Bridge Report:(8061)Seika the second quarter of the fiscal year March 2021

President Akihiko Sakurai | Seika Corporation (8061) |

|

Company Information

Market | TSE 1st Section |

Industry | Wholesale |

President | Akihiko Sakurai |

HQ Address | Shin-Tokyo Bldg, 3-1, Marunouchi 3-chome, Chiyoda-ku, Tokyo |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥1,270 | 12,820,650 shares | ¥16,282 million | -4.7% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥45.00 | 3.5% | ¥134.51 | 9.4x | ¥2,058.12 | 0.53x |

*The share price is the closing price on December 8. Shares Outstanding, DPS and EPS were taken from the brief financial report for the second quarter of the term ending March 2021. ROE and BPS are based on the results in the previous term.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2017 (Actual) | 150,742 | 3,046 | 3,390 | 2,140 | 161.29 | 55.00 |

March 2018 (Actual) | 165,585 | 2,598 | 2,877 | 1,655 | 128.38 | 55.00 |

March 2019 (Actual) | 157,145 | 2,118 | 2,418 | 1,587 | 125.50 | 45.00 |

March 2020 (Actual) | 140,677 | 2,809 | 3,122 | -1,262 | -100.73 | 45.00 |

Match 2021(Forecast) | 135,000 | 2,400 | 2,700 | 1,650 | 134.51 | 45.00 |

*Unit: million yen or yen. The company implemented a reverse stock split at 1:5 on October 1, 2017. EPS and DPS adjusted retroactively. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

This report outlines the overview of Seika Corporation for the second quarter of the fiscal year March 2021 earnings results.

Table of Contents

Key Points

1. Company Overview

2. The second quarter of Fiscal Year March 2021 Earnings Results

3. Fiscal Year March 2021 Earnings Forecasts

4. Mid-term management plan “Re-SEIKA 2023”

5. Conclusions

<Reference1: The Long-term Management Vision>

<Reference2: Regarding Corporate Governance>

Key Points

- For the second quarter of the term ending March 2021, the amount of orders decreased 15.6% year-on-year to 63,411 million yen. Despite the orders related to the prevention of COVID-19, such as those for face mask manufacturing equipment and droplet analysis equipment, the amount of orders dropped due to the postponement of regular inspection work for existing customers’ facilities and the cancellation of capital investment plans. Sales increased 13.2% year-on-year to 70,935 million yen, thanks to the growth of sales from large-scale projects in the power plant business, which supports social infrastructure. Operating income augmented 10.9% year-on-year to 953 million yen, with the industrial machinery business, which sells machinery to general industries, contributing to earnings. Despite the poor performance of some overseas subsidiaries, the overall performance of subsidiaries was strong and profits increased. Net income was 530 million yen, up 12.7% year-on-year.

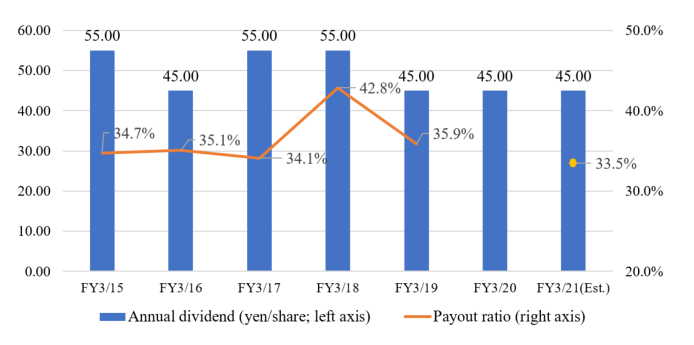

- The earnings forecast for the term ending March 2021 remains unchanged, with sales expected to be 135 billion yen, down 4.0% year-on-year, and operating income projected to be 2.4 billion, down 14.6% year-on-year. The impact of the spread of COVID-19 on the corporate group is still under investigation, and its earnings forecast has been obtained based on the information available at this time. There is a possibility that unexpected changes will occur due to the timing of the subsiding of COVID-19, domestic or overseas market conditions, etc. If an event that affects the corporate group’s business results occurs and it becomes necessary to revise the business forecast, the company will announce it promptly. The dividend is estimated to remain unchanged at 45 yen/share. The estimated payout ratio is 33.5%.

- Seika Daiya Engine Co., Ltd. was established on October 1, 2020, by acquiring shares from Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. (MHIET) based on a transfer agreement for the domestic marine engine sales and service business of Mitsubishi Heavy Industries Engine Systems, a wholly owned subsidiary of MHIET. It is working to enter new fields such as engines for commercial and industrial vessels, including work vessels for offshore wind power generation facilities, and auxiliary engines for large vessels.

- The mid-term management plan “Re-SEIKA 2023” has gotten off to a tough start amid the global spread of COVID-19, but we will pay attention to whether each of the marketing projects (renewable energy, life science, and mobility) can be realized during the period of the current mid-term plan. In particular, developing new sources of revenue during this period will be a key challenge. Also, in the electric power business, which is the company’s forte, it will be important for the company to earn revenues from the replacement of aging thermal power generation facilities without fail.

1. Company Overview

Under the corporate philosophy “To Contribute to Society Through the Expansion of Business,” Seika Corporation sells equipment, devices, etc. and offers services in the fields of electric power, chemistry, energy and industrial machinery, as a general machinery trading company.

Its three characteristics and strengths are sales capability thoroughly versed in fields, extensive expertise in each business, and a wide network including 103 business bases both inside and outside Japan.

1-1 Corporate History

In July 1947, after the Pacific War, Mr. Douglas MacArthur, Supreme Commander for the Allied Powers, ordered the dissolution of the old Mitsubishi Corporation with a memorandum. In October 1947, the first president Koji Nakabayashi and staff of the machinery division of Moji Branch played a central role in founding Seika Corporation in Moji-ku, Kitakyushu-shi.

The corporate name is derived from “Essence of commerce: To pursue the quintessence of commerce, and offer benefits to others while earning money,” “Star company of the west: To aim to become a star company in western Japan,” and “Chin It may become helpful if the trade with China increases.”

The company expanded business actively, establishing branches throughout Japan, including Tokyo and Osaka, and an overseas office in Dusseldorf, Germany (old West Germany), where only a few Japanese people resided around that time, in November 1954. The company was listed in the first section of Tokyo Stock Exchange in October 1961.

Then, it has grown as a general machinery trading company, by fortifying the sales base mainly in western Japan and establishing footholds in the U.S., Europe, and Asia.

The company is currently implementing the long-term management vision “Envisioned Seika Group 10 years from now” and its second step 3-year plan “Mid-term Management Plan Re-SEIKA 2023,” in preparation for 2027, which will mark the 80th anniversary of the company’s founding.

1-2 Corporate Philosophy, etc.

Seika Corporation set up the following corporate philosophy and code of conduct.

Corporate Philosophy | “Our Philosophy is to Contribute to Society Through the Expansion of Business.”

No matter how society changes, we are committed to conducting business that rewards all stakeholders and being a Valuable Business that contributes to the realization of an affluent society. |

Code of conduct | 1. Being trustworthy is a priceless asset.2. To always have a high appreciation of the significance of existence is the basis of the business activities of a trading company.3. Fast and accurate information activities and effective responses win everything.4. To make decisions and handle things using objective consideration and pursue necessity and rationality without being influenced by intuition. 5. To be driven by a pioneering spirit, be challenged, and be proud to overcome all difficulties, barriers, and turbulent times. |

In order to promote unity and group management, Seika Corporation has also established the “Group Policy,” “Code of Conduct,” and “Group Mission,” and each company belonging to the Group and each employee working therein share these policies and link them to daily actions, aiming to improve the corporate value of the entire Group.

Group Policy | Strive for excellence and foster a sustainable society with corporate integrity. |

Code of Conduct | Comply with laws and act with ethical standards to gain the trust of society |

Group Mission | Create a fulfilling society together |

1-3 Business Description

(1) Business segments

As a general machinery trading company, Seika Corporation sells machinery, equipment, devices, and ancillary products and offers services in the fields of electric power, chemistry, energy and industrial machinery.

The segments to be reported are 4 segments, which are “Power Plant,” “Chemicals and Energy Plant,” “Industrial Machinery,” and “Global Business”, from the fiscal year ending March 2021.

① Power Plant

The clients of Seika Corporation are electric power companies in western Japan, including The Kansai Electric Power, Kyushu Electric Power, The Chugoku Electric Power, Shikoku Electric Power, Power Development Electric Power Company, and joint electric power companies, such as Wakayama Kyodo Power. The company sells and provides after-sales services for industrial power generation equipment, such as boilers and gas turbines, as well as environmental conservation equipment for treating discharged water and exhaust gas.

The company also sells anti-crime and anti-disaster equipment, such as security equipment and fire extinguishing equipment for nuclear plants.

Furthermore, the company provides power-generation equipment for renewable energies such as small-sized water, wind, and biomass, and after-sales services.

The suppliers include Mitsubishi Power (MPW), which is a group company of Mitsubishi Heavy Industries (MHI), and Seika Corporation possesses the distributorship for thermal power generation equipment of MPW.

|

|

(taken from the company’s material)

② Chemicals and Energy Plant

Seika Corporation sells in-house power generation equipment, such as boilers and turbines, environmental conservation equipment for treating discharged water and exhaust gas, etc. and offers after-sales services to companies in oil refining, chemical, paper, and steel industries. As in the power plant business, the company procures these from MPW.

In addition, the company sells products that reduce environmental burdens, as well as equipment and fuel for biomass power generation.

|

|

(taken from the company’s material)

③ Industrial Machinery

Seika Corporation provides clients in a broad range of industries with textile equipment, food processing equipment, brewing equipment, various plant machinery, liquid crystal-related equipment, environment-related apparatus, uninterruptible power systems (UPS), printed circuit boards for electronic mea, etc. produced by Japanese or foreign manufacturers. The company also supplies measurement instruments that make full use of advanced technology, such as laser measurement instruments and pore size measurement equipment, to government agencies and research institutes.

In addition, the company sells lithium ion battery-related equipment and motor manufacturing equipment for electronic vehicles (EVs) in China.

The company’s subsidiary Nippon Daiya Valve Co., Ltd. manufactures and sells various industrial valves.

(taken from the company’s material)

④ Global Business

(Europe)

While selling industrial robots to automotive customers in the automotive field, Seika Corporation sells and leases submersible pumps used in public construction, etc. in the social infrastructure field. These products are procured mainly from Japanese manufacturers.

(North America)

As for the automotive field, the company sells Japanese-made industrial machinery in the PCB surface mount production line mainly to the automotive parts industry.

(Asia)

As for the industrial machinery field, the company sells Japanese-made machinery and equipment to companies within the automotive, textile, chemical industries, and also procures raw materials outside Japan and sells them to textile manufacturers.

(taken from the company’s material)

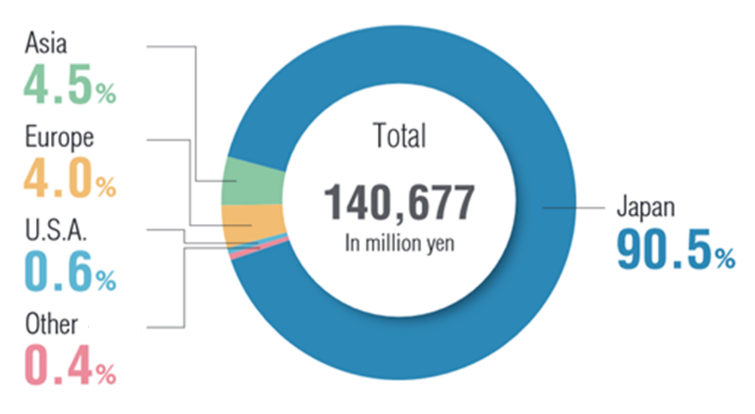

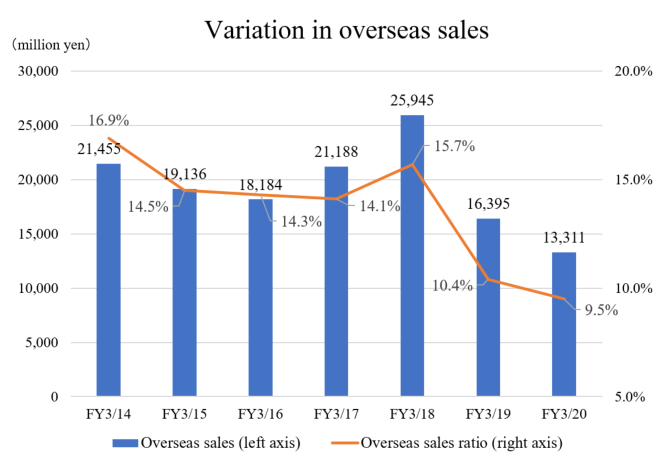

(2) Sales in each region

Domestic sales account for 90% or more, however, the development of overseas markets where there is significant room for growth and expanding overseas sales ratio are challenges for the company.

Ratio of sales in each region in term ended March 2020

(Taken from the website of the company) |

|

1-4 Characteristics and strengths

(1) Hands-on sales capability

The capability of hands-on sales nurtured in their 70 years history is the company's greatest strength.

By building relationships of trust through meticulous customer services and forming personal connections, Seika Corporation is able to obtain a steady stream of orders.

(2) High level of expertise in each business

Although trading companies are sometimes thought of as middlemen, Seika Corporation has garnered excellent reputation as an essential business partner with a high level of expertise, including profound information gathering capabilities and the ability to develop proposals that stay one step ahead of clients.

(3) Extensive network comprised of 103 bases in Japan and overseas

Ten years ago, the company only had thirty bases, but, thanks to M&A, they did not only expand their bases domestically, but also have been rapidly expanding the number of bases in Europe and Southeast Asia in anticipation of globalization. The speed and comprehensiveness of information have increased further, and by utilizing this, the company hopes to further improve its corporate value.

(4) Measures to strengthen employee education and sales capabilities

Seika Corporation primarily uses on-the-job training to develop its employees. Senior staff and those with more experience teach newer employees the essentials for business, and the company also focuses on overseas training programs and seminars for each skill level.

Nowadays, the company requests the former staff of manufacturers and client companies to provide its employees with consultation services and hands-on support for sales.

The advice the company receives allows them to further improve their expertise and sales capabilities.

1-5 ROE analysis

| FY 3/15 | FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 |

ROE (%) | 8.5 | 6.6 | 7.9 | 5.9 | 5.6 | -4.7 |

Net income margin (%) | 1.66 | 1.38 | 1.42 | 1.00 | 1.01 | -0.90 |

Total asset turnover (x) | 1.76 | 1.52 | 1.45 | 1.53 | 1.71 | 1.58 |

Leverage (x) | 2.90 | 3.13 | 3.82 | 3.83 | 3.42 | 3.32 |

The negative ROE in the previous term is only temporary due to the posting of impairment loss. Assuming that the ratio of net income to sales for this term will be 1.2%, ROE will recover to the range of 5-6%, however, it will not be able to maintain the standard 8% in a stable manner, which is commonly required for Japanese companies.

Since leverage is relatively high, profit rate is expected to improve.

If the target net income of 2.5 billion yen for the term ending March 2023 is achieved in the mid-term management plan “Re-SEIKA 2023,” ROE will be 8% or more.

1-6 Efforts for ESG

<E: Environment>

The environmental policy of the company is to “make efforts to protect the earth environment and contribute to the realization of a sustainable society.”

Under this policy, the company obtained the ISO14001 certificate in 2005, and is promoting environmentally-friendly products.

The environmentally friendly products handled by the company are diverse, including equipment for treating exhaust gas from boilers and incinerators and organic solvent recovery equipment for chemical and semiconductor factories. The amount of orders in the term ended March 2020 were 13,479 (up 10.4% from the previous year) and 94.75 billion yen (down 8.6% from the previous year), as mentioned below.

The company will continue to contribute to the conservation of the earth environment through business activities, and not merely from the perspective of social contribution.

Expand sales of environmentally friendly products | ||

Orders for environmentally friendly products in the term ended Mar.2020 | No. of orders received | Amount of orders received (billion yen) |

Energy saving/resource saving/efficiency improving | 11,540 | 87.74 |

Pollution control | 1,127 | 5.75 |

Recycling/reuse | 812 | 1.25 |

Total | 13,479 | 94.75 |

(Taken from the reference material of the company)

<S: Social Responsibility>

To fulfill its “social responsibility,” Seika Corporation engages in work-style reforms as follows.

“Promotion of women’s active participation in the workplace”

●To recruit more women in the main career track

●To support female employees in developing their careers

●To appoint female managers

“Enhancement of health of employees”

●To adopt Premium Friday (Casual day at the same time)

●To promote the use of paid holidays

●The company bears the expense for cancer screening (tumor marker option) in a health checkup

●The company bears the cost of influenza vaccinations

“Personnel development”

●Training at each level

●Overseas training system

<G: Governance>

The website of the company discloses the activities for each item of the Corporate Governance Code.

“The effectiveness of the board of directors” was evaluated, and in order to deal with the revised the Corporate Governance Code, the board of directors established the “review committee for appointment,” and “review committee for compensation,” which are composed of outside directors and outside auditors as an arbitrary system.

The company translated some convocation notices into English, and produced financial results briefing materials and a fact book in English.

In order to grow sustainably and improve its corporate value in the mid-to-long term, the company will strive to strengthen corporate governance, and pursue a sound, transparent management system.

1-7 Shareholder return

The primary managerial mission of the company is to return profit to shareholders, and its basic policy is stable dividend payment.

Through the efficient business operation from the marketing and financial aspects, the company aims to fortify the management base. While dealing with the demand for funds for developing new businesses, etc., the company plans to achieve a consolidated payout ratio of 35%.

For the term ending March 2021, the company plans to pay an interim dividend of 20 yen/share and a term-end dividend of 25 yen/share, that is, a total of 45 yen/share, and the estimated payout ratio is 33.5%.

The company will actively return profit to shareholders while comprehensively considering the dividend policy, full-year results, etc.

2. The second quarter of Fiscal Year March 2021 Earnings Results

(1) Consolidated Business Results

| 2Q of FY 3/20 | Ratio to sales | 2Q of FY 3/21 | Ratio to sales | YoY | Compared with the plan |

Sales | 62,651 | 100.0% | 70,935 | 100.0% | +13.2% | -5.4% |

Gross profit | 6,866 | 11.0% | 6,619 | 9.3% | -3.6% | - |

SG&A | 6,006 | 9.6% | 5,665 | 8.0% | -5.7% | - |

Operating Income | 860 | 1.4% | 953 | 1.3% | +10.9% | -4.7% |

Ordinary Income | 986 | 1.6% | 1,098 | 1.5% | +11.3% | -0.2% |

Quarterly Net Income | 471 | 0.8% | 530 | 0.7% | +12.7% | -11.7% |

*Unit: million yen. Quarterly Net Income is quarterly profit attributable to owners of parent.

Sales and Profit increased

For the second quarter of the term ending March 2021, the amount of orders decreased 15.6% year-on-year to 63,411 million yen. Despite the orders related to the prevention of COVID-19, such as those for face mask manufacturing equipment and droplet analysis equipment, the amount of orders dropped due to the postponement of regular inspection work for existing customers’ facilities and the cancellation of capital investment plans. Sales increased 13.2% year-on-year to 70,935 million yen, thanks to the growth of sales from large-scale projects in the power plant business, which supports social infrastructure. Operating income augmented 10.9% year-on-year to 953 million yen, with the industrial machinery business, which sells machinery to general industries, contributing to earnings. Despite the poor performance of some overseas subsidiaries, the overall performance of subsidiaries was strong and profits increased. Net income was 530 million yen, up 12.7% year-on-year.

Sales didn’t achieve the company’s plan, but operating income and below were generally in line with the plan.

(2) Overview of business performance in each segment

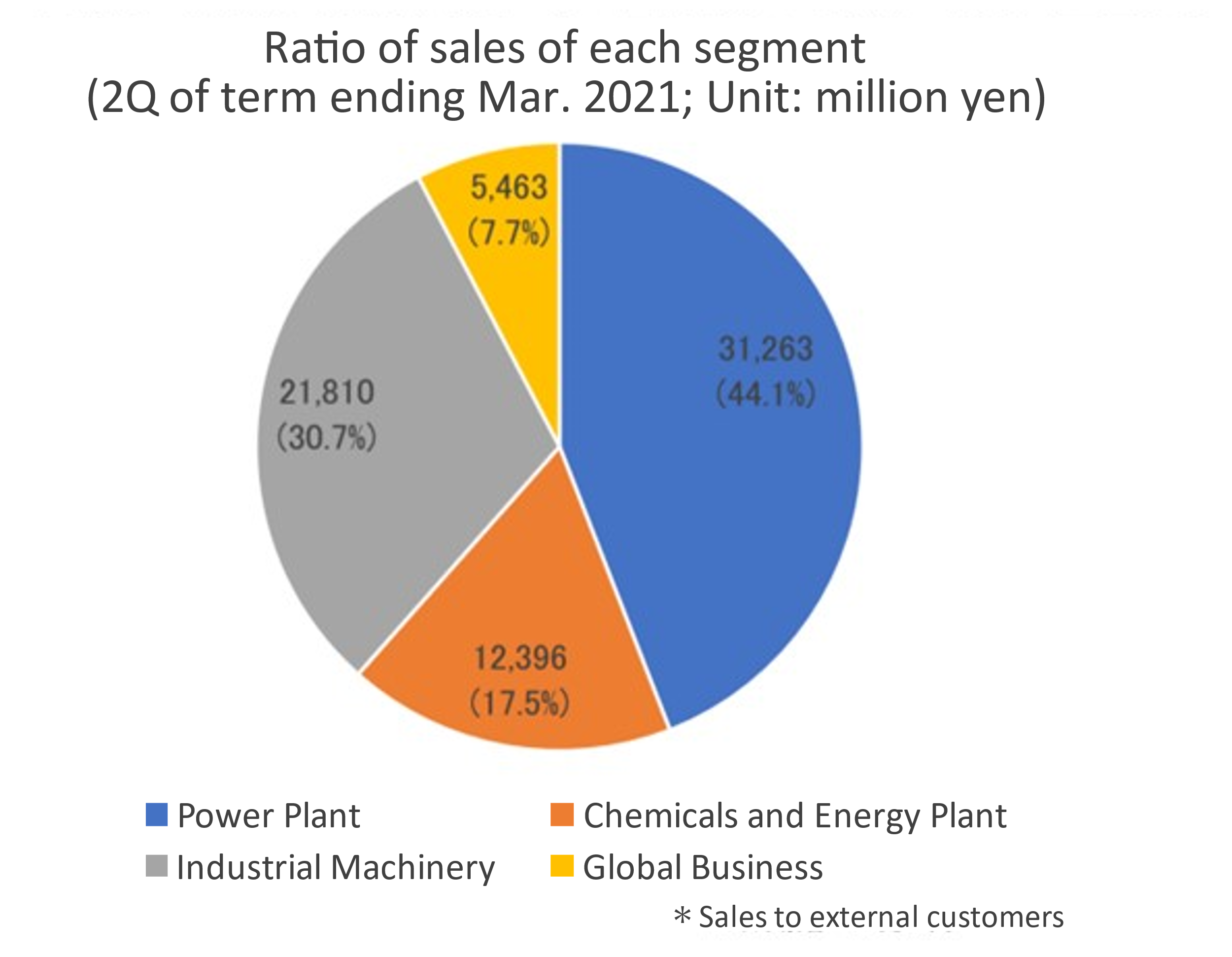

The company has used new business segments from the term ending March 2021.

Out of the previous five segments (Power Plant, Chemicals and Energy Plant, Industrial Machinery, Advanced Materials and Measuring Instruments, and Global Business), the Industrial Machinery business and the Advanced Materials and Measuring Instruments business have been integrated to form the new Industrial Machinery business.

As a result, the company has four segments from the term ending March 2021: Power Plant, Chemicals and Energy Plant, Industrial Machinery, and Global Business. Accordingly, for overview of business performance in each segment, the results for the term ended March 2020 have been converted to those of the new segments.

In addition, the company has changed the method of calculating segment income by allocating “corporate expenses and amortization of goodwill,” which has been an adjustment item for the difference from total segment income, to each segment in accordance with reasonable standards.

◎Sales and Profit

| 2Q of FY 3/20 | Ratio to sales | 2Q of FY 3/21 | Ratio to sales | YoY |

Sales |

|

|

|

|

|

Power Plant | 21,203 | 33.8% | 31,263 | 44.1% | +47.4% |

Chemicals and Energy Plant | 14,951 | 23.9% | 12,396 | 17.5% | -17.1% |

Industrial Machinery | 21,015 | 33.6% | 21,810 | 30.7% | +3.8% |

Global Business | 5,480 | 8.7% | 5,463 | 7.7% | -0.3% |

Total Sales | 62,651 | 100.0% | 70,935 | 100.0% | +13.2% |

Profits in each segment |

|

|

|

|

|

Power Plant | 722 | 3.4% | 452 | 1.4% | -37.4% |

Chemicals and Energy Plant | 73 | 0.5% | 44 | 0.4% | -39.6% |

Industrial Machinery | 123 | 0.6% | 600 | 2.8% | +386.8% |

Global Business | -84 | - | -117 | - | - |

Total profit in all segments | 835 | 1.3% | 979 | 1.4% | +17.3% |

*Unit: million yen. Sales to external clients. The composition ratio of profit means the rate of profit to sales.

① Power Plant

Sales increased but profit decreased.

Sales increased as the sales of large-scale projects including renewal work of power generation equipment for electricity companies increased, but profit decreased due to a decline in medium and small-scale projects for thermal and nuclear power plants.

② Chemicals and Energy Plant

Sales and profit decreased.

Sales declined due to a decrease in deliveries of power generation equipment to general industrial customers. Profit of Shikishimakiki Co., which handles marine engines, expanded, but profit dropped due to additional construction costs in some transactions at Seika Corporation.

③ Industrial Machinery

Sales increased and profit rose substantially.

Sales rose thanks to the increased sales of domestic synthetic fibers and industrial machinery for plants, and steady performance of Nippon Daiya Valves Co., Ltd. Profit increased substantially due to the improved performance of Seika Digital Image Co., Ltd. and large-scale business negotiations for the construction of power distribution equipment for semiconductor manufacturing companies.

④ Global Business

Sales decreased slightly and deficit augmented.

Sales were almost at the same level as the previous year, thanks to the strong sales of submersible pumps used in public constructions of Tsurumi (Europe) GmbH Group and the steady performance of the company’s subsidiaries in the U.S. and Southeast Asia. However, the deficit increased due to the sluggish performance of Seika YKC Circuit (Thailand) Co., Ltd. and Seika (Shanghai) Co., Ltd., which manufacture and sell printed circuit boards.

(3) Financial standing and cash flows

◎Main BS

| March 2020 | September 2020 |

| March 2020 | September 2020 |

Current Assets | 79,417 | 70,073 | Current liabilities | 62,141 | 52,450 |

Cash | 15,062 | 16,962 | Payables | 32,883 | 24,437 |

Receivables | 38,693 | 28,598 | ST Interest-Bearing Liabilities | 7,026 | 7,000 |

Advance payment | 18,823 | 18,127 | Fixed Liabilities | 4,616 | 4,650 |

Noncurrent Assets | 13,251 | 13,812 | LT Interest-Bearing Liabilities | 1,963 | 1,843 |

Tangible Assets | 2,473 | 2,448 | Total Liabilities | 66,757 | 57,100 |

Intangible Assets | 467 | 509 | Net Assets | 25,911 | 26,785 |

Investment, Others | 10,310 | 10,855 | Retained earnings | 15,738 | 15,962 |

Total assets | 92,668 | 83,886 | Total liabilities and net assets | 92,668 | 83,886 |

*Unit: million yen. Interest-bearing debt does not include lease obligations.

Total assets were 83,886 million yen, down 8,782 million yen from the end of the previous term, as receivables declined and other reasons. Total liabilities were 57,100 million yen, down 9,657 million yen from the end of the previous term, due to the decline in payables, etc.

Net assets increased 874 million yen from the end of the previous term to 26,785 million yen, thanks to the increase in retained earnings, etc.

Equity ratio increased 3.7% from the end of the previous term to 30.9%.

(4) Topics

◎ Establishment of Seika Daiya Engine Co., Ltd.

Seika Daiya Engine Co., Ltd. (SDE) was established by acquiring shares from Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. (MHIET) based on a transfer agreement for the domestic marine engine sales and service business of Mitsubishi Heavy Industries Engine Systems, a wholly owned subsidiary of MHIET, on October 1, 2020.

Seika Corporation made Shikishimakiki Co., which is MHIET’s exclusive distributor in Hokkaido, into its subsidiary in 2016, and with the addition of SDE, which has 25 domestic bases, the company expects to expand its marine engine sales and service business through nationwide expansion.

In addition, the company will expand into new fields, such as engines for commercial and industrial vessels, including work vessels for offshore wind power generation equipment, and auxiliary engines for large vessels.

◎ Transfer of shares of Seika YKC Circuit (Thailand) Co., Ltd., which manufactures and sells printed circuit boards in Thailand

On September 10, the Board of Directors decided to suspend operations of Seika YKC Circuit (Thailand) Co., Ltd. (SYC) and had been considering the future direction of SYC. As a result, it decided to withdraw from the business of SYC and transfer its shares to a party that can utilize its assets, as it would require a further investment and time to rebuild the business. The transfer date is January 6, 2021. The impact of this transfer on business performance will be disclosed as soon as details are known.

3. Fiscal Year March 2021 Earnings Forecasts

◎Consolidated Earnings Forecasts

| FY 3/20 | Ratio to sales | FY 3/21 Est. | Ratio to sales | YoY |

Sales | 140,677 | 100.0% | 135,000 | 100.0% | -4.0% |

Operating Income | 2,809 | 2.0% | 2,400 | 1.8% | -14.6% |

Ordinary Income | 3,122 | 2.2% | 2,700 | 2.0% | -13.5% |

Net Income | -1,262 | - | 1,650 | 1.2% | - |

*Unit: million yen. The estimates were announced by the company.

Sales and profits are expected to decrease. The forecasts were unchanged

The earnings forecast for the term ending March 2021 remains unchanged, with sales expected to be 135 billion yen, down 4.0% year-on-year, and operating income projected to be 2.4 billion, down 14.6% year-on-year. The impact of the spread of COVID-19 on the corporate group is still under investigation, and its earnings forecast has been obtained based on the information available at this time. There is a possibility that unexpected changes will occur due to the timing of the subsiding of COVID-19, domestic or overseas market conditions, etc. If an event that affects the corporate group’s business results occurs and it becomes necessary to revise the business forecast, the company will announce it promptly. The dividend is estimated to remain unchanged at 45 yen/share. The estimated payout ratio is 33.5%.

4. Mid-term management plan “Re-SEIKA 2023”

The mid-term management plan “Re-SEIKA 2023,” which will cover the period for the 3 years from April 2020 until March 2023, has begun.

In order to promote unity and group management, Seika Corporation has also established the “Group Policy,” “Code of Conduct,” and “Group Mission,” and each company belonging to the Group and each employee working therein share these policies and link them to daily actions, aiming to improve the corporate value of the entire Group.

◎ Group Policy

Strive for excellence and foster a sustainable society with corporate integrity.

◎ Code of Conduct

Comply with laws and act with ethical standards to gain the trust of society.

◎ Group Mission

Create a fulfilling society together.

(1) Basic policy

The company set the basic policy as “we will change our conventional way of thinking and behavior (Re-formation), continue to challenge all kinds of hardships time after time (Re-challenge), establish a sustainable growth cycle (Re-gain), and create a new stage for improving the corporate value further (Re-start)”

(2) Basic strategy

① Increase the Group’s Revenue | Reorganize Seika Corporation’s individual businesses and the group companies by business details into business units to implement integrated business operations |

② Strengthen the revenue base | Divide the Group’s businesses into base revenue and growth revenue. Push ahead with the optimization of the business portfolio and effectively introduce management resources as appropriate. |

③ Develop new revenue sources

| Continuously introduce management resources to the development of new sources of earnings to accelerate construction of foundations for the Group’s continuous growth. |

④ Strengthen the management base | Stabilize the Group’s financial position. Streamline operations, enhance the workplace environment and develop human resources by introducing and accelerating the IT shift and digital transformation (DX) to boost organizational strength. |

(3)Marketing project

① Renewable energy project | While historically the company has promoted a Power Plant business that is centered on thermal power plants, it has launched this project to develop a new source of earnings (business) in light of the ways that the supplying of electric power is changing as the world trends toward decarbonization. Specifically, the company will promote the sale of stable power supply systems such as a system to pool energy by replacing natural energy sources with hydrogen and storage cells in order to resolve the unstable of renewable energy power supplies. The company is also working to build regional microgrids using small hydroelectric power generation facilities and biomass power generation facilities using thinned wood, etc. to supply electric power locally.

|

② Life science project | The company has launched a project focusing on the field of life science, where living better, eating better and living a better life is the key as society ages and birthrates decline. The company is collaborating with a German manufacturer that leads the world in pharmaceutical manufacturing equipment technology and also working to further develop the pharmaceutical market that is expected to grow by utilizing our subsidiary Nippon Daiya Valve Co., Ltd.’s sales channels in the pharmaceutical field. |

③ Mobility project

| The company has launched this project to deal with products for mobility-related infrastructure businesses such as automotive, 5G, fuel cells and hydrogen-related products. The company aims to quickly commercialize this project by selecting specific products from the perspective of technology trends and market growth. |

(4) Projects to enhance corporate value

① Human resources utilization project | To promote the utilization of human resources as one Group, the company is planning and examining measures to develop the power of the Group’s human resources, including the construction of mechanisms enabling personnel exchanges within the Group, the sharing of each internal training and meetings for people in charge to exchange their knowledge. |

② Social contribution activity project | The Seika Group companies are supporting the activities of A Dream A Day in Tokyo, a public interest incorporated association that supports children with intractable diseases in the realization of their dreams and works to create memories with their families, in addition to disaster rehabilitation assistance in Japan and overseas and other regional contribution activities. The company will continue to work to realize an affluent society through the social contribution activities it conducts as one Group. |

(5) Management's Numerical targets

| FY 3/20 | FY 3/23 (Forecast) | CAGR |

Operating income | 2,800 | 3,700 | +9.7% |

Energy plant business unit | 1,780 | 1,950 | +3.1% |

Industrial machinery business unit | 790 | 1,310 | +18.4% |

Global business unit | 240 | 690 | +42.2% |

Developing new businesses | - | -250 | - |

Net income | -1,262 | 2,500 | - |

* Unit: million yen

The industrial machinery business unit and the global business unit, which are classified as revenue growth fields, will grow significantly and lead the business growth.

If the target net income of 2.5 billion yen for the term ending March 2023 is achieved, ROE will be 8% or higher.

5. Conclusions

The mid-term management plan “Re-SEIKA 2023” has gotten off to a tough start amid the global spread of COVID-19, but we will pay attention to whether each of the marketing projects (renewable energy, life science, and mobility) can be realized during the period of the current mid-term plan. In particular, developing new sources of revenue during this period will be a key challenge. Also, in the electric power business, which is the company’s forte, it will be important for the company to earn revenues from the replacement of aging thermal power generation facilities without fail.

<Reference 1:The Long-term Management Vision>

Seika Corporation formulated a long-term management vision for the year 2027 “Envisioned Seika Group 10 years from now”.

◎Long-term management vision: “Envisioned Seika Group 10 years from now”

*Objective

The year 2027 is a turning point, commemorating the 80th anniversary of the establishment of Seika Corporation, and the company set a long-term management vision “Envisioned Seika Group 10 years from now,” in addition to a mid-term management plan, which had been formulated every three years, in order to clarify the ideal path of the Seika group from the long-term perspective and realize drastic reform involving all employees.

*Overview

The following long-term policies have been set for actualizing the envisioned group.

Envisioned Seika Group 10 years from now

| A global corporate group that can adapt to the changing business environment and has a robust managerial base. The employees of group companies have the pioneering spirit, think their jobs are worthwhile, work vigorously and feel their own growth. |

Long-term managerial policy

| 1. To reform and evolve business models, and enhance the earning capacity of the Seika group further.2. To find and develop personnel who can respond to the change of the times and create new businesses and those who can flourish inside and outside Japan, and use managerial resources in an optimal manner. 3. To develop a working environment that is worthwhile and attractive to employees, and improve productivity. |

<Reference2: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 8 directors, including 3 outside ones |

Auditors | 4 directors, including 2 outside ones |

At the annual general meeting of shareholders held in June 2020, the number of independent outside directors increased by one (to a total of three), securing more than one-third of the board of directors. The company is working to strengthen its governance.

◎Corporate Governance Report

Last update date: :October 20, 2020

< Basic Stance on Corporate Governance>

Our corporate philosophy is “To Contribute to Society Through the Expansion of Business.” We are committed to improving corporate value over the mid-to-long term while establishing a good relationship with all stakeholders. We believe that “soundness and transparency of management” and “prompt decision-making and action” are critical for achieving these goals, and we continually strive to strengthen corporate governance.

In addition, our company intends to strengthen its supervisory structure by appointing independent outside directors and independent outside corporate auditors.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

【Supplementary Principle 1-2-4】 Use of a platform for exercising voting rights, and the English translation of convocation notices | Our company will discuss whether or not to adopt the electronic exercise of voting rights. As for the English translation of convocation notices, we have been translating some convocation notices into English from the annual meeting of shareholders in 2017, and these translations are available in our website. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Principle 1-4 The so-called strategically held shares】 | “Policy for strategically held shares” Considering the details, scales, periods, etc. of transactions with business partners, we hold their shares as necessary, in order to maintain and strengthen the relationships with them. Our company's basic policy is to dispose of and reduce held shares that are deemed to have little strategic purpose. Every year, the Board of Directors decides whether there is an appropriate reason for holding each share. We investigates whether the benefits and risks associated with holding a share are commensurate with the cost of capital, and disclose our findings in the securities report. Our company sold a portion of its held shares during the term ended March 2020.

“Policy on exercising voting rights regarding strategically held shares” Regarding the exercise of voting rights for shares held by our company, while respecting these companies’ management policy, we will confirm whether each proposal contributes to the improvement of our corporate value over the mid-to-long term, and make a comprehensive decision. |

【Principle 5-1 Policy for constructive dialogue with shareholders】 | In order to improve our corporate value in the mid-to-long term through active dialogue with shareholders and institutional investors, the president explains the financial results and the progress of the mid-term management plan at a session for briefing financial results, which is held twice a year, and a general meeting of shareholders has sufficient time for questions and answers, to answer questions from shareholders carefully. The sections of general affairs and personnel affairs deal with the applications for dialogue (interview) from individual shareholders, while the planning section replies to applications from corporate shareholders, including institutional ones. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are provided by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co.,Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Seika Corporation (8061) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/