Bridge Report:(8860)Fuji Second quarter of the fiscal year ending March 2022

President Nobutsuna Miyawaki | Fuji Corporation Ltd. (8860) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Real Estate |

President | Nobutsuna Miyawaki |

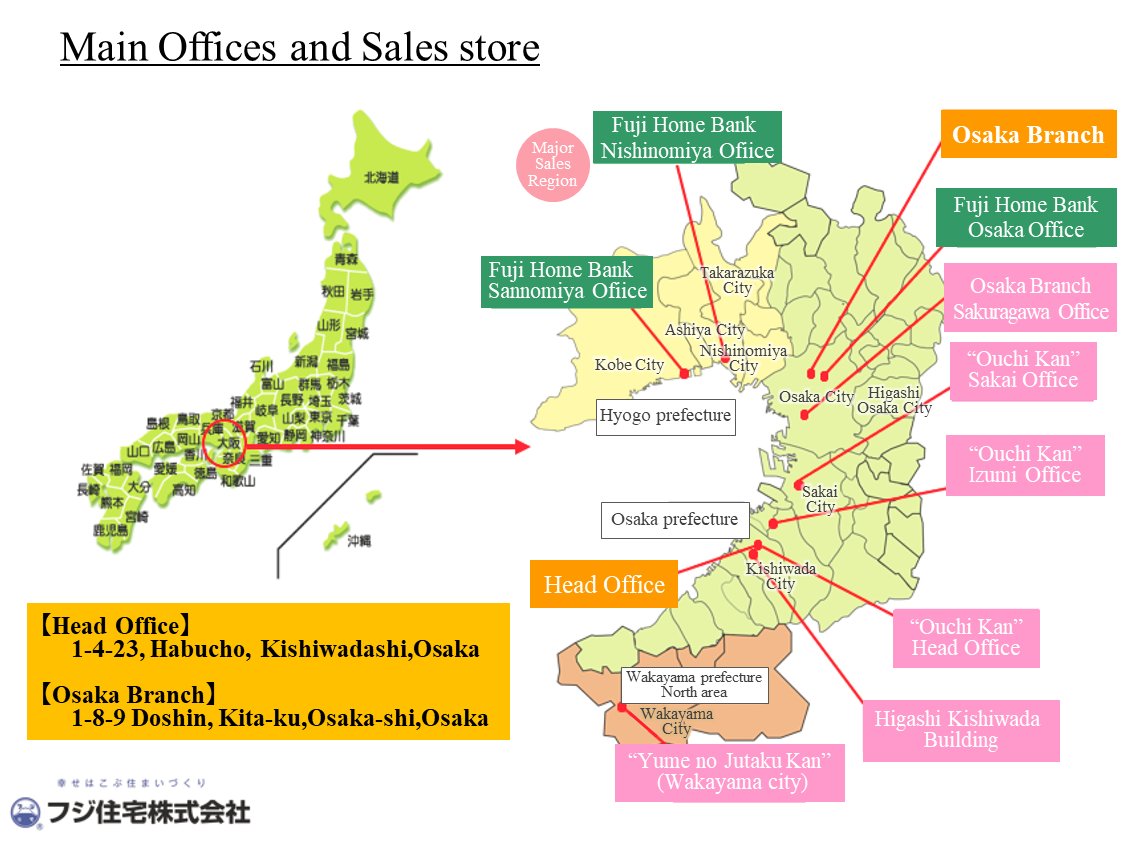

HQ Address | 1-4-23 Habucho, Kishiwada-shi, Osaka |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Share Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥657 | 35,985,543 shares | ¥23,643 million | 5.8% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥27.00 | 4.1% | ¥86.15 | 7.6x | ¥1,162.92 | 0.6x |

*The share price is the closing price on December 20 2021. The number of shares issued at the end of the most recent quarter excludes its treasury shares. Figures are rounded to the nearest decimal point.

*ROE and BPS are based on FY 3/21 earnings results. EPS and DPS are based on FY 3/22 earnings estimates.

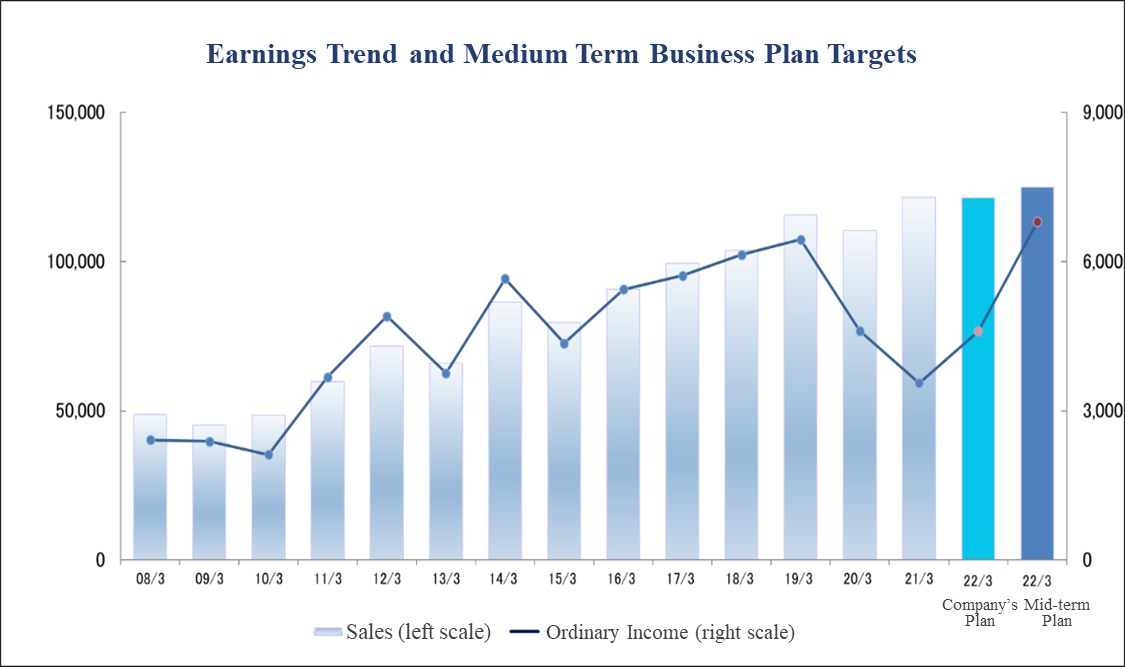

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Parent Net Income | EPS | DPS |

March 2018 Act. | 103,880 | 6,438 | 6,139 | 4,168 | 116.08 | 27.00 |

March 2019 Act. | 115,710 | 6,636 | 6,445 | 4,298 | 120.40 | 27.00 |

March 2020 Act. | 110,444 | 5,002 | 4,611 | 3,038 | 87.40 | 27.00 |

March 2021 Act. | 121,541 | 3,986 | 3,558 | 2,358 | 66.00 | 27.00 |

March 2022 Est. | 121,400 | 5,000 | 4,600 | 3,100 | 86.15 | 27.00 |

*Units: million-yen, yen

This Bridge Report provides information about the second quarter of the fiscal year ending March 2022 earnings results of Fuji Corporation Ltd.

Table of Contents

Key Points

1. Company Overview

2. Mid-term profit plan (FY 3/2020 to FY 3/2022)

3. The Second quarter of Fiscal Year ending March 2022 Earnings Results

4. Fiscal Year ending March 2022 Earnings Estimates

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the second quarter of the fiscal year ending March 2022, sales decreased 0.2% year on year and ordinary income increased 48.5% year on year. In terms of sales, although there was a reactionary decline from the sale of some bare land for large-scale residential properties in Kakogawa City, Hyogo Prefecture, which was recorded in the same period of the previous fiscal year, there were increases in the number of free design houses and rental apartments for sale to individual investors, as well as the completion and delivery of condominiums. In terms of profits, the above-mentioned factors that reduced profits in the same period of the previous fiscal year due to the sale of bare land were offset by improved profitability in the housing distribution segment and the reduction of advertising and other expenses, resulting in a significant increase in profits. The order backlog as of the end of September 2021, which is a leading indicator of sales, increased 3.5% from the end of September 2020 thanks to the favorable number of orders for condominiums and rental apartments for sale to individual investors.

- The first half of the fiscal year has ended, and the company's plan for the fiscal year ending March 2022 remains unrevised with 0.1% decrease in sales and 29.3% increase in ordinary income year on year. In terms of sales, it is expected that the disappearance of the land sales that occurred in the previous fiscal year will produce effects and the housing distribution segment, centered on used condominiums, will continue to face a challenging environment. However, it is projected that the decline in sales will be covered by the rise in the order backlog of the residential properties for sale and the leasing and management segments. Also, the end of the impact of the revision of inventory valuation in the previous fiscal year and the increase in the delivery of highly profitable free-design housing, condominiums for sale, and rental apartment buildings for sale for individual investors is expected to contribute to an improvement in profits. The annual dividend forecast of 27 yen per share (14 yen at the end of the first half and 13 yen at the end of the fiscal year), the same as that in the previous fiscal year, was left unchanged.

- The company's lead time from order receipt to sales is long, except for used residential properties, with free design houses taking about nine months and rental apartments for sale to individual investors taking about a year. Therefore, the backlog of orders at the end of the third quarter will be a very important factor in forecasting the expansion of business in the next fiscal year. The backlog of orders at the end of the current third quarter, which will be a barometer for earnings growth in the next fiscal year, will be closely watched.

1. Company Overview

Fuji Corporation Ltd. provides various real estate related services including sales of new and used condominiums and detached homes primarily in Osaka Prefecture (where the Company is based), between Osaka and Kobe, and within Wakayama City. Their main business is the sale of detached homes, albeit a built-for-sale type, that would maximize customer satisfaction by allowing for the “free-design home” regarding layout, specifications, etc. within the boundaries of Japan’s Building Standards Act. Fuji also boasts of strengths in the development of properties where 50 to 200 homes are constructed in coordination with the surrounding environment and each other to provide uniformity in neighborhoods. The other main pillars of the Company’s business include renovation and sale of used residential properties, collaboration with financial institutions for effective land utilization, sales of rental apartments for sale to individual investors, property leasing and management services.

Fuji boasts of unique knowhow developed in various businesses realms derived from its sales agency and detached home services. Furthermore, the complementary and synergistic effects that occur between its various business divisions allow the Company as a Complete Home Provider to respond with solutions that match the needs of home owners and residents in various geographic regions and times. Another strength of Fuji is local community-based management to match the time and place of the markets, and to maintain high levels of customer satisfaction by upholding the principles of “never ignoring customers after the sale” and “never ignoring customers after the completion of construction.”

(Taken from the reference material of the company)

1-1 Business Description

*The percentage represents the ratio of sales in each business segment to the total sales of the reporting segments (excluding internal sales).

Residential Properties for Sales(35.4% of Total Sales for the second quarter of fiscal year ending March 2022)

Sales of detached homes and condominiums are conducted in this business. A characteristic of this business is Fuji’s ability to develop neighborhoods of new detached homes in 50 to 200 units that match the local neighborhoods, and to allow its customers to participate in the designing of the property. More specifically, these “free-design” homes respond to the needs of individual customers by allowing them to customize the layout and specification of the homes to suit their tastes and needs. Furthermore, new condominiums for sale are also included in the residential properties for sales business segment. Fuji halted the condominium for sale business in spring of 2005, based upon the outlook for a weakening in pricing due to declines in demand and increases in supplies. However, in the aftermath of the Lehman Shock, declines in land prices and improvements in supply and demand conditions in the condominiums for sale market led Fuji to restart the condominiums for sale business in February 2012. Another feature of Fuji is its focus upon condominiums and residential properties that are carefully selected (such as their convenient proximity to stations) and that are attractively priced for first-time buyers.

|

|

(Taken from the reference material of the company)

(Left: “Asumo no Oka Green Central Sakai” Right: “Charman Fuji Wakayama Ekimae Gran Peak”)

Housing Distribution(20.7% of Total Sales for the second quarter of fiscal year ending March 2022)

Sales of refurbished used residential property called "Kaizo Kun" is conducted in this business segment. "Kaizo Kun" refurbished used residential properties are used residential properties purchased for renovation and sales. The company conducts business activities in this segment mainly in the region between Osaka City and Kobe City.

(Taken from the reference material of the company)

“Ouchi Kan” Housing information exhibition hall where visitors are able to see and choose freely. (Kishiwada City, Osaka)

Effective Land Utilization(21.7% of Total Sales for the second quarter of ending March 2022)

Contract construction for leased properties and sales of rental apartment for sale to individual investors are conducted in this business. Construction work is performed for construction of rental residential properties sold on a proposal basis and leverages Fuji’s knowhow developed in its property leasing and management business. In addition, Fuji purchases lands and then constructs rental apartment buildings for sale to individual investor in this business. The highly price competitive wooden structure apartments called “Fuji Palace” were launched in November 2008, subsequently affordable rental apartments for seniors with nursing-care service, which are called “Fuji Palace Senior” as a means of differentiation. With regards to rental apartments for sales to individual investors, the price for apartments is roughly ¥100 million, and the demand for these types of rental properties remains strong as a fund management method. In addition, recently, the Company has been proactively developing affordable rental apartments for seniors with nursing-care services.

(Taken from the reference material of the company)

Low-rent affordable rental apartments for seniors with nursing-care services, “Fuji Palace Senior” (Sakai City, Osaka prefecture)

(Taken from the reference material of the company)

Fuji Palace series, rental apartments for sale to individual investors

Property Leasing and Management(20.7% of Total Sales for the second quarter of ending March 2022)

The fully owned subsidiary Fuji Amenity Services Co., Ltd. provides rental apartment structure management, tenant solicitation, rent collection and other management services, in addition to consigned management of condominiums. Superior rental and management related services not only act as stable source of earnings, but also provide opportunities to achieve high synergy with contract construction of rental income properties, sales of rental apartments for sale to individual investors, and sales of condominiums.

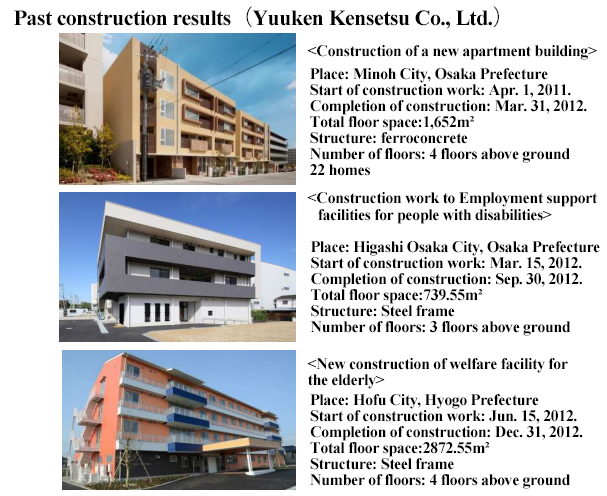

Construction related (1.5% of Total Sales for the second quarter of ending March 2022)

This business consists of the sales of Yuuken Kensetsu Co., Ltd., Kansai Densetsu Kogyo Co., Ltd., and Nikken Setsubi Kogyo Co., Ltd., whose shares were all acquired by the company on January 29, 2020, to make them wholly-owned subsidiaries of the company. It became a reporting segment in the first quarter of the fiscal year ending March 2021.

To further meet the demand for effective land utilization projects, the company welcomed the Yuken Kensetsu Group as a partner in constructing steel frames and reinforced concrete structures. Yuken Kensetsu Group has a wide range of construction achievements for government offices and private companies, mainly in Osaka prefecture. The company aims to stabilize and expand its business performance by enhancing its project lineup by providing non-wooden housing.

1-2 Strengths of Fuji Corporation

Strength as a Complete Home Provider

Knowhow in the realms of acquisition of land and building permits, design, construction and sales cultivated in the detached home services has allowed Fuji to develop a wide range of businesses including its used residential property sales, effective land utilization, rental apartment buildings for sale to individual investors, and property leasing and management, as well as to cultivate synergies between these businesses. Furthermore, its local community-based management has also contributed to cultivate synergies among these wide-ranging businesses and achieve high levels of customer satisfaction in its real estate and related services.

(Taken from the reference material of the company)

Capabilities of the Refurbished Used Residential Property Business by utilizing knowhow

The “Kaizo-kun” refurbished used residential property business was born from the fusion of knowhow cultivated in the residential property agency sales and renovation businesses, which were launched along with the start of the Company. Fuji maintains a unique business model that enables them to conduct the three main functions of the residential property sales process including “acquisition,” “renovation,” and “sales” of used residential properties. The Company also boasts of the ability to create used residential properties that match the needs of customers because of its creation of manuals regarding how to renovate homes and information gathering of local markets based on its local community-based management style. In addition, a service called “Fuji Home Bank” has been created where coordination with judicial scriveners is conducted to purchase properties in cases of conclusion of inheritance registration. This service also offers the convenience of paying the inheritance registration fees from the fees derived from the sale of properties.

(Taken from the reference material of the company)

Ability to Propose Effective Land Utilization which increase returns

Fuji not only provides the ability to propose effective land utilization, but also offers market surveys, planning, design, construction, and rental property management services to maximize its capability as a comprehensive real estate developer. Land purchases and sales, apartment and condominium reconstruction, legal and tax related services, and other various expert opinions and services are available as precise solutions to suit the needs of customers. As to its rental property management business, strict selection of land from the vast amount of real estate information is based upon meticulous market surveys conducted by its full-time marketing staff, and planning is carried out only when long-term and stable management is feasible. In addition, Fuji only purchases properties that boast of highly superior locations and other conditions to be turned into high yielding used real estate products. Moreover, Fuji proposes a bundled leasing system to property owners as a means of providing them with full “security, safety, and stability” in the rental property management service.

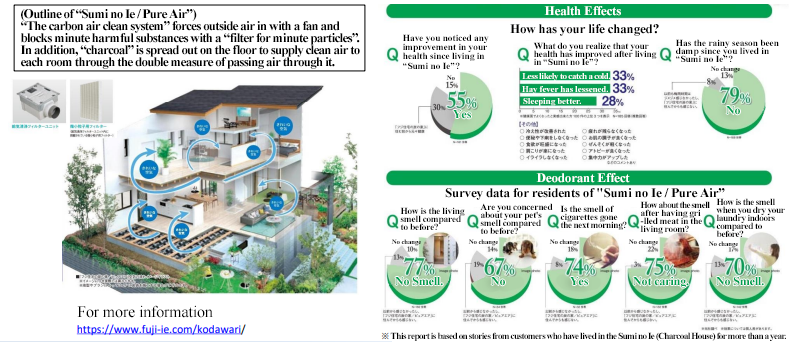

Sumi no Ie(House of Charcoal) / Pure Air

Pollens, bacteria, and viruses are becoming grave problems in addition to air pollution due to such factors as exhaust gas. Fuji Corporation’s “Sumi no Ie / Pure Air” was born through its efforts of putting together the technologies that it has cultivated and focusing thoroughly on air and quality. The company has gained the right to use the patented system “Sumi no Ie” within the corporate group’s sales area, and offers safe housing as a product that differentiates it from other companies and possesses added value.

(Taken from the reference material of the company)

*Examples of the effects felt by customers

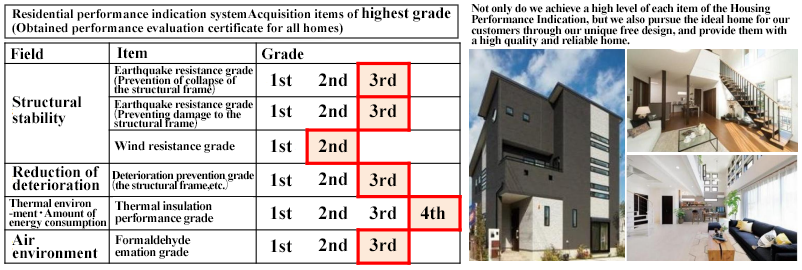

Items on which Fuji has earned the highest grades in the Housing Performance Indication System

The company considers that its mission is to provide customers with high-quality housing that is full of peace of mind. As one of the approaches to the mission, Fuji has obtained the housing performance assessment report for all its free design houses, and this means that the company has established a corporate system that enables it to earn the highest grades for all the housing performance indication items. Furthermore, the company has adopted “TRC Damper”, a vibration control system that dampens seismic vibrations, to achieve more effective prevention of walls from being damaged and furniture from falling down.

(Taken from the reference material of the company)

1-3 Efforts for ESG and SDGs

Fuji Corporation aims to become a corporate group that continues growing sustainably together with the society and builds up trust by contributing to the society while being conscious of the relationship of its local community-based business activities with Environmental, Social, and Corporate Governance (ESG) and the Sustainable Development Goals (SDGs).

Environment | ||

Activity | Fuji Group’s efforts | SDGs |

Environmentally friendly business activities | Efforts in the refurbished used residential properties business Renovation of used residential properties produces significantly less CO2 and waste than house reconstruction, which directly results in conservation of resources.

Total heat exchange system that comes with the indoor air quality (IAQ) control system Fuji’s “Sumi no Ie / Pure Air” is energy-saving houses equipped with the total heat exchange system that prevents loss of thermal energy due to ventilation.

Precut technique Fuji lightens environmental burdens by reducing waste materials with the precut technique in which wood, that is machined at factories in advance, is assembled on site.

Cellulose fiber (heat insulation) Cellulose fibers that Fuji adopts as heat insulation are made by recycling old newspapers that were not delivered, and can be produced with significantly less energy than glass wool, the general internal heat insulation. | 6. Clean water and sanitation

7.Affordable and clean energy

9. Industry, Innovation and infrastructure

11.Sustainable cities and communities

12.Responsible consumption and production

13. Climate action

15.Life on land |

Environmental conservation activities by employees | A tree planting volunteer program, Fuji no Mori, (Hidakagawa Town, Hidaka County, Wakayama Prefecture) Fuji contributes to preserving the local natural environment as a member of the local community and strives to foster its employees’ environmental awareness through the activity. | |

Improvement of the environmental friendliness in the office environment | -Fuji has replaced all its company vehicles for sales activities with hybrid vehicles. -Fuji has gone paperless (abolished the practice of putting seals) for internal documents by adopting an electronic approval system. -Fuji has replaced the lights in their offices with LED lights. -Fuji promotes energy conservation by maintaining the room temperature constant through its proactive cool-biz campaign. -Fuji has installed a demand monitoring system that monitors the maximum electric power demanded in its offices and controls electric power. -Fuji dissolves internally used paper to use them as recycled paper. | |

Social | ||

Activity | Fuji’s efforts | SDGs |

Development of houses conscious of safety, beautiful landscapes, and local communities' revitalization | Development of safe cities Fuji’s houses are equipped with open exteriors, which give open, bright, and beautiful impressions and provide unimpeded view which is excellent for security against crimes, to bring a benefit of preventing strangers from intruding into the houses. The roads in the cities curve gently so that drivers naturally reduce their speed, and the safety is ensured within the cities.

Revitalization of communities Fuji has built parks and meeting places in the towns as community space which everyone, including children and the elderly, can feel free to stop by, with the aim of developing “connecting” cities where people living there always have smiles.

Beautiful landscapes and skylines Fuji creates skylines by planting colorful trees and plants through which people can directly feel the passage of the four seasons, and by using unified colors and materials in the buildings. | 3.Good health and well-being

10.Reduced inequalities

11.Sustainable cities and communities |

Development of health-conscious houses | Fuji’s “Sumi no Ie / Pure Air” Fuji has employed a system of forced air supply and forced exhaust through a fan rather than the general 24-hour ventilation system of natural air supply and forced exhaust. It strives to build health-conscious houses through such approaches as to eliminate harmful substances with a particle size of over 0.5 μm (e.g., PM2.5, yellow dust, bacteria, pollens) and to keep the air clean and fresh for 24 hours within the houses by both blocking toxic substances with fine particle filters at the time of air supply and making the air circulate via the charcoal installed under the floor. | |

Establishment of employee-friendly working environment | Efforts for Health and Productivity Management Fuji Corporation, which has been adhering to the belief “The enterprise is its people; no health or happiness of the employees, no customer satisfaction or company prosperity” since its foundation, considers the most important thing to bring its customers great happiness is that the employees are healthy in both mind and body, lead enriched working and personal life by taking pride, feeling rewarding, and having purposes to live in their work. It is thoroughly developing a workplace environment in which health management of the employees are considered from a management standpoint and which contributes to raising the corporate value from a long-term perspective. The company was awarded the highest grade for the fourth time in the Employees’ Health Management Rated Loan Program operated by the Development Bank of Japan (DBJ) on October 29, 2021, and this indicates that Fuji has been highly acclaimed for its efforts at health and productivity management.

Promotion of work style reform through adoption of telecommuting Fuji has been promoting telecommuting as a flexible, Information and Communication Technology (ICT)-based work style that allows employees to work regardless of place and time, and it received the Top Hundred Telework Pioneers and Awards of Minister for Internal Affairs and Communication in 2018 and the award for excellence in the Telework Promotion Awards in 2021. The company believes that promotion of telecommuting can improve its corporate value because it helps strike a right balance between work and child-rearing or nursing care for family members, secure handicapped people having difficulty in commuting and talented human resources living in rural area, and establish business continuity plans (BCPs).

Proactive approaches to sports Going along with the idea that the original value of sports is to help the citizens lead mentally and physically wholesome and cultured life for the entire lifetime, Fuji Corporation takes a variety of approaches, such as installation of box-shaped chambers for hyperbaric oxygen therapy (with the maximum allowed being 10 people) in which users can do some stretches and training, organization of walking events, and encouragement to wear sneakers and walk to work. | 1.No poverty

3.Good health and well-being

4.Quality education

5.Gender equality

8.Decent work and economic growth

10.Reduced inequalities

11.Sustainable cities and communities |

Efforts against the aging society | Development of affordable rental apartments for seniors with nursing-care services The birthrate has been decreasing and the population has been aging rapidly in recent years, and the ratio of people aged 65 and older to the total population is expected to exceed 30% in 2025. Under these circumstances, how houses as final abodes should be and enrichment of such services as nursing care and medical treatment are crucial social issues. The corporate group provides affordable and quality affordable rental apartments for seniors with nursing-care services based on a concept of housing at which people can entrust their parents with a sense of safety, and the number of the rental housings that it operates is the largest in Japan. It aims to continue building rental housings in which elderly can continuously lead safe, healthy, and enriched life. | |

Contribution to local community | Blue crime prevention patrol Fuji Corporation has formed the Fuji Blue Crime Prevention Patrol Team in cooperation with Kishiwada Police Station with the aim of protecting the safety of the children in the area and eliminating street crimes, and strives to prevent local crimes in the school zones in Kishiwada City as a company.

Donation of goods to all the full-time high schools in Kishiwada City Fuji donated goods and other necessary items to all the five full-time high schools in Kishiwada City in which its headquarters are based.

Donation to the Osaka Nursing Association Fuji gratefully donated to healthcare workers who have been devoting themselves to providing medical services and those who have been committed to continuing the medical system amid the novel coronavirus pandemic.

Environmental beautification activities Fuji’s employees clean the roads around the headquarters building, Higashi-Kishiwada building, and each “Ouchi Kan” shop, including the roads in front of the buildings and shops, which has allowed the sidewalk in front of the Higashi-Kishiwada building to be recognized by Osaka Prefecture as Adopt Road Habu-cho 2-Chome. The company has won a number of awards for its efforts for road beautification and contribution to cleanup activities in the community.

Promotion of e-Tax The Regional Taxation Bureau proactively promotes e-Tax, a system that allows its users to file final tax returns using the Internet. Fuji encourages all its officers and employees to use e-Tax for filing tax returns and received a letter of appreciation for the effort from the superintendent of Kishiwada Tax Office in May of 2021. | 4. Quality education

11.Sustainable cities and communities

15.Life on land |

Governance | ||

Activity | Fuji’s efforts | SDGs |

Governance enhancement based on the organizational structures | The Board of Directors, the Audit & Supervisory Board, and other organizational structures for enhancing corporate governance Fuji’s Board of Directors consists of seven directors (including two outside directors) and its Audit & Supervisory Board is composed of three auditors (including two outside auditors), and the company has set up a risk compliance promotion committee and an internal control promotion committee, and established an internal reporting system. | 4.Quality education

5.Gender equality

8.Decent work and economic growth

12.Responsible consumption and production

16.Peace, justice and strong institutions |

Governance enhancement through human resources development | Booklet of the management philosophy and policies Exactly as stated by the words “The enterprise is its people,” Fuji Corporation gives the top priority to development of human resources. It requires all its employees to carry the booklet of the management philosophy and policies so that they can move forward unwaveringly toward the same goal and purpose, and strives to develop human resources so that all the officers and employees fully understand and follow the management philosophy and policies and to raise the ratio of such human resources.

Direct dialogue between the management and the employees Fuji regularly holds meetings for asking questions for the chairman and the president in which all the employees can have direct dialogue with the chairman and the president. The chairman and the president themselves are committed to settling not only the employees’ work-related issues, but also troubles and issues in their private life through telephone meetings with each employee who has questions. The company believes that direct dialogue between the employees and the management helps cement the relationship of trust and increase a sense of belonging among its employees, and thus it is essential for enhancing corporate governance through understanding and implementation of the management philosophy and policies.

360-degree personnel assessment system Believing that development of human resources that have excellent insight, boldness, and judgment, and thoroughly follow the management philosophy and policies contributes to long-term improvement of its corporate value, Fuji has adopted a fair and equitable personal assessment system, 360-degree personnel assessment system, that assesses the employees from all viewpoints, including not only their direct bosses but their co-workers, subordinates, and the officers in other departments. | |

Governance enhancement through customer satisfaction improvement | Insatiable pursuit of customer satisfaction Fuji records words of joy and appreciation from customers on its “Bravo Card” and “Thank You Report,” and complaints and words of scolding on the “Yellow Card.” They are shared among the internal departments concerned and used for resolving issues arising in the worksites and assessing personnel, and the company believes that these efforts to gain greater customer satisfaction with a focus on the worksites will help identify true needs and fundamental issues and problems, and will directly result in enhanced governance.

The company placed first in the 2021 Oricon Customer Satisfaction (R) Survey in the categories of the built-for-sale housing builder in Kinki region and the built-for-sale housing builder in Osaka Prefecture of the Kinki region. | 4.Quality education

8.Decent work and economic growth

10.Reduced inequalities

11.Sustainable cities and communities

16.Peace, justice and strong institutions |

Proactive dialogue with the stakeholders | Holding IR events and dialogue with the shareholders and institutional investors Fuji holds company information sessions for individual investors and for analysts and institutional investors as necessary in Osaka and Tokyo, and accept requests from its institutional investors and other parties concerned for interviews and telephone meetings to a reasonable extent. It endeavors to give as clear explanations as possible in understandable words to inquiries from its individual investors, and has proactive dialogue with them via the shareholder questionnaire enclosed in the shareholder newsletters published twice a year. Fuji Corporation believes that constructive dialogue with the shareholders and investors will contribute to its medium- and long-term corporate value enhancement and sustainable growth. | |

2. Mid-term profit plan (FY 3/2020 to FY 3/2022)

The company set mid-term goals for the coming 3 years. In order to cope with various changes in the external environment, including the skyrocketing prices of land and construction, the shortage of carpenters, the consumption tax hike, and the hovering of selling prices, the company will actively implement measures for “increasing the number of condominiums supplied,” “concentrating on more profitable areas,” and “raising recurring revenue” and aim to earn a record-high profit in the fiscal year March 2022, which is the final fiscal year of the mid-term profit plan. The numerical goals for the fiscal year March 2022 are sales of 125 billion yen and an ordinary income of 6.8 billion yen.

Medium Term Business Plan Targets

| FY 3/19 Act | FY 3/20 Act | FY 3/21 Act | FY 3/22 Company’s Plan | FY 3/22 Mid-term Plan |

Sales | 115,710 | 110,444 | 121,541 | 121,400 | 125,000 |

Operating income | 6,636 | 5,002 | 3,986 | 5,000 | 7,300 |

Ordinary Income | 6,445 | 4,611 | 3,558 | 4,600 | 6,800 |

Net Income | 4,298 | 3,088 | 2,358 | 3,100 | 4,600 |

ROE | 11.9% | 8.0% | 5.8% | - | Over 10% |

*Units: million yen

Medium Term Business Plan Profit Assumptions

Results during Fiscal Year March 2020

Initially, the medium-term profit plan had the following prospects. This term will be the year for adjustment, as it is the transitional period for supply of condominiums and the consumption tax will be raised. The performance is estimated to decline from the previous term, because this term is the transitional period for supply of condominiums, and it will take time to overcome the shortage of carpenters. In this situation, the investment for relocating the marketing office in Osaka City will be first posted. In addition, the company will increase the sale of land for affordable rental apartments for seniors with nursing-care services to individual investors who do not own land. The property leasing and management business is expected to be healthy, as the company will handle more rental apartments for sale to individual investors and more affordable rental apartments for seniors with nursing-care services.

Sales were higher than the estimated forecast at the beginning of the term, but operating income and ordinary income were lower than anticipated. This is because non-deductible consumption tax on land, etc. increased due to progress in land reclamation work for the sites of large-scale projects to be launched in the next term and the fund procurement costs increased due to accumulation of cash and deposits at the end of the current consolidated fiscal year.

Results during Fiscal Year March 2021

It is expected that more condominiums will be delivered, and overall performance will recover to the level exceeding that in the fiscal year March 2019. The company plans to deliver two condominium buildings in Sakai City and Izumi City, and the sales of the residential properties for sales business are projected to the level of the fiscal year March 2019. In addition, the large-scale project for selling detached homes in Hokusetsu and Hanshinkan areas will be launched. As for the housing distribution business, the company will enhance the procurement of profitable houses in Osaka City, Hokusetsu and Hanshinkan areas. In addition, affordable rental apartments for seniors with nursing-care services ordered in the fiscal year March 2019 will be delivered mainly from the fiscal year March 2021. The property leasing and management business is expected to keep growing steadily, achieving sales of 20 billion yen.

However, in addition to used residential properties, in the residential properties for sales business, the company sped up collecting funds and inventory turnover by promoting land sales and built-for-sale type home sales and set flexible selling prices through price cuts targeting large-scale residential properties for new sales. By these efforts, the company aimed to enhance funds in hand and reduce inventory risk to prepare for the spread of the novel coronavirus. Thus, the company's performance fell below the medium-term target in the plan for the fiscal year ending March 2021.

Plans for Fiscal Year March 2022

The initial medium-term profit plan had the following outlook. It is expected that the sales and profit of rental apartments and condominiums for sale will grow significantly, both marking a record high. The company plans to deliver 3 condominium buildings in Osaka, Sakai, and Settsu Cities, and the sales from residential properties for sales are projected to hit a record high. The large-scale detached home project in Hokusetsu and Hanshinkan areas will enter the delivery phase. While the number of rental apartments delivered will rise considerably, the property leasing and management business is expected to see the number of the company’s own affordable rental apartments for seniors with nursing-care services exceeding 50.

The business operations are in line with the initial expectations, as the number of supplied detached houses, condominiums for sale, and rental apartment buildings for sale increased and the leasing and management segment, which earns recurring revenues, grew. However, due to the impact of the spread of the novel coronavirus infection, the company announced that in its plan at the beginning of the term, both sales and profits will fall below the medium-term earnings targets.

Medium Term Business Plan Targets for each Industry Segment

Segment Sales | FY 3/19 Act | FY 3/20 Act | FY 3/21 Act | FY 3/22 Mid-term |

Residential Properties for Sales | 40,919 | 28,926 | 40,241 | 44,300 |

Housing Distribution | 33,094 | 38,176 | 32,789 | 31,000 |

Effective Land Utilization | 23,847 | 23,298 | 24,401 | 25,700 |

Property Leasing and Management | 17,849 | 20,042 | 21,728 | 24,000 |

Construction related | - | - | 2,379 | - |

Segment Profits | FY 3/19 Act | FY 3/20 Act | FY 3/21 Act | FY 3/22 Mid-term |

Residential Properties for Sales | 3,726 | 1,313 | 395 | 2,720 |

Housing Distribution | 507 | 713 | 505 | 1,140 |

Effective Land Utilization | 2,381 | 2,171 | 2,085 | 2,690 |

Property Leasing and Management | 1,747 | 2,430 | 2,584 | 2,610 |

Construction related | - | - | 22 | - |

* Units: million yen

* Segment profits before adjustments

* Derived from Fuji Corporation’s Medium-Term Business Plan announced on May 8, 2019.

3. The Second Quarter of Fiscal Year ending March 2022 Earnings Results

(1) Consolidated Earnings

| 2Q of FY 3/21 | Share | 2Q of FY 3/22 | Share | YY Change |

Sales | 56,553 | 100.0% | 56,434 | 100.0% | -0.2% |

Gross Income | 8,415 | 14.9% | 8,933 | 15.8% | +6.2% |

SG&A | 5,944 | 10.5% | 5,399 | 9.6% | -9.2% |

Operating Income | 2,470 | 4.4% | 3,534 | 6.3% | +43.1% |

Ordinary Income | 2,258 | 4.0% | 3,354 | 5.9% | +48.5% |

Parent Net Income | 1,474 | 2.6% | 2,331 | 4.1% | +58.2% |

*Data in this table and other parts of this report include figures which have been calculated by Investment Bridge, and may differ from those of the Company (same as below)

*Units: million yen

Sales down 0.2% year on year, ordinary income up 48.5% year on year.

In the second quarter of fiscal year ending March 2022, sales decreased 0.2% year on year to 56,434 million yen. Although the sales of used residential properties in the housing distribution segment declined year on year for both detached homes and condominiums, the sales in the residential properties for sales segment grew year on year, owing to an increase in the number of free design houses delivered, as well as the delivery of condominiums. In addition, an increase in the number of rental apartments for sale delivered to individual investors in the effective land utilization segment contributed to the increase in sales, while the number of rental properties under management linked to the effective land utilization business expanded steadily in the property leasing and management segment. The order backlog at the end of the second quarter (as of the end of September 2021), which is a leading indicator of sales, increased 3.5% from the end of the same period in the previous fiscal year (as of the end of September 2020).

Ordinary income increased 48.5% year on year to 3,354 million yen. In addition to increases in ordinary income in the residential properties for sales segment, the effective land utilization segment, and the property leasing and management segment, where sales increased, there was also an increase in ordinary income in the housing distribution segment, where profit margins improved as a result of careful selection of purchases.

Gross income margin rose 0.9 points year on year, and operating income margin rose 1.9 points to 6.3% thanks to a 0.9-point year on year decline in the SG&A-to-sales ratio through the reduction of actual SG&A expenses. As a result, operating income increased 43.1% year on year to 3,534 million yen. In addition, the rate of increase in ordinary income was higher than that of operating income due to the absence of bond issuance costs incurred in the same period of the previous fiscal year in non-operating expenses and a decrease in interest expenses. Moreover, the main changes in extraordinary income and loss were the posting of 146 million yen in extraordinary income from the sale of noncurrent assets (15 million yen in the same period of the previous fiscal year) and the decrease in loss on sale of noncurrent assets posted in extraordinary loss from 77 million yen in the same period of the previous fiscal year to 2 million yen in the first half of this fiscal year.

(2) Segment Earnings (The Second Quarter of Fiscal Year ending March 2022)

Results by Segment and Topics

| Sales | Share | YY Change | Segment Profits | Share | YY Change |

Residential Properties for Sale | 19,959 | 35.4% | +14.6% | 1,271 | 29.9% | +14.5% |

Housing Distribution | 11,706 | 20.7% | -34.1% | 618 | 14.5% | +260.2% |

Effective Land Utilization | 12,244 | 21.7% | +32.4% | 1,001 | 23.5% | +35.4% |

Property Leasing and Management | 11,673 | 20.7% | +10.3% | 1,368 | 32.1% | +14.4% |

Construction Related | 849 | 1.5% | -45.7% | -2 | - | - |

Adjustment | - | - | - | -722 | - | - |

Total | 56,434 | 100.0% | -0.2% | 3,534 | - | +43.1% |

*Units: million yen

* The composition ratio of profit is the ratio to the total profit of reportable segments.

* The construction related segment represents the sales and segment profits of Yuuken Kensetsu Co., Ltd., Kansai Densetsu Kogyo Co., Ltd., and Nikken Setsubi Kogyo Co., Ltd., whose shares were all acquired by the company on January 29, 2020, to make them wholly-owned subsidiaries of the company. They became a reporting segment in the first quarter of Fiscal Year Ended March 2021.

Sales in the segment of residential properties for sales increased 14.6% year on year to 19,959 million yen, and profit rose 14.5% to 1,271 million yen.

Although sales were impacted by a reactionary decline in large-scale sales of bare land recorded in the same period of the previous fiscal year, sales were boosted by an increase in the delivery of free design houses from 327 units in the same period of the previous fiscal year to 393 units, the completion and delivery of 30 condominiums, and an increase in sales of residential land. Profit also increased on the back of strong sales.

| 2Q of FY 3/21 | 2Q of FY 3/22 | |||

Volume | Value | Volume | Value | YY Change | |

Free-design Homes, etc. | 327 homes | 12,776 | 393 homes | 16,218 | +26.9% |

Condominiums for Sales | - | - | 30 homes | 1,228 | - |

Sale of Residential Land | 31 homes | 534 | 87 homes | 1,815 | +239.9% |

Land Sales | 28,788 m2 | 4,099 | - | 698 | -83.0% |

Net Sales in the Residential Properties for Sales Segment | 358 homes 28,788 m2 | 17,410 | 510 homes 4,388 m2 | 19,959 | +14.6% |

Profit in the Residential Properties for Sales Segment | - | 1,110 | - | 1,271 | +14.5% |

*Units: million yen

In the 2021 Oricon Customer Satisfaction Survey, the company was awarded first place both in the Kinki and Osaka region.

Condominium projects scheduled for delivery in the fiscal year ending March 2022 | |

Branneed Senri-Oka | 10-story, 90 residences, to be completed and delivered on September 24, 2021 |

Charmant Fuji Mikunigaoka Keyakidori | 8-story, 49 residences, handover is scheduled for late March 2022~ |

Charmant Fuji Sakai City Front | 15-story, 147 residences, handover is scheduled for late February 2022~ |

(Taken from the reference material of the company)

Sales in the housing distribution segment decreased 34.1% year on year to 11,706 million yen, and profit increased 260.2% year on year to 618 million yen.

The number of used residential properties (detached homes) delivered decreased to 64 units from 123 units in the same period in the previous fiscal year, and the number of used residential properties (condominiums) delivered also decreased to 457 units from 655 units in the same period in the previous fiscal year. Under the management policy focused on inventory turnover, the company promoted sales of long-term inventory and selective procurement, and significantly reduced unprofitable inventory in the previous fiscal year. Although the number of units delivered and sales declined in the second quarter due to a significant reduction in inventory in the previous fiscal year, profitability improved significantly and profit rose significantly year on year.

| 2Q of FY 3/21 | 2Q of FY 3/22 | |||

Volume | Value | Volume | Value | YY Change | |

Used Residential Properties (Detached Homes) | 123 homes | 3,349 | 64 | 1,445 | -56.8% |

Used Residential Properties (Condominiums) | 655 homes | 14,399 | 457 | 10.253 | -28.8% |

Others | - | 1 | - | 7 | +313.5% |

Net Sales in Housing Distribution Segment | 778 homes | 17,750 | 521 | 11,706 | -34.1% |

Profit in Housing Distribution Segment |

| 171 |

| 618 | 260.2% |

*Units: million yen

According to Japan Journal of Remodeling’s Annual Ranking of Resale Units Sold 2021 (issued on July 26, 2021), the company ranked fifth in Japan in the annual ranking of resale units sold. The company's housing distribution business takes place mainly in the Hanshin region, and although its sales activities are limited to this area, it boasts one of the largest purchase and resale volumes in Japan.

In addition, “Ouchi Kan” main store is a general housing exhibition hall that always displays information on more than 1,000 properties, including properties that are not available on the Internet, and is arranged by area, new construction, and pre-owned to make it easier to find the property of choice, and touch panel devices make it intuitive to search for properties.

Sales in the effective land utilization segment increased 32.4% year on year to 12,244 million yen, and profit rose 35.4% year on year to 1,001 million yen.

Even during the novel coronavirus pandemic, the willingness of wealthy individuals to invest and the need of asset owners to prepare for inheritance taxes were strong, and the number of rental apartments sold to individual investors increased significantly, resulting in a year-on-year increase in both sales and profit. The number of rental apartments sold to individual investors increased to 65 from 34 in the same period of the previous fiscal year.

| 2Q of FY 3/21 | 2Q of FY 3/22 | |||

Volume | Value | Volume | Value | YY Change | |

Contract Construction of Rental Properties | 16 contracts | 1,406 | 15 contracts | 1,357 | -3.5% |

Affordable Rental Apartments for Seniors with Nursing-care Services | 9 contracts | 3,188 | 7 contracts | 1,536 | -51.8% |

Rental Apartments for Sale to Individual Investors | 34 buildings | 4,649 | 65 buildings | 9,351 | +101.1% |

Net Sales in the Effective Land Utilization Segment | 25 contracts 34 buildings | 9,245 | 22 contracts 65 buildings | 12,244 | +32.4% |

Profit in the Effective Land Utilization Segment |

| 739 |

| 1,001 | +35.4% |

*Units: million yen

Number of Households Managed | 28,098 homes | As of March 31, 2021 |

Operation Rate | 97.2% | Full-year results for FY 2020. Occupancy rates for properties managed by the Fuji Corporation Group. |

Repeat Purchase Rate | 49.0% | Ratio of repeat orders from owner in FY 2020. |

Satisfaction with Inheritance Planning | 82.9% | From the results of a questionnaire survey targeted at owners in FY 2020. |

(Taken from the reference material of the company)

Construction Cases from the Fuji Palace Series | |

Fuji Palace Stairwell Type | Urban compact designers' residential rental housing. |

Fuji Palace Senior (Leading Japan in the number of serviced senior housing units in operation) | A new form of land use for an aging society: affordable rental apartments for seniors with nursing-care services |

Fuji Palace Detached Homes for Rent | A savior of suburban land utilization that opens new possibilities for valuable assets that had almost been disregarded for utilization. |

Fuji Palace Three Herbs | All-unit maisonette-type rental housing that achieves high occupancy and high profitability. |

Fuji Palace Loft Type | A loft type to meet the new needs of single people. |

(Taken from the reference material of the company)

Sales in the property leasing and management segment increased 10.3% year on year to 11,673 million yen, and profit rose 14.4% year on year to 1,368 million yen.

Both net sales and profit increased year on year due to an increase in the number of managed properties handled in conjunction with the delivery of rental properties which are linked to the effective land utilization business and an increase in the number of company-owned affordable rental apartments for seniors with nursing-care services.

| 2Q of FY 3/21 | 2Q of FY 3/22 | |

Value | Value | YY Change | |

Rental Income | 7,876 | 8,524 | +8.2% |

Income from Affordable Rental Apartments for Seniors with Nursing-care Services | 2,272 | 2,703 | +19.0% |

Management Fee Income | 433 | 446 | +2.9% |

Net Sales in the Property Leasing and Management Segment | 10,582 | 11,673 | +10.3% |

Profit from Property Leasing and Management | 1,195 | 1,368 | +14.4% |

*Units: million yen

As of November 2020, the company operates and manages 176 affordable rental apartments for seniors with nursing-care services, with 5,598 units under management. In addition, according to the monthly Senior Business Market Nov. 2020, the company ranks first in the number of affordable rental apartments for seniors with nursing-care services units in operation.

(Taken from the reference material of the company)

Sales in the construction related segment declined 30.6% year on year to 1,085 million yen, with a segment loss of 2 million yen (a profit of 12 million yen in the same period of the previous fiscal year).

Net sales and profit declined year on year due to the downturn of private capital investment caused by the impact of the spread of the novel coronavirus and a decrease in the order backlog caused by intensified price competition in public works.

| 2Q of FY 3/21 | 2Q of FY 3/22 | |

Value | Value | YY Change | |

Net Sales in the Construction Related Segment | 1,564 | 1,085 | -30.6% |

Profit in the Construction Related Segment | 12 | -2 | - |

*Units: million yen

*The net sales in the construction related segment includes the sales of Yuuken Kensetsu Co., Ltd., Kansai Densetsu Kogyo Co., Ltd., and Nikken Setsubi Kogyo Co., Ltd., which became wholly owned subsidiaries of the company through the acquisition of all shares on January 29, 2020. It became a segment to be reported in the first quarter of the fiscal year ended March 2021.

To further meet the demand in the effective land utilization business, the company welcomed the Yuuken Kensetsu Group as their partner, which has a proven record of accomplishment in steel-frame and reinforced concrete construction works, and is aiming to stabilize and expand its business performance by enhancing its business lineup to provide non-wooden housing. The company is currently engaged in the construction of affordable rental apartments for seniors with nursing-care services in Minami Suita, Suita City, Osaka Prefecture, which is owned and operated by its wholly owned subsidiary Fuji Amenity Service Co. Ltd., and they expect to increase synergies from the collaboration in the future.

(Taken from the reference material of the company)

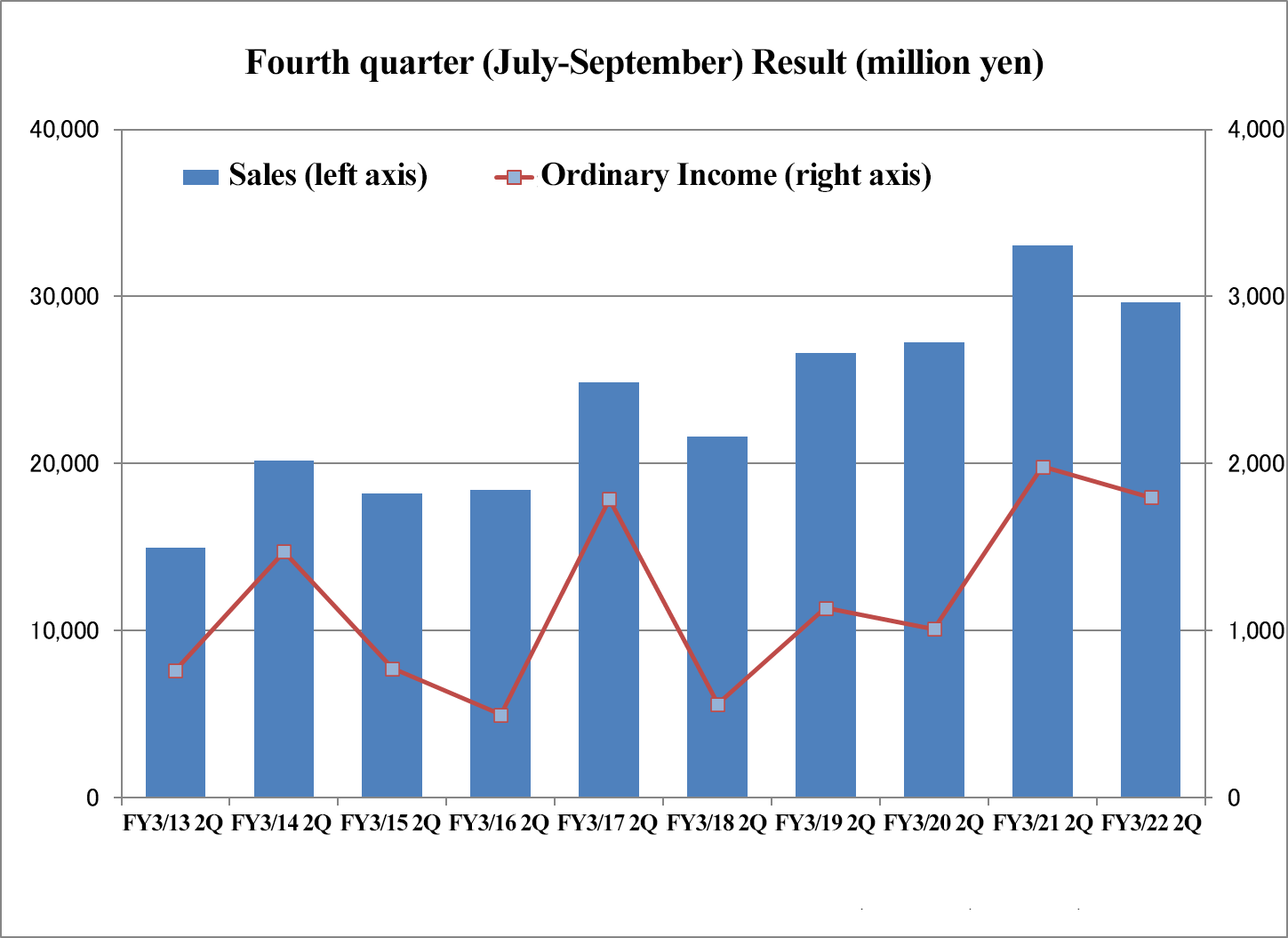

(3) Quarterly Earnings Trends

Consolidated sales and ordinary income for the second quarter (July-September)

In the second quarter (July-September), sales and ordinary income were at a high level compared to the results in the previous second quarters.

Status of order backlog

| 1H of FY 3/21 (End of Sep. 20) | 1H of FY 3/22 (End of Sep. 21) | |||

Volume | Value | Volume | Value | YY Change | |

Free Design Houses, etc. | 592 homes | 24,378 | 552 homes | 22,368 | -8.2% |

Condominiums for Sale | 185 homes | 6,421 | 230 homes | 9,485 | +47.7% |

Sale of Residential Land | 39 homes | 649 | 28 homes | 611 | -5.8% |

Land Sales | 101㎡ | 26 | - | - | - |

Residential Properties for Sales | 816 homes/101㎡ | 31,474 | 810 homes | 32,465 | +3.1% |

Used Residential Properties (Detached Homes) | 40 homes | 906 | 15 homes | 386 | -57.3% |

Used Residential Properties (Condominiums) | 157 homes | 3,227 | 118 homes | 2,743 | -15.0% |

Housing Distribution | 197 homes | 4,134 | 133 homes | 3,130 | -24.3% |

Contract Construction of Rental Properties | 47 contracts | 4,052 | 48 contracts | 4,404 | +8.7% |

Affordable Rental Apartments for Seniors with Nursing-care services | 30 contracts | 4,498 | 22 contracts | 5,568 | +23.8% |

Rental Apartments for Sale to Individual Investors | 80 buildings | 11,284 | 92 buildings | 12,517 | +10.9% |

Effective Land Utilization | 77 contracts/ 80 buildings | 19,835 | 70 contracts/ 92 buildings | 22,490 | +13.4% |

Construction Related | 24 contracts | 1,460 | 28 contracts | 787 | -46.1% |

Total | - | 56,904 | - | 58,874 | +3.5% |

*Units: million yen

(Taken from the reference material of the company)

The order backlog at the end of the second quarter of the fiscal year ending March 2022 (end of September 2021) was 58,874 million yen, up 3.5% from the end of the same period in the previous fiscal year (end of September 2020). In the residential properties for sales business, the order backlog increased 3.1% year on year due to a favorable number of orders for condominiums. In the housing distribution business, inventory turnover ratio improved despite a decrease of orders caused by inventory reduction. In the effective land utilization business, the order backlog increased 13.4% year on year due to a healthy number of orders for rental apartments for sale to individual investors. In the construction related business, the backlog of orders decreased due to the slowdown in private-sector capital investment caused by the spread of the novel coronavirus infection and the fierce price competition in public works.

(4) Financial Conditions and Cash Flow (CF)

| Mar. 2021 | Sep. 2021 |

| Mar. 2021 | Sep. 2021 |

Cash, Equivalents | 20,325 | 21,037 | Payables | 3,956 | 5,630 |

Inventories | 79,117 | 79,423 | ST Interest Bearing Liabilities | 28,225 | 36,244 |

Current Assets | 101,788 | 103,596 | Unpaid Taxes | 1,206 | 1,028 |

Tangible Noncurrent Assets | 40,866 | 42,353 | Prepayments | 4,616 | 3,931 |

Intangible Noncurrent Assets | 667 | 635 | LT Interest Bearing Liabilities | 60,161 | 52,968 |

Investments, Others | 4,271 | 4,096 | Liabilities | 106,101 | 107,330 |

Noncurrent Assets | 45,805 | 47,085 | Net Assets | 41,492 | 43,351 |

Total Assets | 147,594 | 150,682 | Total Interest-Bearing Liabilities | 88,386 | 89,212 |

*Units: million yen

* Inventories = Real estate for sale + Real estate for sale in progress + Real estate for development + Payments for uncompleted construction + Inventories

* Interest bearing liabilities = Loans + Lease liabilities + Debenture

Total assets at the end of September 2021 were 150,682 million yen, up 3,088 million yen from the end of the previous fiscal year. On the asset side, deferred tax assets and other assets decreased, while tangible noncurrent assets, mainly cash and equivalents as well as construction in progress, increased. On the liabilities and net assets side, there were increases in short-term interest-bearing liabilities and retained earnings, while there was a decrease in prepayments. The main components and amounts of inventories are real estate for sale at 18.64 billion yen (15.65 billion yen at the end of the previous fiscal year), real estate for sale in process at 32.0 billion yen (29.22 billion yen at the end of the previous fiscal year), and real estate for development at 28.72 billion yen (34.02 billion yen at the end of the previous fiscal year). Interest-bearing liabilities increased 825 million yen. Capital-to-asset ratio was 28.8%, up 0.7 points from the end of the previous fiscal year.

Cash Flow

| 2Q of FY 3/21 | 2Q of FY 3/22 | YoY Change | |

Operating Cash Flow (A) | 6,965 | 3,292 | -3,703 | -52.9% |

Investing Cash Flow (B) | -2,513 | -2,702 | -189 | - |

Free Cash Flow (A + B) | 4,482 | 590 | -3,892 | -86.8% |

Financing Cash Flow | -373 | 275 | 648 | - |

Cash and Equivalents at Term End | 18,667 | 21,022 | 2,355 | +12.6% |

*Units: million yen

In terms of CF, the operating CF decreased as the reduction amount in inventories dropped despite an increase in quarterly net income before taxes and other adjustments. In addition, the outflow of investing CF expanded due to an increase in the acquisition of tangible noncurrent assets, decreasing positive free CF. On the other hand, financing CF turned positive due to an increase in short-term borrowings. As a result, the balance of cash and cash equivalents at the end of the quarter increased 12.6% year on year.

4. Fiscal Year ending March 2022 Earnings Estimates

(1) Consolidated Earnings

| FY 3/21 Act. | Share | FY 3/22 Est. | Share | YoY |

Sales | 121,541 | 100.0% | 121,400 | 100.0% | -0.1% |

Operating Income | 3,986 | 3.3% | 5,000 | 4.1% | +25.4% |

Ordinary Income | 3,558 | 2.9% | 4,600 | 3.8% | +29.3% |

Parent Net Income | 2,358 | 1.9% | 3,100 | 2.6% | +31.4% |

*Units: million yen

Sales are expected to decrease 0.1% and ordinary income are estimated to increase 29.3%, year on year.

As the first half of the fiscal year has ended, the company's plan for the fiscal year ending March 2022 remains unrevised with net sales of 121.4 billion yen, down 0.1% from the previous fiscal year, and an ordinary income of 4.6 billion yen, up 29.3% from the previous fiscal year.

In terms of sales, although the housing distribution segment is expected to continue to see a difficult environment especially for pre-owned condominiums, this is expected to be offset by increases in sales in the residential properties for sales segment and the property leasing and management segment, where a high level of ordered properties will be delivered. In terms of profits, the impact of the inventory re-evaluation in the previous fiscal year will disappear, and an increase in deliveries of highly profitable free design houses and rental apartments for sale to individual investors will contribute.

The consolidated earnings estimates for the fiscal year ending March 2022 are conservative, as the company took into account concerns over higher procurement prices due to the lumber sticker shock, a lull in the recovery of the domestic housing market, which had been healthy, and a decline in purchasing power due to uncertainty over the containment of the novel coronavirus infection. Based on the balance of contracts scheduled for sales during the fiscal year ending March 2022, and other factors, the results for the first half of the current fiscal year show that sales are on track and profits at each stage are on pace to far exceed the initial estimate. The shortage of housing construction materials and soaring raw material prices due to the lumber sticker shock caused by the increased demand for housing lumber in the U.S. and China are not expected to have a significant impact on the company's business performance, as the company is making progress in procuring housing construction materials and reflecting the increase in prices.

The annual dividend forecast of 27 yen per share (14 yen at the end of the first half and 13 yen at the end of the fiscal year), the same as that in the previous fiscal year, was left unchanged.

Consolidated Sales Forecast by Segment

| FY 3/22 | ||

Volume | Value | Share | |

Free-design Homes, etc. | 866 homes | 35,500 | 29.3% |

Condominiums for Sales | 219 homes | 9,000 | 7.4% |

Land Sales | - | 3,300 | 2.7% |

Residential Properties for Sales | 1,085 homes | 47,800 | 39.4% |

Used Residential Properties | 1,265 homes | 27,000 | 22.2% |

Housing Distribution | 1,265 homes | 27,000 | 22.2% |

Contract Construction of Rental Properties | 27 contracts | 2,380 | 2.0% |

Affordable Rental Apartments for Seniors with Nursing-care Services | 11 contracts | 2,090 | 1.7% |

Rental Apartments for Sale to Individual Investors | 120 buildings | 16,530 | 13.6% |

Effective Land Utilization | - | 21,000 | 17.3% |

Rental Income | - | 17,070 | 14.1% |

Income from Affordable Rental Apartments for Seniors with Nursing-care Services | - | 5,460 | 4.5% |

Management Fee Income | - | 970 | 0.8% |

Property Leasing and Management | - | 23,500 | 19.4% |

Construction Related | - | 2,100 | 1.7% |

Total | 2,350 homes 38 contracts 120 buildings | 121,400 | 100.0% |

*Units: million yen

Progress against consolidated results

| 1H of FY 3/22 Est.(announced on Sep.14,2021) | 1H of FY 3/22 Act. | Progress rate against Est. | FY 3/22 Est.(announced on May 7,2021) | Progress rate against Est. |

Sales | 56,000 | 56,434 | 100.8% | 121,400 | 46.5% |

Operating Income | 3,400 | 3,534 | 103.9% | 5,000 | 70.7% |

Ordinary Income | 3,100 | 3,354 | 108.2% | 4,600 | 72.9% |

Net Income | 2,200 | 2,331 | 106.0% | 3,100 | 75.2% |

*Units: million yen

In the first half of the current fiscal year, sales and all kinds of profits exceeded the upwardly revised estimates for the first half announced on September 14. Although the rate of progress toward the full-year consolidated estimate is below 50%, with that of sales at 46.5%, it can be said to be on track considering the characteristics of the industry, where deliveries are concentrated in the fourth quarter. In addition, the rate of progress for each kind of profit is extremely high.

(2) Growth Strategies

[Balanced Management that Brings Complementary and Synergistic Effects]

The real estate industry is greatly affected by external factors such as changes in the economy and interest rates. As a result, the company has been aiming to create a business portfolio that can stabilize earnings by offering a diverse range of products and services. Each business has its own unique knowledge and promotes balanced management that mutually complements the other business units.

Business Segments | Characteristics of Business Segments | Ratio to Total Sales (2Q of FY 3/22) |

Residential Properties for Sales | The business of selling newly-built detached houses and condominiums with a scale of 50 to 200 units, featuring town development and free design. | 35.4% |

Housing Distribution | Used residential properties resale business that buys used residential properties, renovates them, and then sells them. | 20.7% |

Effective Land Utilization | A business of undertaking the construction of revenue-producing properties and rental housing for the wealthy and selling rental apartments and affordable rental apartments for seniors with nursing-care services. | 21.7% |

Leasing and Management | Management of rental apartments and affordable rental apartments for seniors with nursing-care services that are linked to the effective land utilization, and management of condominiums on consignment from condominium associations. | 20.7% |

Construction Related | Steel-frame and reinforced concrete construction, civil engineering, electrical equipment installation, etc. entrusted by public offices, etc. The goal is to meet the demand for effective land utilization projects. | 1.5% |

* “Ratio to total sales” means the ratio of each segment to total sales, excluding internal sales.

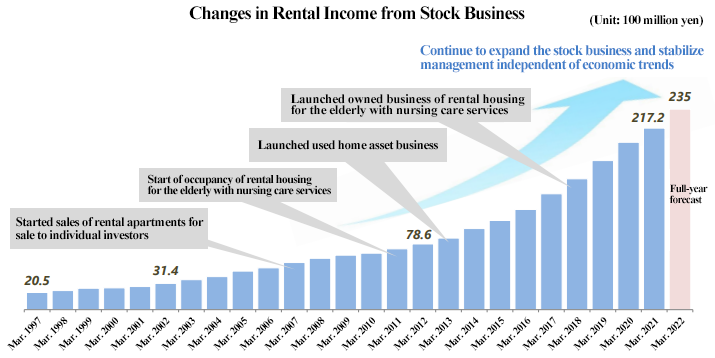

Expansion of recurring-revenue business

The company is expanding its recurring-revenue business with the aim of achieving stable business growth over the medium to long term. The company's recurring-revenue business has been growing steadily, starting with the subleasing of rental apartments for sale to individual investors and affordable rental apartments for seniors with nursing-care services, followed by the diversification into the used residential properties asset business and the ownership of serviced senior housing. Revenues from rental, which is a recurring-revenue business, are growing steadily every year and are expected to reach 23.5 billion yen in the fiscal year ending March 2022.

(Taken from the reference material of the company)

5. Conclusions

Ordinary income for the first half was as healthy as 3.35 billion yen. The progress rate of ordinary income toward the full-year estimate of 4.6 billion yen is as high as 72.9%. The real estate industry, to which the company belongs, is characterized by a high concentration of deliveries in the fourth quarter. In addition, the company plans to have a high-level delivery of free design houses, condominiums, and rental apartments for sale to individual investors in the second half of this fiscal year. Against this backdrop, the company's full-year profit estimates are very conservative, because it took into account various concerns over higher procurement prices due to the lumber sticker shock, a lull in the recovery of the domestic housing market, which had been healthy, and a decline in purchasing power due to uncertainty over the containment of the novel coronavirus infection. Furthermore, the company's mid-term performance target of 6.8 billion yen in ordinary income has been achieved with a progress rate of 49.3% in the first half of the fiscal year, so it is not completely out of reach. It will be interesting to see how far the company will be able to save up to exceed the target ordinary income of 4.6 billion yen set in the company's plan for this fiscal year, and also how close it will be able to get to its mid-term performance target, as well as the status of ordinary income in the following third quarter.

Also, the company's lead time from order receipt to sales is long, except for used residential properties, with free design houses taking about nine months and rental apartments for sale to individual investors taking about a year. Therefore, the order backlog at the end of the third quarter will be a very important factor in determining the expansion of business in the next fiscal year. Unfortunately, the order backlog for free design houses at the end of this second quarter was down 8.2% from the end of the same period in the previous fiscal year. The rise in procurement prices seems to be having an impact on ordering activities. On the other hand, the order backlog for condominiums for sale and rental apartments for sale to individual investors increased steadily from the end of the same period in the previous fiscal year, supported by steady purchasing, the high investment interest by wealthy individuals, and the need for countermeasures against inheritance tax among asset owners. We would like to focus on the status of the order backlog at the end of the third quarter with high expectations, as it will be a barometer for earnings growth in the next fiscal year. In particular, the trend in orders for free design houses, etc., condominiums for sale, and rental apartments for sale to individual investors, which are expected to drive earnings growth in the next fiscal year, will be closely watched.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 7 directors, including 2 external ones |

Auditors | 3 auditors, including 2 external ones |

◎Corporate Governance Report

The company submitted its latest corporate governance report on December 20, 2021.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

【Supplementary principle 1-2-4. Electronic exercise of voting rights and translation of notices of convocation of shareholders’ meetings into English】 | The electronic voting platform is available. Because the proportion of overseas investors in our company is small(As of March 31, 2021, 6.9%), we currently consider that it is not necessary to translate Notice of Convocation of Shareholders' Meetings into English; however, when the ratio of voting rights overseas investors hold to all voting rights exceeds 10%, we will consider providing the English version of Notices of Convocation. Furthermore, the main pages of the Brief Financial Results (Financial Statements) and the main parts of the website (Corporate Profile, etc.) are posted in English. |

[Supplementary Principle 4-10-1. Nomination Committee and Compensation Committee] | The Company's Board of Directors consists of seven directors, two of whom are independent outside directors, which does not constitute a majority. However, we believe that the establishment of the Nomination Committee and the Compensation Committee is unnecessary as of now for the following reasons. ① Nomination Committee Since the Company has adopted a 360-degree personnel evaluation system in which all employees and part-time employees, including directors, evaluate everyone, and directors are also subject to personnel assessment evaluations by all employees, we believe that the establishment of a Nomination Committee is unnecessary as of now.

② Compensation Committee The policy for determining the remuneration of the Company's directors is set forth in the Standards for Raising Directors' Salaries in the Directors' Regulations approved by the Board of Directors, and the Company's directors are comprehensively evaluated by all employees for their performance, experience, and ability through the 360-degree personnel evaluation system. As we regard that this ensures fairness, transparency, and objectivity in the process of determining the remuneration of directors, we believe that the establishment of a Remuneration Committee is unnecessary as of now. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Principle 1-4. Strategically held shares】 | In all of our businesses, we carry out comprehensive transactions with financial institutions, such as borrowing funds for acquisition of real estate, acquiring information on real estate purchasing, and introducing customers in the effective land utilization business. Cooperation with financial institutions is essential for business expansion and sustainable development. For the medium- to long-term goal of improving corporate value, we seek understanding on our management philosophy and management attitude, and we plan to hold investment stocks of financial institutions, which are premised on comprehensive transactions, after verifying their economic rationality. The maximum number of shares held for each issue is 500,000 and the shareholder’s equity is within 2%. In addition to continuously monitoring the status of transactions with financial institutions and the financial position and operating results of financial institutions, the Board of Directors meets once a year to review the reasonableness of holding the Company's shares based on trends in stock prices, dividend amounts, transaction conditions, etc. With respect to the exercise of voting rights for shares held for policy purposes, the Company examines individual proposals closely and makes decisions on whether to approve or disapprove individual proposals based on whether the proposals will lead to an increase in the corporate value of the Company and its investing companies and whether they are compatible with the Company's purpose of holding the shares. |

[Supplementary Principle 4-11-3. Summary of the results of analysis and evaluation of the effectiveness of the overall board of directors] | Every year, the board of directors' effectiveness is evaluated in the form of an anonymous questionnaire, and the results are reported to the Board of Directors. The results of the analysis and evaluation of the effectiveness of the Board of Directors are as follows. ・The frequency of meetings of the Board of Directors and each officer's attendance status is appropriate, and the management of the meetings is carried out appropriately, with appropriate content and quantity in the distribution materials and deliberation on each agenda item. |

[Principle 5-1 Policy on constructive dialogue with shareholders] | The IR Office is in charge of dialogue with shareholders, and the officer in charge of IR is responsible for its supervision. The IR Office cooperates with the Corporate Planning Department, General Affairs Department, Human Resources and Legal Department, Finance Department, and Internal Audit Office on a daily basis, and the necessary information is to be reported to the IR Office. The IR Office holds company information sessions for individual investors and for analysts and institutional investors, in Osaka, Tokyo, Nagoya, and Fukuoka. We are also working to deepen the shareholders' understanding of our management philosophy and policies, by making the content of results briefings, information disclosed on our website, and shareholder newsletters easy to understand for individual investors. We provide feedback to the directors and the Board of Directors regarding the opinions and concerns of shareholders that were identified during the dialogue. |

<Other>

The Company's basic policy on corporate governance is as follows: "Our basic policy on corporate governance is to maximize corporate value from the standpoint of our shareholders while improving management efficiency and transparency and achieving steady business results. We regard this as one of the most important management issues." In addition, it also states the following clause individually.(1) maximizing shareholder value, (2) the Board of Directors, (3) Corporate Auditors and the Board of Corporate Auditors, (4) strengthening the internal information disclosure system, (5) improving the quality of IR activities, and (6) strengthening internal control.

*From the company's release on corporate governance dated Dec. 20.

https://www2.tse.or.jp/disc/88600/140120211206447239.pdf

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |