| SHOEI CO., LTD. (7839) |

|

||||||||||||||

Company |

SHOEI CO., LTD. |

||

Code No. |

7839 |

||

Exchange |

Second Section, TSE |

||

Chairman |

Masaru Yamada |

||

President |

Hironori Yasukochi |

||

Headquarters |

Ueno 5-8-5, Taito-ku, Tokyo |

||

Year End |

September |

||

Website |

|||

* Share price as of close on May 2, 2014. Number of shares outstanding at end of the most recent quarter excluding treasury shares.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company.

This Bridge Report discusses the first half of fiscal year September 2014 earnings results and full fiscal year September 2014 earnings estimates for Shoei Co., Ltd.

|

|

| Key Points |

|

| Company Overview |

|

Management Policy: Achieve World's Top Levels in Three Realms

"World Top Quality": Global brand that is made in Japan"World Top Competitiveness in Cost" World's only helmet maker to utilize the Toyota Production System for cost management

"World Top Delightful Company" Achieve highest levels of satisfaction of customers, shareholders and employees

<Business Description>

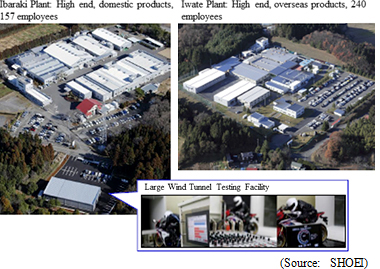

Motorcycle use helmets account for about 90% of total sales. SHOEI focuses upon high value added "premium helmets" that are manufactured at two plants, one each in Ibaraki (Inashiki City), Iwate (Ichinoseki City) Prefectures in Japan. The Company is able to maintain high quality levels and prevent the leakage of its technology by maintaining manufacturing facilities within Japan. In addition, SHOEI is the only helmet company in the world utilizing the "Toyota Production System" to achieve high levels of profitability, inventory turnover and asset efficiency.

<Maintaining Basic Policy for Medium and Long Term Stable Growth and Stable Profit>

(1)Protect Own Company by Ourselves

(2)Made in Japan and maintaining constant employment (Transmission of Manufacturing)

(3)Maintain healthy financial positions

(4)Continuation of Investment (Development of new products, Cost saving, Improvement of quality, Firm safety)

(5)Targeting #1 in All Premium Helmet Markets in the World

(6)Development of New Markets and Deepening of Existing Markets

(7)Fair distribution of retained earnings (50% dividend of profit after tax, distribution to employees and distribution to company (proper retained earnings kept))

<Focus Upon Craftsmanship to Maintain Top Market Share - Two Domestic Plants in Ibaraki and Iwate Responsible for 100% of Products>

SHOEI produces premium brand helmets that are recognized as the highest quality products by motorcycle riders around the world. Their helmets boast of extremely difficult designs that combine to give not only extreme functionality with superior air resistance characteristics while also being very fashionable. SHOEI’s persistence in its pursuit of helmet designs that are “comfortable to their users” is the driving force behind its top market share.

Aerodynamic Efficiency and Quietness

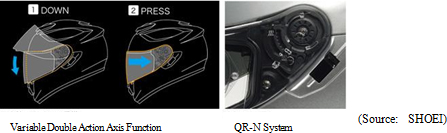

The ability to achieve high levels of aerodynamic efficiency through superior designs contributes to direct reductions in the burden of riders wearing helmet driving at high speeds. Therefore, SHOEI repeatedly tests its products and the impact of wind resistance upon their design in their large wind tunnel to develop ever more effective aero-form designs for helmets (Data is taken each time modifications are made to test sample helmets, and large amounts of time are devoted to making detailed revisions to designs of helmets to improve their aerodynamic efficiency.).In addition, multiple efforts are made to reduce the noise created by their helmets at high speeds, which is a source of fatigue and leads to deterioration in concentration of riders. For example, the new product "Z-7" employs a highly tight sealing system to reduce the amount of wind noise produced by the helmet, and further reduce the noise reaching the rider through the use of a tight sealing interior design. In addition, the helmet interior design allows for an ear pad to be used to further increase the comfort of the rider.   Fashionable and Safe

Making a helmet fashionable is highly difficult because the strength of the helmet could potentially be compromised, which could make equal rigidity across the entire helmet difficult to achieve. However, SHOEI helmets undergo a crash absorption test process of over 3,000 times per year to ensure that their fashionably designed helmets offer strong rigidity and are safe to wear.

Graphic decorations, which help to make helmets fashionable, use technologies used in pottery art including transfer sheets (A type of printing technology. Transfer sheets are provided by the pottery and ceramics manufacturer Noritake Co., Ltd.). An ultra-thin transfer sheet of less than one micron is used to transfer art to the round surface of the helmet and can only be manufactured by craftsmen with long experience in this technology. When compared to competitors' products at exhibitions, the highly superior variety, design, and color variation of SHOEI's helmets is easily recognized. While people have varying tastes in what may be considered fashionable, the advantage of SHOEI helmets when it comes to being fashionable is clearly reflected in the strong demand for its products and top market share. In addition, SHOEI products such as "GT-Air," which has an inner visor, employ "SWANS" visors made by Yamamoto Kogaku Co., Ltd., a renowned Japanese sunglass manufacturer. "SWANS" is recognized as a superior brand of sports sunglasses that is popular amongst golfers, marathon runners and other athletes and they boast of extremely low levels of distortion allowing users to wear them for long periods of time without any adverse effects.  |

| First Half of Fiscal Year September 2014 Earnings Results |

Sales, Ordinary Income Rise 39.4%, 228.2%

Sales rose by 39.4% year-over-year to ¥6.424 billion during the first half. In addition to the favorable demand for premium helmets in both Japan and Europe, the weakening of the yen contributed to a recovery in helmet demand in volume terms in North America as well. Orders from Germany increased by 1.5 times year-over-year during the two months of January and February, and sales in both the United Kingdom and France rose on new model introductions. Furthermore, demand in Spain (where sales of motorcycles had dropped to one third) has begun to recover and has bottomed in Italy, two markets that were severely impacted by the "Lehman Shock."Operating income rose by 3.1 times year-over-year to ¥1.361 billion during the first half. Higher capacity utilization rates arising from increases in production volumes and the effect of the weaker yen contributed to an 8.6% point improvement in cost of goods sold to sales ratio to 59.4%. Gross profit also rose by 76.9% year-over-year due in part to restraint in variable costs within sales, general and administrative expenses, which limited its growth to 19.8% year-over-year. Foreign exchange rates for SHOEI: US Dollar: ¥102.43 (A ¥13.14 weakening) Euro: ¥139.97 (A ¥23.31 weakening) Foreign exchange rates for overseas subsidiaries: US Dollar: ¥105.39 (A ¥18.81 weakening) Euro: ¥145.05 (A ¥30.34 weakening)    |

| Fiscal Year September 2014 Earnings Estimates |

Full Year Earnings Estimates Remain Unchanged: Sales, Ordinary Income Expected to Rise 7.5%, 53.9%

While both sales and profits are trending above initial estimates, SHOEI has decided to maintain its outstanding earnings estimates due to various uncertainties including the potential negative impact from a hike in the consumption tax and the potential direct and indirect impacts of volatility in foreign exchange upon its business.

Favorable Demand for New Product "Z-7"

The new product "Z-7" (The name of this product varies depending upon the market and is called "NXR" in Europe and "RF-1200" in North America) was introduced ahead of the 2014 motorcycle riding season. "Z-7" is designed with sports bike riding in mind and is designed to be light and compact. This product was initially launched in Europe under the "NXR" name in advance of the launch in Japan and sales have been better than expected.

(2) Dividend Expected to Be Raised by ¥16 to ¥45 at Term End

SHOEI views the return of profits to shareholders as a key management issue, and maintains a basic policy of "distribution of profits in line with earnings performance" that focuses upon dividend payout ratio as a guideline. Based upon this policy, SHOEI will fortify its financial and management foundations while at the same time strengthening its shareholder equity. Furthermore, it will endeavor to pay a term end dividend equivalent to a dividend payout ratio of 50% (Currently, dividends are only paid at the yearend). During fiscal year September 2014, dividend projections announced at the start of the term call for a ¥16 increase to ¥45 per share at the end of the fiscal year.

|

| Conclusions |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2014 Investment Bridge Co., Ltd. All Rights Reserved. |