Bridge Report:(8945)Sunnexta Group the Fiscal Year ended June 2025

President Akira Takaki | Sunnexta Group Inc. (8945) |

|

Company Information

Market | TSE Standard |

Industry | Real estate |

Representative director, president, and executive officer | Akira Takaki |

HQ Address | TIME24 Building, 35 Tansu-cho, Shinjuku-ku, Tokyo |

Year-end | June |

Homepage |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE Act. | Trading Unit | |

¥1,036 | 10,813,200 shares | ¥11,202 million | 3.0% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥42.00 | 4.1% | ¥50.07 | 20.7 x | ¥827.59 | 1.3 x |

* The share price is the closing price on September 19. These figures were taken from the brief report on the financial results in the fiscal year ended June 2025.

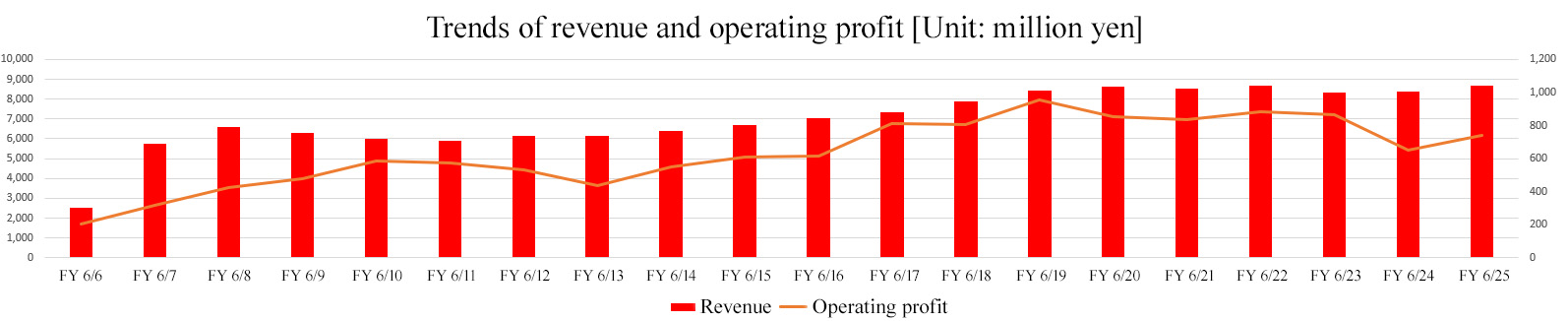

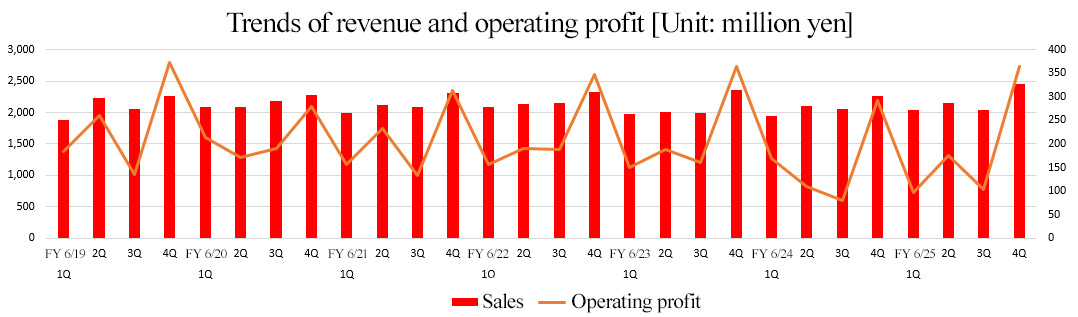

Earnings Trend

Fiscal Year | Revenue | Operating profit | Recurring profit | Net Income | EPS | DPS |

June 2022 Act. | 8,696 | 882 | 932 | 1,976 | 204.80 | 35.00 |

June 2023 Act. | 8,347 | 865 | 904 | 486 | 53.39 | 37.00 |

June 2024 Act. | 8,371 | 653 | 653 | 1,775 | 194.45 | 39.00 |

June 2025 Act. | 8,695 | 742 | 758 | 229 | 25.07 | 41.00 |

June 2026 Est. | 8,900 | 700 | 715 | 461 | 50.07 | 42.00 |

*Unit: million yen or yen. Estimates are those of the company. Net income means net income attributable to owners of the parent. Hereinafter the same shall apply.

This report includes the outline and business performance trend of Sunnexta Group Inc. and the interview with President Takaki.

Table of Contents

Key Points

1. Company Overview

2. Medium-Term Management Plan

3. Fiscal Year ended June 2025 Earnings Results

4. Fiscal Year ending June 2026 Earnings Forecasts

5. Interview with President Takaki

6. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The core businesses of Sunnexta Group are the management of corporate housing and the management of condominiums. Sunnexta Group is an independent enterprise that undertakes tasks to solve issues from “the viewpoint of each client” based on its unique business model, which does not rely on real estate brokerage fees, as they do not broker the trading of real estate or sell condominiums or the like. It is the only company that specializes in undertaking the management of corporate housing. One of its strengths is a stable revenue structure based on recurring revenues.

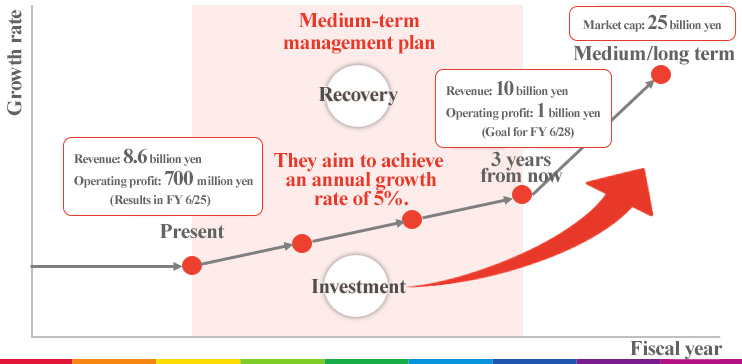

- They formulated and announced a three-year medium-term management plan for the period until the fiscal year ending June 2028. In the period of the previous medium-term management plan, any of their businesses cannot appropriately respond to the changes in social situations or the market environment, so they failed to achieve their management goals. Reflecting on that, they put importance on the two points: “the recovery toward the recurring revenue growth rate and operating profit margin before the COVID-19 pandemic” and “the redevelopment of the mission-critical system and the investment for creating new businesses, including M&A” in the new medium-term management plan, and aim to achieve “a revenue of 10 billion yen and an operating profit of 1 billion yen” in the fiscal year ending June 2028, three years from now. Their medium/long-term goal is to become a corporate group with a market capitalization of 25 billion yen.

- In the fiscal year ended June 2025, revenue grew 3.9% year on year to 8,695 million yen. Operating profit rose 13.6% year on year to 742 million yen, achieving a double-digit profit growth, as gross profit increased 2.9% while SG&A expenses dropped 2.3% due to the drop in taxes and public charges. Net profit dropped 87.1% year on year to 229 million yen. There was no longer gain on sale of investment securities, which was posted in the previous fiscal year, and they decided to suspend the current plan for developing an in-house mission-critical system for their corporate housing management services. Accordingly, a loss from removal of fixed assets, etc. were posted as extraordinary losses. They set the annual dividend amount at 41 yen/share, up 2 yen/share from the previous fiscal year, while comprehensively considering the business environment, their future business operation, etc. as well as their business performance.

- For the fiscal year ending June 2026, revenue is expected to grow 2.3% year on year to 8.9 billion yen. The Corporate Housing Management business and the Condominium Management business are projected to grow steadily. Operating profit is forecast to decrease 5.8% year on year to 700 million yen, as they will see the augmentation of costs for developing systems for business growth and maintaining and stabilizing the quality of operation. The dividend amount is expected to be 42.00 yen/share, up 1.00 yen/share from the previous fiscal year. The expected payout ratio is 83.9%.

- We interviewed President Akira Takaki about their missions, vision, business characteristics, competitive advantages, medium-term growth scenarios, and message toward shareholders and investors. He said, “Unfortunately, over the past five years, we have been unable to achieve sufficient growth in both sales and profits. However, upon analyzing various factors and confirming the current situation, we judge that the order receipt environment is showing signs of recovery and will be able to return to a steady growth trajectory going forward. Furthermore, while one factor behind the increase in cost of sales over the past few years has been upfront investment, we have also implemented measures to restore profitability. We believe that within three years, we will achieve sales growth and a recovery in profits. We understand that investors may be concerned, but we are determined to demonstrate our results through solid performance. We shall also focus on shareholder returns and management mindful of capital cost and share price, and we would greatly appreciate your continued support for our company from a medium- to long-term perspective.”

- The services of the Corporate Housing Management business vary significantly among enterprises. Sunnexta Group upholds the policy of “reproducing the in-house operation of each client” and customizes services according to the business operation method of each client, while the clients of competitors just follow the provided services in many cases. Sunnexta Group grasps the details of the current operation method of each client and reproduces it and does not receive real estate brokerage fees, so their expenses are larger than those of competitors, but most clients evaluate their value highly, so client retention rate is high. Estimated prices vary significantly among companies, but clients often choose the services of Sunnexta Group when they hope that “their commitment to corporate housing systems will be reproduced.” We would like to pay attention to their initiatives aimed at getting back on a growth track in the new medium-term management plan based on the founder’s strong aspiration to “carry out business oriented to client companies” and their progress.

1. Company Overview

The core businesses of Sunnexta Group are the management of corporate housing and the management of condominiums. Sunnexta Group is an independent enterprise that undertakes tasks to solve issues from “the viewpoint of each client” based on its business model as they do not broker the trading of real estate or sell condominiums or the like. It is the only company that specializes in undertaking the management of corporate housing. One of its strengths is a stable revenue structure based on recurring revenues. Their corporate group is composed of Sunnexta Group, Japan Corporate Housing Service Inc., which operates the Corporate Housing Management business, Classite Inc., which operates the Condominium Management business, Classite Real Estate Inc., and Three S Co., Ltd., which offers management support in the Incubation business.

[1-1 Corporate history]

In October 1998, seven people who had belonged to a real estate brokerage company affiliated with a renowned corporate group founded Japan Corporate Housing Service Inc. for the purpose of undertaking all tasks for managing corporate housing. In that real estate brokerage company, they mainly introduced real estate when client companies requested them to find rentable real estate for corporate housing, and brokered deals, but the procedures were cumbersome for client companies, so they started handling paperwork for rented housing, including the management of housing. However, that company was a real estate brokerage company, so they took a stance of conducting paperwork for brokering deals. When managing real estate, they served as an owner and lender. They had doubts about that situation, and strongly aspired to “conduct business oriented to client companies” when starting up their business.

In April 1999, they started undertaking corporate housing management services, which is the current core business. They started business operation as a one-of-a-kind enterprise that manages corporate housing without brokering the trading of real estate. Around that time, “outsourcing” was not well known, so they faced hardships in early days, but they steadily increased contracts with famous listed companies that hoped to support their activities. As such experiences fostered the reliability of their business and “business administration with minimum assets” became popular in the wake of adoption of asset-impairment accounting (from the financial results in FY 3/6), they steadily met the demand for management of rented corporate housing, expanding their business, and the company got listed on Mothers of Tokyo Stock Exchange (TSE) in September 2005, and then got listed on the first section of TSE in June 2019. In July 2020, they shifted to a holding company system and changed their corporate name to Sunnexta Group Inc. In October 2023, the company got listed on the Standard Market of TSE.

[1-2 Corporate philosophy]

They uphold the following founding principles, basic ethos/philosophy for existence, group management philosophies, and principle for networks.

Founding principles | To create a visionary company |

Basic ethos/philosophy for existence | To pursue love, sincerity, and harmony as the basic ethos, and aim to realize the summation of dreams by bringing the highest level of satisfaction to customers, creating and spreading happiness among people. |

Group management philosophies | 1. We aim to become a reliable corporate citizen through open, transparent corporate activities while complying with laws and regulations. 2. We will flexibly respond to the changes in the times and endeavor to conduct business administration with the passion, aspiration, and creativity for achieving innovation constantly. 3. In cooperation with business partners, we will create client-oriented services, pursue fair and impartial benefits, and contribute to comfortable, affluent living and economic and social advancement. |

Principle for networks | With the same ambition, we will pursue the network for creating value where it is possible to share “the pleasure of flourishing together.” |

[1-3 Business environment]

The business environment surrounding the core businesses: the Corporate Housing Management business and the Condominium Management business are as follows.

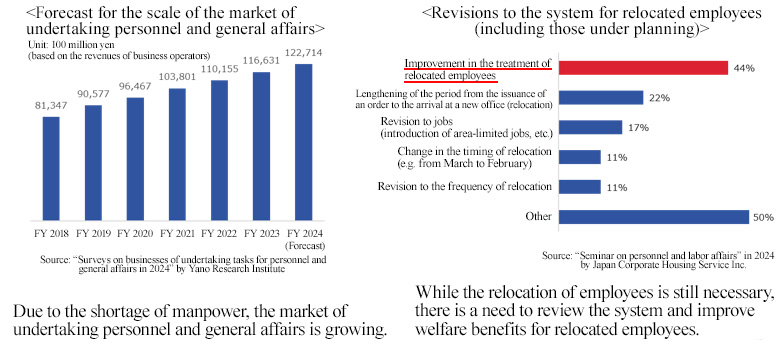

(1) The business environment surrounding the Corporate Housing Management business

While it is becoming more necessary for enterprises to concentrate human resources and time on their core businesses in order to enhance their competitiveness, the shortage of manpower is becoming serious and workstyles are being reformed, so the market of undertaking personnel and general affairs is growing. In the field of corporate housing, the relocation of employees is still necessary and some enterprises are enriching their housing systems and welfare for improving the satisfaction level of employees so as to recruit and retain personnel. There are no data on surveys on the number of corporate housing units in Japan, but Sunnexta Group estimates that companies that outsource the management of corporate housing account for around 40% of large companies and 10-20% of small and medium-sized enterprises, and infers that the demand for not only the entrusted management of corporate housing, but also the revision to housing systems, and the change in operation after the revision is strong, so they can receive a healthy number of orders, and growth potential is significant.

(Taken from the reference material of the company)

(2) Business environment surrounding condominium management

The external environment is becoming harsher year by year. The personnel expenses for superintendents, cleaning staff, and others are augmenting year by year, due to the rise in the minimum wage. In addition, construction costs have increased, so the expenditure of condominium associations is augmenting in an unstoppable manner. The aging of residents progressed, and an increasing number of condominium associations shift to self-management. According to a survey “Variation in the number of condominium units (as of the end of 2024)” conducted by the Ministry of Land, Infrastructure, Transport and Tourism, the total number of condominium units as of the end of 2024 was approx. 7,131,000, indicating that the latent market is significant. Under such environment, they aim to improve profitability rather than increasing the number of condominium units they manage, as described below.

[1-4 Business description]

The segments to be reported are “Corporate Housing Management business,” “Condominium Management business,” and “Incubation business.”

(1) Corporate Housing Management business

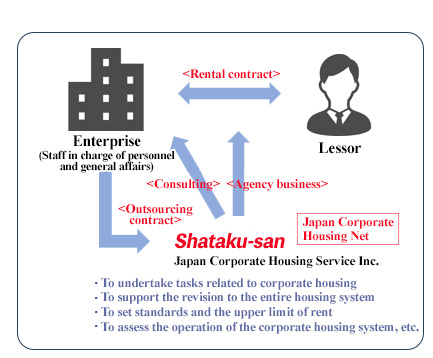

As a leading company in the field of undertaking the management of corporate housing, they operate business processes outsourcing (the business of undertaking clerical tasks) in personnel and general affairs of client companies, including corporate housing management services, which is the core business.

<Major services>

① Corporate Housing Management Service “Shataku-san”

* What is the corporate housing system?

Corporate housing means a welfare system in which enterprises rent out housing to employees at lower rents than the average rent in the neighborhood. Due to the adoption of asset impairment accounting, the necessity to improve asset management efficiency, the diversification of values and lifestyles of workers, etc., an increasing number of enterprises rent general apartments and rent out them to employees instead of owning their own housing to rent out to employees.

In the case of rented corporate housing, the staff of the renting company have to negotiate with the real estate firm and cope with diverse contract formats, which vary among real estate firms, and local commercial customs, including key money and security deposits, so their workload is enormous. In addition, they need to have a broad range of technical knowledge to check the details of each contract, deal with trouble during occupation, check the expenses for moving out, and so on.

*Outline of “Shataku-san”

Enterprises need to concentrate on their human resources and time on their core businesses, in order to enhance their competitiveness and improve efficiency. Under these circumstances, the corporate housing management service “Shataku-san” is to undertake all kinds of tasks for managing corporate housing, which are cumbersome and require technical knowledge as mentioned above, from the standpoint of each client company. Sunnexta Group concludes an outsourcing contract with each client company, and serves an agent for signing a rental contract between each client company and each lessor.

(Taken from the reference material of the company)

Concrete tasks include the introduction of rentable real estate for corporate housing to client companies, the completion of procedures for signing contracts and moving in, the payment of rents, the arrangements for relocation, the response to trouble during occupation, and the check of expenses for restoration to the original state after moving out.

Corporate housing systems vary among enterprises, and they develop and offer customized services according to the characteristics and requests of client companies.

(Taken from the reference material of the company)

*Business model

Major clients are large companies and small and medium-sized enterprises that have a corporate housing system.

The number of transactions in which they undertook tasks related to corporate housing (the sum of the number of orders for corporate housing management and the number of business processes outsourced to them in FY 6/25) amounted to around 310,000, and the number of client companies (mainly large companies) that have signed a contract for outsourcing to them exceeded 300 in FY 6/25. In order to introduce real estate to client companies, they have developed a nationwide network of rental real estate firms exclusively for attending to corporations, which is called Japan Corporate Housing Net. The number of franchised or authorized agencies was over 300 as of the end of June 2025. In order to offer high-quality services, they have concluded a franchising contract with partner enterprises that were rigorously selected in accordance with their unique screening criteria.

Their revenue is composed of compensation for their services offered to client enterprises, rather than real estate brokerage fees arising out of the introduction of real estate. Based on the business model that does not broker the trading of real estate or sell condominiums, they give top priority to solving problems from “the viewpoint of clients.” This makes a big difference from competitors.

The section “1. Company Overview, 1-5 Characteristics, strengths, and competitive advantages” describes the characteristics, strengths, and competitive advantages of the company in detail.

*Other services

<Shataku-san Lite>

This is a cloud-based corporate housing system designed under the concept: “It can be used intuitively by beginners without worry” for enterprises faced with some issues such as “the method for managing corporate housing information varies among staff in charge and office, so management is cumbersome” and “they want to reduce workloads while reducing costs.” They are promoting this system, targeting small and medium-sized enterprises.

(Main features)

・Unified management of corporate housing data, including contract documents, real estate information, written requests, and rent remittance data, based on a cloud system

・It is possible to choose and use only necessary services when necessary during a busy season or the like for each process.

・It can streamline business operations and reduce costs with two plans: “Basic (system usage charge: 12,000 yen/year; installation cost: 50,000 yen),” which enables the streamlining of business operations while curbing prices, and “Standard (system usage charge: 24,000 yen; installation cost: 100,000 yen),” which is targeted at enterprises that want to reduce workloads by outsourcing some tasks.

・They not only explain how to use the system, but also give advice when trouble occurs during occupation, and offer consultation services regarding the revision to systems, to comprehensively support the adoption and operation of a corporate housing system.

|

|

(Taken from the reference material of the company)

<Consulting service for housing systems>

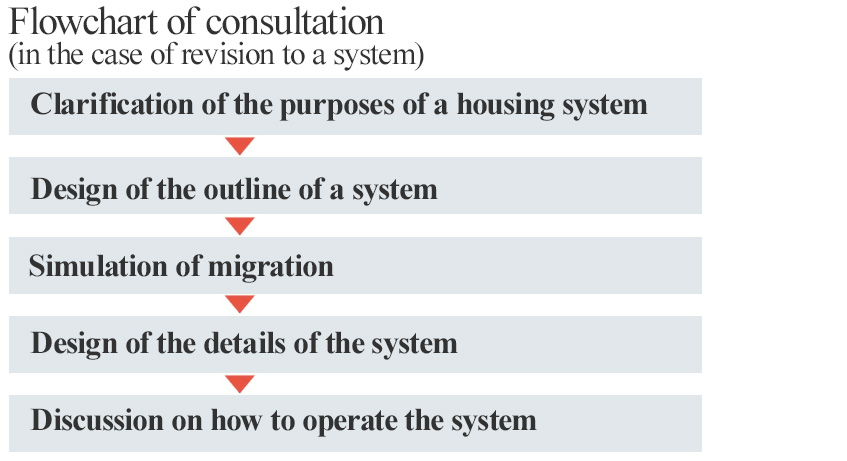

Enterprises need to design housing systems according to the changes in the times and the environment. With the aim of streamlining business operations and enriching welfare in client companies, they not only undertake paperwork for corporate housing management, but also support the optimization of corporate housing systems, including the assessment of the current housing systems and their operation and the design of new systems and operation methods.

(Taken from the reference material of the company)

<Service of operating company-owned facilities>

Some enterprises that own corporate housing or dormitories for the purpose of improving their competitiveness in recruitment and the satisfaction level of employees face difficulty in appropriately managing facilities in the aspects of costs, streamlining of operations, compliance with laws and regulations, etc. as the business environment has changed. Sunnexta Group supports the operation of systems for company-owned housing and dormitories by utilizing the experience and know-how of supporting the corporate housing management for many clients, the nationwide network of real estate firms, their group companies’ know-how for facility management, etc.

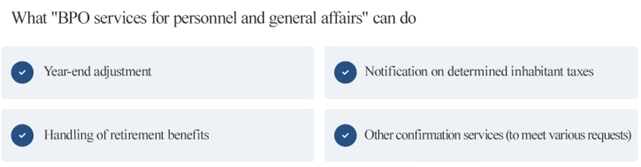

②Business processes outsourcing (BPO) services (services of undertaking business processes) for personnel and general affairs

To solve corporate issues, such as “We hope to concentrate on our core business, but there are a lot of routine tasks, which are cumbersome,” “We have installed a system, but there are many inquiries from employees, so our workload has not decreased,” and “The standardization of business processes is insufficient, so it is difficult to separate tasks that can be outsourced,” they provide BPO services with a high client satisfaction level according to client companies by utilizing the experiences and know-how accumulated through paperwork for corporate housing management since the start of business as a company specializing in undertaking tasks. They propose new operation methods according to requests and situations, and support clients in reducing their workload to “nearly zero.”

(Taken from the reference material of the company)

They also offer “BPO services for commuting expenses,” in which they approve commuting routes and fares in accordance with corporate rules and manage the data on commuting allowances, and “BPO services for co-creation with local communities,” in which they develop a comfortable office environment for local workers and enable flexible workstyles with freely set working hours in cooperation with municipalities and local supporting organizations.

(2) Condominium Management business

Mainly for condominiums, they support the management of facilities and the operation of condominium associations.

Major clients include condominium associations, individual/corporate owners, and enterprises that own corporate housing.

Their business scale ranks 45th in the condominium management field and 12th among independent enterprises*. As an independent management company that has no stakes in condominium sellers, they always put importance on the provision of services from the standpoint of occupants and condominium associations.

*Independent enterprises: Enterprises whose corporate groups do not supply condominiums. They can offer services from a neutral standpoint of owners and residents. The source of the ranking is “Ranking in the number of condominium units entrusted in 2025” (Mansion Kanri Shimbun).

<Major services>

① Condominium management services

As an independent management company, they support condominium associations in operation, accounting, maintenance, repair, management of various facilities, and comprehensive management.

Main services | Outline |

Condominium association supporting service | They support the smooth operation of condominium associations while giving top priority to the benefits of occupants and associations. Concrete tasks include the assistance in operation of a condo association (management of meetings of the board and general meetings of the association, and consultancy for operating the association), the support in holding meetings of the board and general meetings of the association, the production of minutes, the handling of contracts for the condo association, and the management of the list of condo association members. They also assess the situation of condominium management and the operation of condo associations, and give proposals for improvement. |

Supporting the accounting of condo associations | Specialized staff who possess a broad range of know-how conduct accurate, swift accounting and swiftly respond to amendments to laws or the like by utilizing their IT system. So that condo associations’ assets remain healthy, they assess their accounting and give proposals for improvement if there is any problem. |

Maintenance and repair of condominiums | From the viewpoint of managing condominiums together with occupants for a long period of time, they support optimal engineering work while looking ahead to the future. Regarding planned repair, they can undertake the production of financial and master plans, the introduction of cooperative firms, tasks of the condo association, including the management of bidding, and construction and engineering work. They also propose an upgrade that can be achieved efficiently if conducted in parallel with repair work and “a plan for improving functionality” for further enriching the living environment. |

② Real estate services

They support the rental management and moving-in/out processes, and broker the trading of condominiums, detached houses, and land by utilizing the know-how unique to management companies versed in management rules, condominium rules, and customs.

③ Remodeling and renovation services

They conduct simplified assessment of equipment in exclusively-owned areas, renovate real estate, and restore rental properties and corporate housing to the original state.

(3) Incubation business

They offer management support by providing a platform of services targeted at business operators who manage housing.

In order to further grow their corporate group, they are proceeding with the creation of a new core business through M&A, R&D of new services, etc.

<Major services>

① Watch-over security service

They provide a home security system for single-person households. “Type-S NEO,” a home security terminal developed by the company, sends an email to a registered email address in case of emergency, such as the intrusion by a suspicious individual and the rapid worsening of health conditions, based on the telecommunication function of human presence. They can also notify users regularly and check the safety of users. Wiring is not required, and operation is easy.

② Insurance agent service

As an agency for multiple life and non-life insurance companies, they offer insurance for housing, non-life insurance, life insurance, etc.

③ “osumait,” a service of supporting the digital transformation (DX) of condominium management

In the field of condominium management, there are a lot of problems, including the augmentation of workloads of employees due to the shortage of manpower, the inefficiency of paper-based data management, and the difficulty of using systems.

“osumait,” a service of supporting the DX of condominium management, is a cloud service with an app for construction management, which connects construction firms and management companies, and a communication app, which connects occupants and management companies, in addition to systems for accounting, real estate information, and sales management exclusively for condo management. It can automate and simplify the production of documents, which consumes time, and daily tasks, such as data inputting, and enable paperless operation and DX, because it is based on cloud computing. It can be adopted while combining necessary functions freely, so it is possible to unify and streamline business operations flexibly.

[1-5 Characteristics, strengths, and competitive advantages]

(1) Enterprise specializing in undertaking clerical tasks for managing corporate housing

Sunnexta Group is the only independent task-undertaking enterprise that solves problems from “the viewpoint of clients” based on a business model without functions, such as real estate brokerage and sale of condominiums.

Their business model is to deal with all kinds of clerical tasks related to corporate housing, including the conclusion, renewal, and cancellation of contracts, the payment of rents, and troubleshooting during occupation, from a neutral standpoint without brokering the trading of real estate. Their revenue source is the compensation for services, instead of real estate brokerage fees.

Typical competitors in the same industry with the keyword “corporate housing management” in the stock market operate the business model of “sublease” (renting real estate from owners and subleasing them to client enterprises), and earn revenues from all of the enterprises renting real estate, real estate firms and brokers that rent out real estate, and employees who occupy real estate.

Sunnexta Group puts importance on “solving problems from the viewpoint of clients.” This is based on their strong philosophy that “we should launch business oriented to client companies rather than the owners or lessors of housing,” which was announced at the time of establishment in 1988, as mentioned in Section “1. Company Overview, 1-2 Corporate History.” Such philosophy and policy of Sunnexta Group, which is a leading company in the field of undertaking clerical tasks for corporate housing management services, reflect the decisive differences from competitors’ business model.

Their achievements, experiences, and know-how accumulated as an enterprise specializing in undertaking clerical tasks for corporate housing management are outstanding, bringing significant competitive advantages to the company. They offer fully customized services according to the needs, systems, and climates for corporate housing, which vary among client companies. The client satisfaction level is very high compared with that of competitors, which offer unified packaged services. Their revenue does not come from real estate brokerage charges, so the fees of their services are higher than those of competitors, but client companies highly evaluate the quality of their services while understanding their business systems well, and sign contracts.

By utilizing the experiences and know-how nurtured through the paperwork for corporate housing management, they can offer “consultation for housing systems,” to optimize corporate housing systems, including the assessment of corporate housing systems and their operation and the design of new systems and operation methods, and “BPO services for personnel and general affairs” beyond the scope of corporate housing. This characterizes and differentiates the company from competitors.

Being independent is a strength also in the Condominium Management business. Condominium management companies affiliated with real estate developers manage condominiums based on the specs exclusively for the condominiums of their own corporate group.

As an independent enterprise, Sunnexta Group undertakes management as client companies switch from competitors’ services in most cases. Accordingly, they have managed the condominiums of various developers for many years, accumulating an enormous amount of know-how, so when they are entrusted with new properties, they can design management methods suited for them flexibly and smoothly. Such flexibility, too, is highly evaluated.

(2) Stable revenue structure based on recurring revenues

Recurring revenues account for about 80% of the sales of the “Corporate Housing Management business” and the “Condominium Management business.” Like this, their business model is based on recurring revenues, so they have achieved a stable track record and growth. They posted a loss for only 4 years since the establishment of the company, and posted a profit even at the time of the bankruptcy of Lehman Brothers in 2008, in which corporate earnings declined significantly as a whole, and during the COVID-19 pandemic from 2020 to 2022.

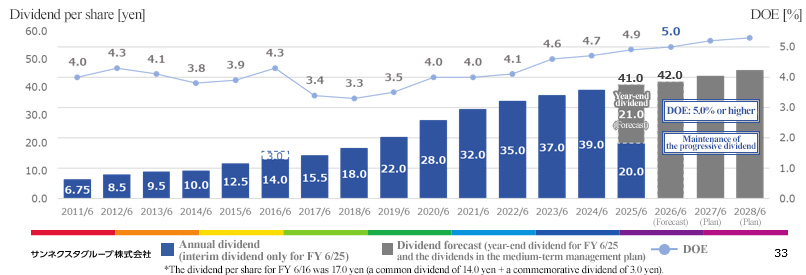

[1-6 Return to shareholders]

They aim to pay dividends stably and continuously by conducting shareholder return conscious of capital efficiency and continuing shareholder return based on progressive dividends while considering the balance between financial safety and require investment. The dividend amount, excluding commemorative dividends, is expected to rise for 15 consecutive fiscal years until FY 6/26.

They will determine the annual dividends for the period of the medium-term management plan (FY 6/26 to FY 6/28), while comprehensively taking into account the earnings forecast, the business environment, future business operation, financial soundness, etc. They aim to keep raising the dividend amount, while pursuing the maintenance of the progressive dividend with a DOE of 5.0%. Between Dec. 2024 and Jun. 2025, they acquired treasury shares at approx. 100 million yen, but they plan to purchase treasury shares when necessary while considering their capital policy, etc.

(Taken from the reference material of the company)

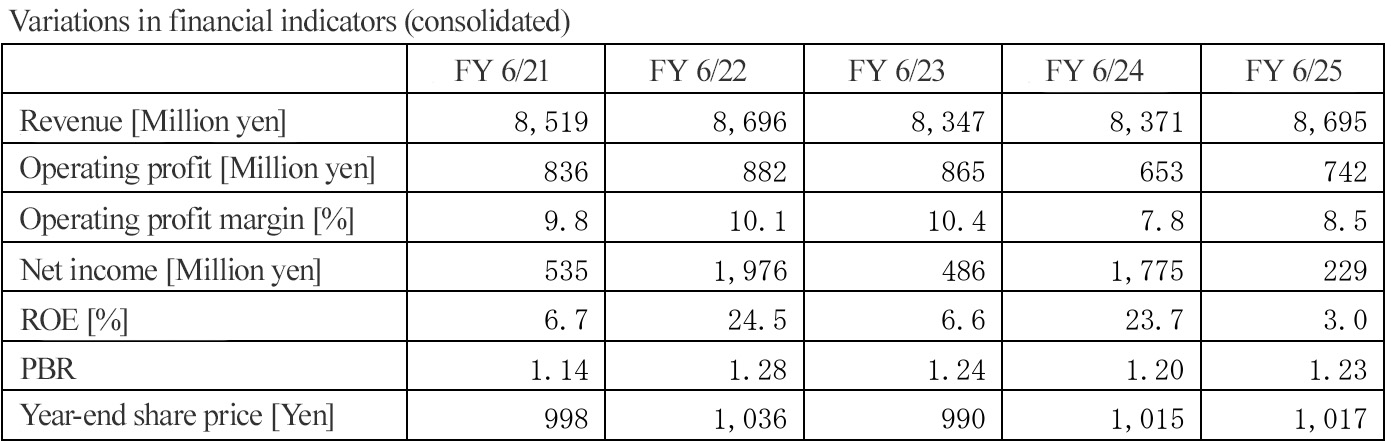

[1-7 ROE analysis]

| FY 6/16 | FY 6/17 | FY 6/18 | FY 6/19 | FY 6/20 | FY 6/21 | FY 6/22 | FY 6/23 | FY 6/24 | FY 6/25 |

ROE [%] | 12.7 | 13.1 | 11.5 | 11.5 | 8.3 | 6.7 | 24.5 | 6.6 | 23.7 | 3.0 |

Net income margin [%] | 6.04 | 7.08 | 7.23 | 8.18 | 6.51 | 6.28 | 22.72 | 5.82 | 21.21 | 2.64 |

Total asset turnover [times] | 1.21 | 1.14 | 1.02 | 0.93 | 0.87 | 0.73 | 0.74 | 0.81 | 0.80 | 0.81 |

Leverage [times] | 1.75 | 1.64 | 1.56 | 1.51 | 1.46 | 1.47 | 1.46 | 1.41 | 1.40 | 1.40 |

The ROE in FY 6/25 stood at 3.0%. In the past 4 fiscal years, ROE was significantly affected by net income margin, and the improvement in profitability was most required for achieving “an ROE of 10% or higher” set in their medium-term management plan. On the other hand, over the past 10 years, total asset turnover has dropped by approx. 30% from 1.21 to 0.81 and leverage (the reciprocal of equity ratio) has declined by 20%. In order to improve ROE, it is necessary to raise asset efficiency while conducting cash allocation based on the balance between appropriate investment for growth and shareholder return.

[1-8 Realization of business administration conscious of capital cost and share price]

On August 12, 2025, they announced “Measures for realizing business administration conscious of capital cost and share price.”

(1) Analysis of the current situation

In accordance with the 5-year medium-term management plan, whose final fiscal year is FY 6/25, they aimed to become a corporate group with a market cap of 25 billion yen, and made efforts to expand the task-undertaking domain and improve operations, but they failed to appropriately respond to various changes in the business environment in their entire business, leading to delays in some initiatives, so they were not able to achieve management goals.

(Analysis and recognition of ROE and PBR)

*ROE

As an extraordinary profit was posted, ROE exceeded 20% in FY 6/22 and FY 6/24, but it dropped to 3.0% in FY 6/25, in which an extraordinary loss was posted. In the past 5 years, excluding special factors, ROE has been declining, as profit margin dropped due to the stagnation of business performance and cash & deposits remained large, so it is considered to be around the cost of shareholders’ equity assumed by the company (around 6%). Accordingly, it is considered important to improve return on capital (ROC) through the recovery of business performance and the investment for growth.

*PBR

PBR has been over 1, partially because share price has been stable while their business performance has fluctuated. It is considered that investors consider the company as a low-risk investee because their business is based on recurring revenues and/or that the dividend amount is expected to grow. It is considered important that investors appropriately evaluate their profitability and growth potential and the company returns profits to shareholders proactively.

(Taken from the reference material of the company)

(2) Policy for improvement

Considering the results of evaluation of the current situation, they formulated a new three-year medium-term management plan (FY 6/26 to FY 6/28), and aim to keep PBR over 1 and achieve an ROE of 10% or higher, exceeding the assumed cost of shareholder’s equity (around 6%) in FY 6/28, based on the appropriate evaluation of shareholders and investors, by steadily implementing business strategies, etc.

(3) Concrete measures

Their concrete measures are “the enhancement of business growth and earning capacity,” “the strengthening of financial and capital strategies,” and “the promotion of active IR activities.”

① Enhancement of business growth and earning capacity

By executing management strategies based on the basic policy set in the medium-term management plan, they aim to grow their business and improve profitability.

In detail, they will reform the sales composition and increase sales and profit margin by expanding non-labor-intensive business models, such as cloud-based services while enriching the existing recurring-revenue domain (expanding its scale and profitability) and expanding the range of targets (including small and medium-sized enterprises and individual industries for undertaking tasks). In addition, they aim to improve labor productivity and reduce the ratio of cost by reforming the cost structure by decreasing the ratio of personnel expenses through digitalization. Furthermore, they will actively conduct investment for the future and establish a foundation for realizing a medium/long-term growth scenario. They aim to achieve an ROE of 10% or higher in FY 6/28, the final fiscal year of the plan.

② Strengthening of financial and capital strategies

By actively investing in businesses, including M&A, and strategically returning profit to shareholders, they aim to enhance business growth and return on capital. In order to realize business administration conscious of capital cost, they aim to improve the capability of generating cash through profit growth, and by appropriately allocating generated cash to the investment for growth and the return to shareholders, they aim to keep improving their balance sheet. While considering shareholder return as an important management policy, they will return profit to shareholders stably and continuously for a long period of time, and in FY 6/26, they will change the standard DOE from 4.0% to 5.0%, and continue efforts to raise the dividend amount while maintaining the progressive dividend. They acquire treasury shares swiftly when necessary while comprehensively considering share price and their financial standing.

③ Promotion of active IR activities

In order to promote the dialogues with shareholders and investors, they will keep holding sessions for briefing financial results for institutional investors while enriching them and increase dialogue opportunities through individual meetings so that they will appropriately evaluate their business models, the progress of plans, and growth strategies to be implemented. They will make efforts to enrich financial and non-financial information in their corporate website, etc. so that shareholders and investors will deepen their understanding of the company.

2. Medium-Term Management Plan

They formulated and announced a medium-term management plan for 3 years from FY 6/26 to FY 6/28.

[2-1 Review of the previous medium-term management plan]

In the previous medium-term management plan, which ended in FY 6/25, they aimed to achieve a market cap of 25 billion yen in the medium/long term, and strove to expand their business domain to increase the degree of their contribution as an enterprise that “enriching people's lives through outsourcing.” At the same time, they pursued a goal of achieving “a revenue of 10 billion yen and an operating profit of 1 billion yen (revised goal announced in Aug. 2023)” in order to further improve the value of their services, while swiftly responding to the diversification of workstyles, the decline in the labor population, etc.

However, the entire business of the company was not able to appropriately deal with the changes in the social situation and the market environment, so their various measures were delayed, and they failed to achieve their management goals.

In particular, the impact of the delay in system development was so significant that the development of new services and the digitalization for improving productivity were delayed.

Between FY 6/20 before the period of the previous medium-term management plan and FY 6/25, revenue remained flat due to the prolonged market stagnation due to the COVID-19 pandemic and the exclusion of the consolidated subsidiary Zennichi Sokanri Co., Ltd. from the scope of consolidation, and profit declined due to the investment in digitalization and the augmentation of personnel expenses caused by the shortage of manpower.

Under these circumstances, they consider that the top priority in the new medium-term management plan is to get back on a growth track for both revenue and profit by completing important measures in the previous plan.

[2-2 Outline of the new medium-term management plan]

(1) Positioning

They uphold the medium/long-term vision:

NEXT STANDARD -Enriching people's lives through outsourcing

-Enriching people's lives through outsourcing

They aim to keep growing by actively investing in business and reforming their revenue structure and evolve as an enterprise that undertakes tasks by winning the trust of stakeholders by improving profit return and governance.

Under this vision, the new medium-term management plan is focused on the following tw

・To “recover” the growth rate of recurring revenue and operating profit margin to the pre-pandemic levels

・To reestablish a mission-critical system and “invest” in the creation of new businesses, including M&A

Considering the new medium-term management plan as a step for medium/long-term growth, they set a goal of achieving “a revenue of 10 billion yen and an operating profit of 1 billion yen” in FY 6/28, three years from now, and aim to become a corporate group with a market cap of 25 billion yen in the medium/long term spanning around 10 years.

(Taken from the reference material of the company)

(2) Gist

① Basic policy

The corporate group has a mission of “creating new value and contributing to society through initiatives for evolving to satisfy the standards in society.”

Accordingly, they formulated the following medium/long-term management policies.

* | To expand the business scale, train personnel who support it, and develop next-generation human resources in order to improve corporate value |

* | To respond to the accelerating changes in the business environment and reform the revenue structure of the entire corporate group from a long-term perspective |

② Management strategies

Under the basic policy, they uphold the management strategies: (1) Growth of the core business: maintenance and expansion of recurring-revenue business, (2) Reform of the revenue structure: further evolution and advance as an enterprise that undertakes tasks, and (3) Investment for the future: establishment of a foundation for actualizing a medium/long-term growth scenario.

◎ Growth of the core business: maintenance and expansion of recurring-revenue business

During the 6-year period from 2014 to 2020, in which the COVID-19 pandemic started affecting business on a full-scale basis, revenue grew 35% with an annual growth rate of approx. 5%. The company has grown through the steady accumulation of recurring revenues, but during the period of the previous medium-term management plan, the growth was sluggish, as recurring revenue declined temporarily in a year.

In the coming three years, they will strive to recover the growth rate of recurring revenue to 5% per year, which is the pre-pandemic rate, by maintaining and expanding the recurring-revenue business in the two core business segments: the Corporate Housing Management business and the Condominium Management business.

Corporate needs for task-undertaking services have been expanding due to the shortage of manpower, but the shortage of workers also affects the service provision system of the company, so they aim to realize steady growth while establishing a system for meeting the needs of clients appropriately.

(Taken from the reference material of the company)

◎ Reform of the revenue structure: further evolution and advance as an enterprise that undertakes tasks

Over the past five years, profit margin has declined, due to the skyrocketing of personnel expenses, etc. amid the weak growth. The Corporate Housing Management business and the Condominium Management business are both labor-intensive, so the rise in personnel expenses produces a significant impact on their business administration. Therefore, they consider that it is necessary to reform the revenue structure.

To do so, they aim to “acquire a new revenue source” and “reform the cost structure of the existing businesses” in the two core businesses.

By changing their revenue composition and cost composition stepwise, they will establish a system for continuously generating profit.

*Change in the sales composition: “expansion of the task-undertaking domain”

By expanding the non-labor-intensive business model, including cloud-based BPO services, they will “change their revenue composition” and strive to increase revenue and profit margin.

*Change in the cost structure: “reform of operations”

As personnel expenses will augment inevitably, they aim to improve labor productivity and reduce the ratio of cost of sales by “changing the cost structure” through the gradual decrease of the ratio of personnel expenses based on digitalization.

In the Corporate Housing Management business, they will concentrate on securing and training personnel and continuing system development. In the Condominium Management business, they will revise the specs for business operations and promote the adoption of an app for condominium management.

|

|

(Taken from the reference material of the company)

◎ Investment

In the period of the medium-term management plan, they will establish a foundation for realizing a medium/long-term growth scenario by “investing” in “systems for facilitating digitalization,” “human resources for securing and training personnel,” and “businesses for researching and developing new businesses.” They aim to achieve sustainable growth and improve medium/long-term corporate value by growing through the above-mentioned investment and returning sufficient profits to stakeholders.

[2-3 Business strategy in each segment]

(1) Corporate Housing Management business

① Priority theme

・To achieve stable growth by receiving more orders for the Corporate Housing Management Service “Shataku-san” from leading companies

As mentioned in Section “1. Company Overview, 1-3 Business Environment,” they are expected to receive a healthy number of orders for corporate housing management.

So that they can meet the strong needs for task-undertaking services without fail, they will strengthen their marketing system continuously with the aim of achieving stable growth by receiving more orders for “Shataku-san” and recovering the annual growth rate of recurring revenue to the pre-pandemic level (5%). In parallel, they will concentrate on recruitment and training and the improvement in employees’ engagement through the raise in remuneration, to establish a robust operation system amid the shortage of manpower.

・Sales promotion of BPO services for personnel and general affairs and “Shataku-san Lite,” a cloud-based corporate housing system service for small and medium-sized enterprises

In order to improve profit margin, they will concentrate on the enrichment and promotion of accompanying services, such as BPO services for personnel and general affairs and “Shataku-san Lite.”

・Improvement in the cost structure of “Shataku-san,” the Corporate Housing Management Service for leading companies

They will improve the cost structure of “Shataku-san” through system development, personnel training, etc.

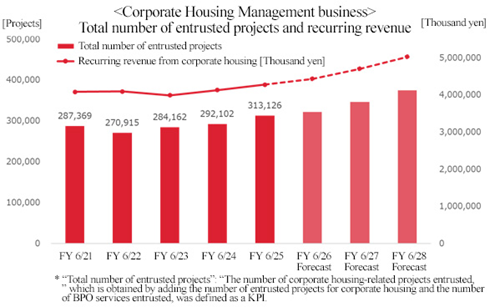

② Maintenance and expansion of recurring revenue

As the number of projects entrusted will increase under a favorable business environment, the recurring revenue from corporate housing management is projected to increase.

(Taken from the reference material of the company)

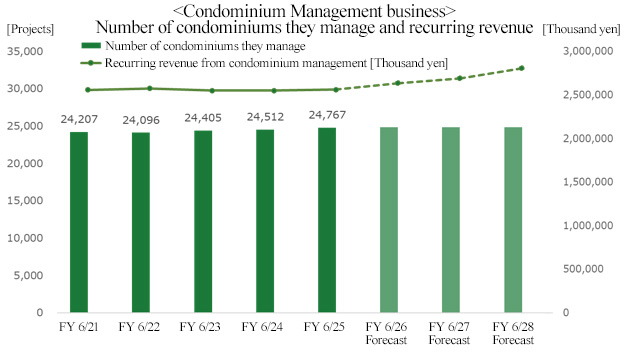

(2) Condominium Management business

① Priority themes

・To maintain or expand the recurring revenue from condominium management

They give top priority to the improvement in earning ratio through the increase of fees for undertaking tasks, the optimization of specs for operations according to the budget of each client, etc. It can be assumed that some clients will face difficulty in continuing outsourcing, so they will prioritize measures focused on profitability without expecting the increase in the number of condominium units entrusted in the coming 3 years.

・To expand their in-store share with remodeling and other real estate services

They will strive to expand their share and profit by meeting the demand for repair of deteriorated properties, services for exclusively-owned areas, other real estate-related services, etc.

・To streamline business operations through digitalization

They will use a newly developed app for condominium management for all clients, to handle documents of all affiliated companies in a paperless manner and streamline business operations, with the aim of improving profit margin.

② Growth of recurring revenue and the improvement in revenue

They have continued activities for receiving orders while considering profitability rather than the increase in the number of condominium units they manage. In the coming three years, they will put more energy into the improvement in revenue, and it is forecast that some contracts will be cancelled, so the number of condominium units is not expected to increase. Although the number of condominium units they manage won’t increase, they will increase recurring revenue by raising the fees for condo management, etc.

(Taken from the reference material of the company)

(3) Incubation business

<Priority themes>

They will keep developing services form management firms and strive to create new businesses.

・Promotion of the watch-over security service and the insurance agent service

Regarding the “management support business,” which is a service of supporting management firms, they will promote the business with the existing watch-over security service and the insurance agent service.

・Expansion of “osumait,” a service for supporting the digital transformation (DX) of condominium management

They will offer “osumait,” a system for condominium management they have developed and digitally transformed, to other companies, securing a new revenue source. Three condominium management companies have already adopted the system, and they will make efforts to expand it further.

・Development of new businesses

They will create new core businesses and develop and grow businesses to add high value to the existing businesses.

[2-4 Sustainable corporate value improvement]

① Promotion of sustainability-oriented business administration

The key concepts are “the health and flourishing of workers” and “the development of a safe, worry-free, comfortable living environment.”

Under the corporate philosophy and the basic sustainability policy, they will fulfill economic roles through business activities, environmental and social roles, and develop, operate, and strengthen a governance structure for fulfilling these roles, and improve corporate value in a sustainable manner and realize a sustainable society in cooperation with various stakeholders, including clients, business partners, local communities, and employees.

They disclose information in accordance with the recommendations of TCFD, and concentrate on BPO services for co-creation with local communities as part of BPO services for personnel and general affairs. In order to solve the shortage of workers, they continue surveys and tentative operation for realizing “BPO services with diverse workers.” As part of this activity, they entrust workers who cannot receive opportunities to work around Japan with the operation of BPO services.

Since the conclusion of a cooperative agreement with Itoigawa City, Niigata Prefecture in March 2023, they have continued activities, and signed a new cooperative agreement with Tateshina Town, Nagano Prefecture in May 2025. In addition, their activities were joined by Val Laboratory Corporation, which developed “Ekispert,” a service of retrieving a route released in Japan for the first time, for expanding the service. Their “BPO services for co-creation with local communities” is scheduled to be offered for “the service of registering initial data on commuting expenses,” which has been developed by the business partner Val Laboratory Corporation. Through these activities, they hope to contribute to the job creation in each region and the settlement of the shortage of manpower in enterprises.

② Governance

Also, in the period of the medium-term management plan, they will separate group business administration and supervision/execution based on the holding company structure, and aim to tighten corporate governance based on the board of directors putting importance on the overseeing function as a company that has an audit and supervisory committee.

③ For realizing business administration conscious of capital cost and share price

They aim to achieve sustainable growth and improve medium/long-term corporate value, by realizing business administration conscious of capital cost and share price. In the medium-term management plan, they set a goal for achieving an ROE that exceeds capital cost, and in order to attain the goal, they will pursue the priority themes based on the basic policy, grow their business and improve profitability. They aim to boost capital efficiency by enhancing their financial strategy and increase share price by promoting IR activities actively.

*For details, see “1. Company Overview, 1-8 Realization of business administration conscious of capital cost and share price.”

④ Financial strategy

They will strive to brush up their capability of generating cash based on business activities and strategically allocate the generated cash while maintaining the stable financial base, with the aims of growing profit through active investment for growth and improving capital profitability through enhanced shareholder return.

In accordance with the medium-term management plan, they will develop new businesses while considering M&A and enhance investment for growth, and conduct investment for fortifying their business base by promoting DX and training personnel, with the aim of achieving sustainable growth.

⑤ HR strategy and personnel development policy

The priority theme regarding human resources in the medium-term management plan is “to make the jobs of employees more worthwhile.” They will improve their capability of responding to diversifying values and the rapidly changing business environment, and create a working environment where employees can work without worry, with the aim of becoming a corporate group in which employees can work vigorously while feeling that their jobs are worthwhile.

[2-5 Target management indicators]

We aim to achieve “a revenue of 10 billion yen or over and an operating profit of 1 billion yen or over” in the fiscal year ending June 2028.

| FY 6/25 | FY 6/28 | CAGR |

Revenue | 8,695 million yen | 10 billion yen or over | + 4.8% or higher |

Operating profit | 742 million yen | 1 billion yen or over | + 10.5% or higher |

Operating profit margin | 8.5% | 10.0% or higher | - |

ROE | 3.0% | 10.0% or higher | - |

DOE | 4.9% | 5.0% or higher | - |

*CAGR was estimated by Investment Bridge with reference to the reference material of Sunnexta Group.

3. Fiscal Year ended June 2025 Earnings Results

[3-1 Outline of consolidated performance]

| FY 6/24 | Ratio to revenue | FY 6/25 | Ratio to revenue | YoY | Compared to the initial forecast | Compared to the revised forecast |

Revenue | 8,371 | 100.0% | 8,695 | 100.0% | +3.9% | -0.0% | -0.0% |

Gross profit | 1,989 | 23.8% | 2,048 | 23.6% | +2.9% | - | - |

SG&A expenses | 1,336 | 16.0% | 1,305 | 15.0% | -2.3% | - | - |

Operating Profit | 653 | 7.8% | 742 | 8.5% | +13.6% | +23.8% | +6.1% |

Recurring profit | 653 | 7.8% | 758 | 8.7% | +16.1% | +26.5% | +8.4% |

Net Income | 1,775 | 21.2% | 229 | 2.6% | -87.1% | -41.2% | 14.7% |

*Unit: million yen. “Difference from the revised forecast” means the difference from the revised forecast announced in June 2025.

Revenue and profit grew, while profit exceeded the forecast.

Revenue rose 3.9% year on year to 8,695 million yen. The Corporate Housing Management business and the Condominium Management business saw the growth of sales.

Operating profit increased 13.6% year on year to 742 million yen. Gross profit grew 2.9% year on year and SG&A expenses decreased 2.3% year on year due to the decline in taxes and other public charges, resulting in a double-digit profit growth.

Net income dropped 87.1% year on year to 229 million yen. A gain on sale of investment securities amounting to 2,213 million yen was posted in FY 6/24, but not in FY 6/25, and they reviewed the policy for developing a mission-critical system for the Corporate Housing Management Service, while considering the recent advancement of IT technologies, and decided to stop the current development plan and choose a more effective development method. As a result, they posted 377 million yen as a loss on retirement of software in progress related to system development in the section of extraordinary loss.

Revenue was almost in line with the forecast, but operating profit and recurring profit exceeded the revised forecast.

Considering their business performance, business environment, future business operation, etc. comprehensively, they decided to pay 41 yen/share per year, up 2 yen/share from the previous fiscal year.

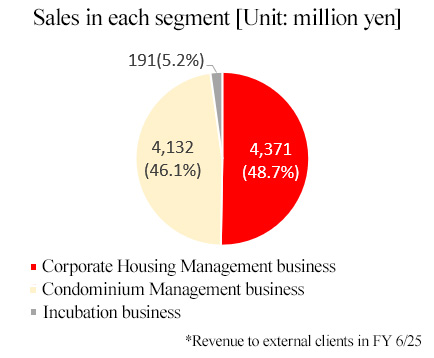

[3-2 Trend in each segment]

| FY 6/24 | Composition ratio | FY 6/25 | Composition ratio | YoY |

Revenue |

|

|

|

|

|

Corporate Housing Management business | 4,279 | 51.1% | 4,371 | 50.3% | +2.1% |

Condominium Management business | 3,808 | 45.5% | 4,132 | 47.5% | +8.5% |

Incubation business | 283 | 3.4% | 191 | 2.2% | -32.3% |

Total revenue | 8,371 | 100.0% | 8,695 | 100.0% | +3.9% |

Segment profit | FY 6/24 | Profit margin | FY 6/25 | Profit margin | YoY |

Corporate Housing Management business | 1,200 | 28.0% | 1,183 | 27.1% | -1.4% |

Condominium Management business | 249 | 6.5% | 350 | 8.5% | +40.9% |

Incubation business | -5 | - | -21 | - | - |

Adjustment | -790 | - | -770 | - | - |

Total segment profit | 653 | 7.8% | 742 | 8.5% | +13.6% |

*Unit: million yen. “Revenue” means the revenue to external clients.

(1) Corporate Housing Management business

Revenue grew 2.1% year on year, but profit declined 1.4% year on year.

As enterprises revised their housing systems and operation methods and strongly wanted to outsource some tasks, they received many inquiries about consultation for revising systems mainly from leading enterprises, and they received a healthy number of new orders from leading enterprises. The spot revenue from the support for adoption of the invoice system, which arose in FY 6/24, declined, but the revenue from outsourced tasks and recurring revenue from cost reduction services, etc. were healthy. Profit decreased, due to the decline in spot revenue and the augmentation of personnel expenses caused by the increase in man-hours and the strengthening of systems for stabilizing services.

(2) Condominium Management business

Revenue grew 8.5% year on year, and profit increased 40.9% year on year.

The number of condominium units they manage increased, as they kept receiving a healthy number of inquiries about undertaking the management of new condominiums. They increase the spot revenues from the remodeling of exclusively owned areas, the planned repair entrusted by the primary contractor, the sale of real estate for sale, etc. Profit grew thanks to the sales growth, despite the augmentation of expenses for personnel, including superintendents.

(3) Incubation business

Revenue dropped 32.2% year on year, and a loss of 21 million yen was posted (a loss of 5 million yen was posted in FY 6/24).

They concentrate on the development of the management support business for providing a service platform targeted at business operators that manage housing, and in the call center service for which a major client cancelled the contract in FY 6/24, They worked on the redevelopment of a growth scenario without an in-house call center, so transactions decreased.

[3-3 Financial condition and cash flows]

◎ Main Balance Sheet

| End of June 2024 | End of June 2025 | Increase/ decrease |

| End of June 2024 | End of June 2025 | Increase/ decrease |

Current assets | 9,730 | 9,494 | -236 | Current liabilities | 2,793 | 2,246 | -547 |

Cash and deposits | 7,340 | 6,970 | -370 | Short-term dept | - | 104 | +104 |

Accounts receivable | 353 | 358 | +5 | Operating deposits | 901 | 909 | +8 |

Operating advances | 1,322 | 1,420 | +97 | Fixed liabilities | 192 | 484 | +291 |

Fixed assets | 1,163 | 964 | -198 | Long-term dept | - | 261 | +261 |

Tangible fixed assets | 257 | 235 | -22 | Total liabilities | 2,985 | 2,730 | -255 |

Intangible fixed assets | 587 | 225 | -362 | Net assets | 7,908 | 7,729 | -178 |

Investments and other assets | 318 | 503 | +185 | Retained earnings | 7,167 | 7,022 | -144 |

Total assets | 10,894 | 10,459 | -434 | Total liabilities and net assets | 10,894 | 10,459 | -434 |

*Unit: million yen

Total assets decreased 400 million yen from the end of the previous fiscal year, due to the decreases in cash and deposits, and software in progress caused by the suspension of development of in-company mission-critical systems, etc.

Total liabilities declined 200 million yen from the end of the previous fiscal year, due to the decrease in accrued income taxes.

Net assets decreased 100 million yen from the end of the previous fiscal year due to the decline in retained earnings, the increase of treasury shares, etc.

Equity ratio rose 1.4 points from the end of the previous fiscal year to 72.3%.

◎ Cash flows

| FY 6/24 | FY 6/25 | Increase/decrease |

Operating CF | 957 | -68 | -1,025 |

Investing CF | 1,969 | -2,256 | -4,225 |

Free CF | 2,926 | -2,324 | -5,251 |

Financing CF | -348 | -45 | +302 |

Cash and Equivalents | 7,316 | 4,946 | -2,370 |

*Unit: million yen

Operating CF and free CF turned negative, due to the decline in net income before taxes and other adjustments, the augmentation of expenses for time deposits, etc.

The cash position degraded.

4. Fiscal Year ending June 2026 Earnings Forecasts

[4-1 Earnings forecast]

| FY 6/25 | Ratio to revenue | FY 6/26 (Forecast) | Ratio to revenue | YoY |

Revenue | 8,695 | 100.0% | 8,900 | 100.0% | +2.3% |

Operating profit | 742 | 8.5% | 700 | 7.9% | -5.8% |

Recurring profit | 758 | 8.7% | 715 | 8.0% | -5.8% |

Net Income | 229 | 2.6% | 461 | 5.2% | +100.9% |

*Unit: million yen. The forecast was made by the company.

Revenue is expected to grow, but profit is projected to decline.

Revenue is forecast to rise 2.3% year on year to 8.9 billion yen. The steady growth of the Corporate Housing Management business and the Condominium Management business is expected. Meanwhile, the initial inventory of real estate for sales is less than before. They will concentrate on procurement this fiscal year, but it is projected that transactions will decrease due to the insufficiency of inventory, so revenue growth is forecast to be slight.

Operating profit is projected to decrease 5.8% year on year to 700 million yen, because they will increase costs for developing systems for business growth and maintaining and stabilizing the quality of operations.

They plan to pay a dividend of 42.00 yen/share, up 1.00 yen/share year on year. The expected payout ratio is 83.9%.

5. Interview with President Takaki

We interviewed President Akira Takaki about the company's mission and vision, the distinctive features and competitive advantages of its business, its medium-term growth scenario, the challenges to achieving growth, and his message to shareholders and investors.

President Takaki was born in August 1973. After gaining experience in sales at a house builder as an employee fresh out of college, he joined Sunnexta Group in January 2001, three years after its establishment. Having gained extensive experience and a proven track record in customer-facing roles such as sales, outsourcing, and housing system consulting, and having also gained broad experience in human resources and management, he was appointed as the third-generation President and Representative Director in September 2019.

Q: In recent years, the social meaning of existence of enterprises has come under spotlight. Could you tell us about your company's mission and vision? Furthermore, how do you ensure these principles are diffused in your workforce?

Our founding principle is “To create a visionary company.” Our fundamental spirit and principle of existence is: “With the fundamental spirit of love, sincerity and harmony, we shall continuously strive to create and expand the highest satisfaction for our customers and the happiness of all who gather, thereby realising the summation of dreams.”

When faced with uncertainty, when a choice has to be made, or when a decision has to be taken, the guiding principle for judgement ultimately comes down to this philosophy.

At the beginning of the year and the start of each fiscal period, as well as at regular meetings and the biannual general staff meetings, we repeatedly emphasize the importance of our guiding principles.

Therefore, these values are recognized and shared not only by the management team, but also by managers, leaders and employees.

Q: What do you consider to be your own mission as the President of the current Sunnexta Group, and what responsibilities do you bear toward stakeholders?

I believe that our foremost responsibility is to pass the torch to the next generation of leaders in the best possible condition.

In addition to developing the next generation of leaders, we are committed to addressing current challenges head-on and establishing an environment where future leaders can manage operations more smoothly. To this end, we continuously implement our development programs.

Q: Next, please describe your company's strengths and distinctive features—particularly those unique to your company—and the competitive advantage that enables you to survive the harsh competition.

While numerous players operate in the company housing management services, our company stands as the sole independent enterprise and a BPO operator.

The group companies of real estate developers undertake tasks to expand their property businesses, and other companies that focus on rental management and brokerage services as their core revenue streams also undertake tasks to expand their operations. However, our company is the only independent entity conducting business solely through the provision of task-undertaking services. The scope of our services, the depth of our services, and our pricing also differ significantly from other companies. Customers who place great importance on the management of company housing systems choose our company, whereas conversely, companies prioritising low cost above all else and willing to compromise to a certain extent on scheme management do not select us. In that respect, differentiation and segregation are already established.

The details of “company housing management services” vary significantly among providers. Some competitors operate with the policy: “We communicate with real estate companies, not with employees.” For example, in cases where high restoration costs arise due to issues with how an employee used the premises upon leaving, if managed internally, the company would naturally communicate with that employee to discuss how the costs should be borne. However, some competitors in the same industry do not undertake such time and effort-consuming tasks.

In our case, our policy is to “reproduce internal company operations.” Some companies stipulate that employees may only be reminded twice, while others stipulate that notice must be given in writing. The methods also vary, including telephone, email, or personal mobile phones, in addition to written documents. Such conditions and circumstances vary from company to company, but our policy is to accurately recognize the particular points each company values and to provide these as part of our service, thereby effectively fulfilling the role of the company's representative. Of course, we will always make proposals to further improve the operation of the system. However, our core value lies in meticulously understanding a company's current operational methods and then reproducing them in an optimal way. As the cost varies depending on the scope and depth of this work, it often ends up being considerably higher than that of other companies. Nevertheless, our clients recognize and appreciate this value highly.

Q: I guess it's not easy to build such services for each company. How are you dealing with that?

The process of transferring operations is complex and time-consuming. We conduct meticulous interviews lasting several hours to understand the company's housing scheme management policies and operational practices, while also incorporating other specific requirements through ongoing communication to establish an operational method.

In the case of housing scheme consulting, we engage from an even earlier stage in the process. This involves joining the company's institutional reform team to support the development of the scheme, followed by its actual implementation. Therefore, the lead time is considerably long.

However, having handled over 400 companies to date, we have developed a certain degree of patterns. These have been accumulated as our company's unique know-how, distinct from other companies, and represent a significant point of differentiation.

Q: When companies consider adopting a company housing agency service, it is natural that many would obtain multiple quotes. What is the situation like in such cases?

While estimated prices of competitors are significantly different from ours, we believe many client companies choose us when considering adoption from the perspective of wanting a service provider to embody their specific requirements for their company housing scheme.

Conversely, for companies where general-purpose operations are deemed sufficient, or those prioritizing price, we consider them to be “customers for whom our services are less suitable.”

Companies that have chosen our services consistently evaluate them as not being expensive when viewed from a long-term and holistic perspective, resulting in an annual contract renewal rate exceeding 95%.

Q: Next, I would like to ask about the new medium-term management plan and medium-term growth scenario. Regarding the previous medium-term management plan, the business as a whole was unable to respond appropriately to changes in social conditions and the market environment, resulting in delays in various initiatives and ultimately failing to achieve the management targets. Could you comment on the factors behind this?

First, in terms of external factors, we were significantly impacted by the COVID-19 pandemic. Our company housing management service requires a process whereby the company recognizes the need for reform, coordinates with internal stakeholders to determine a method for that reform, the responsible personnel submit an internal proposal for approval, and the supervisor also understands this. In some companies, careful consultation may take place between management and labor. Therefore, it is not uncommon to take approximately two to three years or even longer. Amid the uncertainty brought by the COVID-19 pandemic, most companies had completely halted consideration of such reform. The momentum had waned, but as the COVID-19 pandemic subsided, discussions resumed, and as a result, the number of orders is showing signs of recovery. Corporate demand for outsourcing is expected to grow steadily, and amid labor shortages, an increasing number of companies are considering enhancing their company housing schemes as a benefit to boost their competitiveness in recruitment.

Internal factors included the withdrawal of Zennisso Management Co., Ltd., a consolidated subsidiary (March 2022), coupled with delays in system development. This resulted in significant setbacks in launching new services such as the rollout of “Shataku-san Lite” and “osumait” to other companies, as well as in initiatives to enhance productivity through digitalization.

Q: Against this backdrop, the new medium-term management plan sets out two objectives: “restoring recurring revenue growth rate and operating profit margin to the pre-pandemic levels” and “investing in the reconstruction of core systems and the creation of new businesses through M&A and so on.”

Regarding this “restoration,” what specific areas will you be focusing on?

The recovery trend of the company housing management service “Shataku-san” has become apparent. Communication with new customers temporarily ceased during the COVID-19 pandemic, but we have achieved pre-pandemic levels and are steadily gaining customer support. Consequently, there are few significant challenges from a sales perspective. Moving forward, we simply need to respond reliably to the increasing demand for task-undertaking services.

Meanwhile, establishing systems for operations after order receipt remains an internal challenge. Particularly in recent years, operational burdens have increased due to factors such as amendments to laws and regulations concerning invoices and rising rents, including responses to large volumes of price increase notifications arriving during renewal periods. To strengthen our service provision framework and accurately meet customer needs, we must focus on enhancing human resources and improving internal operational efficiency through digitalization.

Regarding digitalization, we are also advancing initiatives such as document scanning utilising AI and partial automation of communications with estate agents through bots.

Regarding the Condominium Management business, our top priority is maintaining and improving profitability per building, rather than increasing the number of properties under management.

We must firmly request price increases from customers whose businesses have become unprofitable. If they refuse, we regret to say that it may become unavoidable to discontinue management in some cases.

With major management companies and numerous competitors actively raising their prices, we are receiving an increasing number of inquiries. However, we cannot accommodate all requests and will carefully assess the profitability of each case before deciding whether to accept the work.

To improve profitability, we will expand the use of our “osumait” service, which digitizes condominium management, and also promote its provision to other condominium management companies facing similar challenges. Several condominium management companies have already begun using the service, and we are currently strengthening our sales efforts further.

Q: Regarding “investment,” what sectors are you considering for M&A?

We are prioritizing companies that provide BPO services to human resources and general affairs departments, as well as real estate management companies, as our primary targets. For example, we are currently identifying and scrutinising potential partners who possess AI technologies or SaaS-based services. By combining our services with their technologies or services to build new systems or services for application in human resources, general affairs, or condominium management, we aim to jointly provide existing customers with fresh added value.

Q: What are the challenges in achieving growth?

Ultimately, strengthening our workforce remains the most important priority. When executing M&A, it is crucial to deploy resources appropriately and swiftly generate synergies as soon as possible. Therefore, enhancing our personnel during the post-merger integration (PMI) phase is essential. Furthermore, as mentioned earlier, we consider the development of next-generation core personnel and management-level talent to be indispensable.

Q: Thank you. Finally, could you share a message for our shareholders and investors?

Unfortunately, over the past five years, we have been unable to achieve sufficient growth in both sales and profits. Some of our shareholders and investors may be concerned that this stagnation and lack of progress may continue.

However, upon analyzing various factors and confirming the current situation, we judge that the order receipt environment is showing signs of recovery and will be able to return to a steady growth trajectory going forward. Furthermore, while one factor behind the increase in cost of sales over the past few years has been upfront investment, we have also implemented measures to restore profitability. We believe that within three years, we will achieve sales growth and a recovery in profits.

We understand that investors may be concerned, but we are determined to demonstrate our results through solid performance.

We shall also focus on shareholder returns and management mindful of capital cost and share price, and we would greatly appreciate your continued support for our company from a medium- to long-term perspective.

6. Conclusions