Bridge Report:(8860)Fuji Corporation Fiscal Year March 2019

President Nobutsuna Miyawaki | Fuji Corporation Ltd. (8860) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Real Estate |

President and Representative Director | Nobutsuna Miyawaki |

HQ Address | 1-4-23 Habucho, Kishiwada-shi, Osaka |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Share Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥716 | 35,288,472 shares | ¥25,267 million | 11.9% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥27.00 | 3.77% | ¥93.51 | 7.66 x | ¥1,068.69 | 0.67 x |

*The share price is the closing price on June 21, 2019. The number of shares issued at the end of the most recent quarter excluding treasury shares.

*ROE and BPS are based on FY 3/19 earnings results; EPS is based on FY 3/20 earnings estimates. Figures are rounded to the nearest decimal point.

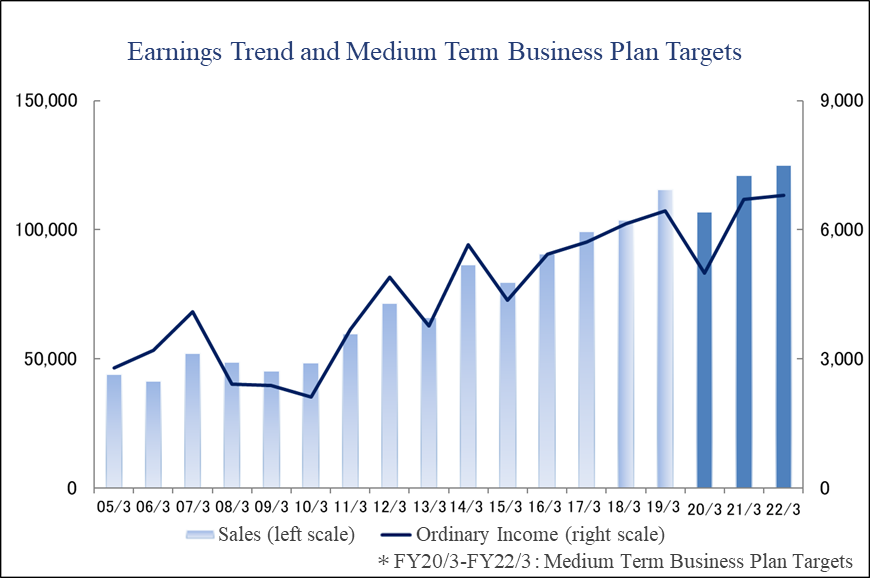

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2016 | 90,726 | 5,441 | 5,298 | 3,430 | 95.18 | 26.00 |

March 2017 | 99,359 | 5,969 | 5,721 | 3,945 | 110.06 | 26.00 |

March 2018 | 103,880 | 6,438 | 6,139 | 4,168 | 116.08 | 27.00 |

March 2019 | 115,710 | 6,636 | 6,445 | 4,298 | 120.40 | 27.00 |

March 2020 Est. | 107,000 | 5,300 | 5,000 | 3,300 | 93.51 | 27.00 |

* Units: ¥mn

*Forecasts are those of the company.

This Bridge Report provides information about Fiscal Year March 2019 earnings results and other details of Fuji Corporation Ltd.

Table of Contents

Key Points

1. Company Overview

2. New Mid-term profit plan (FY 3/2020 to FY 3/2022)

3. Fiscal Year March 2019 Earnings Results

4. Fiscal Year March 2020 Earnings Estimates

5. Future Highlight Points

<Reference: Corporate Governance>

Key Points

- For the fiscal year March 2019, sales and ordinary income grew 11.4% and 5.0%, respectively, year on year. Sales rose in the residential properties for sales business, in which free-designed homes increased, the housing distribution business, in which used houses increased, the effective land utilization business, in which rental apartments for sale to individual investors, etc. increased, the property leasing and management business, in which the revenue from rents, etc. increased, and so on. Profit grew in the businesses of residential properties for sales, housing distribution, property leasing and management, etc. for which sales growth contributed, while the profit from the effective land utilization business declined as a reaction to the delivery of large rental apartments for individual investors in the same period of the previous year. The amount of order contracts, which indicates the actual sales conditions, increased 8.9% year on year, thanks to the increase of orders for used houses in the housing distribution business and orders for affordable rental apartments for seniors with nursing-care services in the effective land utilization business.

- For the fiscal year March 2020, the company estimates that sales and ordinary income will decline 7.5% and 22.4%, respectively, year on year. The forecast is conservative, because the term is the transitional period for the supply of condominiums and there are some negative factors, such as the increase in land price, the skyrocketing of construction prices, and the consumption tax hike. The annual dividend amount is estimated to be 27 yen/share (an interim dividend of 14 yen/share and a term-end dividend of 13 yen/share), unchanged from the previous term.

- Sales and profits reached the goals of the mid-term plan, whose final fiscal year is the fiscal year March 2019. Sales and profit will inevitably decline because the fiscal year March 2020 is the transitional period for the supply of condominiums, but the company will establish a bridgehead for achieving the goals for the final fiscal year of the new mid-term plan. For achieving the mid-term goals, the company will implement measures for “increasing the number of condominiums supplied,” “concentrating on more profitable areas,” and “raising recurring revenue.” We will pay attention to how their intensive measures will bear fruit.

1. Company Overview

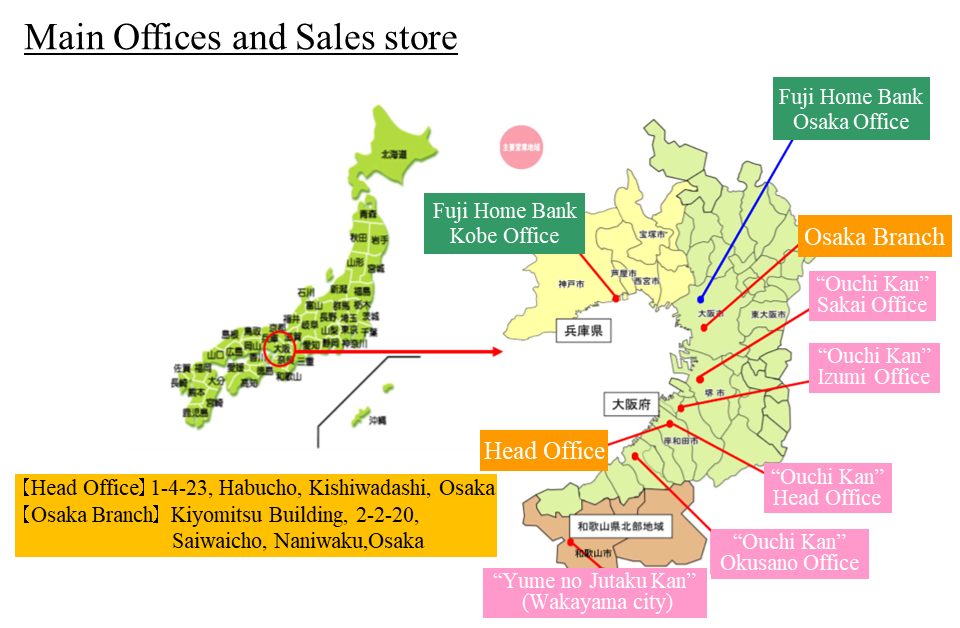

Fuji Corporation Ltd. provides various real estate related services including sales of new and used condominiums and detached homes primarily in Osaka Prefecture (where the Company is based), between Osaka and Kobe, and within Wakayama City. Their main business is the sale of detached homes, albeit a built-for-sale type, that would maximize customer satisfaction by allowing for the “free-design home” regarding layout, specifications, etc. within the boundaries of Japan’s Building Standards Act. Fuji also boasts of strengths in the development of properties where 50 to 200 homes are constructed in coordination with the surrounding environment and each other to provide uniformity in neighborhoods. The other main pillars of the Company’s business include renovation and sale of used residential properties, collaboration with financial institutions for effective land utilization, sales of rental apartments for sale to individual investors, property leasing and management services, and custom housing.

Fuji boasts of unique knowhow developed in various businesses realms derived from its sales agency and detached home services. Furthermore, the complementary and synergistic effects that occur between its various business divisions allow the Company as a Complete Home Provider to respond with solutions that match the needs of home owners and residents in various geographic regions and times. Another strength of Fuji is local community-based management to match the time and place of the markets, and to maintain high levels of customer satisfaction by upholding the principles of “never ignoring customers after the sale” and “never ignoring customers after the completion of construction.”

(Source: Fuji Corporation)

1-1 Business Description

Residential Properties for Sales (35.1% of the Fiscal Year March 2019 Total Sales)

Sales of detached homes and condominiums are conducted in this business. A characteristic of this business is Fuji’s ability to develop neighborhoods of new detached homes in 50 to 200 units that match the local neighborhoods, and to allow its customers to participate in the designing of the property. More specifically, these “free-design” homes respond to the needs of individual customers by allowing them to customize the layout and specification of the homes to suit their tastes and needs. Furthermore, new condominiums for sale are also included in the residential properties for sales business segment. Fuji halted the condominium for sale business in spring of 2005, based upon the outlook for a weakening in pricing due to declines in demand and increases in supplies. However, in the aftermath of the Lehman Shock, declines in land prices and improvements in supply and demand conditions in the condominiums for sale market led Fuji to restart the condominiums for sale business in February 2012. Another feature of Fuji is its focus upon condominiums and residential properties that are carefully selected (such as their convenient proximity to stations) and that are attractively priced for first-time buyers.

(Source: Fuji Corporation)]

“Nishinomiya Hama Kohshien” (Nishinomiya City, Hyogo)

Housing Distribution (28.3% of the Fiscal Year March 2019 Total Sale)

Sales of refurbished used residential property called "Kaizo Kun" is conducted in this business segment. "Kaizo Kun" refurbished used residential properties are used residential properties purchased for renovation and sales. Fuji’s unique knowhow is leveraged in local community-based management and manualized procedure for renovation.

(Source: Fuji Corporation)

“Ouchi Kan” Housing information exhibition hall where visitors are able to see and choose freely. (Kishiwada City, Osaka)

Effective Land Utilization (20.6% of the Fiscal Year March 2019 Total Sale)

Contract construction for leased properties and sales of rental apartments for sale to individual investors are conducted in this business. Construction work is performed for construction of rental residential properties sold on a proposal basis and leverages Fuji’s knowhow developed in its property leasing and management business. In addition, Fuji purchases lands and then constructs rental apartment buildings for sale to individual investor in this business. The highly price competitive wooden structure apartments called “Fuji Palace” were launched in November 2008, subsequently affordable rental apartments for seniors with nursing-care service, which are called “Fuji Palace Senior” as a means of differentiation. With regards to rental apartments for sale to individual investors, the price for apartments is roughly ¥100 million, and the demand for these types of rental properties remains strong as a fund management method. In addition, recently, the Company has been proactively developing affordable rental apartments for seniors with nursing-care services.

(Source: Fuji Corporation)

Low-rent affordable rental apartments for seniors with nursing-care services, “Fuji Palace Senior” (Sakai City, Osaka prefecture)

(Source: Fuji Corporation)

Fuji Palace series, rental apartments for sale to individual investors

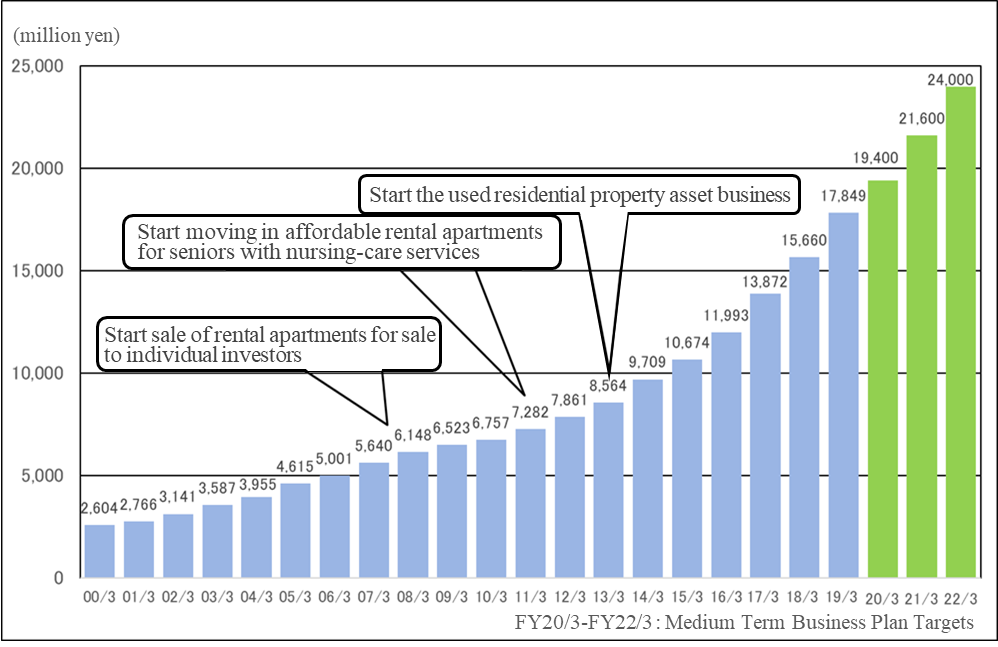

Property Leasing and Management (15.4% of the Fiscal Year March 2019 Total Sale)

The fully owned subsidiary Fuji Amenity Services Co., Ltd. provides rental apartment structure management, tenant solicitation, rent collection and other management services, in addition to consigned management of condominiums. Superior rental and management related services not only act as stable source of earnings, but also provide opportunities to achieve high synergy with contract construction of rental income properties, sales of rental apartments for sale to individual investors, and sales of condominiums.

Custom Housing (0.3% of the Fiscal Year March 2019 Total Sale)

By leveraging the knowhow cultivated in the detached homes business, Fuji has successfully grown and marketed its services of reconstruction of existing detached homes and construction of new detached homes to land owning clients. This business has also grown to become the fifth cornerstone of its overall business.

(Source: Fuji Corporation)

Exhibition of custom housing (Kishiwada City, Osaka)

1-2 Strengths of Fuji Corporation

Strength as a Complete Home Provider

Knowhow in the realms of acquisition of land and building permits, design, construction and sales cultivated in the detached home services has allowed Fuji to develop a wide range of businesses including its used residential property sales, effective land utilization, rental apartment buildings for sale to individual investors, and property leasing and management, as well as to cultivate synergies between these businesses. Furthermore, its local community-based management has also contributed to cultivate synergies among these wide ranging businesses and achieve high levels of customer satisfaction in its real estate and related services.

(Source: Fuji Corporation)

Capabilities of the Refurbished Used Residential Property Business

The “Kaizo-kun” refurbished used residential property business was born from the fusion of knowhow cultivated in the residential property agency sales and renovation businesses, which were launched along with the start of the Company. Fuji maintains a unique business model that enables them to conduct the three main functions of the residential property sales process including “acquisition,” “renovation,” and “sales” of used residential properties. The Company also boasts of the ability to create used residential properties that match the needs of customers because of its creation of manuals regarding how to renovate homes and information gathering of local markets based on its local community-based management style. In addition, a service called “Fuji Home Bank” has been created where coordination with judicial scriveners is conducted to purchase properties in cases of conclusion of inheritance registration. This service also offers the convenience of paying the inheritance registration fees from the fees derived from the sale of properties.

(Source: Fuji Corporation)

Ability to Increase Returns by Proposing Effective Land Utilization

Fuji not only provides the ability to propose effective land utilization, but also offers market surveys, planning, design, construction, and rental property management services to maximize its capability as a comprehensive real estate developer. Land purchases and sales, apartment and condominium reconstruction, legal and tax related services, and other various expert opinions and services are available as precise solutions to suit the needs of customers. As to its rental property management business, strict selection of land from the vast amount of real estate information is based upon meticulous market surveys conducted by its full-time marketing staff, and planning is carried out only when long-term and stable management is feasible. In addition, Fuji only purchases properties that boast of highly superior locations and other conditions to be turned into high yielding used real estate products. Moreover, Fuji proposes a bundled leasing system to property owners as a means of providing them with full “security, safety, and stability” in the rental property management service.

(Source: Fuji Corporation)

Business Portfolio Synergies

The real estate industry is hugely influenced by external factors such as the economic environment and changes in interest rates. To establish a business model that can withstand these conditions, Fuji Corporation has endeavored to build a business portfolio that can generate stable profits by providing diversified products and services. Looking at the sales composition during the last 5 years, residential properties for sales has previously accounted for more than 40% of total sales in the past. However, Fuji Corporation has been able to achieve a more balanced business portfolio as the three business segments, 1) residential properties for sales, 2) housing distribution, and 3) effective land utilization and property leasing and management businesses, now account for over 30%.

2. New mid-term profit plan (FY 3/2020 to FY 3/2022)

The company set new mid-term goals for the coming 3 years. In order to cope with various changes in the external environment, including the skyrocketing prices of land and construction, the shortage of carpenters, the consumption tax hike, and the hovering of selling prices, the company will actively implement measures for “increasing the number of condominiums supplied,” “concentrating on more profitable areas,” and “raising recurring revenue” and aim to earn a record-high profit in the fiscal year March 2022, which is the final fiscal year of the mid-term profit plan. The numerical goals for the fiscal year March 2022 are sales of 125 billion yen and an ordinary income of 6.8 billion yen.

Sales, ordinary income, net income, and ROE exceeded the goals of the previous mid-term plan, which was implemented for 4 years until the fiscal year March 2019, thanks to the expansion of the businesses of residential properties for sales, effective land utilization, and property leasing and management. It can be said that the company’s strong ambition for attaining the mid-term goals was confirmed through the 4 years.

Medium Term Business Plan Targets |

|

|

|

|

| ||||||

| FY 3/19 Plan | FY 3/19Act | FY 3/20 Plan | FY 3/21 Plan | FY 3/22 Plan | ||||||

Sales | 102,000 | 115,710 | 107,000 | 121,000 | 125,000 | ||||||

Operating Income | - | 6,636 | 5,300 | 7,000 | 7,300 | ||||||

Ordinary Income | 6,000 | 6,445 | 5,000 | 6,700 | 6,800 | ||||||

Net Income | 3,900 | 4,298 | 3,300 | 4,500 | 4,600 | ||||||

ROE | Over 10% | 11.9% | Over 10% | Over 10% | Over 10% | ||||||

*Units: ¥mn

Medium Term Business Plan Profit Assumptions

Plans during Fiscal Year March 2020

This term will be the year for adjustment, as it is the transitional period for supply of condominiums and the consumption tax will be raised. The performance is estimated to decline from the previous term, because this term is the transitional period for supply of condominiums and it will take time to overcome the shortage of carpenters. In this situation, the investment for relocating the marketing office in Osaka City will be first posted. In addition, the company will increase the sale of land for affordable rental apartments for seniors with nursing-care services to individual investors who do not own land. The property leasing and management business is expected to be healthy, as the company will handle more rental apartments for sale to individual investors and more affordable rental apartments for seniors with nursing-care services.

Plans during Fiscal Year March 2021

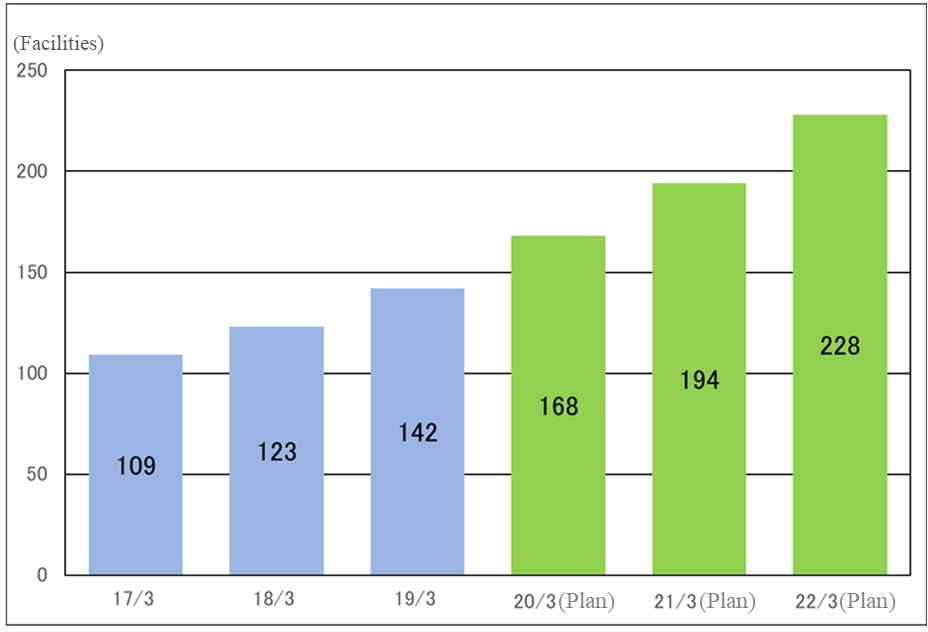

It is expected that more condominiums will be delivered and overall performance will recover to the level exceeding that in the fiscal year March 2019. The company plans to deliver two condominium buildings in Sakai City and Izumi City, and the sales of the residential properties for sales business are projected to the level of the fiscal year March 2019. In addition, the large-scale project for selling detached homes in Hokusetsu and Hanshinkan areas will be launched. As for the housing distribution business, the company will enhance the procurement of profitable houses in Osaka City, Hokusetsu and Hanshinkan areas. In addition, affordable rental apartments for seniors with nursing-care services ordered in the fiscal year March 2019 will be delivered mainly from the fiscal year March 2021. The property leasing and management business is expected to keep growing steadily, achieving sales of 20 billion yen.

Plans during Fiscal Year March 2022

It is expected that the sales and profit of rental apartments and condominiums for sale will grow significantly, both marking a record high. The company plans to deliver 3 condominium buildings in Osaka, Sakai, and Settsu Cities, and the sales from residential properties for sales are projected to hit a record high. The large-scale detached home project in Hokusetsu and Hanshinkan areas will enter the delivery phase. While the number of rental apartments delivered will rise considerably, the property leasing and management business is expected to see the number of the company’s own affordable rental apartments for seniors with nursing-care services exceeding 50.

*Units: ¥mn

Medium Term Business Plan Targets for each Industry Segment

Segment Sales | FY 3/19 Act | FY 3/20 Mid-term | FY 3/21 Mid-term | FY 3/22 Mid-term |

Residential Properties for Sales | 40,562 | 30,540 | 42,900 | 44,300 |

Housing Distribution | 33,094 | 32,100 | 30,500 | 31,000 |

Effective Land Utilization | 23,847 | 24,400 | 26,000 | 25,700 |

Property Leasing and Management | 17,849 | 19,400 | 21,600 | 24,000 |

Segment Profits | FY 3/19 Act | FY 3/20 Mid-term | FY 3/21 Mid-term | FY 3/22 Mid-term |

Residential Properties for Sales | 3,698 | 1,530 | 2,680 | 2,720 |

Housing Distribution | 507 | 1,100 | 1,110 | 1,140 |

Effective Land Utilization | 2,381 | 2,430 | 2,720 | 2,690 |

Property Leasing and Management | 1,747 | 1,960 | 2,230 | 2,610 |

*Units: ¥mn

* Segment profits before adjustments

* Derived from Fuji Corporation’s Medium Term Business Plan announced on May 8, 2019.

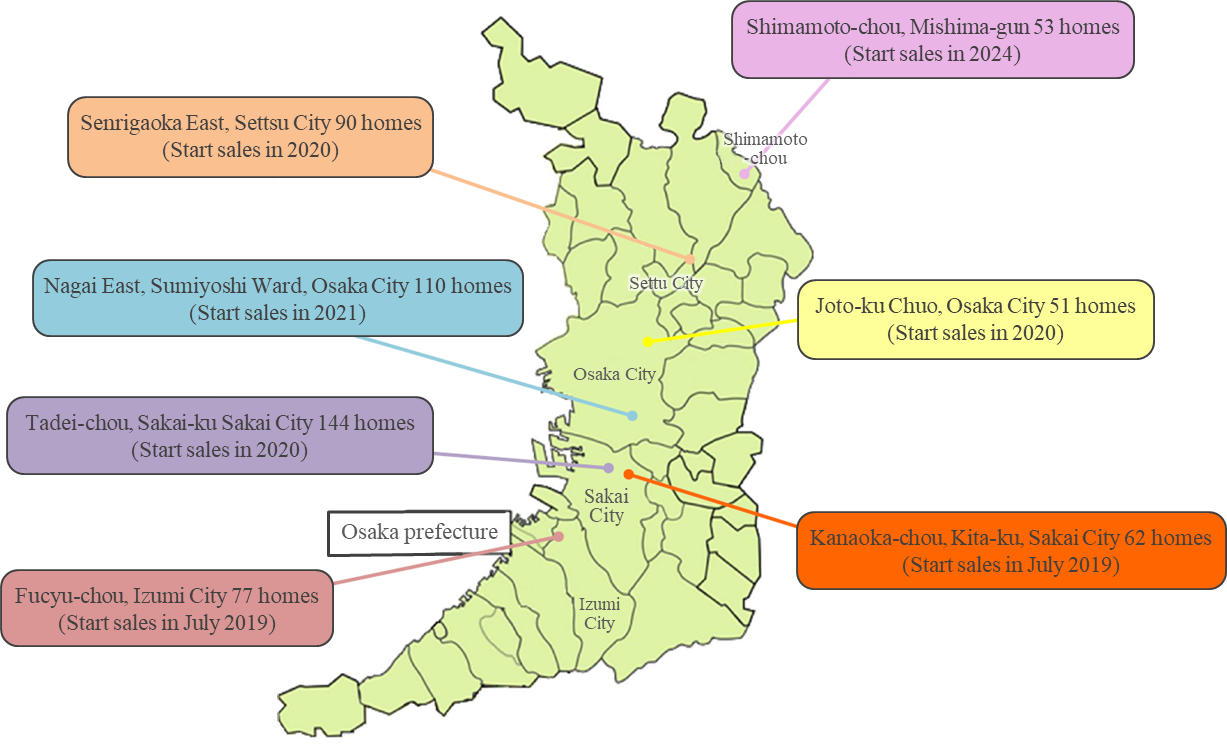

Topics about the residential properties for sales business

【Upcoming major projects for selling condominiums】

(From the mid-term profit plan of the company)

In the residential properties for sales business, the company plans to deliver 2 condominium buildings in Sakai and Izumi Cities in the fiscal year March 2021 and 3 condominium buildings in Osaka, Sakai, and Settsu Cities in the fiscal year March 2022.

Topics about the housing distribution business

【Area where used homes are distributed】

(From the mid-term profit plan of the company)

In the housing distribution business, the company plans to enhance procurement in Osaka City, Hanshinkan and Hokusetsu areas, to improve profit ratio.

Topics about the effective land utilization business

【Variation in the cumulative number of affordable rental apartments for seniors with nursing-care services】

In the effective land utilization business, the affordable rental apartments for seniors with nursing-care services ordered in the fiscal year March 2019 are estimated to be delivered mainly from the fiscal year March 2021.

Topic of Property Leasing and Management

【Transition of the recurring revenue】

Recurring revenue is expected to grow stably and sales are projected to reach 20 billion yen in the fiscal year March 2021.

3. Fiscal Year March 2019 Earnings Results

(1)Consolidated Earnings

| FY 3/18 | Share | FY 3/19 | Share | YY Change | Initial Est. (10/29) | Divergence |

Sales | 103,880 | 100.0% | 115,710 | 100.0% | +11.4% | 110,000 | +5.2% |

Gross Income | 17,830 | 17.2% | 18,565 | 16.0% | +4.1% | - | - |

SG&A | 11,392 | 11.0% | 11,928 | 10.3% | +4.7% | - | - |

Operating Income | 6,438 | 6.2% | 6,636 | 5.7% | +3.1% | 6,700 | -0.9% |

Ordinary Income | 6,139 | 5.9% | 6,445 | 5.6% | +5.0% | 6,500 | -0.8% |

Parent Net Income | 4,168 | 4.0% | 4,298 | 3.7% | +3.1% | 4,350 | -1.2% |

*Data in this table and other parts of this report include figures which have been calculated by Investment Bridge, and may differ from those of the Company

*Units: ¥mn

Sales and ordinary income grew 11.4% and 5.0%, respectively, year on year.

For the fiscal year March 2019, sales grew 11.4% year on year to 115,710 million yen, marking a record high. Sales increased in the residential properties for sales business where the number of delivered free-designed homes rose and the housing distribution business where the number of delivered used houses increased. Additionally, sales grew in the effective land utilization business, where affordable rental apartments for seniors with nursing-care services as well as rental apartments for sale to individual investors have increased, and the property leasing and management business, where revenue from rent, etc. increased. Furthermore, the amount of order contracts, which reflects the actual sales conditions, went up 8.9% year on year owing to the expanding number of orders placed for used residential properties in the housing distribution business, and affordable rental apartments for seniors with nursing-care services in the effective land utilization business.

Ordinary income was 6,445 million yen, up 5.0% year-on-year.

As for profit per segment, it dropped in the effective land utilization business as a reaction to the delivery of a large-scale apartment for sale to individual investors in the same period last year, however, the reduction was offset by the increase in the number of delivered free-designed homes in the residential properties for sales business, and the increase of delivered used residential houses in the housing distribution business. Moreover, profit increased for the property leasing and management business owing to the increase in the handling of property management derived from the delivery of condominiums for sale and rental properties within the effective land utilization business, and the increase in rented used residential houses in the used residential property asset business.

The total gross profit declined by 1.2 points from the same period last year due to the decrease in profit of the effective land utilization business, etc. The sales to SG&A ratio declined by 0.7 points due to the decline in advertising expenses, however, the sales to operating income margin ratio declined by 0.5 points to 5.7%.

As a result, operating income was 6,636 million yen, up 3.1% year on year. In addition, the growth rate of ordinary income has exceeded that of operating income due to posting 181 million yen in revenue from subsidies in non-operating income, etc. The revenue from subsidies is expected to increase in the future due to the increase in affordable rental apartments for seniors with nursing-care services developed by the company.

Extraordinary losses were huge, as the loss on disposal of fixed assets was 69 million yen (1 million yen in the previous year) and loss on valuation of investments securities was 71 million yen (none in the previous year). Moreover, all levels of profits were slightly below the company’s plan amended on 29th October last year, however, it marked a record high.

The annual dividend is expected to be 27 yen/share as estimated in the initial forecasts, unchanged from the previous year.

(2)Segment Earnings

Segment Sales, Profits |

|

|

|

|

|

|

| Sales | Share | YY Change | Segment Profits | Share | YY Change |

Residential Properties for Sales | 40,562 | 35.1% | +6.5% | 3,698 | 44.2% | +6.6% |

Housing Distribution | 33,094 | 28.6% | +12.7% | 507 | 6.1% | +15.5% |

Effective Land Utilization | 23,847 | 20.6% | +16.8% | 2,381 | 28.5% | -7.8% |

Property Leasing and Management | 17,849 | 15.4% | +14.0% | 1,747 | 20.9% | +15.5% |

Custom Housing | 357 | 0.3% | +2.8% | 28 | 0.3% | +117.3% |

Adjustment | - | - | - | -1,726 | - | - |

Total | 115,710 | 100.0% | +11.4% | 6,636 | 100.0% | +3.1% |

*Units: ¥mn

Sales of the residential properties for sales segment were 40,562 million yen, up 6.5% year on year, and the segment profit was 3,698 million yen, up 6.6% year on year.

Mainly, the increase in the number of delivered properties of free-design homes from 728 in the previous year to 890 contributed to the increase in both sales and profit.

The number of free-designed homes was 801 (825 in the previous year), and 33 condominiums for sale (132 in the previous year), however, land sales were 3,727 million yen (398 million yen in the previous year), thus, the value of orders was 35,150 million yen, down by only 3.8% year on year.

Land sales were attributed to selling a part of the land for large scale residential properties for sales.

Sales of the housing distribution segment were 33,094 million yen, up 12.7% year on year, and the segment profit was 507 million yen, up 15.5% year on year.

An increase in the entry by new participants to the used residential properties for resales business contributed to difficulties in the acquisition of properties, but stable pricing allowed the company to grow its purchases and subsequently expand sales of used residential properties.

On the other hand, the Company terminated supplies of spec new homes and shifted its business focus towards free-designed homes, which led to a decline in sales of spec new homes. As for the profit, the increase in the number of delivered used residential properties contributed.

The volume of orders in the used residential properties rose to 1,497 (from 1,322 in the same period of the previous year), and the value of orders in the housing distribution segment grew by 16% year-on-year to 33,966 million yen.

Sales of the effective land utilization segment were 23,847 million yen, up 16.8% year on year, and the segment profit was 2,381 million yen, down 7.8% year on year.

Sales increased thanks to the expansion of affordable rental apartments for seniors with nursing-care services and rental apartments for sale to individual investors, however, the profit dropped in the effective land utilization business as a reaction to the delivery of a large-scale condominium for sale to individual investors in the same period last year.

The order value was 27,009 million yen, up 20.3% year on year. Orders value transitioned favorably as the order value of consigned construction of rental properties and affordable rental apartments for seniors with nursing-care services rose by 78.4% and 52.1% year on year respectively, while rental apartments for sale to individual investors fell by 0.6% year-on-year.

Additionally, sales of the property leasing and management segment were 17,849 million yen, up 14.0% year on year, and the segment profit was 1,747 million yen, up 15.5% year on year. The increases in the number of properties handled in the property leasing and management segment arising from deliveries of condominiums for sale and rental properties within the effective land utilization segment, and the rise in used properties within the used residential property asset business also contributed to the strong earnings.

Furthermore, Sales of the custom housing segment were 357 million yen, up 2.8% year on year, and the segment profit was 28 million yen, up 117.3% year on year (12 million yen of segment profit in the previous year).

Segment Sales |

|

| ||||

| FY 3/18 | FY 3/19 | ||||

Volume | Value | Volume | Value | Share | YY Change | |

Free-design Homes | 728 | 27,364 | 890 | 33,953 | 29.3% | +24.1% |

Condominiums for Sale | 255 | 8,805 | 87 | 3,097 | 2.7% | +64.8% |

Land Sales | 11,485㎡ | 1,932 | 20,119㎡ | 3,511 | 3.0% | +81.7% |

Residential Properties for Sales | - | 38,102 | - | 40,562 | 35.1% | +6.5% |

Used Residential Properties | 1,330 | 28,684 | 1,470 | 32,953 | 28.5% | +14.9% |

Spec New Homes | 23 | 664 | 6 | 139 | 0.1% | -78.9% |

Others | - | 4 | - | 1 | 0.0% | -72.0% |

Housing Distribution | 1,353 | 29,352 | 1,476 | 33,094 | 28.6% | +12.7% |

Contract Construction of Rental Properties | 36 | 3,144 | 26 | 2,288 | 2.0% | -27.2% |

Affordable Rental Apartments for Seniors with Nursing-care Services | 8 | 1,976 | 13 | 4,015 | 3.5% | +103.2% |

Rental Apartments for Sale to Individual Investors | 116 | 15,295 | 143 | 17,543 | 15.2% | +14.7% |

Effective Land Utilization | - | 20,416 | - | 23,847 | 20.6% | +16.8% |

Rental Income | - | 11,962 | - | 13,579 | 11.7% | +13.5% |

Income from Affordable Rental Apartments for Seniors with Nursing-care Services | - | 2,868 | - | 3,390 | 2.9% | +18.2% |

Management Fee Income | - | 830 | - | 879 | 0.8% | +5.9% |

Property Leasing and Management | - | 15,660 | - | 17,849 | 15.4% | +14.0% |

Custom Housing Construction | 14 | 347 | 15 | 357 | 0.3% | +2.8% |

Custom Housing | - | 347 | - | 357 | 0.3% | +2.8% |

Total | - | 103,880 | - | 115,710 | 100.0% | +11.4% |

*Units: ¥mn

Segment Order Contracts |

|

| |||

| FY 3/18 | FY 3/19 | |||

Volume | Value | Volume | Value | YY Change | |

Free-design Homes | 825 | 31,594 | 801 | 30,238 | -4.3% |

Condominiums for Sale | 132 | 4,535 | 33 | 1,184 | -73.9% |

Land Sales | 4,458㎡ | 398 | 21,630㎡ | 3,727 | - |

Residential Properties for Sales | - | 36,528 | - | 35,150 | -3.8% |

Used Residential Properties | 1,322 | 28,811 | 1,497 | 33,920 | +17.7% |

Spec New Homes | 16 | 471 | 2 | 45 | -90.4% |

Others | - | 4 | - | 1 | -72.0% |

Housing Distribution | 1,338 | 29,287 | 1,499 | 33,966 | +16.0% |

Contract Construction of Rental Properties | 26 | 2,413 | 44 | 4,305 | +78.4% |

Affordable Rental Apartments for Seniors with Nursing-care Services | 24 | 5,302 | 30 | 8,064 | +52.1% |

Rental Apartments for Sale to Individual Investors | 112 | 14,733 | 119 | 14,639 | -0.6% |

Effective Land Utilization | - | 22,449 | - | 27,009 | +20.3% |

Custom Housing Construction | 19 | 466 | 21 | 517 | +10.8% |

Custom Housing | - | 466 | - | 517 | +10.8% |

Total | - | 88,732 | - | 96,644 | +8.9% |

*Units: ¥mn

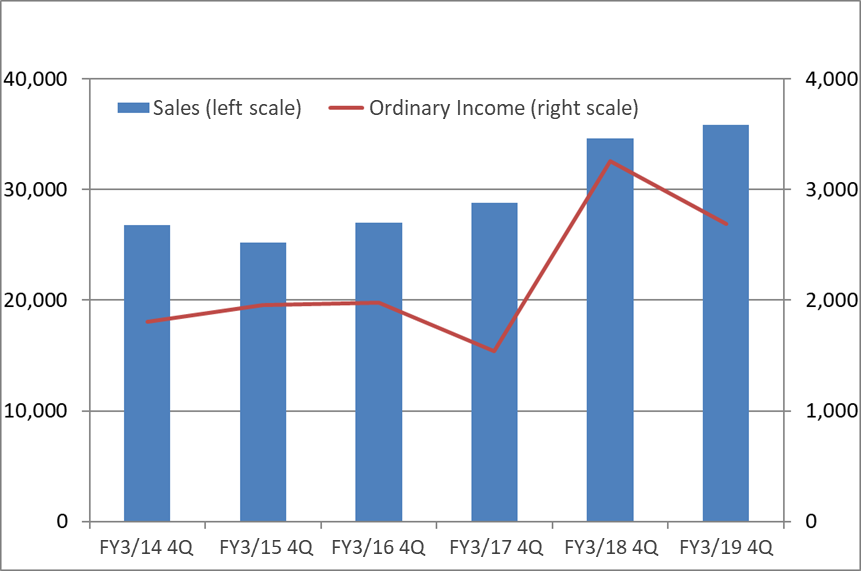

(3)Quarterly Earnings Trends

Consolidated Earnings Trends of the Fourth Quarter (million yen)

In the fourth quarter of FY 3/2019 (Jan. to Mar.), thanks to the increase of deliveries in free-designed homes, the used residential properties, the affordable rental apartments for seniors with nursing-care services, rental apartments for sale to individual investors, etc. the sales and ordinary income of the fourth quarter reached high levels compared to the past results. Selling part of the land for large scale residential properties for sales contributed to this achievement. The sales and ordinary income of the fourth quarter (Jan. to Mar.) have been generally on an upward trend owing to the expansion of free-design homes, rental apartments for sale to individual investors, and property leasing and management segments.

(4)Financial Conditions and Cash Flow (CF)

|

|

|

|

|

|

| March 2018 | March 2019 |

| March 2018 | March 2019 |

Cash, Equivalents | 10,486 | 12,041 | Payables | 3,963 | 4,642 |

Inventories | 98,297 | 93,370 | ST Interest Bearing Liabilities | 21,114 | 24,107 |

Current Assets | 110,242 | 107,998 | Unpaid Taxes | 1,345 | 1,398 |

Tangible Noncurrent Assets | 22,442 | 35,963 | Prepayments | 3,854 | 3,572 |

Intangible Noncurrent Assets | 272 | 359 | LT Interest Bearing Liabilities | 65,745 | 70,558 |

Investments, Others | 2,605 | 3,144 | Liabilities | 100,711 | 109,708 |

Noncurrent Assets | 25,321 | 39,466 | Net Assets | 34,852 | 37,756 |

Total Assets | 135,563 | 147,465 | Total Interest-Bearing Liabilities | 86,859 | 94,665 |

*Units: ¥mn

* Inventories = Real estate for sale + Real estate for sale in progress + Real estate for development + Payments for uncompleted construction + Inventories

* Interest bearing liabilities = Loans + Lease liabilities+Debenture

Cash Flow

| FY 3/18 | FY 3/19 | YY Chgange | |

Operating Cash Flow (A) | -10,606 | 11,962 | 22,569 | - |

Investing Cash Flow (B) | -7,928 | -16,749 | -8,821 | - |

Free Cash Flow (A + B) | -18,534 | -4,786 | 13,747 | - |

Financing Cash Flow | 16,749 | 6,341 | -10,407 | -62.1% |

Cash and Equivalents at Term End | 10,486 | 12,041 | 1,554 | +14.8% |

*Units: ¥mn

With regard to cash flow, declines in inventories and other factors allowed Operating CF to turn to a net inflow. Increases in the purchase of property, plant and equipment and other factors caused the net outflow of Investing CF to expand. However, the margin of free cash outflow contracted. At the same time, a reduction in the margin of increase in long term debt caused the margin of inflow of Financing CF to contract. The term-end balance of cash and equivalents rose by 14.8% year-on-year.

4. Fiscal Year March 2020 Earnings Estimates

(1)Consolidated Earnings

| FY 3/19 Act. | Share | FY 3/20 Est. | Share | YY Change |

Sales | 115,710 | 100.0% | 107,000 | 100.0% | -7.5% |

Operating Income | 6,636 | 5.7% | 5,300 | 5.0% | -20.1% |

Ordinary Income | 6,445 | 5.6% | 5,000 | 4.7% | -22.4% |

Parent Net Income | 4,298 | 3.7% | 3,300 | 3.1% | -23.2% |

*Units: ¥mn

Sales and ordinary income are estimated to decline 7.5% and 22.4%, respectively, year on year.

For the fiscal year March 2020, the company forecasts that sales will decrease 7.5% year on year to 107 billion yen and ordinary income will drop 22.4% year on year to 5 billion yen, considering that the supply of condominiums will enter the transitional phase and there will be negative factors, such as the rise in land price, the skyrocketing of construction prices, and the consumption tax hike.

As for sales, the company will sell land for affordable rental apartments for seniors with nursing-care services to individual investors who do not own land, increasing sales in the effective land utilization segment, and grow its recurring-revenue business, increasing sales in the segment of property leasing and management stably. On the other hand, the segment of residential properties for sales will see a significant drop in sales, as the supply of condominiums will enter the transitional phase while the supply of free-designed homes will be stagnant due to the shortage of carpenters, and the segment of housing distribution, too, will witness a slight decline in sales, due to the sluggish procurement of used houses.

As for profit, it is forecasted that profit will rise in the segment of housing distribution, due to the increase of procurement of used houses in highly profitable areas, and the segments of effective land utilization and property leasing and management, due to sales growth, while the segment of residential properties for sales will see a considerable drop in profit, due to the significant decline in sales. In addition, it is estimated that advertisement cost will augment for the sale of condominiums and the company will incur expenses for relocating a marketing base in Osaka City.

Operating income ratio is estimated to be 5.0%, down 0.7 points year on year.

Although profit is projected to decline, the annual dividend amount is estimated to be 27 yen/share (an interim dividend of 14 yen/share and a term-end dividend of 13 yen/share), unchanged from the previous term.

Full Year Consolidated Sales Estimates by Business Segment

Segment Sales | FY 3/19 Act. | FY 3/20 Est. |

Residential Properties for Sales | 40,562 | 30,540 |

Housing Distribution | 33,094 | 32,100 |

Effective Land Utilization | 23,847 | 24,400 |

Property Leasing and Management | 17,849 | 19,400 |

Segment Profit | FY 3/19 Act. | FY 3/20 Est. |

Residential Properties for Sales | 3,698 | 1,530 |

Housing Distribution | 507 | 1,100 |

Effective Land Utilization | 2,381 | 2,430 |

Property Leasing and Management | 1,747 | 1,960 |

*Derived from Fuji Corporation’s Medium Term Business Plan announced on May 8, 2019.

* Segment profits before adjustments

(2)Main Topics

Nominated for “2019 Health and Productivity Management Award” and “2019 Certified Health & Productivity Management Outstanding Organizations, Large Enterprise Category (White 500)”

On February 21, 2019, the company was nominated for “2019 Health and Productivity Management Award” by the Ministry of Economy, Trade and Industry, in coordination with the Tokyo Stock Exchange, for the second year in a row for the third time. The Company was also nominated for the “2019 Certified Health & Productivity Management Outstanding Organizations, Large Enterprise Category (White 500)” by the Ministry of Economy, Trade and Industry in coordination with Japan Health Conference, for the third year in a row. The “Health and Productivity Management Award” recognizes those companies listed in the Tokyo Stock Exchange which think of, and take strategic initiatives regarding healthcare for their employees from a management point of view as companies that are excellent in “Health and Productivity Management,” and by introducing them as companies that are appealing for investors that give importance to the long-term increase in a company’s value, aims to promote company initiatives regarding “Health and Productivity Management.” This year, out of all the domestic companies listed in the stock exchange (3,740 companies), 37 companies were nominated.

Acquisition of Fixed Assets

The company acquired fixed assets as a plot area of 2,097.33 m2 and a total floor area of 11,007.63 m2, in Doshin, Kita Ward. The cost of acquisition was 8.18 billion yen and the assets were acquired on March 29, 2019. It will be utilized as property for business purposes and the business establishment in Osaka City is to be relocated in the future.

Acquisition Vote and Circumstances Regarding Treasury Stocks

In a board of directors meeting held on October 29, 2018, the company made decisions on matters relating to the acquisition of treasury stocks. The following are the contents of those decisions.

・The total number of stocks acquired: 700,000 (upper limit) (Ratio to the total number of outstanding stocks excluding treasury stocks: 1.95%)

・Total cost of stock acquisition: 636 million yen (upper limit)

・The acquisition period will be from October 30, 2018 to March 31, 2019.

Under these decisions, a total of 700,000 treasury shares were acquired (acquisition cost: 598,794,100 yen) by February 8, 2019.

5. Future Highlight Points

The forecast for the fiscal year March 2020 is so grim with sales and ordinary income dropping 7.5% and 22.4%, respectively, year on year. This is because the supply of condominiums will enter the transitional phase and there are negative factors, such as the rise in land prices, the skyrocketing of construction prices, and the consumption tax hike. At first glance, the growth potential of the company is doubted, but in the fiscal year March 2021, the company will deliver condominiums, launch a large-scale project for selling detached homes, and deliver affordable rental apartments for seniors with nursing-care services, so that sales and profits will recover and mark a record high. The performance of the company is temporarily stagnant before the growth stage, so it seems that we do not necessarily have to worry about their growth potential.

However, in order to dispel such concern over the stock market, it is necessary to verify the certainty of performance recovery in the fiscal year March 2021. In the new mid-term profit plan starting this term, the company set the goals of “increasing the number of condominiums supplied,” “concentrating on more profitable areas,” and “raising recurring revenue.” As for “increasing the number of condominiums supplied,” the progress of sale of two condominium buildings this term is noteworthy. As for “concentrating on more profitable areas,” the progress of used housing procurement and profit rate improvement is noteworthy. As for “raising recurring revenue,” the increase of the company’s own real estate, including affordable rental apartments for seniors with nursing-care services, is noteworthy. We would like to pay attention to how they will complete the measures for attaining the mid-term goals.

In addition, in order to keep growing even after the new mid-term plan, the company needs to procure large attractive land for detached homes and condominiums. We would like to keep paying attention to the progress of land development in the residential properties for sales business.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory board |

Directors | 7 directors, including 2 external ones |

Auditors | 3 auditors, including 2 external ones |

◎Corporate Governance Report

The company submitted its latest corporate governance report on June 21, 2019.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

【Supplementary principle 1-2-4. Electronic exercise of voting rights and translation of notices of convocation of shareholders’ meetings into English】 | Our company adopted the electronic voting platform.Because the proportion of overseas investors in our company is small, we currently consider that it is not necessary to translate notices of convocation of shareholders’ meetings into English; however, when the ratio of overseas investors exceeds 20% of all investors, we will consider providing the English version of notices of convocation. For IR activities, we offer some reports and the bare minimum of pages of our website in English. |

【Principle 1-4. Strategically held shares】 | Cooperative relationships with financial institutions are vital for business expansion and sustainable development of real estate agents. Aiming at the medium- to long-term goal of enhancing our corporate value, we will hold shares when we regard such shareholding as necessary for strategic purposes after comprehensively taking account of relationships with financial institutions and the like. As for the exercise of voting rights, our company does not have concrete standards. From the perspectives of medium- to long-term enhancement of the corporate value, corporate governance, and social responsibility, we will consider and determine for each case whether or not we should exercise our voting rights. |

【Principle 2-6. Exertion of functions as an asset owner of corporate pensions】 | There is no corporate pension system. Considering the fact that the needs for payment for ongoing contribution are growing as the concept of lifetime employment is weakening, we tack retirement benefits on current salaries, with the aim of securing excellent personnel. |

【Supplementary Principle 4-10-1. Utilization of arbitrary systems】 | Our company has the board of auditors. Independent outside directors do not hold a majority in the board of directors, but we appointed two outside directors and two outside auditors, who appropriately engage in and give advice about the appointment of directors and the determination of their remunerations by utilizing plenty of experience and profound knowledge as a certified public accountant or a lawyer. Therefore, we think that an arbitrary advisory body is unnecessary as of now, but will plan to establish it if necessary. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Supplementary Principle 4-11-3. Overview of the results of analysis and evaluation of the effectiveness of the board of directors】 | Every year, the effectiveness of the board of directors is evaluated with an anonymous questionnaire, and its results are reported to the board of directors. The results of analysis and evaluation of the effectiveness of the board of directors are as follows: ・The frequency of a meeting of the board of directors and the attendance situation of directors are healthy, and reference material, etc. are distributed in advance so that each bill will be deliberated appropriately.・From now on, in order to have more profound discussions at a meeting of the board of directors, we will make some improvement measures, such as a system in which each executive submits questions about bills and reports in advance and these questions are answered at a meeting of the board of directors. |

【Principle 5-1. Policy on constructive dialogue with shareholders】 | The IR Office, which is managed by the director responsible for IR activities, is in charge of communication with shareholders.The IR Office constantly cooperates with the Corporate Planning Department, the General Affairs Department, the Legal Department, the Finance Department, and the Internal Audit Office, establishing a system where necessary information is conveyed to the IR Office.The IR Office is engaged in activities to allow shareholders and investors to broaden their understanding about our management philosophy and policy by holding company information sessions for individual investors and those for analysts and institutional investors in Osaka and Tokyo, as well as through financial results briefings, information disclosure on our website, and simplification of News for Shareholders so that it can be easily understood not only by analysts and institutional investors but also by individual investors.Our company feeds back to the directors and the board of directors every opinion and concern obtained through communication with our shareholders. |

<Other>

In Basic Views regarding corporate governance, the company states that “it is crucial for the improvement of our business performance that the president himself demonstrates the management philosophy, business purposes, and code of conduct and the directors with excellent “capabilities,” “enthusiasm,” and “attitude” and great willingness to contribute to our company work in a complete solidarity toward the same aim in order to increase the shareholder investment value.”

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved.

The back number of Bridge Report (Fuji Corporation: 8860) and the contents of Bridge Salon (IR Seminar) can be viewed here: www.bridge-salon.jp/