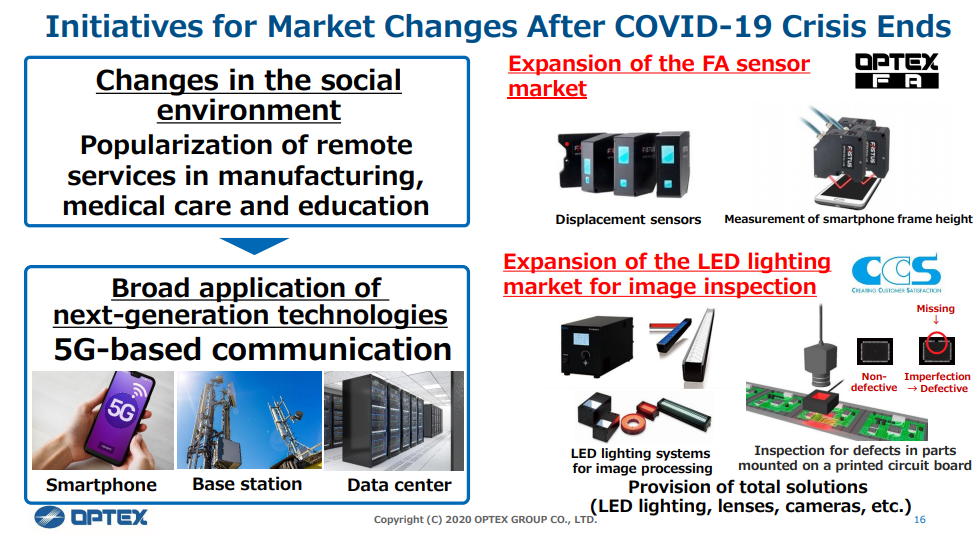

4. Measures to address changes to the market after the crisis of coronavirus passes

In the meantime, the business environment is harsh, however, the company considers the following measures for responding to changes in the market after the coronavirus crisis passes.

・ | The novel coronavirus crisis did not only change people's values but also accelerated the reform of social structures; our company perceives the social problems that emerge along this process as a business opportunity that would lead to more growth. |

・ | In the FA field, increasing product quality, comfort, and safety requirements and the increasing need for the product line automation using FA sensors. |

・ | As for 5G, whose spread is expected to accelerate, the operation of a base station cannot be halted as social infrastructure, so circuit boards used in a base station need to have an extremely high level of functionality. |

・ | As such, they will continue to steadily meet demand by working towards providing solutions to social problems and providing highly competitive products as the markets for FA sensors and image inspection LED lights are expected to expand. |

5. Conclusions

It is currently difficult to predict losses due to the novel coronavirus, and for the short term, there is no other way than to check reports for each quarter. In the short term, human casualties were significant and we would like to pay attention to how quickly the businesses in foreign markets, where social distancing regulations are stricter than Japan, will be able to recover. On the other hand, for the medium to long term, we would like to raise our expectations for the company to implement measures for promoting ESGs as the company has a clear story of creating value and improving business performance by providing solutions to social problems.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 11directors, including 4 outside ones |

◎Corporate Governance Report

The latest revision date: March 27, 2020

<Fundamental concept>

As the Group, we recognize that it is our greatest mission to continuously improve corporate value while earning the trust of our shareholders, investors, customers and society. To practice it, we consider enhancement of the corporate governance as one of important management tasks and aim to improve the transparency of management, maintain management systems accompanying fair and prompt decision making and strengthen management monitoring function.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Our company is fully compliant with the Principles of the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle | Items to be disclosed |

Principle 1-4 The strategically held shares

| The company will acquire and hold shares after the board of directors’ deliberations and decision-making being processed only when it is judged that the holding of shares would contribute to strengthening of transaction relations and the improvement in corporate value in the business strategy of our corporate group. Every year, the board of directors discusses the meanings of the holding of the shares, and if it is judged that the reasonable value of the shareholding is insufficient, the company will sell the shares while considering the market trend, etc. Listed cross-shareholdings owned by the company: 1 brand, 48 million yen (posted on the balance sheet)

Regarding the exercise of voting rights for the shares, we will individually examine whether it will contribute to sustainable growth of the enterprise and enhance corporate value over the medium to long term as well as whether shareholder value is not significantly impaired. Based on the examination, we will decide approval or rejection of it in a comprehensive manner. |

Principle 5-1 Policy for the constructive dialogues with shareholders | The company has the publicity and IR sections, and makes efforts to explain its managerial policy and situation in an understandable manner, so that it can talk with shareholders proactively and constructively. In addition, IR staff and officers hold briefing sessions for institutional and individual investors as planned, and respond to the request for an interview from institutional investors. In addition, for each annual meeting of shareholders, the company set the suitable venue which a broad range of shareholders can attend. After the meeting, the company holds a briefing session and a convivial party for shareholders, so that they can understand the policy of the company. ※Regarding the 41st annual meeting of shareholders, due to the spread of the novel coronavirus, the “shareholders’ friendly gathering” was canceled as a preventive measure. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020, All Rights Reserved by Investment Bridge Co., Ltd. |