Bridge Report:(6914)OPTEX GROUP the third quarter of fiscal year Ending December 2020

Isamu Oguni President and CEO | OPTEX GROUP (6914) |

|

Company Information

Market | TSE 1st Section |

Industry | Electric equipment (manufacturer) |

President and CEO | Isamu Oguni |

HQ Address | 4-7-5, Nionohama, Otsu, Shiga Prefecture |

Year-end | December |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥1,707 | 37,735,784 shares | ¥64,414 million | 6.8% | 100shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥30.00 | 1.8% | ¥33.19 | 51.4x | ¥891.06 | 1.9x |

*The share price is the closing price on November 9. Shares outstanding, EPS and DPS are from the third quarter financial report. ROE and BPS

are the actual values as of the end of the previous fiscal year.

Earnings Trend

Fiscal Year | Sales | Operating profit | Ordinary profit | Net profit | EPS | DPS |

December 2016 | 31,027 | 3,015 | 3,086 | 1,809 | 54.67 | 22.50 |

December 2017 | 37,504 | 4,885 | 5,036 | 3,386 | 97.63 | 27.50 |

December 2018 | 40,113 | 4,989 | 5,038 | 3,775 | 104.85 | 30.00 |

December 2019 | 37,517 | 2,856 | 2,876 | 2,197 | 60.02 | 32.50 |

December 2020 Est. | 34,500 | 1,800 | 2,000 | 1,200 | 33.19 | 30.00 |

* Net profit is net profit attributed to parent shareholders. On April 1, 2018, a 2-for-1 stock split was implemented. Both EPS and DPS are revised retroactively.

This Bridge Report presents OPTEX GROUP’s earnings results for the third quarter of fiscal year Ending December 2020 and so on.

Table of Contents

Key Points

1. Company Overview

2. The Third Quarter of Fiscal Year Ending December 2020 Earnings Results

3. Fiscal Year Ending December 2020 Earnings Forecasts

4. Growth Strategy

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the third quarter of the fiscal year ending December 2020, sales decreased 8.7% year on year to 25,178 million yen. Economic activity was restricted by the worldwide spread of the novel coronavirus. Sales declined in all segments. The sales of the domestic business dropped 8.9% year on year to 11,196 million yen, and the sales of the overseas business fell 8.7% year on year to 13,982 million yen. Compared to the cumulative second quarter, the decline in domestic profits expanded, while it decreased overseas. Operating profit decreased 32.2% year on year to 1,266 million yen. SG&A expenses fell 5.9% year on year, but the impact of the decline in sales could not be absorbed.

- The full-year earnings forecast for the fiscal year ending December 2020 has not changed. Sales are expected to decrease 8.0% year on year to 34.5 billion yen, and operating profit is estimated to decrease by 37.0% year on year to 1.8 billion yen. The dividend is to be 30.00 yen/share on a regular dividend basis, unchanged from the previous year. The expected payout ratio is 90.4%. Quarterly, overseas sales will decrease in the fourth quarter compared to the third quarter, while domestic sales will recover. Also, sales are projected to increase in all three segments compared to the third quarter. The sales of the FA business are expected to grow year on year.

- In the fourth quarter (October-December), overseas sales are estimated to slow down, and domestic sales will bottom out. Sales in all three segments are expected to increase from the third quarter, and the company as a whole is predicted to recover steadily. In particular, the FA business is forecasted to increase in sales, even if it is compared to the fourth quarter of the fiscal year ended December 2019 before the novel coronavirus crisis.

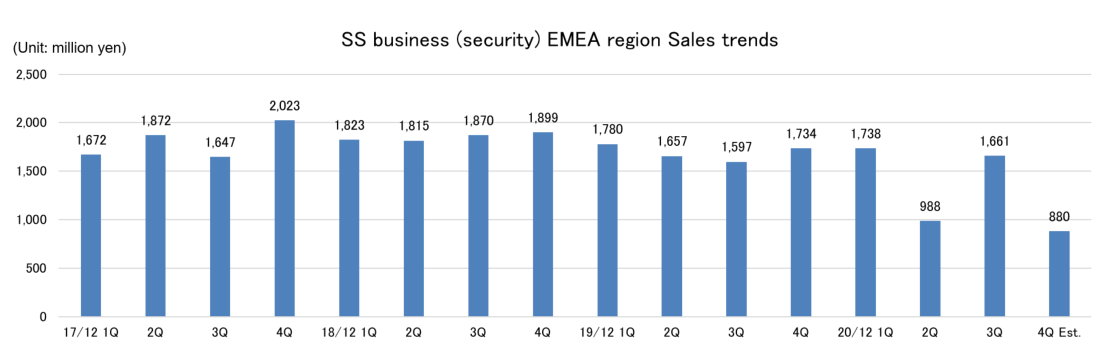

- On the other hand, the European business centered on outdoor security sensors, which was the driving force of growth, recovered sharply in the third quarter after falling drastically in the second quarter. However, at the moment, the company predicts that it will be sluggish again in the fourth quarter. As the number of people infected with the novel coronavirus is increasing rapidly in Europe, the company will have to be aware of the future risks.

- However, during the novel coronavirus crisis, the company considers social phenomena such as "the importance of crime prevention systems," "the expansion of needs for contactless services," "refraining from going out and the increase of time at home" as opportunities to expand and create business opportunities. Thus, it plans to develop the business aggressively. We want to pay attention to whether the company can capture each demand during this term and the next term.

1. Company Overview

OPTEX GROUP Co., Ltd. is a holding company centered around OPTEX Co., Ltd. that manufactures and sells outdoor sensors (top share of 40% in the global market), automatic door sensors (30% share of the global market and 50% share of the domestic market) and environment-related products.

OPTEX GROUP holds subsidiaries including OPTEX FA CO., LTD., which deals with FA related sensing business; CCS Inc., which holds the global top share in the LED lighting business for image processing; Three Ace Co., Ltd., which specializes in the development of various systems, applications, and digital content; Optex MFG Co., Ltd., which is responsible for manufacturing Group products, RAYTEC LIMITED (UK), which has attained the largest global share (about 50 %) for supplemental lights for CCTV; and FIBER SENSYS INC. (US), which deals with optical fiber intrusion detection systems.

As of December 31, 2019, the company operates in 80 locations worldwide, including 26 overseas companies.

OPTEX CO., LTD. | Develops and sells sensors for various uses, such as security sensors and sensors for automatic doors |

OPTEX FA CO., LTD. | Development and sales of photoelectric sensors, image inspection systems, displacement sensors and measuring instruments |

CCS Inc. | Development, manufacturing and sales of LED lighting devices, and systems for image processing |

THREE ACE CO., LTD. | Development of various systems, applications, and digital content |

OPTEX MFG CO., LTD. | Manufactures products for the Group and provides contract manufacturing service for electronic equipment |

SICK OPTEX CO., LTD. | Development of general-purpose photoelectric sensors. A joint venture of SICK AG (Germany) and OPTEX FA CO., LTD. |

GIKEN TRASTEM CO., LTD. | Development, manufacturing and sales of people counting systems, customer traffic counting/management systems |

ZENIC INC. | Contracted development of IC and LSI for image processing, and design and sales of FA systems |

O’PAL OPTEX CO., LTD. | Management of membership sports clubs and environmental hands-on learning programs |

FIBER SENSYS INC. (US) | Development, manufacturing and sales of fiber-optic intrusion detection systems |

FARSIGHT SECURITY SERVICES LTD. (UK) | Security company providing remote video surveillance services |

RAYTEC LIMITED. (UK) | Development, manufacturing and sales of supplemental lighting for surveillance cameras |

GARDASOFT VISION LIMITED. (UK) | Development, manufacturing, and sale of LED lighting controllers for machine vision |

1-1 Business Description

The Company’s business is composed of its main Sensing Solution (SS) business (security-related business and automatic door-related business), Factory Automation (FA) business (sensors for industrial machinery), Machine vision lightning (MVL) business (LED lighting device and system for image processing), “EMS business,” which was included in the SS business up until the previous term and provides contract manufacturing services for electronic equipment in China, and Other business (operation of sport clubs and development of applications and digital content).

Segment | Business Description | |

SS Business | Security-related | Main products include various indoor and outdoor sensors, wireless security systems and LED lighting control systems, etc. For outdoor sensors, the company has the leading share in the global market. Recently, it focuses on development of the automobile detection sensor using microwave technologies. |

Automatic door-related | The company developed the world’s first automatic door sensor using infrared rays. Main products are automatic door opening/closing sensors, shutter sensors for factories, wireless touch switches, etc. | |

Others | Equipment for measuring water quality. Manufacturing/marketing of measuring instruments, Transportation safety products, Customer traffic counting/management systems, developing/marketing of image processing-related products. | |

FA Business | Main products include photoelectric sensors used for quality control and automation of production lines, displacement sensors, image sensors, LED lights, etc. In Japan, these products are provided to a wide range of industries such as food or pharmaceutical for quality control of production lines. In Europe, its products are sold broadly through its technological partner SICK AG (Germany) that has the largest share in industrial sensor market. Also, its house-brand products have been launched in Asia and North America. | |

MVL Business | The company has a significant share in the LED lighting business for image processing. The company offers solutions using the natural light LED developed by the company, which boasts the best color rendering property in the field. | |

EMS-related | Contract manufacturing services for electronic equipment, developed at a factory in China. | |

Others | Operating sports clubs and development of applications and digital content. | |

1-2 Advantages: Diversified Technologies/Expertise on Sensing and Unique Sensing Algorithm

To produce stable and reliable sensors, it is essential to build on a number of elemental technologies and expertise, as well as “algorithms” to control physical changes. The company takes advantage of its technologies/expertise suitable for intended applications and its unique sensing algorithm to secure the largest share in the global market.

Noise abatement technology | ・Hardware design to minimize various noises ・Conduct a number of environmental assessments based on its own standard, and launch products that passed the assessments |

Sophisticated optical design | ・Make use of optical simulation to achieve high-density areas eliminating blind spots ・Packaging technologies to enable downsizing |

Compliant to public standards for reliability | ・Adapted and compliant to any global standards ・Adapted and compliant to industry standards and guidelines (CE marking, EN standard [TUV certified], ANSI, JIS, etc.) |

Environment friendly design | ・By identifying 15 restricted-use materials and 10 self-control materials, the company succeeded in excluding toxic substances in all products ・Compliant to RoHS directive, lead-free solder alloy ・Design to minimize the effect from CO2 when in use |

Secure & safe control | ・Adopt self-diagnosis functions in emergency or in failure to prevent system outage, and fail-safe devices for sensors ・Propose preventive maintenance measures to maintain functions |

Unique sensing algorithm | ・Unique algorithm to eliminate the impact of noise ineliminable by hardware, detect, scan and analyze only the intended events ・Various automatic correction functions to maintain performance in the field |

1-3 Corporate History

OPTEX was established in 1979 and developed the world's first automatic door sensors using infrared rays in the following year. Back then, most of the automatic doors were using pressure sensitive rubber mats, which contained sensors, and sensors using infrared rays were very innovative. The company also showed unrivaled abilities in product maintenance and implementation, and captured the top share in the automatic door sensors market in only three years since its foundation (currently, about 60% share in the domestic market). The company expanded operations and got listed on the over-the-counter market (equal to listing on JASDAQ) in 1991. Then it got listed on the second section of Tokyo Stock Exchange in 2001 and moved to its first section in 2003.

Recently, it has been working on enhancement of solutions based on image processing technologies and high-end security systems. In 2008, it acquired ZENIC INC., which specialized in contracted development of IC/LSI for image processing systems. Furthermore, it acquired FIBER SENSYS INC. (US) in 2010 and RAYTEC LIMITED (UK) in 2012, respectively. Also, CCS Inc. (6669, JASDAQ), which holds the largest market share in the world for LED lighting for image processing, was reorganized into a subsidiary in May 2016 (and became a wholly owned subsidiary in July 2018). On January 1, 2017, the company shifted to the holding company system, with the aim of advancing to next-generation management and pursuing group synergy.

1-4 ROE analysis

| FY 12/ 11 | FY 12/ 12 | FY 12/ 13 | FY 12/ 14 | FY 12/ 15 | FY 12/ 16 | FY 12/ 17 | FY 12/ 18 | FY 12/ 19 |

ROE (%) | 6.0 | 4.6 | 8.2 | 8.6 | 8.7 | 7.4 | 12.6 | 12.3 | 6.8 |

Net profit margin (%) | 5.58 | 3.99 | 6.87 | 7.39 | 7.38 | 5.83 | 9.03 | 9.41 | 5.86 |

Total asset turnover (times) | 0.85 | 0.91 | 0.92 | 0.89 | 0.91 | 0.91 | 0.95 | 0.95 | 0.86 |

Leverage (times) | 1.27 | 1.28 | 1.30 | 1.31 | 1.30 | 1.41 | 1.48 | 1.38 | 1.35 |

The company targets an ROE of "10% or more" and aims to return to 10% or more in the final year of the medium-term management plan, starting next fiscal year.

1-5 Efforts on ESG

The company believes that building a relationship of trust with a wide range of stakeholders is essential for improving corporate value and has posted 「ESG information」(https://www.optexgroup.co.jp/en/esg/stakeholder.html)on its website to further enhance ESG information disclosure. In addition, Published the ESG Bridge Report through Investment Bridge Inc.

The company identify the materiality for sustainable growth, mention the challenges and initiatives for the future in the report.

https://www.bridge-salon.jp/report_bridge/archives/eng/6914/20200609.html

2. The Third Quarter of Fiscal Year Ending December 2020 Earnings Results

(1) Business Results

| FY 12/19 3Q | Ratio to sales | FY 12/20 3Q | Ratio to sales | YoY |

Sales | 27,591 | 100.0% | 25,178 | 100.0% | -8.7% |

Gross profit | 14,868 | 53.9% | 13,495 | 53.6% | -9.2% |

SG&A | 13,000 | 47.1% | 12,228 | 48.6% | -5.9% |

Operating profit | 1,868 | 6.8% | 1,266 | 5.0% | -32.2% |

Ordinary profit | 1,814 | 6.6% | 1,343 | 5.3% | -26.0% |

Net Profit | 1,355 | 4.9% | 713 | 2.8% | -47.4% |

*Unit: million yen. The Net profit is the profit attributable to owners of the parent company. The same shall apply hereinafter.

Sales and profit declined

Sales decreased by 8.7% year on year to 25,178 million yen. Economic activities were restricted due to the global spread of the novel coronavirus, the FA business was almost flat, and sales in other segments decreased. Domestic business decreased by 8.9% to 11,196 million yen, and overseas business decreased by 8.7% to 13,982 million yen. Compared to the cumulative second quarter, the profit decline in the domestic business expanded, while the overseas business shrank.

Operating profit fell 32.2% year on year to 1,266 million yen. SG&A expenses decreased by 5.9% year on year, but the impact of the decline in sales could not be absorbed.

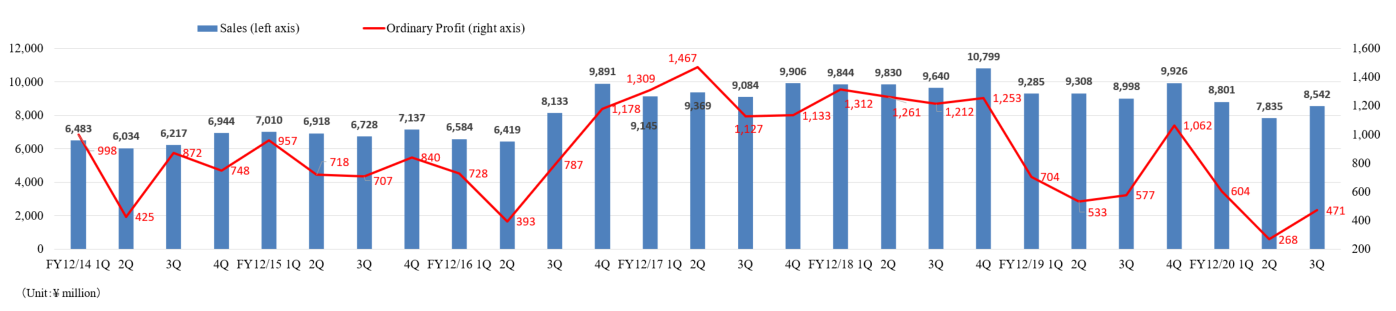

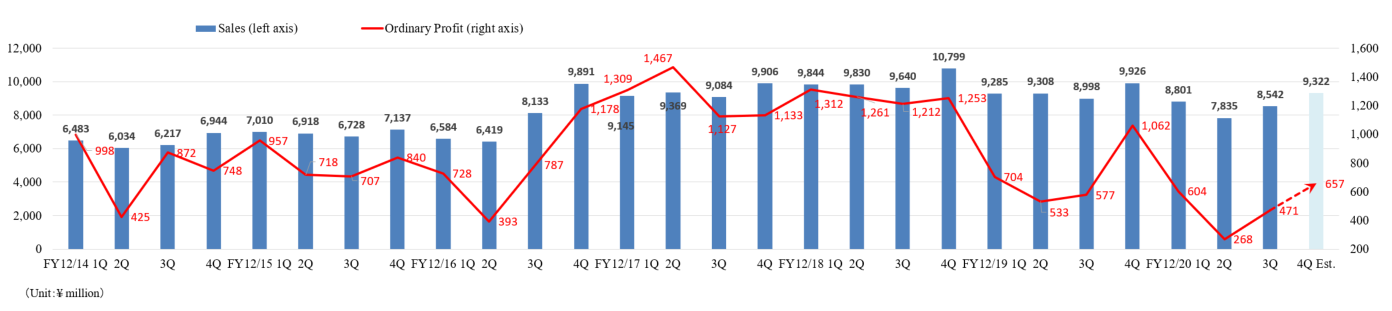

◎Trends in each quarter

Quarterly, sales and profits increased year on year. Sales recovered to about 90% and ordinary income to about 80% compared to the first quarter.

◎Regional trends

| FY 12/19 3Q | Ratio to sales | FY 12/20 3Q | Ratio to sales | YoY |

Sales | 27,591 | 100.0% | 25,178 | 100.0% | -8.7% |

Domestic | 12,285 | 44.5% | 11,196 | 44.5% | -8.9% |

Overseas | 15,306 | 55.5% | 13,982 | 55.5% | -8.7% |

America | 3,550 | 12.9% | 3,205 | 12.7% | -9.7% |

Europe | 8,482 | 30.7% | 7,600 | 30.2% | -10.4% |

Asia | 3,274 | 11.9% | 3,177 | 12.6% | -3.0% |

◎Average exchange rate

| FY 12/19 3Q | FY 12/20 3Q |

USD | ¥109.15 | ¥107.59 |

EURO | ¥122.66 | ¥120.90 |

(2) Earnings by Segment

①Trends in each segment

| FY 12/19 3Q | Ratio to sales | FY 12/20 3Q | Ratio to sales | YoY |

SS Business | 14,518 | 52.6% | 12,831 | 46.5% | -11.6% |

FA Business | 5,302 | 19.2% | 5,294 | 19.2% | -0.2% |

MVL Business | 6,894 | 25.0% | 6,403 | 25.4% | -7.1% |

EMS Business | 444 | 1.6% | 299 | 1.2% | -32.7% |

Others | 430 | 1.6% | 349 | 1.3% | -18.8% |

Sales | 27,591 | 100.0% | 25,178 | 100.0% | -8.7% |

SS Business | 1,124 | 7.7% | 712 | 5.5% | -36.7% |

FA Business | 424 | 8.0% | 497 | 9.4% | +17.2% |

MVL Business | 387 | 5.6% | 120 | 1.9% | -69.0% |

EMS Business | -6 | - | 45 | 15.1% | - |

Others | 18 | 4.2% | -35 | - | - |

Adjustments | -80 | - | -74 | - | - |

Operating profit | 1,868 | 6.8% | 1,266 | 5.0% | -32.2% |

*Unit: million yen. Ratio to sales of Operating profit refers to Sales Profit margin.

The sales of the FA business in the third quarter (July-September) increased from the previous quarter and the last year.

②Trends in each segment and region

| FY 12/19 3Q | Ratio to sales | FY 12/20 3Q | Ratio to sales | YoY |

SS: Security | 9,686 | 100.0% | 8,659 | 100.0% | -10.6% |

Japan | 1,704 | 17.6% | 1,613 | 18.6% | -5.3% |

AMERICAs | 1,972 | 20.4% | 1,725 | 19.9% | -12.5% |

EMEA | 5,034 | 52.0% | 4,387 | 50.7% | -12.9% |

Asia | 976 | 10.1% | 934 | 10.8% | -4.3% |

|

|

|

|

|

|

SS: Automatic door | 3,272 | 100.0% | 2,886 | 100.0% | -11.8% |

Japan | 1,631 | 49.8% | 1,492 | 51.7% | -8.5% |

AMERICAs | 878 | 26.8% | 749 | 26.0% | -14.7% |

EMEA | 670 | 20.5% | 558 | 19.3% | -16.7% |

Asia | 93 | 2.8% | 87 | 3.0% | -6.5% |

|

|

|

|

|

|

SS: Other | 1,560 | 100.0% | 1,287 | 100.0% | -17.5% |

Japan | 1,356 | 86.9% | 1,131 | 87.9% | -16.6% |

AMERICAs | 1 | 0.1% | 0 | 0.0% | -100.0% |

Asia | 203 | 13.0% | 156 | 12.1% | -23.2% |

|

|

|

|

|

|

FA | 5,303 | 100.0% | 5,294 | 100.0% | -0.2% |

Japan | 2,601 | 49.0% | 2,462 | 46.5% | -5.3% |

AMERICAs | 81 | 1.5% | 77 | 1.5% | -4.9% |

EMEA | 1,704 | 32.1% | 1,691 | 31.9% | -0.8% |

Asia | 917 | 17.3% | 1,064 | 20.1% | +16.0% |

|

|

|

|

|

|

MVL | 6,895 | 100.0% | 6,403 | 100.0% | -7.1% |

Japan | 4,367 | 63.3% | 3,941 | 61.5% | -9.8% |

AMERICAs | 618 | 9.0% | 654 | 10.2% | +5.8% |

EMEA | 1,074 | 15.6% | 964 | 15.1% | -10.2% |

Asia | 836 | 12.1% | 844 | 13.2% | +1.0% |

|

|

|

|

|

|

EMS Business | 444 | 100.0% | 299 | 100.0% | -32.7% |

Japan | 195 | 43.9% | 207 | 69.2% | +6.2% |

Asia and Oceania | 249 | 56.1% | 92 | 30.8% | -63.1% |

*Unit: million yen

◎SS Business

(Security-related)

Japan: The sales of outdoor security sensors for security companies and large important facilities were sluggish, and sales declined.

AMERICAs: Due to restrictions on operations, sales, and installation activities because of the novel coronavirus crisis, projects at large important facilities were postponed, and sales decreased.

EMEA: Due to restrictions on operations, sales, and installation activities because of the novel coronavirus crisis, sales of outdoor security sensors for general housing in Southern Europe were sluggish, and sales declined.

Asi Sales declined due to slow sales in China and South Korea due to the novel coronavirus crisis.

(Automatic door-related)

Japan: Sales declined as the sales of sensors for automatic doors were sluggish due to the restraints on opening new stores in the retail industry.

AMERICAs: Due to the impact of the novel coronavirus crisis, operations, sales, and installation activities for major North American customers were restricted, resulting in a significant drop in sales.

EMEA: Due to the impact of the novel coronavirus crisis, operations, sales, and installation activities for major European customers were restricted, resulting in a significant sales decrease.

◎FA Business

Japan: Although the sales of image sensors to the food industry were firm, profit declined due to sluggish capital investment demand in the automobile-related industry.

EMEA: As the restraints on economic activity due to the novel coronavirus's impact easing up, sales at OEM destinations began to recover and leveled off.

Asi Due to an increase in demand for capital investment in China, sales of displacement sensors increased steadily, resulting in a significant rise in sales.

◎MVL lighting business

Japan: The sales for 5G-related investments were firm, but sales declined due to restrictions on operating activities from the second quarter onward.

AMERICAs: Sales increased due to easing the restraints on economic activity in the third quarter (July-September) and favorable sales for 5G-related investment.

EMEA: Sales declined due to the restrictions on economic activity in the second quarter (April-June) because of the impact of the novel coronavirus crisis.

Asi Sales increased slightly due to the Chinese economy's rapid recovery and increased investment related to semiconductors and smartphones.

(3) Financial Conditions and Cash Flow

◎Main BS

| End of Dec.2019 | End of Sep.2020 |

| End of Dec.2019 | End of Sep.2020 |

Current Assets | 30,027 | 29,451 | Current liabilities | 8,066 | 7,834 |

Cash | 12,396 | 12,944 | Payables | 1,754 | 1,706 |

Receivables | 8,700 | 7,321 | ST Interest Bearing Liabilities | 3,368 | 3,521 |

Inventories | 7,217 | 7,258 | Noncurrent liabilities | 3,528 | 3,364 |

Noncurrent Assets | 13,939 | 13,529 | LT Interest Bearing Liabilities | 433 | 397 |

Tangible Assets | 5,792 | 5,984 | Net defined benefit liabilities | 1,248 | 1,269 |

Intangible Assets | 3,829 | 3,620 | Liabilities | 11,595 | 11,199 |

Investment, Others | 4,317 | 3,924 | Net Assets | 32,372 | 31,781 |

Total assets | 43,967 | 42,980 | Total Liabilities and Net Assets | 43,967 | 42,980 |

*Unit: million yen

Total assets decreased by 987 million yen compared to the end of the previous year to 42.980 billion yen, mainly due to a decrease in trade receivables. Total liabilities decreased 396 million yen to 11,199 million yen. Net assets decreased by 591 million yen to 31,781 million yen, due to a decrease in retained earnings and an increase in the negative amount of foreign currency translation adjustment. The equity ratio was 73.5%, up 0.3 points from the end of the previous fiscal year.

(4) Topics

◎ Launched Japan's first automatic door data platform

In October 2020, OPTEX Co., Ltd. announced that it would launch an automatic door data platform that can provide data (operation information, various setting values such as speed and error information) obtained from automatic doors in January 2021.

(Development background)

"JIS A 4722" has been established as a safety standard for automatic doors in Japan. It clarifies what manufacturers and other related companies should work on as safety measures for automatic doors and requires more devices for safety measures such as mutual monitoring of doors using CAN (*).

Also, improving the efficiency of maintenance for automatic doors and reducing risks and costs through preventive maintenance have become global issues.

(Overview of automatic door data platform)

In response to these social needs, Optex has developed an automatic door data platform that consists of a gateway that transmits data,

a setting application, and various data storage servers. The platform combines an automatic door system using CAN with IoT technology.

This is the first data service in Japan that can visualize the usage status of automatic doors in real-time even in places away from the site by utilizing the collected data, and it improves the efficiency of preventive maintenance and maintenance support of equipment and facilities. It can also acquire the operating status of connected devices such as automatic door itself and sensors, the number of times they are opened and closed, and monitor automatic door abnormalities and failures in real time.

(Offering of services)

As the first step for offering services, this data platform will be used for the "automatic door maintenance contract service by a remote monitoring system" jointly developed with Fulltech Co., Ltd. (TSE1: 6546), which sells, installs, and maintains automatic door devices.

Data acquired from various automatic door systems are sent to Fulltech's server via Optex's server, and the data are used to handle failures, signs, and maintenance.

Currently, the person in charge regularly visits the site for confirmation and inspection to maintain the automatic doors. However, by adopting this system, you can grasp the situation at the site remotely in real time. Thus, efficient maintenance can be conducted.

In "JIS A 4722," the entire process including product design, manufacturing, and installation for automatic doors, and maintenance and inspection by the operation manager to check whether the automatic door is operating safely is covered. By utilizing the expertise of both Fulltech and Optex and using the data that visualize the implicit knowledge of monitoring and inspection, which depended on individual employees, as explicit knowledge, it has become possible to provide efficient and high-level automatic door maintenance services.

The company aims at cumulative sales of 300 million yen over the next three years.

CAN (*): A communication technology that complies with ISO (International Organization for Standardization) standards used in a wide range of fields such as automobiles, medical equipment, FA, and industrial equipment.

◎ Joint development of LED lighting for image inspection with a major manufacturer of industrial cameras

In October 2020, CCS Inc. announced that it would release the "Basler Camera Light," which is LED lighting for image inspection that was jointly developed with Basler AG (Headquarters: Germany), a major industrial camera manufacturer.

(Overview of Basler AG)

Founded in 1988, it is a world leader in manufacturing high-quality image processing equipment for computer vision.

With its excellent reliability, cost performance, and long supply period, it contributes to a wide range of industries including factory automation, medical care, transportation, logistics, retail, and robots.

(Development background)

When establishing an image inspection system, components such as lighting, cameras, and control equipment are integrated, and settings are made for each of them. Detailed settings such as synchronizing the camera and lighting with the signal input, adjusting the camera's exposure time, the light emission of the lighting, and flash level are required.

In the process, complicated calculations and operation confirmations are often needed, especially in Europe and the United States, there have been many requests for reducing these man-hours.

(Outline of LED lighting for image inspection "Basler Camera Light")

The LED lighting for image inspection "Basler Camera Light" solves these problems and has the following features.

* Contributes to the reduction of system design man-hours and costs

Designed for the Basler camera series, the Basler Camera Light provides communication between the camera and LED lighting with a single cable, allowing you to set the lighting using Basler camera software.

Moreover, it is possible to reduce the overall cost by sharing the camera and lighting power supply and reducing the number of devices for system construction.

* Various lighting lineup suitable for image inspection

CCS will start selling LED lighting for image inspection developed for Basler cameras in Japan and overseas.

There are four types of lighting, bar type, ring type, flat type, and large bar type, and the lineup of emission colors is red, white, and blue, which can be selected according to the user's inspection environment. As a result, the user can start the image processing inspection easily and speedily.

3. Fiscal Year Ending December 2020 Earnings Forecasts

(1) Earnings forecast

| FY 12/19 | Ratio to sales | FY 12/20 Est. | Ratio to sales | YoY | Percentage of progress |

Sales | 37,517 | 100.0% | 34,500 | 100.0% | -8.0% | 73.0% |

Operating profit | 2,856 | 7.6% | 1,800 | 5.2% | -37.0% | 70.3% |

Ordinary profit | 2,876 | 7.7% | 2,000 | 5.8% | -30.5% | 67.2% |

Net profit | 2,197 | 5.9% | 1,200 | 3.5% | -45.4% | 59.4% |

*Unit: million yen.

No change in earnings forecast/ Sales and profit declined

The full-year earnings forecast for the fiscal year ending December 2020 has not changed. Sales are expected to decrease 8.0% year on year to 34.5 billion yen, and operating profit is estimated to decrease by 37.0% year on year to 1.8 billion yen. The dividend is to be 30.00 yen/share on a regular dividend basis, unchanged from the previous year. The expected payout ratio is 90.4%.

◎Regional trends

| FY 12/19 | Ratio to sales | FY 12/20 Est. | Ratio to sales | YoY | Percentage of progress |

Consolidated sales | 37,517 | 100.0% | 34,500 | 100.0% | -8.0% | 73.0% |

Domestic | 16,971 | 45.2% | 16,000 | 46.4% | -5.7% | 70.0% |

International | 20,546 | 54.8% | 18,500 | 53.6% | -10.0% | 75.6% |

AMERICAs | 4,766 | 12.7% | 4,420 | 12.8% | -7.3% | 72.5% |

Europe | 11,333 | 30.2% | 9,696 | 28.1% | -14.4% | 78.4% |

Asia | 4,447 | 11.9% | 4,384 | 12.7% | -1.4% | 72.5% |

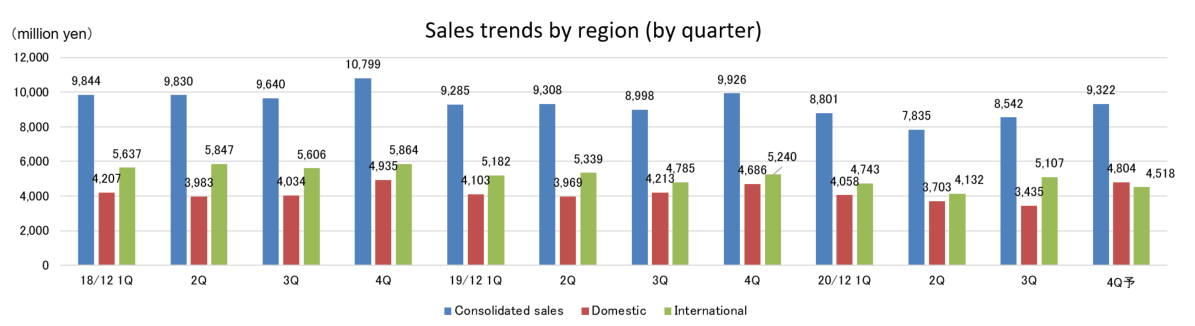

By quarter, the fourth quarter will see a decline in sales overseas compared to the third quarter, but a recovery in domestic sales.

◎Average exchange rate

| FY 12/19 | FY 12/20 Est. |

USD | ¥109.05 | ¥106.64 |

EURO | ¥122.07 | ¥117.15 |

(2) Trends in each segment

①Sales of each segment

| FY 12/19 | Ratio to sales | FY 12/20 Est. | Ratio to sales | YoY | Percentage of progress |

SS Business | 19,802 | 52.8% | 17,454 | 50.6% | -11.9% | 73.5% |

FA Business | 7,140 | 19.0% | 7,250 | 21.0% | +1.5% | 73.0% |

MVL Business | 9,449 | 25.2% | 8,850 | 25.7% | -6.3% | 72.4% |

EMS Business | 570 | 1.5% | 419 | 1.2% | -26.5% | 71.4% |

Others | 553 | 1.5% | 527 | 1.5% | -4.7% | 66.4% |

Consolidated sales | 37,517 | 100.0% | 34,500 | 100.0% | -8.0% | 73.0% |

*Unit: million yen.

*Operating profit composition as a percentage of sales

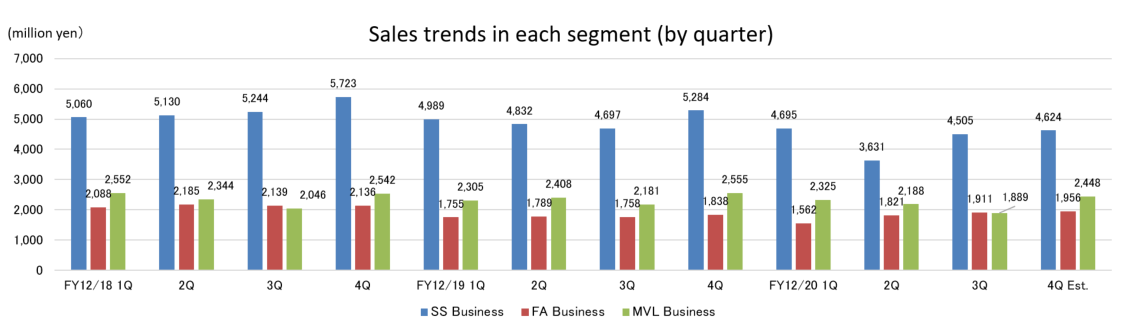

In the fourth quarter, all three segments are expected to see an increase in revenue compared to the third quarter, with the FA business also expected to see an increase in revenue compared to the same period last year.

②Trends in each segment and region

| FY 12/19 | Ratio to sales | FY 12/20 Est. | Ratio to sales | YoY | Percentage of progress |

SS: Security | 13,254 | 100.0% | 11,494 | 100.0% | -13.3% | 75.3% |

Japan | 2,495 | 18.8% | 2,506 | 21.8% | +0.4% | 64.4% |

AMERICAs | 2,648 | 20.0% | 2,459 | 21.4% | -7.1% | 70.2% |

EMEA | 6,768 | 51,1% | 5,267 | 45.8% | -22.2% | 83.3% |

Asia | 1,343 | 10.1% | 1,262 | 11.0% | -6.0% | 74.0% |

|

|

|

|

|

|

|

SS: Automatic door | 4,439 | 100.0% | 3,990 | 100.0% | -10.1% | 72.3% |

Japan | 2,267 | 51.1% | 2,123 | 53.2% | -6.4% | 70.3% |

AMERICAs | 1,159 | 26.1% | 1,021 | 25.6% | -11.9% | 73.4% |

EMEA | 878 | 19.8% | 710 | 17.8% | -19.1% | 78.6% |

Asia | 135 | 3.0% | 136 | 3.4% | +0.7% | 64.0% |

|

|

|

|

|

|

|

SS: Other | 2,110 | 100.0% | 1,970 | 100.0% | -6.6% | 65.3% |

Japan | 1,840 | 87.2% | 1,688 | 85.7% | -8.3% | 67.0% |

AMERICAs | 2 | 0.1% | 1 | 0.1% | -50.0% | 0.0% |

Asia | 268 | 12.7% | 281 | 14.3% | +4.9% | 55.5% |

|

|

|

|

|

|

|

FA | 7,140 | 100.0% | 7,250 | 100.0% | +1.5% | 73.0% |

Japan | 3,616 | 50.6% | 3,448 | 47.6% | -4.6% | 71.4% |

AMERICAs | 113 | 1.6% | 134 | 1.8% | +18.6% | 57.5% |

EMEA | 2,158 | 30.2% | 2,319 | 32.0% | +7.5% | 72.9% |

Asia | 1,253 | 17.5% | 1,349 | 18.6% | +7.7% | 78.9% |

|

|

|

|

|

|

|

MVL | 9,449 | 100.0% | 8,850 | 100.0% | -6.3% | 72.4% |

Japan | 5,947 | 62.9% | 5,491 | 62.0% | -7.7% | 71.8% |

AMERICAs | 844 | 8.9% | 805 | 9.1% | -4.6% | 81.2% |

EMEA | 1,529 | 16.2% | 1,400 | 15.8% | -8.4% | 68.9% |

Asia | 1,129 | 11.9% | 1,154 | 13.0% | +2.2% | 73.1% |

|

|

|

|

|

|

|

EMS Business | 571 | 100.0% | 419 | 100.0% | -26.6% | 71.4% |

Japan | 252 | 44.1% | 217 | 51.8% | -13.9% | 95.4% |

Asia and Oceania | 319 | 55.9% | 202 | 48.2% | -36.7% | 45.5% |

*Unit: million yen.

4. Growth Strategy

In order to achieve further growth, the company believes that it is necessary to take on the challenge of transforming the business model from “selling goods” to “selling services” (= providing solutions) in each segment.

In addition to this, the company believes that the novel coronavirus crisis will lead to the expansion and creation of business opportunities in all businesses.

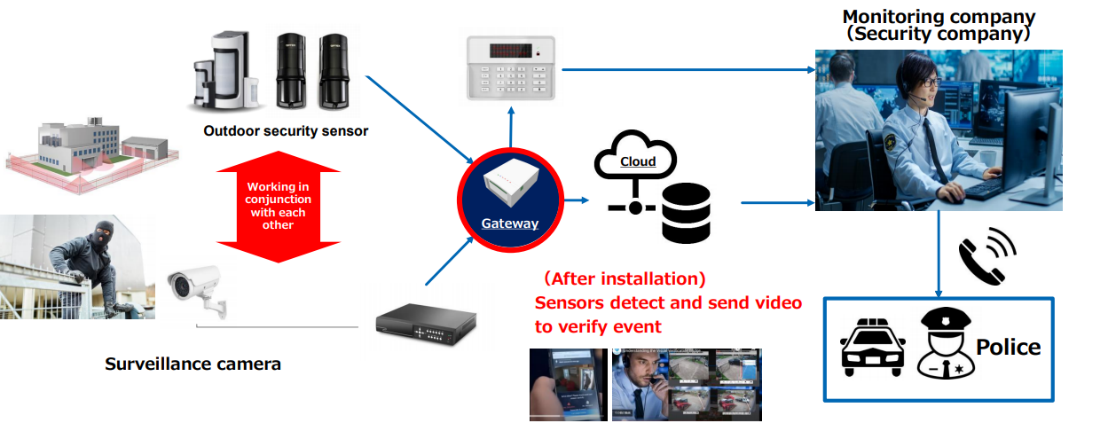

(1) SS business (security)

* "The deterioration of public security" as a social phenomenon expected in the future

* Provided solution: "Image confirmation solution"

The number of crimes targeting empty business establishments and stores is on the rise due to telecommuting, refraining from business activities, and shortening business hours because of the novel coronavirus crisis.

In the U.S., according to the New York Police Department's statistics, as of the end of June 2020, trespassing increased by 46%, and car theft rose 61% from the previous year.

As the importance of crime prevention systems has been reaffirmed, the company will focus on expanding sales of "image confirmation solutions," which have few false alarms, in Europe and the United States where the novel coronavirus crisis is predicted to prolong.

OPTEX GROUP Co., Ltd. has the exclusive right to sell this system in North America and the U.K., and offer the system to high-end customers such as commercial facilities, offices, and high-end residences. The company doesn’t only sell products, including the gateway, security sensor, but also carries out the subscription-type charging business providing the system.

This system can be installed at low cost and rarely causes false alarms, so it is considered beneficial to all stakeholders, including users, monitoring companies, and the police. The company aims to diffuse a win-win business model.

(Taken from the reference material of the company)

(2) SS business (automatic door)

* "Non-contact" as a social phenomenon expected in the future

* Solution provided: "Non-contact automatic doors"

There is an increasing need for "non-contact" in every aspect of our lives, such as elevator buttons, lighting ON/OFF switches, touch panels, and thermometers.

The company's automatic door business field is currently promoting the switch from existing products to "contactless" automatic doors such as "clean switches" and "light ray-type touchless switches" that do not need to be touched.

Also, in places where manual doors were used, switching to automatic doors is increasing, and it is expected that the demand for sensors for automatic doors will surely rise.

(Taken from the reference material of the company)

(3) FA business and MVL business

* "Refraining from going out and an increase in time staying at home" as a social phenomenon expected in the future

* Solutions to be provided: "factory sensors for each manufacturing industry, expanding the image inspection lighting lineup and solution proposals"

Due to refraining from going out and the establishment of remote work, the time spent at home is increasing, and the market size of prepared meals (side dishes, convenience store boxed lunches, etc.) is expanding.

Also, the spread of 5G is expected to accelerate due to increased remote work, online lessons, online medical care, etc.

Due to such circumstances, the food industry is actively investing in food factories that manufacture frozen foods and boxed lunches. Thus, the company is also expanding sales of inspection image sensors.

Moreover, as the demand for 5G infrastructure development and capital investment in related equipment fields is forecasted to grow, the company will strengthen sales and proposals of displacement sensors, image inspection lighting, and image inspection solutions for semiconductors and electronic component industries.

(Taken from the reference material of the company)

5. Conclusions

In the fourth quarter (October-December), overseas sales will lag, but domestic sales will bottom out, and all three segments are expected to increase compared to the third quarter, and the entire company is expected to make a good recovery. In particular, the FA business is expected to increase in sales, even if it is compared to the fourth quarter of the fiscal year ended December 2019, before the corona crisis.

On the other hand, the European business, which has been a driver of growth, centered on outdoor securities sensors, saw a sharp decline in the second quarter and recovered sharply in the third quarter, but the company now expects it to be sluggish again in the fourth quarter.

With the number of people infected with the novel coronaviruses expanding rapidly in Europe, the company will continue to be aware of the risks in this regard.

However, during the novel coronavirus crisis, the company considers social phenomena such as "the importance of crime prevention systems," "the expansion of needs for contactless services," "refraining from going out and the increase of time at home" as opportunities to expand and create business opportunities. Thus, it plans to develop the business aggressively. We want to pay attention to whether the company can capture each demand during this term and the next term.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 11directors, including 4 outside ones |

◎Corporate Governance Report

The latest revision date: March 27, 2020

<Fundamental concept>

As the Group, we recognize that it is our greatest mission to continuously improve corporate value while earning the trust of our shareholders, investors, customers and society. To practice it, we consider enhancement of the corporate governance as one of important management tasks and aim to improve the transparency of management, maintain management systems accompanying fair and prompt decision making and strengthen management monitoring function.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company has implemented all of the principles of the Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle | Items to be disclosed |

Principle 1-4 Cross-Shareholdings | Only if the Company deems it to be strategically conducive to the enhancement of business relationships and increased corporate value for the Group will it acquire shares for cross-shareholding upon discussions and resolutions of the Board of Directors. In addition, the Company examines the significance of cross-shareholdings at a meeting of the Board of Directors every year. If the Company determines it to be rationally pointless to hold certain shares in light of the intended objectives of cross-shareholding, it will sell them in consideration of market trends, etc., thereby endeavoring to reduce such holdings. Listed shares currently held by the Company: One stock amounting to 48 million yen (amount recorded on the balance sheet) With regard to exercising the voting rights it holds, the Company approves or disapproves shareholder proposals based on comprehensive judgment by examining each agenda item individually according to its criteria for exercising voting rights and by taking into consideration whether or not the proposed motion will contribute to the sustained growth of the subject company and the enhancement of corporate value thereof and whether or not the proposed motion will cause significant damage to shareholder value. |

Principle 5-1 Policy for the constructive dialogues with shareholders | To facilitate proactive and constructive dialogue with shareholders, the Company has established an IR section and endeavors to provide clear explanations of the Company’s management policy and management situation. In addition, IR personnel and officers systematically hold briefings for institutional investors and briefings for individual investors and field requests for interviews from institutional investors. Moreover, the ordinary general meetings of shareholders are held on Saturdays to ensure the attendance of a wide range of shareholders, and these meetings are followed by briefings for shareholders and social gatherings for shareholders to ensure that they understand the Company’s policies for the future. Note: At the 41st Ordinary General Meeting of Shareholders, the Company cancelled the social gathering for shareholders to prevent the spread of COVID-19. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020, All Rights Reserved by Investment Bridge Co., Ltd. All rights Reserved. |