Bridge Report:(9600)I-NET Corp The Second Quarter of Fiscal Year ending March 2023

President Tomomichi Saeki | I-NET Corp. (9600) |

|

Corporate Information

Exchange | TSE Prime Section |

Industry | Information and communications |

Representative Director, Executive President | Tomomichi Saeki |

Address | 23F, Mitsubishi Juko Yokohama Bldg., 3-3-1 Minatomirai, Nishi-Ku, Yokohama |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding (Less treasury stock) | Total Market Cap | ROE (Actual) | Trading Unit | |

¥1,850 | 15,984,840shares | ¥29,571million | 7.7% | 100 shares | |

DPS (Estimate) | Dividend Yield (Estimate) | EPS (Estimate) | PER (Estimate) | BPS (Actual) | PBR (Actual) |

¥52.00 | 2.8% | ¥126.37 | 14.6x | ¥1,099.90 | 1.7x |

*The share price is the closing price on November 9. The number of outstanding shares was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the latest term.

*ROE and BPS are the actual values in the term ended March 2023. EPS and DPS are the forecast values for the term ending March 2024.

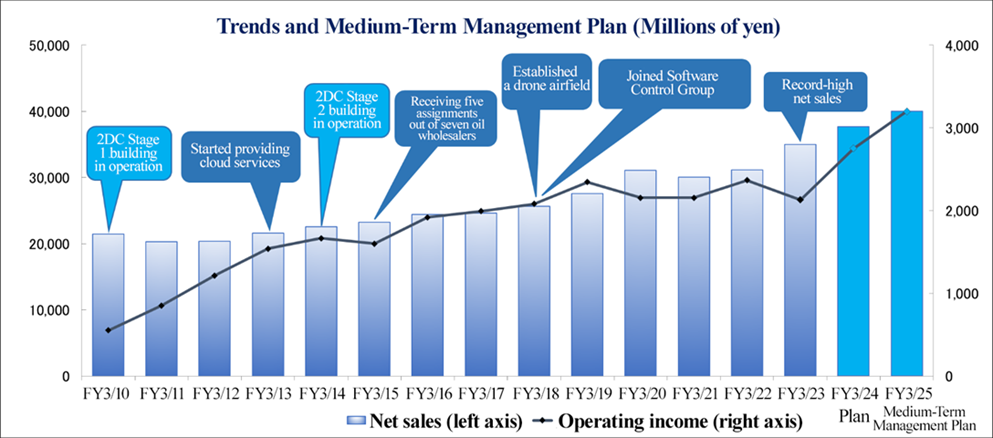

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Profit | Ordinary Profit | Profit | EPS | DPS |

March 2020 (Actual) | 31,097 | 2,501 | 2,531 | 1,672 | 105.13 | 43.00 |

March 2021(Actual) | 30,016 | 2,155 | 2,279 | 1,494 | 93.62 | 46.00 |

March 2022(Actual) | 31,169 | 2,367 | 2,542 | 1,694 | 106.08 | 47.00 |

March 2023(Actual) | 34,988 | 2,129 | 2,175 | 1,343 | 84.06 | 48.00 |

March 2024(Estimate) | 37,700 | 2,750 | 2,900 | 2,020 | 126.37 | 52.00 |

*Unit: Million-yen, yen. Profit is profit attributable to owners of the parent. Hereinafter the same applies.

This Bridge Report presents I-NET Corp’s overview of the financial results for the second quarter of the fiscal year ending March 2024, and other information.

Table of Contents

Key Points

1. Company Overview

2. Medium-Term Management Plan (April 2022-March 2025)

3. The Second Quarter of Fiscal Year ending March 2023 Earnings Results

4. Fiscal Year ending March 2024 Earnings Forecasts

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

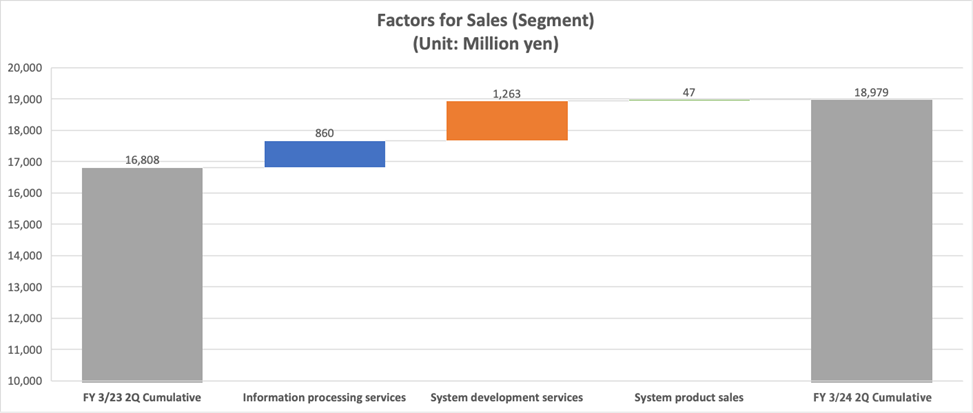

- In the cumulative second quarter of the term ending March 2024, sales grew 12.9% year on year to 18,979 million yen and operating income rose 48.7% year on year to 1,575 million yen. In terms of sales, cloud services and information processing services, including commissioned calculation for service stations (gas stations), performed well, and the sales from system development projects for the financial industry, too, were better than expected. In terms of profit, costs remained high due to the hovering electricity charges, etc., but the company curbed its impact on profit/loss by investing in energy-saving for data centers and so on, and the healthy sales growth, too, contributed.

- For the term ending March 2024, the company forecasts that sales will rise 7.7% year on year to 37,700 million yen and operating income will increase 29.2% year on year to 2,750 million yen. No revision to forecasts at the second quarter of FY 3/24. The sales from information processing and system development services are expected to be healthy. In terms of profit, the company revised selling prices related to data centers to reflect the augmentation of costs caused by the skyrocketing of electricity charges, etc. from the previous term, and actively invested in energy-saving equipment. These activities are expected to contribute to the improvement in profitability. The dividend remains unchanged at 52.00 yen/share, an increase of 4.00 yen/share from the previous year, increasing the dividend amount for the 12th consecutive term. The expected payout ratio is 41.1%.

- In the second quarter (Jul-Sep), operating income margin recovered to 9.4%, reaching the highest in the second quarter (Jul-Sep) since the term ended March 2020. It was proved that even if electricity charges keep rising, they will be able to reflect it in prices, and even if profit margin drops temporarily, they will be able to catch up. The profit margin in the second half of the term is noteworthy, to confirm whether they can improve profitability more than they did in the first half while the external environment remains uncertain due to the hovering electricity charges, etc.

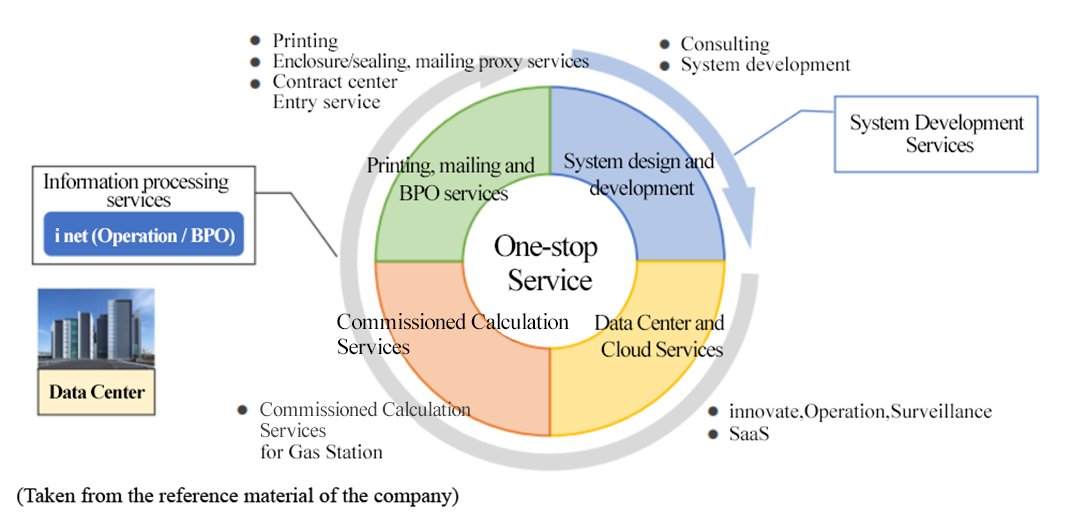

1. Company Overview

Based on its own data center with Japan’s highest level of safety and management of system operations which has been nurtured for many years, I-NET Corp. offers optimal one-stop solutions to meet various needs from customers, including system planning, development, operation, and monitoring, as well as printing, enclosing and sealing, and advanced cloud computing. Its strengths are the great capability of operating business through vertical integration and horizontal expansion and the stable business model supported by a robust customer portfolio.

1-1 Corporate history

Although private automobiles were distributed rapidly and the number of gas stations (hereinafter called "Service Stations") were expected to increase, the service station managers were suffering from the fact that it was difficult to manage accounts receivable, sale, customers, etc. surely and efficiently at that time.

Considering that introducing a system which could solve those problems would bring a big business chance, Mr. Noriyoshi Ikeda from a foreign-affiliated oil company (Founder of I-NET Corp.) established Fuji Consult Co., Ltd., the predecessor of I-NET Corp., in 1971, with the purpose of undertaking the counting at service stations.

As Mr. Ikeda expected, the company was designated as a regional or nationwide calculation center first by Idemitsu Kosan and then by other oil wholesalers, including Showa Shell Sekiyu, Mobil, Kygnus Sekiyu, and Mitsui Oil, resulting in rapid business growth. Listed on the OTC market in 1995, and in 1997, it was listed in the second section of Tokyo Stock Exchange.

Later, it expanded its business domains beyond the distribution of oil such as M&A, etc., and intensified its presence in its current main fields, including data centers, finance, manufacturing, retail, and distribution. In 2006, it was listed in the first section of Tokyo Stock Exchange. In April 2022, the company got listed on the Prime Market of TSE through market reorganization.

1-2 Corporate philosophy

As I-NET Corp. set “inet Way” as the corporate group’s ethos, considering that it is necessary for executives and employees to share common values as their standards when taking any action all together in order to grow further and become an enterprise that can grow sustainably.

“inet Way” consists of 4 pillars: “Corporate Philosophy,” “Corporate Vision,” “Management Policy,” and “Mid-term Management Plan.” It is based on “Charter of Corporate Code” corporations should follow and “Course of Action” which serves as the driving force for attaining “inet Way.”

(Taken from the reference material of the company) |

“inet Way” set a new management policy: “To become an excellent company that enables sustainable growth” to expand its business scale and develop a sturdy foundation for business growth.

It indicates the mindset: “The company and employees need to keep growing by changing themselves while seeing the changes of the times and trends.”

Corporate Philosophy | To create new systems and values using information technology and contribute to the realization of a prosperous, happy society. |

Corporate Vision | With "Create" "Challenge" "Trust" as our foundation, we aspire for the sustainable improvement of our corporate values and will grow as a company that contributes to society and our stakeholders.

integrated A company that understands the value of knowledge and leads an IT society

networking A company that strives to create a network connecting technology-to-technology, heart-to-heart(person-to-person), and individual-to-society.

energy An energetic company that takes on creativity and innovation for the realization of a sustainable society.

technology A company that works towards the realization of a prosperous and happy society through information technology. |

Management Policy | Becoming an excellent company that makes sustainable growth possible |

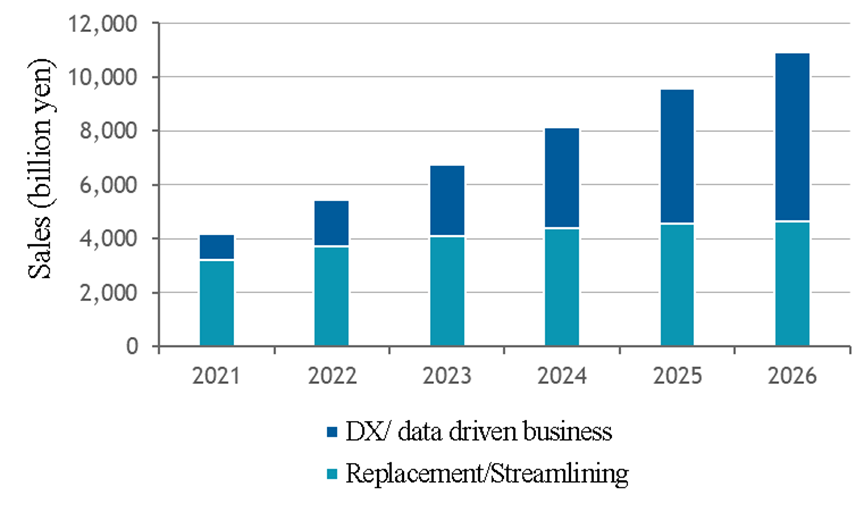

1-3 Market environment

I-NET Corp. recognizes the industrial and business environments of its major domains and those the company will focus on as follows.

(Taken from the reference material of the company) |

The market of data centers in which the company is competitive is expected to grow steadily.

Through the consolidation and reorganization of oil wholesalers, the number of them decreased from 15 in 1990 to 5. As a result, the number of domestic service stations has halved from the peak around 1990.

Amid this situation, the company acquired new customers and increased its market share based on its experiences and capabilities it has developed, and it cemented its No.1 position as competitors withdrew from their businesses.

There are many orders for the development of systems for interconnecting credit cards and sales data, etc., and it is unnecessary to conduct significant investment for increasing customers. This situation is favorable for the company.

Through the advent and spread of technologies and methods to increase business efficiency, such as cloud computing, AI, IoT, and RPA, the demand for investment in systems is growing in almost all fields in addition to petroleum-related ones, and the business environment surrounding the company is good.

1-4 Business contents

Based on its own data center with Japan’s highest level of safety and management of system operations which has been nurtured for many years, I-NET Corp. offers optimal one-stop solutions to meet various needs from customers, including system planning, development, operation, and monitoring, as well as printing, enclosing, and sealing, and advanced cloud computing.

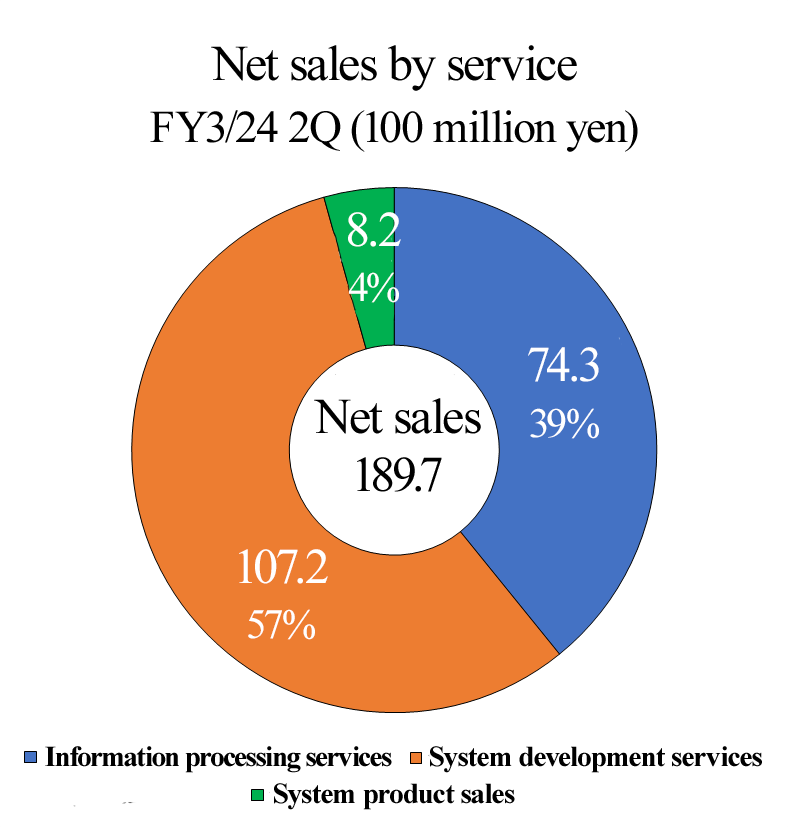

Its core businesses are “Information processing services,” “System development services,” and “System product sales.”

|

|

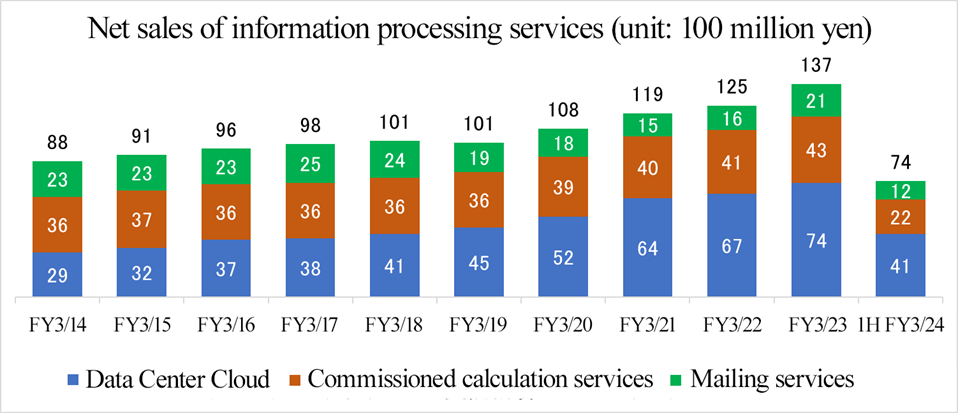

【Information processing services(accounting for 39% of net sales in the second quarter of the fiscal year ending March 2024)】

The company is involved in the operation of data centers, cloud services, commissioned calculation services, and mailing services etc. It is positioned as a growth driver. The company defines this information processing service as a recurring-revenue business and considers it the foundation for stable growth. The sales of "Data Center and Cloud Services." have grown 2.5 times over the past 10 years. sales in the segment of Information Processing Services have increased in line with the growth of "Data Center and Cloud Services."

◎ Data center Cloud services

The company offers in-house cloud services, cloud services for corporations (including SaaS), co-location services for corporations, etc.

In the Information processing services, the company is recently exerting their strengths and concentrating on “the data center service” and “the cloud service” the most. The company developed these services earlier than its competitors. The data centers are located in Yokohama (4 buildings). Backup bases are in Hokkaido (1 center), Nagano (1 center) and Osaka (1 center), which back up one another and can cope with disasters.

Also, in the cloud service, started by utilizing the business base nurtured through the data center business, the company not only offers its own services, but also cooperates with various competitive enterprises that offer useful applications to customers for mounting a platform. By improving the customer satisfaction level, the company has established this service as a stable recurring-revenue business.

◎ Commissioned calculation services

The company operates a platform for sales management and payment settlement for service stations (SS), which occupies about 30% of the Japanese market, a platform for charging and settlement compatible with smart meters for propane gas providers (brand name: Propanet), etc.

While "Commissioned calculation services" have maintained stable sales, sales have been gradually increasing over the past few years. This is because retailers are shifting from owning their own business systems to using business platforms, and are increasingly using this company's proven services.

As for the commissioned calculation and payment processing for service stations (gas stations), the company’s initial business, it offers services related to credit cards and settlement of accounts receivable for payment at service stations. Credit-card transactions are handled by data centers of I-NET via networks. On behalf of service stations, the company processes data of accounts receivable and calculates quantities, unit prices, discounts, etc., and then it produces and dispatches bills at the end of each month. The company has the largest market share, as about 30% of service stations in Japan use the systems of I-NET. By utilizing its know-how, experiences, and business base nurtured through the processing of credit cards and accounts receivable, I-NET handled settlement tasks in other fields, including finance and retail, and expanded its business scale.

Recently, the company has been distributing the "Government Demand Card System" for oil unions across the country to support emergency activities by making the fueling of emergency vehicles and other vehicles seamless. Under a blanket contract, the system allows public organizations in each prefecture (prefectural police headquarters, hospitals, prefectural offices, etc.) to refuel preferentially in the events of an emergency or disasters with the same card at service stations of any provider within each prefecture. It has been deployed to oil associations around the country and has so far been introduced in four prefectures and are planning to expand in the future. Additionally, the company's service "Propanet," which is a sales management and billing system for LP gas dealers, is a platform for the energy industry that supports social infrastructure and is used by approximately 200 companies. The company also began offering a service for propane gas retail businesses, which operate its LPG sales management system on its own cloud. In addition to providing one-stop services for development, operation, BPO, and call centers, the company plans to strengthen its sales structure and further expand sales.

◎ Mailing services

The company offers printing and mailing services for general corporations and administrative agencies, hybrid distribution services using printed matter and emails, etc. They give new ledger solutions compatible with both paper and electronic ledgers and so on. By utilizing the merits of printing and electronic distribution, they achieve the digital transformation (DX) of ledgers, flexibly respond to the selection of methods for distribution according to the timing of each client, and minimize the risk of data leakage by completing the processes inside the data center of the company. "Mailing services" is on an upward trend in revenue. This is because the number of competitors is decreasing and the company's services, which can handle everything from printing to mailing of data stored at its centers, are highly valued.

As the company has dealt with the task of dispatching bills at service stations, it also prints, encloses, and seals credit-card statements, tax notices, government mail, direct mails, bills, etc. It also undertakes the tasks of inputting data, receiving applications for credit cards, handling inquiries about status of card utilization, and operating call centers from credit card companies, which are major clients, through business process outsourcing (BPO).

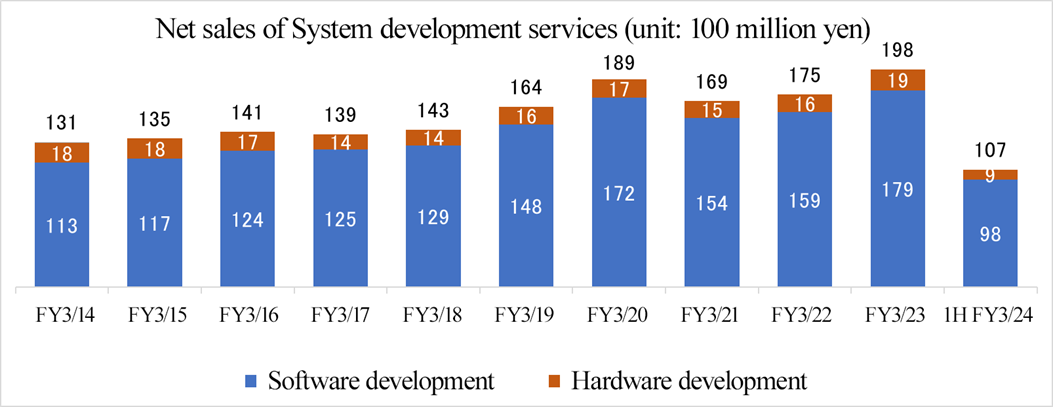

【System development services(accounting for 57% of net sales in the second quarter of the fiscal year ending March 2024)】

Sales in the system development division have increased every fiscal year until the term ended March 2020, partly due to successful M&A. Although sales declined for the first time in the term ended March 2021 due to COVID-19, they began to increase again from the following term ended March 2022. The sales of the system development department have grown 1.5 times over the past 10 years. One software development subsidiary became a group company in the term ended March 2019. Two other subsidiaries are also performing well, contributing to the overall performance of the development services division. The "LOAN RANGER" is an unsecured card loan system designed for banks and non-banks, and can handle all loan-related tasks at sales offices. The system can also offer a diverse range of security products, and analyze the customer's current situation to provide optimal plans. Furthermore, the company has a proven track record in designing, assembling, and operating small artificial satellites, having participated in projects such as the "Himawari" meteorological satellite, as well as "Hayabusa" and "Hayabusa 2.”

◎ Commissioned development

The company undertakes the development of systems in a broad range of fields, including systems for the energy industry, financial institutions, transportation systems, outer space (commissioned development, inspection, testing, operation, evaluation and analysis), the distribution industry, general corporations, the manufacturing industry, security, telecommunications carriers, and embedded control systems.

◎ Development of system products

In addition, the company develops system products in a broad range of fields, including financial products (such as the unsecured loan system “Loan Ranger” and the cost control system for financial institutions “ABC Financial”), the credit-card payment system “i-Gateway,” the Pos-linked system, security-related items (such as vulnerability diagnosis and Darktrace), and DX-related products (such as operation streamlining systems and RPA).

【System product sales(accounting for 4% of net sales in the second quarter of fiscal year ending March 2024)】

The company procures and sells PCs, POS, supplies, and packaged software that are necessary to install systems in customers’ facilities, and it also gives instructions for operating devices and software.

1-5 Strengths

【A group of engineers with 4,300 clients】

◆With a history of 52 years, a group of 1,200 development engineers support 4,300 clients.

◆In particular, they have built a multitude of deep and long-lasting relationships with clients in various industries, including the energy industry, distribution industry (such as convenience stores), finance industry (including banks and non-banks), and artificial satellite development.

【A recurring-revenue business that supports social infrastructure】

◆Cloud services utilizing their own data center

◆A platform service that supports the backbone of the energy industry

◆Business systems for financial institutions (such as card loans and cost management), which were adopted by many banks and non-banks

【One-stop service for information processing, development, and BPO】

◆In addition to providing cloud services, data processing, and calculation, the company can handle a series of processes in house, including the development of related systems and the notification of processing results to customers (via e-mail and postal mail).

◆Existing clients value the company as a strong partner for streamlining and digital transformation (DX).

【Stable growth through the expansion of recurring-revenue business】

The sales of the Information processing services account for about 40%, while the sales of the System development services account for about 60%, but the company defined the Information processing services as a “recurring-revenue business” and considers it as the base for stable growth.

The recurring-revenue business means a business that can “earn fixed sales every month” and “maintain contracts for the following fiscal years.” Cloud and data center services fall under it, and SS (service station) commissioned calculation, printing, enclosing and sealing are included.

Data center and cloud services have grown rapidly over the past decade with a 2.5-fold increase in sales as the market grew. Driven by data centers and cloud services, the sales of information processing services have also grown 1.5 times over the past decade. Excluding the previous fiscal year, there were only two periods of revenue decline in system development services and only one in total sales during this period, which is precisely due to the stable growth of the "recurring-revenue business."

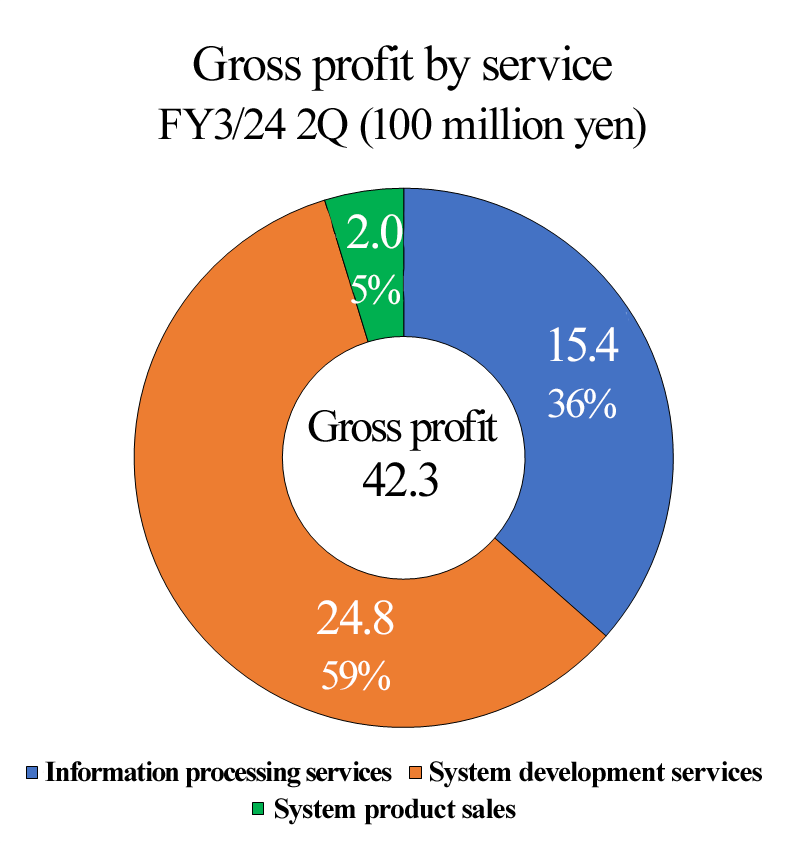

And, gross profit margin of the first half of FY3/24 was 22.3%, which is also characterized by its high profitability.

The company plans to grow stably by expanding the recurring-revenue business, mainly data center and cloud services, from this term onward.

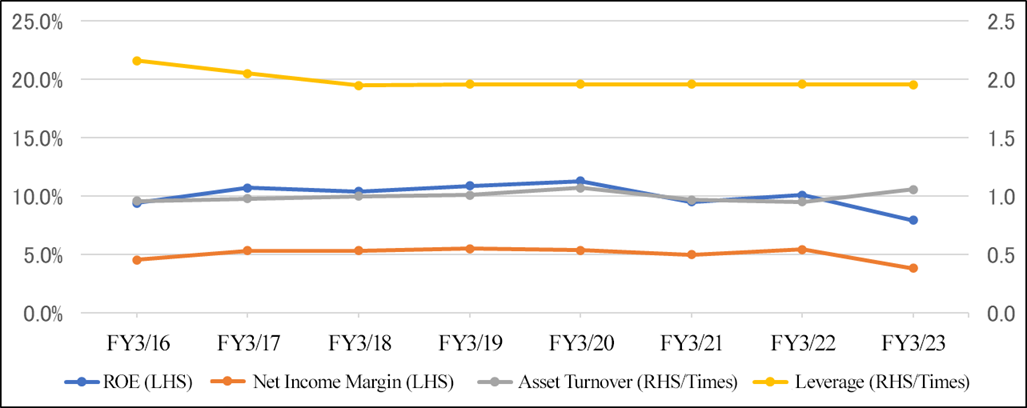

1-6 Target managerial indicators

The company’s important managerial indicators are “sales,” “operating income,” “operating income ratio,” and “ROE” as they imply main business results to improve its corporate value sustainably through its continuous expansion on business scale.

1-7 ROE analysis

| FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 | FY 3/21 | FY 3/22 | FY 3/23 |

ROE (%) | 9.4 | 10.7 | 10.4 | 10.9 | 11.3 | 9.5 | 10.1 | 7.7 |

Net income margin [%] | 4.56 | 5.34 | 5.34 | 5.52 | 5.38 | 4.98 | 5.44 | 3.84 |

Total asset turnover [times] | 0.96 | 0.98 | 1.00 | 1.01 | 1.07 | 0.97 | 0.95 | 1.07 |

Leverage [times] | 2.16 | 2.05 | 1.95 | 1.96 | 1.96 | 1.96 | 1.96 | 1.86 |

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

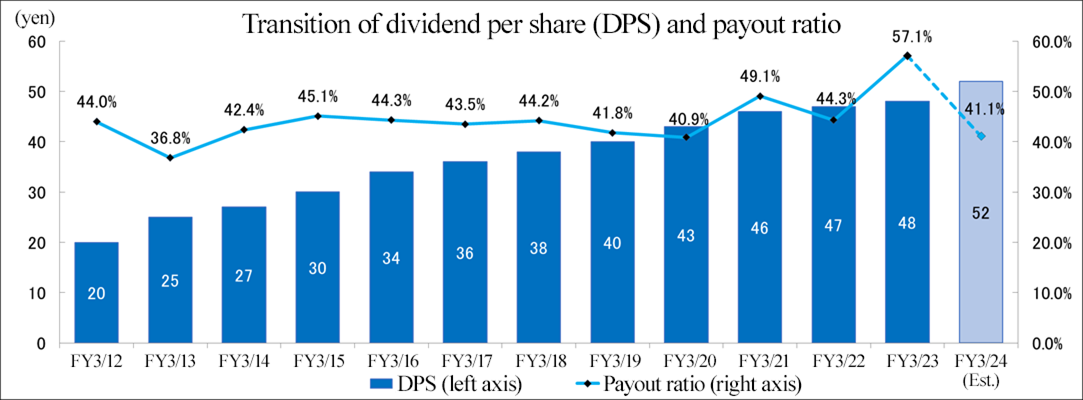

1-8 Dividend policy and the system for shareholder benefits

The company’s dividend policy is to continue paying stable dividends while securing some retained earnings for the future capital requirements.

The company has not set a target payout ratio. However, it has been over 40% in the past several years.

The expected payout ratio for the term ending March 2024 is 41.1%.

The company expects to increase its dividend for 12 consecutive terms in the term ending March 2024.

The company established a system for shareholder benefits.

Previously, the company provided a QUO card once a year to shareholders who owned 1,000 or more shares as of September 30th, based on the number of shares they owned. However, at the end of September 2023, the shareholder benefit program has expanded. Under the new system, shareholders who own 100 or more shares will receive a QUO Card Pay based on the number of shares they own, and shareholders who own 1,000 or more shares will receive a QUO card worth an additional 1,000 yen compared to the previous system.

In addition, the company will donate 10% of the amount of the QUO card to social contribution organizations, allowing shareholders to participate in social contribution activities.

1-9 Initiatives for ESG and SDGs

【Environment】

◎ To realize carbon neutrality by 2050

As part of sincere efforts to tackle global environmental issues, the I-NET Group expressed its agreement with the recommendations from the Task Force on Climate-related Financial Disclosures (TCFD), and aims to realize zero GHG emissions from its entire value chain by FY 2050. As the first step, they will partially change the electric power consumed at their data center to the power generated from renewable energy by FY 2030. Through this, they are expected to reduce the GHG emissions (Scopes 1 and 2) from the I-NET Group by 33.6% or higher from FY 2022.

◎ Participation in the TCFD Consortium

The company joined the TCFD Consortium, where enterprises, financial institutions, etc. that agree with the recommendations from the TCFD hold discussions. Through the participation in this consortium, the company will analyze and deal with the risks and opportunities derived from climate change in an enhanced manner, and disclose related information.

【Social Contribution】

◎Promoting Employment of People with Disabilities: I-NET DATA SERVICE CORP.

In April 2009, I-NET established a special subsidiary (certified by the Minister of Health, Labor and Welfare) to promote employment of people with disabilities. As of June 1, 2022, there were 579 special-purpose subsidiaries nationwide, including 49 in Kanagawa Prefecture, and I-NET DATA SERVICE CORP. is one of them.

The major tasks of disabled workers include data inputting, scanning, light-duty work, and business card production.

◎ Childcare Support Site: Working Moms Supporter

The company operates a childcare support site called "Working Moms Supporter," which is a childcare facility search site that utilizes open data from Yokohama City. The site was renewed in June 2022 and a childcare blog was launched. The company operates "Working Moms Supporter," a website to support childcare and women's activities that allows users to search for childcare facilities using open data from the city of Yokohama, where the company's headquarters is located.

◎I-NET Foundation

The I-NET Foundation implements ESG activities and social contributions by supporting social activities that contribute to the development of local communities, and conducts the following projects in Kanagawa Prefecture.

(1) Projects to support and subsidize, or evaluate and commend the sustainability and activities of organizations and others engaged in activities related to the following

・Healthy development and education of children and young people

・Physical and mental development through sports and other activities

・Improvement of public health

・Environmental conservation and maintenance

・Sound development of local communities

(2) Other activities necessary to achieve public interest purposes

Since its establishment, the company has supported the activities of 14 organizations in FY 2020, 22 organizations in FY 2021, 27 organizations in FY 2022, and 29 organizations in FY 2023.

【Diversity】

Based on the belief that employees are the greatest asset in management, the company promotes health management, believing that the health of its employees, both physically and mentally, is the source of sustainable corporate value enhancement. The company will continue to promote the transformation of work styles to create a working environment in which all employees can exercise their abilities with peace of mind.

- Hataraku Yell 2023: Received the highest award of "Excellent Employee Benefit Corporation (General)”

- White 500 certification for five consecutive years

- PRIDE Index 2023: The highest rank “Gold” for two consecutive years

2. Medium-Term Management Plan (April 2022-March 2025)

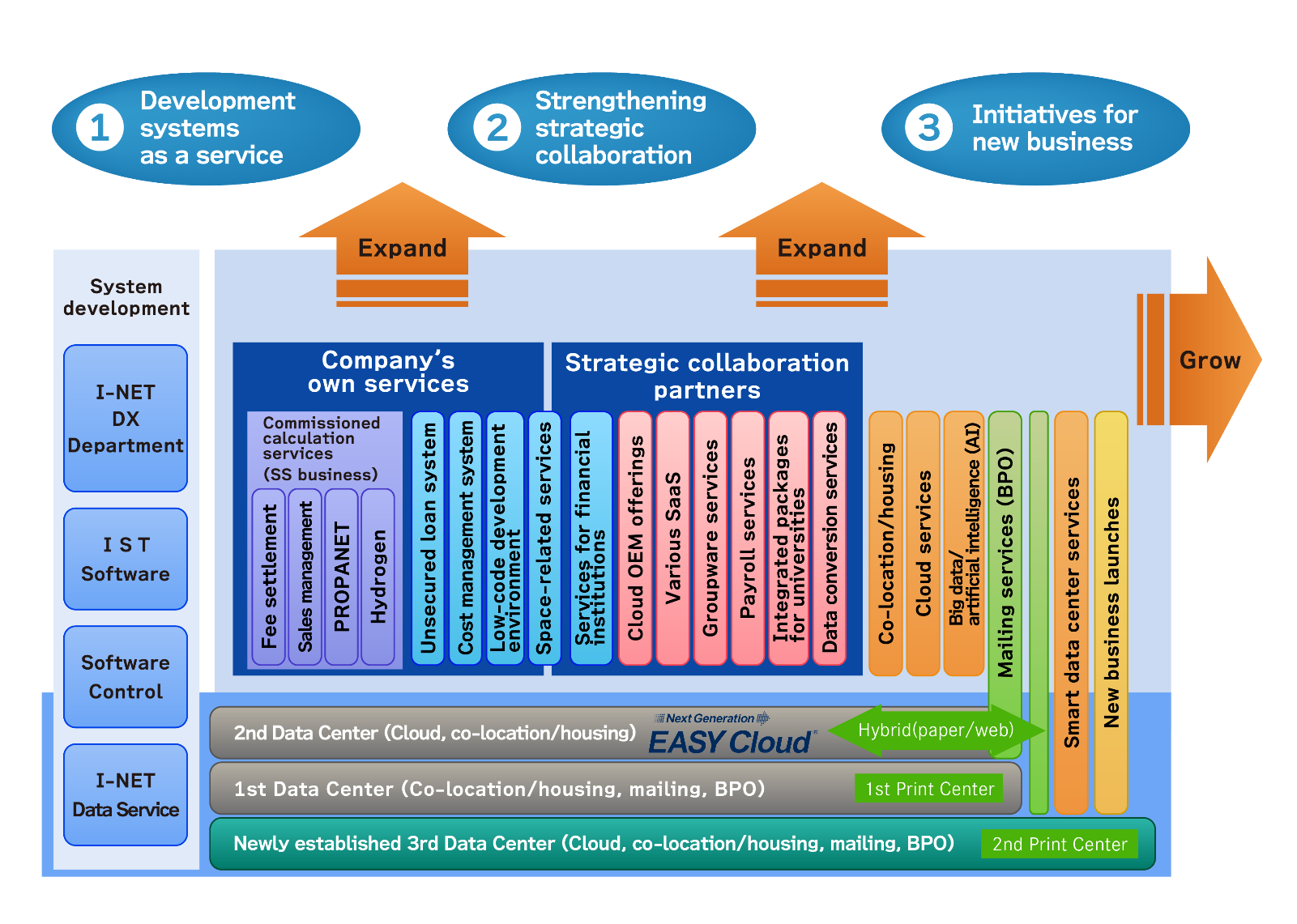

The new three-year medium-term management plan was announced.

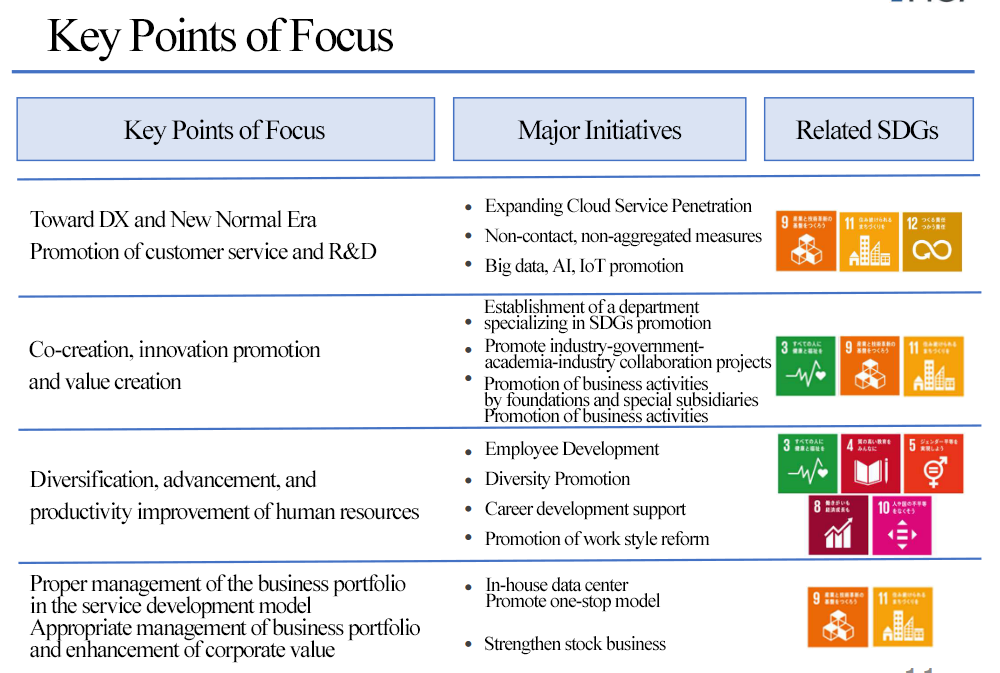

(1) Key points

Based on the company’s service development model of providing a one-stop shop for system development, data center/cloud service, commissioned counting settlement, and BPO, the company has identified the following key points.

(Taken from the reference material of the company)

(2) Business strategy in each service

◎ Information processing services

<Data center and cloud service>

* Promote providing a wide range of services, including infrastructure operation, system operation, and business operation.

* Provide extensive support for migration to the cloud in accordance with customers’ needs.

* Expand new services such as security and storage.

* Provide energy-saving services using high-efficiency, low-power consumption servers and storage devices.

<Commissioned calculation services>

* Strengthen DX promotion for petroleum wholesalers and trading companies, while giving proposals to improve operational efficiency.

* Expand services for major distributors such as complying with regulations, expanding ASP use, etc.

* Expand services for service stations and develop services for the LPG industry to increase the number of customers.

<Printing/mailing, and BPO services>

* Promote consulting services to improve operational efficiency by developing hybrid systems using electronic and paper documents.

* Promote collaboration with business partners in BPO, delivery services, etc., to diversify services.

* Promote enhancement of facilities and efficient operations to strengthen the quality and quantity of operations.

Position the information processing services, which yields stable recurring revenues, as a foundation for growth through continuous sales, and aim to increase per capita sales and profit.

◎ System development services

* Strengthen services for financial institutions

* Strengthen service development of sales management systems and IoT platforms

* Strengthen collaboration and in-house services in the space and satellite business

(3) Capital investment

Strengthen capital investment centered on data centers, which are the source of growth and the service pillar, as a social infrastructure.

From FY2019 to FY2021, the company enhanced its facilities along with the use of customers’ data centers. From FY2022 onward, the enhancement will continue in line with the expansion of cloud service.

New data center construction will also be considered.

(4) Strengthening human capital

Recognizing the importance of strengthening human capital, the company has established the following policies and will promote the following initiatives.

<Policies>

Based on the philosophy that employees are the greatest asset in management, the company has established a fair personnel system that leads to a sense of job satisfaction for employees and enables both the company and employees to grow.

◎Expanding the growth scale of business performance through investment in human resources

Aim for sustainable growth while focusing on improving productivity and increasing the number of employees.

Actively promote the hiring of new graduates and strengthen mid-career hiring. Work to prevent the resignation of employees.

Focus on DX human resource development, placing the right people in the right jobs, and improving employee satisfaction to increase productivity.

◎Ideal IT human resources

Cultivate technical and human skills that customers can trust.

Create an environment where young people, seniors, and all generations can play an active role.

<Initiatives>

The main initiatives to strengthen human capital are as follows.

Human resources development | -Foster advanced DX human resources (AI, data science, etc.) -Early training of young employees (one year of training support for new employees) -Provide learning opportunities (joint industry-academia research, university for working adults, and e-learning) -Increase third-party evaluation of engineers by encouraging them to acquire qualifications |

Workstyle reform | -Promote telework -Promote reviewing office layout (free-address, etc.) -DX of internal systems, promote paperless, and improving productivity -Consider permitting side jobs |

Diversity and inclusion | -Activities by the Diversity Promotion Office -Continuous active recruitment of female employees (40% of new recruits are women) -Hiring of diverse human resources, including foreigners and people with disabilities -Maintain the "Eru-boshi" and certified as “Platinum Kurumin (an enterprise supporting childcare)” -Actively promote women to management positions |

Health management | -Continue to maintain 100% of employees receiving periodic health checkups -Increase the consultation rate for specific health guidance in cooperation with the health insurance association -Continue to hold sports tournaments and support club activities -Maintain certification as a White 500 company |

(5) Target Value

| FY 3/23 (Act.) | FY 3/25 (Plan) | Decrease/Increase |

Net sales | 34,988 | 40,000 | +6.9% |

Operating profit | 2,129 | 3,200 | +22.6% |

ROE | 7.7% | Over 10% | - |

Operating profit ratio | 6.1% | 8.0% | +1.9pt |

*Unit: Million yen. Changes in sales and operating profit are CAGR (Compound Annual Growth Rate). Calculated by Investment Bridge based on company data.

Considering the recent business performance, the company upwardly revised the target sales for the term ending March 2025 from 37,700 million yen to 40,000 million yen.

On the other hand, the target operating income remains 3,200 million yen, as set in the initial plan. This is because the business environment is harsher than initially expected and depreciation augmented as the company actively invested in equipment in a positive manner for the purpose of improving the capacity of its data center. The company aims to improve operating income margin and ROE, while increasing sales and operating income.

3. The Second Quarter of Fiscal Year ending March 2024 Earnings Results

(1) Earnings Results

| FY 3/23 2Q Cumulative | Ratio to sales | FY 3/24 2Q Cumulative | Ratio to sales | YoY |

Net sales | 16,808 | 100.0% | 18,979 | 100.0% | +12.9% |

Gross profit | 3,530 | 21.0% | 4,230 | 22.3% | +19.8% |

SG&A expenses | 2,470 | 14.7% | 2,654 | 14.0% | +7.4% |

Operating income | 1,059 | 6.3% | 1,575 | 8.3% | +48.7% |

Ordinary income | 1,074 | 6.4% | 1,601 | 8.4% | +49.0% |

Profit | 648 | 3.9% | 1,041 | 5.5% | +60.7% |

*Unit: Million yen.

*The figures include those calculated by Investment Bridge Co., Ltd. as reference values, and may differ from the actual figures (the same applies below).

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

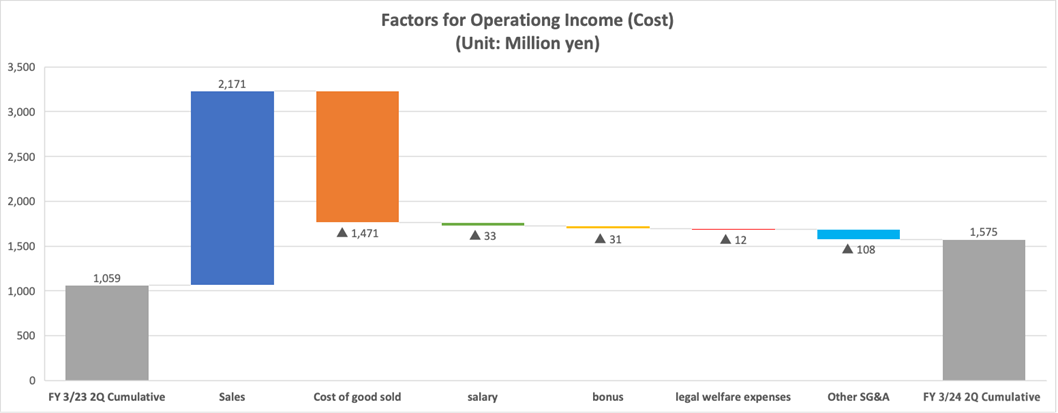

*The ▲ in the expense item indicates an increase in expenses.

Sales and operating income grew 12.9% and 48.7%, respectively, year on year.

In the cumulative second quarter of the term ending March 2024, sales grew 12.9% year on year to 18,979 million yen and operating income rose 48.7% year on year to 1,575 million yen, achieving record-high sales for the first half. In terms of sales, information processing services kept performing well. In addition to the growth of revenues from cloud services for SaaS, the performance of mailing services recovered, and in-house services, such as “Propanet,” a platform for sales management for propane gas, performed well. The sales from system development services increased, as development projects for coping with the invoice system, in-house financial services, etc. were healthy, despite the delay in some commissioned projects and the delay caused by external factors, such as the postponement of launch of a satellite.

In terms of profit, the sales growth and cost reduction contributed. As the skyrocketing of electricity charges since last year subsided and energy-saving systems were adopted for the data center, costs decreased. Gross profit rose 700 million yen year on year, thanks to the sales growth and so on. Gross profit margin rose 1.3 points year on year to 22.3%. In addition, the ratio of SGA declined 0.7 points, as the company kept the augmentation rate of SGA below the sales growth rate, although mainly personnel expenses increased. Accordingly, operating income margin rose 2 points year on year to 8.3%.

Ordinary income rose 49.0% year on year to 1,601 million yen, thanks to the year-on-year decreases in interest paid and commission paid in non-operating expenses, etc. Net income rose 60.7% year on year to 1,041 million yen, as extraordinary losses included a loss on valuation of investment securities of 49 million yen and a loss on sale of fixed assets of 20 million yen in the same period of the previous year, but not in the first half of the term ending March 2024.

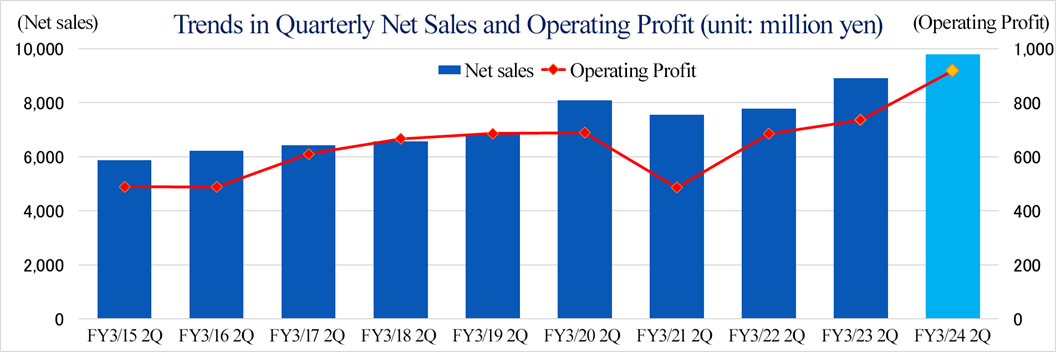

2nd Quarter (July-Sep) Financial Trends

In the second quarter (Jul-Sep), sales and profit increased year on year, both hitting a record high for the second quarter (Jul-Sep), and also increased from the previous quarter (Apr-Jun). As there was no longer the impact of the skyrocketing of electricity charges, operating income margin reached 9.4%, up from the same period of the previous year and the year before that.

(2) Trend by Segment

| FY 3/23 2Q Cumulative | Ratio to sales | FY 3/24 2Q Cumulative | Ratio to sales | YoY |

Information processing services | 6,570 | 39.1% | 7,430 | 39.2% | +13.1% |

System development services | 9,462 | 56.3% | 10,725 | 56.5% | +13.3% |

System product sales | 776 | 4.6% | 823 | 4.3% | +6.1% |

Net Sales | 16,808 | 100.0% | 18,979 | 100.0% | +12.9% |

Information processing services | 1,225 | 18.6% | 1,545 | 20.8% | +26.1% |

System development services | 2,142 | 22.6% | 2,484 | 23.2% | +16.0% |

System product sales | 161 | 20.7% | 200 | 24.3% | +23.7% |

Gross profit | 3,530 | 21.0% | 4,230 | 22.3% | +19.8% |

*Unit: Million yen. The composition ratio of gross profit means profit ratio.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

◎Information Processing Services

Sales increased 13.1% year on year to 7,430 million yen, and gross profit grew 26.1% year on year to 1,545 million yen.

Gross profit margin improved, as the use of data center/cloud services increased steadily in parallel with the systematization of the entire society and the company strove to improve the profitability of transactions by enhancing its capability of coping with the rise in costs due to the skyrocketing of electricity charges. The business of the I-NET Group started with calculation services, including clerical work and payment settlement, and the amount of transactions with service stations, in which they have strengths, increased steadily. In addition, the sales from BPO services centered around mailing were healthy and on the upward trend.

【Factors in Increase/Decrease in Information Processing Services】

FY3/23 2Q Cumulative Net sales | 6,570 |

|

Data Center Cloud | +554 |

|

Commissioned calculation services | +23 |

|

Mailing services | +283 |

|

FY3/24 2Q Cumulative Net sales | 7,430 |

|

|

|

|

FY3/23 2Q Cumulative Gross profit | 1,225 |

|

Data Center Cloud | +202 | Sales growth effect: +67, Fluctuation in profitability: +135 |

Commissioned calculation services | -10 | Sales growth effect: +8, Fluctuation in profitability: -18 |

Mailing services | +128 | Sales growth effect: +69, Fluctuation in profitability: +59 |

FY3/24 2Q Cumulative Gross profit | 1,545 |

|

*Unit: Million yen.

◎System Development Services

Sales grew 13.3% year on year to 10,725 million yen and gross profit rose 13.7% year on year to 2,484 million yen.

Projects for developing systems in the financial and distribution fields, in which the I-NET Group has a competitive advantage, maintained an upward trend, and projects for development in response to the invoice system, which started in October 2023, increased. In addition, the business of operation and maintenance of systems for major clients expanded as a stable revenue source. Furthermore, the performance of the two subsidiaries for system development was healthy.

Regarding the sales of each service, the sales of commissioned software development increased 14.6% year on year, while the sales of commissioned hardware development, etc. grew 1.8% year on year.

【Factors in Increase/Decrease for System Development Services】

FY3/23 2Q Net sales | 9,462 |

|

Software development | +1,246 |

|

Hardware development, etc. | +17 |

|

FY3/24 2Q Net sales | 10,725 |

|

|

|

|

Y3/23 2Q Gross profit | 2,142 |

|

Software development | +317 | Sales growth effect: +281, Fluctuation in profitability: +36 |

Hardware development, etc. | +25 | Sales growth effect: +5, Fluctuation in profitability: +20 |

FY3/24 2Q Gross profit | 2,484 |

|

*Unit: Million yen.

◎System Product Sales

Sales increased 6.1% year on year to 823 million yen, and gross profit rose 23.7% year on year to 200 million yen. Sales and profit grew, mainly because the devices for information processing services sold well.

(3) Financial Conditions and Cash Flow

◎Major BS

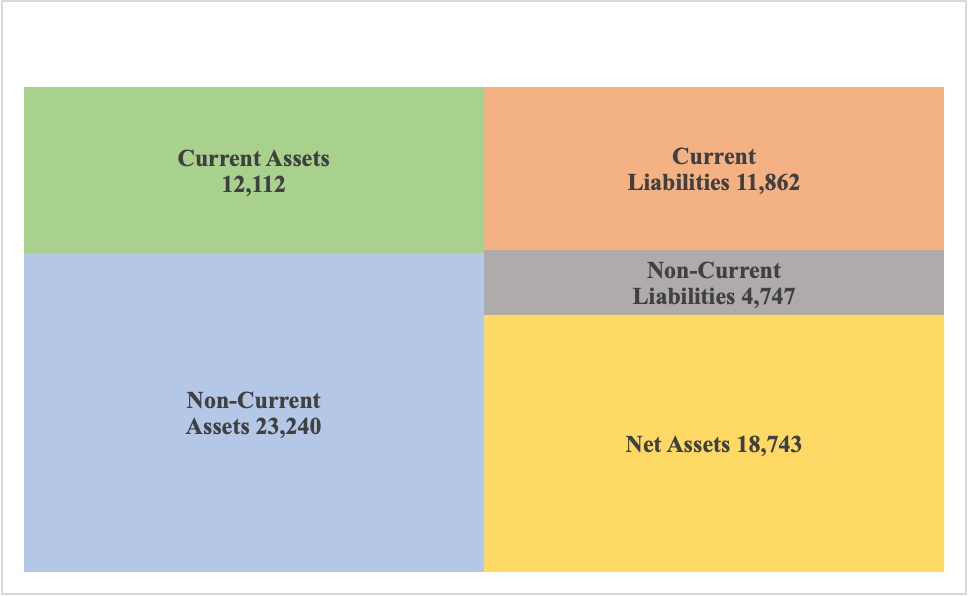

| End of Mar. 2023 | End of Sep. 2023 |

| End of Mar. 2023 | End of Sep. 2023 |

Cash and deposits | 2,310 | 3,738 | Accounts payable | 1,743 | 2,447 |

Notes and accounts receivable | 7,287 | 7,511 | Short-term borrowings | 3,068 | 3,584 |

Merchandise and finished goods | 203 | 253 | Current liabilities | 9,294 | 11,862 |

Current assets | 10,246 | 12,112 | Long-term borrowings | 5,239 | 4,065 |

Property, plant and equipment | 14,951 | 14,883 | Non-current liabilities | 5,753 | 4,747 |

Software | 1,895 | 2,111 | Liabilities | 15,048 | 16,609 |

Intangible assets | 2,093 | 2,295 | Net assets | 17,581 | 18,743 |

Investments and other assets | 5,339 | 6,062 | Liabilities and net assets | 32,630 | 35,352 |

Non-current assets | 22,384 | 23,240 | Interest-bearing debt | 8,307 | 7,650 |

*Unit: Million yen.

*Inventories = merchandise and finished goods + work in process + raw materials and supplies

*Interest-bearing debt = borrowings (excluding lease obligations)

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

The total assets as of the end of September 2023 stood at 35,352 million yen, up 2,722 million yen from the end of the previous term. Regarding assets, main factors in increasing them were cash & deposits, accounts receivable, software, and investment securities. Regarding liabilities and net assets, main factors in increasing them were accounts payable, short-term debt, income taxes payable retained earnings, while main factors in decreasing them were long-term debt. Capital-to-asset ratio was 53.0%, down 0.9 points from the end of the previous term. Interest-bearing debt decreased 657 million yen from the end of the previous term.

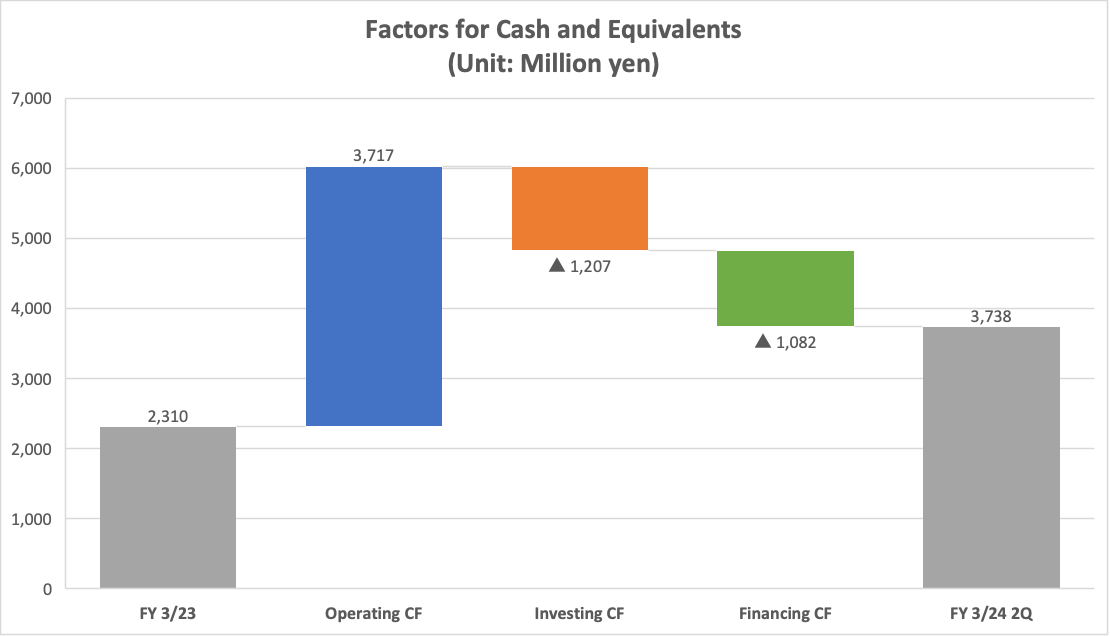

◎ Cash flow

| FY 3/23 2Q Cumulative | FY 3/24 2Q Cumulative | YoY | |

Cash flows from operating activities | 1,158 | 3,717 | 2,559 | +221.0% |

Cash flows from investing activities | -1,163 | -1,207 | -44 | - |

Free cash flows | -4 | 2,510 | 2,515 | - |

Cash flows from financing activities | -191 | -1,082 | -890 | - |

Cash and cash equivalents at end of period | 3,487 | 3,738 | 250 | +7.2% |

*Unit: Million yen.

*Prepared by Investment Bridge Co., Ltd. based on disclosed material.

In terms of cash flows, the cash inflow from operating activities increased due to the increases in net income before taxes and other adjustments, accounts payable, contract liabilities, and accrued consumption tax and the decrease in income taxes. The cash outflow from investing activities augmented slightly due to the increase in purchase of property, plant and equipment, but free cash flow turned positive. On the other hand, the cash outflow from financing activities expanded due to the decline in proceeds from long-term borrowings, etc. Accordingly, the cash position as of the end of September 2023 was up 7.2% year on year.

(4) Topics

◎ Received “2023 Darktrace Partner of the Year (Japan)” from Darktrace

On July 21, 2022, the company concluded a distributorship contract with Darktrace Holdings Limited, which is a global leading company in AI-based cyber security, and made AI-based cyber security products installed by 15 companies in 1 year. This achievement was highly evaluated, so the company received “2023 Darktrace Partner of the Year (Japan),” which is an award for the distributor that showed the most excellent performance in Japan. The company will keep supporting corporate security measures by selling “Darktrace,” which autonomously detects, surveys, and blocks all kinds of threats in the network on a single platform, by utilizing the original self-learning AI technology.

◎ Data center tour for kids

The company held a data center tour for kids as a summer vacation event for the purpose of stirring children’s interest in IT as they will lead the future. As part of this activity, the company distributed the comic-based brochure of the data center for kids, and held a data center tour for elementary school pupils and their parents at the company’s own data center.

4. Fiscal Year ending March 2024 Earnings Forecasts

(1) Earnings Forecasts

| FY 3/23 | Ratio to sales | FY 3/24(Est.) | Ratio to sales | YoY |

Net sales | 34,988 | 100.0% | 37,700 | 100.0% | +7.7% |

Operating profit | 2,129 | 6.1% | 2,750 | 7.3% | +29.2% |

Ordinary profit | 2,175 | 6.2% | 2,900 | 7.7% | +33.3% |

Profit | 1,343 | 3.8% | 2,020 | 5.4% | +50.3% |

*Unit: Million yen.

They project a 7.7% increase in sales and a 29.2% increase in operating income from the previous fiscal year.

For the term ending March 2024, the company forecasts that sales will rise 7.7% year on year to 37,700 million yen and operating income will increase 29.2% year on year to 2,750 million yen. No revision to forecasts at the second quarter of FY 3/24. The sales from information processing and system development services are expected to be healthy. In terms of profit, the company revised selling prices related to data centers to reflect the augmentation of costs caused by the skyrocketing of electricity charges, etc. from the previous term, and actively invested in energy-saving equipment. These activities are expected to contribute to the improvement in profitability. This year, the rise in electricity charges for business subsided, so it will not decrease profitability. Operating income margin is projected to rise 1.2 points from the previous term to 7.3%.

The dividend remains unchanged at 52.00 yen/share, an increase of 4.00 yen/share from the previous year, increasing the dividend amount for the 12th consecutive term. The expected payout ratio is 41.1%.

(2) Progress ratio

| FY 3/24 2Q Cumulative (Act.) | FY 3/24(Est.) | Progress ratio |

Net sales | 18,979 | 37,700 | 50.3% |

Operating profit | 1,575 | 2,750 | 57.3% |

Ordinary profit | 1,601 | 2,900 | 55.2% |

Profit | 1,041 | 2,020 | 51.6% |

*Unit: Million yen.

As of the end of the cumulative second quarter, the progress rate toward the full-year forecast is as healthy as over 50% for both sales and all kinds of profits.

(3) Business strategy

No matter how society changes, the I-NET Group will increase services and partners in the platform while adapting to changes, and aim to expand business through measures for new businesses.

(Taken from the reference material of the company)

5. Conclusions

In the first half of the term ending March 2024, sales and operating income grew 12.9% and 48.7%, respectively, year on year. This is because the sales of cloud services and information processing services, including the calculation service for service stations (gas stations), were healthy and the projects for developing systems for the financial industry performed better than expected. In terms of profit, profitability improved as the company revised the selling prices related to the data center while reflecting the rise in costs due to the skyrocketing of electricity charges, etc. from the previous term, and actively invested in energy-saving equipment, although costs remained high due to the hovering electricity charges, etc. In the second quarter (Jul-Sep), operating income margin recovered to 9.4%, hitting a record high for the second quarter (Jul-Sep) since the term ended March 2020. While sales were healthy, the most significant risk among the risks that would affect the performance of the company turned out to be the rise in electricity charges, etc. However, it was proved that even if electricity charges keep rising, they will be able to reflect it in prices, and even if profit margin drops temporarily, they will be able to catch up. This is expected to reassure investors and improve their evaluations on the stock price of the company. As the results in the first half were favorable, the progress rate toward the full-year forecast is as healthy as over 50% for both sales and all kinds of profits. Every year, the sales and profit of the company tend to be largest in the fourth quarter (Jan-Mar) and larger in the second half. The performance trend in the second half of the current term is noteworthy, to see how much the company can exceed the forecast for the current term to achieve the medium-term management plan for the next term. In particular, the profit margin in the second half is noteworthy, to see whether the company can improve profitability more than they did in the first half, while the external environment remains uncertain due to the hovering electricity charges, etc.

In the ongoing medium-term management plan, the company will concentrate on the enhancement of (1) customer services and R&D for DX and the New Normal, (2) co-creation, innovation, and value creation, (3) diversification, advance, and productivity improvement of personnel, and (4) the appropriate management of the business portfolio in the service provision model and improvement in corporate value. We would like to keep an eye on the progress and outcomes of these priority measures.

<Reference: Regarding Corporate Governance>

◎Organization type and the composition of directors

Organization type | Company with audit and supervisory committee |

Directors | 10 directors, including 6 outside ones |

Audit and Supervisory Committee Member | 3 auditors, including 3 outside ones |

◎Corporate Governance Report

Last update date: June 23, 2023

<Basic Idea>

We promote construction and maintenance of business management systems as priority items which can cope with a change of the management environment quickly, while we improve business transparency for the purpose of effectiveness and efficiency of business operations, reliability of the financial statements, and the compliance with the relevant laws and ordinances.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle | Details |

Principle 1-4 [Strategically-held shares] | <Policy on strategic shareholding> We will hold shares strategically for the purpose of smooth business operations, maintenance and strengthening of business relationships, etc., only when it is deemed necessary after comprehensively considering the medium to long-term economic rationality and future prospects. With regard to strategically-held shares, we will discuss the purpose of shareholding, the risks associated, and investment returns for each stock while considering changes in the business environment, etc., and periodically review our shareholding policy with a view to reducing the number of shares we hold.

<Criteria for exercising voting rights for strategically-held shares> With respect to the exercise of voting rights for strategically-held shares, our company makes decisions on whether to approve or disapprove proposals, based on a comprehensive review of the management policy and business strategy of the company concerned, in addition to whether each proposal conforms to our shareholding policy, and whether it would lead to an improvement in corporate value. In addition, we will engage in dialogue with the issuing company regarding the content of the proposal, etc. as necessary. |

Principle 2-4-1 [Ensuring Diversity in the Promotion of Core Human Resources, etc.] | Our company has been actively and continuously recruiting and appointing diverse human resources, including women, non-Japanese workers, and mid-career hires, and making efforts to create a working environment that makes the most of the characteristics and abilities of each individual and to educate the management. We have set a target of increasing the ratio of female managers from the current 8.2% to 12% by March 2026, and have adopted a policy of keeping the ratio of female employees fresh out of college 40% or higher every year. To know more about our other initiatives, please refer to our website. https://www.inet.co.jp/english/sustainability/social/diversity.html In addition to the initiatives, we have made so far, the medium-term management plan includes a mid-career recruitment strategy and the strengthening of the education and training system and content to improve human resources at all levels. |

Supplementary Principle 3-1-3 [Sustainability Initiatives] | For more information on our management strategy, sustainability initiatives, etc., please refer to our website. (1) Medium to Long-term Goals/Management Strategy https://www.inet.co.jp/english/ir/policy/goal.html#contents (2) Medium-term Management Plan https://www.inet.co.jp/english/ir/policy/mid-goal.html#contents (3) Sustainability Initiatives https://www.inet.co.jp/english/sustainability/

<Investment in human capital and intellectual property> We formulate mid-term management plans, design management strategies based on our company-wide priority measures, with a "defense" strategy of strengthening ties with customers and an "offense" strategy of developing new market areas and services, and strive to enhance both tangible and intangible value by thoroughly adopting a customer-first approach, offering value-added proposals, developing products and services with growth potential, and promoting investment in human resources. In addition, we are making future-oriented investments based on our medium-term management plan, including investments in human resources that form the basis of everything we do, data centers that are the core of our business model, and research and development, which will help us differentiate our products and strengthen our competitiveness. <Disclosure, etc. based on the recommendations of TCFD> Please refer to our website for our climate-related financial information (disclosure based on TCFD recommendations). https://www.inet.co.jp/english/sustainability/tcfd.html |

Principle 5-1 [Policy for Constructive Dialogue with Shareholders] | Our company has established an IR policy and discloses basic policies, disclosure standards, disclosure methods, quiet periods, etc. In order to contribute to sustainable growth and medium/long-term improvement of corporate value, we are open to dialogue with shareholders and investors to a reasonable extent. Our company has established a Corporate Strategy & Investor Relations Department as a department in charge of IR, and has established an IR system with an executive officer in charge of IR. The IR department fully cooperates with the Corporate Planning, General Affairs, Accounting, Human Resources, and Business Divisions, etc. to disclose management and financial information to stakeholders, including shareholders and investors, in a timely and appropriate manner. In terms of dialogue with shareholders, we hold business briefings after the announcement of full-year financial results, as well as financial results briefings for analysts and institutional investors twice a year, at which the President and Representative Director provides explanations and holds dialogue. In addition, the President and Representative Director, the senior management, and the IR department hold individual meetings with institutional investors and company briefing sessions for individual investors when necessary. The officer in charge of IR submits the opinions of shareholders and investors as feedback for discussion and reporting to the Board of Directors, etc., as necessary. In addition, when engaging in dialogue, the company pays close attention to the management of insider information in accordance with internal regulations. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages, or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |