Bridge Report:(8061)Seika Second quarter of the fiscal year ending March 2022

President Akihiko Sakurai | Seika Corporation (8061) |

|

Company Information

Market | TSE 1st Section |

Industry | Wholesale |

President | Akihiko Sakurai |

HQ Address | Shin-Tokyo Bldg, 3-1, Marunouchi 3-chome, Chiyoda-ku, Tokyo |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥1,594 | 12,820,650 shares | ¥20,436 million | 10.0% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥55.00 | 3.5% | ¥162.93 | 9.9x | ¥2,365.06 | 0.7x |

*The share price is the closing price on December 3. Shares Outstanding, DPS and EPS were taken from the brief financial report for the second quarter of the term ending March 2022. ROE and BPS are based on the results in the term ended March 2021.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2018 (Actual) | 165,585 | 2,598 | 2,877 | 1,655 | 128.38 | 55.00 |

March 2019 (Actual) | 157,145 | 2,118 | 2,418 | 1,587 | 125.50 | 45.00 |

March 2020 (Actual) | 140,677 | 2,809 | 3,122 | -1,262 | -100.73 | 45.00 |

March 2021 (Actual) | 136,273 | 2,581 | 2,906 | 2,721 | 221.87 | 45.00 |

Match 2022(Forecast) | 88,500 | 2,850 | 3,100 | 1,950 | 162.93 | 55.00 |

*Unit: million yen or yen. The company implemented a reverse stock split at 1:5 on October 1, 2017. EPS and DPS adjusted retroactively. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

This report outlines the overview of Seika Corporation for the second quarter of the fiscal year ending March 2022 earnings results.

Table of Contents

Key Points

1.Company Overview

2.The Second Quarter of Fiscal Year Ending March 2022 Earnings Results

3. Fiscal Year Ending March 2022 Earnings Forecasts

4. Conclusions (Topics)

<Reference: Regarding Corporate Governance>

Key Points

- The amount of orders received in the second quarter of the term ending March 2022 was 41,667 million yen, up 12.6% year on year. Despite the postponement of investments in equipment caused by COVID-19, etc., it grew due to the contribution made by affiliated companies, etc. Sales stood at 40,452 million yen, up 19.9% year on year. While the Power Plant Business and Industrial Machinery Business were unchanged from the previous term, Seika Daiya Engine, which became a consolidated subsidiary in the previous term, contributed to the Chemicals and Energy Plant Business, and the rise in selling prices of textile materials in China contributed to the Global Business, increasing operating income to 1,304 million yen, up 36.8% year on year. Although additional expenses were incurred through some of the transactions with China in the Industrial Machinery Business, they were offset by the increase in sales in the Chemicals and Energy Plant Business and the Global Business. Net income increased 31.6% year on year to 698 million yen. Order backlog also grew 8.5% year on year to 62,141 million yen.

- Regarding the earnings forecast for the term ending March 2022, the initial estimates remain unchanged, with sales projected to be 88.5 billion yen, operating income to rise 10.4% year on year to 2,850 million yen and net income to drop 28.4% year on year to 1,950 million yen. With regard to sales, the “Accounting Standard for Revenue Recognition” was adopted this term, which means that only commission fees of agency transactions rather than the total amount will be recorded. The conventional sales will be indicated as trade volume in the new standard. Taking into account the downturn risks brought about by the COVID-19 pandemic, the trade volume is projected to decline 4.6% year on year to 130 billion yen in this term. Net income is expected to drop as the temporary factors present in the previous term (decrease in tax expenses such as the corporate income tax) no longer exist. The company plans to pay a dividend of 55 yen/share, up 10 yen/share from the previous term. The expected payout ratio is 33.8%.

- It is noteworthy whether they can put each marketing project (renewable energy, life science, and mobility) into practice. The key to achieving the goals is the growth of revenues from relatively healthy affiliated companies in addition to the maintenance of revenues from the Power Plant Business and the Chemicals and Energy Plant Business and the expansion of revenues from the Industrial Machinery Business. In the medium/long term, the actualization of power generation from hydrogen in the energy business (the Power Plant Business and the Chemicals and Energy Plant Business), which is the revenue base of the company, for realizing a decarbonized society may become a new revenue source. Accordingly, their future performance is noteworthy.

1. Company Overview

Under the corporate philosophy “To Contribute to Society Through the Expansion of Business,” Seika Corporation sells equipment, devices, etc. and offers services in the fields of electric power, chemistry, energy and industrial machinery, as a general machinery trading company.

Its three characteristics and strengths are sales capability thoroughly versed in fields, extensive expertise in each business, and a wide network including 102 business bases both inside and outside Japan.

1-1 Corporate History

In July 1947, after the Pacific War, Mr. Douglas MacArthur, Supreme Commander for the Allied Powers, ordered the dissolution of the old Mitsubishi Corporation with a memorandum. In October 1947, the first president Koji Nakabayashi and staff of the machinery division of Moji Branch played a central role in founding Seika Corporation in Moji-ku, Kitakyushu-shi.

The corporate name is derived from “Essence of commerce: To pursue the quintessence of commerce, and offer benefits to others while earning money,” “Star company of the west: To aim to become a star company in western Japan,” and “Chin It may become helpful if the trade with China increases.”

The company expanded business actively, establishing branches throughout Japan, including Tokyo and Osaka, and an overseas office in Dusseldorf, Germany (old West Germany), where only a few Japanese people resided around that time, in November 1954. The company was listed in the first section of Tokyo Stock Exchange in October 1961.

Then, it has grown as a general machinery trading company, by fortifying the sales base mainly in western Japan and establishing footholds in the U.S., Europe, and Asia.

The company is currently implementing the long-term management vision “Envisioned Seika Group 10 years from now” and its second step 3-year plan “Mid-term Management Plan Re-SEIKA 2023,” in preparation for 2027, which will mark the 80th anniversary of the company’s founding.

1-2 Corporate Philosophy, etc.

Seika Corporation set up the following corporate philosophy and code of conduct.

Corporate Philosophy | “Our Philosophy is to Contribute to Society Through the Expansion of Business.”

No matter how society changes, we are committed to conducting business that rewards all stakeholders and being a Valuable Business that contributes to the realization of an affluent society. |

Code of conduct | 1. Being trustworthy is a priceless asset.2. To always have a high appreciation of the significance of existence is the basis of the business activities of a trading company.3. Fast and accurate information activities and effective responses win everything.4. To make decisions and handle things using objective consideration and pursue necessity and rationality without being influenced by intuition. 5. To be driven by a pioneering spirit, be challenged, and be proud to overcome all difficulties, barriers, and turbulent times. |

In order to promote unity and group management, Seika Corporation has also established the “Group Policy,” “Code of Conduct,” and “Group Mission,” and each company belonging to the Group and each employee working therein share these policies and link them to daily actions, aiming to improve the corporate value of the entire Group.

Group Policy | Strive for excellence and foster a sustainable society with corporate integrity. |

Code of Conduct | Comply with laws and act with ethical standards to gain the trust of society |

Group Mission | Create a fulfilling society together |

1-3 Business Description

(1) Business segments

As a general machinery trading company, Seika Corporation sells machinery, equipment, devices, and ancillary products and offers services in the fields of electric power, chemistry, energy and industrial machinery.

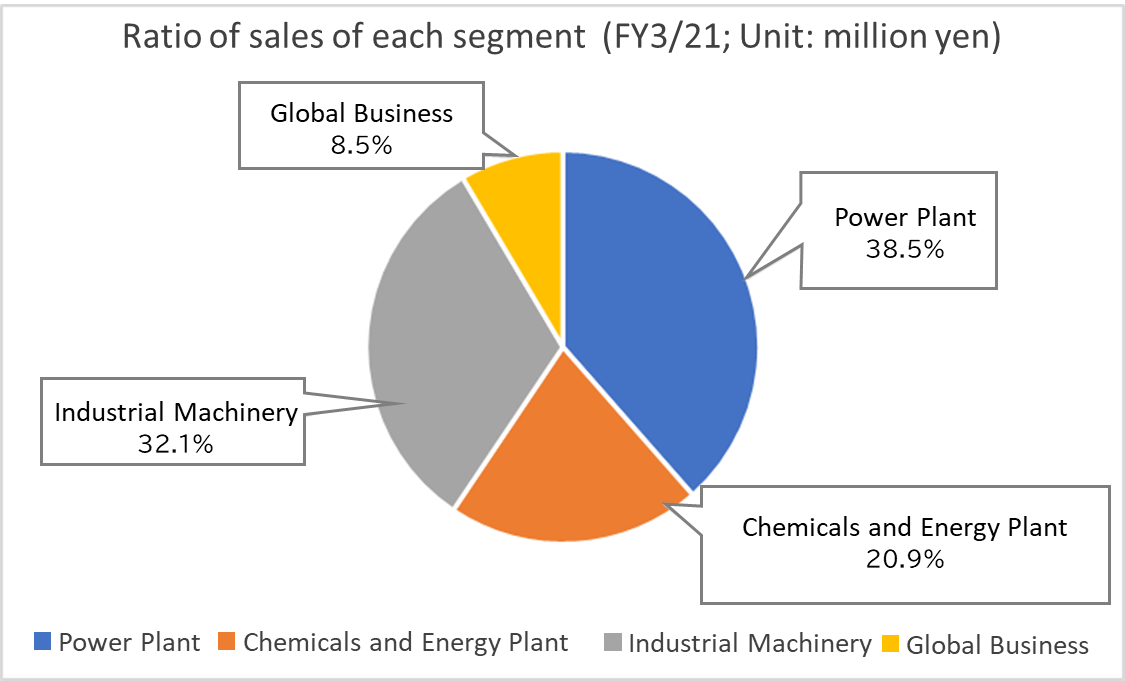

The segments to be reported are 4 segments, which are “Power Plant,” “Chemicals and Energy Plant,” “Industrial Machinery,” and “Global Business”, from the fiscal year ending March 2021.

① Power Plant

The clients of Seika Corporation are electric power companies in western Japan, including The Kansai Electric Power, Kyushu Electric Power, The Chugoku Electric Power, Shikoku Electric Power, Power Development Electric Power Company, and joint electric power companies. The company sells and provides after-sales services for industrial power generation equipment, such as boilers and gas turbines, as well as environmental conservation equipment for treating discharged water and exhaust gas.

The company also sells anti-crime and anti-disaster equipment, such as security equipment and fire extinguishing equipment for nuclear plants.

Furthermore, the company provides power-generation equipment for renewable energies such as small-sized water, wind, and biomass, and after-sales services.

The suppliers is mainly a group company of Mitsubishi Heavy Industries (MHI), and Seika Corporation possesses the distributorship for thermal power generation equipment of the company`s group.

|

|

(taken from the company’s material)

② Chemicals and Energy Plant

Seika Corporation sells in-house power generation equipment, such as boilers and turbines, environmental conservation equipment for treating discharged water and exhaust gas, etc. and offers after-sales services to companies in oil refining, chemical, paper, and steel industries. As in the power plant business, the company procures these mainly from a group company of Mitsubishi Heavy Industries (MHI).

In addition, the company sells products that reduce environmental burdens, as well as equipment and fuel for biomass power generation.

The business of sale and service of engines for ships transferred from Mitsubishi Heavy Industries was launched on October 1, 2020, and is operated by Seika Daiya Engine.

|

|

(taken from the company’s material)

③ Industrial Machinery

Seika Corporation provides clients in a broad range of industries with textile equipment, food processing equipment, brewing equipment, various plant machinery, liquid crystal-related equipment, environment-related apparatus, uninterruptible power systems (UPS), printed circuit boards for electronic mea, etc. produced by Japanese or foreign manufacturers. The company also supplies measurement instruments that make full use of advanced technology, such as laser measurement instruments and pore size measurement equipment, to government agencies and research institutes.

In addition, the company sells lithium ion battery-related equipment and motor manufacturing equipment for electronic vehicles (EVs) in China.

The company’s subsidiary Nippon Daiya Valve manufactures and sells various industrial valves.

(taken from the company’s material)

④ Global Business

(Europe)

While selling industrial robots to automotive customers in the automotive field, Seika Corporation sells and leases submersible pumps used in public construction, etc. in the social infrastructure field. These products are procured mainly from Japanese manufacturers.

(North America)

As for the automotive field, the company sells Japanese-made industrial machinery in the PCB surface mount production line mainly to the automotive parts industry.

(Asia)

As for the industrial machinery field, the company sells Japanese-made machinery and equipment to companies within the automotive, textile, chemical industries, and also procures raw materials outside Japan and sells them to textile manufacturers.

|

|

(taken from the company’s material)

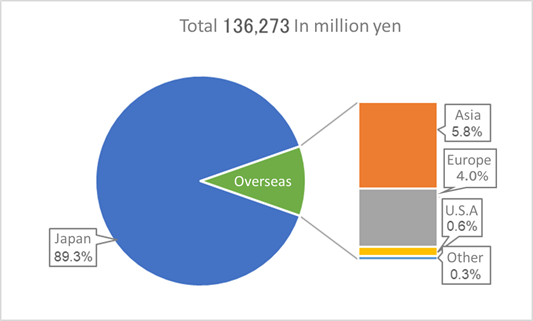

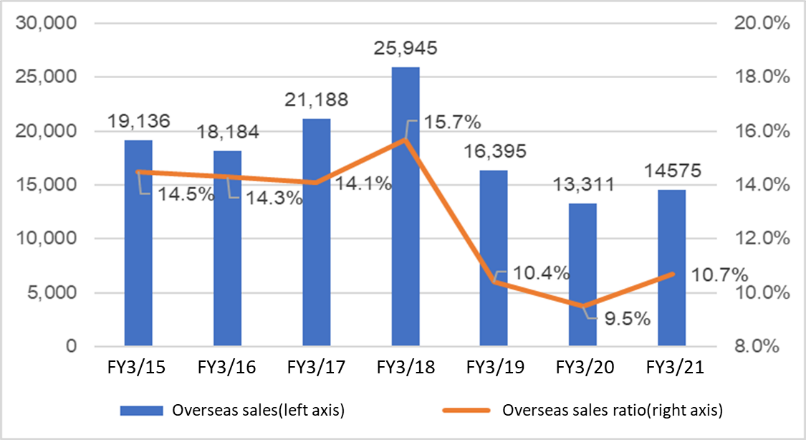

(2) Sales in each region

Domestic sales account for about 90%, however, the development of overseas markets where there is significant room for growth and expanding overseas sales ratio are challenges for the company.

Ratio of sales in each region in term ended March 2021

| Variation in overseas sales

|

1-4 Characteristics and strengths

(1) Hands-on sales capability

The capability of hands-on sales nurtured in their more than 70 years’ history is the company's greatest strength.

By building relationships of trust through meticulous customer services and forming personal connections, Seika Corporation is able to obtain a steady stream of orders.

(2) High level of expertise in each business

Seika Corporation has garnered excellent reputation as an essential business partner with a high level of expertise, including profound information gathering capabilities and the ability to develop proposals that stay one step ahead of clients.

(3) Extensive network comprised of 102 bases in Japan and overseas

Ten years ago, the company only had thirty bases, but, thanks to M&A, they did not only expand their bases domestically, but also have been rapidly expanding the number of bases in Europe and Southeast Asia in anticipation of globalization. The speed and comprehensiveness of information have increased further, and by utilizing this, the company hopes to further improve its corporate value.

(4) Measures to strengthen employee education and sales capabilities

Seika Corporation primarily uses on-the-job training to develop its employees. Senior staff and those with more experience teach newer employees the essentials for business, and the company also focuses on overseas training programs and seminars for each skill level.

Nowadays, the company requests the former staff of manufacturers and client companies to provide its employees with consultation services and hands-on support for sales.

The advice the company receives allows them to further improve their expertise and sales capabilities.

1-5 ROE analysis

| FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 | FY 3/21 |

ROE (%) | 6.6 | 7.9 | 5.9 | 5.6 | -4.7 | 10.0 |

Net income margin (%) | 1.38 | 1.42 | 1.00 | 1.01 | -0.90 | 2.00 |

Total asset turnover (x) | 1.52 | 1.45 | 1.53 | 1.71 | 1.58 | 1.40 |

Leverage (x) | 3.13 | 3.82 | 3.83 | 3.42 | 3.32 | 3.67 |

In the term ended March 2021, ROE recovered to positive. According to the conventional accounting method, net income margin in the term ending March 2022 is estimated to decrease to 1.5%, but we would like to expect that profit margin will rise as leverage is relatively high.

If the target net income of 2.5 billion yen for the term ending March 2023 is achieved in the mid-term management plan “Re-SEIKA 2023,” ROE will be 8% or more.

1-6 Efforts for ESG

<E: Environment>

The environmental policy of the company is to “make efforts to protect the earth environment and contribute to the realization of a sustainable society.”

Under this policy, the company obtained the ISO14001 certificate in 2005, and is promoting environmentally-friendly products.

The environmentally friendly products handled by the company are diverse, including equipment for treating exhaust gas from boilers and incinerators and organic solvent recovery equipment for chemical and semiconductor factories. The amount of transaction in the term ended March 2021 were 12,473 (down 7.5% from the previous year) and 88.6 billion yen (down 6.5% from the previous year), as mentioned below.

The company will continue to contribute to the conservation of the earth environment through business activities, and not merely from the perspective of social contribution.

Expand sales of environmentally friendly products | ||

Orders for environmentally friendly products in the term ended Mar.2021 | No. of orders received | Amount of orders received (billion yen) |

Energy saving/resource saving/efficiency improving | 10,800 | 80.3 |

Pollution control | 985 | 7.1 |

Recycling/reuse | 688 | 1.2 |

Total | 12,473 | 88.6 |

<S: Social Responsibility>

To fulfill its “social responsibility,” Seika Corporation engages in work-style reforms as follows.

“Promotion of women’s active participation in the workplace”

●To recruit more women in the main career track

●To support female employees in developing their careers

●To appoint female managers

“Enhancement of health of employees”

●To adopt Premium Friday (Casual day at the same time)

●To promote the use of paid holidays

●The company bears the expense for cancer screening (tumor marker option) in a health checkup

●The company bears the cost of influenza vaccinations

“Personnel development”

●Training at each level

●Overseas training system

“Initiatives amid the COVID-19 pandemic”

●To recommend telework

●To provide employees with portable PCs

●To reduce the use of paper, etc.

<G: Governance>

In accordance with the Corporate Governance Code revised in June 2021, initiatives for all subjects are disclosed on the company’s website.

The website of the company discloses the activities for each item of the Corporate Governance Code.

The effectiveness of the board of directors in the term ended March 2021 was evaluated by an external organization, and the Nomination Examination Committee and the Remuneration Examination Committee, which are composed of outside directors and outside auditors, were established under the board of directors as an arbitrary system for following the corporate governance code.

In addition, the company translated some convocation notices into English, produced the English versions of reference material for briefing financial results and fact books, and adopted a platform for electronic exercise of voting rights.

In order to grow sustainably and improve its corporate value in the mid-to-long term, the company will strive to strengthen corporate governance, and pursue a sound, transparent management system.

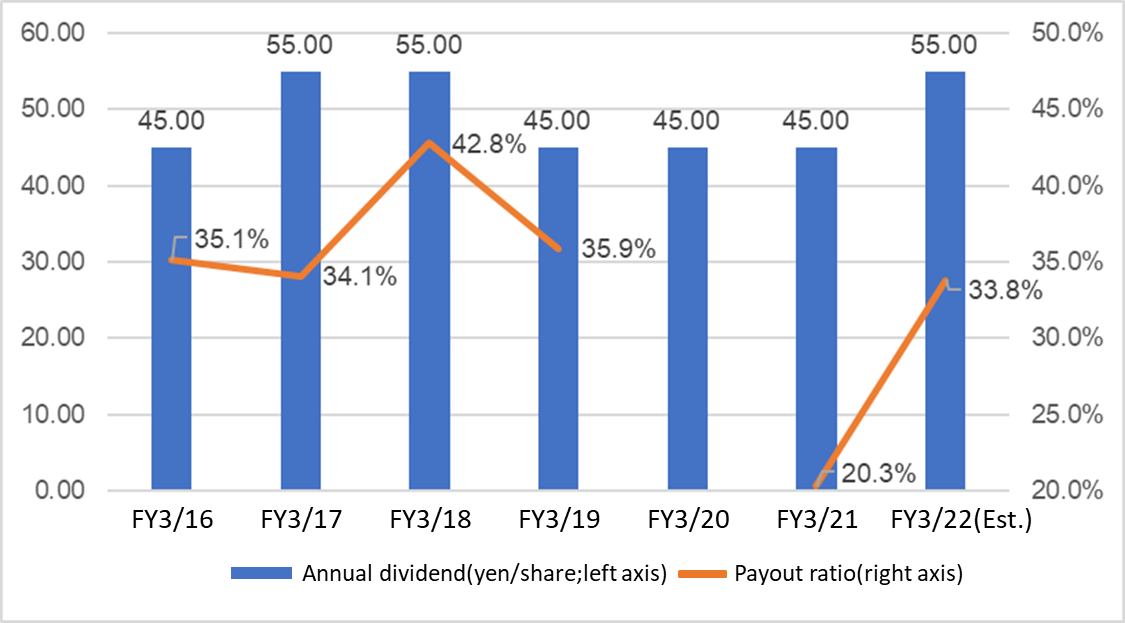

1-7 Shareholder return

The primary managerial mission of the company is to return profit to shareholders, and its basic policy is stable dividend payment.

Through the efficient business operation from the marketing and financial aspects, the company aims to fortify the management base. While dealing with the demand for funds for developing new businesses, etc., the company plans to achieve a consolidated payout ratio of 35%.

For the term ending March 2022, the company plans to pay an interim dividend of 25 yen/share and a term-end dividend of 30 yen/share, that is, a total of 55 yen/share, and the estimated payout ratio is 33.8%.

The company will actively return profit to shareholders while comprehensively considering the dividend policy, full-year results, etc.

2.The Second Quarter of Fiscal Year Ending March 2022 Earnings Results

(1) Consolidated Business Results

| 2Q of FY 3/21 | Ratio to sales | 2Q of FY 3/22 | Ratio to sales | YoY |

Orders | 36,996 | 109.7% | 41,667 | 103.0% | +12.6% |

Orders Backlog | 57,282 | 169.8% | 62,141 | 153.6% | +8.5% |

Transaction Volume | 70,935 | 210.3% | 69,027 | 170.6% | -2.7% |

Sales | 33,730 | 100.0% | 40,452 | 100.0% | +19.9% |

Gross profit | 6,619 | 19.6% | 8,186 | 20.2% | +23.7% |

SG&A | 5,665 | 16.8% | 6,881 | 17.0% | +21.5% |

Operating Income | 953 | 2.8% | 1,304 | 3.2% | +36.8% |

Ordinary Income | 1,098 | 3.3% | 1,315 | 3.3% | +19.8% |

Quarterly Net Income | 530 | 1.6% | 698 | 1.7% | +31.6% |

*Unit: million yen. Quarterly Net Income is quarterly profit attributable to owners of parent.

Sales increased and profit increased dramatically.

The amount of orders received in the second quarter of the term ending March 2022 was 41,667 million yen, up 12.6% year on year. Despite the postponement of investments in equipment caused by COVID-19, etc., it grew due to the contribution made by affiliated companies, etc. Sales stood at 40,452 million yen, up 19.9% year on year. While the Power Plant Business and Industrial Machinery Business were unchanged from the previous term, Seika Daiya Engine, which became a consolidated subsidiary in the previous term, contributed to the Chemicals and Energy Plant Business, and the rise in selling prices of textile materials in China contributed to the Global Business, increasing operating income to 1,304 million yen, up 36.8% year on year. Although additional expenses were incurred through some of the transactions with China in the Industrial Machinery Business, they were offset by the increase in sales in the Chemicals and Energy Plant Business and the Global Business. Net income increased 31.6% year on year to 698 million yen. Order backlog also grew 8.5% year on year to 62,141 million yen.

(2) Overview of business performance in each segment

◎Sales and Profit

| 2Q of FY 3/21 | Ratio to sales | 2Q of FY 3/22 | Ratio to sales | YoY |

Sales |

|

|

|

|

|

Power Plant | 4,946 | 14.7% | 4,436 | 11.0% | -10.3% |

Chemicals and Energy Plant | 4,872 | 14.4% | 10,553 | 26.1% | +116.6% |

Industrial Machinery | 18,447 | 54.7% | 16,950 | 41.9% | -8.1% |

Global Business | 5,463 | 16.2% | 8,512 | 21.0% | +55.8% |

Total Sales | 33,730 | 100.0% | 40,452 | 100.0% | +19.9% |

Profits in each segment |

|

|

|

|

|

Power Plant | 452 | 9.1% | 458 | 10.3% | 1.4% |

Chemicals and Energy Plant | 44 | 0.9% | 200 | 1.9% | +351.6% |

Industrial Machinery | 600 | 3.3% | 263 | 1.6% | -56.1% |

Global Business | -117 | - | 374 | 4.4% | - |

Total profit in all segments | 979 | 2.9% | 1,296 | 3.2% | +32.4% |

*Unit: million yen. Sales are the sales to external clients. The composition ratio of profit means the rate of profit to sales.

① Power Plant

Sales decreased while profit was unchanged from the previous term.

Sales declined due to the drop in sales from upgrade of power generation equipment for power companies, etc. Profit was almost unchanged from the previous term, owing to the contribution of small and medium-scale projects for nuclear power plants.

② Chemicals and Energy Plant

Sales and profit considerably increased.

Sales considerably rose thanks to the contribution of the sales of Seika Daiya Engine, which became a consolidated subsidiary in the previous term and handles engines for ships. Profit considerably grew in step with the increase in sales.

③ Industrial Machinery

Sales declined and profit considerably decreased.

Despite the sales of new biomass-related equipment for drink makers, sales dropped due to the impact of the postponement of investments in equipment caused by COVID-19 (industrial machinery for synthetic fiber and plant companies, etc. in Japan). Profit considerably declined as additional expenses were incurred, mainly in transactions for the Chinese market.

④ Global Business

Sales increased and profit turned positive.

Sales grew thanks to the contribution of the rise in sales of textile materials in China as well as sales of large equipment for treating discharged water for petrochemical companies of SEIKA (SHANGHAI) CO., LTD. Profit turned positive, also owing to the favorable performance of the Tsurumi (Europe) GmbH group, which mainly handles submersible pumps used in public construction works.

(3) Financial standing

◎Main BS

| March 2021 | September 2021 |

| March 2021 | September 2021 |

Current Assets | 81,371 | 81,491 | Current liabilities | 64,536 | 64,132 |

Cash | 15,763 | 16,252 | Payables | 32,730 | 29,391 |

Receivables | 36,159 | 33,975 | ST Interest-Bearing Liabilities | 7,565 | 7,566 |

Inventories | 7,636 | 7,029 | Advance received | 21,913 | 24,266 |

Advance payment | 20,639 | 23,477 | Fixed Liabilities | 3,032 | 2,994 |

Noncurrent Assets | 16,087 | 15,548 | LT Interest-Bearing Liabilities | 53 | 45 |

Tangible Assets | 2,816 | 2,763 | Total Liabilities | 67,568 | 67,126 |

Intangible Assets | 834 | 797 | Net Assets | 29,889 | 29,913 |

Investment, Others | 12,436 | 11,988 | Retained earnings | 17,907 | 18,294 |

Total assets | 97,458 | 97,040 | Total liabilities and net assets | 97,458 | 97,040 |

*Unit: million yen. Interest-bearing debt does not include lease obligations.

Despite the increase in advance payments, etc., total assets decreased 417 million yen from the end of the previous term to 97,040 million yen, due to the drop in accounts receivable. Although advances received increased, accounts payable decreased considerably, decreasing total liabilities by 441 million yen from the end of the previous term to 67,126 million yen.

Net assets grew 24 million yen from the end of the previous term to 29,913 million yen due to the increase in retained earnings, etc.

Capital-to-asset ratio remained unchanged from the end of the previous term, standing at 29.8%.

3. Fiscal Year Ending March 2022 Earnings Forecasts

◎Consolidated Earnings Forecasts

| FY 3/21 | Ratio to sales | FY 3/22 Est. | Ratio to sales | YoY |

Transaction Volume | 136,273 | - | 130,000 | 146.9% | -4.6% |

Sales | - | - | 88,500 | 100.0% | - |

Operating Income | 2,581 | - | 2,850 | 3.2% | +10.4% |

Ordinary Income | 2,906 | - | 3,100 | 3.5% | +6.6% |

Net Income | 2,721 | - | 1,950 | 2.2% | -28.4% |

*Unit: million yen. The estimates were announced by the company.

The initial estimates remain unchanged

Regarding the earnings forecast for the term ending March 2022, the initial estimates remain unchanged, with sales projected to be 88.5 billion yen, operating income to rise 10.4% year on year to 2,850 million yen and net income to drop 28.4% year on year to 1,950 million yen. With regard to sales, the “Accounting Standard for Revenue Recognition” was adopted this term, which means that only commission fees of agency transactions rather than the total amount will be recorded. The conventional sales will be indicated as trade volume in the new standard. Taking into account the downturn risks brought about by the COVID-19 pandemic, the trade volume is projected to decline 4.6% year on year to 130 billion yen in this term. Net income is expected to drop as the temporary factors present in the previous term (decrease in tax expenses such as the corporate income tax) no longer exist. The company plans to pay a dividend of 55 yen/share, up 10 yen/share from the previous term. The expected payout ratio is 33.8%.

4. Conclusions (Topics)

It is noteworthy whether they can put each marketing project (renewable energy, life science, and mobility) into practice. The key to achieving the goals is the growth of revenues from relatively healthy affiliated companies in addition to the maintenance of revenues from the Power Plant Business and the Chemicals and Energy Plant Business and the expansion of revenues from the Industrial Machinery Business. In the medium/long term, the actualization of power generation from hydrogen in the energy business (the Power Plant Business and the Chemicals and Energy Plant Business), which is the revenue base of the company, for realizing a decarbonized society may become a new revenue source. Accordingly, their future performance is noteworthy.

◎Application for Selection of “Prime Market,” a new market segment of the Tokyo Stock Exchange.

On July 9, 2021, the company received the initial assessment results regarding the compliance with listing criteria for the new market segment from the Tokyo Stock Exchange, Inc., confirming the eligibility to be listed on the “Prime Market,” the transition to which will take place on April 4, 2022.

At the Board of Directors’ meeting held on October 14, 2021, the company resolved to select and apply for the “Prime Market.”

◎Seika Corporation’s initiatives regarding the environment

Laser-based gas concentration gauge: It is characterized by the ability to perform measurement in real time and little need for maintenance.

Measuring the concentrations of oxygen and carbon monoxide in exhaust gas will allow for optimal combustion in thermal power equipment and waste incineration equipment, leading to the reduction of carbon dioxide. For maintenance, the company formed an alliance with Chugai Technos, a major company in the measurement business.

The company imports and sells hydrogen sulfide and hydrogen fluoride concentration meters produced by Neo Monitors in Norway. An alliance was formed with Horiba, Ltd., a top manufacturer of measurement instruments.

◎Seika Daiya Engine’s initiatives regarding the environment

A branch office was established in Akita City, the mecca of offshore wind power generation construction, in July 2021.

It works on grasping the trends and publishing information on offshore wind power generation in the whole Akita Prefecture. It aims to receive orders related to offshore wind power as a step toward the realization of a carbon-free society.

The company consented to forming partnership with Euglena Co., Ltd. for cooperation in the utilization of biofuel on October 21, 2021.

They were the first to supply next-generation biodiesel fuel (SUSTEO) to fishing vessels, gaining attention from the government and fishery authorities.

◎Seika Corporation’s initiatives concerning semiconductors

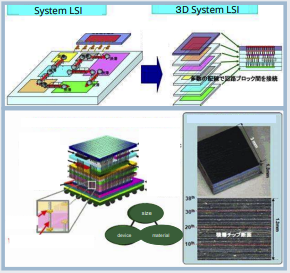

The evolution of electronic devices is crucial for 5G, IoT and electric vehicles. The company targets the demand for R&D specialized in the 3D installation technologies.

They were entrusted with the development of 3D installation technology for vertically stacking heterogeneous semiconductor chips (for prototypes and small lots) by a major semiconductor manufacturer.

(taken from the company’s material)

◎Drone business

Inspection of plant equipment by ultrasonic testing (UT) drones.

Utilization of the ultrasonic testing function leads to the reduction of time and cost required for the inspection of tanks, chimneys, boilers, etc. as there is no need for setting up a scaffolding.

The service was launched in March 2021, with both demand and expectations on the rise. It has accomplished steady performance.

(taken from the company’s material)

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 8 directors, including 3 outside ones |

Auditors | 4 directors, including 2 outside ones |

At the annual general meeting of shareholders held in June 2020, the number of independent outside directors increased by one (to a total of three), securing more than one-third of the board of directors. The company is working to strengthen its governance.

◎Corporate Governance Report

Last update date: November 5, 2021

< Basic Stance on Corporate Governance>

Our corporate philosophy is “To Contribute to Society Through the Expansion of Business.” We are committed to improving corporate value over the mid-to-long term while establishing a good relationship with all stakeholders. We believe that “soundness and transparency of management” and “prompt decision-making and action” are critical for achieving these goals, and we continually strive to strengthen corporate governance.

In addition, our company intends to strengthen its supervisory structure by appointing independent outside directors and independent outside corporate auditors.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Principle 1-4 The so-called strategically held shares】 | “Policy for strategically held shares” Considering the details, scales, periods, etc. of transactions with business partners, we hold their shares as necessary, in order to maintain and strengthen the relationships with them. Our company's basic policy is to dispose of and reduce held shares that are deemed to have little strategic purpose. Every year, the Board of Directors decides whether there is an appropriate reason for holding each share. We investigates whether the benefits and risks associated with holding a share are commensurate with the cost of capital, and disclose our findings in the securities report. Our company sold a portion of its held shares during the term ended March 2021. “Policy on exercising voting rights regarding strategically held shares” Regarding the exercise of voting rights for shares held by our company, while respecting these companies’ management policy, we will confirm whether each proposal contributes to the improvement of our corporate value over the mid-to-long term, and make a comprehensive decision. |

【Principle 5-1 Policy for constructive dialogue with shareholders】 | In order to improve our corporate value in the mid-to-long term through active dialogue with shareholders and institutional investors, the president explains the financial results and the progress of the mid-term management plan at a session for briefing financial results, which is held twice a year, and a general meeting of shareholders has sufficient time for questions and answers, to answer questions from shareholders carefully. The sections of general affairs and personnel affairs deal with the applications for dialogue (interview) from individual shareholders, while the planning section replies to applications from corporate shareholders, including institutional ones. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Seika Corporation (8061) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/