Bridge Report:(8860)Fuji the Second quarter of fiscal year ending March 2021

President Nobutsuna Miyawaki | Fuji Corporation Ltd. (8860) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Real Estate |

President | Nobutsuna Miyawaki |

HQ Address | 1-4-23 Habucho, Kishiwada-shi, Osaka |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Share Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥636 | 35,676,982 shares | ¥22,691 million | 8.0% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥27.00 | 4.2% | ¥36.44 | 17.5x | ¥1,126.40 | 0.6x |

*The share price is the closing price on December 4 2020. The number of shares issued at the end of the most recent quarter excludes its treasury shares.

*ROE and BPS are based on FY 3/20 earnings results. EPS and DPS are based on FY 3/21 earnings estimates. Figures are rounded to the nearest decimal point.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2017 | 99,359 | 5,969 | 5,721 | 3,945 | 110.06 | 26.00 |

March 2018 | 103,880 | 6,438 | 6,139 | 4,168 | 116.08 | 27.00 |

March 2019 | 115,710 | 6,636 | 6,445 | 4,298 | 120.40 | 27.00 |

March 2020 | 110,444 | 5,002 | 4,611 | 3,038 | 87.40 | 27.00 |

March 2021 Est. | 119,000 | 2,500 | 2,000 | 1,300 | 36.44 | 27.00 |

*Units: million yen, yen

This Bridge Report provides information about the Second quarter of fiscal year ending March 2021 earnings results of Fuji Corporation Ltd.

Table of Contents

Key Points

1. Company Overview

2. Mid-term profit plan (FY 3/2020 to FY 3/2022)

3. The Second quarter of Fiscal Year ending March 2021 Earnings Results

4. Fiscal Year March 2021 Earnings Estimates

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the second quarter of the fiscal year ending March 2021, sales and ordinary income increased 10.6% and 13.0%, respectively, year on year. Both the number of units delivered and sales of free-design homes and condominiums were slightly smaller than those in the same period of the previous term. However, the sales from selling part of the land for large-scale residential properties in Hyogo Prefecture boosted sales and profits at all stages in the segment of residential properties for sale. The steady sales growth of the number of leased and managed properties linked to the effective land utilization business in the property leasing and management segment has also contributed. As for the number of orders received, which indicates the sales status, the orders for (1) the housing distribution business dropped, where orders for used residential properties decreased, (2) the effective land utilization business dropped too, where orders for affordable rental apartments for seniors with nursing-care services decreased, however, (3) the residential properties for sales business increased due to the improvement in orders for free-design homes and land sales, and contributed to a 2.6% year-on-year increase. The orders backlog, which is a leading indicator of sales, increased 6.5% from the end of the previous term, reaching a record high on a quarter-end basis.

- The company’s plan for the fiscal year ending March 2021, which targets a 7.7% increase in sales and a 56.6% decrease in ordinary income, year on year, remains unchanged. In terms of sales, the increase in sales of the residential properties for sales business, where the company plans to deliver two condominium buildings in Sakai City and Izumi City, and sell a part of the cleared land for large-scale building lot, will contribute to sales growth. Moreover, in the second half of the term, (1) further enhancement of funds in hand, (2) promotion of land sales and built-for-sale type housing sales to reduce inventory risk, and (3) setting flexible selling prices through price cutting for newly launched large-scale residential housings, will have an impact on profit. The dividend forecast remains unchanged at the same amount as the previous term, which is 27 yen per share (14 yen at the end of the first half and 13 yen at the end of the term).

- The newly launched condominium brand Branneed went on sale in October. Branneed is a brand for urban condominiums built in good locations mainly within a five-minute walk from the station, and is expected to attract consumers. Moreover, the existing condominium brand, Charmant Fuji, is scheduled to be delivered in the next term. We will focus on the status of orders for condominiums planned to be sold this term, which is expected to be a driving force for the recovery of business performance in the next term.

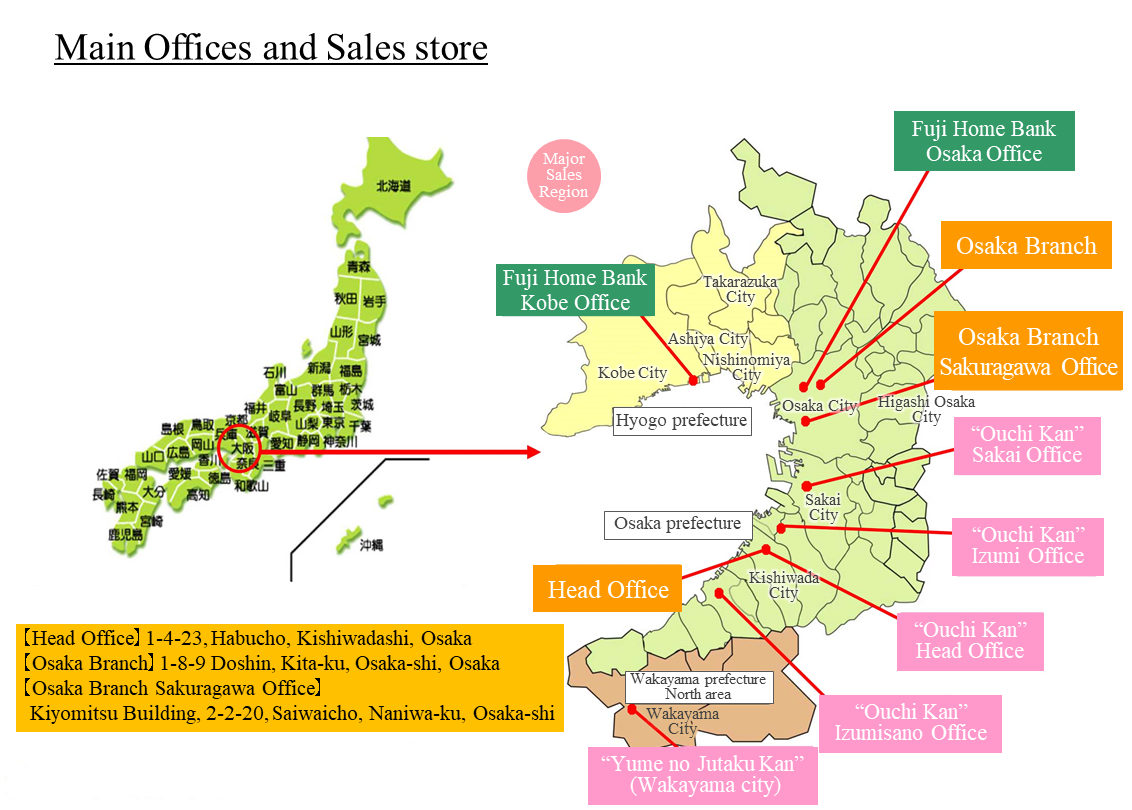

1. Company Overview

Fuji Corporation Ltd. provides various real estate related services including sales of new and used condominiums and detached homes primarily in Osaka Prefecture (where the Company is based), between Osaka and Kobe, and within Wakayama City. Their main business is the sale of detached homes, albeit a built-for-sale type, that would maximize customer satisfaction by allowing for the “free-design home” regarding layout, specifications, etc. within the boundaries of Japan’s Building Standards Act. Fuji also boasts of strengths in the development of properties where 50 to 200 homes are constructed in coordination with the surrounding environment and each other to provide uniformity in neighborhoods. The other main pillars of the Company’s business include renovation and sale of used residential properties, collaboration with financial institutions for effective land utilization, sales of rental apartments for sale to individual investors, property leasing and management services.

Fuji boasts of unique knowhow developed in various businesses realms derived from its sales agency and detached home services. Furthermore, the complementary and synergistic effects that occur between its various business divisions allow the Company as a Complete Home Provider to respond with solutions that match the needs of home owners and residents in various geographic regions and times. Another strength of Fuji is local community-based management to match the time and place of the markets, and to maintain high levels of customer satisfaction by upholding the principles of “never ignoring customers after the sale” and “never ignoring customers after the completion of construction.”

(Source: Fuji Corporation)

1-1 Business Description

Residential Properties for Sales(30.8% of Total Sales for the consolidated cumulative second quarter of fiscal year ending March 2021)

Sales of detached homes and condominiums are conducted in this business. A characteristic of this business is Fuji’s ability to develop neighborhoods of new detached homes in 50 to 200 units that match the local neighborhoods, and to allow its customers to participate in the designing of the property. More specifically, these “free-design” homes respond to the needs of individual customers by allowing them to customize the layout and specification of the homes to suit their tastes and needs. Furthermore, new condominiums for sale are also included in the residential properties for sales business segment. Fuji halted the condominium for sale business in spring of 2005, based upon the outlook for a weakening in pricing due to declines in demand and increases in supplies. However, in the aftermath of the Lehman Shock, declines in land prices and improvements in supply and demand conditions in the condominiums for sale market led Fuji to restart the condominiums for sale business in February 2012. Another feature of Fuji is its focus upon condominiums and residential properties that are carefully selected (such as their convenient proximity to stations) and that are attractively priced for first-time buyers.

(Source: Fuji Corporation)

“Nishinomiya Hama Kohshien” (Nishinomiya City, Hyogo)

Housing Distribution(31.4% of Total Sales for the consolidated cumulative second quarter of fiscal year ending March 2021)

Sales of refurbished used residential property called "Kaizo Kun" is conducted in this business segment. "Kaizo Kun" refurbished used residential properties are used residential properties purchased for renovation and sales. Fuji’s unique knowhow is leveraged in local community-based management and manualized procedure for renovation.

(Source: Fuji Corporation)

“Ouchi Kan” Housing information exhibition hall where visitors are able to see and choose freely. (Kishiwada City, Osaka)

Effective Land Utilization(16.3% of Total Sales for the consolidated cumulative second quarter of fiscal year ending March 2021)

Contract construction for leased properties and sales of rental apartment for sale to individual investors are conducted in this business. Construction work is performed for construction of rental residential properties sold on a proposal basis and leverages Fuji’s knowhow developed in its property leasing and management business. In addition, Fuji purchases lands and then constructs rental apartment buildings for sale to individual investor in this business. The highly price competitive wooden structure apartments called “Fuji Palace” were launched in November 2008, subsequently affordable rental apartments for seniors with nursing-care service, which are called “Fuji Palace Senior” as a means of differentiation. With regards to rental apartments for sales to individual investors, the price for apartments is roughly ¥100 million, and the demand for these types of rental properties remains strong as a fund management method. In addition, recently, the Company has been proactively developing affordable rental apartments for seniors with nursing-care services.

(Source: Fuji Corporation)

Low-rent affordable rental apartments for seniors with nursing-care services, “Fuji Palace Senior” (Sakai City, Osaka prefecture)

(Source: Fuji Corporation)

Fuji Palace series, rental apartments for sale to individual investors

Property Leasing and Management(18.7% of Total Sales for the consolidated cumulative second quarter of fiscal year ending March 2021)

The fully owned subsidiary Fuji Amenity Services Co., Ltd. provides rental apartment structure management, tenant solicitation, rent collection and other management services, in addition to consigned management of condominiums. Superior rental and management related services not only act as stable source of earnings, but also provide opportunities to achieve high synergy with contract construction of rental income properties, sales of rental apartments for sale to individual investors, and sales of condominiums.

Construction (2.8% of Total Sales for the consolidated cumulative second quarter of fiscal year ending March 2021)

This business consists of the sales of Yuuken Kensetsu Co., Ltd., Kansai Densetsu Kogyo Co., Ltd., and Nikken Setsubi Kogyo Co., Ltd., whose shares were all acquired by the company on January 29, 2020, to make them wholly-owned subsidiaries of the company. It became a reporting segment in the first quarter of the fiscal year ending March 2021.

1-2 Strengths of Fuji Corporation

Strength as a Complete Home Provider

Knowhow in the realms of acquisition of land and building permits, design, construction and sales cultivated in the detached home services has allowed Fuji to develop a wide range of businesses including its used residential property sales, effective land utilization, rental apartment buildings for sale to individual investors, and property leasing and management, as well as to cultivate synergies between these businesses. Furthermore, its local community-based management has also contributed to cultivate synergies among these wide-ranging businesses and achieve high levels of customer satisfaction in its real estate and related services.

(Source: Fuji Corporation)

Capabilities of the Refurbished Used Residential Property Business by utilizing knowhow

The “Kaizo-kun” refurbished used residential property business was born from the fusion of knowhow cultivated in the residential property agency sales and renovation businesses, which were launched along with the start of the Company. Fuji maintains a unique business model that enables them to conduct the three main functions of the residential property sales process including “acquisition,” “renovation,” and “sales” of used residential properties. The Company also boasts of the ability to create used residential properties that match the needs of customers because of its creation of manuals regarding how to renovate homes and information gathering of local markets based on its local community-based management style. In addition, a service called “Fuji Home Bank” has been created where coordination with judicial scriveners is conducted to purchase properties in cases of conclusion of inheritance registration. This service also offers the convenience of paying the inheritance registration fees from the fees derived from the sale of properties.

(Source: Fuji Corporation)

Ability to Propose Effective Land Utilization which increase returns

Fuji not only provides the ability to propose effective land utilization, but also offers market surveys, planning, design, construction, and rental property management services to maximize its capability as a comprehensive real estate developer. Land purchases and sales, apartment and condominium reconstruction, legal and tax related services, and other various expert opinions and services are available as precise solutions to suit the needs of customers. As to its rental property management business, strict selection of land from the vast amount of real estate information is based upon meticulous market surveys conducted by its full-time marketing staff, and planning is carried out only when long-term and stable management is feasible. In addition, Fuji only purchases properties that boast of highly superior locations and other conditions to be turned into high yielding used real estate products. Moreover, Fuji proposes a bundled leasing system to property owners as a means of providing them with full “security, safety, and stability” in the rental property management service.

(Source: Fuji Corporation)

Business Portfolio Synergies

The real estate industry is hugely influenced by external factors such as the economic environment and changes in interest rates. To establish a business model that can withstand these conditions, Fuji Corporation has endeavored to build a business portfolio that can generate stable profits by providing diversified products and services. Looking at the sales composition during the last 5 years, residential properties for sales has previously accounted for more than 40% of total sales in the past. However, Fuji Corporation has been able to achieve a more balanced business portfolio as the three business segments, 1) residential properties for sales, 2) housing distribution, and 3) effective land utilization and property leasing and management businesses, now account for over 30%.

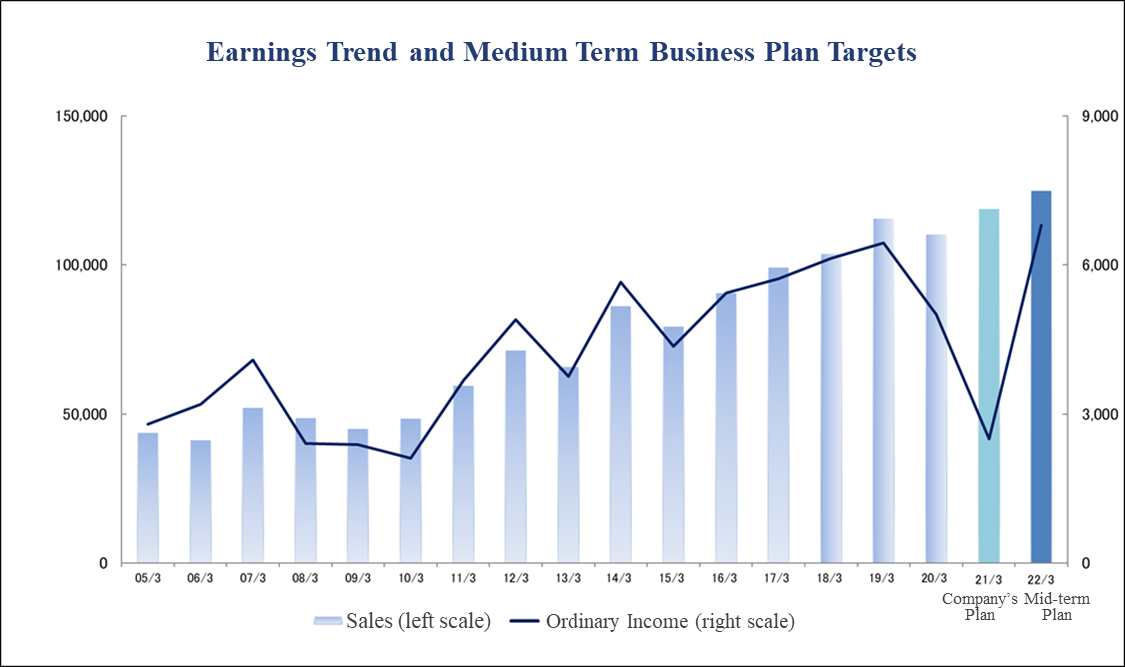

2. Mid-term profit plan (FY 3/2020 to FY 3/2022)

The company set mid-term goals for the coming 3 years. In order to cope with various changes in the external environment, including the skyrocketing prices of land and construction, the shortage of carpenters, the consumption tax hike, and the hovering of selling prices, the company will actively implement measures for “increasing the number of condominiums supplied,” “concentrating on more profitable areas,” and “raising recurring revenue” and aim to earn a record-high profit in the fiscal year March 2022, which is the final fiscal year of the mid-term profit plan. The numerical goals for the fiscal year March 2022 are sales of 125 billion yen and an ordinary income of 6.8 billion yen.

Sales, ordinary income, net income, and ROE exceeded the goals of the previous mid-term plan, which was implemented for 4 years until the fiscal year March 2019, thanks to the expansion of the businesses of residential properties for sales, effective land utilization, and property leasing and management. It can be said that the company’s strong ambition for attaining the mid-term goals was confirmed through the 4 years.

Medium Term Business Plan Targets

| FY 3/19 Previous Mid-term Plan | FY 3/19Act | FY 3/20 Act | FY 3/21 Company’s Plan | FY 3/22 Plan |

Sales | 102,000 | 115,710 | 110,444 | 119,000 | 125,000 |

Operating income | - | 6,636 | 5,002 | 2,500 | 7,300 |

Ordinary Income | 6,000 | 6,445 | 4,611 | 2,000 | 6,800 |

Net Income | 3,900 | 4,298 | 3,088 | 1,300 | 4,600 |

ROE | Over 10% | 11.9% | 8.0% | - | Over 10% |

*Units: ¥mn

Medium Term Business Plan Profit Assumptions

Results during Fiscal Year March 2020

Initially, the medium-term profit plan had the following prospects. This term will be the year for adjustment, as it is the transitional period for supply of condominiums and the consumption tax will be raised. The performance is estimated to decline from the previous term, because this term is the transitional period for supply of condominiums and it will take time to overcome the shortage of carpenters. In this situation, the investment for relocating the marketing office in Osaka City will be first posted. In addition, the company will increase the sale of land for affordable rental apartments for seniors with nursing-care services to individual investors who do not own land. The property leasing and management business is expected to be healthy, as the company will handle more rental apartments for sale to individual investors and more affordable rental apartments for seniors with nursing-care services.

Sales were higher than the estimated forecast at the beginning of the term, but operating income and ordinary income were lower than anticipated. This is because non-deductible consumption tax on land, etc. increased due to progress in land reclamation work for the sites of large-scale projects to be launched in the next term and the fund procurement costs increased due to accumulation of cash and deposits at the end of the current consolidated fiscal year.

Plans during Fiscal Year March 2021

It is expected that more condominiums will be delivered and overall performance will recover to the level exceeding that in the fiscal year March 2019. The company plans to deliver two condominium buildings in Sakai City and Izumi City, and the sales of the residential properties for sales business are projected to the level of the fiscal year March 2019. In addition, the large-scale project for selling detached homes in Hokusetsu and Hanshinkan areas will be launched. As for the housing distribution business, the company will enhance the procurement of profitable houses in Osaka City, Hokusetsu and Hanshinkan areas. In addition, affordable rental apartments for seniors with nursing-care services ordered in the fiscal year March 2019 will be delivered mainly from the fiscal year March 2021. The property leasing and management business is expected to keep growing steadily, achieving sales of 20 billion yen.

However, in addition to used residential properties, in the residential properties for sales business, the company will speed up collecting funds and inventory turnover by promoting land sales and built-for-sale type home sales, and setting flexible selling prices through price cuts targeting large-scale residential properties for new sales. By these efforts, the company will enhance funds in hand and reduce inventory risk to prepare for the second wave of the novel coronavirus. Thus, the company's performance is predicted to fall below the medium-term target in the plan for the fiscal year ending March 2021.

Plans during Fiscal Year March 2022

It is expected that the sales and profit of rental apartments and condominiums for sale will grow significantly, both marking a record high. The company plans to deliver 3 condominium buildings in Osaka, Sakai, and Settsu Cities, and the sales from residential properties for sales are projected to hit a record high. The large-scale detached home project in Hokusetsu and Hanshinkan areas will enter the delivery phase. While the number of rental apartments delivered will rise considerably, the property leasing and management business is expected to see the number of the company’s own affordable rental apartments for seniors with nursing-care services exceeding 50.

Medium Term Business Plan Targets for each Industry Segment

Segment Sales | FY 3/19 Act | FY 3/20 Act | FY 3/21 Mid-term | FY 3/22 Mid-term |

Residential Properties for Sales | 40,919 | 28,926 | 42,900 | 44,300 |

Housing Distribution | 33,094 | 38,176 | 30,500 | 31,000 |

Effective Land Utilization | 23,847 | 23,298 | 26,000 | 25,700 |

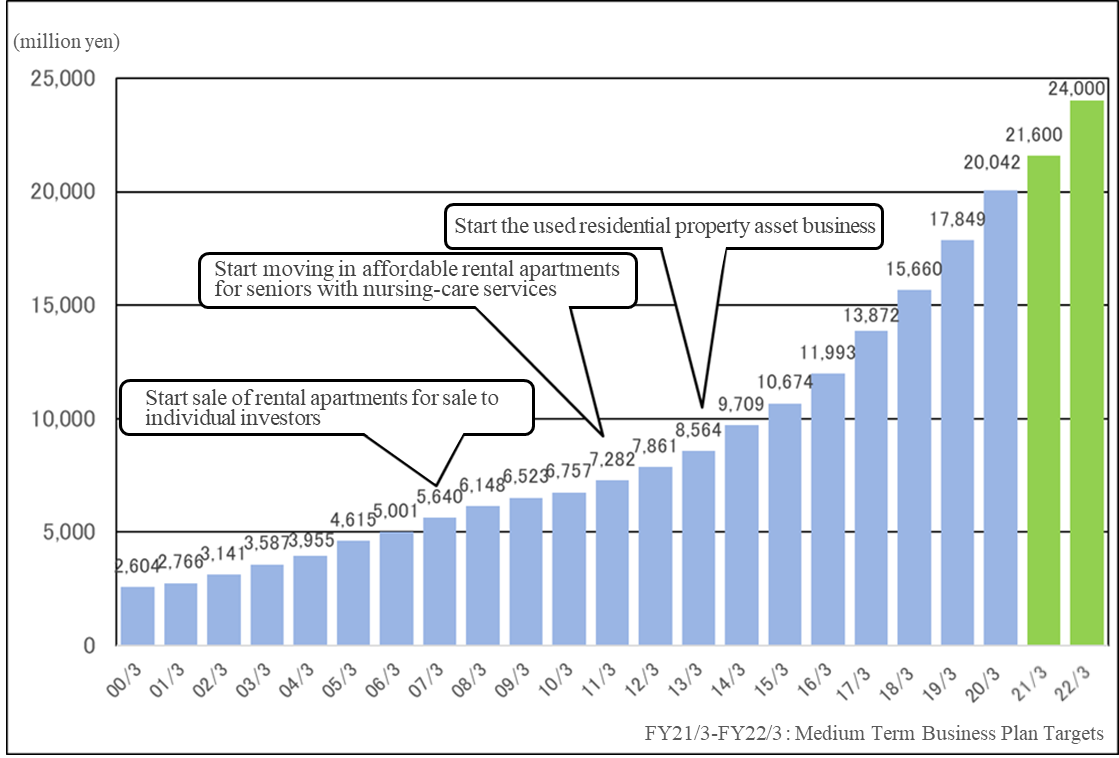

Property Leasing and Management | 17,849 | 20,042 | 21,600 | 24,000 |

Segment Profits | FY 3/19 Act | FY 3/20 Act | FY 3/21 Mid-term | FY 3/22 Mid-term |

Residential Properties for Sales | 3,726 | 1,313 | 2,680 | 2,720 |

Housing Distribution | 507 | 713 | 1,110 | 1,140 |

Effective Land Utilization | 2,381 | 2,171 | 2,720 | 2,690 |

Property Leasing and Management | 1,747 | 2,430 | 2,230 | 2,610 |

* Units: ¥mn

* Segment profits before adjustments

* Derived from Fuji Corporation’s Medium-Term Business Plan announced on May 8, 2019.

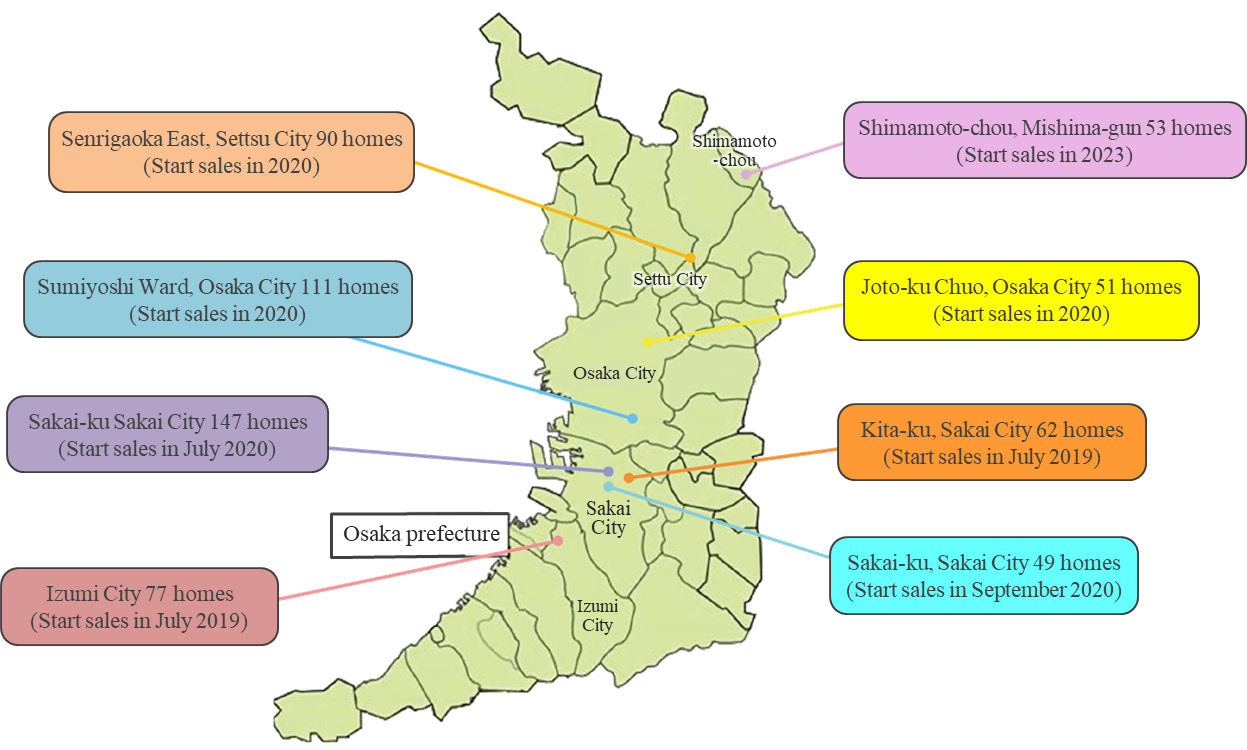

Topics about the residential properties for sales business

【Upcoming major projects for selling condominiums】

(From the mid-term profit plan of the company)

In the residential properties for sales business, the company plans to deliver 2 condominium buildings in Sakai and Izumi Cities in the fiscal year March 2021 and 4 condominium buildings in Osaka, Sakai, and Settsu Cities in the fiscal year March 2022.

Topics about the housing distribution business

【Area where used homes are distributed】

(From the mid-term profit plan of the company)

In the housing distribution business, the company plans to enhance procurement in Osaka City, Hanshinkan and Hokusetsu areas, to improve profit ratio.

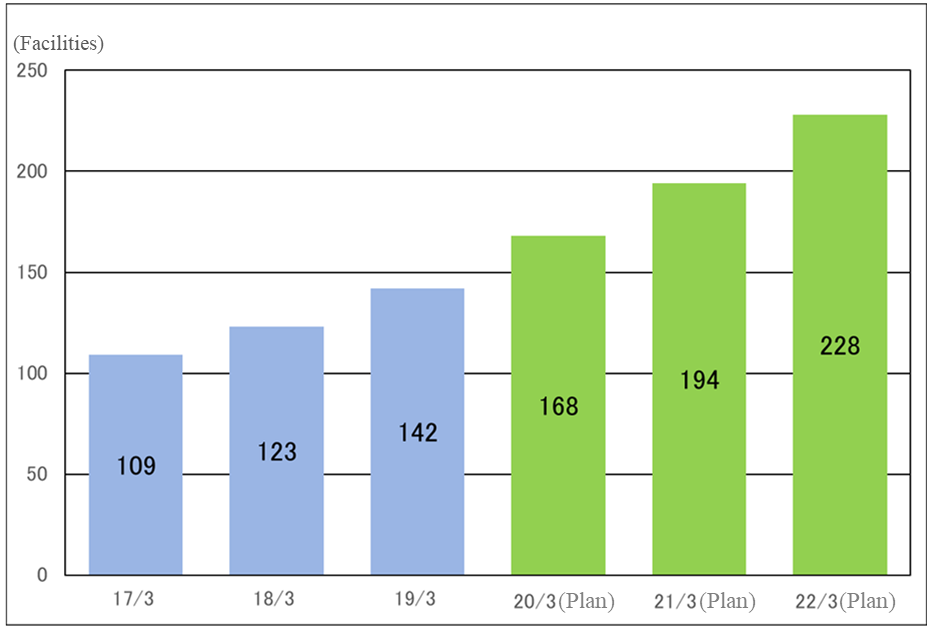

Topics about the effective land utilization business

【Variation in the cumulative number of affordable rental apartments for seniors with nursing-care services】

In the effective land utilization business, the affordable rental apartments for seniors with nursing-care services ordered in the fiscal year March 2019 are estimated to be delivered mainly from the fiscal year March 2021.

Topic of Property Leasing and Management

【Transition of the recurring revenue】

Recurring revenue has been increasing steadily, reaching 20 billion yen in sales in FY3/20.

3. The Second quarter of Fiscal Year ending March 2021 Earnings Results

(1) Consolidated Earnings

| FY 3/20 1H | Share | FY 3/21 1H | Share | YoY |

Sales | 51,136 | 100.0% | 56,553 | 100.0% | +10.6% |

Gross Income | 7,920 | 15.5% | 8,415 | 14.9% | +6.2% |

SG&A | 5,772 | 11.3% | 5,944 | 10.5% | +3.0% |

Operating Income | 2,148 | 4.2% | 2,470 | 4.4% | +15.0% |

Ordinary Income | 1,999 | 3.9% | 2,258 | 4.0% | +13.0% |

Parent Net Income | 1,287 | 2.5% | 1,474 | 2.6% | +14.5% |

*Data in this table and other parts of this report include figures which have been calculated by Investment Bridge, and may differ from those of the Company

*Units: ¥mn

Sales and ordinary income increased 10.6% and 13.0%, respectively, year on year.

In the second quarter of the fiscal year ending March 2021, sales increased 10.6% year on year to 56,553 million yen. Sales of (1) the housing distribution business dropped in which sales of used residential properties declined, and (2) the effective land utilization business fell too, where the number of rental apartments for sale for individual investors decreased, however, (3) residential properties for sales business improved because free-design homes and land sales increased, and (4) the property leasing and management business augmented as rental income rose. Also, (5) the construction business contributed to sales by making several companies into wholly-owned subsidiaries. The number of orders received, which indicates the sales status, increased 2.6% year on year. This was due to an improvement in the number of orders for free-design homes and land sales in the residential properties for sales business, despite the drop in the number of orders for used residential properties in the housing distribution business and the drop in the number of orders for affordable rental apartments for seniors with nursing-care services in the effective land utilization business. The order backlog, which is a leading indicator of sales, increased 6.5% from the end of the previous term, reaching a record high on a quarter-end basis.

Ordinary income rose 13.0% year on year to 2,258 million yen. As for segment profits, income decreased in (1) the housing distribution business due to setting flexible selling prices through price cuts and such, and in (2) the effective land utilization business too, due to a drop in the number of rental apartments for sale for individual investors. Nonetheless, income increased in (3) the residential properties for sales business due to the sale of a part of the land for large-scale residential properties, and also in (4) the property leasing and management business, and (5) the consolidation in the construction business factored in improved income.

Gross income margin fell 0.6 points year on year. The ratio of SG&A to sales fell 0.8 points year on year due to efforts to reduce costs such as cost reductions such as advertisement and personnel costs. As a result, the ratio of operating income to sales increased 0.2 points to 4.4%, leading to a rise in operating income by 15.0% year on year to 2,470 million yen. On the other hand, the growth rate in ordinary income was lower than the growth rate of operating income due to factors such as a decrease in subsidy income from non-operating income compared to the same period of the previous year, and an increase in interest expense year on year in non-operating expenses. As for extraordinary gains and losses, the company mainly recorded a loss on sales of noncurrent assets of 77 million yen, and a loss on retirement of noncurrent assets of 24 million yen.

(2) Segment Earnings

Segment Sales, Profits

| Sales | Share | YY Change | Segment Profits | Share | YY Change |

Residential Properties for Sales | 17,410 | 30.8% | +32.2% | 1,110 | 34.4% | +142.6% |

Housing Distribution | 17,750 | 31.4% | -4.9% | 171 | 5.3% | -63.2% |

Effective Land Utilization | 9,245 | 16.3% | -2.4% | 739 | 22.9% | -10.7% |

Property Leasing and Management | 10,582 | 18.7% | +7.5% | 1,195 | 37.0% | +5.7% |

Construction | 1,564 | 2.8% | - | 12 | 0.4% | - |

Adjustment | - | - | - | -759 | - | - |

Total | 56,553 | 100.00% | +10.6% | 2,470 | 100.00% | +15.0% |

*Units: ¥mn

* The construction segment represents the sales and segment profits of Yuuken Kensetsu Co., Ltd., Kansai Densetsu Kogyo Co., Ltd., and Nikken Setsubi Kogyo Co., Ltd., whose shares were all acquired by the company on January 29, 2020, to make them wholly-owned subsidiaries of the company. They became a reporting segment in the first quarter of this term.

Sales in the residential properties for sales segment increased 32.2% year on year to 17,410 million yen, and segment profit rose 142.6% year on year to 1,110 million yen.

In terms of sales, the delivery of free-design homes decreased from 334 units in the same period of the previous year to 327 units, and the delivery of condominiums dropped from 10 units to zero, year on year. However, selling part of the land for large-scale residential properties in Hyogo Prefecture contributed greatly to sales growth. As for segment profit, in preparation for the second wave of the novel coronavirus, the company adopted a policy of enhancing funds in hand and reducing inventory risk, and setting flexible selling prices through price reductions for newly launched large-scale residential properties. This impacted profit; however, the sale of part of the land for large-scale residential properties made a significant contribution to profit.

The volume of orders received increased 25.1% year on year to 20,871 million yen as the volume of orders for free-design homes rose to 358 units (346 units in the same period of the previous year), the volume of orders for condominiums for sale decreased to 50 units (86 units for the same period of the previous year), and land sales was 4,276 million yen (288 million yen for the same period of the previous year).

Sales in the housing distribution segment decreased 4.9% year on year to 17,750 million yen, and segment profit dropped 63.2% year on year to 171 million yen.

The number of used residential properties (detached homes) delivered declined from 170 units in the same period of the previous year to 123 units, and the number of used residential properties (condominiums) delivered also decreased from 660 units in the same period of the previous year to 655 units. Like the residential properties for sales segment, the flexible selling price setting through price reduction and such of used residential properties was the reason behind the rate of decrease in segment profit exceeding the rate of decline in sales.

The number of used residential properties (detached homes) orders received fell to 118 units (159 units in the same period of the previous year), and the number of used residential properties (condominiums) ordered received decreased to 649 units (673 units in the same period of the previous year). The volume of orders for the housing distribution segment was 17,037 million yen, a decrease of 7.8% from the same period of the previous year.

Sales in the effective land utilization segment declined 2.4% year on year to 9,245 million yen, and segment profit decreased 10.7% year on year to 739 million yen.

The decrease in the number of rental apartments for sale to individual investors delivered has resulted in the decline in sales and profits. The volume of orders received was 10,234 million yen, down 14.6% year on year. The volume of orders increased 1.3% year on year for rental apartments for sale to individual investors. Still, it decreased significantly for contract construction of rental properties and affordable rental apartments for seniors with nursing-care services.

Furthermore, sales in the property leasing and management segment increased 7.5% year on year to 10,582 million yen, and segment profit was up 5.7% year on year to 1,195 million yen. In addition to the rise in the number of managed properties due to the delivery of rental properties linked to the effective land utilization business, the increase in building numbers of affordable rental apartments for seniors with nursing-care services owned by the company contributed to improved profits.

Also, in the construction segment, which became a newly reported segment due to the new consolidation of subsidiaries, sales were 1,564 million yen, and segment profit was 12 million yen.

Segment Sales

| FY 3/20 1H | FY 3/21 1H | ||||

Volume | Value | Volume | Value | Share | YY Change | |

Free-design Homes, etc. | 334 homes | 12,458 | 327 homes | 12,776 | 22.6% | +2.6% |

Condominiums for Sale | 10 homes | 380 | - | - | 0.0% | - |

Land Sales | 2,481m2 | 327 | 33,232m2 | 4,634 | 8.2% | - |

Residential Properties for Sales | - | 13,166 | - | 17,410 | 30.8% | +32.2% |

Used residential properties (detached homes) | 170 homes | 4,045 | 123 homes | 3,349 | 5.9% | -17.2% |

Used residential properties (condominiums) | 660 homes | 14,609 | 655 homes | 14,399 | 25.5% | -1.4% |

Others | - | 2 | - | 1 | 0.0% | -9.4% |

Housing Distribution | 830 homes | 18,656 | 778 homes | 17,750 | 31.4% | -4.9% |

Contract Construction of Rental Properties | 12 contracts | 1,350 | 16 contracts | 1,408 | 2.5% | +4.2% |

Affordable Rental Apartments for Seniors with Nursing-care Services | 10 contracts | 2,946 | 9 contracts | 3,188 | 5.6% | +8.2% |

Rental Apartments for Sale to Individual Investors | 42 buildings | 5,175 | 34 buildings | 4,649 | 8.2% | -10.2% |

Effective Land Utilization | - | 9,472 | - | 9,245 | 16.3% | -2.4% |

Rental Income | - | 7,440 | - | 7,876 | 13.9% | +5.9% |

Income from Affordable Rental Apartments for Seniors with Nursing-care Services | - | 1,927 | - | 2,272 | 4.0% | +17.9% |

Management Fee Income | - | 471 | - | 433 | 0.8% | -8.1% |

Property Leasing and Management | - | 9,840 | - | 10,582 | 18.7% | +7.5% |

Construction | - | - | 71 contracts | 1,564 | 2.8% | - |

Total | - | 51,136 | - | 56,553 | 100.0% | +10.6% |

*Units: ¥mn

* The construction segment represents the sales and segment profits of Yuuken Kensetsu Co., Ltd., Kansai Densetsu Kogyo Co., Ltd., and Nikken Setsubi Kogyo Co., Ltd., whose shares were all acquired by the company on January 29, 2020, to make them wholly-owned subsidiaries of the company. They became a reporting segment in the first quarter of this term.

Segment Order Contracts

| FY 3/20 1H | FY 3/21 1H | |||

Volume | Value | Volume | Value | YY Change | |

Free-design Homes, etc. | 346 homes | 13,435 | 358 homes | 14,834 | +10.4% |

Condominiums for Sale | 86 homes | 2,956 | 50 homes | 1,760 | -40.5% |

Land Sales | 2,443m2 | 288 | 32,254m2 | 4,276 | - |

Residential Properties for Sales | - | 16,680 | - | 20,871 | +25.1% |

Used residential properties (detached homes) | 159 homes | 3,891 | 118 homes | 3,049 | -21.6% |

Used residential properties (condominiums) | 673 homes | 14,591 | 649 homes | 13,986 | -4.1% |

Others | - | 2 | - | 1 | -9.4% |

Housing Distribution | 832 homes | 18,485 | 767 homes | 17,037 | -7.8% |

Contract Construction of Rental Properties | 12 contracts | 1,392 | 8 contracts | 930 | -33.2% |

Affordable Rental Apartments for Seniors with Nursing-care Services | 8 contracts | 2,337 | 3 contracts | 946 | -59.5% |

Rental Apartments for Sale to Individual Investors | 61 buildings | 8,250 | 59 buildings | 8,356 | +1.3% |

Effective Land Utilization | - | 11,981 | - | 10,234 | -14.6% |

Construction | - | - | 63 contracts | 221 | - |

Total | - | 47,147 | - | 48,364 | +2.6% |

*Units: ¥mn

* The construction segment represents the sales and segment profits of Yuuken Kensetsu Co., Ltd., Kansai Densetsu Kogyo Co., Ltd., and Nikken Setsubi Kogyo Co., Ltd., whose shares were all acquired by the company on January 29, 2020, to make them wholly-owned subsidiaries of the company. They became a reporting segment in the first quarter of this term.

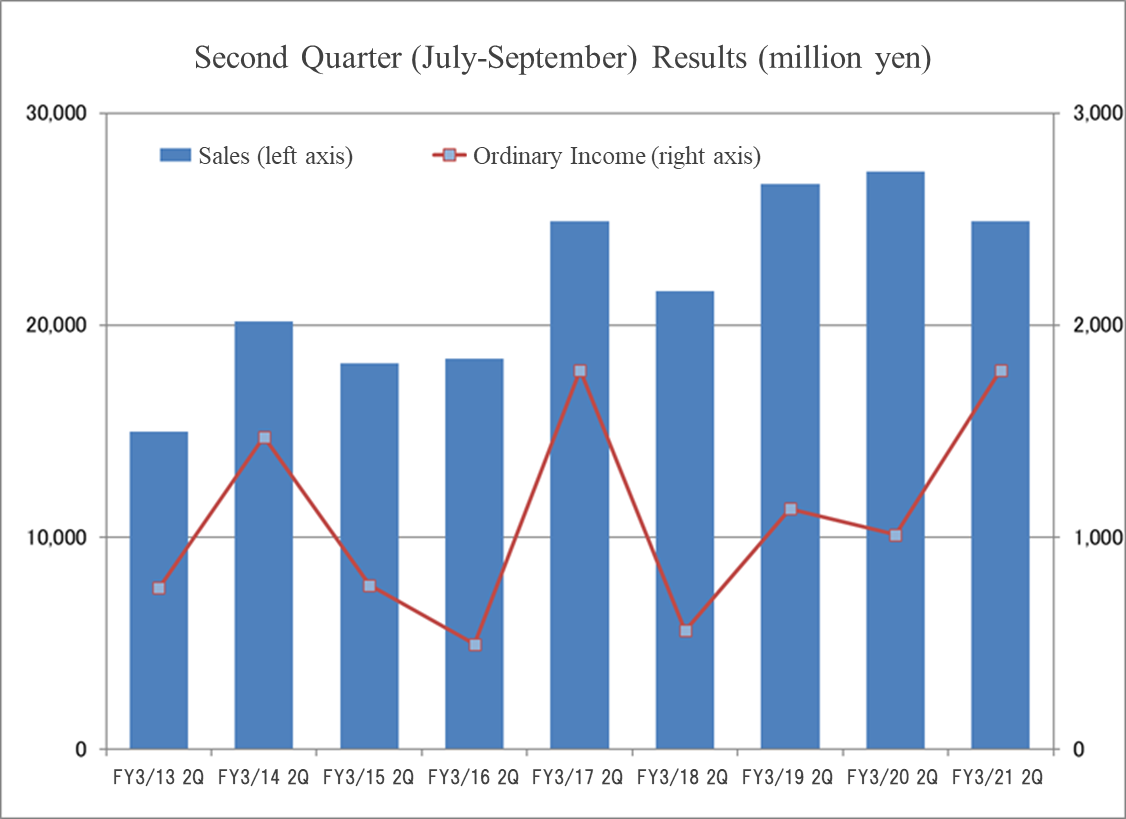

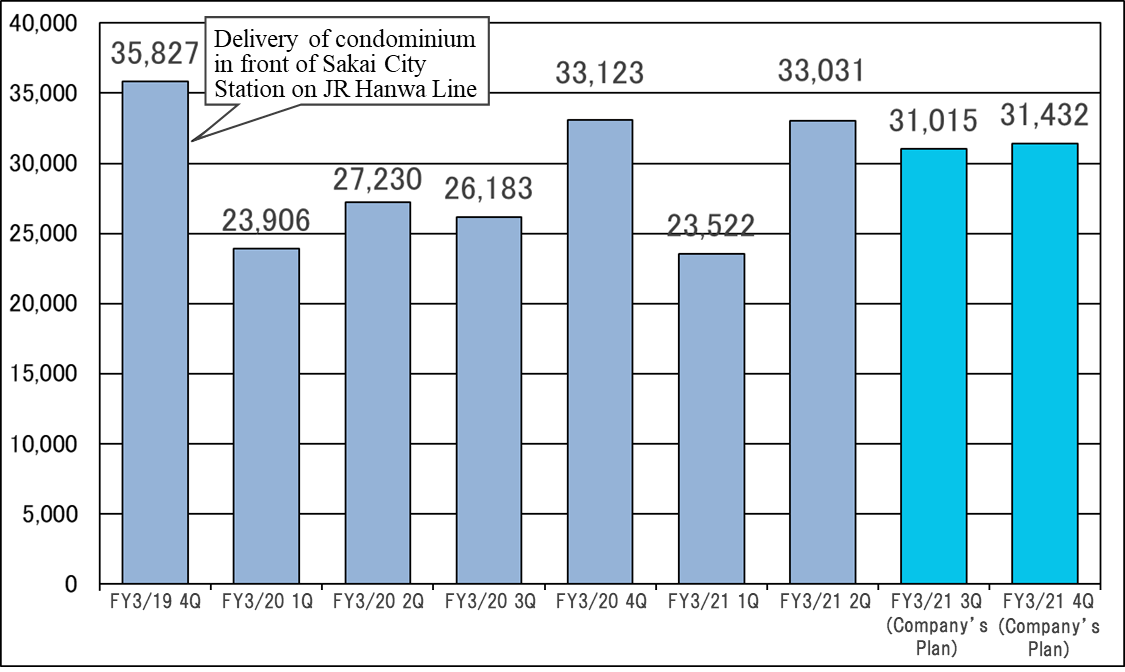

(3) Quarterly Earnings Trends

Consolidated sales and ordinary income for the second quarter (July-September)

In the second quarter (July-September) of this fiscal year, sales and recurring profit were boosted by the sale of part of the land for large-scale residential properties in Hyogo Prefecture.

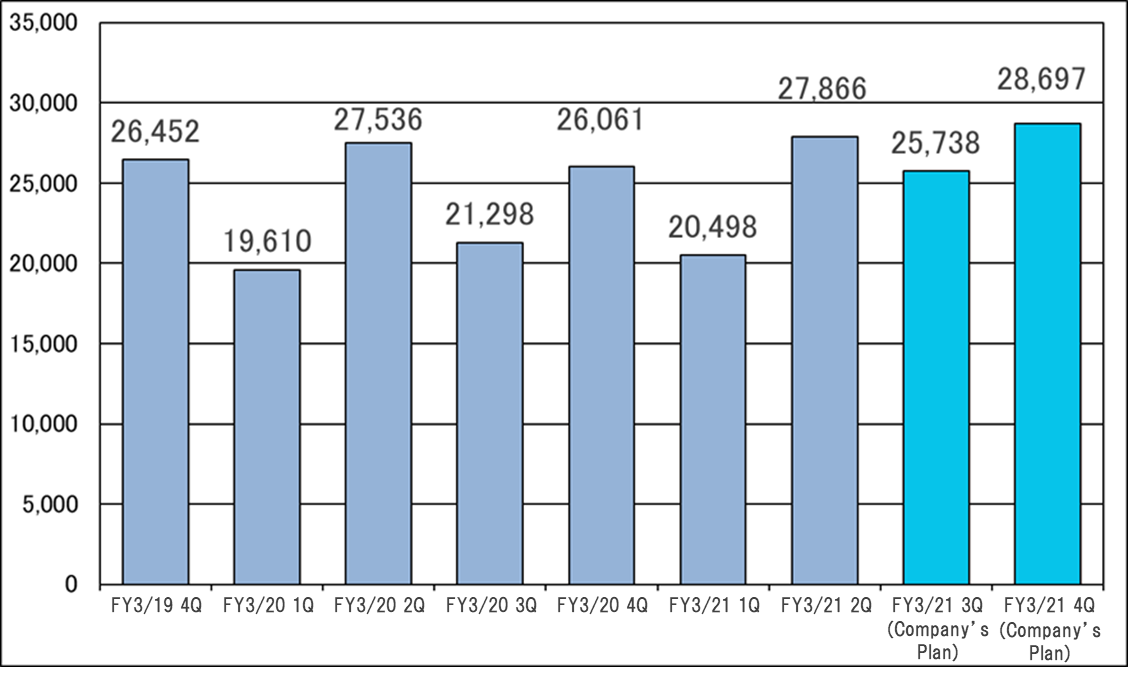

Variations in Quarterly Amount of Order Contracts and Estimates

*Units: ¥mn

(taken from the supplemental material for the company’s earnings summary)

Consolidated sales for the second quarter (July-September) of this term were 33,031 million yen. In the residential properties for sales segment, the sale of part of the land for large-scale residential properties in Hyogo Prefecture contributed significantly to sales growth. Under the policy of increasing funds in hand in preparation for a further downturn in the economic outlook for the medium- to long-term due to the spread of the novel coronavirus in this term, the company plans to increase liquidity by setting flexible selling prices in the second half of this term as well.

Variations in Quarterly Consolidated Amount of Order Contracts and Estimates

*Units: ¥mn

(taken from the supplemental material for the company’s earnings summary)

The consolidated volume of orders received in the second quarter (July-September) was 27,866 million yen, a record high for the quarterly accounting period. The main factor contributing to the volume of orders was the sale of part of the land for large-scale residential properties in Hyogo prefecture. However, after the state of emergency over the novel coronavirus spread was lifted, the real estate industry resumed business activities, and it is returning gradually to the same level before the spread of the virus. The volume of orders received for all segments during the second quarter of the current consolidated cumulative term is at the same level as the same period of the previous year or higher, except for April to May, when sales activities were not possible under the state of emergency.

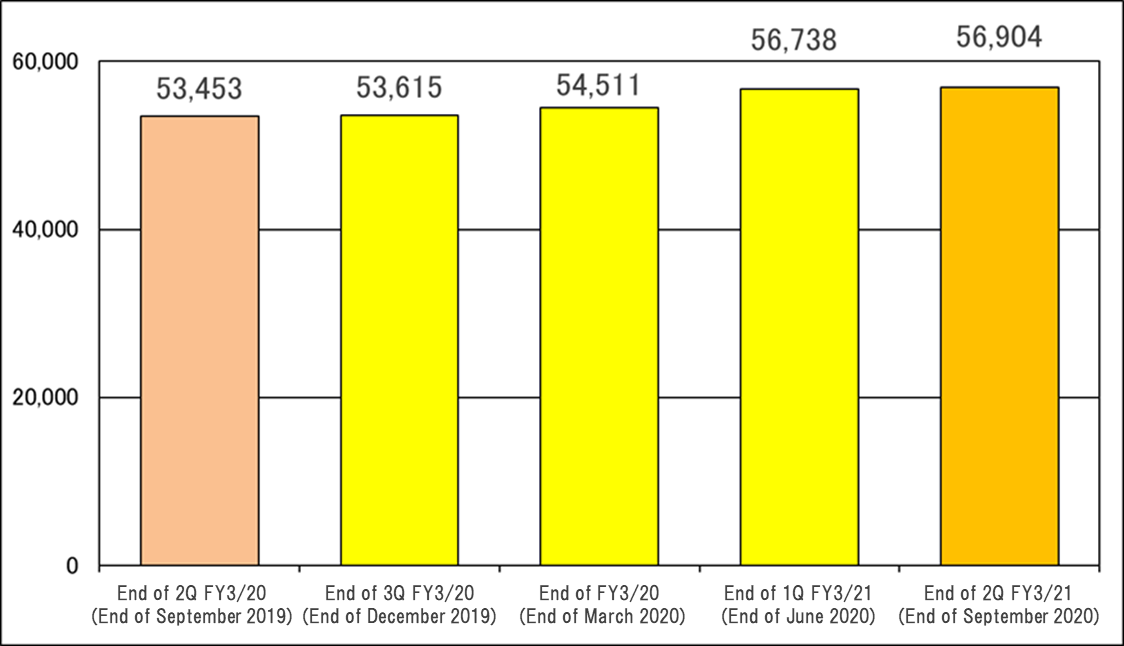

Variations in Amount of Order Contracts

*Units: ¥mn

(taken from the supplemental material for the company’s earnings summary)

The order backlog at the end of the second quarter reached a record high of 56,904 million yen, up 6.5% from the end of the same period of the previous year.

(4) Financial Conditions and Cash Flow (CF)

| March 2020 | September 2020 |

| March 2020 | September 2020 |

Cash, Equivalents | 14,757 | 18,856 | Payables | 4,199 | 4,298 |

Inventories | 102,064 | 96,621 | ST Interest Bearing Liabilities | 33,792 | 33,632 |

Current Assets | 119,763 | 118,267 | Unpaid Taxes | 1,278 | 918 |

Tangible Noncurrent Assets | 38,717 | 39,906 | Prepayments | 4,837 | 4,855 |

Intangible Noncurrent Assets | 716 | 694 | LT Interest Bearing Liabilities | 72,024 | 71,291 |

Investments, Others | 3,237 | 3,546 | Liabilities | 122,507 | 121,364 |

Noncurrent Assets | 42,671 | 44,147 | Net Assets | 39,927 | 41,050 |

Total Assets | 162,435 | 162,414 | Total Interest-Bearing Liabilities | 105,816 | 104,924 |

*Units: ¥mn

* Inventories = Real estate for sale + Real estate for sale in progress + Real estate for development + Payments for uncompleted construction + Inventories

* Interest bearing liabilities = Loans + Lease liabilities+Debenture

Total assets at the end of September 2020 were 162,414 million yen, down 20 million yen from the end of the previous term. On the asset side, inventories, mainly real estate for sale and real estate for development, decreased, and cash equivalents increased. On the liabilities and net assets side, short-term and long-term interest-bearing liabilities decreased and retained earnings increased. The main breakdown and amount of inventories are as follows: real estate for sale was 19.78 billion yen (24.82 billion yen at the end of the previous term), real estate for sale in progress was 29.93 billion yen (15.25 billion yen at the end of the previous term), and real estate for development was 46.63 billion yen (61.7 billion yen at the end of the previous term). Interest-bearing liabilities dropped by 892 million yen. Equity ratio was 25.3%, up 0.7 points from the end of the previous term.

Cash Flow

| FY 3/20 1H | FY 3/21 1H | YY Change | |

Operating Cash Flow (A) | -10,716 | 6,995 | 17,712 | - |

Investing Cash Flow (B) | -3,082 | -2,513 | 569 | - |

Free Cash Flow (A + B) | -13,799 | 4,482 | 18,282 | - |

Financing Cash Flow | 15,360 | -373 | -15,733 | -102.4% |

Cash and Equivalents at Term End | 13,602 | 18,667 | 5,064 | +37.2% |

*Units: ¥mn

Concerning the cash flow, operating CF turned positive due to a decrease in inventories. The deficit of investing CF shrank due to the decline in the acquisition amount of tangible noncurrent assets and an increase in the sales amount of tangible noncurrent assets, so free CF turned positive. On the other hand, financial CF decreased due to the expansion of the repayment range of long-term debt. As a result, cash and equivalents at term end rose 37.2% year on year.

4. Fiscal Year March 2021 Earnings Estimates

(1) Consolidated Earnings

| FY 3/20 Act. | Share | FY 3/21 Est. | Share | YY Change |

Sales | 110,444 | 100.0% | 119,000 | 100.0% | +7.7% |

Operating Income | 5,002 | 4.5% | 2,500 | 2.1% | -50.0% |

Ordinary Income | 4,611 | 4.2% | 2,000 | 1.7% | -56.6% |

Parent Net Income | 3,088 | 2.8% | 1,300 | 1.1% | -57.9% |

*Units: ¥mn

Sales are expected to increase 7.7% and ordinary income are estimated to decline 56.6%, year on year.

The company plan for the fiscal year ending March 2021 is unchanged from the forecast that sales will increase 7.7% year on year to 119 billion yen and ordinary income will decrease 56.6% to 2 billion yen year on year.

After the state of emergency over the novel coronavirus was lifted, the real estate industry resumed business activities, and it is returning gradually to the same level before the spread of the virus. The volume of orders received for each segment during the first half of the current term is the same level as the same period of the previous year or higher, except for April to June, when sales activities were not possible under the state of emergency.

Under these circumstances, sales in the housing distribution business will decline significantly. However, sales of the residential properties for sales business, which plans to deliver two condominium buildings in Sakai City and Izumi City and sell some land for large-scale building lot, are predicted to contribute to sales growth.

As for profits, promoting land sales and built-for-sale type housing sales, and setting flexible selling prices through price reductions and such for newly launched large-scale residential properties to further enhance funds in hand and reduce inventory risk, will have an impact on profit. The operating income margin is assumed to be 2.1%, down 2.4 points from the previous year.

The dividend forecast remains unchanged at the same amount as the previous term, which is 27 yen per share (14 yen at the end of the first half and 13 yen at the end of the term).

Full-year consolidated sales forecast by segment

| FY 3/20 Act. | FY 3/21 Est. | |||

Volume | Value | Volume | Value | YY Change | |

Free-design Homes | 736 homes | 27,666 | 740 homes | 29,950 | +8.3% |

Condominiums for Sale | 14 homes | 519 | 140 homes | 4,880 | +839.8% |

Land Sales | 6,142m2 | 740 | - | 6,070 | +719.6% |

Residential Properties for Sales | - | 28,926 | - | 40,900 | +41.4% |

Housing Distribution | 1,707 homes | 38,176 | 1,402 homes | 30,200 | -20.9% |

Contract Construction of Rental Properties | 29 contracts | 3,250 | 38 contracts | 3,750 | +15.4% |

Affordable Rental Apartments for Seniors with Nursing-care Services | 19 contracts | 5,581 | 26 contracts | 5,300 | -5.0% |

Rental Apartments for Sale to Individual Investors | 110 buildings | 14,466 | 103 buildings | 14,250 | -1.5% |

Effective Land Utilization | - | 23,298 | - | 23,300 | +0.0% |

Rental Income | - | 15,080 | - | 15,930 | +5.6% |

Income from Affordable Rental Apartments for Seniors with Nursing-care Services | - | 4,017 | - | 4,700 | +17.0% |

Management Fee Income | - | 944 | - | 970 | +2.7% |

Effective Land Utilization | - | 20,042 | - | 21,600 | +7.8% |

Construction | - | - | - | 3,000 | - |

Total | - | 110,444 | - | 119,000 | +7.7% |

*Units: ¥mn

* The construction segment represents the sales and segment profits of Yuuken Kensetsu Co., Ltd., Kansai Densetsu Kogyo Co., Ltd., and Nikken Setsubi Kogyo Co., Ltd., whose shares were all acquired by the company on January 29, 2020, to make them wholly-owned subsidiaries of the company. They became a reporting segment in the first quarter of this term.

In this term, the company plans to deliver two condominium buildings in Sakai City and Izumi City and sell part of the land for large-scale building lot, which is expected to contribute to sales of the residential properties for sales segment.

Full-year consolidated operating income forecast by segment

| FY 3/20 Act. | FY 3/21 Est. | YY Change | Factor |

Residential Properties for Sales | 1,313 | -160 | -112.2% | Promotion of land sales and built-for-sale type housing sales and setting flexible selling prices such as price reductions for newly launched large-scale residential properties will have an impact. |

Housing Distribution | 713 | 20 | -97.2% | Setting flexible selling prices such as price cuts for used residential properties will have an impact. |

Effective Land Utilization | 2,171 | 1,980 | -8.8% | Due to the spread of the novel coronavirus, the number of rental apartments for sale to individual investors delivered decreased due to refraining from business activities from April to May. |

Property Leasing and Management | 2,430 | 2,440 | +0.4% | Due to the delivery of rental properties linked to the effective land utilization business, the number of managed properties and the number of buildings of affordable rental apartments for seniors with nursing-care services owned by the company increased. |

Construction | - | 100 | - | The operating income of Yuuken Kensetsu Co., Ltd., Kansai Densetsu Kogyo Co., Ltd., and Nikken Setsubi Kogyo Co., Ltd., which became wholly-owned subsidiaries of the company on January 29, 2020. |

Total | 6,629 | 4,380 | -33.9% |

|

*Units: ¥mn

*Total operating income is before deduction of corporate expenses

(2) The progress rate of sales in the first half against the full-year earnings estimates

| Sales | Operating Income | Ordinary Income | (Quarterly) Parent Net Income |

Full year forecast (announced on Aug. 4) | 119,000 | 2,500 | 2,000 | 1,300 |

1H Results | 56,553 | 2,470 | 2,258 | 1,474 |

Full-year forecast progress rate | 47.5% | 98.8% | 112.9% | 113.4% |

*Units: ¥mn

The progress rate of sales in the first half against the full-year earnings estimates was favorable at 47.5%. However, the company adopted a policy of further enhancing funds in hand, promoting land sales and built-for-sale type housing sales to reduce inventory risk, and setting flexible selling prices through price cutting and such for newly launched large-scale residential properties. Therefore, the full-year company plan forecast has been unchanged.

Results for the second quarter of the current consolidated cumulative term of fiscal year ending March 2021 and the progress status of the full-year company forecast.

It is predicted that the company will achieve 95,068 million yen in sales (79.9% of the full-year target), which is adding the scheduled sales for this term which are 38,514 million yen out of the contract backlog (56,904 million yen) at the end of September 2020, to the consolidated sales for the second quarter of the current consolidated cumulative term of fiscal year ending March 2021 that amounted to 56,553 million yen. Moreover, by adding the sales of 11,017 million yen for property leasing and management after October, which will not be significantly fluctuate, the company would achieve 89.2% of the full-year target. The 12,914 million yen (10.8% of the full-year target) difference from the full-year target will be reached through the sales of used residential properties, land sales, and built-for-sale homes that will be included in sales for this term out of orders received after October. The company is making good progress toward achieving its plan.

(3) Birth of the New Condominium Brand Branneed

The company launched a new condominium brand, Branneed, an urban high-range condominium brand, and started selling three condominium projects in October. Branneed is mainly located in good locations within a five-minute walk from the station. Setting focus on the essential value of urban life, Branneed's concept is to enrich the lives of the dwellers and creates high-range residences that will continue to be needed through time.

It is anticipated that sales will expand in the future, along with the existing condominium brand Charmant Fuji.

(taken from the supplemental material for the company’s earnings summary)

5. Conclusions

The volume of orders received in the second quarter (July-September) was strong, with a record high for the quarterly accounting period. The sale of part of the land for large-scale residential properties in Hyogo Prefecture was also a factor in the expansion in orders. Nonetheless, after the state of emergency over the novel coronavirus was lifted, the real estate industry resumed business activities, and it is returning gradually to the same level before the spread of the virus. The volume of orders received for each segment during the second quarter of the current consolidated cumulative term is at the same level as the same period of the previous year or higher, except for April to May, when sales activities were not possible under the state of emergency. With an abundant backlog of orders, sales in the second half are expected to move steadily toward achieving the company plan's target. On the other hand, the company forecasts that there will be a profit deficit in the second half at all stages. This forecast is based on taking into consideration the deterioration of profitability due to the recording of orders received in the second half through discount sales conducted in the second half of the previous term and the first half of this term. There is no need for aggressive discounts in the current favorable order environment. So, it is questionable whether the profitability of orders for many properties, except for some projects, will really deteriorate to this extent or whether it is a fairly conservative profit plan considering the uncertainty due to the spread of the novel coronavirus. Thus, we will focus on the profitability of the third quarter.

The newly launched condominium brand Branneed went on sale in October. Branneed is a group of urban condominiums built in good locations mainly within a five-minute walk from the station and is expected to attract consumer demand. Moreover, the existing condominium brand, Charmant Fuji, is scheduled to be delivered next term. We will focus on the status of orders for condominiums scheduled to be sold next term, which is expected to be a driving force for the recovery of business performance in the next term.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 7 directors, including 2 external ones |

Auditors | 3 auditors, including 2 external ones |

◎Corporate Governance Report

The company submitted its latest corporate governance report on December 4, 2020.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

【Supplementary principle 1-2-4. Electronic exercise of voting rights and translation of notices of convocation of shareholders’ meetings into English】 | The electronic voting platform is available. Because the proportion of overseas investors in our company is small, we currently consider that it is not necessary to translate Notice of Convocation of Shareholders' Meetings into English; however, when the ratio of voting rights overseas investors hold to all voting rights exceeds 20%, we will consider providing the English version of Notices of Convocation. For IR activities, we offer some reports and the bare minimum of pages of our website in English. |

[Principle 2-6. Activating the function of corporate pension funds as asset owners] | There is no corporate pension system. We believe that the diminishing of the lifetime employment concept increases the need to reward the current contributions. Thus, we strive to secure excellent human resources by providing severance pay that they should receive in the future in addition to their current salary. |

[Supplementary Principle 4-10-1. Utilization of optional structures] | We are a company with a board of corporate auditors, and although the number of independent outside directors has not reached the majority of the board of directors, two outside directors and two outside auditors have been appointed. Based on their abundant experience and deep insight as certified accountants, tax accountants, and lawyers, we believe that we have received appropriate involvement and advice regarding the nomination and compensation of directors. Therefore, we do not think that an optional advisory board is necessary at this time, but we will consider establishing it if necessary. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Principle 1-4. Strategically held shares】 | In all of our businesses, we carry out comprehensive transactions with financial institutions, such as borrowing funds for acquisition of real estate, acquiring information on real estate purchasing, and introducing customers in the effective land utilization business. Cooperation with financial institutions is essential for business expansion and sustainable development. For the medium- to long-term goal of improving corporate value, we seek understanding on our management philosophy and management attitude, and we plan to hold investment stocks of financial institutions, which are premised on comprehensive transactions, after verifying their economic rationality. The maximum number of shares held for each issue is 500,000 and the shareholder’s equity is within 2%. With regard to the exercise of voting rights for shares held for policy purposes, we will make a decision to approve or disapprove after carefully examining each individual proposal based on whether the proposal will lead to an increase in the corporate value of the Company and its investee companies and whether it is compatible with the Company's purpose of holding the shares. |

[Supplementary Principle 4-11-3. Summary of the results of analysis and evaluation of the effectiveness of the overall board of directors] | Every year, the board of directors' effectiveness is evaluated in the form of an anonymous questionnaire, and the results are reported to the Board of Directors. The results of the analysis and evaluation of the effectiveness of the Board of Directors are as follows. The frequency of meetings of the Board of Directors and each officer's attendance status is appropriate, and the management of the meetings is carried out appropriately, allowing the deliberations on each agenda item, such as by the advance distribution of materials. As for future issues, to deepen discussions at the Board of Directors, we will make improvements such as submitting questions from all officers in advance regarding agenda items, and report items and answering those questions at the Board of Directors. |

[Principle 5-1 Policy on constructive dialogue with shareholders] | The IR Office is in charge of dialogue with shareholders, and the officer in charge of IR is responsible for its supervision. The IR Office cooperates with the Corporate Planning Department, General Affairs Department, Human Resources and Legal Department, Finance Department, and Internal Audit Office on a daily basis, and the necessary information is to be reported to the IR Office. The IR Office holds company information sessions for individual investors and for analysts and institutional investors, in Osaka, Tokyo, Nagoya, and Fukuoka. We are also working to deepen the shareholders' understanding of our management philosophy and policies, by making the content of results briefings, information disclosed on our website, and shareholder newsletters easy to understand for individual investors. We provide feedback to the directors and the Board of Directors regarding the opinions and concerns of shareholders that were identified during the dialogue. |

<Other>

In the basic policy concerning corporate governance, it states, “We aim to be a company that is always trusted by our customers, business partners, and shareholders and contributes to society through our business by cultivating the existing business areas, aggressively entering in Osaka City, which is the largest market in the prefecture, as well as the northern area of Osaka Prefecture and the southern area of Hyogo Prefecture and improving profitability and strengthening the financial position based on the idea of expanding the business in line with the growth of human resources.”

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

The back number of Bridge Report (Fuji Corporation: 8860) and the contents of Bridge Salon (IR Seminar) can be viewed here: www.bridge-salon.jp/