Bridge Report:(9616)Kyoritsu Maintenance Fiscal Year March 2019

Haruhisa Ishizuka, Chairman |

Takumi Ueda, President | Kyoritsu Maintenance Co., Ltd. (9616) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Service |

Chairman | Haruhisa Ishizuka |

President | Takumi Ueda |

HQ Address | 2-18-8 Soto Kanda, Chiyoda-ku, Tokyo |

Year-end | March |

Website |

Stock Information

Share Price | Shares Outstanding (Excluding Treasury Shares) | Market Cap. | ROE (Act.) | Trading Unit | |

¥5,250 | 38,990,696 shares | ¥204,701 million | 12.6% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥47.00 | 0.9% | ¥261.60 | 20.07x | ¥2,040.75 | 2.6x |

* Share price as of closing on June 12, 2019. Number of shares outstanding as of the end of the most recent quarter excluding treasury shares.

ROE and BPS as of the end of the previous term.

*DPS and EPS as of the end of the next term, which are rounded off.

Consolidated Business Results

Fiscal Year | Sales | Operating Profit | Ordinary Profit | Net Profit | EPS(¥) | DPS(¥) |

March 2016 | 135,053 | 10,244 | 9,775 | 5,970 | 314.56 | 52.00 |

March 2017 | 135,828 | 11,815 | 11,514 | 7,135 | 368.70 | 62.00 |

March 2018 | 152,021 | 13,087 | 12,928 | 8,778 | 225.86 | 40.00 |

March 2019 | 162,811 | 14,567 | 14,321 | 9,567 | 245.41 | 45.00 |

March 2020 Forecast | 183,000 | 15,700 | 15,400 | 10,200 | 261.60 | 47.00 |

*Forecast is announced by the Company. A 2 for 1 stock split was implemented on April 1, 2017.

This Bridge Report provides information about Kyoritsu Maintenance Co., Ltd. including a review of fiscal year ended March 2019 financial results and fiscal year ended March 2020 financial forecast.

Index

Key Points

1. Company Overview

2. Medium-Term Management Plan “Kyoritsu Jump Up Plan”

3. Fiscal Year Ended March 2019 Financial Results

4. Outlook for Fiscal Year Ended March, 2020

5. Remarkable points of the future

Reference: Corporate Governance

Key Points

- In the term ended March 2019, revenue and ordinary profit grew 7.1% and 10.8%, respectively, year on year. The Hotel Business was affected by the natural disasters, but the Company couldn’t have done prompt recover, and RevPAR (occupancy rate × ADR) surpassed levels in the previous year. The occupancy rate of the Dormitory Business at the beginning of the term was lower than that in the previous year due to temporary factors, but recovered during the period and grew stably. Despite recorded expenses related to preparations to open new facilities, the earnings results in fiscal year ended March 2019 were ahead of the financial forecast of the Company and the annual dividend per share increased 5 yen vs. previous year to 45.0 yen.

- Revenue and ordinary profit in the fiscal year ended March 2020 are estimated to increase 12.4% and 7.5% vs. previous year, respectively. The Dormitory Business made a good start with an occupancy rate of 98.7% at the beginning of the term, up 1.0 point from the previous year. The forecasted profit growth vs. previous term is lower than that of the previous term due to the investment in advance for building a solid business foundation and increase in huge renewal expenses and system modification fees for further enhancement of customer satisfaction. Growth of ”underlying” operating profit excluding special factors vs. previous term (expected) is +15.4%, higher than +7.8% of reported basis. The Company projected an annual dividend per share of 47.0 yen (including 22.0 yen in the first half).

- Despite some successive natural disasters in the fiscal yera ended March 2019, the company couldn’t have done prompt recover and the term ending March 2020 made a good start with an occupancy rate of 98.7% in the Dormitory Business at the beginning of the term. In the Hotel business, in addition to the expected increase in the number of foreign customers, some successive natural disasters in the previous year will result in the high growth rate in this term. The Company has been struggling with improving the quality of the Internet service for customers for years, but various measures are taken these days. The Company will be stronger if it is able to attain good results. PER is over 20x, but it can be said that there are still scope for share price improvement considering the underlying double-digit growth in profit, conservative financial forecast of the Company and medium-to-long-term growth potential.

1. Company Overview

Kyoritsu Maintenance has been conducted business activities under the management policy upon the concept of “contributing to development of society through the provision of healthy food, comfortable living services in various stages of people’s lives and great comfort.” In its dormitory business, Kyoritsu seeks to provide modern versions of the “traditional Japanese boarding house” (Geshukuya – Traditional Japanese dormitories that also provide food services). Its hotel business segment can be divided into the business hotel operations, where “large hot spring type bathing facilities” and “good tasting breakfast menus” maximized the accumulated know-how in its dormitory business are provided, and resort hotel operations, where “high quality resort lifestyles in spite of reasonable price” are provided. Kyoritsu also provides various services such as building maintenance for both residential and office buildings, building rental and leasing services and parking lot operations management. In its food services business, eating-out business and restaurant operations are conducted. Furthermore, for the primary revenue stream, Kyoritsu is using its massive power of brand recognition to maintain its position as the leader within the dormitory business, and to accelerate growth in its hotel business.

The composition of consolidated fiscal year March 2019 revenue by business segment is provided below.

Business Segment | Business Description | Revenue Share* |

Dormitory | Dormitories for students and employees, Domeal and outsourced dormitory management | 27.5% |

Hotel | Dormy Inn (Business hotels), Resort hotels | 44.0% |

Contracted Services | Management of office building and residential property | 8.7% |

Food Services | Restaurant business, outsourced cafeteria business, hotel restaurant outsourcing business | 3.9% |

Construction | Construction, planning, design, brokerage, condominium sales, Sales and lease back of real estate, other related business of real estate | 8.9% |

Other (Not an official consolidated business segment) | Senior Life Business (senior citizen residence management and operations), Public Kyoritsu Partnership business (PKP: commissioned business for local governments ), Support services for live-alone insurance agency business, comprehensive human resources services, financing services and administrative outsourcing services | 7.0% |

*Before elimination of intersegment transactions

<Corporate History>

Kyoritsu Maintenance was established in September 1979. The founder, Haruhisa Ishizuka, has long been associated with the food service industry and started the Company by taking on the operations of corporate cafeteria facilities on a commissioned basis. In the following year of 1980, the Company established a two-story wooden structure with 28 small-four-Japanese-straw-mat-rooms as its first dormitory facility in Sakura City, Chiba Prefecture. Based on the principle of providing “nutritious food” that “fosters the health and well-being of students to put their parents’ minds at ease,” Kyoritsu was able to steadily expand its business of dormitories for students through partnerships with various schools. Also, the Company steadily expanded its operating territory to cover the Tokyo, Kanagawa, Nagoya and Osaka regions. In April 1985, Kyoritsu started offering dormitories for employees which have highly unique features of “individual rooms with commissary functions providing breakfast and dinner,” and “large bathing facilities”. In June 1993, the Company moved its headquarter to its current location and in July of the same year, it came to the resort hotel business with the opening of a facility in Nagano Prefecture, followed by their entry to the business hotel realm in August with the opening of a facility in Saitama Prefecture. In September 1994, Kyoritsu got listed its shares on the JASDAQ Market, and in March 1999 it moved its listing to the Second Section of the Tokyo Stock Exchange, and then to the First Section in September 2001.

2. Medium Term Business Plan “Kyoritsu Jump Up Plan”: 5 Years from Fiscal Year 3/2018 to 3/2022 and the progress

The New Medium -Term Business Plan "Kyoritsu Jump Up Plan" started in the fiscal year ended March 2018 has been performing well since the first year. The actual performance such as the development of dormitories and hotels is much greater than the targets of this plan.

(1) “Kyoritsu Jump Up Plan” Overview

Name: “Kyoritsu Jump Up Plan”

Fundamental Strategy

Ⅰ.Improving Customer Satisfaction

Produce products and services that lead to better customer satisfaction, raise customers’ assessment of the Company and get greater trust

Ⅱ.Anticipatory Investments in Development

Expand business bases and build a solid business fundation

Period: April 2017 to March 2022

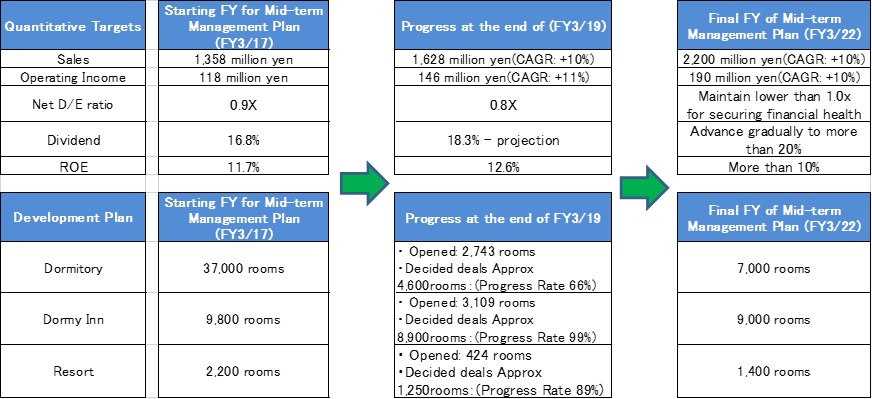

Key Quantitative Targets and Progress

(Source: Kyoritsu Maintenance)

(2) Important Measures to Further Improve Customer Satisfaction

1. Strengthening Human Resources Development

The Company has been implementing measures to secure human resources needed to ensure that the speed of its business expansion can be maintained. Along with proactive hiring of new graduates, efforts will be made to stably secure highly skilled human resources that can respond well to the needs of our customers.

*Stable Securing of Human Resources: Further Strengthen Hiring Capabilities, Promote High Rates of Retention

Number of New Graduate Hires

April 2019 | April 2020 | April 2021 |

296 (Act) | 300 (Plan) | 300~320/year (Plan) |

General work: 31 | General work: 22 | General work: 20 |

Hotel: 260 | Hotel: 270 | Hotel: 290 |

Senio 5 | Senio 8 | Senio 10 |

(Created by Investment Bridge using Kyoritsu Maintenance Disclosure Material)

Kyoritsu Maintenance employed 57 foreign students from Nepal, Vietnam, China, Republic of Korea, etc. in April 2019. There are no restrictions in the number of recruits for foreign students, and the company will actively recruit talented personnel.

Utilizing the good relationships with universities and colleges cultivated through the Dormitory Business, the Company has a strong recruiting route for graduates with a recommendation from the them. The number of recruits who graduated and were introduced from the universities and colleges that used the Company's dormitories was 147, which is 49.7% of the total recruits, in April 2019.

↓

*Enhance Training Programs: Improve the Level of Service, Enhance Training Programs by Hierarchy Level

↓

*Promote Racial Diversity

↓

*Further Improve Customer Satisfaction

2. Dormitory Business

Expand Product Lineup, Improve Added Value

(Source : Kyoritsu Maintenance Disclosure Material)

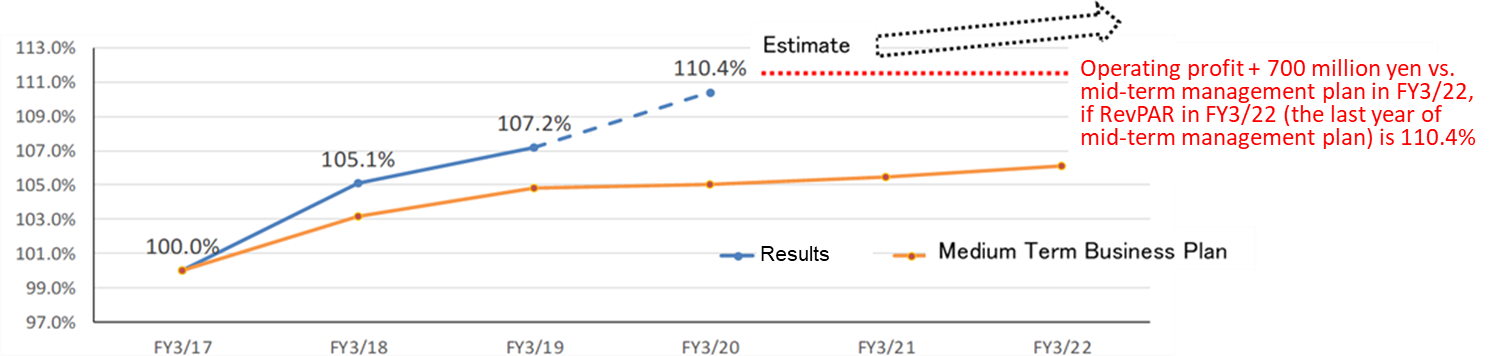

3. Hotel Business

RevPAR of Dormy Inn business exceeding mid-term management plan across the board

(Source : Kyoritsu Maintenance Disclosure Material)

The number of foreign visitors to Japan was 24.82 million in FY 3/2017, 29.77 million in the FY 3/2018, and 31.63 million in FY 3/2019, making the government’s target of having 40 million visitors in 2020 achievable. Against this backdrop, both the occupancy rates and ADR grew up, and RevPAR was exceeding the estimation of the medium-term plan.

(Note) RevPAR is considered as KPI (Key Performance Indicator) of the Hotel Business, which refers to occupancy rate × ADR.

(3) Development Plan

Development Plan of dormitories and hotels for Sustainable Growth.

During Medium-Term Management Plan, the Company plans to develop 7,000 rooms in the Dormitory Business, 9,000 rooms in the Dormy Inn Business, and 1,400 rooms in the Resort Hotel Business.

The progression rates have reached 66% in the Dormitory Business, 99% in the Dormy Inn Business and 89% in the Resort Hotel Business in the end of the fiscal year ended March 2019.

| FY3/18 | FY3/19 | FY3/20 | FY3/21 | FY3/22 | |||||

Result | Result | Plan | Plan | Plan | ||||||

Dormitory/ | 10* | 963* | 15* | 1,852* | 14 | 1,506 | 5 | 416 |

|

|

Domeal | Facilities | Rooms | Facilities | Rooms | Facilities | Rooms | Facilities | Rooms |

|

|

FY3/17 | Available facilities 472 facilities | Available facilities 485 facilities | Available facilities 499 facilities | Available facilities 504 facilities | Available facilities 504 facilities | |||||

463 facilities/ 37,000 rooms | Lease ratio 88.4% | Lease ratio 88.7% | Lease ratio 88.8% | Lease ratio 88.9% | Lease ratio 88.9% | |||||

Available rooms 38,102 room | Available rooms 39,863 rooms | Available rooms 41,369 rooms | Available rooms 41,785 rooms | Available rooms 41,785 rooms | ||||||

Mid-term plan 7,000 rooms | Noda ANNEX, | [L]Waseda, [L]Hikifune, | [L]SendaithigashiguchiV, [L]Motoyama, [L]Kobe, [L]Osaka tenmangu, | [L]Sapporokita, |

| |||||

[L]Senjunakamachi, [L]Tsunashimaekimae, | [L]Keiotsunashima, | [L]Kagoshima, | [L]Sapporoekihigashi |

| ||||||

→Already Decided Approx. 4,600 rooms | Higashiosaka, | [L]Tsurugashima, Omoromachi, | [L] Ichigaya, | [L]Nippori, |

| |||||

[L]Minamikoshigaya, [L]Maihama, | [L]Kaihinmakuhari, [L]Tokorozawa, | Meidai Global Village, | [L]Sendaihigashiguchi |

| ||||||

Progression Rate 66% | [L]IrinakaII, [L]Koroen etc. | [L]Hakataekiminami Ⅱ Kokuraekimae,etc. | [L]Komagome, [L]Setagayatodoroki etc. | [L]Nagoyanisshin |

| |||||

Dormy Inn | 9 | 1,579 | 9* | 1,530* | 8 | 1,842 | 11 | 2,382 | 7 | 1,573 |

Facilities | Rooms | Facilities | Rooms | Facilities | Rooms | Facilities | Rooms | Facilities | Rooms | |

FY3/17 | Available facilities 73 facilities | Available facilities 81 facilities | Available facilities 89 facilities | Available facilities 100 facilities | Available facilities 107 facilities | |||||

64 facilities/ 10,200 rooms | Lease ratio 98.7% | Lease ratio 98.8% | Lease ratio 98.9% | Lease ratio 99.1% | Lease ratio 99.2% | |||||

Available rooms 38,102 room | Available rooms 13,279 rooms | Available rooms 15,121 rooms | Available rooms 17,503 rooms | Available rooms 19,076 rooms | ||||||

Mid-term plan 9,000 rooms | [L]PREMIUM Kanda, | [L]Honhachinohe, | [L]Maebashi, [L]Fukui, | [L]Nono Kyotoshichijo, | [L]Tokyo Bay (Toyosu), | |||||

[L]Miyazaki, | [L]Osakatanimachi, | [L]Morioka, | [L]Ikebukuro, | [L]HiroshimaANNEX, | ||||||

| [L]global cabin Suidobashi, | [L]Korakuen, [L]Oita, | [L]Nono Asakusa, | [L]Kobe, [L]Nagasakiekimae, | [L]Nono Yodoyabashi, | |||||

→Already Decided Approx. | [L]Koufumarunouchi, | [L]global cabin Hamamatsu, | [L]Kawasaki, | [L]Gotenba, [L]Toyohashi, | [L]Nono Matsumoto, | |||||

8,900 rooms | [L]Izumo, | [L]global cabin Yokohama Chinatown, | [L]Furano, | [L]PREMIUM Ginza, | [L]Nono Sendai, | |||||

| [L]EXPRESS Sendai Seaside, | [L]Takamatsu chuokoenmae, | [L]Mito, | [L]Nono Asakusabettei, | [L]Okayama, | |||||

Progression Rate 99% | [L]NonoNara, | [L]PREMIUM Namba ANNEX, | [L]Nono Kanazawa, | [L]Yokohama, [L]Matsue, | [L]Nono Kumamoto, | |||||

| [L] Kochi, [L]Matsuyama | [L]PREMIUM Osakakitahama, |

| [L]Fukuyama |

| |||||

Resort | 4 | 253 | 2 | 171 | 3 | 241 | 6 | 418 | 2 | 174 |

| Facilities | Rooms | Facilities | Rooms | Facilities | Rooms | Facilities | Rooms | Facilities | Rooms |

FY3/17 | Available facilities 28 facilities | Available facilities 30 facilities | Available facilities 33 facilities | Available facilities 39 facilities | Available facilities 41 facilities | |||||

24 facilities/ 2,200 rooms | Lease ratio 59.5% | Lease ratio 61.0% | Lease ratio 62.4% | Lease ratio 66.2% | Lease ratio 70.3% | |||||

Available rooms 2,462 room | Available rooms 2,633 rooms | Available rooms 2,874 rooms | Available rooms 3,292 rooms | Available rooms 3,466 rooms | ||||||

Mid-term plan 1,400 rooms | Keiun (Izumo), Tsukiyo no Usagi (Izumo), | [L]La vista Kirishima Hills,(Kagoshima), | [L]Echigoyuzawa (Niigata) | [L]La Vista Kusatsu (Gunma), | [L]La Vista Hakodate Bay ANNEX etc. | |||||

→Already Decided Approx. 1,250 rooms | [L]Le Chien Kyu-Karuizawa,

| [L]Shirakawago (Gifu), | [L]Kotohira (Kagawa), | [L]Nasushiobara Rengetsu(Tochigi), [L]Wakuraonsen (Ishikawa), |

| |||||

Progression Rate 89.0% | [L]Suiun (Gora) |

| Inazumi (Akita) | Kikuyabettei Suigetsu (Shizuoka),etc |

| |||||

Lease ratio(Total) | 89.2% | 89.7% | 89.9% | 90.2% | 90.7% |

*The number of increase in development facilities/rooms (not available facilities/rooms at the end of FY)

(Note) Red-highlighted parts mean the development facility with higher inbound ratio than our average. Underline parts mean the development facilities planed to real estate securitization.

[L]parts mean lease facilities.

(Source: Kyoritsu Maintenance)

(4) Financial Strategy

A total of ¥140.0 billion is expected to be spent on investments in development during the mid-term management plan . At the beginning of this plan , ¥70.0 billion was expected to be derived from cash flow, ¥30.0 billion from sales and lease back of real estate and ¥40.0 billion from externally raised funds. However, Kyoritsu Maintenance expects to gain more funding from sales and lease back of real estate than the estimation including 14 pieces of real estate at 65 billion yen with Sumitomo Mitsui Finance and Leasing Company, maintaining a soundness of financial condition with a Net D/E ratio of less than 1.0 (the ratio at the end of FY3/19 was 0.8).

(5) Dividend Payout Ratio Target

Kyoritsu Maintenance has continuously raised dividend per share from fiscal year ended March, 2013 onwards. Dividend payout ratio has remained in the 10% range, but it maintains a target dividend payout ratio over 20% to be achieved by fiscal year ended March, 2022.

(6) Measures to improve company recognition

■ Distributed corporate TV commercials to live broadcasting of the “Hakone Ekiden” and “Izumo Ekiden” – undoubtedly one of the well-known Ekiden races held in Japan

■ Distributed corporate radio commercials to TBS radio through the program we sponsored

■ Distributed TV commercials of Kyoritsu Resort “La Vista” in Hokkaido and Kyushu areas

■ Acting as an official sponsor of 2019 Japan Women’s Football League in 2019

■ Participation in various IR events

(7) Further improvement in customer satisfaction

■ Setting up and enhancement of comprehensive customer network

・Utilization of comprehensive customer database that leads to very kind hospitality

✓ Possessing customer data in advance will enable the company to provide customers with more appropriate reception using its service Customer data makes it possible to provide each customer with higher-quality service

✓ Use historical information on usage by customer as an effective way of marketing and take thorough countermeasures to secure customer information

・Designing a membership program so that customers can use our company over an extended period of time

✓ Make most valued customers understand our business and service better/ Grant some privileges/services to them

・Starting point program so that our customers can enjoy the benefits by using of our site to reserve our hotels.

The number of members of our site at the end of FY6/19 was 700 thousand people, increasing +29.2% compared to the end of FY3/18

✓Arranged a tie-up with “d point” program produced by NTT DOCOMO – very easy to earn and use “points”

■ Developed the application of “Domico” for residents of our dormitories

- Gradually expanded this operation from FY3/20

・Made it possible to apply for and cancel the board service at our dormitories on the day with simple method “by mobile phone”

・In addition, made it possible to file the notification of sleepover with dormitory “by mobile phone”

3. Financial Results for Fiscal Year Ended March, 2019

(1) Consolidated Earnings

| FY3/18 | Share | FY3/19 | Share | YY Change | Forecasts As of Nov. | vs Forecast |

Revenue | 152,021 | 100.0% | 162,811 | 100.0% | +7.1% | 164,600 | -1.1% |

Gross Profit | 33,806 | 22.2% | 37,581 | 23.1% | +11.2% | - | - |

SG&A | 20,719 | 13.6% | 23,014 | 14.1% | +11.1% | - | - |

Operating Profit | 13,087 | 8.6% | 14,567 | 8.9% | +11.3% | 14,300 | +1.9% |

Ordinary Profit | 12,928 | 8.5% | 14,321 | 8.8% | +10.8% | 13,900 | +3.0% |

Net Profit | 8,778 | 5.8% | 9,567 | 5.9% | +9.0% | 9,500 | +0.7% |

*Unit: million yen

* Figures include reference figures calculated by Investment Bridge Co., Ltd. Actual results may differ (applies to all tables in this report)

Revenue and ordinary profit grew by 7.1% and 10.8%, respectively, compared to the previous fiscal year .

Revenue increased 7.1% year on year to 162,811 million yen.

Our business environment remained favorable for our core business of dormitory and hotel mainly due to increase in the higher-level educational establishment-going rate, companies introducing dormitories and inbound demand year by year. On the other hand, our business environment was also affected by a string of unpredictable natural disasters from June, including an earthquake and torrential rainfall. Under the circumstances, we couldn’t have done prompt recover from the negative impact of natural disasters any better. We also proactively pursued management of business to further improve customer satisfaction and expanded the business foundation by pursuing advanced developments, which together constitute the framework for the medium-term management plan. In addition, we endeavored to increase in our visibility by running television commercials and participating in various IR events. These included co-sponsoring the university relay race in Hakone (Hakone Ekiden), which is closely related to our dormitory business, one of the Company’s core businesses.

In addition to the negative impact of natural disasters, the Company recorded ¥1,870 million in expenses related to preparations to open new facilities, as well ¥290 million in expenses for large-scale renovations contributing to further improvement of customer satisfaction. However, we achieved steady growth in the dormitory business, and in the hotel business, revenue per available room (RevPAR; calculated as the product of the average room price by the occupancy rate for each room), one of the key performance indicators, surpassed levels in the previous fiscal year. In addition, income was generated from the real estate securitization. As a result, the Company’s profit was higher than both previous fiscal year and announced forecast, offsetting the above temporary negative factors.

(2) Financial performance by Business Segment

| FY3/18 | Share | FY3/19 | Share | YY Change |

Dormitory | 47,052 | 27.2% | 48,936 | 27.5% | +4.0% |

Hotel | 70,160 | 40.5% | 78,342 | 44.0% | +11.7% |

Others | 55,904 | 32.3% | 50,775 | 28.5% | -9.2% |

Adjustments | -21,097 | - | -15,243 | - | - |

Total Revenue | 152,021 | 100.0% | 162,811 | 100.0% | +7.1% |

Dormitory | 7,579 | 46.7% | 7,807 | 42.9% | +3.0% |

Operating Profit Margin | 16.1% | - | 16.0% | - | - |

Hotel | 7,155 | 44.1% | 8,219 | 45.2% | +14.9% |

Operating Profit Margin | 10.2% | - | 10.5% | - | - |

Others | 1,489 | 9.2% | 2,172 | 11.9% | +45.9% |

Operating Profit Margin | 2.7% | - | 4.3% | - | - |

Adjustments | -3,137 | - | -3,632 | - | - |

Total Operating Profit | 13,087 | 100.0% | 14,567 | 100.0% | +11.3% |

Operating Profit Margin | 8.6% | - | 8.9% | - | - |

*Units: million yen

*Others = Comprehensive Building Management Business, Food Services Business, Development Business and the businesses not included in reported segments

Operating profit margin increased 0.3 pp year on year to 8.9% mainly driven by robust growth in Hotel Business.

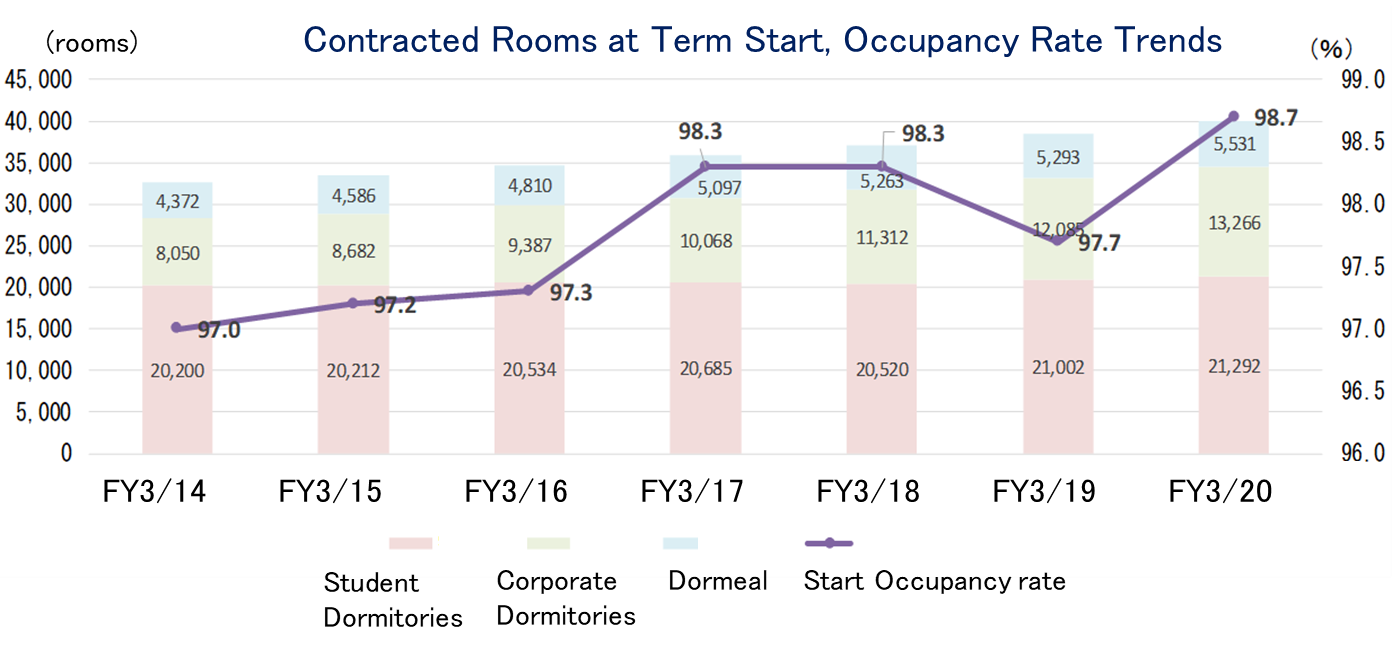

Dormitory Business

Revenue and operating profit increased 4.0% and 3.0% year on year to ¥48,936 million and ¥7,807 million, respectively. The number of dormitory facilities increased by 12 over the previous year (excluding commissioned facilities) to 485, resident capacity grew by 1,325 people to 39,450 people.

Initial occupancy rates at the beginning of the fiscal year in April 2018 were 97.7% (down 0.6 percentage points from the previous fiscal year), but this was caused by the temporary occurrence of empty rooms resulting from the completion timing of a new dormitory for the exclusive use of educational establishments. The number of contracts in the dormitory business for students returned to the previous upward trend, in addition to which the dormitory business for employees also saw a substantial increase in the number of contracts. As a result, the number of contracted residents in the dormitories increased by 1,466 year on year to 38,857 residents as of the end of March, 2019.

Created by Investment Bridge using Kyoritsu Maintenance Data.

The dormitory business for students continued to benefit from a high demand for dormitories mainly driven by the rise in university-going rate and an increase in foreign students attending universities in Japan. The number of contracts increased mainly due to an increase in new dormitories, including two international dormitories for students, and new affiliations with universities. As a result, revenue of dormitory business for students increased 2.2% year on year to ¥25,831 million.

The dormitory business for employees achieved substantial gains in the number of contracts mainly due to continuous improvement of the employment environment and the rise in the number of corporations introducing employee dormitories. As a result, revenue of the dormitory business for employees increased 7.8% year on year to ¥14,120 million.

In our Domeal business, we received support from client educational establishments and companies through their introductions of new residents and also met rising demand of moving to dormitories without board (studio-type rooms) to ones with board. Consequently, revenue of Domeal business grew by 1.3% year on year to ¥4,524 million.

Hotel Business

Revenue increased 11.7% year on year to ¥78,342 million. Domestic travelers and inbound demand continued to increase, despite the impact of natural disasters. In addition, our efforts to ensure that customers were put first resulted in RevPAR that exceeded levels in the previous year. Consequently, both revenue and operating profit increased year on year fully offsetting hotel opening expense. Operating profit increased 14.9% year on year to ¥8,219 million offsetting around ¥1,650 million in expenses for the opening of new facilities, including a new office to be opened in the future, around ¥190 million in large-scale renovation expense aimed at further improving customer satisfaction, and the negative impact of natural disasters.

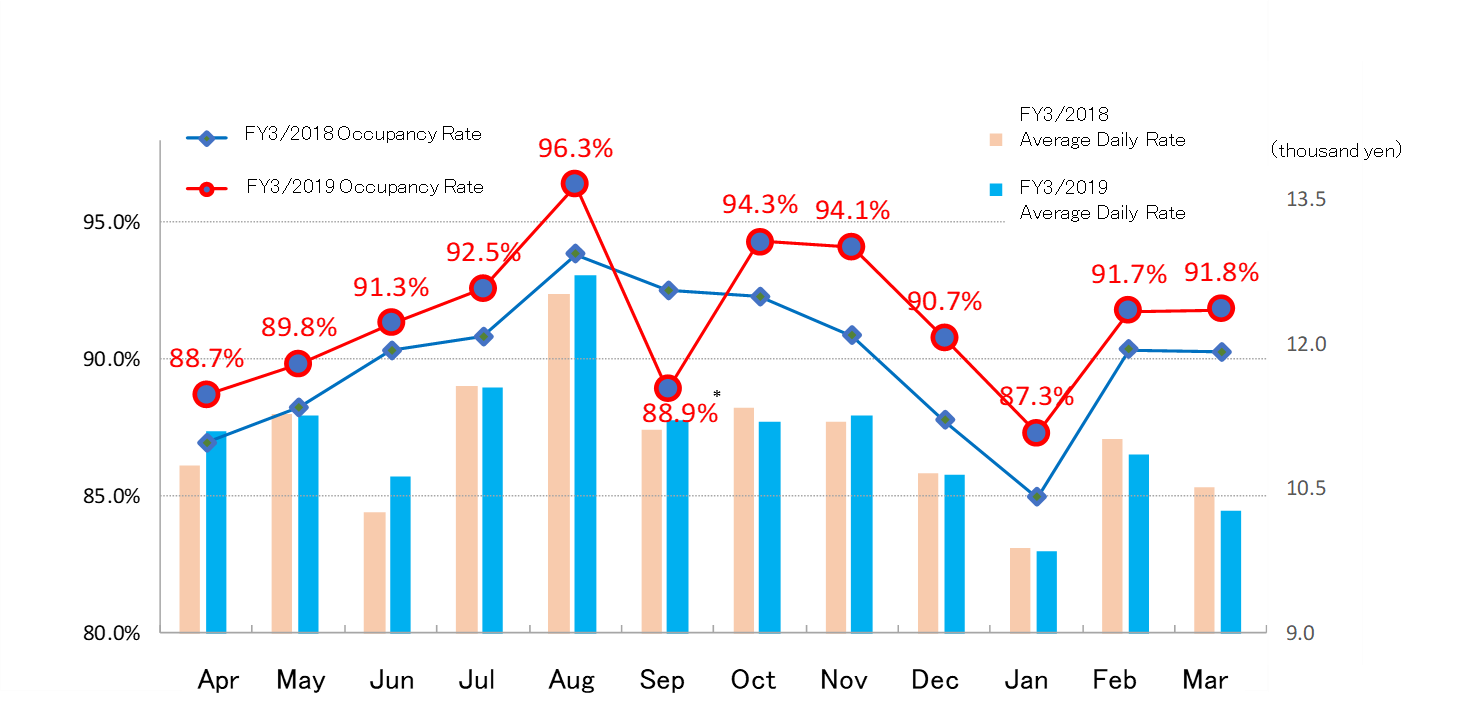

Dormy Inn (Business Hotel) Division

This fiscal year we have opened nine hotels: “Natural Springs Nanbu no Yu Dormy Inn Honhachinohe,” “Natural Springs Shiraito no Yu Dormy Inn Oita,” “Natural Springs Naniwa no Yu Dormy Inn Osaka Tanimachi,” “Kasuga no Yu Dormy Inn Korakuen,” “Dormy Inn Global Cabin Hamamatsu,” “Natural Springs Tamamo no Yu Dormy Inn Takamatsuchuokoenmae,” “Dormy Inn Global Cabin Yokohama Chukagai,” “Natural Springs Asagiri no Yu Dormy Inn PREMIUM Namba ANNEX,” and “Natural Springs Suito no Yu Dormy Inn PREMIUM Osakakitahama.”

The natural disasters above mentioned did have an impact, but we took steps, such as guiding inbound customers to areas outside of the affected regions, by taking advantage of our chain of hotels around the country. As a result, the inbound ratio exceeded the previous year’s level, and many customers in Japan also used our hotels, sustaining increases in the occupancy rates and average daily rate. Consequently, revenue of Dormy Inn business increased 17.7% year on year to ¥46,792 million.

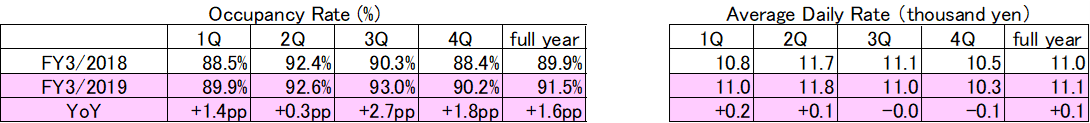

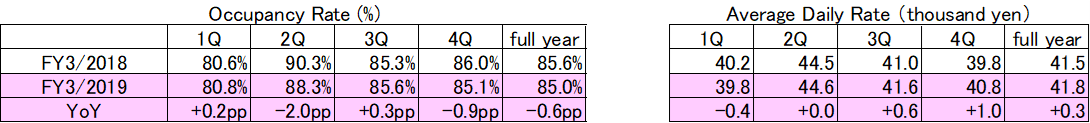

Trend of Current Dormy Inn (Business Hotel) Occupancy Rate

* Damage caused by the earthquake in Hokkaido and Typhoon No. 21 in September 2018

(Note) Above figures are excl. the impact of facilities that have been opened on and after April 1, 2017 to compare 2 periods of occupancy rate and ADR on a common basis

(Source: Kyoristu Maintenance)

Created by Investment Bridge using Kyoritsu Maintenance Data.

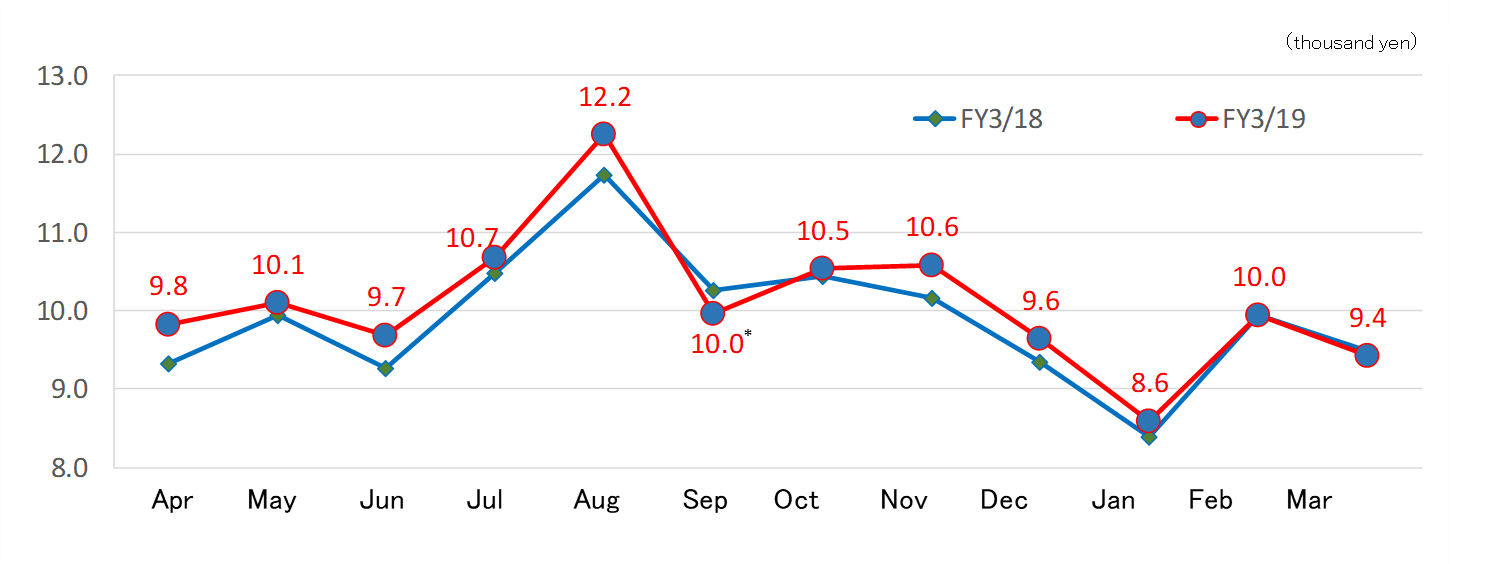

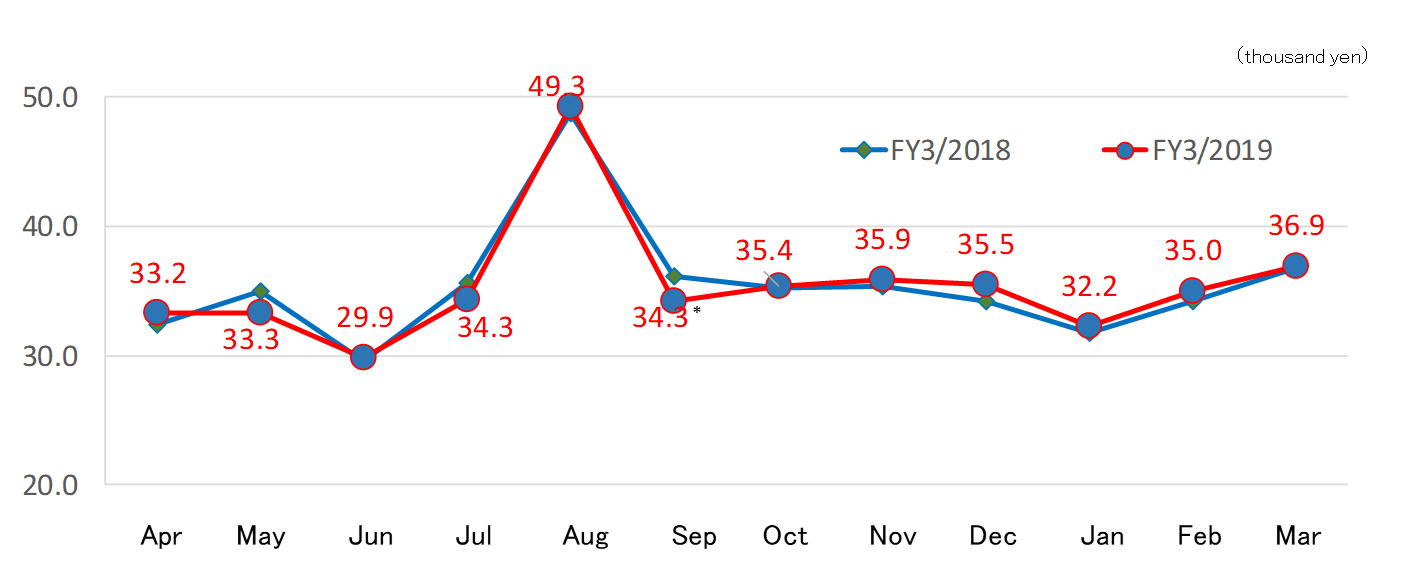

Trend of Dormy Inn Revenue Per Available Room

* Damage caused by the earthquake in Hokkaido and Typhoon No. 21 in September 2018

(Note) Above figures are excl. the impact of facilities that have been opened on and after April 1, 2017 to compare 2 periods of RevPAR on a common basis

(Source: Kyoritsu Maintenance)

Created by Investment Bridge using Kyoritsu Maintenance Data.

Resort Hotel Division

we opened “LA VISTA Kirishima Hills” as our first resort hotel in the Kyushu region, and also opened the “Natural Springs Yururi no Yu Onyado Yuinosho” in Shirakawago in Gifu Prefecture. Although occupancy rates fell temporarily due to the effects of a series of natural disasters and it took time to recover, RevPAR was maintained at high levels for this fiscal year due to our efforts to further improve customer satisfaction. Moreover, we thoroughly implemented cost controls by means of flexible personnel assignments tailored to occupancy cnditions. As a result, revenue of resort business increased 3.7% year on year to ¥31,550 million and operating profit of resort business increased 3.8% year on year to ¥1,675 million.

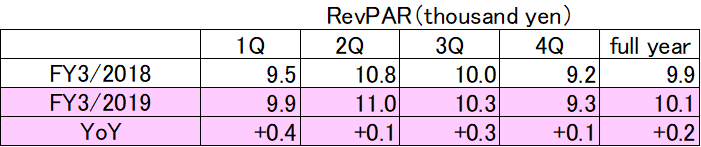

Trend of Resort Hotel Existing Facility Occupancy Rate

* Damage caused by the earthquake in Hokkaido and Typhoon No. 21 in September 2018

(Note) The above graph excludes the hotels opened in or after April 2017. (to compare the above two terms under the same conditions Above figures are excl. the impact of facilities that have been opened on and after April 1, 2017 to compare 2 periods of occupancy rate and ADR on a common basis

(Source: Kyoritsu Maintenance)

Created by Investment Bridge using Kyoritsu Maintenance Data.

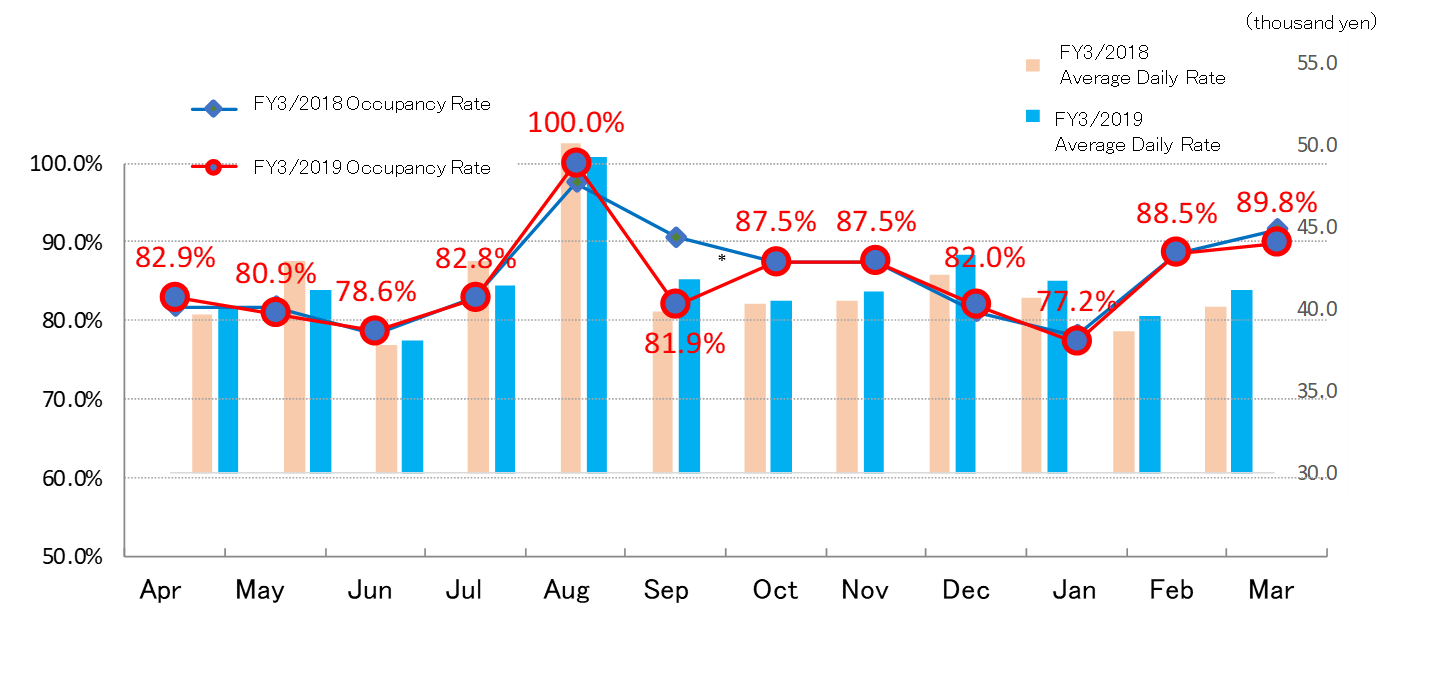

Trend of Resort Hotel Revenue Per Available Room

* Damage caused by the earthquake in Hokkaido and Typhoon No. 21 in September 2018

(Note) Above figures are excl. the impact of facilities that have been opened on and after April 1, 2017 to compare 2 periods of RevPAR on a common basis

(Source: Kyoritsu Maintenance)

Created by Investment Bridge using Kyoritsu Maintenance Data.

Other Business

In the comprehensive building management business, revenue increased 4.3% year on year to ¥15,524 million mainly driven by an increase in construction projects, but operating profit decreased 41.2% year on year to ¥296 million due to the expiry of certain contracts in the building management division. In the food service business, revenue increased 4.0% to ¥6,998 million mainly driven by increase in the number of contracted hotel restaurants managed, but operating profit decreased 39.8% year on year to ¥95 million due to the costs incurred in preparing for the launch of a restaurant business. In the development business, revenue decreased 29.4% to ¥15,851 because a part of revenue was carried over to the next fiscal year due to timing difference in the completion of construction, but operating profit increased significantly 70.6% year on year to ¥1,906 million due to real estate securitization carried out in this fiscal year and an increase in construction projects with high profit margins. Revenue of the other business segments (including Senior Life business (management of senior citizen housing), the Public Kyoritsu Partnership business (PKP: commissioned services business for regional government bodies), single life support business and insurance agency business, comprehensive human resource services business, and financing and administrative outsourcing services) increased 4.7% year on year to ¥12,402 million and operating profit increased to loss of ¥125 million. The Senior Life business has grown steadily.

(3) Financial Conditions and Cash Flow

◎Summarized Balance Sheet

| 3/18 | 3/19 |

| 3/18 | 3/19 |

Cash and Cash Equivalents | 17,298 | 16,643 | Trade payables | 7,998 | 6,788 |

Inventories | 3,229 | 7,400 | ST Interest Bearing Liabilities | 17,553 | 16,150 |

Current Assets | 38,353 | 41,056 | LT Interest Bearing Liabilities | 60,892 | 66,802 |

Tangible Assets | 102,964 | 108,991 | Liabilities | 119,090 | 122,961 |

Intangible Assets | 4,012 | 3,236 | Net Assets | 71,839 | 79,570 |

Investments and others | 45,036 | 48,569 | Total Liabilities and Net Assets | 190,929 | 202,531 |

Noncurrent Assets | 152,013 | 160,796 | Interest Bearing Liabilities | 78,445 | 82,952 |

*Inventories = real estate for sale + real estate for sale in progress + expense of uncompleted constructs

*LT Interest Bearing Liability includes convertible bonds

*Units: million yen

Total assets as of March 31,2019 were ¥202,531 million, reflecting an increase of ¥11,601 million compared to the end of the previous fiscal year mainly due to increase in land and real estate for sale in process. Total liabilities as of March 31,2019 were ¥122,961 million, reflecting an increase of ¥3,870 million mainly due to increase in interest-bearing debt. Total net assets as of March 31, 2019 were ¥79,570 million, reflecting an increase of ¥7,730 million mainly due to increase in retained earnings.

Shareholders’ equity ratio increased by 1.7 percentage points from the end of the previous fiscal year to 39.3%.

Net D/E ratio, one of key performance indicators for us, was 0.8x, indicating that the Company maintains the financial soundness.

◎Consolidated Cash Flow

| FY3/18 | FY3/19 | YY Change | |

Cash Flows from operating activities | 13,029 | 17,963 | +4,934 | +37.9% |

Cash Flows from investing activities | -16,676 | -21,474 | -4,798 | - |

Free Cash Flow | -3,647 | -3,511 | +136 | - |

Cash Flows from financing activities | 5,804 | 2,606 | -3,198 | -55.1% |

Cash and cash equivalents at the end of the period | 16,972 | 16,070 | -901 | -5.3% |

*Units: million yen

Consolidated cash and cash equivalents at the end of the period decreased by ¥901 million from the end of the previous term to ¥16,070 million.

Net cash inflow from operating activities increased by ¥4,934 million from the previous fiscal year to ¥17,963 million mainly due to improvement in accounts receivable-trade and inventories.

Net cash used in investing activities was ¥21,474 million, mainly coming from “purchase of property, plant and equipment” and “payments for lease and guarantee deposits”, an increase of ¥4,798 million from the previous fiscal year.

A net cash inflow in financing activities decreased by ¥3,198 million from the previous fiscal year to ¥2,606 million mainly due to decrease in proceeds from issuance of bonds.

4. Outlook for Fiscal Year Ended March, 2020

(1) Consolidated Financial Forecasts

| FY3/19 (Act.) | Share | FY3/20 (Forecast) | Share | YY Change |

Revenue | 162,811 | 100.0% | 183,000 | 100.0% | +12.4% |

Operating Profit | 14,567 | 8.9% | 15,700 | 8.6% | +7.8% |

Ordinary Profit | 14,321 | 8.8% | 15,400 | 8.4% | +7.5% |

Profit Attributable to Owners of the Company | 9,567 | 5.9% | 10,200 | 5.6% | +6.6% |

*Units: million yen

Revenue and ordinary profit are forcasted to increase 12.4% and 7.5%, respectively, year on year.

In the Dormitory Business, occupancy rate at the beginning of fiscal year ended March, 2020 increased 1.0 pp year on year to 98.7%. and we expect solid growth in dormitory business for both students and employees. Also, we will continuously make an effort to respond flexibly to the greater diversification of residents and their needs, while maintaining a stable growth by optimizing costs.

In the Dormy Inn (business hotel) business, we plan to open a total of eight facilities: the “Dormy Inn Maebashi,” “Dormy Inn Fukui,” “Dormy Inn Morioka,” “Onyado Nono Aasakusa,” “Dormy Inn Kawasaki,” “LA VISTA Furano Hills,” “Dormy Inn Mito,” and “Onyado Nono Kanazawa” (some of these names are tentative). In the resort business, we plan to open a total of three facilities, namely “Echigoyuzawa Hot Spring Yukemuri no Yado Yuki no Hana,” “Toji no Sato Akinomiya Inazumi Hot Spring” and “Kotohira Hot Spring Hatago Shikishimakan” (some of these names are tentative). We intend to accelerate development of hotels to achieve the medium-term management plan. We will also steadily hire staff for these new facilities.

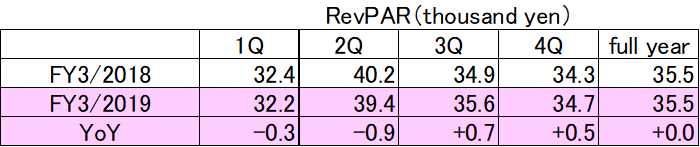

In the comprehensive building management business, we will implement measures to increase our credibility with customers through improvements in our specialized technologies and product lineup. These measures will also allow us to aggressively provide customers with high-quality building maintenance, and other services that are highly competitive within the market, with our new enhanced organization. In the food services business, we will develop products and services with high levels of customer satisfaction, and implement strict management of variable expenses. In the development business, we will continue to support the Kyoritsu Group development and new facility opening plans, in addition to cultivating external clients and strictly managing expenses. In the other business segment, we will focus on developing the best business model as soon as possible to strengthen the Senior Life business and the Public Kyoritsu Partnership (PKP) with a potential for becoming one of our core businesses and realize higher levels of profitability. The profit growth in FY3/20 forecast is slower than prior year because we expect additional expenses of around +¥1,450 million higher than in FY3/19 to be booked in FY3/20. These expenses are as follows;

- | Opening expense of around +¥450 million higher than in FY3/19 due to the development facilities to establish a solid business foundation for accelerated growth at a final phase of the medium-term management plan |

- | Huge renewal expense of around +¥800 million higher than in FY3/19 for further customer satisfaction improvement |

- | System modification fee of around +¥200 million higher than in FY3/19 for further customer satisfaction improvement |

The underlying growth rate (FY3/20 forecast vs. PY), which is calculated by excluding the effect of one-time expenses above mentioned and sales and lease back of real estate, is as follows;

(Source: Kyoritsu Maintenance)

DPS in FY3/20 (projected) is 47.0 yen (22.0 yen in the first half).

5. Remarkable points of the future

Despite some successive natural disasters, the company recovered in the early stage, and the performance in the term ended March, 2019 largely exceeded the forecast in the beginning of the term. In FY3/20, dormitory business had a good start with an occupancy rate of 98.7% at the beginning of the term. In the Hotel business, in addition to the increase in the number of foreign customers, some successive natural disasters in the previous fiscal year will result in the high growth rate in this term. The company has been struggling with improving the quality of the Internet service for customers for years and taking various measures. The company will be stronger if it is able to attain good results. The long-term outlook looks promising, because World Expo 2025 will be held in Osaka, after the Tokyo Olympics in 2020. PER is over 20x, but it can be said that stock price is still to be improved considering double-digit growth of underlying profit, conservative financial forecast of the company and medium-to-long-term growth potential.

<Reference: Corporate Governance>

◎ Organization type, and the composition of directors and auditors (as of June 26, 2019)

Organization type | Company with audit and supervisory committee |

Directors (excluding the members of the audit and supervisory board) | 13 directors, including 1 external ones |

Auditors | 3 auditors, including 2 external ones |

◎ Corporate Governance Report

Modified date: December 25, 2018

<Basic Policy>

Our company has, since inauguration, been following our management philosophy of “customers first” and striving for attaining our management policy of great contribution to society through provision of services of supplying food and shelter. In addition, we consider that it is essential to enrich our corporate governance system in order to achieve sustainable company development and long-term maximization of shareholder’s interest and therefore take multitudinous measures, including acceleration of management decision-making, strengthening of the function of management supervision, enhanced and thorough accountability, expeditious and appropriate information disclosure, and the like. Our company has recognized that one of the most important business challenges is to secure transparency, soundness, etc.

Furthermore, our company as an organization in compliance with the Companies Act has set up general meetings of shareholders, the board of directors, the audit and supervisory board, and accounting auditors. We have also established the compliance committee and meetings to exchange management information on our corporate group.

<Implementation of each principle of the Corporate Governance Code>

Principles | Reasons for non-compliance |

【Supplementary principle 4-10-1 Involvement of and advice from independent external directors regarding important matters, such as nomination and remuneration】

| Our company has not established any advisory committee that consists mainly of independent external directors under our board of directors.In our company, when the board of directors examines nomination and remuneration, it takes into account opinions of multiple independent external directors. |

<Disclosure Based on the Principles of the Corporate Governance Code>

Principles | Reasons |

【Principle 1-4 So-called strategically held shares】

| < Policy on strategic shareholding>Our company has held shares of our partner companies as strategically held shares for the purpose of cementing our transaction relationships.Taking into consideration various factors of a relevant partner company, such as the profitability at this moment and in the future, the corporate planning department and the department in charge of transactions at our company will assess whether or not it is appropriate to strategically hold shares of the company from the perspective of whether or not strengthening of the business relationship with the company contributes to maintenance and improvement of our company’s corporate value.

<Screening of strategically held shares>Regarding the shares of all of our partner companies that our company has held, once a year, our corporate planning department asks the department in charge of transactions about the status of shareholding, taking into account the initial purpose of acquiring the shares, the trading conditions, such as the current transaction amount and transaction content, and economic rationale based on cost of capital and other related factors.When it turns out, through the screening, that some of the shares do not suit our initial purpose of share acquisition any longer, we will reduce them through sale or any other means. The details of the screening is reported to the board of directors every year.

<Criteria for exercising voting rights> Regarding the exercise of the voting rights related to the strategically held shares, our company will exercise the rights in a proper manner, after assessing whether or not the content of a relevant bill contributes to maintenance and improvement of our company’s corporate value and enhancement of shareholders’ value through dialogue with a related company by the department (company) in charge of transactions and examination by dedicated departments, such as our corporate planning department. With respect to any bill that could damage our company’s corporate value or shareholder value, we will not exercise the voting rights in a positive manner, regardless of whether or not the bill has been proposed by our company or any of the shareholders. |

【Principle 2-6 Fulfillment of functions as an asset owner of corporate pension funds】 | Our company has adopted a contract-type corporate pension plan, and endeavors to prevent any conflict of interest from arising between beneficiaries of the corporate pension funds and our company by entrusting multiple Japanese and overseas pension fund management institutions with management of the reserve fund, and leaving entirely to each of those institutions selection of organizations to invest in and exercise of the voting rights. Our company has assigned human resources with expertise in finance and personnel affairs to the department in charge of fund management so that the department will be able to develop greater expertise and fulfill their expected functions, such as monitoring of pension fund management institutions. |

【Principle 4-11 Preconditions for ensuring the effectiveness of the board of directors and the audit and supervisory committee】 ≪Supplementary principle 4-11-1≫ Views on the appropriate balance, diversity, and size of the board of directors as a whole

| Our company has appointed people with extensive knowledge and experience in various fields, such as corporate management and finance, as directors in accordance with our policy of designating directors regardless of nationality, race, or gender. With each of the directors possessing considerable expertise, our board of directors as a whole is well balanced and diverse in terms of knowledge, experience, and skills. In addition, we endeavor to achieve greater diversity by appointing those who have profound knowledge and insight as independent external directors. |

≪Supplementary principle 4-11-2≫ Status of members holding concurrent posts among the board of directors and the audit and supervisory committee | Our company discloses, every year, the status of directors who concurrently hold multiple posts through the reference material attached to the Notice of Convocation of General Meeting of Shareholders. Furthermore, as the attendance rate of the directors, including independent external directors, at meetings of the board of directors is high, where the directors proactively speak up, ask questions, and hold discussion with each other, we have considered that the number of directors holding concurrent posts is reasonable and acceptable, and the directors have properly fulfilled their respective roles and responsibilities. |

≪Supplementary principle 4-11-3≫ Evaluation of the effectiveness of the board of directors | Our company believes that the effectiveness of our board of directors has been satisfactorily ensured, as the attendance rate of the directors at meetings of the board of directors is high, and the directors, including independent external directors, proactively speak up, ask questions, and hold discussion with each other. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved.