Bridge Report:(9416)Vision the second quarter of FY December 2022

President Kenichi Sano | Vision Inc. (9416) |

|

Company Information

Market | TSE Prime Market |

Industry | Information and telecommunications |

CEO | Kenichi Sano |

HQ Address | Shinjuku i-Land Tower, 6-5-1 Nishi-Shinjuku, Shinjuku-ku, Tokyo |

Year-end | December |

HP |

Stock Information

Share Price | Number of Shares Issued (End of the term) | Total Market Cap | ROE(Act.) | Trading Unit | |

¥1,312 | 50,342,400 shares | ¥66,049 million | 7.7% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR |

¥0.00 | - | ¥25.50 | 51.5x | ¥212.52 | 6.2x |

* Stock price as of the close on August 16, 2022. Shares outstanding, DPS and EPS are taken from the brief financial report for the second quarter of FY December 2022. ROE and BPS are the results in the previous term.

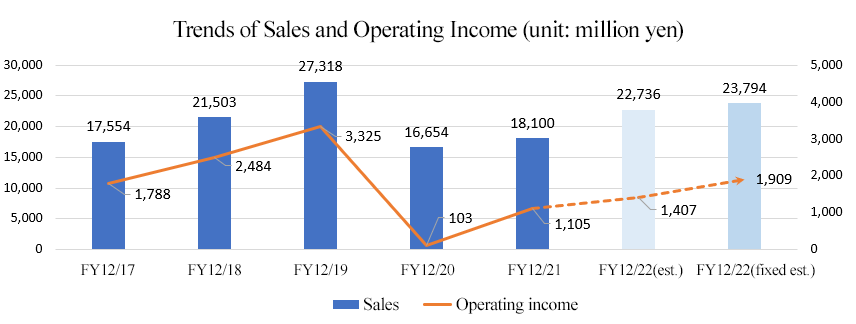

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

Dec. 2018 (Actual) | 21,503 | 2,484 | 2,499 | 1,529 | 31.40 | 0.00 |

Dec. 2019 (Actual) | 27,318 | 3,325 | 3,358 | 2,226 | 46.05 | 0.00 |

Dec. 2020 (Actual) | 16,654 | 103 | 227 | -1,183 | -25.07 | 0.00 |

Dec. 2021 (Actual) | 18,100 | 1,105 | 1,143 | 729 | 15.47 | 0.00 |

Dec. 2022 (Forecast) | 23,794 | 1,909 | 1,909 | 1,245 | 25.50 | 0.00 |

* The forecasted values were provided by the company. Unit: Million yen or yen. In October 2019, the company split one share into three shares (EPS retroactively adjusted).

This Bridge Report outlines Vision's results for the second quarter of FY December 2022 and the forecast for the fiscal year ending December 2022.

Table of Contents

Key Points

1. Company Overview

2. The Second Quarter of Fiscal Year Ending December 2022 Earnings Results

3. Fiscal Year Ending December 2022 Earnings Forecasts

4. Growth strategy considering the post-pandemic world

5. Conclusions

<Reference1: Initiatives for ESG・SDGs>

<Reference2: Regarding corporate governance>

Key Points

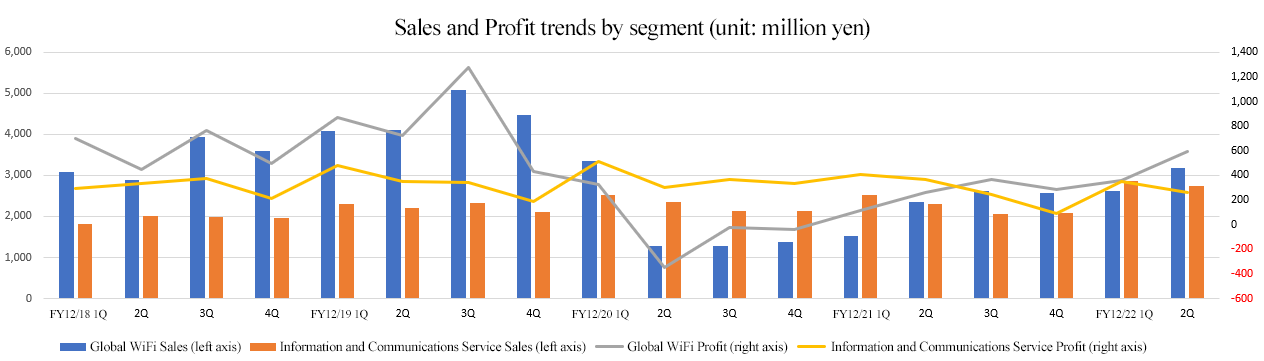

- In the second quarter of the fiscal year ending Dec. 2022, sales were 11,628 million yen, up 34.5% year on year. Sales increased in both the Global WiFi business and the Information and Communications Services Business. Gross profit increased 21.1% year on year, despite a decline in gross profit margin due to an increase in personnel costs (cost of goods sold) for app checking operations, which are part of border control operations conducted by airport quarantine stations in the Global WiFi business. Operating income rose 40.9% year on year to 921 million yen. SG&A expenses increased 17.7%, due to increases of personnel, bonuses and advertising expenses, but it was offset by the sales growth.

- Sales grew and profit increased significantly in the Global WiFi business. Since around April 2022, the number of international travelers has been showing signs of recovery following the relaxation of entry restrictions in countries around the world, and the number of WiFi router rentals has been gradually increasing, mainly among corporations. “Global WiFi for Biz,” an in-house standard WiFi service for corporations, continued to see an increase in the number of subscriptions as well as communication usage, as it provides additional use for telecommuting. In addition to the continued acquisition of various usage needs in Japan (hospitalization, moving, telecommuting, business trips, use during events, combined use with home WiFi, etc.), there were increases in commissioned tasks at airports, as well as PCR tests for various events such as entrance ceremonies for schools, colleges and offices, domestic travel as well as returning to one's hometown.

- The sales in the Information and Communications Services Business increased and profit decreased. The sale of merchandize (mobile communications equipment, office automation equipment, etc.) was strengthened. Adval Co., Ltd., which manages the Space Management Business (rental service of conference rooms and telecommuting spaces), which became a subsidiary in December 2021, also contributed to the revenue. Recurring revenues and in-house services (monthly basis) remained steady. Segment profit decreased due to the establishment of a strong revenue base, aggressive sales promotion of the company's own monthly services that temporarily increase operating costs to maximize lifetime value (customer lifetime value), investment in new businesses, and provision for bonuses for special account settlements.

- The earnings forecast was revised upwardly. Although it is difficult to forecast the future due to the uncertainty over the impact of COVID-19, the company took into account the favorable results in the first half, the recent situation, and the aggressive investment in each business to achieve record profits early in the next fiscal year and beyond. Sales are expected to rise 31.5% year on year to 23,794 million yen and operating income is projected to rise 72.8% year on year to 1,909 million yen.

- In the Global WiFi business, sales have been flat since the third quarter of the previous fiscal year, but sales in the second quarter of the current fiscal year exceeded 3 billion yen for the first time in 9 quarters since the first quarter of the fiscal year ended Dec. 2020. Despite the difficult situation of the COVID-19 pandemic, the sales growth was driven by the company steadily meeting a variety of domestic demand for telecommuting, etc. as well as the start of recovery in the number of overseas travelers, which in turn resulted in the upward revision to the earnings forecast. The company will continue to pay attention to whether this trend will continue from the third quarter onward.

1. Company Overview

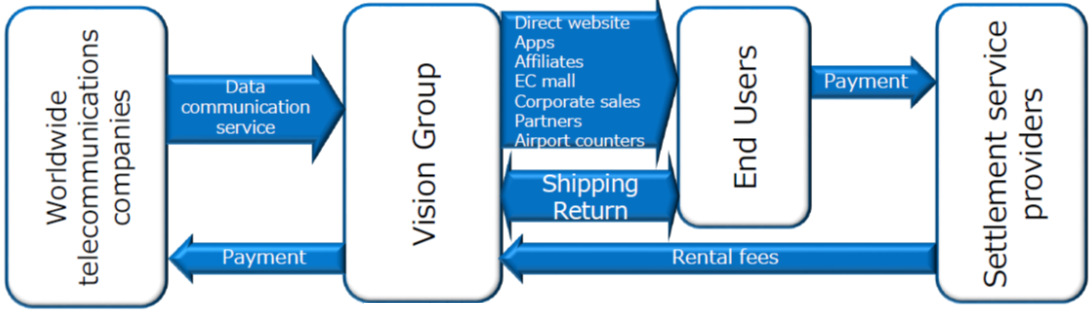

Under the management philosophy of “Contributing to the Information and Communications Revolution,” Vision conducts the Global WiFi business, which leases the personal Wi-Fi (wireless LAN) routers which can be used in over 200 countries and regions on a flat-rate basis, and as an Information and Communications Service distributor, it also provides Information and Communications Service business of arranging telecommunications infrastructure and office equipment necessary for business activities, such as fixed-line telecommunications, mobile telecommunications, broadband etc.

The company forms a group with its 20 consolidated subsidiaries, both inside and outside Japan. Of those, the 8 based in Japan include Members Net Inc. (which conducts the business of charging agency, fixed-line telephone service subscription agency, etc.) and Best Link Inc. (which carries out the business of broadband service subscription agency). There are 12 overseas subsidiaries that operate as overseas hubs for the Global WiFi service in South Korea, Singapore, UK, Hong Kong, Hawaii, Taiwan, China (Shanghai), France, Italy, California and New Caledonia; there is also a local subsidiary in Vietnam, which is an offshore hub for database construction and system development.

【Vision Group’s management philosophy – Contributing to the Information and Communications Revolution in the world】

We will actively promote the Information and Communications Revolution in the world, bring innovations to an individual’s lifestyle and the company’s business style, and contribute to the advancement of humanity and society by continuing to be an distributor that effectively and efficiently connects the client companies with end users and makes sure that its employee’s unlimited ambition, dreams and thoughts are contributing to the stakeholders, without compromising nor ever forgetting the venture spirit and add to the progress of the human race and the society.

Business Description

Global WiFi Business

The company offers services including “Global WiFi” (a Wi-Fi router rental service that allows people traveling overseas to use local internet services at a competitive rate through its partnerships with the overseas operators) and “NINJA WiFi” (a Wi-Fi router rental service for overseas visitors to Japan, etc.), while also engaging in services for the travelers between foreign countries in overseas bases (South Korea, Taiwan and California).

The term-end number of leased Wi-Fi routers that are equipped with the next-generation telecommunication technology (Cloud WiFi) capable of managing Subscriber Identity Modules (SIMs) on the cloud accounts for over 90% of all leased devices (Depending on telecommunication carriers, some countries are not supported, thus the company has almost reached the upper limit).

(From the reference material of the company)

Advantages (1) Affordable fixed-rate system, (2) the most comprehensive area coverage, (3) comfort, (4) safety/security, and (5) substantial support bases and corporate sales capabilities ⇒ One of the largest customer bases in the industry

The advantages of “Global WiFi” and “NINJA WiFi” include the following: (1) cost benefits of up to 89.9% (the rental fee per day is 300 yen at the minimum, depending on the travel destination) compared to the overseas fixed-rate packet plans offered by other Japanese mobile carriers, (2) the industry’s most comprehensive coverage of over 200 countries and regions, (3) high-speed telecommunications services through partnerships with telecommunication operators all over the world, (4) available at 24 hours a day, 365 days a year, at 47 bases worldwide, and (5) the industry’s largest number of available spots at airport counters.

Furthermore, from the business perspective, another advantageous point is the fact that use by corporations, through which stable demand can be expected, has accounted for about 30%~40% in this business segment. As a result, the company has secured a great number of users, which is one of the largest market shares in the industry.

The store digitalization strategy and establishment of the super last-minute online order receipt system

The company is proceeding with the strategy of making stores digitalized by (1) installing automatic delivery lockers (Smart Pickup), (2) adopting self-registration KIOSK terminals with multilingual support and payment settlement functions (Smart Entry), and (3) the QR code-based reception counter that features immediate customer identification (Smart Check), while expanding the number of manned counters in Japan. The company aims to evolve its stores to ones that can be used by Japanese tourists travelling abroad and foreign tourists visiting Japan, more conveniently, more comfortably, and with greater peace of mind, as well as strengthen its efforts toward the increase of routers on lease (number of routers delivered) and increase of optional services (such as insurance services and accessories).

(From the reference material of the company)

In addition to strengthening the contact point with users, the store digitalization will make it possible to optimize the level of services according to user needs (reducing the waiting time for repeat users who do not require explanations while making airport staff deal with users who need it). As it is difficult to expand and install more airport counters, the company is planning to increase Smart Pickup lockers, which will save labor, and improve throughput and reduce costs by utilizing the limited space effectively.

Furthermore, the combination of the store digitalization strategy, Cloud WiFi, and the customer database has established a “super last-minute online order receipt system,” enabling the company to provide services for customers who are about to depart (the system has made it possible for the company to cope expeditiously with online application submitted right in front of airport counters by linking it with the database).

Although demand for both inbound and outbound services have disappeared due to the spread of the novel coronavirus, the company is aggressively expanding sales of the domestic plan option of its indefinite use service for corporations, Global WiFi for Biz, to meet the growing demand for telework.

At the moment, corporate employees' overseas travel is stagnant, but the company is strengthening its relationships with corporate clients to gain a competitive advantage when travel recovers.

Information and Communications Service Business

With Best Link Inc., a consolidated subsidiary, at its core, the group offers services aimed mainly at newly established corporations, venture businesses and multi-store development enterprises such as food-service chains, from its 13 offices nationwide and in cooperation with its partner companies. The services include subscription agency operations for various telecommunications services such as business phones, agency operations of arranging lines for landline telephones, subscriber telephones, and NTT Hikari telephones, corporate mobile phones, broadband lines, sales and maintenance of mobile telecommunication devices, OA equipment and security products (UTM), etc., designing websites, and agency operations for new power services targeting enterprises.

The company has advantages in prospecting for corporations newly established (within 6 months), one of its major targets, and it is estimated, according to the data by the Ministry of Justice (the number of newly registered companies was 118,999 in Japan in 2020), that the company has conducted transactions with around one in every 10 corporations newly founded in Japan. These advantageous points are backed by the company’s strong power to attract customers through its unique online marketing (Internet media strategy), through which the company maximizes running yield (recurring revenue-type business) and conducts additional sales with high productivity (up/cross selling) through the Customer Relationship Management (CRM; customer relationship and ongoing transactions) strategy.

For example, the company receives commission from operators for telephone line arrangements unless contracts for the service are cancelled, and it can earn maintenance fees for multifunction photocopiers on a continuous basis. Moreover, the follow-up service by its customer loyalty team has enabled the company to establish a recurring revenue-type business model, in which earnings are accumulated by taking in demand for lines and equipment that increases with customers’ business growth, and providing optimal services according to customers’ growth stage (additional sales with high productivity through up/cross selling). The company will evolve its recurring revenue-type business model while expanding the target customer from enterprises with growth potential to ones in the growth stage.

2. The Second Quarter of Fiscal Year Ending December 2022 Earnings Results

2-1 Consolidated Business Results

| 2Q of FY 12/21 | Ratio to sales | 2Q of FY 12/22 | Ratio to sales | YoY |

Sales | 8,644 | 100.0% | 11,628 | 100.0% | +34.5% |

Gross profit | 4,505 | 52.1% | 5,454 | 46.9% | +21.1% |

SG&A expenses | 3,851 | 44.5% | 4,532 | 39.0% | +17.7% |

Operating income | 654 | 7.6% | 921 | 7.9% | +40.9% |

Ordinary income | 680 | 7.9% | 922 | 7.9% | +35.5% |

Quarterly net income | 455 | 5.3% | 566 | 4.9% | +24.2% |

*Unit: ¥mn The Quarterly net profit is the quarterly profit attributable to owners of the parent company.

Significant increase in sales and income

Sales were 11,628 million yen, up 34.5% year on year. Sales increased in both the Global WiFi business and the Information and Communications Services Business. Gross profit increased 21.1% year on year, despite a decline in gross profit margin due to an increase in personnel costs (cost of goods sold) for app checking operations, which are part of border control operations conducted by airport quarantine stations in the Global WiFi business. Operating income rose 40.9% year on year to 921 million yen. SG&A expenses increased 17.7%, due to increases of personnel, bonuses and advertising expenses, but it was offset by the sales growth.

Quarterly business results

| 20/12-1Q | 2Q | 3Q | 4Q | 21/12-1Q | 2Q | 3Q | 4Q | 22/12-1Q | 2Q | 3Q | 4Q |

Sales | 5,989 | 3,641 | 3,477 | 3,546 | 3,938 | 4,706 | 4,747 | 4,708 | 5,609 | 6,019 | - | - |

Gross profit | 3,252 | 1,569 | 2,001 | 1,969 | 2,176 | 2,328 | 2,313 | 2,189 | 2,544 | 2,910 | - | - |

SG&A expenses | 2,764 | 2,072 | 1,928 | 1,923 | 1,890 | 1,960 | 1,953 | 2,098 | 2,140 | 2,392 | - | - |

Operating income | 488 | -503 | 73 | 45 | 285 | 368 | 359 | 91 | 403 | 517 | - | - |

Ordinary income | 496 | -429 | 101 | 60 | 313 | 367 | 361 | 101 | 406 | 516 | - | - |

Quarterly net income | 116 | -1,468 | 124 | 42 | 232 | 223 | 246 | 27 | 245 | 320 | - | - |

Gross Profit Margin | 54.3% | 43.1% | 57.6% | 55.5% | 55.3% | 49.5% | 48.7% | 46.5% | 45.4% | 48.3% | - | - |

SG&A ratio | 46.2% | 56.9% | 55.4% | 54.2% | 48.0% | 41.7% | 41.2% | 44.6% | 38.2% | 39.7% | - | - |

Operating income ratio | 8.1% | -13.8% | 2.1% | 1.3% | 7.3% | 7.8% | 7.6% | 1.9% | 7.2% | 8.6% |

|

|

*Unit: ¥mn

On a quarterly basis, both sales and profit increased year on year and quarter on quarter in the second quarter.

2-2 Trends by segment

| 2Q of FY 12/21 | Composition Ratio | 2Q of FY 12/22 | Composition Ratio・Profit Ratio | YoY |

Global WiFi | 3,865 | 44.7% | 5,793 | 49.8% | +49.9% |

Information and Communications Service | 4,654 | 53.8% | 5,610 | 48.2% | +20.5% |

Others | 124 | 1.4% | 224 | 1.9% | +80.5% |

Consolidated Sales | 8,644 | 100.0% | 11,628 | 100.0% | +34.5% |

Global WiFi | 380 | 9.8% | 952 | 16.4% | +150.4% |

Information and Communications Service | 777 | 16.7% | 606 | 10.8% | -22.0% |

Others | -40 | - | -66 | - | - |

Adjustments | -463 | - | -570 | - | - |

Consolidated Operating Income | 654 | 7.6% | 921 | 7.9% | +40.9% |

*Unit: ¥mn. Sales represents sales to external customers. The revised forecast was announced in May2021.

| 20/12-1Q | 2Q | 3Q | 4Q | 21/12-1Q | 2Q | 3Q | 4Q | 22/12-1Q | 2Q | 3Q | 4Q |

Global WiFi | 3,347 | 1,286 | 1,272 | 1,371 | 1,515 | 2,349 | 2,628 | 2,577 | 2,618 | 3,174 | - | - |

Information and Communications Service | 2,514 | 2,003 | 2,145 | 2,133 | 2,357 | 2,297 | 2,068 | 2,080 | 2,871 | 2,739 | - | - |

Others | 126 | 351 | 59 | 41 | 65 | 59 | 50 | 51 | 118 | 105 | - | - |

Consolidated Sales | 5,989 | 3,641 | 3,477 | 3,546 | 3,938 | 4,706 | 4,747 | 4,708 | 5,609 | 6,019 | - | - |

Global WiFi | 326 | -347 | -27 | -42 | 117 | 262 | 368 | 284 | 359 | 593 | - | - |

Information and Communications Service | 517 | 299 | 367 | 335 | 410 | 367 | 246 | 92 | 347 | 259 | - | - |

Others | -91 | -214 | -49 | -36 | -17 | -22 | -22 | -31 | -34 | -32 | - | - |

Adjustments | -264 | -240 | -217 | -210 | -224 | -239 | -234 | -252 | -268 | -302 | - | - |

Consolidated Operating Income | 488 | -503 | 73 | 45 | 285 | 368 | 359 | 91 | 403 | 517 | - | - |

*Unit: ¥mn. Sales represents sales to external customers.

Global WiFi Business

Sales grew and profit increased significantly.

Since around April 2022, the number of international travelers has been showing signs of recovery following the relaxation of entry restrictions in countries around the world, and the number of WiFi router rentals has been gradually increasing, mainly among corporations.

"Global WiFi for Biz," an in-house standard WiFi service for corporations, has been increasing in the number of subscriptions as well as communication usage, as it is used for telecommuting.

In addition to the continued satisfaction of various needs in Japan (hospitalization, moving, telecommuting, business trips, use during events, combined use with home WiFi, etc.), there were increases of commissioned tasks at airports, as well as PCR tests for various events such as entrance ceremonies for schools, colleges and offices, domestic travel as well as returning to one's hometown.

Information and Communications Service Business

Sales increased and profit decreased.

The sale of merchandize (mobile communications equipment, office automation equipment, etc.) was strengthened. Adval Corp., which manages the Space Management Business (rental service for conference rooms and telecommuting spaces), which became a subsidiary in December 2021, also contributed to the revenue.

Recurring revenues and in-house services (monthly basis) remained steady.

Segment profit decreased due to the establishment of a strong revenue base, aggressive sales expansion of the company's own monthly services that temporarily increase operating costs to maximize lifetime value (customer lifetime value), investment in new businesses, and provision for bonuses for special account settlements.

2-3 Financial Condition and Cash Flow

◎Financial Condition

| December 2021 | June 2022 | Increase/ decrease |

| December 2021 | June 2022 | Increase/ decrease |

Current assets | 10,748 | 11,353 | +604 | Current liabilities | 3,880 | 3,977 | +97 |

Cash and deposits | 7,602 | 7,259 | -342 | Trade payables | 914 | 907 | -7 |

Trade receivables | 2,183 | 3,145 | +962 | Provision for bonuses | 929 | 1,092 | +162 |

Noncurrent assets | 4,183 | 4,727 | +544 | Noncurrent liabilities | 4,809 | 5,070 | +260 |

Property, plant and equipment | 534 | 1,597 | +1,062 | Total liabilities | 10,122 | 11,010 | +888 |

Intangible fixed assets | 1,482 | 1,399 | -83 | Net assets | 7,088 | 7,654 | +566 |

Investments and other | 2,166 | 1,730 | -435 | Net retained earnings | 14,932 | 16,080 | +1,148 |

Total assets | 14,932 | 16,080 | +1,148 | Total liabilities Equity | 872 | 1,035 | +163 |

*Unit: ¥mn

Property, plant and equipment increased due to trade receivables and investment in the glamping business, and total assets were 16 billion yen, up 1.1 billion from the end of the previous fiscal year.

Total liabilities increased 200 million yen from the end of the previous term to 5 billion yen due to an increase in loan payable.

Net assets increased 800 million yen from the end of the previous term to 11 billion yen due to an increase in retained earnings and foreign currency translation adjustments.

Capital-to-asset ratio increased 0.7 points from the end of the previous term to 68.4%.

3. Fiscal Year Ending December 2022 Earnings Forcasts

3-1 Consolidated Earnings Forecast

| FY 12/21 | Ratio to sales | FY 12/22 (forecast) | Ratio to sales | YoY | Revision rate | Progress rate |

Sales | 18,100 | 100.0% | 23,794 | 100.0% | +31.5% | +4.7% | 48.9% |

Gross Profit | 9,008 | 49.8% | 11,307 | 47.5% | +25.5% | +5.6% | 48.2% |

SG&A | 7,903 | 43.7% | 9,398 | 39.5% | +18.9% | +1.1% | 48.2% |

Operating income | 1,105 | 6.1% | 1,909 | 8.0% | +72.8% | +35.7% | 48.3% |

Ordinary income | 1,143 | 6.3% | 1,909 | 8.0% | +66.9% | +36.0% | 48.3% |

Net income | 729 | 4.0% | 1,245 | 5.2% | +70.8% | +35.2% | 45.5% |

* Unit: ¥mn

Revised the earnings forecast upwardly.

Although it is difficult to forecast the future due to the uncertainty over the impact of COVID-19, the company took into account the favorable results in the first half, the recent situation, and the aggressive investment in each business to achieve record profits early in the next fiscal year and beyond. Sales are expected to rise 31.5% year on year to 23,794 million yen and operating income is projected to rise 72.8% year on year to 1,909 million yen.

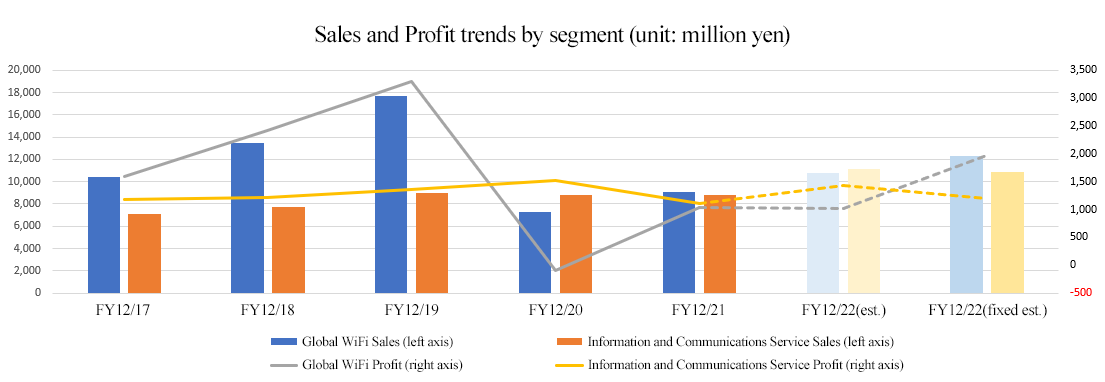

3-2 Forecast by Segment

| FY 12/21 | Composition Ratio・Profit Ratio | FY 12/22 (forecast) | Composition Ratio・Profit Ratio | YoY | Revision rate | Progress rate |

Global WiFi | 9,070 | 50.1% | 12,332 | 51.8% | 36.0% | +14.0% | 47.0% |

Information and Communications Service | 8,803 | 48.6% | 10,877 | 45.7% | 23.5% | -2.3% | 51.6% |

Others | 226 | 1.2% | 595 | 2.5% | 163.0% | -24.1% | 37.8% |

Consolidated net sales | 18,100 | 100.0% | 23,794 | 100.0% | 31.5% | +4.7% | 48.9% |

Global WiFi | 1,033 | 11.4% | 1,966 | 15.9% | 90.2% | +92.5% | 48.5% |

Information and Communications Service | 1,116 | 12.7% | 1,194 | 11.0% | 6.9% | -16.3% | 50.8% |

Others | -94 | - | -90 | - | - | - | - |

Adjustments | -950 | - | -1,160 | - | - | - | - |

Consolidated operating income | 1,105 | 6.1% | 1,909 | 8.0% | 72.8% | +35.7% | 48.3% |

* Unit: ¥mn

Global WiFi Business

Forecasted increase in sales and income.

The forecast for overseas travelers (outbound and inbound) is based on the assumption that July-September will be the same level as each month in 2021, and that October-December will see a 25% recovery compared to the same period in 2019. The company expects that the contracted application verification service will continue through December, and that domestic demand acquisition and "Global WiFi for Biz" acquisition will continue to be strong.

Information and Communications Service Business

Forecasted increase in sales and income.

The impact on the business activities of the company and its stores is forecast to continue, but the company expects that the business will remain steady as it can respond flexibly to changes in the external environment by taking advantage of its strength in having multiple businesses (products and services) and sales channels instead of being dependent on a single business or sales channel.

The company will continue to strengthen sales of its own services (on a monthly basis) and build a stable revenue base over the long term.

The company has not revised its forecast for the second half to reflect its performance in the first half. Both sales and profits were adjusted downward for the full year.

4. Growth strategy considering the post-pandemic world

4-1 Growth strategy

For existing businesses, the company will focus on improving productivity by adapting to an online environment, so-called the New Normal.

It has set the following key topics: (1) providing products and services that meet the needs of customers and the times, (2) building and strengthening online sales systems, (3) strengthening up/cross-selling via online business negotiations, etc., (4) brushing up the revenue structure, and (5) enhancing and expanding in-house services.

As for the creation of new businesses and services, Vision aims to foster businesses that will become a third pillar that utilizes its customer base that includes corporate customers in the startup growth phase, corporate customers that undergo business with overseas companies, government offices, local governments and schools, and individual customers that like traveling.

4-2 Specific initiatives

The main initiatives are outlined below.

To actively expand sales of Global WiFi for Biz | The company will aggressively expand sales of the domestic plan option of Global WiFi for Biz, which is an indefinite use service for corporations. With the re-issuance of the emergency state declaration, the demand for this service for telework is on the rise. In terms of overseas telecommunication achievements (long-term use by local expatriates, etc.), utilization rate is gradually recovering in China, the U.S., Indonesia, Vietnam, South Korea, Thailand, etc. |

To strengthen domestic Wi-Fi sales | In addition to strengthening sales of Wi-Fi for telework, the company will focus on expanding sales of Wi-Fi for educational institutions and local governments. Due to the convenience of renting in one-day units, the use of this service is increasing as a substitute for moving or hospitalization. The company has advantages in marketing, brand strength (Global WiFi), price, the various communication plans that meet the needs, remote support in case of failure, and customer base. Even after the lifting of the emergency declaration, the churn rate has remained lower than expected due to additional demand from companies that have already installed the system. The company has been ranked No. 1 among WiFi rental services in Japan for a consecutive year due to its convenience as well as other factors. |

To start to offer a super-high-speed 5G plan | The company has started to offer a super-high-speed 5G plan, the first of its kind in the overseas Wi-Fi router rental industry. The service will start in Hawaii and the U.S. mainland and will be expanded to South Korea, China, Hong Kong, Taiwan, and such, as soon as it is ready. The company will continue its efforts to improve service quality, network quality, and expand the area of connectivity to provide comfortable mobile Internet access around the world for both tourism and business during and after the pandemic is controlled. Although corporate overseas travel is currently stagnant, in order to demonstrate its competitive edge when travel does recover, the company plans to strengthen its relationships with corporate customers. |

World eSIM Offerings | As with the "5G Plan," the company has launched the eSIM service "World eSIM," which can be used in more than 120 countries around the world, to give customers a competitive advantage when recovering from travel. The service offers the advantages of not having to carry a Wi-Fi router device, eliminating the need for additional luggage, and not having to return the device to the airport counter upon departure or upon return, as is the case with rental devices. In addition, the service can be applied for online, not only in Japan, but also from overseas. The service can be used for a variety of purposes, such as renting a mobile Wi-Fi router for multiple people and devices (smartphones, tablets, laptops, etc.), or using a World eSIM for a single smartphone. Since the SIM lock has been unlocked for some time, the company plans to actively market the service to overseas travelers in Europe and the United States, where there is a strong culture of purchasing SIM cards locally overseas, once their travel is restored. |

Vision WiMAX | A sales model service geared toward customers considering the purchase of a Wi-Fi router, created to meet the needs of people that want to be able to try using a Wi-Fi router before buying it (the most common answer in a questionnaire targeted at customers after renting a Wi-Fi router). Customers will first try out the router by renting it (with a special limited discount), check the communication environment, and then purchase the Wi-Fi router that meets their needs. Vision trades in the device when the contract is canceled. |

tsuyaku-fukikae.com (Interpreter-Dubbing.com) | The company has launched interpretation services for online and offline business meeting and conference, as well as video translation and dubbing services under the slogan, "Overcoming the language barrier, make your business more global." It provides interpretation, translation, and dubbing services that can be used in a variety of business situations at reasonable prices. The company provides simultaneous and consecutive interpretation for business meetings and conferences with overseas companies and investors via web and telephone conferences, and creates dubbed videos, etc. |

To strengthen in-house services | Sales of the VWS series, which provides only necessary functions in the cloud for a monthly fee, and Vision Crafts!, which is also a monthly home page building service, have been strong. |

Vision Denki, a new electricity service | As mentioned above, even after the deregulation of electricity, the company has been supporting customers in reducing their electricity bills by partnering with retail electricity providers and acting as a subscription agency in response to their comments that the rate system is difficult to understand and remains expensive in the end. However, by becoming a direct retail electricity provider and offering its own rate plans, the company believes it will be able to provide more affordable and stable low-voltage electricity. In addition, the company started providing this service because it is expected to be a stable source of revenues. The company will contribute to the decarbonization (carbon neutrality) of customers. In terms of electricity use, this is a service that could be offered to all existing customers.

The change from shot revenues (sales commissions) from subscription agency to recurring revenues (electricity charges) from end-user usage will result in a temporary negative impact on Group revenues. However, the Company plans to increase future earnings while covering the impact with earnings from other businesses. |

The glamping business "VISION GLAMPING Resort & Spa " | The company launched the glamping business as its third pillar of business to grow after the information communication service business and the global WiFi business. As a first step, the company opened "VISION GLAMPING Resort & Spa Koshikano Onsen" in Koshikano Onsen (Kirishima City, Kagoshima Prefecture), which has a reputation for the quality of its hot springs. Koshikano Onsen, the first glamping facility in Japan to have an open-air hot spring bath in every private room, was renovated and scaled up to become a major glamping facility with a grand opening in April 2022. The second step will be the opening of “VISION GLAMPING Resort & Spa Yamanakako” in Yamanakako Village, Yamanashi Prefecture, a prime location with a view of Mt. Fuji. It was scheduled to open in the summer of 2022, but its opening has been delayed from the original schedule due to a delay in the delivery of machinery and equipment (boilers, pressurizing devices, etc.) caused by the Shanghai lockdown and the adverse effect on the supply chain due to the Russian invasion of Ukraine. A major advantage is that President Sano's family already has the experience and knowledge in running the business. |

Offering rental meeting rooms and space for teleworking with a fixed monthly service | Adval Corp., which provides more than 200 spaces (for rental conference rooms and telework) nationwide for BtoB with a fixed monthly fee service, became a subsidiary in December 2021through a simple stock issuance. The joint creation of Vision Group's BtoB sales capabilities and Adval's planning capabilities will promote the provision of rental meeting rooms and telework space subscriptions. By maximizing the use of both companies' customer bases, products and services, business partners, and know-how, the company expects to increase sales, improve procurement efficiency, and reduce costs, which it believes will lead to medium- to long-term improvements in corporate value. |

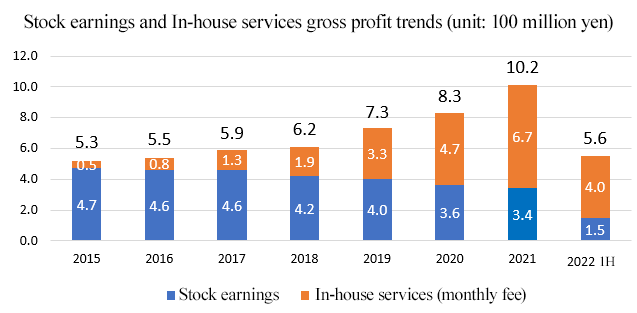

4-3 Expansion of Recurring Revenue and In-house Services

The company is working to strengthen its recurring revenue and in-house services (monthly subscription), which will provide a stable revenue base over the long term.

Since the fiscal year ended Dec. 2019, the company has been focusing on increasing subscriptions to in-house services (monthly subscription) and is strengthening sales and expanding services to achieve a gross profit of 1 billion yen. Gross profit for the first half of 2021 was made with good progress of 480 million yen.

The company will further expand its services and strengthen its sales.

(Recurring revenue includes the recurring fees associated with subscription agency contracts in the Information and Communications Service business and maintenance fees in the office automation equipment sales business.)

5. Conclusions

In the Global WiFi business, sales have been flat since the third quarter of the previous fiscal year, but sales in the second quarter of the current fiscal year exceeded 3 billion yen for the first time in 9 quarters since the first quarter of the fiscal year ended Dec. 2020. Despite the difficult situation of the COVID-19 pandemic, the sales growth was driven by the company steadily meeting a variety of domestic demand for telecommuting, etc. as well as the start of recovery in the number of overseas travelers, which in turn resulted in the upward revision to the earnings forecast. The company will continue to pay attention to whether this trend will continue from the third quarter onward.

<Reference 1: Initiatives for ESG・SDGs>

In a desire to contribute to “the future of telecommunication will be for the betterment of everyone’s future,” the company aims to increase its corporate value and for continuous growth through management and business strategies giving consideration to ESG (“Environment, Social, and Governance.”) Further, it will contribute to the revolution in telecommunications technology and sustainable development of the society by taking measure to solve major social issues included in the SDGs provided by the United Nations. The SDGs are global goals intended to be achieved between 2016 and 2030, specified in the “2030 Agenda for Sustainable Development” adopted in the United Nations Summit held in September 2015.

Environmental

The company has acquired “Green Site License” that offsets carbon emissions via websites and an environmental certification for prevention of global warming by “Green Power” as part of CO2 reduction activities of website. The company carries out information transmission, support activities in affected areas, and cooperates with and provides support for “Shinsai Regain,” a specified NPO supporting various activities, to achieve “realize a society where people can support each other in times of earthquake disasters.” Furthermore, the company is promoting affordable rental of energy-saving LED lighting and paperless operation within the company. The company is also operating its business with the minimum necessary amount of property, plant and equipment necessary. At the end of the fiscal year ended December 2021, property, plant and equipment accounted for 3.6% of total assets, with the company adapting to various changes in the environment.

Social

With health and well-being, the balance between job satisfaction and economic growth, and equality in mind, the company is promoting measures such as the use of various recruitment channels (fair hiring, referral hiring, employment of female workers (34%), multinational workers (16.1%), and disabled people), the introduction of a personnel system and its own benefit system in line with the environment of the times (shorter working hours, shift-work system, flextime system, hydration allowance in summer, flu shots subsidy, etc.). Also, the company is making efforts to ensure an environment where employees can focus on their work by running “Vision Kinds Nursery,” a company-led nursery and hire human resources with childcare responsibilities and motivation to work, in addition to making work rules flexible and enhancing the leave system for employees at the time of childbirth or with small children, in order to support their child care and create a working environment with comfort. (established a childcare facility on CLT’s premises, where more than 90% of the employees are women.) In addition to the above, the company supports the activities of Japan Heart, which works based on the idea of “delivering medical care to where it does not reach” to realize a society where everyone can receive medical care equally regardless of their countries, regions, race, politics, religion or circumstances and feel “grateful to have been born,” as one of the corporate members.

With regard to the spread of new coronavirus infection, the Ministry of Health, Labour and Welfare (MHLW) had commissioned the airport quarantine station to perform application confirmation work, which is part of the airport quarantine station's waterborne countermeasure operations, for "new measures pertaining to waterborne countermeasures.

Governance

The company has obtained “ISO/IEC 27001,” the ISMS international standard, and is taking measures for information assets’ correct and safe handling, operation, monitoring, revision, maintenance, and continuous improvement, in order to protect them within the applicable range from the threats related to information security.

Furthermore, the company promotes risk management in business activities and thorough compliance to strengthen governance considering the importance to win continuous trust from the stakeholders, and also appoints 3 out of 6 directors from outside (including one woman) who are enterprise managers, and all 4 auditors too from outside who are accountants or lawyers to ensure transparency and soundness in management.

<Reference2: Regarding corporate governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 6 directors, including 3 outside one |

Auditors | 4 auditors, including 4 outside ones |

All outside directors and outside corporate auditors are independent directors and corporate auditors.

◎ Corporate Governance Report: Updated on April 1, 2022

Basic policy

Our corporate group improves ourselves to change clients’ expectations into impression, pursues innovation without hesitation to actualize the ideal, always feels grateful about the support of many people (stakeholders), and operates its business activities with a humble mindset. Under this code of conduct, Vision observes laws, in-company regulations, and policies, carries out business in good faith, and strives to realize optimal corporate governance.

<Main Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts) >

【Principle 2-4-1 Ensuring diversity when promoting core personnel】

We actively employ a diverse range of human assets (human resources) regardless of educational background, work experience, gender, nationality, or disability. Based on the belief that making the most of each employee's individuality will lead to the creation of diverse products and services and the growth of our company, we are working to create a fulfilling work environment in which all people working for our company can grow. We have a policy of actively hiring and promoting talented people without regard to their educational background, work experience, gender, nationality, disability, or other attributes. However, we recognize the importance of human resource strategy for medium and long term improvement of corporate value, including from the perspective of ensuring diversity, and will consider formulating a human resource development policy and internal environment improvement policy to ensure diversity.

【Supplementary principle 3-1-3 Sustainability initiatives】

From the viewpoint of increasing corporate value over the medium to long term, we recognize that addressing issues related to sustainability is an important element of our management strategy. We disclose our sustainability initiatives on our website and in financial results presentation materials. In addition to matters related to the environment, we will also consider disclosing information in light of the importance of social factors such as investment in human capital and intellectual property. For details on Vision's approach to ESG and SDGs, please refer to our website:

https://www.vision-net.co.jp/company/esg.html

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Cross-shareholdings】

Our basic policy is not to hold any strategic stock holdings in principle, except in cases where it is recognized that such holdings will contribute to medium to long term improvement in corporate value. In cases where listed shares are held as policy stockholdings, the Board of Directors will review all shares on a quarterly basis and sell shares of companies that the Board of Directors determines cannot be expected to increase corporate value over the medium to long term, taking into consideration factors such as share price and market trends. With respect to the exercise of voting rights, we will make decisions on a case-by-case basis, taking into consideration whether the exercise of voting rights will contribute to the enhancement of our corporate value over the medium to long term.

We do not disclose the results of verifying the purpose of holding shares held by policy holdings, as it is related to our business strategy and disclosure may damage the interests of the Company and its shareholders.

【Principle 4-8 Effective utilization of independent outside directors】

In the company, three of the six directors are independent outside directors. We believe that the three independent outside directors will contribute to strengthening our corporate governance by utilizing their extensive experience in web marketing, inbound business, the financial industry, global business, and other areas, as well as their experience as corporate managers, to monitor the company’s management and provide advice on the company’s overall management.

【Principle 4-9 Criteria for judging the independence of independent outside directors and their qualifications】

The company selects its directors with reference to the Companies Act and the standards established by the Tokyo Stock Exchange. In addition, the company has selected individuals who can provide advice on all aspects of the company’s management based on their extensive experience and knowledge.

【Principle 5-1 Policy for constructive dialogue with shareholders】

If shareholders or others want to have a dialogue with Vision, the company will respond positively within a reasonable range, to contribute to the sustainable growth of the company and the medium to long-term improvement in corporate value. As of now, Vision holds a briefing session attended by the president or a director in charge of IR two or more times per year, meetings with institutional investors domestic and foreign, briefing sessions for individual investors several times a year, and so on. The information on their results is properly shared through meetings of the board of directors, etc. In addition, Vision takes thoroughgoing measures for preventing the leakage of insider information.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |