Bridge Report:(9278)BOOKOFF GROUP HOLDINGS Fiscal Year March 2019

President Yasutaka Horiuchi | BOOKOFF GROUP HOLDINGS LIMITED(9278) |

|

Company Information

Market | TSE 1st Section |

Industry | Retail (commerce) |

President | Yasutaka Horiuchi |

HQ Address | 2-14-20 Kobuchi, Minami-ku, Sagamihara-shi |

Year-end | March |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥844 | 17,447,413 shares | 14,726 million | 16.7% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥18.00 | 2.1% | 68.78 | 12.3 x | 736.20 | 1.1 x |

*The share price is the closing price on May 17.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2016 (Actual) | 76,564 | -530 | 5 | -528 | -25.69 | 25.00 |

March 2017 (Actual) | 81,344 | 116 | 588 | -1,159 | -56.41 | 10.00 |

March 2018 (Actual) | 80,049 | 613 | 1,092 | -889 | -43.31 | 10.00 |

March 2019 (Actual) | 80,796 | 1,550 | 2,120 | 2,172 | 112.19 | 15.00 |

March 2020 (Forecast) | 83,000 | 1,800 | 2,300 | 1,200 | 68.78 | 18.00 |

*The forecasted values were provided by the company.

*Unit: Million yen or yen

※The number of the financial statements in this report is generally based on the number of financial reports. As this company changed unit display (FY 3/18 : thousand → FY 3/19 : million), YoY means the comparison between the number of units in FY 3/18 (thousand) and the number of units in FY 3/19 (million). Abbreviated hereafter.

We present this Bridge Report reviewing the trend of business results and growth strategy of BOOKOFF GROUP HOLDINGS LIMITED.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year March 2019 Earnings Results

3. Growth Strategy

4. Fiscal Year March 2020 Earnings Estimates

5. Conclusions

<Reference: Corporate Governance>

Key Points

- For the fiscal year ended March 2019, sales and operating income increased 0.9% and 152.6% year on year, respectively. HUGALL business channels (department store purchasing desks) were narrowed down, the company refrained from opening new stores (only 4 stores opened in the last two terms) and closed 28 unprofitable stores in the last two terms. Authority for store operations was transferred from the headquarters to regional sales departments, and operating costs were lowered (from 60.3% in FY 3/2016 to 57.8% in FY 3/2019). The results of these efforts are beginning to pay off. The dividend is to be 15 yen/share, up 5 yen/share.

- Sales and operating income for the fiscal year ending March 2020 are forecast to rise 2.7% and 16.1% year on year, respectively. While steady growth in existing stores is expected, sales will also increase due to new store openings and direct management of franchised stores. In addition to the effects of sales growth, the HUGALL business is expected to be profitable in the year. The company will open new stores, refurbish existing stores, and make prior investment in IT systems; but these costs will be offset and operating income margin will continue to rise. The dividend is to be 18 yen/share, 3 yen/share higher (with expected payout ratio of 26.2%).

- Efforts under the 2 core business strategies; “upgrading individual stores” and “using all the BOOKOFF group strength”, have been successful. The company emphasizes accuracy in its performance forecasts, but sales exceeded the second upward revision in FY 3/2019. Sales strategies involved creating stores that are closely linked to the community, and utilizing reviews received from the book review community website (operated by a subsidiary). These strategies were successful, and sales of books (the company has the largest stock of books in Japan) recovered faster than expected. We would like to keep an eye on the company’s future development as they move out of the recovery stage and into a growth stage.

1. Company Overview

The company runs a group of the largest reuse chain stores that has expanded its reuse business into various fields, including books, CDs, DVDs, games, apparel, sporting goods, baby goods and miscellaneous goods. It has more than 800 (directly managed + franchised) store network covering all over the country. Also they pursue synergies between “reuse at physical stores” and “reuse at online stores.”

[Corporate philosophies of the BOOKOFF Group]

・Contributing to society through our business activities

・The pursuit of employee’s material and spiritual wellbeing With these corporate philosophies, the BOOKOFF Group has made efforts towards the reuse of various items, with a focus on the purchase and sale of books. By doing so, they have nurtured the brand, the store network, and human resources, which in turn have become the Group's strength. With their mission “Being a source of an enjoyable and prosperous life for many people “, they aim to be a leading company in the reuse business, and a company where people can grow and work with peace of mind, confidence, and passion.

[Efforts towards diversity]

The company believes that “employees are the greatest asset” and that “developing skills and intelligence of human resources will directly lead to growth of the company.” They strive to improve the work environment by utilizing the strengths of each employee, both male and female; and to provide opportunities for employee to develop their skills and fulfill themselves. As part of this, a region selection system was implemented in October 2014, allowing employees to work within a specific area. In addition, under the “married couple transfer system,” employees who are married couples may transfer to a store near their spouse’s workplace.

The BOOKOFF Group also makes an effort to provide employment for persons with disabilities, and they established B-Assist, Inc. in October 2010 (which was recognized as a special subsidiary under the Employment Promotion Act for Persons with Disabilities in December 2010). The company provides employment opportunities and an environment where disabled persons who are capable of working can do so not as “welfare” but as “part of everyday business activities.” There are currently more than 100 persons with disabilities working in and contributing to the BOOKOFF Group.

Business Description

The company’s reported business segments are; the Reuse Store business, BOOKOFF Online business which operates the E-commerce (EC) site “BOOKOFF Online” and the HUGALL, which provides purchasing and trading services for the wealthy class at major department stores. They also manage new bookstores, a book review community website, and other various businesses.

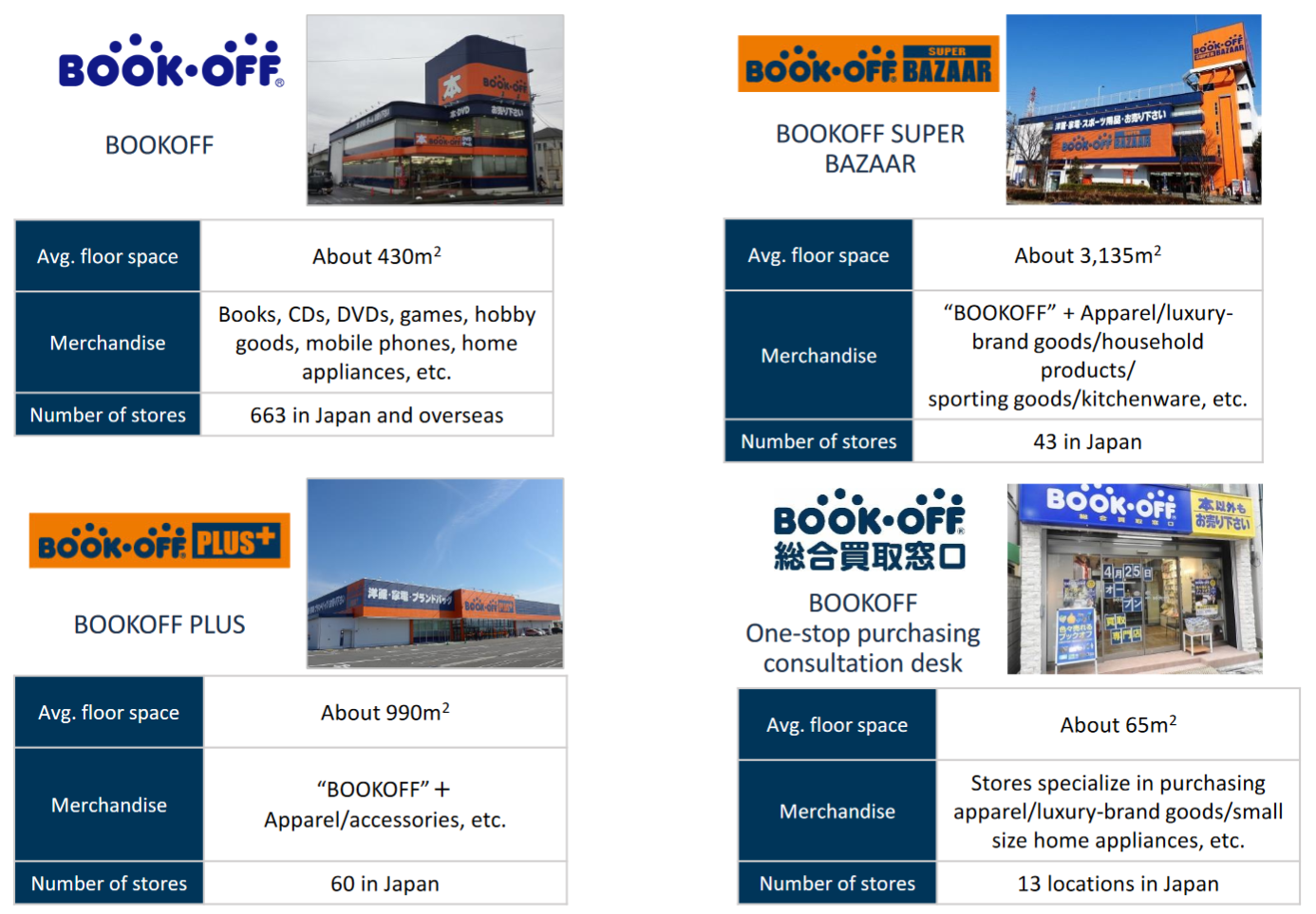

Reuse Store BusinessAs the chain headquarter of the reuse stores “BOOK・OFF” for books, software and more, the company operates the franchise (FC) system and directly managed stores. There are three types of directly managed stores;1)“BOOK・OFF” (books, CDs, DVDs, games, electronics and mobile phones, etc.), 2)“BOOK・OFF PLUS” (a medium-sized complex BOOKOFF with apparel & brand-name goods), and 3) “BOOK・OFF SUPER BAZAAR” (a large-sized complex BOOKOFF with a wide variety of commodities; books, software, electronics (audio and visual devices, computers, etc.), apparel, sporting goods, baby goods, watches, brand bags, jewelry, tableware and miscellaneous goods).

Its main subsidiaries, Booklet Co. Ltd., BOOKOFF-With Co., Ltd, BOOK・OFF Okinawa Inc., Reuse Connect Co., Ltd and Manas Co., Ltd operate “BOOKOFF” stores in Japan. BOOKOFF-With Co., Ltd operates reuse stores for apparel, baby goods and others, besides BOOKOFF stores. BOOKOFF-With is also a franchisee of a reuse chain store, “Kingram,” which handles watches, brand bags and jewelry. Also, Booklet , BOOKOFF-With and BOOKOFF Okinawa operate reuse stores for apparel and more.

As for overseas business operation, BOOK・OFF U.S.A. INC. runs “BOOK・OFF” stores in the United States, BOK MARKETING SDN.BHD runs “Jalan Jalan Japan” in Malaysia, and SCI BOC FRANCE leases real estate owned in France.

2. Fiscal Year March 2019 Financial Results

| FY 3/18 | Ratio to sales | FY 3/19 | Ratio to sales | YOY | Revised forecasts (3Q) | Difference from the forecast |

Sales | 80,049 | 100.0% | 80,796 | 100.0% | +0.9% | 80,500 | +0.4% |

Gross profit | 46,994 | 58.7% | 48,235 | 59.7% | +2.6% | - | - |

SG&A expenses | 46,381 | 57.9% | 46,684 | 57.8% | +0.7% | - | - |

Operating income | 613 | 0.8% | 1,550 | 1.9% | +152.6% | 1,500 | +3.3% |

Ordinary income | 1,092 | 1.4% | 2,120 | 2.6% | +94.0% | 2,000 | +6.0% |

Profit attributable to owners of parent | -889 | - | 2,172 | 2.7% | - | 1,700 | +27.8% |

*Unit: million yen

Sales and operating income increased 0.9% and 152.6% year on year, respectively.

Sales increased 746 million yen to 80,796 million yen. Despite the strong performance of the company’s EC business, the combined sales of the BOOKOFF Online and HUGALL businesses fell 700 million yen due to the withdrawal of event sales in the HUGALL business in the previous term. Closing their new bookstores and other factors also caused sales to decrease 400 million yen, but sales in the Reuse Store business climbed 1,800 million yen due to strong sales at existing stores and the new opening of large format stores and consolidation of subsidiaries in the previous term.

Operating income rose 936 million yen to 1,550 million yen. Profit from the Reuse Store business increased 240 million yen due to strong sales at existing stores, and the combined profit from the BOOKOFF Online and HUGALL businesses augmented 370 million yen due to strong sales of EC and reducing losses by withdrawing from unprofitable business channels in HUGALL business in the previous term. Other profits (company-wide profit and adjustments) also increased 310 million, due to a decrease in taxes and public dues for the reorganization of the Group. The company posted an extraordinary loss of 500 million yen, including an impairment loss of 270 million yen. However, due to the rebound from last term’s extraordinary loss of 1,250 million yen (including an impairment loss of 1,100 million yen) and tax effect accounting associated with the reorganization of the Group (corporate tax, etc.: from 780 million yen to negative 410 million yen), net income was 2,172 million yen, exceeding ordinary income.

Trends by segment

| FY 3/18 | Composition ratio | FY 3/19 | Composition ratio | YoY |

Reuse Store | 70,565 | 88.2% | 72,444 | 89.7% | +2.7% |

BOOKOFF Online + HUGALL | 8,211 | 10.3% | 7,506 | 9.3% | -8.6% |

Others | 1,272 | 1.6% | 845 | 1.0% | -33.6% |

Consolidated sales | 80,049 | 100.0% | 80,796 | 100.0% | +0.9% |

Reuse Store | 3,419 | 4.8% | 3,666 | 5.1% | +7.24% |

BOOKOFF Online + HUGALL | -665 | - | -289 | - | - |

Others | -114 | - | -52 | - | - |

Adjustment | -2,026 | - | -1,773 | - | - |

Consolidated Operating Income | 613 | +0.8% | 1,550 | +1.9% | +152.8% |

*Unit: million yen

Number of stores at the end of the term

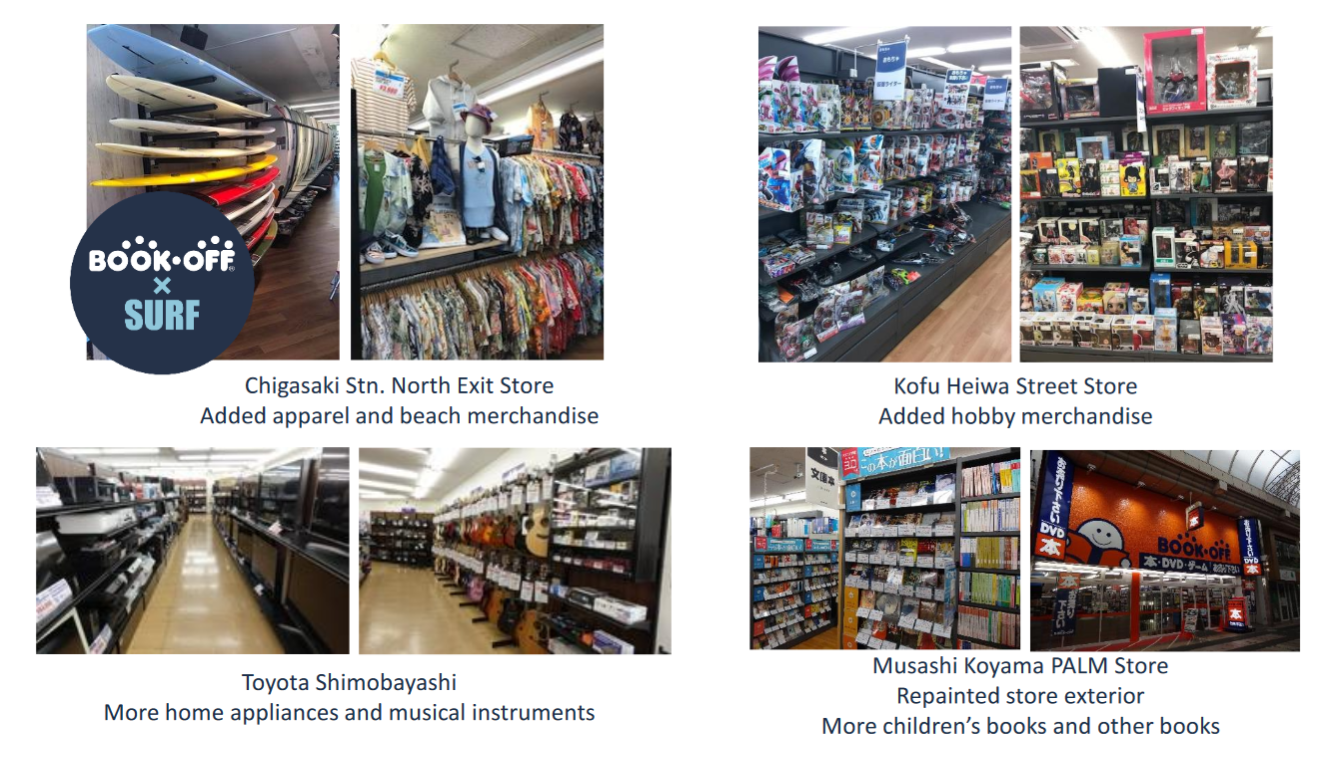

At the end of FY 3/2019, there were 780 stores in Japan (including BOOKOFF: 663; BOOKOFF PLUS: 60; and BOOKOFF SUPER BAZAAR: 43). In addition to the scheduled opening of 1 large-scale domestic store and 6 general purchase desks, the company also refurbished the interiors and exteriors of 69 directly-managed stores in Japan, and added merchandise to each store matching the characteristics of that area. 28 stores were closed over the 3/2018 and 3/2019 terms. There are 14 overseas locations (9 in the United States, 2 franchises in France and 3 in Malaysia).

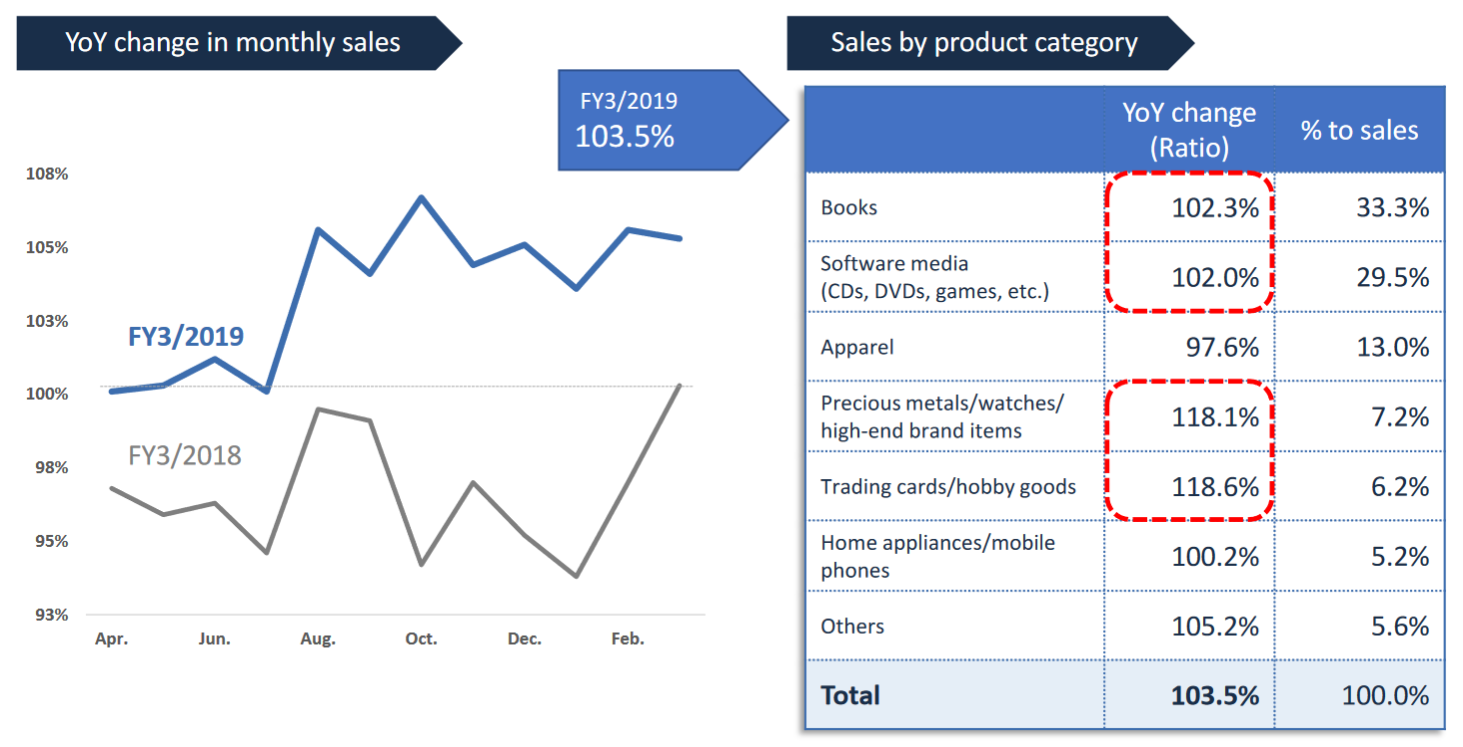

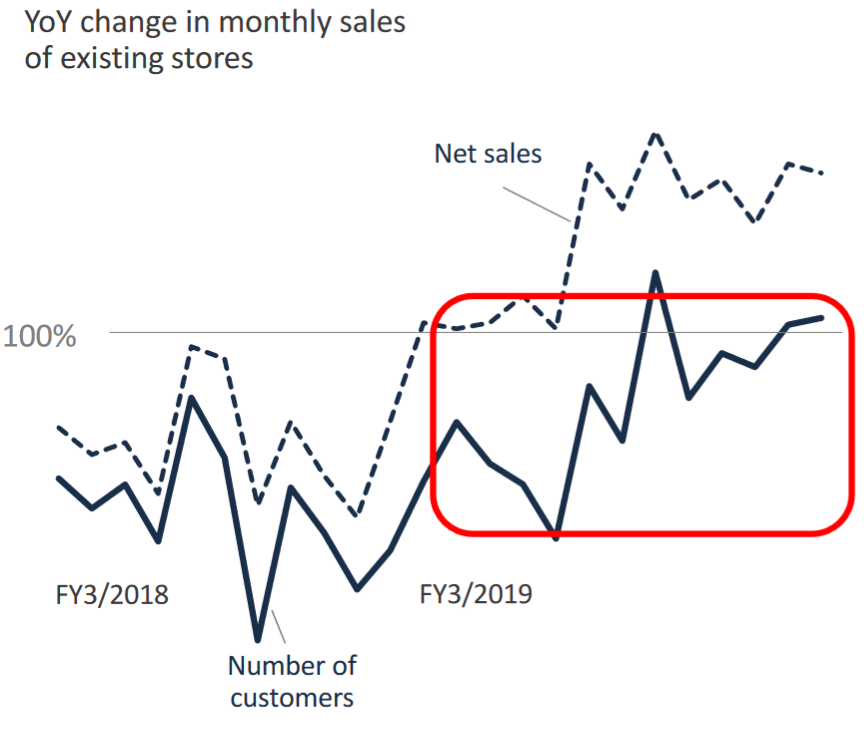

Reuse Store Business: Status of existing directly managed stores

Monthly sales for existing stores in this term exceeded all those of their corresponding months in the previous term, and sales for the entire term were 103.5% of the previous year. Jewelry, watches, high-end brand items, trading cards, and other hobby-related goods sold well, thanks to improved merchandise handling based on each store’s regional characteristic. Books and soft media (which account for a large portion of sales) also outperformed the previous year. Also, in order to make stores simpler, easier to navigate, more convenient, and give them greater value, the company launched the “BOOKOFF App,” combining store members and E-commerce members for a total of 500,000 members at the end of FY 3/2019.

Financial Condition and Cash Flow

Financial Conditions

| March. 2018 | March. 2019 |

| March. 2018 | March. 2019 |

Cash | 13,860 | 6,142 | Income Taxes Payable | 666 | 135 |

Inventories | 12,949 | 12,958 | Interest-bearing liabilities (Including lease obligations) | 26,016(1,694) | 18,924(1,507) |

Current Assets | 31,430 | 23,765 | Liabilities | 34,580 | 27,640 |

Investments and Others | 8,644 | 9,744 | Net Assets | 13,307 | 13,006 |

Noncurrent Assets | 16,458 | 16,882 | Total Liabilities and Net Assets | 47,882 | 40,647 |

*Unit: million yen

Total assets at the end of the term were 40,647 million yen, down 7,235 million yen from the end of the previous term. Cash and deposits, interest-bearing debt and net assets decreased due to a 7,700 million-yen advance redemption of bonds with share options, retirement of treasury shares (September 28, 2018, 2,025,785 shares), and acquisition of treasury shares (November 13, 2018, 3,100,000 shares; 2,343 million yen). While significant decrease in cash and deposits, combination of decline in interest-bearing debt and increase in operating CF, caused CF ratio fell from 9.1 in the previous term to 6.3. Equity ratio rose from 27.5% to 31.6%, and financial leverage approached reasonable levels.

Cash Flows (CF)

| FY3/18 | FY3/19 | YOY | |

Operating cash flow(A) | 2,668 | 2,751 | +82 | +3.1% |

Investing cash flow (B) | -940 | -559 | +381 | - |

Free cash flow(A+B) | 1,727 | 2,192 | +464 | +26.9% |

Financing cash flow | -3,394 | -9,895 | -6,500 | - |

Cash and Equivalents at the end of term | 13,860 | 6,142 | -7,718 | -55.7% |

*Unit: million yen

Ended the capital tie-up with Yahoo Japan Corporation and acquisition of treasury stock

Through business partnerships with Yahoo Japan, such as collaborative buying, the company became the top store in Yahoo-auction site. Both companies were able to see the fruits of their efforts to create an infrastructure for the reuse lifestyle. Based on these results, the capital tie-up with Yahoo Japan was dissolved in November 2018 (the capital tie-up began in 2014) to allow each company the flexibility to respond to changes in the business environment and promote individual growth strategies. The collaboration in the reuse business is still in place.

3. Growth Strategy

The company’s two core growth strategies are “upgrading individual stores” (store management and merchandise) and “using all the BOOKOFF Group strength” (attracting customers and improvement of IT systems). To “upgrade individual stores”, the company will continue to work on creating unique stores and altering the organization to promote the delegation of authority. The company has refrained from opening new stores, but will start opening new stores actively. As for “using all the BOOKOFF Group strength”, under the “one BOOKOFF” tactics, the company will promote “Omni-channel O2O” using E-commerce, while also strengthening HUGALL, a purchasing and trading service for wealthy class. As an exit strategy, they will also work on overseas business development, particularly in Malaysia, which supports the BOOKOFF way of thinking positively regarding buying and trade-ins in Japan.

Developing individual stores

Continue creating unique stores

During FY 3/2019, the company will continue to renew and add merchandise to the 69 directly-managed stores based on the characteristics of each area.

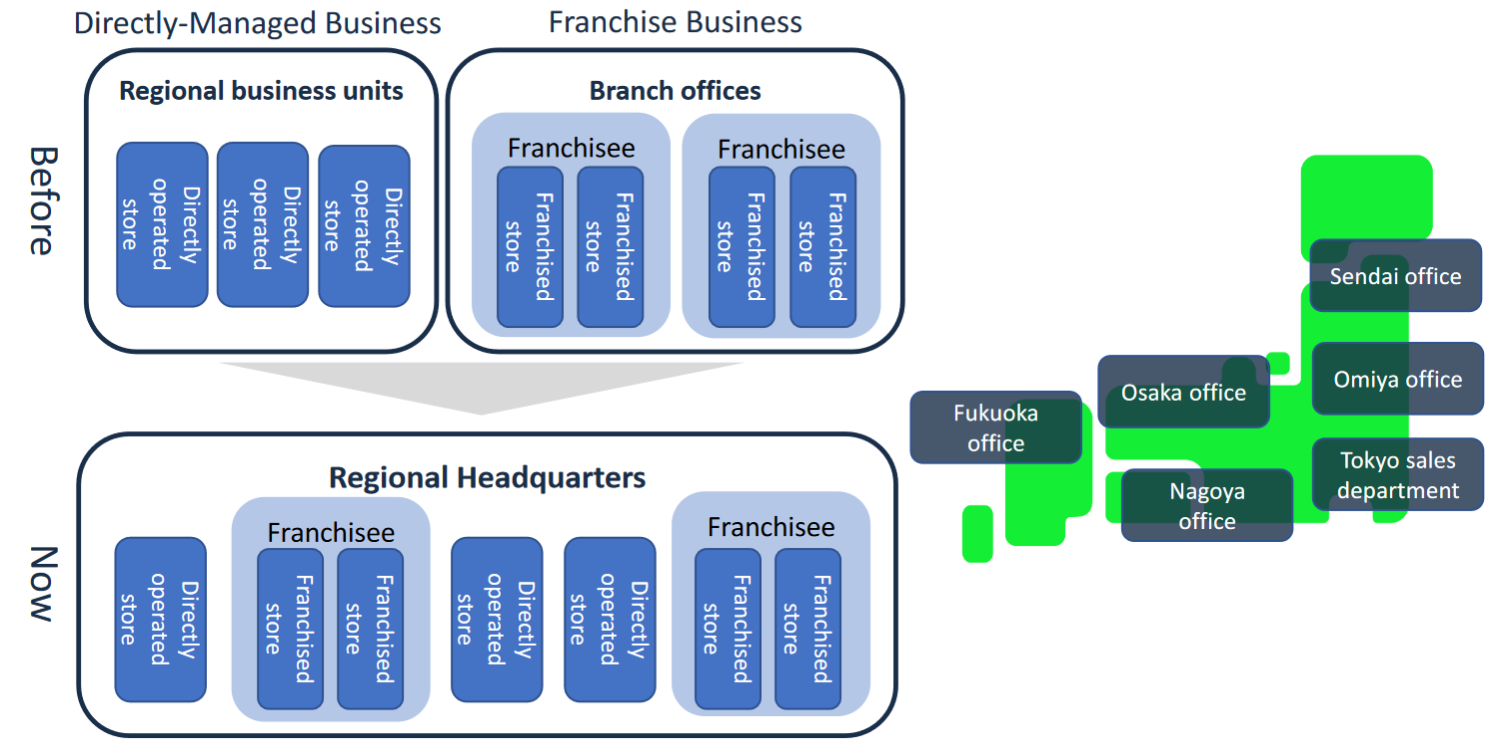

Changing the organization to promote the delegation of authority

The company will give more authority to each area branch so that closest decisions can be made to the customers they affect, thus giving a sense of speed to the policy. They will also integrate management for directly-managed stores and franchises in each area by promoting exchange of knowledge and human resources between them.

Actively opening stores

The company will open both large suburban stores and small comprehensive stores in city centers. The large suburban stores are large-scale, comprehensive reuse stores with an area of 1,650-3,300 square meters, able to attract customers with an abundant inventory and merchandise lineup. The company plans to open 4 to 5 of these stores per year, focusing on major urban areas in Japan. The small comprehensive stores in city centers will employ professionals to take care of customers and assess the buying price at a purchase counter. These stores will buy and sell not only books and software, but a variety of other merchandise as well. The company plans to open 7 to 8 small stores in FY 3/2020, with the goal of growing the current 13 locations into 50 locations as soon as possible.

"Using all the BOOKOFF Group strength”

By providing a good shopping experience through E-commerce and electronic purchasing, and by utilizing smartphone applications to create opportunities for members to revisit the shop, the notion of “selling” becomes more familiar, and people can enjoy a reuse lifestyle, maximizing LTV (customer lifetime value). The company’s plan for this is shown below.

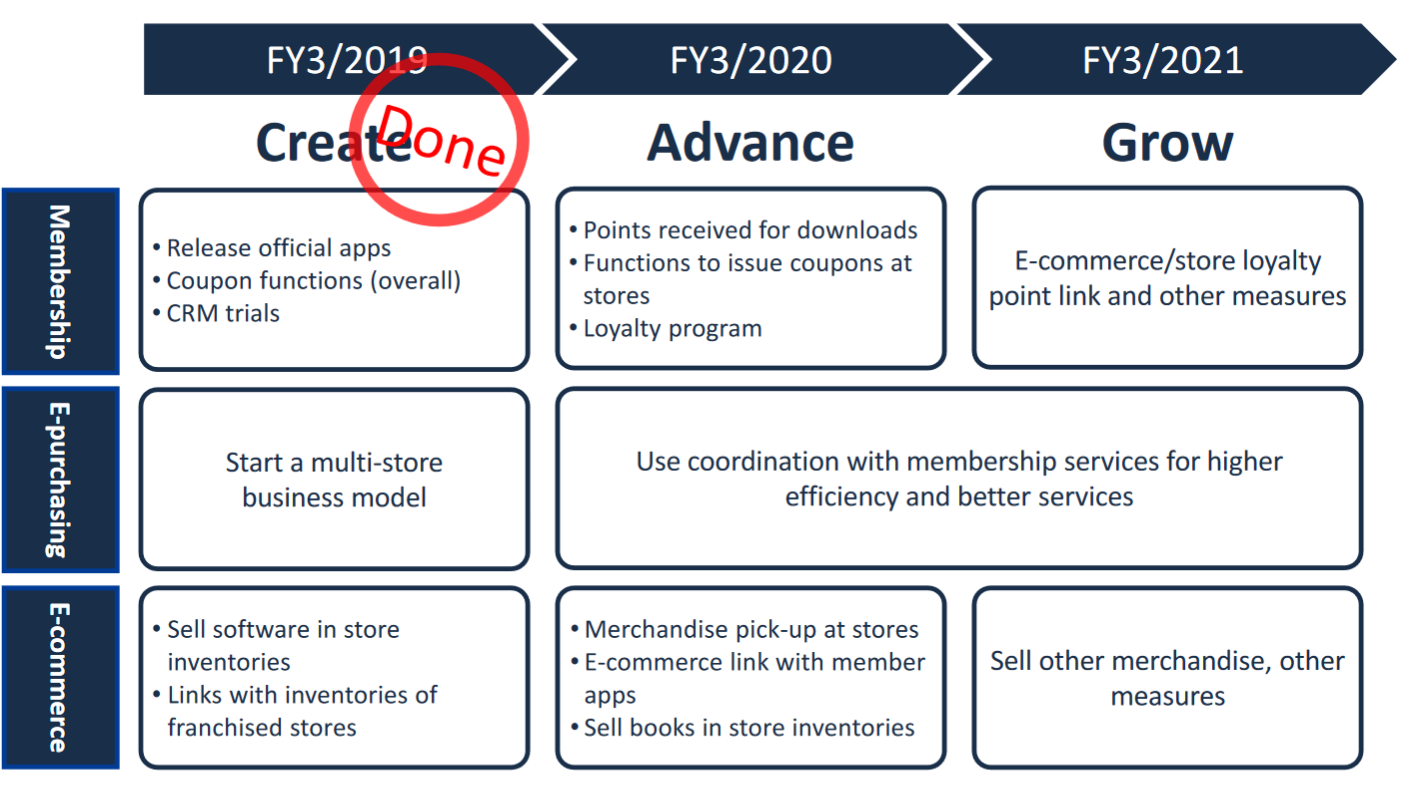

In FY 3/2019, under “Create” period, their measures for membership growth progressed smoothly, with the number of smartphone application members exceeding 500,000 at the end of the term. The development schedule for additional functions has also been decided, and the functions will be added one after another. In “Electronic Purchasing,” IT systems were introduced to all directly-managed stores, and have begun to be introduced to franchises as well. For “E-commerce,” several trials have started with software products. Using the online sales channel and the nationwide store network, the company will develop an “Omni-channel O2O” that delivers to all users in an optimal way.

Also, with regard to strengthening HUGALL, the company will expand their active event promotion to include other department stores in addition to the 5 existing major department stores (Nihombashi Mitsukoshi, Nagoya Mitsukoshi Sakae, Isetan Urawa, Omiya Takashimaya, and Daimaru Umeda).

Overseas strategy

The company operates in the United States, France, and Malaysia. There are 9 directly-operated BOOKOFF stores in the United States, 2 franchise in France and 3 Jalan Jalan Japan stores in Malaysia. Product lineups that meet the needs of the local area, and knowledge cultivated in Japan for managing stores and developing human resources are both highly evaluated overseas. In both the United States and France, books and soft media bought from local customers are the main products, but some stores are also focusing on hobby items.

The company entered the Malaysian market in 2016 and opened its fourth store this May. They have released a Malaysian original package called “Jalan Jalan Japan.” The package focuses on selling products that were not sold locally in Japan, and supports the BOOKOFF way of thinking regarding buying and trade-ins in Japan as being a viable group exit strategy. The store concepts of “Preloved in Japan,” “large amounts of goods,” and “low prices” match local needs, and business performance is strong. The company will strive to expand their network of stores while developing human resources.

Performance target

The targets for the fiscal year ending March 2023 are “3 billion yen in ordinary income, a ROA (ordinary income to total assets ratio) of 6.5% or more and an interest-bearing debt-to-operating CF ratio of 5.0x or less”. Based on the core business strategies of “upgrading individual stores” and “using all the BOOKOFF Group strength”, the company will establish their goals during the first two years, and reap the rewards during the second two years. They also plan to raise ROE by improving capital efficiency while maintaining a reasonable amount of capital leverage.

In addition, a total investment of 10 billion yen is planned during the four years from FY 3/2020 to FY 3/2023. In each term, 1 billion yen will be used for opening new stores such as BOOKOFF SUPER BAZAAR and comprehensive reuse stores, and 600-800 million yen for improving distribution and for the refurbishment and repair of existing stores. A further 1 billion yen will be used to build the “One BOOKOFF” system, reinforce the price database, update equipment, and introduce a next-generation operating system (the yearly total will be between 2.6-2.8 billion yen).

4. Fiscal Year March 2020 Financial Forecast

The company will leave the recovery period and aim for a steady increase in profits. In addition, they will aggressively invest into future growth. In terms of business, the company will continue to revitalize stores in each region by giving them more authority (develop individual stores) and work on the realization, penetration, and expansion of “One BOOKOFF.” They will also aim for year-round profitability of HUGALL and take on new challenges. For organization and human resources, the company will work on integrating directly-managed stores and franchises, based on the regional branch system. At the same time, they will expand the human resource training budget to support employee growth and enrich the contents of the training.

| FY3/19 Results | Ratio to sales | FY 3/20 Forecast | Ratio to sales | YOY |

Sales | 80,796 | 100.0% | 83,000 | 100.0% | +2.7% |

Operating income | 1,550 | 1.9% | 1,800 | 2.2% | +16.1% |

Ordinary income | 2,120 | 2.6% | 2,300 | 2.8% | +8.5% |

Profit attributable to owners of parent | 2,172 | 2.7% | 1,200 | 1.4% | -44.8% |

*Unit: million yen

Sales and operating income are forecast to rise 2.7% and 16.1% year on year, respectively.

Sales are forecast to increase 2.7% year on year to 83 billion yen, thanks to the revitalization of existing stores through continuous investment, the opening of new stores, and direct management of franchised stores. Although net income will fall 44.8% to 1.2 billion yen because of many temporary factors influencing business performance in the previous term, it is expected that HUGALL will be profitable for the full fiscal year, and that the company will be able to offset costs related to investment into IT for the realization of “one BOOKOFF,” phasing out Windows 7, increased consumer tax, and reduced tax rates. As a result, operating income (which is forecast to increase 16.1% to 1.8 billion yen) and ordinary income (forecast to increase 8.5% to 2.3 billion yen) will maintain an upward trend.

Sales in existing directly-managed stores are expected to be 100.5% of the previous term. The company plans to refurbish around the same number of stores as they did in Fiscal 3/2019 (69 stores). New stores will be opened, including 4 BOOKOFF SUPER BAZAAR stores and 7-8 BOOKOFF comprehensive reuse stores. Additionally, 9 other franchised stores will be acquired and directly managed instead (resulting in the number of franchises decreasing).

Issues and initiatives

In the reuse store business, the number of customers down needs to be dealt with. Throughout the year, monthly sales in existing stores were greater than those of their corresponding months in the previous term, but the monthly number of customers was generally lower.

In FY 3/2020, as a promotion plan for bringing customers to the store, the company will continuously run campaigns to acquire members for the smartphone application, and other periodical campaigns. They will aim to raise awareness of the slogan “BOOKOFF: More than just books” with a television commercial featuring famous child actor Kokoro Terada promoting products other than books. Promotion of the smartphone application is expected to lead to more visits to the store, enhancing a point management system, push notifications, and a store location function. The goal is to reach 1 million members by the end of September 2019. Periodical campaigns and PR activities will be conducted at times when large numbers of customers can be expected, such as around New Years’ holiday and Golden Week, as has been done in the past.

Shareholder return

The dividend is to be 18 yen/share, an increase of 3 yen/share. The estimated payout ratio is 26.2%. The company recognizes profit sharing as one of the most important matters in management, and while aiming to increase dividends by improving performance, they make effective use of profits for strategic investment aimed at strengthening the financial position and future business foundation. The company intends to pay stable dividends backed by business results, aiming for a payout ratio of around 25%.

5. Conclusions

Results of developing individual stores already visible

In FY 3/2019, sales in existing stores increased to 103.5% of the previous term, due to a rise in unit prices. In addition to a rise in the sales composition ratio of high price items, the unit price of “books” (which at 34% accounts for the largest portion of sales), also increased. These are both the results of the business strategies to “upgrade individual stores;” creating stores according to the characteristics of that region. However, “books,” which includes printed books with a high unit price such as comics, was also influenced by the policy to “make all-out efforts.” The company was able to use impressions and reviews of books posted on a community book review website run by subsidiary Booklog, Inc. to boost book sales at stores.

According to the company's data (Source: Article contributed by Mr. Takaya Toukodou, a website publishing consultant for Japanese Writers Promotion Center website), the number of regular readers in Japan is estimated to be about 50 million people. In addition, according to the “National Language Opinion Poll” by the Agency for Cultural Affairs in Fiscal 2013, 84% to 89% of women and 69% to 76% of men aged teens through forties responded “Yes” to the question “Do you want to read more?” Based on the results of these surveys, the company believes that “there is a persistent need for reasonably priced books,” and in FY 3/2019, they succeeded in realizing potential demand by pursuing store development. Although sales of “books” do not grow quickly, there is believed to be a large room for improvement in sales, such as by using devices that can immediately display where a desired book can be found.

Although not all refurbished stores have been successful, the fact that there was an overwhelming number of successful ones was reflected in existing store sales. However, what is even more important than these results are that motivation has improved at each store, and staff are “creating sales opportunities of their own volition.” The company wants to “maintain a high level of awareness by continuing this effort.” By doing so, they intend to accumulate and share knowledge, using it when opening new stores and for efforts regarding franchises, who are important business partners.

Using all the BOOKOFF Group strength: Progress of the “One BOOKOFF” tactics

The “one BOOKOFF” tactics involves taking the member policies, electronic purchasing, and systems for utilizing E-commerce that were created in FY 3/2019, will work on their implementation during FY 3/2020, and will complete the system in FY 3/2021, expanding the number of target stores and products handled. As part of this, the company began selling with “Omni-channel O2O” by utilizing E-commerce for software products. Customers can search for CD they want on the BOOKOFF website, then purchase it from a nearby store if it is in stock or purchase it online if the store is farther away. As of May, it is possible to check the stock at 50 stores. In the future, this number will be increased, and it will be possible to check store stocks from the smartphone application as well as from the BOOKOFF website. In addition to preventing the loss of business opportunities, this will increase the inventory turnover rate, and the ability to sell items before having to reduce their price will also improve the profitability of each item.

The above investment will be completed in the first two years of the four-year plan, and in the final two years, the company plans to make investments into IT (such as updating cash register systems and automating operations) in order to achieve more efficient operations and improved productivity. They are planning to invest a total of 10 billion yen over a four-year period.

Message from President Horiuchi

We went through some tough times, but we were able to recover completely. We can also now see a clear path towards further growth; a path towards achieving an ordinary income of 3 billion yen. All of our employees will work together to achieve these goals, and we look forward to your continued support.

Efforts under the business policies of “developing individual stores” and “make all-out efforts” have been successful. In FY 3/2019, the company upwardly revised their business forecast once at the end of the second quarter, and again at the end of the third quarter, but by the end of the term, sales had exceeded the second upward revision.

Although the revisions were upward, the company is reflecting upon multiple revisions. They emphasize accuracy in their performance forecasts, but sales of books recovered faster than expected in FY3/2019 exceptionally. As mentioned above, the rise in book sales is not a temporary phenomenon, and represents a solid recovery. We would like to keep an eye on the company’s future development as they move out of the recovery stage and into a growth stage.

Reference: Corporate Governance

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 6 directors, including 4 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report:Updated on December. 25, 2018

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

[Principle 1-4]

In accordance with the “Regulations on Investment and Securities Management,” the company stipulates policy not to acquire cross-holding shares in principle. However, as an exception, it may hold shares of its franchise chain member companies. Regarding the exercise of voting rights of cross-holding shares, the company will examine the contents of the proposal carefully, conduct dialogue with the companies as necessary, and judge whether it will contribute to the improvement of shareholders’ value, and will exercise appropriately.

[Supplementary principle 4-2①]

The Company has a system in place for the compensation of directors and executive officers. Going forward, we will continue to consider introducing stock-based compensation in order to improve the relationship between long-term business results and shareholder value.

[Principle 4-11]

Currently, there are 2 internal directors, 4 outside directors (of which 3 are independent outside directors), 1 full-time corporate auditor, and 2 outside corporate auditors (of which 1 is an independent outside corporate auditor). The directors consist of experienced business executives, certified public accountants, persons with extensive business experience, and persons highly qualified in their field. The auditors consist of certified public accountants, lawyers, and persons coming from business companies. In particular, the outside directors and outside corporate auditors are persons with abundant knowledge and experience, and we consider the balance of members in a way that ensures stable and sustainable growth can be achieved. Due to the Group's overseas business ratio, we do not consider nationalities on the Board of Directors, but we do consider the gender ratio as a subject for further discussion.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

[Principle 4-9]

The Company has set criteria for determining the independence of outside directors and outside corporate auditors, and discloses this in the report on corporate governance. In addition, 3 of the Company’s independent outside directors have extensive knowledge in corporate management, marketing, and the publishing industry. Based on this specialized knowledge and abundant experience, they offer pertinent advice and opinions on management strategies, supervise important managerial decisions, and oversee conflicts of interest from an independent position.

[Supplementary principle 4-14②]

The Company holds at least one seminar per year on corporate governance and insider information, where all directors and corporate auditors participate in, led by legal professionals. The Company also bears the expense of external training for directors and corporate auditors as needed.

[Principle 5-1]

The company appoints an executive in charge of IR and designates the Corporate Planning Department as in charge of IR. For shareholders and investors, the company holds financial results briefings once in six months, and is conducting small meetings and individual interviews as needed. In addition, the company has established the IR policy and disclosed it on its website.

■IR Policy <Policy to promote constructive dialogue with shareholders>https://www.bookoffgroup.co.jp/ir/policy.html

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved.

For back numbers of Bridge Reports on BOOKOFF GROUP HOLDINGS LIMITED(9278) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/