| Vision Inc. (9416) |

|

||||||||

Company |

Vision Inc. |

||

Code No. |

9416 |

||

Exchange |

TSE 1st Section |

||

Industry |

Information and telecommunications |

||

President |

Kenichi Sano |

||

Address |

Shinjuku i-Land Tower, 6-5-1 Nishi-Shinjuku, Shinjuku-ku, Tokyo |

||

Year-end |

December |

||

URL |

|||

* Stock price as of the close on February 20, 2019. Number of shares issued at the end of the most recent quarter excluding treasury shares.

|

||||||||||||||||||||||||

|

|

* The forecasted values were provided by the company. From FY12/16, net income is profit attributable to owners of the parent company. Hereinafter the same shall apply.

* The company conducted a 100-for-1 share split in January 2015 and a 2-for-1 share split in July 2017. This Bridge Report outlines Vision's results for the fiscal year ending December 2018 and the forecast for the fiscal year ending December 2019. |

|

| Key Points |

|

| Company Overview |

|

Under the management philosophy of "Contributing to the Information and Communications Revolution," Vision conducts the Global WiFi service, which leases the personal Wi-Fi (wireless LAN) routers which can be used in over 200 countries and regions on a flat-rate packet basis, and as an information and telecommunications service distributor, it also provides information and telecommunications services of arranging telecommunications infrastructure and office equipment necessary for business activities, such as fixed-line telecommunications, mobile telecommunications, broadband etc.

The company forms a group with its 18 consolidated subsidiaries, both inside and outside Japan. Of those, the 6 based in Japan are Members Net Inc. (which conducts the business of charging agency, fixed-line telephone service subscription agency, etc.) and Best Link Inc. (which carries out the business of broadband service subscription agency), etc. There are 12 overseas subsidiaries that operate as overseas hubs for the Global WiFi service in South Korea, Singapore, UK, Hong Kong, Hawaii, Taiwan, China (Shanghai), France, Italy, California and New Caledonia; there is also a local subsidiary in Vietnam, which is an offshore hub for database construction and system development.

【Business Description】

Global WiFi business

The company offers services including "Global WiFi" (a Wi-Fi router rental service that allows people traveling overseas to use local internet services at a competitive rate through its partnerships with the overseas operators) and "NINJA WiFi" (a Wi-Fi router rental service for overseas visitors to Japan, etc.), while also engaging in services for the travelers between foreign countries in overseas bases (South Korea, Taiwan and California).

Advantages

① Affordable fixed-rate system, ② the most comprehensive area coverage, ③ comfort, ④ safety/security, and ⒕ substantial support bases and corporate sales capabilities ⇒ One of the largest customer bases in the industry

The advantages of "Global WiFi" and "NINJA WiFi" include the following: ① cost benefits of up to 89.9% (the rental fee per day is 300 yen at the minimum, depending on the travel destination) compared to the overseas fixed-rate packet plans offered by other Japanese mobile carriers, ② the industry's most comprehensive coverage of over 200 countries and regions, ③ high-speed telecommunications services through partnerships with telecommunication operators all over the world, ④ available at 24 hours a day, 365 days a year, at 47 bases worldwide, and ⒕ the industry's largest number of available spots at airport counters.

Furthermore, from the business perspective, another advantageous point is the fact that use by corporations, through which stable demand can be expected, has accounted for about 50% in this business segment. As a result, the company has secured a great number of users, which is one of the largest market shares in the industry. Advantages

① Affordable fixed-rate system, ② the most comprehensive area coverage, ③ comfort, ④ safety/security, and ⒕ substantial support bases and corporate sales capabilities ⇒ One of the largest customer bases in the industry

The advantages of "Global WiFi" and "NINJA WiFi" include the following: ① cost benefits of up to 89.9% (the rental fee per day is 300 yen at the minimum, depending on the travel destination) compared to the overseas fixed-rate packet plans offered by other Japanese mobile carriers, ② the industry's most comprehensive coverage of over 200 countries and regions, ③ high-speed telecommunications services through partnerships with telecommunication operators all over the world, ④ available at 24 hours a day, 365 days a year, at 47 bases worldwide, and ⒕ the industry's largest number of available spots at airport counters.

Furthermore, from the business perspective, another advantageous point is the fact that use by corporations, through which stable demand can be expected, has accounted for about 50% in this business segment. As a result, the company has secured a great number of users, which is one of the largest market shares in the industry.

Growth Story

About 31.19 million foreign tourists visited Japan (inbound travelers) in 2018 (according to the Japan National Tourism Organization). The company has estimated the scale of the personal Wi-Fi router rental market at approximately 218.3 billion yen, based on the average customer unit price. As the Japanese government has cited "40 million tourists annually in 2020" "60 million tourists annually in 2060" as a goal, the market scale is expected to further increase. Meanwhile, the number of Japanese tourists traveling to overseas nations (outbound travelers) is about 17 million per year, and the company estimated that the market scale is about 132.6 billion yen. The number of tourists travelling from one overseas country to another has exceeded 1.3 billion (according to the reference material of the company; source: officially published material by the United Nations World Tourism Organization), and the market scale estimated by the company is over 9 trillion yen.

The company is growing rapidly, but its market share is still 14.9% for overseas use (outbound: from Japan to overseas) and 2.5% for domestic use (inbound: from overseas to Japan, including Japanese people). Accordingly, their share in the Japanese market (outbound and inbound travelers) is 7.1%, which indicates that there remains room for increasing the market share. The company will endeavor to further increase the percentage by not only prospecting for new users but also accumulating repeat users and taking in corporate demand. Furthermore, it will strengthen the business foundation through cost reduction and productivity improvement in an attempt to boost profitability.

In the medium and long term, the company plans to develop a new business, "travel-related service platform," using the customer bases of "Global WiFi" and "NINJA WiFi." Growth Story

About 31.19 million foreign tourists visited Japan (inbound travelers) in 2018 (according to the Japan National Tourism Organization). The company has estimated the scale of the personal Wi-Fi router rental market at approximately 218.3 billion yen, based on the average customer unit price. As the Japanese government has cited "40 million tourists annually in 2020" "60 million tourists annually in 2060" as a goal, the market scale is expected to further increase. Meanwhile, the number of Japanese tourists traveling to overseas nations (outbound travelers) is about 17 million per year, and the company estimated that the market scale is about 132.6 billion yen. The number of tourists travelling from one overseas country to another has exceeded 1.3 billion (according to the reference material of the company; source: officially published material by the United Nations World Tourism Organization), and the market scale estimated by the company is over 9 trillion yen.

The company is growing rapidly, but its market share is still 14.9% for overseas use (outbound: from Japan to overseas) and 2.5% for domestic use (inbound: from overseas to Japan, including Japanese people). Accordingly, their share in the Japanese market (outbound and inbound travelers) is 7.1%, which indicates that there remains room for increasing the market share. The company will endeavor to further increase the percentage by not only prospecting for new users but also accumulating repeat users and taking in corporate demand. Furthermore, it will strengthen the business foundation through cost reduction and productivity improvement in an attempt to boost profitability.

In the medium and long term, the company plans to develop a new business, "travel-related service platform," using the customer bases of "Global WiFi" and "NINJA WiFi."

Information and Communications Service business

With Best Link Inc., a consolidated subsidiary, at its core, the group offers services aimed mainly at newly established corporations, venture businesses and multi-store development enterprises such as food-service chains, from its 7 offices nationwide and in cooperation with its partner companies. The services include subscription agency operations for various telecommunications services such as business phones, agency operations of arranging lines for landline telephones, subscriber telephones, and NTT Hikari telephones, corporate mobile phones, broadband lines, sales and maintenance of mobile telecommunication devices, OA equipment and security products (UTM), etc., designing websites, and agency operations for new power services targeting enterprises. Information and Communications Service business

With Best Link Inc., a consolidated subsidiary, at its core, the group offers services aimed mainly at newly established corporations, venture businesses and multi-store development enterprises such as food-service chains, from its 7 offices nationwide and in cooperation with its partner companies. The services include subscription agency operations for various telecommunications services such as business phones, agency operations of arranging lines for landline telephones, subscriber telephones, and NTT Hikari telephones, corporate mobile phones, broadband lines, sales and maintenance of mobile telecommunication devices, OA equipment and security products (UTM), etc., designing websites, and agency operations for new power services targeting enterprises.

The company has advantages in prospecting for corporations newly established (within 6 months), one of its major targets, and it is estimated, according to the data by the Ministry of Justice (the number of newly registered companies was 118,811 in 2017 all around Japan), that the company has conducted transactions with one in every 6 - 7 corporations newly founded in Japan. These advantageous points are backed by the company's strong power to attract customers through its unique online marketing (Internet media strategy), through which the company maximizes running yield (recurring revenue-type business) and conducts additional sales with high productivity (up/cross selling) through its unique know-how, the Customer Relationship Management (CRM; customer relationship and ongoing transactions) strategy. The company continuously receives commission from operators for telephone line arrangements unless contracts for the service are cancelled, and it can earn maintenance fees for multifunction photocopiers on a continuous basis. Moreover, the follow-up service by its customer loyalty team has enabled the company to establish a recurring revenue-type business model, in which earnings are accumulated by taking in demand for lines and equipment that increases with customers' business growth, and providing optimal services according to customers' growth stage (additional sales with high productivity through up/cross selling).

In the Information and Communications Service business, the company will evolve its recurring revenue-type business model while shifting the target customer from enterprises with growth potential to ones in the growth stage.

The company has advantages in prospecting for corporations newly established (within 6 months), one of its major targets, and it is estimated, according to the data by the Ministry of Justice (the number of newly registered companies was 118,811 in 2017 all around Japan), that the company has conducted transactions with one in every 6 - 7 corporations newly founded in Japan. These advantageous points are backed by the company's strong power to attract customers through its unique online marketing (Internet media strategy), through which the company maximizes running yield (recurring revenue-type business) and conducts additional sales with high productivity (up/cross selling) through its unique know-how, the Customer Relationship Management (CRM; customer relationship and ongoing transactions) strategy. The company continuously receives commission from operators for telephone line arrangements unless contracts for the service are cancelled, and it can earn maintenance fees for multifunction photocopiers on a continuous basis. Moreover, the follow-up service by its customer loyalty team has enabled the company to establish a recurring revenue-type business model, in which earnings are accumulated by taking in demand for lines and equipment that increases with customers' business growth, and providing optimal services according to customers' growth stage (additional sales with high productivity through up/cross selling).

In the Information and Communications Service business, the company will evolve its recurring revenue-type business model while shifting the target customer from enterprises with growth potential to ones in the growth stage.

|

| Fiscal Year December 2018 Earnings Results |

Due to the increase of rental transactions and the improvement in profitability, the sales and profit of the Global WiFi business expanded, and the Information and Communications Service business kept growing stably.

Sales grew 22.5% year on year to 21,503 million yen. The sales of the Global WiFi business rose 30.0% year on year, as corporate clients repeatedly used its services, new customers, including corporations and individuals, increased, and then the number of rental transactions grew. The sales of the Information and Communications Service business grew 9.4%, thanks to the increase of new clients, including newly established corporation and venture firms, the strengthening of profitable services, and up-selling and cross-selling strategies. The sales of others, including new businesses, such as time-based vehicle-for-hire time sharing, media, and catalogue sales businesses, increased from 58 million yen in the previous term to 231 million yen.

Operating income rose 38.9% year on year to 2,484 million yen. Gross profit rate increased 0.9 points to 58.8%, as telecommunication cost declined through volume discount in the Global WiFi business and the company made continuous efforts to reduce costs by utilizing Cloud WiFi, etc. SGA augmented 21.4% year on year through business expansion, as the number of employees, especially sales staff, rose nearly 18% year on year from 497 to 586, but the company reduced labor for dealing with inquiries and delivering products. Consequently, SGA rate improved 0.4 points to 47.3%.

Due to the posting of exchange gain, etc., ordinary income was 2,499 million yen, up 39.3%. Although an extraordinary loss of 310 million yen, including a loss on valuation of investment securities of 309 million yen, was posted, net income increased 26.5% year on year to 1,529 million yen. Due to the increase of rental transactions and the improvement in profitability, the sales and profit of the Global WiFi business expanded, and the Information and Communications Service business kept growing stably.

Sales grew 22.5% year on year to 21,503 million yen. The sales of the Global WiFi business rose 30.0% year on year, as corporate clients repeatedly used its services, new customers, including corporations and individuals, increased, and then the number of rental transactions grew. The sales of the Information and Communications Service business grew 9.4%, thanks to the increase of new clients, including newly established corporation and venture firms, the strengthening of profitable services, and up-selling and cross-selling strategies. The sales of others, including new businesses, such as time-based vehicle-for-hire time sharing, media, and catalogue sales businesses, increased from 58 million yen in the previous term to 231 million yen.

Operating income rose 38.9% year on year to 2,484 million yen. Gross profit rate increased 0.9 points to 58.8%, as telecommunication cost declined through volume discount in the Global WiFi business and the company made continuous efforts to reduce costs by utilizing Cloud WiFi, etc. SGA augmented 21.4% year on year through business expansion, as the number of employees, especially sales staff, rose nearly 18% year on year from 497 to 586, but the company reduced labor for dealing with inquiries and delivering products. Consequently, SGA rate improved 0.4 points to 47.3%.

Due to the posting of exchange gain, etc., ordinary income was 2,499 million yen, up 39.3%. Although an extraordinary loss of 310 million yen, including a loss on valuation of investment securities of 309 million yen, was posted, net income increased 26.5% year on year to 1,529 million yen.

Global WiFi business

Sales were 13,505 million yen, up 30.0% year on year, and operating income was 2,413 million yen, up 51.5% year on year. While the business environment remained healthy as the number of travelers from Japan to overseas and the number of foreign visitors to Japan marked a record high, the efforts to increase rental transactions and profitability paid off.

As for sales, the orders from independent travelers from Japan to overseas increased considerably thanks to the effects of promotional campaigns, and the company met the demand from corporations and foreign visitors to Japan. As for profitability, telecommunication cost declined through volume discount, the efficiency of operation of personal Wi-Fi(Wireless LAN) routers and telecommunication lines improved, and Cloud WiFi was utilized to reduce shipping processes and streamline the monitoring of the telecommunication situation, improving cost ratio. The labor for dealing with inquiries was reduced with FAQ based on AI and RPA, chatbots, etc., and the labor for delivering products was reduced through the stationary plan for corporations "Global WiFi for Biz" and the increase of the automatic receipt locker "Smart Pickup," cutting down on personnel expenses and improving SGA ratio.

Information and Communications Service business

Sales were 7,775 million yen, up 9.4% year on year, and operating income was 1,218 million yen, up 3.9% year on year. While increasing clients, including newly established corporations and venture firms steadily, the company increased sales from existing clients by continuing transactions through CRM (a recurring-revenue model) and implementing up-selling and cross-selling strategies. However, profit rate declined temporarily. The business of mediating the subscription to the electric power service "Haluene Electricity" grew steadily after the deregulation of electric power, and the delivery of LED lighting provided together with that service, too, increased. In response to customer needs, the company recouped the cost of LED by collecting the charges for LED lighting for the 3-year contract period of "Haluene Electricity." In accounting, it was handled as sale (sellout), and the cost of LED lighting devices was posted at once when the service was started (therefore, a loss was posted in the first year). However, the contracts for "Haluene Electricity" increased more considerably than expected, and profit/loss worsened due to the lump-sum posting of costs, decreasing the profit rate of the entire business. In the fiscal year ending Dec. 2019 or later, this business model will be changed to a rental model (change from lump-sum posting to 3-year depreciation of rental assets); therefore, profit rate is expected to rise.

Other

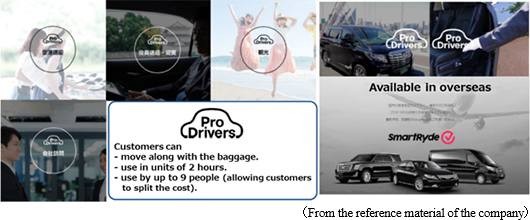

Sales were 231 million yen (58 million yen in the previous term), and operating loss was 194 million yen (102 million yen in the previous term). The company launched "ProDrivers (time-based vehicle-for-hire sharing service)," a service of transporting customers in a comfortable manner in any kinds of scenes of daily life in addition to business scenes, including the transportation of customers to airports and the transportation of executives. The company can handle the booking of transportation of domestic (Tokyo) and overseas travelers to airports in over 500 cities in 150 countries. Global WiFi business

Sales were 13,505 million yen, up 30.0% year on year, and operating income was 2,413 million yen, up 51.5% year on year. While the business environment remained healthy as the number of travelers from Japan to overseas and the number of foreign visitors to Japan marked a record high, the efforts to increase rental transactions and profitability paid off.

As for sales, the orders from independent travelers from Japan to overseas increased considerably thanks to the effects of promotional campaigns, and the company met the demand from corporations and foreign visitors to Japan. As for profitability, telecommunication cost declined through volume discount, the efficiency of operation of personal Wi-Fi(Wireless LAN) routers and telecommunication lines improved, and Cloud WiFi was utilized to reduce shipping processes and streamline the monitoring of the telecommunication situation, improving cost ratio. The labor for dealing with inquiries was reduced with FAQ based on AI and RPA, chatbots, etc., and the labor for delivering products was reduced through the stationary plan for corporations "Global WiFi for Biz" and the increase of the automatic receipt locker "Smart Pickup," cutting down on personnel expenses and improving SGA ratio.

Information and Communications Service business

Sales were 7,775 million yen, up 9.4% year on year, and operating income was 1,218 million yen, up 3.9% year on year. While increasing clients, including newly established corporations and venture firms steadily, the company increased sales from existing clients by continuing transactions through CRM (a recurring-revenue model) and implementing up-selling and cross-selling strategies. However, profit rate declined temporarily. The business of mediating the subscription to the electric power service "Haluene Electricity" grew steadily after the deregulation of electric power, and the delivery of LED lighting provided together with that service, too, increased. In response to customer needs, the company recouped the cost of LED by collecting the charges for LED lighting for the 3-year contract period of "Haluene Electricity." In accounting, it was handled as sale (sellout), and the cost of LED lighting devices was posted at once when the service was started (therefore, a loss was posted in the first year). However, the contracts for "Haluene Electricity" increased more considerably than expected, and profit/loss worsened due to the lump-sum posting of costs, decreasing the profit rate of the entire business. In the fiscal year ending Dec. 2019 or later, this business model will be changed to a rental model (change from lump-sum posting to 3-year depreciation of rental assets); therefore, profit rate is expected to rise.

Other

Sales were 231 million yen (58 million yen in the previous term), and operating loss was 194 million yen (102 million yen in the previous term). The company launched "ProDrivers (time-based vehicle-for-hire sharing service)," a service of transporting customers in a comfortable manner in any kinds of scenes of daily life in addition to business scenes, including the transportation of customers to airports and the transportation of executives. The company can handle the booking of transportation of domestic (Tokyo) and overseas travelers to airports in over 500 cities in 150 countries.

Term-end total assets grew 2,068 million yen from the end of the previous term to 13,552 million yen. As cash flows improved due to the rise in profit and fund efficiency, cash and deposits grew, and all items increased through business expansion. Capital-to-asset ratio was 72.2% (74.6% at the end of the previous term).

Term-end total assets grew 2,068 million yen from the end of the previous term to 13,552 million yen. As cash flows improved due to the rise in profit and fund efficiency, cash and deposits grew, and all items increased through business expansion. Capital-to-asset ratio was 72.2% (74.6% at the end of the previous term).

*ROE (Return on equity) is obtained by multiplying "net income margin (net income/sales), "Total asset tumover (sales/total asset)", and "levarage (total asset/equity capital, or the reciprocal of capital-to-asset ratio)." ROE=net income margin×total asset tumover×leverage

*The above values were calculated based on the data of brief financial reports and securities reports. The total assets and equity capital used for the calculation were the average values of the balances as of the end of the previous term and as of the end of the current term. (Since the capital to asset ratio posted in brief financial reports and securities reports is the term-end value, and reciprocol does not necessarily equal the above average.)

(4) Summary of the fiscal year ended Dec. 2018

Under the slogan "Challenge for Evolution: Chapter 2," the company is striving to achieve the two goals: "to differentiate itself by expanding its business and making peripheral businesses profitable" and "to become overwhelmingly No.1 in the industry (for productivity, market share, and profit)." Through these efforts, the company produced some results in both the Global WiFi business and the Information and Communications Service business in the fiscal year ended Dec. 2018. The company also launched ProDrivers, a time-based vehicle-for-hire sharing service, as a new business. It is currently at the stage of demonstration experiment, but they found that there exist a variety of needs in business scenes, such as the use of vehicles for hire on an hourly basis and transportation of luggage, including costumes. The company will make efforts to move into the black as soon as possible.

In the Global WiFi business, more repeat customers and new customers used the rental service. Global WiFi for Biz (stationary WiFi) is being popularized, repeat corporate clients increased, and the cooperation with partners, such as travel agencies and airliners, bore fruit. In addition, call centers accumulated data, and AI-based response became more precise, so that the number of call center staff members can be curtailed.

In the Information and Communications Service business, cross-selling performed well as the business of mediating the subscription to "Haluene Electricity" grew steadily thanks to the sales promotion targeted at corporations. Both sales and profit increased, as the company engaged in the development and education of new employees (and supplied trained personnel to the Global WiFi business). The company will improve productivity based on its corporate culture and business model while developing and selling its own services, including services based on the know-how of call center operation. *ROE (Return on equity) is obtained by multiplying "net income margin (net income/sales), "Total asset tumover (sales/total asset)", and "levarage (total asset/equity capital, or the reciprocal of capital-to-asset ratio)." ROE=net income margin×total asset tumover×leverage

*The above values were calculated based on the data of brief financial reports and securities reports. The total assets and equity capital used for the calculation were the average values of the balances as of the end of the previous term and as of the end of the current term. (Since the capital to asset ratio posted in brief financial reports and securities reports is the term-end value, and reciprocol does not necessarily equal the above average.)

(4) Summary of the fiscal year ended Dec. 2018

Under the slogan "Challenge for Evolution: Chapter 2," the company is striving to achieve the two goals: "to differentiate itself by expanding its business and making peripheral businesses profitable" and "to become overwhelmingly No.1 in the industry (for productivity, market share, and profit)." Through these efforts, the company produced some results in both the Global WiFi business and the Information and Communications Service business in the fiscal year ended Dec. 2018. The company also launched ProDrivers, a time-based vehicle-for-hire sharing service, as a new business. It is currently at the stage of demonstration experiment, but they found that there exist a variety of needs in business scenes, such as the use of vehicles for hire on an hourly basis and transportation of luggage, including costumes. The company will make efforts to move into the black as soon as possible.

In the Global WiFi business, more repeat customers and new customers used the rental service. Global WiFi for Biz (stationary WiFi) is being popularized, repeat corporate clients increased, and the cooperation with partners, such as travel agencies and airliners, bore fruit. In addition, call centers accumulated data, and AI-based response became more precise, so that the number of call center staff members can be curtailed.

In the Information and Communications Service business, cross-selling performed well as the business of mediating the subscription to "Haluene Electricity" grew steadily thanks to the sales promotion targeted at corporations. Both sales and profit increased, as the company engaged in the development and education of new employees (and supplied trained personnel to the Global WiFi business). The company will improve productivity based on its corporate culture and business model while developing and selling its own services, including services based on the know-how of call center operation.

|

| Fiscal Year December 2019 Earnings Estimates |

Sales and operating income are estimated to grow 13.8% and 21.2%, respectively, year on year.

Sales are projected to grow to 24,470 million yen. While the sales of the Global WiFi business are expected to increase 15.3% year on year, the sales of the Information and Communications Service business is forecasted to rise 3.4% year on year. As for the Global WiFi business, the company aims to increase corporate clients by promoting Global WiFi for Biz (stationary WiFi), cementing the cooperation with partners, including travel agencies and airliners, and increasing sales channels. As for the Information and Communications Service business, the company will constantly increase new client corporations by 18,000 per year, strengthen profitable services, and implement up-selling and cross-selling strategies, to increase sales from existing customers.

Operating income is forecasted to rise 21.2% year on year to 3,012 million yen. As for the Global WiFi business, the company will keep striving to reduce the cost for procuring lines, promote the utilization of Cloud WiFi, and curtail operation cost, etc. As for the Information and Communications Service business, profit rate is estimated to grow through the shift to the posting of cost for rental of LED lighting devices. On the other hand, the company plans to conduct upfront investment (including personnel expenses) for establishing a business base of ProDrivers (time-based vehicle-for-hire sharing service), but the platform for travel-related services is expected to move into the black. Sales and operating income are estimated to grow 13.8% and 21.2%, respectively, year on year.

Sales are projected to grow to 24,470 million yen. While the sales of the Global WiFi business are expected to increase 15.3% year on year, the sales of the Information and Communications Service business is forecasted to rise 3.4% year on year. As for the Global WiFi business, the company aims to increase corporate clients by promoting Global WiFi for Biz (stationary WiFi), cementing the cooperation with partners, including travel agencies and airliners, and increasing sales channels. As for the Information and Communications Service business, the company will constantly increase new client corporations by 18,000 per year, strengthen profitable services, and implement up-selling and cross-selling strategies, to increase sales from existing customers.

Operating income is forecasted to rise 21.2% year on year to 3,012 million yen. As for the Global WiFi business, the company will keep striving to reduce the cost for procuring lines, promote the utilization of Cloud WiFi, and curtail operation cost, etc. As for the Information and Communications Service business, profit rate is estimated to grow through the shift to the posting of cost for rental of LED lighting devices. On the other hand, the company plans to conduct upfront investment (including personnel expenses) for establishing a business base of ProDrivers (time-based vehicle-for-hire sharing service), but the platform for travel-related services is expected to move into the black.

(2) Initiatives in each business segment

Global WiFi business

The company will work to disseminate "Global WiFi for Biz" by taking advantage of Cloud WiFi, pursue corporate demand, and strengthen our relationships with corporate customers. Moreover, while implementing the store digitalization strategy, the company will link this strategy with Cloud WiFi and the customer database to boost the "super last-minute online order receipt system," preventing the loss of business opportunities.

Cloud WiFi and Global WiFi for Biz (1,970 yen monthly fee, issuing invoices for each department)

The term-end number of leased personal Wi-Fi(Wireless LAN) routers that are equipped with the next-generation telecommunication technology (Cloud WiFi) and capable of managing Subscriber Identity Modules (SIMs) on cloud increased to about 88% of all leased devices (about 51% at the end of FY 12/17. Depending on telecommunication operators, some countries are not supported, thus the percentage of about 90% is considered to be the upper limit. This means that the company almost reaches the upper limit). Cloud WiFi is a differentiated service that utilizes users' own SIMs, to allow them to use telecommunication lines with just 1 device all over the world without inserting or replacing SIMs. The security hurdle for making a seamless connection with carriers in many countries and regions is high, however, the company has already enabled usage in over 100 countries and regions.

The merits of Cloud WiFi to the company include reducing telecommunications cost (improving the efficiency of using telecommunication lines), saving labor for shipping and operation (reducing SGA), and offering new services and methods (improving profitability). We can enumerate some examples of the new services offered, such as offering the Global WiFi for Biz service (a standing-type service that doesn't require renting every time, offers up to 3GB free of charge per month to use in domestic telecommunication, and ready for everyday use), which is expected to promote long-term continuous use by corporate users (improving convenience and satisfaction levels), forging alliances with travel agencies and incorporate the service into overseas travel products, expanding the stock at the airport counters as well as the support area coverage (minimizing opportunity loss), and having a system to provide services to travelers who are about to depart (increasing the number of users).

The store digitalization strategy and the super last-minute online order receipt system

The company is proceeding with the strategy of making stores digitalized by installing automatic delivery lockers (Smart Pickup), adopting self-registration KIOSK terminals with multilingual support and payment settlement functions (Smart Entry), and the QR code-based reception counter that features immediate customer identification (Smart Check). The company aims to evolve its stores to ones that can be used by Japanese tourists travelling abroad and foreign tourists visiting Japan, more conveniently, more comfortably, and with greater peace of mind, as well as strengthen its efforts toward the increase in the number of routers on lease (number of routers delivered) and increase of optional services (such as insurance services and accessories).

The company has installed 18 automatic delivery lockers (Smart Pickup) at 5 major airport counters out of its 15 airport counters in Japan (8 units as of the end of FY 12/17). In addition to strengthening the contact point with users, optimizing the level of services according to user needs will be possible (reducing the waiting time for repeat users who do not require explanations while making airport staff deal with users who need it). As it is difficult to expand and install more airport counters, the company is planning to increase SmartPickup lockers, which will save labor, and improve throughput and reduce costs by effectively utilizing the limited space. (2) Initiatives in each business segment

Global WiFi business

The company will work to disseminate "Global WiFi for Biz" by taking advantage of Cloud WiFi, pursue corporate demand, and strengthen our relationships with corporate customers. Moreover, while implementing the store digitalization strategy, the company will link this strategy with Cloud WiFi and the customer database to boost the "super last-minute online order receipt system," preventing the loss of business opportunities.

Cloud WiFi and Global WiFi for Biz (1,970 yen monthly fee, issuing invoices for each department)

The term-end number of leased personal Wi-Fi(Wireless LAN) routers that are equipped with the next-generation telecommunication technology (Cloud WiFi) and capable of managing Subscriber Identity Modules (SIMs) on cloud increased to about 88% of all leased devices (about 51% at the end of FY 12/17. Depending on telecommunication operators, some countries are not supported, thus the percentage of about 90% is considered to be the upper limit. This means that the company almost reaches the upper limit). Cloud WiFi is a differentiated service that utilizes users' own SIMs, to allow them to use telecommunication lines with just 1 device all over the world without inserting or replacing SIMs. The security hurdle for making a seamless connection with carriers in many countries and regions is high, however, the company has already enabled usage in over 100 countries and regions.

The merits of Cloud WiFi to the company include reducing telecommunications cost (improving the efficiency of using telecommunication lines), saving labor for shipping and operation (reducing SGA), and offering new services and methods (improving profitability). We can enumerate some examples of the new services offered, such as offering the Global WiFi for Biz service (a standing-type service that doesn't require renting every time, offers up to 3GB free of charge per month to use in domestic telecommunication, and ready for everyday use), which is expected to promote long-term continuous use by corporate users (improving convenience and satisfaction levels), forging alliances with travel agencies and incorporate the service into overseas travel products, expanding the stock at the airport counters as well as the support area coverage (minimizing opportunity loss), and having a system to provide services to travelers who are about to depart (increasing the number of users).

The store digitalization strategy and the super last-minute online order receipt system

The company is proceeding with the strategy of making stores digitalized by installing automatic delivery lockers (Smart Pickup), adopting self-registration KIOSK terminals with multilingual support and payment settlement functions (Smart Entry), and the QR code-based reception counter that features immediate customer identification (Smart Check). The company aims to evolve its stores to ones that can be used by Japanese tourists travelling abroad and foreign tourists visiting Japan, more conveniently, more comfortably, and with greater peace of mind, as well as strengthen its efforts toward the increase in the number of routers on lease (number of routers delivered) and increase of optional services (such as insurance services and accessories).

The company has installed 18 automatic delivery lockers (Smart Pickup) at 5 major airport counters out of its 15 airport counters in Japan (8 units as of the end of FY 12/17). In addition to strengthening the contact point with users, optimizing the level of services according to user needs will be possible (reducing the waiting time for repeat users who do not require explanations while making airport staff deal with users who need it). As it is difficult to expand and install more airport counters, the company is planning to increase SmartPickup lockers, which will save labor, and improve throughput and reduce costs by effectively utilizing the limited space.

Collaboration between the store digitalization strategy, Cloud WiFi, and the customer database has established a "super last-minute online order receipt system," enabling the company to provide services for customers who are about to depart, whom the company failed to secure before the system was established (the system has made it possible for the company to cope expeditiously with online application submitted right in front of airport counters by collaborating with the database).

Initiative examples: initiating "GO BEYOND," in-flight advertising on ANA international flights

The company has started the "GO BEYOND" campaign activities, through which it will support them by certifying individuals and corporations that aim to attain new beliefs and achieve growth by going beyond borders and boundaries as "GO-BEYONDER" and offering all Global WiFi services. The number of certified GO-BEYONDERs has reached 200 in FY 12/2018, including athletes, artists, entertainers, racers, adventurers, photographers, and activist organizations.

CONCEPT https://global-wifi.com/index.html

CONCEPT MOVIE https://global-wifi.com/movie.html

Furthermore, the company started broadcasting in-flight commercials about GlobalWiFi®, a Wi-Fi router rental service for people traveling overseas, and WiFi Rental.com, a Wi-Fi router rental service for domestic use in Japan, on ANA international flights. It plans to narrow down the target audience of the advertising activities instead of a mass advertisement.

Commercial story https://www.youtube.com/watch?v=rO5QAqx9BNA

Information and Communications Service business

The company has focused on development of "Vision Business Market" as part of its effort to expand the inflow channels (strengthen its sales channels). "Vision Business Market" is a business support website designed for start-up companies, small- and medium-sized enterprises, and ventures. Targeted also at individuals who are preparing for starting business, the website offers the company's services, partner companies' merchandise, as well as useful information.

Furthermore, it started selling in-house developed services in the first half of this term in order to make the most of its customer foundation. The company sells Cloud-based services that it has developed internally using its know-how, and as the first step, it began to sell "VWS WEB CALL SYSTEM," a total solution for telephone appointment business support. The service is easy to be adopted even by small-scale business operators because it has a competitive edge in terms of the functions of increasing the staff operation efficiency and grasping the business condition, and the burden of fixed cost is insignificant. The service is subject to the "IT-introduction subsidies." The company plans to provide services with growing customer needs one after another.

Other (travel-related service platform)

By utilizing the customer base of a total of 3.6 million people who stayed for 25.22 million nights (outbound: about 2.82 million people who stayed 19.76 million nights, inbound: about 780,000 people who stayed for 5.45 million nights; actual data in 2018, surveyed by the company), the company provides services and information (media) that help solve problems during overseas travel; it launched the new service "ProDrivers," transportation service that makes all kinds of business and daily transportation more convenient by offering airport pickup, transportation for executives, etc.

The company launched the service in Tokyo; the ProDrivers service offers features such as that it can be used in units of 2 hours, customers can move along with their baggage, and it can be used by up to 9 people (allowing customers to split the cost). The company is not only targeting customers of the Global WiFi business, but also the customers of the Information and Communications Service business, and, of course, they are putting effort into gaining new customers. They plan to sequentially expand the service area to cover major cities nationwide while forming partnerships. In overseas nations, the company will meet the needs by offering the pickup-reservation service, "SmartRyde" of DLGB Inc. (Representative: Sota Kimura, Chuo-ku, Tokyo), one of the enterprises with which the company has established capital and business alliances.

Collaboration between the store digitalization strategy, Cloud WiFi, and the customer database has established a "super last-minute online order receipt system," enabling the company to provide services for customers who are about to depart, whom the company failed to secure before the system was established (the system has made it possible for the company to cope expeditiously with online application submitted right in front of airport counters by collaborating with the database).

Initiative examples: initiating "GO BEYOND," in-flight advertising on ANA international flights

The company has started the "GO BEYOND" campaign activities, through which it will support them by certifying individuals and corporations that aim to attain new beliefs and achieve growth by going beyond borders and boundaries as "GO-BEYONDER" and offering all Global WiFi services. The number of certified GO-BEYONDERs has reached 200 in FY 12/2018, including athletes, artists, entertainers, racers, adventurers, photographers, and activist organizations.

CONCEPT https://global-wifi.com/index.html

CONCEPT MOVIE https://global-wifi.com/movie.html

Furthermore, the company started broadcasting in-flight commercials about GlobalWiFi®, a Wi-Fi router rental service for people traveling overseas, and WiFi Rental.com, a Wi-Fi router rental service for domestic use in Japan, on ANA international flights. It plans to narrow down the target audience of the advertising activities instead of a mass advertisement.

Commercial story https://www.youtube.com/watch?v=rO5QAqx9BNA

Information and Communications Service business

The company has focused on development of "Vision Business Market" as part of its effort to expand the inflow channels (strengthen its sales channels). "Vision Business Market" is a business support website designed for start-up companies, small- and medium-sized enterprises, and ventures. Targeted also at individuals who are preparing for starting business, the website offers the company's services, partner companies' merchandise, as well as useful information.

Furthermore, it started selling in-house developed services in the first half of this term in order to make the most of its customer foundation. The company sells Cloud-based services that it has developed internally using its know-how, and as the first step, it began to sell "VWS WEB CALL SYSTEM," a total solution for telephone appointment business support. The service is easy to be adopted even by small-scale business operators because it has a competitive edge in terms of the functions of increasing the staff operation efficiency and grasping the business condition, and the burden of fixed cost is insignificant. The service is subject to the "IT-introduction subsidies." The company plans to provide services with growing customer needs one after another.

Other (travel-related service platform)

By utilizing the customer base of a total of 3.6 million people who stayed for 25.22 million nights (outbound: about 2.82 million people who stayed 19.76 million nights, inbound: about 780,000 people who stayed for 5.45 million nights; actual data in 2018, surveyed by the company), the company provides services and information (media) that help solve problems during overseas travel; it launched the new service "ProDrivers," transportation service that makes all kinds of business and daily transportation more convenient by offering airport pickup, transportation for executives, etc.

The company launched the service in Tokyo; the ProDrivers service offers features such as that it can be used in units of 2 hours, customers can move along with their baggage, and it can be used by up to 9 people (allowing customers to split the cost). The company is not only targeting customers of the Global WiFi business, but also the customers of the Information and Communications Service business, and, of course, they are putting effort into gaining new customers. They plan to sequentially expand the service area to cover major cities nationwide while forming partnerships. In overseas nations, the company will meet the needs by offering the pickup-reservation service, "SmartRyde" of DLGB Inc. (Representative: Sota Kimura, Chuo-ku, Tokyo), one of the enterprises with which the company has established capital and business alliances.

|

| Conclusions |

|

In the Information and Communications Service business, there is a virtuous cycle in which the loyalty of customers is increased through CRM and then the increase of customers leads to the sales promotion of new products. In addition, the capability of selling products to corporations, which has been nurtured in the Information and Communications Service business, has formed their corporate culture and become the base for their business models.

On the other hand, in the Global WiFi business, which is their growth driver, the company has increased corporate, individual, repeat, and new customers in a balanced manner, and there is a virtuous cycle in which the increase of use helps reduce the procurement cost for telecommunication lines. According to Japan Tourism Agency, the number of foreign visitors to Japan increased nearly 9% and the number of Japanese people who traveled abroad rose nearly 6% in 2018. The number of rental transactions of the company grew 35% for overseas use (outbound) and 43% for domestic use (inbound). However, their market share is still 14.9% for outbound travelers and 2.5% for inbound travelers. Considering the governmental goals of "achieving 40 million foreign visitors to Japan in 2020" and "60 million foreign visitors to Japan in 2060," it is indispensable for the company to meet the demand from inbound travelers while making ProDrivers profitable sooner. In Taiwan, where the business targeted at inbound travelers got on the right track, the company formed alliances with local credit card companies, banks issuing credit cards, etc. and reportedly supplies "NINJA WiFi" as the added value service for credit cards. In China and South Korea, the collaboration with local enterprises turned out to be effective. Like "ProDrivers," it seems that the capability of selling products to corporation is essential. In this light, "ProDrivers" seems to be similar to, but different from conventional platform services for travel. We would like to pay attention to their future activities.

|

| <Reference: Regarding corporate governance> |

Basic policy

Our corporate group improves ourselves to change clients' expectations into impression, pursues innovation without hesitation to actualize the ideal, always feels grateful about the support of many people (stakeholders), and operates its business activities with a humble mindset. Under this code of conduct, Vision observes laws, in-company regulations, and policies, carries out business in good faith, and strives to realize optimal corporate governance.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Principle 4-1-3 Roles and responsibilities of the board of directors (1) (To oversee the planning by a successor to the chief executive officer and others)】

Under a business environment that will change from time to time, our company will have thorough discussion before appointing top executives. For instance, in our company the board of directors will designate top executives from candidates who are considered appropriate for the position in terms of their personality, knowledge, business performance, and other factors, in accordance with our management philosophy and business strategies. We will hold discussion on supervision of succession planning.

【Supplementary Principle 4-3-3 Roles and responsibilities of the Board of Directors (CEO Dismissal Procedure)】

We have not established uniform criteria or requirements for dismissing the CEO.

If it is judged that dismissal of the CEO is objectively appropriate, for example, when the CEO violates laws, regulations, and the Articles of Incorporation, and it is deemed that the corporate value of the company has been severely impaired, the Board of Directors attended also by independent external directors will resolve the matter based on careful deliberation. In addition to overseeing the plan of the successor of the CEO as described in [Principle 4-1-3], we will make this matter a future agenda for discussion.

【Supplementary Principle 4-10-1 Involvement and advice from independent directors on the matters of nomination and remuneration by establishing a voluntary independent advisory committee.】

Regarding the nomination and appointment of candidates for directors and corporate auditors, we comprehensively take into account the knowledge, experience, capabilities, etc. and decide upon deliberation at the Board of Directors. Remuneration is determined in accordance with the Board of Directors Regulations established by the Board of Directors including external directors within the framework of the total remuneration resolved at a shareholders' meeting. Based on these facts, we believe there is no need to establish a voluntary advisory committee and the current system is functioning properly.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 So-called strategically held shares】

The basic policy of Vision is not to hold the shares of other companies strategically, unless it is considered beneficial for improving corporate value in the medium to long term. If we hold listed shares for cross-shareholding, we will examine all the shares individually at the Board of Directors every quarter. As for the shares of companies that are no longer expected to contribute to the improvement of our corporate value over the medium to long term, we will sell the shares taking into consideration stock prices and market trends. Regarding the exercise of voting rights, we have a policy to decide whether or not to approve for each case, and the decision is made based on its potential contribution to the improvement of our corporate value over the medium to long term.

Regarding disclosure of the verification results of purposes of cross-shareholding, we do not disclose them because they are linked with our business strategies and benefits of the company and shareholders may be damaged by the disclosure.

【Principle 5-1 Policy for constructive dialogue with shareholders】

If shareholders or others want to have a dialogue with Vision, the company will respond positively within a reasonable range, to contribute to the sustainable growth of the company and the medium to long-term improvement in corporate value. As of now, Vision holds a briefing session attended by the president or a director in charge of IR two or more times per year, meetings with institutional investors, briefing sessions for individual investors several times a year, and so on. The information on their results is properly shared through meetings of the board of directors, etc. In addition, Vision takes thoroughgoing measures for preventing the leakage of insider information.

Basic policy

Our corporate group improves ourselves to change clients' expectations into impression, pursues innovation without hesitation to actualize the ideal, always feels grateful about the support of many people (stakeholders), and operates its business activities with a humble mindset. Under this code of conduct, Vision observes laws, in-company regulations, and policies, carries out business in good faith, and strives to realize optimal corporate governance.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Principle 4-1-3 Roles and responsibilities of the board of directors (1) (To oversee the planning by a successor to the chief executive officer and others)】

Under a business environment that will change from time to time, our company will have thorough discussion before appointing top executives. For instance, in our company the board of directors will designate top executives from candidates who are considered appropriate for the position in terms of their personality, knowledge, business performance, and other factors, in accordance with our management philosophy and business strategies. We will hold discussion on supervision of succession planning.

【Supplementary Principle 4-3-3 Roles and responsibilities of the Board of Directors (CEO Dismissal Procedure)】

We have not established uniform criteria or requirements for dismissing the CEO.

If it is judged that dismissal of the CEO is objectively appropriate, for example, when the CEO violates laws, regulations, and the Articles of Incorporation, and it is deemed that the corporate value of the company has been severely impaired, the Board of Directors attended also by independent external directors will resolve the matter based on careful deliberation. In addition to overseeing the plan of the successor of the CEO as described in [Principle 4-1-3], we will make this matter a future agenda for discussion.

【Supplementary Principle 4-10-1 Involvement and advice from independent directors on the matters of nomination and remuneration by establishing a voluntary independent advisory committee.】

Regarding the nomination and appointment of candidates for directors and corporate auditors, we comprehensively take into account the knowledge, experience, capabilities, etc. and decide upon deliberation at the Board of Directors. Remuneration is determined in accordance with the Board of Directors Regulations established by the Board of Directors including external directors within the framework of the total remuneration resolved at a shareholders' meeting. Based on these facts, we believe there is no need to establish a voluntary advisory committee and the current system is functioning properly.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 So-called strategically held shares】

The basic policy of Vision is not to hold the shares of other companies strategically, unless it is considered beneficial for improving corporate value in the medium to long term. If we hold listed shares for cross-shareholding, we will examine all the shares individually at the Board of Directors every quarter. As for the shares of companies that are no longer expected to contribute to the improvement of our corporate value over the medium to long term, we will sell the shares taking into consideration stock prices and market trends. Regarding the exercise of voting rights, we have a policy to decide whether or not to approve for each case, and the decision is made based on its potential contribution to the improvement of our corporate value over the medium to long term.

Regarding disclosure of the verification results of purposes of cross-shareholding, we do not disclose them because they are linked with our business strategies and benefits of the company and shareholders may be damaged by the disclosure.

【Principle 5-1 Policy for constructive dialogue with shareholders】

If shareholders or others want to have a dialogue with Vision, the company will respond positively within a reasonable range, to contribute to the sustainable growth of the company and the medium to long-term improvement in corporate value. As of now, Vision holds a briefing session attended by the president or a director in charge of IR two or more times per year, meetings with institutional investors, briefing sessions for individual investors several times a year, and so on. The information on their results is properly shared through meetings of the board of directors, etc. In addition, Vision takes thoroughgoing measures for preventing the leakage of insider information.

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2019 Investment Bridge Co.,Ltd. All Rights Reserved. |