Bridge Report:(6914)OPTEX GROUP first quarter of the fiscal year ending December 2022

Isamu Oguni President and CEO | OPTEX GROUP (6914) |

|

Company Information

Market | TSE Prime Market |

Industry | Electric equipment (manufacturer) |

President and CEO | Isamu Oguni |

HQ Address | 4-7-5, Nionohama, Otsu, Shiga Prefecture |

Year-end | December |

Homepage |

Stock Information

Share Price | Shares Outstanding (Term end) | Total market cap | ROE Act. | Trading Unit | |

¥1,833 | 37,735,784 shares | ¥69,169 million | 11.2% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥36.00 | 2.0% | ¥129.50 | 14.2x | ¥987.36 | 1.9x |

*The share price is the closing price on May 11. Shares Outstanding, DPS and EPS was taken from the brief report in 1Q of FY 12/22. ROE and BPS are the results of the previous year.

Earnings Trend

Fiscal Year | Sales | Operating profit | Ordinary profit | Net profit | EPS | DPS |

December 2018 | 40,113 | 4,989 | 5,038 | 3,775 | 104.85 | 30.00 |

December 2019 | 37,517 | 2,856 | 2,876 | 2,197 | 60.02 | 32.50 |

December 2020 | 34,846 | 2,098 | 2,176 | 1,395 | 38.59 | 30.00 |

December 2021 | 45,866 | 4,630 | 5,130 | 3,762 | 104.18 | 30.00 |

December 2022 Est. | 53,000 | 6,000 | 6,100 | 4,600 | 129.50 | 36.00 |

* Net profit is net profit attributed to parent shareholders. On April 1, 2018, a 2-for-1 stock split was implemented. Both EPS and DPS are revised retroactively.

This Bridge Report presents OPTEX GROUP’s earnings results for the first quarter of the fiscal year ending December 2022 and so on.

Table of Contents

Key Points

1. Company Overview

2. First quarter of Fiscal Year Ending December 2022 Earnings Results

3. Fiscal Year Ending December 2022 Earnings Forecasts

4. Conclusion

<Reference 1: Mid-term Management Plan 2024 >

<Reference 2: Regarding Corporate Governance>

Key Points

- In the first quarter of the fiscal year ending December 2022, sales increased 26.7% year on year to 13,901 million yen. In addition to the sales expansion of existing businesses, mainly the SS Business and IA Business, Mitsutec, which became a subsidiary in the previous term, also contributed to the sales growth. The exchange rate also had a positive effect of about 400 million yen. Operating profit increased 59.8% year on year to 2,120 million yen. Gross profit margin decreased 2.0 points due to the acquisition of Mitsutec as a subsidiary, but gross profit grew 21.7% year on year due to increased sales, absorbing the rise in SG&A expenses. Operating profit margin rose 3.2 points year on year.

- There are no revisions to the earnings forecast. The supply-demand balance for parts continues to be tight, and the procurement side of the business remains extremely uncertain. For the fiscal year ending December 2022, sales are expected to increase 15.6% year on year to 53 billion yen, and operating profit is expected to rise 29.6% year on year to 6 billion yen. Sales are expected to increase in all segments and all regions. Although there are still uncertainties, such as the impact of a shortage of parts, all businesses will surely meet demand. The company will also proceed with price revisions with the understanding of the customers. The company plans to pay a dividend of 36.00 yen/share, up 6 yen/share from the previous term. The expected payout ratio is 28.3%.

- Although there is still a shortage of parts, the company has positioned the provision of products as a top priority to maintain a trusting relationship with customers. Thus, gross profit margin has dropped 2.0 points. However, even when the contribution of Mitsutec is excluded, sales have increased about 20%, and the company's businesses are firmly meeting demand. In addition, profits increased significantly due to appropriate control of SG&A expenses.

- It is considered that the tight supply of parts will continue at least for the rest of this year, but we would like to pay close attention to whether the company can maintain the sales and profits growth despite the impact of the rising cost of sales from the second quarter onward.

1. Company Overview

OPTEX GROUP Co., Ltd. is a holding company centered around OPTEX Co., Ltd. that manufactures and sells outdoor sensors (top share of 40% in the global market), automatic door sensors (30% share of the global market and 50% share of the domestic market) and environment-related products.

OPTEX GROUP holds subsidiaries including OPTEX FA CO., LTD., which deals with FA related sensing business; CCS Inc., which holds the global top share in the LED lighting business for image processing; Sanritz Automation Co., Ltd., which has a wealth of results in the development, manufacturing and sales of industrial computers, MITSUTEC CO., LTD., which plans, develops, manufactures, and sells image processing, inspection, and measuring equipment and automated machinery and equipment, contributing to the improvement in quality of manufacturing with its advanced technologies (included in the scope of consolidation from the fiscal year ending December 2022), Three Ace Co., Ltd., which specializes in the development of various systems, applications, and digital content; Optex MFG Co., Ltd., which is responsible for manufacturing Group products, RAYTEC LIMITED (UK), which has attained the largest global share (about 50 %) for supplemental lights for CCTV; and FIBER SENSYS INC. (US), which deals with optical fiber intrusion detection systems.

As of December 31, 2021, the company operates in 84 locations worldwide, including 28 overseas companies.

OPTEX CO., LTD. | Develops and sells sensors for various uses, such as security sensors and sensors for automatic doors |

OPTEX FA CO., LTD. | Development and sales of photoelectric sensors, image inspection systems, displacement sensors and measuring instruments |

CCS Inc. | Development, manufacturing and sales of LED lighting devices, and systems for image processing |

Sanritz Automation Co., Ltd. | Development, manufacturing and sales of industrial computers |

MITSUTEC CO., LTD. (included in the scope of consolidation from the fiscal year ending December 2022) | Development, manufacturing, and sale of image processing, inspection, and measuring equipment and automated machinery and equipment |

THREE ACE CO., LTD. | Development of various systems, applications, and digital content |

OPTEX MFG CO., LTD. | Manufactures products for the Group and provides contract manufacturing service for electronic equipment |

SICK OPTEX CO., LTD. | Development of general-purpose photoelectric sensors. A joint venture of SICK AG (Germany) and OPTEX FA CO., LTD. |

GIKEN TRASTEM CO., LTD. | Development, manufacturing and sales of people counting systems, customer traffic counting/management systems |

ZENIC INC. | Contracted development of IC and LSI for image processing, and design and sales of FA systems |

O’PAL OPTEX CO., LTD. | Management of outdoor activities and environmental hands-on learning programs |

FIBER SENSYS INC. (US) | Development, manufacturing and sales of fiber-optic intrusion detection systems |

FARSIGHT SECURITY SERVICES LTD. (UK) | Security company providing remote video surveillance services |

RAYTEC LIMITED. (UK) | Development, manufacturing and sales of supplemental lighting for surveillance cameras |

GARDASOFT VISION LIMITED. (UK) | Development, manufacturing, and sale of LED lighting controllers for machine vision |

1-1 Corporate History

In May 1979, Mr. Toru Kobayashi (currently serving as a director and senior corporate adviser), who was developing security sensors in a manufacturer of anti-crime devices in Kyoto, established OPTEX Co., Ltd. with the spirit of the endeavor to “make their products recognized in the world as much as possible.”

In November 1979, the company developed “the world’s first far-infrared sensor for automatic doors.” Around that time, pressure-sensitive rubber mats were used for automatic doors, and an automatic door sensor that utilizes far-infrared light was epoch-making. OPTEX was unrivaled in maintenance and installation services and seized the largest share in the market of automatic door sensors in the third year after inauguration (currently occupying about 50% of the Japanese market).

Since then, the company has developed a wide array of products for security, automatic doors, and industrial equipment with its unique ideas and technologies that embodies them.

In the 1980s, the company entered overseas markets. While it had been considered impossible to set a far-infrared sensor outdoors because external factors, such as light, would cause errors, the company developed the outdoor far-infrared sensor “VX-40” with its original technology, and that sensor was highly evaluated mainly in the European market, and occupied the largest share in the global market of outdoor intrusion detection sensors.

Through business expansion, the company became an over-the-counter company (equivalent to being listed in the JASDAQ market) in 1991. Then, it was listed in the second section of Tokyo Stock Exchange (TSE) in 2001, and in the first section of TSE in 2003.

In April 2022, the company was listed on the Prime Market following the restructuring of the Tokyo Stock Exchange.

Recently, the company has been strengthening solutions based on image processing technologies and high-end security systems. In 2008, it reorganized ZENIC INC., which undertakes the development of ICs and LSI for image processing, etc., into a subsidiary. In 2010, it acquired FIBER SENSYS INC. (US), which has plenty of experience handling high-end security systems (optical fiber intrusion detection systems) for important facilities in Europe and the U.S., as a subsidiary. In 2012, it acquired RAYTEC LIMITED (UK), which handles supplemental lighting for cameras of high-end security systems for important large-scale facilities, as a subsidiary.

In May 2016, it acquired CCS Inc., which has the world’s largest share in the market of LED lighting for image processing, as a subsidiary, and transformed it into a 100% subsidiary in July 2018.

With the aim of adopting next-generation business administration and pursuing group synergy, it shifted to the holding company system on January 1, 2017.

Mr. Isamu Oguni was appointed as President and CEO in March 2019.

In December 2020, the company acquired Sanritz Automation Co., Ltd., which has an abundance of experience in developing, manufacturing, and selling industrial computer systems, as a subsidiary. Furthermore, the company made MITSUTEC CO., LTD. into a subsidiary in November 2021. MITSUTEC CO., LTD. is a company that plans, develops, manufactures, and sells image processing inspection / measuring equipment and automated machinery and equipment. In February 2022, it announced its three-year mid-term management plan with the final year being the fiscal year ending December 2024. To achieve this plan, the company aims for further growth as the global niche No. 1 company by promoting business model reforms and strengthening solution proposal capabilities.

1-2 Business Description

The Company’s business is composed of its main SS business (security sensor segment and automatic door sensor segment), sensors for industrial machinery, LED lighting device and system for image processing, the “IA Business” which works towards the automation, labor saving, and optimization of the production line using industrial computers, “EMS business,” which was included in the SS business up until the previous term and provides contract manufacturing services for electronic equipment in China, and “Other business”, which operates programs for outdoor activities and experiencing and learning of the environment and develops apps and digital content.

Segment | Business Description | |

SS Business | Security Sensor segment | Main products include various indoor and outdoor sensors, wireless security systems and LED lighting control systems, etc. For outdoor sensors, the company has the leading share in the global market. Recently, it focuses on development of the automobile detection sensor using microwave technologies. |

Automatic Door Sensor segment | The company developed the world’s first automatic door sensor using infrared rays. Main products are automatic door opening/closing sensors, shutter sensors for factories, wireless touch switches, etc. | |

Other | Equipment for measuring water quality. Transportation safety products, Customer traffic counting/management systems, developing/marketing of image processing-related products. | |

IA Business | FA segment | Main products include photoelectric sensors used for quality control and automation of production lines, displacement sensors, image sensors, LED lights, etc. In Japan, these products are provided to a wide range of industries such as food or pharmaceutical for quality control of production lines. In Europe, its products on an OEM basis through its technological partner SICK AG (Germany) that has the largest share in industrial sensor market. Also, its house-brand products have been launched in Asia and North America. |

MVL segment | The company has a significant share in the LED lighting business for image processing. The company offers solutions using the natural light LED developed by the company, which boasts the best color rendering property in the field. | |

IPC segment | The company has shown great results in the development, manufacturing, and sale of industrial computers. Specializes in the development of devices and systems that require both “hardware” and “software” of industrial built-in computers. | |

MECT segment | The company possesses advanced mechatronics technologies, such as high-speed and high-precision filling and high-speed conveyance technologies, and provides high-quality automation equipment that meets strict requirements. Regarding image processing inspection and measurement equipment, the company has built an image processing inspection system for dealing with customers' issues. | |

EMS-related | Contract manufacturing services for electronic equipment, developed at a factory in China. | |

Others | Operating outdoor activities and environmental hands-on learning programs and development of applications and digital content. | |

*SS: Sensing Solution, IA:Industrial Automation, FA:Factory Automation, MVL:Machine Vision Lighting, IPC:Industrial PC MECT:Mechatronics, EMS: Electronics Manufacturing Service.

1-3 Advantages: Diversified Technologies/Expertise on Sensing and Unique Sensing Algorithm

To produce stable and reliable sensors, it is essential to build on a number of elemental technologies and expertise, as well as “algorithms” to control physical changes. The company takes advantage of its technologies/expertise suitable for intended applications and its unique sensing algorithm to secure the largest share in the global market.

Noise abatement technology | ・Hardware design to minimize various noises ・Conduct a number of environmental assessments based on its own standard, and launch products that passed the assessments |

Sophisticated optical design | ・Make use of optical simulation to achieve high-density areas eliminating blind spots ・Packaging technologies to enable downsizing |

Compliant to public standards for reliability | ・Adapted and compliant to any global standards ・Adapted and compliant to industry standards and guidelines (CE marking, EN standard [TUV certified], ANSI, JIS, etc.) |

Environment friendly design | ・By identifying 15 restricted-use materials and 10 self-control materials, the company succeeded in excluding toxic substances in all products ・Compliant to RoHS directive, lead-free solder alloy ・Design to minimize the effect from CO2 when in use |

Secure & safe control | ・Adopt self-diagnosis functions in emergency or in failure to prevent system outage, and fail-safe devices for sensors ・Propose preventive maintenance measures to maintain functions |

Unique sensing algorithm | ・Unique algorithm to eliminate the impact of noise ineliminable by hardware, detect, scan and analyze only the intended events ・Various automatic correction functions to maintain performance in the field |

High market share | The company has a high share in unique products with their motto, “global niche No. 1.” Outdoor intrusion detection sensors: 40% Sensors for automatic doors: 30% LED lighting for image inspections: 30% |

1-4 ROE analysis

| FY12/ 12 | FY12/ 13 | FY12/ 14 | FY12/ 15 | FY12/ 16 | FY12/ 17 | F 12/ 18 | FY12/ 19 | FY12/ 20 | FY12/ 21 |

ROE (%) | 4.7 | 8.2 | 8.6 | 8.7 | 7.4 | 12.6 | 12.3 | 6.8 | 4.3 | 11.2 |

Net profit margin (%) | 3.99 | 6.87 | 7.39 | 7.38 | 5.83 | 9.03 | 9.41 | 5.86 | 4.00 | 8.20 |

Total asset turnover (times) | 0.91 | 0.92 | 0.89 | 0.91 | 0.91 | 0.95 | 0.95 | 0.86 | 0.76 | 0.87 |

Leverage (times) | 1.28 | 1.30 | 1.31 | 1.30 | 1.41 | 1.48 | 1.38 | 1.35 | 1.41 | 1.56 |

The ROE of the company recovered to its target of 10% or more for the first time in three terms in the fiscal year ended December 2021. It is aiming for an operating profit margin of 15% or more in its Mid-term Management Plan 2024. Under this aim, it will promote cost efficiencies and a transformation from selling goods to selling things with the aim of reliably improving its ROE and maintaining it to at least 10%.

1-5 Efforts on ESG

The company believes that building a relationship of trust with a wide range of stakeholders is essential for improving corporate value and has posted 「ESG information」(https://www.optexgroup.co.jp/en/esg/stakeholder.html)on its website to further enhance ESG information disclosure. In addition, Published the ESG Bridge Report through Investment Bridge Inc.

The company identify the materiality for sustainable growth for the first time, and mention the challenges and initiatives for the future in the report.

https://www.bridge-salon.jp/report_bridge/archives/eng/6914/20220531.html

2. First quarter of Fiscal Year Ending December 2022 Earnings Results

(1) Business Results

| 1Q of FY 12/21 | Ratio to sales | 1Q of FY 12/22 | Ratio to sales | YoY |

Sales | 10,974 | 100.0% | 13,901 | 100.0% | +26.7% |

Gross profit | 5,808 | 52.9% | 7,069 | 50.9% | +21.7% |

SG&A | 4,482 | 40.8% | 4,949 | 35.6% | +10.4% |

Operating profit | 1,326 | 12.1% | 2,120 | 15.3% | +59.8% |

Ordinary profit | 1,582 | 14.4% | 2,431 | 17.5% | +53.7% |

Quarterly Net Profit | 1,057 | 9.6% | 1,743 | 12.5% | +64.8% |

*Unit: million yen. The Quarterly Net profit is the quarterly profit attributable to owners of the parent company. The same shall apply hereinafter.

Sales and profit increased.

Sales grew 26.7% year on year to 13,901 million yen. In addition to the expansion of the existing businesses, mainly SS business and IA business, Mitsutec, which became a subsidiary in the previous term also contributed to the sales. Exchange rates increased sales by about 400 million yen. Operating profit was 2,120 million yen, up 59.8% year on year. Through the acquisition of Mitsutec as a subsidiary, gross profit margin declined by 2.0 point, but gross profit rose by 21.7% thanks to the sales growth. The augmentation of SG&A was absorbed and operating profit rose by 3.2 points.

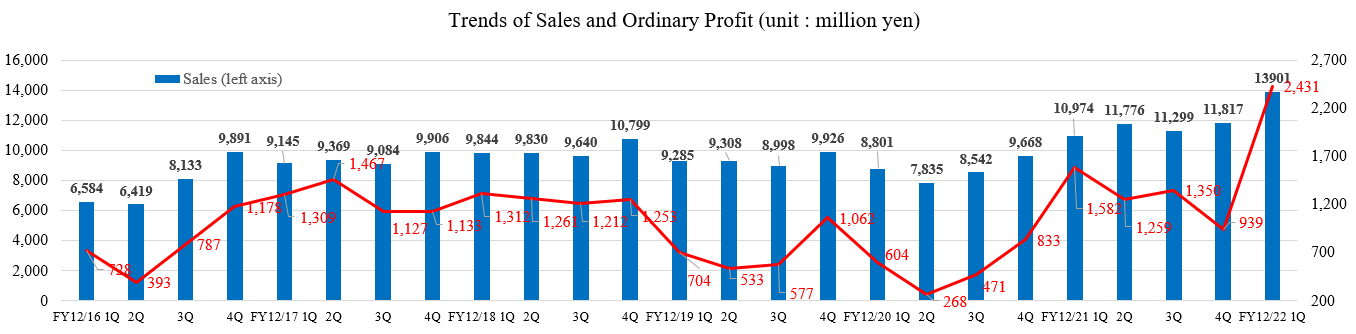

◎Trends in each quarter

◎Regional trends

| 1Q of FY 12/21 | Ratio to sales | 1Q of FY 12/22 | Ratio to sales | YoY |

Consolidated Sales | 10,974 | 100.0% | 13,901 | 100.0% | +26.7% |

Domestic | 5,298 | 48.3% | 6,772 | 48.7% | +27.8% |

Overseas | 5,676 | 51.7% | 7,129 | 51.3% | +25.6% |

America | 1,140 | 10.4% | 1,592 | 11.5% | +39.6% |

Europe | 3,036 | 27.7% | 3,781 | 27.2% | +24.5% |

Asia | 1,500 | 13.7% | 1,756 | 12.6% | +17.1% |

*Unit: million yen.

Sales increased both in Japan and overseas. The sales of the America rose about 40%.

◎Average exchange rate

| 1Q of FY 12/21 | 1Q of FY 12/22 |

USD | ¥105.90 | ¥116.20 |

EURO | ¥127.69 | ¥130.39 |

(2) Earnings by Segment

①Trends in each segment

| 1Q of FY 12/21 | Ratio to sales | 1Q of FY 12/22 | Ratio to sales | YoY |

SS Business | 4,898 | 44.6% | 5,654 | 40.7% | +15.4% |

IA Business | 5,806 | 52.9% | 7,973 | 57.4% | +37.3% |

EMS Business | 156 | 1.4% | 177 | 1.3% | +13.5% |

Others | 113 | 1.0% | 96 | 0.7% | -15.0% |

Sales | 10,974 | 100.0% | 13,901 | 100.0% | +26.7% |

SS Business | 696 | 14.2% | 856 | 15.1% | +23.0% |

IA Business | 735 | 12.7% | 1,358 | 17.0% | +84.8% |

EMS Business | 22 | 14.1% | 2 | 1.1% | -90.9% |

Others | -18 | - | -26 | - | - |

Adjustments | -109 | - | -71 | - | - |

Operating profit | 1,326 | 12.1% | 2,120 | 15.3% | +59.8% |

*Unit: million yen. Ratio to sales of Operating profit refers to Sales Profit margin.

②Trends in each segment and region

| 1Q of FY 12/21 | Ratio to sales | 1Q of FY 12/22 | Ratio to sales | YoY |

SS: Security | 3,274 | 100.0% | 3,808 | 100.0% | +16.3% |

Japan | 649 | 19.8% | 591 | 15.5% | -8.9% |

AMERICAs | 578 | 17.7% | 832 | 21.8% | +43.9% |

EMEA | 1,778 | 54.3% | 2,118 | 55.6% | +19.1% |

Asia・Oceania | 269 | 8.2% | 267 | 7.0% | -0.7% |

|

|

|

|

|

|

SS: Automatic door | 1,089 | 100.0% | 1,230 | 100.0% | +12.9% |

Japan | 560 | 51.4% | 575 | 46.7% | +2.7% |

AMERICAs | 261 | 24.0% | 334 | 27.2% | +28.0% |

EMEA | 241 | 22.1% | 289 | 23.5% | +19.9% |

Asia・Oceania | 27 | 2.5% | 32 | 2.6% | +18.5% |

|

|

|

|

|

|

IA:FA | 2,106 | 100.0% | 2,710 | 100.0% | +28.7% |

Japan | 912 | 49.2% | 1,193 | 49.7% | +30.8% |

AMERICAs | 39 | 25.9% | 48 | 25.2% | +23.1% |

EMEA | 523 | 21.9% | 688 | 21.8% | +31.5% |

Asia・Oceania | 632 | 2.9% | 781 | 3.2% | +23.6% |

|

|

|

|

|

|

IA:MVL | 2,723 | 100.0% | 3,413 | 100.0% | +25.3% |

Japan | 1,496 | 54.9% | 1,834 | 53.7% | +22.6% |

AMERICAs | 256 | 9.4% | 375 | 11.0% | +46.5% |

EMEA | 494 | 18.1% | 686 | 20.1% | +38.9% |

Asia・Oceania | 477 | 17.5% | 518 | 15.2% | +8.6% |

|

|

|

|

|

|

IA:IPC | 977 | 100.0% | 1,304 | 100.0% | +33.5% |

Japan | 971 | 99.4% | 1,301 | 99.8% | +34.0% |

AMERICAs | 6 | 0.6% | 3 | 0.2% | -50.0% |

|

|

|

|

|

|

IA:MECT | 0 | - | 546 | 100.0% | - |

Japan | 0 | - | 519 | 95.1% | - |

Asia・Oceania | 0 | - | 27 | 4.9% | - |

|

|

|

|

|

|

EMS | 157 | 100.0% | 178 | 100.0% | +13.4% |

Japan | 103 | 65.6% | 86 | 48.3% | -16.5% |

AMERICAs | 0 | 0.0% | 0 | 0.0% | - |

Asia・Oceania | 54 | 34.4% | 92 | 51.7% | +70.4% |

*Unit: million yen.

◎SS Business

Sales and profits increased.

(Security sensor segment)

Sales increased.

*Japan | Sales decreased. While sales of products for large-scale critical facilities were strong, sales of outdoor intrusion detectors were sluggish due to delays in product supply because of the shortage of parts |

*AMERICAs | Sales grew. Due to the direct marketing effect, sales of products for large-scale critical facilities such as infrastructure were strong. There was also a last-minute surge in demand before the product price hike. |

*EMEA | Sales increased. Due to the direct marketing effect, sales of products for large-scale critical facilities such as data centers were strong. Like in the AMERICAs, there was a last-minute surge in demand before the product price increase. |

*Asia・Oceania | Sales declined. Sales of outdoor intrusion detectors were strong in India, but sales in China and Southeast Asia were sluggish due to activity restrictions. |

(Automatic door sensor segment)

Sales increased.

*Japan | Sales increased. Market conditions continued to recover, and sales to major automatic door manufacturers were strong. |

*AMERICAs | Sales increased. Although there were delays in product supply due to a shortage of parts, sales to major North American automatic door manufacturers were strong. |

*EMEA | Sales increased. Although there were delays in product supply due to a shortage of parts, sales to major European automatic door manufacturers were strong. |

◎IA Business

Sales and profits increased.

(FA segment)

Sales increased.

*Japan | Sales increased. Sales to the food industry and investments related to electricity, electronics, and semiconductors were strong. |

*EMEA | Sales increased. Sales of displacement sensors for electronic components were strong. |

*Asia・Oceania | Sales increased. Sales of displacement sensors were strong in China due to capital investment demand for semiconductors, electronic components, and rechargeable batteries. |

(MVL segment)

Sales increased.

*Japan | Sales increased. Sales to electricity, electronics, and semiconductor-related customers were strong. |

*AMERICAs | Sales increased. Sales of continued projects for the North American medical industry were strong. Sales to the logistics industry were also solid. |

*EMEA | Sales increased. Sales of the French subsidiary were strong. |

*Asia・Oceania | Sales increased. Sales for semiconductor-related investments were strong in China. |

(IPC segment)

Sales increased.

*Japan | Sales increased. Sales of industrial PCs for semiconductor manufacturing equipment were strong. |

(3) Financial Conditions

◎Main BS

| End of Dec.2021 | End of Mar.2022 | Increase/ decrease |

| End of Dec.2021 | End of Mar.2022 | Increase/ decrease |

Current Assets | 42,544 | 44,897 | +2,353 | Current liabilities | 18,562 | 18,953 | +391 |

Cash | 17,120 | 16,816 | -304 | Payables | 2,589 | 3,117 | +528 |

Receivables | 10,444 | 12,203 | +1,759 | ST Interest Bearing Liabilities | 10,684 | 11,307 | +623 |

Inventories | 11,635 | 12,128 | +493 | Noncurrent liabilities | 3,846 | 4,091 | +245 |

Noncurrent Assets | 15,224 | 15,342 | +118 | LT Interest Bearing Liabilities | 210 | 480 | +270 |

Tangible Assets | 6,993 | 7,102 | +109 | Net defined benefit liabilities | 1,366 | 1,374 | +8 |

Intangible Assets | 3,204 | 3,192 | -12 | Liabilities | 22,408 | 23,044 | +636 |

Investment, Others | 5,026 | 5,048 | +22 | Net Assets | 35,360 | 37,195 | +1,835 |

Total assets | 57,769 | 60,240 | +2,471 | Total Liabilities and Net Assets | 57,769 | 60,240 | +2,471 |

*Unit: million yen

Total assets increased 2,471 million yen from the end of the previous term to 60,240 million yen, due to the growth of receivables, inventories, etc.

Total liabilities went up 636 million yen from the end of the previous term to 23,044 million yen, due to an increase in interest bearing liabilities, etc.

Net assets were 37,195 million yen, up 1,835 million yen from the end of the previous term, due to an increase in retained earnings, etc.

The equity ratio was 61.2%, up 0.5 point from the end of the previous fiscal year.

(4) Topics

① OPTEX Co., Ltd. was certified as a DX Business Operator by the Ministry of Economy, Trade and Industry

In April 2022, OPTEX Co., Ltd. was certified as a DX Business Operator by the Ministry of Economy, Trade and Industry. OPTEX received this certification as it is highly evaluated for its management vision, business strategy, DX promotion system, and other efforts meeting the certification criteria based on the DX promotion index of the Ministry of Economy, Trade and Industry and for appropriately disclosing information to stakeholders.

OPTEX has improved its management base and promoted DX for a long period of time to respond swiftly to rapidly changing social conditions.

Business Model Transformation (Business DX), Global Business Reform (Inner DX), and Strengthening of Human Resources are their three pillars of DX promotion.

Most recently, the company has released the following solutions and services in Business DX:

◎ Cloud-based security monitoring system GENIO Map Cloud for Southeast Asia

The company developed the world's first cloud-based real-time security monitoring platform for consumers. It is a low-priced, full-featured, all-in-one solution that allows you to easily manage security workflows for alarm monitoring and management in gated communities and small and medium-sized businesses such as factories and warehouses. It targets Thailand, Vietnam, Malaysia, and Indonesia.

◎ WATER it Data Management Service that brings digital transformation to water quality management

This service was developed as a DX of water quality control by utilizing OPTEX's sensing and IoT technologies to reduce on-site workloads significantly. The service achieves remote and real-time water quality management in local governments and factory facilities. Another feature of this service is that it can be linked with sensors that have already been installed on-site, making it easy to introduce at a low cost.

② Improved the domestic system of the security-related SS Business

There were two domestic bases for the security-related SS Business in Tokyo and Shiga (headquarters). However, since 2021, the company has expanded to four bases in Fukuoka, Sendai, Nagoya, and Osaka.

Focusing on large-scale critical facilities such as electric power and airport-related facilities, the company has enhanced sales and service operations to respond promptly to customer requests.

By strengthening the sales system, the company aims to achieve double-digit growth in the domestic security-related business.

3. Fiscal Year Ending December 2022 Earnings Forecasts

(1) Earnings forecast

| FY 12/21 | Ratio to sales | FY 12/22 Est. | Ratio to sales | YoY | Rate of progress |

Sales | 45,866 | 100.0% | 53,000 | 100.0% | +15.6% | 26.2% |

Operating Profit | 4,630 | 10.1% | 6,000 | 11.3% | +29.6% | 35.3% |

Ordinary Profit | 5,130 | 11.2% | 6,100 | 11.5% | +18.9% | 39.9% |

Net Profit | 3,762 | 8.2% | 4,600 | 8.7% | +22.3% | 37.9% |

*Unit: million yen. Rate of progress is the progress against the full-year forecast.

No change in earnings forecast, Sales and profit expected to increase

There are no revisions to the earnings forecast. The supply-demand balance for parts continues to be tight, and the procurement side of the business remains extremely uncertain. The forecasts for the fiscal year ending December 2022 are for sales to be up 15.6% year-on-year to 53 billion yen and operating profit to be up 29.6% year-on-year to 6 billion yen. Sales are expected to increase in all segments and all regions. The impact of parts shortages and other uncertainties remains. Nevertheless, the company will reliably capture demand in each business. It will also revise its prices while obtaining the understanding of its customers. The company plans to increase its dividend payment year-on-year by 6 yen per share to 36.00 yen per share. Its expected dividend payout ratio is 28.3%.

◎Regional trends

| FY 12/21 | Ratio to sales | FY 12/22 Est. | Ratio to sales | YoY | Rate of progress |

Consolidated sales | 45,866 | 100.0% | 53,000 | 100.0% | +15.6% | 26.2% |

Domestic | 21,157 | 46.1% | 25,568 | 48.2% | +20.8% | 26.5% |

International | 24,709 | 53.9% | 27,432 | 51.8% | +11.0% | 26.0% |

AMERICAs | 5,381 | 11.7% | 5,933 | 11.2% | +10.3% | 26.8% |

Europe | 12,965 | 28.3% | 14,461 | 27.3% | +11.5% | 26.1% |

Asia | 6,363 | 13.9% | 7,038 | 13.3% | +10.6% | 25.0% |

*Unit: million yen. The cells with year-on-year sales growth rates exceeding 15.6% (company-wide sales growth rate) and company-wide sales progress rate of more than 26.2%. are colored.

(2) Trends in each segment

①Sales of each segment

| FY 12/21 | Ratio to sales | FY 12/22 Est. | Ratio to sales | YoY | Rate of progress |

SS Business | 20,164 | 44.0% | 21,984 | 41.5% | +9.0% | 25.7% |

IA Business | 24,409 | 53.2% | 29,489 | 55.6% | +20.8% | 27.0% |

EMS Business | 756 | 1.6% | 873 | 1.6% | +15.5% | 20.3% |

Others | 534 | 1.2% | 654 | 1.2% | +22.5% | 14.7% |

Consolidated sales | 45,866 | 100.0% | 53,000 | 100.0% | +15.6% | 26.2% |

*Unit: million yen. The cells with year-on-year sales growth rates exceeding 15.6% (company-wide sales growth rate) and company-wide sales progress rate of more than 26.2%. are colored.

②Trends in each segment and region

| FY 12/21 | Ratio to sales | FY 12/22 Est. | Ratio to sales | YoY | Rate of progress |

SS: Security | 13,653 | 100.0% | 14,947 | 100.0% | +9.5% | 25.5% |

Japan | 2,465 | 18.1% | 2,779 | 18.6% | +12.7% | 21.3% |

AMERICAs | 2,811 | 20.6% | 3,062 | 20.5% | +8.9% | 27.2% |

EMEA | 7,044 | 51.6% | 7,678 | 51.4% | +9.0% | 27.6% |

Asia | 1,333 | 9.8% | 1,428 | 9.6% | +7.1% | 18.7% |

|

|

|

|

|

|

|

SS: Automatic door | 4,443 | 100.0% | 4,818 | 100.0% | +8.4% | 25.5% |

Japan | 2,186 | 49.2% | 2,395 | 49.7% | +9.6% | 24.0% |

AMERICAs | 1,152 | 25.9% | 1,215 | 25.2% | +5.5% | 27.5% |

EMEA | 975 | 21.9% | 1,052 | 21.8% | +7.9% | 27.5% |

Asia | 130 | 2.9% | 156 | 3.2% | +20.0% | 20.5% |

|

|

|

|

|

|

|

IA:FA | 9,711 | 100.0% | 10,364 | 100.0% | +6.7% | 26.1% |

Japan | 4,389 | 45.2% | 4,363 | 42.1% | -0.6% | 27.3% |

AMERICAs | 143 | 1.5% | 189 | 1.8% | +32.2% | 25.4% |

EMEA | 2,621 | 27.0% | 3,034 | 29.3% | +15.8% | 22.7% |

Asia | 2,558 | 26.3% | 2,778 | 26.8% | +8.6% | 28.1% |

|

|

|

|

|

|

|

IA:MVL | 11,364 | 100.0% | 12,717 | 100.0% | +11.9% | 26.8% |

Japan | 5,881 | 51.8% | 6,405 | 50.4% | +8.9% | 28.6% |

AMERICAs | 1,233 | 10.9% | 1,452 | 11.4% | +17.8% | 25.8% |

EMEA | 2,325 | 20.5% | 2,697 | 21.2% | +16.0% | 25.4% |

Asia | 1,925 | 16.9% | 2,163 | 17.0% | +12.4% | 23.9% |

|

|

|

|

|

|

|

IA:IPC | 3,334 | 100.0% | 3,781 | 100.0% | +13.4% | 34.5% |

Japan | 3,294 | 98.8% | 3,766 | 99.6% | +14.3% | 34.5% |

AMERICAs | 40 | 1.2% | 15 | 0.4% | -62.5% | 20.0% |

|

|

|

|

|

|

|

IA:MECT | 0 | - | 2,627 | 100.0% | - | 20.8% |

| 0 | - | 2,627 | 100.0% | - | 19.8% |

| 0 | - | 0 | - | - | - |

|

|

|

|

|

|

|

EMS | 757 | 100.0% | 873 | 100.0% | +15.3% | 20.4% |

Japan | 529 | 69.9% | 623 | 71.4% | +17.8% | 13.8% |

AMERICAs | 2 | 0.3% | 0 | 0.0% | - | - |

Asia | 226 | 29.9% | 250 | 28.6% | +10.6% | 36.8% |

*Unit: million yen. The cells with year-on-year sales growth rates exceeding 15.6% (company-wide sales growth rate) and company-wide sales progress rate of more than 26.2%. are colored.

4. Conclusion

Although parts shortages continue, the gross profit margin declined by 2.0 percentage points as the company considers the provision of products to be its top priority to maintain relationships of trust with its customers. However, even excluding Mitsutec's contribution, net sales increased approximately 20%, firmly capturing demand. In addition, appropriate control of SG&A expenses resulted in a significant increase in profit.

While it is widely believed that the parts shortage situation will continue at least through the end of this year, it will be interesting to see whether the company can maintain its "sales and profit growth" in the second quarter and beyond, despite the impact of the rising cost of sales.

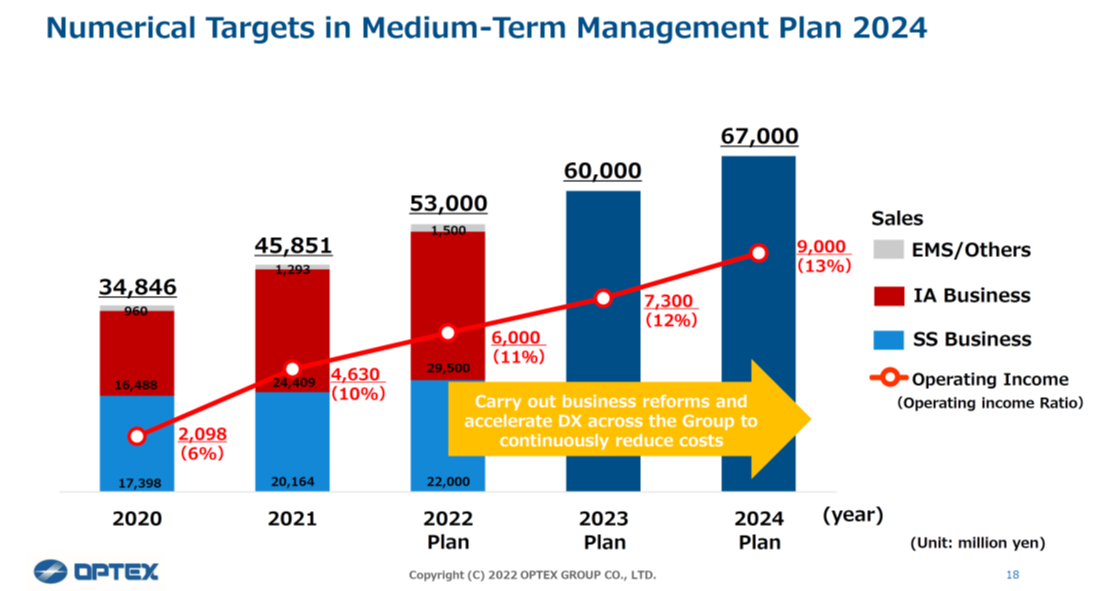

<Reference 1:Mid-term Management Plan 2024>

(1) Overview of the Mid-term Management Plan 2024

The company is aiming for operating profit of at least 10 billion yen and an operating profit margin of 15% in 2025 under its group corporate philosophy of “aim to be a corporate group brimming with a venture spirit.”

It believes that promoting the optimization of costs is an important issue.

(taken from the company’s material)

(2) Strategy for target achievement

The three prongs of its strategy are “growth of existing businesses,” “growth of companies acquired,” and “synergy with companies acquired.”

① Growth of existing businesses: Provide system solutions

*SS Business:Security Sensor segment

The company will expand sales of its image verification solutions in the United States and Europe. It will provide not only sensors but systems as well.

*SS Business: Automatic Door Sensor Segment

The company will expand its Data Service Business using its advantage of occupying 50% of the domestic market.

The company launched a sharing service, OMNICITY, in February, 2021.

*IA Business:FA segment

The company will further promote collaboration with SICK AG, which is the world top sensor manufacturer, to provide systems that enable remote monitoring and predictive maintenance. It will contribute to converting factories to the IoT.

*IA Business (Machine Vision Lighting (MVL) segment)

The company proposes comprehensive solutions by using AI and robots to cultivate data in the field of visual inspection that is currently performed with the human eye.

② Growth of companies acquired: Main businesses of companies acquired through M&As expand with favorable conditions in the market environment

*IA Business: Sanritz Automation

Embedded boards that control semiconductor manufacturing devices, medical equipments, and other products are indispensable parts.

Sanritz Automation has been highly praised for its environmental resistance, noise resistance, and long-term supply capabilities (long-term ongoing support and maintenance). It will now aim to further expand sales in the future.

*IA Business: Mitsutec

Mitsutec has been involved in rechargeable battery manufacturing devices since its establishment. As a system integrator of factory automation, it utilizes advanced mechatronic technologies and image processing technologies in battery manufacturing devices and other products that are indispensable for a decarbonized society.

It aims to expand sales of rechargeable battery manufacturing devices that are expected to grow significantly in electric vehicles and other fields using its high-speed and high-precision filling technologies, high-speed transportation technologies, and other advanced mechatronic technologies.

③ Synergy with companies acquired

*Sanritz Automation

Sanritz Automation handles parking lot management, important facility surveillance cameras, and more in addition to traffic control (ETC).

The company believes it will be able to create great synergies by promoting system sales that utilize the strengths of each party together with the SS business (security-related) of the OPTEX Group (e.g., automobile license plate management and surveillance cameras).

*Mitsutec

Mitsutec is active as a system integrator in factory automation for various industrial fields. It has many customers. However, it does not manufacture or sell sensors or cameras on its own.

Accordingly, the company believes it will be able to generate synergies by partnering it with its IA business to provide cameras, LED lighting, various measuring instruments, and other products according to the issues of customers and then building and providing image processing inspection systems that combine those.

*CCS

CCS promotes business accompanying OPTEX FA. It has excellent customers in the electricity, electronics and semiconductor industries. It has been efficiently expanding sales channels that could not be cultivated by OPTEX FA alone before now.

(3) Management indicators

The company has stated that its management indicators are a sales growth rate of 10%, an operating profit margin of at least 15%, and an ROE of at least 10%.

The profit margins of Sanritz Automation and Mitsutec are not as high as that of the OPTEX Group. Therefore, the company expects its operating profit margin for the fiscal year ending December 2024 – the final fiscal year of its mid-term management plan – to remain at 13%. It will work to expand systems solutions in its existing businesses and to improve profitability over the entire group by promoting cost optimization.

<Reference 2: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 11directors, including 4 outside ones |

◎Corporate Governance ReportThe latest revision date: March 28, 2022

<Fundamental concept>

As the Group, we recognize that it is our greatest mission to continuously improve corporate value while earning the trust of our shareholders, investors, customers and society. To practice it, we consider enhancement of the corporate governance as one of important management tasks and aim to improve the transparency of management, maintain management systems accompanying fair and prompt decision making and strengthen management monitoring function.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code >

We state this based on the code revised in June 2021. (This includes content for the Prime Market that will apply from April 4, 2022 onward).

[Supplementary Principle 3-1-3. Sustainability Initiatives]

The Group’s initiatives are posted in “3. Issues, Materialities, and Initiatives” in the ESG Report on our website (https://www.optexgroup.co.jp/shareholder/library/index.html#esgreport).

However, the company is currently forming a project team to start studying the quality and quantity of internationally established disclosure methods and equivalent disclosures.

[Supplementary Principle 4-2-2. Basic Policy for the Sustainability of Our Company]

The Group’s initiatives are posted in “3. Issues, Materialities, and Initiatives” in the ESG Report on our website (https://www.optexgroup.co.jp/shareholder/library/index.html#esgreport).

However, the company is currently forming a project team to start studying the formulation of a system and the basic policy regarding sustainability from the perspective of improving corporate value over the medium to long term.

<Disclosures Based on the Principles in the Corporate Governance Code (Excerpt)>

[Principle 1-4. Cross-shareholdings]

The Company acquires and possesses cross-shareholdings upon deliberations and a resolution by the Board of Directors only when it is determined that it will contribute to strengthening business relationships and increasing corporate value in the Group’s business strategy. In addition, the Board of Directors verifies the significance of the shares we held every year. If it determines that the reasonable value sought is poor, we will strive to sell and reduce that holding in consideration of market trends and other factors.

Cross-shareholdings held by the Company at present: 54 million yen in one company (Amount on the balance sheet for December 31, 2021)

The Company makes a comprehensive judgement to determine the advisability of exercising the voting rights for the shares we hold. We individually examine this based on whether doing so will contribute to the sustainable growth and improvement of mid- to long-term corporate value improvement of that company and whether doing so will significantly harm shareholder value.

[Supplementary Principle 2-4-1. Ensuring Diversity in the Promotion of Core Personnel]

The concept of our corporate group since the business start-up has been "a desire to be a company in which self-actualization is possible for employees with the company serving as the stage for that." Under this desire, we have focused on creating an environment so that employees themselves can make the stages of their lives full of changes and inspiration without discriminating between men and women, nationalities, and between new employees fresh out of college and mid-career hires.

The status of employees of our domestic group companies (12 companies including our company) is as follows.

- Male / female rati Male : Female = 77% : 23%

- Ratio of mid-career hires: 62%

- Ratio of foreign employees: 2%

- Male-female ratio of managers: Male : Female = 97% : 3%

- Ratio of mid-career hires among managers: 64%

As mentioned above, due to the characteristics of the Group's business areas and business content, there are potentially few female and foreign employees, and their percentage among managers is not high at present.

On the other hand, more than 60% of mid-career hires have been promoted to managerial positions showing that we recognize that diverse human resources with various experiences and skills shall occupy the core of management.

In addition, our corporate group has consolidated subsidiaries worldwide. Thus, we believe that we have sufficiently ensured the diversity of our corporate group as a whole, including these subsidiaries.

We will consider the features of each operating company in each business area and continue to actively promote and review the environment to fully demonstrate the capabilities of each employee to secure more diversity of employees.

[Principle 5-1. Policy on Constructive Dialogue with Shareholders]

The Company has established an public relations・IR Department. The IR Department strives to provide easy-to-understand explanations about our management policies and business conditions to engage in positive and constructive dialogue with our shareholders. In addition, the President, the responsible officer, and IR personnel give briefings for institutional investors and briefings for private investors on a planned basis. We respond to requests for meetings with institutional investors as the occasion calls.

We establish a venue to allow the attendance of diverse shareholders at our ordinary general meeting of shareholders. We then hold a shareholder briefing and a shareholder social gathering to obtain understanding for our future policies after the end of that meeting.

*We canceled the shareholder social gathering at the 43rd Ordinary General Meeting of Shareholders from the perspective of preventing the spread of the novel coronavirus.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |