Bridge Report:(9416)Vision the fiscal year ended December 2022

Chairman and CEO Kenichi Sano | Vision Inc. (9416) |

|

Company Information

Market | TSE Prime Market |

Industry | Information and telecommunications |

CEO | Kenichi Sano |

HQ Address | SHINJUKU EASTSIDE SQUARE 8F, 6-27-30 Shinjuku, Shinjuku-ku, Tokyo 160-0022, Japan |

Year-end | December |

HP |

Stock Information

Share Price | Number of Shares Issued (End of the term) | Total Market Cap | ROE(Act.) | Trading Unit | |

¥1,621 | 50,422,200 shares | ¥81,734 million | 14.0% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR |

¥0.00 | - | ¥40.69 | 39.8 x | ¥245.75 | 6.6 x |

* Stock price as of the close on August 19, 2023. Each figure is from the financial results for the fiscal year ended December 2022.

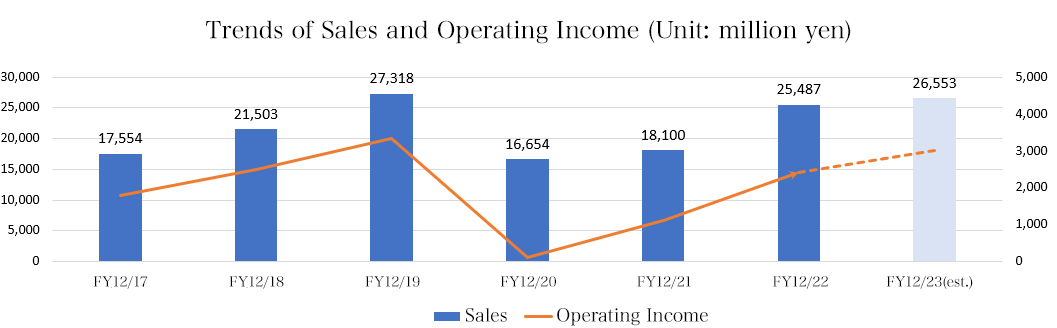

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

Dec. 2019 (Actual) | 27,318 | 3,325 | 3,358 | 2,226 | 46.05 | 0.00 |

Dec. 2020 (Actual) | 16,654 | 103 | 227 | -1,183 | -25.07 | 0.00 |

Dec. 2021 (Actual) | 18,100 | 1,105 | 1,143 | 729 | 15.47 | 0.00 |

Dec. 2022 (Actual) | 25,487 | 2,414 | 2,422 | 1,548 | 31.96 | 0.00 |

Dec. 2023 (Forecast) | 26,553 | 3,000 | 2,998 | 1,990 | 40.69 | 0.00 |

* The forecasted values were provided by the company. Unit: Million yen or yen. In October 2019, the company split one share into three shares (EPS retroactively adjusted).

This Bridge Report outlines Vision’s results for the fiscal year ended December 2022.

Table of Contents

Key Points

1. Company Overview

2. The Fiscal Year Ended December 2022 Earnings Results

3. The Fiscal Year Ending December 2023 Earnings Forcasts

4. Growth strategy considering the post-pandemic world

5. Conclusions

<Reference1: Initiatives for ESG・SDGs>

<Reference2: Regarding corporate governance>

Key Points

- In the fiscal year ended Dec. 2022, sales increased 40.8% year on year to 25,487 million yen, with both the Global WiFi and Information and Communications Services businesses seeing sales growth. The accelerated easing or lifting of entry restrictions in various countries has contributed to the recovery of outbound travel (Japanese travelers going abroad). Gross profit increased 36.9% year on year, despite a decline in gross profit margin due to higher labor costs (cost of sales) for application verification operations, part of the airport quarantine station’s border control operations in the Global WiFi business. Operating income increased 118.5% year on year to 2,414 million yen. Selling, general and administrative expenses, including personnel expenses and advertising expenses, increased 25.5%, but the effect of the increase in sales absorbed these costs. The actual sales and profit exceeded the revised forecasts.

- The Global WiFi business achieved a significant increase in sales and profit. Rental transactions for outbound travel increased by approximately 23.7% as the number of Japanese travelers going abroad recovered by 23.1% from the pre-pandemic period (October-December 2019). The number of subscribers to “Global WiFi for Biz,” an in-house Wi-Fi service for corporate customers, continued to increase, as did the number of teleworking subscribers and the number of telecommunication use. In addition, the business continues to meet various usage needs in Japan, such as temporary return, hospitalization, moving, homecoming, travel and business trips, events, teleworking, and combined use with home lines. The entrusted operations at airports and PCR testing at events and when returning home have increased.

- The Information and Communications Services business experienced increased sales, but decreased profit. This was due to the strengthening of sales of goods such as mobile communication and office automation equipment, as well as the contribution from adval Corp., a subsidiary that provides rental services for meeting rooms and telework spaces, which was acquired in December 2021. The company’s recurring revenue and monthly subscription services also performed well. Although segment profit decreased due to the active upfront investment in monthly subscription services and increased expenses related to the relocation of the back-office departments, the company is focused on building a strong revenue base and maximizing customer lifetime value. Given the high electricity prices in the market, the company decided to suspend its “Vision Denki” service (electricity supply) at the end of December 2022.

- The projected sales for the fiscal year ending Dec. 2023 are 26.5 billion yen, up 4.2% from the previous year, with an operating income of 3 billion yen, up 24.3% from the previous year. As consumer spending recovers and companies invest in equipment, the company expects a gradual recovery of the domestic-demand-led economy, and some increase in international travel due to the relaxation of border controls in various countries. While improving the profitability and profit margin of existing businesses, the company plans to expand its new businesses and services. The Global WiFi business is expected to experience decreased sales and profit, while the Information and Communications Services business is expected to experience increased sales and profit. The Glamping and Tourism business is expected to increase sales and move into the black.

- On the other hand, the Global WiFi business, which saw significant sales and profit growth in the previous period, is expected to experience decreased sales and profit due to the expected decrease in domestic Wi-Fi demand, which had been driven by factors such as telework needs, as well as the end of airport quarantine and PCR testing due to the relaxation and lifting of entry restrictions caused by the COVID-19 pandemic. However, with the recovery of Japanese overseas travel, an increase in Wi-Fi rentals is also expected, and we will be paying attention to trends on a quarterly basis going forward. In addition, the new Glamping and Tourism business is expected to move into the black as early as this second fiscal year, and the speed of its growth is noteworthy.

1. Company Overview

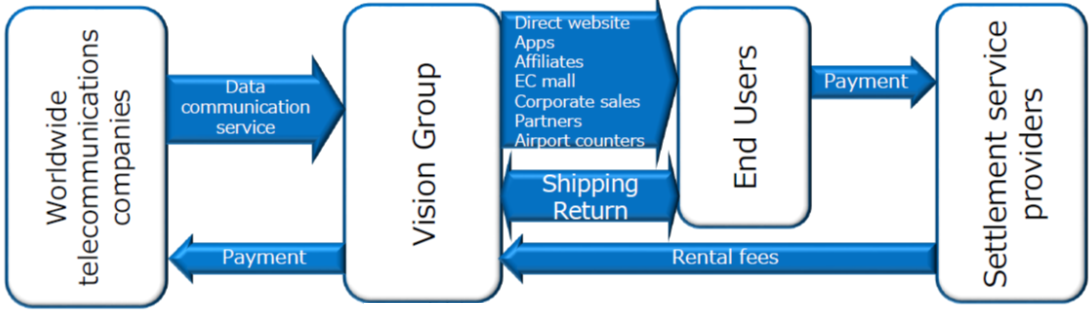

Under the management philosophy of “ To Contribute to the Global Information and Communications Revolution,” Vision conducts the Global WiFi business, which leases the personal Wi-Fi (wireless LAN) routers which can be used in over 200 countries and regions on a flat-rate basis, and as an Information and Communications Service distributor, it also provides Information and Communications Service business of arranging telecommunications infrastructure and office equipment necessary for business activities, such as fixed-line telecommunications, mobile telecommunications, broadband etc.

The company forms a group with its 21 consolidated subsidiaries, both inside and outside Japan. Of those, the 9 based in Japan include Members Net Inc. (which conducts the business of charging agency, fixed-line telephone service subscription agency, etc.) and Best Link Inc. (which carries out the business of broadband service subscription agency). There are 12 overseas subsidiaries that operate as overseas hubs for the Global WiFi service in South Korea, Singapore, UK, Hong Kong, Hawaii, Taiwan, China (Shanghai), France, Italy, California and New Caledonia; there is also a local subsidiary in Vietnam, which is an offshore hub for database construction and system development. (At the end of December 2022)

【Vision Group’s management philosophy – To Contribute to the Global Information and Communications Revolution】

We will actively promote the Information and Communications Revolution in the world, bring innovations to an individual’s lifestyle and the company’s business style, and contribute to the advancement of humanity and society by continuing to be an distributor that effectively and efficiently connects the client companies with end users and makes sure that its employee’s unlimited ambition, dreams and thoughts are contributing to the stakeholders, without compromising nor ever forgetting the venture spirit and add to the progress of the human race and the society.

1-1 Business Description

①Global WiFi Business

The company offers services including “Global WiFi” (a Wi-Fi router rental service that allows people traveling overseas to use local internet services at a competitive rate through its partnerships with the overseas operators) and “NINJA WiFi” (a Wi-Fi router rental service for overseas visitors to Japan, etc.), while also engaging in services for the travelers between foreign countries in overseas bases (South Korea and Taiwan).

The term-end number of leased Wi-Fi routers that are equipped with the next-generation telecommunication technology (Cloud Wi-Fi) capable of managing Subscriber Identity Modules (SIMs) on the cloud accounts for over 90% of all leased devices (Depending on telecommunication carriers, some countries are not supported, thus the company has almost reached the upper limit).

(From the reference material of the company)

Advantages (1) Affordable fixed-rate system, (2) the most comprehensive area coverage, (3) comfort, (4) safety/security, and (5) substantial support bases and corporate sales capabilities ⇒ One of the largest customer bases in the industry

The advantages of “Global WiFi” and “NINJA WiFi” include the following: (1) cost benefits of up to 89.9% (the rental fee per day is 300 yen at the minimum, depending on the travel destination) compared to the overseas fixed-rate packet plans offered by other Japanese mobile carriers, (2) the industry’s most comprehensive coverage of over 200 countries and regions, (3) high-speed telecommunications services through partnerships with telecommunication operators all over the world, (4) available at 24 hours a day, 365 days a year, at 47 bases worldwide, and (5) the industry’s largest number of available spots at airport counters.

Furthermore, from the business perspective, another advantageous point is the fact that use by corporations, through which stable demand can be expected, has accounted for about 30%~40% in this business segment. As a result, the company has secured a great number of users, which is one of the largest market shares in the industry.

The store digitalization strategy and establishment of the super last-minute online order receipt system

The company is proceeding with the strategy of making stores digitalized by (1) installing automatic delivery lockers (Smart Pickup), (2) adopting self-registration KIOSK terminals with multilingual support and payment settlement functions (Smart Entry), and (3) the QR code-based reception counter that features immediate customer identification (Smart Check), while expanding the number of manned counters in Japan. The company aims to evolve its stores to ones that can be used by Japanese tourists travelling abroad and foreign tourists visiting Japan, more conveniently, more comfortably, and with greater peace of mind, as well as strengthen its efforts toward the increase of routers on lease (number of routers delivered) and increase of optional services (such as insurance services and accessories).

(From the reference material of the company)

In addition to strengthening the contact point with users, the store digitalization will make it possible to optimize the level of services according to user needs (reducing the waiting time for repeat users who do not require explanations while making airport staff deal with users who need it). As it is difficult to expand and install more airport counters, the company is planning to increase Smart Pickup lockers, which will save labor, and improve throughput and reduce costs by utilizing the limited space effectively.

Furthermore, the combination of the store digitalization strategy, Cloud Wi-Fi, and the customer database has established a “super last-minute online order receipt system,” enabling the company to provide services for customers who are about to depart (the system has made it possible for the company to cope expeditiously with online application submitted right in front of airport counters by linking it with the database).

Although demand for both inbound and outbound services have disappeared due to the spread of the novel coronavirus, the company is aggressively expanding sales of the domestic plan option of its in-house permanent service for corporations, “Global WiFi for Biz,” to meet the growing demand for telework.

At the moment, corporate employees’ overseas travel is stagnant, but the company is strengthening its relationships with corporate clients to gain a competitive advantage when travel recovers.

②Information and Communications Service Business

With Best Link Inc., a consolidated subsidiary, at its core, the group offers services aimed mainly at newly established corporations, venture businesses and multi-store development enterprises such as food-service chains, from its 13 offices nationwide and in cooperation with its partner companies. The services include subscription agency operations for various telecommunications services such as business phones, agency operations of arranging lines for landline telephones, subscriber telephones, and NTT Hikari telephones, corporate mobile phones, broadband lines, sales and maintenance of mobile telecommunication devices, OA equipment and security products (UTM), etc., designing websites, and agency operations for new power services targeting enterprises.

The company has advantages in prospecting for corporations newly established (within 6 months), one of its major targets, and it is estimated, according to the data by the Ministry of Justice (the number of newly registered companies was 132,343 in Japan in 2021), that the company has conducted transactions with around one in every 10 corporations newly founded in Japan. These advantageous points are backed by the company’s strong power to attract customers through its unique online marketing (Internet media strategy), through which the company maximizes running yield (recurring revenue-type business) and conducts additional sales with high productivity (up/cross selling) through the Customer Relationship Management (CRM; customer relationship and ongoing transactions) strategy.

For example, the company receives commission from operators for telephone line arrangements unless contracts for the service are cancelled, and it can earn maintenance fees for multifunction photocopiers on a continuous basis. Moreover, the follow-up service by its Customer Loyalty Team has enabled the company to establish a recurring revenue-type business model, in which earnings are accumulated by taking in demand for lines and equipment that increases with customers’ business growth, and providing optimal services according to customers’ growth stage (additional sales with high productivity through up/cross selling). The company will evolve its recurring revenue-type business model while expanding the target customer from enterprises with growth potential to ones in the growth stage.

③ Glamping and Tourism Business

The glamping business was launched as a business that will grow to become the third pillar of the company’s business. Currently, the company operates two facilities, “VISION GLAMPING Resort & Spa Koshikano Onsen” (Kirishima City, Kagoshima Prefecture) and “VISION GLAMPING Resort & Spa Yamanakako” (Yamanakako Village, Minamitsuru-gun, Yamanashi Prefecture).

This business has a major advantage in that President Sano’s family already has experience and expertise in the management of this business.

2. The Fiscal Year Ended December 2022 Earnings Results

2-1 Consolidated Business Results

| FY 12/21 | Ratio to sales | FY 12/22 | Ratio to sales | YoY | *Revised forecasts |

Sales | 18,100 | 100.0% | 25,487 | 100.0% | +40.8% | +3.8% |

Gross profit | 9,008 | 49.8% | 12,330 | 48.4% | +36.9% | +3.3% |

SG&A expenses | 7,903 | 43.7% | 9,916 | 38.9% | +25.5% | +3.2% |

Operating income | 1,105 | 6.1% | 2,414 | 9.5% | +118.5% | +4.2% |

Ordinary income | 1,143 | 6.3% | 2,422 | 9.5% | +111.8% | +4.2% |

Quarterly net income | 729 | 4.0% | 1,548 | 6.1% | +112.4% | +1.5% |

*Unit: ¥mn The Quarterly net profit is the quarterly profit attributable to owners of the parent company.

*Revised forecasts are ratios to the forecasts announced in November 2022.

(From the reference material of the company)

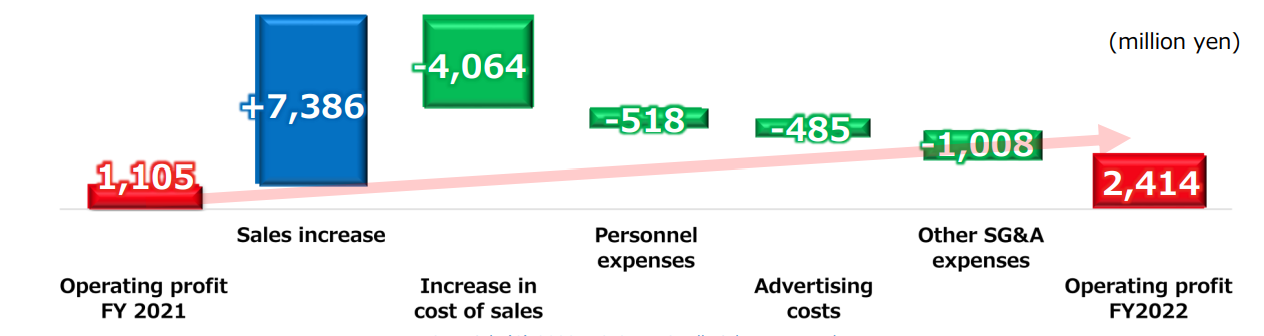

Significant increase in sales and income, exceeds expectations.

Sales were 25,487 million yen, up 40.8% year on year. Sales increased in both the Global WiFi business and the Information and Communications Services business. The accelerated easing or lifting of entry restrictions in various countries has contributed to the recovery of outbound travel (Japanese travelers going abroad).

Gross profit increased 36.9% year on year, despite a decline in gross profit margin due to higher labor costs (cost of sales) for application verification operations, part of the airport quarantine station’s border control operations in the Global WiFi business.

Operating income increased 118.5% year on year to 2,414 million yen. Selling, general and administrative expenses, including personnel expenses and advertising expenses, increased 25.5%, but the effect of the increase in sales absorbed these costs. The actual sales and profit exceeded the revised forecasts.

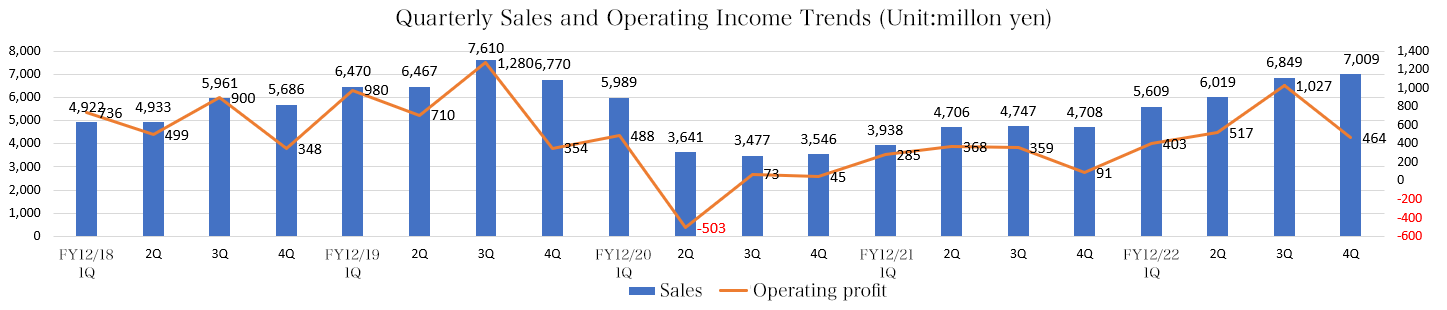

Quarterly business results

| 20/12-1Q | 2Q | 3Q | 4Q | 21/12-1Q | 2Q | 3Q | 4Q | 22/12-1Q | 2Q | 3Q | 4Q |

Sales | 5,989 | 3,641 | 3,477 | 3,546 | 3,938 | 4,706 | 4,747 | 4,708 | 5,609 | 6,019 | 6,849 | 7,009 |

Gross profit | 3,252 | 1,569 | 2,001 | 1,969 | 2,176 | 2,328 | 2,313 | 2,189 | 2,544 | 2,910 | 3,525 | 3,350 |

SG&A expenses | 2,764 | 2,072 | 1,928 | 1,923 | 1,890 | 1,960 | 1,953 | 2,098 | 2,140 | 2,392 | 2,497 | 2,885 |

Operating income | 488 | -503 | 73 | 45 | 285 | 368 | 359 | 91 | 403 | 517 | 1,027 | 464 |

Ordinary income | 496 | -429 | 101 | 60 | 313 | 367 | 361 | 101 | 406 | 516 | 1,031 | 468 |

Quarterly net income | 116 | -1,468 | 124 | 42 | 232 | 223 | 246 | 27 | 245 | 320 | 704 | 278 |

Gross Profit Margin | 54.3% | 43.1% | 57.6% | 55.5% | 55.3% | 49.5% | 48.7% | 46.5% | 45.4% | 48.3% | 51.5% | 47.8% |

SG&A ratio | 46.2% | 56.9% | 55.4% | 54.2% | 48.0% | 41.7% | 41.2% | 44.6% | 38.2% | 39.7% | 36.5% | 41.2% |

Operating income ratio | 8.1% | -13.8% | 2.1% | 1.3% | 7.3% | 7.8% | 7.6% | 1.9% | 7.2% | 8.6% | 15.0% | 6.6% |

*Unit: million yen

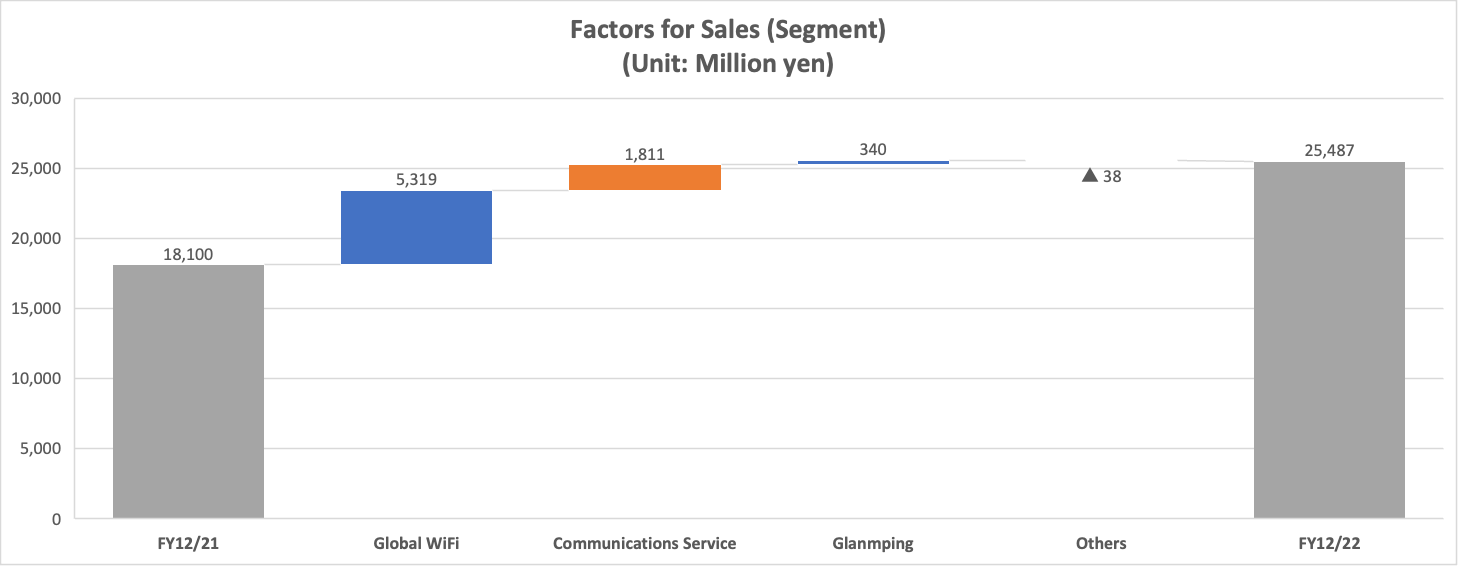

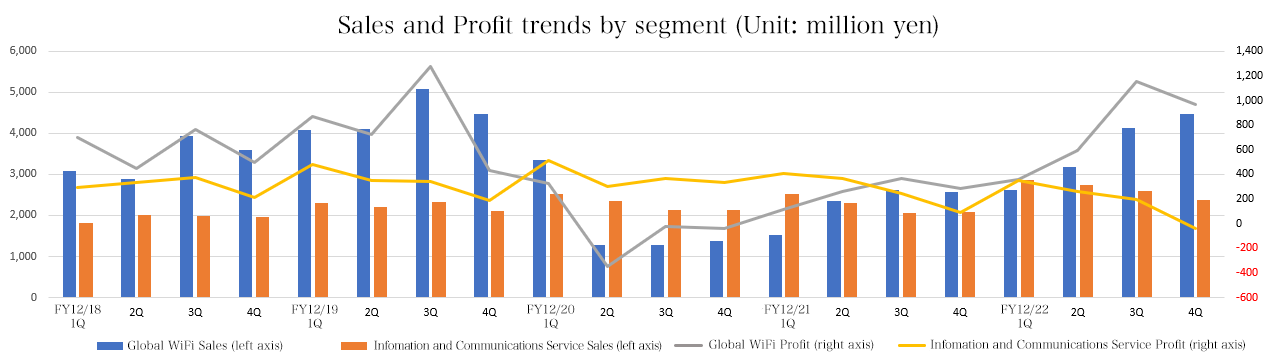

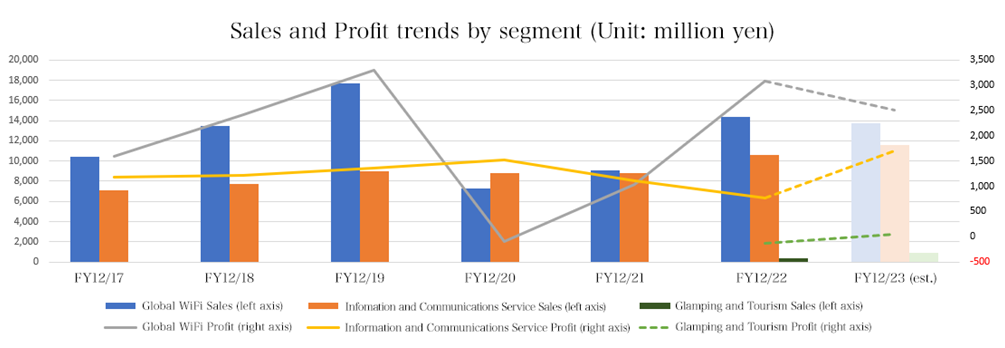

2-2 Trends by segment

| FY 12/21 | Composition Ratio・Profit Ratio | FY 12/22 | Composition Ratio・Profit Ratio | YoY |

Global WiFi | 9,070 | 50.1% | 14,389 | 56.5% | +58.6% |

Information and Communications Service | 8,804 | 48.6% | 10,615 | 41.5% | +20.6% |

Glamping and Tourism | 0 | 0.0% | 340 | 1.3% | - |

Others | 235 | 1.3% | 197 | 0.8% | -16.0% |

Consolidated Sales | 18,100 | 100.0% | 25,487 | 100.0% | +40.8% |

Global WiFi | 1,033 | 11.4% | 3,078 | 21.4% | +197.9% |

Information and Communications Service | 1,116 | 12.7% | 765 | 7.2% | -31.4% |

Glamping and Tourism | - | - | -122 | - | - |

Others | -94 | - | -119 | - | - |

Adjustments | -950 | - | -1,186 | - | - |

Consolidated Operating Income | 1,105 | 6.1% | 2,414 | 9.5% | +118.5% |

*Unit: million yen. Sales represents sales to external customers.

| 20/12-1Q | 2Q | 3Q | 4Q | 21/12-1Q | 2Q | 3Q | 4Q | 22/12-1Q | 2Q | 3Q | 4Q |

Sales |

|

|

|

|

|

|

|

|

|

|

|

|

Global WiFi | 3,347 | 1,286 | 1,272 | 1,371 | 1,515 | 2,349 | 2,628 | 2,577 | 2,618 | 3,174 | 4,125 | 4,471 |

Information and Communications Service | 2,514 | 2,003 | 2,145 | 2,133 | 2,357 | 2,297 | 2,068 | 2,080 | 2,875 | 2,744 | 2,594 | 2,370 |

Operating profit |

|

|

|

|

|

|

|

|

|

|

|

|

Global WiFi | 326 | -347 | -27 | -42 | 117 | 262 | 368 | 284 | 359 | 593 | 1,156 | 968 |

Information and Communications Service | 517 | 299 | 367 | 335 | 410 | 367 | 246 | 92 | 347 | 259 | 197 | -36 |

*Unit: million yen. Sales represents sales to external customers.

*Investment Bridge Co., Ltd. prepared this based on disclosed material.

Global WiFi Business

Sales grew and profit increased significantly.

Rental transactions for outbound travel increased by approximately 24% as the number of Japanese travelers going abroad recovered by 23.1% from the pre-pandemic period (October-December 2019).

“Global WiFi for Biz,” an in-house standard Wi-Fi service for corporations, has been increasing in the number of subscriptions as well as communication usage, as it is used for telecommuting.

In addition, the business continues to meet various usage needs in Japan, such as temporary return, hospitalization, moving, homecoming, travel and business trips, events, teleworking, and combined use with home lines. The entrusted operations at airports and PCR testing at various events and for homecoming have increased.

Information and Communications Service Business

Sales increased and profit decreased.

The sale of merchandize (mobile communications equipment, office automation equipment, etc.) was strengthened. adval Corp., which manages the Space Management Business (rental service for conference rooms and telecommuting spaces), which became a subsidiary in December 2021, also contributed to the revenue.

Recurring revenues and in-house services (monthly basis) remained steady.

Due to the active upfront investment in monthly subscription services and increased expenses related to the relocation of the back-office departments, which are aimed at building a strong revenue base and maximizing customer lifetime value, the segment profit decreased temporarily. Given the high electricity prices in the market, the company decided to suspend its “Vision Denki” service (electricity supply) at the end of December 2022.

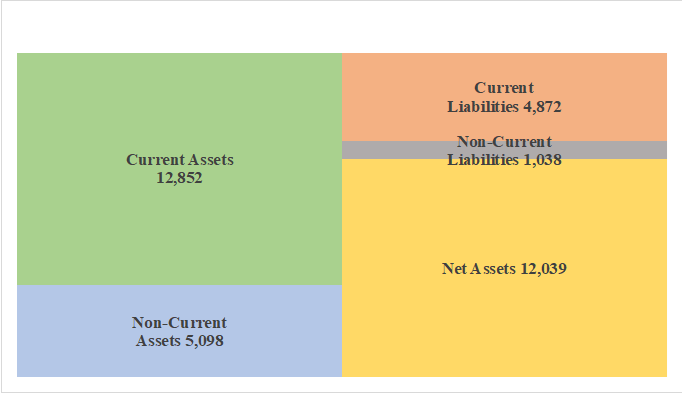

2-3 Financial Condition and Cash Flow

◎Financial Condition

| December 2021 | December 2022 | Increase/ decrease |

| December 2021 | December 2022 | Increase/ decrease |

Current assets | 10,748 | 12,852 | +2,103 | Current liabilities | 3,880 | 4,872 | +992 |

Cash and deposits | 7,602 | 8,156 | +554 | Trade payables | 914 | 820 | -93 |

Trade receivables | 2,183 | 3,658 | +1,474 | Provision for bonuses | 929 | 1,038 | +108 |

Noncurrent assets | 4,183 | 5,098 | +915 | Noncurrent liabilities | 4,809 | 5,911 | +1,101 |

Property, plant and equipment | 534 | 2,185 | +1,650 | Total liabilities | 10,122 | 12,039 | +1,917 |

Intangible fixed assets | 1,482 | 1,331 | -150 | Net assets | 7,088 | 8,637 | +1,548 |

Investments and other | 2,166 | 1,581 | -584 | Net retained earnings | 14,932 | 17,951 | +3,019 |

Total assets | 14,932 | 17,951 | +3,019 | Total liabilities Equity | 872 | 967 | +94 |

*Unit: million yen

*Investment Bridge Co., Ltd. prepared this based on disclosed material.

Tangible fixed assets increased due to investments in accounts receivable and glamping business, etc., and total assets increased by 3.0 billion yen from the end of the previous term to 17.9 billion yen.

Total liabilities increased 1.1 billion yen year-on-year to 5.9 billion yen due to increases in accounts payable and borrowings.

Net assets increased 1.9 billion yen from the end of the previous term to 12.0 billion yen due to increases in retained earnings and foreign currency translation adjustments.

Equity ratio decreased by 0.7 points from the end of the previous term to 67.0%.

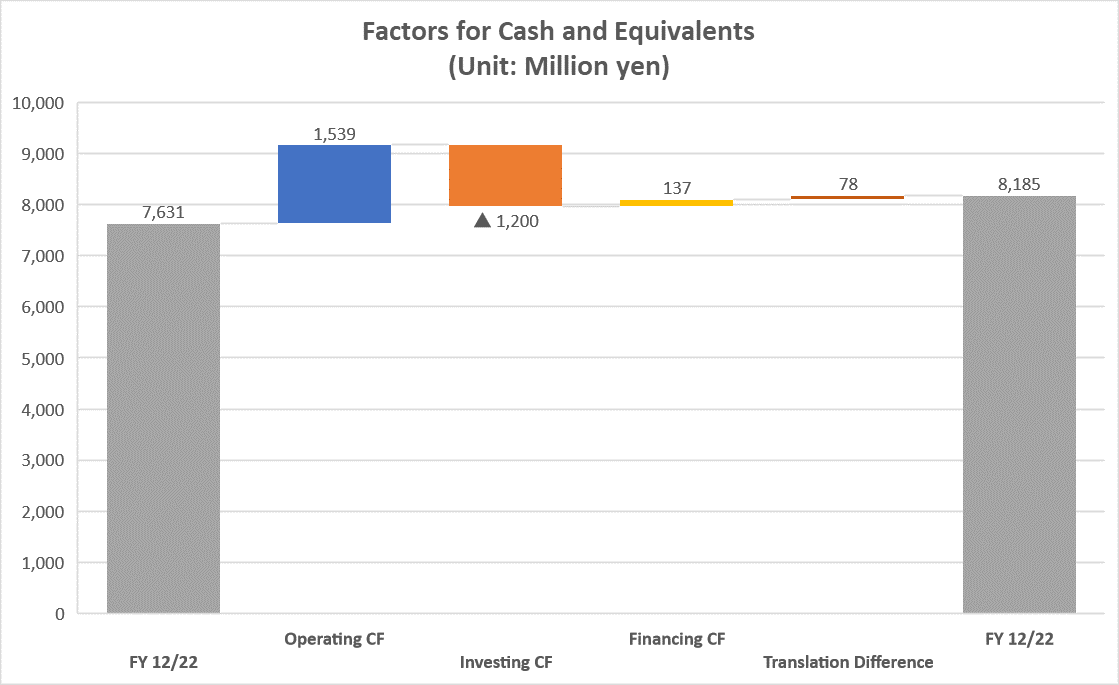

◎Cash Flow

| FY12/21 | FY12/22 | Increase/Decrease |

Operating CF | 1,412 | 1,539 | +126 |

Investing CF | -554 | -1,200 | -646 |

Free CF | 858 | 338 | -519 |

Financing CF | 30 | 137 | +106 |

Cash and Equivalents at the Term End | 7,631 | 8,185 | +554 |

*Unit: million yen

*Investment Bridge Co., Ltd. prepared this based on disclosed material.

The cash inflow from operating activities expanded due to factors such as an increase in net income before taxes and other adjustments. However, the company’s free cash inflow shrank, due to an increase in purchase of property, plant and equipment.

The cash position improved.

3. The Fiscal Year Ending December 2023 Earnings Forecasts

3-1 Consolidated Earnings Forecast

| FY 12/22 | Ratio to sales | FY 12/23 (forecast) | Ratio to sales | YoY |

Sales | 25,487 | 100.0% | 26,553 | 100.0% | +4.2% |

Gross Profit | 12,330 | 48.4% | 14,135 | 53.2% | +14.6% |

SG&A | 9,916 | 38.9% | 11,134 | 41.9% | +12.3% |

Operating income | 2,414 | 9.5% | 3,000 | 11.3% | +24.3% |

Ordinary income | 2,422 | 9.5% | 2,998 | 11.3% | +23.8% |

Net income | 1,548 | 6.1% | 1,990 | 7.5% | +28.6% |

* Unit: million yen

Forecast higher sales and profits

The projected sales for the fiscal year ending Dec. 2023 are 26.5 billion yen, up 4.2% from the previous year, with an operating income of 3 billion yen, up 24.3% from the previous year. As consumer spending recovers and companies invest in equipment, the company expects a gradual recovery of the domestic-demand-led economy, and some increase in international travel due to the relaxation of border controls in various countries.

While improving the profitability and profit margin of existing businesses, the company plans to expand its new businesses and services. The Global WiFi business is expected to experience decreased sales and profit, while the Information and Communications Services business is expected to experience increased sales and profit. The Glamping and Tourism business is expected to increase sales and move into the black.

3-2 Forecast by Segment

| FY 12/22 | Composition Ratio・Profit Ratio | FY 12/23 (forecast) | Composition Ratio・Profit Ratio | YoY |

Global WiFi | 14,389 | 56.5% | 13,741 | 51.7% | -4.5% |

Information and Communications Service | 10,572 | 41.5% | 11,623 | 43.8% | +9.5% |

Glamping and Tourism | 338 | 1.3% | 885 | 3.3% | +160.3% |

Others | 186 | 0.7% | 302 | 1.1% | +53.0% |

Consolidated net sales | 25,487 | 100.0% | 26,553 | 100.0% | +4.2% |

Global WiFi | 3,078 | 21.4% | 2,502 | 18.2% | -18.7% |

Information and Communications Service | 765 | 7.2% | 1,708 | 14.7% | +123.2% |

Glamping and Tourism | -122 | - | 45 | 5.1% | - |

Others | -119 | - | 53 | 17.5% | - |

Adjustments | -1,186 | - | -1,309 | - | - |

Consolidated operating income | 2,414 | 9.5% | 3,000 | 11.3% | +24.3% |

* Unit: million yen

Global WiFi Business

Sales and profit are projected to decrease.

Regarding the measures implemented to prevent the spread of the novel coronavirus infection at ports of entry, the trend of easing or lifting entry restrictions leads to the end of airport quarantine business and PCR testing, as well as a decrease in domestic Wi-Fi. This trend was taken into account.

However, Global WiFi and NINJA WiFi are showing signs of steady recovery. Going forward, there is a possibility that they may recover faster than the recovery speed at the time the budget plan was created.

Information and Communications Service Business

Forecasted increase in sales and income.

Although there will remain an impact on the procurement of merchandise (equipment procurement due to the shortage of semiconductors, etc.), the company expects the business to remain strong as it can flexibly respond to changes in the external environment by leveraging its strength of having multiple businesses (products/services) and sales channels that are not dependent on any single business or sales channel.

The company will continue to strengthen sales of its own services (on a monthly basis) and build a stable revenue base over the long term.

4. Growth strategy considering the post-pandemic world

4-1 Growth strategy

For existing businesses, the company will focus on improving productivity by adapting to an online environment, so-called the New Normal.

It has set the following key topics: (1) providing products and services that meet the needs of customers and the times, (2) building and strengthening online sales systems, (3) strengthening up/cross-selling via online business negotiations, etc., (4) brushing up the revenue structure, and (5) enhancing and expanding in-house services.

As for the creation of new businesses and services, the company is setting keywords as “With Covid-19, Adaptation to the new normal” “Utilization of the sales channel and the business structure” “Making use of the customer base” “Development of the service incorporating customer feedback” “Regional revitalization”. Vision aims to foster businesses that will become a third pillar that utilizes its customer base that includes corporate customers in the startup growth phase, corporate customers that undergo business with overseas companies, government offices, local governments and schools, and individual customers that like traveling.

4-2 Specific initiatives

The main initiatives are outlined below.

To actively expand sales of Global WiFi for Biz | The company will aggressively expand sales of the domestic plan option of “Global WiFi for Biz,” which is an in-house permanent service for corporations. The demand for this service for telework is on the rise. In terms of overseas telecommunication achievements (long-term use by local expatriates, etc.), utilization rate is gradually recovering in China, the U.S., Thailand, Vietnam, Germany, European countries. Compared to the end of December 2019, the number of contracts and sales are rapidly recovering, up approximately 131% and 30%, respectively (base rate up approximately 72%). |

To strengthen domestic Wi-Fi sales | In addition to strengthening sales of Wi-Fi for telework, the company will focus on expanding sales of Wi-Fi for educational institutions and local governments. Due to the convenience of renting in one-day units, the use of this service is increasing as a substitute for moving or hospitalization. The company has advantages in marketing, brand strength (Global WiFi), price, the various communication plans that meet the needs, remote support in case of failure, and customer base. As the efforts to balance infection prevention measures and social and economic activities continue, the convenience of rental services that can be used for a necessary period (in units of one day) and in a necessary location for in-person work and telework has led to an increase in continued usage. The company has been ranked No. 1 among Wi-Fi rental services in Japan for 5 consecutive year due to its convenience as well as other factors. |

To start to offer a super-high-speed 5G plan | The company has started to offer a super-high-speed 5G plan, the first of its kind in the overseas Wi-Fi router rental industry. The service will start in Hawaii and the U.S. mainland and will be expanded to 8 countries: South Korea, Taiwan, Thailand, England, Italy, France, Germany and Spain then gradually will expand. The company will continue its efforts to improve service quality, network quality, and expand the area of connectivity to provide comfortable mobile Internet access around the world for both tourism and business during and after the pandemic is controlled. Although corporate overseas travel is currently stagnant, in order to demonstrate its competitive edge when travel does recover, the company plans to strengthen its relationships with corporate customers. |

World eSIM offerings | As with the “5G Plan,” the company has launched the eSIM service “World eSIM,” which can be used in more than 120 countries around the world, to give customers a competitive advantage when recovering from travel. The service offers the advantages of not having to carry a Wi-Fi router device, eliminating the need for additional luggage, and not having to return the device to the airport counter upon departure or upon return, as is the case with rental devices. In addition, the service can be applied for online, not only in Japan, but also from overseas. The service can be used for a variety of purposes, such as renting a mobile Wi-Fi router for multiple people and devices (smartphones, tablets, laptops, etc.), or using a World eSIM for a single smartphone. The company plans to actively market the service to overseas travelers in Europe and the United States, where SIM cards are often purchased locally overseas, once their travel is restored. |

Vision WiMAX | A sales model service geared toward customers considering the purchase of a Wi-Fi router, created to meet the needs of people that want to be able to try using a Wi-Fi router before buying it (the most common answer in a questionnaire targeted at customers after renting a Wi-Fi router). Customers will first try out the router by renting it (with a special limited discount), check the communication environment, and then purchase the Wi-Fi router that meets their needs. Vision trades in the device when the contract is canceled. |

Mobile communications equipment (corporate cell phones) and related services | In an environment where the spread of COVID-19 has forced a change in work style, the business is growing while increasing recurring revenue by accurately meeting the needs of customers, the market, and the times, acquiring new customers, and up-selling and cross-selling according to the growth stage of the company. |

Strengthening In-house Services | The sales of the “VWS Series,” which provides necessary cloud functions on a monthly basis according to the required amount, are healthy, thanks to the promotion of DX (digital transformation). |

The Glamping business “VISION GLAMPING Resort & Spa” | The company launched the glamping business as its third pillar of business to grow after the Information Communications Service business and the Global WiFi business. As a first step, the company opened “VISION GLAMPING Resort & Spa Koshikano Onsen” in Koshikano Onsen (Kirishima City, Kagoshima Prefecture), which has a reputation for the quality of its hot springs. Koshikano Onsen, the first glamping facility in Japan to have an open-air hot spring bath in every private room, was renovated and scaled up to become a major glamping facility with a grand opening in April 2022. As the second step, “VISION GLAMPING Resort & Spa Yamanakako” opened in Yamanakako Village, Yamanashi Prefecture, a prime location with a view of Mt. Fuji in December 2022. With a view of the world heritage site, Mt. Fuji, and surrounded by not only natural and scenic attractions that are popular worldwide, but also prominent tourist spots such as Gotemba Premium Outlets and Fuji-Q Highland, the location is convenient for planning travels. A major advantage is that President Sano’s family already has the experience and knowledge in running the business. |

Offering rental meeting rooms and space for teleworking with a fixed monthly service | adval Corp., which provides more than 200 spaces (for rental conference rooms and telework) nationwide for BtoB with a fixed monthly fee service, became a subsidiary in December 2021through a simple stock issuance. The joint creation of Vision Group’s BtoB sales capabilities and adval’s planning capabilities will promote the provision of rental meeting rooms and telework space subscriptions. By maximizing the use of both companies’ customer bases, products and services, business partners, and know-how, the company expects to increase sales, improve procurement efficiency, and reduce costs, which it believes will lead to medium- to long-term improvements in corporate value. |

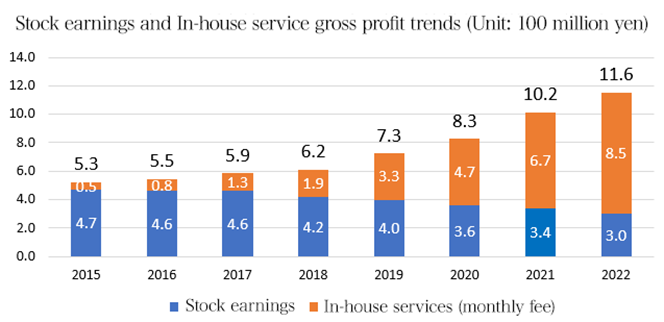

4-3 Expansion of Recurring Revenue and In-house Services

The company is working to strengthen its recurring revenue and in-house services (monthly subscription), which will provide a stable revenue base over the long term.

Since the fiscal year ended December 2019, the company has been focusing on acquiring customers for its in-house services (monthly subscription) and has been promoting sales and expanding services in order to achieve a gross profit of 1 billion yen. As a result, the gross profit for the fiscal year ended Dec. 2021 exceeded 1 billion yen, and the growth rate remained in the double digits for Dec. 2022 as well.

(Recurring revenue includes the recurring fees associated with subscription agency contracts in the Information and Communications Service business and maintenance fees in the office automation equipment sales business.)

5. Conclusions

The Global WiFi business, which saw significant sales and profit growth in the previous period, is expected to experience decreased sales and profit due to the expected decrease in domestic Wi-Fi demand, which had been driven by factors such as telework needs, as well as the end of airport quarantine and PCR testing due to the relaxation and lifting of entry restrictions caused by the COVID-19 pandemic. However, with the recovery of Japanese overseas travel, an increase in Wi-Fi rentals is also expected, and we will be paying attention to trends on a quarterly basis going forward.

In addition, the new Glamping and Tourism business is expected to move into the black as early as this second fiscal year, and the speed of its growth is noteworthy.

<Reference 1: Initiatives for ESG・SDGs>

In a desire to contribute to “the future of telecommunication will be for the betterment of everyone’s future,” the company aims to increase its corporate value and for continuous growth through management and business strategies giving consideration to ESG (“Environment, Social, and Governance.”) Further, it will contribute to the revolution in telecommunications technology and sustainable development of the society by taking measure to solve major social issues included in the SDGs provided by the United Nations. The SDGs are global goals intended to be achieved between 2016 and 2030, specified in the “2030 Agenda for Sustainable Development” adopted in the United Nations Summit held in September 2015.

Environmental

The company has acquired “Green Site License” that offsets carbon emissions via websites and an environmental certification for prevention of global warming by “Green Power” as part of CO2 reduction activities of website. The company carries out information transmission, support activities in affected areas, and cooperates with and provides support for “Shinsai Regain,” a specified NPO supporting various activities, to achieve “realize a society where people can support each other in times of earthquake disasters.” Furthermore, the company is promoting affordable rental of energy-saving LED lighting and paperless operation within the company. The company is also operating its business with the minimum necessary amount of property, plant and equipment necessary. At the end of the fiscal year ended December 2022, property, plant and equipment accounted for 12.2% of total assets, with the company adapting to various changes in the environment.

Social

With health and well-being, the balance between job satisfaction and economic growth, and equality in mind, the company is promoting measures such as the use of various recruitment channels (fair hiring, referral hiring, employment of female workers (34%), multinational workers (16.1%), and disabled people), the introduction of a personnel system and its own benefit system in line with the environment of the times (shorter working hours, shift-work system, flextime system, hydration allowance in summer, flu shots subsidy, etc.). Also, the company is making efforts to ensure an environment where employees can focus on their work by running “Vision Kinds Nursery,” a company-led nursery and hire human resources with childcare responsibilities and motivation to work, in addition to making work rules flexible and enhancing the leave system for employees at the time of childbirth or with small children, in order to support their child care and create a working environment with comfort. (Established a childcare facility on CLT’s premises, where more than 90% of the employees are women.) In addition to the above, the company supports the activities of Japan Heart, which works based on the idea of “delivering medical care to where it does not reach” to realize a society where everyone can receive medical care equally regardless of their countries, regions, race, politics, religion or circumstances and feel “grateful to have been born,” as one of the corporate members.

With regard to the spread of new coronavirus infection, the Ministry of Health, Labour and Welfare (MHLW) had commissioned the airport quarantine station to perform application confirmation work, which is part of the airport quarantine station’s waterborne countermeasure operations, for “new measures pertaining to waterborne countermeasures.”

Governance

The company has obtained “ISO/IEC 27001,” the ISMS international standard, and is taking measures for information assets’ correct and safe handling, operation, monitoring, revision, maintenance, and continuous improvement, in order to protect them within the applicable range from the threats related to information security. Furthermore, the company promotes risk management in business activities and thorough compliance to strengthen governance considering the importance to win continuous trust from the stakeholders, and also appoints 3 out of 6 directors from outside (including one woman) who are enterprise managers, and all 4 auditors too from outside who are accountants or lawyers to ensure transparency and soundness in management.

<Reference2: Regarding corporate governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 6 directors, including 3 outside one |

Auditors | 4 auditors, including 4 outside ones |

All outside directors and outside corporate auditors are independent directors and corporate auditors.

◎ Corporate Governance Report: Updated on August 23, 2022

Basic policy

Our corporate group improves ourselves to change clients’ expectations into impression, pursues innovation without hesitation to actualize the ideal, always feels grateful about the support of many people (stakeholders), and operates its business activities with a humble mindset. Under this code of conduct, Vision observes laws, in-company regulations, and policies, carries out business in good faith, and strives to realize optimal corporate governance.

<Main Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts) >

【Principle 2-4-1 Ensuring diversity when promoting core personnel】

We actively employ a diverse range of human assets (human resources) regardless of educational background, work experience, gender, nationality, or disability. Based on the belief that making the most of each employee’s individuality will lead to the creation of diverse products and services and the growth of our company, we are working to create a fulfilling work environment in which all people working for our company can grow. We have a policy of actively hiring and promoting talented people without regard to their educational background, work experience, gender, nationality, disability, or other attributes. However, we recognize the importance of human resource strategy for medium- and long-term improvement of corporate value, including from the perspective of ensuring diversity and will consider formulating a human resource development policy and internal environment improvement policy to ensure diversity.

【Supplementary principle 3-1-3 Sustainability initiatives】

From the viewpoint of increasing corporate value over the medium to long term, we recognize that addressing issues related to sustainability is an important element of our management strategy. We disclose our sustainability initiatives on our website and in financial results presentation materials. In addition to matters related to the environment, we will also consider disclosing information in light of the importance of social factors such as investment in human capital and intellectual property. For details on Vision’s approach to ESG and SDGs, please refer to our website: https://www.vision-net.co.jp/en/esg.html

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Cross-shareholdings】

Our basic policy is not to hold any strategic stock holdings in principle, except in cases where it is recognized that such holdings will contribute to medium to long term improvement in corporate value. In cases where listed shares are held as policy stockholdings, the Board of Directors will review all shares on a quarterly basis and sell shares of companies that the Board of Directors determines cannot be expected to increase corporate value over the medium to long term, taking into consideration factors such as share price and market trends. With respect to the exercise of voting rights, we will make decisions on a case-by-case basis, taking into consideration whether the exercise of voting rights will contribute to the enhancement of our corporate value over the medium to long term.

We do not disclose the results of verifying the purpose of holding shares held by policy holdings, as it is related to our business strategy and disclosure may damage the interests of the Company and its shareholders.

【Principle 4-8 Effective utilization of independent outside directors】

In the company, three of the six directors are independent outside directors. We believe that the three independent outside directors will contribute to strengthening our corporate governance by utilizing their extensive experience in web marketing, inbound business, the financial industry, global business, and other areas, as well as their experience as corporate managers, to monitor the company’s management and provide advice on the company’s overall management.

【Principle 4-9 Criteria for judging the independence of independent outside directors and their qualifications】

The company selects its directors with reference to the Companies Act and the standards established by the Tokyo Stock Exchange. In addition, the company has selected individuals who can provide advice on all aspects of the company’s management based on their extensive experience and knowledge.

【Principle 5-1 Policy for constructive dialogue with shareholders】

If shareholders or others want to have a dialogue with Vision, the company will respond positively within a reasonable range, to contribute to the sustainable growth of the company and the medium to long-term improvement in corporate value. As of now, Vision holds a briefing session attended by the president or a director in charge of IR two or more times per year, meetings with institutional investors domestic and foreign, briefing sessions for individual investors several times a year, and so on. The information on their results is properly shared through meetings of the board of directors, etc. In addition, Vision takes thoroughgoing measures for preventing the leakage of insider information.

This report is intended solely for information purposes and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |