Bridge Report:(9438)MTI Fiscal Year ended September 2022

President and CEO, Toshihiro Maeta | MTI Ltd. (9438) |

|

Company Information

Market | TSE Prime Market |

Industry | Information and communication |

President and CEO | Toshihiro Maeta |

HQ Address | 35th Floor, Tokyo Opera City Tower 3-20-2 Nishi-Shinjuku, Shinjuku-ku, Tokyo |

Year-end | End of September |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE Act. | Trading Unit | |

507 yen | 61,263,000 shares | 31,060 million yen | -5.9% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

16.00 yen | 3.2% | -10.99 yen | - | 256.61 yen | 2.0x |

* Share price as of closing on January 17. All figures are taken from the financial statements for FY 9/22

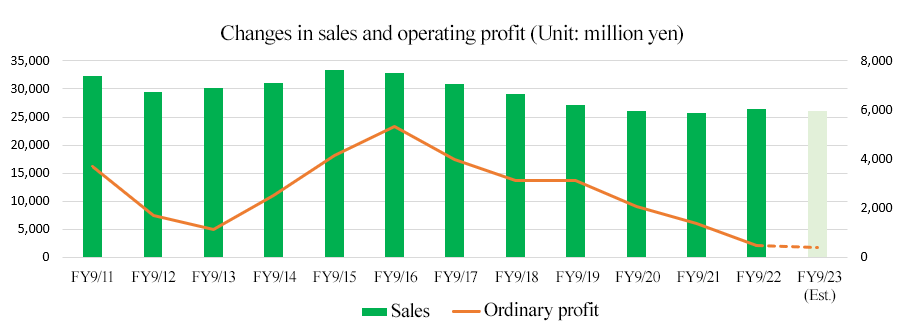

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

September 2019 Act. | 27,112 | 2,959 | 3,134 | 1,508 | 27.59 | 16.00 |

September 2020 Act. | 26,082 | 2,507 | 2,082 | 506 | 9.28 | 16.00 |

September 2021 Act. | 25,743 | 1,929 | 1,370 | -1,164 | -21.28 | 16.00 |

September 2022 Act. | 26,479 | 870 | 485 | -930 | -16.99 | 16.00 |

September 2023 Est. | 26,000 | 800 | 400 | -600 | -10.99 | 16.00 |

*Unit: million yen, yen. Estimates are those of the Company. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

This report includes the outline, business performance trend, etc. of MTI Ltd.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended September 2022 Earnings Results

3. Fiscal Year ending September 2023 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The MTI Group is an IT corporate group that is engaged in content business, healthcare business, and AI business. Under the vision: “Taking the world a step forward,” it is making efforts to actualize a better future society by remaining clients’ partner for leading a daily life and offering services that would make living more convenient and affluent. It reports the three segments: “Content Business,” “Healthcare Business,” and “Other Business.”From the term ending September 2023, the new segment “School DX Business” will be included.

- Its strengths include “Development speed that allows us to catch up with technological innovation speed,” “Advanced UI/UX design,” “A business model that emphasizes stock,” and “Marketing ability for communicating the merits of our services.”

- In the term ended September 2022, sales grew 2.9% year on year to 26,479 million yen. The enterprise DX business has grown. Operating income dropped 54.9% year on year to 870 million yen. While gross profit declined 0.3% year on year due to the sales growth of the other business, whose cost ratio is high, and the increase of less profitable projects, the company saw a 6.0% rise in SGA, including expenses for personnel, outsourcing, and depreciation, for enhancing development in the school DX business, etc. A net loss of 930 million yen was posted. An impairment loss of 897 million yen was posted.

- For the term ending September 2023, sales are projected to decline 1.8% year on year to 26 billion yen and operating income is forecast to drop 8.1% year on year to 800 million yen. The company is expected to meet the demand due to enterprises’ investment in IT, including strategic investment for DX. They aim to achieve the forecast sales, as sales dropped in the previous term, falling below the forecast. The company plans to pay an interim dividend of 8.00 yen/share and a term-end dividend of 8.00 yen/share for a total of 16.00 yen/share like in the previous term.

- After the term ended September 2022, the company considers that the visions of the three segments were clarified: “Minimization of factors in a decline in profit in the content business,” “Further expansion of the top line and achievement of profitability in the school DX business,” and “Steady growth of the pharmacy DX business.” This term, sales and profit are projected to decrease, and the company is forecast to post a net loss. However, if the school DX business moves into the black, it will improve profit by around 1 billion yen.

- We would like to keep an eye on the progress of the growth scenario including “the rapid growth through the school DX business in the short term and the full-scale expansion of revenues through the healthcare business in the medium/long term.”

1. Company Overview

【1-1 History】

In 1996, the founder Toshihiro Maeta (currently the company's president) foresaw the further possibilities of mobile content-related services and established MTI to create various entertainment, lifestyle information, and solution services the world needs.

In addition to mobile phone sales and content distribution, the company has diversified its spot-type business for Internet-related services such as Internet payment systems and website system management leading to the expansion of the business backed by the fast growth of the mobile content market. In 1999, its stock was registered over the counter, and in 2004 it was listed on the JASDAQ stock exchange.

After that, as main mobile communication devices shifted from mobile phones to smartphones, the company shifted to the content business for smartphones and further expanded earnings, and in 2015, the company was listed on the first section of the Tokyo Stock Exchange.

In 2016, the Ministry of Internal Affairs and Communications launched a plan to abolish 0-yen devices (a system that offsets the price of phones with campaigns and benefits). Thus, the total number of paying members continues to decline*. The company is harnessing its strengths in UI/UX and marketing it has acquired through many years in the content business to focus on expanding the healthcare business, which has great potential for future growth.

In 2022, it got listed on the Prime Market of the Tokyo Stock Exchange through market restructuring.

*For the company, mobile phone shops were the center of attraction for paying members. The company provided mobile shops with the funds for the discount amount associated with the purchase of content when changing models as a sales incentive. The content business grew significantly with the spread of smartphones, but the abolishing of 0-yen devices in 2016 led to a significant decrease in the number of members.

【1-2 Philosophy】

As the world changes day by day, the MTI Group believes that it is important to create and deliver the services that are required at the time all over the world in order to realize a society where customers can live more freely and in their own way.

With a vision of "Taking the world a step forward," the company will continue to be a partner that accompanies its customers in their daily lives, and it will work to realize a better future society by providing services that make their lives more convenient and richer.

In the healthcare business, on which the company is currently focusing, MTI aims to improve people's QOL and reduce medical expenses by maintaining health and preventing illness based on data analysis.

【1-3 Business description】

The company has 28 consolidated subsidiaries, and eight affiliates, for a total of 36 companies that operate the content, healthcare, and AI businesses.

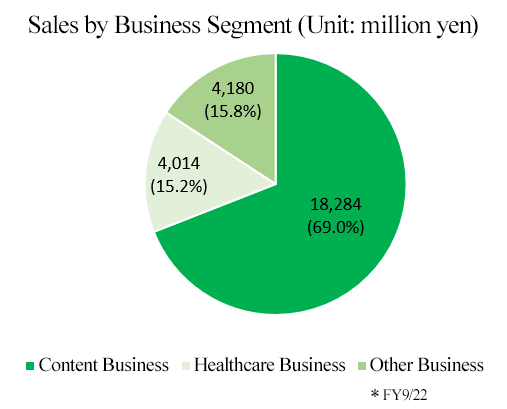

There are three reportable segments: the content business, the healthcare business, and other business.

(1) Content Business

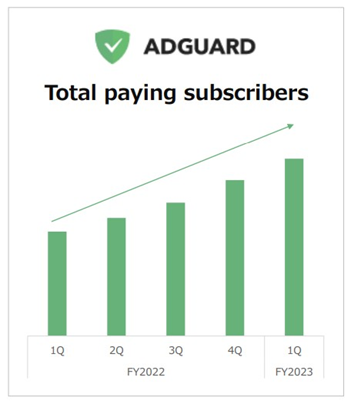

The content business provides end users with mobile content services mainly for smartphones. These services include entertainment content, such as videos, music, books, and comics centering on music.jp, weather and map road information services, and the security-related application AdGuard.

The company is also developing a B2B original comic business that provides original comics to comic distribution companies.

It has been the company's original business since its founding and still accounts for 70% of sales, but as mentioned in the history section, the number of paying members continues to decline. The number of paying members at the end of September 2022 was 3.2 million, down 320,000 from the end of the previous term.

Currently, the rate of decline is shrinking, and the company plans to reduce the decrease further and slow down its rate while prioritizing securing profit by concentrating on content with high demand.

◎ Main businesses and services

1) The security-related application AdGuard

AdGuard is a mobile security-related application featuring four functions: ad blocking, tracking blocking, threat blocking, and parental control function (child protection function).

The number of paid members as of the end of September 2022 is 440,000. The number of paying members is steadily increasing, and further expansion is expected because the application is highly recognized for enabling one account to be used on multiple devices.

(Source: the company's documents)

2) Original manga business

Under a marketing strategy aimed at expanding sales, the company's staff plan and build stories, which are then turned into works by amateur and professional comics artists and offered to client publishers.

Currently, about 20 works have been published, and the business continues to grow steadily.

(2) Healthcare Business

Aside from distributing information useful for healthcare, the healthcare business operates several services to promote "Taking the world a step forward," through which each user can utilize individual health data in various life aspects via smartphones in order to lead a more convenient and comfortable daily life.

In order to use the health data, the medical institutions and municipalities accumulated individually more effectively, the business is working on building a new system to link the data on the multiple different systems in each institution through the use of the group's healthcare services.

The number of paying members as of the end of September 2022 is 590,000.

◎ Main business and services

1) The Cloud-based medication history service for dispensing pharmacies "CARADA electronic medication history Solamichi"

Dispensing pharmacies are increasingly important in improving regional medical care, as evidenced by the government's efforts to promote the spread of family pharmacies.

On the other hand, dispensing pharmacies require diverse and complex operations to provide users with safety, security, trust, and convenience. Therefore, the company wants to solve problems such as "I want to quickly write a complete medication history," "I want to add up things without leaving anything out," and "I want to strengthen interpersonal work."

The cloud-based medication history record "CARADA electronic medication history Solamichi" mainly provides the following functions to solve the above problems, improve the operational efficiency of dispensing pharmacies, and provide an environment in which patients can take medicine safely and securely.

☆ | Medication history | Medication history can be easily created by simply checking the boxes to shorten the writing time and improve quality. |

☆ | Medication administration follow-up | By recording the answers from patients in the medication history, follow-up of the period of administration is conducted to support communication with the patients. |

☆ | Prescription audit | An automatic check for drug interactions is performed. Audit items that are often overlooked can be checked immediately to ensure safer medical treatment |

☆ | Operational analysis | In addition to aggregating the operating status of each store in real time, it is also possible to check whether there is an unrecorded item within the medication history. |

☆ | Home visit | Compilation of necessary documents for work from home |

☆ | Patient information management | Support for the creation of patient information without excess or deficiency through thorough information management for each patient |

(Based on the company's website)

In the future, the company will also promote the development of inventory management and receipt computers* and support the DX of pharmacies, which reforms all pharmacy operations with ICT.

*Receipt computer

It is a computer for creating receipts (medical fee statements). It can improve efficiency by linking data for issuance at medical institutions and collection at pharmacies instead of using paper.

◎ Features

Even if you are not good at operating a computer, you can intuitively use it without looking at the manual as it has easy-to-watch screen and simple operability. Anyone can use it without stress as it displays only the minimum necessary menus and buttons.

It not only creates the medication history quicker than by handwriting, but also uniforms the contents of the medication history in a way that does not rely on the experience level of pharmacists.

The system leverages the advanced UI/UX design the company cultivated in the content business.

◎ Market development

As of the end of September 2022, 1,264 pharmacies have installed the system. Of the approximately 60,000 dispensing pharmacies across Japan, the company targets 10,000 small and medium-sized pharmacies (so-called pop-and-mom pharmacies), excluding major chains, and aims to reach 2,000 pharmacies by the end of September 2023.

In terms of sales, the company is developing customers using the dispensing pharmacy network owned by MEDIPAL HOLDINGS Corporation (TSE Prime, 7459), a wholesaler of ethical pharmaceuticals, with which it formed a capital and business alliance in 2016.

The on-premise systems of other companies in the same industry already have a share of the market. However, the company will focus on expanding the number of pharmacies that have installed this system, leveraging its strengths as a cloud system.

◎ Fee system

The required cost for a dispensing pharmacy is the initial cost only for the first month of introduction and the monthly fee every month.

Depending on the manufacturer, additional terminal costs may be required based on the number of terminals that use the electronic medication history system, but "CARADA electronic medication history" does not require additional terminal costs when using it on several terminals.

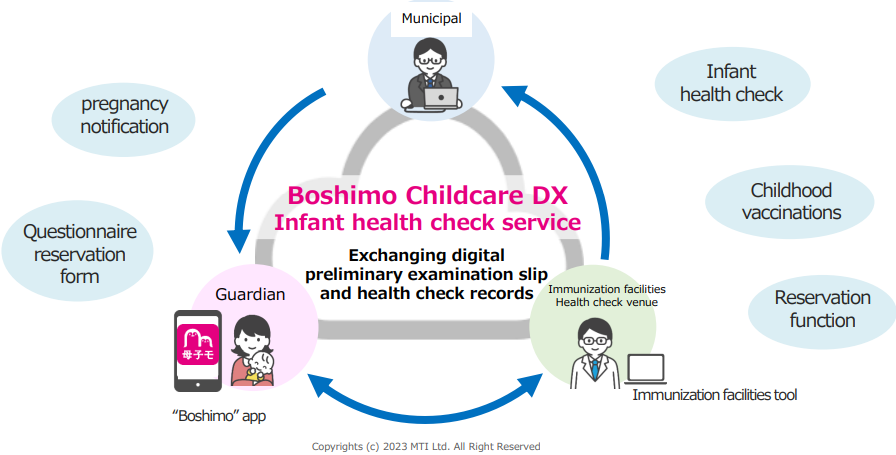

2) Boshimo, a mother and child health handbook app for municipalities

Boshimo is an electronic mother and child health handbook service that easily supports everything from records of the mother and child health handbook to local information using mobile phones.

It has various functions such as recording health data of pregnant and nursing mothers and children, displaying weight and growth graphs, managing vaccination schedules, giving advice on childbirth and childcare, childcare diaries with photos, functions for sharing information with families, and local childcare information. The service uses ICT to reduce the anxiety and burden of the child-rearing generation.

(Based on the company's website)

Customers (users) are municipalities, and 500 out of 1,741 municipalities nationwide have introduced this service.

A monthly fee of 50,000 yen is collected from municipalities, and app users can use the services for free.

The company set a low fee as it believed it was necessary to increase the number of users. However, since the number of municipalities using the service has exceeded 500, the company aims to expand profitability by providing "Childcare DX" in the future in order to increase sales.

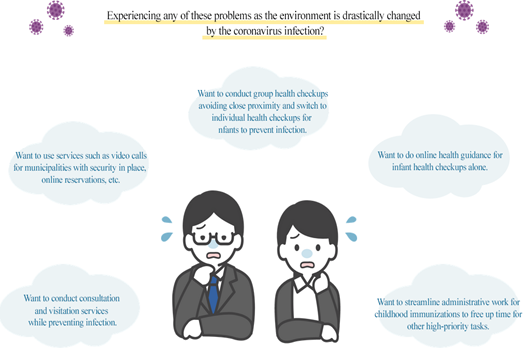

<Childcare DX>

The company aims to realize a safe, secure, and convenient child-rearing society by enhancing child-rearing support in the region through the spread of services that utilize digital technology and data. These services are called "Childcare DX."

The main service of "Childcare DX" is the mother and child health notebook application "Boshimo." In addition to the basic functions mentioned above, the company provides three services to support the use of the Internet by child-rearing businesses and solve various issues municipalities face.

(Based on the company's website)

Service | Overview | Provided functions | Target business |

Boshimo Childcare DX Consultation and home visit services | It provides efficient and high-quality consultations and home visits while avoiding contact. | Video calls, digitization of pre-questionnaires, online booking, etc. | Home visit guidance for pregnant and nursing mothers, home visits for newborn babies, home visits for infants, home visits for childcare support, home visits for premature babies, childcare counseling, infant counseling, pregnancy counseling (postpartum care), single parent counseling, etc. |

Boshimo Childcare DX Infant health checkup service | It switches to group or individual health checkups that offers a way to avoid crowds and reduce labor. | Digitalization of medical interviews, digitalization of medical examinations, online health guidance, etc. | Infant checkups |

Boshimo Childcare DX Pediatric vaccination Service | It provides efficient and safe vaccinations that reduce the time and cost for parents, municipalities, and medical institutions. | Digitization of vaccination procedures, etc. | Pediatric vaccinations |

In addition, the company is considering using the Internet in various child-rearing-related applications and maternal health checkups.

Rather than simply using an app, "Childcare DX" links the data of the parents, municipalities, and medical institutions not only to provide convenience to parents but also to effectively resolve the problems in conventional administrative processes at municipalities and medical institutions.

Regarding the fees for these services, the company set separate initial costs and monthly payments according to the number of births. Orders, including orders from ordinance-designated cities, are steadily increasing, and the company expects significant earnings growth in the future.

3) Others

The company offers a variety of services, including:

"Luna Luna," a health care service for women (free) | A health information service that supports women throughout their lives according to their life stages and concerns |

"CARADA" package for companies (paid) | A corporate service that supports corporate health management and employee health using smartphones |

“Luna Luna” online medical consultation (paid) | Online medical examination system for obstetricians and gynecologists in collaboration with "Luna Luna." |

“CARADA” online consultation (paid) | A system that can implement both online medical treatment and online medication guidance |

(3) Other business

For corporate customers, the company develops and operates systems such as AI businesses, DX support businesses for major corporations, solution businesses, and school DX businesses.

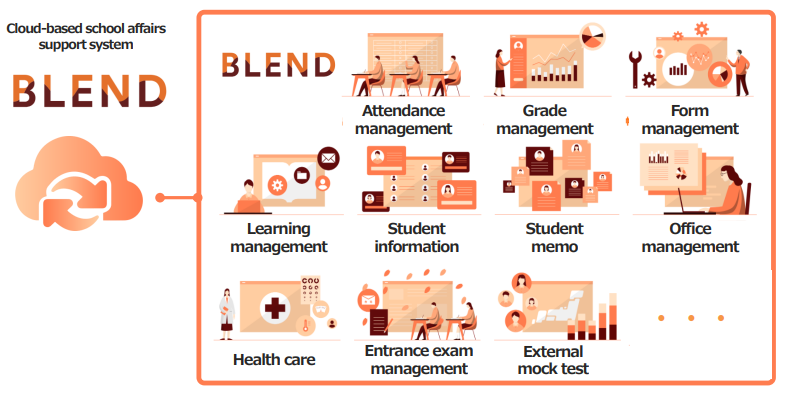

◎ School DX business: "BLEND," a full cloud-integrated school affairs support system

“BLEND” is a school affairs support system that streamlines the daily school affairs of teachers at nursery schools, kindergartens, elementary and middle schools, high schools, technical colleges, specialized training colleges, and universities. Motivation Works Co., Ltd., a subsidiary of MTI, provides a cloud-based school affairs support system mainly for private middle and high schools.

Due to the "GIGA School Concept" promoted by the Ministry of Education, Culture, Sports, Science, and Technology, many schools have developed an ICT environment, and the ICT environment for students is progressing. As for the work style reforms for teachers, many schools do not provide a remote work environment, and it is necessary to go to work even during the spread of infectious diseases. In addition, many school affairs, such as student attendance management, grade management, and form management, are processed on paper. Even school affairs that have been converted to ICT have usability issues due to network and security restrictions.

In addition, the average working hours of teachers and staff exceed 10 hours per day; thus, reducing schoolwork is an urgent issue.

"BLEND" is a service that solves these issues.

"BLEND" is equipped with all the functions necessary for school affairs, focusing on academic affairs such as attendance and grade registration and output of forms such as teaching records and survey reports.

Since the system links various data, it reflects it collectively, eliminating the need to fill in various forms and preventing repeating school work. Also, because it is a cloud-based system, it supports multiple OSs and multiple devices and can perform school duties without being limited to devices or locations; therefore, it supports the digital transformation of schools.

Motivation Works Co., Ltd. formed a business alliance with KDDI Corporation in June 2022. By collaborating with "KDDI Business Online Support" and "KDDI Business ID" provided by KDDI Corporation, the company can support both efficiency and security of school work for faculty and staff.

As of the end of September 2022, the total number of schools that have introduced the system reached 340, which is about three times the number at the end of the previous term.

Currently, the company is increasing users mainly among private high schools and aims to develop clients among public middle schools and high schools in the future. As for sales to municipalities, the company will also utilize its knowledge and know-how cultivated through Boshimo.

(Taken from the website of the company)

【1-4 Features, Strengths, and Competitive Advantages】

The following four items are the company’s strengths.

(1) Development speed that allows them to catch up with technological innovation speed

The speed of internet-related technological innovation is accelerating and complex data links between different systems are becoming possible through AI, clouds, API connections, and other technologies, but at the same time, the developers of those technologies have diverse needs for development technologies, including the indispensable building of solid security systems.

MTI hires excellent developers with advanced specialized skills both inside Japan and from overseas throughout the year, while also engaging in technological collaboration with various corporate partners so that MTI can generate new added value and continuously catch up with the speed of technological innovation in this field.

While growing with the content business, the company has polished its development capacity for multiple devices, including PCs, cellphones, smartphones, and tablets.

Cloud-unique development capacity and compatibility with all devices, including security check ones, are the company’s major fortes.

(2) Advanced UI/UX design

For a content service to be used by many end users, it is important to develop UI design with excellent navigability, including button placement on the screen and explanatory text that is easy to use and understand for as many as possible, regardless of age or gender and produce high-quality UX for end users.

MTI is designing advanced UI/UX based on the experiences of planning and developing content services of all kinds of genres, such as videos, music, comics, and other forms of entertainment, maps, weather information, and other types of lifestyle information, and healthcare information.

(3) A business model that emphasizes stock

Many businesses in the MTI Group have a stock-type business model, with monthly billing making up the majority of sales. The company is able to invest accumulated profit generated by the solid revenue base into new growth businesses and the development of services that use the latest technologies.

(4) Marketing ability for communicating the merits of our services

Also, in the internet industry to which the company belongs, it is important to enhance the marketing and business ability so that the company can properly communicate the merits of the services to end users and convince them to keep using them. It is for this reason that the company has promoted content service sales in the cellphone stores across Japan as well as conducted active business activities based on an effective marketing strategy for many years, despite being a content provider.

At present, the company is working with municipalities, medical institutions, companies, and others to introduce the services through business activities based on an effective marketing strategy, not just in the content business, but also in the healthcare business, DX business, AI business, and other businesses.

2. Fiscal Year ended September 2022 Earnings Results

【2-1 Business Results】

| FY 9/21 | Ratio to sales | FY 9/22 | Ratio to sales | YoY | Ratio to forecasts |

Sales | 25,743 | 100.0% | 26,479 | 100.0% | +2.9% | +2.6% |

Gross Profit | 18,741 | 72.8% | 18,691 | 70.6% | -0.3% | - |

SG&A | 16,811 | 65.3% | 17,820 | 67.3% | +6.0% | - |

Operating Income | 1,929 | 7.5% | 870 | 3.3% | -54.9% | +190.2% |

Ordinary Income | 1,370 | 5.3% | 485 | 1.8% | -64.5% | - |

Net Income | -1,164 | - | -930 | - | - | - |

*Unit: million yen. “Ratio to forecasts” means a difference from the earnings forecasts announced in Aug. 2022.

Sales grew slightly, and profit declined.

Sales grew 2.9% year on year to 26,479 million yen. The enterprise DX business has grown.

Operating income dropped 54.9% year on year to 870 million yen. While gross profit declined 0.3% year on year due to the sales growth of the other business, whose cost ratio is high, and the increase of less profitable projects, the company saw a 6.0% rise in SGA, including expenses for personnel, outsourcing, and depreciation, for enhancing development in the school DX business, etc. A net loss of 930 million yen was posted. An impairment loss of 897 million yen was posted.

In the fourth quarter (July to September), the company changed the consumption tax process for point-giving monthly content, so sales, operating income, and ordinary income exceeded the latest forecast (announced in August 2022).

【2-2 Trends by Segment】

| FY 9/21 | Composition ratio | FY 9/22 | Composition ratio | YoY |

Content Business | 18,674 | 72.5% | 18,284 | 69.1% | -2.1% |

Healthcare Business | 3,620 | 14.1% | 4,014 | 15.2% | +10.9% |

Other Business | 3,447 | 13.4% | 4,180 | 15.8% | +21.3% |

Total sales | 25,743 | 100.0% | 26,479 | 100.0% | +2.9% |

Content Business | 5,940 | 31.8% | 6,200 | 33.9% | +4.4% |

Healthcare Business | -1,267 | - | -1,108 | - | - |

Other Business | -105 | - | -1,667 | - | - |

Adjustments | -2,637 | - | -2,553 | - | - |

Total segment profit | 1,929 | 7.5% | 870 | 3.3% | -54.9% |

*Unit: million yen. The composition ratio of the segment profit is the ratio of profit to sales.

(1) Content business

Sales declined, but profit grew.

While paying members decreased from the previous term, the company corrected the consumption tax process for expired points in monthly point-giving content services, and recognized sales from expired points as non-taxable transactions. Then, sales increased by 717 million yen.

Profit rose, thanks to this sales growth, etc.

The number of paying members as of the end of the term stood at 3.2 million, down 320,000 from the end of the previous term. As cellphone carriers discontinued featurephone services, the number of paying members decreased significantly in a temporary manner, but excluding this factor, the number of paying members for the security-related app “AdGuard” has been increasing, so the decrease of the members is subsiding.

The content business is stably growing, thanks to hit serial original comics as the company kept releasing the constant number of comics.

(2) Healthcare business

Sales grew, and loss shrank.

The number of paying members decreased from the previous term, but sales increased thanks to the expansion of sales from installation of “Cloud Yakureki (Medication History).” However, an operating loss was posted due to the continuous cost for upfront investment.

The number of paying members as of the end of the term was 590,000, down 50,000 from the end of the previous term. On the other hand, the company concentrated on making “Cloud Yakureki” installed by more dispensaries as their willingness to adopt it is growing. As a result, the number of dispensaries with Cloud Yakureki as of the end of September 2022 stood at 1,264, up 499 from the end of the previous term, hitting a record high for the fourth quarter.

(3) Other business

Sales grew, but loss augmented.

Sales increased thanks to the growth of sales in the DX support business for leading corporations and the school DX business, but loss augmented as cost of sales rose due to the increase of less profitable projects in the DX support business for leading corporations, personnel expenses augmented due to the strengthening of systems in the school DX business, and outsourcing costs and depreciation increased through the enhancement of development.

【2-3 Financial Condition and Cash Flow】

◎Main BS

| End of September 2021 | End of September 2022 | Increase/ Decrease |

| End of September 2021 | End of September 2022 | Increase/ Decrease |

Current Assets | 21,262 | 18,778 | -2,484 | Current Liabilities | 6,655 | 6,386 | -269 |

Cash | 15,540 | 12,097 | -3,442 | Payables | 1,147 | 1,068 | -78 |

Receivables | 4,501 | 4,294 | -206 | Contract Liabilities | 0 | 2,356 | +2,356 |

Noncurrent Assets | 10,646 | 10,487 | -158 | Noncurrent Liabilities | 4,009 | 5,001 | +992 |

Intangible Assets | 3,711 | 3,790 | +78 | LT Borrowings | 2,429 | 3,178 | +748 |

Software | 1,791 | 2,058 | +267 | Total Liabilities | 10,665 | 11,387 | +722 |

Investment, Other Assets | 6,731 | 6,503 | -227 | Net Assets | 21,243 | 17,877 | -3,365 |

Investment Securities | 4,511 | 3,675 | -836 | Retained earnings | 8,665 | 5,224 | -3,440 |

Total Assets | 31,908 | 29,265 | -2,643 | Total Liabilities and Net Assets | 31,908 | 29,265 | -2,643 |

*Unit: million yen.

Total assets dropped 2,643 million yen from the end of the previous term to 29,265 million yen, due to the drop in cash & deposits, etc.

Total liabilities augmented 722 million yen to 11,387 million yen.

Net assets decreased 3,365 million yen to 17,877 million yen, due to the drop in retained earnings.

Capital-to-asset ratio decreased 6.5% from the end of the previous term to 48.1%.

◎Cash Flow

| FY 9/21 | FY 9/22 | Increase/Decrease |

Operating cash flow | 3,516 | -1,393 | -4,910 |

Investing cash flow | -1,996 | -2,460 | -464 |

Free cash flow | 1,520 | -3,854 | -5,374 |

Financing cash flow | 649 | 343 | -305 |

Cash and equivalent | 15,540 | 12,097 | -3,442 |

*Unit: million yen.

Operating CF and free CF turned negative, due to the posting of net loss before taxes and other adjustments, etc.

The cash position dropped.

【2-4 Topics】

(1)Favorable “Luna Luna Pill Service”

“Luna Luna Pill Service,” a healthcare service for women, is performing favorably.

Brand appeal and subscription strategy were fruitful in this service of regular delivery of a low-dose contraceptive pill following an online examination, and the number of subscription members significantly increased in a short time.

(2)Establishment of LIFEM

In July 2022, the three consolidated subsidiaries, CARADA medica Inc., Marubeni Corporation and MTI Ltd., established the company LIFEM, with a goal of improving health issues of working women and realizing a society where anybody can easily work.

As for investment ratio, CARADA medica Inc. accounts for 51%, Marubeni Corporation for 40% and MTI Ltd. for 9%.

(Background of the establishment)

According to a study by the Ministry of Economy, Trade and Industry, 94% of working women with symptoms related to menstruation and 95% of women who are aware of their menopause symptoms feel that their work performance is impacted by these symptoms. Furthermore, instances of infertility treatment show an increasing trend, with one in about fourteen newborns born in 2018 owing their birth to assisted reproductive technology.

On the other hand, few women take a low-dose pill, which is one of remedies for menstrual pain and the premenstrual syndrome (PMS), and their reluctance to visit a gynecologist is strong. Moreover, effects brought about by women’s health issues are diverse, such as giving up on career due to menopause symptoms and having difficulties in achieving a balance between infertility treatment and work, and the recognition that the whole society should work to resolve them has been spreading.

Amid such an environment, the three companies, CARADA medica, Marubeni and MTI, formed a business alliance in July 2021 and have been developing and providing a femtech service for corporations to support the improvement of health issues of working women. Expectations have been held for the service as an approach for enterprises to take the initiative to improve health issues of women as it has been selected in the FY 2021 “Subsidy Project for Demonstration Projects for Femtech and Similar Support Services” by the Ministry of Economy, Trade and Industry, for instance. The name of the service was changed to “Luna Luna Office” in March 2022 and it has been provided to enterprises.

The goal of this establishment of LIFEM lies in promoting the creation of a system for corporations to support the improvement of health issues of working women and becoming a leading company which will realize a society where anybody can easily work by utilizing the femtech expertise and know-how of each company and reinforcing the alliance.

(Future prospects)

In addition to providing service related to improving health issues of working women, they will also engage in enlightenment activities with the objective of elevating literacy regarding health issues of women in the whole society by sharing the reality of women who suffer from health issues, results of effectivity assessment following the introduction of “Luna Luna Office,” etc.

Moreover, they will develop and offer diverse solutions and services in order to widely support the improvement of health issues and promotion of understanding tailored for each life stage of women.

They will spread the recognition that “health issues of working women are issues that enterprises should tackle” and provide support for taking the first step for changing the society into a kind one, where enterprises accept and accommodate the health state and situation of individuals.

3. Fiscal Year ending September 2023 Earnings Forecasts

【3-1 Earnings Forecast】

| FY 9/22 | Ratio to Sales | FY 9/23 Est. | Ratio to Sales | YoY |

Sales | 26,479 | 100.0% | 26,000 | 100.0% | -1.8% |

Gross Profit | 18,691 | 70.6% | 18,400 | 70.8% | -1.6% |

SG&A | 17,820 | 67.3% | 17,600 | 67.7% | -1.2% |

Operating Income | 870 | 3.3% | 800 | 3.1% | -8.1% |

Ordinary Income | 485 | 1.8% | 400 | 1.5% | -17.7% |

Net Income | -930 | - | -600 | - | - |

* Unit: million yen. Forecasts are the figures announced by the company.

Sales and profit forecast to decline

Sales are projected to decline 1.8% year on year to 26 billion yen and operating income is forecast to drop 8.1% year on year to 800 million yen.

The company is expected to meet the demand due to enterprises’ investment in IT, including strategic investment for DX.

They aim to achieve the forecast sales, as sales dropped in the previous term, falling below the forecast.

The company plans to pay an interim dividend of 8.00 yen/share and a term-end dividend of 8.00 yen/share for a total of 16.00 yen/share like in the previous term.

【3-2 Activities in each business】

(1) Healthcare business

The company aims to grow sales by expanding the cloud medication history business further and implementing the platform strategy for the childcare DX “Boshimo.”

①Expansion of Cloud Yakureki (Medication History)

The company aims to increase the number of dispensaries with Cloud Yakureki to 2,000 by the end of this term (from 1,264 as of the end of the previous term).

To do so, the company will share more marketing information with the business partner Medipal Holdings, streamline business operations, and cement the cooperative relationships with Mitsubishi Electric IT Solutions Corp. and FUJIFILM Healthcare Systems Corporation, which are leading system companies for dispensaries, with which MTI formed alliances in 2021.

②Platform strategy for the childcare DX “Boshimo”

The company will conduct the platform business with the following three phases, starting with the mother and child health handbook app “Boshimo.”

Phase 1: The mother and child health handbook app “Boshimo”

Phase 2: Online consultation

Phase 3: Childcare DX service

◎Phase 1, 2

The number of municipalities that have adopted the mother and child health handbook app “Boshimo” as of the end of September 2022 stood at 500, up 86 from the end of the previous term, and the number of transactions for online consultation increased steadily to 65 through upselling.

This term, too, the company will grow this business, making “Boshimo” the standard for mother and child health handbook apps.

◎Phase 3

The municipalities with “Boshimo” promote the linkage of data among guardians, municipalities, and medical institutions, and conduct health checkups for infants and childhood vaccination, input interview booking sheets, and install the booking function, etc. seamlessly, to achieve “Childcare DX.”

The number of orders from government-designated cities, etc. is increasing steadily, so they consider that they will be able to meet demand without fail.

(Taken from the reference material of the company)

(2) School DX business

The company aims to grow sales by upgrading “BLEND,” a cloud-type school affairs supporting system, and increasing the number of schools that have adopted the system.

The number of schools that have adopted “BLEND,” a cloud-type school affairs supporting system, in the previous term was 340, up about 3 times from 114 in the term ended September 2021.

The collaboration with KDDI, with which the company formed an alliance in June 2022, has begun, so the company expects that the number of orders received will keep increasing steadily.

Sales are expected to grow steeply, thanks to the increase of schools that have adopted the company’s product, but the company is projected to post an operating loss this term like in the previous term and the term before that, because of the upfront investment for growth, including the development of new versions and the fortification of systems for dealing with the rapid growth of demand. The company plans to move into the black in the next term ending September 2024.

They aim to develop a standard platform for educational IT.

(3) Content business

The company aims to secure profit through the thriving original comic business and the growth of security-related apps.

(4) Other business (AI business and DX support business)

The company aims to increase sales by expanding the AI business and the DX support business.

【3-3 Envisioned growth】

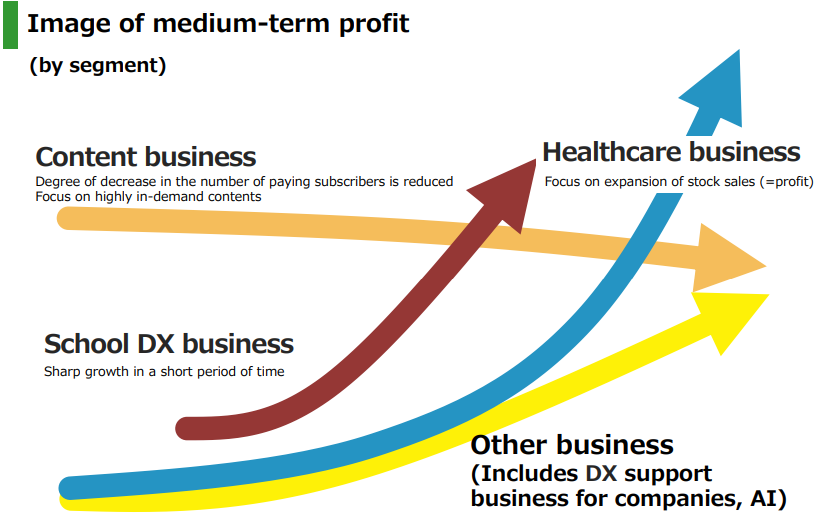

Considering the market environment and characteristics of each segment, they envision the following growth path.

☆ | In the content business, where the decrease of paying members is subsiding, the company will concentrate on highly demanded content, such as original comics, and prioritize the securing of profit. |

☆ | The school DX business, in which the number of schools that have adopted the company’s products is rapidly growing, will serve as a growth driver for the foreseeable future. |

☆ | For the healthcare business, which is positioned as the core business from the medium/long-term viewpoint, the company will concentrate on the expansion of “stock-type sales = profit” by taking advantage of its high profitability. |

☆ | In the other business, including the DX support for leading corporations and the AI business, the company will meet demand steadily by taking advantage of its forte. |

(Taken from the reference material of the company)

4. Conclusions

After the term ended September 2022, the company considers that the visions of the three segments were clarified: “Minimization of factors in a decline in profit in the content business,” “Further expansion of the top line and achievement of profitability in the school DX business,” and “Steady growth of the pharmacy DX business.”

This term, sales and profit are projected to decrease, and the company is forecast to post a net loss. However, if the school DX business moves into the black, it will improve profit by around 1 billion yen.

We would like to keep an eye on the progress of the growth scenario including “the rapid growth through the school DX business in the short term and the full-scale expansion of revenues through the healthcare business in the medium/long-term.”

<Reference: Regarding Corporate Governance>

◎Composition of the organizational structure, directors and auditors

Organizational structure | Company with audit and supervisory board |

Directors | 10 including 6 outside director |

Auditors | 4 including 4 outside auditors |

◎Corporate Governance Report

Last update date: December 27, 2022

<Basic policy>

The company regards the establishment of a transparent and sound management structure and a prompt and accurate decision-making system that responds to changes in the business environment as its important management tasks.

As part of the effort, the term of office for directors is set at one year, and each year, there is an opportunity for shareholders to vote for their confidence in the company, ensuring that management is conducted with a sense of tension. In addition, the company is promoting the strengthening and establishment of legal compliance.

For financial results and important management information, the company strives to enhance management transparency and build trust with the market, by disclosing information in a timely and appropriate manner, as well as by engaging in two-way communication with stakeholders, in accordance with its IR policy.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The information is based on the Corporate Governance Code revised in June 2021.

[Principle 1-4] (Strategically Held Shares)

The policy on strategically held shares and the criteria for existing voting rights thereof are described in “Basic Policy on Corporate Governance 1. Ensuring the Rights and Equality of Shareholders (6).”

The policy stipulates that, for the major strategic shareholdings, the performance of the investee companies, the objective of such shareholdings, the status of their achievement, etc. shall be reported to the Board of Directors on a regular basis, and that the company shall appropriately exercise its voting rights as a shareholder from the perspective of the sustainable growth and the medium/long-term corporate value of such companies and the company.

With regard to particular strategically held shares, the company specifically examines and scrutinizes the medium/long-term economic reasonableness, appropriateness of the purpose of the shareholding, and whether the benefits and risks associated with the shareholding are commensurate with the cost of capital. If the significance of the shareholding is determined to be not necessarily adequate, the company will consider establishing a process to reduce the number of such shares.

[Supplementary Principle 2-4-1] (Ensuring Diversity in Human Resources)

The company recognizes that respecting diversity in human resources engaged in the corporate group is essential for sustainable growth. Therefore, the company is working to improve the productivity of the entire corporate group by respecting diverse human resources and diverse values, regardless of gender, age, or nationality, and by creating an organization in which employees accept each other.

In addition, the company aims to create a workplace where all employees can work with peace of mind and where they are allowed to choose flexible work styles according to their own life stages and fully demonstrate their individual abilities.

With regard to the recruitment of diverse human resources, the company does not disclose specific numerical targets because of its flexibility in accordance with changes in the business environment. Nonetheless, the company mainly promotes the following initiatives.

・Promotion of women’s activities

The General Business Owner Action Plan under the Law for the Promotion of Women’s Activities includes the company’s goal of keeping a ratio of female employees in new hires at least 25%.

・Mid-career recruitment of potential managers

The company hires human resources throughout the year as appropriate, based on its business strategy and the status of the business. The company hires talent who are expected to perform well and play active roles after joining the company, and talent who can draw a career path to management and other positions.

・Diversity in recruitment

The company conducts recruitment regardless of race or nationality to develop global human resources, and people with disabilities as well.

The company provides a wide range of opportunities for such diverse human resources, and is committed to rewarding those who produce higher results and creating a comfortable working environment.

[Supplementary Principle 3-1-3] (Sustainability Initiatives, Investment in Human Assets, Intellectual Capital, etc.)

The company has formulated management strategies to achieve sustainable growth and to enhance corporate value over the medium/long-term, however, it has not announced its medium-term management plan, while it publishes its outlook for the next fiscal year. It is because the company’s business environment has been changing rapidly, which is making it difficult to foresee the future. Nevertheless, the company recognizes that disclosing more specific details of its management strategy and indicating its long-term direction are important tasks for enhancing dialogue with its shareholders. Therefore, the company will establish an internal system to enhance disclosure information that takes into account factors including investment in human assets and intellectual property, as well as sustainability, in the process of formulating future management strategies.

In addition, with regard to sustainability, the company does not expect climate change to have a material impact on its business, as the business is based on Internet technology that has no significant environmental impact, and thus, it has not implemented initiatives based on the TCFD or equivalent framework imposed only on companies listed in the Prime Market. However, guided by the vision of “Taking the world a step forward,” the company has been creating and providing a variety of technologies. Furthermore, the company believes that the use of its services by clients and end users in various industries related to climate change will promote various IT systems to address climate change in the future. Based on the above approach, the company continues promoting sustainability in line with the company’s vision.

Current sustainability initiatives are posted on the company’s website as indicated below.

The company’s sustainability:

https://www.mti.co.jp/eng/?page_id=3661

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Based on the basic approach stated in Section 1 above, the company has formulated the “Basic Policy on Corporate Governance” with the aim of realizing the management philosophy, achieving sustainable growth and enhancing its corporate value over the medium to long term, and constantly pursuing the best possible corporate governance and continuously working to improve it to earn the trust of its stakeholders including shareholders.

Basic Policy on Corporate Governance URL:

https://ir.mti.co.jp/wp-content/uploads/library/tse/2022/corporate20221227.pdf

[Principle 5-1] (Policy on Constructive Dialogue with Shareholders)

The company’s policy on the establishment of systems and initiatives to promote constructive dialogue with shareholders is described in “Basic Policy on Corporate Governance, 5. Dialogue with Shareholders,” as well as “III. Implementation Status of Measures Concerning Shareholders and Other Interested Parties, 2. Status of IR-Related Activities” of this report. Moreover, the company’s IR Policy is posted on its website (Investors Relations page).

IR Policy URL: https://ir.mti.co.jp/ir_policy/

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |

The back issues of the Bridge Report (MTI Ltd.: 9438) and the contents of the Bridge Salon (IR Seminar) can be found at :https://www.bridge-salon.jp/for more information.