Bridge Report:(8130)Sangetsu Fiscal Year March 2019

President Shosuke Yasuda, | Sangetsu Corporation (8130) |

|

Company Information

Market | First Section, Tokyo and Nagoya Stock Exchanges |

Industry | Wholesale (Commerce) |

Executive Director and President・Executive officer | Shosuke Yasuda |

HQ Address | 1-4-1 Habashita, Nishi-ku, Nagoya-shi |

Year-end | March |

Homepage |

Stock Information

Share Price | Shares Outstanding (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥2,056 | 62,850,000 shares | ¥129,219 million | 3.5% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥57.00 | 2.8% | ¥92.72 | 22.2 x | ¥1,612.59 | 1.3 x |

*The share price is the closing price on July 10. The number of shares issued, ROE, DPS, EPS, BPS are taken from the financial report for FY March 19.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

March 2016 Act. | 133,972 | 9,112 | 9,463 | 6,393 | 89.92 | 47.50 |

March 2017 Act. | 135,640 | 7,572 | 8,368 | 6,570 | 97.53 | 52.50 |

March 2018 Act. | 156,390 | 5,033 | 5,698 | 4,514 | 68.97 | 55.50 |

March 2019 Act. | 160,422 | 5,895 | 6,699 | 3,579 | 57.28 | 56.50 |

March 2020 Est. | 163,000 | 8,000 | 8,300 | 5,700 | 92.72 | 57.00 |

*Unit: million yen. Estimates are those of the Company. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

This Bridge Report provides a review of the fiscal year March 2019 earnings overview and more.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year March 2019 Earnings Results

3. Fiscal Year March 2020 Earnings Forecasts

4. The Progress of the Medium-Term Business Plan (2017-2019) “PLG 2019”

5. Conclusions

<Reference 1: Medium Term Business Plan “PLG 2019”>

<Reference 2: Regarding Corporate Governance>

Key Points

- The sales for the term ended March 2019 were ¥160.4 billion, up 2.6% year on year. In the Interior business, sales of flooring materials were healthy, but sales of wallcovering materials decreased due to problems with the return of sample books. The Exterior Business and the Lighting Business both performed well, and Goodrich Global Holdings, which was acquired by the company in December 2017, also contributed, leading to a rise in overseas sales. Price increases also took hold in the market, and gross profit rose by 6.6%, exceeding the increase rate of sales, and gross profit rate increased 1.2 points. In addition to Goodrich’s SG&A expenses, Sangetsu’s SG&A costs, including personnel and distribution expenses, augmented 5.4% year on year, but these costs were offset, and operating income rose 17.1% to ¥5.8 billion. Sales and profits were slightly below the initial forecast.

- The sales for the term ending March 2020 are expected to rise 1.6% year on year to ¥163 billion. Sales are estimated to increase for the interior segment, after having declined in the previous fiscal year. Gross profit is projected to increase 3.5% year on year, exceeding the rate of sales growth, and gross profit rate is estimated to rise 0.6 points. The company will improve profitability in overseas segments. Operating income is estimated to rise 35.7% year on year to ¥8 billion. The dividend is forecast to be ¥57.00/share, up ¥0.5/share over the previous term. The estimated payout ratio is 61.5%.

- Sales had increased 2.0% and operating income had decreased 9.4% by the third quarter, but for the full fiscal year, these numbers were 2.6% increase and 17.1% increase respectively, reflecting strong performance in the fourth quarter (January-March), although figures were not as high as initial estimates. This term marks the final year of the medium-term business plan “PLG 2019” (2017-2019), but due to the delay in improving overseas profitability, sales and profits will not be enough to reach the initial targets set when the plan was formulated.

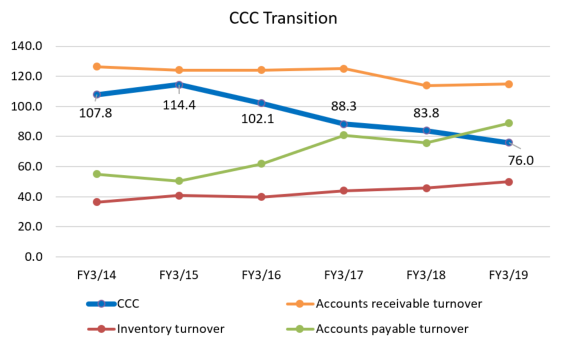

- Sangetsu places emphasis on “CCC” (Cash Conversion Cycle), which is a cash flow management indicator. CCC continues to grow shorter, and is likely to reach the target of completing a cycle in 60-75 days. According to President Yasuda, it is difficult for other companies to invest for installing core systems, establishing and consolidating bases, and building infrastructure for logistics (such as strengthening in-house delivery systems). Because Sangetsu has nearly finished strategic investment in these areas ahead of competitors, their competitive advantage will become even stronger.

- The current term is the final year of the medium-term business plan. Raising sales and profits to their respective medium-term targets will be critical in terms of creating a starting point for the next medium-term plan. We believe that the key to accomplishing this lies in improving profitability of the overseas business, therefore we would like to pay attention to the company’s progress with regards to this matter, as well as whether they will be able to recover the lost market share for wallcovering materials.

1. Company Overview

Sangetsu Corporation is the largest among all Japanese trading companies specializing in wallcoverings, flooring materials, curtains and other interior decorating products. Being a trading firm, the Company also operates as a “fabless company” that plans and develops interior decorating products. Sangetsu boasts of a business model that is able to produce stable earnings and top market share in its main product realms. The group is composed of seven companies including “Sangetsu Okinawa Corporation,” which sells interior materials in the Okinawa area, Sungreen Co., Ltd., a dedicated distributor of exterior products, Sangetsu (Shanghai) Corporation, the company responsible for business in China, “Koroseal Interior Products Holdings, Inc.,” the United States company conducting sales of wallcovering materials for non-residential applications, Fairtone Co., Ltd., which seeks to grow orders on the back of increases in installation capabilities, “Sangetsu Vosne Corporation,” specialized in curtain fabrics, and “Goodrich Global Holdings Pte. Ltd.,” the company selling interior materials in Southeast Asia.

1-1 Corporate History

Sangetsu was founded in 1849 under the original name of “Sangetsudo” to sell various traditional Japanese interior decorating products including scrolls, wall scrolls, folding screens, sliding doors, partitioning screens, and other products made of cloth and paper. Sangetsu Corporation was incorporated in 1953 by the founding family. From the latter half of the 1970s onwards, the business was expanded into Tokyo, Fukuoka, Osaka and other parts of Japan. In 1980, Sangetsu was listed on the Second Section of the Nagoya Stock Exchange, and later in 1996 its shares were also listed on the First Section of the Tokyo Stock Exchange. Currently, Sangetsu is expanding its operations into overseas markets and has established itself as the largest total interior decorating product provider within Japan, with a widely recognized brand of interior products.

Shosuke Yasuda was appointed as the first President who is not from the founding family of Sangetsu in April 2014. He will direct the Company during its third stage of growth entitled “Our Third Founding Phase,” following on the heels of the original first phase of founding and the second phase when the company became a publicly listed corporation.

1-2 Corporate Philosophy

Sangetsu established a new corporate philosophy including a new brand philosophy in April 2016 that will enable it to take on the challenge of implementing reforms necessary to take it to its next stage of growth.

A new “brand philosophy” has been added to the “corporate creed,” “corporate mission,” and “Three Principles of Sangetsu” to create an expanded corporate philosophy.

<Corporate Creed>

Integrity

<Corporate Mission>

To contribute to society through interior design and strive to create daily culture of enrichment

<Three Principles of Sangetsu>

Creative Designs, High Reliable Quality, Fair Price

<Brand Philosophy>

・Brand statement: | “Joy of Design” |

・Brand purpose: | “We provide the joy of design to those who create new spaces.” |

Sangetsu endeavors to share the joy of creating new value through interior business with all of its stakeholders.

1-3 Market Environment

◎ Overview

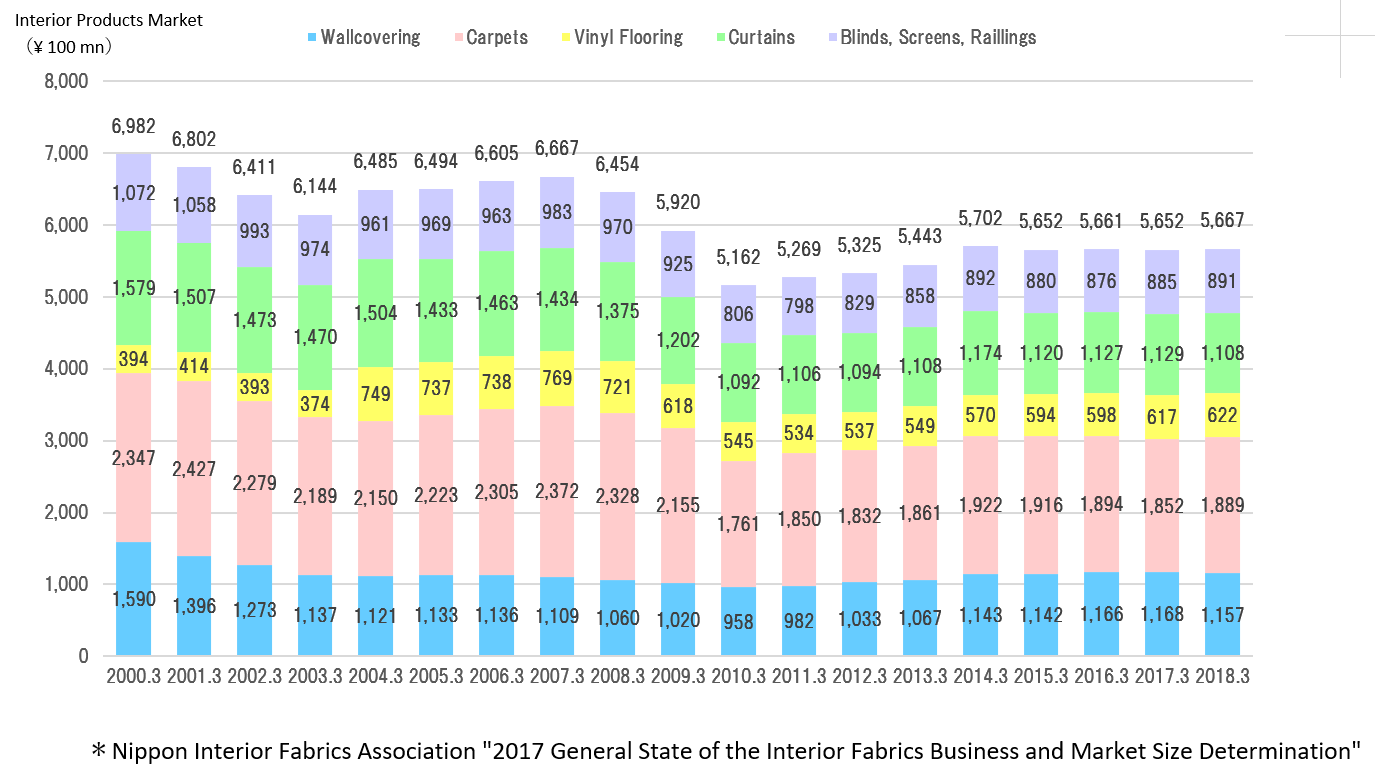

The market environment for the main wallcoverings and flooring materials is strongly influenced by trends in the Japanese construction market. Declines in new housing start arising from declining population and changing family structures within Japan, and deflationary trends have depressed sales of the interior products market as shown in the graph below.

(Source: the company)

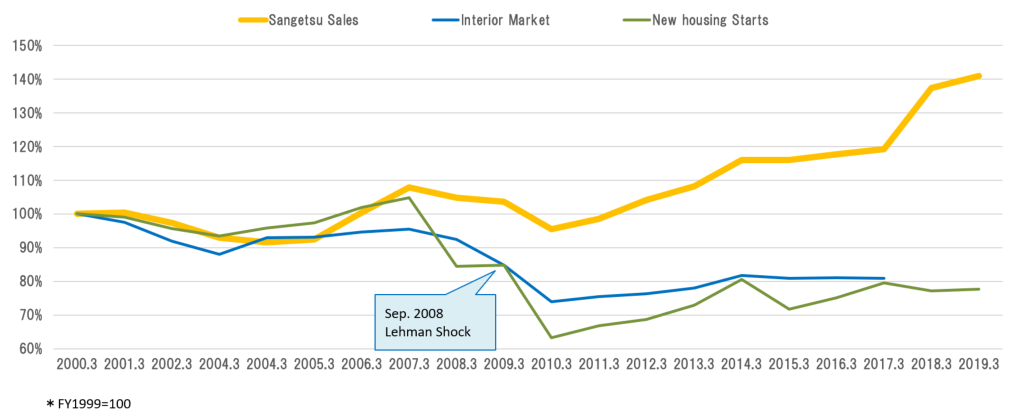

At the same time, the graph below shows the correlation between sales of Sangetsu relative to sales of the Japanese interior market and new housing starts (Ministry of Land, Infrastructure, Transport, and Tourism data).

The trends for both Sangetsu’s sales and the Japanese interior market have been closely linked to new housing starts. After the Lehman Brother’s Shock, however, this link has been overcome with Sangetsu’s sales reaching consecutive record highs despite the sluggish trends in new housing starts and the weak overall market.

This strong recovery is attributed to Sangetsu’s efforts to cultivate business in the non-residential realm in addition to M&A and private housing.

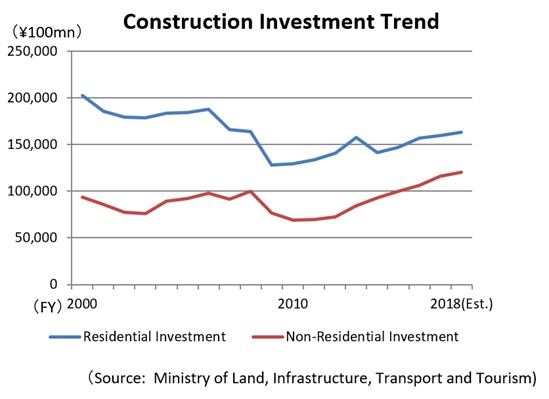

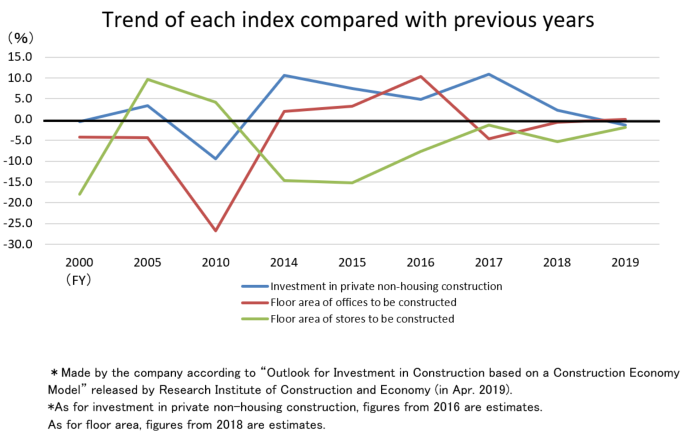

According to “Outlook for Investment in Construction” released by the Ministry of Land, Infrastructure, Transport and Tourism, the investments in private housing and non-housing constructions have been recovering since the bankruptcy of Lehman Brothers, but the estimated investment in private housing construction is still about 80% of the level in the year 2000, while the investment in private non-housing construction exceeds the level in the year 2000.

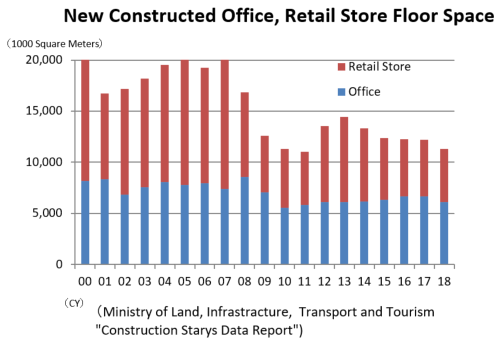

However, since the floor area of new offices and stores, which had been rising in past several years, shrank in 2018, it can’t really be said that it performed well.

According to “Outlook for Investment in Construction based on a Construction Economy Model” released by Research Institute of Construction and Economy (on April 24, 2019), The growth rate of investment in private, non-residential buildings increased 10.6% in FY 2014, 7.4% in FY 2015, 4.8% in FY 2016, 10.9% in FY 2017, and 2.3% in FY 2018 (estimate), but is expected to fall 1.4% in FY 2019 (estimate).

While the growth rate of the floor area of offices to be constructed was 10.3% in fiscal year 2016, it turns out to minus 4.6%. The company estimates that the growth will continues to slow down such that the growth rate will be minus 0.7% in fiscal year 2018 and 0.0% in fiscal year 2019. Retail stores will continue to be lower than that in the previous year like it has been since fiscal 2014.

Estimates for market trends after the 2020 Tokyo Olympics and Paralympic Games seem to be becoming unclear.

For the above reasons, the residential and non-residential market environments are currently unfavorable, but there is steady demand for renovations in the non-residential market, so the company intends to meet the demand mainly through the contract sales department. They are also making efforts to develop overseas businesses, pursuing further growth by reinforcing the advantages they have over other companies.

◎ Competitors

In addition to Sangetsu, there are eight publicly traded competitors that operate in the interior decorating market.。

Stock Code | Company | Sales | YY Change of Sales | Operating Income | YY Change of Operating Income | Operating Income Margin | Total Market Cap | PER | PBR | ROE |

3501 | Suminoe Textile Co., Ltd. | 98,500 | +0.6% | 3,100 | +37.9% | 3.1% | 2,230 | 19.1 | 0.6 | 3.2% |

4206 | Aica Kogyo Co., Ltd. | 200,000 | +4.5% | 21,800 | +4.6% | 10.9% | 247,381 | 17.3 | 1.9 | 10.7% |

4215 | C.I. TAKIRON Corporation | 151,000 | +0.2% | 9,300 | +2.4% | 6.2% | 64,057 | 4.7 | 0.9 | 8.8% |

4224 | Lonseal Corporation | 20,500 | +1.0% | 1,600 | -17.0% | 7.8% | 7,798 | 6.8 | 0.5 | 9.0% |

5956 | TOSO COMPANY, LIMITED | 22,800 | +0.7% | 600 | -12.8% | 2.6% | 4,260 | 10.5 | 0.3 | 3.8% |

7971 | TOLI Corp. | 93,500 | +3.5% | 2,200 | +10.5% | 2.4% | 16,105 | 9.3 | 0.4 | 3.8% |

7989 | TACHIKAWA CORPORATION | 42,200 | +8.0% | 4,100 | +11.5% | 9.7% | 26,473 | 9.7 | 0.7 | 6.7% |

8130 | Sangetsu Corporation | 163,000 | +1.6% | 8,000 | +35.7% | 4.9% | 130,288 | 22.4 | 1.3 | 3.5% |

9827 | Lilycolor Co., Ltd. | 36,800 | +8.3% | 700 | +282.8% | 1.9% | 2,697 | 9.0 | 0.4 | 0.6% |

*Unit: million yen, times. Estimates are from those of the respective companies. Total market capitalization, PER and PBR are based upon the closing share price of each stock on June 24, 2019. ROE is based on the previous year.

1-4 Business Description

The main businesses include planning, development, and sales of wallcoverings, flooring materials, curtains, upholstery and other interior products. Sangetsu boasts of a “fabless operation” and does not maintain any manufacturing facilities, but its capabilities exceed that of typical trading firms, and all of the products it sells are planned, designed and developed in-house. Sangetsu also provides exterior products through its subsidiary. The overseas business is operated by three subsidiaries located in the U.S., China, and Singapore.

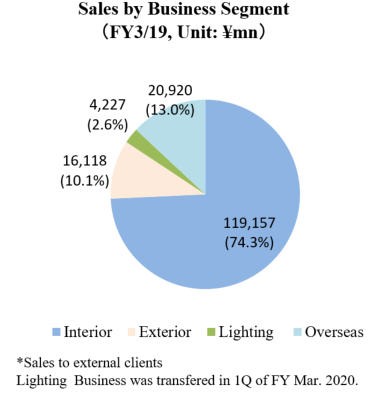

① “Interior Business”

(FY3/19: Sales and Operating Income of ¥119.157 and ¥6.174 Billion respectively)

◎ Main Products

Wallcoverings | Sangetsu’s main product, used in a wide range of residential and non-residential applications. High functionality products have become popular in recent years that are resistant to staining, odor absorbing, and scratch resistant. Also, wallcoverings with colorful designs are being used to decorate all or part of walls in homes to add an accent to interiors, and collaboration with rental property management companies being promoted for the development of products to raise the value addition of rental properties. |

Cushion Vinyl Sheet | Sheet formed flooring materials that are used in both residential and retail store applications, and commonly used in apartments and condominiums. They boast of wood grain, stone, and a wide range of other motif designs and have cushioning function for use in a wide range of applications. |

Vinyl Sheets | Sheet formed flooring materials used in commercial applications including medical and welfare institutions, and educational institutions. This product boasts of high levels of safety and hygiene, and is designed to reduce maintenance costs by being easy to keep clean. It also has been designed with the environment in mind and helps to reduce the environmental burden. |

PVC Floorings | Sheet formed flooring materials used in medical and welfare institutions, and educational institutions. Uniquely manufactured with design patterns printed on entire flooring materials so patterns will continue to show even after being worn down. They do not require wax for easy maintenance, and thereby reducing maintenance costs and environmental burden. |

Luxury Vinyl Tiles | Tile formed vinyl flooring materials used in a wide range of applications including apartments, condominiums, educational institutions, and commercial facilities. Manufactured with wood and stone motifs, with highly detailed embossed printing processes used to show highly detailed designs. |

Carpets, Carpet Tiles | Textile flooring materials used in a wide range of applications including ryokans (i.e. Japanese inns), hotels, residential and office facilities. Multiple colorful designs with high functionality, formed in 50-centimeter square tile sections for easy installation and superior maintenance. |

Curtains | All of the curtains sold by Sangetsu are custom made and boast of the ability to create unique designs and custom sizes of curtains to match room decorations in which they are used. In addition to highly fashionable designs and heavy materials, mirror-like insulating characteristic lace curtains, which make it difficult to see inside from the outside and reduce the amount of heat transferred into the rooms, have also become popular. |

Sangetsu boasts a diverse product lineup with about 12,000 different products in total. There are about 4,300 different wallcovering products alone. Sample books are updated every two years (those for curtains are updated every three years), with an existing product replacement rate for wallcoverings of 30% to 40%.

Disposal of outdated products leads to producing wastes, but because keeping a sample book up-to-date is necessary to enhance customer satisfaction, the company has maintained a balance between efficiency and freshness through the company’s energetic engagement and long-cultivated know-how.

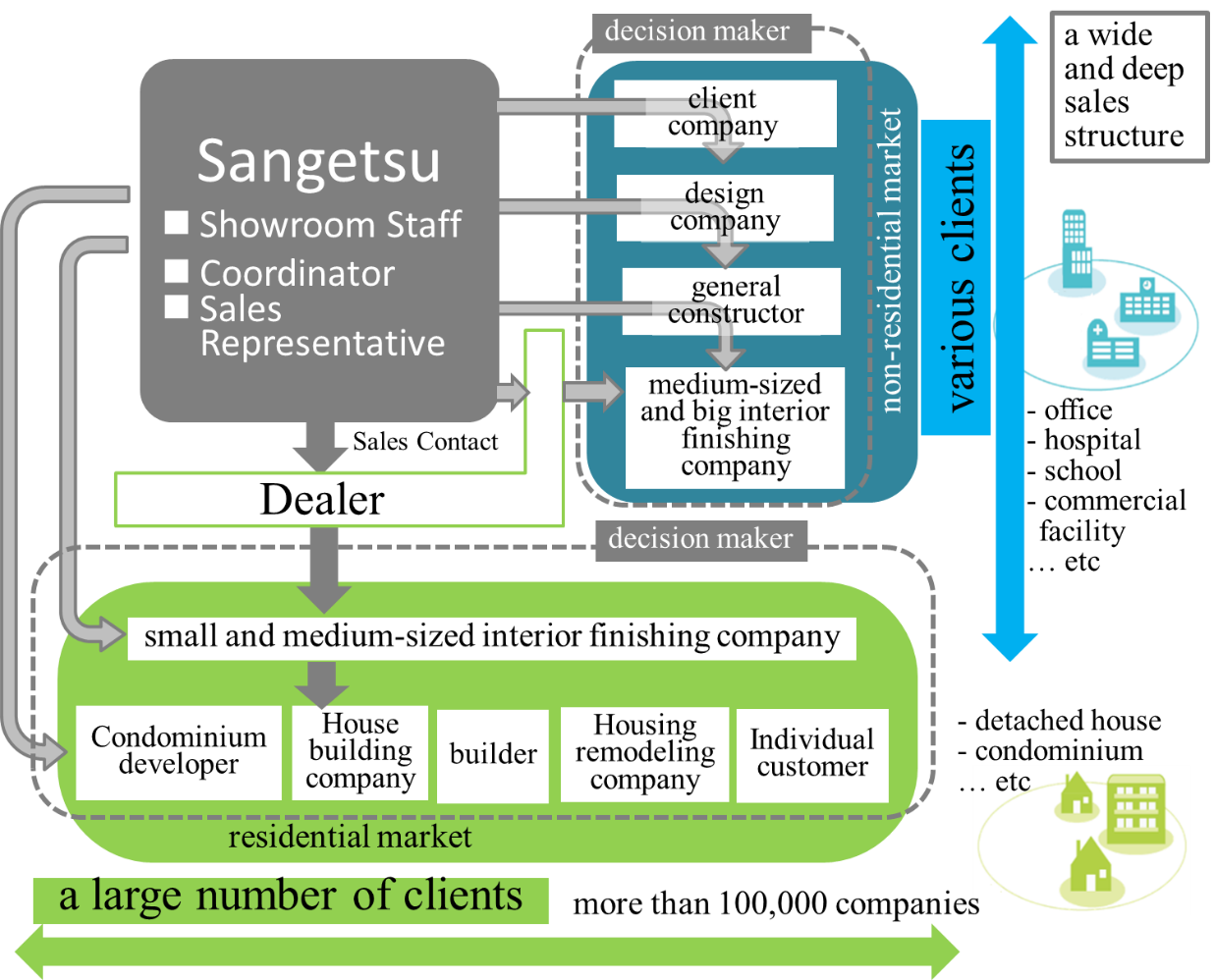

◎ Marketing Structure

In addition to the headquarters located in Nagoya, Sangetsu maintains 8 regional offices and 50 marketing offices throughout Japan, with 8 of these marketing offices also hosting showrooms.

(Source: the company)

The downstream interior finishing process includes the final delivery of products, booking of sales, and receipt of cash. The main customers are interior construction companies and interior and building material shops that are serviced through dealers. Furthermore, public relations and advertising for products at the start of the process are also very important.

Therefore, Sangetsu conducts public relations and advertising for its products through its sample books, showrooms, and others. In addition to these “passive” marketing activities, Sangetsu also conducts “proactive” marketing of its products through its Contract Sales Department and its 460 marketing staff to provide and gather information, and propose products to clients.

While the main marketing efforts are conducted through dealers, Sangetsu also conducts direct marketing to customers in the Nagoya and surrounding Chubu area, and the number of its directly accessed customer totals 6,000 in these regions alone. While the number of customers dealt with through dealers is not known, the total number of customers is estimated to amount to several tens of thousands nationwide.

◎ Distribution Structure

Sangetsu maintains a network of 11 distribution centers nationwide. Most all products are normally stocked at the Company’s distribution centers in Tokyo, Nagoya, Osaka and Fukuoka, with the number of products shipped from these centers surpassing 60,000 per day and the out-of-stock ratio amounting to a low 0.14% (about 70 products) per day.

Sangetsu seldom asks their clients for backordering because the out-of-stocks are covered by surrounding distribution centers immediately.

Sangetsu’s nationwide distribution network makes “Just-in-Time” provision of products to match the interior construction schedules of its clients possible. Products are sourced from a wide range of over 100 supplier companies.

② “Exterior Business”

(FY3/19 Sales and Operating Income of ¥16.118 Billion and ¥594 Million)

Sungreen Co., Ltd., which was turned into a subsidiary in 2005, sells doors, fences, terraces and other exterior products within Japan.

③ “Lighting Business”

(FY3/19 Sales and Operating Income of ¥4.227 Billion and ¥ 65 Million)

Yamada Shomei Lighting Co., Ltd., which became a subsidiary of the company in 2008 and was selling general lighting fixtures both domestically and overseas, was transferred to Odelic Co., Ltd. on April 5, 2019, after the company judged that the synergistic effects were limited.

④ Overseas business

(FY3/19 Sales and Operating Income of ¥20.920 Billion and ¥ -960 Million)

This segment comprises 3 companies, i.e., Koroseal Interior Products Holdings, Inc. acquired in November 2016, Sangetsu (Shanghai) Textile Co., Ltd. established in April 2016, and Goodrich Global Holdings Pte. Ltd. acquired in December 2017.

1-5 ROE Analysis

| FY 3/12 | FY 3/13 | FY 3/14 | FY 3/15 | FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 |

ROE (%) | 3.5 | 4.1 | 4.6 | 3.7 | 5.6 | 6.0 | 4.2 | 3.5 |

Net income margin (%) | 3.50 | 3.90 | 4.14 | 3.33 | 4.77 | 4.84 | 2.89 | 2.23 |

Total asset turnover [times] | 0.84 | 0.88 | 0.93 | 0.91 | 0.95 | 0.88 | 0.91 | 0.94 |

Leverage [times] | 1.18 | 1.19 | 1.20 | 1.21 | 1.24 | 1.41 | 1.60 | 1.67 |

The new Medium-Term Business Plan calls for the quantitative target for return on equity of between 8% and 10% to be achieved by fiscal year ending March 2020.

In addition to reducing owned capital based on the capital policy, efforts to improve profitability are to be made.

1-6 Characteristics and strengths

① Business Model Capable of Yielding Stable Earnings

Sangetsu is a pioneer in the realm of “fabless operation” with no in-house manufacturing facilities and therefore has lower fixed expense burdens because they do not have to carry facilities for the manufacturing process. Besides, the Company boasts of over 12,000 products, sourced from over 100 suppliers, supplied to several tens of thousands of customers, which diversifies risk in many ways. Moreover, while Sangetsu may be considered as an economically sensitive company as its business and earnings performances are closely linked to trends in the construction market, the Company has never seen losses since its founding.

② “Creating,” “Proposing,” “Providing”

“Creating”

While the actual manufacturing of products is not conducted in-house, Sangetsu performs the planning, design and development process internally. The Company launched its original wallcoverings for the first time in 1965. Since the establishment of its fundamental values in 1973, Sangetsu has continuously made active investments for “creative designs,” one of the three principles of the Company. 25 in-house designers develop new and original versions of products based upon numerous basic designs. The cultivation of designers responsible for various products is done through participation in foreign exhibitions, communication with marketing staff, and discussions with outside design consultants as part of their on-the-job training. Furthermore, Sangetsu maintains a policy of actively taking the perceptions and opinions of younger designers and staff into consideration. Sangetsu also boasts of an overwhelming number of products of about 12,000 that far exceeds the number of products of its competitors. In addition, the Company conducts revisions of its products on a regular basis every 2 to 3 years with more than 30 types of sample books, which surpass by far those of its competitors.

(Source: the company)

“Proposal based sales marketing”

Nearly one third of all employees or about 460 staffs work in marketing functions at Sangetsu, the largest marketing function within the industry. These marketing staffs are assigned to 50 offices and 8 branches located throughout Japan and conduct proposal-based marketing to clients. Sangetsu also staffs its 8 showrooms with 80 employees. In addition, about 50 interior designers create design boards that combine samples of various products for customers to use when choosing interior products. This high level of proposal-based marketing capability is unmatched within the industry and sets Sangetsu apart from its competitors.

|

|

(Source: the company)

“Distribution system”

As mentioned earlier in this report, Sangetsu normally maintains inventories of all of its products so that they can be provided on a “Just-in-Time” basis using their nationwide distribution network. However, the Company is required to conduct speedy processing techniques as product orders are placed so that loss rates can be limited to avoid the maintenance of excess inventories and reduced efficiencies. Generally, wallcoverings are produced in rolls as long as 50 meters, and Sangetsu cuts these rolls into shorter segments when orders are placed for shipment. The remaining segments of wallcoverings are then cut to match other orders to eliminate losses. This type of custom-made cutting technology has been cultivated over the long years of experience in the interior decorating business and is an important factor that differentiates Sangetsu from its competitors.

|

|

(Source: the company)

2. Fiscal Year March 2019 Earnings Results

(1) Earnings Results

| FY 3/18 | Ratio to sales | FY 3/19 | Ratio to sales | YoY | Difference from the forecast |

Sales | 156,390 | 100.0% | 160,422 | 100.0% | +2.6% | -2.2% |

Gross profit | 47,572 | 30.4% | 50,720 | 31.6% | +6.6% | -2.5% |

SG&A | 42,538 | 27.2% | 44,824 | 27.9% | +5.4% | -2.6% |

Operating Income | 5,033 | 3.2% | 5,895 | 3.7% | +17.1% | -1.7% |

Ordinary Income | 5,698 | 3.6% | 6,699 | 4.2% | +17.6% | +1.5% |

Net Income | 4,514 | 2.9% | 3,579 | 2.2% | -20.7% | -22.2% |

*Unit: million yen

Sales and profits increased, but fell slightly short of estimates.

Sales were ¥160.4 billion, up 2.6% year on year. In the Interior business, sales of flooring materials were healthy, but sales of wallcovering materials decreased due to problems with the return of sample books. The Exterior Business and the Lighting Business both performed well, and Goodrich Global Holdings, which was acquired by the company acquired in December 2017, also contributed, leading to a rise in overseas sales.

Price increases also took hold in the market, and gross profit rose 6.6%, surpassing the increase rate of sales, and gross profit rate increased 1.2 points. In addition to Goodrich’s SG&A expenses, Sangetsu’s SG&A costs, including personnel and distribution expenses, augmented 5.4% year on year, but these costs were offset, and operating income rose 17.1% to ¥5.8 billion.

Sales and profits were slightly below the initial forecast.

(2) Business Segment Trends

| FY 3/18 | Ratio to sales | FY 3/19 | Ratio to sales | YoY | Difference from the forecast |

Sales |

|

|

|

|

|

|

Interior | 120,852 | 77.3% | 119,508 | 74.5% | -1.1% | -2.8% |

Wallcoverings | 57,588 | 36.8% | 57,155 | 35.6% | -0.8% | - |

Flooring Materials | 42,877 | 27.4% | 43,116 | 26.9% | +0.6% | - |

Fabric Materials | 7,907 | 5.1% | 8,311 | 5.2% | +5.1% | - |

Others | 12,478 | 8.0% | 10,924 | 6.8% | -12.5% | - |

Exterior | 15,013 | 9.6% | 16,121 | 10.1% | +7.4% | +6.1% |

Lighting | 3,663 | 2.3% | 4,227 | 2.6% | +15.4% | +15.8% |

Overseas | 17,151 | 11.0% | 20,920 | 13.0% | +22.0% | -7.2% |

Adjustments | -291 | - | -354 | - | - | - |

Total | 156,390 | 100.0% | 160,422 | 100.0% | +2.6% | -2.2% |

Operating Income |

|

|

|

|

|

|

Interior | 5,752 | 4.8% | 6,174 | 5.2% | +7.3% | -1.2% |

Exterior | 439 | 2.9% | 594 | 3.7% | +35.0% | +48.5% |

Lighting | -137 | - | 65 | 1.5% | - | - |

Overseas | -870 | - | -960 | - | - | - |

Adjustments | -150 | - | 22 | - | - | - |

Total | 5,033 | 3.2% | 5,895 | 3.7% | +17.1% | -1.7% |

*Unit: million yen. Ratio to sales of operating income represents the operating income margin. The fabric materials category of sales includes both curtains and upholstery.

① Interior Business

Sales and profit dropped.

The market share of the wallcovering materials business fell due to a decline in sales volume caused by problems with the return of sample books, distribution issues at the start of the new core system, and offensives by other companies with low-cost wallcovering materials. Sales also decreased in the entire interior business.

Efforts to raise prices for wallpapers and fabrics are progressing mostly as expected. Prices for part of flooring materials have been raised.

The company has developed their own delivery system, in addition to levying and shifting burdens, to deal with fare increases along distribution routes. Although there were increased costs associated with operation of the new core system, SG&A expenses were kept within estimated limits.

<Wallcovering Materials>

Sales declined. With urban redevelopment mainly in the Tokyo metropolitan area and the continued Olympic-related demand, sales of FAITH, a sample book including flame-retardant wallpaper for non-residential buildings, remained steady. Product-specific marketing activities in the film sales department, which was newly established in April 2018, were successful, and sales of adhesive film “REATEC” and “Glass film” grew. Meanwhile, market penetration was delayed for “Reserve 1000” and “Reform Selection,” which were released in June. Sales were also affected by offensives of other companies that mass-produce low-cost wallpaper, and a decline in rental properties.

<Flooring Materials>

Sales increased for the ninth consecutive term. Sales of “carpet tile DT/NT,” a fiber-based flooring material launched in October, grew in the office and hotel markets due to the demand from foreign visitors and demand for improvements in the office environment accompanying working style reforms. In addition, the market for polyvinyl-chloride tile floors in residential buildings and commercial facilities continued to expand, driving sales. On the other hand, the market in the medical and welfare fields shrank, resulting in a decline in the sale of long-length sheets.

<Fabric Materials>

Measures taken to make improvements over the past four years were successful, and sales increased.

Sales continued to be driven by the residential curtain sample book “STRINGS” and the “Simple Order” catalog, which was created to make selection easier by listing all items at the same price. In addition, Sangetsu Vosne Co., Ltd., which specializes in the sale of curtains, has developed sales systems in the four major cities of Tokyo, Osaka, Nagoya, and Fukuoka, bolstering sales activities specializing in the residential field.

<Others>

Sales decreased. The performance of Fairtone Co., Ltd., which operates the installation system, and the fees for installation work are included.

② Exterior Business

Sales and profits increased.

The work to repair damage caused by natural disasters, such as typhoons, in the second quarter (July-September) increased. Therefore the sales of aluminum products, such as fences and carports, also grew substantially, and there were increased orders for storage.

In addition, for some products, price revisions made by the company’s manufacturing suppliers took hold in the market, leading to increased sales. Furthermore, demand has increased in public properties for reinforcement of existing block fences or upgrading to fences, due to heightened safety awareness.

Regarding the sales management system, Sangetsu focused on reviewing their follow-up procedures by taking actions such as establishing a branch in Toyohashi, and also improved construction capabilities.

③ Lighting Business

Sales increased and the business became profitable.

Competition is intensifying due to new companies entering the market and price reductions by existing companies, but the demand from foreign visitors and Olympic-related demand in the contract market is steady, and the designability of custom orders and Sangetsu’s ability to make proposals for them are highly desired by the market. As a result, sales at hotels and other accommodations increased. The company also strengthened specification sales activities by increasing the number of sales development staff.

In April 2019, all shares of Yamada Shomei Lighting Co., Ltd. were transferred to ODELIC CO., LTD., after the company judged that the synergistic effects were limited.

④ Overseas Business

Both sales and losses increased.

At Koroseal, which targets the North American market, sales of digital prints grew, mainly in the hotel and commercial markets. Sangetsu also acquired sales rights for products from the European wallpaper manufacturer “VESCOM” in September 2018, further contributing to sales growth. Sangetsu also made an effort to improve their system for raising profits by strengthening human resources in management.

As for Sangetsu (Shanghai), which targets the Chinese market, sales of wallcovering materials in the residential field and sales of floor coverings in the medical, welfare, and commercial fields continued to increase. In addition, the Shanghai showroom was opened in November 2018 in order to raise awareness of the Sangetsu brand. All previously accumulated losses were cleared off.

Goodrich, which is responsible for the Southeast Asian market, worked to create a synergistic structure within the Sangetsu Group by integrating its Shanghai sales base with Sangetsu (Shanghai), but sales decreased due to insufficient marketing before acquisition and defects of products and sample books.

Loss augmented due to increased SG&A expenses at Koroseal, such as the costs of labor and marketing tools.

(3) Financial standing and cash flows

◎ Main BS

| End of FY 3/18 | End of FY 3/19 |

| End of FY 3/18 | End of FY 3/19 |

Current Assets | 94,955 | 97,674 | Current Liabilities | 34,275 | 39,389 |

Cash, Equivalents | 22,482 | 27,220 | Payables | 24,081 | 26,522 |

Receivables | 49,805 | 50,504 | Noncurrent Liabilities | 30,783 | 31,342 |

Marketable Securities | 2,003 | 300 | Long-Term Debt | 17,404 | 18,925 |

Inventories | 17,295 | 17,331 | Total Liabilities | 65,058 | 70,732 |

Noncurrent Assets | 76,463 | 73,200 | Net Assets | 106,360 | 100,143 |

Tangible Assets | 36,928 | 35,688 | Shareholders’ Equity | 103,012 | 97,897 |

Intangible Assets | 19,739 | 16,686 | Treasury Stock | -4,577 | -2,889 |

Investments, Others | 19,796 | 20,825 | Total Liabilities, Net Assets | 171,419 | 170,875 |

Total Assets | 171,419 | 170,875 | Capital Adequacy Ratio | 61.4% | 58.0% |

*Unit: million yen.

Current assets rose ¥2.7 billion from the end of the previous term due to increases in cash and deposits and receivables. Noncurrent assets fell ¥3.2 billion due to a decline in intangible assets. As a result, total assets decreased ¥500 million to ¥170.8 billion.

Current liabilities increased ¥5.1 billion year on year due to a rise in payables. Noncurrent liabilities also augmented ¥500 million due to an increase in long-term debt. Total liabilities increased ¥5.6 billion to ¥70.7 billion. Net assets were ¥100.1 billion, down ¥6.2 billion year on year due to a decrease in retained earnings. Capital adequacy ratio fell 3.4% from 61.4% at the end of the previous term to 58.0%.

◎ Cash Flow

| FY 3/18 | FY 3/19 | Increase/decrease |

Operating Cash Flow | 7,196 | 10,370 | +3,174 |

Investing Cash Flow | -5,732 | 3,649 | +9,381 |

Free Cash Flow | 1,464 | 14,019 | +12,555 |

Financing Cash Flow | -4,831 | -7,196 | -2,365 |

Cash and Equivalents | 19,856 | 26,613 | +6,757 |

*Unit: million yen.

The surplus of operating CF grew as a result of an increase in payables. Investing CF turned positive, because there was no spending for the acquisition of subsidiary shares although there was in the previous term. The surplus of free CF grew.

The income from long-term loans decreased, and the deficit of financing CF grew.

The cash position improved.

3. Fiscal Year March 2020 Earnings Forecasts

(1) Earnings Forecasts

| FY 3/19 | Ratio to sales | FY 3/20 Est. | Ratio to sales | YoY |

Sales | 1604.2 | 100.0% | 1630.0 | 100.0% | +1.6% |

Gross profit | 507.2 | 31.6% | 525.0 | 32.2% | +3.5% |

SG&A | 448.2 | 27.9% | 445.0 | 27.3% | -0.7% |

Operating Income | 58.9 | 3.7% | 80.0 | 4.9% | +35.7% |

Ordinary Income | 66.9 | 4.2% | 83.0 | 5.1% | +23.9% |

Net Income | 35.7 | 2.2% | 57.0 | 3.5% | +59.2% |

*Unit: million yen. Estimates are those of the Company

Sales, profit, and profit rate will increase.

Sales are expected to rise 1.6% year on year to ¥163 billion. Sales are estimated to increase for the interior segment, after having declined in the previous fiscal year. Gross profit is projected to increase 3.5% year on year, exceeding the rate of sales growth, and gross profit rate is estimated to rise 0.6 points. The company will improve profitability in overseas segments.

Operating income is estimated to rise 35.7% year on year to ¥8 billion.

The dividend is forecast to be ¥57.00/share, up ¥0.5/share over the previous term. The estimated payout ratio is 61.5%.

(2) Business Segment Trends

| FY 3/19 | Ratio to sales | FY 3/20 Est. | Ratio to sales | YoY |

Sales |

|

|

|

|

|

Interior | 1195.0 | 74.5% | 1,265.0 | 77.6% | +5.9% |

Exterior | 161.2 | 10.0% | 155.0 | 9.5% | -3.9% |

Lighting | 42.2 | 2.6% | - | - | - |

Overseas | 209.2 | 13.0% | 215.0 | 13.2% | +2.8% |

Adjustment | -3.5 | - | -5.0 | - | - |

Total | 1604.2 | 100.0% | 1,630.0 | 100.0% | +1.6% |

*Unit: 100million yen.

Operating Income | FY 3/19 | Ratio to sales | FY 3/20 Est. | Ratio to sales | YoY |

Interior | 61.7 | 5.2% | 85.0 | 6.7% | +37.7% |

Exterior | 5.9 | 3.7% | 4.0 | 2.6% | -32.7% |

Lighting | 0.6 | 1.5% | - | - | - |

Overseas | -9.6 | - | -7.2 | - | - |

Adjustment | 0.2 | - | -1.8 | - | - |

Total | 58.9 | 3.7% | 80.0 | 4.9% | +35.7% |

* Unit: 100 million yen. The operating income of the overseas business is after amortization of goodwill.

◎ Interior Business

As the company was able to offset part of SG&A by raising prices, they aim to maintain these prices and recover sales volume and market share for further improvement from now on. They also plan to recover the market share by revising the sample books for mass-produced wallcovering materials, where the company is struggling against other competitive companies.

◎ Overseas Business

The company is expected to incur an operating loss of ¥180 million even before posting amortization of goodwill, and they acknowledge that improving sales and profits is the main goal this term as well.

They aim to fortify their management structure and cost competitiveness by installing new equipment.

4. The Progress of the Medium-Term Business Plan (2017-2019) “PLG 2019”

The progress of the medium-term management plan so far is as follows.

<Functional enhancement>

① Function and services

It is essential for Sangetsu to install advanced IT systems to maintain and reinforce the company’s strong points, such as immediate delivery (orders received by 10 a.m. can be shipped at 1 or 2 p.m. on the same day), receiving mass orders (60,000 orders per day on average), the capability to process a large number of diverse products in-house, and large numbers of shipments. A few years ago, the company began adopting systems on an as-needed basis, and the new core system began operation in the previous term.

Although there was some confusion immediately after the new system was introduced, it is currently running smoothly.

Because no other company in the industry is able to invest on the same scale as Sangetsu, fortifying business infrastructure with the IT systems is projected to further improve the company’s competitive superiority.

② Sales structure

The company focused on areas with a low market share, and on strengthening sales activities rooted in each area.

The newly opened Sangetsu Okinawa began full-scale operation, including a showroom and a logistics center.

In addition, Sangetsu’s Chugoku-Shikoku branch was relocated from Okayama to Hiroshima.

As for the sales structure in general, the company shifted focus from individual work to teamwork, and made progress towards integrating sales offices and sales promotion (the back office for sales).

Also, in order to add higher value to advice given to customers, the company launched an interior adviser system in the showroom, and began utilizing highly specialized contract employees.

In addition, the company began the EC curtain business “WARDROBE sangetsu” at Sangetsu Vosne in March 2019.

③ Logistics

◎ Base locations

When selecting locations for bases, the company will consider sustainability, efficiency, and scalability.

The company completed the establishment and integration of the LCs (Logistics Center) in Hokkaido, Tokyo, and Chubu, and established a new LC in Okinawa.

In addition, equipment renewal for LC’s in Tohoku, Chugoku-Shikoku, and Kyushu has been completed.

In the future, the company plans to conduct automation and systematization of facilities in order to maintain and improve long-term services. The Kansai LC, which has aging and narrowing issues and is split into two locations, will be referred to as a model case.

◎ Strengthening the in-house delivery system

Sangetsu is working on strengthening their in-house delivery system in response to the increase in fares for delivery routes.

Recruitment of high school graduates has been suspended since fiscal 2017, since the company switched to third-party logistics. However, as a result of comprehensively examining cost and sustainability, Sangetsu decided to change the policy, stop outsourcing and construct an in-house system.

For this reason, they launched a specialist personnel system for handling in-house processing and delivery operations.

Sangetsu is in the process of rebuilding their own delivery service, based on regional characteristics.

First, in the Tohoku region, they collaborated with major delivery companies and local shipping companies in Tohoku area to build a co-operative logistics network. By doing so, it became possible to ship products from the Tohoku LC to 14 major cities and 29 major regional bases across various prefectures.

The company was able to take this measure due to the company’s scale, which is a major factor separating it from other companies.

Using this case as a precedent, the company plans to extend this work into other regions as well.

④ Strengthening product competitiveness

The low-price curtain sample book “Simple Order” is performing well. Simple Order emphasizes making selection easy by listing all items at the low price and same price.

Because prices are comparable to those of large furniture stores, sales are increasing, driving the recovery of the fabric business.

⑤ Overseas segment

◎ United States (Koroseal)

In order to improve profitability, they are working on the following items.

1. The two plants located in Louisville will be integrated in September 2019, and new equipment (for wallpaper manufacturing) will be installed to enhance cost competitiveness.

2. Enhance facilities for handling orders of digital printing wallpaper, for which demand is growing.

3. Koroseal began to handle VESCOM products. VESCOM is a leading European wallpaper manufacturer for non-residential buildings.

4. In addition to dispatching their own senior executives, Sangetsu will also send employees to the accounting department.

◎ China (Sangetsu (Shanghai))

In addition to the Japanese customers, the number of Chinese customers is also growing. Transactions for both wallcovering and flooring materials are increasing.

After clearing off accumulated losses in the previous term, Sangetsu aims to further raise earnings.

◎ Southeast Asia (Goodrich)

Contribution to earnings is behind schedule than expected. In addition to selling a new sample book in collaboration with Sangetsu, Goodrich is promoting rejuvenation among executives, including those in charge of product development.

The Sangetsu (Shanghai) and Goodrich Shanghai offices were also merged together in order to achieve greater efficiency and synergistic effects. A shared showroom was established.

⑥ Efforts to shift business

In April 2019, Sangetsu established the Renovation department.

The home improvement market remains stable, and the non-residential renovation market is steadily expanding. Sangetsu aims to expand business in the non-residential renovation market through design proposals, construction management, and diverse work capabilities.

⑦ Human resources

As of April 1, 2019, female employees accounted for 33.9% of supervisory positions, and 12.0% of department managers. Sangetsu aims to raise the ratio of female employees in managerial positions to 15% in 2020.

The company’s employment rate for persons with disabilities is 2.41% (the legal requirement is 2.2%). In the future, the compnay will look into increasing the scope of work, aiming for an employment rate of 3.0%.

⑧ ESG and Governance

Sangetsu is promoting the establishment of a more transparent and fair management system.

At the 67th General Meeting of Shareholders held on June 20, 2019, one new outside director was appointed. Then, the ratio of directors who concurrently serve as audit or supervisory committee members to executive directors changed from 5:5 to 5:2 in the previous term, and the number of outside directors comprised the majority.

Additionally, there are now more independent outside directors than in-house directors, with the ratio changing from 4:6 in the previous term to 4:3

⑨ Acquisition of treasury shares and shareholder returns

In the term ended March 2019, the company purchased 2.46 million shares, valued at ¥5.3 billion.

When combined with ¥3.5 billion in total dividends, the total return amount was ¥8.8 billion, with a return ratio of 245.5%. This follows the previous year’s trend (234.0%) of actively pursuing shareholder returns.

5. Conclusions

Sales had increased 2.0% and operating income had decreased 9.4% by the third quarter, but for the full fiscal year, these numbers were 2.6% increase and 17.1% increase respectively, reflecting strong performance in the fourth quarter (January-March), although figures were not as high as initial estimates. This term marks the final year of the medium-term business plan “PLG 2019” (2017-2019), but due to the delay in improving overseas profitability, sales and profits will not be enough to reach the initial targets set when the plan was formulated.

Sangetsu places emphasis on “CCC” (Cash Conversion Cycle), which is a cash flow management indicator. CCC continues to grow shorter, and is likely to reach the target of completing a cycle in 60-75 days. According to President Yasuda, it is difficult for other companies to invest for installing core systems, establishing and consolidating bases, and building infrastructure for logistics (such as strengthening in-house delivery systems). Because Sangetsu has nearly finished strategic investment in these areas ahead of competitors, their competitive advantage will become even stronger.

The current term is the final year of the medium-term business plan. Raising sales and profits to their respective medium-term targets will be critical in terms of creating a starting point for the next medium-term plan. We believe that the key to accomplishing this lies in improving profitability of the overseas business, therefore we would like to pay attention to the company’s progress with regards to this matter, as well as whether they will be able to recover the lost market share for wallcovering materials.

<Reference 1: Medium Term Business Plan “PLG 2019” (2017-2019) Overview>

◎ Vision

Based upon the “Corporate Creed: Integrity” and “Brand Philosophy: Joy of Design”, Sangetsu has created its Medium-Term Business Plan “PLG 2019” with the goal of establishing strong roots within both the Japanese and overseas markets by leveraging the Group’s “diversified product lineup and highly specialized knowledge.”

“P” stands for personal and reflects the highly professional employees that helps it to link to people outside of the Company.

“L” stands for local and refers to the strong positioning in local markets.

“G” stands for global and represents Sangetsu’s global lineup of products and designs.

◎ Targets for the Final Year 2019

Target | ROE: 8~10% |

Associated Targets | ・Sales: ¥165.0~¥175.0 billion ・Net Income: ¥8.0~¥10.0 billion ・Capital: ¥105.0~¥100.0 billion ・CCC: 75~60 days |

In line with the previous Medium-Term Business Plan, Sangetsu will focus upon raising its capital efficiency as a common goal shared with all of its stakeholders. The details of its sales targets are outlined below.

Interior Business | ¥122.0~¥126.0 billion |

Exterior Business | ¥15.5~¥16.0 billion |

Lighting Business | ¥5.0 billion |

Overseas Business (NA, China, SE Asia) | ¥22.5~¥28.0 billion |

Total Sales | ¥165.0~¥175.0 billion |

* The lighting business was transferred in April 2019.

◎ Themes

As a basic policy, Sangetsu has identified the following measures as part of its strategy of “strengthening the function and expanding geographic sales of the interior materials business (planning, procurement, logistics, sales).”

(1) Business Strategy for Growth

① Realizing Stable Growth in Earnings through Expansion and Strengthening of the Value Chain Activities Realm in Japan as a Fundamental and Stable Source of Revenues

Sangetsu will promote “development and procurement of materials and raw materials through alliances with superior suppliers within and outside of Japan”, “strengthen interior coordinator proposal and installation capability”, “fortify alliances and cooperation with dealers” and “conduct reviews of internal sales structure”.

② Strengthen Activities in Overseas Markets with High Growth Potential, Fortify Product Lineup and Functionality to Promote Geographic Expansion

Local logistic and sales structures will be strengthened in important markets including North America, Asia and others.

③ Create a Global Product Planning, Procurement Structure to Promote Global Designs, Cultivate Global Product

Sangetsu will strengthen cooperation with local facilities in Japan, United States and China for the implementation of “cooperation between Sangetsu globally and superior overseas product manufacturers” and “efforts to promote joint marketing of products and deployment of European and Japanese designs”.

④ Strengthen Consolidated Management Structure to Pursue Comprehensive Synergies, Integrated Management of Affiliates Responsible for Special Markets, Functions and Geographic Regions

A management structure system will be introduced to maximize business synergies and conduct clearly controlled earnings management, and to act as a surveillance support structure for the overall Group.

A consolidated management division will be newly established with authority to oversee the entire Group.

In addition, regularly scheduled monitoring and communications will be introduced to increase the overall effectiveness of the Group.

⑤ Business Format Conversion Trials to be Conducted with a View to the New Medium Term Business Plan

In order to pursue synergies and leverage business resources and the characteristics of each Group company, Sangetsu will conduct trials and promote business format conversion.

(2) Strengthen Human Resources

In order to cultivate real professionals, all of the Sangetsu Group companies will implement measures to 1) cultivate professional human resources, 2) conduct strict adherence to performance, 3) promote diversity, 4) reform work styles and 5) maintain a healthy management structure.

(3) Strengthen the Earnings Management Structure

① Strict Control, Reduction of Sales, General and Administrative Expenses

A chief cost controller will be appointed, and sales, general and administrative expense control methodologies will be facilitated. Also, the total number of staff of the parent company Sangetsu will be reduced.

② CCC Management Will be Introduced for All Group Companies

Targets for return on equity and CCC management through Dupont analysis on a consolidated basis will be promoted.

③ Sangetsu to Clearly Define and Promote Management Benchmarks for Each Business, Company

Targets for sales and gross income by employee will be established for each of the Group companies.

(4) ESG/CSR Policies

① E: Environment

The Sangetsu Group will assess the environmental burden of its overall businesses to create a structure that seeks to achieve sustainability and prevent global warming.

・A plan to achieve CO2 zero emissions will be created.

② S: Society

☆Provide support to workers including those who are socially vulnerable to foster diversity of each Group company.

・Retain women in 15% of all management positions (Actual 10.6% as of FY3/17).

・Retain workers with disabilities as 3% of the total workforce (Currently 2.3%).

☆Promote Corporate Social Responsibility in Supply Chain Function

☆Expand Societal Contribution Activities of Employees

・Provide support for interiors of childcare welfare facilities (Target: Over 20 facilities per year)

➂ G: Governance

☆Strict implementation of compliance, maintain and improve transparency of corporate governance activities

・Improve communications with shareholders, investors, employees, business partners and all other stakeholders

(5) Capital Policy

① Financial Policy for Improvement of Capital Efficiency

Sangetsu will continue to conduct share buybacks and stable increases in dividend payments with a goal of reducing its net worth to between ¥100.0 and ¥105.0 billion (¥110.3billion as of FY3/17) with a view to conditions within the capital markets.

② Shareholder Return Policy of the Medium Term Business Plan

・Achieve over 100% total consolidated shareholder return ratio over a three year period

・Conduct stable increases in dividends over the long term

・Conduct share buybacks flexibly and in response to stock market conditions

We provide details of our capital procurement and capital allocation below.

Capital Creation, Sourcing |

| Capital Allocation | ||

Cash, Equivalents as of End FY3/17 | ¥30.0 billion |

| LT Investments | ¥10.0~¥25.0 billion |

Operating CF (Medium Term Plan) | ¥31.0~¥38.0 billion | = | Shareholder Returns | ¥25.0~¥33.0 billion |

Debt (Medium Term Plan) | ¥0~¥22.0 billion |

| Term End Cash, Equivalents | ¥25.0~¥30.0 billion |

Total | ¥61.0~¥90.0 billion |

| Total | ¥60.0~¥88.0 billion |

<Reference 2:Regarding Corporate Governance>

◎ Organization type and the composition of directors

Organization type | Company with audit and supervisory committee |

Directors | 7 directors, including 4 outside ones |

◎ Corporate Governance Report

Last update date: July 2, 2019

<Basic Concept>

Our corporate creed is “Integrity,” and we aim to foster good relationships with all stakeholders to improve our corporate value and grow stably on a long-term basis.

To attain these goals, we consider that it is essential to improve our corporate governance based on the transparency, swiftness, and efficiency of business administration.

Our company has been reorganizing to a company with an audit committee, with the aim of strengthening the auditing and supervising functions of the board of directors, by having outside directors join the management.

Under this governance system, we will make efforts to further improve our corporate value.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company implements each principle of the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

Principle 1-4 So-called strategically held shares | 1. Policy on strategically held shares We make decisions on shares to strategically hold for the medium- to long-term by comprehensively judging from various perspectives, considering companies with which we should newly forge relationships and companies with which we should continue to strengthen relationships as our clients for business strategies. With regard to holding shares, each year we will check the associated cost and returns, and if it is determined that holding the shares has no strategic value in the medium-and long-term, we will sell the shares, and conduct operations based on that decision. The Board of Directors’ decision and a disclosure of the shares we decide to continue holding will appear in the “Share holding status” column of the securities report. 2. Attitude toward exercise of voting rights We will keep an open dialogue and communicate through various channels, while respecting the management policies of companies that we invest in. We will make a comprehensive judgment based on company’s stance on shareholder returns and improving corporate value in the medium-to long-term, their corporate governance policies, and CSR activities. We will also separately examine whether holding the shares of the company is constructive to our goals and whether it will lead to improving the corporate value of the company we invest in. |

Principle 5-1 Policy on constructive communication with shareholders | Aiming to establish good relationships with shareholders by encouraging constructive communication with them and striving for information disclosure and interaction with high transparency, our company proactively performs IR activities as follows: ・In our company, the Chief Executive Officer manages the implementation of IR activities. ・・Our company has established the Public Relations and IR Department for rational communication with our shareholders and swift IR activities. ・The Chief Executive Officer, the executive in charge, and the Public Relations and IR Department carry out interviews with both Japanese and overseas institutional investors, and analysts, upon their request. ・Although the IR department specializes in handling IR activities, other departments such as the headquarters of each business, the Finance and Accounting Department, and the Office of the President’s Corporate Planning Division cooperate with the IR department to provide information with higher effectiveness. ・Our company announces our financial statements, arranges financial results briefings for investors, and participates in IR events for individual investors hosted by stock exchanges and the like to hold explanatory meetings. ・Since 2017, we have held company briefings for shareholders at our Shinagawa showroom in mid-July, after the general meeting of shareholders. This has created opportunities to introduce our company to mainly individual shareholders in the Kanto region. All directors attend this briefing session, and the president and executive officers describe the company. In September 2018 and March 2019, we held IR meetings related mostly to governance, led by directors (who are also audit and supervisory committee members) and institutional investors. ・Our company publishes on our website explanatory material we used at the above-mentioned events (the English-version of such material is also published as needed). ・Our company creates an integrated report for every fiscal year and publishes such reports both in Japanese and in English through our website. ・Our company conducts activities which contribute to enhancement of our shareholders’ understanding about various items, including our management strategy, business environment, business progress, and financial information, through direct communication and material published on our website. ・Our company responsibly utilizes opinions obtained from interaction with our shareholders and investors for administrative improvement through The Public Relations and IR Department. ・Our company properly deals with the management of insider information in accordance with the regulations for the management of insider trading (regulations for the prevention of insider trading), by assiduously managing unpublished material facts. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on Sangetsu Corporation (8130) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/