Bridge Report:(8061)Seika the second quarter of fiscal year ending March 2023

President Akihiko Sakurai | Seika Corporation (8061) |

|

Company Information

Market | TSE Prime Market |

Industry | Wholesale |

President | Akihiko Sakurai |

HQ Address | Shin-Tokyo Bldg, 3-1, Marunouchi 3-chome, Chiyoda-ku, Tokyo |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥1,540 | 12,320,650 shares | ¥18,973 million | 7.6% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥70.00 | 4.5% | ¥208.30 | 7.4x | ¥2,516.57 | 0.6x |

*The share price is the closing price in December 2. Each number is based on the result in the term ended March 2022.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2019 (Actual) | 157,145 | 2,118 | 2,418 | 1,587 | 125.50 | 45.00 |

March 2020 (Actual) | 140,677 | 2,809 | 3,122 | -1,262 | -100.73 | 45.00 |

March 2021 (Actual) | 71,933 | 2,581 | 2,906 | 2,721 | 221.87 | 45.00 |

March 2022 (Actual) | 85,307 | 3,824 | 3,879 | 2,246 | 186.85 | 65.00 |

March 2023(Forecast) | 95,000 | 3,700 | 3,700 | 2,500 | 208.30 | 70.00 |

*Unit: Million yen. Net income is profit attributable to owners of the parent. “The Accounting Standard for Revenue Recognition” has been used since the term ended March 2022 and was only applied for the sake of comparison in the term ended March 2021.

This report outlines the second quarter of Seika Corporation for the fiscal year ending March 2023 earnings results.

Table of Contents

Key Points

1.Company Overview

2.Second Quarter of Fiscal Year Ending March 2023 Earnings Results

3. Fiscal Year Ending March 2023 Earnings Forecasts

4. Conclusions

5.Topics

<Reference: Regarding Corporate Governance>

Key Points

- In the second quarter of the term ending March 2023, trade volume declined 0.2% year on year to 68,866 million yen. Sales were 40,452 million yen, unchanged year on year, as performance was first better than that in the same period of the previous year, but some large-scale projects were postponed until the third quarter. Operating income rose 10.7% year on year to 1,444 million yen, thanks to the significant contribution of subsidiaries. Ordinary income declined 7.4% year on year to 1,217 million yen, because the company posted an investment loss on equity method of 421 million yen. Net income increased 20.9% year on year to 844 million yen, due to the posting of a gain on sale of securities of 369 million yen. The reason why the results fell below the initial forecast, which called for sales of 50 billion yen, an operating income 1.6 billion yen, an ordinary income of 1.5 billion yen, and a net income of 1 billion yen, is the postponement of some large-scale projects.

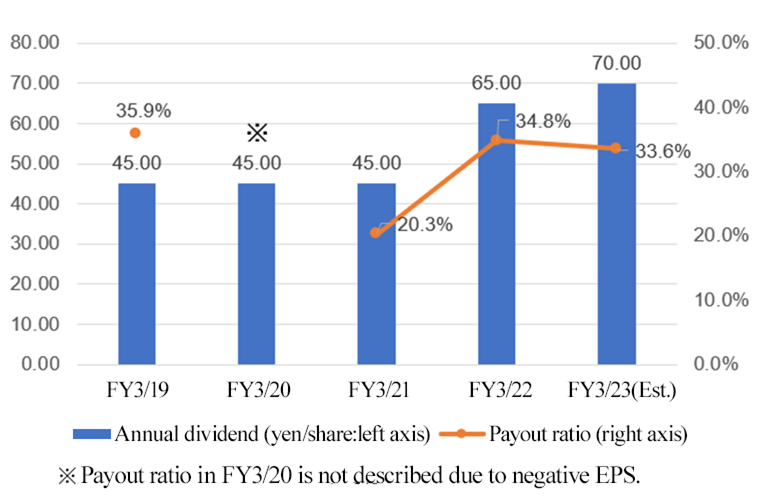

- Regarding the earnings forecast for the term ending March 2023, the company maintains the previous forecast that is Gross salesof 170 billion yen, up 26.6% year on year, sales of 95 billion yen, up 11.4% year on year, an operating income of 3.7 billion yen, down 3.3% year on year, and a net income of 2.5 billion yen, up 11.3% year on year. The quantitative goals for the term ending March 2023, which is the last fiscal year of the mid-term business plan “Re-SEIKA 2023” on which the company has been working since April 2020, are deemed possible to achieve. The company plans to pay a dividend of 70 yen/share, up 5 yen/share from the term ended March 2022. The estimated payout ratio is 33.6%.

- The term ending March 2023 is the last fiscal year of the mid-term business plan “Re-SEIKA 2023” and it is projected that an operating income of 3.7 billion yen and a net income of 2.5 billion yen will be achieved. Meanwhile, expectations are held also regarding to challenges in new fields for achieving the long-term vision “VIORB 2030” announced on April 22, 2022.

1. Company Overview

Under the corporate philosophy “To Contribute to Society Through the Expansion of Business,” Seika Corporation sells equipment, devices, etc. and offers services in the fields of electric power, chemistry, energy, and industrial machinery, as a general machinery trading company.

Its three characteristics and strengths are sales capability thoroughly versed in fields, extensive expertise in each business, and a wide network including 103 business bases both inside and outside Japan.

1-1 Corporate History

In July 1947 after the end of the Pacific War, the Supreme Commander Douglas MacArthur for the Allied Powers ordered the dissolution of the former Mitsubishi Shoji Kaisha with a memorandum. In October 1947, the first president Tsuneji Nakabayashi and his colleagues of the machinery marketing section of Moji Branch established Seika Corporation in Moji-shi, Fukuoka Prefecture (present: Moji-ku, Kitakyushu-shi, Fukuoka Prefecture).

The corporate name is derived from “Essence of commerce: To pursue the quintessence of commerce, and offer benefits to others while earning money,” “Star company of the west: To aim to become a star company in western Japan,” and “Chin It may become helpful if the trade with China increases.”The company expanded business actively, establishing branches throughout Japan, including Tokyo and Osaka, and an overseas office in Dusseldorf, Germany (old West Germany), where only a few Japanese people resided around that time, in October 1954. The company was listed in the first section of Tokyo Stock Exchange in October 1961.

In April 2022, the company got listed on the Prime Market of TSE.

While proceeding with the mid-term business plan “Re-SEIKA 2023” in the term ending March 2023, the company announced the long-term vision “VIORB 2030” for the year 2030 on April 22, 2022.

1-2 Corporate Philosophy, etc.

Seika Corporation set up the following corporate philosophy and code of conduct.Corporate Philosophy | “Our Philosophy is to Contribute to Society Through the Expansion of Business.” |

Code of conduct | 1. Being trustworthy is a priceless asset. 2. To always have a high appreciation of the significance of existence is the basis of the business activities of a trading company. 3. Fast and accurate information activities and effective responses win everything. 4. To make decisions and handle things using objective consideration and pursue necessity and rationality without being influenced by intuition. 5. To be driven by a pioneering spirit, be challenged, and be proud to overcome all difficulties, barriers, and turbulent times. |

In order to promote unity and group management, Seika Corporation has also established the “Group Policy,” “Code of Conduct,” and “Group Mission,” and each company belonging to the Group and each employee working therein share these policies and link them to daily actions, aiming to improve the corporate value of the entire Group.

Group Policy | Strive for excellence and foster a sustainable society with corporate integrity. |

Code of Conduct | Comply with laws and act with ethical standards to gain the trust of society |

Group Mission | Create a fulfilling society together |

1-3 Business Description

(1)Business segments

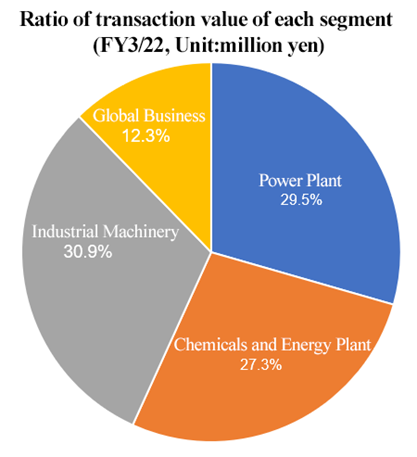

As a general machinery trading company, Seika Corporation sells machinery, equipment, devices, and ancillary products and offers services in the fields of electric power, chemistry, energy, and industrial machinery. The segments to be reported are 4 segments, which are “Power Plant,” “Chemicals and Energy Plant,” “Industrial Machinery,” and “Global Business”, from the fiscal year ending March 2021.

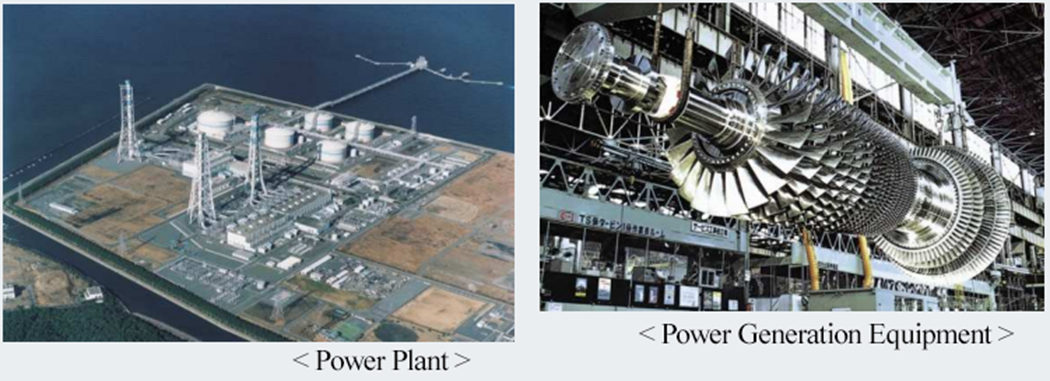

① Power Plant

The clients of Seika Corporation are electric power companies in western Japan, including The Kansai Electric Power, Kyushu Electric Power, The Chugoku Electric Power, Shikoku Electric Power, Electric Power Development Co.Ltd., and joint electric power companies. The company sells and provides after-sales services for industrial power generation equipment, such as boilers and gas turbines, as well as environmental conservation equipment for treating discharged water and exhaust gas. The company also sells anti-crime and anti-disaster equipment, such as security equipment and fire extinguishing equipment for nuclear plants.

Furthermore, the company provides power-generation equipment for renewable energies such as small-sized water, wind, and biomass, and after-sales services.

The suppliers are mainly a group company of Mitsubishi Heavy Industries (MHI), and Seika Corporation possesses the distributorship for thermal power generation equipment of a group company of Mitsubishi Heavy Industries (MHI).

(Taken from the company’s material)

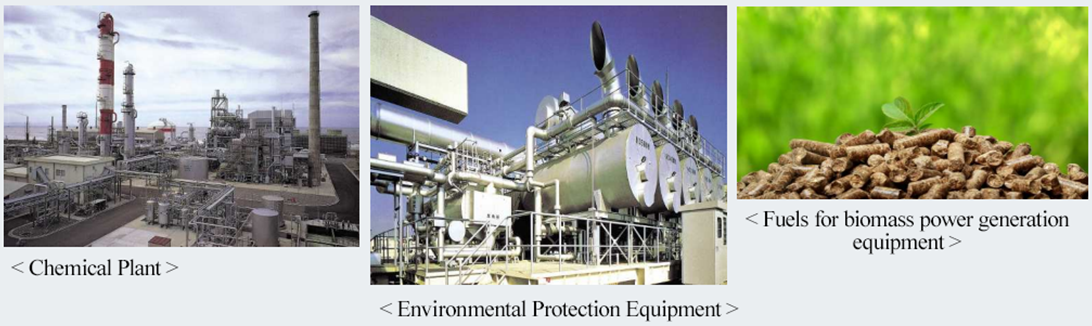

② Chemicals and Energy Plant

Seika Corporation sells in-house power generation equipment, such as boilers and turbines, environmental conservation equipment for treating discharged water and exhaust gas, etc. and offers after-sales services to companies in oil refining, chemical, paper, and steel industries. As in the power plant business, the company procures these mainly from a group company of Mitsubishi Heavy Industries (MHI).

In addition, the company sells products that reduce environmental burdens, as well as equipment and fuel for biomass power generation.

(Taken from the company’s material)

③ Industrial Machinery

To clients in a broad range of industrial fields, the company sells fiber manufacturing equipment, food processing equipment, brewing equipment, plant equipment, liquid crystal-related equipment, environment-related equipment, uninterruptible power supply (UPS) equipment, printed circuit boards for electronic devices, etc. and inspection services utilizing drones equipped with ultrasonic inspection devices.

The subsidiary Nippon Daiya Valve Corporation manufactures and sells industrial valves, while Seika Digital Image Corporation sells cutting-edge measurement devices and software.

(Taken from the company’s material)

④ Global Business

(Europe)

While selling industrial robots to automotive customers in the automotive field, Seika Corporation sells and leases submersible pumps used in public construction, etc. in the social infrastructure field. These products are procured mainly from Japanese manufacturers.

(North America)

As for the automotive field, the company sells Japanese-made industrial machinery in the PCB surface mount production line and provides technical support, mainly to the automotive parts industry.

(Asia)

As for the industrial machinery field, the company sells Japanese-made machinery and equipment to companies within the automotive, textile, chemical industries, and also procures raw materials outside Japan and sells them to textile manufacturers.

(Taken from the company’s material)

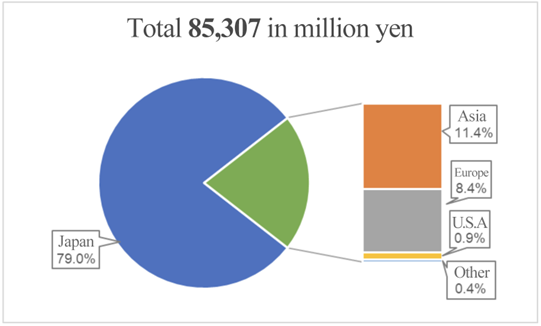

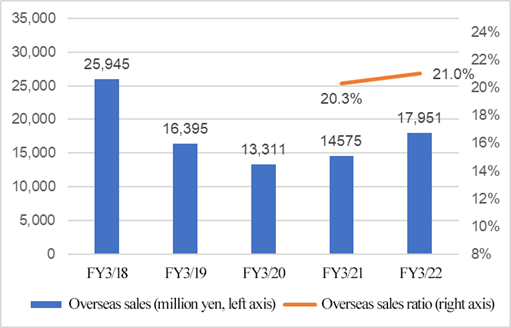

(2)Sales in each region

In order to expand the business scale further, it is indispensable to cultivate overseas markets. The key is how much they can raise the ratio of overseas sales from the current 20%.

Ratio of sales in each region in term ended March 2022 | Variation in overseas sales |

|

|

1-4 Characteristics and strengths

(1)Hands-on sales capability

The capability of hands-on sales nurtured in their more than 70 years’ history is the company's greatest strength. By building relationships of trust through meticulous customer services and forming personal connections, Seika Corporation is able to obtain a steady stream of orders.

(2)High level of expertise in each business

Seika Corporation has garnered excellent reputation as an essential business partner with a high level of expertise, including profound information gathering capabilities and the ability to develop proposals that stay one step ahead of clients.

(3)Extensive network comprised of 103 bases in Japan and overseas

Owing to M&A, they did not only expand their bases domestically, but also have been rapidly expanding the number of bases in Europe and Southeast Asia in anticipation of globalization. The speed and comprehensiveness of information have increased further, and by utilizing this, the company hopes to further improve its corporate value.

(4)Measures to strengthen employee education and sales capabilities

Seika Corporation primarily uses on-the-job training to develop its employees. Senior staff and those with more experience teach newer employees the essentials for business, and the company also focuses on overseas training programs, purpose-specific training and seminars for each skill level. Nowadays, the company requests the former staff of manufacturers and client companies to provide its employees with consultation services and hands-on support for sales. The advice the company receives allows them to further improve their expertise and sales capabilities.

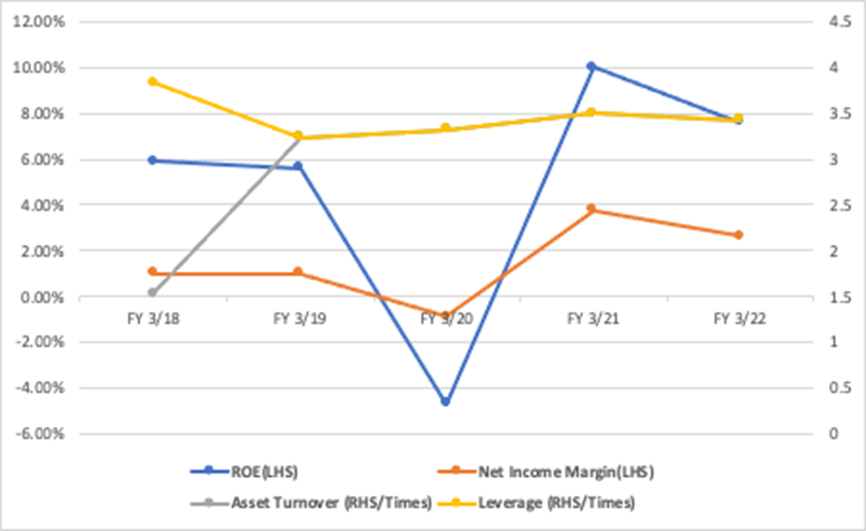

1-5 ROE analysis

| FY 3/18 | FY 3/19 | FY 3/20 | FY 3/21 | FY 3/22 |

ROE (%) | 5.9 | 5.6 | -4.7 | 10.0 | 7.6 |

Net income margin (%) | 1.00 | 1.01 | -0.90 | 3.78 | 2.63 |

Total asset turnover (x) | 1.53 | 1.71 | 1.58 | 0.76 | 0.84 |

Leverage (x) | 3.83 | 3.24 | 3.32 | 3.50 | 3.42 |

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

Sales in the term ended March 2022 are the results of applying the “Accounting Standard for Revenue Recognition.”

According to the conventional accounting method, net income margin in the term ending March 2022 is estimated to 1.67%, but we would like to expect that profit margin will rise as leverage is relatively high. If the target net income of 2.5 billion yen for the term ending March 2023, the last fiscal year of the mid-term business plan “Re-SEIKA 2023” is achieved, ROE will be 8% or more.1-6 Efforts for ESG

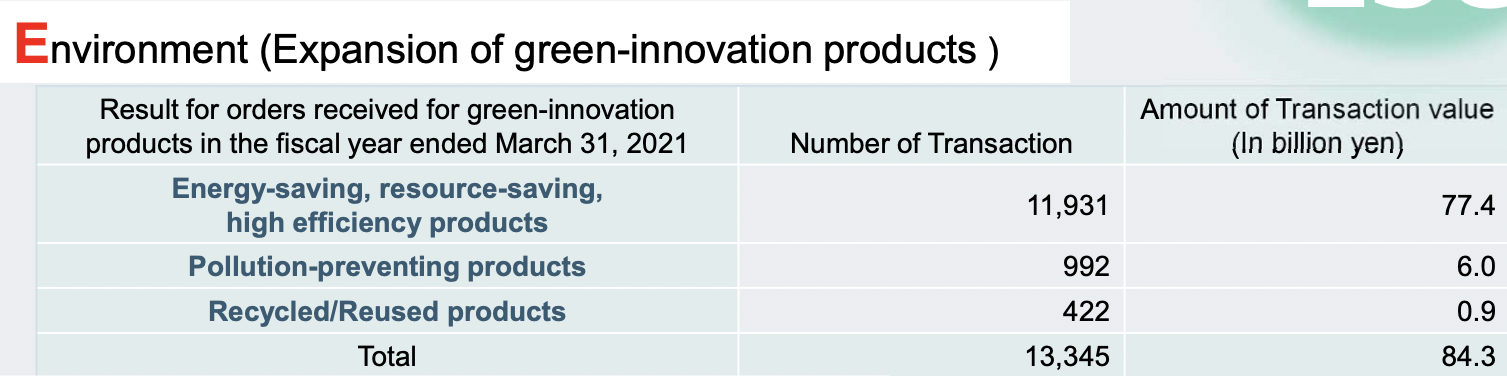

<E: Environment>

The company holds up the basic philosophy of “making efforts to conserve and improve the Earth environment and contribute to the realization of a sustainable society as a creative partner bringing value to industry” as their environmental policy. Under this policy, the company obtained the ISO14001 certificate in 2005, and is promoting environmentally-friendly products.

(Taken from the company’s material)

<S: Social Responsibility>

To fulfill its “social responsibility,” Seika Corporation engages in work-style reforms as follows.

Organizations and working hours

● Adoption of a flexible time system

● Promotion of Premium Friday and Casual Friday

● To encourage employees to take paid leave

Enrichment of the working environment

● Establishment of refreshing rooms for realizing a comfortable working environment

● To conduct a questionnaire survey targeted at employees (to check the satisfaction level of employees and ask about personnel development and the working environment)

Management of health of employees

● To check the stress of employees once a year

● To have employees and executives aged 30 years or older undergo a health checkup for detecting lifestyle diseases and a comprehensive one in addition to the statutory one.

● To have employees undergo tumor marker diagnosis and flu vaccination

“Personnel development”

● Training for each class and each purpose

● Overseas training system

<G: Governance>

In accordance with the Corporate Governance Code revised in June 2021, initiatives for all subjects are disclosed on the company’s website.

According to the “evaluation of the effectiveness of the board of directors” in the term ended March 2022, they follow the Corporate Governance Code, and voluntarily established “Nomination Examination Committee,” which is composed of independent outside directors, and “Remuneration Examination Committee,” which is composed of independent outside directors and inside directors, under the board of directors.

In June 2022, the company shifted to a company with an audit and supervisory committee, and two out of three audit committee members are outside auditors.

1-7 Shareholder return

The primary managerial mission of the company is to return profit to shareholders, and its basic policy is stable dividend payment. Through the efficient business operation from the marketing and financial aspects, the company aims to fortify the management base.While dealing with the demand for funds for developing new businesses, etc., the company plans to achieve a consolidated payout ratio of 35%.

For the term ending March 2023, the company plans to pay an interim dividend of 35 yen/share and a term-end dividend of 35 yen/share, that is, a total of 70 yen/share, and the estimated payout ratio is 33.6%. The company will actively return profit to shareholders while comprehensively considering the dividend policy, full-year results, etc.

2. Second Quarter of Fiscal Year Ending March 2023 Earnings Results

(1) Consolidated Business Results

| 2Q of FY 3/22 | Ratio to sales | 2Q of FY 3/23 | Ratio to sales | YoY |

Orders | 41,667 | 103.0% | 46,468 | 114.9% | 11.5% |

Orders Backlog | 62,141 | 153.6% | 64,772 | 160.1% | 4.2% |

Transaction Volume | 69,027 | 170.6% | 68,866 | 170.2% | -0.2% |

Sales | 40,452 | 100.0% | 40,452 | 100.0% | 0.0% |

Gross profit | 8,186 | 20.2% | 8,610 | 21.3% | 5.2% |

SG&A | 6,881 | 17.0% | 7,166 | 17.7% | 4.1% |

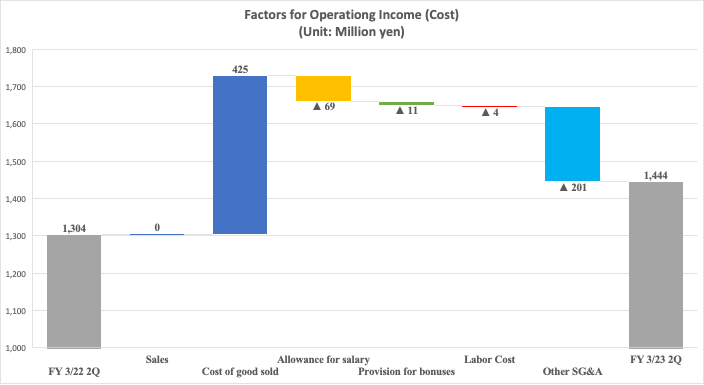

Operating Income | 1,304 | 3.2% | 1,444 | 3.6% | 10.7% |

Ordinary Income | 1,315 | 3.3% | 1,217 | 3.0% | -7.5% |

Net Income | 698 | 1.7% | 844 | 2.1% | 20.9% |

*Orders received and order backlogs are before application of accounting standards.

*Unit: million yen. Net Income is profit attributable to owners of parent.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

*▲ of expense account indicates that the expense has increased.

Sales increased and profit considerably increased.

Gross sales in 2Q of fiscal year ending March 2023 were 68,866 million yen, down 0.2% year on year. Sales were flat at 40,452 million yen year on year. Although sales were higher than in the same period of the previous year in the early part of the period, they remained at the same level as in the same period of the previous year due to the postponement of some large projects to the third quarter of the year. Moreover, operating income reached 1,444 million yen, up 10.7% year on year, due to a large contribution from affiliated companies. Ordinary income was 1,217 million yen, down 7.4% year on year, due to a 421 million yen equity in losses of affiliates. Net income was 844 million yen, up 20.9% year on year, due in part to a gain on sales of securities (369 million yen). The reason for the lower-than-expected sales, operating income, recurring income, and net income of 50 billion yen, 1.6 billion yen, 1.5 billion yen, and 1 billion yen, respectively, was due to the postponement of some large projects, as mentioned above.

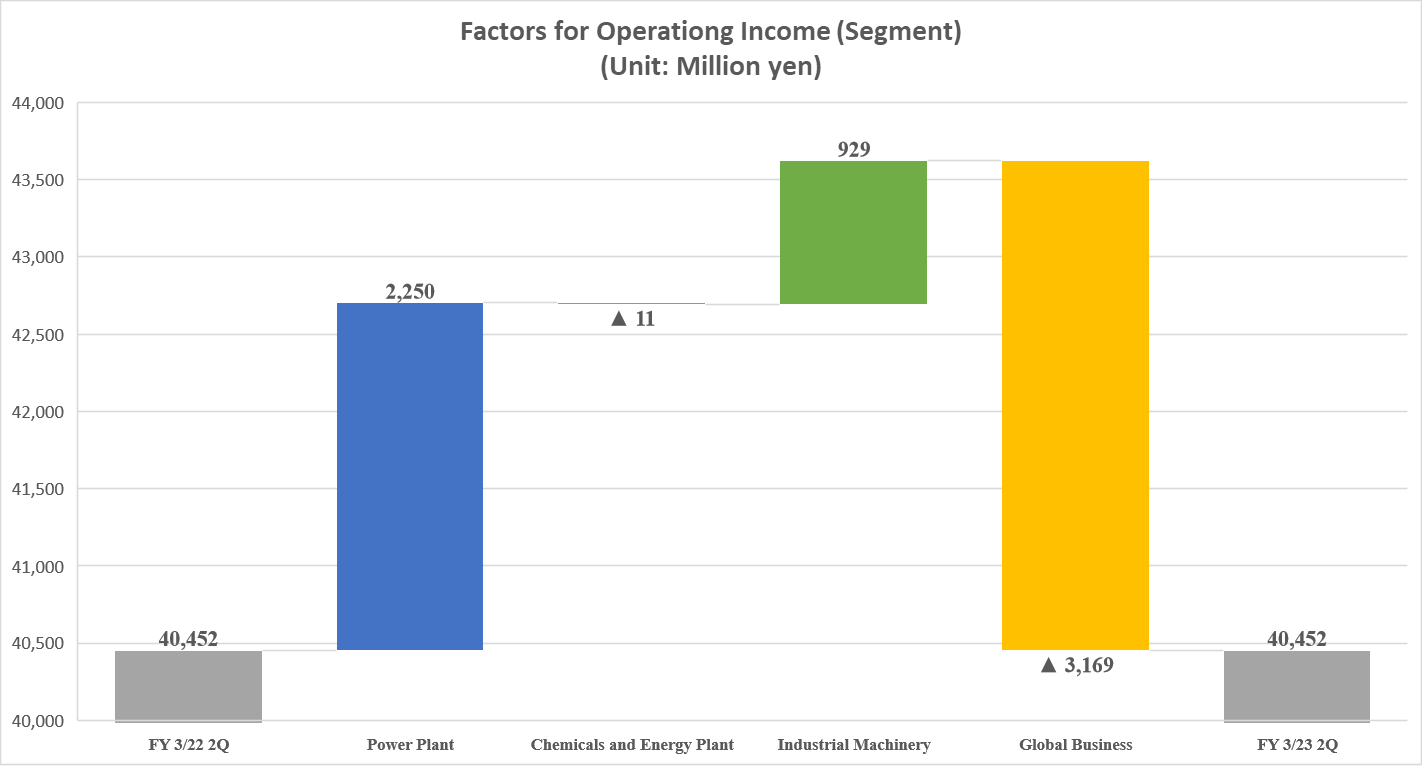

(2) Overview of business performance in each segment

◎Sales and Profit

| FY 3/22 2Q | Ratio to sales | FY 3/23 2Q | Ratio to sales | YoY |

Sales |

|

|

|

|

|

Power Plant | 4,436 | 11.0% | 6,686 | 16.5% | 50.7% |

Chemicals and Energy Plant | 10,553 | 26.1% | 10,542 | 26.1% | -0.1% |

Industrial Machinery | 16,950 | 41.9% | 17,880 | 44.2% | 5.5% |

Global Business | 8,512 | 21.0% | 5,342 | 13.2% | -37.2% |

Total Sales | 40,452 | 100.0% | 40,452 | 100.0% | 0.0% |

Profits in each segment |

|

|

|

|

|

Power Plant | 458 | 1.1% | 351 | 0.9% | -23.4% |

Chemicals and Energy Plant | 200 | 0.5% | 381 | 0.9% | 90.5% |

Industrial Machinery | 263 | 0.7% | 544 | 1.3% | 106.8% |

Global Business | 374 | 0.9% | 197 | 0.5% | -47.3% |

Total profit in all segments | 1,296 | 3.2% | 1,475 | 3.6% | 13.8% |

*Unit: million yen. Sales are the sales to external clients. The composition ratio of profit means the rate of profit to sales.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

① Power Plant

Sales grew considerably, but profit declined.

Sales increased considerably, thanks to the upgrade of equipment at a large-scale thermal power plant in the Hokuriku area, the enhancement of security systems for nuclear power plants in the Chugoku area. Profit decreased, as negotiations for profitable business deals related to disaster prevention and security decreased and the less profitable fuel business affected profit margin.

② Chemicals and Energy Plant

Sales were unchanged from the previous term, while profit rose considerably.

Large-scale projects, including hydroelectric power generation equipment for a leading transportation company, progressed as planned, so sales were unchanged from the previous term. Profit increased significantly, thanks to the good performance of Seika Daiya Engine Corporation and Shikishimakiki Corporation, which are consolidated subsidiaries.

③ Industrial Machinery

Sales increase and profit grew considerably.

Sales increased due to contributions from large-scale projects such as bookbinding facilities for government agencies and manufacturing facilities for health food manufacturers, as well as continued strong performance by Nippon Daiya Valve Co. Segment income increased significantly due to the absence of a one-time loss incurred in the same period of the previous year on a project in China and the impact of increased profits from export projects for the Tsurumi (Europe) GmbH group due to the yen's depreciation.

④ Global Business

Sales and profit dropped considerably.

The Tsurumi (Europe) GmbH Group, which handles submersible pumps for construction, performed well, but sales and profit dropped considerably, due to the restrictions on marketing activities, the delay of business talks, etc. caused by the novel coronavirus in mainly China and Southeast Asia.

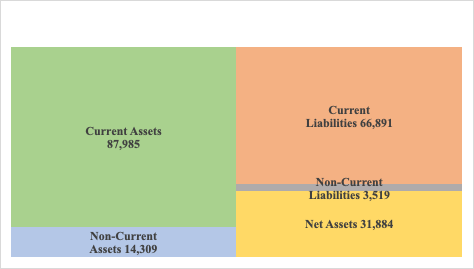

(3) Financial standing

◎Main BS

| March 2022 | September 2022 |

| March 2022 | September 2022 |

Current Assets | 89,746 | 87,985 | Current liabilities | 70,409 | 66,891 |

Cash and deposits | 17,334 | 12,710 | Notes and accounts payable - trade | 31,602 | 27,870 |

Notes and accounts receivable – trade, and contract assets | 36,029 | 31,825 | Short-term borrowings | 5,506 | 4,256 |

Inventories | 7,007 | 9,307 | Advance received from customers | 29,354 | 32,015 |

Advance payment to suppliers | 28,551 | 33,003 | Non-current liabilities | 3,354 | 3,519 |

Noncurrent Assets | 15,119 | 14,309 | Long-term borrowings | 27 | 27 |

Property, plant and equipment | 2,743 | 2,892 | Total Liabilities | 73,764 | 70,411 |

Intangible Assets | 793 | 750 | Net Assets | 31,101 | 31,884 |

Investment, Other assets | 11,582 | 10,666 | Retained earnings | 18,734 | 19,079 |

Total assets | 104,865 | 102,295 | Total liabilities and net assets | 104,865 | 102,295 |

*Unit: million yen. Interest-bearing debt does not include lease obligations.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

Owing to the decrease in cash and deposits and account receivables, total assets decrease 2,570 million yen to 102,295 million yen. In addition, interest-bearing debt and trade payables are decreased which decreased total liabilities by 3,352 million yen to 70,411 million yen.

Net assets grew 782 million yen from the end of the previous term to 31,884 million yen due to the increase in retained earnings, etc. Equity ratio standing at 30.5%.

3. Fiscal Year Ending March 2023 Earnings Forecasts

◎Consolidated Earnings Forecasts

| FY 3/22 | Ratio to sales | FY 3/23 Est. | Ratio to sales | YoY |

Gross sales | 134,261 | 157.4% | 170,000 | 178.9% | 26.6% |

Sales | 85,307 | 100.0% | 95,000 | 100.0% | 11.4% |

Operating Income | 3,824 | 4.5% | 3,700 | 3.9% | -3.3% |

Ordinary Income | 3,879 | 4.5% | 3,700 | 3.9% | -4.6% |

Net Income | 2,246 | 2.6% | 2,500 | 2.6% | 11.3% |

*Unit: million yen. The estimates were announced by the company.

Increase in sales and decrease in profit forecast

Regarding the earnings forecast for the term ending March 2023, the company maintains its forecast: a number of gross sales of 170 billion yen, up 26.6% year on year, sales of 95 billion yen, up 11.4% year on year, an operating income of 3.7 billion yen, down 3.3% year on year, and a net income of 2.5 billion yen, up 11.3% year on year. The company plans to pay a dividend of 70 yen/share, up 5 yen/share from the term ended March 2022. The estimated payout ratio is 33.6%.

4. Conclusions

The fiscal year ending March 31, 2023, is the final year of the "Re-SEIKA 2023" medium-term management plan, and while operating income of 3.7 billion yen and net income of 2.5 billion yen are expected to be achieved, we also expect the company to continue taking on challenges in new fields to achieve the long-term vision "VIORB 2030" announced on May 27, 2022.

◎Long-Term Vision “VIORB 2030”

The vision was formulated in order to contribute to the realization of a prosperous society by implementing the purpose of “supporting sustainable energy creation and industrial activities in harmony with the earth environment.”

◎Purpose of the company

As a corporate group centered on trading companies strong in the energy and industrial infrastructure fields, Seika Group would like to support sustainable energy creation and industrial activities in harmony with the earth’s environment.

◎Priority business domains in terms of business

Decarbonization: Quickly develop insight into users' needs related to decarbonization and technological innovation to commercialize solutions

Energy and Resources conservation: Expanding support of permanent needs in the industrial circles for energy and resources conservation

Circular economy: Accelerate progress and actions towards a circular economy

DX: View digital transformation from a broad perspective to seek business opportunities

◎Key management measures

①Improve cash management mechanisms to maximize funding capacity

②Invest around 10 billion yen in businesses to deepen existing businesses and expand business domains

③Establish 1 billion yen fund to support businesses and activities working to achieve the SDGs

④Streamline the organization and increase productivity to introduce human resources in priority domains

⑤Clarify strengths based on the unique characteristics of individual group companies and concentrate company resources

◎ Index for gauging achievements

120 billion yen in green innovation-related gross sales in fiscal 2030.

◎ Consolidated net income goal

4 billion yen in consolidated net income as the goal to be reached in fiscal 2030

5. Topics

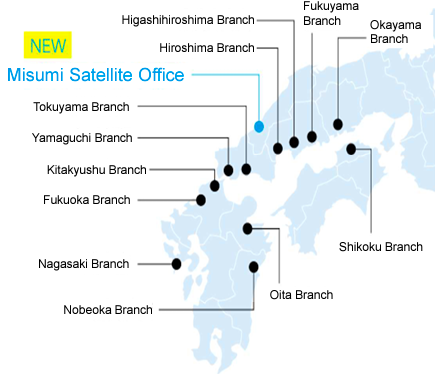

◎ Establishment of Misumi Satellite Office

In October 2022, the company established Misumi Satellite Office in Hamada-shi, Shimane Prefecture as a base under the control of Hiroshima Branch.

The company conducted marketing activities targeted at users in the coastal region of Shimane Prefecture, including The Chugoku Electric Power Co., Inc. based on Hiroshima Branch. Chugoku Electric Power installed boiler power generation equipment with an output of 1 million kW, which was produced by Mitsubishi Heavy Industries, in Misumi Power Plant, and plans to start operating it on November 1 this year. Accordingly, the company opened the satellite office for the purpose of conducting marketing activities more swiftly.

(Taken from the company’s material)

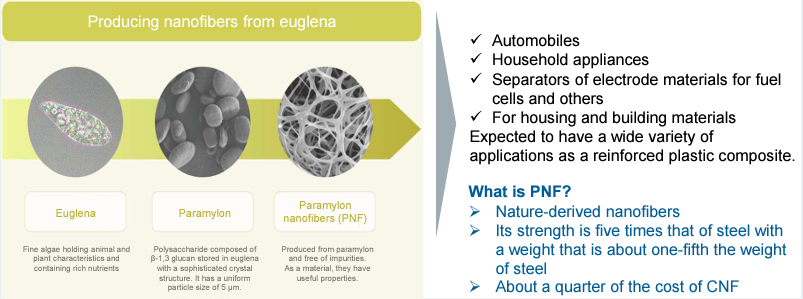

◎Capital injection into Euglead Inc.

The company invested in Euglead Inc., which is a venture firm that manufactures the “paramylon nanofiber (PNF)” from Euglena, and formed a business alliance for selling the PNF.

The PNF is a natural nanofiber that has a chemical structure and characteristics similar to those of the cellulose nanofiber (CNF), which is expected to be demanded increasingly as a composite for strengthening plastics. The PNF is attracting attention as a composite for plastics used for automobiles, home appliances, housing, and building materials, as its strength is 5 times higher than that of steel while its weight is about one fifth of that of steel like the CNF.

(Taken from the company’s material)

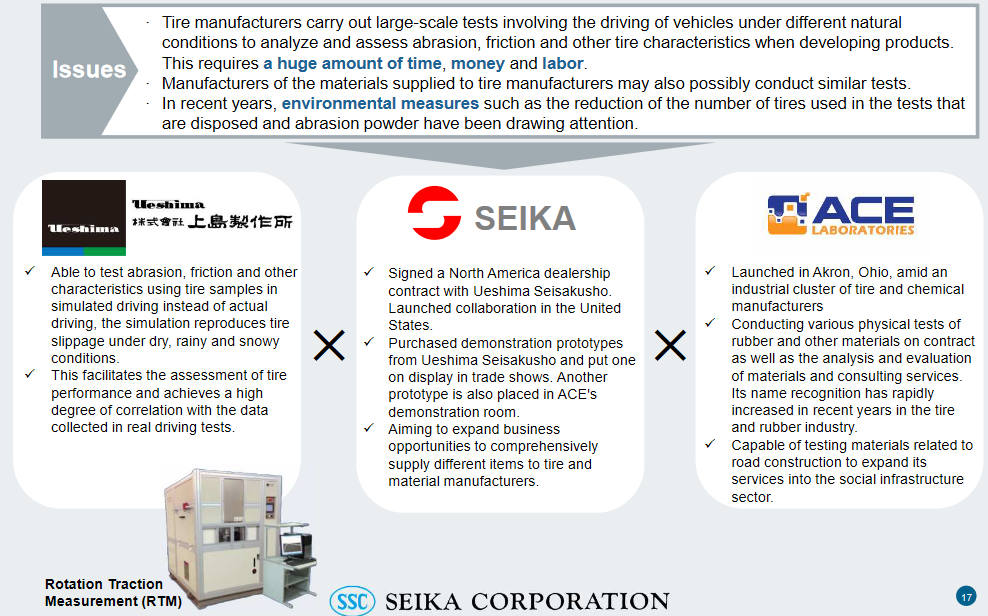

◎U.S. subsidiary Seika Machinery Inc. concluded contracts for business alliances with the private testing institute ACE.

(Taken from the company’s material)

◎ Introduction of social contribution activities

In order to support the “Metallo-balance cancer screening” business of Renatech Co., Ltd., the company invested 15 million yen in Renatech.

This screening would contribute to the early detection of cancer as a low-cost, reliable cancer risk diagnosis tool. Considering that their business would help achieve the SDG “3: Ensure healthy lives and promote well-being for all at all ages,” the company invested in it as the first project of the fund for attaining SDGs in the long-term vision “VIORB 2030.”

The company donated about 600,000 nonwoven face masks including hydro silver titanium® produced by DR.C Medical Medicine Co., Ltd. to Okayama Prefecture, Yamaguchi Prefecture, Nagasaki Prefecture, Kitakyushu City, Tokyo Community Chest, Food Bank Osaka, Food Bank Tama, Fukushima Inochi-no-mizu, etc.

That product is a functional face mask produced by DR. C Medical Medicine, which specializes in the development of medicines against infectious diseases and allergy diseases, based on the cleaning technology with hydro silver titanium®, which decomposes unhealthy proteins and proteins inside pollens into water, carbon dioxide, nitrogen, etc.

(Taken from the company’s material)

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory committee |

Directors | 9 directors, including 4 outside ones |

◎Corporate Governance Report

Last update date: June 29, 2022

< Basic Stance on Corporate Governance> Our corporate philosophy is “To Contribute to Society Through the Expansion of Business.” We are committed to improving corporate value over the mid-to-long term while establishing a good relationship with all stakeholders. We believe that “soundness and transparency of management” and “prompt decision-making and action” are critical for achieving these goals, and we continually strive to strengthen corporate governance.

Our company shifted from “a company with the board of auditors” to “a company with an audit and supervisory committee,” after obtaining an approval at the 99th annual meeting of shareholders held in June this year. We are making efforts to strengthen a system in which independent outside directors and the audit committee oversee our business administration and a system for auditing the legality and appropriateness of our business execution.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Principle 1-4 The so-called strategically held shares】 | “Policy for strategically held shares” Considering the details, scales, periods, etc. of transactions with business partners, we hold their shares as necessary, in order to maintain and strengthen the relationships with them. Our company's basic policy is to dispose of and reduce held shares that are deemed to have little strategic purpose. Every year, the Board of Directors decides whether there is an appropriate reason for holding each share. We investigate whether the benefits and risks associated with holding a share are commensurate with the cost of capital, and disclose our findings in the securities report. Our company sold a portion of its held shares during the term ended March 2021. “Policy on exercising voting rights regarding strategically held shares” Regarding the exercise of voting rights for shares held by our company, while respecting these companies’ management policy, we will confirm whether each proposal contributes to the improvement of our corporate value over the mid-to-long term and make a comprehensive decision. |

【Principle 5-1 Policy for constructive dialogue with shareholders】 | In order to improve our corporate value in the mid-to-long term through active dialogue with shareholders and institutional investors, the president explains the financial results and the progress of the mid-term business plan at a session for briefing financial results, which is held twice a year, and a general meeting of shareholders has sufficient time for questions and answers, to answer questions from shareholders carefully. The sections of general affairs and personnel affairs deal with the applications for dialogue (interview) from individual shareholders, while the planning section replies to applications from corporate shareholders, including institutional ones. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on Seika Corporation (8061) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/