Bridge Report:(9278)BOOKOFF GROUP the fiscal year ended March 2020

President Yasutaka Horiuchi | BOOKOFF GROUP HOLDINGS LIMITED(9278) |

|

Company Information

Market | TSE 1st Section |

Industry | Retail (commerce) |

President | Yasutaka Horiuchi |

HQ Address | 2-14-20 Kobuchi, Minami-ku, Sagamihara-shi |

Year-end | March |

HOMEPAGE |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥796 | 17,447,413 shares | ¥13,888 million | 1.9% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

- | - | - | - | ¥731.85 | 1.1x |

*The share price is the closing price on July 21. Number of shares issued is obtained by excluding the number of treasury shares from the number of shares issued at the end of the latest quarter. ROE and BPS are the actual value as of the end of the previous year.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2017 (Actual) | 81,344 | 116 | 588 | -1,159 | -56.41 | 10.00 |

March 2018 (Actual) | 80,049 | 613 | 1,092 | -889 | -43.31 | 10.00 |

March 2019 (Actual) | 80,796 | 1,550 | 2,120 | 2,172 | 112.19 | 15.00 |

March 2020 (Actual) | 84,389 | 1,428 | 1,898 | 240 | 13.77 | 6.00 |

May 2021 (Forecast) | - | - | - | - | - | - |

*The forecast is yet to be determined. Unit: Million yen or yen

*Since each fiscal year will end in May from now on, the fiscal year 2020 (the term ending May 2021) will be 14 months.

We present this Bridge Report reviewing the fiscal year ended March 2020 financial results and fiscal year ending May 2021 financial forecast of BOOKOFF GROUP HOLDINGS LIMITED.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2020 Financial Results

3. Fiscal Year ending May 2021 Financial Forecast

4. Medium Term Management Policy and Progress Status

5. Conclusions

<Reference: Corporate Governance>

Key Points

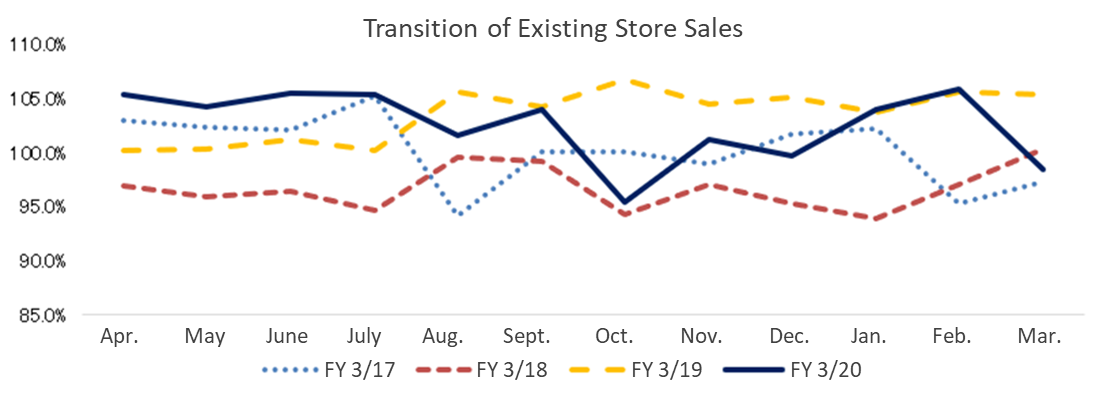

- For the fiscal year ended March 2020, sales increased 4.4% year on year while operating income decreased 7.8% year on year. Sales were favorable at existing directly managed stores in Japan (up 2.3% year on year). Also, sales rose due to the M&A impact and expansion of the HUGALL business. Nonetheless, operating income margin declined due to sluggish sales of apparel, which has a high profit margin, caused by the consumption tax hike and the effect of the warm winter, and the fact that more than half of the directly operated stores in Japan were temporarily closed during the typhoon in October 2019. The year-end dividend was 6 yen/share (payout rati 43.6%).

- Since the closing date of the fiscal year was changed to May 31, the fiscal year 2020 (the term ending May 2021) will be 14 months. In April and May, the majority of group-operated stores had to close all day or close on Saturdays, Sundays, and holidays due to the novel coronavirus crisis. Operations resumed gradually after the emergency declaration was lifted. Nonetheless, it is difficult to make a rational estimation at this point. Thus, the earnings forecast is undetermined. As soon as it becomes possible to disclose it, the company will announce it along with the dividend forecast. Meanwhile, the company celebrated its 30th anniversary in May 2020.

- Although the start of FY 5/21 was a difficult situation, it seems that the worst period has passed as the operations at all the stores are going back to normal. However, now they have to overcome the challenges that emerged in the FY 3/20. There are several challenges to tackle, but the main challenge is to accelerate the pace of increasing the number of app members. Although the omni-channel O2O strategy is progressing through the creation of attractive stores and the use of e-commerce, the number of customers continues to fall below the previous year’s level, and the results of their efforts have not fully materialized. There seems to be much room to cultivate member assets such as conventional card members (about 17 million) and e-commerce members of BOOKOFF Online (about 3.6 million). Thus, we will focus on future developments in these areas to overcome the challenge mentioned above.

1. Company Overview

The company runs a group of the largest reuse chain stores that has expanded its reuse business into various fields, including books, CDs, DVDs, video games, apparel, sporting goods, baby goods and miscellaneous goods. It has about 800 (directly managed + franchised) store network covering all over the country from Hokkaido to Okinawa. Also, they pursue synergies with “reuse at online stores”.

[Corporate philosophies of the BOOKOFF Group]

・Contributing to society through our business activities

・The pursuit of employee’s material and spiritual wellbeing

With these corporate philosophies, the BOOKOFF Group has made efforts towards the reuse of various items, with a focus on the purchase and sale of “books”. By doing so, they have nurtured the brand, the store network, and human resources, which in turn have become the Group's strength. With their mission “Being a source of an enjoyable and prosperous life for many people “, they aim to be a leading company in the reuse business, and a company where people can grow and work with peace of mind, confidence, and passion.

[Efforts towards diversity]

The company believes that “employees are the greatest asset” and that “developing skills and intelligence of human resources will directly lead to growth of the company.” Therefore, they strive to improve the work environment so each employee can utilize their strengths, and to provide opportunities for employee to develop their skills and fulfill themselves. As part of this, a region selection system was implemented in October 2014, allowing employees to work within a specific area. In addition, under the “married couple transfer system,” employees who are married couples may transfer to a store near their spouse’s workplace.

The BOOKOFF Group also makes an effort to provide employment for persons with disabilities, and they established B-Assist, Inc. in October 2010 (which was recognized as a special subsidiary under the Employment Promotion Act for Persons with Disabilities in December 2010). B-Assist, Inc. provides people with disabilities who are capable to work with employment opportunities and a suitable environment as part of "corporate activities" rather than "welfare" to support social participation and independence (BOOKOFF Group as a whole has employed more than 140 people with disabilities).

1-1 Business Description

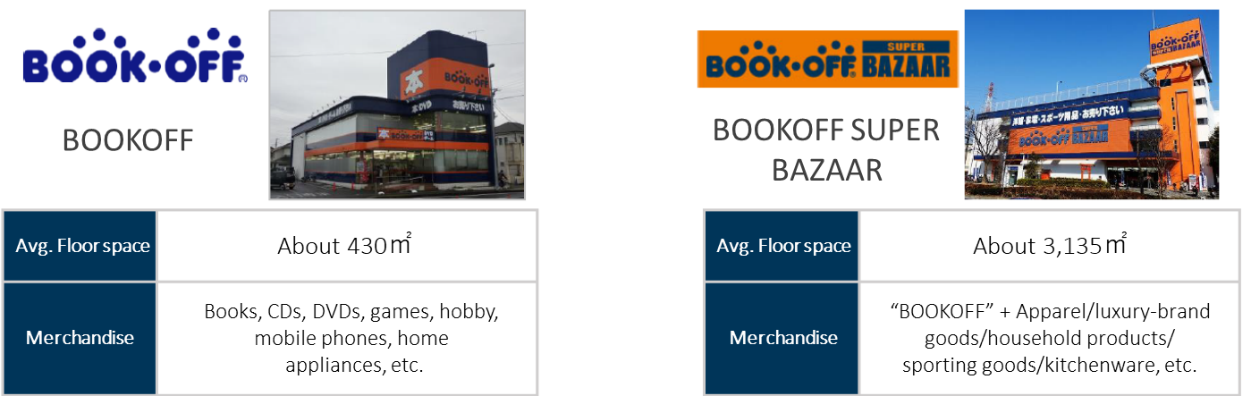

As the chain headquarter of the reuse stores “BOOK・OFF” for books, software and more, the company operates the franchise (FC) system and directly managed stores. There are three types of directly managed stores;1)“BOOK・OFF” (books, CDs, DVDs, video games, electronics and mobile phones, etc.), 2)“BOOK・OFF PLUS” (a medium-sized complex BOOKOFF with apparel & brand-name goods), and 3) “BOOK・OFF SUPER BAZAAR” (a large-sized complex BOOKOFF with a wide variety of commodities; books, software, electronics (audio and visual devices, computers, etc.), apparel, sporting goods, baby goods, watches, brand bags, jewelry, tableware and miscellaneous goods).

It also operates the E-commerce (EC) site “BOOKOFF Online”, HUGALL that provides purchasing and trading services for the wealthy class at major department stores, new bookstores, and book review community websites.

(Source: the Company’s material)

Book Off Group

Its main subsidiaries, Booklet Co. Ltd., BOOKOFF With Co., Ltd, BOOKOFF Okinawa Inc, Manas Co., Ltd and BOOKOFF Minami Kyushu, Inc. operate “BOOKOFF” stores in Japan. BOOKOFF With Co., Ltd operates reuse stores for apparel, baby goods and others, besides BOOKOFF stores. BOOKOFF With is also a franchisee of a reuse chain store, “Kingram,” which handles watches, brand bags and jewelry. Also, Booklet, BOOKOFF With and BOOKOFF Okinawa operate reuse stores for apparel and more.

As for overseas business operation, BOOKOFF U.S.A. INC. runs “BOOK・OFF” stores in the United States, BOK MARKETING SDN.BHD runs “Jalan Jalan Japan” in Malaysia.

The company entered the Malaysian market in 2016 and have released a Malaysian original package called “Jalan Jalan Japan.” The store concepts of “Preloved in Japan,” “large amounts of goods,” and “low prices” match local needs, and business performance is strong. It will focus on human resource development and work to further expand the store network. First, they want to establish a ten-store system within three to four years, and in their mid-term plan, they are also considering the acceptance of discarded products from competitors. The business in Malaysia is profitable, and it not only contributes to earnings, but also serves as an exit strategy for the Group (it sells products that could not be sold at stores in Japan locally). Domestic unsold products are disposed of as industrial waste. The Malaysian business leads reduction of disposal costs, and all stores are performing well. Store operations require securing a large number of products and operations to deal with a large number of products, making it difficult for other companies to develop similar businesses. As a result, this business is unique to the company, which boasts the best sales in the industry. In addition to the fact that Malaysian store managers are receiving training in management and other activities in Japan, Japanese employees of the manager class are dispatched to Malaysia to penetrate the management skills.

1-2 Initiatives to achieve SDGs

The act of selling and buying goods at BOOKOFF itself leads to the social contribution of extending the life of products and reducing the amount of waste. This plays a significant role in achieving the SDGs’ 12th goal, which is “responsible production and consumption.” In addition to these efforts, they will contribute to the achievement of SDGs through various activities centered on the reuse industry, which is the company’s core business.

| Reuse and recycle of old paper |

|

| Creating employment, providing high-quality products and apparel goods |

|

| Jewelry repair and succession for generations

|

|

| Supporting people with disabilities and creating employment |

|

| Partnerships with companies, governments, and NPOs |

|

(Source: the Company’s material)

2. Fiscal Year ended March 2020 Financial Results

2-1 Consolidated Results

| FY 3/19 | Ratio to sales | FY 3/20 | Ratio to sales | YOY | Estimate made in the 3Q | Comparison to estimate |

Sales | 80,796 | 100.0% | 84,389 | 100.0% | +4.4% | 84,000 | +0.5% |

Gross profit | 48,235 | 59.7% | 51,077 | 60.5% | +5.9% | - | - |

SG&A expenses | 46,684 | 57.8% | 49,648 | 58.8% | +6.3% | - | - |

Operating income | 1,550 | 1.9% | 1,428 | 1.7% | -7.8% | 1,400 | +2.0% |

Ordinary income | 2,120 | 2.6% | 1,898 | 2.2% | -10.5% | 1,900 | -0.1% |

Profit attributable to owners of parent | 2,172 | 2.7% | 240 | 0.3% | -88.9% | 900 | -73.3% |

* Unit: million yen

* Due to the unification of the methods in a group for recording expenses related to purchases, some expenses that were recorded as cost of sales until the third quarter of the previous fiscal year have been recorded as SG&A expenses in the current fiscal year (When the previous methods were applied, a gross profit margin of 59.1% and SG&A expense ratio of 57.4% were recorded).

Sales increased 4.4% year on year and operating income decreased 7.8% year on year

Sales increased 4.4% year on year to 84.3 billion yen. The sales of existing stores of BOOKOFF rose 2.3% year on year due to the enhancement of all the stores. Furthermore, HUGALL, which resumed aggressive development, the direct operation of nine franchise stores in the Kyushu area (May 2019), and making Jewelry Asset Managers Inc. a subsidiary (September 2019) contributed in the improvement of sales. The sales of existing stores of BOOKOFF rose 1.25 billion yen, of which about 900 million yen was via the Internet. As the number of smartphone app members exceeded 1.55 million, the effect of promotion using the omni-channel strategy at stores and e-commerce (online sales of store inventories) led to a 10.2% increase in group e-commerce sales (*) to 11.2 billion yen.

As for the profit, there was a company-wide cost reduction such as the improvement of HUGALL’s profit and loss, the reorganization of the Group. Nonetheless, operating income margin declined because of the sluggish apparel sales due to the consumption tax hike and the effects of the warm winter, as well as the impact of the typhoon in October 2019 (more than half of the directly managed stores in Japan were forced to close temporarily). Also, the strategic investments to promote the “One BOOKOFF” concept, such as PR measures (IT investment and TV commercials) and M&A expenses, were factors contributing to the decrease in the operating income margin.

As a way to further improve the efficiency of logistics functions, extraordinary losses of one billion yen were recorded, including a loss on disposal of fixed assets of 200 million yen due to the consolidation and abolition of distribution centers and an impairment loss of 500 million yen on stores owned by the Group. This resulted in the net income being limited to 200 million yen.

* Group e-commerce sales = “BOOKOFF Online” sales + BOOKOFF auction store’s sales at “Yahoo! Auctions” + Sales of directly managed stores via “BOOKOFF Online” + HUGALL ‘s e-commerce sales

Store development and investment

At the end of this term, the company had 404 directly managed stores and 397 franchised stores, a total of 801 stores (780 stores at the end of the previous term). As for directly managed stores, there are nine new stores in Japan and two Jalan Jalan Japan stores in Malaysia. The nine stores in Japan consists of five “BOOKOFF SUPER BAZAAR” stores (Route 5 Sapporo Miyanosawa Store, Ito Yokado Nagareyama Store, Himego store in Mito, Agro Garden Kobe Komagabayashi store, Route 25 Nagahata store in Yao), one “BOOKOFF” independent store (Hikifune store), three “BOOKOFF one-stop purchasing consultation desks” (Kyodo Nodai Dori Store, Hiroo Store and Yoga Station North Exit Store). As for repackaging, one directly managed store was shifted from being a “BOOKOFF” independent store to a “BOOKOFF PLUS” and three franchised stores were repackaged. Moreover, investment budgets were set for each region, and 97 stores were renewed. As for investments other than stores, in addition to streamlining operations in distribution warehouses, the company worked on expanding services for application members and developing electronic purchase systems for franchise affiliated stores to realize the “One BOOKOFF” concept. Also, the company is pushing forward the adoption of the omni-channel strategy, which used the e-commerce website “BOOKOFF Online” and further promotion of the O2O strategy.

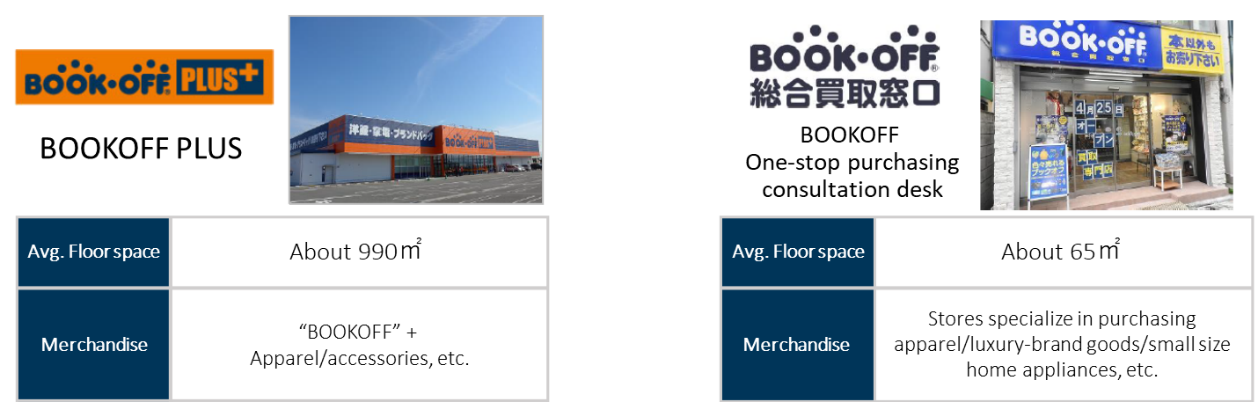

Sales of Existing Stores

| YOY | Ratio |

|

| YOY | Ratio |

Books | 100.1% | 32.4% |

| Home Appliances, Mobile phones | 97.1% | 4.9% |

Music | 98.8% | 7.0% |

| Apparel | 92.7% | 11.9% |

Videos | 106.1% | 9.9% |

| Precious Metals, Watches, High-end Brand Bags | 109.1% | 7.9% |

Video Games | 105.8% | 12.9% |

| Other | 111.9% | 6.1% |

Trading cards and Hobby related products | 112.4% | 7.0% |

| Total | 102.3% | 100.0% |

Full-year sales at existing directly managed stores in Japan exceeded the previous year at 102.3% year on year, despite the effects of natural disasters (95.3% in October) and the novel coronavirus (97.2% in March). As for sales by product category, the company maintained the sales of its mainstay products: books. Also, sales of precious metals, watches, high-end brand items, and trading cards and hobby related products, which the company is strengthening based on the regional characteristics of each store, performed well. Additionally, soft media (music, videos, and video games: 104.2%, composition rati 29.8%) also increased from the previous term. On the other hand, apparel sales were below the past year’s level due to factors such as weather and temperature.

2-2 Financial Condition and Cash Flow

Financial Conditions

| March. 2019 | March. 2020 |

| March. 2019 | March. 2020 |

Cash and Deposits | 6,142 | 6,094 | ST Interest-Bearing Liabilities (Lease Liability) | 9,990(348) | 10,180(417) |

Inventories | 12,915 | 13,129 | Current liabilities | 16,518 | 16,697 |

Current Assets | 23,765 | 23,704 | LT Interest-Bearing Liabilities (Lease Liability) | 8,934(1,159) | 9,239(1,181) |

Property, Plant, and Equipment | 5,932 | 6,273 | Fixed liabilities | 11,121 | 11,990 |

Intangible Assets | 1,204 | 2,003 | Net Assets | 13,006 | 12,848 |

Investments and Others | 9,744 | 9,553 | Total Liabilities and Net Assets | 40,647 | 41,535 |

Non-Current Assets | 16,882 | 17,830 | Total Interest-Bearing Liabilities (Lease Liability) | 18,924(1,507) | 19,419(1,598) |

Unit: million yen

Total assets at the end of this term were 41.5 billion yen, an increase of just under 900 million yen from the end of the previous fiscal year. This is due to the rise in non-current assets and liabilities due to new store openings, system investments, and M&A, including the transfer of franchised stores. Equity ratio was 30.7% (31.6% in the previous term).

Cash Flows (CF)

| FY3/19 | FY3/20 | YOY | |

Operating cash flow | 2,751 | 3,543 | +792 | +28.8% |

Investing cash flow | -559 | -2,744 | -2,185 | - |

Financing cash flow | -9,895 | -832 | +9,063 | - |

Cash and Equivalents at the end of term | 6,142 | 6,094 | -48 | -0.8% |

Unit: million yen

The company secured an operating CF of 3.5 billion yen through recording the income before tax of 900 million yen (1.7 billion yen in the previous year), depreciation and amortization of 1.5 billion yen (1.5 billion yen in the previous year), an impairment loss of 500 million yen (200 million yen in the previous year) and paying 500 million yen in income taxes (1 billion yen in the previous year). Investing CF was due to the acquisition of tangible and intangible noncurrent assets and M&A etc., and it was covered by operating CF. Financing CF was due to changes in interest-bearing liabilities and payment of dividends (redemption of bonds with stock acquisition rights was 7.7 billion yen in the previous fiscal year, and the purchase of treasury stocks was 2.3 billion yen). An interest-bearing debt-to-operating CF ratio was 5.1 (6.4 in the previous term), approaching the target of 5.0 in the medium-term management policy.

2-3 Main initiatives in FY 3/20

In the fiscal year ended March 2020, the company has passed the recovery period of its business, aiming for steady profit growth, and have made aggressive investments toward growth in the future. They continued their efforts under the growth strategies, “upgrading individual stores” and “using all the BOOKOFF Group strength,” which were set as part of the mid-term management policy. Under the growth strategy of “upgrading individual stores,” they delegated the authority and moved to integrated management of direct management and franchising centered on a regional branch system, enhanced the training programs, and worked to revitalize stores through the local authority. Furthermore, under the growth strategy of “using all the BOOKOFF Group strength,” they have been working on the realization, widespread, and development of the “One BOOKOFF” concept. Also, they worked to achieve full-year profitability of HUGALL and started new challenges through M&A.

Upgrading individual stores

Delegation of authority through organizational change

In all regions, they have shifted to a system in which they integrate the management of directly operated stores and guidance of franchised stores. Specifically, by strengthening the authority of the region and enabling decision making within the shortest distance from the users, the system helped in swiftly adopting necessary measures and promoting know-how and human resources exchange between directly managed and franchised stores.

Enhancing Training Programs

As for improving the training budgets and programs, they have developed more than 50 training programs not only on basic business etiquette, customer service, and product knowledge but also on strategic understanding and management training to enable unique product selection according to the regional characteristics of each store as well as taking the management to the next level.

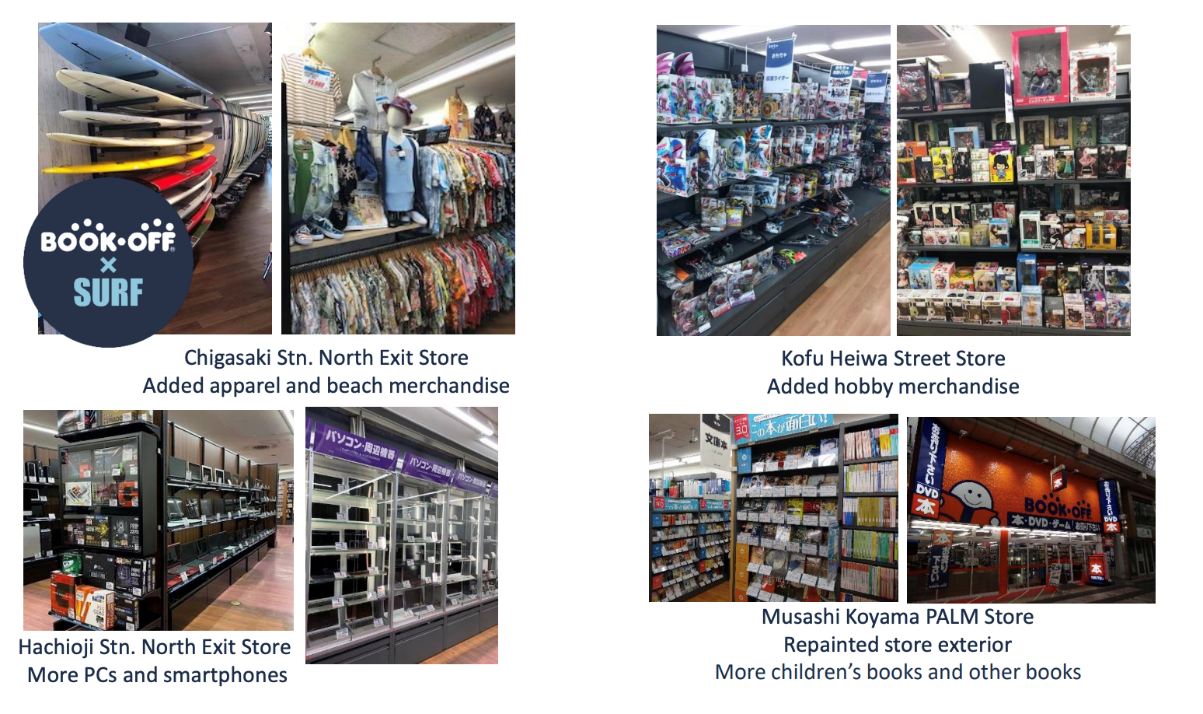

Store revitalization through the regional authority

They added and strengthened products that match regional characteristics and renewed the interior and exterior at 97 directly managed stores in Japan. For example, they added outdoor sports equipment to the Higashi Tokorozawa Store, which has many sports facilities around it and added hobby-related goods (animated goods) to the Yokohama Vivre Store and Yamato Tsukimino Store, which are often visited by children. They also set up a kids’ space at the Kitakyushu Tobata Ichieda Store, and strengthened sales of apparel and high-end brand items at the Jiyugaoka Stn. Store to accommodate the regional characteristics that are popular with women. Such efforts customized to each of the individual stores have produced results. As explained above, sales at existing directly managed stores in Japan exceeded the previous year at 102.3% year on year, despite the adverse challenges of stormy weather and the coronavirus crisis in the fiscal year ended in March 2020.

Using all the BOOKOFF Group strength

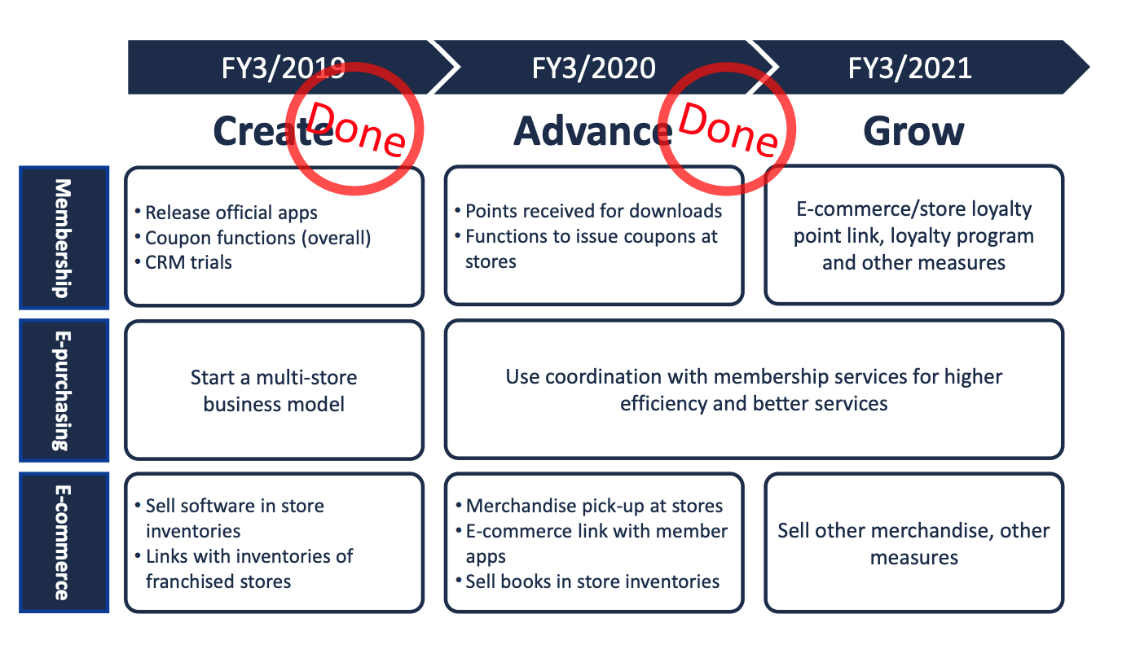

Realizing, spreading and developing the “One BOOKOFF” concept

The number of members of the smartphone app released in June 2018 reached 1.55 million at the end of March 2020. The purchase frequency and the amount of money used by the conventional card members who became smartphone application members have increased. Omni-channel strategy using the e-commerce website “BOOKOFF Online” and real stores has made it possible to sell in-store inventory at BOOKOFF Online. Thus, the number of directly managed stores and franchised stores adopting such strategies is currently expanding.

In the fiscal year ended March 2020, the Group’s e-commerce sales increased significantly due to the effect of linking “BOOKOFF Online” with store stocks. Nonetheless, as “BOOKOFF Online” is still less recognized than stores, there is much room for business expansion through improving the awareness of the website (According to Macromill Inc., the store’s user awareness is 96%. On the other hand, according to Rakuten Research, “BOOKOFF Online” user awareness is less than 20%).

(Source: The Company’s material)

Moreover, they are working to improve customer convenience and store productivity, eliminating waiting times in stores. They started offering a service where customers can receive the money (in return for their sold item) using Bookoff purchase points and smartphones that can receive cash through LINE Pay, au WALLET (au PAY), etc. Also, in addition to increasing the number of stores that have introduced an electronic purchase system, they have introduced a barcode settlement system.

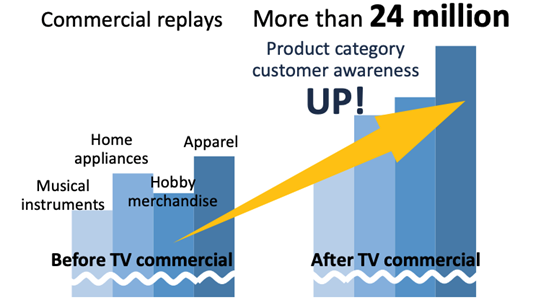

Additionally, as a measure to promote store visits (a measure to raise awareness of “book-off as a store selling not only books”), various promotions were carried out, such as TV commercials featuring TV personality Kokoro Terada and through SNS. It seems that this has contributed to the improvement of the awareness of products other than books, with a significant response centering on SNS and a number of video views exceeding 24 million times.

|

|

(Source: The Company’s material)

Monetization of HUGALL

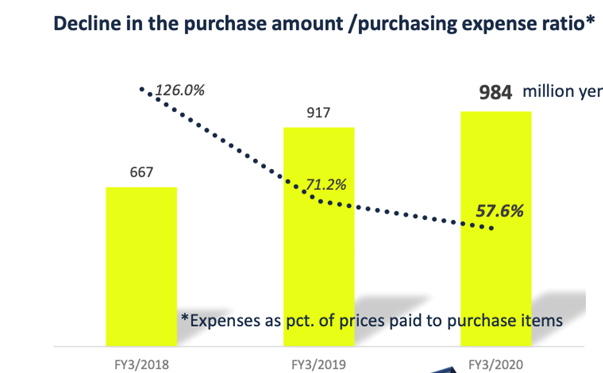

FY3/20, opening new stores at Daimaru Tokyo and Daimaru Ashiya and strengthening purchases at department stores compensated for the effect of closing the flagship Nihonbashi Mitsukoshi Store. The purchase amount increased 7.3% from 910 million yen in the previous term to 980 million yen. Also, the ratio of purchase costs decreased (71.2% → 57.6%) due to the efficiency improvement through the integration of distribution functions with the e-commerce department, which has been promoted since the previous fiscal year, and due to the effect of reviewing purchasing operations and distribution. These efforts led to achieving a full-year profit.

|

|

(Source: The Company’s material)

New Challenges

They acquired all shares of Jewelry Asset Managers Inc., in September 2019. Utilizing the company’s customer base, human resources, and know-how in repairing and remaking, it will become possible for the BOOKOFF Group to approach new customers and propose new services through offering repairing and remaking to existing customers. They are currently working on improving operations and establishing a system for group collaboration.

3. Fiscal Year ending May 2021 Financial Forecast

[Earnings forecast is undecided]

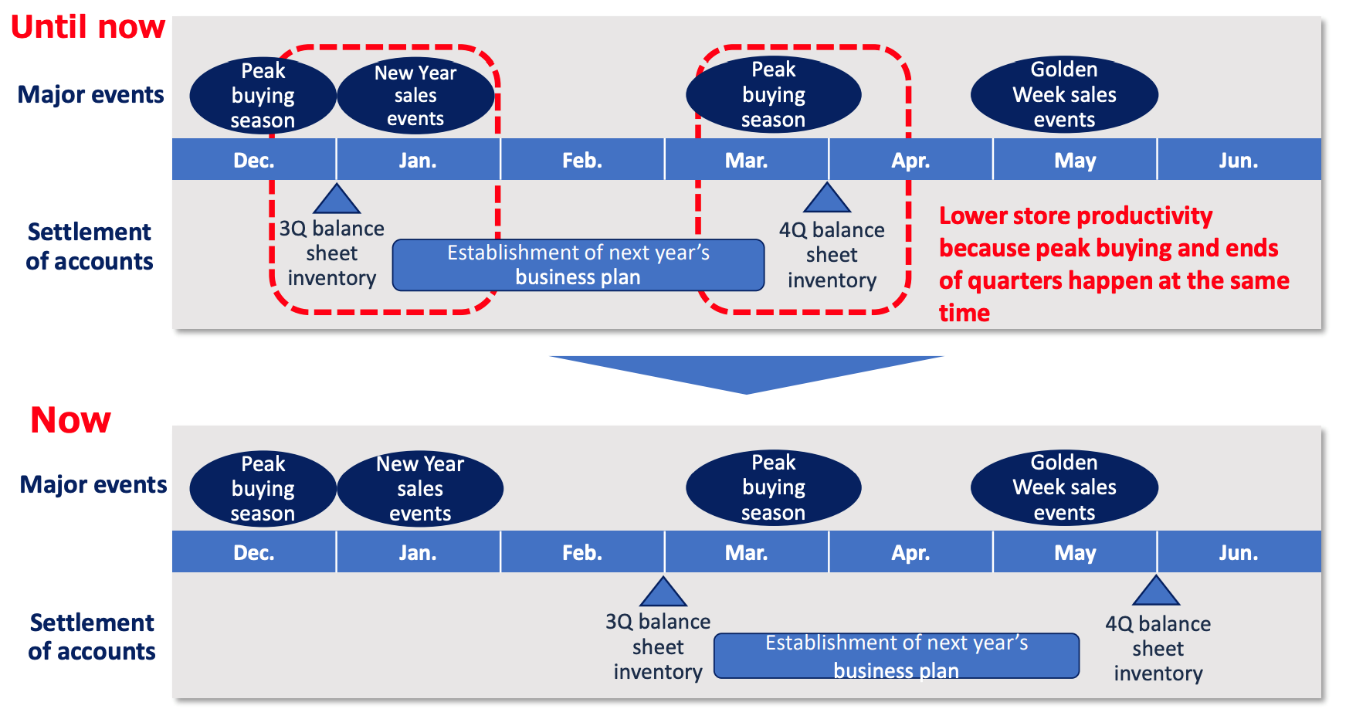

They changed the fiscal year period so that it will end on May 31 from now on. The company aims to maximize purchases and realize efficient business operations by shifting the fiscal year-end to avoid the busiest period from January to March. For this reason, the fiscal year 2020 will be the 14 months for the group and will end in May 2021.

Due to the spread of COVID-19, the majority of stores directly managed by the group, mainly in the areas and stores that were required to be closed, had to be closed all day or closed on weekends and holidays. Thus, sales of existing stores declined sharply in April (64.4%) and May (68.4%). Stores are reopening gradually since mid-May while reducing business hours and sales floor and paying the utmost consideration to prevent coronavirus infections. Also, the company is not worried about the cash flow for the time being because they are securing additional credit lines from financial institutions. However, at present, it is difficult to make rational earnings forecast for the fiscal year ending May 2021, so the earnings forecast has not been decided. As soon as the calculation is possible, they will announce it promptly along with the dividend forecast.

The company plans to pay a stable dividend based on the business performance, aiming for a dividend payout ratio of around 25% on a consolidated basis (FY 3/19: 15 yen per share and payout ratio of 13.4% and FY 3/20: 6 yen per share, and payout ratio of 43.6%).

(Source: The Company’s material)

3-1 The impact of COVID-19

The domestic BOOKOFF business has resumed operations sequentially from mid-May. However, existing directly managed stores, mainly for large stores, were profoundly affected by closures (Franchised stores, mostly small regional stores did not witness many closures, so the impact on royalty sales was limited). Also, HUGALL and Jewelry Asset Managers Inc. (JAM) were forced to close all stores temporarily because commercial facilities they occupy had been closed. Also, Overseas, all the stores in Malaysia and the USA, were forced to close temporarily. In each case, operations are being resumed gradually, but the impact on business results is inevitable.

On the other hand, for BOOKOFF Online, orders increased due to rising e-commerce needs, and the website sales in April and May (total of e-commerce center sales and directly managed store inventory sales via “BOOKOFF Online”) rose 18 % year on year.

Domestic BOOKOFF business conditions

Sales at stores continuing operations (existing directly managed stores that did not close) were robust, increasing at 110.7% year on year in April 2020 and 103.9% in May. However, when including the closed stores, sales drop drastically to 64.4% in April 2020 and 68.4% in May. Since mid-May, stores have reopened one after the other while reducing sales floors and business hours. Sales of reopening stores in the period from May 18 to May 31 recovered to 99.3% year-on-year, so sales were about the same as the same month last year. Upon taking measures such as anti-coronavirus measures at stores, requesting users to wear masks, and avoiding the “Three Cs,” they will shift to regular operations in June.

Examining policies during the coronavirus crisis

There are no concerns about cash flow in the meantime, as they secured an additional funding line through financial institutions. However, they are considering partially reviewing the business and investment policies set out in the mid-term management policy.

In “upgrading individual stores,” as part of their policy of continuing unique store creation and proactively opening stores, they will continue to renew existing stores and open four to five new “BOOKOFF SUPER BAZAAR” stores per year. However, they will re-examine the store location and scale in the store opening strategy putting the ongoing coronavirus crisis in mind.

On the other hand, in “using all the BOOKOFF Group strength” strategy, they will accelerate the initiatives (membership policy, using e-commerce and utilizing IT in purchasing operations) to realize the “One BOOKOFF” concept. As for the growth of HUGALL, they will review purchasing operations and logistics and strengthen purchasing at department stores. In their overseas strategy, they will continue to actively open stores in Malaysia, aiming for an early normalization of operations.

Policies | Actions | Review status |

Upgrading individual stores | ||

Continue to create unique stores | Existing store renewal | Store opening strategy: re-examine the location and scale |

Continue to open stores aggressively | Four to five “BOOKOFF SUPER BAZAAR” annually | |

50 “BOOKOFF one-stop purchasing consultation desks” stores (currently 16 stores) | ||

Using all the BOOKOFF Group strength | ||

Realizing the “One BOOKOFF” concept | Measures for the members | Further focus on meeting e-commerce and contactless needs |

Utilization of e-commerce | ||

Utilization of IT in purchasing operations | ||

Growth of HUGALL | Solid profit growth | Policy maintenance: Aim for early normalization |

Overseas strategies | Proactively opening stores in Malaysia | |

4. Medium Term Management Policy and Progress Status

4-1 Mid-term management policy

Aiming to be “a leading reuse company centered on books,” they have two business policies: “upgrading individual stores” (store management and merchandise) and “using all the BOOKOFF Group strength” (attracting customers and improvement of IT systems). Regarding “upgrading individual stores,” they will focus on strengthening existing stores by delegating authority and creating unique stores and opening new stores in the suburbs (BOOKOFF SUPER BAZAAR) and downtown (BOOKOFF one-stop purchasing consultation desk).

On the other hand, with regards to “using all the BOOKOFF Group strength,” under the concept of “One BOOKOFF,” they are working to promote “Omni-channel O2O” through the usage of e-commerce and to strengthen the purchasing service “HUGALL” for the affluent. Also, they are working to increase the number of stores in Malaysia, which is also helping to boost the purchase mindset of domestic BOOKOFF as an exit strategy for the Group, and they aim to establish a ten-store system within three to four years.

Investment towards new stores and IT

A total investment of 10 billion yen is planned during the four years from FY 3/2020 to FY 3/2023. In each term, 1 billion yen will be used for opening new stores such as BOOKOFF SUPER BAZAAR and comprehensive reuse stores, and 600-800 million yen for improving distribution and for the refurbishment and repair of existing stores. A further 1 billion yen will be used to build the “One BOOKOFF” system, reinforce the price database, update equipment, and introduce a next-generation operating system (the yearly total is planned to be between 2.6-2.8 billion yen).

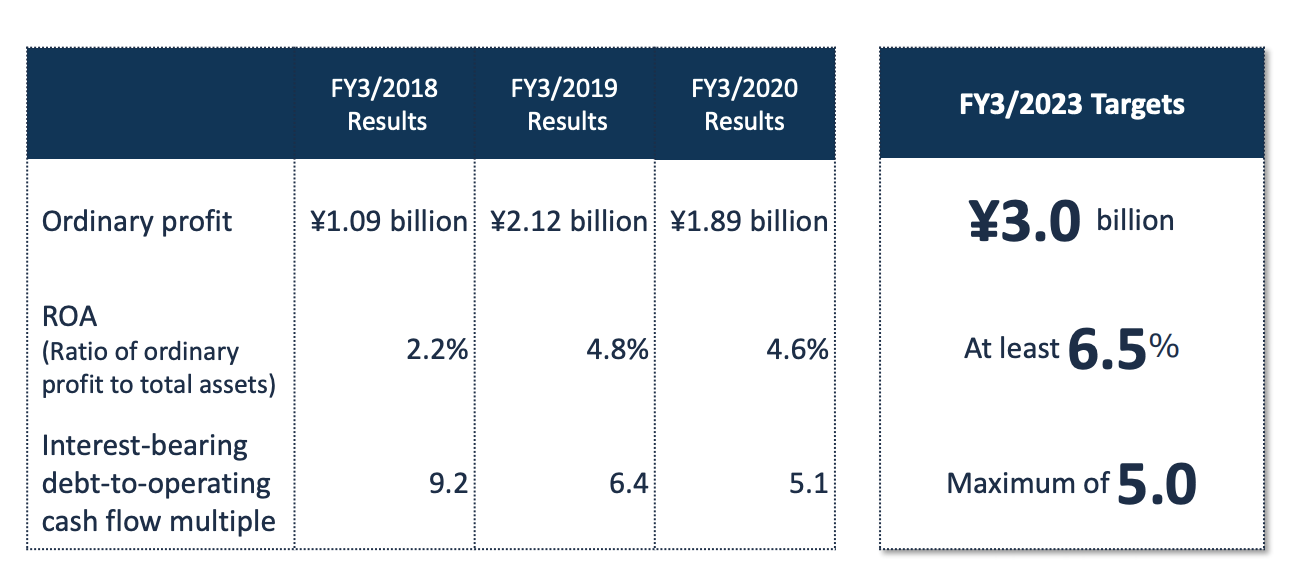

3/23 Performance target

(Source: The company)

The targets for the fiscal year ending March 2023 are “3 billion yen in ordinary income, a ROA (ordinary income to total assets ratio) of 6.5% or more and an interest-bearing debt-to-operating CF ratio of 5.0x or less”. Based on the core business strategies of “upgrading individual stores” and “using all the BOOKOFF Group strength”, the company will establish their goals during the first two years (FY 3/20~FY 3/21), and reap the rewards during the second two years (FY 3/22~FY3/23). They also plan to raise ROE by improving capital efficiency while maintaining a reasonable amount of capital leverage.

4-2 Status and evaluation of efforts over the past two years

Upgrading individual stores

As part of creating unique stores, they are promoting the renewal of existing stores that are directly managed by BOOKOFF, and they renewed 69 stores in FY 3/19 and 97 stores in FY3/20. The effect of revitalizing the stores through their renewal was reflected in the sales of existing stores directly managed by BOOKOFF in FY 3/20 (102.3% of the sales of the previous term). Also, they have been aggressively opening directly managed stores since FY 3/20. As for “BOOKOFF SUPER BAZAAR,” which they have been expanding in the suburbs, they have opened five stores in FY 3/20 (one store in FY 3/19). However, starting the stores took longer than expected, mainly due to the failure to achieve the apparel plan. Regarding the BOOKOFF one-stop purchasing consultation desk, which they are developing in the downtown area, they opened three stores (seven stores in FY 3/19). However, the purchase volume was lower than expected, and it could not contribute as much as they expected to the profit of the destination stores.

(Source: The company)

Using All the BOOKOFF Group Strength

To realize the “One BOOKOFF” concept, they focused on acquiring smartphone application members and started linking BOOKOFF Online with store stocks. Also, they began enabling customers to receive purchased items at stores. Moreover, they expanded the number of stores that use an electronic purchase system and started a service where customers can receive the money (in return for sold items) through smartphones to improve customer convenience. The acquisition of smartphone app members progressed smoothly, and the number of members at the end of the year reached 1.55 million. However, they still faced a challenge as the number of directly managed existing store customers in the fiscal year ended March 2020 remained at 97.7% of the number in the previous term. It is crucial that they increase the number of customers to reach five to six million. On the other hand, the results of linking BOOKOFF Online and store stocks and enabling customers to receive products at stores were reflected in the Group’s e-commerce sales (10% increase year on year to 11.2 billion yen), which is a satisfactory result for the fiscal year ended March 2020. Additionally, the increase of using an electronic purchase system at stores and the service which allows customers to receive the money in return of their sold items through smartphones are progressing smoothly according to the schedule and moving into the expansion phase.

As for HUGALL, they achieved the target full-year surplus. The reason for this profitability was establishing a low-cost structure by reducing logistics costs while purchases increased steadily. Going forward, they will expand their business by strengthening purchasing in department stores.

In terms of their overseas strategy, they have established five stores in Malaysia. They will continue to open stores proactively to improve local awareness of their brand.

(Source: The company)

5. Conclusions

In April and May, many directly managed stores were closed due to the spread of COVID-19, and thus sales at existing stores fell sharply. As of the end of April, more than 80 of their directly managed stores, mainly those with an area of more than 1,000 m2 were closed all day, and more than 140 stores were closed on Saturdays, Sundays, and holidays. As for the other stores, they worked to ensure the safety of users and employees by taking measures such as shortening business hours. For this reason, profits declined substantially in April and May. However, in mid-May, closed stores have been resuming their operations one after another. Hence, towards the end of the month, sales were about the same as the same month last year, even with the many restrictions on the stores resuming operations.

They feel that the worst period in terms of business performance has passed, as the sales of stores continuing operations have remained robust, surpassing the sales in the same month of the previous year. Nonetheless, now, they have to overcome the challenges that emerged in FY3/20. They are concerned about the future of BOOKOFF SUPER BAZAAR’s store opening strategy, and they are interested in improving the performance of the BOOKOFF one-stop purchasing consultation desk. However, we believe that acquiring new application members and accelerating the pace of increasing the number of members is their main challenge. Although Omni-channel and O2O strategies are progressing through the use of e-commerce under the concept of “One BOOKOFF” and creating attractive stores, they cannot fully utilize the results of their efforts while the number of customers is below the previous year. The company believes that five to six million app members are required to increase the number of customers (1.55 million at the end of March). However, the number of the conventional card members was about 17 million, and the number of e-commerce members of the “BOOKOFF Online” website alone was about 3.6 million, significantly exceeding the number of app members. There seems to be much room for further cultivation of these member assets, and thus future developments are expected.

<Reference: Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 7 directors, including 4 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report:Updated on June 29, 2020

Basic policy

Under the BOOKOFF GROUP HOLDINGS Limited, which is a pure holding company, the Group’s common corporate philosophy is “Contributing to the economic and social development through our corporate activities” and “Providing opportunities for fulfillment both professionally and personally to all our dedicated employees” and the basic principles of our corporate governance are “ensuring transparency and efficiency of management,” “rapid decision-making,” and “enhancing accountability.” Based on these principles, we will establish good relationships with our stakeholders, including shareholders, customers, employees, business partners, and local communities, and establish a system to make transparent, fair, prompt, and decisive decision-making. We aim to achieve sustainable growth and increase corporate value over the medium to long term.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

[Principle 1-4]

In accordance with the “Regulations on Investment and Securities Management,” the company stipulates policy not to acquire cross-holding shares in principle. However, as an exception, it may hold shares of its franchise chain member companies. The Company examines the shares held by the Board of Directors and the significance of each strategically held stock.

(Items to be examined)

□ Qualitative items

・Background for acquisition

・Existence of a business relationship

・Necessity of possession of such shares

・Possibility of future business

・Risk of not holding such shares

・Advantages and disadvantages of continued ownership

□ Quantitative items

・Annual dividend received

・Share valuation gain/loss

At the Board of Directors meeting held on October 16, 2019, we have confirmed that all strategically held shares are held for the purpose in line with the holding policy.

Regarding the exercise of voting rights, we will exercise it appropriately upon carefully examining the content of the agenda, considering the business performance and financial status of the previous three years, conducting dialogue with companies as necessary, and determining whether it will contribute to the improvement of shareholder value.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary principle 4-11①】

The Company considers that it is appropriate to have about 8 to 10 directors and about 3 to 4 corporate auditors in order to have substantial and effective discussions at the Board of Directors meetings. Currently, there are 3 internal directors, 4 outside directors (of which 2 are independent outside directors), 1 full-time corporate auditor, and 2 outside corporate auditors (of which 1 is an independent outside corporate auditor). The directors consist of experienced business executives, certified public accountants, persons with extensive business experience, and persons highly qualified in their field. The corporate auditors consist of certified public accountants, lawyers, and persons coming from business companies. In particular, the outside directors and outside corporate auditors are persons with abundant knowledge and experience, and we consider the balance of members in a way that ensures stable and sustainable growth can be achieved. Regarding the appointment of directors, we select them based on whether the candidates contribute to the enhancement of our corporate value, have dialogue with them, and discuss at the Nominating Advisory Committee, which consists of the President and independent outside directors, based the Committee’s rules. Finally, the decision is made at the Board of Directors. Guidelines regarding the appointment of outside directors are in place, and their independence criteria are in the convocation notice and the report on corporate governance.

[Principle 5-1]

The company appoints an executive in charge of IR and designates the Corporate Planning Department as in charge of IR. For shareholders and investors, the company holds financial results briefings once in six months, and is conducting small meetings and individual interviews as needed. In addition, the company has established the IR policy and disclosed it on its website.

■IR Policy <Policy to promote constructive dialogue with shareholders>

https://www.bookoffgroup.co.jp/ir/policy.html

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved.

For back numbers of Bridge Reports on BOOKOFF GROUP HOLDINGS LIMITED(9278) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/