Bridge Report:(7199)Premium Group Fiscal year ended March 2021

President and CEO Yohichi Shibata | Premium Group Co., Ltd. (7199) |

|

Company Information

Market | TSE 1st Section |

Industry | Other financial business (finance and insurance) |

President and CEO | Yohichi Shibata |

HQ Address | 19th Floor, The Okura Prestige Tower, 2-10-4, Toranomon, Minato-ku, Tokyo |

Year-end | March |

Homepage |

Stock Information

Share Price | Share Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥3,140 | 13,334,390 shares | ¥41,869 million | 38.3% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥50.00 | 1.6% | ¥186.99 | 16.8x | ¥563.12 | 5.6x |

*The share price is the closing price on May 28, 2021. Each number is based on the results in the Fiscal year ended March 2021.

Consolidated Earnings Trends (IFRS)

Fiscal Year | Operating Income | Pretax profit | Net Income | Profit attributable to owners of parent | EPS (¥) | DPS (¥) |

March 2018 (Act.) | 9,065 | 1,979 | 1,293 | 1,293 | 107.44 | 85.00 |

March 2019 (Act.) | 10,759 | 2,097 | 1,391 | 1,388 | 113.08 | 85.00 |

March 2020 (Act.) | 14,016 | 2,604 | 1,452 | 1,466 | 112.33 | 44.00 |

March 2021 (Act.) | 17,825 | 3,463 | 2,393 | 2,383 | 186.74 | 46.00 |

March 2022 (Est.) | 21,446 | 3,500 | 2,400 | 2,409 | 186.99 | 50.00 |

*The forecast is from the company. Unit: million yen, yen. In August 2017, a 100-for-1 stock split was conducted. In April 2019, a 2-for-1 stock split was conducted. (EPS is revised retroactively.)

This Bridge Report reviews the overview of Premium’s earnings results of the fiscal year ended March 2021, earnings estimate for fiscal year March 2022 and Medium-term Management plan “VALUE UP 2023” etc.

Table of Contents

Key Points

1.Company Overview

2.Fiscal Year ended March 2021 Earnings Results

3.Fiscal Year ending March 2022 Earnings Forecasts

4. Overview of Medium-term Management plan “VALUE UP 2023”

5.Conclusions

<Reference: Corporate Governance>

Key Points

- Operating income in the term ended March 2021 was 17,825 million yen, up 27.2% year on year. The impact of the novel coronavirus on sales of automobiles was not as enormous as it was anticipated and the company made a recovery in its business performance toward the second half of the term, allowing sales in both the Finance Business and the Automobile Warranty Business to improve. Pretax profit rose 33.0% year on year to 3,463 million yen. Both operating income and profit exceeded the forecast.

- For the term ending March 2022, operating income and pretax profit are estimated at 21,446 million yen and 3,500 million yen, up 20.3% and 1.1% year on year, respectively. Pretax profit excluding temporary profit and loss is projected to increase 16.4% year on year. An interim dividend and a term-end dividend are both to be 25 yen per share, and an annual dividend will be 50 yen per share, up 4 yen per share year on year. The payout ratio will be 26.9%.

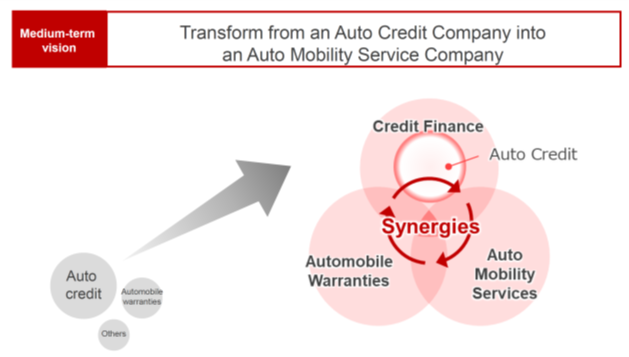

- While pressing ahead with VALUE UP 2023, a three-year medium-term management plan started in the term ended March 2021 and ending in the term ending March 2023, the company republished the reviewed plan on May 13, 2021, following changes in the business environment caused by the spread of the novel coronavirus. Believing that it is necessary not only to grow the existing businesses, but also to stimulate the used car market through management support for its direct clients, used car dealers and car maintenance shops, the company has outlined a medium-term vision of evolving from its conventional business model as an auto credit company whose major services are auto credit and warranties, into an auto mobility company building up a network with automobile dealers and maintenance shops through which it offers multifarious automobile-related services.

- The numerical goals that the company has set are operating income of 25.8 billion yen and pretax profit of 4.9 billion yen for the term ending March 2023 and operating income of 41.9 billion yen, pretax profit of 10 billion yen, and market capitalization of 175 billion – 200 billion yen for the term ending March 2025, the final year of the next medium-term vision.

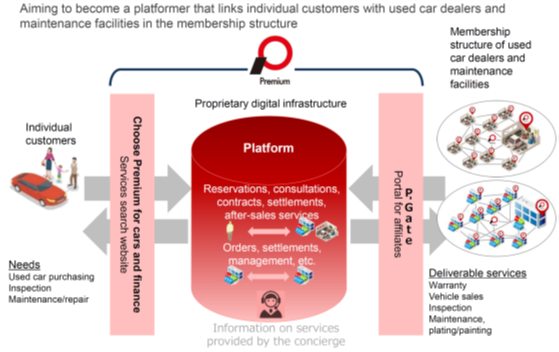

- While considering digital transformation (DX) that changes business models with the power of digital technologies and helps establish greater competitive superiority to be the highest-priority issue relating to its sustainable corporate growth, the company announced its DX strategies in May 2021. The company believes that mobility operators can increase their earning capacity and individual customers can utilize used cars safely and conveniently when the company’s platform related to distribution of used cars is used by its important clients, used car dealers and car maintenance shops, and individual customers of theirs. The Premium Group will establish its competitive superiority through this trinity innovation.

- This term, the company aims to improve the credit transaction volume, which went into the red in the previous term, by increasing the number of sales staff members and reducing the number of areas uncharted for marketing activities with the BIZ site method*. The credit transaction volume in the third and fourth quarters of the previous term exceeded those of the same period of the term before, and the company is steadily increasing the transaction volume this term as well with the amount in April growing by about 20% from the same month of the previous term. The company successfully expanded the transaction volume even under the second state of emergency issued this year, which means that its business performance is not likely to be affected negatively by the extension of the current state of emergency. We would like to wait for the company to deliver business results for the first quarter (April to June).*BIZ site method A marketing method of setting up bases in major cities and visiting target areas nearby as necessary, rather than opening branches in each region.

- From a more medium-term perspective, we would like to pay attention to how fast the company forms members-only organizations, PFS Premium Club and FIXMAN Club, which hold the key to the evolution into an auto mobility company as mentioned in the medium-term management plan, VALUE UP 2023. Progress with the DX strategies for offering the club members attractive added value is also a point to keep an eye on.

1. Company Overview

Premium Co., Ltd., which is the core enterprise operating the Financial Business, Premium Warranty Services Co., Ltd., the core enterprise conducting the Automobile Warranty Business, Premium Mobility Services Co., Ltd., the core enterprise offering Auto Mobile Services Business, and over 15 group companies inside and outside Japan provide automobile-related services, including Credit Finance services and Automobile Warranty services for the purchase of used cars.

Premium Group Co., Ltd. manages the corporate group and deals with accompanying and related tasks as a holding company.

【1-1. Corporate history】

Mr. Yohichi Shibata used to handle auto loans in a leading financing company, and believed in the high affinity between automobiles and finance and its growth potential.

He joined Gulliver International Corporation (current name: IDOM Inc.), which was his client company, following their request. In 2007, he established G-ONE Credit Services Co., Ltd., which is the predecessor of Premium Co., Ltd., a second-tier subsidiary of Gulliver International Cooperation, and started providing services.

However, the business environment surrounding Gulliver International Cooperation changed, and the business was discontinued, and its shareholders shifted to the SBI Group and the Marubeni Group.

In that situation, a desirable capital policy was actualized while maintaining the forte of “independence” from financial institutions, which is the greatest competitive advantage, based on the negotiation skill of President Shibata, and a holding company system was adopted with Premium Group Co., Ltd. being a holding company in 2016. Their business performance improved steadily with the rich product lineup as an independent corporate group and the advanced knowledge of auto finance, and the company was listed in the second section of Tokyo Stock Exchange (TSE) in 2017 and then in the first section of TSE in 2018.

【1-2. Corporate ethos】

(Missions)

Contribute to the construction of a prosperous society by providing top level financing and services to the world. |

By further improving our financing and services, and spreading them across the world, we will create a prosperous society. |

|

We will foster employees who are broadminded, have a positive outlook, and assiduously work their way towards creating results. |

We will not give up before we start by thinking we cannot do something, or something is not possible. We will promote innovation with creative ideas and great ambition, and forge ahead to the next step ourselves. |

The management policy is to improve corporate value in the medium/long term, by fulfilling the above missions and developing human resources who can take over these missions.

【1-3. Business description】

The corporate group provides clients, including used car dealers and car maintenance shops, with credit finance, automobile warranty, auto mobility services (such as the sale of auto parts and software for task management at maintenance shops, maintenance, and sheet-metal work of automobiles), etc. Also, in Thailand, Indonesia, and the Philippines, they offer credit finance, automobile warranty, and so on via overseas affiliates.

There is only the Credit-related Business as its business segment, but it is classified into the three businesses: Credit Finance, Automobile Warranty, and Auto Mobility, to disclose the revenue status of each business.

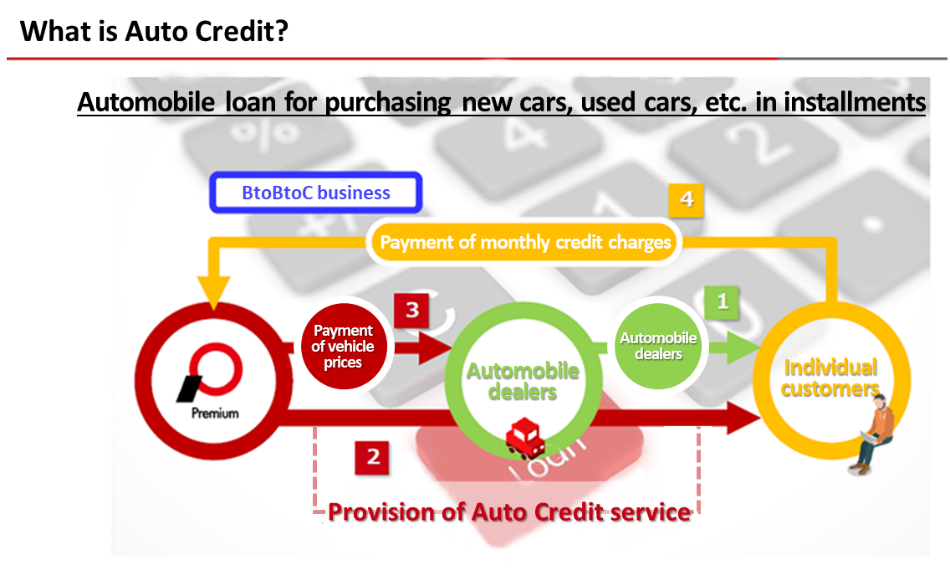

(1) Finance Business

As a business segment run by one of the company’s major subsidiaries, Premium Co., Ltd., the Finance Business provides services related not only to loans for purchasing automobiles (auto credit), but also to loans for purchasing photovoltaic power generation systems (ecology credit), shopping credit and such. The business also offers auto lease services targeting individual customers and debt recovery services on consignment.

(Taken from the reference material of the company)

Most of credit receivables are off-balance-sheet because they are affiliated loans with banks (which will be described below). For cases that do not satisfy the loan conditions of banks, such as the case in which the representatives of small and medium-sized enterprises purchase automobiles in corporate name and the case in which the total amount of credits exceeds a certain amount, the Premium Group’s own funds are used, and they are posted in balance sheets as receivables. Such receivables are from “out-of-pocket funds” differing from those from affiliated loans, but the commissions for installments paid by credit users and profit after deducting procurement costs are at almost the same level.

The financial guarantee contract posted in the credit side of the balance sheet represents future (unrealized) revenues of the credit business, and when credits are repaid, they are posted as operating income.

Its partner financial institutions are SBI Sumishin Net Bank, Ltd., ORIX Bank Corporation, Rakuten Bank, Ltd., and GMO Aozora Net Bank, Ltd.

For affiliated loans, Premium Co., Ltd. screens credit users, pays credit charges and sales promotion expenses to affiliated dealers, and receives credit charges from partner banks about 10 days later. The company serves as a co-signer for each credit contract, undertakes the task of collecting credit charges, and receives them as well as installment fees from credit users. As for receivables, trade credit insurance is taken out for most receivables, so even if some receivables become irrecoverable, they will be covered by the insurance, so as not to cause any loss to the company. Accordingly, the company posts insurance premiums as operating costs every term. The insurance premiums vary according to the number of irrecoverable receivables.

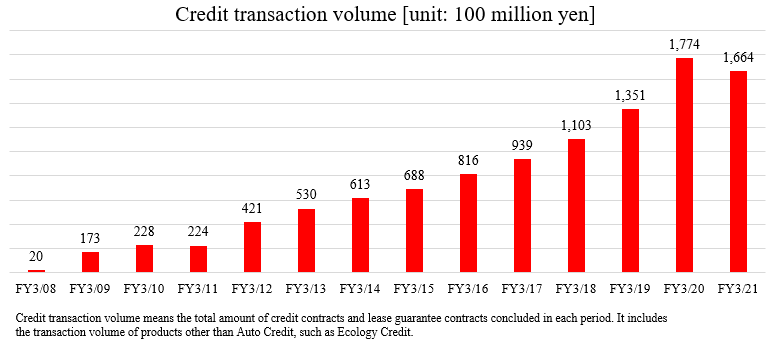

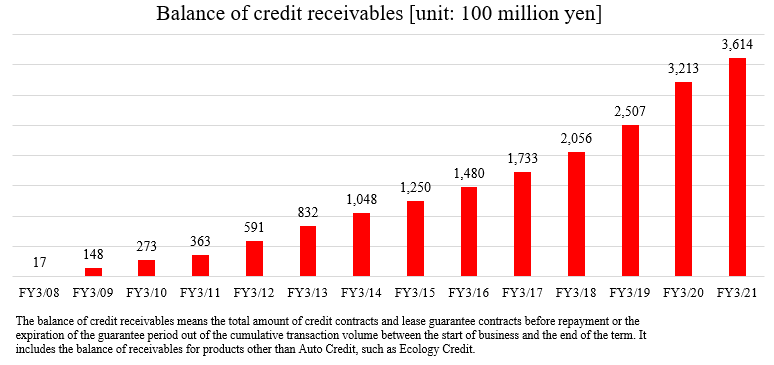

The sales of the term ended March 2021 was 166.4 billion yen, The balance of credit receivables as of the end of the same term was 361.4 billion yen. the ratio of delinquent receivables (over three months) as of the end of the term ended March 2021 was as low as 0.91%.

As a characteristic, the average balance of credit receivables for individuals is as small as 1.173 million yen and its risk has been dispersed.

For collecting receivables, the company approaches credit users early and utilizes SMS to minimize default cases and streamline the collection process. In April 2020, Central Servicer Corporation joined the Premium Group, boosting its capability of collecting receivables.

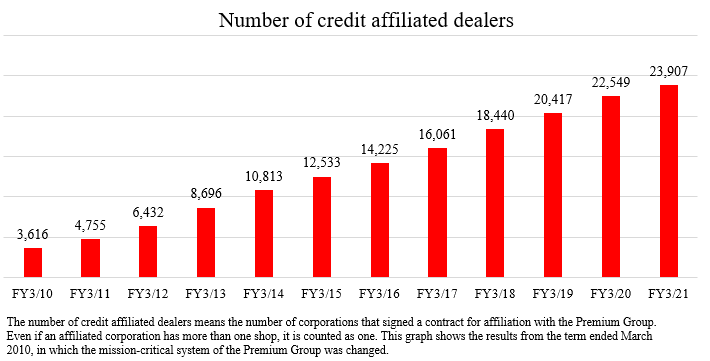

The number of affiliated dealers has been increasing steadily, standing at 23,907 as of the end of the term ended March 2021, up 6.0% year on year.

While seeking new affiliated dealers, the company is promoting other services, such as automobile warranty, targeting existing affiliated dealers, and concentrating on the improvement of utilization rate. In addition, the company is promoting dealers that are affiliated but not using their services to use its services by utilizing the contact center (outbound marketing).

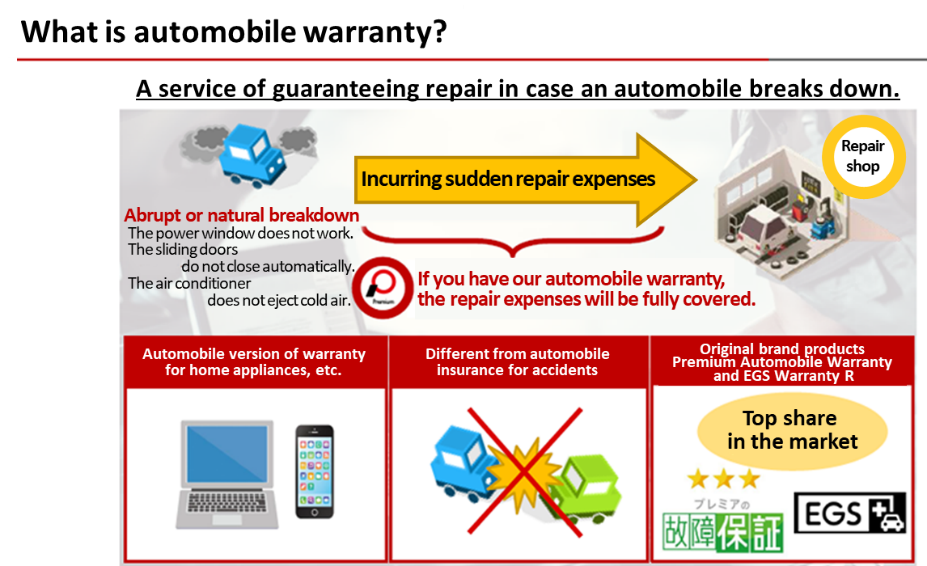

(2) Automobile Warranty Business

In a case where a credit user pays a warranty fee for this service when purchasing an automobile from an affiliated dealer (such as a used car dealer) of the Premium Group, he/she will be able to receive repair services free of charge within the predetermined coverage of the warranty if the purchased automobile breaks down.

(Taken from the reference material of the company)

Via affiliated dealers, the automobile warranty of Premium Warranty Services Co., Ltd. of the Premium Group is offered to those who have purchased an automobile. By accumulating and analyzing data on the broken-down cars’ travel distances, age, and detail of repairs, it is possible to design more appropriate warranties and prices. The Premium Group has designed products and set prices based on the accumulated big data on repairs, including about one million automobile warranty contracts held by Premium Warranty Services Co., Ltd.

While the insurance provided by non-life insurance companies covers accidents, etc., their automobile warranty covers natural breakdowns. Up to 397 parts can be covered by the warranty, and the company offers about 1,000 kinds of warranties with various coverages and periods. The automobile warranty dispels the anxiety over the purchase of used cars, and the company receives the automobile warranty fee in advance in one-time payment based on warranty period.

Automobile warranties are classified into their original brands, Premium Automobile Warranty and EGS Warranty, and their customized version, OEM Warranty.

The OEM Warranty is classified into Car Sensor After-sales Warranty, which is provided by the affiliates using the used car media, Car Sensor, published by Recruit Marketing Partners Co., Ltd., and covers the vehicles listed in Car Sensor, and other OEM Warranty in which target vehicles and coverages are customized for medium and large-sized used car dealers.

To deal with repairs, the company assigns employees who are qualified as auto technicians to call centers for accepting orders for repair, and they directly communicate with warranty beneficiaries and maintenance shops. Accordingly, automobile warranty can be applied accurately and swiftly. Thus, this system brings a sense of reassurance to warranty beneficiaries.

In addition, by appropriately applying automobile warranty, using recycled and rebuilt parts, owning directly managed maintenance shops, browsing FAINES*, and so on, they can reduce repair costs and prevent unnecessary repairs.

*FAINES

Information database on maintenance manuals, repair cases, etc. provided by Japan Automobile Service Promotion Association (JASPA) for car maintenance enterprises.

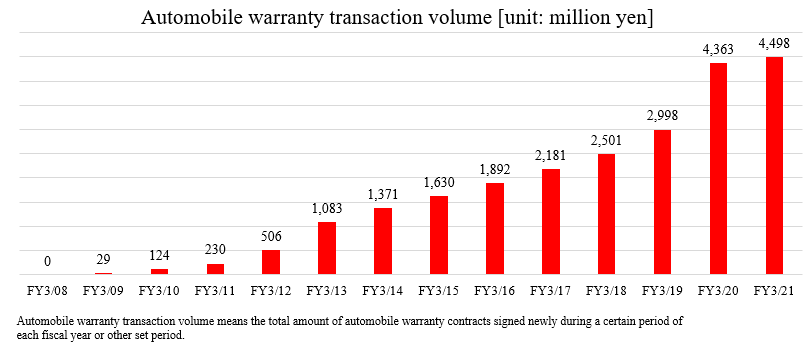

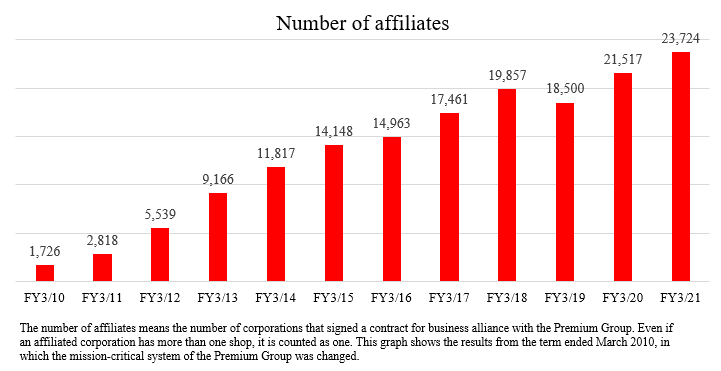

The volume of automobile warranty transactions in the term ended March 2021 stood at 4,498 million yen. The number of affiliated dealers and maintenance shops at the end of the term was 23,724.

The company is taking measures to encourage automobile dealers, including used car dealers, to use the automobile warranty service as it does to the dealers affiliated with the auto credit service.

(3) Auto Mobility Business

In addition to credit finance and automobile warranty, the company operates a broad range of businesses related to the distribution of used cars. Currently, the company operates recycled parts business which distributes parts of used cars, reuse business which distributes repossessed vehicles and uses them inside the Premium Group, and repair business which offers maintenance services for inspecting and repairing automobiles and sheet-metal services for repairing scratches, dents, etc. on automobiles. All of them are environmentally friendly, and the company focuses on these businesses as “new 3Rs.”

In addition, the company established an organization for fee-paying members targeting existing affiliated used car dealers and maintenance shops, and the company has built a growth strategy to become a platform provider by connecting the members to customers in the future and is already taking action for that.

(4) Regarding overseas business operation

The Premium Group applies the knowledge for credits, automobile warranty, maintenance, and sheet-metal work related to the sale of automobiles in Thailand, Indonesia, and the Philippines.

In Thailand, the company gives management and business consulting services to Eastern Commercial Leasing p.l.c., an equity-method affiliate conducting auto finance, and carries out automobile warranty and car maintenance businesses in Premium Services (Thailand) Co., Ltd., which is a joint venture with Eastern Commercial Leasing p.l.c. In Indonesia, PT Premium Garansi Indonesia, which is a joint venture with Sumitomo Corporation and the SinarMas Group, a local industrial conglomerate, offers consulting services about the development and design of automobile warranties. In the Philippines, Premium Warranty Services Philippines, Inc., which is a joint venture with Mitsui & Co., Ltd. and the GT Capital Group, a local industrial conglomerate, offers automobile warranties.

【1-4. Characteristics and strengths】

The competitiveness of the company is attributable to the following three points.

(1) Mixed product lineup achieved by their independency from banks

The services which the competitors under the umbrella of banks can offer are limited to auto credit, auto lease, etc. due to the restrictions of law. Meanwhile, the Premium Group, which is independent from banks, can provide various products and services, including automobile warranty, to meet a broad range of needs from dealers and users.

(2) Expertise in auto finance

Their profound technical knowledge of automobiles and finance makes it possible to offer unique fulfilling services.

As for automobiles, the company possesses data including the breakdown rate in the used car market, which are required for setting an appropriate warranty fee, and judgment for discerning whether prices of parts and repair charges are appropriate.

As for finance, the company possesses knowledge for checking the credibility of individuals and collecting receivables, and the company is deeply trusted by business partners based on plenty of technical knowledge accumulated through the specialization in auto credit.

(3) Firm marketing network covering the entire area of Japan

The marketing offices in each major city and original contact centers form a strong network with about 20,000 affiliates around Japan.

【1-5. ROE analysis】

| FY 3/2019 | FY 3/2020 | FY 3/2021 |

ROE (%) | 24.8 | 27.4 | 38.3 |

Net Income to Sales Ratio (%) | 12.90 | 10.46 | 13.37 |

Asset Turnover Ratio (x) | 0.27 | 0.28 | 0.28 |

Leverage (x) | 7.11 | 9.50 | 10.15 |

In the medium-term management plan, VALUE UP 2023, the target return on equity (ROE) is 31.7% for the term ending March 2023.

The company intends to maintain a ROE of 20% or higher while pursuing an optimum business portfolio and streamlined business operations through the promotion of DX.

2. Fiscal Year ended March 2021 Earnings Results

【2-1. Consolidated Earnings (IFRS)】

| FY 3/20 | Ratio to Operating Income | FY 3/21 | Ratio to Operating Income | YoY | Forecast 1 | Forecast 2 |

Operating Income | 14,016 | 100.0% | 17,825 | 100.0% | +27.2% | +4.0% | +3.0% |

Other Income | 2,110 | 15.1% | 694 | 3.9% | -67.1% | - | - |

Operating expenses | 12,458 | 88.9% | 14,857 | 83.3% | +19.3% | - | - |

Pretax profit | 2,604 | 18.6% | 3,463 | 19.4% | +33.0% | +20.9% | +4.9% |

Net Income | 1,452 | 10.4% | 2,393 | 13.4% | +64.8% | +26.5% | +10.3% |

Profit attributable to owners of parent | 1,466 | 10.5% | 2,383 | 13.4% | +62.6% | +25.8% | +10.8% |

*Unit: million yen. Forecast 1 and Forecast 2 are the percentage increase/decrease from the forecasts announced in August 2020 and February 2021, respectively.

Sales and profit increased, exceeding the revised forecast

Operating income was 17,825 million yen, up 27.2% year on year. The impact of the novel coronavirus on sales of automobiles was not as enormous as it was anticipated and the company made a recovery in its business performance toward the second half of the term, allowing sales in both the Finance Business and the Automobile Warranty Business to improve. Pretax profit rose 33.0% year on year to 3,463 million yen. Both operating income and profit exceeded the forecast.

Classification of operating expenses

| FY 3/20 | FY 3/21 | YoY | Factors driving change |

Guarantee Commission | 1,854 | 2,009 | +8.4% | The credit transaction volume increased (the balance of credit receivables grew). |

Warranty Cost | 2,421 | 2,616 | +8.1% | The Automobile Warranty Business was expanded. |

Personnel Expenses | 3,307 | 4,110 | +24.3% | The number of employees at the end of the term was 593 (up 111 from the end of the previous term). |

Right-of-use Asset Depreciation | 442 | 797 | +80.3% | Rent went up following the transfer of the headquarters. |

System Operation Cost/Outsourcing Expenses | 936 | 1,139 | +21.7% | - |

Commission Expenses | 811 | 862 | +6.2% | - |

Taxes and Dues | 576 | 658 | +14.2% | - |

Other Expenses | 2,032 | 2,667 | +31.3% | The company began recording the cost of parts (452 million yen) from this term. |

Total Operating Expenses | 12,458 | 14,858 | +19.3% | - |

*Unit: million yen.

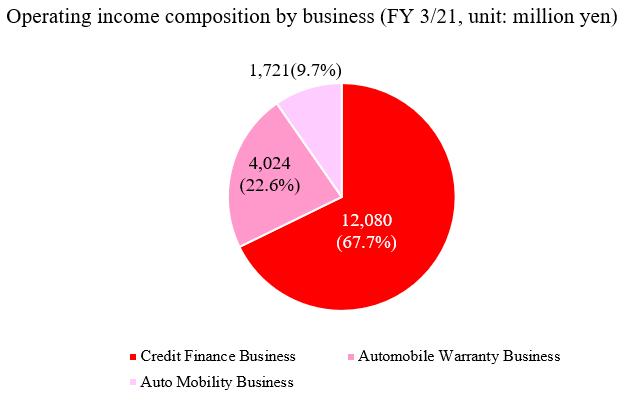

【2-2. Business Segment Trends】

Classification of operating income

| FY 3/20 | Ratio to operating income | FY 3/21 | Ratio to operating income | YoY |

Finance Business | 9,716 | 69.3% | 12,080 | 67.8% | +24.3% |

Automobile Warranty Business | 3,661 | 26.1% | 4,024 | 22.6% | +9.9% |

Auto mobility Business | 638 | 4.6% | 1,721 | 9.7% | +169.6% |

Total operating income | 14,016 | 100.0% | 17,825 | 100.0% | +27.2% |

*Unit: million yen.

(1)Finance Business

*Credit transaction volume

The credit transaction volume decreased for the first time in ten terms by 6.2% year on year to 166.4 billion yen in the term ended March 2021. The transaction volume went up 5.3% in the fourth quarter (January to March) from the same period of the previous term, showing a recovery in the second half of the term; however, the decline in the first half due to the voluntary restraint in marketing activities amid the novel coronavirus pandemic could not be offset.

On the other hand, credit gross profit increased 2.2% year on year, which allowed the company to certainly secure profit as it forecasted.

The company started to expand business in the fourth quarter toward this term by increasing the number of sales staff members and making steady progress with recruitment activities.

*Loan receivables

The balance of credit receivables as of the end of March 2021 grew steadily by 12.5% from the end of the previous term to 361.4 billion yen. The ratio of delinquent receivables went up slightly from 0.86% at the end of the previous term to 0.91%, not because of a negative trend in credit receivables themselves, but because the temporary business suspension in the first half hindered the company from accumulating the balance. Thus, there is no impact on calculation of the insurance rate of credit receivables, and the company is successfully entering into insurance contracts at almost the same rate in the term ending March 2022.

*Number of network stores

The number of dealers and shops affiliated with the credit finance services as of the end of March 2021 stood at 23,907, up 6.0% from the end of the previous term. The voluntary restraint in sales activities in the wake of the novel coronavirus crisis made the company focus on taking a higher share among the existing affiliates and improving the utilization rate of newly acquired affiliates, rather than on prospecting for new clients.

(2)Automobile Warranty Business

*transaction volume

The transaction volume was 4.5 billion yen, up 3.1% year on year. The transaction volume at Premium went up 2.1% year on year and that at EGS, Inc. rose by 6.6% year on year.

Although the transaction volume improved toward the second half through successful marketing activities using videos explaining their products amid the novel coronavirus pandemic while the market picked up, walk-in sales activities were curbed, resulting in only a slight growth in the transaction volume.

(3)Auto mobility Business

Sales of parts and software showed significant growth, accounting for nearly 10% of the total sales.

The number of dealers affiliated with FIXMAN Club, an organization for fee-paying members, stood at 38 as of the end of March 2021. The number of diamond-rank affiliates and gold-rank affiliates of PFS Premium Club is 62 and 353, respectively.

【2-3. Financial Condition and Cash Flow】

◎Balance Sheet Summary

| End of March 2020 | End of March 2021 | Increase/ decrease |

| End of March 2020 | End of March 2021 | Increase/ decrease |

Cash and Cash Equivalents | 6,286 | 8,054 | +1,768 | Financial Guarantee Contracts | 22,063 | 25,079 | +3,016 |

Financing Receivables | 20,011 | 23,394 | +3,383 | Borrowings | 16,421 | 19,641 | +3,220 |

Other Financial Assets | 6,408 | 9,829 | +3,421 | Other Financial Liabilities | 6,340 | 6,703 | +363 |

Property, Plant and Equipment | 3,092 | 3,644 | +552 | Income Taxes Payable | 386 | 648 | +262 |

Intangible Assets | 5,950 | 5,768 | -182 | Other Liabilities | 5,999 | 7,087 | +1088 |

Goodwill | 3,958 | 3,958 | 0 | Total Liabilities | 52,891 | 60,865 | +7,974 |

Investments accounted for using Equity Method | 1,224 | 1,434 | +210 | Total Equity attributable to Owners of Parent | 5,242 | 7,211 | +1,969 |

Insurance Assets | 2,965 | 3,111 | +146 | Total Equity | 5,312 | 7,291 | +1,979 |

Total Assets | 58,203 | 68,156 | +9,953 | Total Liabilities and Equity | 58,203 | 68,156 | +9,953 |

*Unit: million yen.

Finance receivables and other financial assets increased following business expansion, raising total assets by 9,952 million yen from the end of the previous term to 68,156 million yen.

Total liabilities were 60,865 million yen, up 7,974 million yen from the end of the previous term owing to increases in financial guarantee contracts and borrowings.

◎CF

| FY3/20 | FY3/21 | YoY |

Operating CF(A) | -1,246 | 1,321 | +2,567 |

Investing CF(B) | -1,618 | -1,172 | +446 |

Free CF(A+B) | -2,864 | 149 | +3,013 |

Financing CF | 2,967 | 1,617 | -1,350 |

Cash and Cash Equivalents | 6,286 | 8,054 | +1,768 |

*Unit: million yen.

The rate increase of pretax profit and that of finance receivables were lower than those of the previous term, allowing operating and free CFs to go into the black.

The cash position grew.

【2-4 Topics】

The company’s main topics are below.

Year/Month | Content | |

2020 | April | Premium Group acquired Central Servicer Corporation, a servicer that has extensive experience collecting auto credit receivables with its national-scale units for door-to-door survey and negotiation, as a group company in hopes of creating significant synergy with the Credit Finance Business. |

July | Premium Group began making a shift from paper-based contracts in its mainstay Auto Credit Business by using a system that allows customers to apply for credit online, which is aimed at providing greater convenience and realizing a new work style suitable for the era of living with the novel coronavirus. | |

Premium Group launched FIXMAN Club, a members-only service for car maintenance shops that provides the affiliated shops with myriad services, including priority car storing for repair in the warehouse, introducing job seekers, and provision of advanced technologies. | ||

October | Premium Group established Premium Warranty Services Co., Ltd. that presides over both the Japanese and overseas group companies operating the Automobile Warranty Business to focus on further expanding the automobile warranty sector. | |

2021 | January | In the Automobile Warranty Business, the cumulative number of cars for which contracts have been concluded exceeded a million since Premium Group started to offer the service in 2008. Premium Group will contribute to expand the third-party guarantee market as a leading company of automobile warranty services. |

February | While people are once again recognizing the advantages of owning cars in the wake of the spread of the novel coronavirus, Premium Group opened a new website for searching used cars, Kuruma to Okane no kotonara Premium (meaning that you can count on Premium Group when it comes to cars and money), which brings forward proposals in a comprehensive manner, including search engine specific for searching cars, proposals for how to purchase cars, and after-sales services. | |

Premium Group established Premium Warranty Services Philippines, Inc. that provides automobile warranty services in the Republic of the Philippines jointly with GT Mobility Ventures, Inc., which is a business investment company co-founded by Mitsui & Co., Ltd. and GT Capital Auto Dealership Holdings, Inc. | ||

April | Premium Group decided to adopt an AI-based system for automatic screening at its subsidiary, Premium Co., Ltd., with the aim of reducing the time spent for screening, improving user-friendliness, and enhancing operational efficiency. It aims to screen all inquiries automatically in three years by gradually increasing the number of inquiries that can be covered. | |

A subsidiary, Premium Auto Parts Co., Ltd., began providing estimates online in its service of automobile parts sales with the aim of dealing with inquiries for estimates in a swifter manner by shifting from the conventional way of receiving inquiries by facsimile to an Internet-based system. | ||

3. Fiscal Year ending March 2022 Earnings Forecasts

3-1 Full-year consolidated earnings

| FY3/21 | Ratio to operating income | FY3/22(Est.) | Ratio to operating income | YoY |

Operating Income | 17,825 | 100.0% | 21,446 | 100.0% | +20.3% |

Pretax profit | 3,463 | 19.4% | 3,500 | 16.3% | +1.1% |

Net Income | 2,393 | 13.4% | 2,400 | 11.2% | +0.3% |

Profit attributable to owners of parent | 2,383 | 13.4% | 2,409 | 11.2% | +1.1% |

Operating income and pretax profit are estimated to be increased.

For the term ending March 2022, operating income and pretax profit are estimated at 21,446 million yen and 3,500 million yen, up 20.3% and 1.1% year on year, respectively. Pretax profit excluding temporary profit and loss is projected to increase 16.4% year on year. An interim dividend and a term-end dividend are both to be 25 yen per share, and an annual dividend will be 50 yen per share, up 4 yen per share year on year. The payout ratio will be 26.9%.

3-2 Major approaches

(1) Finance Business

Expansion of the credit transaction volume | Increase the credit transaction volume, which decreased in the previous term, again this term. Forge ahead with the business expansion policy by appointing 100 workers as sales staff. Increase the number of areas for marketing activities with the BIZ site method*. Proactively appoint young employees as the leader of the sales offices to enhance employees’ motivation. Started to consider adopting an AI-based screening system to further streamline the operations and reduce delinquent receivables. Provide greater convenience for the affiliated dealers and shops and streamline the business operations through DX. |

Management of credit receivables | Continue to focus on eliminating as many delinquent receivables as possible in an earlier stage to prevent long-term delays in payment. Adopted an interactive voice response (IVR; automatic call) system in May 2021 to propel forward operation innovation based on DX. Facilitated reduction of the rate of the balance of delinquent receivables by taking advantage of the knowledge of Central Servicer Corporation that was acquired as a group company in April 2020 and entrusting it with relevant operations. |

Increase the number of credit affiliates | Continue to focus on increasing the utilization rate while continuously prospecting for new affiliated dealers and shops. Encourage the affiliates that have not been active users of Premium’s credit finance services to use the services via the contact centers (outbound sales) in tandem with the aforementioned effort. Maintain and increase the market share through enhanced convenience of the existing affiliated dealers and shops by utilizing P-Gate, a portal site for the affiliates. |

*BIZ site format

BIZ site format refers to an approach to expand sales not by establishing branches in each sales area, but instead by setting up headquarters in major cities and assigning staff to sales areas as needed.

(2)Automobile Warranty Business

The company will cut down on the cost by having broken-down cars repaired by the affiliated maintenance shops in its network. The cost rate declined by 1.1 points in the term ended March 2021 compared to the previous term.

In addition to continuing to seek prospective dealers that will affiliate with PFS Premium Club, a members-only service for automobile dealers, and facilitating cross-selling, the company focuses on selling highly profitable proper products.

(3)Auto mobility Business

The company further expands the network of FIXMAN Club by offering content to their original network of automobile maintenance shops.

It also gives a focus on developing business related to the distribution of cars while taking mergers and acquisitions into consideration.

It aims to achieve an operating income composition ratio of 20% and an operating income margin of 10% in the term ending March 2022 through these measures.

(4)Other

*Expanded contribution to profit through promotion of DX (operational innovation)

As mentioned later, the company is addressing a variety of issues in the medium-term management plan, VALUE UP 2023, by expanding the existing businesses and developing new businesses with the aim of improving profitability, solidifying the business foundation, and further raising the corporate value. The spread of the novel coronavirus has ushered us in an era of a new normal in which conventional methods do not work, changing the company’s business environment at an accelerated rate.

Under these circumstances, the company announced DX strategies in May 2021 because it believes that not only digitization of operations, but also DX, which changes business models with the power of digital technologies and establishes greater competitive superiority is important for the survival of companies.

The company believes that mobility operators can increase their earning capacity and individual customers can utilize used cars safely and conveniently when the company’s platform related to distribution of used cars is used by its important clients, used car dealers and car maintenance shops, and individual customers of theirs. The Group will establish its competitive superiority through this trinity innovation.

The following are the major three approaches that the company is taking:

-To establish a platform that connects mobility operators (used car dealers and car maintenance shops) and end users

-To reform internal operations with the aim of improving employees’ well-being

-To keep up with changes in the automobile industry, such as CASE (Connected, Autonomous, Shared, and Electric), Mobility as a Service (MaaS), and electric vehicles

In the five years from the term ended March 2021 to the term ending March 2025, the company aims to fully operate the platform as early as possible by moving ahead with DX and the above three approaches in tandem with one another based on a plan of investing 500 million to 1,000 million yen each year.

① To establish a platform that connects mobility operators and end users

Premium Group aims to open a greater number of business opportunities by establishing a system that allows a series of B to C transactions related to the sales of used cars to be completed online.

② To reform internal operations with the aim of improving employees’ well-being

Premium Group thoroughly streamlines the business processes by adopting AI, robotic process automation (RPA), and other similar technologies, which will lessen burdens on the employees without the need for increasing the number of workers even when the company scales up its business and needs to deal with a larger number of inquiries.

③ To keep up with changes in the automobile industry, such as CASE, MaaS, and electric vehicles

In the automobile industry that is undergoing a once-in-a-century change, Premium Group creates a new business model that can deal with CASE, MaaS, electric vehicles, and the changing ways to own and use cars through innovation based on DX.

*Overseas business

The company forges ahead with the Automobile Warranty Business mainly in Asia as a reaction to growing needs for automobile warranty services in Thailand and Indonesia. It also engages in a business of exporting primarily parts for used cars to Africa, and Central and South America.

It operates business not independently by, for example, setting up new companies, but mainly through non-asset approaches, such as establishing joint ventures.

4. Overview of Medium-term Management plan “VALUE UP 2023”

The 3-year mid-term management plan, VALUE UP 2023, which started the term ended March 2021 and will end in the term ending March 2023, is ongoing. On May 13, 2021, the company revised and re-announced the plan due to a change in business environment caused by the spread of COVID-19.

(1) Progress so far

Since the start of the business in 2007, the company has expanded the credit and automobile warranty businesses as the mainstays, and got listed in the first section of Tokyo Stock Exchange in 2018, showing steady growth. As for business performance, sales and profit grew significantly, and ROE and ROA rose steadily.

(2) Regarding the mid-term vision

(Recognition of the business environment)

Considering the impact of the novel coronavirus, the company recognizes the business environment as follows.

Target | Situation | Recognition | Necessary measure |

Individual customers | Used cars sold increased in number in the second half of the term although fewer people purchased used cars when a state of emergency was issued in April 2020 | Constant demand for used cars, which is a daily necessity, is recognized again | To further grow the Finance Business and the Automobile Warranty Business |

Used car market (dealers/maintenance shops) | A decline in the quantity of new cars distributed resulted in a drop of the quantity of used cars distributed, which increased the cost price | -Dealers and maintenance shops with less financial power are struggling -The quantity sold and the number of opportunities for contacting customers decreased | To support small- and medium-sized dealers and maintenance shops in running business |

Social trend | An era of the new normal in which conventional thoughts and methods do not work began | It is necessary to establish competitive superiority for sustainable growth | To make shifts to a new business model and promote business innovation based on DX |

(Mid-term vision: ideal state)

Recognizing the business environment as mentioned above, the company considers that it is necessary to grow the existing businesses and vitalize the used car market by supporting the management of used car dealers and maintenance shops, which are their direct customers. For this, the company upholds the mid-term vision of evolving from an auto credit company, offering mainly auto credits and warranties, to an auto mobility company that develops networks with automobile dealers, maintenance shops, and customers and creating the synergy among credit finance, automobile warranty, and auto mobility.

(Taken from the reference material of the company)

(Materiality based on the mid-term vision)

Based on the recognition of the business environment, the company defined the following four as materiality items.

Business environment recognition | Materiality |

It is important to expand the existing Credit Finance and Automobile Warranty Businesses to grow the company. | ① To improve the Credit Finance Business, which is its forte ② To expand the market of automobile warranty |

It is necessary to support the management of small and medium-sized dealers and maintenance shops. | ③ To enrich the Auto Mobility Business |

It is important to establish new business models and promote industrial innovation through DX. | ④ To become a provider of platforms in the used car and car maintenance markets |

The company announced digital transformation (DX) strategies, recognizing that it is essential to promote DX to realize sustainable growth and enhance competitiveness.

(2) Initiatives in each business

To realize an ideal state, it is necessary to develop a system to offer the best finance and the best service.

Based on the mid-term vision, VALUE UP 2023, the company will implement the following measures in each field.

① Credit Finance Business

Auto credit and auto lease for individuals

The priority measures are to enhance marketing and to proceed with industrial innovation.

For enhancing marketing, the company will expand the target area with the BIZ site method* and increase the number of marketing staff members by 50 to 130.

In addition, the company will upgrade outbound contact centers, start operating affiliates that are still not in operation, cultivate uncultivated areas, promote the development of a members-only organization for affiliates, and grow the top line steeply.

For promoting industrial innovation, the company will develop an automatic screening system based on AI, make back-office operations unmanned, and do away with paper to increase business efficiency and profit margin.

* BIZ site method means the marketing method of establishing footholds in major cities rather than establishing branches in respective regions and visiting the target area when necessary.

Servicer

The priority measures are to collect receivables jointly with other group companies and sell repossessed cars*.

For collecting receivables with other group companies, the company will collect receivables in cooperation with Central Servicer Corporation, which was acquired as a subsidiary in April 2020, and exert synergy to grow revenues further.

For selling repossessed cars*, the company will sell the vehicles repossessed at the time of collection of receivables to affiliates of the members-only organization, to create new earning opportunities.

*Repossessed cars: Vehicles repossessed when the company collects receivables for auto credits.

② Automobile Warranty Business

The company considers that it is indispensable to expand the market itself.

To do so, the company will implement the following measures and reduce the scrapping of cars by maintaining used cars.

Measure | Outline |

Development of extended warranties | To increase business opportunities by increasing the contact points with customers through extended warranties. |

Improvement in profitability | To curtail repair costs and discount selling prices by putting cars in the maintenance shops of the members-only organization and using recycled auto parts procured within the corporate group. |

Advertisement for increasing popularity | To popularize automobile warranty and disseminate its effectiveness through advertisement via TV, the Internet, etc. |

③ Auto Mobility Business

The company will concentrate on the expansion of the “new 3Rs” businesses, which are environmentally friendly. The new 3Rs are Recycle (recycled parts) business, which distributes the parts of used cars, Reuse business, which distributes repossessed vehicles within the corporate group, and Repair business, which offers maintenance services for inspecting and repairing automobiles, sheet-metal services for repairing scratches, dents, etc. on automobiles, and so on. At present, the company offers a broad range of services, including the sale of recycled parts, repossessed vehicles, and task management software for maintenance shops, etc., via subsidiaries acquired through M&A.

The priority measures are to enrich the service lineup, to develop members-only organizations for affiliated used car dealers and maintenance shops, and to proceed with the platform scheme. The company aims to actualize the sustainable growth of the corporate group, by diversifying revenue sources.

Among the network which the company has developed so far (including over 30,000 automobile dealers and over 3,000 maintenance shops), the company will establish members-only organizations with affiliates with an increasing number of transactions: PFS Premium Club for automobile dealers and FIXMAN Club for maintenance shops.

By connecting these members-only organizations and customers, the company aims to become a platform provider for offering a wide array of services.

(Taken from the reference material of the company)

④ Overseas strategy

As indicated in the mission, the company will target to the world and expand our know-how cultivated in Japan to overseas.

While keeping an eye on the situation of the pandemic, etc., the company will strive to exhibit its products and services in more countries, while recognizing Phase I of the mid-term vision as a planting season. The company will make inroads into foreign markets by establishing joint ventures with local capital, etc. instead of establishing a company with its own funds.

Phase II of the mid-term vision will be recognized as the reaping period, and the company will engage in overseas businesses on a full-scale basis while considering the reorganization of joint ventures into consolidated subsidiaries.

(5) Numerical goals

In VALUE UP 2023, they aim to achieve an operating revenue of 25.8 billion yen and a net profit of 3.3 billion yen, in the term ending March 2023. In the term ending March 2025, which is the final fiscal year of the next mid-term vision, they aim to achieve an operating revenue of 41.9 billion yen, a net profit of 6.5 billion yen, and a market cap of 175 to 200 billion yen.

| FY 3/21 Results | FY 3/22 Est. | FY 3/23 Est. | FY 3/24 Est. | FY 3/25 Est. | CAGR |

Operating income | 178 | 214 | 258 | 329 | 419 | +23.9% |

Pretax profit | 35 | 35 | 49 | 65 | 100 | +30.0% |

Net profit | 24 | 24 | 33 | 43 | 65 | +28.3% |

ROE | 38.3% | - | 31.7% | - | 37.0% | - |

Market cap | 322 | - | 900-1,000 | - | 1,750-2,000 | - |

*Unit: 100 million yen. Net profit means the profit attributable to owners of parent. Market cap means the closing value on March 31, 2021. CAGR is the average annual growth rate in the four years from FY 3/21 to FY 3/25. Calculated by Investment Bridge Co., Ltd. with reference to the plan of Premium Group.

(6) Initiatives toward ESG and SDGs

Being deeply conscious of its social significance and responsibility, Premium Group published an Environment, Society, and Governance (ESG) report from an ESG perspective covering its business and corporate activities.

It will move ahead with efforts by identifying nine materiality items regarding the environment, social capital, human capital, business models and innovation, and risk management and governance.

5. Conclusions

This term, the company aims to improve the credit transaction volume, which went into the red in the previous term, by increasing the number of sales staff members and reducing the number of areas uncharted for marketing activities with the BIZ site method. The credit transaction volume in the third and fourth quarters of the previous term exceeded those of the same period of the term before, and the company is steadily increasing the transaction volume this term as well with the amount in April growing by about 20% from the same month of the previous term. The company successfully expanded the transaction volume even under the second state of emergency issued this year, which means that its business performance is not likely to be affected negatively by the extension of the current state of emergency. We would like to wait for the company to deliver business results for the first quarter (April to June).

From a more medium-term perspective, we would like to pay attention to how fast the company forms members-only organizations, PFS Premium Club and FIXMAN Club, which hold the key to the evolution into an auto mobility company as mentioned in the medium-term management plan, VALUE UP 2023. Progress with the DX strategies for offering the club members attractive added value is also a point to keep an eye on.

<Reference: Corporate Governance>

Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 8 directors, including 3 outside ones |

Auditors | 3 auditors, including 2 outside ones |

Corporate governance report (updated on June 29, 2020)

Basic policy

(1) Ensuring the rights and equal treatment of shareholders

Our company is responding appropriately to create an environment that allows proactive information disclosure and smooth exercise of the voting rights to ensure the substantive equality of all our shareholders.

(2) Appropriate cooperation with stakeholders other than shareholders

On the premise of thoroughly ensuring compliance, including conformity to the relevant laws and regulations, our company is aware that cooperation with all our stakeholders, including shareholders, is essential for our corporate group’s sustainable growth and medium- and long-term increase of our corporate value. To fully cooperate with the stakeholders, we are endeavoring to foster a corporate climate in which the top executives take the lead in respecting the rights and positions of the stakeholders, and the corporate ethics by holding a corporate strategy meeting every year, in which the top executives, including the president, give explanations directly to all the employees with their own words, as well as formulating our corporate group’s missions and visions.

(3) Ensuring appropriate information disclosure and transparency

Pursuant to the disclosure policy, our company in principle provides information on our company’s business policies, business strategies, business performance, and financial affairs in a fair, accurate, swift, easy-to-understand, and proactive manner in order to earn trust and fair evaluation of the market. Besides information disclosed in compliance with the relevant laws and regulations, we proactively disclose information that we believe will help our shareholders and investors deepen their understanding. We strive to disclose information, including non-financial information, in a manner that is highly useful to users with precise, plain, and detailed descriptions.

(4) Responsibilities of the Board of Directors

Our company takes responsibility for sustainable growth of our corporate group as a whole, will increase our corporate value in the medium and long term, and improve profitability and capital efficiency by developing an environment that supports appropriate risk-taking by the top executives and providing a broad sense of direction to go in, such as corporate strategies, as well as supervise the top executives, including the president, and the directors in a highly effective manner.

(5) Dialogue with shareholders

In order to attain sustainable growth of our corporate group as a whole and increase our corporate value in the medium and long term, our company is aware that it is important to grow our corporate group together with our shareholders by appropriately reflecting their opinions and requests through proactive dialogue with them at all times. We, therefore, have built an investor relations (IR) framework for which the president bears the primary responsibility and create opportunities for dialogue with the shareholders and investors to obtain their understanding of our corporate group’s business strategies and plans. We have also established a structure that helps report opinions of the shareholders and investors to the Board of Directors as appropriate and feed them back to our company’s business operations.

<Disclosure based on the principles of the Corporate Governance Code>

[Principle 5-1. Policy on constructive dialogue with shareholders]

Our company has adopted a positive attitude toward constructive dialogue with our shareholders as much as is reasonably possible. With the president assuming the primary responsibility for our company’s dialogue with the shareholders in general, the president and the directors mainly have dialogue with the shareholders according to such matters as the number of our company’s shares held by and the scale of the shareholder to interview with. The public relations and IR department supervised by the director in charge conducts business operations for effective IR activities. We have established a structure that encourages various departments including the management department, department supervising corporate governance, the general affairs department, the accounting department, and the legal compliance department, to cooperate with the public relations and IR department, in order to assist in the dialogue with the shareholders. Our efforts at dialogue with the shareholders include disclosure of information through financial results briefings and our website, and proactive IR activities that help the shareholders broaden their understanding of our corporate group’s present condition and other relevant matters. Specifically, we hold individual meetings with institutional investors and analysts’ meetings for dialogue with such stakeholders, in which mainly the president and the directors have direct dialogue with them, depending on the situation. Regarding dialogue with individual investors, our company proactively participates in company information sessions and online seminars hosted for individual investors by financial securities firms and other similar organizations so that our president and directors can explain our corporate group’s present condition and other relevant matters with their own words. We disclose the schedule of IR events targeting individual investors on our website (https://ir.premium-group.co.jp/en/calendar.html). In addition, we provide information to overseas investors who have a certain volume of share transactions in the Japanese stock market through such means as individual meetings by phone, translation of relevant material into English, and the English version of our website. Our company uses opinions that we have gotten through dialogue with the shareholders for sharing information and improving our business operations after the public relations and IR department has summarized them and reported them, as necessary, to the Board of Directors. Regarding control of insider information when we have dialogue with the shareholders, we strictly manage undisclosed information pursuant to the regulations for insider transaction prevention.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness, or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved |

The back number of Bridge Report (Premium Group Co., Ltd. : 7199) and the contents of Bridge Salon (IR Seminar) can be viewed here: www.bridge-salon.jp/