Bridge Report:(7839)SHOEI Co., Ltd.

Kenichiro Ishida, President | SHOEI Co., Ltd.(7839) |

|

Company Information

Exchange | First Section, TSE |

Industry | Other Products (Manufacturing) |

President | Kenichiro Ishida |

Address | Taito 1-31-7, Taito-ku, Tokyo |

Year-end | September |

URL |

Stock Information

Share price | Shares Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥4,565 | 13,771,567shares | ¥62,867 million | 19.9% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥86.00 | 1.9% | ¥173.55 | 26.3x | ¥981.29 | 4.7x |

*Stock price as of the close on May 23, 2019. The number of shares issued is obtained by deducting the number of treasury stocks from the number of shares issued at the end of the latest quarter.

* Figures have been rounded off, and ROE is the actual value as of the end of the previous year.

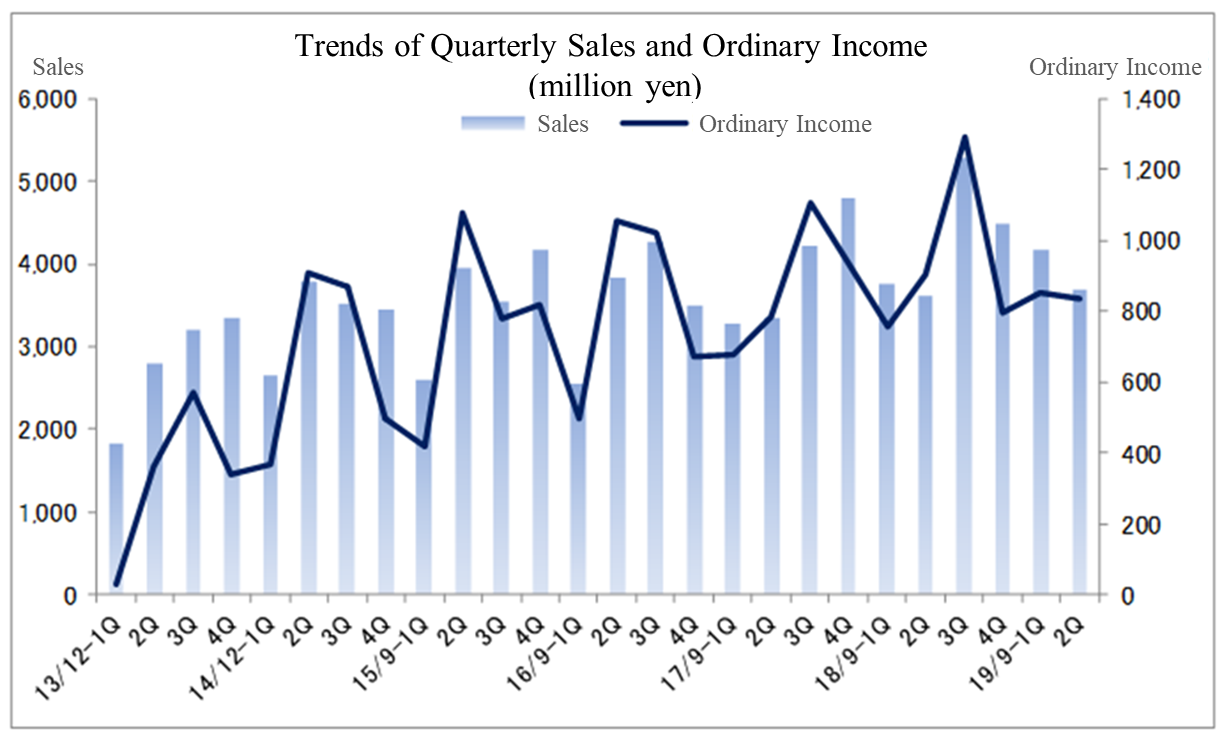

Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

September 2014 | 13,406 | 2,765 | 2,646 | 1,669 | 121.20 | 60.00 |

September 2015 | 14,244 | 3,210 | 3,092 | 1,996 | 145.00 | 72.00 |

September 2016 | 14,138 | 3,145 | 3,244 | 2,192 | 159.22 | 79.00 |

September 2017 | 15,641 | 3,461 | 3,497 | 2,358 | 171.29 | 85.00 |

September 2018 | 17,148 | 3,734 | 3,772 | 2,578 | 187.21 | 93.00 |

September 2019 Est. | 18,150 | 3,440 | 3,450 | 2,390 | 173.55 | 86.00 |

*Unit: million yen, yen

*The forecasted values were provided by the company. From fiscal year September 2016, net income means the profit attributable to owners of parent. Hereinafter the same applies.

This Bridge Report reports the earnings results for the first half of fiscal year September 2019 and full year estimates for fiscal year September 2019 for SHOEI Co., Ltd.

Table of Contents

Key Points

1. Company Overview

2. First Half of Fiscal Year ending September 2019 Earnings Results

3. Fiscal Year September 2019 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the first half of the fiscal year September 2019, sales and operating income grew 6.2% and 1.1%, respectively, year on year. Domestic and international consumer spending was favorable. Sales in Europe and the U.S. have expanded, as a favorable performance was maintained in the European market, which is the main market, with 18.8% increase in sales, and sales in North America, where the company is strengthening the distribution networks, increased 2% even though sales in March was carried over to 3Q due to a delay in shipping, while sales in Japan was affected by tight production conditions and decreased by 12%. Total gross profit declined from 42.3% year on year to 42.0%, and operating income margin decreased from 22.7% to 21.6% due to the increase of SG&A, etc. However, the company still achieved a profit increase. Both the sales and profits were below the company’s estimates.

- There is no change in the full-year forecast. In the fiscal year September 2019, sales are expected to rise 5.8% year on year, and operating income is projected to decline 7.9% year on year. Sales are estimated to be healthy in Europe and the U.S, where the company improved its distribution network using a 2-distributor system. The amount of orders received performed well as it increased 19.8% year on year in the first half, and the amount of orders received at the end of the first half rose 40.9% year on year. Furthermore, the exchange rates are assumed to be 1 US dollar = 110.00 yen and 1 euro = 125.00 yen.

- Despite the 10.6% increase in sales and 16.8% increase in operating income in the first quarter, sales grew 6.2% and operating income rose 1.1% in the first half. The company’s estimates weren’t achieved, and despite the increase in sales and profit, the performance in 2Q seemed sluggish. This is thought to be caused by the carry-over of sales in North America in March due to the shipping delay and the tight production conditions in Japan. However, the progress rate toward the all-year forecast exceeded those of the previous year's sales and profit and was seemingly maintained within the expected range. The trend of orders received is most noticeable. The European and U.S markets are likely to continue to lead the company’s performance in the short to medium term. As for the medium to long term, growth is expected, thanks to the recovery of China and the income improvement in emerging countries. Given the substantially increased backlog of orders, the production-related issues persist. The company needs to establish a system to increase production.

1. Company Overview

SHOEI is the world’s largest helmet manufacturer in the premium helmet market. As for motorcycle helmets, which account for about 90% of total sales, the company specializes in “premium helmets,” which have high quality and high added value, and manufactures them in two domestic factories: Ibaraki Factory in Inashiki City, Ibaraki Prefecture and Iwate Factory in Ichinoseki City, Iwate Prefecture. By clinging to domestic manufacturing, the company maintains high quality and prevents its technologies from being leaked. Meanwhile, its sales network covers not only Japan, but also over 70 countries, including European countries and the U.S. The safety, functionality, and beautiful shapes of SHOEI’s helmets are highly evaluated around the world, and the SHOEI brand is now synonymous with “premium helmets.” The SHOEI group is composed of SHOEI and 5 consolidated subsidiaries in the U.S., Germany (two subsidiaries), France, and Italy.

Management Policy | : Achieve World’s Top Levels in Three Realms |

“World’s Top Product Quality” | : Global brand that is made in Japan |

“World’s Top Cost Competitiveness” | : World’s only helmet maker to utilize the Toyota Production System for cost management |

“World’s Most Delightful Company” | : Achieve highest levels of satisfaction of customers, shareholders and employees |

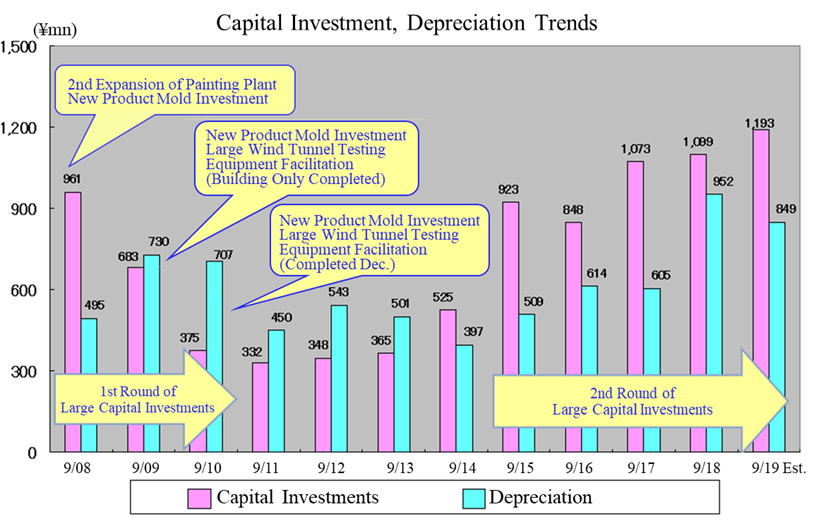

Basic Strategy to Achieve Stable Medium Term Growth, Stable Profitability

1) Maintain healthy financial conditions (Defend our Company)

2) Maintain the “Made in Japan” high quality reputation of its products established by creating high value added products and rationalizing its production capabilities

3) Ongoing investments

4) Become the number one manufacturer in global premium helmet markets, including newer markets

5)We will not establish unreasonable targets which could lead to potential illicit acts. We will continue to promote our business in earnest and tackle issues that we confront in the immediate term.

6) We will maintain our traditional policy for distribution of profits: 50% dividend payout ratio to shareholders, compensate employees, and fortify our company by fortifying retained earnings

At the end of fiscal year September 2018, current ratio, which reflects the Company’s ability to meet its short term payment commitments, stood at 600%., fixed ratio, which reflects the Company’s long term financial safety, stood at 21.8%, and capital adequacy ratio stood at 81.5% with no outstanding debt. SHOEI’s balance sheet proves that its management philosophy is successful in achieving its goals of 1) maintain healthy financial conditions (Defend our own Company).

With the manufacture of all its products at two Japanese plants, one each located in Ibaraki and Iwate Prefectures, SHOEI strives to achieve the 4) number one position in the global premium helmet market by 2) maintaining the concept of “Made in Japan” through high value addition and manufacturing rationalization (Carrying on the tradition of craftsmanship) and 3) sustained investments (New product development, cost reductions, product quality improvements, higher levels of safety).

2. First Half of Fiscal Year ending September 2019 Earnings Results

1) Overview of Business Results (Total)

| 9/18 1H | Ratio to sales | 9/19 1H | Ratio to sales | YoY | Forecast | Difference from the forecast |

Sales | 7,381 | 100.0% | 7,841 | 100.0% | +6.2% | 8,470 | -7.4% |

Gross Income | 3,120 | 42.3% | 3,290 | 42.0% | +5.5% | - | - |

SG&A | 1,445 | 19.6% | 1,598 | 20.4% | +10.5% | - | - |

Operating Income | 1,674 | 22.7% | 1,692 | 21.6% | +1.1% | 1,900 | -10.9% |

Ordinary Income | 1,657 | 22.4% | 1,686 | 21.5% | +1.7% | 1,910 | -11.7% |

Net Income | 1,122 | 15.2% | 1,156 | 14.7% | +3.1% | 1,330 | -13.0% |

*Unit: million yen

* Some data is calculated by Investment Bridge, and some data contained within this report may vary from actual results. (Applies to all data in this report)

Sales and operating income grew 6.2% and 1.1%, respectively, year on year.

Sales were 7,841 million yen, up 6.2% year on year. The sales in Europe and America expanded, as a favorable performance was maintained in the European market, which is the main market, with 18.8% increase in sales, and in North America, where the company is strengthening the distribution networks, sales increased 2% even though sales in March was carried over to 3Q due to a delay in shipping, while sales in Japan were affected by tight production conditions and decreased 12%.

The operating income was 1,692 million yen, up 1.1% year on year. Gross profit margin declined from 42.3% year on year to 42%, and operating income margin decreased from 22.7% to 21.6% due to the increase of SG&A, etc. However, the company still achieved a profit increase. As for the non-operating income/loss, foreign exchange losses were reduced, and consequently, the ordinary income was 1,686 million yen, up 1.7% year on year. Profit attributable to owners of parent was 1,156 million yen, up 3.1% year on year. Both the sales and profits were below the company’s estimates.

As for the exchange rate, the exchange rates for the sales of SHOEI were 1 US dollar = 111.83 yen (2.51-yen depreciation from the previous term) and 1 euro = 126.33 yen (6.95-yen appreciation from the previous term). The exchange rates for overseas subsidiaries (as of Dec. 28, 2018) were 1 US dollar = 111.00 yen (2.00-yen appreciation from the previous term) and 1 euro = 127.00 yen (7.94-yen appreciation from the previous term).

The environment surrounding the company in Europe had some uncertainty regarding the future of Brexit, however, consumer spending remained strong. Under the “U.S-first” policy in the U.S, there is concern over the trade friction with China judging from the trend of protective trade, however, as the employment and income environments improve, consumer spending was stabilized. Even domestically, based on the US-China movements, the future leaves some uncertainty due to the turbulence of the stock market and currency exchange rates, however, thanks to the strong corporate performance and the inbound demand, the consumer spending remained firm. As for Asian countries, while policies vary among countries, the economy remained stable.

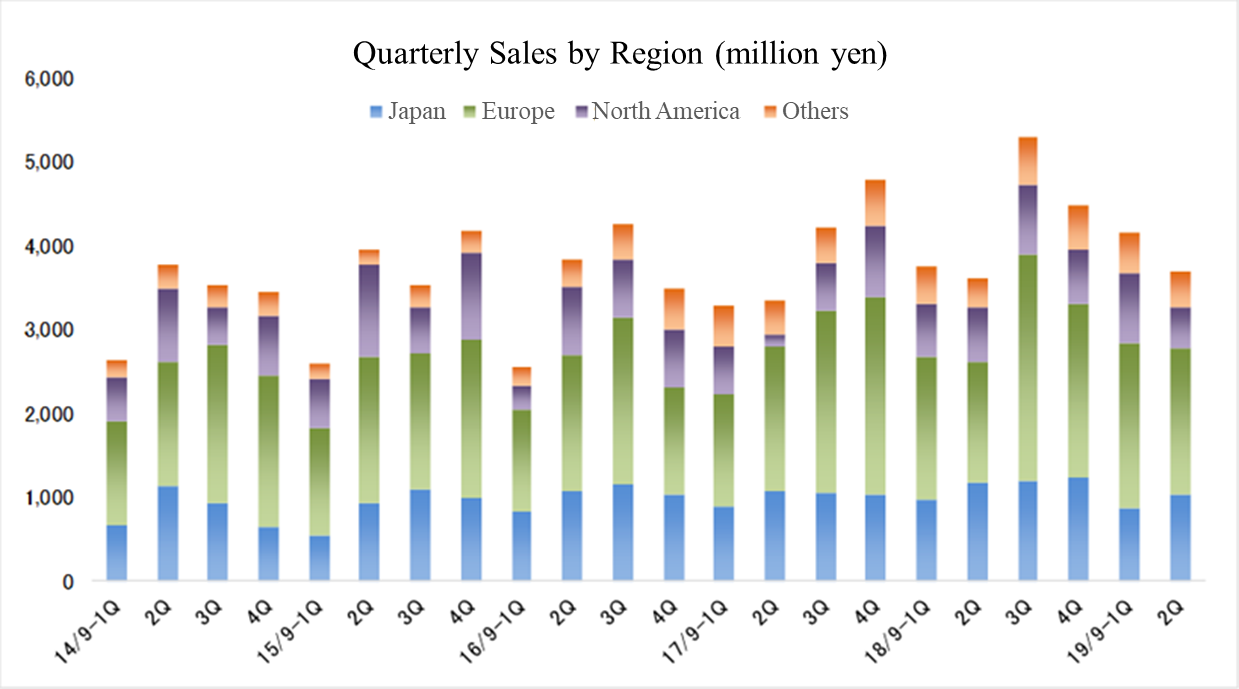

2) Trends by Regions

| 9/18 1H | Share | 9/19 1H | Share | YOY |

Japan | 2,152 | 29.2% | 1,893 | 24.1% | -12.0% |

Overseas | 5,229 | 70.8% | 5,948 | 75.9% | +13.7% |

Europe | 3,144 | 42.6% | 3,734 | 47.6% | +18.8% |

North America | 1,279 | 17.3% | 1,304 | 16.6% | +2.0% |

Other Regions | 805 | 10.9% | 909 | 11.6% | +12.9% |

Total | 7,381 | 100.0% | 7,841 | 100.0% | +6.2% |

*Unit: million yen

The performance of premium helmets remained healthy in all regions of Europe, including Germany, France, and Italy, thanks to robust consumer spending. In North America, the sales of new motorcycles were sluggish, and the helmet market was on a plateau. In Japan, the sales of new motorcycles of 251 cc or larger were on a plateau compared to the previous year, due to robust consumer spending. The helmet market has also continued the trend where seniors mainly own more than one or high-grade helmet. As for the Asian market, the sales of medium and large-sized motorcycles are declining in China, and there were some effects of the revision to the helmet specifications in Aug. and the helmet market scale has stagnated. However, other countries of Asia are seemingly expanding well although not as good as the company expected.

In this perspective, the sales volume in Japan and overseas in the first half was 239,000 units, up 4% year on year. In the European market, the sales volume of the Neotec2 which was released last spring and the new graphics 2019, was firm and rose 17% to 116,000 units. In North America, despite the effects of bad weather at the beginning of the year, the sales volume rose 3% to 43,000 units thanks to the effect of the shift from a 1-distributor system to a 2-distributor system in the previous year as well as the good sales performance of the Neotec2 and the new graphics 2019. In Japan, the sales volume from distributors to the market was favorable and rose 23%. However, due to tight production conditions, the sales volume from the company to distributors dropped 19% to 50,000 units. In Asia, the performance was good outside China as the effects of China's revising the specifications of helmets was significant from last August, thus the sales volume in Asia decreased by 4%. In the Chinese market, the company was ahead of its competitors to launch 2 models that meet the new specs in October. This kept the decrease in sales volume at 39%.

The "NEOTEC II," a sun visor-attached helmet compatible with an intercom, is popular for its unorthodox design and intercom function and is highly appreciated domestically and internationally. It became a record-breaking hit, and it's still popular even in the second year from its launch, thus it has been the main driver of helmet sales for the company in FY 9/2019.

NEOTECⅡ

| Sales are Europe Released in Jan. 2018

Sales are North America Released in Mar. 2018

Sales are Japan Released in May 2018

|

The amount of orders received was firm. The amount of orders as of the end of the first half increased 19.8% year on year, and the backlog of orders rose 40.9% year on year.

Orders and Backlogs

| 9/18 1H | 9/19 1H | ||||||

Orders | YOY | Backlogs | YOY | Orders | YOY | Backlogs | YOY | |

Premium Helmets | 6,883 | 22.8% | 3,243 | 4.8% | 8,186 | 18.9% | 4,554 | 40.4% |

Helmets supplied to the Government, Others | 538 | 11.8% | 119 | -1.5% | 705 | 30.9% | 185 | 55.4% |

Total | 7,421 | 22.0% | 3,363 | 4.6% | 8,892 | 19.8% | 4,739 | 40.9% |

*Unit: million yen

3) Balance Sheet Summary

| 9/18 | 3/19 |

| 9/18 | 3/19 |

Cash and deposits | 8,115 | 7,430 | Payables | 655 | 1,119 |

Receivables | 2,179 | 1,604 | Outstanding payments | 249 | 268 |

Inventories | 2,508 | 3,689 | Outstanding taxes | 671 | 508 |

Current Assets | 13,516 | 13,413 | Retirement reserves | 773 | 807 |

Tangible assets | 2,690 | 2,783 | Interest-bearing debt | - | - |

Intangible assets | 68 | 61 | Total Liabilities | 3,096 | 3,305 |

Investments, others | 479 | 561 | Net Assets | 13,659 | 13,513 |

Noncurrent Assets | 3,238 | 3,405 | Total Liabilities, Net Assets | 16,755 | 16,819 |

*Unit: million yen

The balance of assets at the end of the first half of FY 9/2019 is 16,819 million yen, up 63 million yen from the end of the previous term. Inventory assets increased while cash and deposits decreased. The balance of liabilities is 3,305 million yen, up 209 million yen from the end of the previous term, mostly due to the increase in trade payables. Net assets were 13,513 million yen, down 145 million yen from the end of the previous term.

The equity ratio was 80.3% (81.5% as of the end of the previous term).

3. Fiscal Year September 2019 Earnings Estimates

1) Consolidated Earnings

| FY9/18 | Ratio to sales | FY9/19 Est. | Ratio to sales | YOY |

Sales | 17,148 | 100.0% | 18,150 | 100.0% | +5.8% |

Operating Income | 3,734 | 21.8% | 3,440 | 19.0% | -7.9% |

Ordinary Income | 3,772 | 22.0% | 3,450 | 19.0% | -8.5% |

Net Income | 2,578 | 15.0% | 2,390 | 13.2% | -7.3% |

*Unit: million yen

In the fiscal year September 2019, sales are expected to grow 5.8%, while operating income is projected to decline 7.9% year on year.

There is no change in the full-year forecast. In the fiscal year September 2019, sales are expected to rise 5.8% year on year to 18,150 million yen and operating income will drop 7.9% year on year to 3,440 million yen. Below is the initial forecast for the premium helmets markets in major regions. It’s thought that there will be no major fluctuations.

In Europe, the sales of new motorcycles are firm, and unless there is extremely bad weather, the sales of helmets are expected to be firm like in FY 9/2018.

In the U.S., the sales of new motorcycles are stagnant, and the helmet market is estimated to be on a plateau, but since the company upgraded its distribution network to a 2-distributor system in October. last year, the sales volume is projected to be healthy.

In Asia, excluding China, business performance is expected to be firm as a whole. In China, sales are forecasted to decrease, because it will take time to respond to the revision to the helmet specifications in August.

In Japan, there is concern over the aging of riders, but the sales, mainly to seniors, are expected to be healthy like in FY 9/2018, as the employment and income environments are improving before the Olympics. In addition, the company plans to release new mainstay products one after another in each market and is expected to maintain or expand its market share.

Trends by Regions

| FY9/18 | Share | FY9/19 Est. | Share | YOY |

Japan | 4,586 | 26.7% | 4,353 | 24.0% | -5.1% |

Overseas | 12,562 | 73.3% | 13,797 | 76.0% | +9.8% |

Europe | 7,910 | 46.1% | 8,714 | 48.0% | +10.2% |

North America | 2,767 | 16.1% | 3,272 | 18.0% | +18.2% |

Other Regions | 1,884 | 11.0% | 1,811 | 10.0% | -3.9% |

Total | 17,148 | 100.0% | 18,150 | 100.0% | +5.8% |

*Unit: million yen

Moreover, it is assumed that the exchange rates for SHOEI will be 1 US dollar = 110.00 yen (0.22-yen depreciation from the previous term) and 1 euro = 125.00 yen (7.03-yen appreciation from the previous term). The exchange rates for overseas subsidiaries (as of the end of June 2019) will be 1 US dollar = 110.00 yen (0.54-yen appreciation from the previous term) and 1 euro = 125.00 yen (2.91-yen appreciation from the previous term). This assumption also is not likely to change. Foreign exchange sensitivity is 29 million yen per US dollar for sales, 12 million yen per US dollar for net income, 54 million yen per euro for sales, and 23 million yen per euro for net income (per year; the yen depreciation would increase all of them).

The dividend is to be 86.00 yen/share (down 7.00 yen/share from the previous term), which is 50% of the estimated net income per share (173.55 yen/share).

2) Important theme for the fiscal year September 2019

① To enhance productivity by increasing the capability of manufacturing (equipment installation and manpower increase), JIT (improvement) activities, etc.

SHOEI will pursue the original goal of increasing production output from 500,000 products to 600,000 products per year between the fiscal year September 2018 and the fiscal year September 2020. In order to attain this goal, the company will enhance productivity and sales single-mindedly by investing in equipment, increasing manpower, developing new promising models, and improving the Just-in-Time (JIT) system. In the fiscal year September 2019, the company plans to produce 548,000 products (working on 10 holidays).

(Source: SHOEI)

② To analyze the needs of customers thoroughly and release new attractive models by fusing electronics and IT.

By doing so, the company aims to raise unit prices of its products.

New products to be released in the fiscal year September 2019

EX-ZERO Vintage-taste full-face model |

|

| Sales are Japan Release date: November 2018 The retail price suggested by the manufacturer: 38,000 yen to 46,000 yen (tax excluded)

|

GT-Air Ⅱ Sun visor-attached full-face helmet |

|

| Sales are Europe Release date: March 2019 The retail price suggested by the manufacturer: Germany and France: EUR499.00 to 629.00 (tax included) GT-Ai EUR479.00 to 579.00 (tax included) Sales are North America Release date: April 2019 The retail price suggested by the manufacturer: US$599.00 to 699.00 (tax excluded) GT-Ai US$549.99 to 670.99 (tax excluded) Sales are Japan Release date: April 2019 The retail price suggested by the manufacturer: 51,000 yen to 59,000 yen (tax excluded) |

J-Cruise II Sun visor-attached open-face helmet |

|

| Sales are Japan Release date: June 2019 The retail price suggested by the manufacturer: 49,000 yen to 56,000 yen (tax excluded) |

③ Brand strategy

Under the recognition that it is difficult to expand the market considerably in advanced countries, the company aims to strengthen its brand power and retain consumers and leading retailers, by promoting the personal fitting system (PFS), utilizing the Internet, and pursuing effective advertisement.

The period of the contract with Mr. Marc Marquez, a famous racer, will end in 2020.

In the personal fitting system (PFS), each part of the head is measured meticulously, to obtain the optimal helmet size, and by using a dedicated pad, the company will produce the inner parts that fit each user perfectly like a custom-made product.

④ Sales promotion in promising markets

Development of products that satisfy the new safety standards for helmets in the Chinese market

State Council of China changes certification standards for manufactured products

Currently, in terms of safety standards, helmets sold to China are exported under the Japanese Industrial Standards (JIS), but due to the State Council of China announcing a change in certification standards for manufactured products in September of 2017 (items subject to the change were released on Oct. 11), there will be new safety standards (*GB 811-2010) in China (excluding Hong Kong) effective from Aug. 1, 2018. Because some helmets currently on sale would be difficult to obtain certification from the Chinese authorities under the new standard, the company is considering changing specifications and is reviewing product strategy.

Main features of the GB811-2000 standard

· Penetration resistance test: In the 3 kg × 3 m penetration test, the striker should not come in contact with the dummy’s head.

· Helmet weight limit: All sizes of full face or jet helmets (A type) should weigh less than 1,600 g.

Japan Industrial Standard (JIS)

· Penetration resistance test: In the 3 kg × 2 m penetration test, the striker should not come in contact with the dummy’s head.

· Helmet weight limit: None in particular.

In Asia, excluding China, such as Taiwan, Thailand, and Malaysia, the company will allocate its managerial resources into mainly promising fields.

The market share is low in Thailand, whose market is relatively large. Accordingly, the company will strive to expand sales there, by reviewing distributors, etc.

4. Conclusions

Despite the 10.6% increase in sales and the 16.8% increase in operating income in the first quarter (October to December), sales increased 6.2% and operating income grew 1.1% in the first half. The company's estimates weren't achieved, and despite the increase in sales and profit, the performance in the second quarter (January to March) appears to be slow. This is thought to be caused by the carry-over of sales in March in North America due to the shipping delay and the tight production conditions in Japan. However, the progress rates towards the full-year forecast have all exceeded those in the previous year, namely, 43.2% for sales (compared to 43% achieved in the same period a year ago), 49.2% for operating income (44.8% a year ago), 48.9% for ordinary income (43.9% a year ago), and 48.4% for profit attributable to owners of parent (43.5% a year ago). This indicates that it was maintained within the expected range. The trend of orders received is most noticeable. The amount of orders received increased 19.8% year on year, and the backlog of orders substantially rose 40.9% year on year. The U.S. Market has just started gaining momentum, and the European and U.S markets seem to continue to lead the business performance in the short to medium term. As for the medium to long term, growth is expected thanks to the recovery of China and the income improvement in emerging countries. Even at the beginning of the term, the production capacity couldn't keep up. Giving the substantially increased backlog of orders, the production-related issues persist. The company needs to establish a system to increase production as soon as possible.

<Reference: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 6 directors, including 2 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report Updated on December 25 ,2018

Basic Views

Our company considers it as the most important issue in corporate management to seek steady growth and profit in mid-long term, improving the company value. To realize this, we think it is important to build good relationships between us and our shareholders, client companies, employees, and each stakeholder and supply good products that can make our clients satisfied. This view is written on “World’s Top Levels in Three Realms ( World’s Top Product Quality, World’s Top Cost Competitiveness, World’s Most Delightful Company” and “Basic Policy” to let all of us know. We are going to carry out various measures to enhancing our corporate governance.

Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)

【Principle 4-2】 Roles and duties of the Board of Directors (2)

At SHOEI, the positions of executives and staff are always fair, and the company environment does not impede proposals. The executives (called “advisors” or “directors” at the company) in the management team recognize issues in the workplace for which he or she was responsible, and present those issues and their possible solutions during discussion venues such as management meetings. At these venues, honest and open-minded discussions are held between the proposer, director, and executives. Remuneration for senior executives is a fixed annual salary based on ability, contribution to the previous year's performance, etc., while taking lifestyle factors into consideration.

【Supplementary principle 4-2-1】 Roles and responsibilities of the Board of Directors

Remunerations for Directors are based on a system that preferentially pays fixed salaries within the range approved at the general meeting of stockholders, where the remuneration amounts depend on their positions as defined in the "Regulations for Directors’ Remunerations" while taking in consideration the factors related to living expenses, as well as the retirement benefit system (excluding Outside Directors). The Board of Directors plans to examine the remuneration system, reflect the risks, and make voluntary deliberations with mainly outside directors to redesign the system so that it incorporates incentives that would contribute to drawing out the directors' entrepreneurial spirit. Furthermore, when carrying out the deliberations related to the important matters of the directors’ remunerations, etc., we will provide an environment where the voluntary deliberation by outside directors is incorporated as the most important process, including forming a voluntary advisory committee of mainly independent outside officers and outside directors with fair and highly transparent procedures.

【Principle 4-11】 Prerequisites for ensuring the effectiveness of the Board of Directors and the Board of Auditors

Our company tries to assign executive directors mainly from the management, who are aware of all the company's businesses, while the outside directors who function as auditory members are selected from outside personnel who can make a judgment from an independent and unbiased standpoint, and proactively express their opinion. Moreover, we strive to make this structure for position assignment balanced in terms of individuals and quality. While we don't currently have any women or foreign directors, each director has the qualities and diversity required to achieve the company's management policies of "The world's best quality." "The best cost competitiveness," and "The most fun company," and independent outside directors constitute one - third of the Board of Directors, thus we think that our structure has captured independence and objectivity. Furthermore, we put importance on diversity in the Board of Directors' structure and consider strengthening the Board of Directors' auditory function and increasing its effectiveness as issues that need to be addressed in the future. Additionally, we are developing a system for selecting the candidates of auditory directors, which ensures that we can select persons who have relevant experience, skills, and adequate knowledge of finance, accounting, and law. Our standards for nominations are as follows: (1) a person who has engaged with our company's management as a director or an auditor, (2) a person who has engaged in accounting, general affairs, managerial planning, or internal auditing for 3 years or longer as a department manager, (3) a person who has engaged in corporate management as a director or an auditor in other companies, and (4) a person who has qualifications of being a lawyer, certified accountant, or the like and can demonstrate this knowledge and experience when appointed as an auditor.

【Supplementary Principle 4-11-1】Prerequisites for ensuring the effectiveness of the Board of Directors and the Board of Auditors

Our company’s basic approach is to assign executive directors mainly from the management-level, who are aware of all the company’s businesses, while the outside directors who function as auditory members are selected from outside personnel who can make a judgment from an independent and unbiased standpoint, and proactively express their opinions. As for our stance regarding diversity and scale, we will continue to have dialogue (meetings) with stockholders, etc., earnestly listen, and make considerations based on their input.

Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)

【Principle 1-4】 Strategically held shares

As per our basic policy, we do not hold the shares of other companies in a strategic manner or conduct any risky securities investment, and the Board of Directors examines this basic policy at least once a year. Moreover, by adhering to the policy and not owning strategically held shares, we disclose that there were no records of strategically held shares in the Annual Securities Report, etc.

【Principle 1-7】 Transactions among parties concerned

Our company has no plans to make transactions with related parties other than the transactions for distributorship, outsourcing of distribution and marketing with subsidiaries and related transactions, and has not made such transactions so far. In addition, the "action guidelines" in the compliance regulations stipulate that personal matters shall be distinguished from business matters in the transactions with the company that is handled by executives, employees, or related personnel. We will not make any transactions among related parties other than the transactions with subsidiaries.

【Principle 2-6】 To demonstrate functionality as the asset owner of company pension

To cover the employees' retirement benefits, we have adopted the defined benefit corporate pension plan. Regarding the management and operation of defined benefit corporate pension deposit, we outsource all operations in general account as we have a contract with a life insurance company, which is a specialized institution. The specialized life insurance company gives us monthly, quarterly, half-term, and annual reports regarding the operation of pension assets, financial situation, etc. The reported pension assets operations, financial situation, etc. are reviewed by our General Affairs Department and we exchange opinions mainly regarding the financial situation of pension assets with the life insurance company on a regular basis or when necessary.

【Principle 5-1】 Policy for constructive dialogue with shareholders

Our company always tries to communicate with shareholders and investors in a fair manner, and promote active dialogues with them through one-on-one meetings, including the briefing sessions for individual investors and the financial results briefing sessions for institutional investors, the mass media and financial institutions, which are held by executives and the section in charge of IR (the business administration division).

In addition, the shareholding ratio of foreign investors is 32.3% (the term ended Sep. 2015). We continue highly transparent, sincere dialogues with foreign investors, and IR activities. In addition, the ratio of foreign shareholders is around 33%, and the company continues to conduct IR activities and open sincere, transparent dialogue with foreign investors.

Tokyo Stock Exchange: Search for corporate governance information: https://www2.tse.or.jp/tseHpFront/CGK020010Action.do?Show=Show

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co.,Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on SHOEI Co., Ltd.(7839) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/