Bridge Report:(9600)I-NET CORPFiscal year ended March 2021

President Mitsuru Sakai | I-NET CORP. (9600) |

|

Corporate Information

Exchange | TSE 1st Section |

Industry | Information and communications |

Representative Director, Executive President | Mitsuru Sakai |

Address | 23F, Mitsubishi Juko Yokohama Bldg., 3-3-1 Minatomirai, Nishi-Ku, Yokohama |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE (Actual) | Trading Unit | |

¥1,427 | 16,242,424 shares | ¥23,177 million | 9.5% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥47.00 | 3.3% | ¥100.15 | 14.2 x | ¥1,014.82 | 1.4 x |

*The share price is the closing price on June 1. Each value is taken from the brief report on results for the term ended Mar. 2021.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2018 (Actual) | 25,615 | 2,081 | 2,051 | 1,368 | 86.06 | 38.00 |

March 2019 (Actual) | 27,591 | 2,345 | 2,347 | 1,521 | 95.72 | 40.00 |

March 2020 (Actual) | 31,097 | 2,501 | 2,531 | 1,672 | 105.13 | 43.00 |

March 2021(Actual) | 30,016 | 2,155 | 2,279 | 1,494 | 93.62 | 46.00 |

March 2022(Estimate) | 32,500 | 2,330 | 2,330 | 1,600 | 100.15 | 47.00 |

*Unit: Million yen, yen. Net income is profit attributable to owners of the parent. Hereinafter the same applies.

This Bridge Report presents I-NET CORP’s overview of the financial results for the fiscal year ended March 2021 and earnings forecasts for the fiscal year ending March 2022.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2021 Earnings Results

3. Fiscal Year ending March 2022 Earnings Forecasts

4. Conclusions

<Reference1: Progress of the Mid-term Management Plan>

<Reference2: Regarding Corporate Governance>

Key Points

- Based on its own data center with Japan’s highest level of safety and management of system operations which has been nurtured for many years, I-NET CORP. offers optimal one-stop solutions to meet various needs from customers, including system planning, development, operation, and monitoring, as well as printing, enclosing and sealing, and advanced cloud computing. Its strengths are the great capability of operating business through vertical integration and horizontal expansion and the stable business model supported by a robust customer portfolio.

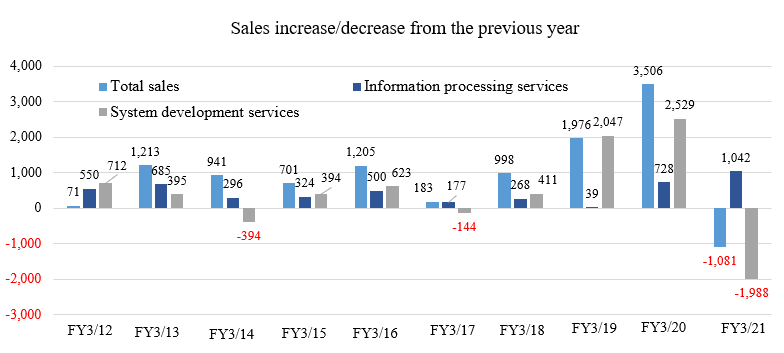

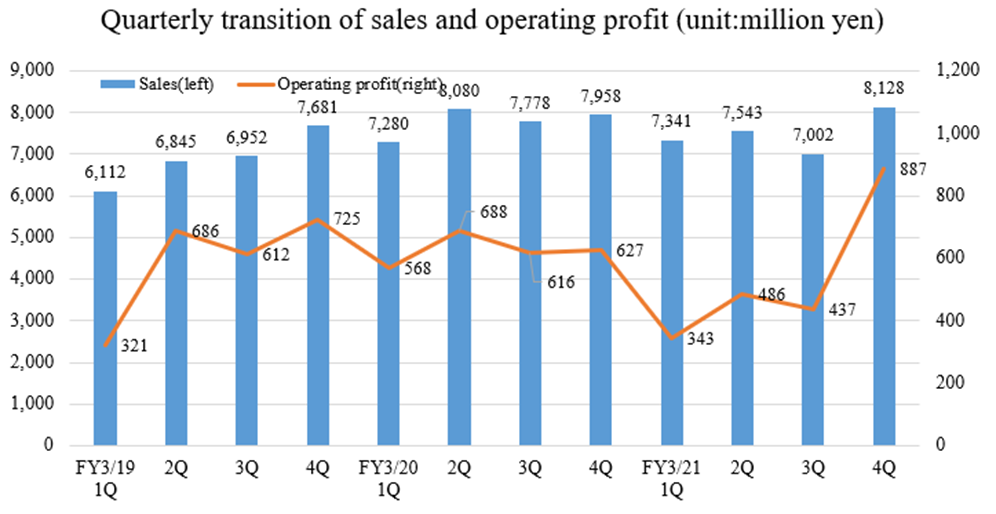

- For the term ended March 2021, net sales decreased 3.5% year on year to 30 billion yen. Although the sales of information processing services increased, the sales of system development services and system product sales services decreased. The gross profit for the information processing services was unchanged from the previous term, while that of the system development services declined. Profit margins also declined. Operating income fell 13.8% year on year to 2.1 billion yen as SG&A expenses increased 1.2% year on year. Sales and profits both exceeded the revised forecasts.

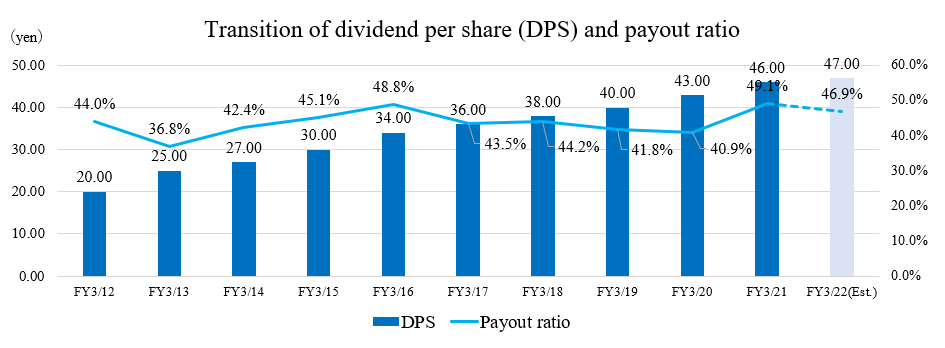

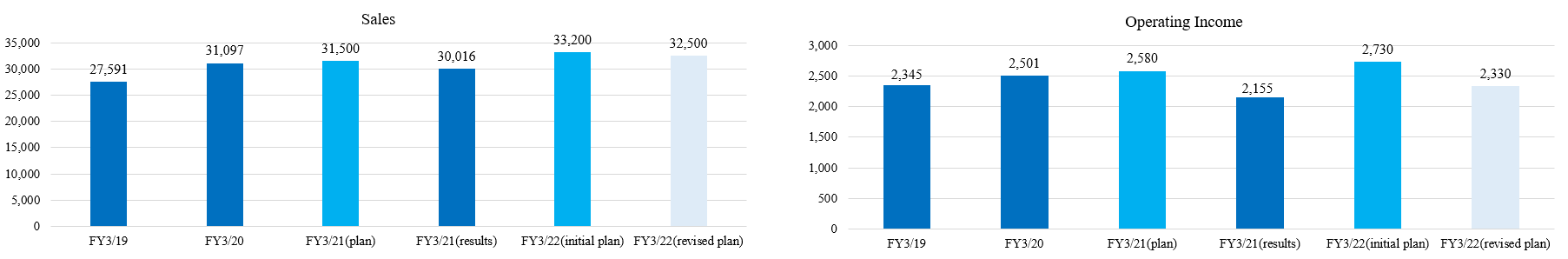

- For the term ending March 2022, the company expects net sales to increase 8.3% year on year to 32.5 billion yen, and operating income to grow 8.1% year on year to 2.3 billion yen. The company aims to return to its existing growth path by expanding data center service and cloud service that continue to be strong, and steadily responding to the system development projects that were suspended and postponed in the previous term. The company expects a two-digit increase in sales and profits (gross profit) with the system development services. The dividend is scheduled to be 47.00 yen/share, up 1 yen/share from the previous term’s dividend of 46.00 yen/share, consisting of an ordinary dividend of 44.00 yen/share and a commemorative dividend of 2.00 yen/share. Dividend is to be increased for the 10th consecutive year. The estimated payout rate is 46.9%.

- Regarding the ongoing medium-term management plan, both sales and profits achieved the estimates in the first year, but in the second year, which was the term ended March 2021, due to COVID-19, estimated sales and profits were not reached. There has been no change in the measures to be taken, but as a result of scrutiny of the business environment, the initial plan for the term ending March 2022, which is the plan’s final year, has been revised downward.

- Sales and profits declined, and the estimates for the term ending March 2022, which is the final year of the medium-term management plan, were revised downward. The measures to strategically undertake large-scale projects with low profit margins in the data center service and the cloud service to cover the decline in profits with system development services did not work well due to COVID-19. However, the data center service and cloud service, which the company regards as the pillars of growth, continued to grow, and it is true that the company was able to strengthen the growth base for the future even in the severe environment. Although it is difficult to hope for a sharp improvement in the environment this term, we would be watching with interest how much the company can add to the sales of 32.5 billion yen and operating income of 2.3 billion yen by taking advantage of its strengths in having a stable business model supported by a strong customer portfolio.

1. Company Overview

Based on its own data center with Japan’s highest level of safety and management of system operations which has been nurtured for many years, I-NET CORP. offers optimal one-stop solutions to meet various needs from customers, including system planning, development, operation, and monitoring, as well as printing, enclosing and sealing, and advanced cloud computing. Its strengths are the great capability of operating business through vertical integration and horizontal expansion and the stable business model supported by a robust customer portfolio.

【1-1 Corporate history】

Although private automobiles were distributed rapidly and the number of gas stations were expected to increase, the gas station managers were suffering from the fact that it was difficult to manage accounts receivable, sale, customers, etc. surely and efficiently at that time.

Considering that introducing a system which could solve those problems would bring a big business chance, Mr. Noriyoshi Ikeda from a foreign-affiliated oil company (currently, Founder Supreme Advisor of I-NET CORP.) established Fuji Consult Co., Ltd., the predecessor of I-NET CORP., in 1971, with the purpose of undertaking the counting at gas stations.

As Mr. Ikeda expected, the company was designated as a regional or nationwide calculation center first by Idemitsu Kosan and then by other oil wholesalers, including Showa Shell Sekiyu, Mobil, Kygnus Sekiyu, and Mitsui Oil, resulting in rapid business growth. In 1997, it was listed in the second section of Tokyo Stock Exchange.

Later, it expanded its business domains beyond the distribution of oil such as M&A, etc., and intensified its presence in its current main fields, including data centers, finance, manufacturing, retail, and distribution. In 2006, it was listed in the first section of Tokyo Stock Exchange.

The company is still cultivating new promising fields, including drones.

【1-2 Corporate philosophy】

As I-NET CORP. will commemorate the 50th anniversary of incorporation in 2021, it set “inet Way” as the corporate group’s ethos, considering that it is necessary for executives and employees to share common values as their standards when taking any action all together in order to grow further and become an enterprise that can grow sustainably.

“inet Way” consists of 4 pillars: “Corporate Philosophy,” “Corporate Vision,” “Management Policy,” and “Mid-term Management Plan.” It is based on “Charter of Corporate Code” corporations should follow and “Course of Action” which serves as the driving force for attaining “inet Way.”

(Taken from the reference material of the company) |

“inet Way” set a new management policy: “To become an excellent company that enables sustainable growth” to expand its business scale and develop a sturdy foundation for business growth.

It indicates the mindset: “The company and employees need to keep growing by changing themselves while seeing the changes of the times and trends.”

Corporate Philosophy | To create new systems and values using information technology and contribute to the realization of a prosperous, happy society. |

Corporate Vision | With "Create" "Challenge" "Trust" as our foundation, we aspire for the sustainable improvement of our corporate values and will grow as a company that contributes to society and our stakeholders.

integrated A company that understands the value of knowledge and leads an IT society

networking A company that strives to create a network connecting technology-to-technology, heart-to-heart(person-to-person), and individual-to-society.

energy An energetic company that takes on creativity and innovation for the realization of a sustainable society.

technology A company that works towards the realization of a prosperous and happy society through information technology. |

Management Policy | Becoming an excellent company that makes sustainable growth possible |

The mid-term management plan will be described later.

【1-3 Market environment】

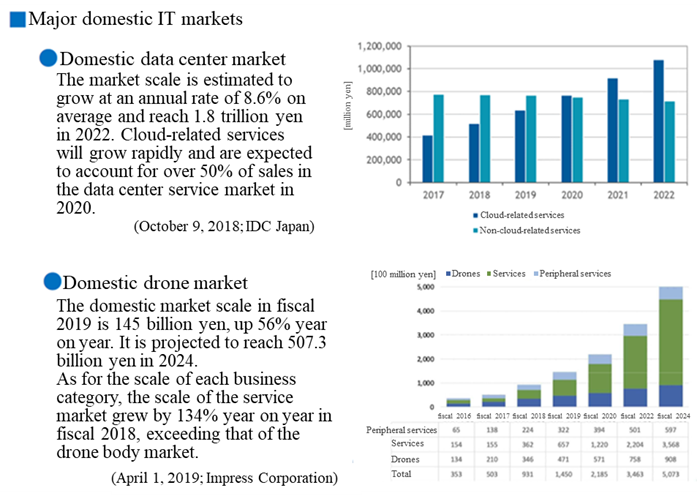

I-NET CORP. recognizes the industrial and business environments of its major domains and those the company will focus on as follows

(Taken from the reference material of the company) |

The market of data centers in which the company is competitive and the market of drones it focuses on are both expected to grow steadily.

Through the consolidation and reorganization of oil wholesalers, the number of them decreased from 15 in 1990 to 5. As a result, the number of domestic service stations has halved from the peak around 1990.

Amid this situation, the company acquired new customers and increased its market share based on its experiences and capabilities it has developed, and it cemented its No.1 position as competitors withdrew from their businesses.

There are many orders for the development of systems for interconnecting credit cards and sales data, etc., and it is unnecessary to conduct significant investment for increasing customers. This situation is favorable for the company.

Through the advent and spread of technologies and methods to increase business efficiency, such as cloud computing, AI, IoT, and RPA, the demand for investment in systems is growing in almost all fields in addition to petroleum-related ones, and the business environment surrounding the company is good.

【1-4 Business contents】

Based on its own data center with Japan’s highest level of safety and management of system operations which has been nurtured for many years, I-NET CORP. offers optimal one-stop solutions to meet various needs from customers, including system planning, development, operation, and monitoring, as well as printing, enclosing and sealing, and advanced cloud computing.

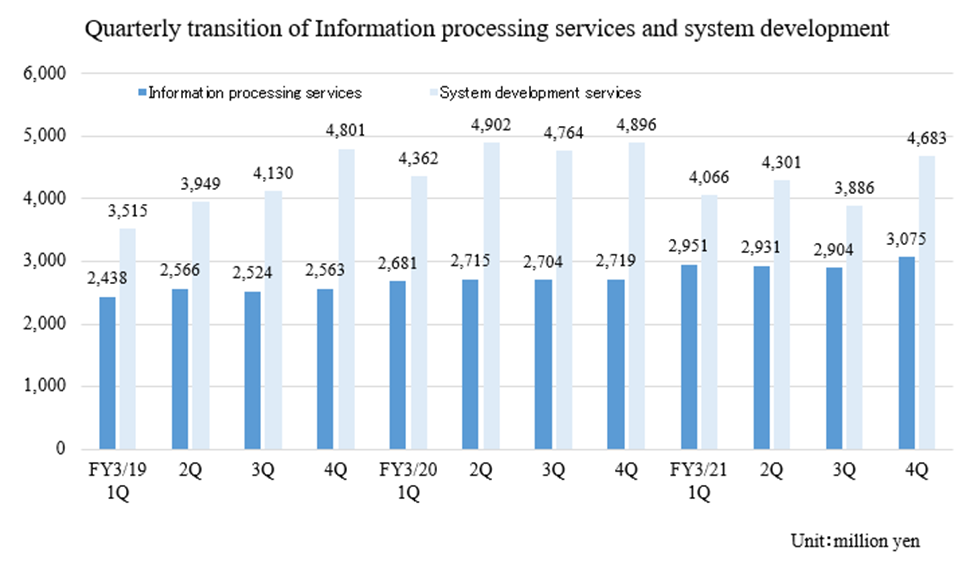

Its core businesses are “Information processing services,” “System development services,” and “System product sales.”

(1) Information processing services

It is composed of the 5 services: “IT management services,” “cloud services,” “undertaking of accounting and information processing in the fields of oil sale, retail, distribution, finance, etc.,” “management of credit data and delivery to card companies,” “printing, processing, and dispatch of bills, direct mails for sales promotion, etc.”

The company defines this Information processing services as a recurring-revenue business and considers it as a base for stable growth. (For details, see Section 【1-5: Characteristics and Strengths】.)

◎ Data center service

In the information processing service, the company is recently exerting their strengths and concentrating on “the data center service” and “the cloud service” the most. The company developed these services earlier than its competitors.

It has 7 data centers in 4 regions: Hokkaido (1 center), Yokohama (4 centers), Nagano (1 center) and Osaka (1 center), which back up one another and can cope with disasters.

◎ Cloud service

In the cloud service, started by utilizing the business base nurtured through the data center business, the company not only offers its own services, but also cooperates with various competitive enterprises that offer useful applications to customers for mounting a platform.

By improving the customer satisfaction level, the company has established this service as a stable recurring-revenue business.

|

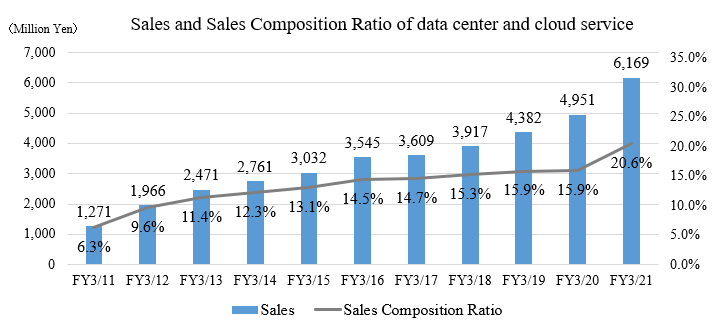

The data center and cloud services have grown nearly five times as the market grew over the past decade.

They are considered as growth drivers.

◎ Commissioned counting settlement for service stations

As for the commissioned counting settlement services for service stations (gas stations), the company’s initial business, it offers services related to credit cards and settlement of accounts receivable for payment at gas stations.

Credit-card transactions are handled by data centers of I-NET via networks.

On behalf of gas stations, the company processes data of accounts receivable and calculates quantities, unit prices, discounts, etc., and then it produces and dispatches bills at the end of each month.

The company has the largest market share, as about 33% of gas stations in Japan use the systems of I-NET.

By utilizing its know-how, experiences, and business base nurtured through the processing of credit cards and accounts receivable, I-NET handled settlement tasks in other fields, including finance and retail, and expanded its business scale.

Recently, the company has been distributing the "Government Demand Card System" for oil unions across the country to support emergency activities by making the fueling of emergency vehicles and other vehicles seamless.

Under a blanket contract, the system allows public organizations in each prefecture (prefectural police headquarters, hospitals, prefectural offices, etc.) to refuel preferentially in the events of an emergency or disasters with the same card at gas stations of any provider within each prefecture. It has been deployed to oil associations around the country and has so far been introduced in four prefectures and are planning to expand in the future.

The company also started providing services for the propane gas business, which operates LPG sales management systems on its own cloud.

The company provides the one-stop development, operation, BPO, and call centers. The company strengthens the sales structure and further expands sales.

◎ Printing/Mailing

As the company has dealt with the task of dispatching bills at gas stations, it also prints, encloses, and seals credit-card statements, tax notices, election cards, direct mails, bills, etc.

It also undertakes the tasks of inputting data, receiving applications for credit cards, handling inquiries about status of card utilization, and operating call centers from credit card companies, which are major clients, through business process outsourcing (BPO).

(2) System development services

Based on the trusting relationship that has been fostered for many years, the company designs and develops systems for customers in a broad range of fields, including development of business applications, packaged software and general-purpose tools, embedding control, and space development.

There are customers from a wide array of business fields such as banks and financial institutions, gas stations, convenience stores, supermarkets, space development, construction, architecture, aviation, travel, public offices, municipalities, medical and manufacturing.

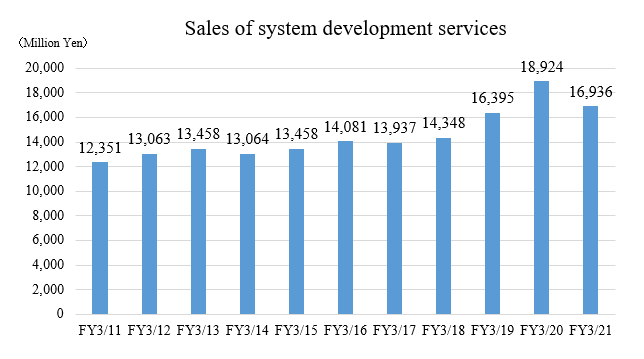

|

In the term ended March 2021, the investment of client companies was sluggish due to COVID-19 and sales from this service declined, but the demand for software investment is expected to be strong in the medium to long term as they would seek to strengthen their competitiveness, starting with the improved operational efficiency and the response to labor shortages.

(3) System product sales

The company procures and sells PCs, POS, supplies, and packaged software that are necessary to install systems in customers’ facilities, and it also gives instructions for operating devices and software.

【1-5 Characteristics and strengths】

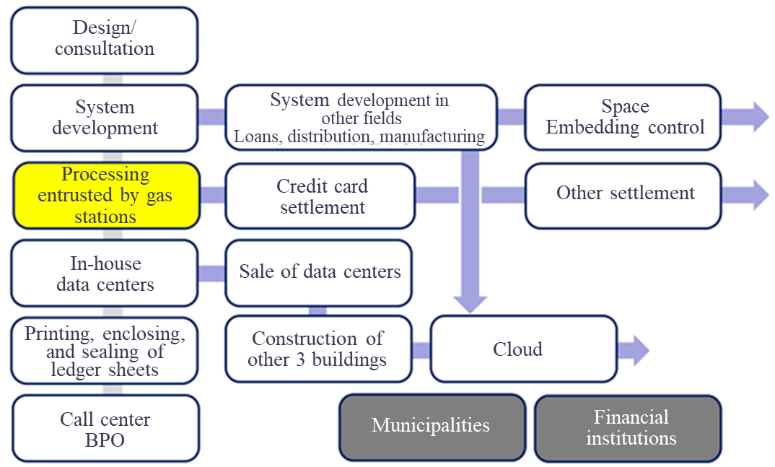

(1) Advanced capability of operating business based on vertical integration and horizontal expansion

I-NET’s business started with the processing for gas stations, and then it vertically integrated the business operations for design and consultation for installing systems, development of systems, operation of its own data centers, printing, enclosing, and sealing of bills, call center operation, and BPO. Thus, it established and strengthened the base for business targeted at gas stations, and it expanded its business domain.

In addition, based on the know-how and technologies nurtured through the above businesses, the company undertook system development in fields other than gas stations, such as distribution, manufacturing, and financial institutions, and it sold data centers to expand business horizontally and acquired customers in various fields.

The company’s advanced capability of operating business, which realized the expansion of its business domain and customer base, cannot be ignored when evaluating the company.

(Taken from the reference material of the company) |

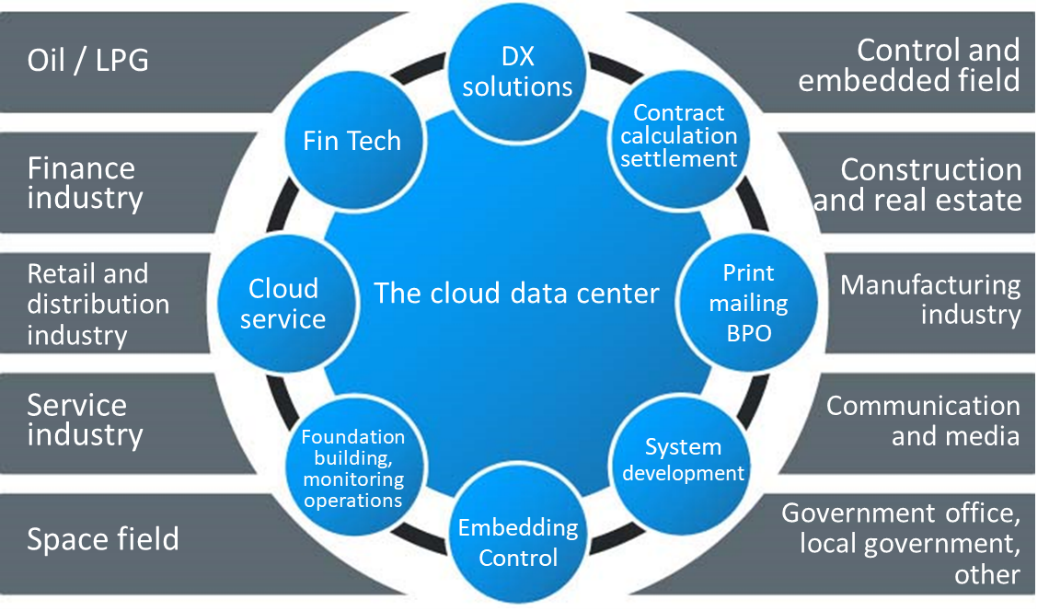

(2) Stable business model supported by its robust customer portfolio

The number of client companies gained with the above-mentioned advanced capability of operating business exceeds 4,000. The customer portfolio is composed of various enterprises in a broad range of fields. Since I-NET offers a wide array of services centered around its cloud data center according to the business types of customers, its business model is stable and not affected by the ups and downs of customers and industries.

(Taken from the reference material of the company) |

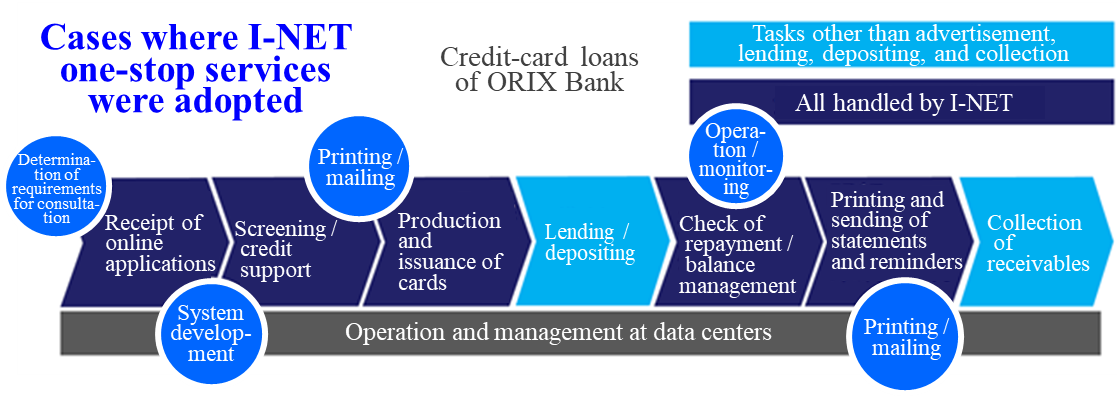

(3) Provision of one-stop services

One of its strengths is the capability to offer various IT-related services to customers in a broad range of industries and fields on a one-stop basis.

For example, ORIX Bank Corporation, one of the customers, entrusts I-NET with all processes for credit-card loans, excluding advertisement, lending, depositing, and collection. Thus, I-NET operates and manages the tasks at data centers.

(Taken from the reference material of the company) |

There are few companies that can offer services with a high security level in all IT-related processes ranging from upstream to downstream ones, including system development, operation of data centers, construction and operation of systems, provision of various cloud services, and printing, enclosing, sealing, and dispatch of bills. On the other hand, I-NET gives high convenience and satisfaction to customers, which leads to a high barrier to entry and a significant competitive advantage.

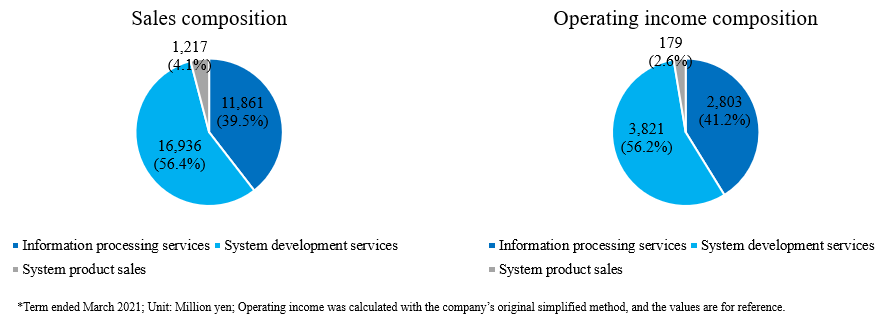

(4) Stable growth through the expansion of recurring-revenue business

The sales of the information processing services account for over 30%, while the sales of the system development services account for 60%, but the company defined the information processing services as a “recurring-revenue business” and considers it as the base for stable growth.

The recurring-revenue business means a business that can “earn fixed sales every month” and “maintain contracts for the following fiscal years.” Cloud and data center services fall under it, and SS (gas station) commissioned counting settlement, printing, enclosing and sealing are included.

As mentioned above, the data center and cloud services have rapidly grown nearly fivefold, and 17.1% is recorded as the CAGR of sales, as the market grew over the past decade.

Led by the data center and cloud services, the information processing services had a CAGR of 5.4% during the same terms, exceeding 4.0% for total sales and 3.2% for system development services.

Excluding the previous term, which was heavily affected by COVID-19, there were two periods of decline in sales in system development services, but there was no decrease in sales for total sales: this is certainly due to the stable growth of the recurring-revenue business.

The company’s most recent gross profit margin was 23%, which is also characterized by its high profitability.

The company plans to grow stably by expanding the recurring-revenue business, mainly data center and cloud services, from this term onward.

*CAGR is the average annual growth rate in a period from the term ended March 2011 to the term ended March 2021.

|

【1-6 Target managerial indicators】

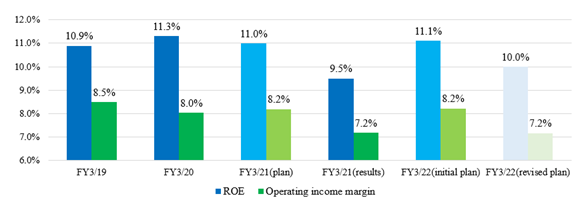

The company’s important managerial indicators are “sales,” “operating income,” “operating income ratio,” and “ROE” as they imply main business results to improve its corporate value sustainably through its continuous expansion on business scale.

【1-7 ROE analysis】

| FY 3/15 | FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 | FY 3/21 |

ROE (%) | 8.8 | 9.4 | 10.7 | 10.4 | 10.9 | 11.3 | 9.5 |

Net income margin [%] | 4.23 | 4.56 | 5.34 | 5.34 | 5.52 | 5.38 | 4.98 |

Total asset turnover [times] | 0.92 | 0.96 | 0.98 | 1.00 | 1.01 | 1.07 | 0.97 |

Leverage [times] | 2.27 | 2.16 | 2.05 | 1.95 | 1.96 | 1.96 | 1.96 |

The ROE for the term ended March 2021 was in the single digit for the first time in five years due to a decline in profitability and asset efficiency. The medium-term management plan sets a target ROE of 10.0% for the term ending March 2022, but also forecasts a net income margin of 4.92%. To achieve the target, it is necessary to further accumulate sales and profits.

【1-8 Dividend policy and the system for shareholder benefits】

The company’s dividend policy is to continue paying stable dividends while securing some retained earnings for the future capital requirements.

The company has not set a target payout ratio. However, it has been over 40% in the past several years.

The expected payout ratio for the term ending March 2022 is 46.9%.

In addition, the company established a system for shareholder benefits.

The company presents Quo Cards once a year to shareholders who hold 1,000 or more shares as of September. 30 according to the number of shares they hold, and it also provides premium benefits worth 1,000 yen to shareholders who hold shares for 3 or more years.

Furthermore, the company donates 10% of the amounts of shareholder benefits to organizations for disabled people, etc. so that shareholders can contribute to the society.

|

2. Fiscal Year ended March 2021 Earnings Results

(1) Earnings Results

| FY 3/20 | Ratio to sales | FY 3/21 | Ratio to sales | YOY | Ratio to initial estimates➀ | Ratio to initial estimates② |

Net sales | 31,097 | 100.0% | 30,016 | 100.0% | -3.5% | -4.7% | +0.1% |

Gross profit | 7,096 | 22.8% | 6,804 | 22.7% | -4.1% | - | - |

SG&A expenses | 4,594 | 14.8% | 4,648 | 15.5% | +1.2% | - | - |

Operating income | 2,501 | 8.0% | 2,155 | 7.2% | -13.8% | -16.5% | +7.8% |

Ordinary income | 2,531 | 8.1% | 2,279 | 7.6% | -9.9% | -10.3% | +10.7% |

Net income | 1,672 | 5.4% | 1,494 | 5.0% | -10.6% | -10.8% | +8.3% |

*Unit: Million yen.

*Ratio to initial estimates① is the ratio to estimates which the company announced on July 2020. Ratio to initial estimates② is that announced on January 2021.

Sales and profit decreased, but both exceeded the revised forecasts

For the term ended March 2021, net sales decreased 3.5% year on year to 30 billion yen. Although the sales of information processing services increased, the sales of system development services and system product sales services decreased. The gross profit for the information processing services was unchanged from the previous term, while that of the system development services declined. Profit margins also declined. Operating income fell 13.8% year on year to 2.1 billion yen as SG&A expenses increased 1.2% year on year.

The measures for the future growth to strategically undertake large-scale projects with low profit margins in the data center service and the cloud service to cover the decline in profits with system development services did not work well due to COVID-19.

Sales and profits both exceeded the revised forecasts.

(2) Trend by Segment

| FY 3/20 | Ratio to sales | FY 3/21 | Ratio to sales | YOY |

Sales |

|

|

|

|

|

Information processing services | 10,819 | 34.8% | 11,861 | 39.5% | +9.6% |

System development services | 18,924 | 60.9% | 16,936 | 56.4% | -10.5% |

System product sales | 1,353 | 4.4% | 1,217 | 4.1% | -10.0% |

Total | 31,097 | 100.0% | 30,016 | 100.0% | -3.5% |

Gross profit |

|

|

|

|

|

Information processing services | 2,783 | 25.7% | 2,803 | 23.6% | +0.7% |

System development services | 4,136 | 21.9% | 3,821 | 22.6% | -7.6% |

System product sales | 176 | 13.1% | 179 | 14.8% | +1.7% |

Total | 7,096 | 22.8% | 6,804 | 22.7% | -4.1% |

*Unit: Million yen. The composition ratio of gross profit means profit ratio.

(Information processing services)

Both sales and profit increased.

Sales grew because the use of data center was strong. Due to the recent progress in digitalization, the decreased use of mailing services, and strategically taking in low profit margin projects for the purpose of expanding the business, profit margins and gross margins declined at the same level as the previous term.

(System development services)

Both sales and profit decreased.

With the spread of COVID-19, the company postponed and discontinued a series of system investments, mainly for distribution and service industries, oil industries, and manufacturing industries, and the operation ratio of engineers declined.

(System products sales)

Sales decreased and profit increased.

Sales declined due to the measures for coping with the consumption tax hike in the business of selling POS equipment to gas stations, and the postponement of investments in some of the system product sales associated with various services due to the impact of the COVID-19.

(3) Financial Conditions and Cash Flow

◎Major BS

| End of Mar. 2020 | End of Mar. 2021 |

| End of Mar. 2020 | End of Mar. 2021 |

Current assets | 9,628 | 10,561 | Current liabilities | 8,407 | 8,625 |

Cash and deposits | 3,083 | 4,027 | Trade payables | 1,102 | 1,409 |

Trade receivables | 5,739 | 5,930 | Short-term loans payable | 2,872 | 3,039 |

Noncurrent assets | 19,960 | 21,494 | Noncurrent liabilities | 5,957 | 7,218 |

Property, plant, and equipment | 14,875 | 15,547 | Long-term loans payable | 5,589 | 6,868 |

Investments and other assets | 3,904 | 4,652 | Total liabilities | 14,365 | 15,843 |

Total assets | 29,589 | 32,056 | Net assets | 15,224 | 16,212 |

|

|

| Retained earnings | 9,089 | 9,890 |

|

|

| Total liabilities and net assets | 29,589 | 32,056 |

|

|

| Total borrowings | 8,461 | 9,908 |

*Unit: Million yen.

Total assets increased 2.4 billion yen to 32 billion yen from the end of the previous term due in part to the growth of cash and deposits caused by an increase in borrowings. Total liabilities increased 1.4 billion yen to 15.8 billion yen from the end of the previous term.

Net assets increased 900 million yen to 16.2 billion yen from the end of the previous term, due in part to an increase in retained earnings.

Equity ratio fell 0.9 points from the end of the previous term to 50.6%.

◎ Cash flow

| FY 3/20 | FY 3/21 | Increase/Decrease |

Operating CF | 3,965 | 3,419 | -545 |

Investing CF | -3,872 | -2,929 | +943 |

Free CF | 92 | 489 | +397 |

Financing CF | -308 | 454 | +763 |

Cash and cash equivalents | 3,083 | 4,027 | +944 |

*Unit: Million yen.

The surplus of operating CF decreased due to a decrease in net income before taxes, but the surplus of free CF increased owing to a decrease in purchases of property, plant and equipment.

Financing CF turned positive, due to the increase in proceeds from long-term loans payable, etc.

The cash position improved.

(4) Main Topics

The following efforts were made with a view to achieving the medium-term management plan and future growth.

(1) Enhancement of Space Development Projects

The company, which started with the development of the first meteorological satellite Himawari in 1977 and has contributed to space development for more than 40 years, has a rich track record in satellite’s system/subsystem design, inspection/testing, operation/evaluation analysis, and is highly regarded with most of the leading startups asking the company for satellite development cooperation.

The company will continue to strengthen cooperation in the future.

<Initiatives for New Space Projects>

1. Satellite data utilization & ultra-small satellite development businesses

The company participated in an ultra-small astronomical, land, and sea observation satellite project through industry-academia collaboration led by Tokyo Institute of Technology.

It is scheduled to be installed in JAXA’s Innovative Satellite Technology Demonstration Unit 3.

2. Antenna operation business

By reducing the non-uptime of antennas and increasing the operation ratio, the company will aim to earn recurring revenues from antenna operation.

(2) Building a digital platform in art education

In November 2020, the company concluded a partnership agreement with Oiso Town (Kanagawa Prefecture), Wacom Co., Ltd., and Celsys, Inc. to strengthen mutual cooperation in order to promote “New Normal Digital Creative Education”, which aims to further improve the quality of primary and secondary education in Oiso Town.

“New Normal Digital Creative (NDC) Education” aims to actively utilize creative activities that take advantage of the “unique benefits of digital” in education, such as sharing and working together on works using the convenience of networks, in addition to conducting “analog creation activities” that have been drawn on paper with pens and brushes in a digital environment.

By stimulating the students’ creativity and by students inspiring each other, they are naturally exposed to the digital technologies, fostering morality in the network world through sharing experiences, and in addition to blossoming creativity from early in primary and secondary education, they aim to cultivate a ground that will continue to be familiar with art in the future.

In promoting the NDC education, each company will bring in their fields of experts, I-NET will bring in technologies and services related to the network environment and maintenance and management of educational data, and they will work together with the actual educational sites in Oiso Town as a “stage.”

(3) ESG Initiatives

The company has declared the following initiatives to promote health management and diversity.

“Based on the idea that employees are the greatest asset in management, I-NET believes that the health of employees both mentally and physically is the source of sustainable enhancement of corporate value, and promotes health management. In addition, we will promote work style reforms to create a work environment where all employees can demonstrate their abilities with peace of mind.”

In February 2021, the company was certified as an excellent health and productivity management corporation “White 500” (common name for the large-scale corporate division of the Excellent Health and Productivity Management Corporation Certification System awarded by the Ministry of Economy, Trade and Industry) for the third consecutive year.

In addition to declaring health management, the Human Resources Department, Health Support Office, and Health Insurance Society are working together under the Chief Health Officer (CHO).

The company also received the upper superior certification of Y-SDGs, which is the SDGs certification system of Yokohama City.

Among the regional, social, environmental, and governance evaluation items, the company was particularly highly evaluated in the regional aspect.

3. Fiscal Year ending March 2022 Earnings Forecasts

(1) Earnings Forecasts

| FY 3/21 | Ratio to sales | FY 3/22(Est.) | Ratio to sales | YOY |

Net sales | 30,016 | 100.0% | 32,500 | 100.0% | +8.3% |

Gross profit | 6,804 | 22.7% | 7,380 | 22.7% | +8.5% |

SG&A expenses | 4,648 | 15.5% | 5,050 | 15.5% | +8.6% |

Operating income | 2,155 | 7.2% | 2,330 | 7.2% | +8.1% |

Ordinary income | 2,279 | 7.6% | 2,330 | 7.2% | +2.2% |

Quarterly Net income | 1,494 | 5.0% | 1,600 | 4.9% | +7.0% |

*Unit: Million yen.

Sales and profit are estimated to increase

The company expects net sales to increase 8.3% year on year to 32.5 billion yen, and operating income to grow 8.1% year on year to 2.3 billion yen. The company aims to return to its existing growth path by expanding data center service and cloud service that continue to be strong, and steadily responding to the system development projects that were suspended and postponed in the previous term. The company expects a two-digit increase in sales and profits (gross profit) with the system development services.

The dividend is scheduled to be 47.00 yen/share, up 1 yen/share from the previous term’s dividend of 46.00 yen/share, consisting of an ordinary dividend of 44.00 yen/share and a commemorative dividend of 2.00 yen/share. Dividend is to be increased for the 10th consecutive year. The estimated payout rate is 46.9%.

(2) Trend by Segment

| FY 3/21 | Ratio to sales | FY 3/22(Est.) | Ratio to sales | YOY |

Sales |

|

|

|

|

|

Information processing services | 11,861 | 39.5% | 12,500 | 38.5% | +5.4% |

System development services | 16,936 | 56.4% | 18,660 | 57.4% | +10.2% |

System product sales | 1,217 | 4.1% | 1,340 | 4.1% | +10.1% |

Total | 30,016 | 100.0% | 32,500 | 100.0% | +8.3% |

Gross profit |

|

|

|

|

|

Information processing services | 2,803 | 23.6% | 2,890 | 23.1% | +3.1% |

System development services | 3,821 | 22.6% | 4,250 | 22.8% | +11.2% |

System product sales | 179 | 14.7% | 240 | 17.9% | +34.1% |

Total | 6,804 | 22.7% | 7,380 | 22.7% | +8.5% |

*Unit: Million yen. The composition ratio of gross profit means profit ratio.

(3) Estimates in the medium-term management plan revised downwardly

In the first year, both sales and profits achieved the estimates, but in the second year, due to COVID-19, estimated sales and profits were unachieved.

There has been no change in the measures to be taken, but as a result of scrutiny of the business environment, the initial plan for the term ending March 2022, which is the plan’s final year, has been revised downward.

4.Conclusions

Sales and profits declined, and the estimates for the term ending March 2022, which is the final year of the medium-term management plan, were revised downward.

The measures to strategically undertake large-scale projects with low profit margins in the data center service and the cloud service to cover the decline in profits with system development services did not work well due to COVID-19.

However, the data center service and cloud service, which the company regards as the pillars of growth, continued to grow, and it is true that the company was able to strengthen the growth base for the future even in the severe environment.

Although it is difficult to hope for a sharp improvement in the environment this term, we would be watching with interest how much the company can add to the sales of 32.5 billion yen and operating income of 2.3 billion yen by taking advantage of its strengths in having a stable business model supported by a strong customer portfolio.

<Reference1:Progress of the Mid-term Management Plan>

(1) Positioning of the mid-term management plan

As the first step for becoming “an excellent company that enables sustainable growth,” which is set as a management policy, the company produced a mid-term management plan, started this term and expected to end three years later, in the term ending March 2022, and it is proceeding with this plan.

To improve its corporate value and expand its business scale, the company is proceeding with the three plans: “the business strategy plan,” “the investment strategy plan,” and “the ESG plan.”

(2) Management strategy

The basic management strategy is to emphasize the balance between “defense” which cements the bond with customers and “offense” which cultivates new market fields and services.

The company will establish a firm customer-first philosophy, provide proposals with added value, develop promising products and services, and invest in human resources.

In particular, the company will hone its capabilities to the level of being able to give proposals with high added value exceeding the customer expectation.

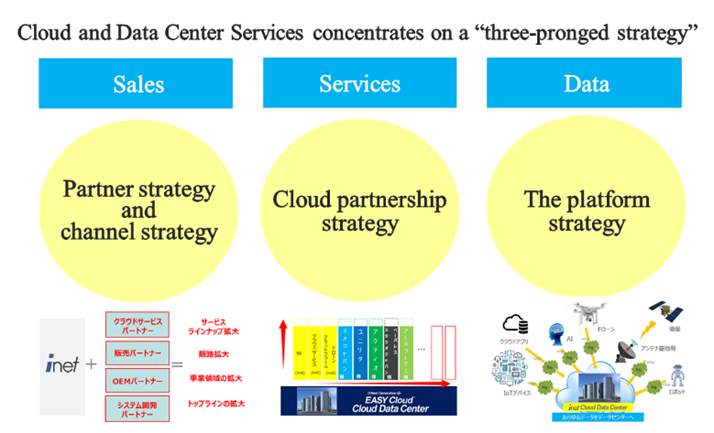

Company-wide intensive measure (1): Partner strategy and sales channel strategy

Since it has become difficult to operate all businesses by itself, I-NET will deepen the cooperation with partners that excel at system development, cloud services, sale, and OEM as well as striving to raise the top line, enrich the lineup of services, increase sale, and expand its business domain.

Company-wide intensive measure (2): Building services of cloud platform (NGEC) + applications as a platform operator

I-NET will mount not only its services, but also a variety of excellent applications useful for customers on the cloud platform, which is an advantage of the company, in order to improve its strengths and value significantly as a platform operator.

Company-wide intensive measure (3): Further promotion of cross-selling in business covering from planning to BPO

As I-NET offers a wide array of services on a one-stop basis, it will conduct marketing activities, targeting a broad range of customers regardless of industries and businesses and promote cross-selling, for system planning and development, operation at data centers, cloud operation, enclosing and sealing of printed matter.

(3) State of progress

As mentioned above, both sales and profits achieved the estimates in the first year, but in the second year, due to COVID-19, estimated sales and profits were unachieved.

There has been no change in the measures to be taken, but as a result of scrutiny of the business environment, the initial plan for the term ending March 2022, which is the plan’s final year, has been revised downward.

While data center and cloud services continue to perform well, in the term ending March 2022, the plan’s final year, the company aims to strengthen engagement with customers (expanding contacts with more customers, establishing a backup system for new transactions); improve its product and service capabilities for IoT, fintech, big data, AI, telework, etc.; and strengthen the promotion of cloud service, and increase sales and profits.

(4) Business strategy plan

① Information processing services

Field | Measures |

SS, commissioned counting settlement | *To raise the share in the number of processed SS (33% ⇒ over 50% in the mid/long term) *To expand the non-oil business by utilizing the nationwide network of sales branches *To promote sales of services targeting LPG distributors |

Cloud service | *To expand the sale of the cloud service base (NGEC) *To strengthen and expand sales channels (to increase the number of resellers and promote the OEM model) |

Printing, mailing/BPO | *To revise and expand the scope of services *To expand the BPO service business actively |

DX solution | *To early monetize the BIM and CIM businesses utilizing drones *To enrich the AI cloud service for small and medium-sized enterprises and expand sales *To establish and operate an IoT business model |

Although the number of domestic gas stations is decreasing, the company received orders from new service stations, expanding its market share and maintaining the top position. It will continue implementing new defensive and aggressive measures to further expand its market share.

【Measures for cloud and data center services】

For the expansion of cloud and data center services, on which the company is concentrating, the company employs 3 strategies: the partner strategy and channel strategy for sales, the cloud partnership strategy to handle services, and the platform strategy, which handles data.

(Taken from the reference material of the company)

*Partner strategy and channel strategy for sales

This strategy is not limited to the cloud and data center services but extends to cover the entire company.

As industries and environments widely change every day, it is difficult to run all the businesses by the company alone, thus it strengthens its relationship with trustworthy partners which have their own strengths for system development, and it will enhance this cooperation.

Moreover, regarding sales, like the business alliance with NEOJAPAN Inc (TSE 1st section: 3921), which operates its own cloud services, the company will expand the collaboration with NEOJAPAN as a cloud service partner that handles I-NET CORP's operations and sells NEOJAPAN’s products so that NEOJAPAN’s business chat, etc. run on I-NET CORP's cloud foundation; further, it will increase sales and OEM partnerships.

In addition, the company will focus on collaborative marketing with companies that have multiple customer bases and a strong sales force. By utilizing these strategies, the company aspires to expand its lineup of services, expand sales channels, widen the business region, and achieve top-line growth.

*Cloud partnership strategy to handle services

Taking advantage of the company’s strength as a platformer, the company will load applications of other companies that are strong in each specialty field and offer it as a cloud service.

For example, the company can convert the systems of Aktio, PaperLess Studio Japan Co., Ltd., BIM (Building Information Modeling), etc. which are strong in the fields aimed at architectural design, as well as the automatic driving package system of UNIRITA Inc., and offer them to customers as a service.

In the future, the company will collaborate with companies with varying specialties to diversify its services and will proactively market each service.

*The platform strategy for handling data

Devices and instruments such as drones, AI, satellites, and robots utilize data and each service produces a huge amount of data.

The company collects all these data in its data centers, with which it creates big data and becomes able to make use of it through accumulation and analysis. In the future, the company will actively engage in more growing fields such as IoT, AI, and FinTech. It will create data centers and cloud services to steadily improve the company’s profitability.

【Measures for digital transformation】

The company is also making efforts in developing solutions related to “DX (Digital Transformation),” for which customers’ needs are rapidly increasing.

*Measures for major fields

Reform of ways of working | As needs have increased for avoiding commuter congestion during the Tokyo Olympics and Paralympics, the reform of ways of working by adopting remote work due to the spread of COVID-19, etc., the company established a contact point for promoting remote work and offered tools such as remote desktop and real-time information sharing with multiple members. |

Data and AI | The company is expanding the domains of data science and AI business. Further, it is working on strengthening sales of AI cloud services targeting small and medium enterprises. |

FinTech | The company will pay attention to market trends and will strengthen its financial package, which is one of its strengths. Additionally, it will reassess the financial products and will consider and plan for renewing the package. |

Solutions for specific industries and solutions | Differentiating the company from competing companies by taking advantage of the know-how of sales management activities aimed at the distribution industry and working towards accurately responding to the needs from customers with BIM and CIM businesses targeting the construction industry. |

5G | The company is considering measures for the regional BWA, which is a wireless system for the telecommunications business utilizing the 2.5GHz band, which uses the frequencies (2,575-2,595MHz) and was introduced to solve the digital divide problem as well as to contribute to the promotion of public welfare. |

* Implementing structural reform

The company made structural reforms in April 2020 to strongly promote DX.

- Responding to the needs for DX

In order to accurately meet the customers' needs for DX, the company reorganized the solution headquarters into the “DX headquarter,” and formed the new departments, “FinTech Solutions Division,” “Distribution・Services Solutions Division,” “Enterprise Solutions Division,” “IoT Solutions Division,” and ”Space・Satellite Solutions Division.”

Regarding the needs required by a variety of customers, the company offers advanced business know-how, promotes nimble business execution, and supports customers so that they reach the desired DX.

- Strengthening the data center business

The company switched from the conventional structure of “1 headquarter and 2 business divisions” to “2 headquarters and 5 business divisions.”

The company reorganized the “Data Center department” to the 3 business divisions, “Data Center Division,” “Cloud Services Division,” “Business Solutions Division.” Establishing the “DC headquarters,” it works towards expanding the data center business while cultivating new businesses.

Moreover, the IT managed service division was upgraded to “IT Managed Services Department,” consisting of the 2 divisions, “Data Center Managed Services Division” and “IT Solutions Division,” through which it enhanced the data center operation structure in both offense and defense. In doing so, the company does not only enrich the operational management function but will also integrate the cloud service technical support with the product marketing function.

- Improving R&D functionality

Based on the basic policy of aspiring to be an excellent governor, which will make sustainable growth possible, the company seeks innovation and thus has established an “R&D promotion office” within the “Management Planning Department.”

It is a new research and development space to create new values by utilizing advanced cloud services and the latest data science, AI, and IoT technologies; the company promotes research and development as well as acquiring DX technology, which will lead to the future.

*Establishing an exclusive contact point to support remote working to promote “reform of workstyles”

The interest in remote work has rapidly increased due to the spread of the COVID-19, in addition to the recent trend promoting “reforming ways of working” in Japanese enterprises.

The company offers a variety of services including remote desktop, business chat, online conference systems, and file sharing services, all offered as SaaS. The company swiftly and accurately offered advice according to each enterprise’s situation, and in order to capture such demand surely, in March 2020, it established an exclusive contact point to support remote work tools within the cloud services division of the data center headquarters.

② System development services

Field | Measures |

Finance | *To upgrade and revise financial packages to adapt to the changes in needs in the financial market |

Distribution and services | *To differentiate its service from those of competitors by utilizing the know-how to manage sales in the distribution industry (operating the business of installing business templates) *To utilize the know-how of modernization of AS400 legacy assets and expand the number of orders |

Space | *To increase transactions with new space corporations and venture firms for developing original satellites, to expand the business scope |

New markets and services | *To enter new business markets, including “parking area” and “rental”-related ones |

In the field of “space,” I-NET has started transactions with several venture firms and will develop a new business model.

As for new service markets, it will cultivate new business fields which market reform will be demanded, such as sharing and rental businesses.

(5) Investment strategy plan

Field | Measures |

Data centers/cloud platforms | *Developing the next generation cloud platform from the cloud base (NGEC) *Systematic implementation of upgrading data center facilities, increasing space, and expansion. * Launching the data analysis and data science business |

Human resources development | * Implementing policies to achieve the target number of newly graduated recruits while strengthening mid-career recruitment of personnel who can work immediately *To strengthen the systems for educating and training personnel at each level and improve their contents |

R&D | *To develop the next-generation cloud platform with evolved NGEC *To operate data analysis and data science businesses *To utilize the data of artificial satellites for business |

Overseas business | *Building business foundations in Southeast Asia (plan to establish business bases) *To aim to offer services based on the company’s expertise and cutting-edge technologies |

◎ Capital investment

To handle the increase of customers of the data center services and to meet a wide variety of needs for cloud services, the company is strengthening the data centers’ facilities. The company does not fully equip data centers once they are established, but it improves facilities in accordance with the timing of receiving projects. As a result, the sales of data center services and cloud services are favorably increasing along with the increase in facilities.

The company continues to respond to needs flexibly while keeping the balance between improving facilities and its expenses in check. It strives to expand the business domain by growing the mainstay business, data center services and cloud services.

◎ Investing in human resources

The company believes that investing in human resources is the most important investment to expand business scale and improve corporate value, which are set as the medium- to long-term goals.

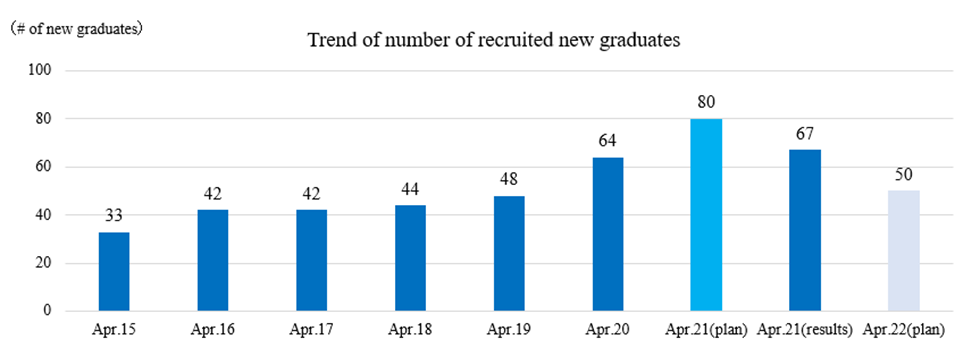

New graduates who will lead the growth of the company in the future, I-NET CORP has independently recruited 67 people (80 planned), in April 2021. For April 2022, considering the impact of COVID-19, the company plans to recruit 50 people.

With regard to mid-career recruitment, the company will actively recruit high-level IT personnel, including data scientists, who possess technologies to respond to new technologies such as AI and big data, and personnel who are ready to work in the space development field, which is the company’s business of focus.

As for the human resources training, the company conducts various types of training according to the needs of each employee including training aimed at young employees, “the new employee training,” which it had polished long ago. Also, the “Management school,” a training aimed at the level of section and division managers, through which employees learn about administration and management, and it builds up talents for the management level which will create policies to grow the company in the future. Moreover, the training with different themes including diversity, to respond to the needs of the employees whose ways of working vary. Additionally, the company plans to further improve the training.

◎ R&D

It will increase investment in R&D to differentiate its business and enhance its competitiveness. They will especially invest in the development of the next-generation cloud platform by evolving the current cloud base and the data science business, including the analysis of big data, which is expected to grow rapidly.

◎ Overseas business

Aiming to conduct market research in Southeast Asia, where the IT-related market is growing significantly, the company opened a representative office in Singapore in November 2019.

There, it collects information, conducts market research, and considers launching new businesses. Based on the intensive business, the data center and cloud services, and fields of strength such as the development of commissioned calculation system aimed at gas stations, which it has been cultivating for many years, the company aspires to develop services using cutting-edge technology such as IoT, AI, and data analysis and will consider overseas strategies for the future.

(6) ESG plan

<S:Social>

Focusing on society among ESG (environment, society, and governance), the company upheld the promotion of wellness management and diversity and declared the following stance.

“I-NET CORP., under a philosophy that employees are the greatest assets in management, actively promotes the wellness management, considering both physical and mental wellness of our employees as a source of continuous development of our corporate value. I-NET CORP. promotes the innovation of individual work style to make working environment where our employees can exert all their abilities in peace.”

Our concrete activities were highly evaluated, and we received the following public certifications.

System | Date of certification | Outline and activities |

The Outstanding Health and Productivity Management Organizations (White 500) (The large-scale corporation section of the “Certified Health and Productivity Management Organizations Recognition Program” by the Ministry of Economy, Trade, and Industry) | Mar. 2021 (certified for 3 consecutive years from 2019) | *Declared wellness management *Under the Chief Health Officer (CHO), the Human Resources Department, Health Support Office, and Health Insurance Society work together.

*To encourage all employees to undergo a health checkup regularly, and give follow-up care based on diagnosis results *To employ industrial doctors and establish a health support division *To encourage employees to take the certification test for mental health management |

Eruboshi (Certification mark given to enterprises that satisfy certain criteria specified by the certification system in accordance with the Act on Promotion of Women's Participation and Advancement in the Workplace and are excellent in empowering women) | October 2018 | *Ratio of female employees: 24.4% *Ratio of new female graduates recruited: over 40% *Establishment of a women’s committee *Establishment of a diversity promotion division *Appointment of female directors (3 out of 12 directors) *Woman act. Supporters for Kanagawa women empowerment |

Kurumin (Mark given to enterprises certified by the Minister of Health, Labour and Welfare as enterprises that support child rearing, if it is applied for after satisfying certain requirements) | May 2012 | *Enrichment of a system for shortening working hours for employees who have a child (until the child becomes a fourth grader) *Setting of no overtime day *Leave for spouse’s childbirth *Memorial leave *Teleworking system *Re-employment system |

In I-NET DATA SERVICE CORP., a special subsidiary (approved by the Minister of Health, Labour and Welfare) established for the purpose of providing disabled people with job opportunities and helping them become independent and self-sufficient, disabled people conduct data inputting, scanning, chores and business card production.

In addition, we established “A cheering squad for working mothers,” a website for supporting child care and women’s empowerment, where users can find nursery facilities by utilizing the open data of the City of Yokohama, where its headquarters is located.

In addition, in 2019, Mr. Noriyoshi Ikeda, who is founder Supreme Advisor, established “Inet Ikeda Foundation,” for the purpose of supporting and financing the sustainable activities of social contribution groups in Kanagawa Prefecture. In January 2020, the company obtained public interest certification, establishing a system for contributing to society further, and restarted activities. The company will continue long-term, stable activities, to contribute to the development of a better local society.

<G:Governance>

After adopting the entrusted executive officer system and the system for stock options with transfer limitations, the company strived to tighten corporate governance, established nomination and remuneration advisory committees, and have an audit committee.

The company established nomination and remuneration advisory committees as arbitrary advisory organs of the board of directors, in order to enhance the functional independence, objectivity, and accountability of the board of directors regarding the selection and dismissal of executives, the nomination of candidate directors, the remunerations for executives and directors, etc. and enrich the corporate governance system.

When becoming a company with an audit committee, the board of directors includes the audit committee members, who audit the execution of duties of directors, etc. to strengthen the overseeing function of the board of directors, and the company aims to tighten corporate governance by strengthening the overseeing system.

<Reference2: Regarding Corporate Governance>

◎Organization type and the composition of directors

Organization type | Company with an audit and supervisory committee |

Directors | 12 directors, including 6 outside ones |

Audit and Supervisory Committee Member | 4 auditors, including 4 outside ones. |

◎Corporate Governance Report

Last update date: April 28, 2021

<Basic Idea>

We promote construction and maintenance of business management systems as priority items which can cope with a change of the management environment quickly, while we improve business transparency for the purpose of effectiveness and efficiency of business operations, reliability of the financial statements, and the compliance with the relevant laws and ordinances.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

Supplemental principle 1-2-4 (Exercise of rights at the general meeting of shareholders) | We have implemented the electronic exercise of voting rights, but we have not made an English version of the convocation notice. However, we plan to provide the English translations from the notice of convocation for the 50th Ordinary General Meeting of Shareholders scheduled to be held in June 2021. However, we have prepared English translations of the financial summary and annual report. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

Principle 1-4. Strategically held shares | <Policy regarding strategically held shares> Aiming for smooth business management and the maintenance and strengthening of business relationships, we will hold shares strategically only when deemed necessary after comprehensively examining medium and long-term economic rationality and the outlook. Regarding the shares which we may hold, we will examine the purpose of holding, the risk associated with holding, the return on investment, and so forth for each individual stock based on changes in the business environment and other factors, and we will periodically review our holding policy in consideration of reducing the number of shares.

<Criteria for exercising voting rights pertaining to strategically held shares> Regarding the exercise of voting rights for strategically held shares, we check the management policies and business strategies of the relevant companies and comprehensively discuss whether improvement of corporate value will be achieved, in addition to checking whether the respective case is in accordance with our holding policy. Then we judge the opinions in favor of and against each measure on an individual basis. In addition, we will have dialogue with respective issuing companies regarding proposal contents, etc. as necessary.

|

Principle 5-1 Policy regarding constructive dialogue with shareholders | We have established an IR policy, and disclose basic policies, disclosure criteria, disclosure methods, silence periods, and so on. To a reasonable extent, we also engage in dialogue with shareholders and investors to contribute to sustainable growth and medium-to-long term improvement of corporate value. We have put the management strategy and IR division in charge of IR, and have established an IR system in which the director who manages the IR department is the staff in charge of IR. With regard to stakeholders including shareholders and investors, the IR staff fully cooperates with the divisions of management planning, general affairs, accounting, human resources, business divisions, and so on, and management and financial conditions, etc. are disclosed in a timely and appropriate manner. Dialogues with shareholders take place in the form of business briefing sessions held after financial results announcements, as well as in the form of financial results briefings for analysts and institutional investors we hold twice every year, in which explanation and dialogue are carried out by the president and representative director. In addition, when appropriate, we hold private interviews with institutional investors and company briefings for individual investors, and to a reasonable extent, active IR activities are handled by management executives and IR staff, not to mention the president and representative director. The relevant IR staff member makes an appropriate decision on the opinions, etc. of shareholders and investors grasped from dialogues, and seeks feedback by discussing with and reporting to the board of directors, etc. as necessary. Regarding the management of insider information, we carry out dialogue in accordance with internal regulations. |

This report is intended solely for information purposes and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness, or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on I-NET CORP. (9600) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/