Bridge Report:(8931)WADAKOHSAN second quarter of Fiscal Year ending February 2022

Chairperson Norimasa Wada |

President Takero Takashima | WADAKOHSAN CORPORATION(8931) |

|

Company Information

Market | TSE, Second Section |

Industry | Real Estate |

Chairperson | Norimasa Wada |

President | Takero Takashima |

HQ Address | 4-2-13, Sakaemachidori, Chuo-ku, Kobe-shi, Hyogo |

Fiscal Year End | February |

Website |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥794 | 11,099,752 shares | ¥8,813 million | 5.2% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥38.00 | 4.8% | ¥135.14 | 5.9x | ¥2,280.99 | 0.3x |

*The share price is the closing price on October 28. The number of shares issued is the number of shares outstanding at the end of the most recent quarter, excluding treasury stock. ROE is taken from the previous quarter.

Non-Consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Feb. 2018 Act. | 35,149 | 3,304 | 2,424 | 1,589 | 158.23 | 30.00 |

Feb. 2019 Act. | 39,287 | 3,445 | 2,687 | 1,843 | 166.07 | 32.00 |

Feb. 2020 Act. | 40,093 | 3,290 | 2,442 | 1,781 | 160.49 | 35.00 |

Feb. 2021 Act. | 39,806 | 2,737 | 1,918 | 1,267 | 114.22 | 35.00 |

Feb. 2022 Est. | 40,000 | 2,900 | 2,200 | 1,500 | 135.14 | 38.00 |

*The forecasted values were provided by the company. Unit: Million yen, yen.

This Bridge Report presents WADAKOHSAN’s earnings results for the second quarter of Fiscal Year ending February 2022 and earnings forecasts.

Table of Contents

Key Points

1. Company Overview

2. Second quarter of fiscal Year ending February 2022 Earnings Results

3. Fiscal Year ending February 2022 Earnings Forecasts

4. Conclusions

<Reference:ESG activities >

<Reference:Regarding Corporate Governance>

Key Points

- In the first half of the fiscal year ending Feb. 2022, sales increased 9.6% year on year and operating income increased 18.9% year on year. The increase in the sale of investment apartments for sale and the highly profitable land sales were the main factors behind the strong performance. Furthermore, the mainstay condominium sales business saw a decline in revenues due to a decrease in the number of units delivered because of the uneven distribution of completed condominiums in the second half of the year, but the actual performance of the business, including the acquisition of sales contracts, was strong. In addition, rental revenues were not affected by the novel coronavirus, and occupancy rates and rent levels were stable, contributing to the increase in revenues. In terms of profit, ordinary income increased 35.5% year on year to 1,189 million yen, and net income increased 59.0% year on year to 821 million yen.

- Sales and operating income are expected to increase 0.5% and 5.9% year on year, respectively, in the fiscal year ending Feb. 2022. In the other real estate sales business, the selling of highly profitable land and the continuous favorable sales of investment apartments for sale are likely to make up for the decline in sales of condominiums. In terms of profits, the company plans to increase profit while taking into consideration the continuing upward trend in land prices and construction costs and the possibility of recording impairment losses, which was a factor in the decline in profits in the previous fiscal year. The company also intends to increase the annual dividend by 3 yen/share year on year to 38 yen/share (the expected payout rati 28.1%).

- Although the condominium market growth is drawing to an end, it seems that the business environment is generally favorable because the average price per unit in the Kinki region continues to rise, and the company has indicated that the purchasing land environment itself is not problematic. The company also mentioned at the briefing session that it plans to increase the pace of its business activities in the second half of the year in the area of detached housing unit sales, which have been struggling somewhat, and we will be watching its progress.

1. Company Overview

This time-honored real estate firm was founded in 1899. With its main bases among Kobe-shi, Akashi-shi and Hanshin area in Hyogo Prefecture, the company has developed its community based real estate business by selling lots for condominiums and detached houses, and dealing in real estate leases and effective land use. The company specializes in buying up sites and planning, and outsources design, architecture and sales to other firms. As for the sales of condominiums under the “WAKOHRE” brand name, although its focus is on medium scale condominiums with 30-50 units, in recent years, it is also working on the development of large-scale condominiums. The company is also expanding the business area to Hokusetsu area, Osaka-shi and Himeji-shi, which are adjacent to the above-mentioned business areas. The company is the first-place condominium supplier in Kobe-shi for 23 consecutive years, and is in the third place in the Kinki region (both in 2020). As of the end of August 2021, the cumulative supply results were 519 buildings with 19,811 residences (based on those which had started construction).

The company began a real estate leasing business in Kobe-shi in January 1899. It was incorporated as Wadakohsan Ltd. in December 1966, and reorganized into Wadakohsan Co., Ltd. in September 1979.

【Business philosophy - symbiosis (living together) your way of living contributes to others’ happiness-】

The corporate philosophy is “symbiosis,” where your way of living contributes to the happiness of others, values the connections between people and supports one another. Based on this idea, the company holds up “PREMIUM UNIQUE” as its product concept, and aims to create unique places to live in that fit each customer’s own way of life, while responding to the feelings of each person who resides there.

1-1. Business segments

The business segments are divided into (1) sales of condominiums developed for the “WAKOHRE” brand, (2) sales of detached houses developed for the “WAKOHRE-Noie” brand (the sales for both businesses are entrusted to external enterprises), (3) other real estate revenue from dealing in the sale and development of real estate for investment and residential land, property leasing revenue from the lease of condominiums (the brand name “WAKOHRE-Vita” and others), stores, parking lots etc., (4) real estate rental income and (5)“others,” including things like insurance agency fees, contract cancellation fees and brokerage fees, etc. not included in the report segment.

The sales composition for the term ended Feb. 2021 puts the condominium sales at 79.6% (FY2/20: 77.1%), sales of detached houses at 5.8% (FY2/20: 5.3%), other real estate sales revenue at 6.4% (FY2/20: 10.4%), real estate rental income at 7.9% (FY2/20: 7.1%), and others at 0.3% (FY2/20: 0.2%). The segment profit composition puts condominium sales at 60.1% (FY2/20: 58.7%), sales of detached houses at 0.5% (FY2/20: -0.2%), other real estate sales at 4.2% (FY2/20: 17.2%), real estate rental income at 32.4% (FY2/20: 22.8%), and others at 2.9% (FY2/20: 1.5%).

Condominium sales business

The main areas are the Kobe and Akashi areas (around Kobe-shi and Akashi-shi in Hyogo Prefecture), the Hanshin area (Ashiya-shi, Nishinomiya-shi, Amagasaki-shi, Itami-shi and Takarazuka-shi in Hyogo Prefecture), and the focus is on developing medium scale condominiums with 30-50 units whose market has low competition, under the “WAKOHRE” brand with leading condominium businesses.

In addition to a sales strategy that focuses on highly popular areas and supplies different types of condominiums in the same area, thereby realizing diversified needs of consumers and achieving high sales efficiency. Strengths include establishing an efficient business model with unique local community strategy, such as condominium gallery strategy that suppresses selling costs through the sales of multiple condominiums at the same time in one permanent condominium gallery. Also, in recent years, the company is pursuing new possibilities by carrying out large-scale projects over 100 units, responding to increasing construction cost and reflecting purchasing power, and expanding the business areas to the Hokusetsu area and Osaka city in Osaka Prefecture and Himeji-shi in Hyogo Prefecture, which are adjacent to Kobe-shi and the Hanshin area.

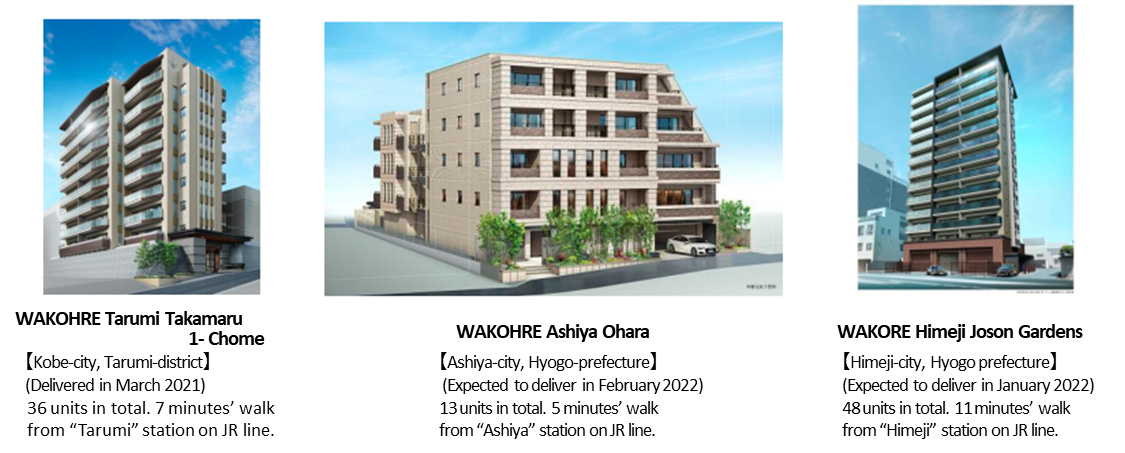

FY Feb. 22 Project Example

WAKOHRE Tarumi Takamaru 1-Chome was sold out in a short period of time due to its proximity to Tarumi Station, one of the most popular stations in the suburbs of Kobe City, as well as its excellent living environment. WAKOHRE Ashiya Ohara is one of the most expensive condominiums in the Hanshin area, with a price of about 5 million yen per tsubo and an average price of about 120 million yen per unit. "WAKOHRE Himeji Joson Gardens” was developed in Himeji City, Hyogo Prefecture, as part of the company's regional expansion strategy, and it can be said that regional expansion is now firmly established as part of the company's business expansion.

Detached house sales business

Since 2007, the company has been developing around 10 houses with the “WAKOHRE-Noie” brand, in Kobe-shi and the Hanshin area, including the Hokusetsu area in Osaka Prefecture.

From the large amount of various site information, the company is able to gather, there are many properties suitable for sale for detached house lots in terms of location, area, and site shape. In addition, where the business period for condominiums is just under two years, these projects can be as short as one year, meaning that with high capital turnover and they can be used to fill the gaps of the period completed the condominium construction.

Utilizing the development concept with a focus on landscaping and design and planning abilities cultivated by the work in condominiums, the company aims to differentiate itself from traditional “power builders.”

Other real estate sales business

The company conducts planning, development and sales of steel-framed apartments and other profitable properties (for sale as a single building) and sales of residential land. As well as shouldering the function of effective utilization of property information, revenue from selling off lease properties (inventory assets) that accompanies property handover is also included in this segment. In recent years, the company has enhanced the development of aforementioned smaller investment properties for sale (steel-framed/wooden-framed apartments).

Property leasing business

The company mainly manages residential properties, in addition, stores and offices, parking lots, self-storage and others. As a business that can maintain a stable cash flow, in an industry that tends to be strongly influenced by condominium market conditions, since its founding the company has continued to contribute to the stability of revenue. Its basic strategies are to assure stable revenue by improving the occupancy rate (the rate of tenants moving in), and to maintain and improve the quality of its portfolio through movement of property. With the residences, keeping in mind the movement of property after a fixed period of time has expired, the asset composition is focused on 200-300 million yen properties, with many hopeful buyers amongst high net worth individuals. The company maintains an occupancy rate of around 95%. In addition, by managing assets and liabilities appropriately, it also aims to reduce the risk of lengthening investment return periods, and the risks associated with assets becoming excessive. The yield of each person is high, at 9-10%, and it aims to cover the burden of indirect expenses with the stable revenue from the leasing operations.

1-2 Strengths of WADAKOHSAN

Japan’s foremost residential area as their region of business

They meet the high demand for housing by making Japan’s foremost residential area, area among Kobe, Akashi and Hanshin, their main area of business while establishing a comparative advantage with their information capabilities; they even have a reputation for building a community entrenched in the region.

Prevailing WAKOHRE brand in Kansai

Their WAKOHRE brand is prevailing in Kansai, and the power of the brand lets them hold their own against other major condominium developers. In the 23rd (2020) Condominium Brand Questionnaire Survey, conducted by the Osaka headquarters of Nihon Keizai Shimbun Inc., WAKOHRE was ranked in the 5th place in the Individuality brand section and 3rd in the Familiarity brand section.

Maintaining sound finances via thorough risk management

They are maintaining sound finances via thorough risk management, have well-balanced transactions with financial institutions and remain stable. As a result, in their corporate history spanning over 120 years in the real estate industry, where many companies have gone out of business, they have only reported a deficit during fiscal year ended Feb. 2010 after being affected by the global financial crisis. They continue to have stable dividends.

Successful in differentiating themselves from major firms, and having room for growth due to expand their business areas

Small and medium condominium businesses were eliminated due to the real-estate recession after the global financial crisis, and only major real estate companies and railway real estate companies survived. However, since these real estate companies specialize in large-scale properties and properties along the railroads, there are not many cases where they compete in site acquisitions with WADAKOHSAN, who develops medium-scale condominiums with around 30-50 units. Meanwhile, WADAKOHSAN has its sights on further expanding its operations, making efforts to develop large-scale properties in the existing business area and expanding into Himeji-shi in Hyogo Prefecture and Osaka Prefecture (Hokusetsu area), which are next to their existing business area.

Rankings for the number of condominium buildings supplied in the Kinki region

| 2016 | 2017 | 2018 | 2019 | 2020 | |||||

1st | Pressance | 37 | Pressance | 42 | Pressance | 53 | Pressance | 62 | Eslead | 25 |

2nd | WADAKOHSAN | 21 | Nihon Eslead | 22 | Nihon Eslead | 29 | Eslead | 24 | Pressance | 24 |

3rd | Nihon Eslead | 15 | WADAKOHSAN | 12 | WADAKOHSAN | 21 | WADAKOHSAN | 11 | WADAKOHSAN | 20 |

4th | Tokyu Land Corporation | 9 | Hankyu Realty | 11 | Hankyu Hanshin Properties | 12 | Nissho Estem | 8 | Hankyu Hanshin Properties | 12 |

5th | NTT Urban Development Corporation | 8 | Nissho Estem | 10 | Nissho Estem | 10 | Kintetsu Real Estate | 7 | Kanden Realty & Development | 11 |

Rankings for the number of condominium units supplied in the Kinki region

| 2016 | 2017 | 2018 | 2019 | 2020 | |||||

1st | Pressance | 2,435 | Pressance | 3,845 | Pressance | 4,133 | Pressance | 3,825 | Pressance | 2,766 |

2nd | Nihon Eslead | 1,476 | Nihon Eslead | 2,017 | Nihon Eslead | 2,401 | Eslead | 2,121 | Eslead | 1,861 |

3rd | WADAKOHSAN | 800 | Sumitomo Realty & Development | 968 | Nissho Estem | 1,053 | Sumitomo Realty & Development | 744 | ES-CON Japan | 670 |

4th | Kintetsu Real Estate | 730 | Nomura Real Estate Development | 769 | Hankyu Hanshin Properties | 966 | Kintetsu Real Estate | 704 | WADAKOHSAN | 654 |

5th | Tokyu Land Corporation | 713 | Nissho Estem | 759 | Kintetsu Real Estate | 734 | Nissho Estem | 646 | Kintetsu Real Estate | 535 |

6th | DAIWA HOUSE INDUSTRY | 658 | Hankyu Realty | 700 | Nomura Real Estate Development | 703 | Hankyu Hanshin Properties | 596 | Hankyu Hanshin Properties | 529 |

7th | Hankyu Realty | 620 | Kintetsu Real Esatate | 620 | WADAKOHSAN | 653 | Kanden Realty & Development | 524 | Nippon Steel Kowa Real Estate | 517 |

8th | Sumitomo Realty & Development | 570 | Tokyu Land Corporation | 520 | Sumitomo Realty & Development | 589 | WADAKOHSAN | 507 | Kanden Realty & Development | 515 |

9th | Nissho Estem | 565 | WADAKOHSAN | 464 | Tokyu Land Corporation | 575 | ES-CON Japan | 445 | Tokyu Land Corporation | 443 |

10th | RIVER | 555 | Sekisui House | 436 | ES-CON Japan | 522 | Tokyu Land Corporation | 435 | Sumitomo Realty & Development | 415 |

(Source: WADAKOHSAN)

2. Second quarter of Fiscal Year ending February 2022 Earnings Results

【The impact of the spread of the novel coronavirus on business was minor.】

Even during the pandemic, the impact on sales was generally minor, as various measures had already been taken company-wide since the previous fiscal year (e.g., continuing to operate condominium galleries by appointment to prevent the spread of the infection, providing adequate space for business negotiations, thorough ventilation and sterilization, etc.). According to a survey by a real estate research firm, the new supply of condominiums in the Kinki region in the first half of the year (January-June) increased 58.0% year on year to 8,373 units, and the contract rate was 73.0% (up 2.5 points from the same period last year), exceeding 70%, which indicates good performance. The number of newly supplied units in Kobe City increased 105.5% from the same period last year to 1,149, while the number in Hyogo Prefecture rose 145.2% from the same period last year to 1,187.

In terms of operations, the company promptly provided vaccinations to its employees, their families, and business partners. In addition, remote work and remote meetings were continued to combat infections, and remote support was also used for some delivery operations. As a result, neither the company nor its business partners experienced any stagnation in operations due to the outbreak of infections, and the impact of the novel coronavirus was kept to a minimum.

2-1 Non-consolidated results

| 1H of FY 2/21 | Ratio to sales | 1H of FY 2/22 | Ratio to sales | YoY | Initial Forecast | Compared to Forecast |

Sales | 15,965 | 100.0% | 17,494 | 100.0% | +9.6% | 16,800 | +4.1% |

Gross profit | 3,178 | 19.9% | 3,496 | 20.0% | +10.0% | - | - |

SG&A expenses | 1,905 | 11.9% | 1,984 | 11.3% | +4.1% | - | - |

Operating Income | 1,272 | 8.0% | 1,512 | 8.6% | +18.9% | 1,200 | +26.1% |

Ordinary Income | 877 | 5.5% | 1,189 | 6.8% | +35.5% | 850 | +39.9% |

Net Income | 516 | 3.2% | 821 | 4.7% | +59.0% | 600 | +36.9% |

*Unit: million yen

Sales increased 9.6% year on year and operating income rose 18.9% year on year.

Sales increased 9.6% year on year to 17,494 million yen. The increase in the sale of investment apartments for sale and the highly profitable land sales were the main factors behind the strong performance. Furthermore, in the mainstay condominium sales business, sales declined due to a decrease in the number of units delivered because of the uneven distribution of completed condominiums in the second half of the year, but the actual performance was strong. In addition, rental revenues were not affected by the novel coronavirus, and occupancy rates and rent levels were stable, contributing to the increase in revenues.

Despite some negative factors, operating income increased 18.9% year on year to 1,512 million yen, mainly due to the impact of increased profits from other real estate sales, and also due to increased rental income. Net income was also up 59.0% year on year to 821 million yen.

Factors behind differences from initial forecast

In terms of sales, the impact of the novel coronavirus was minor, and sales of investment apartments for sale were strong, exceeding the initial forecast. In terms of profit, operating income and ordinary income exceeded the previous year's levels due to the effect of increased revenue and improved profitability of condominiums for sale. Detached housing sales have been relatively weak compared to the forecast.

2-2 Trend of each business segment

| 1H of FY 2/21 | Ratio to sales | 1H of FY 2/22 | Ratio to sales | YoY |

Condominium sales | 13,358 | 83.7% | 11,490 | 65.7% | -14.0% |

Detached housing unit sales | 639 | 4.0% | 825 | 4.7% | +29.0% |

Other real estate sales | 354 | 2.2% | 3,539 | 20.2% | +897.2% |

Property leasing revenue | 1,550 | 9.7% | 1,613 | 9.2% | +4.1% |

Other | 62 | 0.4% | 26 | 0.2% | -57.6% |

Sales | 15,965 | 100.0% | 17,494 | 100.0% | +9.6% |

Condominium sales | 1,194 | 8.9% | 879 | 7.7% | -26.4% |

Detached housing unit sales | -31 | - | -31 | - | - |

Other real estate sales | -22 | - | 440 | 12.4% | - |

Property leasing revenue | 546 | 35.3% | 627 | 38.9% | +14.8% |

Other | 56 | 90.6% | 18 | 69.6% | -67.4% |

Adjustment sum | -470 | - | -420 | - | - |

Operating Income | 1,272 | 8.0% | 1,512 | 8.6% | +18.9% |

*Unit: million yen. The ratio to sales in operating income is the ratio of profit to net sales.

Condominium sales

Sales were 11,490 million yen (down 14.0% year on year), and profit was 879 million yen (down 26.4% year on year). The company delivered 274 units (three units below the initial plan), including WAKOHRE Tsukaguchi Ekimae First Emblem. The number of units delivered dropped from the same period of the previous year, but this should not be considered as a negative factor as the company plans to focus on the second half of the fiscal year. The average price per unit was 42 million yen, up about a million yen year on year. As for profit, gross profit margin was 18.0%, showing a slight improvement from the same period last year.

Other KPIs are as follows: the number of units sold was 343 (up 12.1% year on year), the number of contracted units was 393 (up 76.2% year on year), the number of undelivered contracted units was 841 (up 33.1% year on year). There was one unit in completion inventory at the end of the second quarter, but it was sold out in September. In the second half of the fiscal year, the company plans to complete the construction of 13 buildings with 438 units, of which 332 units finished contract as of the end of the second quarter (contract rate: 75.8%).

The number of units purchasing land decreased 30.4% from the previous fiscal year, but remained at a normal level of 325 units. The number of units procured peaked at 705 in the first half of the fiscal year ended Feb. 2020, which was particularly large, and has been on a downward trend to 467 units in the first half of the fiscal year ended Feb. 2021. As of the end of the second quarter, the number of unreleased procured projects was 25 with 1,171 units, which by area breaks down to 11 buildings (432 units) in Kobe City, 5 buildings (313 units) in the Hanshin area, 5 buildings (284 units) in Akashi City/Himeji City, and 4 buildings (142 units) in Osaka Prefecture.

KPI for Condominium Sales Business

| 1H of FY 2/21 | YoY | 1H of FY 2/22 | YoY |

No. of units delivered | 326 | -0.6% | 274 | -16.0% |

Average price per unit | 41 million yen | -18 million yen | 42 million yen | +1 million yen |

No. of units launched | 306 | +109.6% | 343 | +12.1% |

No. of units contracted | 223 | -23.6% | 393 | +76.2% |

No. of units contracted (undelivered) | 632 | -1.6% | 841 | +33.1% |

No. of units purchased | 467 | -33.8% | 325 | -30.4% |

Detached house sales

Sales were 825 million yen (up 29.0% year on year), and the company posted a loss of 31 million yen (a loss of 31 million yen in the same period of the previous year). The number of units delivered was 14, unchanged from the previous fiscal year. The number of contracted units was 13 (16 in the same period of the previous year), and the number of contracted units yet to be delivered was 6 (10 in the same period of the previous year).

Other real estate sales

Sales were 3,539 million yen (up 897.2% year on year), and profit was 440 million yen (a loss of 22 million yen in the same period last year). In addition to the steady sales of investment properties for sale, the sale of land worth over a billion yen to a school corporation in the first quarter contributed significantly to the strong performance. The breakdown of projects is as follows: 5 development-related projects, worth 552 million yen (1 development-related project, worth 225 million yen in the same period of the previous year), 12 investment properties for sale, worth 1,737 million yen (1 investment property for sale, worth 105 million yen in the same period of the previous year), and 1 other project, worth 1,250 million yen (1 project, worth 25 million yen in the same period of the previous year). As for investment properties for sale, the company sold 3 wooden buildings with 19 units and 9 steel-framed buildings with 113 units (1 steel-framed building with 9 units in the same period of the previous year).

The company also made steady progress with purchase, bringing the total number of properties under development at the end of the second quarter to 63 buildings and 972 units (88 buildings and 1,223 units in the same period previous year).

Breakdown of other real estate sales

| 1H of FY 2/21 | 1H of FY 2/22 | |||

| Project number | Sales | Project number | Sales | YoY |

Other real estate sales | 3 | 354 | 18 | 3,539 | +900.0% |

Development related | 1 | 225 | 5 | 552 | +145.3% |

Investment property | 1 | 105 | 12 | 1,737 | +1,548.3% |

Other(*) | 1 | 25 | 1 | 1,250 | +4,999.8% |

*Unit: million yen

Property leasing revenue

Real estate rental income was 1,613 million yen (up 4.1 % YoY) and segment profit was 627 million yen (up 14.8 % YoY). The company's mainstay residential properties maintained relatively stable leasing revenue. The mainstay residential properties' leasing revenue increased due to the company improving the occupancy rate and delinquency rate and acquiring new properties, promoting business operations to secure stable leasing revenue.

Breakdown of property leasing revenue

| Income | Composition ratio | YoY |

Residences | 1,187 | 73.6% | +5.9% |

Stores and offices | 347 | 21.5% | -0.1% |

Parking lots | 45 | 2.8% | -14.3% |

Self-storage and other | 33 | 2.1% | +17.4% |

Total | 1,613 | 100.0% | +4.1% |

*Unit: million yen

Change of occupancy rate

| End of 1H of 2/20 | End of 2/20 | End of 1H of 2/21 | End of 2/21 | End of 1H of 2/22 |

Residences | 93.7% | 96.5% | 95.8% | 97.1% | 96.4% |

Stores and offices | 93.4% | 95.9% | 94.1% | 97.2% | 96.3% |

Parking lots | 66.1% | 67.3% | 68.5% | 68.6% | 64.5% |

Gross profit of each business segment

| 1H of FY 2/21 | Gross profit rate | 1H of FY 2/22 | Gross profit rate | YoY |

Condominium sales | 2,314 | 17.3% | 2,065 | 18.0% | -10.8% |

Detached housing unit sales | 71 | 11.1% | 63 | 7.7% | -11.9% |

Other real estate sales | 58 | 16.4% | 601 | 17.0% | +926.2% |

Property leasing revenue | 675 | 43.5% | 748 | 46.4% | +10.7% |

Others | 60 | - | 19 | - | -68.3% |

Total | 3,178 | 19.9% | 3,496 | 20.0% | +10.0% |

*Unit: million yen

2-3 Balance Sheets And Cash Flow(CF)

Balance Sheets

| End of Feb.21 | End of Aug.21 |

| End of Feb.21 | End of Aug.21 |

Cash and deposits | 11,835 | 13,694 | Accounts payable-trade | 7,674 | 7,192 |

Real estate for sale | 11,145 | 9,890 | ST Interest-Bearing Debts | 19,533 | 27,039 |

Real estate for sale in process | 39,447 | 39,569 | Advances received | 4,028 | 4,484 |

Current Assets | 63,610 | 64,426 | LT Interest-Bearing Debts | 33,659 | 26,203 |

Property, plant and equipment | 26,297 | 26,300 | Liabilities | 67,453 | 67,817 |

Intangible Assets | 620 | 619 | Net Assets | 24,882 | 25,318 |

Investments and Other Assets | 1,807 | 1,789 | Total Liabilities and Net Assets | 92,335 | 93,135 |

Noncurrent Assets | 28,725 | 28,709 | Interest-bearing debts | 53,192 | 53,242 |

*Unit: million yen

Total assets at the end of the second quarter were 93,135 million yen, up 800 million yen from the end of the previous fiscal year, mainly due to an increase in cash and deposits. On the other hand, liabilities increased 364 million yen from the end of the previous fiscal year to 67,817 million yen due to an increase in advances received (deposits received in connection with sales contracts). The breakdown of interest-bearing debts is 41.1% for major banks (41.8% at the end of the previous fiscal year), 33.6% for regional banks (35.5% at the end of the previous fiscal year), and 25.2% for shinkin banks (22.7% at the end of the previous fiscal year). Capital-to-asset ratio was 27.2% (26.9% at the end of the previous fiscal year).

The 9,890 million yen in real estate for sale breaks down to 217 million yen for condominiums, 733 million yen for detached houses, and 8,940 million yen for other properties, mainly investment properties. This is due to the effect of returning properties for sale that had been transferred to inventories to fixed assets due to internal accounting rules. The 39,569 million yen for in-process real estate breaks down to 36,842 million yen for condominiums, 1,438 million yen for detached houses, and 1,290 million yen for other properties, mainly those for investment purposes.

Cash Flow (CF)

| 1H of FY 2/21 | 1H of FY 2/22 | YoY | |

Operating CF (A) | -3,075 | 2,551 | +5,626 | - |

Investing CF (B) | -437 | -96 | +341 | - |

Free CF (A+B) | -3,513 | 2,455 | +5,968 | - |

Financing CF | 3,676 | -338 | -4,014 | - |

Cash and Equivalents at the end of term | 6,424 | 11,507 | +5,083 | +79.1% |

*Unit: million yen

A pretax income of 1,205 million yen (815 million yen in the previous fiscal year), depreciation and amortization amounting to 367 million yen (355 million yen in the previous fiscal year), and a decrease in inventories of 1,132 million yen (an increase of 5,829 million yen in the previous fiscal year) resulted in an operating CF of 2,551 million yen, and as a result, the free CF status improved significantly. Financing CF was negative 338 million yen owing to the difference in net increase/decrease in short-term loans payable and dividend payments.

3. Fiscal Year ending February 2022 Earnings Forecasts

3-1 Full-year non-consolidated forecasts

| FY 2/21 Actual | Ratio to sales | FY 2/22 Forecast | Ratio to sales | YoY |

Sales | 39,806 | 100.0% | 40,000 | 100.0% | +0.5% |

Operating Income | 2,737 | 6.9% | 2,900 | 7.3% | +5.9% |

Ordinary Income | 1,918 | 4.8% | 2,200 | 5.5% | +14.7% |

Net Income | 1,267 | 3.2% | 1,500 | 3.8% | +18.3% |

*Unit: million yen

Sales and operating income are expected to increase 0.5% and 5.9% year on year, respectively

Sales are projected to increase 0.5% year on year to 40 billion yen. Considering that deliveries will be concentrated in the fourth quarter in the mainstay condominium sales business, and due to the company's conservative calculation, the number of units to be delivered is expected to decrease 8.5% year on year. In other real estate sales business, the selling of highly profitable land and the continuous favorable sales of investment properties for sale are likely to make up for the decline in sales of condominiums.

Profit is forecast to rise, despite the possibility of recording impairment losses, which was a factor in the decline in profits in the previous fiscal year and the continuing upward trend in land prices and construction costs. Moreover, SG&A expenses are expected to be flat, and loan fees will be eliminated. Thus, operating income is projected to rise 5.9% to 2.9 billion yen, and ordinary income is expected to augment 14.7% to 2.2 billion yen. Regarding net income, although the gain on sales of tangible fixed assets is conservatively estimated, it is expected to improve 18.3% year on year to 1.5 billion yen.

The company paid an interim dividend of 18 yen per share. As for the year, the company plans to increase the common dividend by 3 yen/share to 38 yen/share (estimated payout rati 28.1%).

3-2 Forecasts for each segment

| FY 2/21 Actual | Ratio to sales | FY 2/22 Forecast | Ratio to sales | YoY |

Condominium sales | 31,697 | 79.6% | 29,000 | 72.5% | -8.5% |

Detached housing unit sales | 2,303 | 5.8% | 2,800 | 7.0% | +21.6% |

Other real estate sales | 2,551 | 6.4% | 5,300 | 13.3% | +107.8% |

Property leasing revenue | 3,140 | 7.9% | 2,900 | 7.3% | -7.7% |

Other | 114 | 0.3% | - | - | - |

Total | 39,806 | 100.0% | 40,000 | 100.0% | +0.5% |

*Unit: million yen

Condominium sales

Sales are forecast to decline year on year to 29 billion yen. The number of units to be delivered is 630, down 6.9% from the previous term. The number of units to be delivered in the first half is estimated to be 277 (achieved 274 units) while the units to be delivered in the second half will be 353 (particularly 293 in the fourth quarter). Thus, the second half is expected to see better performance. The number of ordered units at the end of first half of fiscal year ending 2022 was 332.

The company plans to launch 670 units (down 25.4% YoY), and expects the number of units contracted to come to 650 (down 2.1% YoY).

The number of units purchased is estimated to be 600. Regarding the purchasing stance, the company has indicated that it will continue to make thorough purchasing with an emphasis on profitability, taking into consideration market conditions and other factors. In addition, it will continue to focus on area renovation (retail market redevelopment). For example, the “WAKOHRE City KOBE Minatogawa Koen” (Hyogo Ward, Kobe City; a total of 168 units, all units were sold out.) released in October 2020, is a large-scale renovation property and a competition project offered by the Kobe City Government (Minatogawa Market Redevelopment Project).

Furthermore, the company is also continuing with the development of condominiums in Osaka Prefecture and Himeji City in Hyogo Prefecture as part of efforts to expand its business area. Currently, the company is selling WAKORE Fukushima Noda The Residence (Fukushima-ku, Osaka City, 56 units in total), a condominium project in Osaka City, and in Himeji City, Hyogo Prefecture, WAKORE Himeji Joson Gardens (Himeji City, Hyogo Prefecture, 48 units in total), scheduled to be delivered in January 2022, as well as WAKORE Himeji Owner's Residence (Himeji City, Hyogo Prefecture, 92 units in total).

KPI for Condominium Sales Business

| FY 2/21 Actual | YoY | FY 2/22 Forecast | YoY |

No. of units delivered | 677 | +22.0% | 630 | -6.9% |

No. of units launched | 898 | +123.9% | 670 | -25.4% |

No. of units contracted | 664 | +8.5% | 650 | -2.1% |

No. of units purchased | 601 | -41.5% | 600 | -0.2% |

Detached house sales

The company projects sales to grow 21.6% YoY to 2.8 billion yen. It mainly supplies houses in the Hanshin area and the Hokusetsu area in Osaka Prefecture, including high-priced houses. It expects the number of delivered houses to exceed 44 units, which was achieved in the previous term.

Other real estate sales

Sales are projected to double year on year to 5.3 billion yen. Currently, the purchase, development, and sales of investment properties for sale are progressing steadily.

Projects under development and properties to be sold in this term

| Number of projects under development | Units | Properties scheduled to sell in the second half of the year | Units |

wood-framed buildings | 12 buildings | 139 | 3 buildings | 32 |

steel-framed buildings | 51 buildings | 833 | 5 buildings | 109 |

RC construction, S construction | 4 buildings | 156 | 1 building | 23 |

Total | 63 buildings | 972 | 8 buildings | 141 |

Property leasing revenue

While aiming to maintain a high occupancy rate, the company intends to aggressively sell old and unprofitable properties in order to build a high-quality portfolio. The company expects a decrease in sales of 7.7% from the previous fiscal year to 2.9 billion yen.

4. Conclusions

Although condominium sales appear to be struggling due to the double-digit decline in sales, the business is progressing well with the contracts for approximately 75% of the properties scheduled for completion in the second half of the fiscal year already signed. In addition, we positively recognize the company's efforts to further increase the added value of its projects by conducting various customer surveys and planning properties based on the results.

Although the condominium market growth is drawing to an end, it seems that the business environment is generally favorable because the average price per unit in the Kinki region continues to rise, and the company has indicated that the purchasing land environment itself is not problematic. The company also mentioned at the briefing session that it plans to increase the pace of its business activities in the second half of the year in the area of detached housing unit sales, which have been struggling somewhat, and we will be watching its progress.

<Reference: ESG activities >

As an ESG activities, WADAKOHSAN is working to create safe, secure, and healthy housing for residents and is also focusing on social contribution by providing housing compensation at the time of natural disasters and youth development support. Furthermore, in terms of governance, the company considers that the establishment of a sound, transparent, and efficient management system is its top priority and works on the development and enhancement of the governance system.

<Environment>

In addition to adopting the Kobe City’s environmental performance standard for condominiums, the company also applies the standards for Approved Low-carbon Housing to its detached houses. It is also taking measures against Sick-House Syndrome for all housing, and is working on the development of smart condominiums, including the adoption of services that use smartphones, at some of its condominiums.

Adoption of the City of Kobe’s environmental performance standard for condominiums. | In Kobe, when constructing a building of a certain scale, the operating company self-evaluates the environmental efforts such as consideration to global warming and safety and security of the residents, and notifies them to the city. The city announces the scoring results on the website, etc. The company publishes this result on the leaflets of condominiums and advertising materials such as websites to show the safety of the building. |

Achieving a highly insulated and airtight home | For WAKOHRE NOIE Kobe Kanokodai, the company uses a two-by-four construction method for all its residences, which offers greater airtightness than the conventional axial construction method. By using a double roof structure, floor insulation, and highly insulated equipment for the front door and bathroom, the houses have approximately 1.5 times the insulation performance of a Grade 4 house based on the Housing Quality Assurance Act. |

Measures against Sick-House Syndrome | For the floor and fittings of the company’s buildings, materials of F ☆☆☆☆ grade that emit very little formaldehyde are used. Also, non-formalin type is selected as the vinyl adhesive in consideration for Sick-House Syndrome, etc. |

Enhancing support functions via smartphone apps

| Some of the company’s condominiums adopt services that use smartphones. This enables users to confirm energy usage, operate Eco-Jozu (a water heater), gas equipment even when not at home, and bathroom monitor system to prevent death in the bathroom with a single smartphone. The company supports safe and secure living. |

<Social>

Joined the "Phoenix Mutual Aid," a housing reconstruction mutual aid system implemented by Hyogo Prefecture

Based on lessons learnt from the Great Hanshin-Awaji Earthquake, in September 2005 Hyogo Prefecture rolled out Phoenix Mutual Aid, a house reconstruction mutual aid system that gives aid for the reconstruction/repair of housing in the case of damage caused by a natural disaster, the first of its kind in Japan. The company participates in this mutual aid for all of its condominiums sold in Hyogo Prefecture, and can receive compensation by bearing the cost of mutual aid premiums until the end of the fiscal year the unit is delivered and one fiscal year after the delivered year.

Donation to the anti-coronavirus support fund through SDGs private placement bonds

On September 30, 2020, the company donated to the Hyogo Support Fund for Coping with the Novel Coronavirus through funding by the Tokushima Taisho Bank SDGs Private Placement Bond. The fund is being used to support medical personnel and secure medical supplies. For this donation, the company received a letter of appreciation from the Governor of Hyogo Prefecture.

Activities to support youth development

As an aging society with fewer children progresses, the company provides various support for children to have a healthy social life.

Organizer and Special Sponsor of the WAKOHRE Cup Chibirinpic Hyogo Prefecture Tournament Since 2018, the company has been the organizer and special co-sponsor of the tournament to provide opportunities for children to be in contact with soccer and to discover players who can compete on a national level. |

Vissel Kobe Soccer School Partner In order to support activities to promote soccer among young people, the company sponsors a “soccer school” run by Vissel Kobe. |

Childcare Support Project “Skip” by Kobe Shimbun Co., Ltd. The company cosponsors a parent-child participatory regional event “Skip Salon” hosted by Kobe Shimbun on the “Childcare Day,” which is on the 12th of each month. |

<Governance, etc.>

Transformation into a company with audit and supervisory committee

The company transformed into a company with audit and supervisory committee, at the general meeting of shareholders in May 2019, in order to tighten corporate governance and improve corporate value. Then, from May 2021, 13 directors were appointed, including 5 outside directors.

Compliance system

The company established various manuals including “Internal Reporting Regulations” and “Supplier Management Regulations” using the “Compliance Regulations” as a basic policy. In addition, the Internal Control Committee was established as the department in charge of compliance to appropriately verify the status of legal compliance and implement improvement measures. An internal audit office was also established directly under the Audit and Supervisory Committee to strengthen the check function. It also entered into advisory contracts with an external law firm and tax accountants to enhance the compliance system.

Launching condominiums that incorporate the ideas of female employees

As housing facilities that meet the needs of women are popular, the company formed a project team with six female employees so that they can create houses from a female perspective, and they have planned a condominium that reflects the voices of women. The company is making efforts to increase added value from various perspectives, by summarizing dissatisfaction and points for improvement in daily life and incorporating efficient equipment and ingenuity to make it easier for the whole family to use the house.

Creating a pleasant working environment

In order to create a working environment in which employees can work comfortably, the company is making efforts to improve various welfare programs, including paid vacation and hourly vacation. To improve the working environment for women, it also established the systems of maternity leave, childcare leave and short working hours. For maintaining the health of employees, a health committee meeting with an industrial physician is also held every month, and medical checkups and mental health checks are provided to keep track of their health.

Retention rate within 3 years from joining the company | 91.4% | Gender difference in average years of employment | 2.8 month |

Rate to take maternity and childcare leaves | 100.0% | Rate of female employees within 5 years of joining a company | 35.3% |

Rate to return to work from maternity and childcare leaves | 100.0% |

(As of the end of August. 2021)

<Reference:Regarding Corporate Governance>

◎ Organization type

Organization Structure | Company with audit and supervisory committee |

Directors | 13 directors of whom 5 are outside directors |

◎Corporate Governance Report

Last update date: October 20, 2021.

<Basic policy>

As our basic policy for corporate governance, we give top priority to the establishment of a sound, transparent, efficient managerial structure, and strive to improve it. Our company is small-sized, but we have established a simple, efficient organizational structure while considering mutual supervision and independence, and make efforts to develop a governance structure while putting importance in the following five items, to streamline the decision-making process and actualize highly transparent business administration.

Exertion of the overseeing function based on practical discussions at meetings of the board of directorsTimely, appropriate deliberation on important items for making managerial decisions by the board of managing directorsHighly effective audit by an audit committeeDevelopment of an internal control system by establishing an internal audit division, organizing an internal control committee, etc.Cooperation with external institutions, such as law offices, for actualizing a system for compliance

< Main principles of the Corporate Governance Code which the Company doesn’t Carry out and the Reasons>

【Principle 5-2. Establishing and Disclosing Business Strategies and Business Plans】

We use ROE as a management index with the goal of continuously improving shareholder value. In addition, we are aware of the numerical value of capital cost. However, we recognize that utilizing other numerical targets rather than formulating profit plans and business policies using these figures will enable us to operate more effectively on a practical level. Having said so, as it is more than ever required of us to improve shareholder value and accountability to investors, we will continue to manage our business by formulating investment plans using indicators such as capital costs and promoting efficient capital management and strive to improve management.

【Supplementary Principle 5-2①】

In formulating our management strategy, we comprehensively take into account the business characteristics, profitability, and financial impact of each segment, and strive to create an optimal business portfolio and review it as necessary in response to changes in the business environment. However, at this point, we have not yet announced our medium-term management plan, and we will consider how to respond to this situation in conjunction with our analysis of profitability relative to the cost of capital by segment.

< Main Principles of the Corporate Governance Code which the Company Disclosed>

【Supplementary Principle 2-4①】

From the perspective of ensuring diversity in human resources, we hire mid-career workers as appropriate and promote them to management positions. We are also striving to improve our maternity leave system so that women can work for many years, and our return rate after childbirth is 100%. Furthermore, we have established a new Human Resources Division to promote our human resources strategy.

【Principle 3-1. Enhancement of information disclosure】

In our securities report, we clearly state the basic philosophy regarding management, business development policy, etc., including our corporate philosophy of “symbiosis (living together).” The concept of corporate governance is also described in the securities report and “1. Basic policy” above.Regarding the determination of remuneration, the total amount is determined at the general meeting of shareholders, and the remuneration of each director is determined at the Board of Directors according to the duties and roles in charge.Regarding the appointment/dismissal of the senior management including directors, the Board of Directors determines the agenda item for the General Meeting of Shareholders, and they are determined by the resolution of the General Meeting of Shareholders based on the achievements of each director.The reasons for the appointment of directors are disclosed in the business report.

【Principle 5-1. Policy for Constructive Dialogue with Shareholders】

We hold a briefing on financial results twice a year in Kobe and Tokyo with the Corporate Planning Division of the General Planning Department as the IR department. We also hold briefings for individual investors in Osaka and Tokyo to proactively communicate with shareholders and others. In addition, we are striving to improve our website in order to enhance the understanding of our company among shareholders.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |