Bridge Report:(9416)Vision the fiscal year December 2019

President Kenichi Sano | Vision Inc. (9416) |

|

Company Information

Market | TSE 1st Section |

Industry | Information and telecommunications |

CEO | Kenichi Sano |

HQ Address | Shinjuku i-Land Tower, 6-5-1 Nishi-Shinjuku, Shinjuku-ku, Tokyo |

Year-end | December |

HP |

Stock Information

Share Price | Number of Shares Issued (Treasury stock excluded) | Total Market Cap | ROE(Act) | Trading Unit | |

¥1,140 | 47,988,156 shares | ¥54,706 million | 21.5% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR |

- | - | ¥55.73 | 20.5x | ¥226.80 | 5.0x |

* Stock price as of the close on February 21, 2020. Number of shares issued at the end of the most recent quarter excluding treasury shares.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

Dec. 2016 (Actual) | 14,843 | 1,290 | 1,298 | 812 | 16.70 | - |

Dec. 2017 (Actual) | 17,554 | 1,788 | 1,795 | 1,208 | 24.76 | - |

Dec. 2018 (Actual) | 21,503 | 2,484 | 2,499 | 1,529 | 31.40 | - |

Dec. 2019 (Actual) | 27,318 | 3,325 | 3,358 | 2,226 | 46.05 | - |

Dec. 2020 (Forecast) | 31,396 | 4,003 | 4,005 | 2,674 | 55.73 | - |

* The forecasted values were provided by the company.

*Unit: ¥mn.

*In October 2019, we split one share into three shares (EPS retroactively adjusted).

This Bridge Report outlines Vision's results for the fiscal year ended December 2019 and the forecast for the fiscal year ending December 2020.

Table of Contents

Key Points

1.Company Overview

2.Fiscal Year December 2019 Earnings Results

3.Fiscal Year December 2020 Earnings Estimates

4.Conclusions

<For reference: Initiatives for ESG・SDGs>

<Reference: Regarding corporate governance>

Key Points

- For the fiscal year ended Dec. 2019, sales and operating income grew 27.0% and 33.8%, respectively, year on year. While the sales of the Global WiFi business increased 31.3% year on year due to the rise in the number of rental transactions and the improvement in ARPU (sales per rental transaction), the sales of the Information and Communications Service business rose 15.2% year on year through up/cross-selling. They offset the costs for increase of staff, the investment for business growth in the fiscal year ending Dec. 2020, and the new business “Pro Drivers.”

- For the fiscal year ending Dec. 2020, sales and operating income are estimated to increase 14.9% and 20.4%, respectively, year on year. The sales of the Global WiFi business are projected to increase 18.9% year on year, due to the sales promotion of Global WiFi for Biz and the increase in rate of selection of Unlimited Plan, and the Information and Communications Service business is forecasted to be healthy, due to the expansion of the existing business and the promotion of the company’s original services. As for profit, the estimated profit rate of the Global WiFi business is conservative, but “Pro Drivers” will start contributing to profit, and the profit rate of the Information and Communications Service business will improve through the change in the sales composition.

- For the earnings forecast for the fiscal year ending Dec. 2020, the impact of the spread of the novel coronavirus has not been taken into account, because it is difficult to estimate it as of the disclosure of the earnings forecast.

1. Company Overview

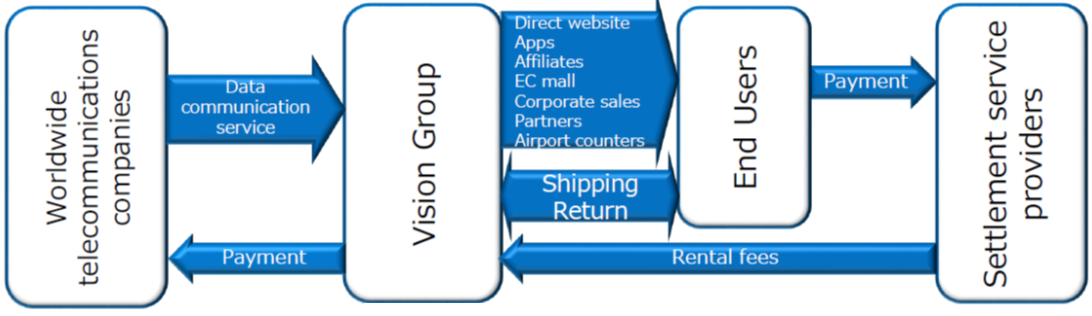

Under the management philosophy of “Contributing to the Information and Communications Revolution,” Vision conducts the Global WiFi business, which leases the personal Wi-Fi (wireless LAN) routers which can be used in over 200 countries and regions on a flat-rate basis, and as an Information and Communications Service distributor, it also provides Information and Communications Service business of arranging telecommunications infrastructure and office equipment necessary for business activities, such as fixed-line telecommunications, mobile telecommunications, broadband etc.

The company forms a group with its 19 consolidated subsidiaries, both inside and outside Japan. Of those, the 7 based in Japan are Members Net Inc. (which conducts the business of charging agency, fixed-line telephone service subscription agency, etc.) and Best Link Inc. (which carries out the business of broadband service subscription agency), etc. There are 12 overseas subsidiaries that operate as overseas hubs for the Global WiFi service in South Korea, Singapore, UK, Hong Kong, Hawaii, Taiwan, China (Shanghai), France, Italy, California and New Caledonia; there is also a local subsidiary in Vietnam, which is an offshore hub for database construction and system development.

【Corporate slogan - More vision, More success】

The present era, where information and telecommunication technology are rapidly advancing, is full of business and communication opportunities, and the company continues to be the No.1 distributer in many fields related to Information and Communications Service. The company believes that it is because the company was able to “provide the best value by considering a customer’s perspective.” The future of telecommunication will be for the betterment of everyone’s future. The company will support customers in realizing many dreams by creating new services that customers can use with more peace of mind, convenience and efficiency.

【Vision Group’s management philosophy – Contributing to the Information and Communications Revolutions in the world】

This philosophy is put in with Vision’s determination to “actively promote the Information and Communications Revolution in the world, bring innovations to an individual’s lifestyle and the company’s business style, and contribute to the advancement of humanity and society by continuing to be an distributor that effectively and efficiently connects the client companies with end users and makes sure that its employee’s unlimited ambition, dreams and thoughts are contributing to the stakeholders, without compromising nor ever forgetting the venture spirit.”

1-1 Business Description

Global WiFi business

The company offers services including “Global WiFi” (a Wi-Fi router rental service that allows people traveling overseas to use local internet services at a competitive rate through its partnerships with the overseas operators) and “NINJA WiFi” (a Wi-Fi router rental service for overseas visitors to Japan, etc.), while also engaging in services for the travelers between foreign countries in overseas bases (South Korea, Taiwan and California).

The term-end number of leased Wi-Fi routers that are equipped with the next-generation telecommunication technology (Cloud WiFi) capable of managing Subscriber Identity Modules (SIMs) on the cloud accounts for over 90% of all leased devices (Depending on telecommunication carriers, some countries are not supported, thus the company has almost reached the upper limit).

(From the reference material of the company)

Advantages

(1) Affordable fixed-rate system, (2) the most comprehensive area coverage, (3) comfort, (4) safety/security, and (5) substantial support bases and corporate sales capabilities ⇒ One of the largest customer bases in the industry

The advantages of “Global WiFi” and “NINJA WiFi” include the following: (1) cost benefits of up to 89.9% (the rental fee per day is 300 yen at the minimum, depending on the travel destination) compared to the overseas fixed-rate packet plans offered by other Japanese mobile carriers, (2) the industry’s most comprehensive coverage of over 200 countries and regions, (3) high-speed telecommunications services through partnerships with telecommunication operators all over the world, (4) available at 24 hours a day, 365 days a year, at 47 bases worldwide, and (5) the industry’s largest number of available spots at airport counters.

Furthermore, from the business perspective, another advantageous point is the fact that use by corporations, through which stable demand can be expected, has accounted for about 30%~40% in this business segment. As a result, the company has secured a great number of users, which is one of the largest market shares in the industry.

The store digitalization strategy and establishment of the super last-minute online order receipt system

The company is proceeding with the strategy of making stores digitalized by (1) installing automatic delivery lockers (Smart Pickup), (2) adopting self-registration KIOSK terminals with multilingual support and payment settlement functions (Smart Entry), and (3) the QR code-based reception counter that features immediate customer identification (Smart Check), while expanding the number of manned counters in Japan. The company aims to evolve its stores to ones that can be used by Japanese tourists travelling abroad and foreign tourists visiting Japan, more conveniently, more comfortably, and with greater peace of mind, as well as strengthen its efforts toward the increase of routers on lease (number of routers delivered) and increase of optional services (such as insurance services and accessories).

(From the reference material of the company)

In addition to strengthening the contact point with users, the store digitalization will make it possible to optimize the level of services according to user needs (reducing the waiting time for repeat users who do not require explanations while making airport staff deal with users who need it). As it is difficult to expand and install more airport counters, the company is planning to increase SmartPickup lockers, which will save labor, and improve throughput and reduce costs by utilizing the limited space effectively.

Furthermore, the combination of the store digitalization strategy, Cloud WiFi, and the customer database has established a “super last-minute online order receipt system,” enabling the company to provide services for customers who are about to depart (the system has made it possible for the company to cope expeditiously with online application submitted right in front of airport counters by linking it with the database).

(From the reference material of the company)

Earnings structure

Title | Outline |

Sales | ①Rental fee per day × No. of days a router is used *Average: 1,000 yen/day; average number of days of use: 7 * Optional services, such as the insurance services and mobile batteries ②Basic monthly fee (1,970 yen) + Charges for data telecommunications (plan) × No. of days of use |

Cost of sales | ・Data telecommunications fee (to carriers in each country) ・Price of terminals (mobile Wi-Fi routers) *It is posted in rental assets (depreciation costs are recorded; the depreciation period is 2 years). ・Outsourcing expenses (commission for distributors), etc. |

SG&A expenses | ・Personnel cost ・Advertising cost ・Operation costs and land and building rent of shipping centers, airport counters, customer centers, etc. ・Other SG&A expenses |

(Created based on company data. Same below).

Comparison of means of connecting to the Internet at overseas destinations (1)

Connection method | Price | Area | Communication speed | Management | Security |

“GLOBAL WiFi” “NINJA WiFi” | 〇 | 〇 | 〇 | 〇 | 〇 |

Procurement in partnership with local high-quality lines. Local fastest. Reliable Price. Safe. Easy (apply and use). | |||||

International roaming | × | △ | △ | 〇 | 〇 |

There are problems with price and quality. (High price of 980 – 2,980 yen. Users may be charged even more.) | |||||

SIM (Local procurement) | △ | △ | 〇 | × | 〇 |

Need knowledge and management. (Local purchase, problem in capacity, recharge regularly, etc.) | |||||

Free Wi-Fi spot | 〇 | × | △ | 〇 | × |

Limited location. The speed may be slow depending on the facility line and the number of people connected. Security concerns. | |||||

Comparison of means of connecting to the Internet at overseas destinations (2)

Wi-Fi router rental | Comparison table | Roaming (Telecom carriers’ fixed-rate) | Free Wi-Fi spot/ Hotel Wi-Fi |

300 yen/day – 1,970 yen/day Apply on the web and rent | Charge | 980 yen/day – 2,980 yen/day Prior confirmation of construct details, compatible models, and setting is required according to the plan (depending on contract mobile company) | Free Wi-Fi spot: Free Hotel Wi-Fi: included in accommodation fee or 500-3,000 yen |

Reliable flat-rate system and stable communication speed ・Enhanced security and compensation ・Flat-rate system ・Capacity can be selected according to the rental scene. | Merit | Easy connection (tethering is also possible) | Easy to use Available area is limited, but many places are provided free of charge and easy to connect |

More luggage It is necessary to carry a Wi-Fi router in addition to the smartphone. | Demerit | The price is expensive ・Pricing is more expensive than rental WiFi. ・Incorrect data roaming setting can result in high charges. | Careful about unauthorized access While easy to use, there is a risk of unauthorized access and virus infection and personal information being stolen |

・For those who want to communicate at a stable transmission speed without worrying about additional charges with the flat-rate system. (Can be used by multiple people, even cheaper by splitting) ・If you carry it, you can use it in various places. ・Access is not concentrated and difficult to connect. | Recommended | Those who want to use it easily with their own devices | Use area is limited but it is cheap. Overseas Internet is sufficient in a limited time.

|

Trends by attribute (FY Dec. 2019)

Ratio of overseas usage (outbound Japan → overseas) by individuals and corporations

No. of rentals | FY 2016 | FY 2017 | FY 2018 | FY 2019 |

| Amount | FY 2016 | FY 2017 | FY 2018 | FY 2019 |

Corporation | 50.8% | 43.6% | 37.4% | 36.9% |

| Corporation | 54.4% | 50.9% | 46.4% | 45.8% |

Individual | 49.2% | 56.4% | 62.6% | 63.1% |

| Individual | 45.6% | 49.1% | 53.6% | 54.2% |

Ratio of overseas usage (outbound Japan → overseas) by repeat users and new users

No. of rentals | FY 2016 | FY 2017 | FY 2018 | FY 2019 |

| Amount | FY 2016 | FY 2017 | FY 2018 | FY 2019 |

Repeat users | 53.9% | 53.1% | 54.4% | 55.3% |

| Repeat users | 53.0% | 53.1% | 53.6% | 53.6% |

New users | 46.1% | 46.9% | 45.6% | 44.7% |

| New users | 47.0% | 46.9% | 46.4% | 46.4% |

Ratio of total overseas usage (outbound Japan → overseas) by age composition

| 18 or younger | 19-24 | 25-29 | 30-34 | 35-39 | 40-44 | 45-49 | 50-54 | 55-59 | 60 or more | Unknown |

Male Female | 1.1% | 13.9% | 14.7% | 13.2% | 11.8% | 10.6% | 11.4% | 8.9% | 6.4% | 6.7% | 1.4% |

Male | 0.7% | 8.2% | 11.2% | 12.7% | 13.0% | 12.4% | 13.3% | 9.9% | 7.3% | 9.1% | 2.2% |

Female | 1.4% | 19.4% | 18.1% | 13.7% | 10.6% | 8.9% | 9.7% | 7.9% | 5.5% | 4.4% | 0.6% |

Information and Communications Service business

With Best Link Inc., a consolidated subsidiary, at its core, the group offers services aimed mainly at newly established corporations, venture businesses and multi-store development enterprises such as food-service chains, from its 15 offices nationwide and in cooperation with its partner companies. The services include subscription agency operations for various telecommunications services such as business phones, agency operations of arranging lines for landline telephones, subscriber telephones, and NTT Hikari telephones, corporate mobile phones, broadband lines, sales and maintenance of mobile telecommunication devices, OA equipment and security products (UTM), etc., designing websites, and agency operations for new power services targeting enterprises.

The company has advantages in prospecting for corporations newly established (within 6 months), one of its major targets, and it is estimated, according to the data by the Ministry of Justice (the number of newly registered companies was 116,208 in Japan in 2018), that the company has conducted transactions with one in every 7-8 corporations newly founded in Japan. These advantageous points are backed by the company’s strong power to attract customers through its unique online marketing (Internet media strategy), through which the company maximizes running yield (recurring revenue-type business) and conducts additional sales with high productivity (up/cross selling) through the Customer Relationship Management (CRM; customer relationship and ongoing transactions) strategy.

For example, the company receives commission from operators for telephone line arrangements unless contracts for the service are cancelled, and it can earn maintenance fees for multifunction photocopiers on a continuous basis. Moreover, the follow-up service by its customer loyalty team has enabled the company to establish a recurring revenue-type business model, in which earnings are accumulated by taking in demand for lines and equipment that increases with customers’ business growth, and providing optimal services according to customers’ growth stage (additional sales with high productivity through up/cross selling). The company will evolve its recurring revenue-type business model while expanding the target customer from enterprises with growth potential to ones in the growth stage.

Earnings structure

Title | Overview | |

Fixed-line telecommunications, mobile phones, electric power | OA equipment (multifunction machine, business phones), websites, security | |

Sales | ・Commission fee (brokerage) ・Renewal commission (depending on the customer usage status) *Deposited by telecommunication operators and distributors | ・Sales proceeds: deposited by leasing companies and credit card companies ・Maintenance cost: deposited and factoring (for maintenance of websites) by manufacturers, |

Cost of sales | ・Price of terminal (mobile phones) *No cost of sales for fixed-line telecommunications and electric power *Payment to telecommunication operators and distributors ・Outsourcing expenses (commission for distributors), etc. | ・Price of equipment (OA equipment, security) *Payment to manufacturers ・Outsourcing expenses (commission for distributors), etc. |

SG&A expenses | Personnel cost, advertising cost (websites), land and building rent of call centers, etc., and other SG&A expenses | |

Competitive advantage

Startups | The company has conducted transactions with one in every 7-8 corporations* newly founded in Japan. The number of newly registered companies was 116,208 in Japan in 2018. (according to the Ministry of Justice). |

Web strategy | It has strong power to attract customers through its unique online marketing (Internet media strategy) |

Customer loyalty | Customer Relationship Management (CRM; customer relationship and ongoing transactions) strategy based on unique knowhow. Maximization of continuous earnings = recurring-type revenue business. Additional sales with high productivity (up/cross selling). |

Products and services | Products and services that lead to customers’ “sales improvement,” “cost reduction,” “increased operational efficiency,” “enhanced communication” and “promotion of DX” (products that are not likely to be influenced by economic environment). It is possible to change the business structure according to the situation (economic environment, trends, economic conditions, etc.) as the company has multiple business segments (a flexibly-changeable business system). |

*The total number of corporations (including sole proprietors) established within 6 months that have started trading with the company (according to the company’s data).

*The number is subject to change due to changes in handled services and products.

1-2 Growth strategy

In the Global WiFi business, the company will work toward expansion (exploring a new market: growth of each stage, global expansion), extension (improving profitability) and utilization (business development: platform for travel-related services) of the customer and business bases, and in the Information and Communications Service business, strengthen the channels, products/services and the business model.

Global WiFi business

About 31.88 million foreign tourists visited Japan (inbound travelers) in 2019 (according to the Japan National Tourism Organization). Meanwhile, the number of Japanese tourists traveling to overseas nations (outbound travelers) is about 20.08 million per year. The number of tourists travelling from one overseas country to another has exceeded 1.4 billion (according to the reference material of the company; source: officially published material by the United Nations World Tourism Organization), and the market scale estimated by the company is over 9 trillion yen.

The company is growing rapidly, but its market share is still 17.3% for overseas use (outbound: from Japan to overseas) and 3.1% for domestic use (inbound: from overseas to Japan, including Japanese people). Accordingly, their share in the Japanese market (outbound and inbound travelers) is 8.6%, which indicates that there remains room for increasing the market share. The company will endeavor to further increase the percentage by not only prospecting for new users, but also offering services to repeat users and taking in corporate demand. Furthermore, it will strengthen the business foundation through cost reduction and productivity improvement in an attempt to boost profitability.

In the medium and long term, the company plans to develop a new business, “a travel-related service platform,” using the customer bases of “Global WiFi” and “NINJA WiFi.”

Information and Communications Service business

According to the data of the Ministry of Justice, the number of newly registered companies was 116,208 in Japan in 2019. It is continuing to grow thanks to the support for starting business and companies provided by the government, and the company plans to implement the backward integration strategy by attracting customers through utilization of the know-how of online marketing, which has 15 years of success.

Also, the (total) number of registered head and branch offices for transfer was 144,597 (excluding the offices not requiring registration for transfer). In addition to taking in demand for change procedures at the time of adding commodities and transferring offices, etc., the company will conduct up/cross selling through high-level operations of the Customer Royalty Team (CLT).

Furthermore, the company will utilize the business model that it established in 25 years since its foundation and corporate sales strengths (structure, know-how, various sales channels) in all the businesses including the Global WiFi business (adopting the Vision Hybrid Synergy model).

(From the reference material of the company)

2.Fiscal Year December 2019 Earnings Results

2-1 Consolidated Business Results

| FY 18/12 | Ratio to Sales | FY 19/12 | Ratio to Sales | YoY | Revised forecast at 2Q | Compared with the forecast |

Sales | 21,503 | 100.0% | 27,318 | 100.0% | +27.0% | 25,793 | +5.9% |

Gross profit | 12,650 | 58.8% | 15,690 | 57.4% | +24.0% | 15,094 | +4.0% |

SG&A expenses | 10,165 | 47.3% | 12,365 | 45.3% | +21.6% | 11,830 | +4.5% |

Operating income | 2,484 | 11.6% | 3,325 | 12.2% | +33.8% | 3,264 | +1.9% |

Ordinary income | 2,499 | 11.6% | 3,358 | 12.3% | +34.4% | 3,248 | +3.4% |

Net income | 1,529 | 7.1% | 2,226 | 8.1% | +45.6% | 2,116 | +5.2% |

*Unit: ¥mn

Sales and operating income grew 27.0% and 33.8%, respectively, year on year.

Sales were 27,318 million yen, up 27.0% year on year. While the sales of the Global WiFi business increased 31.3% year on year due to the rise in the number of rental transactions and the improvement in ARPU (sales per rental transaction) through the rise in the rate of selection of Unlimited Plan, the sales of the Information and Communications Service business rose 15.2% year on year through up/cross-selling.

Operating income was 3,325 million yen, up 33.8% year on year. Cost of sales augmented 31.3% year on year to 11,627 million yen, due to the change in the product lineup in the Information and Communications Service business and the effects of the new business “Pro Drivers.” SGA increased 21.6% year on year to 12,365 million yen, due to the investment for business growth in the fiscal year ending Dec. 2020, including the increase in the number of employees (from 708 to 795) and the establishment of a collection center (which will be described later), but it was offset by sales growth, and operating income hit a record high.

The augmentation of cost of sales was mainly caused by the rise in the ratio of products that require procurement costs, such as mobile communication devices (cellphones) and OA equipment (all-in-one copiers), in the Information and Communications Service business, and the posting of personnel expenses for drivers (new costs) in the new business “ProDrivers.” which was launched in the third quarter of the fiscal year ended Dec. 2018. Cost rate rose 1.4 points to 42.6%. As for the Global WiFi business, cost rate declined about 2.9 points, due to the improvement in the procurement conditions through the volume discount, cost reduction and streamlining of operation through the utilization of Cloud WiFi.

SGA increased due to business expansion and upfront investment, but the ratio of personnel expenses to sales declined about 3.1 points due to the streamlining of business operation by using AI chatbots and RPA in the Global WiFi business. Accordingly, SGA ratio decreased 2.0 points to 45.3%.

Quarterly Net Sales and Operating Income

| 17/12-1Q | 2Q | 3Q | 4Q | 18/12-1Q | 2Q | 3Q | 4Q | 19/12-1Q | 2Q | 3Q | 4Q |

Net sales | 4,326 | 4,024 | 4,827 | 4,377 | 4,922 | 4,933 | 5,961 | 5,686 | 6,470 | 6,467 | 7,610 | 6,770 |

Operating Income | 513 | 336 | 688 | 249 | 736 | 499 | 900 | 348 | 980 | 710 | 1,280 | 354 |

*Unit: ¥mn

2-2 Trends by segment

| FY 18/12 | Composition Ratio | FY 19/12 | Composition Ratio | YOY | Revised forecast at 2Q | Compared with the forecast |

Global WiFi | 13,505 | 62.8% | 17,732 | 64.9% | +31.3% | 16,395 | +8.2% |

Information and Communications Service | 7,775 | 36.2% | 8,955 | 32.8% | +15.2% | 8,587 | +4.3% |

Others | 231 | 1.1% | 637 | 2.3% | +175.8% | 814 | -21.7% |

Adjustments | -8 | - | -7 | - | - | -4 | - |

Consolidated Sales | 21,503 | 100.0% | 27,318 | 100.0% | +27.0% | 25,793 | +5.9% |

Global WiFi | 2,413 | 17.9% | 3,301 | 18.6% | +36.8% | 2,916 | +13.2% |

Information and Communications Service | 1,218 | 15.7% | 1,363 | 15.2% | +11.9% | 1,543 | -11.7% |

Others | -194 | - | -266 | - | - | -69 | - |

Adjustments | -954 | - | -1,073 | - | - | -1,126 | - |

Consolidated Operating Income | 2,484 | 11.6% | 3,325 | 12.2% | +33.8% | 3,264 | +1.9% |

*Unit: ¥mn

Global WiFi business

While the number of travelers from Japan to overseas and the number of foreign visitors to Japan hit a record high, new users increased thanks to stable repeat users, and the company’s shares in the markets of outbound and inbound travelers expanded. The number of rental transactions grew and ARPU rose, thanks to the outcomes of measures, including the rise in the rate of selection of Unlimited Plan (released in February 2019) and the increase in shipments of “Global WiFi for Biz,” which is installed in each corporation for regular use. Continuous efforts for improving profitability bore fruit, as cost efficiency and operation improved.

Eight new counters were established, and 12 units of SmartPickup were installed. They include unstaffed shops as new-style ones, which are equipped with SmartPickup, a box for receiving and returning devices, and a vending machine for prepaid SIM cards to be used in Japan (Kitakyushu Airport and Shimojishima Airport). The vending machines for prepaid SIM cards to be used in Japan are strongly demanded by foreign visitors to Japan and those who return to Japan temporarily. By running unstaffed shops, it is possible to meet needs 24 hours a day, including the early morning and midnight, as this has been difficult from the viewpoint of staffing, and it is also possible to accelerate the increase of touch points at low cost while saving space (improvement in convenience and revenue).

As of the end of the term, the company has installed 38 counters, 31 units of SmartPickup, and return boxes in 18 airports in Japan (automatic delivery lockers in 10 airports).

Number of rentals per year

| FY 12/12 | FY 13/12 | FY 14/12 | FY 15/12 | FY 16/12 | FY 17/12 | FY 18/12 | FY 19/12 |

Overseas use | 4 | 22 | 46 | 64 | 88 | 130 | 175 | 216 |

Domestic use | 0 | 0 | 3 | 9 | 19 | 28 | 40 | 59 |

Overseas business | 0 | 1 | 1 | 4 | 6 | 6 | 6 | 7 |

Sum | 5 | 24 | 51 | 78 | 114 | 165 | 223 | 283 |

Unit: ten thousand

(From the reference material of the company)

Information and Communications Service business

As the number of major clients, including newly established corporations and venture firms, is steadily rising, the company increased the retention rate of existing clients through CRM and received more orders through up/cross-selling strategies. The company increased transactions for its original services, including the cloud-type workflow service, and consultation tailored to each growth stage.

In detail, the number of orders for communications infrastructure lines and shifts to new electric power did not grow well, but the performance of mobile communication (cellphones), OA devices (all-in-one copiers), etc. was healthy. In addition, the sale of the cloud-type workflow service “VWS” (which contributed to the increase in recurring revenue), which was developed by the company and for which users are charged monthly, produced good results. As for profit, the company strived to enhance profitability by raising the average spending by selling multiple products as sets, reducing the costs for installation of OA devices, etc. and producing websites by promoting in-house production, but the ratio of products that require procurement costs increased, so profit rate declined.

2-3 Financial Condition and Cash Flow

Financial Condition

| December 2018 | December 2019 |

| December 2018 | December 2019 |

Cash and deposits | 7,563 | 8,485 | Trade payables | 877 | 1,203 |

Trade receivables | 1,966 | 2,218 | Income taxes payable | 598 | 634 |

Current assets | 10,262 | 11,792 | Provision for bonuses | 242 | 280 |

Property, plant and equipment | 1,071 | 1,200 | Current liabilities | 3,748 | 4,222 |

Intangible fixed assets | 676 | 666 | Noncurrent liabilities | 0 | 46 |

Investments and Other | 1,541 | 1,514 | Net assets | 9,803 | 10,905 |

Noncurrent assets | 3,289 | 3,381 | Total liabilities Equity | 13,552 | 15,173 |

*Unit: ¥mn

Term-end total assets were 15,173 million yen, up 1,621 million yen from the end of the previous term. Cash and deposits account for 55.9% of total assets (55.8% at the end of the previous term), indicating debt-free management. 73.6% (62.6% at the end of the previous term) of rental assets, which are dominant in tangible fixed assets, have been depreciated. Capital-to-asset ratio is 71.7% (72.2% at the end of the previous term).

Cash Flow

| FY 12/18 | FY 12/19 | YOY | |

Operating Cash Flow (A) | 2,888 | 3,549 | +661 | +22.9% |

Investing Cash Flow (B) | -1,457 | -1,435 | +22 | - |

Free Cash Flow (A+B) | 1,430 | 2,114 | +683 | +47.8% |

Financing Cash Flow | -312 | -1,164 | -852 | - |

Balance of cash and cash equivalents at end of period | 7,563 | 8,485 | +922 | +12.2% |

*Unit: ¥mn

The company secured an operating CF of 3,549 million yen, as pretax profit was 3,199 million yen (2,192 million yen in the previous term), depreciation was 1,053 million yen (830 million yen in the previous term), increase in accounts receivable was -257 million yen (-496 million yen in the previous term), and so on. Investing CF is attributable to the purchase of property, plant and equipment, including rental assets, the purchase of intangible assets, etc. while financing CF is due to the acquisition of treasury shares, etc.

Reference: Trend of ROE

| FY 12/15 | FY 12/16 | FY 12/17 | FY 12/18 | FY 12/19 |

ROE | 13.94% | 11.79% | 15.23% | 16.67% | 21.55% |

Net profit margin on sales | 4.69% | 5.48% | 6.89% | 7.11% | 8.15% |

Total asset turnover [times] | 2.01 times | 1.61 times | 1.64 times | 1.72 times | 1.90 times |

Leverage [times] | 1.48x | 1.34x | 1.35x | 1.36x | 1.39x |

*ROE(Return on Equity) is obtained by multiplying “net income margin(net income/sales)”, “Total asset turnover(sales/total asset)”, and ”leverage(total asset/equity capital, or the reciprocal of capital-to-asset ratio)”. ROE = Net income margin × Total asset turnover × Leverage

*The above calculations are based on the data in the summary of Financial statements and the Annual securities report, but the total assets and shareholders' equity required for the calculations are the average of the balance at the end of the previous fiscal year and the balance at the end of the current fiscal year (the capital adequacy ratios in the Summary of Financial Statements and the Annual Securities Report are calculated based on the balance at the end of the fiscal year, so the reciprocal of these ratios does not necessarily match the above leverage).

3.Fiscal Year December 2020 Earnings Estimates

3-1 Consolidated Earnings

| FY 12/19 (actual) | Ratio to sales | FY 12/20 (forecast) | Ratio to sales | YOY |

Sales | 27,318 | 100.0% | 31,396 | 100.0% | +14.9% |

Gross Profit | 15,690 | 57.4% | 18,256 | 58.1% | +16.4% |

SG&A | 12,365 | 45.3% | 14,253 | 45.4% | +15.3% |

Operating income | 3,325 | 12.2% | 4,003 | 12.8% | +20.4% |

Ordinary income | 3,358 | 12.3% | 4,005 | 12.8% | +19.2% |

Net income | 2,226 | 8.1% | 2,674 | 8.5% | +20.1% |

*Unit: ¥mn

Sales are estimated to rise 14.9% year on year, while operating income is projected to increase 20.4% year on year.

Sales are estimated to be 31,396 million yen, up 14.9% year on year. The sales of the Global WiFi business are projected to increase 18.9% year on year, due to the sales promotion of Global WiFi for Biz and the increase in rate of selection of Unlimited Plan, through the improvement in popularity based on promotional activities. The sales of the Information and Communications Service business is forecasted to increase 2.8% year on year, due to the expansion of the existing business and the promotion of the company’s original service SaaS (cloud application service). The new business “Pro Drivers” is expected to grow steadily.

Operating income is estimated to be 4,003 million yen, up 20.4% year on year. The profit rate of the Global WiFi business will decline due to promotional campaigns and upfront investment, including the improvement of touch points and handover sites/methods, but the profit rate of the Information and Communications Service business will increase due to the change in sales composition, and “Pro Drivers” will become profitable, so other losses are estimated to drop significantly.

Trends by segment

| FY 12/19 (actual) | Composition Ratio | FY 12/20 (forecast) | Composition Ratio | YOY |

Global WiFi | 17,732 | 64.9% | 21,076 | 67.1% | +18.9% |

Information and Communications Service | 8,955 | 32.8% | 9,210 | 29.3% | +2.8% |

Others | 637 | 2.3% | 1,108 | 3.5% | +74.0% |

Adjustments | -7 | - | 0 | - | - |

Consolidated Sales | 27,318 | 100.0% | 31,396 | 100.0% | +14.9% |

Global Wifi | 3,301 | 18.6% | 3,736 | 17.2% | +13.2% |

Information and Communications Service | 1,363 | 15.2% | 1,497 | 16.3% | +9.8% |

Others | -266 | - | -35 | - | - |

Adjustments | -1,073 | - | -1,194 | - | - |

Consolidated Operating Income | 3,325 | 12.2% | 4,003 | 12.8% | +20.4% |

*Unit: ¥mn

3-2 Activities in each business segment

As for the Global WiFi business, the company will promote Global WiFi for Biz and strive to increase the rate of selection of Unlimited Plan by improving the popularity through promotional campaigns, and enrich services for travelers. In addition, the company will open shops and operate the FC business according to regional characteristics and markets, and proceed with overseas (global) business by cooperating with other companies in each area (offering lines), etc. The company will make continuous efforts to improve convenience by improving touch points and handover sites/methods.

As for the Information and Communications Service business, the company will work on the expansion of the existing business (communication lines, OA devices, website production, etc.) and the sales promotion of SaaS (cloud application services). For SaaS, the company will actively conduct investment (in-house development, acquisition of companies, and business and capital tie-ups), to enrich the lineup of its services.

In addition, the company will actively operate services and businesses that exert synergy (including the acquisition of companies and business/capital alliances), and reconsider operations and management systems that are not linked with the increase of orders received (reducing the ratio of SGA).

Global WiFi business

Promotion of use of Cloud WiFi

The rented Wi-Fi routers mounted with the next-generation communications technology (Cloud WiFi) for managing SIM in the cloud account for a slightly less than 94% of the total number of rented terminals (which is near to the upper limit, because they cannot be used in some countries according to communications carriers). Cloud WiFi is a differentiation service utilizing SIM based on their own contract, and users can use communications lines around the world with a single terminal without inserting or replacing a SIM card. There exists a high hurdle from the aspect of security for connecting a single terminal with carriers in many countries and regions seamlessly via Cloud WiFi, but the company made it possible to use the terminal in over 100 countries and regions.

On the other hand, Cloud WiFi is beneficial, because it reduces the ratio of costs for communications (improving the efficiency of use of communications lines), saves labor for shipping and operation (reducing SGA), and offers services based on it and new methods (increasing revenue).

In August 2019, the company launched the rental service of the cloud-compatible smartphone-type Wi-Fi router “GW01,” down 59% in thickness and down 25% in weight from the previous model, to meet users’ request for improvement in the weight and thickness of terminals. It keeps the previous models’ function to get connected to over 108 areas automatically, and has an upgraded battery, and can utilize ad distribution and location information. The battery can be used continuously for up to 12 hours. Therefore, users can check the state of use with a big display without worrying about the remaining battery power.

Effects of utilization of Cloud WiFi

Reduction of rate of cost for communications (Improvement in efficiency of use of communications lines) | Allocation of an appropriate line when used Since the number of rented terminals exceeds the number of terminals in operation, it is possible to offer the appropriate number of communications lines and capacities. |

Labor saving in shipping and operation (reduction of SGA) | Plentiful inventory of terminals not in operation By stocking them at airport counters, etc., it is possible to eliminate out-of-stock cases. |

Promotion of Global WiFi for Biz (installed in each office with a monthly charge of 1,970 yen)

By adopting Cloud WiFi, it became possible to offer “Global WiFi for Biz,” which is expected to promote the continuous use by corporate users (improving convenience and satisfaction level). “Global WiFi for Biz” is installed in each office, so it is unnecessary to rent devices for use. In addition, for domestic communications, it is possible to transmit up to 3GB per month free of charge, so users can use the device for their daily lives. This leads to the adoption of services and new methods, including the incorporation into products of travel agencies and overseas travels, the enrichment of inventory at airport counters, the expansion of target areas (minimization of loss of opportunities), and the provision of services to departing customers (increase of cases of use).

Increase in the rate of selection of Unlimited Plan

Recently, data communication volume has been increasing, due to the diversification of smartphone apps, the transmission of heavy images and videos, the posting in SNS, etc. In addition, an increasing number of users share services with their friends, family members, and others, so there was strong demand for a plan that can be used without worrying about communication volume. To meet such demand, the company released Unlimited Plan in February 2019, and the service could be used in 73 countries as of the end of October 2019.

Enrichment of services for travelers

To support anxiety-free, safe, comfortable travel, the company will meet users’ requests and enrich its services for travelers, including optional services. The company has already released limousine services, translation devices (Pocketalk and ili), compact photo printers, noise cancelling earphones, 360°cameras, ultralight folding umbrellas, safety compensation (insurance covering breakdown, submersion in water, loss, and theft), connecting flights, advertisement (information on travel distances), emergency locational information check services, etc. In the fiscal year ending Dec. 2020, the company added “GoPro HERO8,” which is the latest model of the popular camera GoPro, to the lineup of services for travelers, and started renting out it as an optional service of Global WiFi on Jan. 28, 2020. GoPro is a hit product, but it’s expensive and there are many fans who cannot afford to buy it, so the company will meet their demand with affordable rental services.

Establishment of a collection center (Aomi, Tokyo)

The company established a collection center in Aomi, Kōtō-ku, Tokyo, for the purpose of streamlining the backend process (improving capacity without augmenting personnel costs). With the effects of integration, it became possible to handle a large number of devices while improving capacity and quality without augmenting overall operation costs. The center uses wire performance checkers, rechargers, etc. that were developed in house. It can handle over 10,000 devices per day, and recharge 1,080 Wi-Fi routers concurrently as of December 2019.

(From the reference material of the company)

Alice Hirose chosen as a poster girl

The company chose the actress Alice Hirose as a poster girl, in order to improve the image and popularity of “Global WiFi.” From now on, the company will feature her in TV commercials, special websites, promotional goods, in-store panels, etc.

Information and Communications Service business

While expanding the existing business (lines, OA devices, website production, etc.), the company will promote SaaS (cloud application service). For SaaS, the company will actively conduct investment (in-house development, acquisition of companies, and business and capital tie-ups), to enrich the lineup of its services.

SaaS is a business of offering services developed or used in house to users. Since services are offered via the cloud, users can reduce required costs for installation and running. The company plans to expand the business by utilizing the customer base and sales channels it has, and grow it as the revenue base in the Information and Communications Service business.

(From the reference material of the company)

Travel-related service platform

Based on the customer base composed of about 4.06 million people staying 31.22 million nights (outbound: about 3.47 million people staying 24.29 million nights; inbound: about 0.99 million people staying 6.93 million nights in 2019; surveyed by the company), the company offers helpful information (media) and services for solving troubles during overseas travel. “ProDrivers”, a pickup/drop-off service launched in 2019, had a good start, and moved into the black in the fourth quarter of the fiscal year ended December 2019.

“ProDrivers” can be used in units of 2 hours, and users can travel with their luggage. One limousine can be used by up to 9 travelers, so expense per person can be reduced by going Dutch. This service was started in Tokyo, and the company plans to start it in major cities around Japan, while utilizing partnerships. It is currently increasing drivers. The company will first utilize the customer base (including foreign travelers to Japan) of the Global WiFi business, but it also targets the customers of the Information and Communications Service business. Needless to say, the company will also make efforts to reel in new customers. Outside Japan, the company will meet needs by offering “SmartRyde,” a pickup/drop-off service of DLGB Inc. (Chuo-ku, Tokyo; representative: Sota Kimura), with which the company formed capital and business tie-ups.

4.Conclusions

For the earnings forecast for the fiscal year ending Dec. 2020, the impact of the spread of the novel coronavirus has not been taken into account, because it is difficult to estimate it as of now. Unless it lingers and spreads to Europe, the U.S., and the entire Asia, its effects are considered to be limited. We would like to expect that it will wind down soon. The company is enriching services of Cloud WiFi, Unlimited Plan, etc. and taking measures for meeting special demand by establishing and streamlining the backyard by constructing a collection center. In the fiscal year ending December 2020, the company plans to meet demand by increasing popularity through enhanced marketing.

We would like to expect from future developments, including the Information and Communication Services business, which entered a new stage with the SaaS (cloud application service) business, and ProDrivers, which made a good start.

<For reference: Initiatives for ESG・SDGs>

In a desire to contribute to “the future of telecommunication will be for the betterment of everyone’s future,” the company aims to increase its corporate value and for continuous growth through management and business strategies giving consideration to ESG (“Environment, Social, and Governance.”) Further, it will contribute to the revolution in telecommunications technology and sustainable development of the society by taking measure to solve major social issues included in the SDGs provided by the United Nations. The SDGs are global goals intended to be achieved between 2016 and 2030, specified in the “2030 Agenda for Sustainable Development” adopted in the United Nations Summit held in September 2015.

Environmental

The company has acquired “Green Site License” that offsets carbon emissions via websites and an environmental certification for prevention of global warming by “Green Power” as part of CO2 reduction activities of websites (SDGs 7, 12, 13, and 15).

Additionally, the company carries out information transmission, support activities in affected areas, and cooperates with and provides support for “Shinsai Regain,” a specified NPO supporting various activities, to achieve “realization of a society where as many people as possible can survive at the time of earthquake” (SDGs 3 and 11).

Social

People with disabilities have different handicaps and situations. The company is establishing an environment where people willing to work can do enjoyable and fulfilling work, and will continue to put efforts to be a company making the best use of employees’ unique talents in the future as well (SDGs 3, 8, and 10).

Also, the company is making efforts to ensure an environment where employees can focus on their work by running “Vision Kinds Nursery,” a company-led nursery and hire human resources with childcare responsibilities and motivation to work, in addition to making work rules flexible and enhancing the leave system for employees at the time of childbirth or with small children, in order to support their child care and create a working environment with comfort (SDGs 8 and 11).

In addition to the above, the company supports the activities of Japan Heart, which works based on the idea of “delivering medical care to where it does not reach” to realize a society where everyone can receive medical care equally regardless of their countries, regions, race, politics, religion or circumstances and feel “grateful to have been born,” as one of the corporate members (SDGs 1, 3, 10, and 16).

Governance

The company has obtained “ISO/IEC 27001,” the ISMS international standard, and is taking measures for information assets’ correct and safe handling, operation, monitoring, revision, maintenance, and continuous improvement, in order to protect them within the applicable range from the threats related to information security (SDGs 12 and 16).

Furthermore, the company promotes risk management in business activities and thorough compliance to strengthen governance considering the importance to win continuous trust from the stakeholders, and also appoints 3 out of 6 directors from outside who are enterprise managers, and all 4 auditors too from outside who are accountants or lawyers to ensure transparency and soundness in management (SDGs 10 and 16).

<Reference: Regarding corporate governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 6 directors, including 3 outside one |

Auditors | 4 auditors, including 4 outside ones |

◎ Corporate Governance Report : Updated on September 18, 2019

Basic policy

Our corporate group improves ourselves to change clients’ expectations into impression, pursues innovation without hesitation to actualize the ideal, always feels grateful about the support of many people (stakeholders), and operates its business activities with a humble mindset. Under this code of conduct, Vision observes laws, in-company regulations, and policies, carries out business in good faith, and strives to realize optimal corporate governance.

<Main Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts) >

【Principle 4-1-3 Roles and responsibilities of the board of directors (1) (To oversee the planning by a successor to the chief executive officer and others)】

Under a business environment that will change from time to time, our company will have thorough discussion before appointing top executives. For instance, in our company the board of directors will designate top executives from candidates who are considered appropriate for the position in terms of their personality, knowledge, business performance, and other factors, in accordance with our management philosophy and business strategies. We will hold discussion on supervision of succession planning.

【Supplementary Principle 4-10-1 Involvement and advice from independent directors on the matters of nomination and remuneration by establishing a voluntary independent advisory committee.】

Regarding the nomination and appointment of candidates for directors and corporate auditors, we comprehensively take into account the knowledge, experience, capabilities, etc. and decide upon deliberation at the Board of Directors. Remuneration is determined in accordance with the Board of Directors Regulations established by the Board of Directors including external directors within the framework of the total remuneration resolved at a shareholders’ meeting. Based on these facts, we believe there is no need to establish a voluntary advisory committee and the current system is functioning properly.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 So-called strategically held shares】

The basic policy of Vision is not to hold the shares of other companies strategically, unless it is considered beneficial for improving corporate value in the medium to long term. If we hold listed shares for cross-shareholding, we will examine all the shares individually at the Board of Directors every quarter. As for the shares of companies that are no longer expected to contribute to the improvement of our corporate value over the medium to long term, we will sell the shares taking into consideration stock prices and market trends. Regarding the exercise of voting rights, we have a policy to decide whether or not to approve for each case, and the decision is made based on its potential contribution to the improvement of our corporate value over the medium to long term.

Regarding disclosure of the verification results of purposes of cross-shareholding, we do not disclose them because they are linked with our business strategies and benefits of the company and shareholders may be damaged by the disclosure.

【Principle 5-1 Policy for constructive dialogue with shareholders】

If shareholders or others want to have a dialogue with Vision, the company will respond positively within a reasonable range, to contribute to the sustainable growth of the company and the medium to long-term improvement in corporate value. As of now, Vision holds a briefing session attended by the president or a director in charge of IR two or more times per year, meetings with institutional investors, briefing sessions for individual investors several times a year, and so on. The information on their results is properly shared through meetings of the board of directors, etc. In addition, Vision takes thoroughgoing measures for preventing the leakage of insider information.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on Vison Inc. (9416) and Bridge Salon(IR seminar), please go to our website at the following URL: http://www.bridge-salon.jp/