Bridge Report:(9278)BOOKOFF GROUP the first half of fiscal year ending May 2022

President Yasutaka Horiuchi | BOOKOFF GROUP HOLDINGS LIMITED(9278) |

|

Company Information

Market | TSE 1st Section |

Industry | Retail (commerce) |

President | Yasutaka Horiuchi |

HQ Address | 2-14-20 Kobuchi, Minami-ku, Sagamihara-shi |

Year-end | May |

HOMEPAGE |

Stock Information

Share Price | Number of shares issued (End of the term) | Total market cap | ROE (Actual) | Trading Unit | |

¥1,036 | 20,547,413 shares | ¥21,287 million | 1.2% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥15.00 | 1.4% | ¥48.70 | 21.3x | ¥736.74 | 1.4x |

*The share price is the closing price on February 4. DPS and EPS are from the financial results for the second quarter of FY 5/22. ROE and BPS are the results of the previous year.

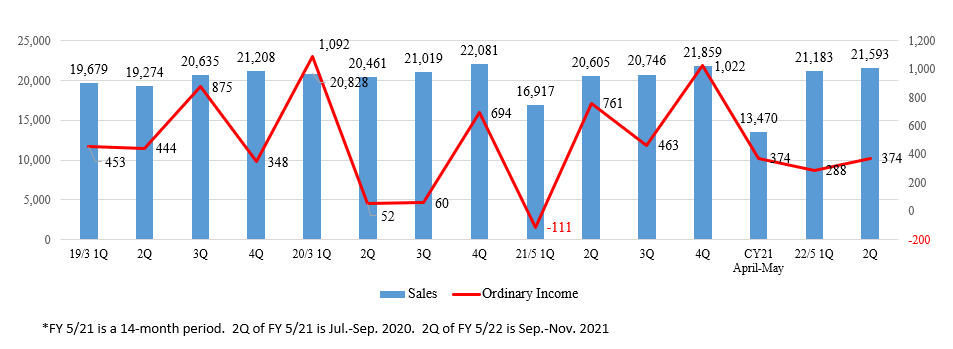

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2018 (Actual) | 80,049 | 613 | 1,092 | -889 | -43.31 | 10.00 |

March 2019 (Actual) | 80,796 | 1,550 | 2,120 | 2,172 | 112.19 | 15.00 |

March 2020 (Actual) | 84,389 | 1,428 | 1,898 | 240 | 13.77 | 6.00 |

May 2021 (Actual) | 93,597 | 1,936 | 2,509 | 157 | 9.03 | 6.00 |

May 2022 (Forecast) * | 87,000 | 1,350 | 1,800 | 850 | 48.70 | 15.00 |

* The fiscal year ended May 2021 is 14 months accounting period. The forecasted values were provided by the company. Unit: million yen or yen.

We present this Bridge Report reviewing the first half of fiscal year ending May 2022 financial results of BOOKOFF GROUP HOLDINGS LIMITED and so on.

Table of Contents

Key Points

1. Company Overview

2. First half of Fiscal Year ending May 2022 Financial Results

3. Fiscal Year ending May 2022 Financial Forecast

4. Interview with President Horiuchi

5. Conclusions

<Reference1: Future Strategy>

< Reference2: Corporate Governance>

Key Points

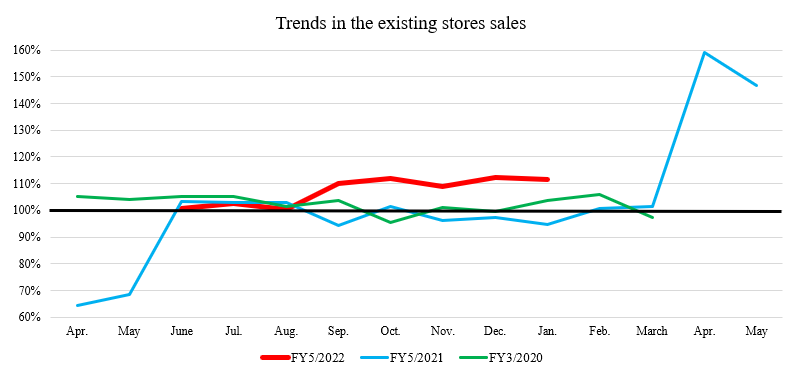

- For the second quarter of the term ending May 2022, sales were 42,776 million yen and ordinary income was 662 million yen (year-on-year changes are not written because the term ended May 2021 is a 14-month period). The sales and number of customers of existing stores in the cumulative second quarter increased 105.6% and 100.6%, respectively, year on year. The number of customers dropped year on year in the first quarter but increased 103.8% year on year in the second quarter, showing a noticeable recovery.

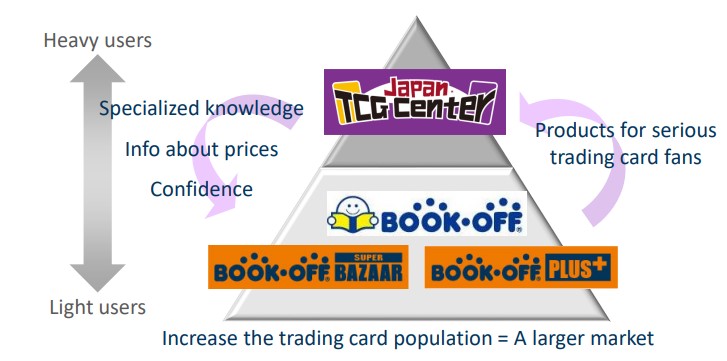

- Regarding the performance of each product category, the sales of books, which grew significantly thanks to the demand from housebound customers in the same period of the previous year, declined year on year in the cumulative second quarter, but increased year on year in the second quarter. The sales of trading cards and hobby-related products, on which the company focuses, kept growing considerably. For apparel, whose performance has been sluggish, the company is proceeding with optimization, for example, by decreasing or streamlining the selling space for apparel while expanding the selling area for trading cards.

- In the cumulative second quarter, 29 stores were renewed. The main purposes of the renewal were “more emphasis on entertainment” and “more sales of trading cards/hobby goods at BOOKOFF SUPER BAZAAR (BSB) and a more productive apparel sales area.” In November 2021, the company opened “Japan TCG Center Kichijoji-eki-kitaguchi Store” as the first store specializing in trading cards in the corporate group.

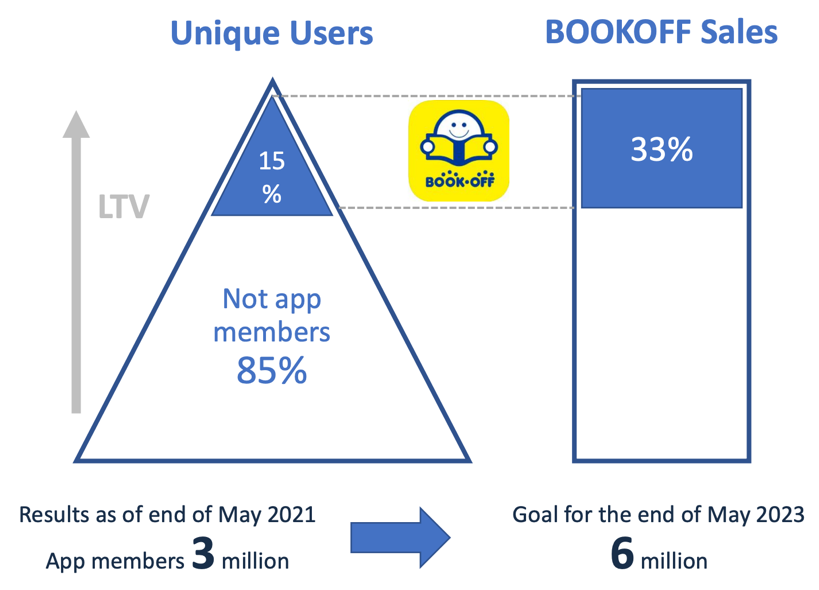

- Regarding the increase of app users, which is the primary measure in the “One BOOKOFF” scheme, the number of app users as of the end of November 2021 stood at 3.73 million, up 600,000 from the end of the previous term. This indicates a steady increase, as the company aims to have 6 million app users by the end of May 2023.

- The earnings forecast has been revised upward. Due to the spread of COVID-19, it was assumed that we would have to wait until the fourth quarter (March to May) for a full-scale recovery of users’ willingness to go out and spend, which has been stagnant, but the number of infected people in Japan decreased toward the second quarter, the sales of existing stores in the domestic BOOKOFF business were healthy, and the company reduced costs. Subsidies for shortened business hours, etc. provided by local governments were posted as non-operating revenues.

- Sales are projected to be 87 billion yen, and ordinary income is forecast to be 1.8 billion yen. The projected sales exceed 84.3 billion yen, which is the amount in the term ended March 2020 (a 12-month period) before the outbreak of the pandemic. Ordinary income is expected to be close to the 1.9 billion yen in the term ended March 2020, although the company will conduct large-scale investment in IT and marketing this term. The expected dividend has increased 7.00 yen/share from 8.00 yen/share to 15.00 yen/share. The expected payout ratio is 30.8%.

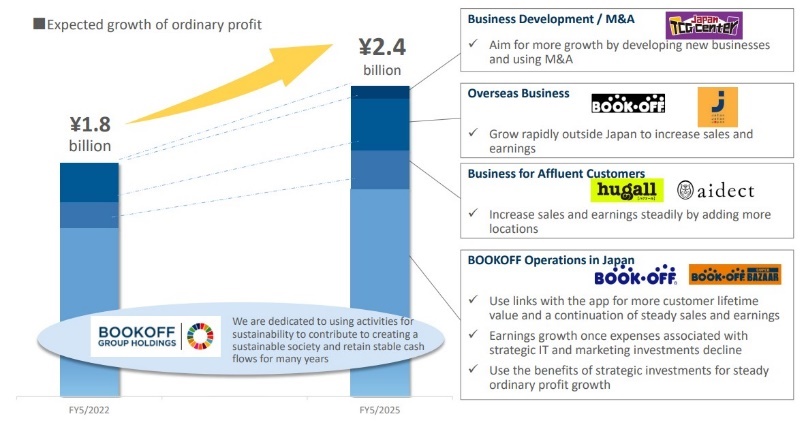

- The company set a goal of achieving “an ordinary income of 2.4 billion yen in the term ending May 2025,” and the president Horiuchi believes that the company has built a foundation for attaining the goal, because the domestic BOOKOFF business became more stable. This is reflected in the upward revision to the earnings forecast announced in January.

- As the company polished individual stores and devoted all its resources to business, the sales of trading cards grew considerably, meeting significant demand, and the company surely satisfied the firm needs for mainly “books,” which are the forte of the company. While the company aims to have 6 million app users by the term ending May 2023, the current number of app users is close to 4 million, leading to stable sales.

- The number of customers declined year on year in the first quarter but recovered remarkably in the second quarter. Although we worry about the impact of the omicron variant, we would like to pay attention to how much they can earn sales and profit in the third and fourth quarters based on healthy performance.

1. Company Overview

The company runs a group of the largest reuse chain stores that has expanded its reuse business into various fields, including books, CDs, DVDs, video games, apparel, sporting goods, baby goods and miscellaneous goods. It has about 800 (directly managed + franchised) store network covering all over the country. Also, they pursue synergies with “reuse at online stores”.

【1-1 Corporate Philosophies of the BOOKOFF Group】

・Contributing to the economic and social development through our corporate activities.

・Providing opportunities for fulfillment both professionally and personally to all our dedicated employees.

With these corporate philosophies, the BOOKOFF Group has made efforts towards the reuse of various items, with a focus on the purchase and sale of “books”. By doing so, they have nurtured the brand, the store network, and human resources, which in turn have become the Group's strength. With their mission “Be a source of enjoyable and enriching lives for as many people as possible “, they aim to be a leading “reuse” company, and a company where people can grow and work with peace of mind, confidence, and enthusiasm.

[Efforts towards diversity]

The company believes that “employees are the greatest asset” and that “developing skills and intelligence of human resources will directly lead to growth of the company.” Therefore, they strive to improve the work environment so each employee can utilize their strengths, and to provide opportunities for employee to develop their skills and fulfill themselves. As part of this, a region selection system was implemented in October 2014, allowing employees to work within a specific area. In addition, under the “married couple transfer system,” employees who are married couples may transfer to a store near their spouse’s workplace.

The BOOKOFF Group also makes an effort to provide employment for persons with disabilities, and they established B-Assist, Inc. in October 2010 (which was recognized as a special subsidiary under the Employment Promotion Act for Persons with Disabilities in December 2010). B-Assist, Inc. provides people with disabilities who are capable to work with employment opportunities and a suitable environment as part of "corporate activities" rather than "welfare" to support social participation and independence (BOOKOFF Group as a whole has employed more than 140 people with disabilities).

【1-2 Business Description】

As the chain headquarter of the reuse stores “BOOKOFF” for books, software and more, the company operates the franchise (FC) system and directly managed stores. There are three types of directly managed stores; 1) “BOOKOFF” (books, CDs, DVDs, video games, electronics and mobile phones, etc.), 2) “BOOKOFF PLUS” (a medium-sized complex BOOKOFF with apparel & brand-name goods), and 3) “BOOKOFF SUPER BAZAAR” (a large-sized complex BOOKOFF with a wide variety of commodities; books, software, electronics (audio and visual devices, computers, etc.), apparel, sporting goods, baby goods, watches, brand bags, jewelry, tableware and miscellaneous goods).

It also operates the E-commerce (EC) site “BOOKOFF Online”, HUGALL that provides purchasing and trading services for the wealthy class at major department stores, new bookstores, and book review community websites.

|

| ||

Avg. floor space | About 430 m2 | Avg. floor space | About 3,135 m2 |

Merchandise | Books, CDs, DVDs, video games, hobby goods, mobile phones, home appliances, etc. | Merchandise | “BOOKOFF” + Apparel/brand-name goods/household products/ sporting goods/kitchenware, etc. |

|

| ||

Avg. floor space | About 990 m2 | Avg. floor space | About 66 m2 |

Merchandise | “BOOKOFF”+ Apparel/accessories, etc. | Merchandise | Stores specialize in purchasing apparel/luxury-brand goods/small size home appliances, etc. |

(Source: the Company’s material)

BOOKOFF Group

Its main subsidiaries, Booklet Co. Ltd., BOOKOFF With Co., Ltd, BOOKOFF Okinawa Inc, Manas Co., Ltd and BOOKOFF Minami Kyushu, Inc. operate “BOOKOFF” stores in Japan. BOOKOFF With Co., Ltd operates reuse stores for apparel, baby goods and others, besides BOOKOFF stores. BOOKOFF With is also a franchisee of a reuse chain store, “Kingram,” which handles watches, brand bags and jewelry. Also, Booklet, BOOKOFF With and BOOKOFF Okinawa operate reuse stores for apparel and more.

Jewelry Asset Managers Inc. operates “aidect,” which specializes in precious metals and offers comprehensive services, including purchase, sale, customization, repair, and remaking.

As for overseas business operation, BOOKOFF U.S.A. INC. runs “BOOKOFF” stores in the United States, BOK MARKETING SDN.BHD runs “Jalan Jalan Japan” in Malaysia.

The company entered the Malaysian market in 2016 and have released a Malaysian original package called “Jalan Jalan Japan.” The store concepts of “Preloved in Japan,” “large amounts of goods,” and “low prices” match local needs, and business performance is strong. It will focus on human resource development and work to further expand the store network. First, they want to establish a twenty-store system within three to four years, and in their mid-term plan, they are also considering the acceptance of discarded products from competitors. The business in Malaysia is profitable, and it not only contributes to earnings, but also serves as an exit strategy for the Group (it sells products that could not be sold at stores in Japan locally). Domestic unsold products are disposed of as industrial waste. The Malaysian business leads reduction of disposal costs, and all stores are performing well. Store operations require securing a large number of products and operations to deal with a large number of products, making it difficult for other companies to develop similar businesses. As a result, this business is unique to the company, which boasts the best sales in the industry. In addition to the fact that Malaysian store managers are receiving training in management and other activities in Japan, Japanese employees of the manager class are dispatched to Malaysia to penetrate the management skills.

2. First half of Fiscal Year ending May 2022 Financial Results

【2-1 Consolidated Results】

| 2Q FY 5/22 (Jun.-Nov. 2021) | Ratio to sales |

Sales | 42,776 | 100.0% |

Gross profit | 25,579 | 59.8% |

SG&A expenses | 25,234 | 59.0% |

Operating income | 345 | 0.8% |

Ordinary income | 662 | 1.5% |

Quarter profit attributable to owners of parent | 457 | 1.1% |

* Unit: million yen.

* Figures and YoY are not shown, because the term ended May 2021 was a 14-month period and the second quarter of FY 5/21 is from April to September 2020.

【2-2 Overview】

The overview of the second quarter of the term ending May 2022 (June to November 2021) is as follows.

◎ Existing Store Sales

The sales of existing stores increased from the previous year. The sales and number of customers of existing stores in the cumulative second quarter increased 105.6% and 100.6%, respectively, year on year.

The number of customers dropped year on year in the first quarter but increased 103.8% year on year in the second quarter, showing a noticeable recovery. The service that allows you to pick up the products you have purchased via the Internet at a nearby store performed well for books and promotes customers to “purchase other products when visiting the store.”

◎ Products and locations

* Products

The sales of books, which grew considerably in the same period of the previous year due to the demand from housebound consumers, declined year on year in the cumulative second quarter, but increased year on year in the second quarter. The sales are healthy, exceeding the pre-pandemic sales in the year before last.

The sales of trading cards and hobby-related products, on which the company focuses, kept increasing. In addition to purchase and sale of items, the company implemented some measures based on its expertise, including the expansion of the selling area while setting spaces for trading cards directly and the increase in precision of reference prices for respective cards, and these measures paid off.

By setting purchase prices while considering competitors, the company is procuring more items.

For apparel, whose performance remained sluggish, the company is proceeding with optimization, for example, by decreasing the selling area while increasing the selling area for trading cards. In addition, by adjusting methods of handling items according to price range, the company succeeded in increasing inventory turnover, and it seems that the performance has bottomed out.

As the ratio of sales of trading cards and hobby-related products, whose gross profit margin is low, is increasing, overall gross profit margin is declining, but the gross profit of existing stores is improving.

(Domestic Directly Managed Stores, Year-on-Year Change in Sales by Products)

| 1Q of FY 5/21 | 2Q | 3Q | 4Q | 5Q | 1Q of FY 5/22 | 2Q | 2Q (cumulative total) |

Books | 84.9% | 106.7% | 103.2% | 97.6% | 127.1% | 93.8% | 100.1% | 96.8% |

Software media (music, videos, and video games) | 89.4% | 95.1% | 94.5% | 92.4% | 118.2% | 97.0% | 104.1% | 100.4% |

Apparel | 48.3% | 82.3% | 84.8% | 90.9% | 270.1% | 94.5% | 107.0% | 101.2% |

Precious metals, watches, high-end bags | 64.6% | 102.8% | 95.6% | 97.5% | 234.5% | 97.9% | 111.5% | 104.2% |

Trading cards and hobby related products | 74.0% | 108.2% | 116.2% | 129.9% | 269.8% | 163.2% | 171.1% | 167.2% |

Home appliances, mobile phones | 73.1% | 89.2% | 88.8% | 95.8% | 164.2% | 92.0% | 108.4% | 99.6% |

Sports and outdoor equipment | 67.3% | 115.9% | 108.1% | 109.8% | 263.7% | 102.2% | 112.1% | 107.0% |

Other | 85.7% | 123.5% | 122.9% | 122.1% | 232.5% | 112.9% | 123.5% | 118.2% |

Total | 78.2% | 100.1% | 98.3% | 98.7% | 152.6% | 101.2% | 110.3% | 105.6% |

*The results of existing store

*Locations

The performance of stores around stations and in downtown areas recovered to the level in the previous year, but not the pre-pandemic level. On the other hand, the performance of stores in suburban and roadside areas remained healthy and exceeded that in the previous year and also that in the year before last.

◎ Stores

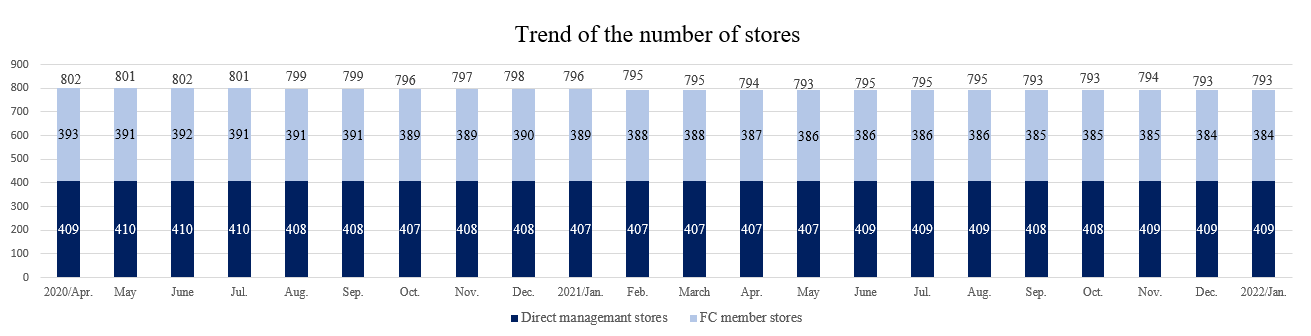

The number of stores as of the end of November 2021 stood at 794. In the cumulative second quarter, the company opened 1 directly managed store (specializing in trading cards) in Japan and opened 2 directly managed stores oversea, for a total of 3 stores, and renewed 29 stores.

This term, the company has no plan to open a new store of the large-scale BOOKOFF SUPER BAZAAR but is considering opening small or medium-sized stores in roadside areas.

(Regarding renewal)

The main purposes of the renewal were “more emphasis on entertainment” and “more sales of trading cards/hobby goods of BOOKOFF SUPER BAZAAR (BSB) and a more productive apparel sales area.”

* more emphasis on entertainment

In November 2021, the company renewed BOOKOFF No. 250 Higashi-okayama Store, converting part of the backyard spaces on the first and second floors into selling areas for trading cards and card duels. In addition, the company concentrated on retro games, toys, hobby-related items, and brand-new products. This renewal was aimed at realizing a store where customers can not only sell and buy used products, but also enjoy themselves there.

In the first half of this term, the company renewed 2 stores for making them more entertaining.

* more sales of trading cards/hobby goods of BOOKOFF SUPER BAZAAR (BSB) and a more productive apparel sales area

In September 2021, the company renewed BSB No. 1 Yokkaichi-Hinaga Store, converting the selling space for trading cards and hobby-related products into the selling space exclusively for trading cards and newly establishing a space for card duels with 64 seats, while reducing the area of the apparel selling space by about 20% to improve the efficiency of selling and counter operations.

For other selling spaces, the company improved counter operations and the routes workers take in stores, and expanded aisle width, to enable customers to walk around more comfortably in the store.

Such renewal was conducted in 9 stores in the first half of this term.

(Opened “Japan TCG Center,” which is the first store specializing in trading cards.)

In November 2021, the company opened “Japan TCG Center Kichijoji-Kitaguchi Store,” which is the first store specializing in trading cards in the BOOKOFF Group. The selling area is 54 tsubo (≒ 178 m2).

In addition to the purchase and sale of used items, this store deals in plenty of brand-new packages and card supplies (goods for card games) and has a space for enjoying card duels inside the store, targeting a broad range of customers, including beginners and experts.

While expanding the selling areas for trading cards and setting spaces for enjoying card duels at existing BOOKOFF stores, the company will operate the specialized store “Japan TCG Center” rather than the “BOOKOFF” brand, in order to attract trading card users.

(Source: the Company’s material)

Investment in Stores

Classification | Store name | Opened date | Location | Selling space area | |

Direct management | Opening of new stores | KAKA'AKO STORE | March 20 | USA | 208 m2 |

Masai Store | May 25 | Malaysia | 1,653 m2 | ||

Kichijoji-Kitaguchi Store | November 27 | Musashino City, Tokyo | 179m2 | ||

◎ EC Sales

Under the “One BOOKOFF” scheme based on the concept of “enabling all customers to have a once-in-a-lifetime encounter with reused products in an optimal way by utilizing its EC channel and nationwide store network with an official smartphone app,” the company has taken some measures, including the increase of app users, the installation and upgrade of electronic purchase systems (decreasing the waiting time of users and streamlining store operations), the linkage of data on store inventory with EC, the start of the service of preparing products ordered in EC at a nearby store, and the start of cashless purchase of used items.

The number of app users as of the end of November 2021 was 3.73 million, up 600,000 from the end of the previous term. The company is steadily increasing app users, to attain the goal of having 6 million app users by the end of May 2023.

It is known that if card users among customers become app users, annual purchase amount (LTV) will increase 1.3 times. In addition, the sales from “the service of preparing products ordered online at actual BOOKOFF stores” in November 2021 were up 46% year on year, and over 30% of customers using this service purchase other products at stores when picking up products they have ordered online. Like this, app users are producing favorable effects on the company’s revenues.

The company will make continuous efforts to stabilize the revenues of the domestic BOOKOFF business by increasing app users.

The sales from the chain via BOOKOFF Online in the cumulative second quarter stood at 4,399 million yen, down 97.1% year on year.

The sales from the chain via BOOKOFF Online means the sum of the sales of products ordered in the EC site “BOOKOFF Online” and shipped from EC centers, the sales of products shipped from directly managed stores and franchised stores, and the sales of products ordered online and picked up at directly managed or franchised stores.

The year-on-year decline is attributable to the recoil from the special demand for shipment from EC centers in the first quarter of the previous year. In the second quarter, the sales increased 102.0% year on year. These results and the above-mentioned growth of the service of preparing products ordered online at actual stores indicate that the recent performance has been healthy.

◎ Wealthy Customers

The service of purchasing used items at department stores, which is a business targeting wealthy people, was strongly affected by the spread of COVID-19 compared with the domestic BOOKOFF business, but its sales increased year on year.

◎ Overseas Business

They had no choice but to temporarily close “Jalan Jalan Japan” due to the lockdown in Malaysia, but “BOOKOFF” stores in the U.S. performed well with respect to purchase and sale. In particular, the sales of local books, anime goods, etc. grew considerably year on year.

In each country, the company opened a new directly managed store for further growth.

【2-3 Financial Condition and Cash Flow】

Financial Conditions

| May 2021 | November 2021 | YoY |

| May 2021 | November 2021 | YoY |

Current assets | 24,017 | 25,410 | +1,393 | Current liabilities | 17,584 | 17,971 | +387 |

Cash and deposits | 5,837 | 6,050 | +213 | Accounts payable-trade | 560 | 724 | +164 |

Accounts receivable-trade | 2,120 | 2,049 | -71 | Short-term borrowings | 11,481 | 11,939 | +458 |

Merchandise | 13,778 | 14,989 | +1,211 | Non-current liabilities | 9,793 | 10,391 | +598 |

Non-current assets | 16,304 | 16,253 | -51 | Long-term borrowings | 7,072 | 7,759 | +687 |

Property, plant and equipment | 5,848 | 5,862 | +14 | Liabilities | 27,377 | 28,362 | +985 |

Intangible assets | 1,220 | 1,379 | +159 | Net assets | 12,944 | 13,301 | +357 |

Investments and other assets | 9,234 | 9,011 | -223 | Retained earnings | 8,603 | 8,956 | +353 |

Guarantee deposits | 7,492 | 7,291 | -201 | Treasury shares | -2,343 | -2,335 | +8 |

Total assets | 40,321 | 41,664 | +1,343 | Total liabilities and net assets | 40,321 | 41,664 | +1,343 |

* Unit: million yen. Borrowings include lease obligations.

Total assets grew 1,343 million yen from the end of the previous term to 41,664 million yen, due to the increases in cash & deposits, inventory assets and so on.

Total liabilities augmented 985 million yen to 28,362 million yen, due to the increase in borrowing for investing in IT-related equipment, opening new stores, and renewing existing stores.

Net assets rose 357 million yen to 13,301 million yen.

Capital-to-asset ratio declined 0.1 points from the end of the previous term to 31.8%.

Cash Flows (CF)

| 2Q of FY 5/22 |

Operating cash flow(A) | 33 |

Investing cash flow(B) | -817 |

Free cash flow (A+B) | -784 |

Financing cash flow | 990 |

Cash and Equivalents at the end of term | 6,050 |

* Unit: million yen

【2-4 Topics】

(1) Produced a plan for satisfying the criteria for remaining listed on a new market

In December 2021, the company submitted an application for the selection of the Prime Market. The company did not satisfy the criteria for remaining listed on that market as of the reference date for transition (June 30, 2021), so the company produced a plan for satisfying the criteria.

Status of compliance with the criteria for remaining listed and the plan period

There are four criteria for remaining listed (No. of tradable shares: 20,000 lots or more; the market capitalization of tradable shares: 10 billion yen or more; the ratio of tradable shares: 35% or higher; the trading value: 20 million yen or larger). As of the reference date for transition (June 30, 2021), the market capitalization of tradable shares of the company was 9.49 billion yen, which only fell below the standard value.

Accordingly, the company will make efforts to satisfy the criteria for remaining listed by the end of the term ending May 2025.

② Basic policy for their efforts

The company will actively invest in IT and marketing for the domestic BOOKOFF business, pursue the “One BOOKOFF” scheme, expand the business targeting wealthy people, actively operate stores overseas, promote M&A and business development, implement measures for attaining SDGs, and promote ESG-related measures, including the response to the corporate governance code, to keep improving its corporate value and then increase its market capitalization.

In addition, according to the results of the first screening by the Tokyo Stock Exchange, the ratio of tradable shares of the company is 47.4%, satisfying the criteria for remaining listed on the Prime Market, but the company will also make efforts to improve the ratio of tradable shares, to increase the market capitalization of tradable shares with the aim of meeting the criteria for remaining listed on the Prime Market.

③ Issues and details of measures

③-1 Current issues and measures for improving the market capitalization

The company thinks that it is necessary to be evaluated appropriately in the stock market while improving its corporate value and will take the following measures.

① Efforts for achieving the assumed mid-term performance

② Promotion of ESG-related measures

③ Measures for returning profit to shareholders

③-2 Current issues and measures for improving the ratio of tradable shares

The company thinks that it is necessary to improve the liquidity of shares. In particular, they will clarify their stance toward the shares of listed companies, etc. they hold strategically, and take measures for improving the liquidity of the company’s shares.

(2) Received “Empathy IR Award” from Japan Investor Relations Association.

In November 2021, the company received “Empathy IR Award” at “IR Excellent Enterprise Award 2021” hosted by Japan Investor Relations Association.

(Outline of “Empathy IR Award”)

This award was introduced by Japan Investor Relations Association in 2020 at the 25th “IR Excellent Enterprise Award.” It is aimed at reflecting the viewpoints of enterprises that have applied for “IR Excellent Enterprise Award” through “voting,” sharing active IR activities, and realizing best practices.

In 2021, it was held under the theme of “IR activities that contribute to sustainability,” and 178 applicants described their own IR activities to be shared, and mutually voted for recommendable activities. The top 17 companies that obtained a large number of votes were selected as the recipients of “Empathy IR Award.”

(Reason for awarding BOOKOFF)

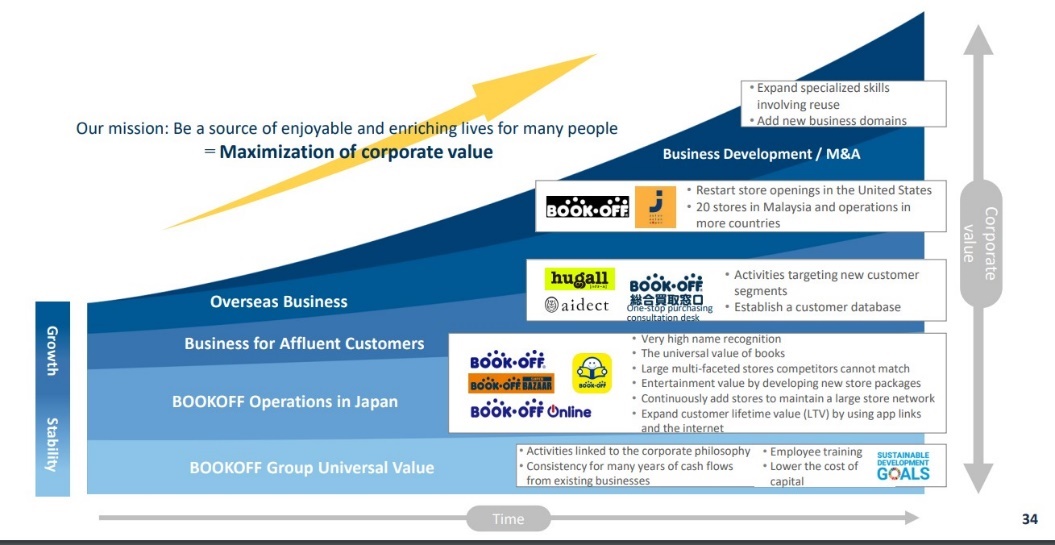

At a session for briefing financial results, the company used “the value creation roadmap of the BOOKOFF group” to show the expected growth and stability of each business in the figure and indicated that the cash flow from its stable business and the profit growth from its growing business will help complete the business mission to improve its corporate value.

The company considers that it was highly evaluated, because it expressed that its corporate value originates from the universal value of the BOOKOFF Group, including its corporate ethos, popularity, and personnel development, based on the reuse business, which is the core business of the company, and explained understandably that the efforts to attain SDGs would not only contribute to society, but also lead to the reduction of capital costs.

3. Fiscal Year ending May 2022 Financial Forecast

【3-1 Earning Forecasts】

| FY 5/21 Act. (14 months) | Ratio to sales | FY 5/22 Est. (12 months) | Ratio to sales | Progress rate |

Sales | 93,597 | 100.0% | 87,000 | 100.0% | 49.2% |

Operating income | 1,936 | 2.1% | 1,350 | 1.6% | 25.6% |

Ordinary income | 2,509 | 2.7% | 1,800 | 2.1% | 36.8% |

Profit attributable to owners of parent | 157 | 0.2% | 850 | 1.0% | 53.8% |

* Unit: million yen.

The earnings and dividend forecasts revised upward

The earnings forecast has been revised upwardly. Due to the spread of COVID-19, it was assumed that we would have to wait until the fourth quarter (March to May) for a full-scale recovery of users’ willingness to go out and spend, which has been stagnant, but the number of infected people in Japan decreased toward the second quarter, the sales of existing stores in the domestic BOOKOFF business were healthy, and the company reduced costs. Subsidies for shortened business hours, etc. provided by local governments were posted as non-operating revenues.

Sales are projected to be 87 billion yen, and ordinary income is forecast to be 1.8 billion yen.

The projected sales exceed 84.3 billion yen, which is the amount in the term ended March 2020 (a 12-month period) before the outbreak of the pandemic.

Ordinary income is expected to be close to the 1.9 billion yen in the term ended March 2020, although the company will conduct large-scale investment in IT and investment in marketing this term.

The expected dividend has increased 7.00 yen/share from 8.00 yen/share to 15.00 yen/share. The expected payout ratio is 30.8%.

【3-2 Activities in the second half】

The major activities in the second half of the term ending May 2022 are as followed. For the activities from the second half of this term, mid-term goals, and the ideal state, please see “Reference 1: Future Management Policy.”

*Domestic BOOKOFF business: continue the investment in stores

The company will keep renewing existing stores and opening new stores, while concentrating on trading cards and hobby-related items, which are strategic products.

The company will make small and medium-sized BOOKOFF stores more entertaining, by setting spaces for trading cards and card duels and concentrating on hobby and anime-related products, so that users can enjoy themselves there.

The company aims to make the large-sized general store “BOOKOFF SUPER BAZAAR” evolutionary, by improving the efficiency of the apparel selling space, concentrating on trading cards, hobby-related items, and products suited for regional characteristics, and enabling users to walk around more comfortably in each store.

As the company renewed 9 stores in the first half, it plans to renew around 10 stores in the second half, too.

* Domestic BOOKOFF business: Enhancement of purchase

In order to minimize the number of chances the company loses in the sales network expanded with the “One BOOKOFF” scheme, the company will increase the number of items to provide by purchasing more used items.

In detail, the company will expand the network for purchasing used items from users who cannot visit stores by using package-delivery services and visiting customers’ houses. For in-store purchase, the company will develop an environment where customers can sell used items more casually without worry, by upgrading the cashless purchase service, shortening the waiting time of those who sell used items by improving the purchase counters, and increasing the precision of purchase price data to enhance usability.

* Store opening plan

The company will open 4-5 BOOKOFF stores, including new ones and relocated ones. Regarding the large-sized store BOOKOFF SUPER BAZZAR, the company will mainly renew stores this term, and resume the opening of new stores next term.

The company will open 4-5 counters for wealthy people in department stores.

The company also plans to open new stores actively oversea.

(Source: the Company’s material)

4. Interview with President Horiuchi

We asked President Horiuchi about the review of the results in the first half of the fiscal year, the progress of the One BOOKOFF scheme and other future initiatives as well as his message to shareholders and investors.

(1) Financial Results for the Second Quarter of the Fiscal Year Ending May 2022

Both sales and profits were better than expected for the first half of the fiscal year.

There are two factors behind this.

The first was the success of aggressive efforts to expand the business of trading cards, which has been growing rapidly since the previous fiscal year.

At the large-scale BOOKOFF SUPER BAZZAR store, we implemented a significant zoning change that reduced the selling space for apparel and expanded the selling space for trading cards. As for trading cards, the creation of a card duel space for playing and the creation of a space where customers can easily gather contributed greatly.

In addition, we created card duel spaces in small and medium-sized stores by making good use of empty spaces such as backyards. In addition, by selling new products together with used products, we were able to provide trading card users with a wide variety of products and more enjoyable spaces than ever before.

The other factor was that we could see the performance of the apparel business bottoming out. Although the business environment remained severe, sales bottomed out and profitability improved in the first half of the fiscal year as we have made efforts to improve efficiency by reducing the sales floor area and devising our pricing since the previous fiscal year, contributing favorably to the results in the first half of the fiscal year.

(2) Progress of the One BOOKOFF scheme

As one of the important initiatives in the realization of the One BOOKOFF vision, the number of app members reached over 3.7 million at the end of November 2021 and is nearly 4 million as of January 2022.

The expansion of app membership is steadily beginning to yield results as the “service of allowing customers to receive products they have ordered online at nearby stores” steadily grew, and an increasing number of customers purchase other products at the time of picking up the products ordered online.

(3) “Upgrade individual stores” × “Use all the BOOKOFF Group’s strengths”

Our company’s business policy for growth is “Upgrade individual stores” × “Use all the BOOKOFF Group’s strengths.”

“Upgrade individual stores” means working on the selection and management of products based on local characteristics and ideas unique to each store, with books at the core.

“Use all the BOOKOFF Group’s strengths” is aimed at increasing contact points with customers through both sales and purchase.

In our business, if we want to expand our “sales”, of course, we must “purchase” more used items as well. However, if this balance does not work out, we will not be able to sell out and lose profit margin. In the past, we had some difficulties, but now, with the expansion of our app membership, we are able to achieve great sales results. In addition, the number of cases in which items purchased in Japan which unfortunately remained unsold and were shipped overseas and sold has increased, and we are now able to compete not only on specific points, but also over wider areas and fields.

On the other hand, as sales capabilities are strengthened, “purchase” is becoming more important, but there is still a lot of room for improvement, because the fusion of the Internet and stores is not as advanced as in the case of sales. Based on the track record created through sales, we will make all-out efforts in purchasing, and aim to broaden and strengthen our contact with customers, thereby further ensuring our sustainable growth potential.

(4) Aiming to Achieve an Ordinary Income of 2.4 billion yen in the Fiscal Year Ending May 2025

Our company has set a goal of achieving an ordinary income of 2.4 billion yen for the fiscal year ending May 2025, and we believe we have laid the groundwork for this goal.

The most important point is that the domestic BOOKOFF business has become very stable. Although we were somewhat affected by the coronavirus pandemic in the two previous fiscal years, we were able to upwardly revise our earnings forecast for the current fiscal year.

I believe that there are three main elements for improving the stability of the domestic BOOKOFF business.

The first is "Upgrade individual stores."

Firstly, efforts have been made at small and medium-sized stores, and now these initiatives are being implemented for large-scale stores. The voluntary efforts of our staff at stores or the places closest to customers paid off, and they are having a successful experience.

The second is the growth of the business of trading cards and hobby-related products.

At first, we focused on adapting to the characteristics of each region, but when it was found that there was a great demand, we decided to try to meet it with the whole chain. Then, we worked with a sense of speed, and achieved great results.

Thirdly, we have been making all-out efforts to steadily expand our app membership base, and we have been able to generate stable sales by meeting the firm needs centered around books, which is our company's strength.

As a result of improving the stability of the domestic BOOKOFF business based on the 3 points above, the feasibility of achieving an ordinary income of 2.4 billion yen for the fiscal year ending May 2025 has further increased.

(5) Message to Shareholders and Investors

In the past, we expanded the BOOKOFF business with the keyword "A BOOKOFF that handles more than just books," but now the keyword "A BOOKOFF Group that is more than just BOOKOFF" has become more appropriate.

Of course, the domestic BOOKOFF business is at the core of our business, but our business targeted at the wealthy and overseas business have entered a stage where we can reliably estimate their contribution to profit. Also, we have just launched “Japan TCG Center”, a store specializing in trading cards and while it may take some time to start generating revenue, we are ready to tap into significant demand. We will continue to focus on new business development and M&A.

In this way, our company's group strength is steadily growing stronger.

On the other hand, regarding the TSE’s transition to the new market classification, we submitted an application to select the prime market and, as of the transition reference date of June 30, 2021, we did not meet the criteria for maintaining our listing on the prime market, and therefore prepared a plan to ensure compliance with the criteria for maintaining our listing on the new market segment. We recognize that it is an important duty to meet the standards as soon as possible and to create an environment where investors can invest in our company stocks with peace of mind.

Please continue to look forward to our company's medium-to-long-term growth.

5. Conclusions

The company set a goal of achieving “an ordinary income of 2.4 billion yen in the term ending May 2025,” and the president Horiuchi believes that the company has built a foundation for attaining the goal, because the domestic BOOKOFF business became more stable. This is reflected in the upward revision to the earnings forecast announced in January.

As the company polished individual stores and devoted all its resources to business, the sales of trading cards grew considerably, meeting significant demand, and the company surely satisfied the firm needs for mainly “books,” which are the forte of the company. While the company aims to have 6 million app users by the term ending May 2023, the current number of app users is close to 4 million, leading to stable sales.

The number of customers declined year on year in the first quarter but recovered remarkably in the second quarter. Although we worry about the impact of the omicron variant, we would like to pay attention to how much they can earn sales and profit in the third and fourth quarters based on healthy performance.

<Reference1: Future Strategy>

【1 Business Environment】

According to company documents (Survey by Recycle Tsushin, 2020), the size of the Reuse Market, which doubled in the span of 7 years from 1.2 trillion yen in 2011 to 2.1 trillion yen in 2018, is expected to reach 3.2 trillion yen by the year 2025.

As part of this market, CtoC is seeing a rapid increase in usage due to the distribution of flea market apps, but they pose issues, such as the safety and security in interpersonal transactions and reasonability of prices.

Because of this, real recycling shops and stores that purchase used items are the ones that are incorporating the needs of customers who want to safely utilize Reuse Services, which is why BtoC Services, which can offer reliability in addition to convenience, are thought to have a major advantage.

【2 The Company’s Strengths】

Within the company, the following points are thought to be the company’s major strengths within the Reuse Market.

(1) Highest Degree of Recognition

According to a survey among the users of domestic reuse chain companies, the company had a degree of recognition of 96%. Almost all the users surveyed knew about the company.

The long-term store operation and the nationwide operation of physical stores are factors behind the high degree of recognition, which cannot be easily caught up to by other companies, providing a powerful barrier for entry into the market.

(2) Largest Number of Users

The company’s annual number of users is 90 million (gross). In addition to the degree of recognition mentioned above, users have been highly supportive of the company’s convenience in usage, through the store network comprised of 800 stores across the country and the vision of “One BOOKOFF” which is presently being formulated.

(3) Largest Book Inventory

The company’s current book inventory is over 100 million books. Books, which still remain the major products for the company that started its business with the purchase and sale of books, attract a wide range of customers and can easily become an entry point into the Reuse Service, because of which users can be expected to buy other products offered by the company, greatly contributing to the formation of a stable userbase.

(4) Personnel Training System

In order to fulfill the company’s business mission of “Be a source of enjoyable and enriching lives for as many people as possible,” the company believes that the training of personnel in addition to the brand power and store network mentioned above is essential, which is why it has created a personnel training system for all of its employees, not limited to its permanent employees but also including part-time employees.

The company is focusing on personnel training in order to support the operation of its stores through its management philosophy, along with a personnel training curriculum based on a variety of manuals and a career advancement system for all of its workers.

In addition to improving the satisfaction of customers through a “smiling, polite and speedy response” at its stores, the company is also making efforts to improve the sense of participation for each of its workers in increasing the operating efficiency at its distribution center.

(5) Creation of Reliable Stores

The company is taking initiatives to create stores where its users can safely sell their products making sure to comply with the law and create a purchasing service from the user’s point of view.

In particular, regarding the reasonability of purchasing prices which is the most relevant aspect to users, the company has put together a purchasing price database that is based on an enormous amount of transaction data that other companies do not have and uses this database for purchases that take place at its stores.

【3 Value Creation of BOOKOFF】

By fulfilling the company’s business mission of “Be a source of enjoyable and enriching lives for as many people as possible,” the company is aiming for the maximization of its enterprise value.

In order to achieve that, the company will create a solid, universal value by promoting the training of personnel based on its management philosophy and pursue growth by promoting all of its business from that foundation.

(Source: the Company’s material)

【4 Business policy for growth】

The company aims to expand revenues with the synergy between the initiative of “upgrade individual stores” and the initiative of “use all the BOOKOFF Group’s strengths.”

In the initiative of “upgrade individual stores,” the company will pursue store operation that would increase the satisfaction level of customers in each region by increasing products based on the ideas of staff in each store considering regional characteristics while handling books as core products as its forte.

In the initiative of “use all the BOOKOFF Group’s strengths,” the company aims to increase contact points with customers by utilizing real and online stores for selling and purchasing used items.

【5 Business Expansion】

(1) BOOKOFF Business

① Store Expansion

The company will open 4-5 BOOKOFF stores, including new ones and relocated ones. Regarding the large-sized store BOOKOFF SUPER BAZZAR, the company will mainly renew stores this term, and resume the opening of new stores next term.

*BOOKOFF SUPER BAZAAR

The company will concentrate on the renewal of existing stores, by overcoming the sluggish performance of apparel, which occupies a large selling area.

*BOOKOFF

Seeing the formation of smaller business regions due to the impact of the novel coronavirus as a significant business opportunity, the company will prioritize the promotion of locally based business.

The company will implement renewals which pursue the sense of entertainment by procuring more trading cards and hobby related products, which sell well.

* BOOKOFF One-stop Purchasing Consultation Desk

In addition to specializing in the purchase of high-quality products in urban areas and shipping them to stores in the area, the company will also strengthen its coordination and marketing with HUGALL, which is a business targeted at wealthy customers.

② Product-Specific Strategy

*Books and Software media

These remain the core of the company’s sales as well as valuable products for motivating users to visit stores.

In addition to increasing convenience through the utilization of online services, the company plans to expand the usage through trial periods for subscription services.

*Trading Cards and Hobby Related Products

Their sales increased significantly during the coronavirus pandemic. The company will strengthen them through concentrated investments.

Through the handling of new merchandize, the company will improve the freshness of its products and increase sales. While the new merchandize will be a factor in the decrease in gross profit margin, the company believes it will trigger increases in the scale of second-hand sales and purchases.

In November 2021, the company opened the first store specializing in trading cards, to reel in users.

*Apparel

Due to a curtailment of the opportunities to go outside as a result of the coronavirus pandemic, the downtrend due to the primary market slump is expected to continue for a while.

The company plans to improve its profitability by adjusting its sales floor area and optimizing its operation.

*Other Strategic Products

Sports and outdoor goods showed favorable trends amid the coronavirus pandemic. Rental services will also be offered in the future.

The company will continue to foster features of individual stores according to regional characteristics through the enrichment of the lineup of records, etc.

③ Marketing Strategy

The company started its new promotion “Arujan! (We Have It!)” in May 2021.

As the company is aiming to have its users recognize anew the value and services of BOOKOFF such as its complete assortment of books and diversity in products, it shifted its marketing strategy from the conventional sale model and direct advertisement to a value-focused model and brand advertisement with the aim of regularly attracting customers.

The company will not limit itself to TV commercials, but utilize the Internet, social media, PR, and in-store ads, to encourage the dormant customer base which has started to recede from BOOKOFF to visit the stores again.

④ The “One BOOKOFF” Scheme

“One BOOKOFF” Scheme is the concept of “delivering the feeling of a ‘once-in-a-lifetime encounter’ with a used product to every customer through an optimal method by utilizing the EC channel and the nationwide store network and with the official smartphone app as a starting point.” As mentioned previously, the number of official application users exceeded 3.7 million in November 2021.

(Source: the Company’s material)

(Features of the Official App)

Product Search | Allows you to search for products from approximately 4.2 million products through the app. Possible to find products that one could not find in a store near them. |

Purchasing From the App | Allows you to purchase products without going to a store. One can make purchases even if there are no stores near them or they do not have the time to visit a store. Free shipping if your purchase price is 1500 yen or over. |

Pick-up at a Store | Allows you to pick up the products you purchased on the app from a store nearby. Free shipping starting from one product (not applicable in certain stores) |

Coupon | On the app, you can check coupons for the specific store they have registered with, as well as information on sales held in all stores. |

The company will strive to increase the number of app users by further advertising the convenience of the official app.

The company aims to double the number of app users to 6 million by the end of May 2023, as well as to have 15% of BOOKOFF users be app subscribers and have them account for 1/3 of the sales.

(Source: the Company’s material)

(2) Businesses for Wealthy People

According to company documents (Nomura Research Institute ‘NRI Questionnaire Survey for the Upper-Class’”), wealthy people in Japan (sum of lower-upper-class, upper-class and upper-upper-class) consisted of 4.75 million households, which had increased by 1.21 million households over 10 years from 2009 and are expected to continue to increase.

Through an increase in the number of locations, the company can expect an increase in purchases as well as earnings.

Thus, the company will increase reuse oriented toward the upper-class through the following 2 approaches.

The first approach is toward the upper-class customer base who do not use BOOKOFF services.

The company will continue to proactively expand in the future, centered on major department stores through “HUGALL (9 locations),” which provides purchasing services for wealthy people in major department stores, as well as “aidect (14 locations),” which specializes in precious metals, is operated by Jewelry Asset Managers Inc. and provides purchasing and selling services.

The second approach is toward the upper-class customers who use BOOKOFF services.

The company will resume opening the BOOKOFF One-stop Purchasing Consultation Desk (15 stores) in the posh areas mainly in the Tokyo Metropolitan Area.

An impairment loss of goodwill for Jewelry Asset Managers Inc. was posted in the financial report for the previous term, but the revenue structure has been improving due to the optimization of operations and the utilization of the in-house distribution network.

The company will use its unique approach to maximize the points of contact with its target base.

(3) Overseas Business

The following are the policies for each specific region.

① USA (9 stores)

Japanese animation is widely acclaimed in the USA and exported products from Japan are creating high added value.

In addition to export, in order to strengthen purchasing and selling in the USA, the company will focus on training store managers.

As the revenue structure has been well-organized, the company will open new stores for the first time in 8 years.

② Malaysia (8 stores)

The external environment has been harsh due to the lockdowns enforced after the spread of the novel coronavirus, but the company is anticipating business growth as the demand from users remains high. The company is aiming for a 20 store-system by expanding its domestic supply chain.

The company will not purchase used items in Malaysia but sell the products that were not sold in Japan.

By utilizing affiliated stores from external partners, the company will also start expanding into countries other than Malaysia.

③ France (3 stores)

All of the three stores are participating ones.

(4) Promotion of M&A and Business Development

In the reuse domain, by strengthening the specialization of products, creating a store network for covering uncultivated areas, and approaching a new customer base, the company will further expand the business domain through promoting synergy with reuse in domains outside of reuse, a sense of entertainment in stores, and M&A and business development from the viewpoint of being a pillar for future business.

(5) Initiatives Toward SDGs

The act of buying and selling products at BOOKOFF itself expands the lifespan of those products, thus contributing to society by reducing the number of products thrown away. This accomplishes a vitally important role by fulfilling SDG 12, which is about “Responsible Production and Consumption.” Following these, the company is working to make contributions toward the fulfillment of SDGS through its various activities centered around its major business in the reuse industry.

| Reuse and paper recycling |

|

Malaysia Business Jalan Jalan Japan | Creation of jobs and supply of quality products and apparel |

|

Jewelry Asset Managers Inc. | Jewelry repair service for a longer life of jewelry |

|

Authorized by the Law for Employment Promotion of Persons with Disabilities | Assistance and jobs for people with disabilities |

|

Sagamihara City, Minamichita town | Partnerships with companies, governments and NPOs |

|

(Source: the Company’s material)

【6 Investment and Store Opening Plans】

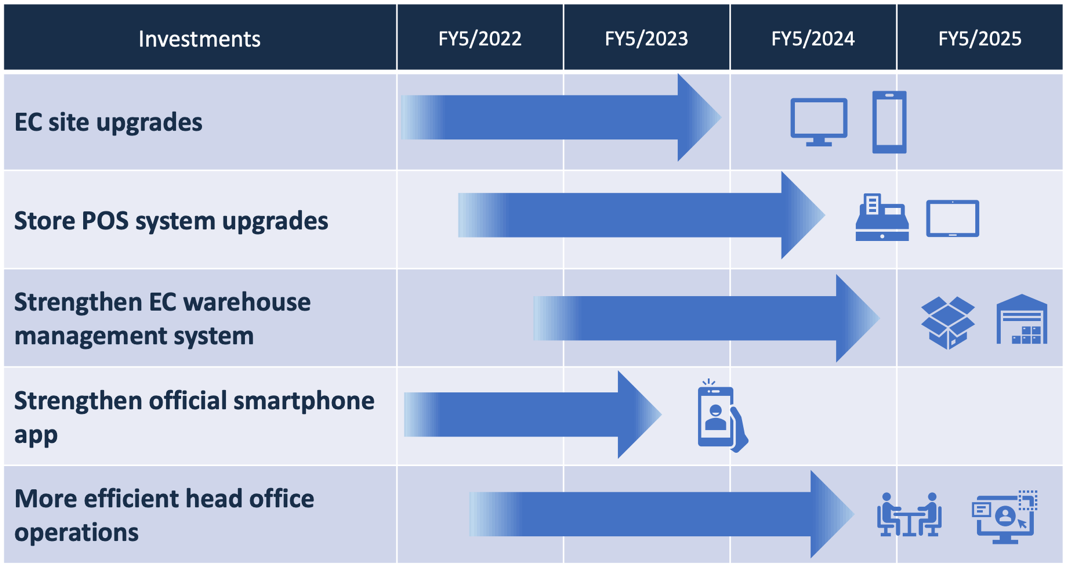

(1) IT Investment

In addition to strengthening coordination between stores and e-commerce and pursuing digital transformation, the company will implement large-scale IT investment to renovate deteriorating IT infrastructure, etc.

Because of this, the next 2-3 years will be a peak in investment and expenses, becoming a factor in the temporary fall in earnings.

(Source: the Company’s material)

(2) Store Opening Plans

This term, the domestic BOOKOFF business is focusing on the renovation of the large-scale store BOOKOFF SUPER BAZAAR. Opening of new stores will resume from the next term. BOOKOFF is opening 4-5 new stores, with a mixture of opening new stores and replacements.

The company is planning to proactively open new stores overseas.

(Source: the Company’s material)

【7 Profit assumption】

According to the financial report for the previous term, the spread of the novel coronavirus had a major impact on their business activities as the company had to temporarily suspend activities for over half of its directly managed stores in Japan, heavily damaging earnings, and curtailing investment in opening new stores.

Since the second quarter of the previous term, profit has been on a recovery track, but considering the delay in opening stores due to the curtailment of investment, the fact that it takes some time to achieve the recovery of services for wealthy people and the overseas business, which are growing, and the significant changes in the market environment after the pandemic, the company put away the goal of achieving an ordinary income of 3 billion yen in the mid-term management plan, which will end in the term ending May 2023, and plans to achieve a profit of 2.4 billion yen in the term ending May 2025, by improving revenues in each business.

(Source: the Company’s material)

*Domestic BOOKOFF Business

The company will increase LTV through the linkage with the app, continuing the stable earnings. Profit will grow from the term ending May 2024 after the disappearance of investment costs.

*Business for Wealthy People

The company will steadily acquire earnings from the term ending May 2023 by increasing the number of locations.

*Overseas Business

The company will increase earnings from the term ending May 2023 through proactive expansion.

*M&A and Business Development

Extra earnings starting from the term ending May 2024.

<Reference2: Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 10 directors, including 6 outside ones |

◎ Corporate Governance Report:Updated on December 21, 2021

Basic policy

Under the BOOKOFF GROUP HOLDINGS Limited, which is a pure holding company, the Group’s common corporate philosophy is “Contributing to the economic and social development through our corporate activities” and “Providing opportunities for fulfillment both professionally and personally to all our dedicated employees” and the basic principles of our corporate governance are “ensuring transparency and efficiency of management,” “rapid decision-making,” and “enhancing accountability.” Based on these principles, we will establish good relationships with our stakeholders, including shareholders, customers, employees, business partners, and local communities, and establish a system to make transparent, fair, prompt, and decisive decision-making. We aim to achieve sustainable growth and increase corporate value over the medium to long term.

The basic policies on each principle of the Corporate Governance Code are disclosed in “Our Company’s Commitment to the Corporate Governance Code.”

■Our Company’s Commitment to the Corporate Governance Code

https://www.bookoffgroup.co.jp/en/ir/corporate.html

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

[Principle 1-4]

In accordance with the “Regulations on Investment and Securities Management,” the company stipulates policy not to acquire cross-holding shares in principle. However, as an exception, it may hold shares of its franchise chain member companies.

As for the voting rights of strategically held shares, we exercise them appropriately, after perusing the contents of bills, communicating with the companies if necessary, and judging whether it would contribute to the improvement of shareholder value.

【Supplementary Principle 3-1③】

<Risk and Revenue Earning Opportunities Associated with Climate Change>

We collect and analyze essential data regarding the impacts of our company’s business activities on climate change and continue our approach to enhancement of quality and quantity in our disclosure based on TCFD, an internationally established framework of disclosure, or an equivalent framework.

【Supplementary Principle 4-1③】

We do not have set a succession plan, however, we established a system which assists us in nominating highly transparent and fair successors and selecting director candidates, at the board meeting held between the time period after the end of the fiscal year and before the general meeting of shareholders is held, based on the effectiveness of the board meetings run by the board of independent outside directors, the chairperson’s assessment, as well as reports from the nomination advisory committee, when there is a change of the president or a selection of directors for nominating the next president and new directors.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary Principle 2-4①】

<Our view on ensuring diversity>

We consider our employees to be the greatest asset and the source of the group’s competitiveness. We strive to create a workplace environment for our employees and provide them with opportunities for skill development and self-fulfillment, in order to secure diversity.

<Objectives and development status for ensuring diversity>

(i) Women

In response to a dialogue between our company’s president and female employees, we launched “the Project for Creating a Pleasant Working Place” in 2012, to design systems, support career development, and foster corporate culture in order to further promote female employees’ advancement by implementing various systems including Workplace Selection System and Rehiring System. Currently, we continue the activities to increase the ratio of female managers 1.5 times from fiscal year 2020 by fiscal year 2025.

(ii) Foreign Nationals

We respect each individual’s personality regardless of their nationality when it comes to recruiting and developing part-time employees in our domestic business. Moreover, in our overseas business, we define “localization” as a key measure from the viewpoint of actively promoting and stabilizing our business, and proactively promote recruitment of home-grown executives and store managers. As of November 2021, we have 9 store managers of local nationals among our 16 overseas stores, and we continue to engage in personnel development, while considering the labor condition in each country and differences in culture and value.

(iii) Mid-career Hires

We regularly hire full-time employees according to our Part-time Staff Recruitment System. As of September 2021, the ratio of mid-career hires to all employees of BOOKOFF Corporation was 45.8%, and that of mid-career hires in the management positions was 13.2%.

【Supplementary Principle 3-1③】

Our sustainability initiatives and investments in human capital and intellectual properties are explained and disclosed in Financial Results Presentation material upon disclosure of our management strategy.

<Our effort in sustainability>

We consider that it is the role of our corporate group to accelerate the formation of a recycling-based society, while providing happy and fulfilling lives to our customers through our reuse business.

As part of our sustainability initiatives, we engage in various activities including (1) promoting the reusing and recycling of disused articles through external partner companies, (2) committing to reuse business, and building curricula associated with SDG 12 “Responsible Consumption and Production” as well as participating in school education, and (3) developing a program to donate the purchase amount from disused articles to humanitarian aid groups and environmental protection organizations.

For more specific details, our PR and SDGs Promotion Office established in September 2021 take the lead to strive for appropriate disclosure on our company’s website, etc.

<Investment in human capital and intellectual properties>

We consider our employees to be our greatest asset and the source of the group’s competitiveness. We strive to create a workplace environment for our employees and provide them with opportunities for skill development and self-fulfillment.

<Risk and Revenue Earning Opportunities Associated with Climate Change>

We collect and analyze essential data regarding the impact of our company’s business activities and continue our approach to enhancement of quality and quantity in our disclosure based on TCFD, an internationally established framework of disclosure, or an equivalent framework.

[Principle 4-9]

Our company formulated the criteria for evaluating the independence of outside directors and outside auditors and discloses them via reports on corporate governance. In addition, two independent outside directors of our company supervise business administration and check whether there is any conflict of interest, while giving appropriate advice and opinions about managerial strategies and making important decisions from an independent viewpoint, based on their technical knowledge and plenty of experiences in business administration, marketing, and retail.

【Supplementary principle 4-11①】

We consider having 8~10 directors are adequate to engage in substantive and effective discussions at the board meetings. Currently, the board consists of 4 internal directors and 6 outside directors (3 of them are independent outside directors), and each director’s expected field, their primary knowledge, experience, capability, and expertise are as presented in “The Composition of the Board of Directors (Skills Matrix)” on the last page of this Report.

With regard to the selection of directors, the Nomination Advisory Committee (consists of president and independent outside directors) selects candidates according to the internal rules, based on the evaluation through interviews for checking whether they can contribute to our company’s sustainable growth and improvement of our corporate value, and then decisions are made at the board meeting after the audit supervisor committee are notified of the candidates. Regarding director candidates who belong to the audit supervisor committee, our selection is based on whether they can contribute to the maintenance and enhancement of the company’s sound management and social trust. If the candidates have ability to perform neutral and objective auditing, then final decisions are made at the board meeting after they are discussed and agreed by the audit supervisor committee. Furthermore, we have an established guideline for the selection of outside directors, and criteria for the independence of outside directors are disclosed in the convening notice as well as the Corporate Governance Report.

[Principle 5-1]

The company appoints an executive in charge of IR and designates the Corporate Planning Department as in charge of IR. For shareholders and investors, the company holds financial results briefings once in six months, and is conducting small meetings and individual interviews as needed. In addition, the company has established the IR policy and disclosed it on its website.

■IR Policy <Policy to promote constructive dialogue with shareholders>

https://www.bookoffgroup.co.jp/en/ir/policy.html

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on BOOKOFF GROUP HOLDINGS LIMITED(9278) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/