Bridge Report:(9416)Vision Interim Period of the Fiscal Year Ending December 2025

Chairman and CEO Kenichi Sano | Vision Inc. (9416) |

|

Company Information

Market | TSE Prime Market |

Industry | Information and telecommunications |

Chairman and CEO | Kenichi Sano |

President, Representative Director and COO | Kenji Ota |

HQ Address | SHINJUKU EASTSIDE SQUARE 8F, 6-27-30 Shinjuku, Shinjuku-ku, Tokyo 160-0022, Japan |

Year-end | December |

HP |

Stock Information

Share Price | Number of Shares Issued (End of the term) | Total Market Cap | ROE(Act.) | Trading Unit | |

¥1,253 | 50,938,600 shares | ¥63,826 million | 21.2% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥45.00 | 3.6% | ¥90.07 | 13.9 x | ¥357.62 | 3.5x |

*Stock price as of the close on August 29, 2025. The number of outstanding shares, DPS and EPS have been taken from the summary of financial results for the interim period of the fiscal year ending December 2025. ROE and BPS are the figures as of the end of the previous fiscal year.

*The number of shares issued includes the number of treasury shares.

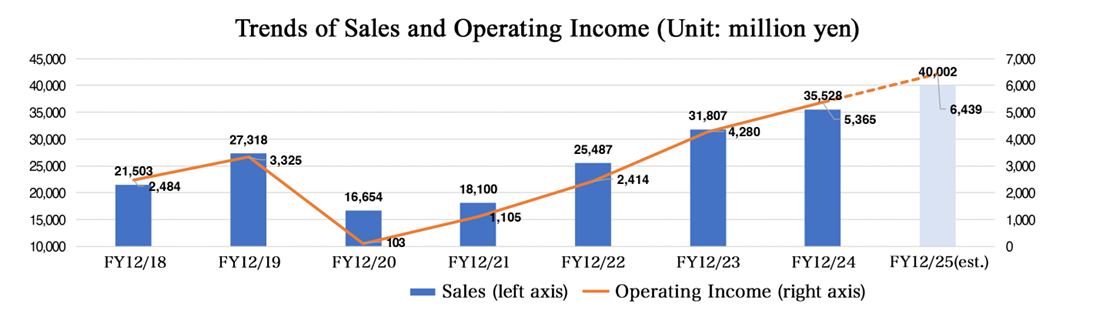

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income Attributable to Owners of Parent | EPS (¥) | DPS (¥) |

Dec. 2021 (Actual) | 18,100 | 1,105 | 1,143 | 729 | 15.47 | 0.00 |

Dec. 2022 (Actual) | 25,487 | 2,414 | 2,422 | 1,548 | 31.96 | 0.00 |

Dec. 2023 (Actual) | 31,807 | 4,280 | 4,337 | 3,025 | 61.87 | 0.00 |

Dec. 2024 (Actual) | 35,528 | 5,365 | 5,422 | 3,375 | 69.59 | 27.00 |

Dec. 2025 (Forecast) | 40,002 | 6,439 | 6,445 | 4,382 | 90.07 | 45.00 |

* The forecasted values were provided by the company. Unit: Million yen.

This Bridge Report outlines Vision’s results for the interim period of the fiscal year ending December 2025.

Table of Contents

Key Points

1. Company Overview

2. Interim Period of the Fiscal Year Ending December 2025 Earnings Results

3. Fiscal Year Ending December 2025 Earnings Forecasts

4. Details of Growth Initiatives

5. Conclusions

<Reference1: Initiatives for ESG・SDGs>

<Reference2: Regarding corporate governance>

Key Points

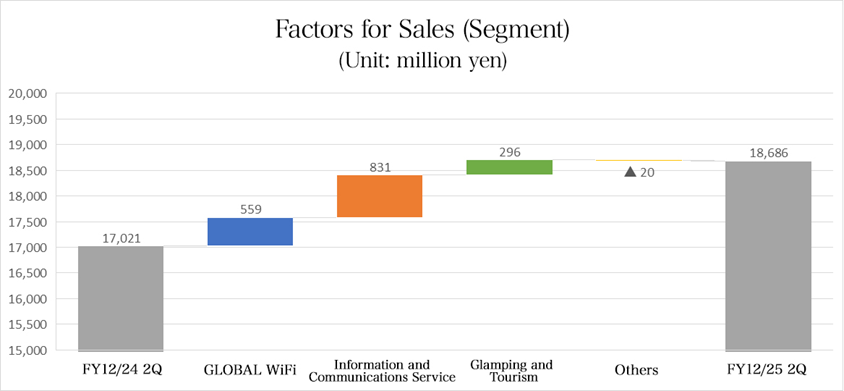

- In the interim period of the fiscal year ending December 2025, sales grew 9.8% year on year to 18,686 million yen. Sales growth rate was 6.1% for the GLOBAL WiFi Business and 11.1% for the Information and Communications Service Business, indicating healthy performance. The sales of the Glamping and Tourism Business increased 58.9%. Operating income rose 6.7% year on year to 2,903 million yen. Gross profit margin declined from 57.5% year on year to 55.4%, but operating income margin decreased from 16.0% year on year to 15.5%, as the SG&A expenses ratio reduced from 41.5% year on year to 39.9%. Regarding non-operating performance, exchange gain or loss improved, but there was no longer revenue from subsidies, so ordinary income rose 5.6% year on year to 2,910 million yen, and interim net income rose 8.9% year on year to 1,944 million yen, as loss on retirement of non-current assets decreased. As each business performed well, sales and all kinds of profits hit a record high in the interim period. They will pay an interim dividend of 20.00 yen/share, as expected.

- The sales and profit of the GLOBAL WiFi Business increased. For foreign visitors to Japan, they concentrated on the Wi-Fi rental “NINJA WiFi®” in Japan and the sale of SIM cards via automatic vending machines at airports. Regarding outbound travelers, the demand for the “Unlimited data volume plan” remained strong, and average spending per customer remains high. For the Expo in Osaka, they developed an environment where customers can use Wi-Fi routers and mobile batteries easily in a cashless manner, to meet demand.

- The sales and profit of the Information and Communications Service Business increased. As a result of actively recruiting mid-career workers and brushed up their marketing capability, sales of mobile communication equipment were healthy. They promoted the sale of recurring-revenue services, to maximize the lifetime value of customers by upselling or cross-selling services, reducing long-term cancellation rates, and offering recurring services.

- The full-year forecast was left unchanged, with sales for the fiscal year ending December 2025 projected to grow 12.6% year on year to 40,002 million yen and operating income is forecast to rise 20.0% year on year to 6,439 million yen. Both are expected to hit a record high in succession. In the GLOBAL WiFi Business, the number of overseas travelers per year is expected to recover to 81.1% of the number in 2019. It is assumed that 1 US dollar = 150 yen. They aim to improve their popularity by enhancing sales promotion. In addition, they will actively invest in World eSIM®. The operation in New York will be started. In the Information and Communications Service Business, they will maximize opportunities for cross-selling products to startup firms and venture companies through strategic data-driven sales. They will establish a stable revenue base based on recurring-revenue products. They will strengthen the support for BPO. In addition, they plan to recruit 40 people. By hiring mid-career workers actively, they plan to enhance their marketing capability. Sales and profit are expected to grow year on year in all of the GLOBAL WiFi Business, the Information and Communications Service Business, and the Glamping and Tourism Business. They plan to pay a year-end dividend of 25.00 yen/share, as initially planned. They plan to pay 45.00 yen/share per year, up 18.00 yen/share from the previous fiscal year. The expected payout ratio is 50.0%.

- In the interim period, sales and all kinds of profits hit a record high. This is not remarkable, but they are about to get on a growth track after the rapid recovery after the COVID-19 pandemic. In both the GLOBAL WiFi Business and the Information and Communications Service Business, recurring revenue grew significantly, and they have established a revenue base that is stable in the long term. For the GLOBAL WiFi Business, they have established a subsidiary in New York, accelerating global business expansion. It can be expected that their business will expand rapidly if it gets on track, so we would like to pay attention to the progress of their business. In every business, they launch new services and update existing services when necessary, enriching services for existing customers as well as increasing new customers. In the aspects of not only sales, but also costs, they have streamlined business operations with AI and robotic process automation (RPA) and carried out new investments, while securing a sufficient profit margin. This brings a sense of security. The valuation of their stock seems to be low for their growth potential. They publicly announced a commitment to achieve a payout ratio of 50% by the fiscal year ending December 2026. It is possible to secure a sufficient return rate through their profit growth.

1. Company Overview

Under the management philosophy of “To Contribute to the Global Information and Communications Revolution,” Vision conducts the GLOBAL WiFi Business, which leases the personal Wi-Fi (wireless LAN) routers which can be used in over 200 countries and regions on a flat-rate basis, and as an Information and Communications Service distributor, it mainly provides Information and Communications Service Business of arranging telecommunications infrastructure and office equipment necessary for business activities, such as fixed-line telecommunications, mobile telecommunications, broadband etc. The Company forms a group with its 22 consolidated subsidiaries, both inside and outside Japan. Of those, the 9 based in Japan include Best Link Inc. (which carries out the business of broadband service subscription agency), Vision Works Inc. (which provides accounting BPO services), and Vision Link Inc. There are 13 overseas subsidiaries that operate as overseas hubs for the GLOBAL WiFi service in South Korea, US (Hawaii), Hong Kong, Singapore, Taiwan, UK, China (Shanghai), France, Italy, US (California, New York), and New Caledonia; there is also a local subsidiary in Vietnam, which is an offshore hub for database construction and system development. (At the end of June 2025)

[Vision Group’s management philosophy – To Contribute to the Global Information and Communications Revolution]

We will actively promote the Information and Communications Revolution in the world, bring innovations to an individual’s lifestyle and the company’s business style, and contribute to the advancement of humanity and society by continuing to be an distributor that effectively and efficiently connects the client companies with end users and makes sure that its employee’s unlimited ambition, dreams and thoughts are contributing to the stakeholders, without compromising nor ever forgetting the venture spirit and add to the progress of the human race and the society.

1-1 Business Description

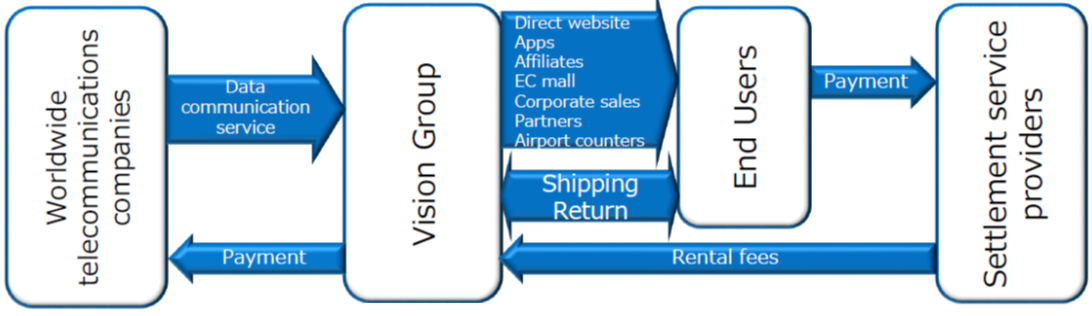

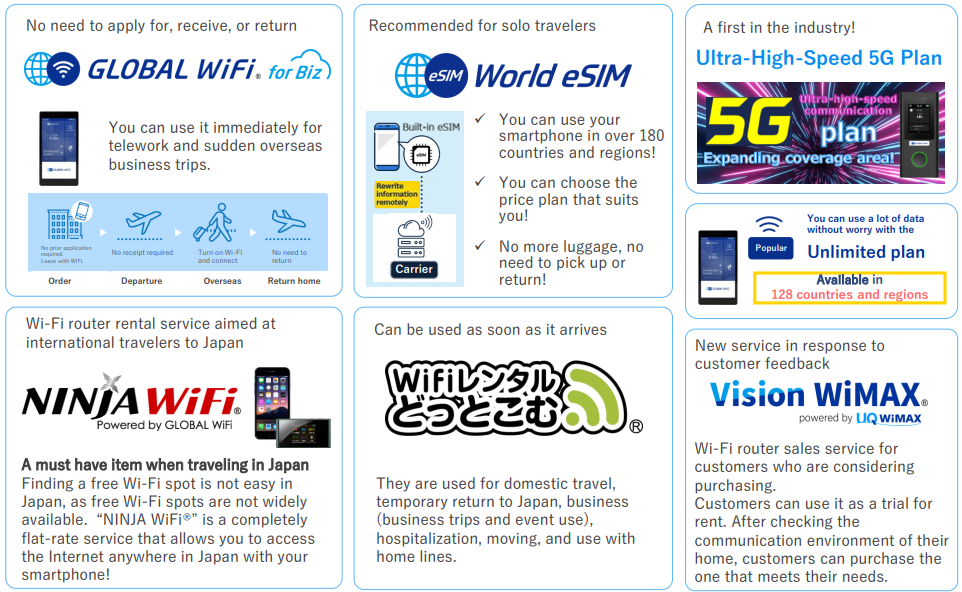

① GLOBAL WiFi Business

The Company offers services including “GLOBAL WiFi®” (a Wi-Fi router rental service that allows people traveling overseas to use local internet services at a competitive rate through its partnerships with the overseas operators) and “NINJA WiFi®” (a Wi-Fi router rental service for overseas visitors to Japan, etc.), while also engaging in services for the travelers between foreign countries in overseas bases (South Korea and Taiwan).

The number of leased Wi-Fi routers that are equipped with the next-generation telecommunication technology (CLOUD WiFi) capable of managing Subscriber Identity Modules (SIMs) on the cloud accounts for over 90% of all leased devices (Depending on telecommunication carriers, some countries are not supported, thus the company has almost reached the upper limit).

(From the reference material of the Company)

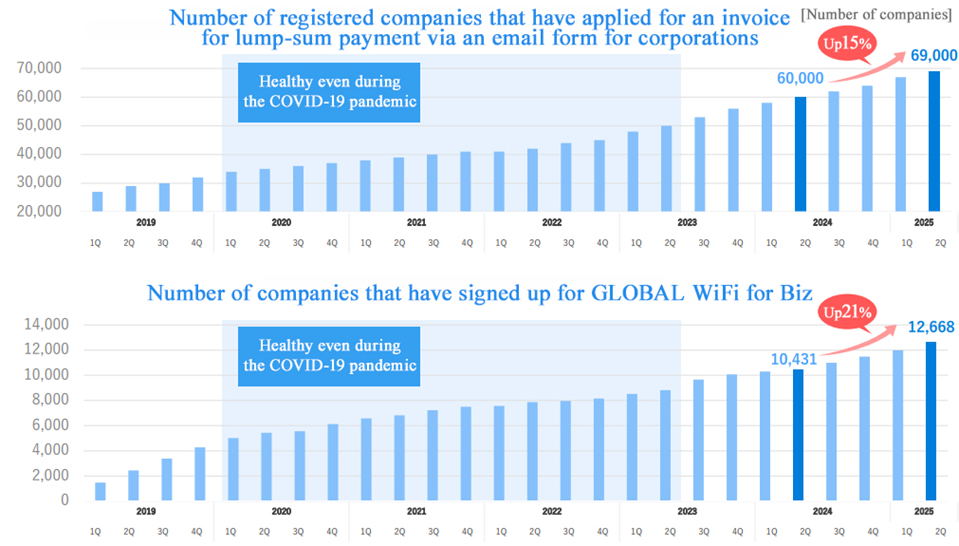

In addition, “GLOBAL WiFi for Biz,” a domestic plan of “GLOBAL WiFi®,” which is installed in corporations for regular use, was promoted aggressively and performed well. The sale of “GLOBAL WiFi for Biz” was promoted by capturing the increasing telework demand during the spread of the new COVID-19 pandemic, and it also demonstrated its competitive advantage during the recovery of traveling. With one “GLOBAL WiFi for Biz” in the company, customers can use it for telework and sudden overseas business trips without making arrangements, eliminating the need to use overseas roaming services when Wi-Fi rentals are not available. The number of subscriptions and actual usage have continued to increase as a result of its proposal as a dual-use service (telework and travel).

Advantages (1) Affordable fixed-rate system, (2) the most comprehensive area coverage, (3) comfort, (4) safety/security, (5) counter, (6) corporate sales capabilities, and (7) number of customers

The advantages of “GLOBAL WiFi®” and “NINJA WiFi®” include the following: (1) cost benefits of up to 89.9% (the rental fee per day is 300 yen at the minimum) compared to the fixed discount offered by other Japanese mobile carriers, (2) covers over 200 countries and regions, the largest in the industry, (3) high-speed telecommunications services through partnerships with telecommunication operators all over the world, (4) available and support 24 hours a day, 365 days a year, (5) the industry’s largest number of available spots at airport counters, and (6) capability to capitalize on the demand from corporations. Owing to these strengths, (7) the number of the Wi-Fi rental service users throughout the corporate group exceeded 23,000,000 (the company’s survey in August 2025).

-Competitive advantage when the demand for travel recovers

① Proactive sales promotion of GLOBAL WiFi for Biz

The sale of “GLOBAL WiFi for Biz,” which is installed in corporations for permanent use, remains favorable owing to proposals for a dual-use system for telework (the subscriptions and instances of actual usage have increased).

Having one “GLOBAL WiFi for Biz” at the company allows for both usage for telework and immediate usage during sudden business trips overseas without any need for making arrangements. There will be no need to resort to using international roaming because there was not enough time to rent a Wi-Fi.

② Ultrahigh-speed telecommunication 5G plan World eSIM®

The first in the industry of rental of Wi-Fi routers for overseas travel. They are expanding the service area of the ultrahigh-speed telecommunication 5G plan. They offer 5G services in the United States mainland, Hawaii, South Korea, Taiwan, Thailand, UK, Italy, France, Germany, Spain, China, Hong Kong, Iceland, Ireland, UAE, India, Australia, Austria (Europe), the Netherlands, Greece, Croatia, Singapore, Sweden, Slovenia, Czechia, New Zealand, Hungary, the Philippines, Finland, Bulgaria, Portugal, Malta, Malaysia, Romania, Luxembourg, Switzerland, Mexico, the Republic of South Africa, Oman, Guam, Saudi Arabia, Bahrain, Brazil, Peru, Macau, Mauritius, Belgium, Cyprus, Latvia, Lithuania, Canada, and Maldives.

World eSIM®

You do not need a physical SIM card or Wi-Fi router for your overseas travel or business trip. You can use your own smartphone. This service is available in over 200 countries and regions, and characterized by diverse plans offered according to your travel destination, period, and data volume. You can reduce your luggage during travel, and feel safe in the aspect of hygiene thanks to the contactless feature. Setting is easy, and you can apply from a foreign country in which you have arrived.

(From the reference material of the Company)

③ Expansion of the service area of the unlimited plan

A large volume of data is transmitted, due to the diversification of smartphone apps, the transmission of heavy images and videos, the posting in social media, etc.

This plan is increasingly shared by customers and their friends or family members, or increasingly used for multiple devices, including smartphones, tablets, and laptop PCs, in business scenes. This is a plan in which users do not need to worry about the limit of transmittable data volume. They have expanded its service area and features to meet the demand for long-term use.

The ratio of customers who choose the unlimited plan increased. ⇒ Rise in average revenue per user (ARPU)

④ Customers can receive the device at a convenience store.

Customers now can select an option in which they can receive the device at any convenience store of Seven-Eleven around Japan, excluding Okinawa, which is close to their workplace or home for convenience.

Customers can receive the device in advance, without lining up in front of a counter on the date of departure. Customers can receive the device even late at night, as long as the convenience store is open.

⑤ Operation of unmanned shops

Locations (as of the end of June 2025)

Mt. Fuji Shizuoka Airport, Kumamoto Airport, Kitakyushu Airport, Miyako Shimojishima Airport, Granduo Kamata and Hiroshima Airport *More shops to be built.

Installed equipment

・Smart Pickup (for receiving the device)

・Return box (for returning the device)

・Vending machine for SIM cards

Features, etc.

・Customers can receive the device in a non-face-to-face manner without lining up in front of an airport counter even during a busy season (for repeat customers who do not require explanations, and this is effective for coping with infectious diseases).

・It is possible to offer services 24 hours a day, including early morning and midnight hours in which it is difficult to secure staff even if there are needs.

・Vending machines of prepaid SIM cards for use by foreign travelers to Japan and those who temporarily return to Japan

・It is possible to increase touch points at low cost without occupying much space (for improving convenience and increasing revenues).

⑥ Wi-Fi for use in Japan

・“NINJA WiFi®,” a Wi-Fi router rental service for foreigners visiting Japan

The Internet available on your own smartphone anywhere in Japan! Unlimited high-speed 4G-LTE!

・“WiFi-rental.com®,” a Wi-Fi router rental service for use in Japan

Can be used right after the delivery! The convenience of rentals for any period (measured in days) and any place allows for use in various scenarios, garnering favorable reviews.

・“Vision WiMAX®,” a Wi-Fi router sale service

Available to buy a Wi-Fi router matching your needs after checking the telecommunication environment of your home, etc. by renting it first for a trial period.

⇒ Router traded in when the contract is cancelled (Vision WiMAX original service).

-Airport counters and Smart Pickup

Receipt and return possible via return boxes at 20 airports, 39 counters and 58 Smart Pickup points in Japan. Lockers for automatic hand-over have been installed at 18 airports out of the aforementioned airports.

The service level is optimized for each client. Clients who do not require an explanation (repeat users, etc.) can get rid of waiting time (by using Smart Pickups). Clients who require an explanation are attended to by airport staff (by using airport counters).

-The store digitalization strategy (smart counters)

Evolved into a shop that can deal with the increases of the number of rental transactions (the number of cases of handover) and optional services (compensation services, accessory items, etc.) and meet the needs of respective customers so that Japanese people traveling abroad and foreign visitors to Japan can use more convenient, comfort, and peace of mind.

-System for receiving online orders “just before departure” (smart counters × CLOUD WiFi × database)

It will be possible to provide services to customers on the day of departure, leading to an increase in the number of users. Linking the system to the database will enable the immediate processing of online applications in front of airport counters as well. Link all imports from the smart counters, CLOUD WiFi and database to further elevate the convenience.

(From the reference material of the Company)

-Expansion of services during travel

By enriching services during travel, including options, to meet the needs of customers, they support worry-free, safe, comfortable travel.

(From the reference material of the Company)

-“Tsuyaku-Fukikae.com,” a service utilizing the client base

We provide service for the interpreting of online and offline negotiations and business meetings, translation and voice-over of videos and text translation.

“To overcome language barriers to make business more global.”

Provide interpreting, translation and voice-over services for usage in various business scenarios at a reasonable price.

Support the enrichment of information disclosure in English, placing importance on dialogue with overseas investors.

Also provide voice-over and subtitling of videos explaining financial results and translation of consolidated financial results, finacial result materials, and notice of the general meetings of shareholders, etc.

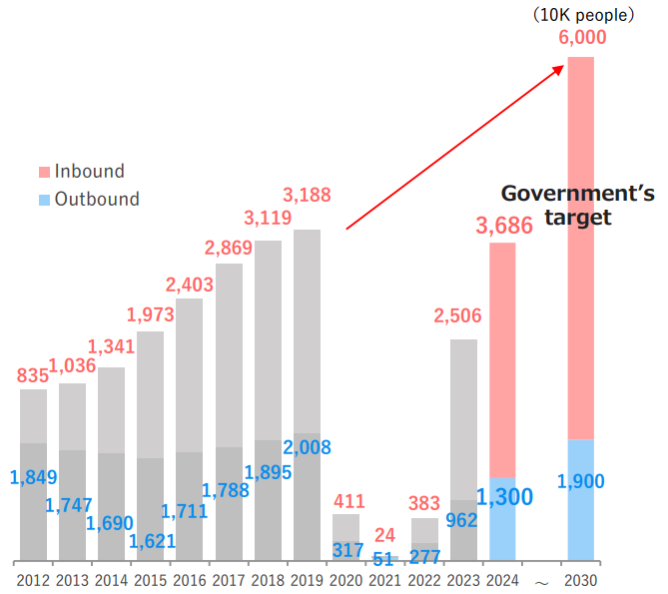

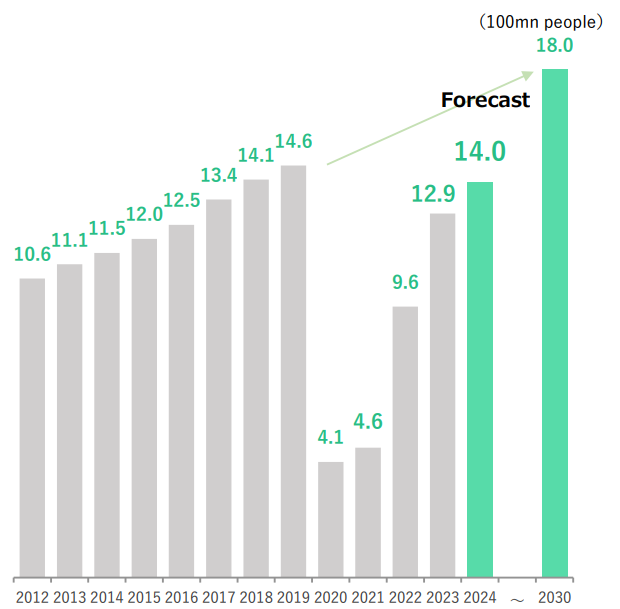

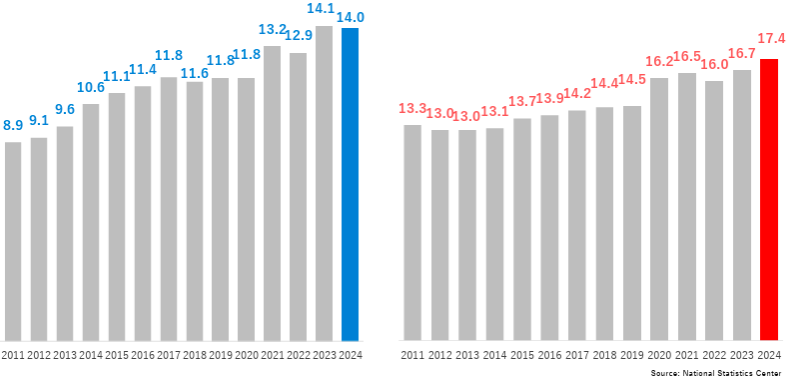

- GLOBAL WiFi Business: Market scale

Foreign visitors to Japan About 31.88 million people (2019), about 36.86 million people (2024). The government’s goal: 60 million people in 2030 Travelers from Japan to overseas About 20.08 million people (2019), about 13 million people (2024) | The number of international travelers in the world was 1.46 billion in 2019. The market targeted at them is huge. The number of international travelers in 2024 is estimated to be about 1.4 billion, 99% of the pre-pandemic level. |

|

|

(Produced by the company based on the reference material of Japan National Tourism Organization (JNTO),

White Paper on Tourism in Japan, and materials published by the World Tourism Organization (UNWTO))

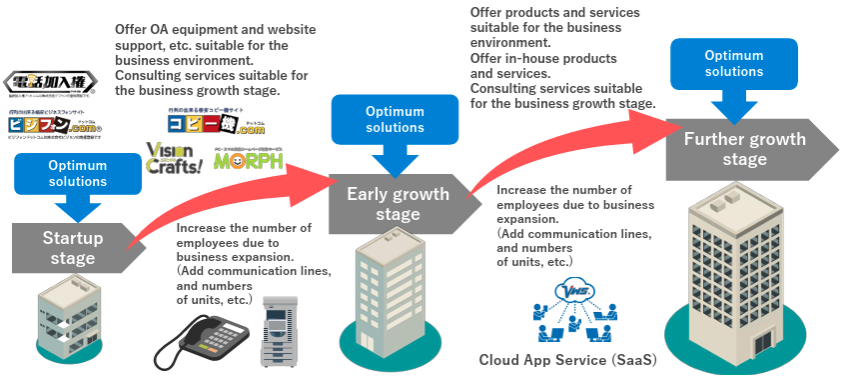

② Information and Communications Service Business

The company, the consolidated subsidiary Best Link Inc., etc. provide telecommunication infrastructure and office equipment, which are necessary for enterprises’ activities, such as mobile communications services, OA equipment, business phones, website production, eco solutions, Vision Hikari, and space management.

The Company has advantages in prospecting for corporations newly established (within 6 months), one of its major targets, and it is estimated, according to the data by the Ministry of Internal Affairs and Communications (the number of newly registered companies was 140,475 in Japan in 2024), that the Company has conducted transactions with around one in every 10 corporations newly founded in Japan. The Company attract customers through its unique online marketing (Internet media strategy). The Company has unique know-how in Customer Relationship Management (CRM; customer relationship and ongoing transactions) strategy. This paves the way for the maximization of continuous revenues (establishment of recurring-revenue business) and highly productive additional sale (upselling and cross-selling). The Company’s products and services are not easily affected by the economic situation as they lead to “improving the sales,” “reducing costs,” “improving business operations,” “stimulating communication” and “promoting DX” for clients. Moreover, the company has set up a business structure which enables flexible adaptations owing to multiple business segments, which allow for changes in the business composition to match the situation (economic situation, trends, economic conditions, etc.)

-Recurring-revenue business model-

In step with the growth of each client enterprise, they offer optimal solutions according to the growth stage.

Profit will grow based on the customer relationship management (CRM) with unique know-how and continuous transactions.

They have targeted mainly promising enterprises, but they will also target growing enterprises from now on.

- Information and Communications Service Business: Market scale

Establishment registrations (in total): 140,475 About 140,000 companies per year. (Continuous increasing trend due to the proactive support for business establishment and enterprises by the government) Utilize online marketing know-how based on about 20 years’ worth of achievements to attract customers. Upstream strategy. | Registration of headquarters/branch office relocations (in total): 174,789 About 160,000 companies per year. (Excluding relocations of offices, etc., which are not required to register the relocation) Cover procedures for additions, changes in step with the relocation, etc. Upselling and cross-selling based on an advanced operation of the Customer Royalty Team (CLT). |

(Unit: 10K cases)

(From the reference material of the Company)

③ Glamping and Tourism Business

The glamping business was launched as a business that will grow to become the third pillar of the company’s business. Currently, the company operates two facilities, “VISION GLAMPING Resort & Spa Koshikano Onsen” (Kirishima City, Kagoshima Prefecture) and “VISION GLAMPING Resort & Spa Yamanaka Ko” (Yamanakako Village, Minamitsuru-gun, Yamanashi Prefecture).

In addition, the grand opening of “VISION GLAMPING Resort & Spa Awajishima” is scheduled for early 2027.

This business has a major advantage in that Chairman Sano’s family already has experience and expertise in the management of this business.

2. Interim Period of the Fiscal Year Ending December 2025 Earnings Results

2-1 Consolidated Business Results

| FY 12/24 Interim period | Ratio to sales | FY 12/25 Interim period | Ratio to sales | YoY | The company’s forecast | Ratio to forecast |

Sales | 17,021 | 100.0% | 18,686 | 100.0% | +9.8% | 18,719 | -0.2% |

Gross profit | 9,789 | 57.5% | 10,357 | 55.4% | +5.8% | - | - |

SG&A expenses | 7,068 | 41.5% | 7,454 | 39.9% | +5.5% | - | - |

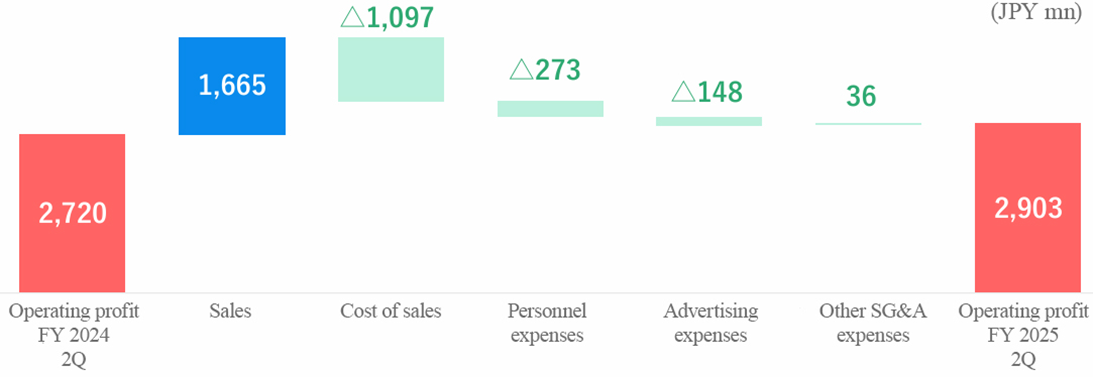

Operating income | 2,720 | 16.0% | 2,903 | 15.5% | +6.7% | 2,797 | +3.8% |

Ordinary income | 2,756 | 16.2% | 2,910 | 15.6% | +5.6% | 2,800 | +4.0% |

Interim net income | 1,785 | 10.5% | 1,944 | 10.4% | +8.9% | 1,904 | +2.1% |

*Unit: million yen. Interim net income is profit attributable to owners of parent.

(From the reference material of the Company)

Significant increase in sales and profit driven by the GLOBAL WiFi Business

Sales grew 9.8% year on year to 18,686 million yen. Sales growth rate was 6.1% for the GLOBAL WiFi Business and 11.1% for the Information and Communications Service Business, indicating healthy performance. The sales of the Glamping and Tourism Business increased 58.9%.

Operating income rose 6.7% year on year to 2,903 million yen. Gross profit margin declined from 57.5% year on year to 55.4%, but operating income margin decreased from 16.0% year on year to 15.5%, as the SG&A expenses ratio reduced from 41.5% year on year to 39.9%. Regarding non-operating performance, exchange gain or loss improved, but there was no longer revenue from subsidies, so ordinary income rose 5.6% year on year to 2,910 million yen, and interim net income rose 8.9% year on year to 1,944 million yen, as loss on retirement of non-current assets decreased. As each business performed well, sales and all kinds of profits hit a record high in the interim period.

They will pay an interim dividend of 20.00 yen/share, as expected.

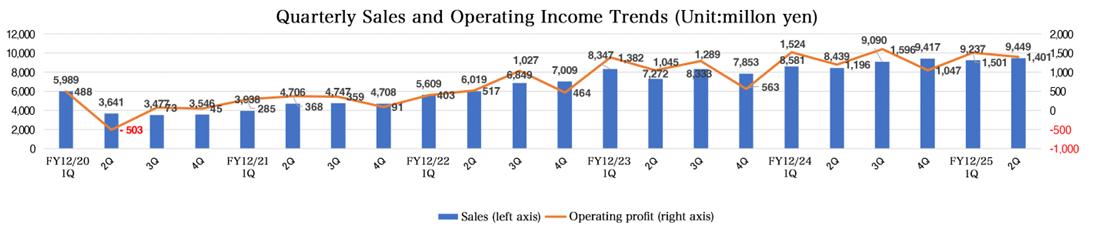

Quarterly Business Results

| 23/12-1Q | 2Q | 3Q | 4Q | 24/12-1Q | 2Q | 3Q | 4Q | 25/12-1Q | 2Q | 3Q | 4Q |

Sales | 8,347 | 7,272 | 8,333 | 7,853 | 8,581 | 8,439 | 9,090 | 9,417 | 9,237 | 9,449 |

|

|

Gross profit | 4,252 | 4,223 | 4,867 | 4,458 | 4,948 | 4,841 | 5,391 | 5,388 | 5,170 | 5,187 |

|

|

SG&A expenses | 2,870 | 3,178 | 3,577 | 3,895 | 3,423 | 3,645 | 3,795 | 4,340 | 3,668 | 3,785 |

|

|

Operating income | 1,382 | 1,045 | 1,289 | 563 | 1,524 | 1,196 | 1,596 | 1,047 | 1,501 | 1,401 |

|

|

Ordinary income | 1,423 | 1,039 | 1,302 | 573 | 1,553 | 1,203 | 1,616 | 1,048 | 1,514 | 1,396 |

|

|

Quarterly net income | 940 | 673 | 900 | 511 | 1,019 | 766 | 1,083 | 506 | 1,047 | 896 |

|

|

Gross Profit Margin | 50.9% | 58.1% | 58.4% | 56.8% | 57.7% | 57.4% | 59.3% | 57.2% | 56.0% | 54.9% |

|

|

SG&A ratio | 34.4% | 43.7% | 42.9% | 49.6% | 39.9% | 43.2% | 41.7% | 46.1% | 39.7% | 40.1% |

|

|

Operating income ratio | 16.6% | 14.4% | 15.5% | 7.2% | 17.8% | 14.2% | 17.6% | 11.1% | 16.3% | 14.8% |

|

|

*Unit: million yen

(Produced by Investment Bridge based on the brief report of financial results)

2-2 Trends by Segment

| FY 12/24 Interim period | Composition Ratio・Profit Ratio | FY 12/25 Interim period | Composition Ratio・Profit Ratio | YoY |

GLOBAL WiFi | 9,186 | 54.0% | 9,745 | 52.2% | +6.1% |

Information and Communications Service | 7,304 | 42.9% | 8,135 | 43.5% | +11.1% |

Glamping and Tourism | 504 | 3.0% | 800 | 4.3% | +58.9% |

Others | 24 | 0.1% | 4 | 0.0% | -82.0% |

Consolidated Sales | 17,021 | 100.0% | 18,686 | 100.0% | +9.8% |

GLOBAL WiFi | 2,753 | 30.0% | 2,791 | 28.6% | +1.4% |

Information and Communications Service | 916 | 12.5% | 951 | 11.7% | +3.8% |

Glamping and Tourism | 37 | 7.5% | 63 | 7.9% | +67.0% |

Others | -106 | - | -41 | - | - |

Adjustments | -881 | - | -860 | - | - |

Consolidated Operating Income | 2,720 | 16.0% | 2,903 | 15.5% | +6.7% |

*Unit: million yen. Sales represents sales to external customers.

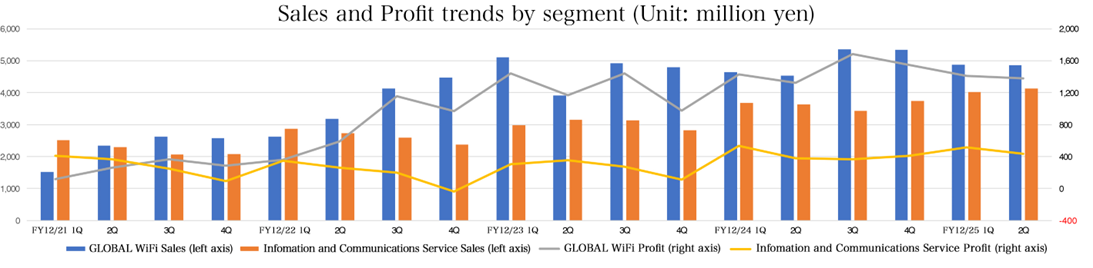

| 23/12-1Q | 2Q | 3Q | 4Q | 24/12-1Q | 2Q | 3Q | 4Q | 25/12-1Q | 2Q | 3Q | 4Q |

Sales |

|

|

|

|

|

|

|

|

|

|

|

|

GLOBAL WiFi | 5,108 | 3,904 | 4,921 | 4,794 | 4,647 | 4,539 | 5,355 | 5,333 | 4,881 | 4,863 |

|

|

Information and Communications Service | 2,984 | 3,147 | 3,145 | 2,829 | 3,681 | 3,640 | 3,425 | 3,735 | 4,012 | 4,122 |

|

|

Operating profit |

|

|

|

|

|

|

|

|

|

|

|

|

GLOBAL WiFi | 1,443 | 1,169 | 1,443 | 975 | 1,431 | 1,322 | 1,685 | 1,547 | 1,413 | 1,377 |

|

|

Information and Communications Service | 302 | 352 | 274 | 111 | 534 | 381 | 364 | 412 | 517 | 433 |

|

|

*Unit: million yen. Sales represents sales to external customers.

*Investment Bridge Co., Ltd. prepared this based on disclosed material.

GLOBAL WiFi Business

Sales and profit increased.

With regard to sales to inbound travelers, the company focused on accepting applications for “NINJA WiFi®,” a Japanese Wi-Fi rental for foreign visitors to Japan, and the SIM card sales via vending machines at airport counters. With regard to sales to outbound travelers, the demand for the “Unlimited data volume plan” remained strong, and average spending per customer remains high. For the Expo in Osaka, they set up two booths in the eastern and western gate plazas of the venue. To meet demand, they have developed an environment where customers can use Wi-Fi routers and mobile batteries easily in a cashless manner, so that guests from around the world can enjoy the Expo comfortably.

Information and Communications Service Business

Sales and profit increased.

As a result of actively recruiting mid-career workers and brushed up their marketing capability, sales of mobile communication equipment were healthy. They promoted the sale of recurring-revenue services, to maximize the lifetime value of customers by upselling or cross-selling services, reducing long-term cancellation rates, and offering recurring services.

Glamping and Tourism Business

Sales and profit increased.

In the Glamping Business, “VISION GLAMPING Resort & Spa Yamanaka Ko” and “VISION GLAMPING Resort & Spa Koshikano Onsen” performed well. They also started the construction of “VISION GLAMPING Resort & Spa Awajishima” with the aim of opening it in early 2027.

In the Tourism Business, they concentrated on the sophistication of the destination management company (DMC) model, which not merely makes arrangements, but also conveys the attractive features of each region through experiences and promote the effective use of sightseeing resources, in order to meet the rapidly growing demand from foreign visitors to Japan.

(Produced by Investment Bridge based on the brief report of financial results)

2-3 Financial Condition

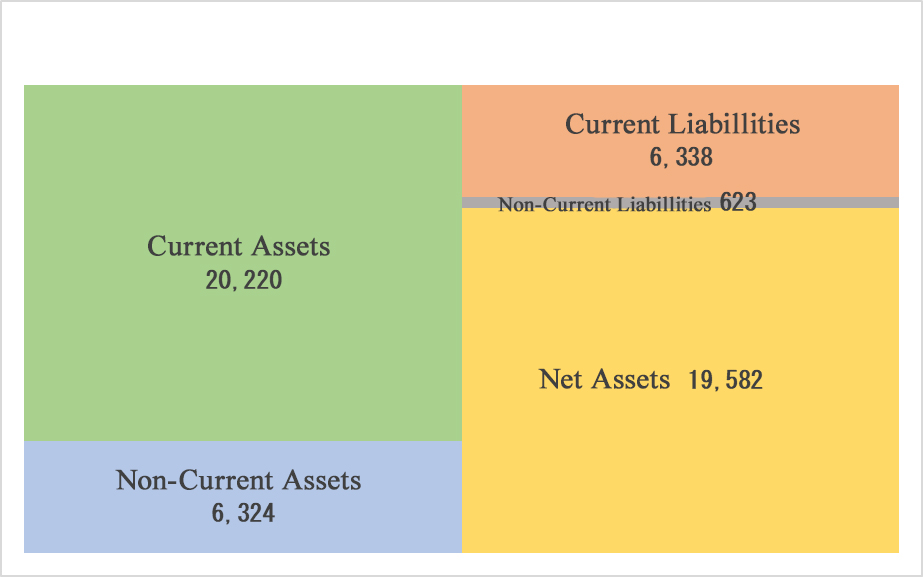

◎ Financial Condition

| Dec. 2024 | Jun. 2025 | Increase/ decrease |

| Dec. 2024 | Jun. 2025 | Increase/ decrease |

Current assets | 19,232 | 20,220 | +987 | Current liabilities | 6,687 | 6,338 | -349 |

Cash and deposits | 11,883 | 11,476 | -406 | Trade payables | 1,462 | 1,562 | +100 |

Trade receivables | 6,187 | 7,041 | +853 | Noncurrent liabilities | 683 | 623 | -60 |

Non-current assets | 6,029 | 6,324 | +295 | Total liabilities | 7,370 | 6,961 | -409 |

Property, plant and equipment | 3,558 | 3,758 | +200 | Net assets | 17,890 | 19,582 | +1,692 |

Intangible fixed assets | 1,008 | 990 | -18 | Retained earnings | 14,145 | 15,405 | +1,260 |

Investments and other | 1,462 | 1,575 | +113 | Total liabilities Equity | 25,261 | 26,544 | +1,282 |

Total assets | 25,261 | 26,544 | +1,282 | Total long- and short-term debt | 599 | 534 | -65 |

*Unit: million yen

*Investment Bridge Co., Ltd. prepared this based on disclosed material.

Total assets increased 1,282 million yen from the end of the previous fiscal year to 26,544 million yen, due to the increase in accounts receivable.

Total liabilities decreased 409 million yen from the end of the previous fiscal year to 6,961 million yen, due to the decrease in the reserve for shareholder benefits, etc.

Net assets increased 1,692 million yen from the end of the previous fiscal year to 19,582 million yen due to the increases in retained earnings.

Equity ratio increased by 3.1 points from the end of the previous fiscal year to 72.2%.

3. Fiscal Year Ending December 2025 Earnings Forecasts

3-1 Full-year Earnings Forecasts

| FY 12/24 | Ratio to sales | FY 12/25 (forecast) | Ratio to sales | YoY |

Sales | 35,528 | 100.0% | 40,002 | 100.0% | +12.6% |

Gross Profit | 20,570 | 57.9% | 23,200 | 58.0% | +12.8% |

SG&A | 15,205 | 42.8% | 16,761 | 41.9% | +10.2% |

Operating income | 5,365 | 15.1% | 6,439 | 16.1% | +20.0% |

Ordinary income | 5,422 | 15.3% | 6,445 | 16.1% | +18.9% |

Net income | 3,375 | 9.5% | 4,382 | 11.0% | +29.8% |

* Unit: million yen

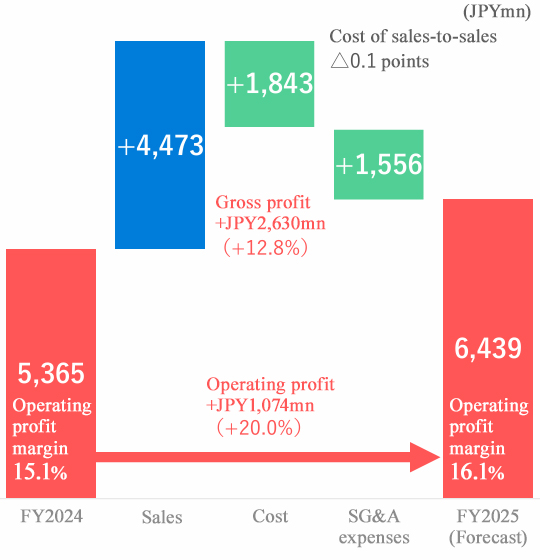

Sales and profit are expected to grow by double digits in the fiscal year ending December 2025.

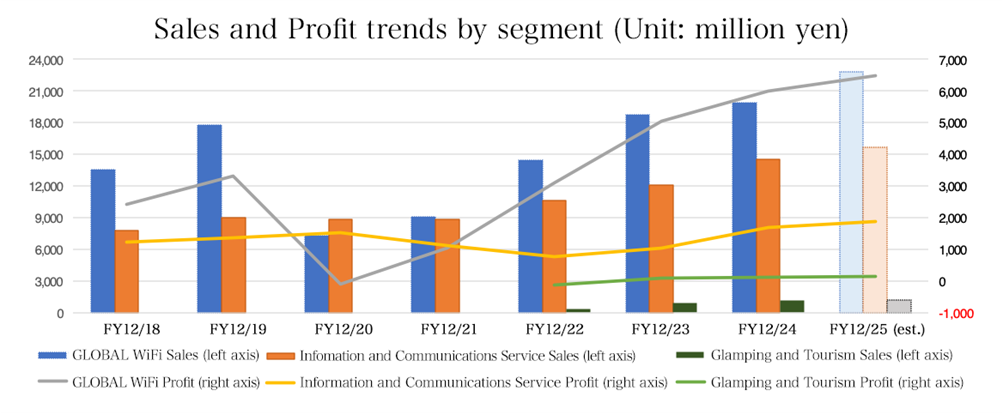

The full-year forecast was left unchanged, with sales for the fiscal year ending December 2025 projected to grow 12.6% year on year to 40,002 million yen and operating income is forecast to rise 20.0% year on year to 6,439 million yen. Both are expected to hit a record high in succession. In the GLOBAL WiFi Business, the number of overseas travelers per year is expected to recover to 81.1% of the number in 2019. It is assumed that 1 US dollar = 150 yen. They aim to improve their popularity by enhancing sales promotion. In addition, they will actively invest in World eSIM®. The operation in New York will be started. In the Information and Communications Service Business, they will maximize opportunities for cross-selling products to startup firms and venture companies through strategic data-driven sales. They will establish a stable revenue base based on recurring-revenue products. They will strengthen the support for BPO. In addition, they plan to recruit 40 people. By hiring mid-career workers actively, they plan to enhance their marketing capability.

Sales and profit are expected to grow year on year in all of the GLOBAL WiFi Business, the Information and Communications Service Business, and the Glamping and Tourism Business.

They plan to pay a year-end dividend of 25.00 yen/share, as initially planned. They plan to pay 45.00 yen/share per year, up 18.00 yen/share from the previous fiscal year. The expected payout ratio is 50.0%.

(Produced by Investment Bridge based on the brief report of financial results)

3-2 Forecast by Segment

| FY 12/24 | Composition Ratio・Profit Ratio | FY 12/25 (forecast) | Composition Ratio・Profit Ratio | YoY |

GLOBAL WiFi Business | 19,875 | 55.9% | 22,778 | 56.9% | +14.6% |

Information and Communications Service Business | 14,465 | 40.8% | 15,623 | 39.1% | +7.8% |

Glamping and Tourism Business | 1,155 | 3.3% | 1,576 | 3.9% | +36.4% |

Others | 32 | 0.1% | 24 | 0.1% | -25.4% |

Consolidated net sales | 35,528 | 100.0% | 40,002 | 100.0% | +12.6% |

GLOBAL WiFi Business | 5,987 | 30.1% | 6,467 | 28.4% | +8.0% |

Information and Communications Service Business | 1,693 | 11.7% | 1,862 | 11.9% | +10.0% |

Glamping and Tourism Business | 119 | 10.4% | 150 | 9.6% | +25.8% |

Others | -202 | - | -80 | - | - |

Adjustments | -2,232 | - | -1,961 | - | - |

Consolidated operating income | 5,365 | 15.1% | 6,439 | 16.1% | +20.0% |

* Unit: million yen

*Sales include the sales or transfer between segments.

(Produced by Investment Bridge based on the brief report of financial results)

Factors in increasing/decreasing forecast operating income

Operating profit margin 16.1% (Approx. +1.0% points YoY) | Assumption Operating income is forecast while taking into account active investment. GLOBAL WiFi Business ・Assumed exchange rate: 1 US dollar = 150 yen ・Recovery rate of overseas travel: 81.1% of the number of transactions of the company in 2019 ・Improvement in recognition level through the enhancement of promotion ・Invest in World eSIM®. ・New York subsidiary begins operation. Information and Communications Service Business ・Maximize cross-selling opportunities ・Build a stable revenue base through recurring-revenue services. ・Strengthen BPO support. ・Strengthen sales capability by actively promoting mid-career recruitment. Expected number of recruits: 40 people Other than the assumption Maximization of business synergy through active M&A |

|

(From the reference material of the Company)

Initiatives for reducing costs

They will make efforts to streamline business operations with AI and RPA. They plan to accelerate digital transformation (DX) and improve productivity. They aim to improve productivity, quality, and customers’ experiences, reduce human resources and personnel costs, support decision making, and curtail overtime working hours.

Merits of utilization of AI and RPA

☆Automation of time-consuming routine work

☆Realization of processes for operation 24 hours a day, 365 days a year

☆Support for decision making through AI-based data analysis

☆Visualization and equalization of their organization

☆Creation of new business models and services

The information system section identifies back-office issues, produces robots, and engages in development while utilizing AI. They support training so that employees can produce simple robots and AI.

In the back office section, employees acquire skills to utilize RPA and generative AI, and produce and utilize robots by themselves. In addition, they enhance the awareness of improvement in business operations with AI, etc. and actively automate systems, to improve the efficiency of business operations.

4. Details of Growth Initiatives

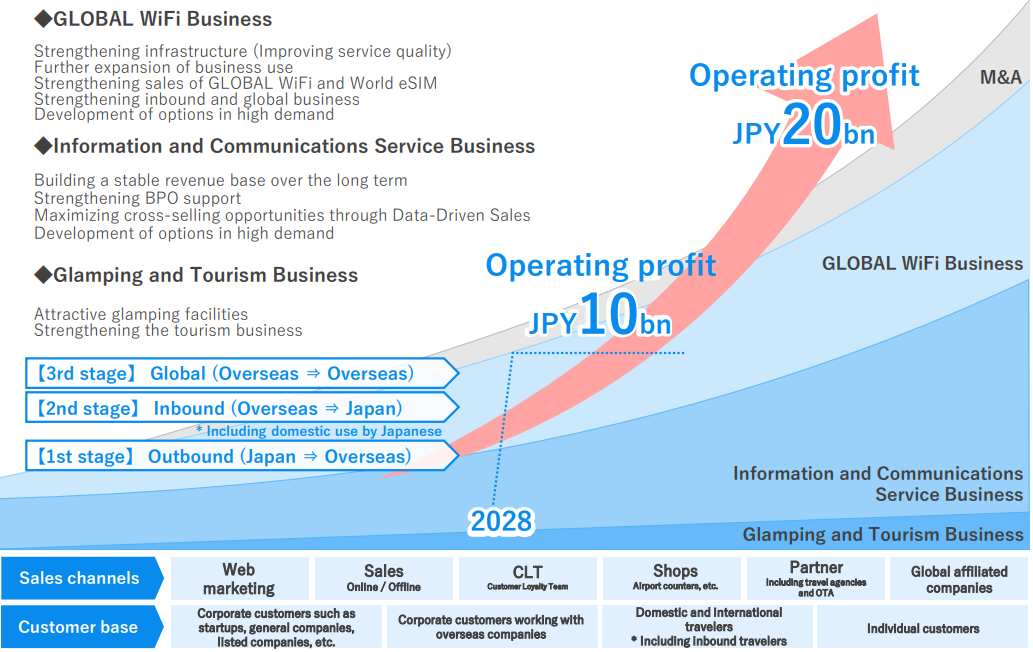

4-1 Business Strategy (2025-2028)

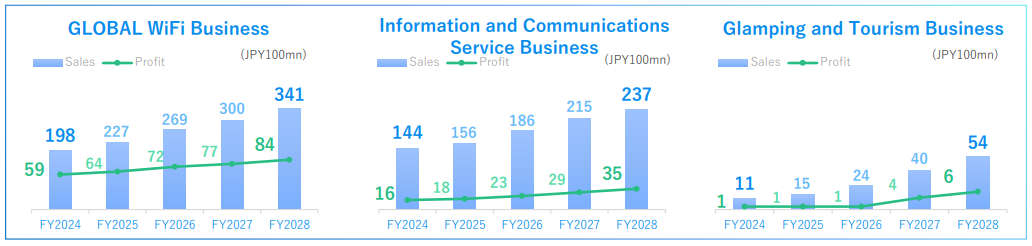

Numerical managerial goals

They aim to achieve sales of 63.4 billion yen and an operating income of 10 billion yen in FY 12/28.

| FY 12/24 | FY 12/25 | FY 12/26 | FY 12/27 | FY 12/28 |

Sales | 35,528 | 40,002 | 48,000 | 55,600 | 63,400 |

Operating income | 5,365 | 6,439 | 7,500 | 8,700 | 10,000 |

Operating income margin | 15.1% | 16.1% | 15.7% | 15.7% | 15.9% |

Net income | 3,375 | 4,382 | 5,100 | 5,900 | 6,800 |

ROE | 21.2% | 23.3% | 23.8% | More than 20% | More than 20% |

Dividend payout ratio | 39.1% | 50% | 50% | Considering | Considering |

While improving their earning capacity, they will conduct capital cost-conscious business administration. They aim to keep ROE 20% or higher and secure a return exceeding capital cost in a continuous manner.

Performance plan in each segment

By promoting strategic data-driven sales, they aim to streamline the marketing activities of all businesses and maximize their outcomes. They aim to actualize sustainable growth by cementing the relationships with existing clients, increasing new clients, and expanding recurring revenue.

(From the reference material of the Company)

4-2 Envisioned Medium-term Growth

An operating income of 10 billion yen in the fiscal year ending December 2028 is a mere milestone. They aim to achieve further growth by conducting M&A actively while growing their existing business.

(From the reference material of the Company)

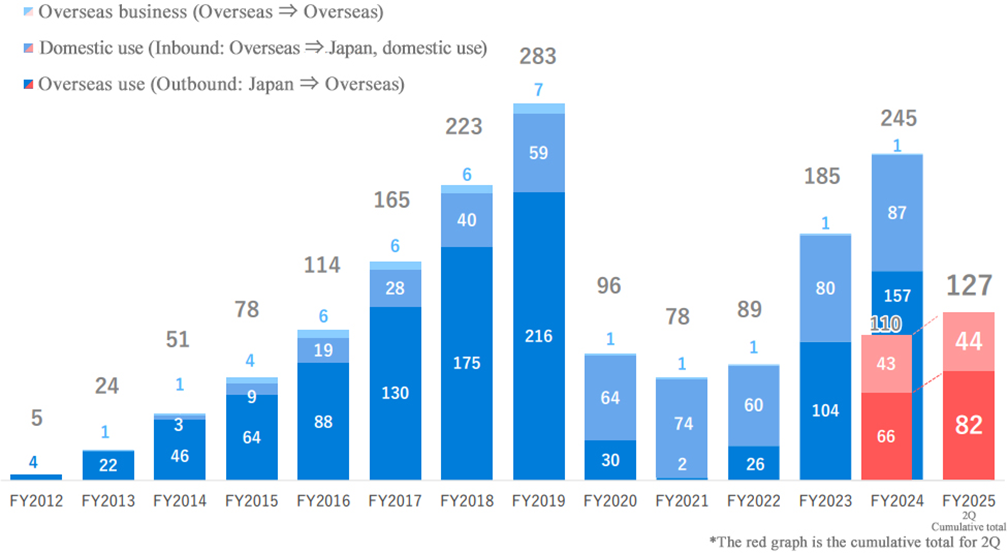

In order to accelerate the third-stage business targeted at travelers from a foreign country to another foreign country shown in the figure, they have established a subsidiary in New York, the U.S. They started marketing in March 2025. The market is huge, so their future developments are noteworthy.

4-3 GLOBAL WiFi Business

They can meet various needs for inbound, outbound, and domestic travelers.

(From the reference material of the Company)

Corporate contracts increased steadily.

A steady increase has continued even amid the COVID-19 pandemic.

(From the reference material of the Company)

Variation in the number of transactions for use

The number of users in Japan in 2024 exceeded that in 2019 significantly, and that in 2025, too, is expected to exceed that in 2019. It can be said that the overall number of users is transitioning from the “recovery” phase to the “growth” phase.

Number of annual usage (10K cases)

(From the reference material of the Company)

4-4 Information and Communications Service Business

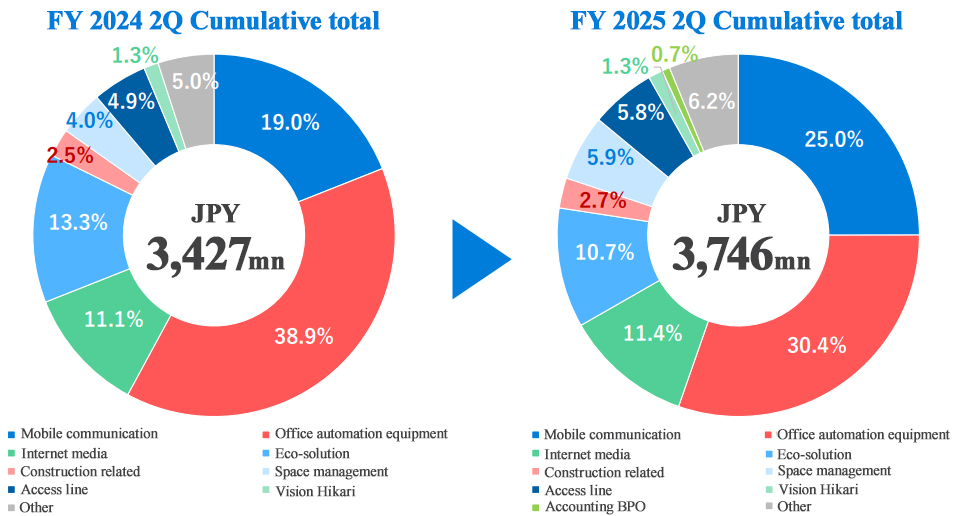

Gross profit composition

Taking advantage of multiple businesses (products and services) and sales channels, they flexibly coped with the changes in the external environment, so gross profit was healthy.

In particular, mobile telecommunication devices sold well.

* The figures are different from those of the segment results because they are monthly changes in profit and loss which do not include closing.

(From the reference material of the Company)

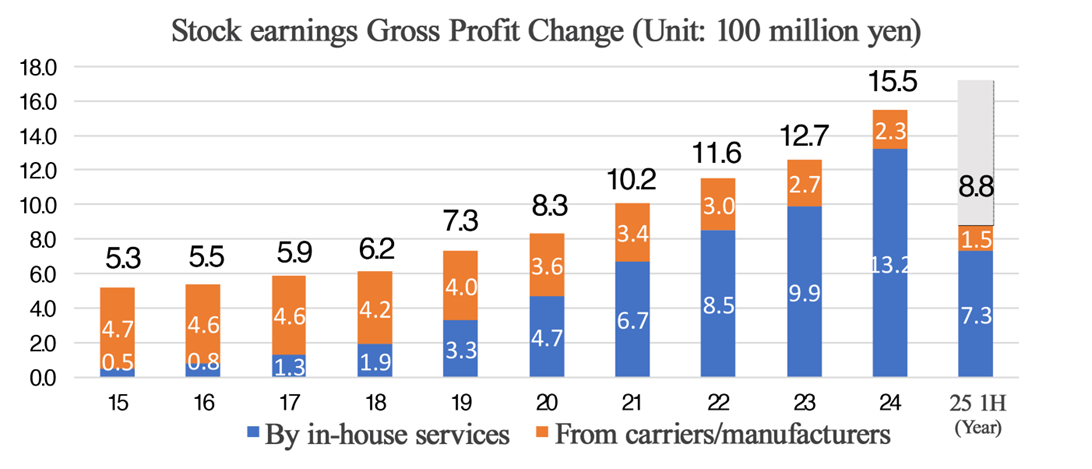

Recurring revenues

Variation in gross profit

The rate of progress toward the forecast for 2025 (1.63 billion yen) is 54.0%.

Strengthen the recurring revenue, which will provide a stable revenue base over the long term.

Strengthen acquisition of in-house services from the fiscal year ended December 2019.

Reached 1 billion yen in the fiscal year ended December 2021.

Launched the service Vision Hikari in September 2023.

(Investment Bridge Co., Ltd. prepared this based on disclosed material.)

The Company’s own services-Provision of products and services to meet the needs of customers and the times

The company was certified as a “DX-certified business operator” in accordance with the DX certification system, which was established by the Ministry of Economy, Trade and Industry.

Amid the novel COVID-19 pandemic, the reform of workstyles was promoted.

By accurately grasping the needs of customers, markets, and the times, they attracted new customers and conducted upselling and cross-selling according to the growth stage of each enterprise, increasing recurring revenue and growing the business.

(From the reference material of the Company)

Sales of the “VWS series” are strong

The Company is developing and operating services used by the company to users (DX promotion).

The Company will provide necessary functions in the cloud as needed on a monthly basis. The sales of network-connected cameras, which can be utilized for preventing crimes, were healthy.

4-5 Glamping and Tourism Business

VISION GLAMPING Resort & Spa Koshikano Onsen | This is a glamping facility in Kagoshima Prefecture with all guest rooms having a private space and an open-air bath with fresh hot spring water for the first time in Japan. Guests can savor the good features of camping in the nature-rich environment of Kirishima, and also enjoy a comfortable space comparable to hotels. |

VISION GLAMPING Resort & Spa Yamanaka Ko | They provide extraordinary time with an accommodation facility beside the Lake Yamanaka, which is surrounded by the abundant nature, including Mount Fuji, which is a world heritage. It is a fully private glamping facility with all guest rooms equipped with an open-air bath, a sauna, etc. |

The grand opening of “VISION GLAMPING Resort & Spa Awajishima” is scheduled for early 2027.

5. Conclusions

In the interim period, sales and all kinds of profits hit a record high. This is not remarkable, but they are about to get on a growth track after the rapid recovery after the COVID-19 pandemic. In both the GLOBAL WiFi Business and the Information and Communications Service Business, recurring revenue grew significantly, and they have established a revenue base that is stable in the long term. For the GLOBAL WiFi Business, they have established a subsidiary in New York, accelerating global business expansion. The business made a small, cautious start, but it can be expected to grow steeply once it gets on track, we would like to pay attention to its developments. In every business, they launch new services and update existing services when necessary, enriching services for existing customers as well as increasing new customers. In the aspects of not only sales, but also costs, they have streamlined business operations with AI and robotic process automation (RPA) and carried out new investments, while securing a sufficient profit margin. This brings a sense of security.

Share price has increased, following the market trend, but the valuation of their stock seems to be low for their growth potential. In addition, they paid a dividend for the first time in the fiscal year ended December 2024, and they publicly announced a commitment to achieve a payout ratio of 50% by the fiscal year ending December 2026. Accordingly, it is noteworthy that a high return rate can be secured when profit grows.

<Reference 1: Sustainability ESG + SDGs>

We have established a Sustainability Committee to further strengthen our ESG and SDG initiatives.

Basic Sustainability Policy

At Vision Group, our management philosophy is “To Contribute to the Global Information and Communications Revolution.” Under this philosophy, we consider our efforts toward sustainability to be a critical management priority and conduct our business with a strong focus on sustainability. Specifically, we aim to contribute to the global environment and realize a sustainable society and economic growth. Through our business, we strive to embody the universal human ideal of “sustainable growth.”

Sustainability Committee

The Sustainability Committee was established in April 2024 to promote management from a sustainability perspective. The Sustainability Committee is responsible for formulating an overall plan for sustainability activities, designing and revising strategies, identifying key issues, and engaging in corporate activities to resolve environmental and social issues in accordance with the Committee’s regulations. We will contribute to the creation of a sustainable society while achieving sustainable growth and increasing corporate value over the medium to long term.

[1] Materiality (Fundamental Initiative)

(From the reference material of the Company)

The Company will promise sustainable growth to their stakeholders, engaging in various business activities, whilst working towards a sustainable global environment and society. As the most material issue, they set the slogan “symbiotic growth” and pursue it as the most important policy for all business activities.

-Social Demands-

Negative effects of business activities

must

Initiatives for realizing a decarbonized society, contributing to the prevention of global warming and environment protection (E)

(From the reference material of the Company)

Actions - Current Initiatives -

1.VWS Attendance Management / Legal Signature to be paperless contracts

2.Promotion of CO2 reduction through proposals to reduce electricity costs(LED, air conditioning, renewable energy)

3.CO2 reduction efforts using carbon offset products such as MFPs

4.Information disclosure through CDP and SBT certification

5.Installation of EV stations at glamping facilities

Actions - Future Initiatives -

1.Private power generators at glamping facilities (Solar energy, etc.)

2.Shifting from cans and bottles to “My Bottle” (Removal of vending machines)

3.In-house power generation and storage/development

Company allowing for diverse workstyles and working at ease for all employees (G)

Actions - Current Initiatives -

1.Establishment of rules for shorter and more flexible working hours

2.Proactive efforts to promote women in the workforce (Eruboshi Certification 2-star approval)

3.Active promotion of maternity leave and implementation of paternity leave

4.Establishment of the Career Design Office and career support for employees

Actions - Future Initiatives -

1.Establishment of employment support for families in need of nursing care, single-mother, and single-father families

2.Establishment of sales departments and products that enable women to play more active roles

3.Skill improvement by supporting the acquisition of qualifications

4.Introducing and operating a company-wide unified personnel evaluation system

-Social Expectations-

Positive effects of business activities

Should

Contribution to economic activities throughout local societies by creating employment (S)

(From the reference material of the Company)

Actions - Current Initiatives -

1.Regional recruitment being possible through telework

2.Reducing food waste at glamping business

3.Promoting local products and tourism resources through glamping business

4.Actively employing people with disabilities, both in the Tokyo metropolitan area and rural areas

Actions - Future Initiatives -

1.Expand local employment by introducing workcations and enforcing local hiring

2.Actively utilize local governments to attract new companies

3.Support the growth of local companies by strengthening cooperation and alliance

4.One-stop service to train local entrepreneurs

Contribution to society through the elimination of disparities in education and medical care for children who will lead our future, educational support and medical care support (S)

(From the reference material of the Company)

Actions - Current Initiatives -

1.Creating a stable working environment for parents by providing Vision Kids nursery school

2.Providing “GLOBAL WiFi®” to local governments (GIGA school program)

Promoting the establishment of online classes through rental services “GLOBAL WiFi®”

3.Supporting Japan Heart(Japan-originated medical NGO) with “GLOBAL WiFi®” devices and donating a portion of sales

4.Supporting the activities of the Peace Piece Project

Actions - Future Initiatives -

1.Support students and young people by expanding the free use of “GLOBAL WiFi®”

2.Operation/support of childcare and child welfare facilities

3.Operation of facilities for children with developmental disabilities, cooperation with local facilities

4.Support for customer-integrated NGOs

[2] ESG+SDGs

Consistent with the ideals to “provide the future of information and communication is for the future of all people,” the Company aims for continuous growth and improvement of corporate value through adherence to the areas of ESG (E=Environment, S=Society, G=Governance) in the management and business strategies. In addition, through solving social issues outlined by the SDGs (established by the United Nations), the Company will take the lead in contributing to the harmonious and sustainable development of society and the planet.

[3] Got “A” in MSCI ESG Rating

Got “A” in MSCI ESG rating as of July 2025 like in 2024.

Got “A” in MSCI ESG rating by MSCI (Morgan Stanley Capital International). In MSCI ESG rating, they analyze corporate initiatives related to ESG (Environment, Social, and Governance), and rate them with 7 ranks ranging from the highest “AAA” to the lowest “CCC.” The Company upheld the slogan “Vision of creating a future together with a diverse society as a member of the earth,” and will engage in many business activities.

[4] Selected as a “Supplier Engagement Leader” in CDP for the First Time

In the 2024 disclosure cycle, we were selected for the first time as a “Supplier Engagement Leader,” the highest rating in this category. This recognition is separate from the standard CDP score and is awarded only to a limited number of top-performing companies among all disclosing companies worldwide.

Additionally, in the “Climate Change Score 2024” of CDP, we were rated at the Management Level with a score of B. In this survey, compared to 2023, the following were evaluated: 1) Enhanced information disclosure: Improvement in the quality and quantity of information disclosure, including provision of detailed data on greenhouse gas emissions and clarification of risk management strategies; 2) Improved internal processes: Improvement in internal processes, including identification and management of environmental risks and enhancement of governance structure; 3) Strengthened communication with stakeholders: Effective communication of environmental strategies and initiatives through dialogue with investors, business partners, employees, and other stakeholders.

[5] SBTi Certified

Vision Group certified by SBTi with GHG emission reduction targets as a company in compliance with international standards in December 2024

(From the reference material of the Company) | SBTi (Science Based Targets initiative) is an international initiative in which companies set greenhouse gas (GHG) emission reduction targets based on scientific evidence and certify whether they are consistent with the 1.5℃ and 2℃ targets of the Paris Agreement. SBTi accreditation allows companies to demonstrate that their climate change measures comply with international standards. |

|

The Vision Group upholds “Vision of creating a future together with a diverse society as a member of the earth” as a slogan for co-existence and co-growth, and engages in “Environmental Protection: Decarbonized Society and Environmental Protection Initiatives” as one of material issues. |

(From the reference material of the Company)

<Reference2: Regarding corporate governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 7 directors, including 4 outside ones |

Auditors | 4 auditors, including 3 outside ones |

All outside directors and outside corporate auditors are independent directors and corporate auditors.

◎ Corporate Governance Report: Updated on April 25, 2025

Basic policy

Our corporate group improves ourselves to change clients’ expectations into impression, pursues innovation without hesitation to actualize the ideal, always feels grateful about the support of many people (stakeholders), and operates its business activities with a humble mindset. Under this code of conduct, Vision observes laws, in-company regulations, and policies, carries out business in good faith, and strives to realize optimal corporate governance.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

[Principle 1-4 Cross-shareholdings]

Our basic policy is not to hold any strategic stock holdings in principle, except in cases where it is recognized that such holdings will contribute to medium to long term improvement in corporate value. In cases where listed shares are held as policy stockholdings, the Board of Directors will review all shares on a quarterly basis and sell shares of companies that the Board of Directors determines cannot be expected to increase corporate value over the medium to long term, taking into consideration factors such as share price and market trends. With respect to the exercise of voting rights, we will make decisions on a case-by-case basis, taking into consideration whether the exercise of voting rights will contribute to the enhancement of our corporate value over the medium to long term.

We do not disclose the results of verifying the purpose of holding shares held by policy holdings, as it is related to our business strategy and disclosure may damage the interests of the Company and its shareholders.

[Principle 2-4-1: Ensuring Diversity]

The Company actively employs a diverse range of personnel, regardless of educational background, work experience, gender, nationality, or disability. We believe that by utilizing individual personalities, we can create a diverse range of products and services that will contribute to the growth of the Company. We are also working to create a fulfilling working environment where all people working for our corporate group can grow.

As of the end of December 2024, 90.3% of managers of our corporate group were mid-career employees, 10.0% were female managers, and 6.7% were non-Japanese managers. Our goal is to increase the percentage of female managers to 12% or higher by 2026. Although we have not set numerical targets for mid-career recruits and non-Japanese nationals, we intend to maintain the current status for mid-career recruits and increase the number of non-Japanese nationals. For policies on the development of human resources and the internal environment, see the Securities Report (URL: https://www.vision-net.co.jp/ir/library/securities.html), “2. Business Situation; (2) Sustainability Policy and Initiatives,” and “Policy on the Promotion of Diversity” on our company’s website (URL: https://www.vision-net.co.jp/company/diversity.html).”

[Principle 3-1 Enrichment of information disclosure]

(1) Our management philosophy and strategy are disclosed on our website.

(2) The basic concepts and policies on corporate governance are disclosed in “I. 1. Basic Policy” and other sections of this report.

(3) The amount of remuneration for each director shall be determined within the remuneration limit approved at a General Meeting of Shareholders and shall be determined by the Board of Directors based on the content of the report after consulting with the Nomination and Renumeration Committee.

(4) The Company’s basic policy is that the Board of Directors shall be composed of the necessary and appropriate number of members to ensure constructive discussions while giving consideration to the balance of knowledge, experience, ability, etc. of each member.

When determining candidates for Directors, the Board of Directors consults with the Nomination and Remuneration Committee and appoints them based on the recommendations of the Committee. With regard to Audit and Supervisory Board Member candidates proposed by Directors, the Board of Directors also adopts a resolution on the Audit and Supervisory Board Member candidates after deliberation and agreement by the Board of Audit and Supervisory Board Members, of which more than half are Outside Audit and Supervisory Board Members, and submits the proposal to a General Meeting of Shareholders for consideration. In addition, the Company selects Outside Directors based on the requirements for Outside Directors under the Companies Act, as well as the qualifications for Independent Directors stipulated by the Tokyo Stock Exchange, while they are deemed not to pose a risk of conflicts of interest with general shareholders. In the case of dismissing a Director, if there is a violation of laws and regulations, the Articles of Incorporation, or if there are circumstances that make it difficult for the Director to perform his/her duties, the Board of Directors will make a decision based on the deliberations, advice, and recommendations of the Nomination and Remuneration Committee in order to enhance objectivity and transparency.

(5) The reasons for the appointment of each candidate for an Outside Director are disclosed in the Notice of the Annual General Meeting of Shareholders and this report.

[Supplementary Principle 3-1-3 Sustainability Initiatives]

<Sustainability Initiatives>

We, the Vision Group, have adopted “to contribute to the revolution of the information and communications industry in the world” as its management philosophy. Under this philosophy, we position sustainability initiatives as important management issues and conduct management that emphasizes sustainability.

Specifically, we aim to contribute to the global environment, realize a sustainable society and economic growth, and contribute to the universal human philosophy of “sustainable growth” through our business.

<Investment in human capital and intellectual property>

Based on the belief that “employees (human capital) are our most important asset and increasing employees’ engagement leads to increased loyalty to the company, which in turn drives the company’s sustainable growth,” we have established an education policy that supports each employee in achieving self-fulfilment.

In order to realize this policy, we provide training programs such as position-based training, task-based training, and e-learning courses to strengthen the literacy required for employees of listed companies and support the improvement of individual skills.

<Disclosure of impacts on climate change>

Our group has adopted “Co-creating the Future Vision with a Diverse Society as a Member of the Global Community” as our shared slogan, which is also a key guiding principle for our business activities.

Based on this slogan and in consideration of the Sustainable Development Goals (SDGs) adopted by the United Nations, we have identified material issues and formulated “fundamental challenges” and “value creation challenges,” which are priority issues for our company.

The material issues were identified and examined by project members selected from among our employees and discussed through exchanges of opinions with our stakeholders.

We will continue to review our material issues as needed, taking into account changes in social conditions and the management environment of our group, with deliberations conducted by the Sustainability Committee.

With regard to fundamental challenges, first of all, we are strengthening our efforts to realize a decarbonized society.

We have set greenhouse gas (GHG) emissions reduction targets and obtained Science Based Targets (SBT) certification. Since fiscal year 2023, we have been calculating our CO₂ emissions, conducting scenario analyses in line with the TCFD recommendations, and identifying climate-related risks and opportunities. Based on these findings, we are implementing concrete measures to reduce environmental impact.

[Principle 5-1 Policy for constructive dialogue with shareholders]

If shareholders or others want to have a dialogue with Vision, the Company will respond positively within a reasonable range, to contribute to the sustainable growth of the Company and the medium to long-term improvement in corporate value. As of now, Vision holds a briefing session four times per year, meetings with institutional investors domestic and foreign, briefing sessions for individual investors several times a year, and so on. The information on their results is properly shared through meetings of the Board of Directors, etc. In addition, Vision takes thoroughgoing measures for preventing the leakage of insider information.

[Measures to realize management conscious of cost of capital and share price] [English version available]

In the “Business Strategy (2025-2028) and Future Dividend Policy,” announced on February 13, 2025, our group set a target of achieving an ROE of 23.3% or higher for the fiscal year ending December 2025. We will continue to strengthen our strategies and promote initiatives to ensure that the value we deliver directly contributes to the realization of a sustainable society.

At the same time, we will strive to improve profitability and implement management practices that take into account the cost of capital, with the aim of continuously generating returns that exceed the cost of capital.

For further details, please refer to the information below.

https://www.vision-net.co.jp/en/ir_capital_management.html

This report is intended solely for information purposes and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |