Bridge Report:(8130)Sangetsu the fiscal year ended March 2022

Shosuke Yasuda, President | Sangetsu Corporation (8130) |

|

Company Information

Market | TSE Prime Market, NSE Premier Market |

Industry | Wholesale (Commerce) |

Executive Director and President Executive officer | Shosuke Yasuda |

HQ Address | 1-4-1 Habashita, Nishi-ku, Nagoya-shi, Aichi-ken |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥1,565 | 59,200,000 shares | 92,648 million | 0.3% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥71.00 | 4.5% | ¥119.36 | 13.1 x | ¥1,497.21 | 1.0 x |

*The share price is the closing price on June 29. Each number is from the financial results for the fiscal year ended March 2022.

Earnings Trend

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2018 Act. | 156,390 | 5,033 | 5,698 | 4,514 | 68.97 | 55.50 |

March 2019 Act. | 160,422 | 5,895 | 6,699 | 3,579 | 57.28 | 56.50 |

March 2020 Act. | 161,265 | 9,268 | 9,844 | 1,432 | 23.56 | 57.50 |

March 2021 Act. | 145,316 | 6,701 | 7,042 | 4,780 | 78.97 | 58.00 |

March 2022 Act. | 149,481 | 7,959 | 8,203 | 276 | 4.66 | 70.00 |

March 2023 Est. | 159,000 | 10,000 | 10,700 | 7,000 | 119.36 | 71.00 |

*Unit: million yen, yen. Estimates are those of the company. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply. From the beginning of the fiscal year ended March 2022, the company will apply the “Accounting Standard for Revenue Recognition” (ASBJ Statement No. 29), etc.

This Bridge Report provides an overview of the fiscal year ended March 2022 of Sangetsu Corporation.

Table of Contents

Key Points

1. Company Overview

2. The Fiscal Year ended March 2022 Earnings Results

3. Fiscal Year ending March 2023 Earnings Forecasts

4. Progress of Medium-term Management Plan

5. Interview with President Yasuda

6. Conclusions

<Reference1: Long-term Vison of Sangetsu Group 【DESIGN 2030】 and Medium-term Business Plan (2020-2022) 【D.C. 2022】>

<Reference2: Regarding Corporate Governance>

Key Points

- Since the fiscal year ended March 2022, the “accounting standard for revenue recognition,” etc. have been applied. In the fiscal year ended March 2022, sales were 149.4 billion yen and operating income was 7.9 billion yen. Without the application of the accounting standard for revenue recognition, sales were 158.8 billion yen, up 9.3% year on year, and operating income was 7.9 billion yen, up 18.6% year on year. For the following contents about the growth of sales and profit in the fiscal year ended March 2022, the accounting standard for revenue recognition was not applied.

- Sales grew, as the company expanded a market share in the Interior Business thanks to the recovery of the housing market and the effects of new sample books and raised prices in September 2021. The sales in the Exterior, Space Creation, and Overseas segments, too, increased. Through the sales growth, gross profit rose, offsetting the augmentation of expenses for upgrading sample books in the Interior Segment, opening Shin-Kansai Logistics Center, and acquiring CREANATE Inc. as a consolidated subsidiary. On the other hand, net income dropped considerably, due to the posting of an impairment loss of 5.5 billion yen for the trademarks related to Koroseal.

- In the fiscal year ending March 2023, sales are projected to grow 6.4% year on year to 159 billion yen and operating income is expected to increase 25.6% year on year to 10 billion yen. Sales are forecast to grow in all segments. Gross profit, too, is expected to grow. Due to the price hikes, gross profit margin is projected to rise. The company plans to pay a dividend of 71.00 yen/share, up 1.00 yen/share from the previous term. The expected payout ratio is 59.5%. The performance of the company is better in the second half due to the seasonality of its business. This term, too, the company was planning to revise the prices of their products as the prices of raw materials, including vinyl chloride, plasticizers, and nylon, were rising, and announced price hikes on June 17, 2022. The prices of wallcoverings, flooring materials, and upholstery will be raised. The company will raise the prices of products ordered from October 1, 2022 by 7-12%. Its impact on the performance in the second half is still unknown.

- In the fourth quarter of the fiscal year ended March 2022, due to the penetration of the price revision in September 2021, profit exceeded the forecast. We would like to check whether such favorable performance has been continued this term, by seeing the financial results for the first quarter. The company announced the second price hike from the orders on October 1, 2022. According to the earnings forecast announced in May, profit in the second half is conservatively projected to decline from the second half of the previous year and from the first half, but it is noteworthy how much they will increase profit through the price hike.

- From the medium-term viewpoint, we would like to expect the speed of recovery of the Overseas Business, mainly in the North American market.

1. Company Overview

Sangetsu Corporation is the largest among all Japanese trading companies specializing in wallcoverings, flooring materials, curtains and other interior decorating products. Being a trading firm, the company also operates as a “fabless company” that plans and develops interior decorating products. Sangetsu boasts of a business model that is able to produce stable earnings and top market share in its main product realms.

As of the end of March 2022, the group is composed of eight companies including “Sangetsu Okinawa Corporation,” which sells interior materials in the Okinawa area, “Sangetsu Vosne Corporation”, a distributor specializing in curtains “Sungreen Co., Ltd.”, a dedicated distributor of exterior products, “Goodrich Global Limited”, the company responsible for business in China and Hong Kong, “Koroseal Interior Products Holdings, Inc.,” the United States company conducting sales of wallcovering materials for non-residential applications, “Goodrich Global Holdings Pte., Ltd.,” the company selling interior materials in Southeast Asia, and “Fairtone Co., Ltd.”, which seeks to grow orders on the back of enhanced installation capabilities, Japan’s largest manufacturer of vinyl wallcovering, CREANATE Inc. (formerly Wavelock Interior Co., Ltd., renamed in January 2022).

1-1 Corporate History

Sangetsu was founded in 1849 under the original name of “Sangetsudo” to sell various traditional Japanese interior decorating products including scrolls, wall scrolls, folding screens, sliding doors, partitioning screens, and other products made of cloth and paper. Sangetsu Corporation was incorporated in 1953 by the founding family. From the latter half of the 1970s onwards, the business was expanded into Tokyo, Osaka, Fukuoka and other parts of Japan. In 1980, Sangetsu was listed on the Second Section of the Nagoya Stock Exchange, and later in 1996 its shares were also listed on the First Section of the Tokyo Stock Exchange. Currently, Sangetsu is expanding its operations into overseas markets and has established itself as a large total interior decorating product provider.

Shosuke Yasuda was appointed as the first President who is not from the founding family of Sangetsu in April 2014. He will direct the company during its third stage of growth entitled “Our Third Founding Phase,” following on the heels of the original first phase of founding and the second phase when the company became a publicly listed corporation.

In April 2022, through the restructuring of stock markets, the company got listed on the Prime Market of Tokyo Stock Exchange and the Premier Market of Nagoya Stock Exchange.

1-2 Corporate Philosophy

Sangetsu established a new corporate philosophy including a new brand philosophy in February 2016 that will enable it to take on the challenge of implementing reforms necessary to take it to its next stage of growth.

A new “brand philosophy” has been added to the “corporate creed” and “corporate mission,”

In addition, “The Long-term Vison of Sangetsu Group 【DESIGN 2030】,” which was produced in 2020, specified that the company aims to become a “Space Creation Company.” (For details, please see Reference1: Long-term Vison of Sangetsu Group 【DESIGN 2030】 and Medium-term Business Plan (2020-2022) 【D.C. 2022】)

<Corporate Creed>

Sincerity

<Corporate Mission>

To contribute to society through interior design and strive to create daily culture of enrichment

<Brand Philosophy>

・Brand statement: | “Joy of Design” |

・Brand purpose: | “We share joy of design with those who create new spaces.” |

Sangetsu endeavors to share the joy of creating new value with all stakeholders involved in the company, including the manufacturers and users of interior products.

1-3 Market Environment

◎ Overview

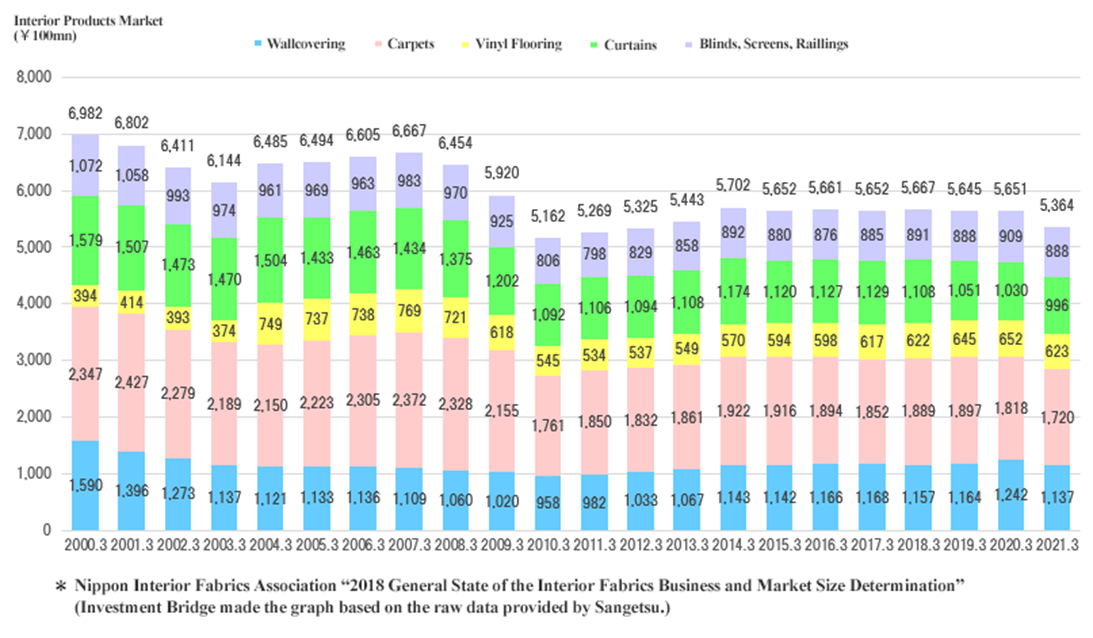

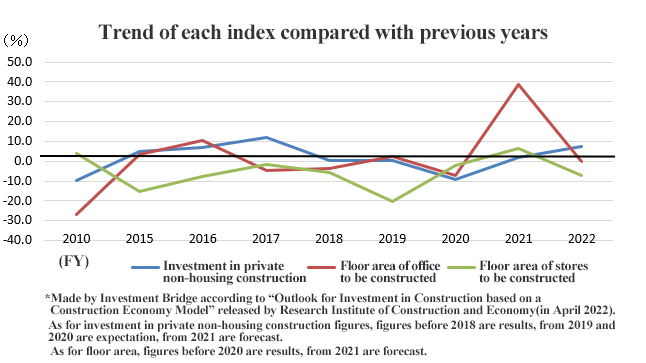

The market environment for the main wallcoverings and flooring materials is strongly influenced by trends in the Japanese construction market. Declines in new housing start arising from declining population and changing family structures within Japan, and deflationary trends have depressed sales of the interior products market as shown in the graph below.

(Source: the company)

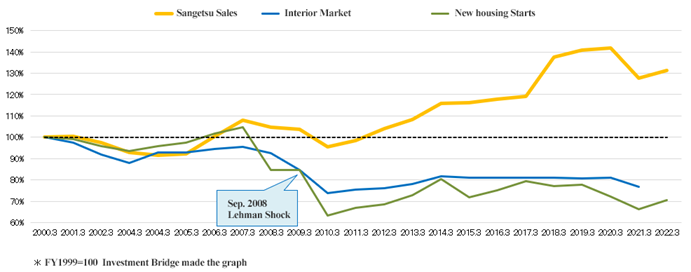

At the same time, the graph below shows the correlation between net sales of Sangetsu relative to net sales of the Japanese interior market and new housing starts (Ministry of Land, Infrastructure, Transport, and Tourism data).

The company’s net sales and trends in the domestic interior market have been largely linked to the number of new housing starts, but following the collapse of Lehman Brothers, while the overall market and new housing starts have remained at low levels, the company’s net sales have been at record highs continuously until March 2020.

In the fiscal year ended March 2021, sales dropped for the first time in 11 terms, due to the novel coronavirus, etc., but in the fiscal year ended March 2022, sales grew again.

Besides M&A, this strong recovery can be attributed to Sangetsu’s efforts to cultivate business in the non-residential realm in addition to private housing.

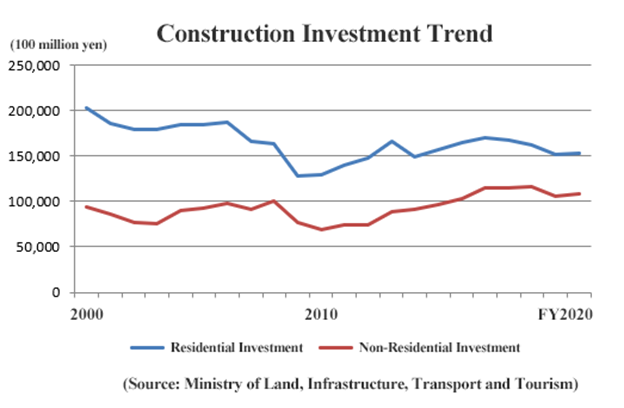

According to the “Outlook for investment in construction in FY2021” released by the Ministry of Land, Infrastructure, Transport and Tourism, both private-sector residential construction investment and private-sector non-residential construction investment were on the way to recovery after the collapse of Lehman Brothers, but private-sector residential construction investment has been reaching peaks since FY2017, and private-sector non-residential construction investment, which had been above the 2000 level, has been flat.

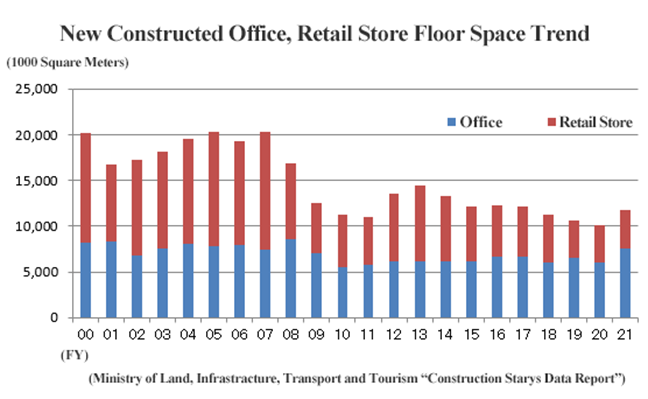

The total floor areas of offices and (newly built) stores had been declining, but in FY 2021, the total floor areas of both offices and stores increased from the previous fiscal year.

In addition, according to “Outlook for investment in construction based on a construction economy model” released by Research Institute of Construction and Economy on November 16, 2021, nominal private investment in non-housing construction rose 11.8% in fiscal 2017, 0.6% in fiscal 2018, and 0.6% (estimated) in fiscal 2019, and dropped considerably by 9.2% (estimated) in fiscal 2020 due to the coronavirus pandemic, but is expected to grow 3.6% (forecast) in fiscal 2021 and 3.8% (forecast) in fiscal 2022, showing a recovery.

The floor area to be constructed

*offices

The floor area of offices whose construction started increased 2.3% in FY 2019, showing a recovery, but dropped 7.3% in FY 2020, due to the novel coronavirus. In FY 2021, it rebounded 38.7%, but in FY 2022, it was flat. They said, “The investment, which was put off in FY 2020, was conducted, so the floor area of offices whose construction started during a period from April 2021 to February 2022 was up 41.0% year on year, thanks to the commencement of large-scale buildings. It is expected to be favorable for the foreseeable future.”

*shops

The floor area of stores whose construction started decreased 20.5% in FY 2019 and 2.0% in FY 2020, increased 6.6% in FY 2021, but is projected to decline 7.0% in FY 2022. They said, “The floor area of stores whose construction started during a period from April 2021 to February 2022 was up 9.4% year on year. It is expected to recover to the level in FY 2019.”

Like this, the non-housing market is showing a sign of recovery due to the rebound from the coronavirus pandemic, but it is difficult to expect that the housing and non-housing markets in Japan will grow considerably.

However, there is steady demand for renovations in the non-residential market, so Sangetsu is intending to meet the demand mainly through the Market Development Department and the contract sales department. They are also making efforts to develop Overseas Segment, pursuing further growth by reinforcing the advantages they have over other companies.

◎Competitors

In addition to Sangetsu, there are eight publicly traded competitors that operate in the interior decorating market.

Stock Code | Company | Net Sales | YY Change of Net Sales | Operating Income | YY Change of Operating Income | Operating Income Margin | Total Market Cap | PER | PBR | ROE |

3501 | Suminoe Textile Co., Ltd. | 83,900 | +5.3% | 402 | -61.7% | 0.5% | 11,338 | 17.8 | 0.3 | 1.5% |

4206 | Aica Kogyo Co., Ltd. | 200,000 | +14.5% | 21,000 | +16.7% | 10.5% | 238,595 | 17.7 | 1.7 | 8.1% |

4215 | C.I.TAKIRON Corporation | 140,000 | +4.1% | 8,000 | -6.0% | 5.7% | 53,625 | 9.7 | 0.6 | 6.4% |

4224 | Lonseal Corporation | 18,500 | +7.8% | 1,250 | +9.6% | 6.8% | 6,910 | 7.7 | 0.4 | 5.2% |

5956 | TOSO COMPANY, LIMITED | 21,700 | - | 720 | - | 3.3% | 5,410 | 10.3 | 0.4 | 6.2% |

7971 | TOLI Corp. | 89,000 | +3.6% | 1,250 | -21.6% | 1.4% | 15,036 | 13.8 | 0.4 | 3.8% |

7989 | TACHIKAWA CORPORATION | 42,040 | +5.2% | 4,800 | +5.8% | 11.4% | 24,770 | 7.6 | 0.6 | 7.5% |

8130 | Sangetsu Corporation | 146,500 | - | 7,600 | +13.4% | 5.2% | 97,062 | 21.2 | 1.0 | 5.1% |

9827 | Lilycolor Co., Ltd. | 34,100 | +4.1% | 500 | +464.2% | 1.5% | 2,279 | 12.3 | 0.3 | 0.9% |

*Unit: million yen, times. Estimates are from those of the respective companies this term. Total market capitalization, PER and PBR are based upon the closing share price of each stock in June 10, 2022. ROE is based on the previous term.

As Lilycolor applied the “Accounting Standard for Revenue Recognition” from the beginning of this fiscal year, the increases in net sales and operating income are not shown.

1-4 Business Description

The main businesses include planning, development, and sales of wallcoverings, flooring materials, curtains, upholstery and other interior products. Sangetsu takes a “fabless operation,” which does not maintain any manufacturing facilities, and it is not a typical trading firm as all the products it sells are planned, designed and developed in-house. Sangetsu also provides exterior products through its subsidiary. The Overseas Segment is operated by three subsidiaries located in the U.S., China/Hong Kong, and Singapore.

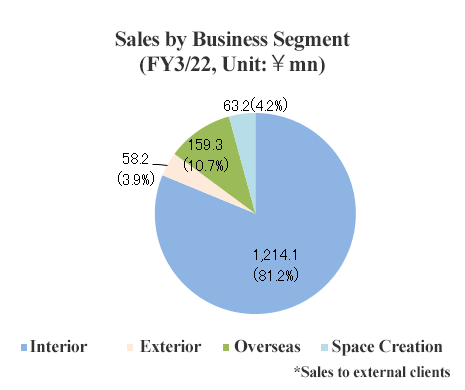

The company has 4 business segments, which are Interior Segment, Exterior Segment, Overseas Segment, and Space Creation Segment.

①“Interior Segment”

◎Main Products

Wallcoverings | Sangetsu’s main product, used in a wide range of residential and non-residential applications. High functionality products have become popular in recent years that are resistant to staining, odor absorbing, and scratch resistant. The product lineup also includes antivirus wallcovering. Also, “Accent Wall” a wallcovering with colorful designs being used to decorate one full wall or a part of a wall in homes, adds an appeal to the living space, and is increasingly adopted in general residences and rental residences. |

Cushion Vinyl Sheet | Sheet formed flooring materials that are used in both residential and retail store applications, and commonly used in apartments and condominiums. They boast of wood grain, stone, and a wide range of other motif designs and have cushioning function for use in a wide range of applications. |

Vinyl Sheets | Sheet formed flooring materials used in commercial applications including medical and welfare institutions, and educational institutions. This product boasts of high levels of safety and hygiene, and is designed to reduce maintenance costs, thanks to the excellent maintenance properties, such as the unnecessity of waxing. It also has been designed with the environment in mind and helps to reduce the environmental burden. |

PVC Tiles | Tile formed PVC flooring which has a wide range of applications, is used in commercial facilities, educational institutions, detached houses and apartments. One feature is its high design, in which the materials used as motifs such as wood and stone are expressed through high-tech printing technology and precise embossing. |

Carpets | Textile flooring materials used in a wide range of applications including ryokans (i.e. Japanese inns), hotels, residential and commercial facilities. Manufactured with variety of designs and high functionality. It also proposes original designs to each property. |

Carpet Tiles | A square-shaped-tile-like carpet with a length of 50 cm, which is used mainly for offices, hotels, commercial facilities, and educational institutions It excels in its feature of easy installation and superior maintenance. |

Curtains | All of the curtains sold by Sangetsu are custom made and boast of the ability to create unique designs and custom sizes of curtains to match room decorations in which they are used. In addition to highly fashionable designs and heavy materials, mirror-like insulating characteristic lace curtains, which make it difficult to see inside from the outside and reduce the amount of heat transferred into the rooms, have also become popular. |

Sangetsu boasts a diverse product lineup with about 12,000 different products in total. There are about 4,300 different wallcovering products alone. Sample books are updated every two years (those for curtains are updated every three years), with an existing product replacement rate for wallcoverings of 30% to 40%.

Disposal of outdated products leads to producing wastes, but because keeping a sample book up-to-date is necessary to enhance customer satisfaction, the company has maintained a balance between efficiency and freshness through the company’s energetic engagement and long-cultivated know-how.

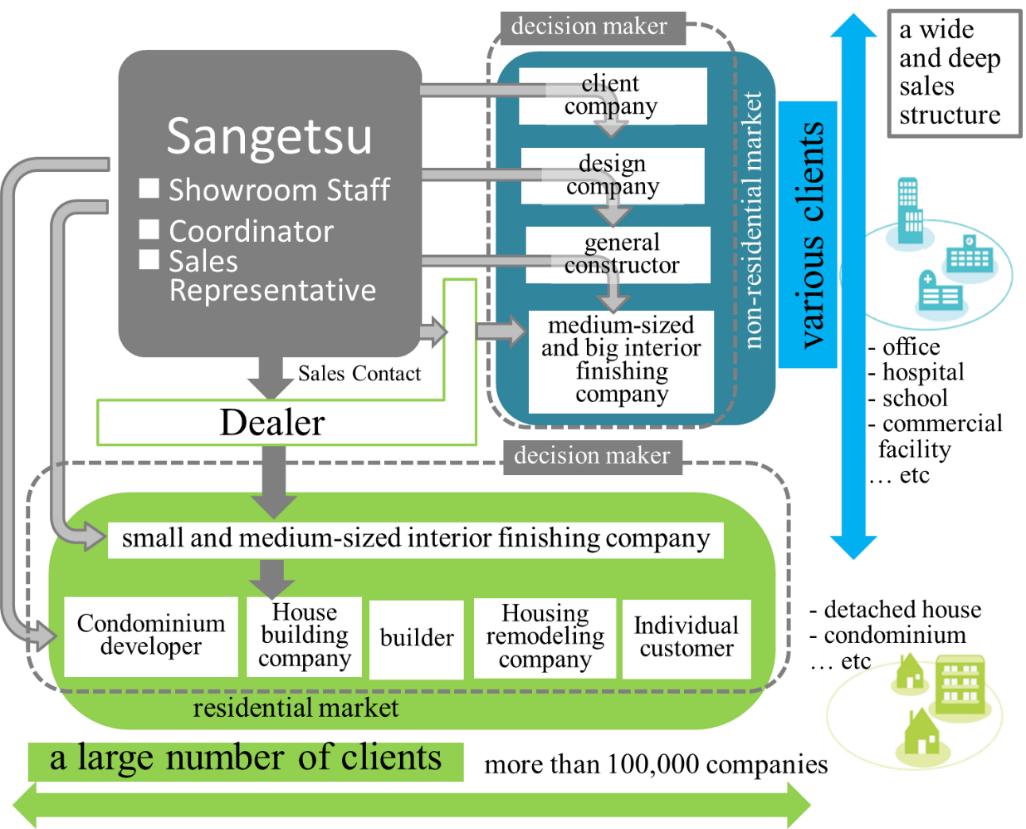

◎Sales Structure

In addition to the headquarters located in Nagoya, Sangetsu maintains 8 regional offices and 50 sales offices throughout Japan, with 8 of these sales offices also hosting showrooms as important sales offices.

(Source: the company)

The downstream interior finishing process includes the final delivery of products, booking of sales, and receipt of cash. The main customers are interior construction companies and interior and building material shops that are serviced through dealers. Furthermore, public relations and advertising for products at the start of the process are also very important.

By the time the residence or building is completed, a large number of players such as the client (facility owner), design office, design office, general contractor, subcontractor, residential manufacturer, etc. are involved, and the interior is finally selected from design and function. In many cases, decision making starts upstream.

Therefore, Sangetsu conducts public relations and advertising for its products through its sample books, showrooms, and others. In addition to these “passive” sales activities, Sangetsu also conducts “proactive” sales of its products through its 680 sales staff which belongs to its Market Development Department and its Contract Sales Department, etc. to provide and gather information, and propose products to clients.

While the main sales efforts are conducted through dealers, Sangetsu also conducts direct sales to customers in the Nagoya and surrounding Chubu area, and the number of its directly accessed customer totals 6,000 in these regions alone. While the number of customers dealt with through dealers is not known, the total number of customers is estimated to amount to several tens of thousands nationwide.

◎Distribution Structure/Delivery System

With the aim of streamlining logistics, they are developing a logistics system. They have two “flagship logistics centers,” which store stocks for each region and to backup broader areas, six “regional logistics centers,” which store stocks for each region, and two “satellite centers,” which are more community-based.

Most products are normally stocked at the company’s distribution centers in Tokyo, Nagoya, Osaka and Fukuoka, with the number of products shipped from these centers surpassing 60,000 per day, and the out-of-stock ratio is 0.9% in average.

Sangetsu seldom asks their clients for backordering because the out-of-stocks are covered by surrounding distribution centers immediately.

Sangetsu’s nationwide distribution network makes “Just-in-Time” provision of products to match the interior construction schedules of its clients possible. Products are sourced from a wide range of about 270 supplier companies.

As for delivery, the company is improving its own delivery system, to cope with the increase of logistics costs.

In the Tohoku region, the company developed a regional delivery system, and in other regions, too, the company will establish regional delivery systems and develop a system for delivering heavy cargoes mainly in metropolitan areas.

②“Exterior Segment”

Sungreen Co., Ltd., which was turned into a subsidiary in 2005, sells and constructs doors, fences, terraces and other exterior products within Japan.

In the new medium-term business plan, the company will concentrate on the landscape business mainly in the Tokyo Metropolitan Area.

③“Overseas Segment”

This segment is centered on Koroseal Interior Products Holdings, Inc. in North American, and Goodrich Global Holdings Pte., Ltd. in Southeast Asia, and Goodrich Global Limited in China/Hong Kong

④“Space Creation Segment”

It consists of Sangetsu’s Space Creation Division and its subsidiary, Fairtone Co., Ltd.

Based on the designing capability of Sangetsu and the interior finishing capability of Fairtone, the company incorporates the new abilities, which is part of the company's soft power, to design spaces, come up with, envisage, and propose spaces, give consultation services, etc. as well as comprehensive skills for woodworking, lighting, electricity, etc., and strengthens the capability of managing installation works, to create and offer the most appropriate spaces for customers.

1-5 ROE Analysis

| FY 3/14 | FY 3/15 | FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 | FY 3/21 | FY 3/22 |

ROE (%) | 4.6 | 3.7 | 5.6 | 6.0 | 4.2 | 3.5 | 1.5 | 5.1 | 0.3 |

Net income margin (%) | 4.14 | 3.33 | 4.77 | 4.84 | 2.89 | 2.23 | 0.89 | 3.29 | 0.19 |

Total asset turnover [times] | 0.93 | 0.91 | 0.95 | 0.88 | 0.91 | 0.94 | 0.96 | 0.90 | 1.01 |

Leverage [times] | 1.20 | 1.21 | 1.24 | 1.41 | 1.60 | 1.67 | 1.74 | 1.73 | 1.69 |

In the Medium-term Business Plan (2020-2022) 【D.C. 2022】 which was started this term, the goal is to achieve ROE of 9% in the term ending March 2023.

It is indispensable to take measures for improving profitability.

1-6 Characteristics and strengths

①Business Model Capable of Yielding Stable Earnings

Sangetsu is a pioneer in the realm of “fabless operation” with no in-house manufacturing facilities except for some parts and therefore has lower fixed expense burdens because they do not have to carry facilities for the manufacturing process. Besides, the company boasts of over 12,000 products, sourced from over 270 suppliers, supplied to several tens of thousands of customers, which diversifies risk in many ways. Moreover, while Sangetsu may be considered as an economically sensitive company as its business and earnings performances are closely linked to trends in the construction market, the company has never posted losses in consolidated financial statements since its founding.

②“Creating,” “Proposing,” “Providing”

“Creating”

While the actual manufacturing of products is little conducted in-house, Sangetsu performs the planning, design and development process internally. The company launched its original wallcoverings for the first time in 1965. Since the establishment of its fundamental values in 1973, Sangetsu has continuously made active investments for “creative designs,” one of the three principles of the company. 35 in-house designers develop new and original versions of products based upon numerous basic designs. The cultivation of designers responsible for various products is done through participation in foreign exhibitions, communication with sales staff, and discussions with outside design consultants as part of their on-the-job training. Furthermore, Sangetsu maintains a policy of actively taking the perceptions and opinions of younger designers and staff into consideration. Sangetsu also boasts of an overwhelming number of products of about 12,000 that far exceeds the number of products of its competitors. In addition, the company conducts revisions of its products on a regular basis every 2 to 3 years with more than 30 types of sample books, which surpass by far those of its competitors.

(Source: the company)

“Proposing”

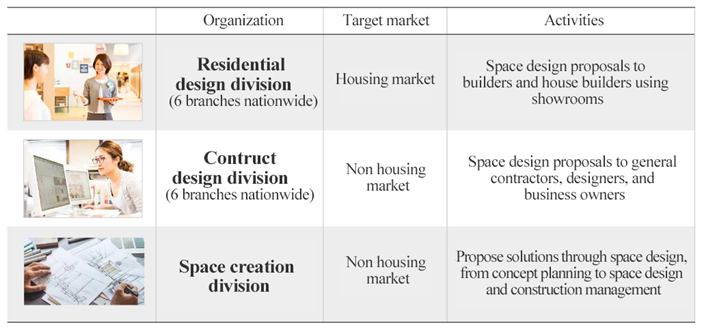

Nearly half of all employees or about 680 staffs work in sales functions at Sangetsu, the largest sales function within the industry. These sales staffs are assigned to 50 offices and 8 branches located throughout Japan and conduct proposal-based sales to clients. Sangetsu also staffs its 8 showrooms with about 110 employees. In addition, they have 30 “residential design staff members,” who propose space designs to clients in the housing market, 40 “contract design staff members,” who propose space designs to clients in the non-housing market, and 11 space creation design staff members, who give comprehensive proposals for design, installation, etc. mainly in the non-housing market.

|

|

(Source: the company)

“Providing”

As mentioned earlier in this report, Sangetsu normally maintains inventories of all of its products so that they can be provided on a “Just-in-Time” basis using their nationwide distribution network. However, the company is required to conduct speedy processing techniques as product orders are placed so that loss rates can be limited to avoid the maintenance of excess inventories and reduced efficiencies. Generally, wallcoverings are produced in rolls as long as 50 meters, and for example, Sangetsu cuts the rolls into a 30 meters and ships it when a 30 meters order is placed for shipment. The remaining segments of wallcoverings are then cut to match other orders to eliminate losses. This type of custom-made cutting technology has been cultivated over the long years of experience in the interior decorating business and is an important factor that differentiates Sangetsu from its competitors.

|

|

(Source: the company)

2. The Fiscal Year ended March 2022 Earnings Results

(1) Earnings Results

| FY 3/21 (not applied) | FY 3/22 (applied) | FY 3/22 (not applied) | YoY (1) | YoY (2) | Compared to forecast |

Net Sales | 145,316 | 149,481 | 158,827 | +2.9% | +9.3% | +1.8% |

Gross profit | 47,640 | 39,962 | 53,130 | -16.1% | +11.5% | -0.3% |

SG&A | 40,938 | 32,002 | 45,182 | -21.8% | +10.4% | -1.1% |

Operating Income | 6,701 | 7,959 | 7,948 | +18.8% | +18.6% | +4.6% |

Ordinary Income | 7,042 | 8,203 | 8,192 | +16.5% | +16.3% | +4.4% |

Net Income | 4,780 | 276 | 265 | -94.2% | -94.4% | -94.1% |

*Unit: million yen. The company has been applying the “Accounting Standard for Revenue Recognition,” etc. from the beginning of the first quarter of the fiscal year ended March 2022. It was not applied in the fiscal year ended March 2021. “Y/Y (1)” means the year-on-year rate of change from FY 3/21 to FY 3/22 (the revenue recognition standard is applied), which is calculated by Investment Bridge Co., Ltd. “Y/Y (2)” means the year-on-year rate of change from FY 3/21 to FY 3/22 (the revenue recognition standard is not applied).

Sales and Profit increase

Sales grew, as the company expanded a market share in the Interior Business thanks to the recovery of the housing market and the effects of new sample books and raised prices in September 2021. The sales in the Exterior, Space Creation, and Overseas segments, too, increased. Through the sales growth, gross profit rose, offsetting the augmentation of expenses for upgrading sample books in the Interior Segment, opening Shin-Kansai Logistics Center, and acquiring CREANATE Inc. as a consolidated subsidiary. On the other hand, net income dropped considerably, due to the posting of an impairment loss of 5.5 billion yen for the trademarks related to Koroseal.

On the other hand, net income declined sharply due to a 5.5 billion yen impairment loss on Koroseal’s trademark rights.

(2) Business Segment Trends

| FY 3/21 (not applied) | FY 3/22 (applied) | FY 3/22 (not applied) | YoY (1) | YoY(2) | Compared to forecast |

Net Sales |

|

|

|

|

|

|

Interior Segment | 111,794 | 123,042 | 122,895 | +10.1% | +9.9% | +1.6% |

Wallcovering Materials business | 55,814 | 62,337 | - | +11.7% | - | - |

Flooring Materials business | 41,271 | 44,881 | - | +8.7% | - | - |

Fabric Materials business | 7,816 | 8,612 | - | +10.2% | - | - |

Others | 6,892 | 7,210 | - | +4.6% | - | - |

Exterior Segment | 14,626 | 5,823 | 15,316 | -60.2% | +4.7% | +1.8% |

Overseas Segment | 15,034 | 15,930 | 15,930 | +6.0% | +6.0% | +3.1% |

Space Creation Segment | 5,239 | 6,579 | 6,579 | +25.6% | +25.6% | +7.9% |

Adjustments | -1,378 | -1,893 | -1,893 | - | - | - |

Total | 145,316 | 149,481 | 158,827 | +2.9% | +9.3% | +1.8% |

Operating Income |

|

|

|

|

|

|

Interior Segment | 7,082 | 9,097 | 9,086 | +28.5% | +28.3% | +8.8% |

Exterior Segment | 417 | 541 | 541 | +29.8% | +29.8% | +15.2% |

Overseas Segment | -985 | -1,821 | -1,821 | - | - | - |

Space Creation Segment | 201 | 139 | 139 | -30.8% | -30.8% | +99.6% |

Adjustments | -13 | 2 | 2 | - | - | - |

Total | 6,701 | 7,959 | 7,948 | +18.8% | +18.6% | +4.6% |

*Unit: million yen. The fabric materials category of sales includes both curtains and upholstery.

The company has been applying the “Accounting Standard for Revenue Recognition,” etc. from the beginning of the first quarter of the fiscal year ending March 2022. It was not applied in the second quarter of the fiscal year ended March 2021. “Y/Y (1)” means the year-on-year rate of change from 2Q of FY 3/21 to 2Q of FY 3/22 (the revenue recognition standard is applied), which is calculated by Investment Bridge Co., Ltd. “Y/Y (2)” means the year-on-year rate of change from 2Q of FY 3/21 to 2Q of FY 3/22 (the revenue recognition standard is not applied).

For the following contents about the growth of sales and profit in the fiscal year ended March 2022, the accounting standard for revenue recognition was not applied.

➀ Interior Segment

Sales and profit increased.

In the housing market, the performance of new construction kept growing year on year, and the performance of remodeling recovered significantly. In the non-housing market, the performance of new construction grew year on year for the first time since FY 2016, and renovation performed well in the second half mainly in the fields of restaurants and commerce.

Amid the firm environment, the company raised prices in September, in response to the increases in procurement costs due to the skyrocketing prices of raw materials and the expenses for distribution. They did not make a good start, but overall performance is in line with their assumption. There was last-minute demand before the second price hike in April 2022.

The sales quantities of wallcoverings, flooring materials, and fabrics increased, thanks to the release of new sample books and the strengthening of the marketing system tailored to the characteristics of regions, clients, and markets.

<Wallcoverings>

The recovery of housing starts in the housing market served as a tailwind, and the sample book for mass-produced wallcoverings “SP” drove sales. In the non-housing market, the sample book for wallcoverings “FAITH” performed well, and “Reatec,” a decorative film with an adhesive released in November 2021, contributed to sales, as its advanced design and “Basic Wood,” a newly released low-priced series, were highly evaluated. Although the delivery of some products was delayed due to the damage to the equipment of CREANATE Inc., which is a wallpaper maker, the last-minute demand before the price revision on April 1, 2022 contributed.

<Flooring materials>

As the recovery of the non-housing renovation market served as a tailwind, PVC sheets and carpet tiles for facilities drove sales and floor tiles that can be used broadly in the housing and non-housing markets kept performing well. In addition, “NT double eco,” an environmentally friendly carpet tile that contributes to the realization of a decarbonized society, was highly evaluated and adopted in the market. In January 2022, the company published “DT,” a sample book for carpet tiles with advanced designs. Like this, the company proceeded with strategic sales promotion and product development.

<Fabrics>

The performance of some products in the contract market was sluggish, but in the housing market, “Strings,” a sample book for high-end curtains, and “Simple Order,” a sample book for single-price curtains, drove sales. In addition, “UP,” a sample book for upholstery, performed well mainly in the non-housing market. In January 2022, the company published “RB Collection,” a sample book for mechanical window-related products, and enriched the lineup of mechanical products with an easy-to-understand sample book and prices. Sangetsu Vosne Corporation actively held a session for selling interiors and fixtures for condominiums and increased original products available only in EC sites, to strengthen the BtoC business. The company also upgraded the website for improving convenience and steadily implemented measures for reeling in customers.

<Other>

The sales of other services and products, including installation and adhesives, are included.

➁ Exterior Segment

Sales and profit grew.

As the new housing market recovered, the installation works of exteriors of housing increased, and the sales of fences, carports, etc. were favorable. In addition, there was last-minute demand before the price hikes of aluminum merchandise in April 2022, so sales grew. On the other hand, in the non-housing market, the number of properties recovered to some degree, but the number of large-scale properties declined. Under these circumstances, the company established an organizational structure for dealing with concept design and supervision of installation works in a new business domain, strengthened its system for installation, and expanded its business of planting and housing exterior finishing.

③ Overseas Segment

Sales grew, and loss augmented.

In the Overseas Segment, the results of group companies from January to December 2021 were taken into account in the results for the fiscal year ended March 2022.

In the North American market, sales kept declining year on year until the first quarter, but have been recovering from the second quarter, thanks to the gentle recovery of the construction market, the release of new design products, etc. However, the revenue earning condition was stringent, due to the turmoil in production caused by the shortage of manpower and the delay in price hikes, although the company revised prices three times in February, October, and December to cope with the skyrocketing of prices of raw materials and personnel expenses. Furthermore, the company decided to withdraw from less profitable products, such as handrails, in the Wall Protection Materials Business, wrote down inventory, and posted reserves for product warranties for some products.

Koroseal did not perform as expected, due to the rapid shrinkage of the market due to the spread of COVID-19 and the skyrocketing of prices of raw materials and personnel expenses, and it is not expected that the market will recover quickly. Accordingly, the company revised its business plan, and posted an impairment loss of 5.5 billion yen as extraordinary loss regarding the trademarks of the company.

In the Southeast Asian market, lockdowns were imposed in some countries in response to the spread of the variants of the novel coronavirus, and the market condition remained severe. While the hospitality market, which is a primary market, was shrinking due to the postponement of construction projects and the changes of plans, they cultivated emerging markets, such as healthcare and residential markets, and renovated showrooms in Singapore and Thailand (Bangkok), enhancing marketing activities. Considering the growth potential of the business, the company sold the shares of Goodrich Global Dubai, which was in charge of the Middle East market, to local partners, and withdrew, to concentrate on the strategic market.

In the Chinese and Hong Kong markets, strict measures, such as the restriction on travel of people for preventing the spread of COVID-19, were continued, but the constraints on the markets were weaker than those in other Asian countries, so the delivery of products to some large-scale properties and high-end housing progressed, and sales grew.

In October, the company merged Sangetsu (Shanghai) Corporation, which was a subsidiary of the company, and Goodrich Global China, which was a subsidiary of Goodrich Global Limited (in Hong Kong) and also a second-tier subsidiary of the company, into Sangetsu Goodrich China, and strived to streamline business operations and enhance earning capacities.

④ Space Creation Segment

Installation Department saw a temporary decrease of installation works due to the pre-emergency measures for preventing the spread of COVID-19, but the situation was favorable, due to the continuation of the gentle recovery of the construction market and the concentration of resumptions of works around the end of the fiscal year, in which demand is high. Accordingly, the business performed well.

In addition, through the collaborative marketing activities with Sangetsu, they made efforts to expand their business domain, including not only offices, which is a primary market, but also the large-scale repair of condominiums, and established a marketing management system focused on profitability.

HEKISO Co., Ltd., which was acquired as a subsidiary, started contributing to business performance in the second half.

Design Department, too, continued marketing while utilizing the customer base of the Interior Business, reeling in customers stably and cultivating new markets. In particular, from January 2022, the construction of properties acquired through their marketing so far was completed, so sales grew.

(3) Financial standing and cash flows

◎Main BS

| End of Mar. 21 | End of Mar.22 | Increase/Decrease |

| End of Mar. 21 | End of Mar.22 | Increase/Decrease |

Current Assets | 89,469 | 87,525 | -1,944 | Current Liabilities | 43,765 | 40,758 | -3,007 |

Cash, Equivalents | 25,719 | 18,347 | -7,372 | Payables | 26,626 | 26,551 | -75 |

Receivables | 44,983 | 49,882 | +4,899 | Short-Term Debt | 7,261 | 1,963 | -5,298 |

Marketable Securities | 300 | 300 | 0 | Noncurrent Liabilities | 21,151 | 18,857 | -2,294 |

Inventories | 17,109 | 17,722 | +613 | Long-Term Debt | 8,660 | 7,734 | -926 |

Noncurrent Assets | 69,196 | 60,417 | -8,779 | Total Liabilities | 64,916 | 59,616 | -5,300 |

Tangible Assets | 40,516 | 35,285 | -5,231 | Net Assets | 93,749 | 88,326 | -5,423 |

Intangible Assets | 10,030 | 4,058 | -5,972 | Retained earnings | 61,387 | 54,537 | -6,850 |

Investments, Others | 18,649 | 21,073 | +2,424 | Treasury Stock | -1,579 | -907 | +672 |

Total Assets | 158,665 | 147,943 | -10,722 | Total Liabilities, Net Assets | 158,665 | 147,943 | -10,722 |

|

|

|

| Capital Adequacy Ratio | 58.8% | 59.4% | +0.6pt |

*Unit: million yen.

*The provisional accounting treatment for business combinations was finalized in the fiscal year ended March 2022, and the respective figures as of March 2021 reflect the details of the finalization of the provisional accounting treatment.

Total assets dropped 10.7 billion yen from the end of the previous term, due to the decreases in cash & deposits, intangible assets, etc.

Total liabilities declined 5.3 billion yen, as debts decreased.

Net assets decreased 5.4 billion yen, due to the drop in retained earnings. As a result, capital-to-asset rose 0.6 points from the end of the previous term to 59.4%. Long- and short-term debt decreased 6.2 billion yen YoY to 9.6 billion yen.

◎Cash Flow

| FY3/21 | FY3/22 | Increase/Decrease |

Operating CF | 9,694 | 5,718 | -3,976 |

Investing CF | -2,599 | -827 | +1,772 |

Free CF | 7,095 | 4,891 | -2,204 |

Financing CF | -11,836 | -13,341 | -1,505 |

Cash and Equivalents | 25,124 | 16,886 | -8,238 |

*Unit: million yen.

Decrease in income before taxes and increase in trade receivables reduced positive operating CF and free CF.

Cash position declined.

◎Cash Conversion Cycle(CCC)

Due to the increase in accounts receivable, CCC rose 7.6 days from the end of the previous term.

3. Fiscal Year ending March 2023 Earnings Forecasts

(1) Earnings Forecasts

| FY3/22 | Composition ratio | FY3/23(Est.) | Composition ratio | YoY |

Net Sales | 149,481 | 100.0% | 159,000 | 100.0% | +6.4% |

Gross profit | 39,962 | 26.7% | 44,500 | 28.0% | +11.4% |

SG&A | 32,002 | 21.4% | 34,500 | 21.7% | +7.8% |

Operating Income | 7,959 | 5.3% | 10,000 | 6.3% | +25.6% |

Ordinary Income | 8,203 | 5.5% | 10,700 | 6.7% | +30.4% |

Net Income | 276 | 0.2% | 7,000 | 4.4% | +2,431.1% |

*Unit: million yen. The company has been applying the “Accounting Standard for Revenue Recognition,” etc.

Forecast Sales and Profit Increase

In the fiscal year ending March 2023, sales are projected to grow 6.4% year on year to 159 billion yen and operating income is expected to increase 25.6% year on year to 10 billion yen. Sales are forecast to grow in all segments. Gross profit, too, is expected to grow. Due to the price hikes, gross profit margin is projected to rise. The company plans to pay a dividend of 71.00 yen/share, up 1.00 yen/share from the previous term. The expected payout ratio is 59.5%. This term, too, the company was planning to revise the prices of their products as the prices of raw materials, including vinyl chloride, plasticizers, and nylon, were rising, and announced price hikes on June 17, 2022. The prices of wallcoverings, flooring materials, and upholstery will be raised. The company will raise the prices of products ordered from October 1, 2022 by 7-12%. Its impact on the performance in the second half is still unknown.

(2) Business Segment Trends

| FY3/22 | FY3/23(Est.) | YoY |

Net Sales |

|

|

|

Interior Segment | 123,042 | 129,000 | +4.8% |

Exterior Segment | 5,823 | 6,000 | +3.0% |

Overseas Segment | 15,930 | 19,000 | +19.3% |

Space Creation Segment | 6,579 | 7,000 | +6.4% |

Adjustment | -1,893 | -2,000 | - |

Total | 149,481 | 159,000 | +6.4% |

Operating Income |

|

|

|

Interior Segment | 9,097 | 11,000 | +20.9% |

Exterior Segment | 541 | 500 | -7.6% |

Overseas Segment | -1,821 | -1,700 | - |

Space Creation Segment | 139 | 200 | +43.1% |

Adjustment | 2 | - | - |

Total | 7,959 | 10,000 | +25.6% |

*Unit: million yen.

* Interior Segment

The domestic housing market is expected to be unchanged, and the non-housing new construction market will be still in the transitional period.

The non-housing renovation market is forecast to keep recovering.

The second price hike conducted on April 1, 2022 is progressing as planned.

Since the procurement cost will augment inevitably this term, the company decided to raise the prices of wallcoverings, flooring materials, and upholstery by 7-12% from the orders placed on October 1, 2022.

* Exterior Segment and Space Creation Segment

The performance in the entire exterior market is expected to be unchanged, but the Space Creation Segment is projected to grow.

* Overseas Segment

In the U.S. market, the shipment of products will be slow from January to March. The recovery of the non-housing construction market will be sluggish, and the hospitality market, including hotels and inns, is forecast to be stagnant.

The Southeast Asian market will recover gradually.

The Chinese and Hong Kong markets will be strongly affected by the lockdown imposed in Shanghai in March.

4. Progress of Medium-term Management Plan

Their understanding of the environment and corresponding measures are as follows.

| Understanding of the environment | Measures |

1 | In addition to tightened supply of raw materials such as vinyl chloride and nylon, the restriction on supply of interior materials for some products has become apparent. | Establishing an integrated system for producing and selling a few kinds of products in large lots |

2 | Response to the problem with the logistics industry in 2024, and delivery capabilities | Drastically reforming the logistics system and improving the service level |

3 | Validation of functions and services relating to designs | Strengthening and upgrading design capabilities of products, space, and experience (proposal) |

4 | Significance of construction capabilities | Construction systems including constructions by prime contractors, subcontractors and second-tier subcontractors |

5 | The limit of the capacity of the Japanese market | Improving profitability of the overseas segment |

(1) Establishing an integrated system for producing and selling a few kinds of products in large lots

The company made CREANATE Inc., Japan’s largest manufacturer of vinyl wallcoverings (former Wavelock Interior Co., Ltd.), its wholly owned subsidiary in May 2022.

The area of mass-produced wallcoverings has been steadily expanding its market scale because of the increasing price consciousness, however, the number of manufacturers that can respond from the price aspect has been declining, which assisted the market share of CREANATE in rising from 11% to 20% in 10 years, leaving the 2nd place far behind.

Sangetsu was able to establish an integrated system for producing and selling a few kinds of products in large lots, by acquiring CREANATE.

The company established a strong dominance in the area of mass-produced wallcoverings, on which the company focuses.

(2) Drastically reforming the logistics system and improving the service level

In accordance with the Work-style Reform Related Act, the “upper limit of overtime hours for vehicle driving businesses” will become effective on April 1, 2024, which will demand that the logistics industry be ultra-efficient with reduced time commitment for drivers, extended lead time, earlier work cutoff time, etc.

The company is establishing its own efficient logistics system and carrying out the enhancement and upgrade of its services and functions.

Based on two flagship logistics centers in northern Kanto and Kansai, the company has local logistics centers and satellite centers across Japan. The development of major footholds was completed for the moment with the launch of Shin-Kansai LC, and now the company seeks to improve its service functions based on their 2 flagship logistics centers.

To establish a working environment, the company has been establishing a meticulous delivery system tailored to the characteristics of each region, while avoiding long-distance and long-hour transportation, and achieving the next-day delivery to anywhere in Japan.

(Source: The company)

(3) Strengthening and upgrading design capabilities of products, space, and experiences (proposed)

The collection of wallcoverings and flooring materials “KAGETOHIKARI” developed in collaboration with the architect Kengo Kuma received the “iF DESIGN AWARD 2022,” for the second consecutive year, following “SHITURAHI” in 2021.

The iF DESIGN AWARD is organized by the iF International Forum Design in Germany. The award has a history dating back to 1954, and is one of the most recognized design awards in the world.

The company has been working on strengthening space design capabilities for each market.

They have been implementing reforms to shift from a system based on division of labor, questionnaire surveys, and support activities with its sales department as a point of contact to a system based on design sales in line with strategic points for each market sector, industry and opportunity.

The enhancement of human resources has been advancing. Compared to 3 years ago, the number of residential design sales staff members increased from 5 to 30, the number of contract design staff members increased from 32 to 40, and the number of space creation designers increased from none to 11.

(Source: The company)

For the establishment of Kansai branch center office in December 2021, Sangetsu’s Space Creation Division and the space creation business headquarter of Sungreen Co., Ltd. took charge of space design, and Fairtone Co., Ltd. conducted overall interior finishing work.

Handling “space design” and “overall interior finishing work” with the group’s overall strength, the office has been embodying a space creation company.

By introducing this office, they are strongly advertising the group’s space design capabilities toward their customers.

(4) Construction systems including constructions by prime contractors, subcontractors and second-tier subcontractors

The company has a diverse range of customers such as business owners for prime contract construction, general contractors for sub-contract construction, and interior finishing companies for sub-subcontract construction, etc., however, the company provides a variety of work systems for all kinds of construction, by combining the architecture departments of all Sangetsu branches, the Space Creation Division, Fairtone, their invested construction companies, etc.

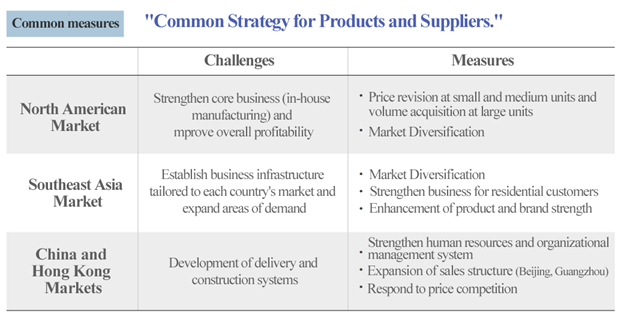

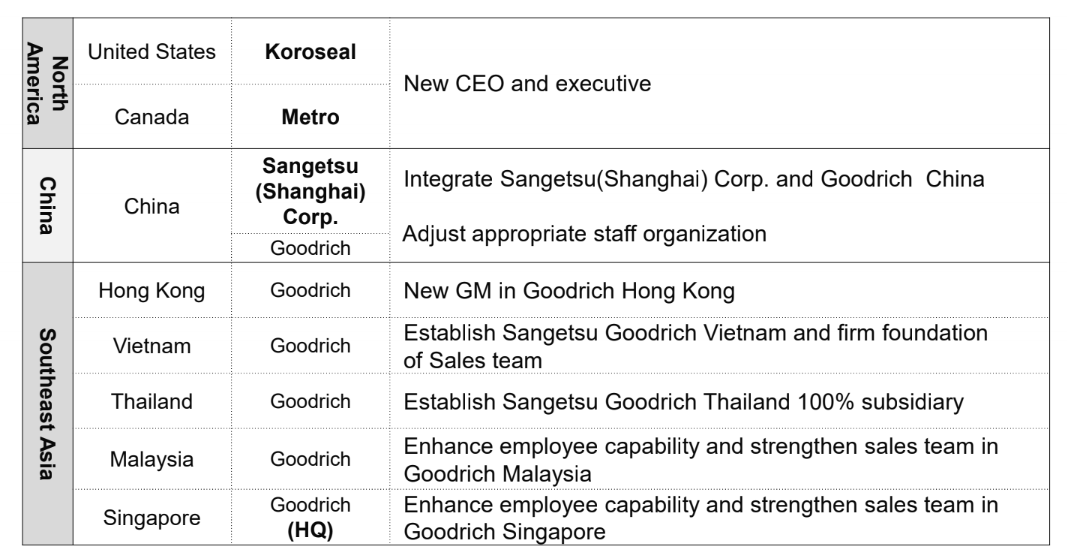

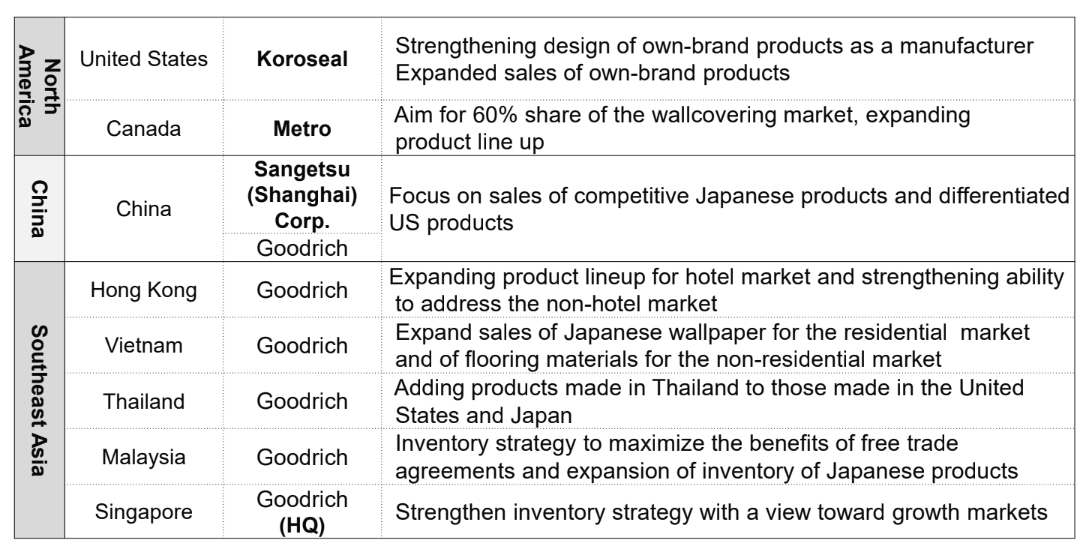

(5) Improving profitability of the overseas segment

The gross profit margin of Sangetsu alone in the previous term without applying the Revenue Recognition Standard, etc. was 35.1%, the highest in the company’s history, however, it is essential for the company to expand their overseas segment and improve profitability, for their sustainable growth.

The company recognizes the challenges for each market as described below, and they will focus their efforts on improving profitability by executing all of these measures.

They aim to implement the “common strategies for products and suppliers” utilizing the group capabilities.

(Source: The company)

5. Interview with President Yasuda

Q: Could you provide a self-evaluation of the financial results for the fiscal year ended March 31, 2022?

In domestic business, we were able to fully demonstrate our strengths.

We were able to increase our market share in each of our product categories, and our operating income grew with each passing fiscal year. The Japanese market is at its peak during the January-March period, but even if we exclude that period, the operating income for the fourth quarter of the previous fiscal year was 3,058 million yen, the highest quarterly level ever.

This was largely due to the fact that the price increase implemented in September 2021 penetrated the market from January, and that the new sample book published in FY 2021 was well received by customers.

The price increase not only reflected the rise in the cost of raw materials in selling prices, but also improved our profitability.

We were also concerned about a loss of market share due to the price increase, but there was no significant impact.

We believe this is the result of our customers' appreciation of our non-price competitiveness, which goes beyond price alone, in areas such as design, coordination proposals, and logistics.

On the other hand, our overseas business suffered an increasing loss for the period, and Koroseal recorded a large impairment loss. We are taking this matter very seriously.

The market environment in the U.S. remains challenging, but we believe that we need to focus on strengthening our business foundation.

Q: Could you comment on the progress of the medium-term management plan?

(1) Establishing an integrated system for producing and selling a few kinds of products in large lots.

With the tightening of the supply of mass-produced wallpaper becoming apparent, it is very important that we were able to acquire CREANATE Inc. Originally, the majority of CREANATE's shipments were to Sangetsu, so it was not simply a matter of dispelling supply concerns. The company has developed a wide range of know-how in the manufacturing of wallpaper, so we are now able to take the initiative in terms of supply. We believe that this will be a major asset from a mid- to long-term perspective.

(2) Drastically reforming the logistics system and improving the service level

Going forward, we will have to streamline logistics to improve our service level, while improving the working styles of drivers.

To do so, we need to build an efficient logistics system of our own, rather than outsourcing it to outside companies such as 3PL.

Centered on two flagship logistics centers in the northern Kanto and Kansai regions, we have established regional logistics centers and satellite centers throughout Japan. In addition, we have developed a delivery system tailored to the characteristics of each region, enabling next-day delivery anywhere in Japan.

Moving forward, we will build more fine-tuned logistics systems in places such as Ishikawa and Toyama in the Hokuriku region, Tokushima and Kochi in the Shikoku region, and Hiroshima in the Chugoku region.

We will also strengthen our sales support function by having our drivers not only deliver products, but also understand customer circumstances and deliver sample books, for example.

(3) Strengthening and upgrading design capabilities of products, space, and experience (proposal)

For example, we are finding that when our sales representatives accompany designers from the Residential Design and Contract Design Offices to interior designers and general contractors' design departments to propose space designs, an unprecedented business flow ensues, whereby customers listen with interest, resulting in the adoption of our products.

Over the past two to three years, I have come to believe that our design capabilities are becoming a powerful asset that will secure customers.

(4) Construction systems including constructions by prime contractors, subcontractors and second-tier subcontractors

There are various forms of construction work, and we are able to handle a large number of construction projects with flexibility due to the resources provided by the Sangetsu Construction Department, Fairtone, and construction companies in which we invest.

It is an important point in our business that we are able to maintain and develop relationships with our customers based not only on the purchase of our products, but on the services we provide, such as our installation services.

(5) Improving profitability of the overseas segment

The North American, Southeast Asian, Chinese and Hong Kong markets have different standards, designs, and materials for wallpaper. So, depending on the characteristics of each region, we use different types of wallpaper in Japan, the U.S., and China.

We therefore believe that we can improve profitability by strengthening joint strategies, such as developing products for Southeast Asia in Japan and manufacturing wallpaper for China at Koroseal, rather than handling the same products globally.

6. Conclusions

In the fourth quarter of the fiscal year ended March 2022, due to the penetration of the price revision in September 2021, profit exceeded the forecast. We would like to check whether such favorable performance has been continued this term, by seeing the financial results for the first quarter. The company announced the second price hike from the orders on October 1, 2022. According to the earnings forecast announced in May, profit in the second half is conservatively projected to decline from the second half of the previous year and from the first half, but it is noteworthy how much they will increase profit through the price hike.

From the medium-term viewpoint, we would like to expect the speed of recovery of the Overseas Business, mainly in the North American market.

<Reference1: Long-term Vison of Sangetsu Group 【DESIGN 2030】 and Medium-term Business Plan (2020-2022) 【D.C. 2022】>

Long-term Vison of Sangetsu Group 【DESIGN 2030】

From 2014, when Mr. Yasuda, who is not from the founding family for the first time, was appointed as president, President Yasuda has made various reforms to the management structure, governance structure, the way of working, communication with the outside, etc. and as a result, the company has transformed and profoundly changed.

However, as for businesses per se, the business model of selling interior materials has not changed, and the company recognizes the need to reform this business model itself.

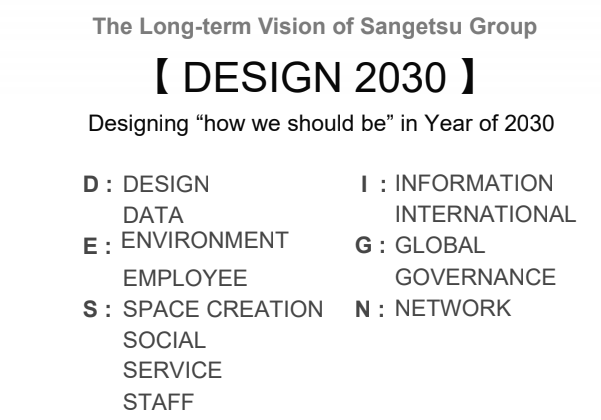

In order to do this, the company made its vision clear and recognizes the need to continue to steadily implement different strategies while keeping in mind its future goals, thus set Long-term Vison of Sangetsu Group【DESIGN 2030】.

【DESIGN 2030】stands for designing the ideal state of the company in 2030.

The respective letters of “DESIGN” represent the initials of various policies the company aims to follow.

(Source: The company)

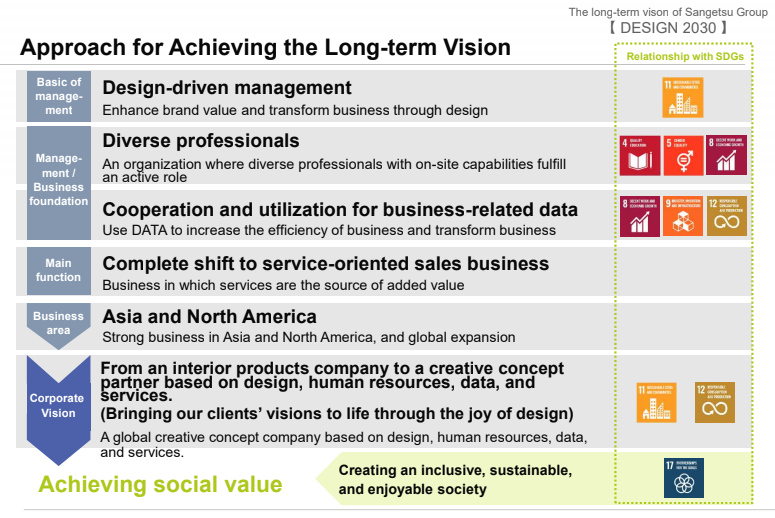

(1) Goal: “Space Creation Company”

Based on the company’s expertise in design, sales, and distribution of its current things and products, it will conceptualize and design new spaces, develop its ability to make proposals, and aim to be a company that creates new spaces.

(2) Steps for the long-term vision

To achieve the long-term vision, the company will set the basic management policy as “design-driven management” and aim to improve its brand value and transform its business with designs. Further, it will recognize “diverse professionals” and “cooperation and utilization for business-related data” as the business and management base in order to be “an organization where diverse professionals with on-site capabilities fulfill” and also “use DATA to increase the efficiency of business and transform business.”

As for the main functions, the company aims to make a complete about-face from the function of selling items to the function of selling services.

Moreover, the business area will be the Pacific Rim region primarily in North America, Japan, China, and Southeast Asia.

Thanks to this approach, the business will shift directions to a “Space Creation Company” while working towards creating social value.

(Source: The company)

(3) Design-driven management

The concept of Design-driven management is as below.

“Sangetsu Group will aim to increase the value we can provide through designing to transform our business.

Not only pursuing the beauty, function and coordination of products and spaces themselves, we will conceptualize, design and propose the interaction of people and space by considering the way people spend time, live, experience and act.

In addition to designing entities and space, we will increase our brand value by designing and proposing experiences, and will aim to transform, from the company that sells things, into the company that creates spaces, and proposes and realizes matters.”

(4) Social value for which the company strives

The company sets its goals for social values as “contributing to achieving an inclusive, sustainable, and enjoyable society.” Moreover, it sets SDGs for each of the “Inclusive,” “Sustainable,” and “Enjoyable.”

An equal and healthy inclusive society

Sangetsu Group will contribute to realize an equal, healthy and inclusive society, where diversity of gender will be respected, through creation of healthy and comfortable spaces. |

|

The global environmental protection with sustainable society

Sangetsu Group will minimize our environmental footprint of the supply chain as a whole and will contribute to realize a sustainable society that will protect the global environment, through creation of spaces usable for the long term and utilization of stock buildings. |

|

A more affluent and enjoyable society

Sangetsu Group will contribute to realize a more enjoyable society by promoting equal, safe, reassuring and efficient ways of working which respect human rights, through creation of spaces appropriate to various cultures and living. |

|

Regarding the third aspect: “enjoyable,” based on the basic concept of SDGs: “to not leave anyone behind,” the company considered its businesses and took one step further setting realizing more prosperous and more enjoyable society as one of the social values it will provide.

(5) Numerical targets

For the term ending March 2030, 10 years from now, the company aims to achieve “net sales of 225 billion yen and operating income of 18.5 billion yen.”

Without application of the "Accounting Standard for Revenue Recognition" and others

Medium-term Business Plan (2020-2022) 【D.C. 2022】

The 3-year Medium-term Business Plan, 【 Design & Creation D.C. 2022 】 is the first step towards achieving this long-term vision.

The following descriptions of actual results and numerical targets are for the case where the revenue recognition standard is not applied.

(1) Review of the previous Medium-term Business Plan “PLG2019”:

In the final term ended March 2020, net sales marked a record high at 161,200 million yen, and operating income increased 57.2% year-on-year to 9,260 million yen, indicating a significant increase in profit. On the other hand, consolidated net income decreased 60% year-on-year to 1,430 million yen due to the posting of impairment losses for the Overseas Segment. ROIC improved thanks to CCC improvement and the increase in operating income, however, ROE declined. |

The policies set in the previous medium-term business plan, including “strengthening the product procurement, sales, logistics, etc.,” “operating overseas businesses,” “personnel-related policies,” and “ESG policies,” have been steadily implemented. |

Below is an overview of each segment.

* Interior Segment Wallcoverings, residential and commercial floorings, and low-price version curtains have increased their market shares thanks to the improvement of sample books, the cementing of cooperation with agents, and the strengthening of order receipt, shipping, and delivery services. The market share of flooring for non-residential purposes, Rear tech, and glass films was unchanged or shrank due to insufficient implementation of specification-based sales activities for the region, the market, and the product management organization. As such, improvement is required. The enormous data about the market, customers, products, shipping, and delivery are not being fully utilized.

* Exterior Segment In FY 3/2017, sales increased 1.3 billion yen. However, the company is facing issues with the quantitative and qualitative deficiency of installation and delivery capabilities, limitations on the business domain, and lack of presence in the Tokyo Metropolitan area.

* Overseas Segment The management system, business model, and brand in each market in each country are vulnerable, especially with the stagnation of Koroseal Interior Products Holdings, Inc. Expanding the Overseas Segment and improving its profitability are important issues for the company.

* Space Creation Segment A new segment added in the term ending March 2021. Fairtone Co., Ltd., which was acquired in January 2017, has been working on expanding the business in the Kansai and Kanto regions, cooperating with Sangetsu’s construction department in the Chubu region, employing designers, and strengthening its general construction capabilities. In April 2019, the company established the Sangetsu Space Creation Division. It has just gotten off the ground and it is necessary to strengthen their expertise and expand its profoundness. |

The business base, business capabilities, and functions were established, strengthened, and enriched. However, the increase in operating income during the period of the previous medium-term business plan was primarily owing to price revisions in the Japanese market while the volume expansion was limited. The policies’ effects are halfway through. The company needs to thoroughly implement the existing policies, utilize data and expand the business to cover wider business categories. |

ESG-related KPIs are steadily improving, as the company achieved the target rate of reduction of greenhouse gas emissions (35%), decreased employees’ turnover rate (within their first 3 years), increased the percentage of female managers and the number of working mothers, implemented health-oriented management policies, improved the ESG evaluation rating, and promoted the employment of disabled workers. |

The target term-end equity capital was unachieved due to the posting of impairment losses. On the other hand, the 3-year total return amount was 24.8 billion yen and total return ratio was 260.5%. The company acquired over 6 million treasury shares during the fiscal period and retired all of the treasury shares. |

*The achievement of quantitative goals

| Mid-term goals in fiscal 2019 | Results in 2019 | Overview |

Net Sales | 165 billion yen | 161.26 billion yen | Slightly smaller than the goal, but marked a record high |

Net income | 8-10 billion yen | 1.43 billion yen | Posted the impairment loss related to Koroseal in the U.S. |

ROE | 8-10% | 1.5% | Financial leverage and asset turnover improved, but net income declined |

CCC | 75-60 days | 72.4 days | The company shortened accounts receivable turnover period and lengthened accounts payable turnover period and inventory turnover period |

ROIC | - | 7.9% | Exceeded the value in fiscal 2016: 7.2%. |

EBITDA | - | 13.49 billion yen | Exceeded the value in fiscal 2016: 11.2 billion yen. |

Capital policy |

|

|

|

Equity capital | 100-105 billion yen | 93.24 billion yen | Decreased from 110.37 billion yen at the end of the term ended March 2017 |

Investment for growth | 10-25 billion yen | 6.2 billion yen | The goal was not achieved. M&A projects not completed. |

Return to shareholders | 25-33 billion yen | 24.8 billion yen | Almost as planned |

Term-End Cash, Equivalents | 25-30 billion yen | 36.8 billion yen | The investment for growth was not conducted, so the cash exceeded the estimate. |

(2) Outline of the Medium-term Business Plan (2020-2022) 【D.C. 2022】

①Positioning and basic policies

【D.C. 2022】 is the medium-term business plan for 3 years and serves as the first step of the long-term vision 【DESIGN 2030】.

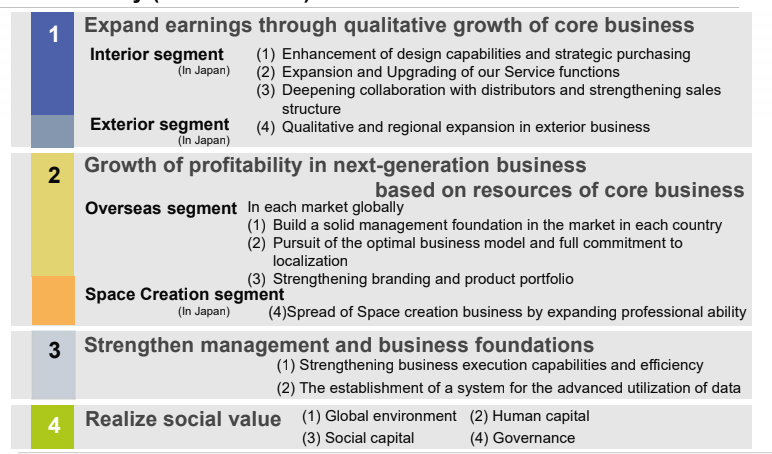

In the 3 years, the company aims to become a Space Creation Company. Its four basic policies are “expand earnings through qualitative growth of core business,” “growth of profitability in next-generation businesses based on resources of the core businesses,” “strengthen management and business foundations,” and “achieving social value.” The company aims to grow by “expanding the revenue from the core business” and “making next-generation businesses profitable.”

Basic policy

(Source: The company)

②Numerical goals of sales and profit *Without application of the "Accounting Standard for Revenue Recognition" and others

They aim to achieve “net sales of 172 billion yen and operating income of 12 billion yen in the term ending March 2023.”

As for segments, the Interior Segment will be dominant in terms of value, but the key points are the bottoming-out and recovery of Overseas Segment and the launch of the new segment: the Space Creation Segment.

| FY 3/20 | FY 3/23 | CAGR |

Net Sales | 1,612.6 | 1,720.0 | +2.2% |

Interior | 1,220.9 | 1,270.0 | +1.3% |

Exterior | 160.8 | 170.0 | +1.9% |

Overseas | 198.0 | 210.0 | +2.0% |

Space Creation | 41.6 | 70.0 | +19.0% |

Operating Income | 92.6 | 120.0 | +9.0% |

Interior | 93.2 | 105.0 | +4.3% |

Exterior | 6.4 | 8.0 | +7.7% |

Overseas | -9.3 | 4.0 | Return to Profitability |

Space Creation | 1.8 | 3.0 | +4.9% |

*Unit: 100 million yen. CAGR was calculated by Investment Bridge.

③Outline of each basic policy

③-1 Expand earnings through qualitative growth of core business

◎Interior Segment

*Market environment

The residential market (new construction and renovation) and the non-residential market (new construction) are on a plateau as a whole, and their quantitative growth cannot be expected, but the market of renewal of non-residential facilities is expected to expand due to the increase of real estate in stock.

*Basic strategies in 4 markets

Market | Basic strategy | Intensive measures |

Residential: new construction | While sales quantity is dropping, the company aims to expand gross profit by raising profit rate. | Deepening collaboration with distributors Developing a sample book for strong-selling products Advancing and expanding of ordering, shipping, and delivery services Strengthening product design capabilities Strengthening strategic purchasing |

Residential: renewal | The company aims to improve its market share and profit rate. | Deepening collaboration with distributors Strengthening space design Advancing and expanding ordering, shipping, and delivery services |

Non-residential: new construction | The company aims to improve its market share and profit. | Strategic allocation of management resources Developmental enhancement of design capabilities Strengthening strategic purchasing |

Non-residential: renewal | The company will improve profit rate by releasing high priced products, while aiming to increase sales quantity. | Strategic allocation of management resources Strengthening design capabilities for experiences |

*Three measures

(1) Enhancement of design capabilities and strategic purchasing

◎Advancing and strengthening design capabilities

In addition to strengthening the capability of designing products, the company will improve the capabilities of designing spaces and services.

Through the mutual interaction among the three designing capabilities, the company will enhance the comprehensive designing capability step by step.

As for designs, the company has proposed product designs in the merchandise development section of each business department, non-housing space designs in the contract design division, coordination mainly related to housing in showrooms, and a variety of space designs in the Space Creation Division. Fairtone, too, recruited designers, to increase construction works with good designs.

The sales section, too, has discussions with design firms, designers, and interior coordinators about designs, and gleans information.

Like this, respective sections of the company recognize design as an important issue, and will strive to improve the designing capability in multiple manners. As the base of their efforts, the company will clarify company-wide design strategies and set them while taking into account designs, functions, and costs demanded by the market, to improve the entire designing capability step by step.

◎Strategic purchasing

The product lineup is composed of a wide array of products whose quantities, designs, and transaction lots vary.

Of these, for products that have plentiful designs and products that are traded in small lots, it is important to emphasize the diversity of designs, diversify suppliers, and receive proposals for designs from various suppliers.

For products, whose designs and diversity are limited and that are traded in large lots, it is considered essential to enhance cost competitiveness and cement the alliances with specific manufacturers and suppliers. So, the company will clarify procurement policies and promote strategic procurement according to the characteristics and situations of products.

(2) Expansion and Upgrading of our Service functions

The company’s processes for receiving orders, shipping and delivering products are as follows:

Order taking (from interior installation tradesmen via distributors) → Shipping (to distributors) → Delivery (to construction sites from distributors or directly from the company)

The lead time from receipt of orders to shipping is usually 2 to 4 hours, during which products are prepared and shipped in units of 10 cm or a few sheets.

Based on this shipping, the company performs quick delivery to interior installation tradesmen and clients within the day of ordering or the following day.

Meanwhile, it takes several weeks or months for a manufacturer (supplier) to produce products after receiving an order from the company.

Under these circumstances, it is important to offer services of receiving orders and shipping and delivering products promptly, but the amount of work of interior installation tradesmen, which are clients, varies considerably from season to season about installation, and the work of interior finishing firms sometimes becomes excessive or insufficient.

When their schedules are tight, they call for support for construction, and in response to such demand, distributors or the company often support construction directly. This is considered as an important function.

While considering that the company’s services and businesses can be strengthened by enriching and improving comprehensive services of receiving orders, storing, shipping, and delivering products, and installing them amid the shortage of manpower, it is necessary to implement measures during the period of this medium-term business plan as well.

(Order taking)

The rate of employees’ involvement in receiving orders dropped considerably from 78.7% through the adoption of business process outsourcing (BPO) during the period of the previous medium-term business plan, and further declined to 13.3%, and BPO ratio decreased to 46.4%, due to the expansion of the ratio of order receipt with EDI and online order receipt.

During the period of the ongoing medium-term business plan, the company will raise the ratio of online order receipt from 40.3% to 62% and decrease BPO ratio and employees’ involvement ratio to 32% and 6%, respectively. The company is also thinking of utilizing AI.

(Shipping)

During the period of the previous medium-term business plan, the company renewed, newly established, and integrated shipping equipment nationwide.

The new Kansai Logistics Center (LC) started operation in January 2021. The company has installed unprecedented unmanned and labor-saving equipment. In order to secure the sustainability for inventory and shipping, the company plans to install labor-saving equipment in the Tokyo Metropolitan Area and the Chubu Area.

(Delivery)

During the period of the previous medium-term business plan, the company established delivery systems mainly in the Tohoku region. The company will upgrade local delivery systems in northern Kanto, Shizuoka, Hokuriku, Kansai and Kyushu regions, and develop systems for delivering heavy items mainly in metropolitan areas.

(Construction)

In Fairtone, about 650 engineers are engaged in installation work. In addition, combined with the engineers entrusted by Sangetsu, partner firms, etc., the company has about 1,000 interior finishing engineers at the moment.

During the period of the ongoing medium-term business plan, the company will strengthen and upgrade the interior finishing capability, improve comprehensive skills, and enrich the network for interior finishing.

(3) Deepening collaboration with distributors and strengthening sales structure

The ratio of sale via distributors rose from 57.7% in the term ended March 2016 to 67.2% in the term ended March 2021.

Since it is important to cement the cooperation with distributors, in order to streamline business operations and expand sales quantity, the company plans to strengthen the cooperation with distributors quantitatively and qualitatively, and increase the ratio of volume of sales via distributors to 70% in the term ending March 2023, which is the final year of the plan.

Furthermore, the company will aim to streamline operations and divide labor by sharing and utilizing information and data.

As for the selling system, which needs to be improved, the company will allocate employees mainly to activities related to specifications in the non-residential market, without changing the current number of sales staff members: 850 to 890, to improve the competitiveness of specifications in the non-residential market.

The company will also strive to enhance sales while utilizing the designing capability.

The contract design division, which is in charge of marketing designs targeted at non-residential clients, proposes space designs and custom-made designs mainly for non-residential facilities, while the show room, which is a foothold for marketing designs targeted at builders, residential manufacturers, and remodeling contractors, concentrates on the proposals for design coordination mainly for housing.

◎Exterior Segment