Bridge Report:(9416)Vision The Fiscal Year Ended December 2024

Chairman and CEO Kenichi Sano | Vision Inc. (9416) |

|

Company Information

Market | TSE Prime Market |

Industry | Information and telecommunications |

Chairman and CEO | Kenichi Sano |

President, Representative Director and COO | Kenji Ota |

HQ Address | SHINJUKU EASTSIDE SQUARE 8F, 6-27-30 Shinjuku, Shinjuku-ku, Tokyo 160-0022, Japan |

Year-end | December |

HP |

Stock Information

Share Price | Number of Shares Issued (End of the term) | Total Market Cap | ROE(Act.) | Trading Unit | |

¥1,148 | 50,422,000 shares | ¥57,884 million | 21.2% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥45.00 | 3.9% | ¥90.07 | 12.7 x | ¥357.62 | 3.2x |

* Stock price as of the close on February 28, 2025. The number of shares issued includes the number of treasury shares. Each value was taken from the brief report on financial results in the fiscal year ended Dec. 2024.

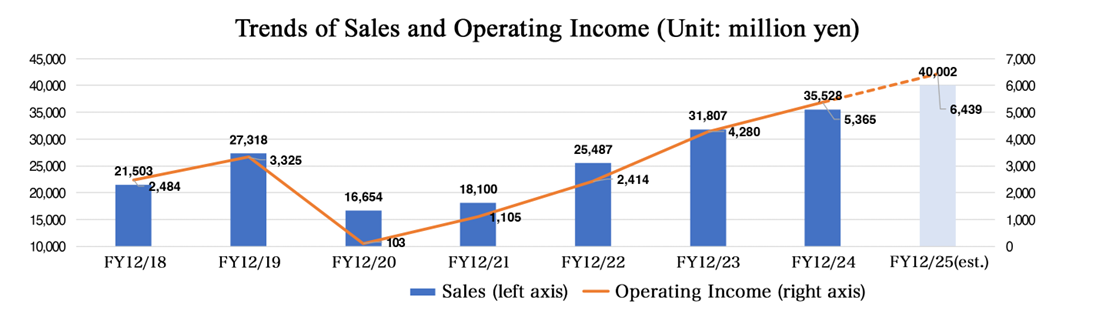

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income Attributable to Owners of Parent | EPS (¥) | DPS (¥) |

Dec. 2021 (Actual) | 18,100 | 1,105 | 1,143 | 729 | 15.47 | 0.00 |

Dec. 2022 (Actual) | 25,487 | 2,414 | 2,422 | 1,548 | 31.96 | 0.00 |

Dec. 2023 (Actual) | 31,807 | 4,280 | 4,337 | 3,025 | 61.87 | 0.00 |

Dec. 2024 (Actual) | 35,528 | 5,365 | 5,422 | 3,375 | 69.59 | 27.00 |

Dec. 2025 (Forecast) | 40,002 | 6,439 | 6,445 | 4,382 | 90.07 | 45.00 |

* The forecasted values were provided by the company. Unit: Million yen or yen.

This Bridge Report outlines Vision’s results for the fiscal year ended December 2024.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year Ended December 2024 Earnings Results

3. Fiscal Year Ending December 2025 Earnings Forcasts

4. Details of Growth Initiatives

5. Conclusions

<Reference1: Initiatives for ESG・SDGs>

<Reference2: Regarding corporate governance>

Key Points

- In the fiscal year ended December 2024, sales grew 11.7% year on year to 35,528 million yen. When the supporting operations, etc. are excluded, it can be considered that sales virtually grew 18.5%. The sales of the GLOBAL WiFi Business increased 6.1%. When the supporting operations, etc. are excluded, it can be considered that the sales virtually rose 17.6%. The sales of the Information and Communications Service Business increased 19.7%. The sales of the Glamping and Tourism Business grew 26.6%. Operating income rose 25.3% year on year to 5,365 million yen. When the supporting operations, etc. are excluded, it can be considered that operating income virtually grew 43.8%. Gross profit margin increased year on year from 56.0% to 57.9%, and operating income margin rose significantly year on year from 13.5% to 15.1%. Thanks to the steady growth of each business, sales and all kinds of profits hit a record high. They paid a year-end dividend of 14.00 yen/share as expected for a total of 27.00 yen/share per year.

- The sales and profit of the GLOBAL WiFi Business grew. The demand from corporations was healthy, the demand for the “Unlimited data volume plan (4G/5G)” remained strong, and average spending per client remained high. In the business targeted at foreign visitors to Japan, they saw the good performance of “NINJA WiFi®,” a WiFi rental service for foreign visitors to Japan, and the sale of SIM cards via vending machines around airport counters. They also concentrated on the sale of “World eSIM” and it sold well. When the supporting operations, etc. are excluded, it can be considered that sales and profit virtually increased 17.6% and 33.6%, respectively.

- The sales and profit of the Information and Communications Service Business increased. They brushed up their marketing capability by actively recruiting mid-career workers. The sale of OA devices and mobile communication devices and the business of electricity brokerage (eco-solution business) were healthy. They concentrated on the development of a stable revenue base by promoting recurring-revenue services, and it progressed steadily. They made efforts to promote their recurring-revenue services by upselling and cross-selling products, reducing churn rate in the long term, and maximizing lifetime value based on continuous revenues from recurring-revenue products.

- For the fiscal year ending December 2025, sales are projected to grow 12.6% year on year to 40,002 million yen and operating income is forecast to rise 20.0% year on year to 6,439 million yen. Both are expected to hit a record high in succession. In the GLOBAL WiFi Business, the annual recovery rate of overseas travel is forecast to be 81.1%. It is assumed that 1 US dollar = 150 yen. They aim to improve their popularity by enhancing sales promotion. In addition, they will actively invest in World eSIM. The operation in New York will be started. In the Information and Communications Service Business, they will maximize opportunities for cross-selling products to startup firms and venture companies through strategic data-driven sales. They will establish a stable revenue base based on recurring-revenue products. They will strengthen the support for BPO. In addition, they plan to recruit 40 people. By hiring mid-career workers actively, they plan to enhance their marketing capability. Sales and profit are expected to grow year on year in all of the GLOBAL WiFi Business, the Information and Communications Service Business, and the Glamping and Tourism Business. For dividends, they plan to pay 45.00 yen/share (including an interim dividend of 20.00 yen/share) per year, up 18.00 yen/share from the previous fiscal year. The expected payout ratio is 50.0%.

- In the fiscal year ended December 2024, sales and all kinds of profits hit a record high. The previous report mentioned “FY 12/2024 is likely to be the transitional year from the recovery observed in FY 12/2023 to growth,” and it can be said that it came true. It is noteworthy that when the supporting operations, etc. conducted in the previous fiscal year are excluded, it can be considered that sales and operating income virtually grew 18.5% and 43.8%. In the GLOBAL WiFi Business, which is the mainstay, sales and operating income exceeded those in 2019 in the pre-pandemic period, while the number of overseas travelers has not recovered to the pre-pandemic level. The performance of the Information and Communications Service Business has gotten on track. The sales of this business are mostly recurring, so a stable revenue base is being established. We feel odd as price-to-earnings ratio (PER) falls much below 20 despite high growth potential. They pledged to achieve a payout ratio of 50% in FY 12/2025 and FY 12/2026. It is noteworthy that shareholder return can be secured when profit grows.

1. Company Overview

Under the management philosophy of “To Contribute to the Global Information and Communications Revolution,” Vision conducts the GLOBAL WiFi Business, which leases the personal Wi-Fi (wireless LAN) routers which can be used in over 200 countries and regions on a flat-rate basis, and as an Information and Communications Service distributor, it also provides Information and Communications Service Business of arranging telecommunications infrastructure and office equipment necessary for business activities, such as fixed-line telecommunications, mobile telecommunications, broadband etc. The Company forms a group with its 24 consolidated subsidiaries, both inside and outside Japan. Of those, the 11 based in Japan include Members Net Inc. (which conducts the business of charging agency, fixed-line telephone service subscription agency, etc.) and Best Link Inc. (which carries out the business of broadband service subscription agency). There are 13 overseas subsidiaries that operate as overseas hubs for the GLOBAL WiFi service in South Korea, US (Hawaii), Hong Kong, Singapore, Taiwan, UK, China (Shanghai), France, Italy, US (California, New York), and New Caledonia; there is also a local subsidiary in Vietnam, which is an offshore hub for database construction and system development. (At the end of December 2024)

[Vision Group’s management philosophy – To Contribute to the Global Information and Communications Revolution]

We will actively promote the Information and Communications Revolution in the world, bring innovations to an individual’s lifestyle and the company’s business style, and contribute to the advancement of humanity and society by continuing to be an distributor that effectively and efficiently connects the client companies with end users and makes sure that its employee’s unlimited ambition, dreams and thoughts are contributing to the stakeholders, without compromising nor ever forgetting the venture spirit and add to the progress of the human race and the society.

1-1 Business Description

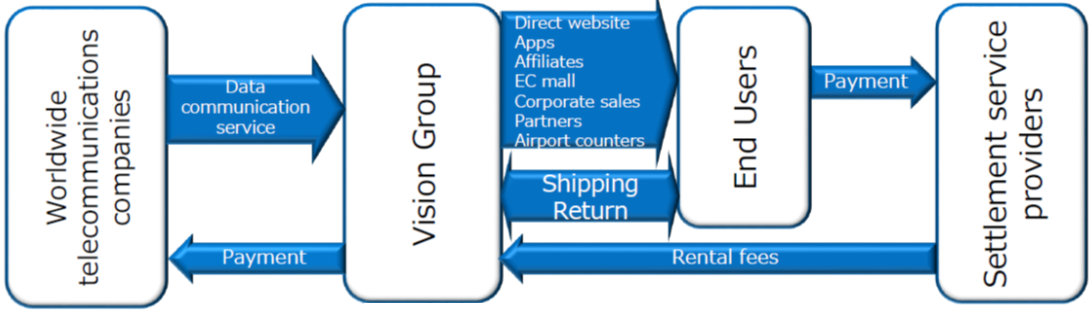

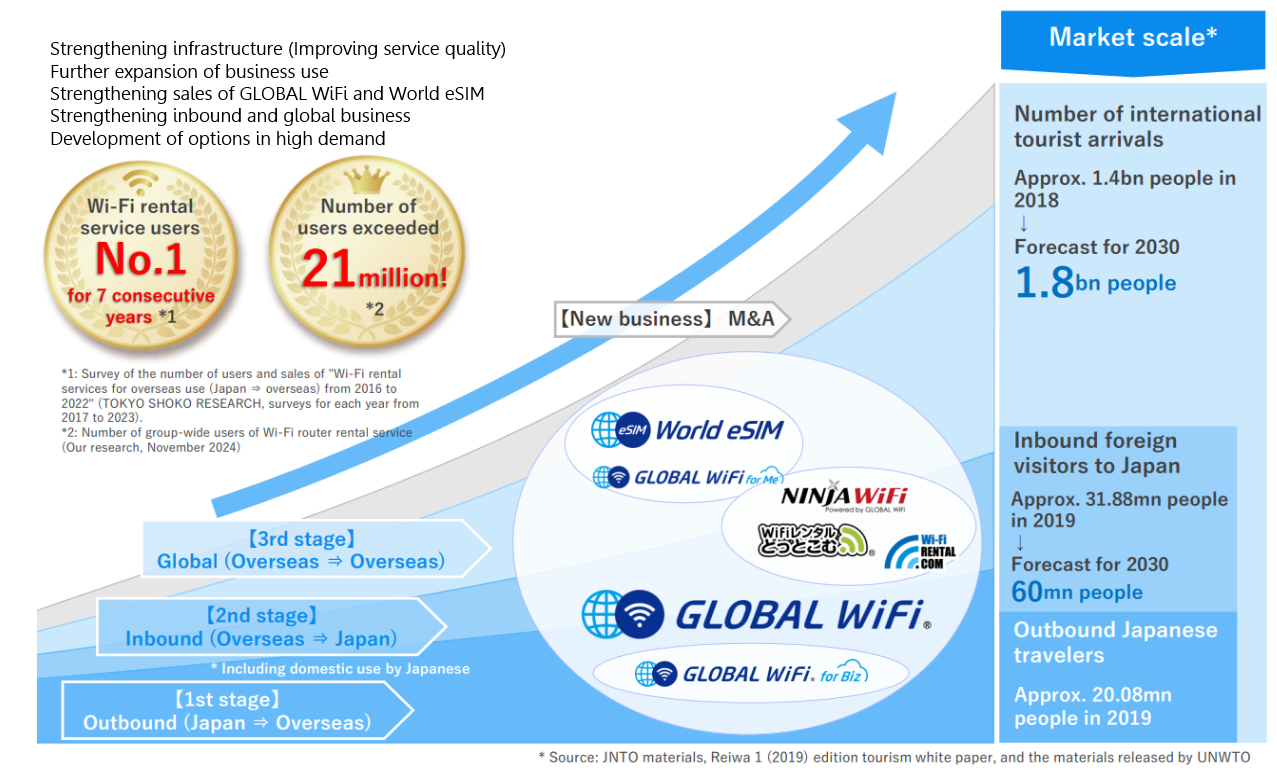

① GLOBAL WiFi Business

The Company offers services including “GLOBAL WiFi®” (a Wi-Fi router rental service that allows people traveling overseas to use local internet services at a competitive rate through its partnerships with the overseas operators) and “NINJA WiFi®” (a Wi-Fi router rental service for overseas visitors to Japan, etc.), while also engaging in services for the travelers between foreign countries in overseas bases (South Korea and Taiwan).

The number of leased Wi-Fi routers that are equipped with the next-generation telecommunication technology (Cloud Wi-Fi) capable of managing Subscriber Identity Modules (SIMs) on the cloud accounts for over 90% of all leased devices (Depending on telecommunication carriers, some countries are not supported, thus the company has almost reached the upper limit).

(From the reference material of the Company)

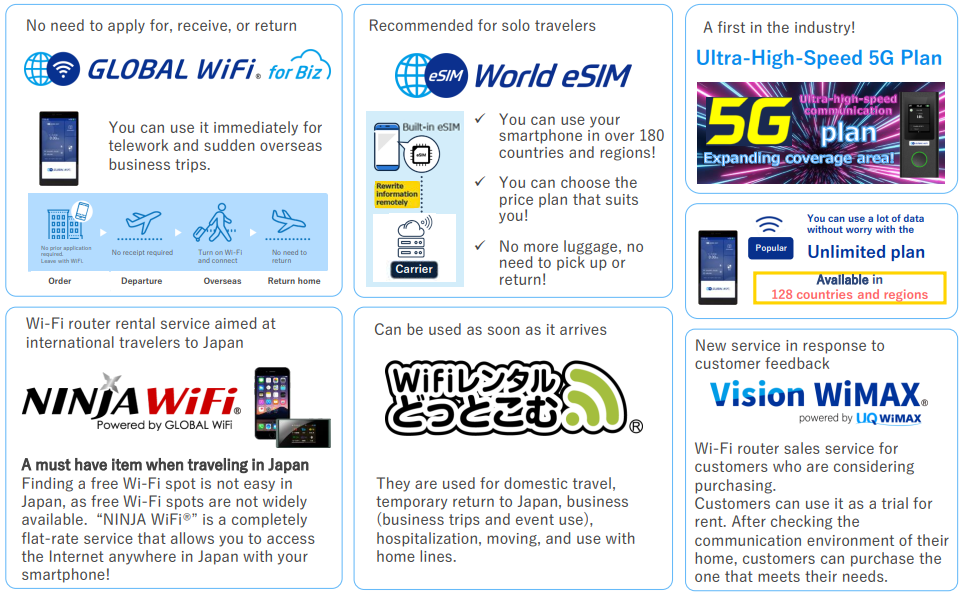

In addition, “GLOBAL WiFi for Biz,” a domestic plan of “GLOBAL WiFi®,” which is installed in corporations for regular use, was promoted aggressively and performed well. The sale of “GLOBAL WiFi for Biz” was promoted by capturing the increasing telework demand during the spread of the new COVID-19 pandemic, and it also demonstrated its competitive advantage during the recovery of traveling. With one “GLOBAL WiFi for Biz” in the company, customers can use it for telework and sudden overseas business trips without making arrangements, eliminating the need to use overseas roaming services when Wi-Fi rentals are not available. The number of subscriptions and actual usage have continued to increase as a result of its proposal as a dual-use service (telework and travel).

Advantages (1) Affordable fixed-rate system, (2) the most comprehensive area coverage, (3) comfort, (4) safety/security, (5) counter, (6) corporate sales capabilities, and (7) number of customers

The advantages of “GLOBAL WiFi®” and “NINJA WiFi®” include the following: (1) cost benefits of up to 89.9% (the rental fee per day is 300 yen at the minimum, depending on the travel destination) compared to the overseas fixed-rate packet plans offered by other Japanese mobile carriers, (2) covers over 200 countries and regions, the largest in the industry, (3) high-speed telecommunications services through partnerships with telecommunication operators all over the world, (4) available and support 24 hours a day, 365 days a year, (5) the industry’s largest number of available spots at airport counters, and (6) capability to capitalize on the demand from corporations. Owing to these strengths, (7) the number of the Wi-Fi rental service users throughout the corporate group exceeded 21,000,000 (the company’s survey in November 2024).

-Competitive advantage when the demand for travel recovers

①Proactive sales promotion of GLOBAL WiFi for Biz

The sale of “GLOBAL WiFi for Biz,” which is installed in corporations for permanent use, remains favorable owing to proposals for a dual-use system for telework (the subscriptions and instances of actual usage have increased).

Having one GLOBAL WiFi for Biz at the company allows for both usage for telework and immediate usage during sudden business trips overseas without any need for making arrangements. There will be no need to resort to using international roaming because there was not enough time to rent a Wi-Fi.

②Ultrahigh-speed telecommunication 5G plan World eSIM

The first in the industry of rental of Wi-Fi routers for overseas travel. They are expanding the service area of the ultrahigh-speed telecommunication 5G plan. They offer 5G services in the United States mainland, Hawaii, South Korea, Taiwan, Thailand, UK, Italy, France, Germany, Spain, China, Hong Kong, Iceland, Ireland, UAE, India, Australia, Austria (Europe), the Netherlands, Greece, Croatia, Singapore, Sweden, Slovenia, Czechia, New Zealand, Hungary, the Philippines, Finland, Bulgaria, Portugal, Malta, Malaysia, Romania, Luxembourg, Switzerland, Mexico, the Republic of South Africa, Oman, Guam, Saudi Arabia, Bahrain, Brazil, Peru, Macau, Mauritius, Belgium, Cyprus, Latvia, and Lithuania.

(From the reference material of the Company)

③ Expansion of the service area of the unlimited plan

A large volume of data is transmitted, due to the diversification of smartphone apps, the transmission of heavy images and videos, the posting in social media, etc.

This plan is increasingly shared by customers and their friends or family members, or increasingly used for multiple devices, including smartphones, tablets, and laptop PCs, in business scenes. This is a plan in which users do not need to worry about the limit of transmittable data volume. They have expanded its service area and features to meet the demand for long-term use.

The ratio of customers who choose the unlimited plan increased. ⇒ Rise in average revenue per user (ARPU)

④ Customers can receive the device at a convenience store.

Customers now can select an option in which they can receive the device at any convenience store of Seven-Eleven around Japan, excluding Okinawa, which is close to their workplace or home for convenience.

Customers can receive the device in advance, without lining up in front of a counter on the date of departure. Customers can receive the device even late at night, as long as the convenience store is open.

⑤ Operation of unmanned shops

Locations (as of the end of December 2024)

Sendai Airport, Mt. Fuji Shizuoka Airport, Kumamoto Airport, Kitakyushu Airport, Miyako Shimojishima Airport, Granduo Kamata and Hiroshima Airport *More shops to be built.

Installed equipment

・Smart Pickup (for receiving the device)

・Return box (for returning the device)

・Vending machine for SIM cards

Features, etc.

・Customers can receive the device in a non-face-to-face manner without lining up in front of an airport counter even during a busy season (for repeat customers who do not require explanations, and this is effective for coping with infectious diseases).

・It is possible to offer services 24 hours a day, including early morning and midnight hours in which it is difficult to secure staff even if there are needs.

・Vending machines of prepaid SIM cards for use by foreign travelers to Japan and those who temporarily return to Japan

・It is possible to increase touch points at low cost without occupying much space (for improving convenience and increasing revenues).

⑥ Wi-Fi for use in Japan

・“NINJA WiFi®,” a Wi-Fi router rental service for foreigners visiting Japan

The Internet available on your own smartphone anywhere in Japan! Unlimited high-speed 4G-LTE!

・“WiFi Rental.com,” a Wi-Fi router rental service for use in Japan

Can be used right after the delivery! The convenience of rentals for any period (measured in days) and any place allows for use in various scenarios, garnering favorable reviews.

・“Vision WiMAX,” a Wi-Fi router sale service

Purchase a Wi-Fi router matching your needs after checking the telecommunication environment of your home, etc. by renting it first for a trial period.

⇒ Router traded in when the contract is cancelled (Vision WiMAX original service).

-Airport counters and Smart Pickup

Receipt and return possible via return boxes at 20 airports, 39 counters and 53 Smart Pickup points in Japan. Lockers for automatic hand-over have been installed at 18 airports out of the aforementioned airports.

The service level is optimized for each client. Clients who do not require an explanation (repeat users, etc.) can get rid of waiting time (by using Smart Pickups). Clients who require an explanation are attended to by airport staff (by using airport counters).

-The store digitalization strategy (smart counters)

Evolved into a shop that can deal with the increases of the number of rental transactions (the number of cases of handover) and optional services (compensation services, accessory items, etc.) and meet the needs of respective customers so that Japanese people traveling abroad and foreign visitors to Japan can use more convenient, comfort, and peace of mind.

-System for receiving online orders “just before departure” (smart counters × CLOUD WiFi × database)

It will be possible to provide services to customers on the day of departure, leading to an increase in the number of users. Linking the system to the database will enable the immediate processing of online applications in front of airport counters as well. Link all imports from the smart counters, CLOUD WiFi and database to further elevate the convenience.

(From the reference material of the company)

-Expansion of services during travel

By enriching services during travel, including options, to meet the needs of customers, they support worry-free, safe, comfortable travel.

(From the reference material of the Company)

-“Tsuyaku-Fukikae.com,” a service utilizing the client base

Service for the interpreting of online and offline negotiations and business meetings, translation and voice-over of videos and text translation.

“To overcome language barriers to make business more global.”

Provide interpreting, translation and voice-over services for usage in various business scenarios at a reasonable price.

Support the enrichment of information disclosure in English, placing importance on dialogue with overseas investors.

Also provide voice-over and subtitling of videos explaining financial results and translation of

consolidated financial results

, finacial result materials, and notice of the general meetings of shareholders, etc.

|

|

|

(From the reference material of the Company)

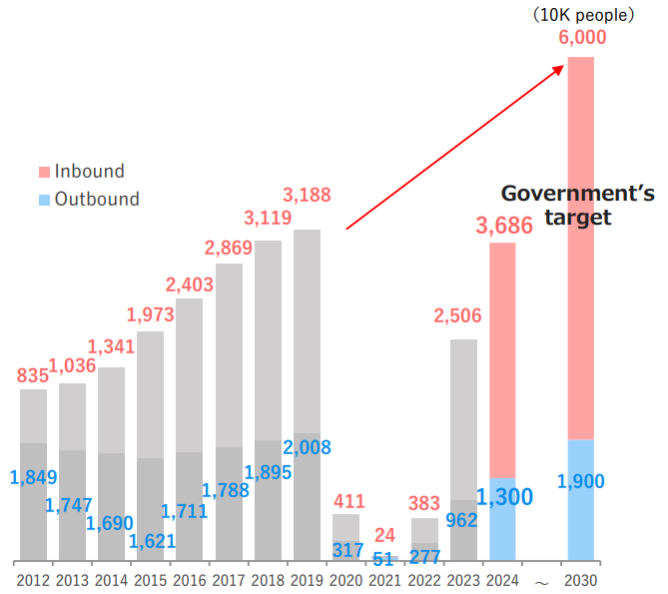

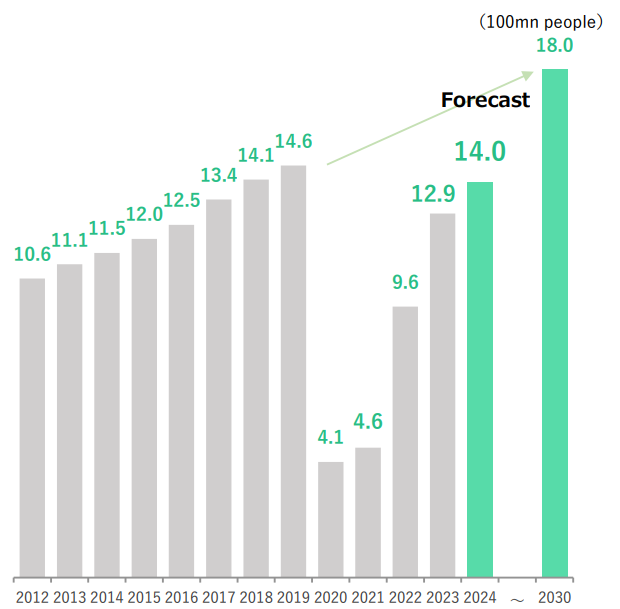

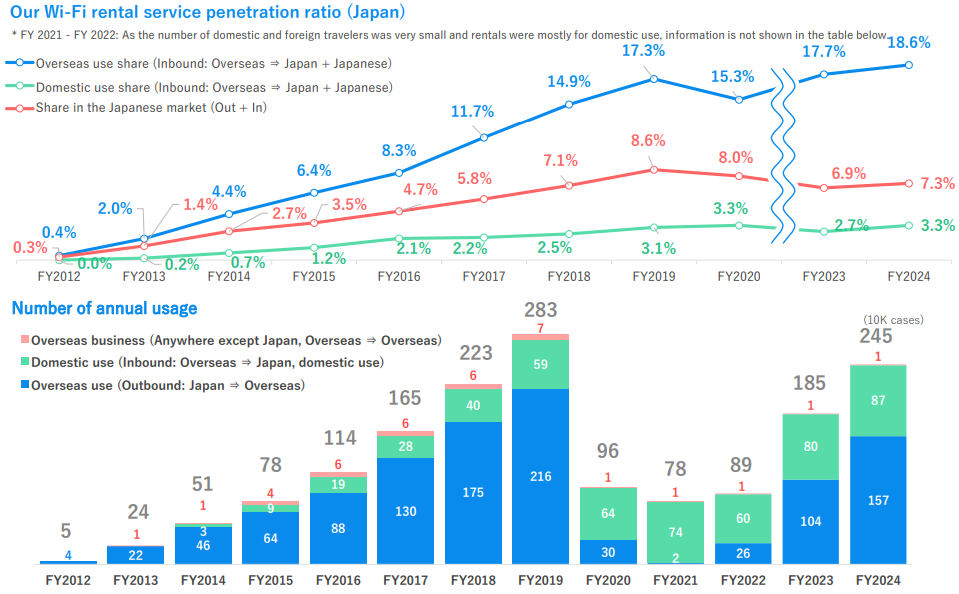

- GLOBAL WiFi Business: Market scale

Foreign visitors to Japan About 31.88 million people (2019), about 36.86 million people (2024). The government’s goal: 60 million people in 2030 Travelers from Japan to overseas About 20.08 million people (2019), about 13 million people (2024) | The number of international travelers in the world was 1.46 billion in 2019. The market targeted at them is huge. The number of international travelers in 2024 is estimated to be about 1.4 billion, 99% of the pre-pandemic level. |

|

|

(Produced by the company based on the reference material of Japan National Tourism Organization (JNTO),

White Paper on Tourism in Japan, 2019 and materials published by the World Tourism Organization (UNWTO))

② Information and Communications Service Business

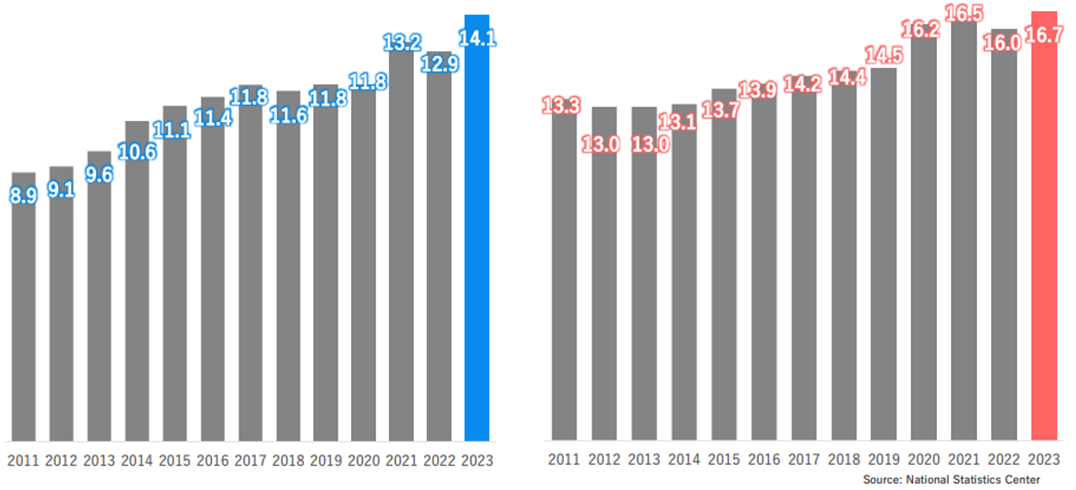

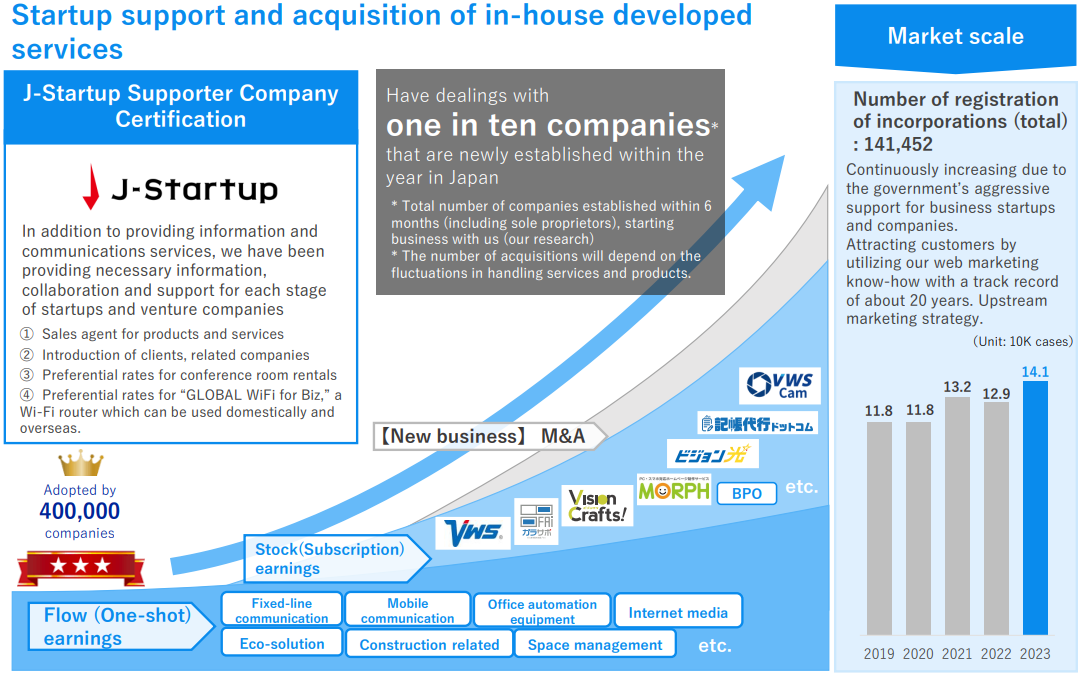

With Best Link Inc., a consolidated subsidiary, at its core, the group offers services aimed mainly at newly established corporations, venture businesses and multi-store development enterprises such as food-service chains, from its 15 offices nationwide and in cooperation with its partner companies. The services include subscription agency operations for various telecommunications services such as business phones, agency operations of arranging lines for landline telephones, subscriber telephones, and NTT Hikari telephones, corporate mobile phones, OA equipment and security products (UTM), etc., designing websites, and agency operations for new power services targeting enterprises.

The Company has advantages in prospecting for corporations newly established (within 6 months), one of its major targets, and it is estimated, according to the data by the Ministry of Internal Affairs and Communications (the number of newly registered companies was 141,452 in Japan in 2023), that the Company has conducted transactions with around one in every 10 corporations newly founded in Japan. The Company attract customers through its unique online marketing (Internet media strategy). The Company has unique know-how in Customer Relationship Management (CRM; customer relationship and ongoing transactions) strategy. This paves the way for the maximization of continuous revenues (establishment of recurring-revenue business) and highly productive additional sale (upselling and cross-selling). The Company’s products and services are not easily affected by the economic situation as they lead to “improving the sales,” “reducing costs,” “improving business operations,” “stimulating communication” and “promoting DX” for clients. Moreover, the company has set up a business structure which enables flexible adaptations owing to multiple business segments, which allow for changes in the business composition to match the situation (economic situation, trends, economic conditions, etc.)

For example, the Company can receive a commission from operators for telephone line arrangements unless contracts for the service are canceled, and it can earn maintenance fees for MFPs on a continuous basis. Moreover, the follow-up service by its Customer Loyalty Team has enabled the Company to establish a recurring revenue-type business model, in which earnings are accumulated by taking in demand for lines and equipment that increases with customers’ business growth, and providing optimal services according to customers’ growth stage (additional sales with high productivity through up/cross selling). The Company will evolve its Recurring Revenue-type Business Model while expanding the target customer from enterprises with growth potential to ones in the growth stage.

- Information and Communications Service Business: Market scale

Establishment registrations (in total): 141,452 About 140,000 companies per year. (Continuous increasing trend due to the proactive support for business establishment and enterprises by the government) Utilize online marketing know-how based on about 20 years’ worth of achievements to attract customers. Upstream strategy. | Registration of headquarters/branch office relocations (in total): 167,032 About 160,000 companies per year. (Excluding relocations of offices, etc., which are not required to register the relocation) Cover procedures for additions, changes in step with the relocation, etc. Upselling and cross-selling based on an advanced operation of the Customer Royalty Team (CLT). |

(Unit: 10k cases)

(From the reference material of the Company)

③ Glamping and Tourism Business

The glamping business was launched as a business that will grow to become the third pillar of the company’s business. Currently, the company operates two facilities, “VISION GLAMPING Resort & Spa Koshikano Onsen” (Kirishima City, Kagoshima Prefecture) and “VISION GLAMPING Resort & Spa Yamanaka Ko” (Yamanakako Village, Minamitsuru-gun, Yamanashi Prefecture).

This business has a major advantage in that Chairman Sano’s family already has experience and expertise in the management of this business.

2. Fiscal Year Ended December 2024 Earnings Results

2-1 Consolidated Business Results

| FY 12/23 | Ratio to sales | FY 12/24 | Ratio to sales | YoY | The company’s forecast | Ratio to forecast |

Sales | 31,807 | 100.0% | 35,528 | 100.0% | +11.7% | 36,145 | -1.7% |

Gross profit | 17,802 | 56.0% | 20,570 | 57.9% | +15.5% | 20,656 | -0.4% |

SG&A expenses | 13,521 | 42.5% | 15,205 | 42.8% | +12.4% | 14,949 | +1.7% |

Operating income | 4,280 | 13.5% | 5,365 | 15.1% | +25.3% | 5,707 | -6.0% |

Ordinary income | 4,337 | 13.6% | 5,422 | 15.3% | +25.0% | 5,738 | -5.5% |

Net income | 3,025 | 9.5% | 3,375 | 9.5% | +11.6% | 3,797 | -11.1% |

*Unit: million yen. Net income is profit attributable to owners of parent.

(From the reference material of the Company)

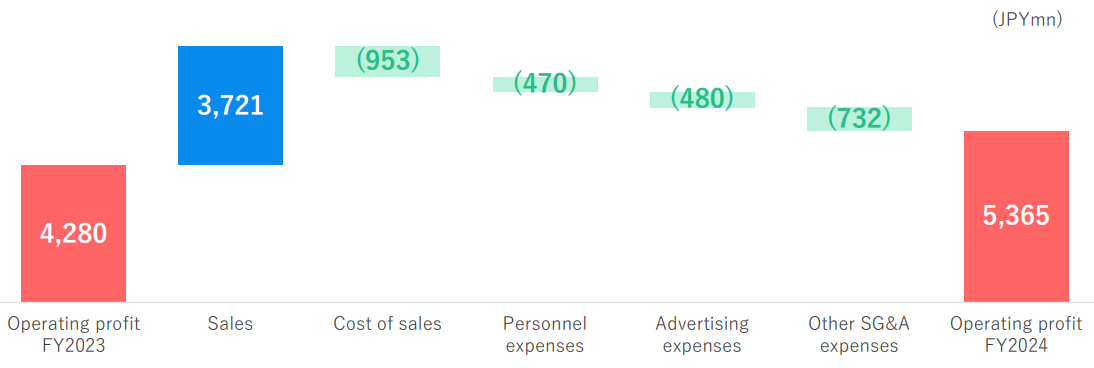

Significant increase in sales and profit driven by the GLOBAL WiFi Business

Sales grew 11.7% year on year to 35,528 million yen. In the same period of the previous year, they engaged in operations for supporting the measures against the novel coronavirus at the branch of Tokyo Airport Quarantine Station, etc. in a project entrusted by the Ministry of Health, Labour and Welfare and offered PCR testing services in cooperation with medical institutions in the GLOBAL WiFi Business. When the supporting operations, etc. are excluded, it can be considered that sales virtually grew 18.5%. The sales of the GLOBAL WiFi Business increased 6.1%. When the supporting operations, etc. are excluded, it can be considered that the sales virtually rose 17.6%. The sales of the Information and Communications Service Business increased 19.7%. The sales of the Glamping and Tourism Business grew 26.6%.

Operating income rose 25.3% year on year to 5,365 million yen. When the supporting operations, etc. are excluded, it can be considered that operating income virtually grew 43.8%. Gross profit margin increased year on year from 56.0% to 57.9%, and operating income margin rose significantly year on year from 13.5% to 15.1% although SG&A expenses ratio increased. Ordinary income grew 25.0% year on year to 5,422 million yen, and net income increased 11.6% year on year to 3,375 million yen, as loss on retirement of non-current assets augmented. Thanks to the steady growth of each business, sales and all kinds of profits hit a record high.

They paid a year-end dividend of 14.00 yen/share as expected for a total of 27.00 yen/share per year.

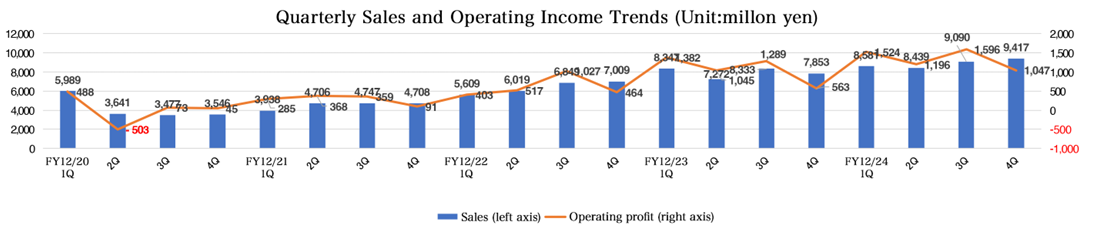

Quarterly Business Results

| 22/12-1Q | 2Q | 3Q | 4Q | 23/12-1Q | 2Q | 3Q | 4Q | 24/12-1Q | 2Q | 3Q | 4Q |

Sales | 5,609 | 6,019 | 6,849 | 7,009 | 8,347 | 7,272 | 8,333 | 7,853 | 8,581 | 8,439 | 9,090 | 9,417 |

Gross profit | 2,544 | 2,910 | 3,525 | 3,350 | 4,252 | 4,223 | 4,867 | 4,458 | 4,948 | 4,841 | 5,391 | 5,388 |

SG&A expenses | 2,140 | 2,392 | 2,497 | 2,885 | 2,870 | 3,178 | 3,577 | 3,895 | 3,423 | 3,645 | 3,795 | 4,340 |

Operating income | 403 | 517 | 1,027 | 464 | 1,382 | 1,045 | 1,289 | 563 | 1,524 | 1,196 | 1,596 | 1,047 |

Ordinary income | 406 | 516 | 1,031 | 468 | 1,423 | 1,039 | 1,302 | 573 | 1,553 | 1,203 | 1,616 | 1,048 |

Quarterly net income | 245 | 320 | 704 | 278 | 940 | 673 | 900 | 511 | 1,019 | 766 | 1,083 | 506 |

Gross Profit Margin | 45.4% | 48.3% | 51.5% | 47.8% | 50.9% | 58.1% | 58.4% | 56.8% | 57.7% | 57.4% | 59.3% | 57.2% |

SG&A ratio | 38.2% | 39.7% | 36.5% | 41.2% | 34.4% | 43.7% | 42.9% | 49.6% | 39.9% | 43.2% | 41.7% | 46.1% |

Operating income ratio | 7.2% | 8.6% | 15.0% | 6.6% | 16.6% | 14.4% | 15.5% | 7.2% | 17.8% | 14.2% | 17.6% | 11.1% |

*Unit: million yen

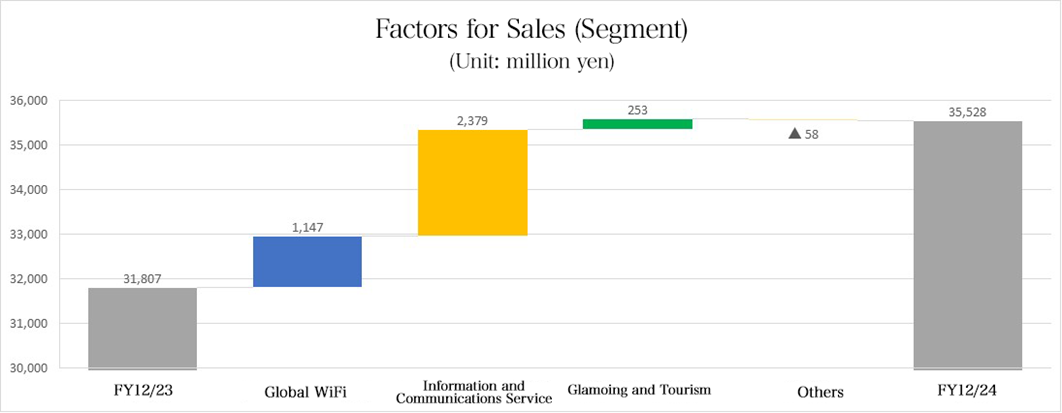

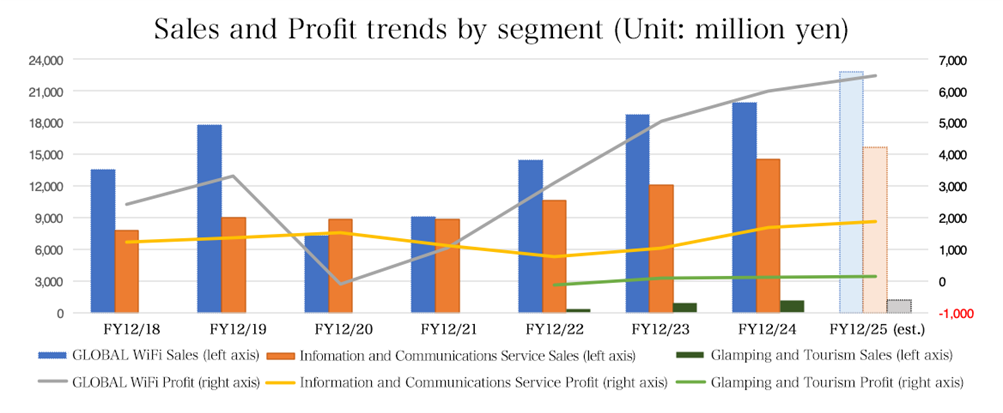

2-2 Trends by Segment

| FY 12/23 | Composition Ratio・Profit Ratio | FY 12/24 | Composition Ratio・Profit Ratio | YoY |

GLOBAL WiFi | 18,728 | 58.9% | 19,875 | 55.9% | +6.1% |

Information and Communications Service | 12,086 | 38.0% | 14,465 | 40.7% | +19.7% |

Glamping and Tourism | 902 | 2.8% | 1,155 | 3.3% | +28.0% |

Others | 90 | 0.3% | 32 | 0.1% | -64.3% |

Consolidated Sales | 31,807 | 100.0% | 35,528 | 100.0% | +11.7% |

GLOBAL WiFi | 5,032 | 26.9% | 5,987 | 30.1% | +19.0% |

Information and Communications Service | 1,040 | 8.6% | 1,693 | 11.7% | +62.7% |

Glamping and Tourism | 88 | 9.7% | 119 | 10.4% | +35.0% |

Others | -176 | - | -202 | - | - |

Adjustments | -1,705 | - | -2,232 | - | - |

Consolidated Operating Income | 4,280 | 13.5% | 5,365 | 15.1% | +25.3% |

*Unit: million yen. Sales represents sales to external customers.

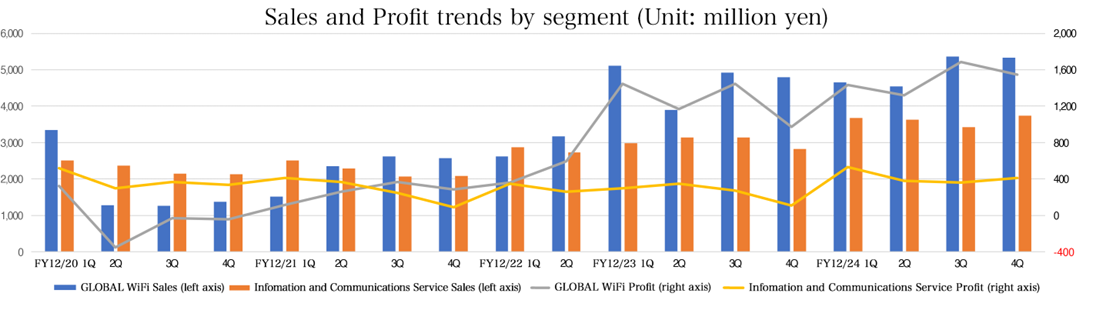

| 22/12 -1Q | 2Q | 3Q | 4Q | 23/12 -1Q | 2Q | 3Q | 4Q | 24/12-1Q | 2Q | 3Q | 4Q |

Sales |

|

|

|

|

|

|

|

|

|

|

|

|

GLOBAL WiFi | 2,618 | 3,174 | 4,125 | 4,471 | 5,108 | 3,904 | 4,921 | 4,794 | 4,647 | 4,539 | 5,355 | 5,333 |

Information and Communications Service | 2,875 | 2,744 | 2,594 | 2,401 | 2,984 | 3,147 | 3,145 | 2,829 | 3,681 | 3,640 | 3,425 | 3,735 |

Operating profit |

|

|

|

|

|

|

|

|

|

|

|

|

GLOBAL WiFi | 359 | 593 | 1,156 | 968 | 1,443 | 1,169 | 1,443 | 975 | 1,431 | 1,322 | 1,685 | 1,547 |

Information and Communications Service | 347 | 259 | 197 | -38 | 302 | 352 | 274 | 111 | 534 | 381 | 364 | 412 |

*Unit: million yen. Sales represents sales to external customers.

*Investment Bridge Co., Ltd. prepared this based on disclosed material.

GLOBAL WiFi Business

Sales and profit increased.

The demand from corporations was healthy, the demand for the “Unlimited data volume plan (4G/5G)” remained strong, and average spending per client remained high. With regard to sales to inbound travelers, applications for “NINJA WiFi®,” a Japanese Wi-Fi rental for foreign visitors to Japan, and the SIM card sales via vending machines at airport counters remained steady. They also concentrated on the sale of “World eSIM,” and it sold well. Real growth rate, excluding support services, etc., was 17.6% for sales and 33.6% for profit.

Information and Communications Service Business

Sales and profit increased.

By hiring mid-career workers actively, they enhanced their marketing capability. The sale of OA equipment and mobile communication devices and the business of electricity brokerage (eco-solution business) were healthy. They concentrated on the development of a stable revenue base by promoting recurring-revenue services, and it progressed steadily. They promoted the sale of recurring-revenue services, to maximize the lifetime value of customers by upselling or cross-selling services, reducing long-term cancellation rates, and offering recurring services.

Glamping and Tourism Business

Sales and profit increased.

Both “VISION GLAMPING Resort & Spa Yamanakako” (Yamanakako Village, Yamanashi Prefecture), opened in December 2022, and “VISION GLAMPING Resort & Spa Koshikano Onsen” (Kirishima City, Kagoshima Prefecture), which was expanded with “hot springs inn glamping” in September 2023, mixing elements from customer experiences at both hot springs inn and glamping were going well. Moreover, the number of foreigners staying overnight has been increasing.

2-3 Financial Condition

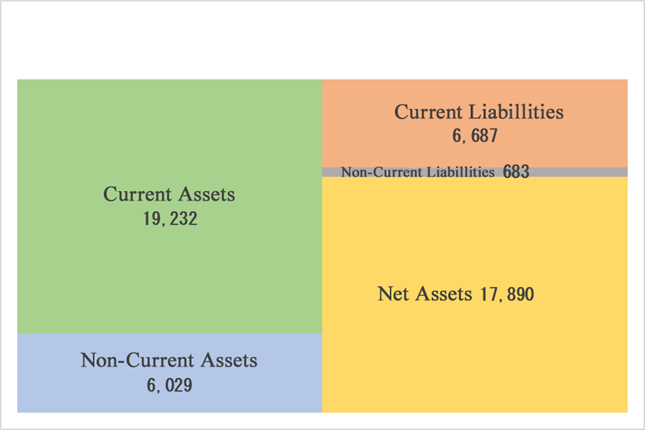

◎Financial Condition

| Dec. 2023 | Dec. 2024 | Increase/ decrease |

| Dec. 2023 | Dec. 2024 | Increase/ decrease |

Current assets | 15,446 | 19,232 | +3,785 | Current liabilities | 5,973 | 6,687 | +713 |

Cash and deposits | 10,221 | 11,883 | +1,662 | Trade payables | 1,229 | 1,462 | +233 |

Trade receivables | 3,713 | 6,187 | +2,474 | Noncurrent liabilities | 785 | 683 | -101 |

Non-current assets | 5,920 | 6,029 | +109 | Total liabilities | 6,758 | 7,370 | +611 |

Property, plant and equipment | 3,188 | 3,558 | +369 | Net assets | 14,607 | 17,890 | +3,283 |

Intangible fixed assets | 1,353 | 1,008 | -345 | Retained earnings | 11,663 | 14,145 | +2,482 |

Investments and other | 1,377 | 1,462 | +84 | Total liabilities Equity | 21,366 | 25,261 | +3,895 |

Total assets | 21,366 | 25,261 | +3,895 | Total long- and short-term debt | 722 | 599 | -122 |

*Unit: million yen

*Investment Bridge Co., Ltd. prepared this based on disclosed material.

Total assets increased 3,895 million yen from the end of the previous fiscal year to 25,261 million yen, due to the increases in cash & deposits and accounts receivable.

Total liabilities augmented 611 million yen to 7,370 million yen, due to the increase in the reserve for shareholder benefits, etc.

Net assets increased 3,283 million yen from the end of the previous term to 17,890 million yen due to the increases in retained earnings.

Equity ratio increased by 1.8 points from the end of the previous term to 69.1%.

2-4 Regarding shareholder benefits

As shareholder benefits were enriched, the total number of shareholders exceeded 30,000, so the Company became more popular and the number of individual shareholders increased. However, costs augmented over two times. In FY 12/2024, the costs for QUO cards or digital gifts in the interim period decreased operating income and net income by 410 million yen each, so the results did not reach the forecasts.

If they continue the provision of QUO cards or digital gifts in FY 12/2025, this will reduce operating income and net income by 800-1,200 million yen each.

Since it is difficult to predict the change in the number of shareholders, it is difficult to forecast the change in operating income and formulate a plan for operating income. In addition, the impact on net income, which influences dividends, is significant.

In this light, they decided to revise the benefit system other than their own services and increase the dividend that does not affect operating income or net income.

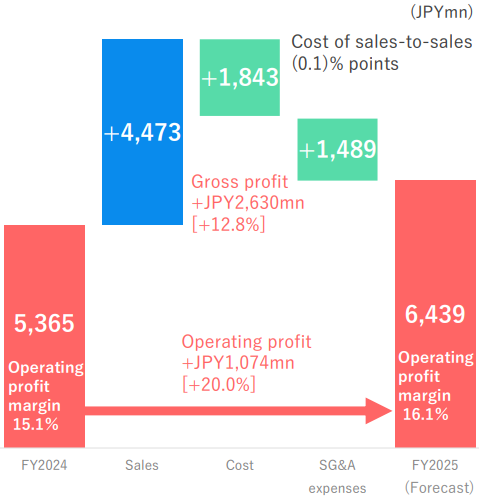

3. Fiscal Year Ending December 2025 Earnings Forecasts

3-1 Full-year Earnings Forecasts

| FY 12/24 | Ratio to sales | FY 12/25 (forecast) | Ratio to sales | YoY |

Sales | 35,528 | 100.0% | 40,002 | 100.0% | +12.6% |

Gross Profit | 20,570 | 57.9% | 23,200 | 58.0% | +12.8% |

SG&A | 15,205 | 42.8% | 16,761 | 41.9% | +10.2% |

Operating income | 5,365 | 15.1% | 6,439 | 16.1% | +20.0% |

Ordinary income | 5,422 | 15.3% | 6,445 | 16.1% | +18.9% |

Net income | 3,375 | 9.5% | 4,382 | 11.0% | +29.8% |

* Unit: million yen

Sales and profit are expected to grow by double digits in the fiscal year ending December 2025.

For the fiscal year ending December 2025, sales are projected to grow 12.6% year on year to 40,002 million yen and operating income is forecast to rise 20.0% year on year to 6,439 million yen. Both are expected to hit a record high in succession. In the GLOBAL WiFi Business, the annual recovery rate of overseas travel is forecast to be 81.1%. It is assumed that 1 US dollar = 150 yen. They aim to improve their popularity by enhancing sales promotion. In addition, they will actively invest in World eSIM. The operation in New York will be started. In the Information and Communications Service Business, they will maximize opportunities for cross-selling products to startup firms and venture companies through strategic data-driven sales. They will establish a stable revenue base based on recurring-revenue products. They will strengthen the support for BPO. In addition, they plan to recruit 40 people. By hiring mid-career workers actively, they plan to enhance their marketing capability.

Sales and profit are expected to grow year on year in all of the GLOBAL WiFi Business, the Information and Communications Service Business, and the Glamping and Tourism Business.

For dividends, they plan to pay 45.00 yen/share (including an interim dividend of 20.00 yen/share) per year, up 18.00 yen/share from the previous fiscal year. The expected payout ratio is 50.0%.

3-2 Forecast by Segment

| FY 12/24 | Composition Ratio・Profit Ratio | FY 12/25 (forecast) | Composition Ratio・Profit Ratio | YoY |

GLOBAL WiFi Business | 19,875 | 55.9% | 22,778 | 56.9% | +14.6% |

Information and Communications Service Business | 14,465 | 40.8% | 15,623 | 39.1% | +7.8% |

Glamping and Tourism Business | 1,155 | 3.3% | 1,576 | 3.9% | +36.4% |

Others | 32 | 0.1% | 24 | 0.1% | -25.4% |

Consolidated net sales | 35,528 | 100.0% | 40,002 | 100.0% | +12.6% |

GLOBAL WiFi Business | 5,987 | 30.1% | 6,467 | 28.4% | +8.0% |

Information and Communications Service Business | 1,693 | 11.7% | 1,862 | 11.9% | +10.0% |

Glamping and Tourism Business | 119 | 10.4% | 150 | 9.6% | +25.8% |

Others | -202 | - | -80 | - | - |

Adjustments | -2,232 | - | -1,961 | - | - |

Consolidated operating income | 5,365 | 15.1% | 6,439 | 16.1% | +20.0% |

* Unit: million yen

*Sales include the sales or transfer between segments.

Factors in increasing/decreasing forecast operating income

Operating profit margin 16.1% (Approx. +2.6% points YoY) | Assumption Operating income is forecast while taking into account active investment. GLOBAL WiFi Business ・Assumed exchange rate: 1 US dollar = 150 yen ・Recovery rate of overseas travel: 81.1% ・Improvement in recognition level through the enhancement of promotion ・Invest in World eSIM. ・New York subsidiary begins operation. Information and Communications Service Business ・Maximize cross-selling opportunities ・ Build a stable revenue base through recurring-revenue services. ・Strengthen BPO support. ・Strengthen sales capability by actively promoting mid-career recruitment. Expected number of recruits: 40 people Other than the assumption Maximization of business synergy through active M&A |

|

(From the reference material of the Company)

4. Details of Growth Initiatives

4-1 Business Strategy (2025-2028)

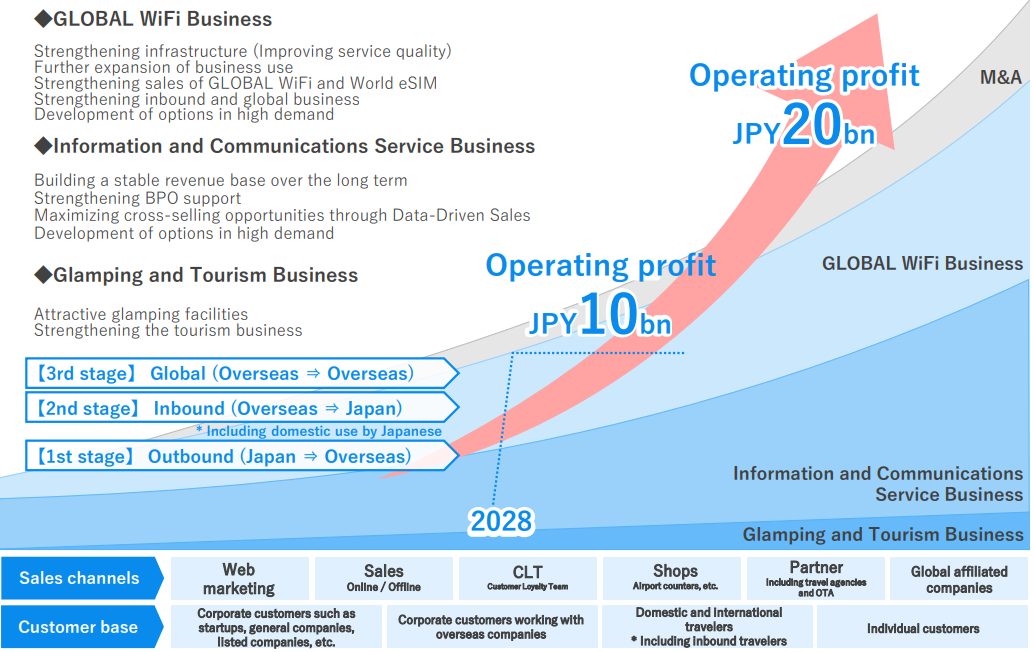

In FY 12/2025, the Business Strategy (2025-2028) will be started.

Until 2024 ●Growth through web-based marketing, systematization, and marketing capability ●Growth based on the GLOBAL WiFi Business ●Acceleration of growth based on active investment ●Development and promotion of their unique services ●Reduction of telecommunication costs through the utilization of cloud technologies ●Sales promotion and marketing via social networks ●Streamlining of business operations through RPA | ➡ | 2025-2028 ●Establishment of a base for supporting sustainable growth ●Establishment of an ultimate CRM system for improving the satisfaction level and loyalty of customers ●Improvement in social value through business activities ●Increase of needs and improvement in average spending through the enrichment of optional services ●Development of new products and services for meeting the needs of customers, and enhancement of market leadership ●Maximization of productivity through the streamlining of back-office operations ●Portfolio balance strategy that takes into account the inflation and risks ●Implementation of job rotation for brushing up individual skills and enhancing the competitiveness of the entire organization |

Numerical managerial goals

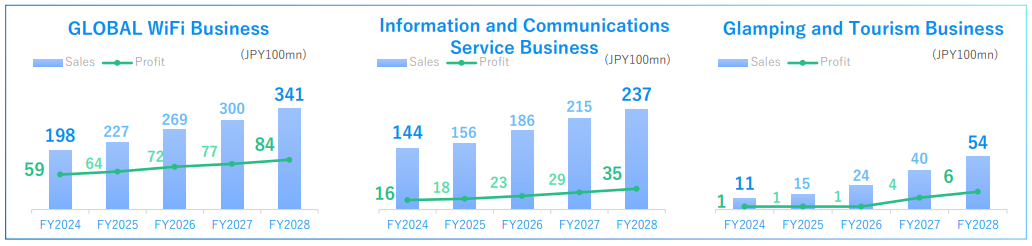

They aim to achieve sales of 63.4 billion yen and an operating income of 10 billion yen in FY 12/2028.

| FY 12/24 | FY 12/25 | FY 12/26 | FY 12/27 | FY 12/28 |

Sales | 35,528 | 40,002 | 48,000 | 55,600 | 63,400 |

Operating income | 5,365 | 6,439 | 7,500 | 8,700 | 10,000 |

Operating income margin | 15.1% | 16.1% | 15.7% | 15.7% | 15.9% |

Net income | 3,375 | 4,382 | 5,100 | 5,900 | 6,800 |

ROE | 21.2% | 23.3% | 23.8% | More than 20% | More than 20% |

Dividend payout ratio | 38.8% | 50% | 50% | Considering | Considering |

Performance plan in each segment

By promoting strategic data-driven sales, they aim to streamline the marketing activities of all businesses and maximize their outcomes. They aim to actualize sustainable growth by cementing the relationships with existing clients, increasing new clients, and expanding recurring revenue.

4-2 Envisioned Medium-term Growth

An operating income of 10 billion yen is a mere milestone. They aim to grow further.

(From the reference material of the Company)

4-3 GLOBAL WiFi Business

The market size is large, they will not only aim to expand their market share, but will also think of entering new fields and conducting M&A, etc.

(From the reference material of the Company)

They can meet various needs for inbound, outbound, and domestic travels.

(From the reference material of the Company)

Variation in the number of transactions for use

Domestic use has already exceeded that in 2019.

(From the reference material of the company)

4-4 Information and Communications Service Business

They aim to grow while increasing recurring revenues.

Created by the company based on data from National Statistics Center materials.

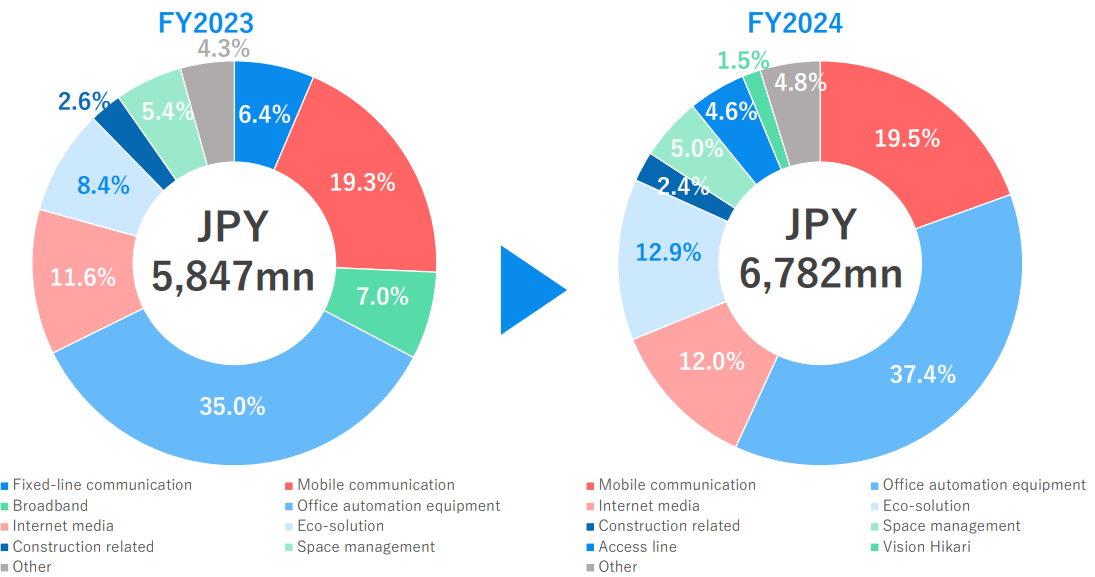

Gross profit composition

Taking advantage of multiple businesses (products and services) and sales channels, they flexibly coped with the changes in the external environment, so gross profit was healthy.

The sale of OA equipment and intermediation business for electricity (eco-solution business) remained favorable.

* The figures are different from those of the segment results because they are monthly changes in profit and loss which do not include closing.

(From the reference material of the Company)

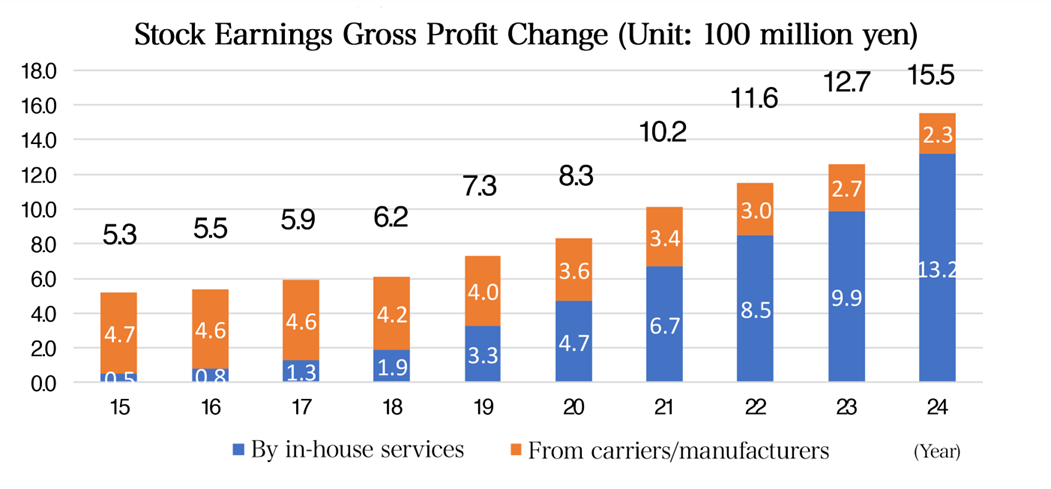

Recurring revenues

Variation in gross profit

Strengthen the recurring revenue, which will provide a stable revenue base over the long term.

Strengthen acquisition of in-house services from the fiscal year ended December 2019.

Reached 1 billion yen in the fiscal year ended December 2021.

Launched the service Vision Hikari in September 2023.

(Investment Bridge Co., Ltd. prepared this based on disclosed material.)

The Company’s own services-Provision of products and services to meet the needs of customers and the times

(From the reference material of the Company)

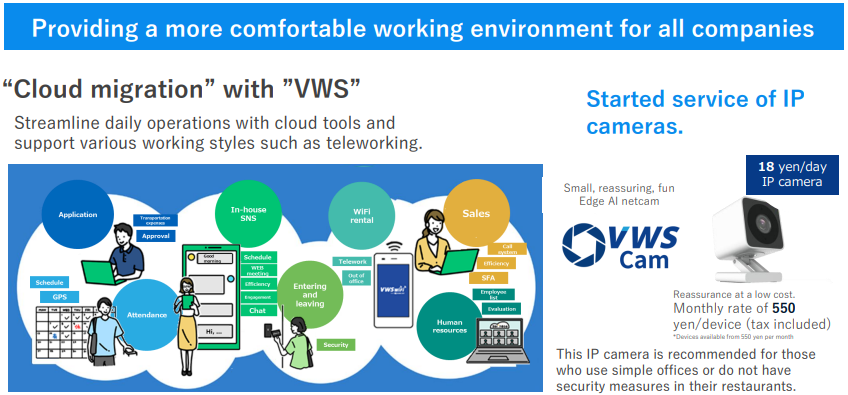

Sales of the “VWS series” are strong

The Company is developing and operating services used by the company to users (DX promotion).

The Company will provide necessary functions in the cloud as needed on a monthly basis.

(From the reference material of the company)

4-5 Glamping and Tourism Business

(From the reference material of the Company)

5. Conclusions

In the fiscal year ended December 2024, sales and all kinds of profits hit a record high. The previous report mentioned “FY 12/2024 is likely to be the transitional year from the recovery observed in FY 12/2023 to growth,” and it can be said that it came true. It is noteworthy that when the supporting operations, etc. conducted in the previous fiscal year are excluded, it can be considered that sales and operating income virtually grew 18.5% and 43.8%. In the GLOBAL WiFi Business, which is the mainstay, sales and operating income exceeded those in 2019 in the pre-pandemic period, while the number of overseas travelers has not recovered to the pre-pandemic level. The performance of the Information and Communications Service Business has gotten on track. The sales of this business are mostly recurring, so a stable revenue base is being established. They released new services in quick succession in the two businesses, and they performed well. They plan to keep releasing new services, so we would like to pay attention to their business operation with expectation.

Since November 2024, share price fluctuated due to the shareholder benefit system, as it dropped from the ex-rights date. However, medium-term performance has been improving steadily. We feel odd as price-to-earnings ratio (PER) falls much below 20 despite high growth potential. They pledged to achieve a payout ratio of 50% in FY 12/2025 and FY 12/2026. It is noteworthy that shareholder return can be secured when profit grows. Without being distracted by shareholder benefits, we would like to pay attention to their performance trend (and resultant shareholder return, including dividends). We expect that the market will notice their performance and share price will rise.

<Reference 1: Initiatives for ESG・SDGs>

[1] Materiality (Fundamental Initiative)

(From the reference material of the Company)

The Company will promise sustainable growth to their stakeholders, engaging in various business activities, whilst working towards a sustainable global environment and society. As the most material issue, they set the slogan “symbiotic growth” and pursue it as the most important policy for all business activities.

-Social Demands-

Negative effects of business activities

must

Initiatives for realizing a decarbonized society, contributing to the prevention of global warming and environment protection (E)

(From the reference material of the Company)

Actions - Current Initiatives -

1.VWS Attendance Management / Legal Signature to be paperless contracts

2.Promotion of CO2 reduction through proposals to reduce electricity costs(LED, air conditioning, renewable energy)

3.CO2 reduction efforts using carbon offset products such as MFPs

4.Information disclosure through CDP and SBT certification

5.Installation of EV stations at glamping facilities

Actions - Future Initiatives -

1.Private power generators at glamping facilities (Solar energy, etc.)

2.Shifting from cans and bottles to “My Bottle” (Removal of vending machines)

3.In-house power generation and storage/development

Company allowing for diverse workstyles and working at ease for all employees (G)

Actions - Current Initiatives -

1.Establishment of rules for shorter and more flexible working hours

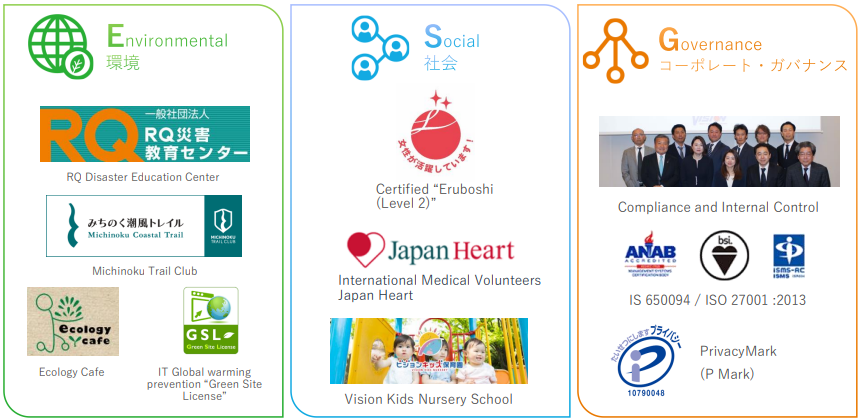

2. Proactive efforts to promote women in the workforce (Eruboshi Certification 2-star approval)

3. Active promotion of maternity leave and implementation of paternity leave

4. Establishment of the Career Design Office and career support for employees

Actions - Future Initiatives -

1. Establishment of employment support for families in need of nursing care, single-mother, and single-father families

2. Establishment of sales departments and products that enable women to play more active roles

3. Skill improvement by supporting the acquisition of qualifications

4. Introducing and operating a company-wide unified personnel evaluation system

-Social Expectations-

Positive effects of business activities

should

Contribution to economic activities throughout local societies by creating employment (S)

Actions - Current Initiatives -

1. Regional recruitment being possible through telework

2. Reducing food waste at glamping business

3. Promoting local products and tourism resources through glamping business

4. Actively employing people with disabilities, both in the Tokyo metropolitan area and rural areas

Actions - Future Initiatives -

1. Expand local employment by introducing workcations and enforcing local hiring

2. Actively utilize local governments to attract new companies

3. Support the growth of local companies by strengthening cooperation and alliance

4. One-stop service to train local entrepreneurs

Contribution to society through the elimination of disparities in education and medical care for children who will lead our future, educational support and medical care support (S)

(From the reference material of the Company)

Actions - Current Initiatives -

1. Creating a stable working environment for parents by providing Vision Kids nursery school

2. Providing “GLOBAL WiFi®” to local governments (GIGA school program)

Promoting the establishment of online classes through rental services “GLOBAL WiFi®”

3. Supporting Japan Heart(Japan-originated medical NGO) with “GLOBAL WiFi®” devices and donating a portion of sales

4. Supporting the activities of the Peace Piece Project

Actions - Future Initiatives -

1. Support students and young people by expanding the free use of “GLOBAL WiFi®”

2. Operation/support of childcare and child welfare facilities

3. Operation of facilities for children with developmental disabilities, cooperation with local facilities

4. Support for customer-integrated NGOs

[2] ESG+SDGs

Consistent with the ideals to “provide the future of information and communication is for the future of all people,” the Company aims for continuous growth and improvement of corporate value through adherence to the areas of ESG (E=Environment, S=Society, G=Governance) in the management and business strategies. In addition, through solving social issues outlined by the SDGs (established by the United Nations), the Company will take the lead in contributing to the harmonious and sustainable development of society and the planet.

(From the reference material of the Company)

[3] Got “A” in MSCI ESG Rating

Got “A” in MSCI ESG rating as of July 2024 like in 2023.

(From the reference material of the Company)

Got “A” in MSCI ESG rating by MSCI (Morgan Stanley Capital International). In MSCI ESG rating, they analyze corporate initiatives related to ESG (Environment, Social, and Governance), and rate them with 7 ranks ranging from the highest “AAA” to the lowest “CCC.” The Company upheld the slogan “Vision of creating a future together with a diverse society as a member of the earth,” and will engage in many business activities.

[4] Got “B” in “Climate Change Report 2024” of CDP

Got the management level “B” score in “Climate Change Report 2024” of CDP.

CDP is a non-governmental organization (NGO) managed by a British charity group established in 2000. It operates a global information disclosure system for allowing investors, enterprises, national governments, regions, and cities to control their environmental impact.

(From the reference material of the Company) | In this survey, compared to 2023, the following were evaluated: 1) Enhanced information disclosure: Improvement in the quality and quantity of information disclosure, including provision of detailed data on greenhouse gas emissions and clarification of risk management strategies; 2) Improved internal processes: Improvement in internal processes, including identification and management of environmental risks and enhancement of governance structure; 3) Strengthened communication with stakeholders: Effective communication of environmental strategies and initiatives through dialogue with investors, business partners, employees, and other stakeholders. |

[5] SBTi Certified

Vision Group certified by SBTi with GHG emission reduction targets as a company in compliance with international standards in December 2024

(From the reference material of the company) | SBTi (Science Based Targets initiative) is an international initiative in which companies set greenhouse gas (GHG) emission reduction targets based on scientific evidence and certify whether they are consistent with the 1.5℃ and 2℃ targets of the Paris Agreement. SBTi accreditation allows companies to demonstrate that their climate change measures comply with international standards. |

| The Vision Group upholds “Vision of creating a future together with a diverse society as a member of the earth” as a slogan for co-existence and co-growth, and engages in “Environmental Protection: Decarbonized Society and Environmental Protection Initiatives” as one of material issues. |

(From the reference material of the Company)

<Reference2: Regarding corporate governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 7 directors, including 4 outside ones |

Auditors | 4 auditors, including 3 outside ones |

All outside directors and outside corporate auditors are independent directors and corporate auditors.

◎ Corporate Governance Report: Updated on May 29, 2024

Basic policy

Our corporate group improves ourselves to change clients’ expectations into impression, pursues innovation without hesitation to actualize the ideal, always feels grateful about the support of many people (stakeholders), and operates its business activities with a humble mindset. Under this code of conduct, Vision observes laws, in-company regulations, and policies, carries out business in good faith, and strives to realize optimal corporate governance.

<Main Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts) >

[Principle 4-1-3 Roles and responsibilities of the Board of Directors (1) (Supervision of planning for successors to the CEO or the like.)] Although our company has not formulated a specific succession plan for the Chief Executive Officer, the Nomination and Renumeration Committee, a voluntary advisory body to the Board of Directors, will discuss the implementation of the succession plan.

[Supplementary Principle 4-3-3 Roles and responsibilities of the Board of Directors]

Because the CEO’s tenure is one year, our company does not intend to remove him from office during that time. In the event that the dismissal of the CEO is objectively deemed appropriate, for example, in the case that he or she has violated laws and regulations, the Articles of Incorporation, or has significantly damaged the corporate value of the Company, the dismissal shall be resolved after a thorough deliberation by the Board of Directors, following consultation with the Nomination and Remuneration Committee.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

[Principle 1-4 Cross-shareholdings]

Our basic policy is not to hold any strategic stock holdings in principle, except in cases where it is recognized that such holdings will contribute to medium to long term improvement in corporate value. In cases where listed shares are held as policy stockholdings, the Board of Directors will review all shares on a quarterly basis and sell shares of companies that the Board of Directors determines cannot be expected to increase corporate value over the medium to long term, taking into consideration factors such as share price and market trends. With respect to the exercise of voting rights, we will make decisions on a case-by-case basis, taking into consideration whether the exercise of voting rights will contribute to the enhancement of our corporate value over the medium to long term.

We do not disclose the results of verifying the purpose of holding shares held by policy holdings, as it is related to our business strategy and disclosure may damage the interests of the Company and its shareholders.

[Principle 2-4-1: Ensuring Diversity]

The Company actively employs a diverse range of personnel, regardless of educational background, work experience, gender, nationality, or disability. We believe that by utilizing individual personalities, we can create a diverse range of products and services that will contribute to the growth of the Company. We are also working to create a fulfilling working environment where all people working for our corporate group can grow.

As of the end of December 2023, 92.5% of managers of our corporate group were mid-career employees, 9.2% were female managers, and 5.0% were non-Japanese managers. Our goal is to increase the percentage of female managers to 12% or higher by 2026. Although we have not set numerical targets for mid-career recruits and non-Japanese nationals, we intend to maintain the current status for mid-career recruits and increase the number of non-Japanese nationals. For policies on the development of human resources and the internal environment, see the Securities Report (URL: https://www.vision-net.co.jp/ir/library/securities.html), “2. Business Situation; (2) Sustainability Policy and Initiatives,” and “Policy on the Promotion of Diversity” on our company’s website (URL: https://www.vision-net.co.jp/company/diversity.html).”

[Principle 3-1 Enrichment of information disclosure]

(1) Our management philosophy and strategy are disclosed on our website.

(2) The basic concepts and policies on corporate governance are disclosed in “I. 1. Basic Policy” and other sections of this report.

(3) The amount of remuneration for each director shall be determined within the remuneration limit approved at a General Meeting of Shareholders and shall be determined by the Board of Directors based on the content of the report after consulting with the Nomination and Renumeration Committee.

(4) The Company’s basic policy is that the Board of Directors shall be composed of the necessary and appropriate number of members to ensure constructive discussions while giving consideration to the balance of knowledge, experience, ability, etc. of each member. When determining candidates for Directors, the Board of Directors consults with the Nomination and Remuneration Committee and appoints them based on the recommendations of the Committee. With regard to Audit and Supervisory Board Member candidates proposed by Directors, the Board of Directors also adopts a resolution on the Audit and Supervisory Board Member candidates after deliberation and agreement by the Board of Audit and Supervisory Board Members, of which more than half are Outside Audit and Supervisory Board Members, and submits the proposal to a General Meeting of Shareholders for consideration. In addition, the Company selects Outside Directors based on the requirements for Outside Directors under the Companies Act, as well as the qualifications for Independent Directors stipulated by the Tokyo Stock Exchange, while they are deemed not to pose a risk of conflicts of interest with general shareholders. In the case of dismissing a Director, if there is a violation of laws and regulations, the Articles of Incorporation, or if there are circumstances that make it difficult for the Director to perform his/her duties, the Board of Directors will make a decision based on the deliberations, advice, and recommendations of the Nomination and Remuneration Committee in order to enhance objectivity and transparency.

(5) The reasons for the appointment of each candidate for an Outside Director are disclosed in the Notice of the Annual General Meeting of Shareholders and this report.

[Supplementary Principle 3-1-3 Sustainability Initiatives]

<Sustainability Initiatives>

We, the Vision Group, have adopted “to contribute to the revolution of the information and communications industry in the world” as its management philosophy. Under this philosophy, we position sustainability initiatives as important management issues and conduct management that emphasizes sustainability.

Specifically, we aim to contribute to the global environment, realize a sustainable society and economic growth, and contribute to the universal human philosophy of “sustainable growth” through our business.

<Investment in human capital and intellectual property>

With regard to investment in human capital, the Vision Group will make necessary investments, as it is essential to increase the number of employees in order to realize sustainable growth in corporate value. For more details, see “2. Business Situation; 2. Sustainability Policy and Initiatives” of the Securities Report (URL: https://www.vision-net.co.jp/ir/library/securities.html).

<Disclosure of impacts on climate change>

Due to the nature of our corporate group’s business, we believe that it is relatively less susceptible to risks and opportunities related to climate change. However, risks and opportunities related to climate change are discussed at the Board of Directors and the Management Committee in discussions on medium/long-term management strategies. Furthermore, as a member of society, we are working to reduce the environmental impact of our operations. Specifically, we are continuing to reduce paper consumption, control air conditioning in our offices, and wear more casual clothing.

Based on the framework of the TCFD recommendations, the Vision Group will respond to initiatives related to sustainability, including the impact of climate change-related risks and profit opportunities on its business activities and profits. For more details, see the Securities Report (URL: https://www.vision-net.co.jp/ir/library/securities.html).

We will continue our efforts to enhance information disclosure based on the TCFD framework.

[Supplementary Principle 4-1-1 Roles and responsibilities of the Board of Directors (1) (Scope of delegation to management)]

The Board of Directors makes decisions on the execution of duties stipulated as matters to be determined by the Board of Directors in laws and regulations, the Articles of Incorporation, and the Rules for the Board of Directors. Regarding delegation to the management team, the Board of Directors approves matters that may have a significant impact on the Company’s corporate governance and consolidated business results, such as projects for investment of a certain amount or more and key personnel matters. Other proposals are approved by the Management Committee, which is a decision-making body at the executive level.

[Principle 4-9 Criteria for judging the independence of Independent Outside Directors and their qualifications]

The Company selects its Directors with reference to the Companies Act and the standards established by the Tokyo Stock Exchange. In addition, the company has selected individuals who can provide advice on all aspects of the company’s management based on their extensive experience and knowledge.

[Supplementary Principle 4-11-1 Preconditions for ensuring the effectiveness of the Board of Directors and the Board of Corporate Auditors (Policy for the diversity of the board of directors and so on)]Our Board of Directors is composed of a diverse group of directors with different backgrounds in terms of gender, expertise, and experience. Majority of our company’s board of directors consists of outside directors, who provide their opinions from an independent and objective standpoint at meetings of the Board of Directors, thereby ensuring a management oversight system. The skill matrix of our directors is disclosed in the notice of convocation of each ordinary general meeting of shareholders.

[Supplementary principle 4-11-2 Preconditions for ensuring the effectiveness of the Board of Directors and the Board of Corporate Auditors (concurrent positions of directors and corporate auditors)]Directors and corporate auditors allocate the time and efforts necessary to properly perform their roles and responsibilities to their duties as directors and corporate auditors, and their concurrent positions are within a reasonable range. The status of their concurrent positions is disclosed in the reference document of the notice of the general meeting of shareholders.

[Supplementary Principle 4-11-3 Preconditions for ensuring the effectiveness of the Board of Directors and the Board of Audit and Supervisory Board Members (analysis and evaluation related to the effectiveness of the Board of Directors)]

The Board of Directors of the Company conducted a questionnaire survey targeted at all of Directors and Audit and Supervisory Board Members in March 2024. Based on these results, it was confirmed that the Board of Directors of our company generally functions appropriately and that the effectiveness of the Board of Directors is ensured. We will continue to enhance the effectiveness of the Board of Directors and strive to further increase corporate value.

[Supplemental Principle 4-14-2 Training of Directors and Audit and Supervisory Board Members (Training policy for Directors and Audit and Supervisory Board Members)]Directors and Audit and Supervisory Board Members continuously acquire the knowledge necessary for their respective businesses, operations, and positions by participating in seminars, study groups, and social gatherings of their affiliated organizations, at their own discretion, and we provide financial support when necessary.

[Principle 5-1 Policy for constructive dialogue with shareholders]

If shareholders or others want to have a dialogue with Vision, the Company will respond positively within a reasonable range, to contribute to the sustainable growth of the Company and the medium to long-term improvement in corporate value. As of now, Vision holds a briefing session four times per year, meetings with institutional investors domestic and foreign, briefing sessions for individual investors several times a year, and so on. The information on their results is properly shared through meetings of the Board of Directors, etc. In addition, Vision takes thoroughgoing measures for preventing the leakage of insider information.

[Measures to realize management conscious of cost of capital and share price (under review)] [English version available]

Although the Company does not disclose our policies or targets regarding “measures to realize management conscious of cost of capital and share price,” we recognize it as an important management issue.

As of the end of the fiscal year ended December 2023, the Company’s return on equity (ROE) was approximately 23%, which is significantly higher than the cost of equity (COE) of approximately 9%, and the return on invested capital (ROIC) was approximately 21%, which is significantly higher than the weighted average cost of capital (WACC) of approximately 8%.

We will continue to maintain a sound management status and focus on improving capital efficiency (ROE, ROIC, etc.).

This report is intended solely for information purposes and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |