Bridge Report:(8931)WADAKOHSAN the Fiscal Year February 2020

Chairperson Norimasa Wada |

President Takero Takashima | WADAKOHSAN CORPORATION(8931) |

|

Company Information

Market | TSE, Second Section |

Industry | Real Estate |

Chairperson | Norimasa Wada |

President | Takero Takashima |

HQ Address | 4-2-13, Sakaemachidori, Chuo-ku, Kobe-shi, Hyogo |

Year-end | February |

HOMEPAGE |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥591 | 11,100,000 shares | ¥6,560 million | 7.7% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥35.00 | 5.9% | ¥153.16 | 3.9x | ¥2,160.29 | 0.3x |

*The share price is the closing price on May 1, 2020.

Non-Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Feb. 2017 Act. | 31,374 | 3,063 | 2,193 | 1,370 | 137.10 | 27.00 |

Feb. 2018 Act. | 35,149 | 3,304 | 2,424 | 1,589 | 158.23 | 30.00 |

Feb. 2019 Act. | 39,287 | 3,445 | 2,687 | 1,843 | 166.07 | 32.00 |

Feb. 2020 Act. | 40,093 | 3,290 | 2,442 | 1,781 | 160.49 | 35.00 |

Feb. 2021 Est. | 40,000 | 3,200 | 2,500 | 1,700 | 153.16 | 35.00 |

* Unit: Million yen, yen (EPS, DPS)

*The forecasted values were provided by the company.

This Bridge Report presents WADAKOHSAN’s earnings results for the Fiscal Year ended February 2020 and Fiscal Year ending February 2021 earnings estimates.

Table of Contents

Key points

1.Company Overview

2.Fiscal Year ended February 2020 Earnings Results

3.Fiscal Year ending February 2021 Earnings Forecasts

4.Conclusions

<Reference:Strategies for ESG >

<Reference:Regarding Corporate Governance>

Key Points

- For the fiscal year ended Feb. 2020, sales grew 2.1% YoY and operating income decreased 4.5% YoY. In the sale of condominiums, which is the mainstay, the decrease in the delivery of properties was absorbed by the increase in prices of real estate, and sales were maintained at about the same level as those in the previous term. In addition, other real estate sales grew significantly, due to an increase in the sales of profitable properties, despite a decrease in the sales of detached houses. Real estate rental income also remained strong. In terms of profits, gross profit was sluggish due to the rise in the cost ratio of condominium sales and detached house sales, while the increase in SG&A expenses mostly from tax and public dues and personnel expenses became a burden. The dividend is to be 35 yen/share, up 3 yen/share YoY, including the commemorative dividend of 1 yen/share for changing the listing to the second section of TSE (the company changed the listing of shares to the second section of TSE on April 22).

- For the fiscal year ending Feb. 2021, sales and operating income are estimated to decrease 0.2% and 2.7%, respectively, YoY. Of the condominiums scheduled for completion during this term, sales contracts were already concluded for about 80% of the units. As for the delivery, despite the company’s concern over potential delay in the delivery of housing equipment and other items due to the spread of the new coronavirus, the properties will be delivered by June 2020. For this reason, although the company recognizes that the future impact of the new coronavirus on the domestic economy is still unforeseeable, it believes that the impact of the pandemic on its business results for the fiscal year ending Feb. 2021 will be minor. As for the dividend, there will be no longer the commemorative dividend, which was distributed in the previous term, and the common dividend will be increased by 1 yen/share, so that a total of 35 yen/share will be paid (with an estimated payout ratio of 22.9%).

- At this stage, the contract for sales of condominiums, which is the mainstay, is on track. It seems that the construction works that the company ordered to local general contractors are going to take place as scheduled. Also, according to the company, because financial institutions are willing to lend funds to the company, it can raise necessary funds for projects without problems. In response to the self- restraint request by the government, condominium galleries were closed, which may delay the establishment of contracts, but the company shows confidence in the business outlook.

1.Company Overview

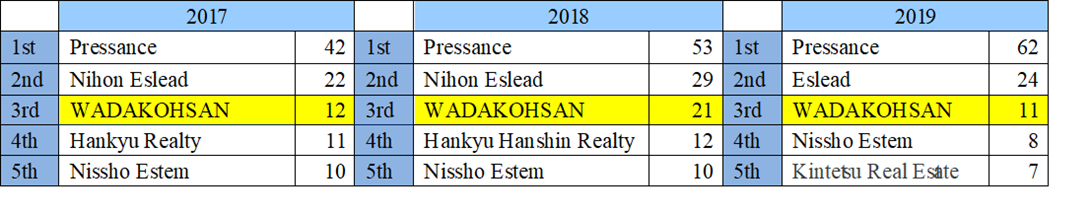

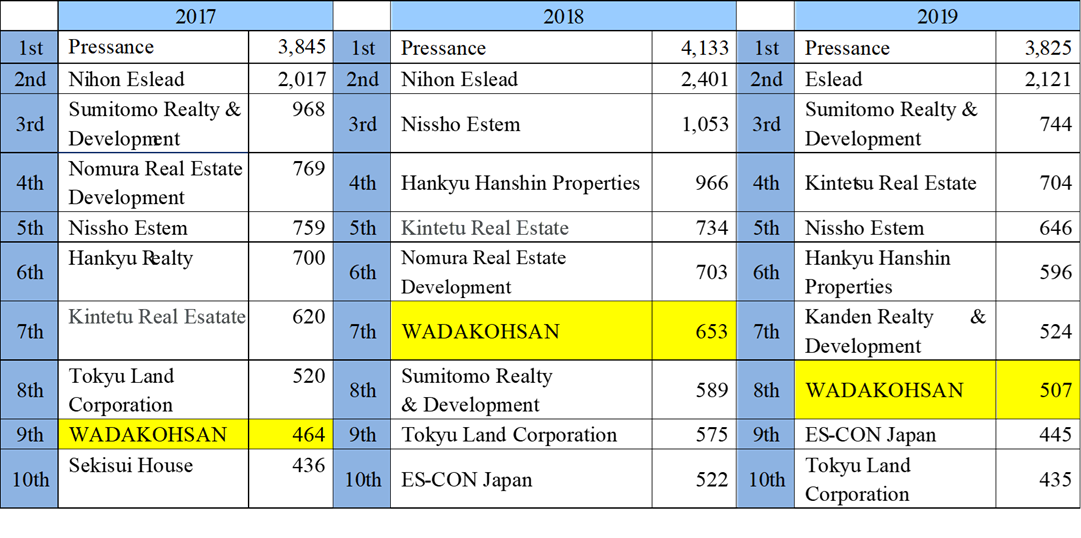

This time-honored real estate firm was founded in 1899. With its main bases among Kobe-shi, Akashi-shi and Hanshin area in Hyogo Prefecture, the company has developed its community based real estate business by selling lots for condominiums and detached houses, and dealing in real estate leases and effective land use. The company specializes in buying up sites and planning, and outsources design, architecture and sales to other firms. As for the sales of condominiums under the “WAKOHRE” brand name, although its focus is on medium scale condominiums with 30-50 units, in recent years, it is also working on the development of large-scale condominiums. The company is also expanding the business area to Hokusetsu area and Himeji-shi, which are adjacent to the above-mentioned business areas. The company is the first-place condominium supplier in Kobe-shi for 22 consecutive years, and is in the third place in the Kinki region (both in 2019). As of the end of February 2020, the cumulative supply results were 493 buildings with 18,710 residences (based on those which had started construction).

The company began a real estate leasing business in Kobe-shi in January 1899. It was incorporated as Wadakohsan Ltd. in December 1966, and reorganized into Wadakohsan Co., Ltd. in September 1979.

【Business philosophy - symbiosis (living together) your way of living contributes to others’ happiness-】

The corporate philosophy is “symbiosis,” where your way of living contributes to the happiness of others, values the connections between people and supports one another. Based on this idea, the company holds up “PREMIUM UNIQUE” as its product concept, and aims to create unique places to live in that fit each customer’s own way of life, while responding to the feelings of each person who resides there.

1-1. Business segments

The business segments are divided into sales of condominiums developed for the “WAKOHRE” brand, sales of detached houses developed for the “WAKOHRE-Noie” brand (the sales for both businesses are entrusted to external enterprises), other real estate revenue from dealing in the sale and development of real estate for investment and residential land, property leasing revenue from the lease of condominiums (the brand name “WAKOHRE-Vita” and others), stores, parking lots etc., and “others,” including things like insurance agency fees not included in the report segment. The sales composition for the term ended Feb. 2020 puts the condominium sales at 77.1% (FY2/19: 79.5%), sales of detached houses at 5.3% (FY2/19: 5.6%), other real estate sales revenue at 10.4% (FY2/19: 7.9%), property leasing revenue at 7.1% (FY2/19: 6.7%), and others at 0.1% (FY2/19: 0.3%). The segment profit composition puts condominium sales at 58.7% (FY2/19: 71.3%), sales of detached houses at -0.2% (FY2/19: 1.7%), other real estate sales at 17.2%(FY2/19: 1.9%), property leasing revenue at 22.8%(FY2/19:23.4%), and others at 1.5% (FY2/19: 1.7%).

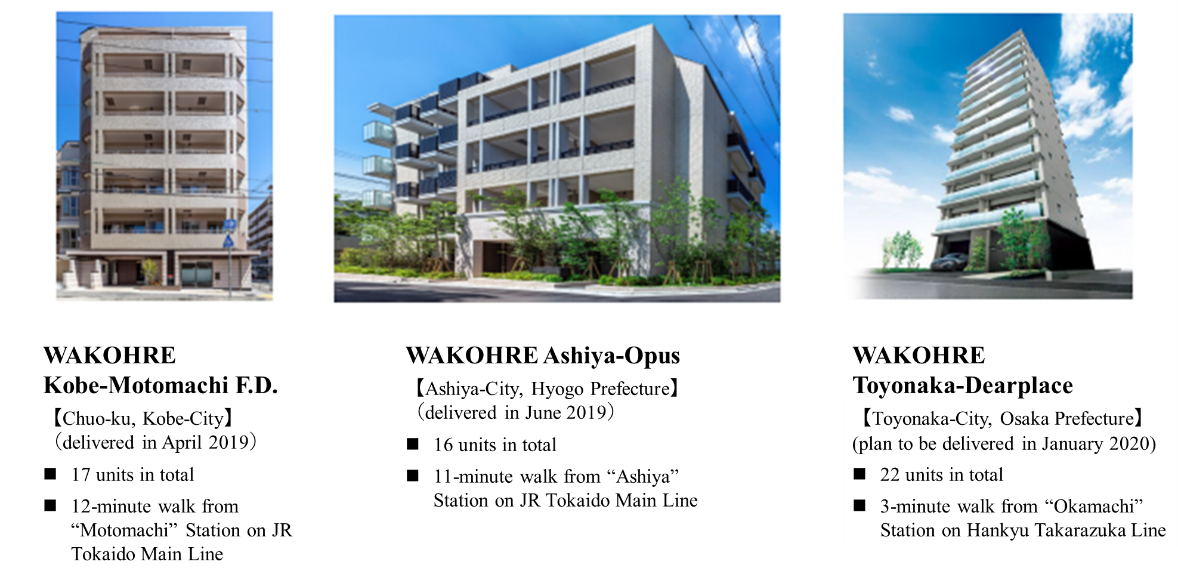

Condominium sales business

The main areas are the Kobe and Akashi areas (around Kobe-shi and Akashi-shi in Hyogo Prefecture), the Hanshin area (Ashiya-shi, Nishinomiya-shi, Amagasaki-shi, Itami-shi and Takarazuka-shi in Hyogo Prefecture), and the focus is on developing medium scale condominiums with 30-50 units whose market has low competition, under the “WAKOHRE” brand with leading condominium businesses. In addition to a sales strategy that focuses on highly popular areas and supplies different types of condominiums in the same area, thereby realizing diversified needs of consumers and achieving high sales efficiency. Strengths include establishing an efficient business model with unique local community strategy, such as condominium gallery strategy that suppresses selling costs by the sale multiple condominiums at the same time in one permanent condominium gallery. Also, in recent years, the company is pursuing new possibilities by carrying out large-scale projects over 100 units, reflecting its cost measures and purchasing power, and expanding the business areas to the Hokusetsu area in Osaka Prefecture and Himeji-shi in Hyogo Prefecture, which are adjacent to Kobe-shi and the Hanshin area.

FY Feb. 20 Project Example

(Source: WADAKOHSAN)

Detached house sales business

Since 2007, the company has been developing around 10 houses with the “WAKOHRE-Noie” brand, in Kobe-shi and the Hanshin area, including the Hokusetsu area in Osaka Prefecture.

From the large amount of various site information, the company is able to gather, there are many properties suitable for sale for detached house lots in terms of location, area, and site shape. In addition, where the business period for condominiums is just under two years, these projects can be as short as one year, meaning that with high capital turnover and they can be used to fill the gaps of the period completed the condominium construction.

Utilizing the development concept with a focus on landscaping and design and planning abilities cultivated by the work in condominiums, the company aims to differentiate itself from traditional “power builders.”

Other real estate sales business

The company conducts planning, development and sales (of single buildings) of real estate for investment, and the sale of residential land and land for industrial use. As well as shouldering the function of effective utilization of property information, revenue from selling off lease properties (inventory assets) that accompanies property handover is also included in this segment. A few years, the company has enhanced sales of single rental housing buildings aimed at investors.

Property leasing business

The company mainly manages residential properties, in addition, stores and offices, parking lots, self-storage and others. As a business that can maintain a stable cash flow, in an industry that tends to be strongly influenced by condominium market conditions, since its founding the company has continued to contribute to the stability of revenue. Its basic strategies are to assure stable revenue by improving the occupancy rate (the rate of tenants moving in), and to maintain and improve the quality of its portfolio through movement of property. With the residences, keeping in mind the movement of property after a fixed period of time has expired, the asset composition is focused on 200-300 million yen properties, with many hopeful buyers amongst high net worth individuals. The company maintains an occupancy rate of around 95%. In addition, by managing assets and liabilities appropriately, it also aims to reduce the risk of lengthening investment return periods, and the risks associated with assets becoming excessive. The yield of each person is high, at 9-10%, and it aims to cover the burden of indirect expenses with the stable revenue from the leasing operations.

1-2 Strengths of WADAKOHSAN

(1) Japan’s foremost residential area as their region of business

They meet the high demand for housing by making Japan’s foremost residential area, area among Kobe, Akashi and Hanshin, their main area of business while establishing a comparative advantage with their information capabilities; they even have a reputation for building a community entrenched in the region.

(2) Prevailing WAKOHRE brand in Kansai

Their WAKOHRE brand is prevailing in Kansai, and the power of the brand lets them hold their own against other major condominium developers. In the 22th (2019) Condominium Brand Questionnaire Survey, conducted by the Osaka headquarters of Nihon Keizai Shimbun Inc., WAKOHRE was ranked in the 3rd place in the Individuality brand section and 5th in the Familiarity brand section.

(3) Maintaining sound finances via thorough risk management

They are maintaining sound finances via thorough risk management, have well-balanced transactions with financial institutions and remain stable. As a result, in their corporate history spanning over 120 years in the real estate industry, where many companies have gone out of business, they have only reported a deficit during fiscal year ended Feb. 2010 after being affected by the global financial crisis. They continue to have stable dividends.

(4) Successful in differentiating themselves from major firms, and having room for growth due to expand their business areas

Small and medium condominium businesses were eliminated due to the real-estate recession after the global financial crisis, and only major real estate companies and railway real estate companies survived. However, since these real estate companies specialize in large-scale properties and properties along the railroads, there are not many cases where they compete in site acquisitions with WADAKOHSAN, who develops medium-scale condominiums with around 30-50 units. Meanwhile, WADAKOHSAN has its sights on further expanding its operations, making efforts to develop large-scale properties in the existing business area and expanding into Himeji-shi in Hyogo Prefecture and Osaka Prefecture (Hokusetsu area), which are next to their existing business area.

[Actual results in 2019]

Rankings for the number of condominium buildings supplied in the Kinki region

Rankings for the number of condominium units supplied in the Kinki region

(Source: WADAKOHSAN)

2. Fiscal Year ended February 2020 Earnings Results

2-1 Non-consolidated results

| FY 2/19 | Ratio to sales | FY 2/20 | Ratio to sales | YoY | Initial Forecast | Compared to Forecast |

Sales | 39,287 | 100.0% | 40,093 | 100.0% | +2.1% | 40,000 | +0.2% |

Gross profit | 7,153 | 18.2% | 7,210 | 18.0% | +0.8% | - | - |

SG&A expenses | 3,707 | 9.4% | 3,920 | 9.8% | +5.7% | - | - |

Operating Income | 3,445 | 8.8% | 3,290 | 8.2% | -4.5% | 3,500 | -6.0% |

Ordinary Income | 2,687 | 6.8% | 2,442 | 6.1% | -9.1% | 2,700 | -9.5% |

Net Income | 1,843 | 4.7% | 1,781 | 4.4% | -3.4% | 1,850 | -3.7% |

*Unit: million yen

Achieved record high sales of 40 billion yen, but profit decreased due to increased costs for purchasing

Sales were 40,093 million yen, up 2.1% YoY. Although the number of units delivered decreased, the sales of condominiums, which are the mainstay, were about the same as those in the previous year due to a rise in average sales price (41 million yen to 55 million yen), which was contributed by high-priced properties. In addition, although sales of detached houses declined 4.5% YoY, the other real estate sales grew 34.4% YoY due to an increase in the sales of profitable properties. Real estate rental income also remained strong at 7.2% YoY.

Operating income was 3,290 million yen, down 4.5% YoY. While gross profit grew only 0.8% YoY, due to an increase in the cost ratio of condominium sales and detached houses sales in association with increased land prices and construction costs, SG&A expenses augmented 5.7% YoY due to an increase in tax and public dues reflecting steady purchases and an increase in personnel expenses, etc. Although non-operating expenses deteriorated due to fee for the loan to acquire funds for large-scale projects, the net income fell only 3.4% YoY, thanks to the posting of a gain on sale of fixed assets of 131 million yen as extraordinary income.

The dividend is to be 35 yen/share, up 3 yen/share YoY, including the commemorative dividend of 1 yen/share for changing the listing in the second section of TSE.

2-2 Trend of each business segment

| FY 2/19 | Ratio to sales | FY 2/20 | Ratio to sales | YoY | Initial Forecast | Compared to Forecast |

Condominium sales | 31,229 | 79.5% | 30,907 | 77.1% | -1.0% | 31,700 | -2.5% |

Detached housing unit sales | 2,205 | 5.6% | 2,106 | 5.3% | -4.5% | 3,000 | -29.8% |

Other real estate sales | 3,106 | 7.9% | 4,174 | 10.4% | +34.4% | 2,700 | +54.6% |

Property leasing revenue | 2,647 | 6.7% | 2,837 | 7.1% | +7.2% | 2,600 | +9.1% |

Other | 97 | 0.2% | 65 | 0.1% | -32.5% | - | - |

Sales | 39,287 | 100.0% | 40,093 | 100.0% | +2.1% | 40,000 | +0.2% |

Condominium sales | 3,016 | 71.3% | 2,394 | 58.7% | -20.6% |

|

|

Detached housing unit sales | 72 | 1.7% | -9 | -0.2% | - |

|

|

Other real estate sales | 80 | 1.9% | 699 | 17.2% | +766.9% |

|

|

Property leasing revenue | 989 | 23.4% | 931 | 22.8% | -5.8% |

|

|

Other | 71 | 1.7% | 61 | 1.5% | -13.0% |

|

|

Adjustment sum | -784 | - | -787 | - | - |

|

|

Operating Income | 3,445 | - | 3,290 | - | -4.5% |

|

|

*Unit: million yen

*Other include cancellation deposit income, insurance agency fee income, brokerage fees, etc.

Condominium sales

Sales were 30,907 million yen, down 1.0% YoY, and profit was 2,394 million yen, down 20.6% YoY. It delivered 555 units (down 26.5% YoY) including “WAKOHRE The Kobe Tor-Road” and “WAKOHRE Sumiyoshi Owner's Residence” (it was unable to reach the initial estimate due to delays in sales and contracts for projects in the Hokusetsu area of Osaka Prefecture). The number of units launched was 12 buildings (401 units), mainly in Kobe, Akashi and the Hanshin area (down 50.4% YoY). The number of units contracted, which shows the sales status, was 612 units (down 1.6% YoY), 28,755 million yen in terms of monetary value (down 6.6% YoY as a reaction to many high-priced contracts in the previous term). Consequently, the number of units contracted yet to be delivered as of the end of this fiscal year was 735 (up 8.6% from the end of the previous term), 32,699 million yen in terms of monetary value (down 6.2% YoY). The number of purchased units was 1,027 (up 87.4% YoY) due to the purchase of a land lot for a large-scale project (“WAKOHRE The Kobe Kyukyoryuchi Residence Tower” (the total number of units: 128, scheduled to be delivered in November 2022)”). It was much higher than the actual results of the previous term (548 units) and the plan (650 units).

KPI for Condominium Sales Business

| FY 2/19 | YoY | FY 2/20 | YoY | Initial Forecast | Compared to Forecast |

No. of units delivered | 755 | +11.7% | 555 | -26.5% | 575 | -3.5% |

No. of units launched | 809 | +36.9% | 401 | -50.4% | 600 | -33.2% |

No. of units contracted | 622 | -1.6% | 612 | -1.6% | 650 | -5.8% |

No. of units contracted(undelivered) | 677 | -16.3% | 735 | +8.6% | - | - |

No. of inventory of units completed | 9.5 | -50.0% | 37 | +289.5% | - | - |

No. of units purchased land | 548 | -30.8% | 1,027 | +87.4% | 650 | +58.0% |

Projects not yet for sale by area (as of the end of the fiscal year ended Feb. 2020)

Region | Number of buildings | Number of units |

Kobe-shi | 17 | 838 |

Hanshin area | 11 | 421 |

Akashi-shi, Himeji-shi | 4 | 172 |

Osaka Prefecture | 4 | 144 |

Sale of detached houses

Sales were 2,106 million yen (down 4.5% YoY), and there was a loss of 9 million yen (a profit of 72 million yen in the previous year). Although it delivered 28 houses of “WAKOHRE-Noie Kobe-Kanokodai” (Kita-ku, Kobe-shi, Hyogo Prefecture: a total of 90 houses), the number of contracted houses decreased (from 65 to 39) due to delays in the launch in association with delayed construction works and coordination with government offices in other projects. As a result, the number of units delivered was 48, which is below the estimated 70.

| FY 2/16 | FY 2/17 | FY 2/18 | FY 2/19 | FY 2/20 |

No. of units (units) | 45 | 38 | 54 | 62 | 48 |

Sales (million yen) | 1,752 | 1,356 | 1,774 | 2,205 | 2,106 |

Gross profit (million yen) | 216 | 165 | 223 | 260 | 232 |

Gross profit margin | 12.3% | 12.2% | 12.6% | 11.8% | 11.1% |

Other real estate sales

Sales were 4,174 million yen (up 34.4% YoY) and there was a gain of 699 million yen (a profit of 80 million yen in the previous year). Sales increased due to an increase in sales of properties for investments such as the sale of land to a vocational school and selling bulk sales 7 buildings (1.3 billion yen) to private funds funded by banks. Gross profit margin was 23.6%, a significant improvement from 9.5% in the previous fiscal year, due to an increase in highly profitable steel-framed properties.

Properties under development at the end of the period are 14 wood-framed buildings for investment (144 units) (there were 16 buildings with 156 units at the end of the previous term) and 66 steel-framed buildings for investment (1,001 units) (there were 43 buildings with 689 units at the end of the previous term). Of these, the properties scheduled to be launched in the next term are 8 steel-framed buildings for investment (69 units) (there were 4 wooden-framed buildings for investment (22 units) and 7 steel-framed buildings for investment (94 units) at the end of the previous period).

Project numbers and sales

| FY 2/19 | FY 2/20 | |||

| Project number | Sales (million yen) | Project number | Sales (million yen) | YoY |

Land for development, etc. | 5 | 1,472 | 6 | 1,687 | +14.6% |

Properties for investment | 9 | 1,277 | 11 | 1,641 | +28.4% |

Wooden-framed buildings | 4 buildings | 34 units | 3 buildings | 16 units | - |

Steel-framed buildings | 5 buildings | 77 units | 8 buildings | 121 units | - |

Lease properties | 4 | 357 | 6 | 848 | +137.4% |

Total | 18 | 3,106 | 23 | 4,174 | +34.4% |

Property leasing revenue

Real estate rental income was 2,837 million yen (up 7.2% YoY) and segment profit was 931 million yen (down 5.8% YoY). The company maintained a high occupancy rate of over 95%, centered on the mainstay residential type, and sales increased thanks to acquiring new properties and the operation of properties for investments that are planned to be sold. However, repair costs and initial costs for new properties for investments became a burden.

Property leasing revenue

| Income (million yen) | Composition ratio | YoY |

Residences | 1,924 | 67.8% | +9.2% |

Stores, offices, and other | 739 | 26.1% | +0.9% |

Parking lots | 105 | 3.7% | +11.1% |

Self-storage and other | 68 | 2.4% | +18.0% |

Total | 2,837 | 100.0% | +7.2% |

Change of occupancy rate

| End of 1H of 2/18 | End of 2/18 | End of 1H of 2/19 | End of 2/19 | End of 1H of 2/20 | End of 2/20 |

Residences | 94.2% | 96.9% | 92.1% | 95.7% | 93.7% | 96.5% |

Stores and offices | 94.0% | 96.0% | 89.7% | 92.3% | 93.4% | 95.9% |

Parking lots | 66.6% | 66.1% | 66.6% | 67.3% | 66.1% | 67.3% |

Gross profit of each business segment

| FY 2/19 | Gross profit rate | FY 2/20 | Gross profit rate | YoY |

Condominium sales | 5,354 | 17.1% | 4,797 | 15.5% | -10.4% |

Detached housing unit sales | 260 | 11.8% | 232 | 11.1% | -10.7% |

Other real estate sales | 295 | 9.5% | 985 | 23.6% | +233.2% |

Property leasing revenue | 1,171 | 44.2% | 1,133 | 39.9% | -3.3% |

Others | 73 | - | 63 | - | - |

Total | 7,153 | 18.2% | 7,210 | 18.0% | +0.8% |

*Unit: million yen

2-3 Balance Sheets And Cash Flow(CF)

Balance Sheets

| End of Feb.19 | End of Feb.20 |

| End of Feb.19 | End of Feb.20 |

Cash and deposits | 12,285 | 8,965 | Accounts payable-trade | 6,652 | 6,745 |

Real estate for sale | 5,575 | 9,223 | ST Interest-Bearing Debts | 23,748 | 18,893 |

Real estate for sale in process | 40,376 | 40,918 | Advances received | 3,816 | 2,795 |

Current Assets | 59,325 | 60,532 | LT Interest-Bearing Debts | 25,188 | 34,498 |

Property, plant and equipment | 24,644 | 26,729 | Liabilities | 63,734 | 65,634 |

Intangible Assets | 618 | 616 | Net Assets | 22,558 | 23,978 |

Investments and Other Assets | 1,704 | 1,734 | Total Liabilities and Net Assets | 86,292 | 89,613 |

Noncurrent Assets | 26,967 | 29,080 | Interest-bearing debts | 48,937 | 53,392 |

*Unit: million yen

The total assets as of the end of the fiscal year were 89,613 million yen, up 3,320 million yen from the end of the previous term. On the debit side, real estate for sale, real estate for sale in process, and property, plant and equipment increased, but cash and deposits decreased. The factors in increasing real estate for sale are attributable to the increase in condominiums for sale (from 1,114 million yen to 2,290 million yen) and real estate for investment (from 3,075 million yen to 5,864 million yen). The major factors in increasing real estate for sale in process are also attributable to the increase in condominiums for sale (from 34,561 million yen to 35,203 million yen) and real estate for investment (2,192 million yen to 2,730 million yen). In addition, property, plant and equipment increased as a result of acquiring real estate for rental.

On the credit side, long- and short-term loans and net assets increased. Equity Ratio is 26.8% (26.1% at the end of the previous term).

Cash Flow (CF)

| FY 2/19 | FY 2/20 | YoY | |

Operating CF (A) | 2,573 | -4,899 | -7,473 | - |

Investing CF (B) | -1,345 | -2,806 | -1,461 | - |

Free CF (A+B) | 1,228 | -7,705 | -8,934 | - |

Financing CF | -2,282 | 4,100 | +6,383 | -279.6% |

Cash and Equivalents at the end of term | 9,867 | 6,261 | -3,605 | -36.5% |

*Unit: million yen

Operating CF was negative 4,899 million yen, as the company posted an increase in inventory assets of 4,189 million yen (a decrease of 88 million yen in the previous term) and a decrease of advances received of 1,020 million yen (a decrease of 3,718 million yen in the previous term). The Investing CF was negative mainly due to the acquisition of rental properties. The financing CF is positive due to an increase of long- and short-term loans in association with financing for purchasing lands to build condominiums for sale.

Reference: ROE Analysis

| FY 2/16 | FY 2/17 | FY 2/18 | FY 2/19 | FY 2/20 |

ROE | 7.24% | 7.55% | 7.99% | 8.45% | 7.66% |

Net Profit Margin | 4.28% | 4.37% | 4.52% | 4.69% | 4.44% |

Asset Turnover Ratio | 0.42 times | 0.43 times | 0.43 times | 0.45 times | 0.46 times |

Leverage | 3.99 x | 4.05 x | 4.12 x | 3.99 x | 3.77 x |

*ROE = Net Profit Margin x Asset Turnover Ratio x Leverage

3.Fiscal Year ending February 2021 Earnings Forecasts

3-1 Full-year non-consolidated forecasts

| FY 2/20 Actual | Ratio to sales | FY 2/21 Forecast | Ratio to sales | YoY |

Sales | 40,093 | 100.0% | 40,000 | 100.0% | -0.2% |

Operating Income | 3,290 | 8.2% | 3,200 | 8.0% | -2.7% |

Ordinary Income | 2,442 | 6.1% | 2,500 | 6.3% | +2.4% |

Net Income | 1,781 | 4.4% | 1,700 | 4.3% | -4.6% |

*Unit: million yen

It is estimated that sales and operating income will decrease 0.2% and 2.7%, respectively, YoY

Of the condominiums scheduled for completion during the fiscal year ending Feb. 2021, sales contracts have been already concluded for about 80% of the units. As for the delivery, although the company was concerned that the delivery of housing equipment and other items would be delayed due to the spread of the new coronavirus, there is a prospect that the properties will be delivered by June 2020. For this reason, although the company recognizes that the future impact of the new coronavirus on the domestic economy is still unforeseeable, it believes that the impact on their business results for the fiscal year ending Feb. 2021 will be minor.

Nonetheless, the forecasts for the fiscal year ending Feb. 2021 were conservative given the high land prices and high construction costs. SG&A expenses are estimated to be unchanged, but gross profit is estimated to decrease. Although operating income will decline, ordinary income is expected to increase 2.4% YoY because there will no longer be a fee for the loan. Meanwhile, net income is estimated to decrease 4.6% YoY, since there will be no gain on sale of fixed assets.

As for the dividend, the common dividend will be 35 yen/share, up 1 yen/share, without the commemorative dividend, which was paid in the previous term (with an estimated payout ratio of 22.9%).

3-2 Forecasts for each segment

| FY 2/20 Actual | Ratio to sales | FY 2/21 Forecast | Ratio to sales | YoY |

Condominium sales | 30,907 | 77.1% | 32,600 | 81.5% | +5.5% |

Detached housing unit sales | 2,106 | 5.3% | 3,000 | 7.5% | +42.4% |

Other real estate sales | 4,174 | 10.4% | 1,600 | 4.0% | -61.7% |

Property leasing revenue | 2,837 | 7.1% | 2,800 | 7.0% | -1.3% |

Other | 65 | 0.1% | - | - | - |

Total | 40,093 | 100.0% | 40,000 | 100.0% | -0.2% |

*Unit: million yen

Condominium sales

Sales are projected to rise 5.5% YoY to 32,600 million yen. The company is expecting to complete the construction of 15 buildings (691 units). The number of units to be launched will be 700 (up 74.6% YoY), including “WAKOHRE The Kobe Kyukyoryuchi Residence Tower (total number of units: 128, scheduled to be delivered in November 2022).” The number of delivered units will be 690 (up 24.3% YoY) including “WAKOHRE Itami-Miyanomae Juan (total number of units: 66 units),” and the number of contracted units will be 650 (up 6.2% YoY). As of the end of the fiscal year ended Feb. 2020, the contracts were already concluded for 568 units. However, sales will only increase by 5.5%, as the average sales price will drop from 55 million yen in the previous term to 47 million yen. The company started focusing on the release of and contracts for the properties to be completed in the fiscal year ending Feb. 2022, such as “WAKOHRE Ashiya The Suite (total number of units: 22 units, scheduled to be delivered in September 2021)” and “WAKOHRE Tsukaguchi Green Promenade (total number of units: 37 units, scheduled to be delivered in July 2021).”

KPI for Condominium Sales Business

| FY 2/20 Actual | YoY | FY 2/21 Forecast | YoY |

No. of units delivered | 555 | -26.5% | 690 | +24.3% |

No. of units launched | 401 | -50.4% | 700 | +74.6% |

No. of units contracted | 612 | -1.6% | 650 | +6.2% |

No. of purchased land | 1,027 | +87.4% | 650 | -36.7% |

The company is scheduled to purchase 650 units (down 36.7% YoY). While emphasizing profitability, it will focus on acquisition in highly convenient areas, such as Kobe-shi, Akashi-shi, and the Hanshin area, which are major supply areas. It will also continue focusing on area renovation (market redevelopment project). Currently, it is selling “WAKOHRE Tsukaguchi Ekimae First Emblem (a total of 117 units, scheduled to be delivered in June 2021) and working on the “Minatogawa Market Redevelopment Project” (Hyogo-ku, Kobe-shi, scheduled to be delivered in April 2022), a competition project offered by Kobe City Government. “Minatogawa Market Redevelopment” will rehabilitate an aged building that had about 40 stores and make it a 14-story condominium (the first floor is

planned to be a commercial space).

The company will also continue sales in the Hokusetsu area in Osaka Prefecture and Himeji-shi, as part of efforts to expand the business area. The Hokusetsu area in Osaka Prefecture consists of seven cities and three towns, such as Toyonaka-shi, Ikeda-shi, Suita-shi, Takatsuki-shi, Ibaraki-shi, Minoo-shi, Settsu-shi, Shimamoto-cho, Toyono-cho, and Nose-cho. The “Kita-Osaka Express Line,” which is connected to the “Midosuji Line,” which is the main artery in Osaka-shi, runs vertically across the Hokusetsu area, and this area is very popular as a bed town for people who work in the center of Osaka-shi. For this area, the company has already supplied 5 buildings (240 units) in Toyonaka-shi, 3 buildings (143 units) in Suita-shi, and 3 buildings (102 units) in Ikeda-shi.In Himeji-shi, the company sells 1 to 2 properties that are close to stations and boast convenience every year and is currently selling “WAKOHRE Himeji The Suite (total number of units: 43, scheduled to be delivered in February 2021).”

In addition, the tower project “WAKOHRE Osaka Shinmachi Tower Residence (a total of 118 units, scheduled to be delivered in January 2021),” which the company supplied for the first time in Osaka-shi, was successfully sold out. It is characterized by excellent lighting and ventilation that takes advantage of the open corners of the three-sided roadway, and has a well-balanced “ease of living” including parks, educational facilities, and commercial facilities within a walking distance. It is also within a walking distance from the Shinsaibashi area where department stores and other stores are located. In addition, a “library” produced by Junkudo Bookstore is in place in the common area.

Hokusetsu area, Osaka Prefecture

| “WAKOHRE Osaka Shinmachi Tower Residence”

|

(Source: WADAKOHSAN)

Sale of detached houses

The company is intending to make more efforts in the Hanshin area and the Hokusetsu area in Osaka Prefecture by targeting the high-priced houses by leveraging its planning ability, which is its strength. Sales are expected to increase 42.4% YoY to 3 billion yen due to the increase of houses sold.

Other real estate sales

Both the number of houses and units to be delivered will decrease, and sales are estimated to decrease 61.7% YoY to 1.6 billion yen. Although sales are estimated to decrease, purchasing and selling are expected to be healthy, and the company will continue the community-based strategy and expand the business area in Osaka Prefecture. The estimates are conservative, and the company will make revisions as appropriate, while looking at the overall progress.

Recently, in the businesses of condominiums for investment, issues of inappropriate lending by some financial institutions and inadequate construction by a major condominium building company emerged, but the company’s business on properties for investment targets only wealthy people with needs for inheritance measures and asset management, instead of corporate employees, and in consideration of compliance, it also does not offer sub-leasing services including after-sale rent guarantee, which often causes problems such as rent reduction. Although it does not guarantee rent, it purchases lands that are not suitable for condominium development at a reasonable price and carries out all relevant works from planning and designing to leasing. Because of this, it is well received by buyers, resulting in many repeat clients. Since it is a business that can utilize the network of local real estate distributors, which is the company’s strength, it is intending to continue to accumulate results.

Projects under development and properties scheduled to be launched in FY Feb. 21

| Number of projects under development | Units | Properties scheduled to be launched in FY 2/21 | Units | FY 2/20 Actual | Units |

wood-framed buildings | 14 buildings | 144 | 0 buildings | 0 | 3 buildings | 16 |

steel-framed buildings | 66 buildings | 1001 | 8 buildings | 69 | 8 buildings | 121 |

RC construction | 6 buildings | 207 | ||||

Total | 80 buildings | 1145 | 8 buildings | 69 | 11 buildings | 137 |

Property leasing revenue

It is intending to aggressively work on property replacement while maintaining a high occupancy rate. It plans to achieve 2.8 billion yen in real estate rental income, which is about the same as that in the previous year (down 1.3% YoY).

Also, in Kamikawa-cho, Hyogo Prefecture, where there are many tourist attractions such as the “Gin no Bashamichi” certified as a Japanese heritage site, Tonomine Kogen Highland and Mineyama Kogen Highland, it started an unoccupied house reproduction project to revitalize the town.

Through this project, it will also make efforts to address the issues of the SDGs.

(Source: WADAKOHSAN)

4. Conclusions

Although the company recognizes that it is necessary to pay close attention to the impact of the declaration of national emergency, contracts for sales of condominiums, which are the mainstay, are progressing smoothly at this stage, and there is no particular change in the cancellation status. The local general contractors with which the company works do not seem to suspend construction works. The financial institutions also continue to be proactively lending to the company, and it can raise the necessary funds for projects without problems. Against the backdrop of strong contracts, it believes this is an opportunity to acquire land at reasonable prices, as land prices are expected to drop in the future due to the effects of the new coronavirus.

Nonetheless, the company is already affected by the new coronavirus to some extent. Some condominium galleries were temporarily closed to follow the requirement for self-quarantine. As a result, there is a possibility that the contract establishment may be delayed (since the company started focusing on contracts for the properties to be delivered from the next fiscal year, it may affect the profits from the next fiscal year), but it is confident in the future business.

<Reference: Strategies for ESG >

As an ESG initiative, WADAKOHSAN is working to create safe, secure, and healthy housing for residents and is also focusing on social contribution by providing housing compensation at the time of natural disasters and youth development support. Furthermore, in terms of governance, as explained in the Corporate Governance Report, the company considers that the establishment of a sound, transparent, and efficient management system is its top priority and works on the development and enhancement of the governance system.

<Environment>

In addition to adopting the City of Kobe’s environmental performance standard for condominiums, the company is also working on the development of smart condominiums. It is also implementing a project to install seismic control device as standard in wooden houses. Furthermore, it is taking measures against Sick-House Syndrome for all of their housing.

Adoption of the City of Kobe’s environmental performance standard for condominiums. | In Kobe, when constructing a building of a certain scale, the operating company self-evaluates the environmental efforts such as consideration to global warming and safety and security of the residents, and notifies them to the city. The city announces the scoring results on the website, etc. The company publishes this result on the leaflets of condominiums and advertising materials such as websites to show the safety of the building. |

Realization of highly insulated and highly airtight housing | “WAKOHRE-Noie Kobe-Kanokodai” adopts the two-by-four method, which has higher air tightness than the conventional framework method, in all residences. Double-roof construction, floor insulation, and high-insulation facilities in the entrance door and bathroom are used to achieve insulation performance about 1.5-fold better than that of the “Thermal Insulation Performance Class 4” houses based on the law to ensure product quality. |

Enhance support function with a smartphone app | “WAKOHRE Okurayama Seasons” adopts a service that uses smartphones. It enables the users to confirm energy usage, operate Eco-Jozu (water heater) and gas equipment from outside, and fill the bathtub with hot water with one smartphone. The company supports safe and secure living. |

Measures against Sick-House Syndrome | For the floor and fittings of the company’s buildings, materials of F ☆☆☆☆ grade that emit very little formaldehyde are used. Also, non-formalin type is selected as the vinyl adhesive in consideration for Sick-House Syndrome, etc. |

<Society>

Joined the "Phoenix Mutual Aid," a housing reconstruction mutual aid system implemented by Hyogo Prefecture

The company joined the “Phoenix Mutual Aid,” the first housing reconstruction mutual aid system of its kind adopted by Hyogo Prefecture in September 2005 (a benefit will be paid for reconstruction or repair in case of damages due to a natural disaster). The company bears the cost of mutual aid premium for one year from the time of delivery of a unit sold by the company in Hyogo Prefecture.

Launch of a condominium incorporating the ideas of female employees

While housing facilities that meet the needs of women are popular, the company formed a project team, consisting of six female employees, for building a home from a female perspective and built a condominium that reflects the voices of women. Based on the dissatisfaction and improvement points in daily life, the company adopted efficient facilities that are convenient to the entire family with care and ingenuity unique to women.

Activities to support youth development

As an aging society with fewer children progresses, the company provides various support for children to have a healthy social life.

Children Painting Competition “My Dream House” It is a competition in which children from preschool to elementary school freely paint their dream houses to develop expressiveness and creativity. |

Vissel Kobe Soccer School Partner In order to support activities to promote soccer among young people, the company sponsors a “soccer school” run by Vissel Kobe. |

Childcare Support Project “Skip” by Kobe Shimbun Co., Ltd. The company cosponsors a parent-child participatory regional event “Skip Salon” hosted by Kobe Shimbun on the “Childcare Day,” which is on the 12th of each month. |

<Governance, etc.>

Transformation into a company with audit and supervisory committee

The company transformed into a company with audit and supervisory committee, at the general meeting of shareholders in May 2019, in order to tighten corporate governance and improve corporate value. Then, 12 directors were appointed, including 4 outside directors, so that outside directors accounts for one third of directors.

Compliance system

The company established various manuals including “Internal Reporting Regulations” and “Supplier Management Regulations” using the “Compliance Regulations” as a basic policy. In addition, the Internal Control Committee was established as the department in charge of compliance to appropriately verify the status of legal compliance and implement improvement measures. An internal audit office was also established directly under the Audit and Supervisory Committee to strengthen the check function. It also entered into advisory contracts with an external law firm and tax accountants to enhance the compliance system.

Disclosure

The company developed a disclosure policy and posted it on its website for investors to clarify the policy concerning timely and fair information disclosure to the stakeholders. Furthermore, as IR activities, it posts information materials on financial results and various indicators on the website for investors and holds financial results briefings for analysts and institutional investors twice a year in Tokyo and Kobe. It also holds briefing sessions for individual investors.

Creating a pleasant working environment

In order to create a working environment in which employees can work comfortably, the company is making efforts to improve various welfare programs, including paid vacation and hourly vacation. To improve the working environment for women, it also established the systems of maternity leave, childcare leave and short working hours. For maintaining the health of employees, a health committee meeting with an industrial physician is also held every month, and medical checkups and mental health checks are provided to keep track of their health.

Retention rate within 3 years from joining the company | 91.2% | Gender difference in average years of employment | 2 months |

Rate to take maternity and childcare leaves | 100% | Rate of female employees within 5 years of joining a company | 36.3% |

Rate to return to work from maternity and childcare leaves | 100% |

(As of February, 2020)

<Reference:Regarding Corporate Governance>

◎” Organization type”

Organization Structure | Company with audit and supervisory committee |

Directors | 12 directors of whom 4 are outside directors |

◎Corporate Governance Report

Last update date: April 30, 2020.

<Basic policy>

As our basic policy for corporate governance, we give top priority to the establishment of a sound, transparent, efficient managerial structure, and strive to improve it. Our company is small-sized, but we have established a simple, efficient organizational structure while considering mutual supervision and independence, and make efforts to develop a governance structure while putting importance in the following five items, to streamline the decision making process and actualize highly transparent business administration.

1. Exertion of the overseeing function based on practical discussions at meetings of the board of directors

2. Timely, appropriate deliberation on important items for making managerial decisions by the board of managing directors

3. Highly effective audit by an audit committee

4. Development of an internal control system by establishing an internal audit division, organizing an internal control committee, etc.

5. Cooperation with external institutions, such as law offices, for actualizing a system for compliance

<Reason for not implementing the principles of the Corporate Governance Code (Excerpt)>

【Supplementary Principle 1-2-(4)】

The ratio of institutional investors and the ratio of overseas investors in the previous fiscal year were 2.2% and 2.7%, respectively. We understand that this is an issue to be examined in the future, considering the cost.

【Principle 1-4. Strategically held shares】

Our basic policy regarding strategic shareholding is that they are just means for facilitating smooth transactions from business and financing perspectives. Strategic shareholding is not the goal itself, and we will continue holding them from a perspective of business compatibility, etc. In addition, the voting rights are exercised with due consideration given to the circumstances of each individual holder and the rationality of the content of the proposal. For the future, from the perspective of further reinforcing the appropriateness of ownership, we will examine numerical verification methods through capital costs, including the trading benefits.

【Principle 5-2. Establishing and Disclosing Business Strategies and Business Plans】

We use ROE as a management index with the goal of continuously improving shareholder value. In addition, we are aware of the numerical value of capital cost. However, we recognize that utilizing other numerical targets rather than formulating profit plans and business policies using these figures will enable us to operate more effectively on a practical level. Having said so, as it is more than ever required of us to improve shareholder value and accountability to investors, we will continue to manage our business by formulating investment plans using indicators such as capital costs and promoting efficient capital management and strive to improve management.

<Disclosure based on each principle of the Corporate Governance Code (Excerpt)>

【Principle 3-1. Enhancement of information disclosure】

(i) In our securities report, we clearly state the basic philosophy regarding management, business development policy, etc., including our corporate philosophy of “symbiosis (living together).”

(ii) The concept of corporate governance is also described in the securities report and “1. Basic policy” above.

(iii) Regarding the determination of remuneration, the total amount is determined at the general meeting of shareholders, and the remuneration of each director is determined at the Board of Directors according to the duties and roles in charge.

(iv) Regarding the appointment/dismissal of the senior management including directors, the Board of Directors determines the agenda item for the General Meeting of Shareholders, and they are determined by the resolution of the General Meeting of Shareholders based on the achievements of each director.

(v) The reasons for the appointment of directors are disclosed in the business report.

【Principle 5-1. Policy for Constructive Dialogue with Shareholders】

We hold a briefing on financial results twice a year in Kobe and Tokyo with the Corporate Planning Division of the General Planning Department as the IR department. We also hold briefings for individual investors in Osaka and Tokyo to proactively communicate with shareholders and others. In addition, we are striving to improve our website in order to enhance the understanding of our company among shareholders.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on WADAKOHSAN CORPORATION (8931) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url:www.bridge-salon.jp/