Bridge Report:(9275)NARUMIYA INTERNATIONAL the Second Quarter of Fiscal Year February 2020 Earnings Results

President Toshiaki Ishii | NARUMIYA INTERNATIONAL Co., Ltd. (9275) |

|

Corporate Information

Exchange | TSE 1st Section |

Industry | Retail Business (Commerce) |

President, representative | Toshiaki Ishii |

Address | 2-4-1 Shibakoen, Minato-ku, Tokyo |

Year-end | February |

URL |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE (Actual) | Trading Unit | |

¥1,231 | 10,082,630 shares | ¥12,411 million | - | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥34.00 | 2.8% | ¥101.65 | 12.1 times | ¥358.86 | 3.4 times |

*The share price is the closing price on November 6. The number of shares outstanding, DPS, and EPS were taken from the brief report on results for the second quarter of the term ending February 2020. BPS was taken from the brief report on results for the term ended February 2019.

Earnings Trends

Fiscal Year | Net Sales | Operating Profit | Ordinary Profit | Net Income | EPS | DPS |

Feb. 2017 (Actual) | 23,474 | 1,157 | 892 | 708 | 74.99 | - |

Feb. 2018 (Actual) | 26,954 | 1,404 | 1,280 | 760 | 80.43 | - |

Feb. 2019 (Actual) | 29,700 | 1,625 | 1,505 | 926 | 94.94 | 31.00 |

Feb. 2020 (Estimate) | 33,007 | 1,712 | 1,646 | 1,007 | 101.65 | 34.00 |

*Unit: Million yen, yen. The estimated values were provided by the Company.

The results for the term ended February 2017 and the term ended February 2018 are consolidated, and the results for the term ended February 2019 are non-consolidated. Net income and EPS are the values after the adjustment of a gain on extinguishment of tie-in shares of 875 million yen.

The results for the term ending February 2020 are estimated to be consolidated. As for DPS (dividend per share), only the amounts after listing are indicated.

This report outlines Narumiya International Co., Ltd. and includes the second quarter of term ending February 2020.

Table of Contents

Key Points

1. Company Overview

2. Second quarter of term ending February 2020 Earnings Results

3. Fiscal Year February 2020 Earnings Estimates

4. Conclusions

<Reference 1: Future growth strategy>

<Reference 2: Regarding Corporate Governance>

Key Points

- Narumiya International plans and manufactures clothes for babies, toddlers, and juniors*, and sells them via department stores, shopping centers (SCs), and e-commerce. As its characteristics and strengths, the Company handles a broad range of brands for each sales channel, and possesses top-class brand power, merchandising capability, excellent customer assets, etc. The Company aims to grow further by expanding shopping center (SC) channels and e-commerce, cultivating the Chinese market, offering intangible services, and so on. (babies and toddlers: 0 to 7 years old; juniors: 8 to 15 years old)

- There was double-digit growth for both sales and profits in the second quarter of term ending February 2020. Sales increased by 15.0% year on year to 15,205 million yen. Although there was unfavorable weather in the second quarter (June-August), both shopping center (SC) channels and e-commerce (EC) continued to perform well, achieving double-digit sales growth. Sales in existing stores augmented 5.1% year on year. Overall store sales grew 11.8%. Operating profit rose by 50.3% to 402 million yen. SG&A expenses increased 14.6% year on year due to percentage-lease rent and fees for permission to sell at other companies’ online shops, but this was offset by increased sales and an improved gross profit margin.

- There is no change to the full-year forecast. The sales for the term ending February 2020 are estimated to be 33 billion yen, up 11.1% year on year. SC channels and e-commerce will keep contributing to sales. Operating profit is projected to rise 5.3% year on year to 1.7 billion yen. As a loyalty program was adopted at shopping centers (SCs), the Company will post a reserve for loyalty points this term, and SG&A expenses will augment, but it will be offset, and profit is expected to grow. The dividend amount is to be 34 yen/share. The estimated payout ratio is 34%.

- SC and EC continued to perform well, resulting in double-digit increases in sales and profits. Sales at existing stores were smaller than those of the previous year only in July but increased year on year in all other months. Overall store sales grew in all six months. This strong performance by the Company is remarkable because many competitors in the same industry are currently struggling. As the number of companies in the children's clothing industry decreases due to a declining birthrate and population, the Company will achieve growth by entering fields that other companies have withdrawn from, utilizing targeted marketing and acquiring new brands through M&A. For these reasons, we conclude that the business environment for the Company remains favorable.

- The progress rate in the first half was 46% for sales and 24% for operating profit. However, operating profit in particular is weighted in the second half, including the New Year holidays and the winter season. Thus, it can be said that the Company is currently making good progress as planned. As we observe the results of the third quarter, we would like to pay attention to how the effects of integrating customer IDs will be seen over the next fiscal year.

1.Company Overview

Narumiya International plans and manufactures clothes for babies, toddlers, and juniors, and sells them via department stores and directly managed shops in shopping centers (SCs). Its e-commerce, too, is rapidly growing. As of 2019, the number of brands is about 20. As its characteristics and strengths, the Company handles a broad range of brands for each sales channel, and possesses top-class brand power, merchandising capability, which enables the successful operation of two sales channels, excellent customer assets, etc.

The Company aims to grow further by expanding shopping center (SC) channels and e-commerce, cultivating the Chinese market, offering intangible services, and so on.

【1-1 Corporate History】

Its predecessor is the Japanese clothes wholesaler Narumiya Orimono, which started business in Hiroshima in 1904. In 1952, Narumiya Orimono Co., Ltd. was established. In 1979, its headquarters was opened in Aoyama, Tokyo, and the Company was renamed Narumiya Co., Ltd. It expanded business throughout Japan, and after Company split-up and business transfer, the corporate name was changed to Narumiya International Co., Ltd. in August 1995. Its business grew, as the Company sold mainly colorful fashion items and products with original mascots, such as “mezzo piano” and “ANGEL BLUE” at directly managed shops in department stores and wholesaled them to specialized shops. It opened shops actively in department stores and fashion buildings throughout Japan, and in March 2005, it was listed in the JASDAQ market.

However, the Company failed to swiftly break away from the dependence on department stores and change its brand concept. Then, its sales and profit declined from the fiscal year in which it was listed in the stock market. Under the guidance of new shareholders, it cultivated new sales channels, established new companies, conducted M&A, entered the Chinese market, withdrew unprofitable brands, relocated the headquarters, and strived to reduce fixed costs, such as personnel expenses, but its performance did not recover. In order to promote speedy structural reform, the Company was delisted in March 2010.

After the delisting, Mr. Toshiaki Ishii, the former president of Adastria Co., Ltd. (1st section of TSE, 2685), was brought on board, in order to recover the business performance.

Mr. Ishii, who was appointed as representative director / chief executive officer / president in June 2010, started selling the toddler’s size products of the brand “petit main” at shopping centers in March 2011, renewed EC systems, shifted from department stores to shopping centers, and concentrated managerial resources into e-commerce, to upgrade its business portfolio.

In addition, the Company proceeded with the reform of its procurement system, effective cost reduction, etc. and succeeded in reforming its business structure, recovering its performance steadily.

In September 2018, it was listed in the second section of Tokyo Stock Exchange, and then listed in the first section of TSE in September 2019.

After the delisting, the Company underwent the transfer of shares, absorption-type merger, the change of the corporate name, etc. due to the replacement of shareholders, and in March 2018, the current Narumiya International Co., Ltd. was established. This is different in form from that before the delisting.

【1-2 Management philosophy】

Narumiya International upholds the following vision, mission, and value.

Vision | To become an enterprise that will be loved by all generations |

Mission | To create “a moment,” “a lifestyle,” and “a future” through creative business activities |

Value | Each employee takes action as a professional. |

【1-3 Market environment】

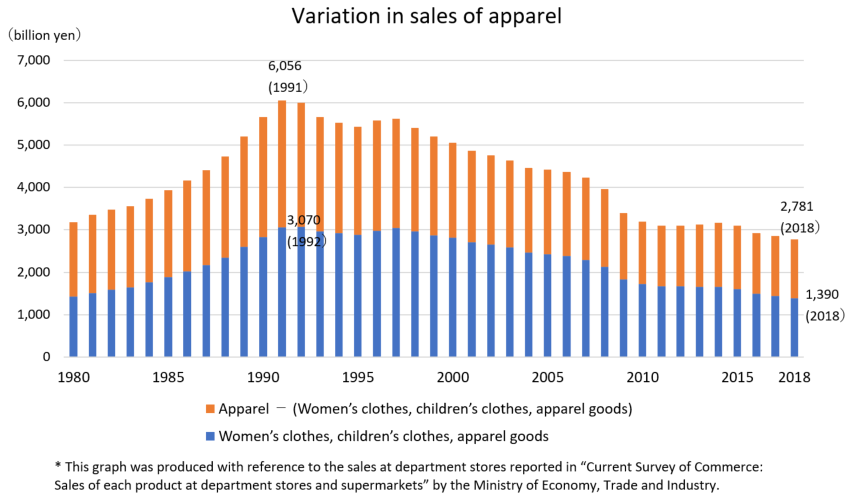

According to Current Survey of Commerce: Sales of each product at department stores and supermarkets by the Ministry of Economy, Trade and Industry, the sales of clothes at department stores have been declining since the peak in the early 1990s, and the total sales of clothes, the sales of women’s clothes, children’s clothes, and apparel goods in 2018 were 45% of their respective peak sales.

The environment surrounding department stores is severe, due to the progress of deflation, the changes in consumer mind, etc. and it is difficult to expect that it will improve considerably in the future.

However, according to the commercial sales in each business category (retail) in Current Survey of Commerce, the sales of “textiles, clothes, and articles of daily use” in 2018 have decreased to around 70% of the peak in 1991, but have bottomed out and have been on a plateau.

Simple comparison is impossible, but it can be inferred that sales channels other than department stores have been healthy.

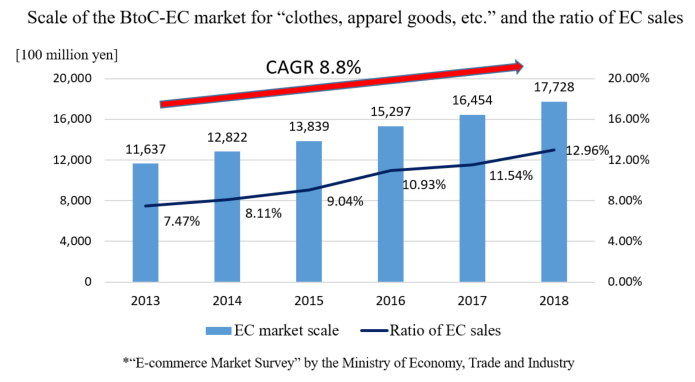

On the other hand, according to “E-commerce Market Survey” by the Ministry of Economy, Trade and Industry, the scale of the BtoC-EC market for “clothes, apparel goods, etc.” in 2018 was 1,772.8 billion yen, up 7.7% year on year. Since 2013, CAGR has grown 8.8%.

In addition, the ratio of EC sales (the ratio of the EC market scale to the scale of all markets of commercial transactions, including those by phone, fax, e-mail, and face-to-face) has steadily grown, and the weight and importance of EC in the apparel market are expected to increase further.

【1-4 Business description】

Narumiya International handles clothes for babies and kids in the format of SPA (specialty store retailer of private label apparel).

(1) Brands the Company handles

For respective sales channels, the Company offers the following brands for babies, toddlers, and juniors.

As of August 2019, the number of brands is 14 for babies or toddlers and 7 for juniors, that is, a total of 21.

① Major brands for babies and toddlers (0 to 7 years old)

◎ Department stores

| This brand has romantic and sweet tastes, so that each girl can become cuter than anyone else. It offers a broad range of clothes, including casual and formal dress. |

| “klädskåp” is a Swedish word meaning “a wardrobe.” The theme of this brand is “clothing-based education,” which means the nurturing of mind through clothes. |

| This brand was born for paying homage to the sensitivity to the wonders of nature and life. Based on natural colors, they design clothes in the motif of familiar nature, including seasonal flowers and fruits. It is characterized by adorable, but not too soft details. The organic cotton certified strictly by the U.S. is used for achieving a supple taste and a comfortable texture. |

◎ SC brands

| This is a brand for girls and boys that offers trendy fashion combined with childishness at affordable prices. Customers can enjoy coordinates linked with the lineup for ladies “LIEN,” which is targeted at active women, including mothers. |

| This is a unisex brand that offers comfortable, relaxing casual wear. |

| “LIEN,” which is derived from a word meaning “a bond,” suggests simple, clear items lightly combined with trends with freewheeling styling. Its clothes blend into the lifestyle scenes of active women, including mothers, and enrich the connections between adults and children and also with beloved ones. |

◎ Licensed brands

| This is a brand of ANNA SUI for children’s clothes, whose keywords are “dreamy,” “classic elegance,” and “sweet grunge.” |

| Kate Spade New York, which was established in New York in 1993, is a lifestyle brand that handles handbags, apparel, jewelry, shoes, children’s wear, gifts, etc. This admires daily personal styles with optimistic, feminine approaches, and supports women who possess a youthful spirit and overflowing confidence. |

(Taken from the website of Narumiya International)

② Major brands for juniors (8 to 15 years old)

◎ Department stores

| This brand is for brilliant, romantic girls. Products range from elegant styles to trendy, causal styles. |

| This is a casual brand with a French taste. It suggests refined daily & school wear with monotone and pastel colors combined with trends. |

| This is a brand for boys who wear clothes designed by mixing American casual styles and current trends in a cheerful, yet cool manner. |

◎ SC brand

| This is a brand for cheerful girls who dress while mixing American casual, rock, and girlish styles. |

(Taken from the website of Narumiya International)

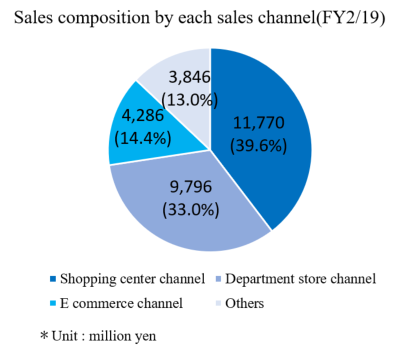

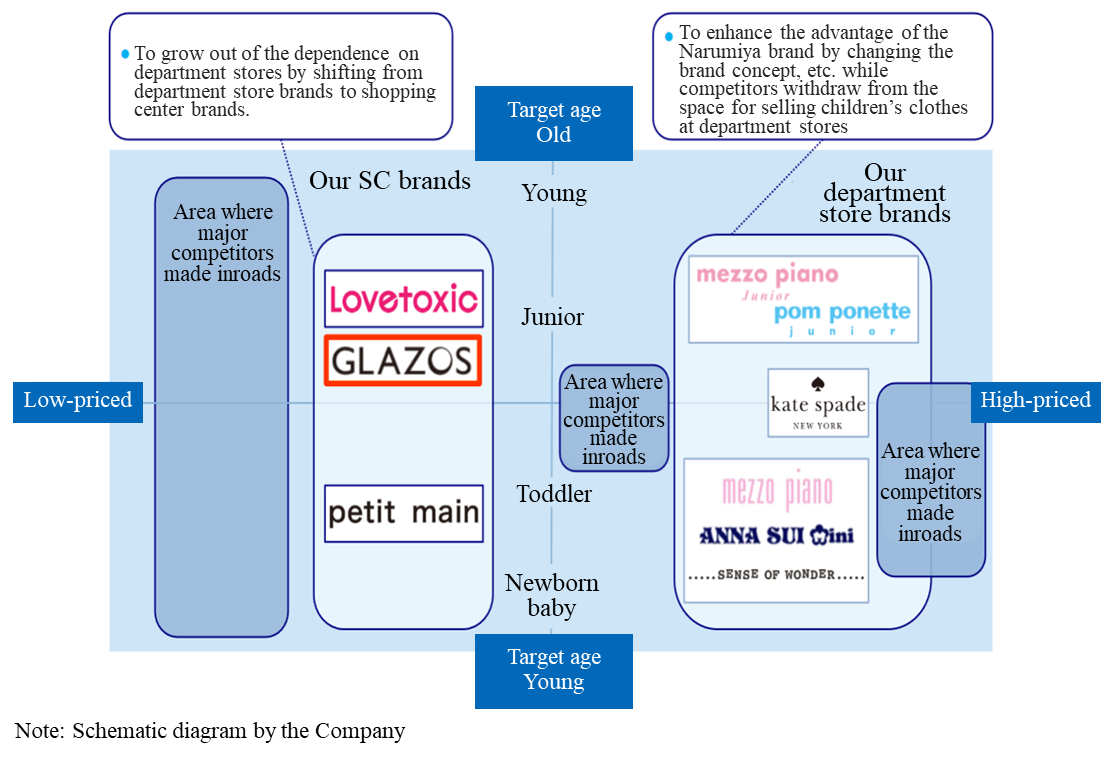

(2) Sales channels

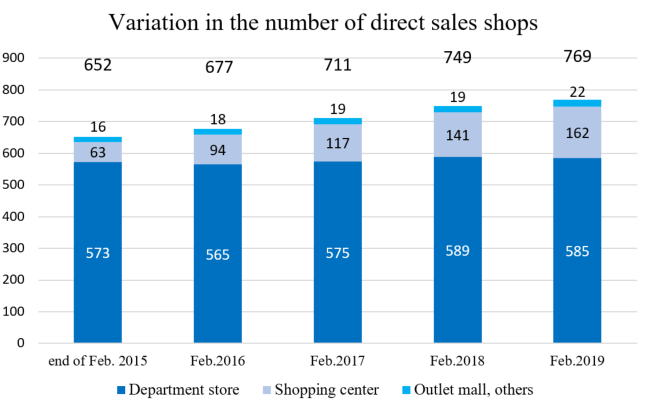

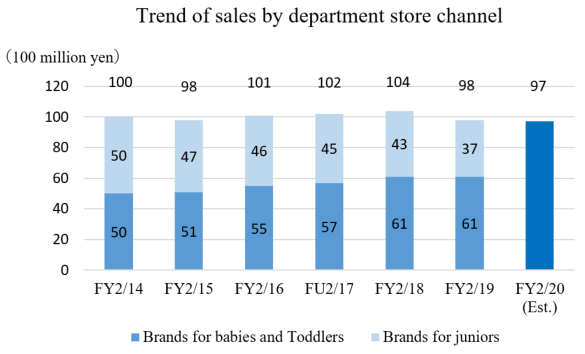

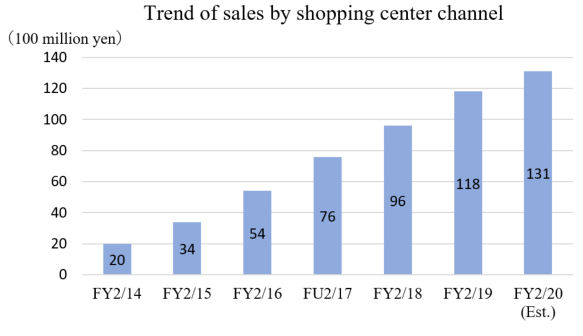

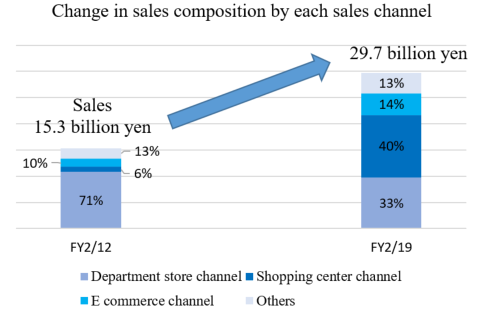

As mentioned in the section of the corporate history, the Company had been selling products via department stores, but is aggressively cultivating the channels of shopping centers (SCs) under the lead of President Ishii, who has strong connections with SCs and some achievements. In the term ended February 2019, the sales from the SC channel exceeded the sales from the department store channel for the first time. In addition, the Company is actively strengthening the e-commerce channel.

|

|

① Department stores

The Company sells products mainly at leading department stores in urban areas. In 1985, it entered the field of children’s clothes with the brand “MINI-K,” which offers clothes for mainly babies and toddlers, and in 1988, it launched “mezzo piano,” which is one of the major brands. In 1991, it released ANGEL BLUE, the first brand for juniors. It cultivated the new market of juniors’ clothes, and released new brands one after another. Since it is unlikely that the department store market will grow considerably, the Company plans to improve profitability while maintaining the current condition.

② Shopping centers

In 2005, the first shop in a shopping center was opened. The Company directly runs shops in shopping centers in urban and suburban areas, such as AEON MALL and LaLaport.

In 2009, it released “Lovetoxic,” a brand for juniors, which offers products at lower prices than the apparel brands in department stores. In 2011, it debuted “petit main,” a low/medium-priced brand for shopping centers like Lovetoxic. The unisex brand “petit main” is targeted at mainly boys and girls aged 0 to 7 years.

③ Outlet malls

In 2006, the Company opened the first outlet in “Rinku Premium Outlets.” It directly runs shops in suburban outlet malls, such as Mitsui Outlet Park and Premium Outlets.

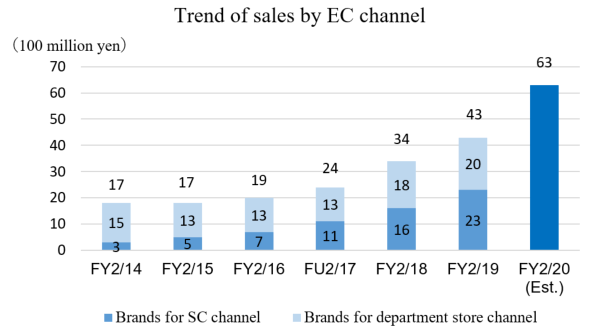

④ E-commerce

In 2008, the Company started concentrating on e-commerce on a full-scale basis, and opened NARUMIYA ONLINE as a directly managed online shop.

In addition to its original website, Narumiya International sells products via other online shopping sites, such as ZOZOTOWN, Rakuten, and Amazon, with the aim of improving convenience for customers and popularizing its brands.

The ratio of EC sales was 14% in the term ended February 2019, and is estimated to reach 20% in this term ending February 2020.

The ratio of sales from its original EC site was 43% in the term ended February 2019, and is estimated to be 50% this term. The Company aims to increase the ratio to 60% in the term ending February 2022.

The number of customers who purchased products at EC sites was about 230,000 in 2018. It is increasing considerably every year.

In August 2018, the Company started selling products via Tmall, the world’s largest BtoC-EC site operated by the Alibaba Group in China, by licensing out distributorship to a Chinese enterprise.

The sales of “petit main,” which is the primary brand of the Company, on November 11, 2018 (Singles’ Day) reached around 30 million yen, and got ranked in the top 10% in the category of children’s clothes, although the Company participated for the first time. In Japan, the average daily sales of “petit main” are about 1 million yen.

In March 2019, the Company acquired all shares of Heartfeel Co., Ltd., which plans and sells mainly casual wear for boys, and reorganized it into a subsidiary. The ratio of e-commerce sales of Heartfeel is over 90%, as Heartfeel specializes in e-commerce.

As Narumiya International specialized in brands for girls, this acquisition would enrich its brand portfolio and enhance its e-commerce.

⑤ Other

The Company wholesales products to local department stores and specialized apparel shops, and offers the license to use its brand trademarks.

(3) Activities for new businesses: the House Studio business

As Narumiya International has been manufacturing and selling clothes for children, it aims to evolve into a kids’ lifestyle company by providing not only materials (clothes), but also experiences (services).

As the first step, it formed a business tie-up with the photo studio LOVST, and opened the photo studio LOVST BY NARUMIYA in MARINE & WALK YOKOHAMA in September 2018. This service is to take pictures of daily scenes and life events as memories after choosing from 300 clothes for kids. It is expected that there will be synergy with the existing business, including the purchase of clothes after the rental for photo shooting. In a year after the start of this business, the number of users exceeded 1,800. The number of customers and average spending per customer are growing steadily.

(Taken from the reference material of the Company)

【1-5 Characteristics and Strengths】

(1) Multi-channel and multi-brand strategies

As unique characteristics and strengths, Narumiya International handles a variety of brands suited for respective sales channels, including department stores, shopping centers, and e-commerce, which are used in a well-balanced manner.

The Company covers a wide range of age groups, from babies to juniors (0 to 15 years old), and prices, and can distribute not only longtime sellers, but also trendy products timely through appropriate channels.

It plans to establish several differentiated brands and cover uncultivated areas in each sales channel, by utilizing M&A like the case of Heartfeel.

(Taken from the reference material of the Company)

(2) Merchandising capability that enables the utilization of 2 sales channels

Department stores and shopping centers (SCs) have different customer segments and needs, so it is necessary to operate brands suited for respective sales channels. In addition, supply chains are totally different between them as shown below, so it is not easy to expand business from department stores to SCs or from SCs to department stores.

(Characteristics of supply chains of each sales channel)

Sales channel | Characteristics of supply chains | Lead time |

Department stores | For providing high-priced products, supply chains can produce high-quality products worth more than the price in small lots. | Long |

Shopping centers (SCs) | For providing low/medium-priced products, supply chains can achieve both high-fashion apparel and cost performance. | Short |

In the contrast, Narumiya International has already established a system for supply chain management for both channels: department stores and SCs.

Since it possesses merchandising capability that enables the utilization of the two channels, it can decentralize revenue sources. This is a noteworthy strength.

Especially, we would like to pay attention to the Company’s competitive advantage in the SC chain, which is considered as the strongest growth driver.

The Company can grasp the trends of children’s wear when necessary, by utilizing its advanced planning capability and network for collecting information on the trends and brands inside and outside Japan, and can distribute more hot-selling products in the middle of a season, based on its robust network for procuring products from various trading companies.

With its flexible planning, manufacturing, and selling systems, which allow them to distribute products in a short period of time, Narumiya International can reduce the loss of opportunities and pursue the maximization of sales.

(3) Top-class brand power

Its brands are characterized by not only the variety but also their high quality.

In “Senken Kids’ Fashion Award in Fiscal 2017” hosted by the leading industrial newspaper “Senken Shimbun,” “petit main” won first place in the SC section, “ANNA SUI mini” won first place in the section of toddlers’ wear of department stores, “mezzo piano junior” won first place in the section of juniors’ wear at department stores, and “SENSE OF WONDER” won second place in the section of babies’ wear at department stores. In this way, they are recognized as top-class brands.

(4) Excellent customer assets

As the Company has nurtured the top brands for children’s clothes for many years, the loyalty* of its customers is extremely high.

These customer assets are the stable base for sale, and allow the Company to meet their needs and develop new brands or new businesses. Accordingly, they are essential intangible assets that constitute its corporate value.

*Loyalty of customers: This means “trust” and “affection” toward a specific brand, product, or service.

2.Second quarter of term ending February 2020 Earnings Results

【2-1 Overview of profit and loss】

| FY 2/19 2Q | Ratio to sales | FY 2/20 2Q | Ratio to sales | YOY |

Net sales | 13,220 | 100.0% | 15,205 | 100.0% | +15.0% |

Gross profit | 7,050 | 53.3% | 8,178 | 53.8% | +16.0% |

SG&A expenses | 6,782 | 51.3% | 7,775 | 51.1% | +14.6% |

Operating profit | 268 | 2.0% | 402 | 2.6% | +50.3% |

Ordinary profit | 197 | 1.5% | 368 | 2.4% | +86.6% |

Net income | 37 | 0.3% | 172 | 1.1% | +361.7% |

*Unit: Million yen. The values for the second quarter of FY 2/19 are non-consolidated. Net income is profit attributable to owners of the parent. Net income for 2Q of FY2 / 19 is the amount after deducting 875 million yen gain on extinction of tie-in shares following the merger on March 1, 2018.

Double-digit increase in sales and profit

Sales increased by15.0% year on year to 15,205 million yen. Although there was unfavorable weather in the second quarter (June-August), both shopping center (SC) channels and e-commerce (EC) continued to perform well, achieving double-digit sales growth. Sales in existing stores augmented 5.1% year on year. Overall store sales grew 11.8%.

Heartfeel Co., Ltd. contributed 424 million yen to sales, and gross profit rate improved by 0.5 points.

Operating profit rose by 50.3% to 402 million yen. SG&A expenses increased by14.6% year on year due to percentage-lease rent and fees for permission to sell at other companies’ online shops, but this was offset by increased sales and an improved gross profit rate. The goodwill amortization of Heartfeel Co., Ltd. was 22 million yen.

【2-2 Trend of each sales channel】

| FY 2/19 2Q | Composition ratio | FY 2/20 2Q | Composition ratio | YOY |

Sales |

|

|

|

|

|

Department stores | 4,550 | 34.4% | 4,317 | 29.2% | -5.1% |

SC | 5,283 | 40.0% | 6,426 | 43.5% | +21.6% |

E-commerce | 1,696 | 12.8% | 2,108 | 14.3% | +24.3% |

Gross profit |

|

|

|

|

|

Department stores | 2,399 | 52.7% | 2,181 | 50.5% | -9.1% |

SC | 3,057 | 57.9% | 3,858 | 60.0% | +26.2% |

E-commerce | 888 | 52.3% | 1,157 | 54.9% | +30.3% |

*Unit: Million yen. Non-consolidated. The composition ratio of profit means profit rate.

① Department stores

Sales and profit dropped.

Sales are declining, especially in juniors’ brands.

18 new stores were opened, and 9 stores were closed.

② Shopping centers (SCs)

Sales and profit grew.

Existing store sales continued to spur growth, rising by 7.8% year on year.

The Company is acquiring customer IDs for use in a new point system, and plans to improve CRM by integrating EC members.

With the aim of streamlining its business, the Company intends to improve the efficiency of warehouse work by introducing RFID tags. They are also working towards reducing the number of store staff by introducing RFID-compatible POS systems.

12 new stores were opened, and 1 store was closed. The Company is steadily progressing toward their yearly target of 19 stores.

③ E-commerce

Sales and profit rose.

Measures to encourage growth are progressing smoothly.

There are 330,000 Narumiya International website members, an increase of 125,000 since March 2019. The number of registered members has increased due to customer integration with shopping centers in April this year. Sales rose by10% for department store brands and 36% for shopping center brands. In addition, 15 types of EC-exclusive brand items were developed, generating sales of 75 million yen.

The Company’s website sales increased by 19.3% year on year, accounting for 43% of sales. Sales via ZOZOTOWN rose by 40.8% year on year, accounting for 39% of sales.

In response to greater needs for boys’ clothing, Heartfeel Co., Ltd., which sells boys’ clothing brands both at shopping centers and EC, will most likely open a store at a shopping center ahead of schedule.

A partner company of Tmall (which operates in China and entered the market in August 2018) posted sales of 160 million yen in the first half.

Tmall manages the sale of 3,000 children's clothing brands in total. They are in the top 10% of clothing vendors, and have a good reputation in the Chinese market. However, the ratio of sales is currently higher for boys' clothes than girls' clothes, and the Company believes that it is necessary to utilize their strengths and increase the ratio of sales for girls’ clothes.

The Company frequently meets with local partners in China to get a more complete picture of essential trends in the Chinese market.

④ House studio

The business is gaining popularity as a photogenic house studio. Both the unit price and the number of customers are steadily increasing and it made surpluses on a single-month bases, indicating that the business is gradually taking shape. The Company is working on organizing management staff into teams that include photographers, with the aim of opening additional stores.

【2-3 Topics】

① Integrated IDs for SC and EC customers

In order to optimize selling areas (such as making EC available to store customers, and encouraging online customers to visit stores), the Company integrated customer IDs for SC and EC.

As a result, the number of new customers increased dramatically, rising from 33,532 in the same period of the previous year to 125,142.

② Listed on the first section of TSE, the Company decided to provide commemorative dividends

On September 6th, 2019, the Company was listed in the first section of TSE.

Consequently, in commemoration of the market change, the Company decided to pay a commemorative dividend of 3 yen/share as a year-end dividend for the term ending February 2020.

As a result, the year-end dividend for the current term is to be 34 yen/share, including the ordinary dividend of 31 yen/share.

③ Establishment of a shareholder rewards program

A shareholder rewards program has been established in order to provide opportunities to use the Company's products and to build a long-term loyalty for the Company.

A 10% discount ticket which can be used at the Company's directly managed stores will be presented to shareholders (those holding at least one lot (100 shares) as of the end of February each year), according to the number of shares held. Shareholders can get a 10% discount (up to 100,000 yen excluding tax) off the store price.

【2-4 Financial Condition and Cash Flow】

① Main BS

| End of Feb. 2019 | End of Aug. 2019 |

| End of Feb. 2019 | End of Aug . 2019 |

Current assets | 8,233 | 7,365 | Current liabilities | 5,263 | 4,913 |

Cash and deposits | 1,847 | 1,487 | Notes and accounts payable - trade | 2,698 | 2,012 |

Notes and accounts receivable - trade | 2,309 | 2,611 | Short-term loans payable | 450 | 670 |

Inventories | 3,694 | 3,182 | Non-current liabilities | 5,362 | 5,724 |

Non-current assets | 5,948 | 6,729 | Long-term loans payable | 4,325 | 4,714 |

Property, plant and equipment | 1,100 | 1,145 | Total liabilities | 10,626 | 10,638 |

Intangible assets | 3,321 | 3,735 | Net assets | 3,556 | 3,455 |

Goodwill | 3,129 | 3,475 | Retained earnings | 1,515 | 1,380 |

Investments and other assets | 1,527 | 1,847 | Total liabilities and net assets | 14,182 | 14,094 |

Total assets | 14,182 | 14,094 | Total loans payable | 4,775 | 5,384 |

|

|

| Equity ratio | 25.1% | 24.5% |

*Unit: Million yen. The values as of the end of February 2019 are non-consolidated, while the values as of the end of August 2019 are consolidated. The increases/decreases in the sentences are for your reference.

Cash and deposits decreased due to acquisition of fixed assets. Goodwill and Investments and other assets increased, while total assets decreased by 88 million yen from the end of the previous term to 14,094 million yen. Liabilities augmented 12 million yen to 10,638 million yen due to a decrease in notes and accounts payable and an increase in long and short-term loans payable that accompanied the acquisition of Heartfeel. Net assets fell 100 million yen to 3,455 million yen. Equity ratio was 24.5%, down 0.6 points from the end of the previous term.

② Cash Flow

| FY 2/19 2Q | FY 2/20 2Q | YoY |

Operating Cash Flow | 200 | 445 | +244 |

Investing Cash Flow | -286 | -519 | -233 |

Free Cash Flow | -85 | -74 | +11 |

Financing Cash Flow | -740 | -284 | +455 |

Cash Equivalents | 1,158 | 1,487 | +329 |

*Unit: Million yen. The values as of the end of February 2019 are non-consolidated.

The surplus of operating CF increased due to a decrease in inventory assets. The deficit of investing CF grew larger due to an increase of stores. The deficit of financing CF shrank due to a decrease in dividend payments. The cash position improved.

3.Fiscal Year February 2020 Earnings Estimates

【3-1 Outlook for profit and loss】

| FY 2/19 | Ratio to sales | FY 2/20 (Est.) | Ratio to sales | YOY | Progress rate |

Net sales | 29,700 | 100.0% | 33,007 | 100.0% | +11.1% | 46.1% |

Gross profit | 15,937 | 53.7% | 17,898 | 54.2% | +12.3% | 45.7% |

SG&A expenses | 14,312 | 48.2% | 16,186 | 49.0% | +13.1% | 48.0% |

Operating profit | 1,625 | 5.5% | 1,712 | 5.2% | +5.3% | 23.5% |

Ordinary profit | 1,505 | 5.1% | 1,646 | 5.0% | +9.4% | 22.4% |

Net income | 926 | 3.1% | 1,007 | 3.1% | +8.7% | 17.1% |

*Unit: Million yen. The results for the term ended February 2019 are non-consolidated. Net income is profit attributable to owners of the parent.

No change to the full-year forecast. Sales and profit are estimated to grow.

There is no change to the full-year forecast. Sales are estimated to be 33 billion yen, up 11.1% year on year. SC channels and e-commerce will keep contributing to sales.

Operating profit is projected to rise 5.3% year on year to 1.7 billion yen. As a loyalty program was adopted at shopping centers (SCs), the Company will post a reserve for loyalty points this term, and SG&A expenses will augment, but it will be offset, and profit is expected to grow. The dividend amount is to be 34 yen/share. The estimated payout ratio is 34.0%.

【3-2 Trend of sales in each sales channel】

| FY 2/19 | FY 2/20 (Est.) | YOY | Progress rate |

Department stores | 9,796 | 9,732 | -0.7% | 44.4% |

Shopping centers | 11,770 | 13,066 | +11.0% | 49.2% |

E-commerce | 4,286 | 6,315 | +47.3% | 40.1% |

*Unit: million yen

① Department stores

Sales are estimated to decrease slightly.

In order to catch up during the second half of the fiscal year, in addition to introducing the foreign-owned Pyrenex brand down jackets, Narumiya International plans to expand their product lineup of gifts for newborns, scale down unprofitable brands (reduce floor space for juniors’ brands, reinforce baby and toddler sections), and consolidate human resources. In addition, they intend to roll out new foreign brands as part of a recovery plan for the following term. The Company will open 10 stores next term (mainly large stores), with the goal of opening 30 stores over the next 3 years.

② Shopping centers (SCs)

Sales are projected to grow by double digits.

This fiscal year, too, the Company will open about 20 shops.

As for existing shops, the Company will try to improve CRM by adopting the loyalty program and enhance its earning capacity by leading customers to each other’s EC site, etc.

In addition, with the aim of streamlining its business, the Company will streamline the warehousing process by adopting RFID, and save manpower by installing self-checkout machines, etc.

③ E-commerce

Sales are forecasted to rise considerably.

In the term ending February 2020, the Company aims to increase the ratio of EC sales to 20%. Through the contribution from Heartfeel Co., Ltd., the ratio is expected to grow.

The Company will improve its original EC site, which has a high profit rate and can obtain customer data, to increase the ratio of sales from that site from 43% in the term ended February 2019 to 50% in the term ending February 2020.

The Company will also work on the promotion of digital marketing.

Thanks to the integration of the customer IDs with shopping centers in April, the store will be optimized to encourage store visits from online customers, and provide EC for customers who visit stores.

In the term ending February 2021, the Company plans to release its original app.

In addition, it will discuss the integration of logistics systems for shopping centers and e-commerce for streamlining business administration.

A partner company of Tmall (which operates in China) is expected to have sales of 360 million yen in the second half, 200 million yen larger than that of the same period last year. Sales of 520 million yen for the full year are expected.

4.Conclusions

SC and EC continued to perform well, resulting in double-digit increases in sales and profits. Sales at existing stores were smaller than those of the previous year in July, but increased year on year in all other months. Overall store sales grew in all six months. This strong performance by the Company is remarkable because many competitors in the same industry are currently struggling. As the number of companies in the children's clothing industry decreases due to a declining birthrate and population, the Company will achieve growth by entering fields that other companies have withdrawn from, utilizing targeted marketing and acquiring new brands through M&A. For these reasons, we conclude that the business environment for the Company remains favorable.

The progress rate in the first half was 46% for sales and 24% for operating profit. However, operating profit in particular is weighted in the second half, including the New Year holidays and the winter season. Thus, it can be said that the Company is currently making good progress as planned. As we observe the results of the third quarter, we would like to pay attention to how the effects of integrating customer IDs will be seen over the next fiscal year.

<Reference1:Future Growth Strategy>

(1)Activities in each sales channel

After President Ishii was appointed, Narumiya International shifted from the business focused on department stores to the one utilizing shopping centers and e-commerce, and will take the following measures in each sales channel.

➀ Shopping center (SC) channel

This remains the strongest trigger for growth.

The number of shopping centers in Japan has been growing and is now about 3,200. It has been on a plateau in the past several years. The Company plans to open shops in about 1,200 shopping centers, but the number of directly managed shops in SCs as of the end of August 2019 was 171. There is significant room for opening shops.

In this situation, in order to further enhance the selling capacity through the SC channel, the Company organized SC Business Section, which specializes in brands for shopping centers, and is concentrating managerial resources and streamlining brand operation.

As the survival of the fittest is progressing among shopping centers, the Company will select shopping centers more carefully and open shops at growing excellent SCs. Furthermore, in order to enhance its earning capacity, the Company will expand its business scale to actualize volume discount and take measures for cost reduction to secure a high gross profit.

In addition, the Company will grasp fashion trends earlier than anyone else and further shorten the business cycle of planning, manufacturing, and sales.

As mentioned in “1-5 Characteristics and strengths,” Narumiya International is excellent in planning, information gathering, and product procurement, and can distribute more hot-selling products in the middle of a season. By utilizing this advantage, the Company will increase sales from the SC channel.

➁ E-commerce

The rapidly growing e-commerce channel is recognized as the second trigger for growth, and the following measures will be implemented for further growth.

Activities | Concrete measures |

Development of an original EC site where consumers can easily choose and purchase products | *To make the website for smartphones more convenient, as those who purchase products with smartphones will increase |

Enhancement of utilization of customer data | *Unified management of stocks for e-commerce and real shops, and integration of customer IDs *To develop an omni-channel system and cement contact points with customers in real shops and the Internet |

Retention of good customers | *To suggest optimal products with reference to the purchase history, etc. *To enrich customer services, including benefits for loyal customers (to enhance loyalty) |

③ Department store channel

It is difficult to increase the sales from the department store channel considerably, but the Company will strive to achieve steady growth, fortify the customer base, and improve profitability through the following activities.

*To share the benefits for market survivors by taking advantage of the merits of multi-brand operation

The Company will open its another brand shop in the selling space after a competing shop was closed, to expand the selling space share.

In addition, it will establish a system for releasing a new brand when necessary.

*Retention of customers for long-selling brands

As Narumiya International has specialized in children’s clothes for many years, in some cases, it has loyal customers of 3 generations.

As its staff will maintain and cement long-term relationships with customers, the Company will implement measures suited for each life stage of customers, to fortify the customer base and maximize LTV*.

*LTV: Life Time Value. This is the amount spent by one customer for products or services. A high LTV means that the customer has purchased and used products and services repeatedly.

*Streamlining of business through the curtailment of personnel expenses

The Company will increase the efficiency of sale by locating different brand shops to one another.

In the department store channel, it is difficult to distribute more products in the middle of a season due to the conventional commercial customs, etc. The Company will approach department stores, with the aim of establishing a system for procuring and releasing products in a short period of time like in the SC channel.

(2)Foray into the Chinese market

The Chinese apparel market is expected to become the world’s largest market whose scale will be about 54 trillion yen by 2020. Due to the effects of the “one-child policy,” the number of births is on a plateau, but it is about 17 million per year, which is much larger than that in Japan, which is less than 1 million.

As mentioned above, the Company opened a shop in Tmall by licensing a Chinese business partner to distribute products in August 2018.

With this foothold, it will cultivate the huge Chinese market on a full-scale basis in various ways.

In addition, it will start research into neighboring Asian countries.

(3)Provision of intangible services

As mentioned above, Narumiya International, which has been manufacturing and selling children’s clothes, aims to evolve into a kids’ lifestyle company, by offering not only materials (clothes), but also experiences (services).

The House Studio business, which was launched as the first step, made a good start.

The Company will operate business in new fields, by utilizing its top-class brand power and excellent customer assets, which are its strengths.

(4)Promotion of M&A and alliances

Like the case of Heartfeel, the Company will cover the uncultivated genres of children’s clothes through M&A and alliances, and enhance its multi-brand strategy further.

<Reference2: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 6 directors, including 4 outside ones |

Auditors | 3 auditors, including 2 outside ones. |

◎ Corporate Governance Report

Last updated: May 30, 2019

<Basic Policy>

In our business activities charter, as a company which cultivates the dreams of children around the world and provides complete and abundant livelihoods for children, we will build a trusting relationship with children, our customers, investors and shareholders, our clients, and regional communities, and will honestly respond to the expectations placed on us, and in order to fulfill our societal responsibilities, we declare the following 10 principles for action.

(1) We will constantly strive to gain the trust and satisfaction of our customers by working on development and providing for our customers in addition to providing socially useful products and services while focusing on safety and the protection of personal and customer information.

(2) We will conduct fair, transparent, and free competition along with proper transactions. Moreover, we will maintain healthy and appropriate relations with the government and authorities.

(3) We will widely communicate with society, including shareholders, and share corporate information in a proactive and fair manner.

(4) In addition to respecting the diversity, personalities, and individuality of our employees, we will foster a safe and comfortable working environment and achieve abundance in a low-pressure fashion.

(5) As environmental problems are a challenge shared by all humanity, and recognizing that a healthy environment is a prerequisite for our company’s existence and activities, we will act independently and proactively.

(6) As part of our company’s effort to be a good citizen, we will proactively conduct activities which contribute to society.

(7) We will take a stand against antisocial forces and organizations which threaten the order and safety of civil society.

(8) Regarding our international business activities, we will not only comply with international rules and local laws, but we will also respect local cultures and customs and conduct our business in such a way which furthers their development.

(9) Recognizing that the implementation of the spirit of this charter is their duty, the heads of management will ensure compliance within the Company and make these points clear to our clients in addition to setting a positive example. In addition, through the continuous consideration of others’ voices from within and outside of the Company, we will create an effective company structure and aim for the thorough enactment of business ethics.

(10) In the event that there exist conditions which go against this charter, the heads of management will openly take preventative measures and investigate the source of the problem. Additionally, we will carry out timely and precise information sharing and accountability measures. In addition to clearly defining the liability and authority concerned, we will conduct our own strict measures.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

【Supplementary Principle 1-2. (4) Digital exercise of voting rights, English version of the convocation notice】

| We have translated the convocation notice into English, but we have not created an environment in which voting rights can be exercised digitally. We are considering measures to create an environment in which voting rights can be exercised digitally. |

【Principle 1-4 Strategically held shares】 | (1) Policies relating to strategically held shares

In addition to strengthening relationships with our clients based on a medium to long-term perspective, we hold our clients’ shares, but in order to ensure the efficiency of our assets, the shares we hold have extremely low impacts. Thus, we are currently not going as far as to conduct periodic checks of the appropriateness of holding strategic stocks. However, based on management decisions, we may consider selling off certain shares in the case that we deem the holding of certain shares to be unnecessary.

(2) Regarding our idea about the ensuring of appropriate measures regarding the exercise of voting rights which relate to the strategic holding of shares

Our basic idea towards the exercise of voting rights which relate to the strategic holding of shares is as follows. Regarding the exercise of voting rights which relate to the strategic holding of shares, we determine whether the Company being invested in has constructed appropriate governance structures and whether they are making appropriate decisions which will lead to a medium- to long-term increase in corporate value, and then make a comprehensive decision for each item on our agenda. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Principle 3-1 Completion of information disclosure】 | (1) Our goals (management principles, etc.), management strategies, and management plan Our corporate philosophy and medium-term management plan will be published on our website as well as on our financial results documents.

(2) Basic approach and policies towards corporate governance based on the various principles of this code With regard to our basic idea and basic policies regarding our corporate governance, please refer to “1. Basic Idea” in the “I Basic idea regarding corporate governance and basic information on capital structure, business attributes, etc.”

(3) Policies and procedures for the board of directors to determine remuneration for management executives and directors As a measure aimed at the improvement of corporate governance, we will enhance the objectivity and rationality of our management through deliberation and findings to the board of directors about our human resources and remuneration policies for directors and executive officers. The nomination and remuneration committee has been established for this purpose, thereby maximizing corporate value. This committee is composed of the president and all non-executive directors, and the chairperson is selected from among the non-executive directors.

(4) Policies and procedures for the board of directors to elect and dismiss management executives and nominate candidates for directors and auditors The board of directors selects candidates who appropriately fulfill their roles and responsibilities as directors and auditors, and possess abundant experience, fine judgment, and excellent personalities. Regarding the appointment and dismissal of directors and executive officers, in order to ensure objectivity and transparency, the board of directors or the president consults with the nomination and remuneration committee about factors such as an evaluation of the Company's performance, and the board of directors makes its decision while considering the nomination and remuneration committee's findings. The nomination of auditor candidates is carried out in accordance with the auditors’ board's audit standards, and the nomination procedures abide by the rules of the auditors’ board and are approved by the auditors’ board.

(5) Reasons for nomination and dismissal of individual candidates for board member and auditor positions The reasons behind the appointment and nomination of each candidate for directors and auditors will be detailed in the convocation notice for the general meeting of shareholders. In the event of a dismissal, we will disclose the relevant information in accordance with policies and procedures. |

【Principle 5-1 Policies regarding constructive dialogue with shareholders, etc.】 | Our policies for our organizational development and initiatives to promote constructive dialogue with shareholders are as follows.

(1) In order to promote IR activities which contribute to the improvement of corporate value, the accounting department and the corporate planning office will work together under the director in charge of information disclosure, who will act as the supervisor of IR activities.

(2) Dialogue with shareholders will be handled by the corporate planning office, and to a reasonable extent, the president or a director in charge of information disclosure.

(3) By conducting regular shareholder surveys, we will strive to better understand our composition of shareholders and implement more effective IR activities.

(4) In addition to holding periodic financial results briefings for institutional investors and analysts, we will hold meetings and information sessions in conjunction with the progression of our business. We plan to provide information to individual investors while focusing on speed and convenience.

(5) When preparing disclosure documents, the accounting department will play a central role regarding accounting information such as brief financial reports, securities reports, financial statements, and so on, and other disclosure documents will be handled primarily by the corporate planning office. The accounting department, the corporate planning office, and the human resources and general affairs department will work together to collect appropriate information and ensure the accuracy of disclosed information. Additionally, we will publish disclosure documents, etc. on our website in English.

(6) Regarding the opinions and concerns identified in dialogues with shareholders and investors, the corporate planning office will report to the board of directors when necessary.

(7) When conducting dialogues with shareholders, we comply with relevant laws and regulations and manage insider information in an appropriate manner. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |