Bridge Report:(7839)SHOEI the first half of the Fiscal Year September 2020

Kenichiro Ishida, President | SHOEI Co., Ltd.(7839) |

|

Company Information

Exchange | First Section, TSE |

Industry | Other Products (Manufacturing) |

President | Kenichiro Ishida |

Address | Taito 1-31-7, Taito-ku, Tokyo |

Year-end | September |

URL |

Stock Information

Share price | Shares Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥2,349 | 26,843,058 shares | ¥63,054 million | 20.4% | 100 shares | |

DPS(Est.) | Dividend Yield (Est.) | EPS(Est.) | PER(Est.) | BPS(Act.) | PBR(Act.) |

¥49.00 | 2.1% | ¥98.78 | 23.8 x | ¥512.35 | 4.6 x |

*Stock price as of the close on May 20. The number of shares issued is obtained by deducting the number of treasury stocks from the number of shares issued at the end of the latest quarter.

* Figures have been rounded off. ROE is the results of the previous term.

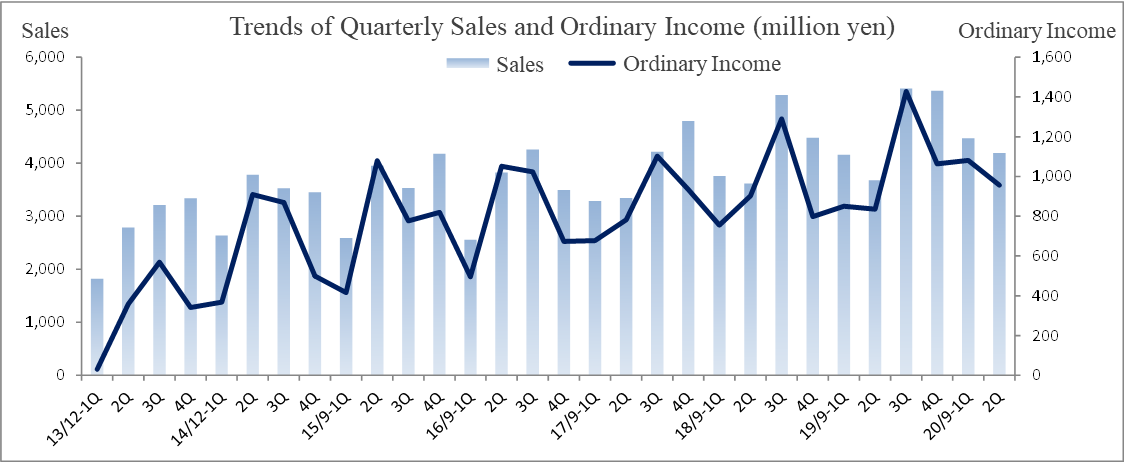

Consolidated Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

September 2016 | 14,138 | 3,145 | 3,244 | 2,192 | 79.61 | 79.00 |

September 2017 | 15,641 | 3,461 | 3,497 | 2,358 | 85.65 | 85.00 |

September 2018 | 17,148 | 3,734 | 3,772 | 2,578 | 93.61 | 93.00 |

September 2019 | 18,616 | 4,203 | 4,179 | 2,935 | 106.58 | 106.00 |

September 2020 Est. | 19,400 | 3,870 | 3,880 | 2,670 | 98.78 | 49.00 |

*The forecasted values were provided by the company. From fiscal year September 2016, net income means the profit attributable to owners of parent. Hereinafter the same applies.

*On April 1, 2020, a 2-for-1 stock split was implemented. EPS reflects the stock split.

This Bridge Report analyzes the earnings results for the first half of the fiscal year September 2020 and full year estimates for fiscal year September 2020 for SHOEI Co., Ltd.

Table of Contents

Key Points

1. Company Overview

2. The First Half of the Fiscal Year September 2020 Earnings Results

3. Fiscal Year September 2020 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the first half of the fiscal year September 2020, sales and operating income grew 10.6% and 21.4%, respectively, year on year. The sales volume increased 6% year on year from 239 thousand units to 255 thousand units. For integrating agencies in North America, inventory adjustments were required, which resulted in a 23% decrease in sales, but sales were favorable in Europe and increased 6% while sales increased 20% in Japan. In Asia, the Chinese market was the main driver and sales increased 75%. As for the profit, thanks to the increase in sales, the yen being slightly more depreciated than estimated, and the favorable sales by subsidiaries, all profit ratios increased, exceeding the company’s initial estimates.

- There is no change in the full-year forecast. In the fiscal year September 2020, sales are projected to rise 4.2%, and operating income is estimated to decline 7.9%. Due to the spread of COVID-19 and the regulations imposed by each government to control retail operations, from March onward, sales especially in the American and European markets have dropped sharply, which is expected to have a major impact on the company's results. However, it is still difficult to reasonably calculate the effect on the consolidated results now, thus the full-year consolidated earnings forecast has not been changed. When it becomes possible to make a reasonable calculation and any revision becomes necessary, the company will swiftly disclose it. As for dividends, assuming a payout ratio of 50%, the company estimates the term-end dividend to be 49.0 yen/share.

- Although the 2Q (January to March) is in the winter, which is off-season, the sales in China, which had declined in the previous term, were making a strong and rapid recovery with an increase of 13.9% year on year while operating income increased 19.1% year on year. However, in the 3Q (from April to June), the impact of the COVID-19 crisis is unavoidable, especially in the U.S. and Europe. On the other hand, given that manufacturing has not been able to keep up with orders, some improvement can be expected in the manufacturing system. Thanks to the strong financial structure of the company, it can withstand the COVID-19 crisis for a long period of time, but the U.S. and Europe are working on resuming their economies, and the 4Q (July to September) is likely to see improvement. It seemingly will reclaim the constant growth trend as it did before. After the supply system is established, we would like to pay attention to the company’s resuming growth in emerging countries.

1. Company Overview

SHOEI is the world’s largest helmet manufacturer in the premium helmet market. As for motorcycle helmets, which account for about 90% of total sales, the company specializes in “premium helmets,” which have high quality and high added value, and manufactures them in two domestic factories: Ibaraki Factory in Inashiki City, Ibaraki Prefecture and Iwate Factory in Ichinoseki City, Iwate Prefecture. By clinging to domestic manufacturing, the company maintains high quality and prevents its technologies from being leaked. Meanwhile, its sales network covers not only Japan, but also over 70 countries, including European countries and the U.S. The safety, functionality, and beautiful shapes of SHOEI’s helmets are highly evaluated around the world, and the SHOEI brand is now synonymous with “premium helmets.” The SHOEI group is composed of SHOEI and 5 consolidated subsidiaries in the U.S., Germany (two subsidiaries), France, and Italy.

Basic Policy for Medium and Long Term Stable Growth and Stable Profit

1. To put top priority to compliance with laws and regulations, as a listed company manufacturing product that protect human life

2.We will develop and manufacture ultra-first-class helmets that meet customers’ needs.

A company moving contrary to customer needs would be pushed out of the market.

3. Maintain “Made in Japan,” focusing on higher value-added products and production rationalization.

4. Brand maintenance

5. To put importance on the utilization rate of factories. The drop-in factory utilization rate would discourage not only employees, but also many other stakeholders, including suppliers of raw materials, affiliated factories, and distributors.

6. Continuation of Investment

7. It takes 10 years to build a castle, but just one day for it to fall. We will not assign an irrational quota that could cause injustice.

Move forward steadily in a simple, honest manner, but without sidestepping the challenges in front of us.

8. Adhering to the tradition of profit sharing.

• Shareholders (50% dividend payout ratio)

• Employees (Pay raise, etc.)

• Company (Investment, Proper retained earnings)

9. We will study new businesses

As of the end of the fiscal year September 2019, current ratio, which indicates the capability of short-term payment, was 655.3%, fixed ratio, which indicates long-term financial safety, was 23.7%, and capital-to-asset ratio was 82.5% thanks to debt-free business administration.

In addition, by manufacturing all products at two factories in Ibaraki and Iwate, the company (2) develops and manufactures ultra-first-class helmets that meet customers’ needs, (3) manufactures products in Japan focusing on higher value-added products and production rationalization, and (4) maintains the brand. While (6) continuing investment, the company (9) started studying new businesses.

2.The First Half of the Fiscal Year September 2020 Earnings Results

(1) Consolidated Earnings

| 1H of FY 9/19 | Ratio to sales | 1H of FY 9/20 | Ratio to sales | YoY | Initial Forecast | Difference from the forecast |

Sales | 7,841 | 100.0% | 8,669 | 100.0% | +10.6% | 8,530 | +1.6% |

Gross Income | 3,290 | 42.0% | 3,688 | 42.6% | +12.1% | - | - |

SG&A | 1,598 | 20.4% | 1,633 | 18.8% | +2.2% | - | - |

Operating Income | 1,692 | 21.6% | 2,054 | 23.7% | +21.4% | 1,930 | +6.5% |

Ordinary Income | 1,686 | 21.5% | 2,037 | 23.5% | +20.9% | 1,930 | +5.6% |

Net Income | 1,156 | 14.7% | 1,412 | 16.3% | +22.2% | 1,320 | +7.0% |

* Some data is calculated by Investment Bridge, and some data contained within this report may vary from actual results. (Applies to all data in this report)

*Unit: million yen

Sales and operating income grew 10.6% and 21.4%, respectively, year on year

Sales were 8,669 million yen, up 10.6% year on year. The sales volume in the first half increased 6% year on year from 239 thousand units to 255 thousand units. From October to January, the orders received from agencies from all countries and sales by European subsidiaries were strong. This is a result of the company’s efforts in thoroughly reducing the costs of the development, sales, and manufacturing departments of the new model that meets customers’ needs, as well as the success of services that support customer’s security. Regarding sales volume in each region, for the European market, the sales of the mainstay model: NEOTEC 2 and GT-Air 2 were favorable and increased 6%. For the North American market, to increase sales efficiency, 2 agencies were integrated into 1. In this

process, the remaining agency took over the shares of the other agency and thus made inventory adjustments resulting in a 23% decrease in sales volume. For the Japanese market, the company followed a policy that prioritized domestic shipping, thus sales increased 20%. Moreover, the overall sales volume in the Asian market increased 75% as the premium helmets market expanded. Particularly in the Chinese market, where the market uncertainty due to the changes made to helmets’ specifications has subsided, sales have been favorable since the latter half of the previous term and increased by 353%.

Operating income was 2,054 million yen, up 21.4% year on year. Thanks to the increase in sales, the yen being slightly more depreciated than estimated, and the favorable sales by subsidiaries, gross profit ratio improved 0.6 points to 42.6%. The increase in SG&A expenses was controlled and operating income rate increased from 21.6% to 23.7%. Thanks to the expansion of non-operating foreign exchange profit, etc., ordinary income was 2,037 million yen, up 20.9% year on year, while profit attributable to owners of parent was 1,412 million yen, up 22.2% year on year.

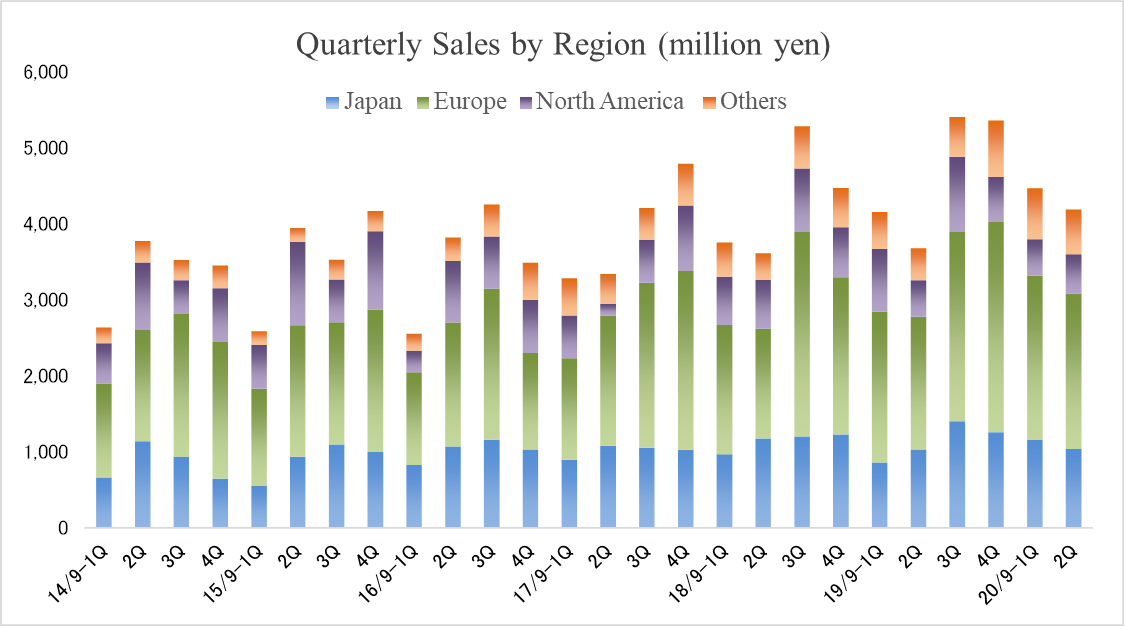

(2) Trends by Regions

| 1H of FY 9/19 | Share | 1H of FY 9/20 | Share | YoY |

Japan | 1,893 | 24.1% | 2,198 | 25.4% | +16.1% |

Overseas | 5,948 | 75.9% | 6,471 | 74.6% | +8.8% |

Europe | 3,734 | 47.6% | 4,203 | 48.5% | +12.6% |

North America | 1,304 | 16.6% | 999 | 11.5% | -23.4% |

Other Regions | 909 | 11.6% | 1,267 | 14.6% | +39.4% |

Total | 7,841 | 100.0% | 8,669 | 100.0% | +10.6% |

*Unit: million yen

In the first half, the global economy had been generally favorable until February except for some regions. As for Japan, the performance had been stable thanks to corporate performance and foreign demand, but since the spread of COVID-19 in February, calls for self-imposed isolation increased and the consumption of products other than daily necessities such as food and sanitary products has dropped significantly.

As for the market of premium helmets for motorcycles, the market was in a similar situation as described above. Namely, from October to January, sales increased compared to the previous term, but due to the spread of COVID-19, lockdowns were implemented, and retail operations were minimized in Asia from February. Demand has been gradually recovering recently in East Asian countries, mainly China, but it is still stagnating in ASEAN countries. In the U.S. and Europe, although some regions affected by the spread of COVID-19 from March such as Germany and the U.S. have started to resume economic activities, the current situation still makes it difficult to predict when the full retail operations can be resumed.

As for the Japanese market, the government called for self-imposed isolation if you don’t have the urgent need, then declared a state of emergency, however, only a few stores including motorcycle accessories stores were completely suspended, and thus the drop in sales was not as severe as expected.

Products with strong sales

<NEOTECⅡ>

| Sales are Europe Release date: January 2018

Sales are North America Release date: March 2018

Sales are Japan Release date: May 2018

|

<GT-Air Ⅱ> Full Face Helmet equipped with Sun Visor

| Sales are Europe Release date: March 2019 Retail price suggested by the manufacture Germany and France: EUR499.00 to 629.00 (tax included) GT-Ai EUR479.00 to 579.00 (tax included) Sales are North America Release date: April 2019 Retail price suggested by the manufacture US$599.00 to 699.00 (tax excluded) GT-Ai US$549.99 to 670.99 (tax excluded) Sales are Japan Release date: May 2019 Retail price suggested by the manufacture 51,000 to 59,000 yen (tax excluded) |

The amount of orders received was firm. The amount of orders in 2Q increased 15.9% year on year, and the backlog of orders rose 30.2% year on year.

Orders and Backlogs

| 1H of FY 9/19 | 1H of FY 9/20 | ||||||

Orders | YoY | Backlog | YoY | Orders | YoY | Backlog | YoY | |

Premium Helmets | 8,186 | +18.9% | 4,554 | +40.4% | 9,453 | +15.5% | 5,880 | +29.1% |

Helmets supplied to the Government, Others | 705 | +30.9% | 185 | +55.3% | 848 | +20.3% | 288 | +55.8% |

Total | 8,892 | +19.8% | 4,739 | +40.9% | 10,302 | +15.9% | 6,169 | +30.2% |

*Backlog is at the end of the period. Unit: million yen

(3) Balance Sheet Summary

| 9/19 | 3/20 |

| 9/19 | 3/20 |

Cash and deposits | 9,018 | 7,377 | Payables | 495 | 1,115 |

Receivables | 2,233 | 1,728 | Outstanding payments | 307 | 399 |

Inventories | 2,592 | 4,022 | Outstanding taxes | 650 | 758 |

Current Assets | 14,679 | 13,967 | Retirement reserves | 904 | 894 |

Tangible assets | 2,883 | 3,353 | Interest-bearing debt | - | - |

Intangible assets | 65 | 69 | Total Liabilities | 3,186 | 4,331 |

Investments, others | 623 | 694 | Net Assets | 15,065 | 13,753 |

Noncurrent Assets | 3,572 | 4,117 | Total Liabilities, Net Assets | 18,252 | 18,084 |

*Unit: million yen

The balance of total assets at the end of the first half was 18,084 million yen, down 167 million yen from the end of the previous term. Inventories increased while receivables as well as cash and deposits decreased. The balance of liabilities was 4,331 million yen, up 1,145 million yen from the end of the previous term. Outstanding payments, payables, etc. have increased. The balance of net assets was 13,753 million yen, down 1,312 million yen from the end of the previous term. The company reorganized Taiyo Co., Ltd. into a wholly owned subsidiary through an absorption-type merger on January 6, acquiring 350,000 treasury stock. As a result, the treasury stock in the first half increased 1,292 million yen. Moreover, the company retired 350,871 treasury stocks on March 26. As a result, retained earnings and treasury stocks each decreased 1,294 million yen at the end of the first half.

Capital-to-asset ratio was 76.0% (82.5% as of the end of the previous term).

3. Fiscal Year September 2020 Earnings Estimates

Consolidated Earnings

| FY 9/19 Act. | Ratio to sales | FY 9/20 Est. | Ratio to sales | YoY |

Sales | 18,616 | 100.0% | 19,400 | 100.0% | +4.2% |

Operating Income | 4,203 | 22.6% | 3,870 | 19.9% | -7.9% |

Ordinary Income | 4,179 | 22.5% | 3,880 | 20.0% | -7.2% |

Net Income | 2,935 | 15.8% | 2,670 | 13.8% | -9.0% |

*Unit: million yen

For the fiscal year September 2020, it is estimated that sales will grow 4.2% year on year and operating income will decline 7.9% year on year.

There is no revision to the forecast for the fiscal year September 2020. Sales are projected to increase 4.2% year on year to 19.4 billion yen, while operating income is forecasted to drop 7.9% year on year to 3,870 million yen.

Due to the spread of COVID-19 and the regulations imposed by each government to control retail operations, from March onward, sales especially in the American and European markets have dropped sharply, which is expected to have a major impact on the company's results. However, it is still difficult to calculate the effect on the consolidated results reasonably now, thus the full-year consolidated results forecast has not been changed. When it becomes possible to make a reasonable calculation and any revision becomes necessary, the company will swiftly disclose it.

The assumed exchange rates for the full year are 1 dollar = 108 yen and 1 euro = 120 yen.

As for dividends, the company plans to pay a term-end dividend of 49.0 yen/share under the assumption that payout ratio is 50%.

New products to be released in the fiscal year September 2020

<J-Cruise Ⅱ> Open Face Helmet equipped with Sun Visor

| Sales are Europe Release date: December 2019 Retail price suggested by the manufacturer Germany and France: EUR479.00 to 579.00 (tax included) Sales are North America Release date: December 2019 Retail price suggested by the manufacture US$549.99 (tax excluded) Sales area: Japan Release date: July 2019 Retail price suggested by the manufacture 49,000 to 56,000 yen (tax excluded) |

<Glamster> New Classic style Full Face Helmet

| Sales are Europe Release date: March 2020 Retail price suggested by the manufacturer Germany and France: EUR449.00 to 549.00 (tax included)

Sales are Japan Release date: 2020 (Autumn) Retail price suggested by the manufacture to be determined |

4. Conclusions

Although the 2Q (January to March) is in the winter, which is off-season, the sales in China, which had declined in the previous term, were making a strong and rapid recovery with an increase of 13.9% year on year while operating income increased 19.1% year on year. However, in the 3Q (from April to June), the impact of the COVID-19 crisis is unavoidable, especially in the U.S. and Europe. On the other hand, given that manufacturing has not been able to keep up with orders, some improvement can be expected in the manufacturing system. Thanks to the strong financial structure of the company, it can withstand the COVID-19 crisis for a long period of time, but the U.S. and Europe are working on resuming their economies, and the 4Q (July to September) is likely to see improvement. It seemingly will reclaim the constant growth trend as it did before. After the supply system is established, we would like to pay attention to the company’s resuming growth in emerging countries.

<Reference: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 5 directors, including 2 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report Updated on December 23 ,2019

Basic Views

Our company considers it as the most important issue in corporate management to seek steady growth and profit in mid-long term, improving the company value. To realize this, we think it is important to build good relationships between us and our shareholders, client companies, employees, and each stakeholder and supply good products that can make our clients satisfied. This view is written on “Basic Policy” to let all of us know. We are going to carry out various measures to enhancing our corporate governance.

Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)

【Principle 4-2】 Roles and duties of the Board of Directors (2)

At SHOEI, the positions of executives and staff are always fair, and the company environment does not impede proposals. The executives (called “advisors” or “directors” at the company) in the management team recognize issues in the workplace for which he or she was responsible, and present those issues and their possible solutions during discussion venues such as management meetings. At these venues, honest and open-minded discussions are held between the proposer, director, and executives. Remuneration for senior executives is a fixed annual salary based on ability, contribution to the previous year's performance, etc., while taking lifestyle factors into consideration.

【Supplementary principle 4-2-1】 Roles and responsibilities of the Board of Directors

Remunerations for Directors are based on a system that preferentially pays fixed salaries within the range approved at the general meeting of stockholders, where the remuneration amounts depend on their positions as defined in the "Regulations for Directors’ Remunerations" while taking in consideration the factors related to living expenses, as well as the retirement benefit system (excluding Outside Directors). The Board of Directors plans to examine the remuneration system, reflect the risks, and make voluntary deliberations with mainly outside directors to redesign the system so that it incorporates incentives that would contribute to drawing out the directors' entrepreneurial spirit. Furthermore, when carrying out the deliberations related to the important matters of the directors’ remunerations, etc., we will provide an environment where the voluntary deliberation by outside directors is incorporated as the most important process, including forming a voluntary advisory committee of mainly independent outside officers and outside directors with fair and highly transparent procedures.

【Principle 4-11】 Prerequisites for ensuring the effectiveness of the Board of Directors and the Board of Auditors

Our company tries to assign executive directors mainly from the management, who are aware of all the company's businesses, while the outside directors who function as auditory members are selected from outside personnel who can make a judgment from an independent and unbiased standpoint, and proactively express their opinion. Moreover, we strive to make this structure for position assignment balanced in terms of individuals and quality. While we do not currently have any women or foreign directors, each director has the qualities and diversity required to achieve the company's management policies of "The world's best quality." "The best cost competitiveness," and "The most fun company," and independent outside directors constitute one - third of the Board of Directors, thus we think that our structure has captured independence and objectivity. Furthermore, we put importance on diversity in the Board of Directors' structure and consider strengthening the Board of Directors' auditory function and increasing its effectiveness as issues that need to be addressed in the future. Additionally, we are developing a system for selecting the candidates of auditory directors, which ensures that we can select persons who have relevant experience, skills, and adequate knowledge of finance, accounting, and law. Our standards for nominations are as follows: (1) a person who has engaged with our company's management as a director or an auditor, (2) a person who has engaged in accounting, general affairs, managerial planning, or internal auditing for 3 years or longer as a department manager, (3) a person who has engaged in corporate management as a director or an auditor in other companies, and (4) a person who has qualifications of being a lawyer, certified accountant, or the like and can demonstrate this knowledge and experience when appointed as an auditor.

【Supplementary Principle 4-11-1】Prerequisites for ensuring the effectiveness of the Board of Directors and the Board of Auditors

Our company’s basic approach is to assign executive directors mainly from the management-level, who are aware of all the company’s businesses, while the outside directors who function as auditory members are selected from outside personnel who can make a judgment from an independent and unbiased standpoint, and proactively express their opinions. As for our stance regarding diversity and scale, we will continue to have dialogue (meetings) with stockholders, etc., earnestly listen, and make considerations based on their input.

Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)

【Principle 1-4】 Strategically held shares

As per our basic policy, we do not hold the shares of other companies in a strategic manner or conduct any risky securities investment, and the Board of Directors examines this basic policy at least once a year. Moreover, by adhering to the policy and not owning strategically held shares, we disclose that there were no records of strategically held shares in the Annual Securities Report, etc.

【Principle 1-7】 Transactions among parties concerned

Our company has no plans to make transactions with related parties other than the transactions for distributorship, outsourcing of distribution and marketing with subsidiaries and related transactions, and has not made such transactions so far. In addition, the "action guidelines" in the compliance regulations stipulate that personal matters shall be distinguished from business matters in the transactions with the company that is handled by executives, employees, or related personnel. We will not make any transactions among related parties other than the transactions with subsidiaries.

【Principle 2-6】 To demonstrate functionality as the asset owner of company pension

To cover the employees' retirement benefits, we have adopted the defined benefit corporate pension plan. Regarding the management and operation of defined benefit corporate pension deposit, we outsource all operations in general account as we have a contract with a life insurance company, which is a specialized institution. The specialized life insurance company gives us monthly, quarterly, half-term, and annual reports regarding the operation of pension assets, financial situation, etc. The reported pension assets operations, financial situation, etc. are reviewed by our General Affairs Department and we exchange opinions mainly regarding the financial situation of pension assets with the life insurance company on a regular basis or when necessary.

【Principle 5-1】 Policy for constructive dialogue with shareholders

Our company always tries to communicate with shareholders and investors in a fair manner, and promote active dialogues with them through one-on-one meetings, including the briefing sessions for individual investors and the financial results briefing sessions for institutional investors, the mass media and financial institutions, which are held by executives and the section in charge of IR (the business administration division).

In addition, the shareholding ratio of foreign investors is 32.3% (the term ended Sep. 2015). We continue highly transparent, sincere dialogues with foreign investors, and IR activities. In addition, the ratio of foreign shareholders is around 33%, and the company continues to conduct IR activities and open sincere, transparent dialogue with foreign investors.

Tokyo Stock Exchange: Search for corporate governance information:

https://www2.tse.or.jp/tseHpFront/CGK020010Action.do?Show=Show

This report is intended solely for information purposes and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on SHOEI Co., Ltd.(7839) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/