Bridge Report:(9278)BOOKOFF GROUP the second quarter of fiscal year ending May 2021

President Yasutaka Horiuchi | BOOKOFF GROUP HOLDINGS LIMITED(9278) |

|

Company Information

Market | TSE 1st Section |

Industry | Retail (commerce) |

President | Yasutaka Horiuchi |

HQ Address | 2-14-20 Kobuchi, Minami-ku, Sagamihara-shi |

Year-end | May |

HOMEPAGE |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥843 | 17,447,413 shares | ¥14,708 million | 1.9% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥6.00 | 0.7% | ¥11.46 | 73.6x | ¥731.85 | 1.2x |

*The share price is the closing price on November 26. Number of shares issued is obtained by excluding the number of treasury shares from the number of shares issued at the end of the latest quarter. ROE and BPS are the actual value as of the end of the previous year.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2017 (Actual) | 81,344 | 116 | 588 | -1,159 | -56.41 | 10.00 |

March 2018 (Actual) | 80,049 | 613 | 1,092 | -889 | -43.31 | 10.00 |

March 2019 (Actual) | 80,796 | 1,550 | 2,120 | 2,172 | 112.19 | 15.00 |

March 2020 (Actual) | 84,389 | 1,428 | 1,898 | 240 | 13.77 | 6.00 |

May 2021 (Forecast) * | 96,000 | 1,300 | 1,650 | 200 | 11.46 | 6.00 |

* The fiscal year ending May 2021 is 14 months accounting period. The forecasted values were provided by the company. Unit: Million yen or yen.

We present this Bridge Report reviewing the second quarter of fiscal year ending May 2021 financial results and fiscal year ending May 2021 financial forecast of BOOKOFF GROUP HOLDINGS LIMITED

Table of Contents

Key Points

1. Company Overview

2. The Second Quarter of Fiscal Year ending May 2021 Financial Results

3. Fiscal Year ending May 2021 Financial Forecast

4. Future strategy considering current circumstances

5. Conclusions

<Reference: Corporate Governance>

Key Points

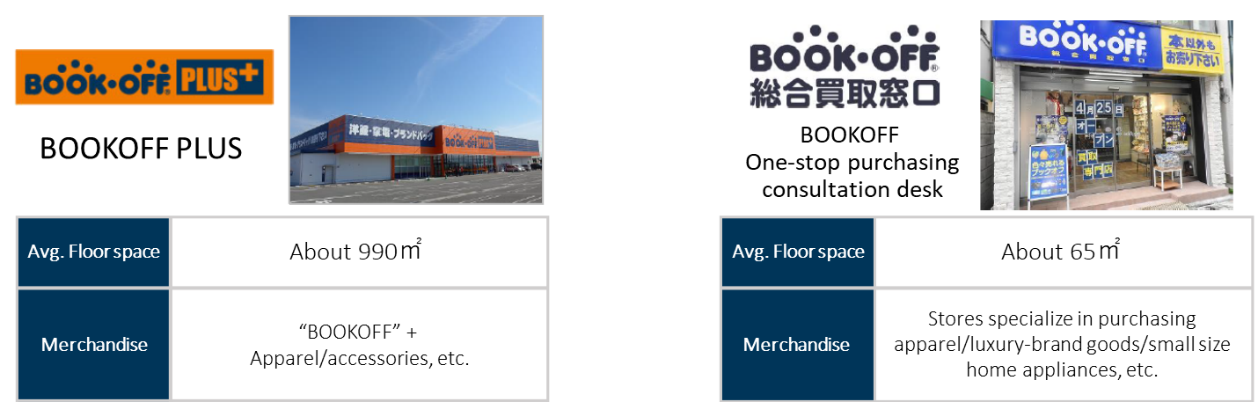

- For the cumulative second quarter of the term ending May 2021, sales and ordinary income decreased 9.1% and 43.2%, respectively, year on year. Due to the temporary closure of stores in the first quarter (April to June), ordinary income declined considerably, but in the second quarter (July to September), ordinary income hit a record high in the past five years, thanks to the demand from people staying home. The company resumed the operation of temporarily closed stores one after another from mid-May while taking measures for preventing infection, and the operation of directly managed stores in Japan became normal overall in June. Since June, the sales of books with a high gross profit margin increased, thanks to the demand from people staying home.

- For the term ending May 2021, which spans 14 months, it is estimated that sales will be 96 billion yen and ordinary income will be 1.65 billion yen. For the 12-month period till the fourth quarter, it is forecasted that sales will be 81 billion yen, down 4.0% year on year, and ordinary income will be 1.3 billion yen, down 31.5% year on year. The full-year financial forecast was left unchanged, considering the recent trend of procurement, the sluggish sales of apparel which will reach a peak in the third quarter, etc. Before the peak in the year-end and new-year period, the company will implement active promotion for procuring merchandise.

- There is no significant revision to the mid-term management policy, but considering the current issues and the expected consumption trend after the coronavirus crisis, the company reconsidered investment in stores and fields they focus on. As for investment in stores, the company will develop a new store package to operate flexibly in a medium-sized trading area in addition to the business model of attracting customers in a broad trading area with a large-sized combined store, responding to the shrinkage of the sphere of activities caused by the voluntary restraint of going out in the coronavirus crisis. As for merchandise, the company will keep focusing on precious metals, watches, and high-end bags, but will also increase trading cards and hobby related products which are expected to exert synergy with their major merchandise and increase customers, and increase sports and outdoor products too, whose demand is recovering amid the coronavirus crisis.

1. Company Overview

The company runs a group of the largest reuse chain stores that has expanded its reuse business into various fields, including books, CDs, DVDs, video games, apparel, sporting goods, baby goods and miscellaneous goods. It has about 800 (directly managed + franchised) store network covering all over the country from Hokkaido to Okinawa. Also, they pursue synergies with “reuse at online stores”.

[Corporate philosophies of the BOOKOFF Group]

・Contributing to the economic and social development through our corporate activities

・Providing opportunities for fulfillment both professionally and personally to all our dedicated employees.With these corporate philosophies, the BOOKOFF Group has made efforts towards the reuse of various items, with a focus on the purchase and sale of “books”. By doing so, they have nurtured the brand, the store network, and human resources, which in turn have become the Group's strength. With their mission “Be a source of enjoyable and enriching lives for as many people as possible “, they aim to be a leading “reuse” company, and a company where people can grow and work with peace of mind, confidence, and enthusiasm.

[Efforts towards diversity]

The company believes that “employees are the greatest asset” and that “developing skills and intelligence of human resources will directly lead to growth of the company.” Therefore, they strive to improve the work environment so each employee can utilize their strengths, and to provide opportunities for employee to develop their skills and fulfill themselves. As part of this, a region selection system was implemented in October 2014, allowing employees to work within a specific area. In addition, under the “married couple transfer system,” employees who are married couples may transfer to a store near their spouse’s workplace.

The BOOKOFF Group also makes an effort to provide employment for persons with disabilities, and they established B-Assist, Inc. in October 2010 (which was recognized as a special subsidiary under the Employment Promotion Act for Persons with Disabilities in December 2010). B-Assist, Inc. provides people with disabilities who are capable to work with employment opportunities and a suitable environment as part of "corporate activities" rather than "welfare" to support social participation and independence (BOOKOFF Group as a whole has employed more than 140 people with disabilities).

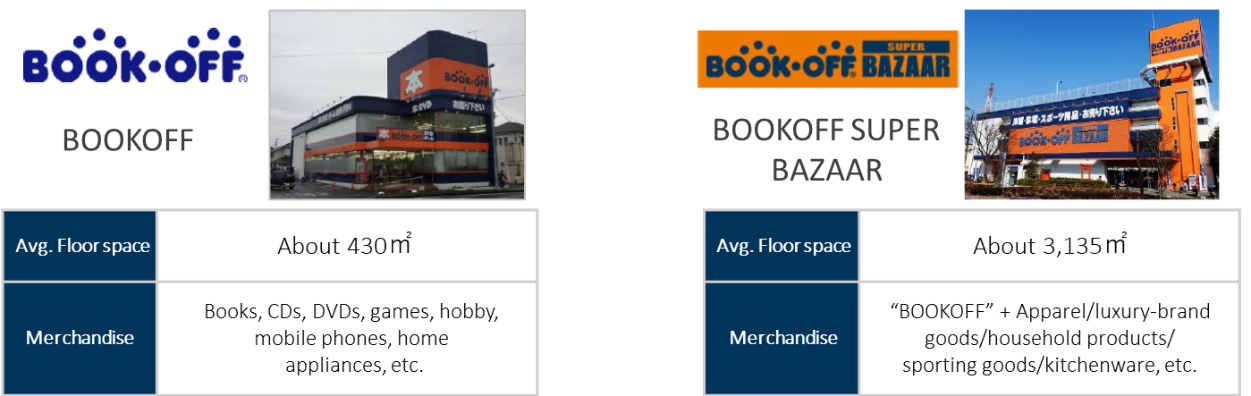

1-1 Business Description

As the chain headquarter of the reuse stores “BOOKOFF” for books, software and more, the company operates the franchise (FC) system and directly managed stores. There are three types of directly managed stores;1)“BOOKOFF” (books, CDs, DVDs, video games, electronics and mobile phones, etc.), 2)“BOOKOFF PLUS” (a medium-sized complex BOOKOFF with apparel & brand-name goods), and 3) “BOOKOFF SUPER BAZAAR” (a large-sized complex BOOKOFF with a wide variety of commodities; books, software, electronics (audio and visual devices, computers, etc.), apparel, sporting goods, baby goods, watches, brand bags, jewelry, tableware and miscellaneous goods).

It also operates the E-commerce (EC) site “BOOKOFF Online”, HUGALL that provides purchasing and trading services for the wealthy class at major department stores, new bookstores, and book review community websites.

(Source: the Company’s material)

Book Off Group

Its main subsidiaries, Booklet Co. Ltd., BOOKOFF With Co., Ltd, BOOKOFF Okinawa Inc, Manas Co., Ltd and BOOKOFF Minami Kyushu, Inc. operate “BOOKOFF” stores in Japan. BOOKOFF With Co., Ltd operates reuse stores for apparel, baby goods and others, besides BOOKOFF stores. BOOKOFF With is also a franchisee of a reuse chain store, “Kingram,” which handles watches, brand bags and jewelry. Also, Booklet, BOOKOFF With and BOOKOFF Okinawa operate reuse stores for apparel and more.

As for overseas business operation, BOOKOFF U.S.A. INC. runs “BOOK・OFF” stores in the United States, BOK MARKETING SDN.BHD runs “Jalan Jalan Japan” in Malaysia.

The company entered the Malaysian market in 2016 and have released a Malaysian original package called “Jalan Jalan Japan.” The store concepts of “Preloved in Japan,” “large amounts of goods,” and “low prices” match local needs, and business performance is strong. It will focus on human resource development and work to further expand the store network. First, they want to establish a ten-store system within three to four years, and in their mid-term plan, they are also considering the acceptance of discarded products from competitors. The business in Malaysia is profitable, and it not only contributes to earnings, but also serves as an exit strategy for the Group (it sells products that could not be sold at stores in Japan locally). Domestic unsold products are disposed of as industrial waste. The Malaysian business leads reduction of disposal costs, and all stores are performing well. Store operations require securing a large number of products and operations to deal with a large number of products, making it difficult for other companies to develop similar businesses. As a result, this business is unique to the company, which boasts the best sales in the industry. In addition to the fact that Malaysian store managers are receiving training in management and other activities in Japan, Japanese employees of the manager class are dispatched to Malaysia to penetrate the management skills.

1-2 Initiatives to achieve SDGs

The act of selling and buying goods at BOOKOFF itself leads to the social contribution of extending the life of products and reducing the amount of waste. This plays a significant role in achieving the SDGs’ 12th goal, which is “responsible production and consumption.” In addition to these efforts, they will contribute to the achievement of SDGs through various activities centered on the reuse industry, which is the company’s core business.

| Reuse and recycle of old paper |

|

Malaysian business, Jalan Jalan Japan | Creating employment, providing high-quality products and apparel goods |

|

Jewelry Asset Managers Inc. | Jewelry repair and succession for generations

|

|

Certified to be pursuant to Act for Promotion of Employment of Persons with Disabilities | Supporting people with disabilities and creating employment |

|

Service for giving donations according to the purchased prices of books, video games, etc. sold to BOOKOFF | Partnerships with companies, governments, and NPOs |

|

(Source: the Company’s material)

Initiatives in the cumulative second quarter of the term ending May 2021

The company forged ahead with initiatives to achieve SDGs, such as participating in a social experiment for reducing vacant homes, selling fresh flowers that do not satisfy standards, so called chance flowers, and taking part in Parent-Child Sustainable Summer School 2020. Furthermore, B-Assist, Inc., which is a special subsidiary providing employment for persons with disabilities in the BOOKOFF Group, celebrated the 10th anniversary of its establishment on October 15, 2020. While the employment rate for persons with disabilities in private enterprises designated by the Act for Promotion of Employment of Persons with Disabilities is 2.2%, that of BOOKOFF Group is 4.33% (as of June 1, 2020), exceeding the standard rate considerably.

Participation in experiment for solving the vacant homes problem

The company entered into a joint agreement with Minamichita Town, Aichi Prefecture, together with AKIYA CONSULTING INC., HAMAYA Corporation, and Japan Reuse Recycle Collection Association (JRRC), and participated in a social experiment to reduce vacant homes, held by the town, the Social Experiment for Treasure Hunting in Vacant Homes.

Selling chance flowers, sub-standard flowers

In cooperation with hanane Co., Ltd., which sells fresh flowers and organizes events, they engaged in selling fresh flowers which would be disposed as out-of-specs products, so called chance flowers, at the BOOKOFF stores.

Taking part in Parent-Child Sustainable Summer School 2020

They gave a speech at the free online event Parent-Child Sustainable Summer School 2020 held by Gaiax Co. Ltd., which operates TABICA, a C-to-C experience-offering reservation service.

2. The Second Quarter of Fiscal Year ending May 2021 Financial Results

2-1 Consolidated Results of second quarter (cumulative total)

| FY 3/20 2Q (cumulative total) | Ratio to sales | FY 5/21 2Q (cumulative total) | Ratio to sales | YOY |

Sales | 41,289 | 100.0% | 37,522 | 100.0% | -9.1% |

Gross profit | 25,322 | 61.3% | 23,272 | 62.0% | -8.1% |

SG&A expenses | 24,441 | 59.2% | 22,754 | 60.6% | -6.9% |

Operating income | 881 | 2.1% | 517 | 1.4% | -41.2% |

Ordinary income | 1,144 | 2.8% | 650 | 1.7% | -43.2% |

Profit attributable to owners of parent | 557 | 1.4% | -284 | - | - |

* Unit: million yen

Sales and ordinary income dropped 9.1% and 43.2%, respectively, year on year.

Sales were 37.52 billion yen, down 3.76 billion yen (9.1%) year on year. In the wake of the declaration of a state of emergency, about 250 stores maximum (over 60% of all directly managed stores) were temporarily closed on Saturdays, Sundays, and holidays or all days, so the sales in the first quarter (April to June) decreased 3.91 billion yen year on year, but in June, the operation of directly managed stores in Japan returned to normal overall. In the second quarter (July to September), sales grew 140 million yen year on year, thanks to the recovery of the domestic BOOKOFF business, which sold mainly books with a high gross profit margin, and the sales growth of HUGALL and aidect.

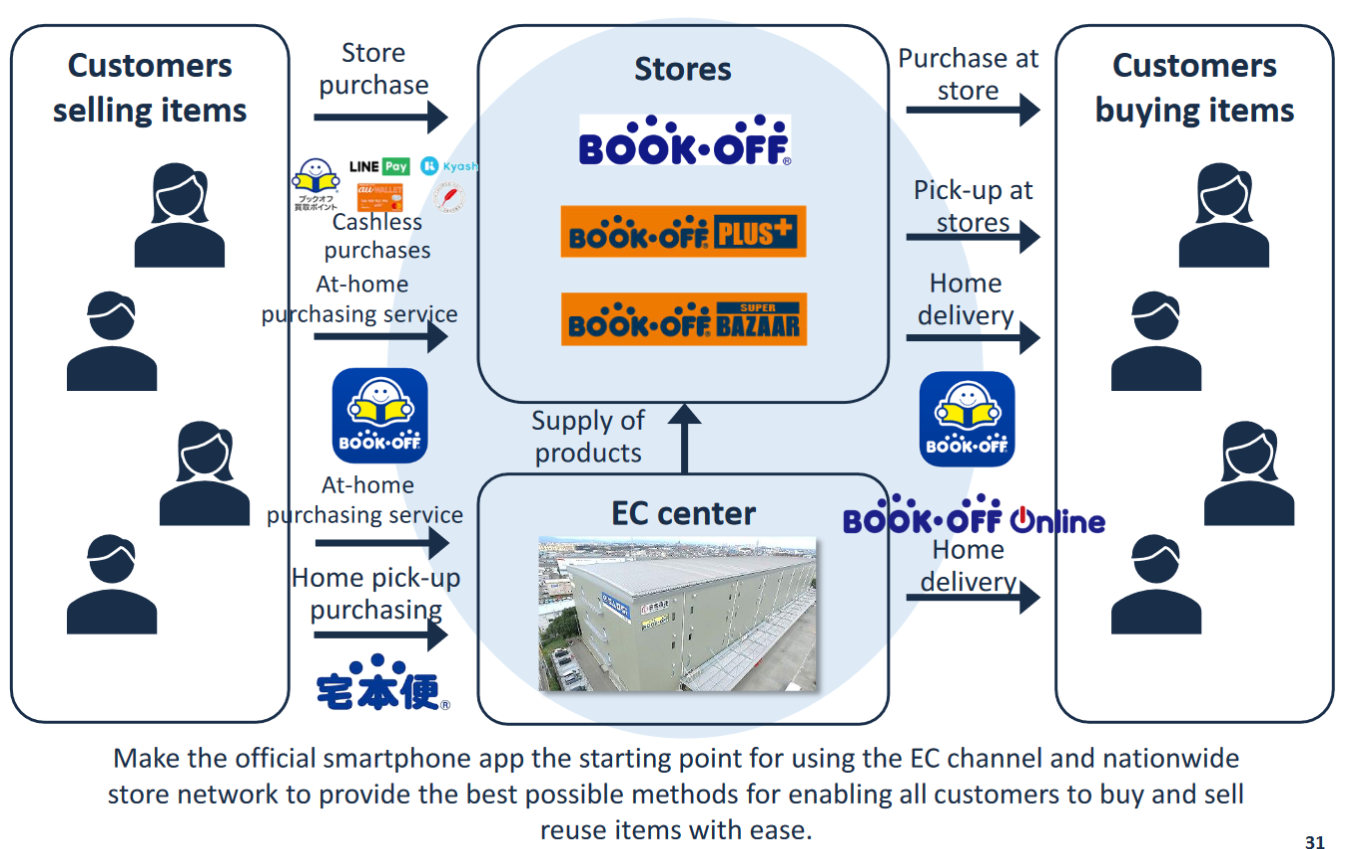

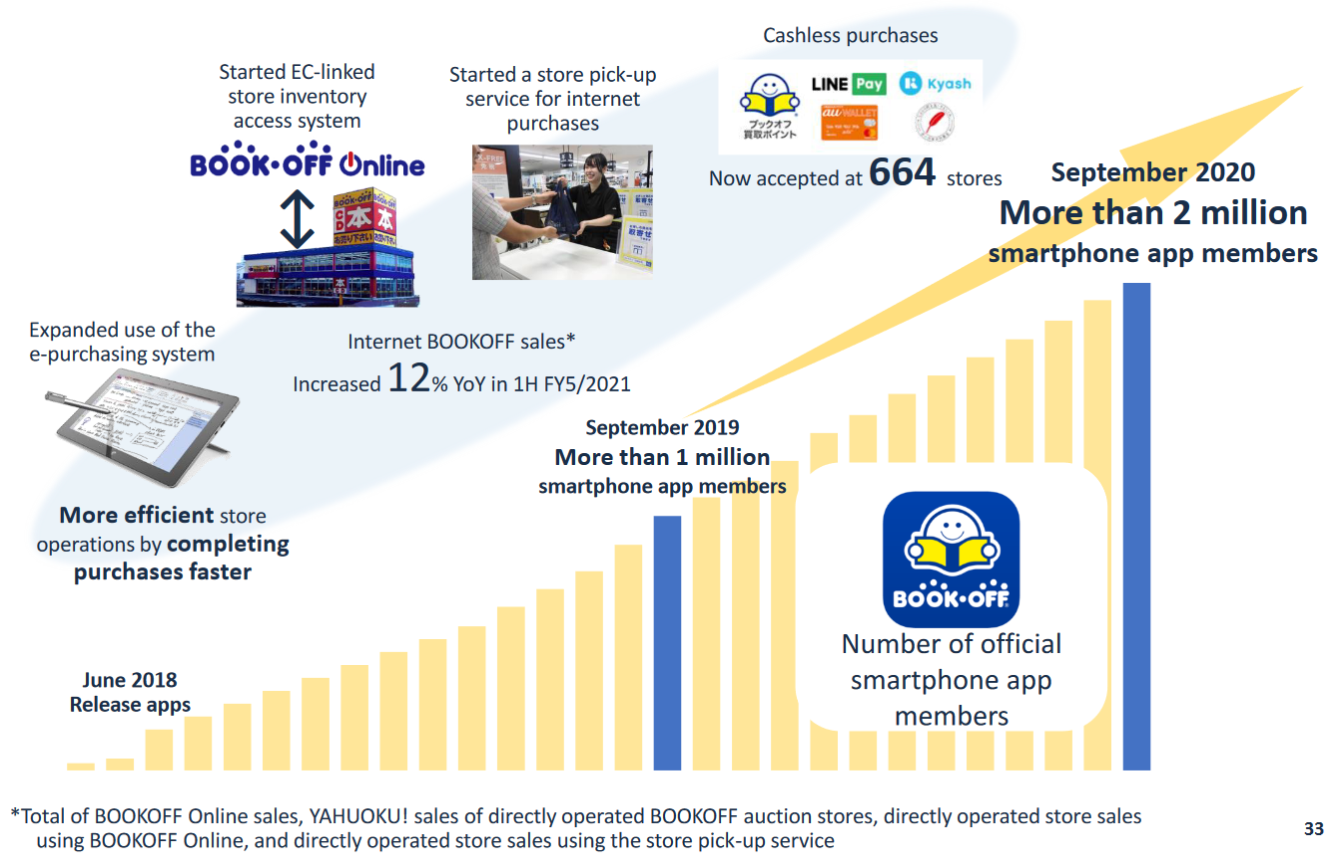

As the company met the demand from people staying home, the sales of BOOKOFF via the Internet in the cumulative second quarter increased 12% year on year. This is an outcome of the “One BOOKOFF” strategy, including launching cashless purchase at 664 stores, to meet the needs for non-face-to-face operations and shortening the time spent at stores, while the number of subscribers of the smartphone app exceeded 2 million.

Ordinary income decreased 490 million yen (43.2%) year on year to 650 million yen. In the first quarter, a loss of 110 million yen was posted, but in the second quarter, a profit of 760 million yen was posted thanks to the recovery of sales of BOOKOFF. A net loss of 280 million yen was posted, because the company booked an extraordinary loss of 810 million yen, including fixed costs, such as rents and depreciation for directly managed stores, which were temporarily closed inside and outside Japan in order to prevent the spread of the novel coronavirus.

Sales of Existing Stores

In the wake of declaration of a state of emergency, about 250 stores maximum (over 60% of directly managed stores) were temporarily closed on Saturdays, Sundays, and holidays or all days, so the sales at existing stores from April to May dropped considerably year on year, but sales from June to August recovered thanks to the demand from people staying home. The sales in September decreased year on year, due to the recoil from the last-minute demand before the consumption tax hike in the previous year.

Domestic Directly Managed Stores, Sales by Products

| 1Q | 2Q | 2Q (cumulative total) | Ratio to sales |

Books | 84.9% | 106.7% | 95.5% | 35.6% |

Software media(Music・Videos・Video Games) | 89.4% | 95.1% | 92.3% | 30.5% |

Apparel | 48.3% | 82.3% | 63.9% | 8.6% |

Precious Metals, Watches, High-end Brand Bags | 64.6% | 102.8% | 84.7% | 7.7% |

Trading cards and Hobby related products | 74.0% | 108.2% | 91.5% | 7.0% |

Home Appliances, Mobile phones | 73.1% | 89.2% | 81.3% | 4.6% |

Sports and outdoor equipment | 67.3% | 115.9% | 91.1% | 2.8% |

Other | 85.7% | 123.5% | 105.1% | 3.2% |

Total | 78.2% | 100.1% | 89.0% | 100.0% |

After the operation of stores returned to normal, books with a high gross profit margin sold well thanks to the demand from people staying home. Especially, in the second quarter, the sales of precious metals, watches, high-end brand bags, trading cards, hobby related products, and sports and outdoor products increased. On the other hand, the recovery of performance of apparel is sluggish, due to the restraint on going out and such.

Domestic Directly Managed Stores, Purchases by Products

| 1Q | 2Q | 2Q (cumulative total) | Ratio to sales |

Books | 75.3% | 96.4% | 85.4% | 24.8% |

Software media(Music・Videos・Video Games) | 65.3% | 96.7% | 80.7% | 37.6% |

Apparel | 38.0% | 79.8% | 57.8% | 7.0% |

Precious Metals, Watches, High-end Brand Bags | 52.2% | 98.4% | 76.0% | 12.9% |

Trading cards and Hobby related products | 55.4% | 108.5% | 82.5% | 8.8% |

Home Appliances, Mobile phones | 45.3% | 86.0% | 64.0% | 5.0% |

Sports and outdoor equipment | 48.8% | 98.6% | 71.9% | 2.8% |

Other | 46.5% | 90.8% | 66.5% | 1.1% |

Total | 60.5% | 95.7% | 77.7% | 100.0% |

In the second quarter, the procurement volumes of books, software media, precious metals, watches, high-end brand bags, and sports and outdoor products recovered, and those of trading cards and hobby related products increased. There is a time lag from the recovery of sales, but procurement volume is recovering.

Investment in stores

Classification | Store name | Opened date | Location | Selling space area | |

Directly managed | Newly opened | BOOKOFF SUPER BAZAAR 1-Gou Kyoto Fushimi Store | May 11 | Kyoto City, Kyoto Pref. | 2,663 m2 |

FC | Newly opened | BOOKOFF Fukuoka-Yukuhashi Store | April 28 | Yukuhashi City, Fukuoka Pref. | 363 m2 |

BOOKOFF Châtelet Store | June 1 | France | 339 m2 | ||

Repackaged | BOOKOFF PLUS Ena Store | May 2 | Ena City, Gifu Pref. | 894 m2 | |

BOOKOFF PLUS Symphony Plaza Hachinohe-Numadate Store | June 12 | Hachinohe City, Aomori Pref. | 1,049 m2 | ||

BOOKOFF PLUS Kani Store | August 7 | Kani City, Gifu Pref. | 1,244 m2 | ||

The number of newly opened directly managed stores decreased from six in the same period of the previous term to one. The number of renewed stores decreased from 36 in the same period of the previous term to 19, as the company curtailed the budget temporarily.

Status of operation of other businesses

HUGALL and aidect (former Jewelry Asset Managers Inc., which was consolidated in the third quarter of the previous term) had to suspend operations, but their operations have returned to normal. There is no change to the policy of active business expansion. HUGALL opened Daimaru Kyoto store in May 2020, and Senboku-Takashimaya store in September 2020.

As for the overseas business, there is no change to the policy of expanding business in Malaysia. Although some impact of the recent lockdown imposed in November is estimated, the company opened the sixth store in November 2020 as planned.

2-2 Financial Condition and Cash Flow

Financial Conditions

| March. 2020 | September. 2020 |

| March. 2020 | September. 2020 |

Cash and Deposits | 6,094 | 6,715 | Accrued corporate tax, etc. | 282 | 252 |

Receivables | 1,898 | 1,813 | Allowance for sales rebate | 512 | 470 |

Inventories | 13,129 | 12,625 | Asset retirement obligations | 2,358 | 2,405 |

Current Assets | 23,704 | 23,435 | Interest-bearing liabilities | 17,822 | 18,244 |

Property, Plant, and Equipment | 6,273 | 6,048 | Lease liabilities | 1,599 | 1,434 |

Intangible Assets | 2,003 | 1,906 | Fixed liabilities | 28,687 | 28,605 |

Investments and Others | 9,553 | 9,700 | Net Assets | 12,848 | 12,486 |

Non-Current Assets | 17,830 | 17,656 | Total Liabilities and Net Assets | 41,535 | 41,091 |

* Unit: million yen

In preparation for temporary closure of stores and such, interest-bearing liabilities were increased temporarily, but the financial balance has returned to normal overall as of the end of the second quarter. In preparation for the resurgence of the novel coronavirus, the company maintained the credit lines of financial institutions. Capital-to-asset ratio was 30.2% (30.7% as of the end of the previous term).

Cash Flows (CF)

| FY3/20 2Q (cumulative total) | FY5/21 2Q (cumulative total) | Increase/Decrease | YOY |

Operating cash flow(A) | 955 | 1,192 | +236 | +24.8% |

Investing cash flow(B) | -1,928 | -650 | +1,277 | - |

Free cash flow (A+B) | -972 | 541 | +1,514 | - |

Financing cash flow | -67 | 89 | +156 | - |

Cash and Equivalents at the end of term | 5,083 | 6,715 | +1,631 | +32.1% |

* Unit: million yen

While operating CF increased due to the decrease in working capital, the deficit of investing CF shrank due to the restraint of opening and renewing stores, so the company secured a free CF of 540 million yen.

3. Fiscal Year ending May 2021 Financial Forecast

3-1 The Term Ending May 2021 Spans 14 Months

They changed the fiscal year period so that it will end on May 31 from now on. The company aims to maximize purchases and realize efficient business operations by shifting the fiscal year-end to avoid the busiest period from January to March. For this reason, the fiscal year 2020 will be the 14 months for the group and will end in May 2021.

| FY5/21 Est. | Ratio to sales | YOY |

Sales | 96,000 | 100.0% | - |

Operating income | 1,300 | 1.4% | - |

Ordinary income | 1,650 | 1.7% | - |

Profit attributable to owners of parent | 200 | 0.2% | - |

* Unit: million yen

No change in the full-year forecast, sales and ordinary income are estimated to be 96 billion yen and 1.65 billion yen, respectively.

Although profit rose significantly in the second quarter (July to September), the company left the full-year financial forecast unchanged, considering the recent procurement trend. Books, trading cards, and hobby related products are selling well, but the sales of apparel are sluggish. Accordingly, the sales from October 2020 to March 2021 are estimated to be almost unchanged year on year. The company will conduct active promotion for procuring merchandise before the peak in the year-end and new-year period.

As for investment in stores, the company will continue the renewal of existing stores at a certain level, but had call off the plan of opening new stores and will develop a new store package.

The term-end dividend is to be 6 yen/share.

In order to make it easier to compare the forecast with the results for the term ended March 2020, the company has disclosed the financial forecast for the cumulative fourth quarter of the term ending May 2021.

| FY3/20 Act. | Ratio to sales | FY5/21 4Q(cumulative total) Est. | Ratio to sales | YOY |

Sales | 84,389 | 100.0% | 81,000 | 100.0% | -4.0% |

Operating income | 1,428 | 1.7% | 1,000 | 1.2% | -30.0% |

Ordinary income | 1,898 | 2.2% | 1,300 | 1.6% | -31.5% |

Profit attributable to owners of parent | 240 | 0.3% | 0 | - | - |

* Unit: million yen

3-2 Facts Revealed Through the Coronavirus Crisis and Issues to be Solved

Through the coronavirus crisis, the company found that (1) the demand for their mainstay merchandise, books, is firm, and (2) the needs for non-face-to-face operations and shortening the time spent at stores have emerged. Meanwhile, a short-term issue is to secure procurement to meet these needs. In order to secure merchandise stocks for the year-end and new-year period, the company will enhance promotion for buying used items from customers. In addition, the company will try to increase app subscribers to proceed with the “One BOOKOFF” strategy from the next term.

For buying more used items from customers, the company started airing TV commercials from November 14, but they will also distribute coupons to buy items from app subscribers. In addition, the company will launch campaigns for visitors to stores, for each region and each merchandise, to buy specific merchandise.

4. Future strategy considering current circumstances

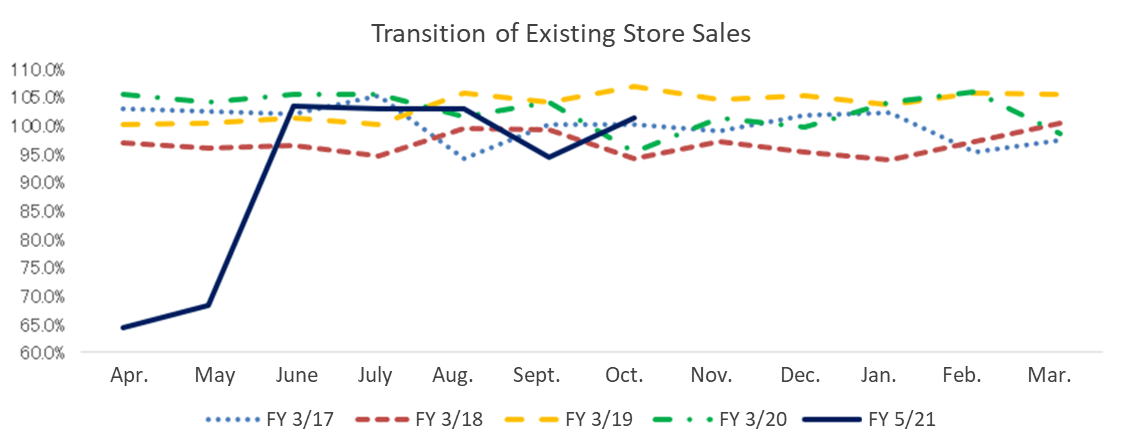

4-1 Recent Situation of Sales for Each Merchandise Category in Directly Managed Stores in Japan and Measures

Books, trading cards, hobby related products, precious metals, watches, and high-end brand bags have been performing well, while the sales of sports and outdoor products have increased recently, because people are trying to avoid “The Three Cs.” On the other hand, considering external factors, apparel will not recover soon, and will continue to be in an unfavorable situation. Accordingly, the company will focus on trading cards, hobby related products, precious metals, watches, and high-end brand bags, which are projected to have high growth, while its profit base will be books and software media, where stable demands are anticipated. Furthermore, they will also put strength into the promotion of sports and outdoor products, which have room for growth.

Considering the above-mentioned trend of sales, they will revise the merchandise composition at BOOKOFF SUPER BAZAAR (BSB), which is their core line of business among directly managed stores in Japan.

(Source: The Company’s material)

In addition, BSB attracts a large number of customers with its spacious stores reaching over approximately 3305 m2, and offering several hundreds of thousands of merchandises, including books, software media, apparel, sports products, and high-end brand items, to meet the demand for selling and buying various merchandise at once.

4-2 Partial Revision to the Mid-term Management Policy

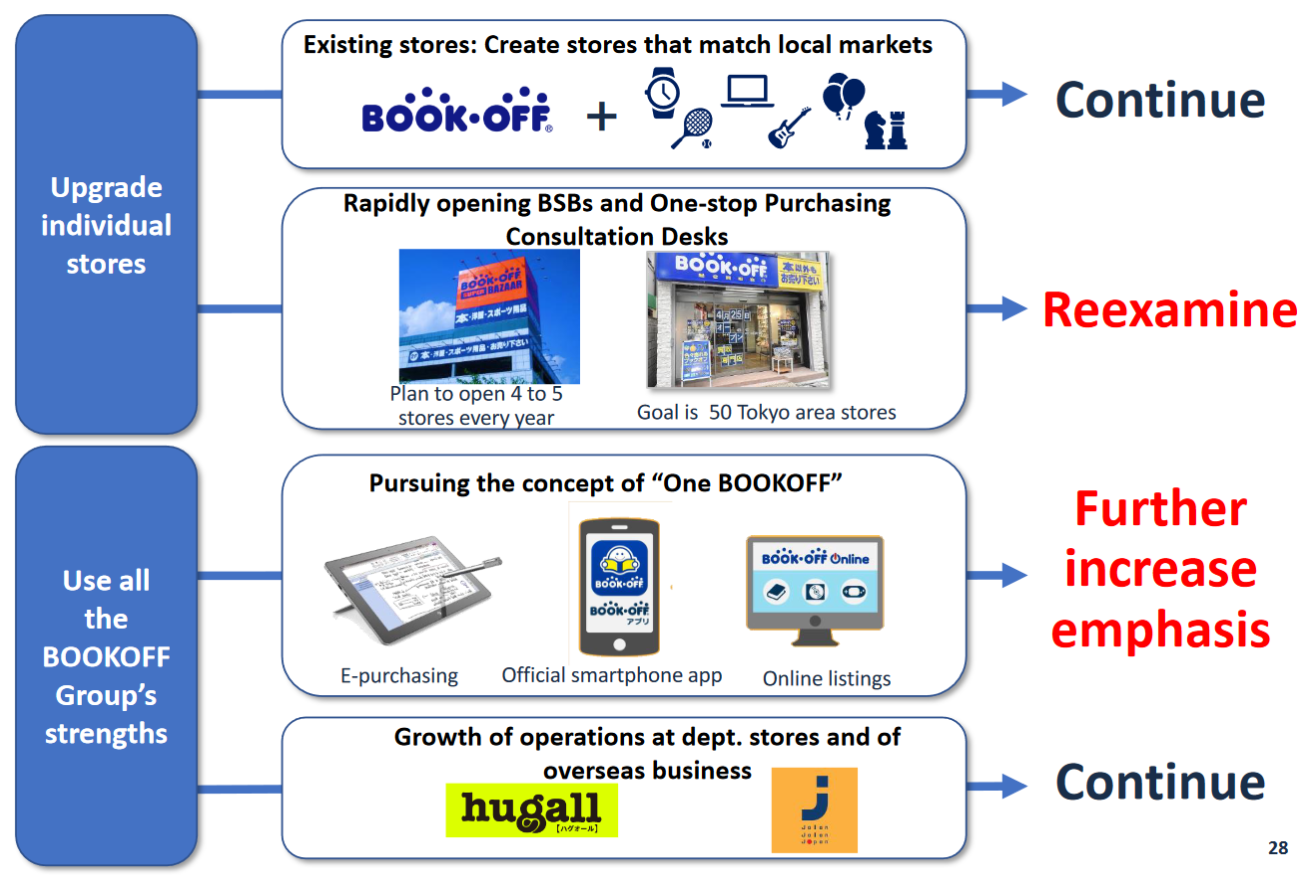

Aiming to be a leading reuse company with the focus on books, the company has two business policies: (1) upgrading individual stores mainly through store management and merchandise, and (2) using all the BOOKOFF Group’s strengths such as attracting customers and systems. About upgrading individual stores, the company is striving to improve existing stores by delegating authority and creating unique stores, and for new stores, by opening BSB in the suburbs and BOOKOFF One-stop Purchasing Consultation Desks in the city area. As for using all the BOOKOFF Group’s strengths, for achieving the concept of “One BOOKOFF”, they are focusing on, (i) electronic purchase, (ii) the official smartphone app and online listings, (iii) the department store business, HUGALL, purchasing service for the high-income customers, and (iv) overseas business activities. They have reevaluated their new store opening plans.

(Source: The Company’s material)

Investment in stores (reevaluating new store opening plans)

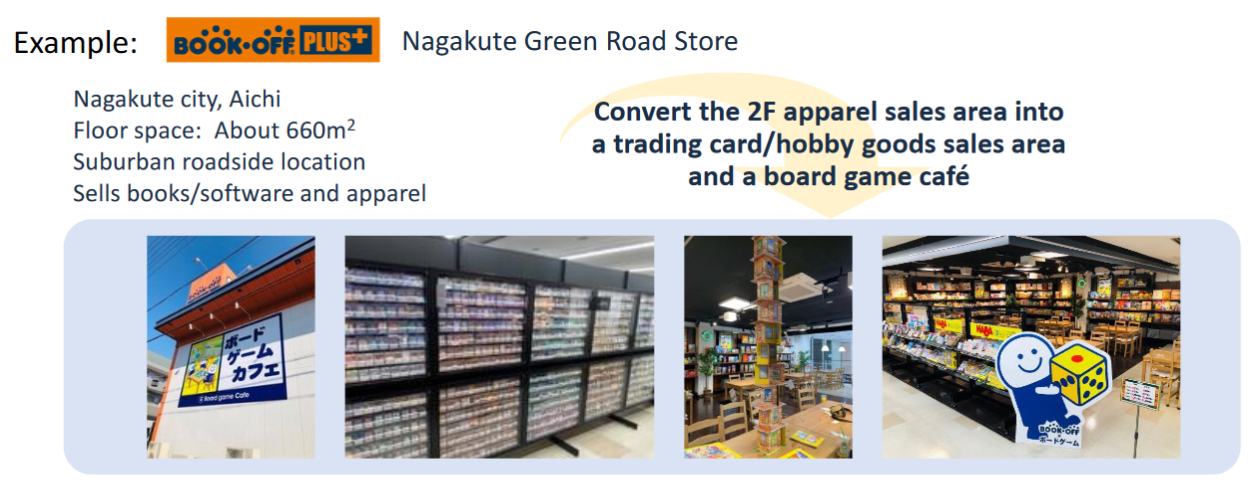

As for investment in stores, the company has made progress in both opening new stores, BSB as well as BOOKOFF One-stop Purchasing Consultation Desks, and the renewal of existing BOOKOFF stores. They will continue with the renewals, but for BSB, they will seek balance between opening new stores and renewals. Furthermore, they will engage in developing a new store package. They have launched the new store package trial at BOOKOFF PLUS Nagakute Green Road Store.

The previous Nagakute Green Road Store focused on offering used items with a great variety at a low price. However, in regard to the new store package, their major targets are families and people with hobbies, and they are focusing on, (1) enhancing merchandise quality by including both used and new items, and (2) offering a place to play to provide additional value other than selling and buying. To make these changes, the second-floor apparel section was changed to a trading card and hobby related products section and to a board game café.

(Source: The Company’s material)

“One BOOKOFF” concept

The concept of “One BOOKOFF” is to offer a once-in-a-lifetime encounter with reused merchandise to all customers in the most suitable way, by utilizing the e-commerce channels and the nationwide store network with the official smartphone app as the starting point.

(Source: The Company’s material)

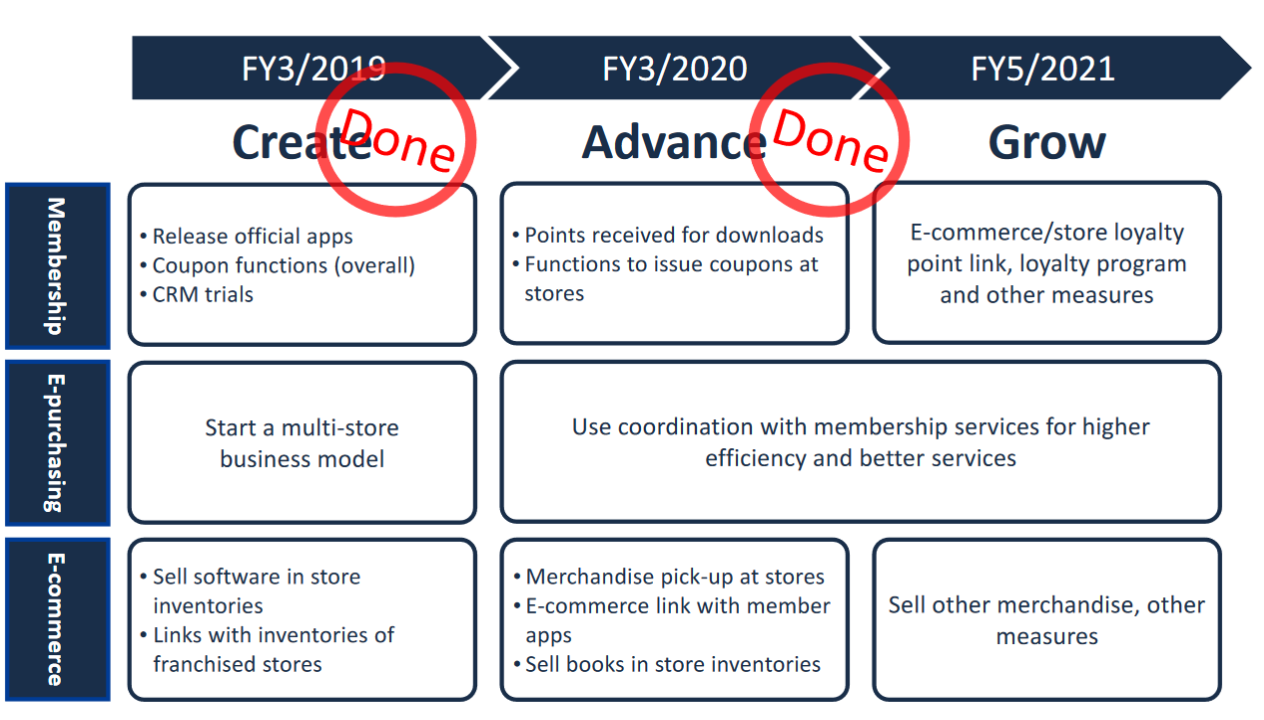

The road map consists of Create phase in FY 3/2019, Advance phase in FY 3/2020 and Grow phase in FY 5/2021. Create phase in FY 3/2019 as well as Advance phase in FY 3/2020 were accomplished according to the plan, and the company is currently in the Grow phase of FY 5/2021. Specifically, the official smartphone app was released in June 2018, number of members exceeded 2 million as of the end of September 2020. Following this, the company gradually expanded their services by, (1) adopting and spreading an electronic purchase system for reducing customers’ waiting time and improving store management efficiency, (2) linking store stocks with e-commerce, (3) enabling customers to receive e-commerce merchandise at their stores, and (4) launching cashless purchasing. The positive results of these initiatives are seen amid the unfavorable business environment caused by the coronavirus crisis, as already explained.

(Source: The Company’s material)

As the “One BOOKOFF” concept matches the post-coronavirus crisis consumer behavior, the company has set new goals such as, (1) more than 5 million subscribers of the official smartphone app, (2) over 10% customers use the cashless purchasing service and (3) linkage between EC and real stores accomplished at over 20% of chain stores, including FC stores. They will invest in them even more proactively.

(Source: the Company’s material)

4-3 Future Policy

There is no significant change to the strategy set in the mid-term management policy, but it became necessary to revise some contents, in order to solve the current issues and respond to changes in the trend caused by the novel coronavirus. The company plans to announce the details of the business goals, investment strategies for stores and others, which reflect the effects of curtailment of investment in the current term and the above-mentioned revision, at the time of announcement of financial results for the term ending May 2021.

The company expects that the reuse market will keep growing, and the company will achieve sustainable growth by responding to changes through combining their network of stores, human resources, and technologies.

5. Conclusions

The company will pursue the “One BOOKOFF” concept by increasing the subscribers of the official smartphone app, adopting cashless settlement, and linking EC and real stores. They will enhance convenience, strengthen merchandise suited for the new normal in the coronavirus-ridden age and the post-coronavirus crisis age, and invest in stores to upgrade individual stores, taking advantage of the growth of the reuse market.

As for the strengthening of merchandise, the company will concentrate on trading cards, hobby related products, precious metals, watches, high-end brand bags, and sports and outdoor products whose sales are growing amid the coronavirus crisis, as already described. Among them, we would like to pay attention to trading cards and hobby related products. Hobby related products include figurines, plastic models of Gundam, model railroads such as N-gauge products, and TOMICA. The demand for them is strong, and the company has increased these products lately, as part of efforts to upgrade individual stores. Its outcome came to the surface in the second quarter. Figurines and some other products are mostly derived from comics and video games, so they go well with the mainstay merchandise of the company. In addition, to expand the base of customers, they can reel in children with these products. Also, these can be displayed in a small space, and competitors in the reuse market are not putting much focus onto them.

On the other hand, the company will increase the productivity of apparel. They are seasonal and have a broad range of categories, which require time and effort, making management costs high. However, some stores need to enrich apparel, so the company will use them occasionally to add unique features to respective stores while prioritizing profitability.

As for the investment in stores, the company will develop a new store package to flexibly operate in the medium-sized trading area, in response to the shrinkage of the range of activities caused by the restraint of going out in the coronavirus crisis. It seems that the company is thinking of the store scale of BOOKOFF PLUS. With that scale, initial investment can be curbed compared to BSB, and real estate meeting their needs would increase. The company will replace existing stores with new ones, so the total number of stores is not expected to grow so much. Furthermore, the company will make efforts to not only sell and buy items, but also to increase revenues from services. The good example of this is the board game café in BOOKOFF PLUS Nagakute Greenroad Store.

The above mentioned is a mere outline, and for details, we must wait for the announcement in May next year, but it will be intriguing. We would like to expect future developments.

<Reference: Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 7 directors, including 4 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report:Updated on June 30, 2020

Basic policy

Under the BOOKOFF GROUP HOLDINGS Limited, which is a pure holding company, the Group’s common corporate philosophy is “Contributing to the economic and social development through our corporate activities” and “Providing opportunities for fulfillment both professionally and personally to all our dedicated employees” and the basic principles of our corporate governance are “ensuring transparency and efficiency of management,” “rapid decision-making,” and “enhancing accountability.” Based on these principles, we will establish good relationships with our stakeholders, including shareholders, customers, employees, business partners, and local communities, and establish a system to make transparent, fair, prompt, and decisive decision-making. We aim to achieve sustainable growth and increase corporate value over the medium to long term.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

[Principle 1-4]

In accordance with the “Regulations on Investment and Securities Management,” the company stipulates policy not to acquire cross-holding shares in principle. However, as an exception, it may hold shares of its franchise chain member companies.

As for the voting rights of strategically held shares, we exercise them appropriately, after perusing the contents of bills, communicating with the companies if necessary, and judging whether it would contribute to the improvement of shareholder value.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

[Principle 4-9]

Our company formulated the criteria for evaluating the independence of outside directors and outside auditors, and discloses them via reports on corporate governance. In addition, two independent outside directors of our company supervise business administration and check whether there is any conflict of interest, while giving appropriate advice and opinions about managerial strategies and making important decisions from an independent viewpoint, based on their technical knowledge and plenty of experiences in business administration, marketing, and retail.

【Supplementary principle 4-11①】

The Company considers that it is appropriate to have about 8 to 10 directors and about 3 to 4 corporate auditors in order to have substantial and effective discussions at the Board of Directors meetings. Currently, there are 3 internal directors, 4 outside directors (of which 2 are independent outside directors), 1 full-time corporate auditor, and 2 outside corporate auditors (1 of which is an independent outside corporate auditor). The directors consist of experienced business executives, certified public accountants, persons with extensive business experience, and persons highly qualified in their field. The corporate auditors consist of certified public accountants, lawyers, and persons coming from business companies. In particular, the outside directors and outside corporate auditors are persons with abundant knowledge and experience, and we consider the balance of members in a way that ensures stable and sustainable growth can be achieved. Regarding the appointment of directors, we select them based on whether the candidates contribute to the enhancement of our corporate value, have dialogue with them, and discuss at the Nominating Advisory Committee, which consists of the President and independent outside directors, based the Committee’s rules. Finally, the decision is made at the Board of Directors. Guidelines regarding the appointment of outside directors are in place, and their independence criteria are in the convocation notice and the report on corporate governance.

[Principle 5-1]

The company appoints an executive in charge of IR and designates the Corporate Planning Department as in charge of IR. For shareholders and investors, the company holds financial results briefings once in six months, and is conducting small meetings and individual interviews as needed. In addition, the company has established the IR policy and disclosed it on its website.

■IR Policy <Policy to promote constructive dialogue with shareholders>

https://www.bookoffgroup.co.jp/en/ir/policy.html

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved.

For back numbers of Bridge Reports on BOOKOFF GROUP HOLDINGS LIMITED(9278) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/