| Kyoritsu Maintenance Co., Ltd. (9616) |

|

||||||||||||||

Company |

Kyoritsu Maintenance Co., Ltd. |

||

Code No. |

9616 |

||

Exchange |

TSE 1st Section |

||

Chairman |

Haruhisa Ishizuka |

||

President |

Mitsutaka Sato |

||

HQ Address |

2-18-8 Soto Kanda, Chiyoda-ku, Tokyo |

||

Year-end |

March |

||

URL |

|||

* Share price as of closing on June 11, 2014. Number of shares outstanding as of most recent quarter end excluding treasury shares.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company.

This Bridge Report provides information about Kyoritsu Maintenance Co., Ltd. including a review of fiscal year March 2014 earnings.

|

|

| Key Points |

|

| Company Overview |

<Corporate History>

Kyoritsu Maintenance was established in September 1979. The founder, Haruhisa Ishizuka, has long been associated with the food service industry and started the Company by taking on the operations of corporate cafeteria facilities on a consigned basis. In the following year of 1980 in Sakura City, Chiba Prefecture, the Company established a two-story wooden structure with 28 small four Japanese straw mat rooms as its first dormitory facility. Based on the principle of providing "food" that "fosters the health and well being of students to put their parents' minds at ease," Kyoritsu was able to steadily expand its student dormitory business through partnerships with various schools. The Company steadily expanded its operating territory to cover the Tokyo, Kanagawa, Nagoya and Osaka regions. In April 1985, Kyoritsu began offering corporate dormitories to employees that offered highly unique features of "individual rooms with commissary functions providing breakfast and dinner," and "large bathing facilities" as comforting amenities for residents. In May 1987, Kyoritsu began eating-out business based on know-how for board, which was cultivated through consignment business for dormitories and facilities for boarding. In June 1993, the Company moved its headquarters to its current location and in July of the same year it entered the resort hotel business with the opening of a facility in Nagano Prefecture, followed by their entry to the business hotel realm in August with the opening of a facility in Saitama Prefecture. In September 1994, Kyoritsu listed its shares on the JASDAQ Market (At the time called the OTC Market), in March 1999 it moved its listing to the Second Section of the Tokyo Stock Exchange, and then to the First Section in September 2001.

<Midterm Business Plan and Hotel Business Promotion>

Kyoritsu is currently in the course of promoting its midterm business plan called "Kyoritsu Value Up Plan!" announced in December 2011 and covering the period from fiscal years March 2012 to 2016. This plan calls for "reforms of the dormitory business and implementation of new growth strategies," "acceleration of the expansion in earnings as the hotel business enters its investment recovery phase," "cultivation of new businesses to become the third pillar of operations," and "training and optimal allocation of human resources." Also, the plan has established sales, and operating and ordinary income targets of ¥137.7, ¥11.0, and ¥8.95 billion to be achieved in the final year of the plan in fiscal year March 2016. At the start of fiscal year March 2014, the third year of the midterm business plan, the hotel business segment got off to a good start with occupancy rates rising 0.5% points above the previous year's level. Consequently, improvements in occupancy rates and customer pricing in both the business and resort hotels allowed higher levels of profits to be achieved than called for by the business plan.

Midterm Business Plan Numerical Targets

Sales, Profits Targets

Hotel Business Promotion

The hotel business of Kyoritsu Maintenance has been well received in the market, and aggressive efforts will be promoted to expand this business. The Company maintains a policy of promoting efforts to expand its relatively small number of facilities in Tokyo in advance of the 2020 Tokyo Olympics.

|

| Fiscal Year March 2014 Earnings Results |

Sales, Ordinary Income Rise by 5.8%, 21.4%

Sales and ordinary income rose by 5.8% and 21.4% year-over-year to ¥105.216 and ¥6.796 billion respectively. Sales of the dormitory business rose on the back of increases in the number of residents due to new facility openings and in occupancy rates of 0.5% points year-over-year at the start of the term. At the same time, the hotel business benefitted from favorable pricing trends and increases in occupancy rates compared with the previous term. Acquisition of new projects allowed sales of the Public Kyoritsu Partnership (PKP) business to rise. With regards to profits, the high occupancy rates of the hotel business contributed to a 0.5% point increase in gross margins, and combined with a 0.2% point decline in sales, general and administrative expense margin to allow operating income to rise by 14.9% year-over-year to ¥7.490 billon. Moreover, declines in interest payments and increases in foreign exchange translation gains allowed ordinary and net incomes to rise by 21.4% and 19.4% year-over-year to ¥6.796 and ¥3.829 billion respectively. Compared with the upward revisions announced in November at the time of the first half earnings announcement to operating, ordinary and net incomes from ¥7.1 to ¥7.4, ¥6.2 to ¥6.6, and ¥3.4 to ¥3.6 billion respectively, Kyoritsu was able to exceed these revised estimates at all levels of profits.

Dormitory Business

Sales and operating income rose by 2.9% and 1.6% year-over-year to ¥41.452 and ¥6.119 billion respectively. Occupancy rates got off to a good start and rose by 0.5% points compared with the previous fiscal year to 97.0%. Sales rose on the back of increases in the number of dormitory facilities and contracted residents by 9 to 427 (Excluding consigned facilities) and 1,268 to 33,681 respectively. Also, strict management of costs on a facility by facility basis contributed to the rise in operating income.Sales of the student dormitory business rose by 2.6% year-over-year to ¥24.743 billion. Business conditions trended favorably on the back of new alliances formed with the Musashino Art University, Dokkyo University, and Tokyo Institute of Technology. Due to services supporting students that leverage Kyoritsu's unique features of "healthy food menus, " "safe and comfortable facilities made possible through full-time supervision," and "employment seminars held within dormitories," the number of contracted residents in student dormitories rose by 1.0% year-over-year to 19,517. Sales of corporate dormitories rose by 2.7% year-over-year to ¥9.673 billion. Favorable conditions reflected the reevaluation of the positive aspects of dormitories by large corporations and their increasing use of them as new employee training facilities and for a wide range of other purposes. Consequently, the number of contracted residents rose by 10.0% year-over-year to 8,684. Sales of the Dormeal studio type condominiums rose by 4.5% year-over-year to ¥3.720 billion. Dormeal responds to the diversifying needs of students and single workers by providing them with studio type condominiums on an individual contract basis, and to the demand from residents looking to move from facilities with commissary facilities to those without. Consequently, the number of contracted residents rose by 3.4% year-over-year to 4,366. In the consigned dormitory management business, Kyoritsu manages corporate and school dormitory facilities on a consigned basis and endeavors to differentiate its services by promoting its status as "Japan's best dormitory operator." These efforts have been successful in growing sales by 4.3% year-over-year to ¥3.315 billion.  Hotel Business

Sales and operating income rose by 11.1% and 34.8% year-over-year to ¥43.475 and ¥3.830 billion respectively. The opening of three new facilities brought the total number of facilities in operation to 71 and contributed to a rise in the number of rooms by 317 to 10,612. This strong sales growth allowed sales of this business to exceed that of the dormitory business.

.Dormy Inn (Business Hotel) Business Sales Rise 13.3% Year-Over-Year to ¥21.755 Billion

Sales of the Dormy Inn business rose by 13.3% year-over-year to ¥21.755 billion. Kyoritsu Maintenance focused upon providing customers with "large hot spring type bathing facilities" and "good tasting breakfast menus," in addition to fortifying foreign language, hospitality and manner training of its staff to raise customer satisfaction. Based upon these efforts, Kyoritsu also promoted aggressive marketing of its other detailed services including web marketing solutions that cater to a wide range of customers including not only business travel users but also pleasure travel users as well. Furthermore, the Company leveraged the correction in the strength of the yen to cultivate customers from Korea and other parts of Asia, subsequently the number of foreign customers grew. Amidst these trends, the opening of new facilities including the "Natural Hot Spring Satsuki no Yu Dormy Inn EXPRESS Kakegawa" and "Natural Hot Spring Yugiri no Yu Dormy Inn PREMIUM Namba" contributed to increases in sales. Both occupancy rates and pricing at existing facilities exceeded not only the previous term, but also beat the outstanding estimates by large margins.

Resort Hotel Business Sales Rise 8.9% Year-Over-Year to ¥21.719 Billion

Sales of the resort hotel business rose by 8.9% year-over-year to ¥21.719 billion. Kyoritsu seeks to satisfy all of its guests by providing them with "high quality resort style accommodations at reasonable prices" and "comforting accommodations." The opening of "Inishie no Yado Ikyu" was timed to match the commemorative ceremonies being held at the Ise Jingu Shrine and contributed to high occupancy rates throughout the year. Furthermore, the Company created a service lineup that was successful in raising the occupancy rates on weekdays and throughout the full year, allowing occupancy rates to trend above the previous year's levels.

Other Business

Sales rose by 2.0% year-over-year to ¥32.738 billion, and the operating loss improved from ¥157 million in the previous term to ¥34 million in the current term. Contracted services business sales declined by 5.6% year-over-year to ¥13.025 billion while operating income grew by 208.8% year-over-year to ¥175 million. The building maintenance business suffered from severe operating conditions with intense competition arising from consolidation of service providers in the greater Tokyo metropolitan area. Under these conditions, the addition of profitable projects and strict cost management allowed operating income to rise despite the loss of sales arising from the sale of self-owned properties. Sales of the food service business rose by 5.2% year-over-year to ¥5.180 billion, and operating loss improved from ¥126 million in the previous term to ¥43 million in the current term. Amidst a continuation of the difficult operating environment, recovery in private consumption led to signs of improvements in the outlook for the industry. The construction business sales and operating income declined by 7.4% and 15.3% year-over-year to ¥7.577 billion and ¥305 million respectively. Sudden increases in development costs contributed to delays in some projects. Other business segment sales rose by 34.0% year-over-year to ¥6.955 billion while operating loss expanded slightly from ¥448 million in the previous fiscal year to ¥472 million in the current term. Operating expenses rose on the back of an expansion in the PKP business.  The issuance of the 3rd unsecured convertible bond in December 2013 raised ¥15.0 billion in capital. Interest bearing liabilities increased from ¥57.650 to ¥67.550 billion, and net interest bearing liabilities (Total liabilities minus cash and equivalents) rose by ¥2.815 billion from ¥40.028 to ¥42.843 billion.  |

| Fiscal Year March 2015 Earnings Estimates |

Sales, Ordinary Income Expected to Rise by 6.5%, 4.5% Year-Over-Year

Sales and ordinary income are expected to rise by 6.5% and 4.5% year-over-year. Occupancy rates in the dormitory business, the key indicator of future earnings, got off to a good start at 97.2% in April. The hotel business, which was a strong driver of growth during fiscal year March 2014, is expected to see a slight slowing in sales growth as a relatively small number of new openings are anticipated in fiscal year March 2015, and the bulk of openings expected to occur from fiscal year March 2016 onwards. Annual dividends are scheduled to be ¥48 per share, comprising an interim and year-end dividend each ¥24.

Endeavors by Business Segment

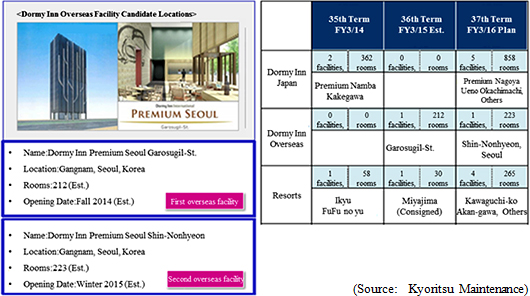

The dormitory business sales and operating income are expected to rise by 2.3% and 3.7% year-over-year to ¥42.421 and ¥6.345 billion respectively. Kyoritsu Maintenance is taking steps to respond to the expanding needs of residents by fortifying its structure and increasing the speed of its development strategy. At the same time, the Company is promoting structural reforms needed to implement strict control of occupancy rates and costs on a facility-by-facility basis. Occupancy rates got off to a good start at 97.2% at the beginning of the term, and the number or residents is expected to grow due to the opening of new facilities. Reviews of management expenses and the contribution of new facilities are expected to allow profits to grow. Moreover, anticipatory investments including large scale renovations will be made with a view to the long-term growth of the Company. In the hotel business, sales and operating income are expected to rise by 6.4% and 5.5% year-over-year to ¥46.242 and ¥4.041 billion respectively. With regards to the Dormy Inn business, favorable reception by customers of existing facilities is expected to contribute to the establishment of the brand and an expansion in earnings. In addition to facilities in Japan, the first overseas facility will be opened in the Gangnam region of Seoul, Korea this fall called "Dormy Inn PREMIUM Seoul Garosugil", with plans to open other facilities in high growth regions of Asia and as part of Kyoritsu's strategy of capturing hotel demand of Japanese traveling overseas and hotel demand of foreigners traveling to Japan. However, the burden from anticipatory investments for overseas facilities is expected to be a negative factor influencing profits. Kyoritsu will endeavor to raise customer satisfaction by focusing upon the "highly comfortable accommodations" to become the number one facility in each of its operating regions, fortifying its customer services and implementing strict cost controls. In addition, the marketing structure will be fortified to cultivate new customers and to maintain a high level of repeat customers, and an accelerated development strategy will be pursued to ensure future growth. In the other business segment, sales are expected to rise by 13.7% year-over-year to ¥37.229 billion and operating income is expected to improve by a large margin from a loss in the previous term of ¥34 million to a profit of ¥576 million in the coming term. The Public Kyoritsu Partnership business, which is being cultivated to become another cornerstone of Kyoritsu's earnings structure, is being conducted to provide consigned services jointly with the cooperation of regional government bodies and has reached critical mass in terms of sales, which should allow it to contribute positively to earnings in the future.  Hotel Business Development Plan

|

| Conclusions |

|

<Disclaimer>

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2014 All Rights Reserved by Investment Bridge Co., Ltd. |