Bridge Report:(7242)KYB second quarter of fiscal year ending March 2022

Representative Director, President Executive Officer Masao Ono | KYB Corporation (7242) |

|

Company Information

Market | TSE 1st Section |

Industry | Equipment for transportation |

Representative Director, President Executive Officer | Masao Ono |

HQ Address | World Trade Center Building South Tower.28F, 4-1, Hamamatsu-cho 2-chome, Minato-ku, Tokyo |

Year-end | End of March |

HOMEPAGE |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE Act. | Trading Unit | |

¥2,959 | 25,748,431shares | ¥76,189million | 18.5% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

90.00 | 3.0% | ¥665.56 | 4.4x | ¥5,145.87 | 0.6x |

* Share price as of closing on November 24. The number of shares outstanding, DPS, EPS and BPS are from the financial results for second quarter of fiscal year ending March 2022. ROE is from the previous results.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Pretax Income | Net Income | EPS | DPS |

March 2018 (results) | 393,743 | 20,885 | 20,881 | 15,202 | 595.09 | 150.00 |

March 2019 (results) | 412,214 | -28,496 | -29,510 | -24,757 | -969.18 | 0.00 |

March 2020 (results) | 381,584 | -40,298 | -41,419 | -61,879 | -2,422.53 | 0.00 |

March 2021 (results) | 328,037 | 18,297 | 16,340 | 17,087 | 668.95 | 75.00 |

March 2022 (estimate) | 380,000 | 25,500 | 22,500 | 17,000 | 665.56 | 90.00 |

* Unit: Million yen or yen. IFRS adjustment. Net income is profit attributable to owners of the parent. The company conducted 1-for-10 reverse share split on October 1, 2017. DPS for the term ending March. 2018 represent the amounts taking the 1-for-10 reverse split into account. EPS and DPS are not adjusted. DPS is a dividend for common stock.

This Bridge Report presents details of KYB earnings results for second quarter of fiscal year ending March 2022 and so on.

Table of Contents

Key Points

1.Company Overview

2.Second Quarter of Fiscal Year ending March 2022 Earnings Results

3. Fiscal Year ending March 2022 Earnings Estimates

4.Conclusions

<Reference1: 2020 Medium-Term Management Plan>

<Reference2: Regarding Corporate Governance>

Key Points

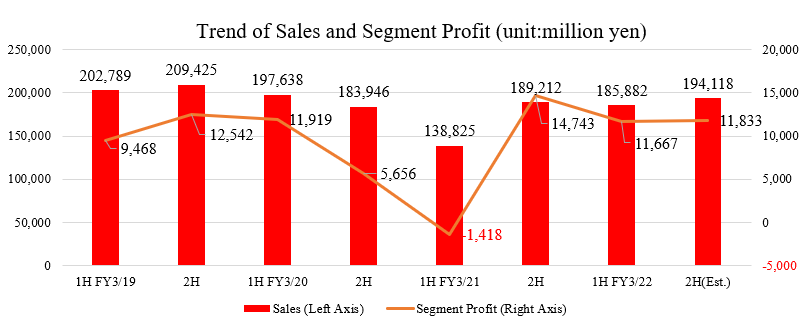

- In the first half of the term ending Mar. 2022, sales increased 33.9% year on year to 185.9 billion yen. The impact of the decline in demand due to COVID-19 has receded. Gross profit also increased 83.7% year on year. The increase in SG&A expenses was offset by the effect of fixed cost reduction, and the segment profit returned to profitability. A decrease in costs related to seismic isolation/mitigation oil dampers also contributed.

- Based on the progress made up to the second quarter, the initial estimates have been revised upwardly. For the term ending Mar. 2022, they estimated net sales of 380 billion yen, up 15.8% year on year, and segment profit of 23.5 billion yen, up 76.4% year on year. Sales are expected to increase in both AC and HC businesses. Production adjustment of automobiles due to the shortage of semiconductors has been prolonged, and OEMs are decreasing due to suspension and adjustment of operations by customers. On the other hand, demand was strong for commercial products that the company supplies to the aftermarket and for construction machinery. The company is building a flexible supply system that takes advantage of its strength in integrating production and sales, and as a result, commercial sales volume has reached a record high level globally. Despite the impact of production adjustments and steel market conditions, the company will also implement measures to improve profits, mainly by reducing fixed costs.

- The company plans to pay an annual dividend of 90.00 yen per share (up 15.00 yen per share from the previous term) on its common stock, with interim and term-end dividends both equally 45.00 yen per share. The expected payout ratio is 13.5%. Dividends on Class A preferred stock are expected to be 1,952,054.80 yen per share for the interim period and 3,739,726.00 yen per share at the end of the term, for a total annual dividend of 5,691,780.80 yen per share.

- The effects of the pandemic are gradually fading, and the conformity of seismic isolation/mitigation oil dampers is progressing smoothly. In addition, although OEMs have been affected by the decline in new car production, the business environment surrounding them has improved, with strong sales of aftermarket products for used cars taking up the slack. However, despite the upward revision, the estimates for the second half calls for a slight increase in both sales and profit. With the global shortage of containers and soaring raw material prices, there are many uncertain factors, but we would like to pay attention to how much sales and profits the company can increase in the second half.

1.Company Overview

The largest manufacturer of independent hydraulic equipment in Japan. Based on hydraulic technology, the company offers products and technologies in a wide range of fields such as "automobiles", "motorcycles", "construction machinery", "industrial vehicles", "aircraft", "railroads" and “special purpose vehicles”.

KYB has a high market share with many products. For instance, shock absorbers for automobiles account for 40% of the domestic market and 14% of the global market.

【1-1 Corporate history】

The roots come from “Kayaba Research Center”, which was established by Shiro Kayaba, who is an inventor and a founder, in November 1919.

In January 1927, a self-employed enterprise, Kayaba Seisakusho, was established for manufacturing hydraulic dampers, catapults, etc. for aircraft.

In March 1935, Kayaba Manufacturing Co., Ltd. was established.

After the end of World War II, in June 1956, Kayaba Auto Service Co., Ltd. was established for offering products and services.In October 1959, company’s stocks were listed on the Tokyo Stock Exchange.

In July 1974, KYB Corporation of America was established in the United States in order to enter the North American commercial market. Then, the company actively entered foreign markets such as Asia and Europe.

In October 1985, the company name “Kayaba” was changed from kanji (Chinese characters) to katakana (Japanese Characters).

In October 2015, the trade name was changed from Kayaba Manufacturing Co., Ltd. to KYB Corporation in order to further strengthen the brand image.

【1-2 Corporate Philosophy/Management Philosophy】

◎KYB Corporate Symbol

As they changed the corporate name from "Kayaba Manufacturing Co., Ltd." to "KYB Corporation" in 2015, they aim to popularize the KYB brand on a global basis.

Therefore, as shown below, the logo “KYB” has the meaning and spirit

(Taken from KYB’s website)

(What the logo means)

Slanted slits in each letter represent comfortable sunlight cast through the trees and sunbeams illuminating the road ahead. The logo represents an image of unconstrained growth and flexible response to the trends of the era. The right side of the letter “B” represents liquid pressure indicating the origin of KYB. Using italic letters expresses a sense of speedy movement, progressiveness, growth potential, innovativeness.

(What the corporate color means)

The corporate color, red stands for love, enthusiasm and passion, etc. and it gives the image of a sun’s warmth, heat and power to grow life that realize an epoch-making society. Red is also a positive color and represents manufacturing that goes the extra mile.

(Taken from KYB’s website)

◎Corporate Statements

The characteristics of products such as precise quality and reliable technology are expressed with the statement.

It means that not only providing reliable quality to general consumers and business partners leads to stakeholders’ “advantage (superiority)”, but also the joy of manufacturing, which enables each employee to realize that they can change the world with sure quality, becomes “advantage (merit).”

◎Corporate Spirit

As the KYB Group, which aims to contribute to society by providing technologies and products for making the living of people safe and comfortable, it reflected on the improper act revealed in Oct. 2018, and revised its Corporate Spirit and Corporate Guiding Principles.

(Corporate Spirit)

We shall follow all rules and face all issues with honesty. |

We shall build a corporate culture full of vitality, and hold high goals. |

We shall value sincerity, cherish nature, care for the environment. |

We shall constantly pursue creativity, contribute to the prosperity of customers, shareholders, suppliers and society. |

(Management Vision)

Human Resources Development | To cultivate the talent to achieve the objectives with a thorough understanding of the principles and the strategy. |

Technology and product development | To provide products that are impressive, comfortable and reliable to customers throughout the world. |

Monozukuri (Manufacturing expertise) | To make our plants enjoyable, dynamic places to work, and at the same time full of discipline based on the field priority doctrine, in order to produce products satisfactory to the customer. |

Management | Always keep social responsibilities of the corporation in mind and provide efficient group management. |

(Corporate Guiding Principles)

See the following URL:

https://www.kyb.co.jp/english/company/guidelines.html

【1-3 Environment Surrounding the Company】

(1) Market Environment

The automobile market and the construction machinery market have a great effect on KYB's performance.

KYB recognizes the current and future situations of the two markets as follows.

①Automobile Market

The global demand for automobiles, including hybrids and EVs, is expected to increase in the medium to long term. The number of automobiles produced, which had temporarily decreased due to the influence of COVID-19, was recovering. However, the business environment is uncertain as Toyota Motor has temporarily suspended the production at some domestic factories due to a shortage of semiconductors.

KYB supplies shock absorbers (SA) for new vehicles directly to automobile manufacturers as Tier 1, and also supplies them to auto parts stores, repair shops, etc. through agencies for aftermarket as well. The company calls the former "OEM" and the latter "marketed".

Japanese cars are popular in Asia, the Middle East and others, and the commercial market is important for KYB.

(Taken from the reference material of KYB)

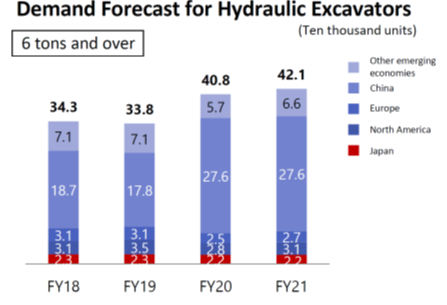

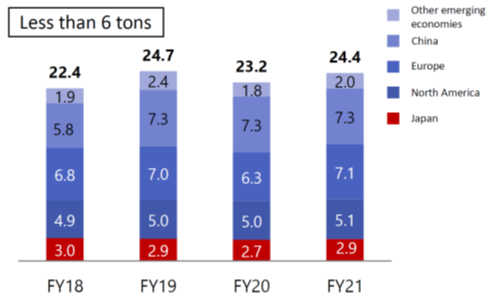

②Construction Machinery Market

While the Chinese and Indian markets are expected to slow down, demand is forecasted to be strong despite the uncertainty in the short term due to the impact of COVID-19.

|

|

(Taken from the reference material of KYB)

(2) Competitors

①AC Business

KYB’s domestic competitors include Hitachi Astemo, Ltd. (unlisted).

Its global competitors consist of ZF in Germany, Tenneco in the U.S., and so on. ZF has a long history and intimate relationships with European automobile manufacturers.

The company’s share in the commercial product market is slightly less than 20%. Monroe (a commercial brand of Tenneco), and Sachs, etc. are competitors in global.

KYB competes with Hitachi Astemo, Ltd. in the market of shock absorbers for motorcycles, and with JTEKT Corporation (6473, TSE 1st section) and NSK Ltd. (6471, TSE 1st section) in the steering market.

②HC Business

In the market of cylinders, which are the parts with the highest sales ratio in KYB, Chinese manufacturers and the like are extending their influences.

KYB’s competitors include Nabtesco (6268, TSE 1st section) in the market of control valves for which KYB has the advanced technology, and Nabtesco and Nachi-Fujikoshi (6474, TSE 1st section) in the market of travel motors.

In addition, the largest construction machinery manufacturer in Japan manufactures a number of parts internally.

Code | Corporate name | Sales | Growth rate | Operating income | Growth rate | Operating income rate | ROE | Market cap | PER | PBR |

5994 | Fine Sinter | 38,000 | +9.7 | 800 | +278.2 | 2.1% | -1.3% | 6,983 | 19.9 | 0.4 |

6268 | Nabtesco | 306,000 | +9.5 | 33,000 | +15.7 | 10.8% | 10.6% | 391,642 | 3.5 | 2.0 |

6471 | NSK | 860,000 | +15.0 | 44,500 | +599.2 | 5.2% | 0.1% | 429,437 | 13.3 | 0.7 |

6473 | JTEKT | 1,400,000 | +12.3 | 45,000 | +182.8 | 3.2% | 0.2% | 363,883 | 17.3 | 0.7 |

6474 | Nachi-Fujikoshi | 225,000 | +11.9 | 13,500 | +97.1 | 6.0% | 2.1% | 102,169 | 10.9 | 0.9 |

7212 | F-Tech | 195,000 | +6.2 | 1,300 | -57.7 | 0.7% | -2.9% | 9,711 | -10.7 | 0.2 |

7242 | KYB | 380,000 | +15.8 | 23,500 | +76.4 | 6.2% | 18.5% | 76,189 | 4.4 | 0.6 |

*The sales and growth rates are forecasts for this term estimated by the company with the unit being million yen. ROE is the results from the previous term.

The aggregate market capitals are the closing price on December 10. The unit is million yen. PER (estimates) and PBR (results) are based on the closing price on December 10 with the unit being times. KYB's operating income is segment profit (calculated by deducting cost of sales and SG&A expenses from net sales).

【1-4 Business contents】

(1) Segments

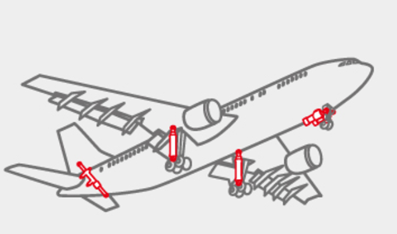

KYB’s business segments are composed of the following four segments: the “AC Business” consisting of hydraulic shock absorbers for automobiles and motorcycles, power steering, etc., the “HC Business” including hydraulic equipment for industrial use mainly for construction machinery, “System products,” which produces theater equipment, equipment for military vessels and vibration suppression devices, etc., and the “Aircraft components business,” which produces devices for take-offs and landings of aircrafts, steering components, control devices, etc. It also has the “Others” segment which handles special purpose vehicles, electronics, and the like.

As a result of a review of the business management classification of System Products in accordance with the reorganization of the Group, it will be included in the HC business from the second quarter of the term ending Mar. 2022.

Fiscal Year ended March 2021 results

| Sales | Composition Ratio | Segment profit | Profit rate |

AC Business | 197,453 | 60.2% | 8,195 | 4.2% |

HC Business | 111,348 | 33.9% | 5,501 | 4.9% |

System products | 5,990 | 1.8% | 1,052 | 17.6% |

Aircraft components business | 3,857 | 1.2% | -2,461 | - |

Others | 9,389 | 2.9% | 1,037 | 11.0% |

Total | 328,037 | 100.0% | 13,325 | 4.1% |

*Unit: million yen

① AC(Automotive Components)Business

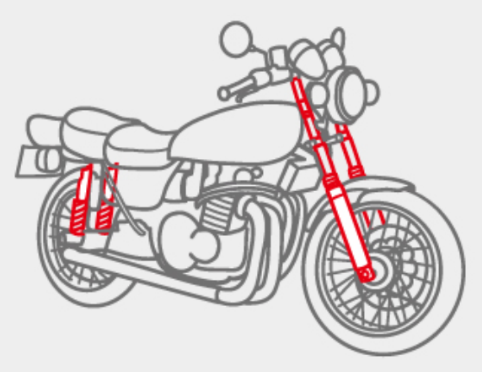

This segment consists of shock absorbers for automobiles and motorcycles, hydraulic equipment for automobiles, and other products.

Composition ratio for Fiscal Year ended March 2021

Product | Sales | Composition ratio | Major products |

Shock absorbers for automobiles | 142,723 | 72.3% | Shock absorbers |

Shock absorbers for motorcycles | 26,087 | 13.2% | Front forks, rear cushion units |

Hydraulic equipment for automobiles | 24,753 | 12.5% | Vane pumps, CVT pumps, EPS |

Others | 3,890 | 2.0% | Shock absorbers for ATVs, Stay dumpers |

Total | 197,453 | 100.0% | - |

*unit: million yen

<Major Products>

◎Automobiles

(Shock absorbers)

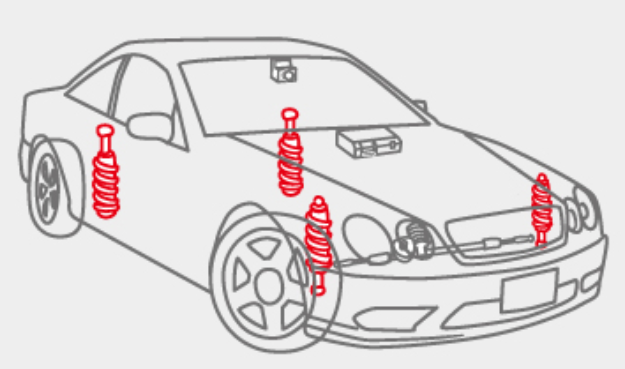

A shock absorber is a device that absorbs vibration of the car body, being mounted between the body and the tires together with a spring.

|

|

(Taken from KYB’s website)

Each automobile is equipped with a “suspension” which is the system that improves riding comfort and operational stability.

Suspensions have two main functions; one is, as buffers, to prevent transmission of rough road profiles to the car body and another is to set the position of the wheels and axles and press the wheels down on the roads.

Basically, a suspension is composed of a suspension arm which fixes the wheel position, a spring which supports the car weight and absorbs vibration, and a shock absorber (damper) which dampens vibration of the spring

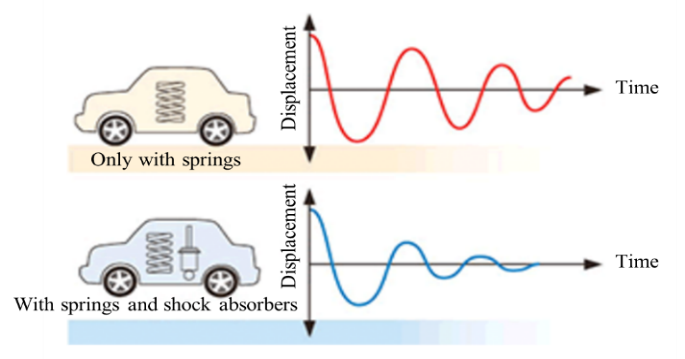

Automobiles absorb shock caused by uneven road profiles by contracting the springs, but due to their characteristics, the springs rebound to get back to their original position after the contraction.

The top of a spring is connected to the car body and the bottom is coupled with a suspension that includes the heavy tires and brake, which results in, due to inertia, repetition of expansion and contraction of a spring in a range wider than one necessary for returning to its original position.

The role of shock absorbers is to reduce the above-mentioned excess vibration as soon as possible in order to stabilize the car body.

(Taken from KYB’s website)

The vehicle in which the shock absorber is functioning properly achieves the following, making a comfortable driving experience possible

☆ | Reduction in unnecessary movement of springs to secure riding comfort |

☆ | Improvement of the brake performance |

☆ | Smoothness in taking corners |

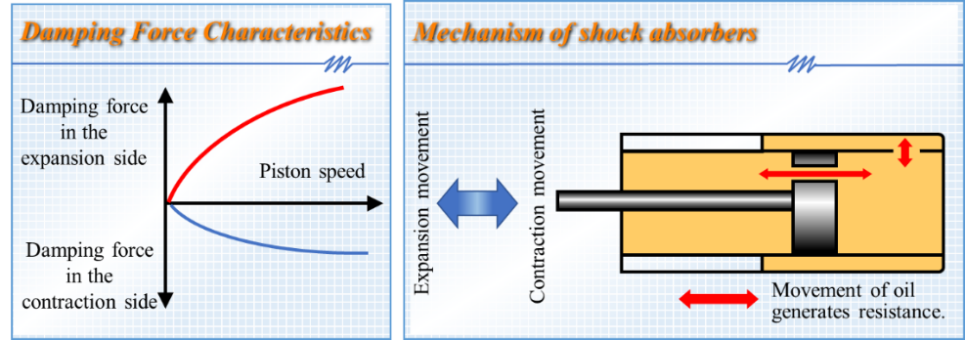

The force that controls expansion and contraction of springs and reduce vibration is called “damping force.” The “hydraulic technology,” which KYB has cultivated and improved since its inauguration, plays a significant role in generating “damping force.”

A piston has holes through which oil passes when the piston moves following vibration, and the resistance of the oil generates “damping force.” In addition, the moving speed of pistons varies with the degree and velocity of vibration from the car body, and the faster a piston moves, the larger “damping force” becomes. This is called “damping force characteristics.”

(Taken from KYB’s website)

KYB’s shock absorbers developed based on its sophisticated technology has earned reputation from a number of automobile manufacturers worldwide, leading to the large market share as mentioned below.

Furthermore, it is said that shock absorbers usually need to be replaced after 5 years from the date of first registration or when the travel distance reached 70,000 km as they deteriorate due to various factors including travel distance and lapse of time and the function decreases.

This replacement demand, which in other words is the commercial product market, is one of the greatest business opportunities for the company.

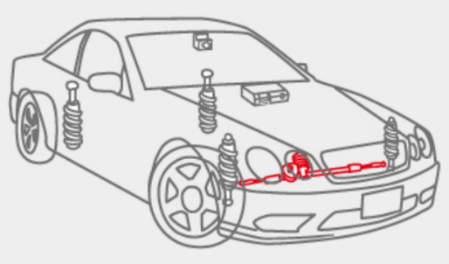

(Steering)

It is the steering system that provides “the function of taking curves,” one of the three basic functions of automobiles including “driving,” “taking curves,” and “stopping.”

KYB’s steering components include the “hydraulic power steering (PS)” that uses the hydraulic power assist unit to support turning of the steering wheel done by drivers and steer the tires, and the “electric power steering (EPS)” that uses the electric power assist unit composed of a motor, a controller, a torque sensor, etc. to support turning of the steering wheel and steer the tires.

The “PS” enables steering operation by a mere movement thanks to hydraulic force and is an indispensable component for safe driving because of its ability to expeditiously avert risks, whereas the “EPS” whose power source is a battery improves fuel efficiency compared to the “PS” whose power source is the engine of a car.

◎ Motorcycles

(Suspensions)

Suspensions minimize shock to the car body regardless of road surface conditions, pursuing comfort.

(Taken from KYB’s website)

*Rear cushion unit (RCU)

The company’s RCUs boost riding comfort by maintaining the posture of vehicles and absorbing vibration and shock from the road surfaces.

(Taken from KYB’s website)

② HC (Hydraulic Components) Business

The HC Business consists of hydraulic equipment for industrial use and other products.

Composition ratio for the Fiscal Year ended March 2021

Products | Sales | Composition ratio | Major products |

Hydraulic equipment for industrial use | 103,973 | 93.4% | Cylinders, valves, pumps, motors |

Others | 7,375 | 6.6% | Railroad dampers, railroad brakes |

Total | 111,348 | 100.0% | - |

* unit: million yen

<Major Products>

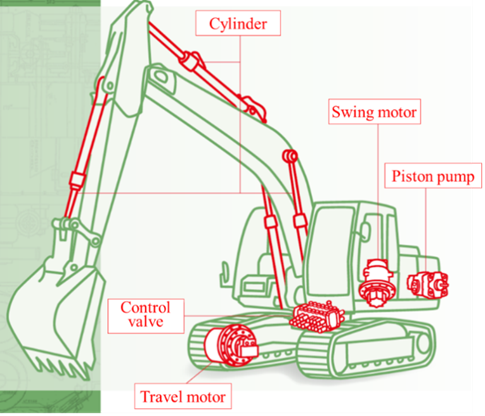

The mechanism of the drive system of construction machinery such as shovels consists of various parts as shown below, including control valves, piston pumps, travel motors, swing motors, and cylinders; it is the control valve, which is the “brain” of construction machinery, that controls a variety of actuators (a drive unit which converts energy to translational or rotary motion through hydraulic pressure and electric motors) to enable smooth movement of driving, turning, and bending and stretching of the arms.

KYB’s control valves have realized more advanced control by combining electric control with its special hydraulic technology.

In addition, KYB is one of the few manufacturers that manufacture all of the above-mentioned parts.

KYB’s competitive edge is that it can make suggestion to construction machinery manufacturers because its manufacturers all kinds of parts as just mentioned.

(Taken from KYB’s website)

③ Segments other than the AC Business and the HC Business

Fiscal Year ended March 2021

Segments | Sales | Major products |

System products | 5,990 | Theater equipment, equipment for military vessels, seismic isolation and vibration suppression devices, simulators, hydraulic systems, tunnel boring machines, and environmental devices |

Aircraft components business | 3,857 | Devices for take-off and landing of aircrafts and its steering components, control devices, and emergency equipment |

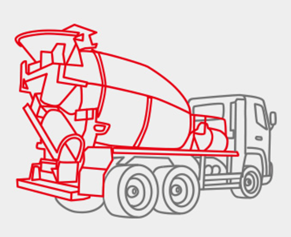

Others (special purpose vehicles, electronics, and the like) | 9,389 | Concrete mixer trucks, granule carriers, special purpose vehicles, and electronic devices |

* unit: million yen

KYB’s concrete mixer trucks have high mixing and emission performance, accounting for about 80% of the domestic market share.

It offers highly reliable products for aircraft, including various actuators, weight-saving accumulators, and wheel brakes.

|

|

(2) Clients and sales channels

◎Clients

The following is a list of KYB’s major clients.

Its shock absorbers are mounted on about 60% of automobiles manufactured by Toyota globally. They are also adopted to about 30% and about 10% of automobiles manufactured by Nissan group and Honda, respectively, contributing to KYB’s large market share.

| Japanese | Non-Japanese |

AC Business | Toyota Motor Yamaha Motor Nissan Motor JATCO Suzuki Motor Honda Motor Daihatsu Motor SUBARU Isuzu Mitsubishi Motors Hino Motors | PSA Renault Volkswagen Daimler Chrysler |

HC Business | Hitachi Construction Machinery Kubota Sumitomo Construction Machinery Kobelco Construction Machinery Takeuchi Mfg Yanmar Komatsu Forklift | Caterpillar Sany Heavy Industry Doosan Sunward Trasmital Bonfiglioli |

◎Sales channels

As previously mentioned, KYB supplies its shock absorbers through 2 sales channels including the OEM production system for new vehicles and sale on the market for used vehicles.

Although sales of OEM products are higher, its commercially-available products sold as its private brand show great profitability and thus the company will expand the business to the global markets

KYB’s commercially-available shock absorbers can be mounted on about 90% of Japanese, American, and European automobiles used worldwide today.

What is behind such a high coverage rate is the strong relationships KYB has with major automobile manufacturers including Toyota.

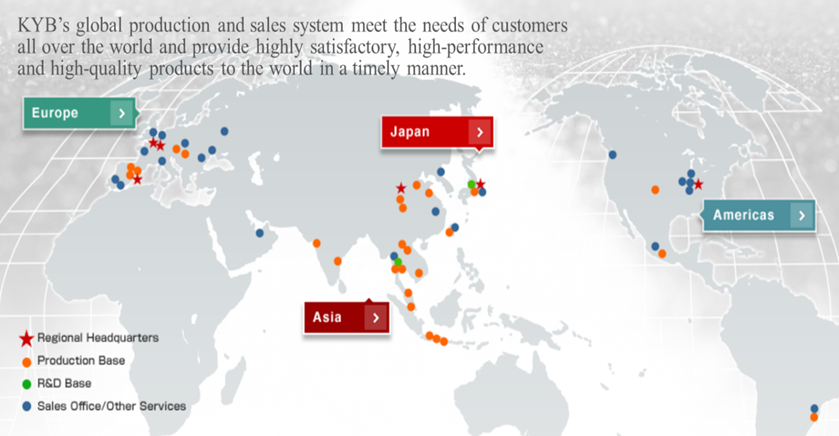

(3) Global network

In 23 countries worldwide including Japan, KYB has 46 group companies, establishing strong global networks.

| No. of Countries | No. of group companies |

Japan | 1 | 13 |

Asia | 7 | 18 |

Europe | 12 | 8 |

America | 3 | 7 |

Total | 23 | 46 |

(As of Fiscal year ended March 2021)

(4) Research and Development

(Structure)

KYB has established a global and optimum research and development (R&D) structure by setting R&D bases in 2 regions, Japan and Europe.

While the R&D bases in regions other than Japan basically engage in development of model products and development for enhancing product appeal such as performance improvement and cost reduction, R&D from the long-term perspectives are carried out mainly in Basic Technology R&D Center (Sagamihara-shi, Kanagawa) and Production Technology R&D Center (Kani-shi, Gifu) in Japan and R&D of highly unique prior art, etc are performed.

In addition, the know-how about production equipment designing which has been cultivated in Production Technology R&D Center and each plant is gathered in Machine Tools Center (Kani-shi, Gifu) in order to strengthen and propel internal manufacturing of equipment, jigs, and tools for which KYB has strived to boost innovative spirit and reliability.

Regarding high-functionality and systematization of its products, KYB, in addition to independent development, propels joint research and development with its clients or related equipment manufacturers. The company is also endeavoring proactively to developing advanced technology through industry-academia collaboration.

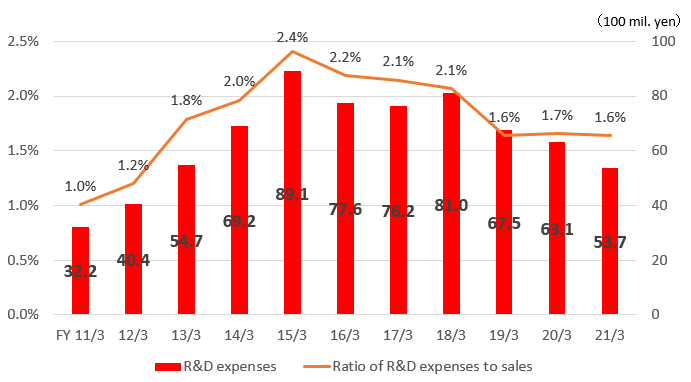

(Variation in R&D expenses)

Since the term ended Mar. 2013, the awareness of R&D costs with respect to sales has been raised, and it is currently around 1.5%.

However, R&D costs are currently declining because of the incident of the nonconforming seismic isolation/mitigation oil dampers. From this term, as business performance is expected to recover, it will be necessary to make aggressive investments again to achieve the medium-term management plan’s goals and achieve longer-term and sustainable growth.

(Area of focus)

KYB is propelling the development of products by dealing with performance improvement, high functionality, and systematization and considering eco-friendliness with respect to energy and environmental issues through weight saving, energy saving, reduction in environmentally hazardous substances. At the same time, it is striving to strengthen its production technology capabilities.

In addition, following the accelerated globalization, it aims to set up a strategic and global production, sales, and technological structure, including development of human resources with global outlooks and establishment of a standardized management system.

Lately, the company has focused on product development related to autonomous driving systems.

One example is the technology that integrates EPS (electronic steering) and shock absorbers.

KYB considers that the technology, which enables more comfortable and smoother driving in any road surface conditions independently of the drivers’ skills and judgment, is definitely indispensable for automobiles with the autonomous driving system.

Furthermore, KYB deems the “steering by wire” system is another technology whose importance will grow in the future.

In the conventional steering operation, movement is transmitted to the steering gear box and tires through the steering shaft, whereas the “steering by wire” system conveys steering movement via electronic signals.

Some of the system’s advantages include the capability of relieving drivers’ fatigue due to less vibration from the tires, and the capability of automatically adjusting sideslips of the car body due to strong winds which conventionally needed to be adjusted through an intentional steering operation by drivers. In addition, thanks to the “steering by wire” system, the steering wheel may not necessarily be mounted on the right front of a car, and therefore, the system’s potential for considerably changing the way automobiles are, including the design and functions, has attracted much attention.

Although several issues still exist, KYB is further brushing up the system as its unique EPS technology.

【1-5 Characteristics and strengths】

◎ Large shares in various product markets

KYB has earned a large market share of multifarious products, with the domestic share of OEM shock absorbers for automobiles being 40% and its global share being 14%, the global share of hydraulic cylinders for construction machinery being 25%, the domestic share of concrete mixer trucks being 83%.

◎ Superior core technology

Such large market shares are attributed to the great trust in its products from clients as indicated by the fact that KYB has about 60% share on a global basis in Toyota Motor which vies with Volkswagen and GM for the position of the world’s largest automobile manufacturer. The basis of the clients’ trust is nothing else but the superior “hydraulic” technology that KYB has cultivated and enhanced for the past 100 years since its foundation.

KYB’s two core technologies, the “vibration control technology” represented by its shock absorbers and oil dampers for seismic isolation and vibration suppression and the “power control technology” typified by its control valves for shovels and electric power steering, have gained high reputation from clients and thus are used in diverse circumstances.

【1-6 ROE analysis】

| FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 | FY 3/21 |

ROE [%] | -2.0 | 9.3 | 8.8 | -15.0 | -55.4 | 18.5 |

Net income margin [%] | -0.89 | 4.09% | 3.87 | -6.01 | -16.22 | 5.21 |

Total asset turnover [times] | 0.95 | 0.96 | 0.99 | 0.97 | 0.90 | 0.78 |

Leverage [times] | 2.35 | 2.37 | 2.30 | 2.59 | 3.81 | 4.53 |

2. Second Quarter of Fiscal Year ending March 2022 Earnings Results

(1) Overview of consolidated results

| FY3/21 2Q | Composition ratio | FY3/22 2Q | Composition ratio | YoY |

Sales | 138,825 | 100.0% | 185,882 | 100.0% | +33.9% |

Gross Profit | 20,699 | 14.9% | 38,025 | 20.5% | +83.7% |

SG&A Expenses | 22,118 | 15.9% | 26,358 | 14.2% | +19.2% |

Segment Profit | -1,418 | - | 11,667 | 6.3% | - |

Operating Profit | -2,671 | - | 13,797 | 7.4% | - |

Profit before Taxes | -3,432 | - | 12,674 | 6.8% | - |

Quarterly Net Profit | -3,757 | - | 9,502 | 5.1% | - |

* Unit: million yen. Segment profit corresponds to the operating income in the Japanese standard. Quarterly net profit is the quarterly profit attributable to the owner of the parent company.

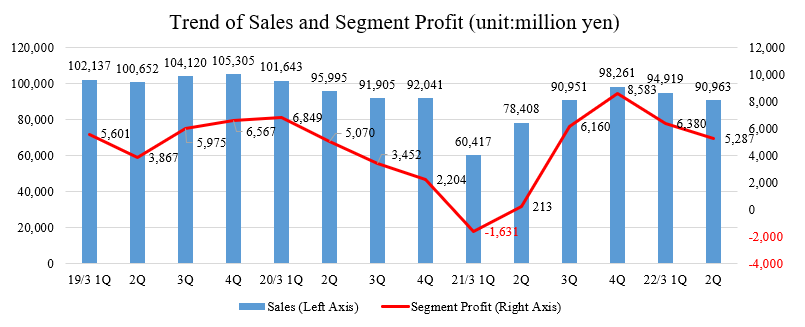

Sales increased, and segment profit returned to the black.

In the first half of the term ending Mar. 2022, sales increased 33.9% year on year to 185.9 billion yen. The impact of the decline in demand due to COVID-19 has receded. Gross profit also increased 83.7% year on year. The increase in SG&A expenses was offset by the effect of fixed cost reduction, and the segment profit returned to profitability. A decrease in costs related to seismic isolation/mitigation oil dampers also contributed.

◎Sales Trends in each region

Region | FY3/21 2Q | FY3/22 2Q | YoY |

Japan | 620 | 794 | +28.1% |

Europe | 214 | 326 | +52.7% |

America | 142 | 170 | +19.8% |

China | 163 | 172 | +5.4% |

Southeast Asia | 77 | 135 | +74.4% |

Others | 173 | 262 | +51.7% |

Total | 1,388 | 1,859 | +33.9% |

* unit: 100 million yen

Sales increased in all regions. Overseas sales ratio increased 2.0% from the previous term 55.3% to 57.3%.

(2) Trend in each segment

Sales | FY3/21 2Q | Composition ratio | FY3/22 2Q | Composition ratio | YoY |

AC business | 81,827 | 58.9% | 110,991 | 59.7% | +35.6% |

HC business | 51,118 | 36.8% | 67,952 | 36.6% | +32.9% |

Aircraft Components business | 1,898 | 1.4% | 1,910 | 1.0% | +0.6% |

Others | 3,982 | 2.9% | 5,029 | 2.7% | +26.3% |

Total | 138,825 | 100.0% | 185,882 | 100.0% | +33.9% |

Segment profit |

|

|

|

|

|

AC business | -1,307 | - | 7,109 | 6.4% | - |

HC business | 455 | 0.9% | 5,877 | 8.6% | +1191.6% |

Aircraft Components business | -828 | - | -1,879 | - | - |

Others | 256 | 6.4% | 526 | 10.5% | +105.5% |

Adjustment | 6 | - | 34 | - | - |

Total | -1,418 | - | 11,667 | 6.3% | - |

* Unit: million yen. The composition ratio for profit is a profit margin.

① AC Business

Product | Sales | Composition ratio | YoY |

Shock Absorbers for Automobiles | 80,991 | 73.0% | +32.6% |

Shock Absorbers for Motorcycles | 15,772 | 14.2% | +70.1% |

Hydraulic Equipment for Automobiles | 11,880 | 10.7% | +21.9% |

Others | 2,348 | 2.1% | +35.2% |

Total | 110,991 | 100.0% | +35.6% |

* Unit: million yen

Region | Sales | Composition ratio | YoY |

Japan | 278 | 25.0% | +25.8% |

Europe | 289 | 26.0% | +49.0% |

America | 131 | 11.8% | +19.1% |

China | 92 | 8.3% | +8.2% |

Southeast Asia | 119 | 10.7% | +72.5% |

Others | 200 | 18.0% | +44.9% |

Total | 1,110 | 100.0% | +35.7% |

* Unit: 100 million yen

② HC Business

Products | Sales | Composition ratio | YoY |

Hydraulic Equipment for Industrial Use | 61,608 | 90.7% | +37.1% |

System Products | 2,060 | 3.0% | -18.2% |

Others | 4,283 | 6.3% | +17.2% |

Total | 67,952 | 100.0% | +32.9% |

* Unit: million yen

Region | Sales | Composition ratio | YoY |

Japan | 464 | 68.2% | +31.4% |

Europe | 37 | 5.4% | +94.7% |

America | 36 | 5.3% | +44.0% |

China | 80 | 11.8% | +2.6% |

Southeast Asia | 15 | 2.2% | +87.5% |

Others | 48 | 7.1% | +71.4% |

Total | 680 | 100.0% | +33.1% |

* Unit: 100 million yen

(3) Financial standing and cash flows

◎ Major BS

| End of Mar. 2021 | End of Sep. 2021 | Increase /Decrease |

| End of Mar. 2021 | End of Sep. 2021 | Increase /Decrease |

Current Assets | 236,252 | 236,553 | +301 | Current Liabilities | 204,480 | 210,717 | +6,237 |

Cash, etc. | 68,700 | 67,412 | -1,288 | Trade Payables | 74,437 | 68,745 | -5,692 |

Trade Receivables | 98,898 | 97,518 | -1,380 | Debts | 70,010 | 87,363 | +17,353 |

Inventories | 53,997 | 59,295 | +5,298 | Noncurrent Liabilities | 105,430 | 75,003 | -30,427 |

Noncurrent Assets | 190,383 | 186,852 | -3,531 | Debts | 54,836 | 26,325 | -28,511 |

Property, Plant and Equipment | 160,308 | 158,306 | -2,002 | Total Liabilities | 309,910 | 285,720 | -24,190 |

Intangible Assets | 4,106 | 3,818 | -288 | Net Assets | 116,726 | 137,685 | +20,959 |

Other Financial Assets | 15,647 | 15,479 | -168 | Retained Earnings | 49,579 | 59,070 | +9,491 |

Total assets | 426,635 | 423,405 | -3,230 | Total Liabilities and Net Assets | 426,635 | 423,405 | -3,230 |

* Unit: million yen. “Cash, etc.” means cash and cash equivalents. “Trade receivables” means trade receivables and other receivables. “Trade payables” mean trade payables and other payables

Current assets increased 300 million yen from the end of the previous term due to an increase in inventories despite a decrease in cash, trade receivables, etc. Noncurrent assets decreased 3.5 billion yen from the end of the previous term mostly due to a decline in property, plant and equipment, and total assets decreased 3.2 billion yen from the end of the previous term to 423.4 billion yen.

Total liabilities declined 24.2 billion yen from the end of the previous term to 285.7 billion yen due to a decrease in debts, etc. Net assets increased 21.0 billion yen from the end of the previous term to 137.7 billion yen due to an increase in retained earnings. As a result, the equity ratio attributable to owners of the parent augmented 5.1% from the end of the previous term to 31.0%.

◎ Cash Flow

| FY3/21 2Q | FY3/22 2Q | Increase/decrease |

Operating CF | 908 | 7,297 | +6,389 |

Investing CF | -6,640 | -5,896 | +744 |

Free CF | -5,732 | 1,401 | +7,133 |

Financing CF | 18,943 | -3,044 | -21,987 |

Cash and equivalents | 63,828 | 67,412 | +3,584 |

* Unit: million yen

Operating CF and free CF greatly increased, because operating income returned to the black.

Financing CF has turned red due to an increase in expenditures for the repayment and decreased income of long-term debt, etc.

The cash position increased.

(4)Topics

①The Progress in the adaption of seismic isolation/mitigation oil dampers

(Overview)

In October 2018, it was revealed that the performance inspection records for seismic isolation/mitigation oil dampers products, which are manufactured and sold by KYB and its subsidiary named Kayaba System Machinery Co., Ltd., were falsified and then the products that do not comply with the criteria approved by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) or clients’ specs were attached to buildings.

As a result of the investigation, 991 buildings in subject were found as of March 31, 2021.

(Response and Progress)

As of the end of October 2021, the company finished working to make nonconforming seismic isolation/mitigation oil dampers compliant with the standards at 943 properties, which account for 95.2% of the target buildings.

Of the 991 subject buildings, a total of 30 (3.0%) are under construction, awaiting construction (adjusting construction schedule), or waiting for production to meet the construction schedule, and 4 (0.4%) are under administrative adjustment.

(waiting for construction to start, construction schedule is being adjusted), and the company is exerting efforts toward the early start of the work at these 14buildings(1.4%).

② Establishment of ESG Promotion Office

In July 2021, the ESG Promotion Office was newly established to apply and promote the basic policy of ESG (Environmental, Social, and Governance) in the corporate group.

The company will be aware of ESG values for all its corporate activities and use them as a basis for formulating policies.

The entire group will work to reduce CO2 emissions and develop products that contribute to the sustainable development of society. In addition, the company will reconsider its existing activities as ESG initiatives and actively communicate them both internally and externally, with the aim of creating products that are trusted by society.

③ Selecting the new market category Prime Market

The company received a notice from Tokyo Stock Exchange regarding the results of the initial assessment of compliance with the listing maintenance criteria for the new market segment. In October 2021, the company decided to select the Prime Market as its market segment, based on the confirmation that it complies with the listing maintenance criteria for the Prime Market in the new market segment.

The company will now proceed with the prescribed procedures related to the application for the selection of a new market segment in accordance with the schedule set by the TSE.

④ Merger with the Wholly Owned Subsidiary KYB Engineering & Service Co., Ltd.

In November 2021, the company announced that it would merge its wholly owned subsidiary KYB Engineering and Service Co., Ltd.

By merging KYB Engineering and Service, a sales subsidiary of KYB for hydraulic equipment, the company aims to strengthen its sales force, improve profitability, and strengthen KYB's financial base.

The company will also work to revitalize the rotation of human resources and strengthen the group governance system.

The merger is scheduled to take effect on January 1, 2022.

3.Fiscal Year ending March 2022 Earnings Estimates

Full-year earnings forecast

| FY3/21 | Composition ratio | FY3/22 Forecast | Composition ratio | YoY | Revised Rate | Progress Rate |

Sales | 328,037 | 100.0% | 380,000 | 100.0% | +15.8% | +4.1% | 48.9% |

Segment profit | 13,325 | 4.1% | 23,500 | 6.2% | +76.4% | +6.8% | 49.6% |

Operating profit | 18,297 | 5.6% | 25,500 | 6.7% | +39.4% | +21.4% | 54.1% |

Profit before taxes | 16,340 | 5.0% | 22,500 | 5.9% | +37.7% | +18.4% | 56.3% |

Net profit | 17,087 | 5.2% | 17,000 | 4.5% | -0.5% | +6.3% | 55.9% |

* Unit: million yen. The forecast was announced by the company. Segment income corresponds to the operating income in the Japanese standards. Net income is profit attributable to owners of the parent.

The initial estimates have been revised upwardly, Substantial increase in segment profit

Based on the progress made up to the second quarter, the initial estimates have been revised upwardly. For the term ending Mar. 2022, they estimated net sales of 380 billion yen, up 15.8% year on year, and segment profit of 23.5 billion yen, up 76.4% year on year. Sales are expected to increase in both AC and HC businesses. Production adjustment of automobiles due to the shortage of semiconductors has been prolonged, and OEMs are decreasing due to suspension and adjustment of operations by customers. On the other hand, demand was strong for commercial products that the company supplies to the aftermarket and for construction machinery. The company is building a flexible supply system that takes advantage of its strength in integrating production and sales, and as a result, commercial sales volume has reached a record high level globally. Despite the impact of production adjustments and steel market conditions, the company will also implement measures to improve profits, mainly by reducing fixed costs.

The company plans to pay an annual dividend of 90.00 yen per share (up 15.00 yen per share from the previous term) on its common stock, with interim and term-end dividends both equally 45.00 yen per share. The expected payout ratio is 13.5%. Dividends on Class A preferred stock are expected to be 1,952,054.80 yen per share for the interim period and 3,739,726.00 yen per share at the end of the term, for a total annual dividend of 5,691,780.80 yen per share.

◎Full-year earnings forecast by segments

Sales | FY3/21 | FY3/22 Forecast | YoY |

AC business | 1,975 | 2,267 | +14.8% |

HC business | 1,173 | 1,375 | +17.2% |

Aircraft Components business | 39 | 48 | +24.4% |

Others | 94 | 110 | +17.2% |

Total | 3,280 | 3,800 | +15.8% |

Segment profit |

|

|

|

AC business | 82 | 151 | +84.3% |

HC business | 66 | 108 | +64.8% |

Aircraft Components business | -25 | -34 | - |

Others | 10 | 10 | -3.6% |

Total | 133 | 235 | +76.4% |

* Unit: 100 million yen.

4.Conclusions

The effects of the pandemic are gradually fading, and the conformity of seismic isolation/mitigation oil dampers is progressing smoothly. In addition, although OEMs have been affected by the decline in new car production, the business environment surrounding them has improved, with strong sales of aftermarket products for used cars taking up the slack. However, despite the upward revision, the estimates for the second half calls for a slight increase in both sales and profit. With the global shortage of containers and soaring raw material prices, there are many uncertain factors, but we would like to pay attention to how much sales and profits the company can increase in the second half.

<Reference1: 2020 Medium-Term Management Plan>

After conducting a review considering the external environment, such as the impact of COVID-19, the company officially announced the 2020 Medium-Term Management Plan.

The theme of the plan is “aiming to transform the company into a highly profitable structure based on moral awareness and strict compliance as the basis of management”, and (1) strict compliance and strengthening of governance, (2) stabilization of the profit base (withdrawal from unprofitable businesses, bases, and products), (3) growth strategy, and (4) evolving into ESG management are listed as focus items.

Strict compliance and improvement of governance is described in the “Progress of making seismic isolation/mitigation oil dampers compliant with the standards.” The entire company will work to establish a moral consciousness as part of the corporate culture.

【Stabilization of the Earnings Base (Withdrawal from Unprofitable Businesses, Bases, and Products) & the Growth Strategy】

(1) Financial Goals

The following financial targets are set for the term ending Mar. 2022.

| 2019 Results | 2022 Goals |

Sales | 3,816 | 3,780 |

AC business | 2,321 | 2,290 |

HC business | 1,253 | 1,300 |

Segment profit | 176 | 250 |

Segment profit ratio | 4.6% | 6.6% |

Capital adequacy ratio | 18.1% | 34% |

* Unit: 100 million yen.

Sales will not reach the level of sales in the term ended Mar. 2019, but the company aims to have record-high segment profit and profit margin. They will also work to transform KYB into an agile company.

(2) About Segment Profit

The profit improvement measures and expected improvement effects for segment profit are as follows.

The total amount is expected to improve 7.4 billion yen from 17.6 billion yen in the term ended Mar. 2019 to 25 billion yen in the term ended Mar. 2022.

Measures | Amount of improvement | Outline of measures |

Productivity improvement (reduction of manufacturing cost) | +34 | Innovative manufacturing (improvement of the automation level), promotion of labor-saving, etc. |

Withdrawal and reduction of unprofitable fields | +17 | Withdrawal from domestic production of unprofitable EPS for passenger cars, closure of the European PS base, etc. |

Variable cost reduction | +10 | VA, VE, promotion of the localization of procurement activities, etc. |

Consolidation of production bases and establishment of an optimal production system | +7 | Reorganization of European bases, construction of CVT global optimum production systems, etc. |

Promotion of sales expansion activities | +6 | Expansion of sales of mini excavators by adopting electronic control, improving the sales network of commercial products, etc. |

*Unit: 100 million yen

(3) Ideal State

The company continues to position the AC business and HC business as the two major core businesses that support KYB, and it has set out its goals as follows.

① AC Business

The goal for the term ending Mar. 2022 is to establish the company’s position as a core supplier by enhancing existing businesses and core technologies.

The three basic strategies are (1) enhancement: stabilizing the earnings base, (2) evolution: innovative manufacturing, and (3) renovation: creating high-value-added products.

◎ Strengthening the Earnings Base

The company’s concrete initiatives include production optimization by consolidating and reorganizing major bases, cost reduction activities, and structural reforms of commercial businesses.

In production optimization, the company aspires to achieve optimal production that matches the shift in customer demand areas.

In Europe, the PS base will be closed, and the SA base in the region will be reorganized from Western Europe centered to Eastern Europe centered.

In EPS production, the company will withdraw from domestic production of unprofitable passenger cars and shift its focus to China.

The company will build a CVT global optimum production system. The surplus production capacity of the two-wheeled Asian base will also be reduced through production restructuring.

◎ Innovative Manufacturing

The company will further promote robotization and labor-saving, reduce processing costs, and strengthen competitiveness.

Innovative manufacturing efforts will be adopted sequentially at all domestic and overseas bases, centering on the commercial line.

◎ Creation of High Value-Added Products

The company will enhance its unique technology in response to the ever-increasing trend toward EV, CASE, and MaaS.

As their technology strategies set as (1) next-generation platform support, (2) enhancing core technology (vibration control/power control technology), (3) hydraulic technology application, and (4) electric and digital system support, the company will create high-value-added products that meet market needs such as quietness, spaciousness, high performance, low vibration, and ride comfort.

② HC Business

The vision for the term ending Mar. 2022 is HC business that is trusted by customers and continues to be used worldwide—to be a trusted manufacturer and the first to be contacted by customers.

The company’s two basic strategies are, meeting automation and complex needs, and promoting cost reduction and the localization of procurement activities.

◎ Excavator Growth Strategy: Meeting Automation and Complex Needs

For excavators, the company’s technology strategies are digitization, expansion of the pump lineup, and electronic control of control valves.

In addition, a vital technology strategy for mini excavators is to expand the lineup and electronically control by the load sensing system.

In the HC business, the company will further refine the power control technology, which is one of their strengths, to fuse the pump, the heart of the excavator, and the valve, its brain, based on KYB’s unique technology, to create new added value and demonstrate a competitive advantage.

The critical technology to realize the cooperation and fusion of the pump and valve is electronically controlled load sensing.

Load sensing is a mechanism that feeds back the load sensed by the valve to the pump to supply the required flow rate and pressure.

The advantages of load sensing are (1) simultaneous or combined operations that rely on the experience of the operator become easy, (2) can be used not only in construction work but also in disaster relief because it can use various attachments, (3) saves energy, and (4) can be digitized and automated without being affected by load.

◎ Promotion of Cost Reduction and the Localization or Procurement

The company will improve market competitiveness by introducing a cost reduction model and localizing procurement.

(4) Enhancing the ESG Management

Currently, the company is proceeding with the following efforts.

Reducing energy consumption and CO2 emissions Energy saving | The company installed a solar power generation facility at the KYB-YS Ueda Plant. The total power generation in 2020 was about 700,000 kW. |

Reducing industrial waste | The company uses waste materials generated at factories and related business partners as in-house casting materials. |

Creating a rewarding workplace | The company is promoting health management and has been certified as an excellent health management corporation for the second consecutive year. |

Going forward, the company will reduce CO2 emissions per unit by 3% from the previous year, raise the composition ratio of renewable energy usage to 15% in 2025, and promote product development that contributes to the sustainable development of society.

In addition, the company will set up an ESG promotion office to strengthen the chain of policies and implementation.(ESG promotion office was established in July 2021.)

<Reference2: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 7 directors, including 3 outside ones |

Auditors | 4 auditors, including 2 outside ones |

◎ Corporate Governance Report

Last update date: December. 8, 2021

<Basic approach>

In order to respond to the expectations of the stakeholders through realization of sustainable growth and corporate value improvement as well as fulfill the corporate social responsibility of contributing to society, it is our basic approach to pursue the development of a rapid and efficient management structure centered on the Board of Directors and establishment of fair and transparent management supervision functions and work on strengthening and enhancing corporate governance based on the following management philosophy and basic policies.

In the new medium-term management plan starting in fiscal 2020, the company is striving to prevent the recurrence of inappropriate events in seismic isolation/mitigation oil dampers and other products, and to transform itself into a highly profitable organization under the slogan "Restore trust and pride" while placing awareness of norms and compliance as part of corporate culture reform at the core of management.

(Management philosophy)

“KYB group contributes to the society, by serving technologies and products that make people’s life safe and comfortable.”

1.Handle all matters with sincerity while adhering to the normative consciousness.

2.We shall build a corporate culture that holds high goals and full of vitality.

3.We shall maintain kindness and sincerity, cherish nature and care for the environment.

4.We shall constantly pursue creativity and contribute to the prosperity of customers, shareholders, business partners and society.

(Corporate Governance Basic policies)

1.We shall respect the rights of shareholders and ensure their equality.

2.We shall take the benefits of stakeholders including our shareholders into consideration and endeavor to appropriately collaborate with those stakeholders.

3.We shall disclose not only the information in compliance with the relevant laws and regulations, but also actively provide the important and/or useful information to the stakeholders for their well-informed decision making.

4.The Board of Directors shall be aware of its fiduciary responsibility and accountability to the shareholders and shall appropriately fulfill its roles and responsibilities in order to promote sustainable and stable corporate growth and increase corporate value, profitability and capital efficiency.

5.The company shall promote constructive dialogues with shareholders to obtain their understandings of the company's management policies, etc., and shall strive to take appropriate actions, such as utilizing their opinions of the company for improving management.

As for our company's sustainability, it is indicated in our management philosophy.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The information is based on the revised Corporate Governance Code, which came into effect on June 11, 2021.

Principles | Reasons for not implementing the principles |

(Supplementary principle 4-1-3 Successive plan for CEO, etc.) | Our company deems successive plans for CEO and the like as an important issue for sustainable growth and medium to long-term improvement of our corporate value. From 2016 we have established a committee of nomination formed with an internal director and an unaffiliated director so we can improve our transparency in terms of the process of nomination. From now on we will consider requirements and development policy regarding CEO and other positions, taking account of the management environment surrounding our company and the corporate culture. At the same time, we will give consideration to the supervision system by the board of directors. |

(Principle 4-11 Precondition for ensuring effectiveness of the board of directors and board of corporate auditors) | The Company does not have female directors. However, we appoint people we judge suitable for incorporating diverse values into management as directors, sufficiently considering the balance in knowledge of the whole board of directors, experience (including international experience), abilities, etc., without distinguishing them based on personal attributes such as gender, as stated in 4-11-1. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

The information is based on the revised Corporate Governance Code, which came into effect on June 11, 2021.

原則 | 開示内容 |

Principle 1-4【So-called strategically held shares】 | (1.) Policy on strategic shareholding From the perspective of medium to long-term improvement of corporate value, our company, when judging as necessary, strategically holds shares through which the relationship of trust and the business relationship are expected to be maintained or strengthened regarding business strategies and operations after comprehensively judging the growth potential and economic rationality of such shares. With regard to strategically held shares, we check the rationality of continued holdings in consideration of whether or not the benefits of holdings are commensurate with the Company’s cost of capital, etc., at a meeting of the board of directors every year. We plan to sell shares when we consider that the rationality in holding them has weakened. (2.) Policy on exercise of voting rights Before exercising the voting rights of shares that our company strategically holds, we consider for each case whether the strategic shareholding contributes to medium to long-term improvement of our corporate value and increase in shareholder return and make judgment after giving thorough consideration to the management policies and business strategies of the company that issues relevant shares. |

(Principle 2-4-1: Promotion of women, foreign nationals and mid-career hires to management positions, etc., and promotion of core human resources, etc.) | We believe that diversification of human resources is one of the most important measures to achieve sound management. As part of this effort, we are strengthening our infrastructure and educational activities to promote the advancement of women. To increase the number of female executives, we have increased the number of female employees in positions that are candidates for executive positions. In the future, we plan to develop a career path for women to change the mindset of the individual, and create a development plan by the supervisor to change the mindset of the people around them. |

(Supplementary Principle 3-1-3: Initiatives for Sustainability, etc.) | In July 2021, we established the ESG Promotion Office in response to the significant changes in the environment surrounding our company related to ESG (Environmental, Social, and Governance). From now on, we will use ESG management as the basis for formulating our policies. In promoting ESG, we will not simply respond to environmental and social issues, but will also explore potential business opportunities and promote activities to enhance corporate value. We will also work to build trust by compiling information on ESG-related activities conducted within the company and proactively communicating this information to stakeholders. |

Principle 5-1【Policy on constructive dialogue with shareholders】 | In our company, the global finance executive presides, and the IR office of the accounting head department deals with shareholders and investors in order to encourage constructive dialogue with shareholders and the like. The IR office has established a system that allows appropriate response in collaboration with related departments of our company to enrich such dialogue. We hold financial results briefings for analysts and institutional investors, where the president and the global finance executive describe our management strategies and financial conditions, once in every half year. In addition, we carry out individual interviews as requested, and strive for proactive communication with overseas shareholders and institutional investors through attendance at conferences in and outside Japan and individual IR activities abroad. Opinions and requests obtained from shareholders and investors through our IR activities are conveyed on a regular basis to the board of directors and the management as feedback in order to share information. Our company gives meticulous attention to handling of insider information not to inflict losses on each other in dialogue with shareholders and investors. Accordingly, for a period beginning with the week before the date of settlement and ending with the day when financial statements are announced, which is called a quiet period, our company refrains from having dialogue with shareholders and investors and endeavors to conduct thorough internal information management. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C), All Rights Reserved by Investment Bridge Co., Ltd.. |