| Vision Inc. (9416) |

|

||||||||

Company |

Vision Inc. |

||

Code No. |

9416 |

||

Exchange |

TSE 1st Section |

||

Industry |

Information and telecommunications |

||

President |

Kenichi Sano |

||

Address |

Shinjuku i-Land Tower, 6-5-1 Nishi-Shinjuku, Shinjuku-ku, Tokyo |

||

Year-end |

December |

||

URL |

|||

* Stock prices as of the close on August 15, 2017. Number of shares issued at the end of the most recent quarter excluding treasury shares. BPS reflects the stock split of July 2017.

|

||||||||||||||||||||||||

|

|

* The forecasted values were provided by the company. From FY12/16, net income is profit attributable to owners of the parent. Hereinafter the same apply.

* The Company conducted a 100-for-1 share split in Jan. 2015. This Bridge report outlines Vision's results for the first half of the fiscal year ending December 2017 and the forecast for the full term. |

| Key Points |

|

| Company Overview |

|

The company forms a group with its 14 consolidated subsidiaries, both inside and outside Japan. Of those, the two based in Japan are Members Net Inc. (which conducts the business of charging agency, fixed-line telephone service subscription agency, etc.) and Best Link Inc. (which carries out the business of broadband service subscription agency). There are 11 overseas subsidiaries that operate as overseas hubs for the Global WiFi service in South Korea, Hawaii, Hong Kong, Singapore, Taiwan, UK, Shanghai, France, Italy, California and New Caledonia; there is also a local subsidiary in Vietnam, which is an offshore hub for database construction and system development.  Global WiFi service Clients can access the service through the company's website (including the rerouted accesses via affiliated sites), apps, corporate sales, and partners (affiliated companies including travel agents, insurance agents and credit card companies), and will receive a Wi-Fi router at locations such as airport/seaport counters. Its users include general consumers, listed companies, government offices, local governments, universities, embassies and foreign-capital enterprise, with roughly 50% of its clients being corporate customers, assuring stable demand. As collecting fees are collected by the collection agent, there is no recovery risk for the company. Corporate sales are aimed at various governmental offices and corporations that carry out frequent overseas business trips, and corporate registration is required, but the application process is simple and the clients can benefit from various discounts and special offers at the time of billing. Furthermore, services through its partner companies (affiliated companies and cooperative companies with sales agency/franchise agreements) are also offered (same for the information and telecommunications service business). Advantages

Its foremost advantages are the fixed-rate system and strong competitive pricing, the most comprehensive coverage amongst the competitors, smooth usage featuring high-speed Internet, safety/security, and substantial corporate sales capability. Specifically, the service's cost advantage could be as high as 89.9% compared to the flat rate overseas packet plan of domestic mobile companies (daily rental fees start from 300 yen depending on the locality) and the coverage offered in over 200 countries/regions worldwide is one of the most comprehensive in the industry. Its partnerships with operators worldwide have enabled a high-speed and smooth user environment (the number of countries/regions employing the high-speed telecommunications standard 4G-LTE is also one of the most comprehensive in the industry), while the connection is highly secure as the telecommunications are encrypted with 51 service counters worldwide (24 hours 365 days) (as of August 2017). As mentioned above, the fact that roughly 50% of its clients are corporate customers promising stable demand is also an advantage.

Market scale for the Global WiFi business

The number of foreign visitors to Japan (inbound travelers) in 2016 exceeds 24.03 million (according to Japan National Tourism Organization), and the market scale of Wi-Fi router rental estimated by the company from the average spending per customer is about 168.2 billion yen. As the Japanese government set a goal of increasing the number of foreign visitors to Japan to 40 million by 2020, the market scale is expected to grow further. On the other hand, the number of outbound travelers from Japan to overseas is around 17 million per year, and the market scale estimated by the company is about 119.8 billion yen. According to the reference material of the company (source: U.N. World Tourism Organization [UNWTO]), the number of global travelers from a foreign country to another foreign country is 1.2 billion. The market scale is estimated to be over 8 trillion yen.   Information and telecommunications service

With Best Link Inc. - a consolidated subsidiary - at its core, the group offers services aimed mainly at new corporations, venture businesses and multi-store development enterprises such as food-service chains, from its 7 offices nationwide and in cooperation with its partner companies. The services include subscription agency operations for various telecommunication services such as photocopier/MFP, telephone lines, business phones and corporate mobile broadband lines, sales of mobile telecommunication devices, OA equipment and security products (UTM), etc., and designing websites.

Major targets are newly established corporations with high growth potential (within 6 months after establishment).

Thanks to governmental measures, etc., the number of corporation established in Japan is increasing. The company aims to increase clients and continue transactions with them, by utilizing its strengths. According to the material produced by the company with reference to the statistics of the number of companies established surveyed by the Ministry of Justice, the number of companies established increased by 3,105 (2.8%) from 111,238 in 2015 to 114,343 in 2016. On the other hand, the number of enterprises (including sole proprietors) that have been established less than 6 months before and started transactions with the company was 18,232 in 2015, and 18,966 in 2016 (up 4.0%). One out of every 6 newly established corporations becomes a client of the company.

Strengths

The strengths of the company are efficient sales activities based on web-based marketing strategies and CRM utilizing its knowhow. The company reels in customers through web-based marketing, achieves a high rate of receiving orders, and promotes repeat orders through continuous contact through customer support, etc. In detail, the company finds newly established corporations with high growth potential, offers optimal services at the best timing according to growth stage, and meets the additional demand for devices. In the brokerage of Internet lines, the company can keep receiving commissions from telecom operators unless services are cancelled, and in the lease of copiers, etc., the company can keep receiving maintenance fees. In parallel with the growth of clients, the numbers of lines and devices are expected to grow. (recurring-revenue business).

|

| Growth strategy and progress |

|

As for the information and telecommunications service business, it will work upon the enhancement of 3 sales channels: "Web marketing," "CLT (Customer Loyalty Team)" and "Sales partners" and also of products, services and business models.  "Useful information (Media)" Service

The company manages the general advertisement for inbound travelers: "NINJA MEDIA." It is an advertisement and marketing for foreign tourists that makes use of the customer base of the Global WiFi service, and has a positive feature, that is, the ability to approach the tourists at every "timing" during their trip to Japan, that includes Before the trip (collecting information, preparing for the trip), During the trip (airports, transportation, sightseeing, accommodation) and After the trip (returning to home countries). It offers business partners' information on shops, tax-free stores, hotels, guest houses, tour, insurance, coupons, rental cars, golf courses, tourist sites, gourmet, etc. through the video media "DOGA.TV", a guidebook "SHINOBI" and also at counters and facilities, and leads customers to their desired places.

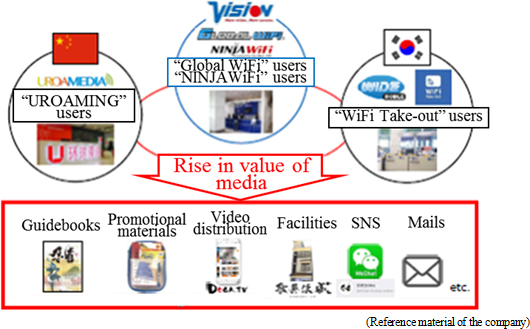

Capital and business partnership with UROAMEDIA

In addition, the company started a capital and business partnership in August 2017 with UROAMEDIA LIMITED (main office: Hong Kong, Representative: SUN DE HUO, hereinafter called UROAMEDIA), which handles a marketing service in the group of China' largest enterprise of foreign Wi-Fi router rental service, Beijing Ulink Technology Co., Ltd. (hereinafter called ULINK), and Korea's largest enterprise of a foreign Wi-Fi router rental service: WIDE MOBILE Co. Ltd. (hereinafter called WIDE).UROAMEDIA is a ULINK-affiliated marketing service enterprise that offers foreign Wi-Fi router rental service called "UROAMING," which is used by over 6 million people per year with a market share of more than 50% in China (Research by UROAMEDIA). At present, it operates a data analyzing service for client companies along with providing print based and digital advertisements to foreign travelers from China and other foreign tourists in China, and especially information provision using mobile telecommunication applications (carried out three times; Before the trip, During the trip and After the trip) was well-received by both users and client companies. The common target of VISION, WIDE, ULINK and UROAMEDIA is an advertiser of media that seeks to reach foreign travelers from Japan, Korea and China and other foreign travelers. With collaboration of Japan, Korea and China's respective number 1 enterprises of Wi-Fi router rental service, it becomes possible to reach an overwhelming number of foreign travelers. The company plans to raise the value of media, such as guidebooks, promotional materials, facilities, SNS, and mail, by utilizing this strong point.  "Useful Service"

A foreign restaurants reservation service and the wearable translation device "ili" rental service (started in June 2017) are offered. Since its usage charges are paid along with usage charges of "Global WiFi" and "NINJA WiFi," business partners can save time and trouble for settlement of account. Also, an inbound tourist building "KABUKI-JO" was opened in the center of the most favorite spot of foreign customers to Japan, in Kabuki-chou (Shinjuku-ku, Tokyo) in June 2017.

|

| First Half of Fiscal Year December 2017 Earnings Results |

Sales and operating income grew 20.1% and 52.3%, respectively, year on year.

Sales were 8,350 million yen, up 20.1% year on year. While the sales of the Global WiFi business increased 36.1% due to the increase of repeat use and client corporations, the sales of the information and telecommunications service business rose 3.6% healthily.Operating income was 850 million yen, up 52.3% year on year. Gross profit rate rose 0.6 points, thanks to cost reduction through the improvement of procurement conditions by volume discount (contracts under original conditions for decreasing telecommunication charges and improving convenience, etc.), the increase in the turnover of rental terminals through the streamlining of shipping operation, etc. In addition, the company curbed the augmentation of SG&A expenses, by reducing the expenses for AI-based call centers for dealing with inquiries, enhancing the utilization rate of Smart Pickup (automatic locker), and partially automatizing the operation through the use of Smart Entry (self-checkout kiosk terminal), for streamlining and saving power.   Global WiFi business

Sales were 4,732 million yen (up 36.1% year on year), and segment income was 737 million yen (up 84.5%). Users increased and sales grew because the company met the demand from corporations for services for supporting business trips, etc. and increased repeat users, and profitability improved thanks to the streamlining of the shipping operation with the cloud WiFi (which will be described later), the curtailment of the cost for call centers by utilizing AI, etc. The ratio of corporate users is 44.8% in terms of the number of transactions (48.1% from Apr. to Jun.), and 52.1% in terms of revenue (55.8% from Apr. to Jun.). On Jun. 1, the company launched a service of leasing the wearable translation device "ili" to the users of "Global WiFi."The number of Wi-Fi router rentals is 736,000, reaching 64% of the full-year result for the previous term. Out of them, the number of Wi-Fi router rentals for overseas use (outbound travelers from Japan to overseas) is 575,000, reaching 65% of the full-year result for the previous term, while the number of rentals for domestic use (inbound travelers from overseas to Japan) is 127,000, and the number of rentals outside Japan (travelers from a foreign country to another foreign country) is 89,000. Cloud WiFi means the next-generation telecommunications technology for managing SIM in a cloud space. This makes it possible to allocate telecommunication operators around the world without physically inserting a SIM card into a device. The company started offering "Global WiFi Cloud" as a monthly-charged Wi-Fi router rental service for corporations at the end of March. With a single device, travelers can automatically access the network of a local telecom operator just by turning on the device, in over 100 countries and regions, including Japan. On the other hand, the company can improve efficiency and attain labor-saving. The cloud WiFi technology has been already installed in about 20% of the Personal Wi-Fi routers owned by the company. In Jul., the company launched "Global WiFi for Biz," a service exclusively for corporations, which is a standing-type service and does not require the procedures for application, receipt, or return. Provision of the high-speed telecommunications standard 4G-LTE, and the expansion of convenient service areas through a large-capacity plan, etc.

Apr. 4: Started offering the high-speed telecommunications standard 4G-LTE and enriched large-capacity plans in India, Myanmar, and Laos (conventionally, 3G).Apr. 21: Started offering the high-speed telecommunications standard 4G-LTE and enriched large-capacity plans throughout Indonesia (conventionally, 3G). Apr. 28: Started offering the high-speed telecommunications standard 4G-LTE and enriched large-capacity plans in the Republic of Albania (conventionally, 3G). Jun. 23: Started offering the high-speed telecommunications standard 4G-LTE and enriched it in San Marino and Madeira (conventionally, 3G). Jun. 30: Started offering the high-speed telecommunications standard 4G-LTE in Ulan Bator, Mongolia (conventionally, WIMAX). Jul. 7: Upgraded the service for Tahiti to the latest high-speed telecommunications standard 4G-LTE (conventionally, 3G).  Information and telecommunications service business

Sales were 3,592 million yen (up 3.6% year on year), and segment income was 599 million yen (up 6.9% year on year). Sales and profit grew, thanks to the promotion of recurring-revenue business, upselling and cross-selling strategies through CRM measures, etc. In this business, the company offers optimal services and products considering the market scale and needs according to client company's growth stage, at appropriate prices in a timely manner, to improve customer satisfaction level and actualize long-term stable transactions. This is supported by "web-based marketing" for reeling in customers, the "customer loyalty team," which takes the role of continuously contacting customers through customer support, etc., and "sales activities" for offering optimal services and products at appropriate prices in a timely manner. The company makes constant efforts to strengthen them.    |

| Fiscal Year December 2017 Earnings Estimates |

The full-year earnings forecast has not been revised, and sales and operating income are estimated to grow 12.6% and 24.5%, respectively, year on year.

Both sales and profit are forecasted to mark a record high. For the Global WiFi business, the company aims to increase sales and profit by meeting the demand from "outbound travelers" and "inbound travelers." For the information and telecommunications service business, the company aims to reel in more start-up firms than the previous term, and meet the needs of existing customers timely, for upselling and cross-selling. While making it easier to invest in the company by decreasing share price per trading lot and improving liquidity, the company conducted 2-for-1 share split on July 1, 2017 (reference date: June 30), in order to increase investors.

|

| Conclusions |

|

|

| <Reference: Regarding corporate governance> |

◎ Corporate Governance Report Updated on Mar. 30, 2017

Basic policy

Our corporate group improves ourselves to change clients' expectations into impression, pursues innovation without hesitation to actualize the ideal, always feels grateful about the support of many people (stakeholders), and operates its business activities with a humble mindset. Under this code of conduct, Vision observes laws, in-company regulations, and policies, carries out business in good faith, and strives to realize optimal corporate governance.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

A new chief executive officer and others are selected by the board of directors from candidates while considering and discussing their personalities, knowledge, experiences, etc. while following its corporate ethos and strategies in the rapidly changing business environment. The company will discuss how to oversee the planning by a successor. <Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

The basic policy of Vision is not to hold the shares of other companies strategically, unless it is considered beneficial for improving corporate value in the mid to long terms. As of now, there are no strategically held shares. If shareholders or others want to have a dialogue with Vision, the company will respond positively within a reasonable range, to contribute to the sustainable growth of the company and the medium to long-term improvement in corporate value. As of now, Vision holds a briefing session attended by the president or a director in charge of IR two or more times per year, meetings with institutional investors, briefing sessions for individual investors several times a year, and so on. The information on their results is properly shared through meetings of the board of directors, etc. In addition, Vision takes thoroughgoing measures for preventing the leakage of insider information. Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright (C) 2017 Investment Bridge Co., Ltd. All Rights Reserved. |