Bridge Report:(9698)CREO CO., LTD.

President and Representative Director Junichi Kakizaki | CREO CO., LTD. (9698) |

|

Company Information

Market | JASDAQ |

Industry | Information and telecommunications |

President | Junichi Kakizaki |

HQ Address | Sumitomo Fudosan Shinagawa Building 4-10-27 Higashi-shinagawa, Shinagawa-Ku, Tokyo |

Year-end | March |

HOMEPAGE |

Stock Information

Share price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

1,939 | 8,299,151 shares | 16,092 million | 12.0% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

34.00 | 1.8% | 81.94 | 23.7 x | 701.42 | 2.8 x |

*The share price is the closing price on May 22.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating income | Ordinary income | Net income | EPS | DPS |

Mar. 2016 (Actual) | 10,305 | 348 | 368 | 413 | 47.79 | 15.00 |

Mar. 2017 (Actual) | 11,559 | 296 | 333 | 267 | 31.11 | 13.00 |

Mar. 2018 (Actual) | 12,268 | 410 | 457 | 305 | 36.79 | 15.00 |

Mar. 2019 (Actual) | 13,526 | 670 | 706 | 664 | 80.05 | 25.00 |

Mar. 2020 (Forecast) | 15,000 | 1,000 | 1,030 | 680 | 81.94 | 34.00 |

*The forecasted values are from the Company. *From the FY 3/16, net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

*Units: Million yen, yen

This Bridge Report overviews the financial results of CREO, for the term ended Mar. 2019, and includes the outlook for the term ending Mar. 2020.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year March 2019 Earnings Results

3. Mid-term Business Plan (FY3/18 to FY3/20) and Its Progress

4. Fiscal Year March 2020 Earnings Estimates

5.Conclusions

Reference: Regarding Corporate Governance

Key Points

- In the fiscal year ended Mar. 2019, sales and operating income grew 10.3% and 63.3%, respectively, year on year. Sales marked a record high. Sales and profit in all business segments increased, led by the Solutions Service Business, as the sales of solution services that integrated the attendance management system, etc. of Amano, which is its major shareholder, into its own ERP package was strong. The dividend is to be 25 yen/share, up 10 yen/share (payout rati 31.2%).

- In the fiscal year ending Mar. 2020, which is the final year of the current mid-term business plan (starting from FY Mar. 2018), sales and operating income are estimated to be 15,000 million yen (up 10.9% year on year) and 1,000 million yen (up 49.1% year on year), respectively. Sales and profit will grow in all business segments, led by the Solutions Service Business, which has abundant backlogged orders. It is anticipated that the company will achieve the goals of the mid-term business plan, and operating income will reach a record high. The dividend is estimated to increase 9 yen/share to 34 yen/share (the estimated payout ratio is 41.5%).

- At the time when the mid-term business plan started, it seemed that the goals to achieve sales of 15,000 million yen and an operating income of 1,000 million yen were very “challenging.” However, the company is about to achieve the goals. Through group reorganization, collaboration with Amano, as well as awareness reform, it has succeeded in capturing the IT investment demand of corporations against the background of shortage of workforce and “reform of work styles.” However, utilization of Amano’s client assets is still in the early stages, and even if the numerical targets of the mid-term business plan are achieved, the operating income margin will remain at 6.7%, leaving room for further improvement. In addition, the company plans to work on fostering new businesses that use new technologies, such as support for digital transformation (DX) advocated by the Ministry of Economy, Trade and Industry. Although the fiscal year ending Mar. 2020 has just begun, expectations are already high for the new mid-term business plan, which will start in the next fiscal year.

1. Company Overview

CREO is a system integrator that offers a variety of solutions. The company offers business solutions, including “ZeeM Series,” a business package software used by over 2,000 enterprises (Enterprise Resource Planning (ERP) for human resources, accounting, asset management, etc.) and “BIZ PLATFORM,” for business process management (BPM), which contributes to the streamlining of business operation and cost reduction, develops systems for governmental offices, municipalities, public-interest corporations, and large companies, produces and operates web systems for leading portal site operators in Japan, provides loyal clients with call-center services, and so on.

The corporate group is composed of CREO, and four consolidated subsidiaries: CoCoTo Co., Ltd., CREATE LAB Co., Ltd., ITI Co., Ltd., and Adams Communications Co., Ltd. Amano (6436) and Yahoo Japan (4689) holds 30.57% and 12.71% of shares of CREO, respectively. CREO is an equity-method affiliate of Amano Corporation (the voting rati 31.89%). In the fiscal year ended Mar. 2019, the sales toward Fujitsu Fsas Inc., accounted for 12.1% of consolidated sales, while the sales toward Yahoo Japan made up 14.3%.

Corporate ethos

We aim to trigger changes that would “impress people” and actualize an affluent society, by combining “human imagination” and “technologies around the world.”

Business details and group companies

Its business is classified into Solutions Service Business, Contracted Development Business, West Japan Business, and subsidiaries’ business domains: Systems Operation and Services Business and Support Services Business.

Solutions Service Business

The company offers “ZeeM Series,” a business package software used by over 2,000 medium-sized enterprises (enterprise resource planning (ERP) for human resources, accounting, and asset management), “BIZ PLATFORM,” for business process management (BPM), which contributes to the streamlining of business operation and cost reduction, the RPA solution for actualizing business processes that use manpower and robots by combining the know-how of ERP and BPM and the robotic process automation (RPA) technology for automating the routine tasks of white-collar workers, and so on.

Contracted Development Business

The company undertakes the development of systems for large companies, governmental offices, and municipalities, typesetting systems for newspaper publishers, odds systems for professional sports organized by the government, etc., which require reliability and experience. As a characteristic, the transactions made via Fujitsu are dominant, and so stable growth can be expected, although there are some short-term fluctuations. It is essential to secure “manpower,” including subcontractors.

West Japan Business

This is a mini-CREO business that offers Solution Services and Contracted Development Services to clients in Nagoya and regions to the west of it. Stable growth can be expected.

Systems Operation and Services Business

This is the business domain of the consolidated subsidiary CoCoTo Co., Ltd. The company offers operation services, including the development, maintenance, and anti-hacking operation of server systems for portal sites and web services, to mainly the leading Japanese portal-site operator Yahoo Japan (4689) and its group companies. Previously, this business was operated by several group companies under the holding company, but they were integrated into CoCoTo Co., Ltd., which was established in Apr. 2016. Then, it became possible to exert the capability of the corporate group in marketing and development, and the company is making transactions with the group companies of Yahoo Japan. The company plans to boost sales from Yahoo Japan and approach its group companies, to expand its business.

Support Services Business

The company offers support services, including help desk and technical support services, and call-center services (making and receiving calls), including election exit polls, social surveys, and market research. A strength of this business is that the company offers technical services to loyal clients, including those related to Fujitsu and NEC, with a good balance. This business can be expected to grow stably, but it is necessary to secure “human resources.” Accordingly, the company makes efforts to recruit foreign workers, too.

Group Companies

Group company | Business details | Voting right |

CoCoTo Co., Ltd. | Systems Operation and Services Business, including the development of systems and networks, the support for development and operation of business apps, and clerical tasks for system operation | 100.0% |

CREATE LAB Co., Ltd. | Support Services Business (mainly help desk services), including support services, such as technical support regarding computers and help desk services, the development of systems, and support for sale | 97.5% |

ITI Co., Ltd. | Support Services Business (mainly the development, operation, and maintenance of systems), including the development, operation, management, and maintenance of computer systems, and the design, building, operation, and maintenance of network systems | 90.0% |

Adams Communications Co., Ltd. | Support Services Business (mainly marketing research and call center services), including the planning, implementation, summarization, and analysis of surveys on public opinion, society, and markets, and the provision of inside sales and call center services | 100.0% |

* For CREATE LAB Co., Ltd., the employee shareholding association holds 2.5% of voting rights. ITI Co., Ltd. and Adams Communications Co., Ltd. are subsidiaries of CREATE LAB Co., Ltd.

2. Fiscal Year March 2019 Earnings Results

| FY3/18 | Ratio to sales | FY3/19 | Ratio to sales | YoY Change | Initial Est. | Divergence |

Sales | 12,268 | 100.0% | 13,526 | 100.0% | +10.3% | 13,500 | +0.2% |

Gross Profit | 2,545 | 20.7% | 2,887 | 21.3% | +13.4% | - | - |

SG & A | 2,134 | 17.4% | 2,216 | 16.4% | +3.8% | - | - |

Operating Income | 410 | 3.3% | 670 | 5.0% | +63.3% | 640 | +4.5% |

Ordinary Income | 457 | 3.7% | 706 | 5.2% | +54.3% | 680 | +3.9% |

Profit attributable to owners of parent | 305 | 2.5% | 664 | 4.9% | +117.4% | 500 | +32.8% |

(Unit: Million yen)

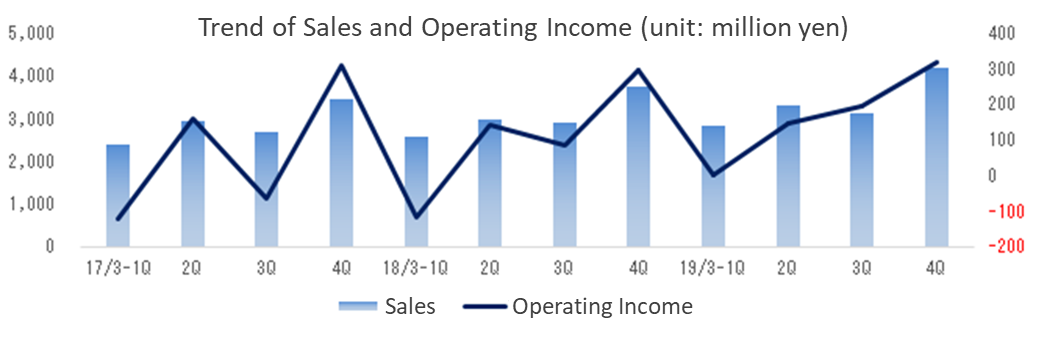

Sales and operating income grew 10.3% and 63.4%, respectively, year on year.

Sales and profit in all business segments increased, led by the Solutions Service Business which is considered the high-growth business in the mid-term business plan. The Solutions Service Business demonstrated strong sales of solution services that integrated multiple packages supported by shortage of workforce and enforcement of laws related to reform of work styles. Efforts such as conversion of business models from single package software sales, improvement of utilization rate of engineers, and cost optimization are bearing fruits.

Net income grew 117.4% year on year to 604 million yen. Software evaluation loss of 25 million yen associated with the review of sales plans for some optional products of the mainstay product “ZeeM” and impairment loss of software assets and goodwill of 93 million yen of IASU, Inc., which became a consolidated subsidiary in April 2016 and absorbed in April 2017, was recorded as extraordinary loss. However, in consideration of the recent recovery of business performance and future business performance trends, etc., deferred tax assets were recorded for portions that are collectable. As a result, a corporation tax adjustment of negative 300 million (negative means gain) was recorded.

The company plans to allocate the dividends of 25 yen at the end of the year, an increase of 10 yen per share. It plans to pay dividends at a target payout ratio of 40%, but the dividend payout ratio will remain at 31.2% in the current fiscal year (it was 40.8% in the previous fiscal year) due to recording of deferred tax asset.

Trend in each segment

| FY 3/18 | Ratio to sales・Profit margin | FY 3/19 | Ratio to sales・Profit margin | YoY

| Plan

| Compared with plan |

Solutions Service | 3,047 | 24.8% | 3,510 | 26.0% | +15.2% | 3,500 | -1.4% |

Contracted Development | 1,404 | 11.4% | 1,609 | 11.9% | +14.1% | 1,580 | +1.9% |

West Japan Business | 1,379 | 11.2% | 1,638 | 12.1% | +18.6% | 1,600 | +2.4% |

Systems Operation and Services | 2,057 | 16.8% | 2,355 | 17.4% | +14.4% | 2,400 | -1.9% |

Support Services | 4,596 | 37.5% | 4,638 | 34.3% | +1.0% | 4,600 | -2.6% |

Adjustment | -216 | -1.8% | -226 | -1.7% | - | -180 | - |

Consolidated sales | 12,268 | 100.0% | 13,526 | 100.0% | +10.3% | 13,500 | +0.2% |

Solutions Service | 414 | 13.6% | 593 | 17.0% | +29.2% | 555 | +7.0% |

Contracted Development | 267 | 19.0% | 332 | 21.0% | +23.8% | 320 | +3.9% |

West Japan Business | 139 | 10.1% | 170 | 10.6% | +8.4% | 170 | +0.0% |

Systems Operation and Services | 133 | 6.5% | 160 | 6.9% | +21.6% | 170 | -5.6% |

Support Services | 198 | 4.3% | 217 | 4.7% | +10.7% | 210 | +3.7% |

Adjustment | -742 | - | -804 | - | +8.4% | -790 | - |

Consolidated operating income | 410 | 3.3% | 670 | 5.1% | +63.4% | 640 | +4.8% |

Unit: Million yen

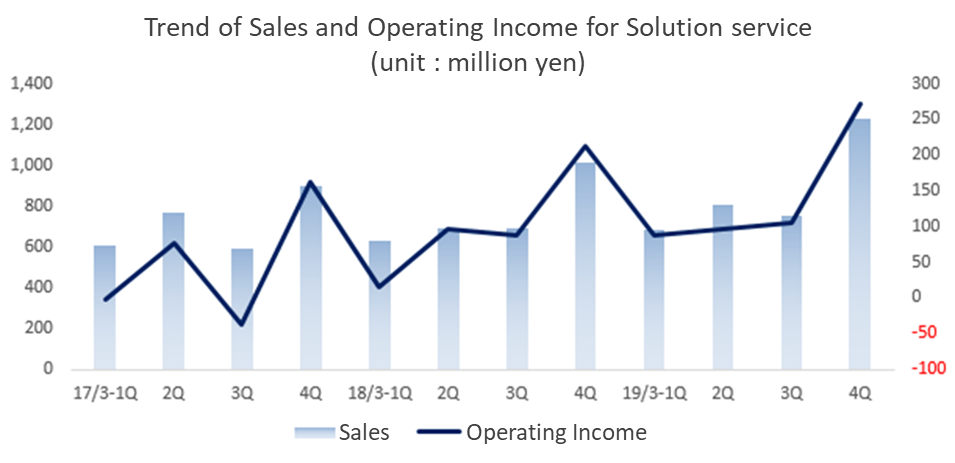

In the Solutions Service Business, sales increased due to orders for large-scale comprehensive solutions, and the profit margin improved 3.4 points to 17.0% as a result of increased sales, improved utilization rate of engineers and cost optimization. Sales and profit of the Contracted Development Business, which has high quality companies as customers including the Fujitsu Group and Amano, Inc., grew as a result of order recovery. Sales and profit of the West Japan Business, which has clients in Nagoya and regions to the west of it, also grew, led by sales of solution services. Furthermore, sales and profit of the System Operations and Service Business, that provides operation services, including the development, maintenance, and anti-hacking operation of server systems to Yahoo Japan, also grew thanks to increased orders for large-scale projects and higher order unit price in general. As for the Support Services Business, although the increase in sales was moderate due to a decrease in orders from existing survey service customers, both sales and profit grew.

Financial Position and Cash Flows (CF)

Financial Position

| Mar. 2018 | Mar. 2019 |

| Mar. 2018 | Mar. 2019 |

Cash | 3,483 | 4,012 | Accounts payable | 518 | 671 |

Receivables | 2,514 | 2,761 | Accounts Payable | 324 | 304 |

Current Assets | 6,445 | 7,192 | Taxes Payable | 119 | 178 |

Tangible Assets | 328 | 303 | Bonus reserves | 490 | 566 |

Intangible Assets | 463 | 276 | Liabilities | 2,210 | 2,571 |

Investments and Others | 288 | 660 | Net Assets | 5,315 | 5,861 |

Noncurrent Assets | 1,079 | 1,240 | Total Liabilities and Net Assets | 7,525 | 8,433 |

Unit: million yen

Total assets at the end of the fiscal year were 8,433 million yen, up 908 million yen from the end of the previous fiscal year. On the debit side, cash and deposits increased due to improvement of CF, and receivables increased because the company expanded the business and also because the end of the period fell on a financial institution holiday. Investments and others also increased due to an increase in deferred tax assets. On the other hand, goodwill decreased due to the impairment treatment (93 million yen → 0). On the credit side, payables and net assets, etc. increased. Equity ratio was 69.0% (It was 70.2% at the end of the previous fiscal year).

Cash Flows (CF)

| FY3/18 | FY3/19 | YoY | |

Operating cash flow(A) | 429 | 900 | +471 | +109.8% |

Investing cash flow (B) | -109 | -236 | -127 | - |

Financing cash flow | -165 | -135 | +30 | - |

Cash and Equivalents at the end of term | 3,488 | 4,012 | +524 | +15.0% |

Unit: million yen

Due to an increase in profit before tax and a decrease in working capital, the operating CF doubled to 900 million yen. The negative investing CF is due to the acquisition of intangible fixed assets and investment securities, and the negative financing CF is due to the payment of dividends.

ROE Analysis

| FY3/15 | FY3/16 | FY3/17 | FY3/18 | FY3/19 |

ROE (%) | 4.57 | 8.36 | 5.21 | 5.86 | 11.96 |

Net income margin (%) | 1.86 | 4.01 | 2.31 | 2.49 | 4.91 |

Total asset turnover (times) | 1.64 | 1.45 | 1.61 | 1.66 | 1.70 |

Leverage (x) | 1.49 | 1.44 | 1.40 | 1.42 | 1.44 |

*ROE = Net income margin × Total asset turnover [times] × Leverage [times]

3. Mid-term Business Plan (FY 3/18 to FY 3/20) and Its Progress

【Basic policy】

Recognizable growth potential | Targets for the term ending Mar. 2020 are sales of 15 billion yen and an operating income of 1 billion yen (operating income rate: 6.7%). Operating income is to exceed a record high (880 million yen after the release of Windows 95, which is attributable to “Fudemame”). |

Comprehensive capability of the corporate group | Enhance cross-selling, strengthen cooperation between departments, and create new business. |

Stable return to shareholders | Acquire treasury shares with an excess amount over 70% of capital-to-asset ratio as capital, maintaining a payout ratio of 40% |

Enhancement of corporate governance | Strengthen dialogue with shareholders, revise systems for executives’ remunerations, and appoint independent executives (outside directors or auditors). |

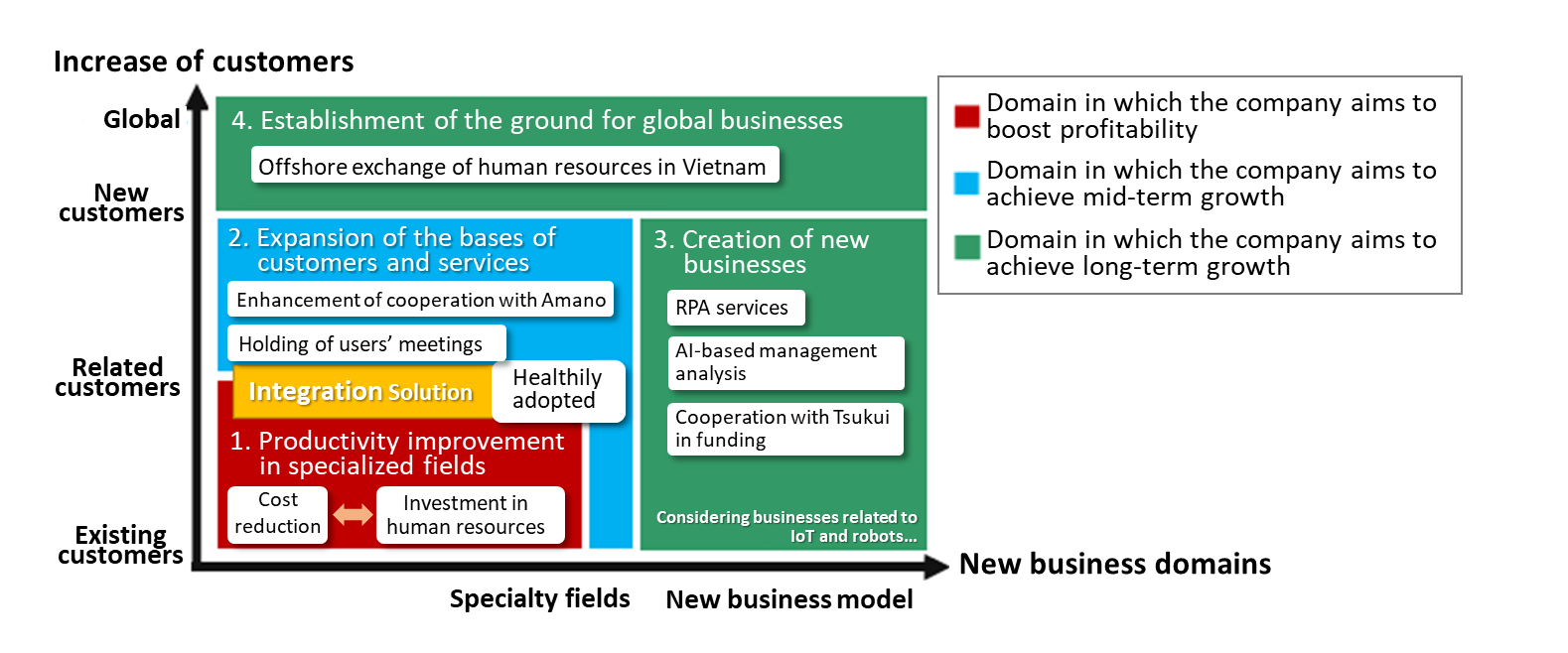

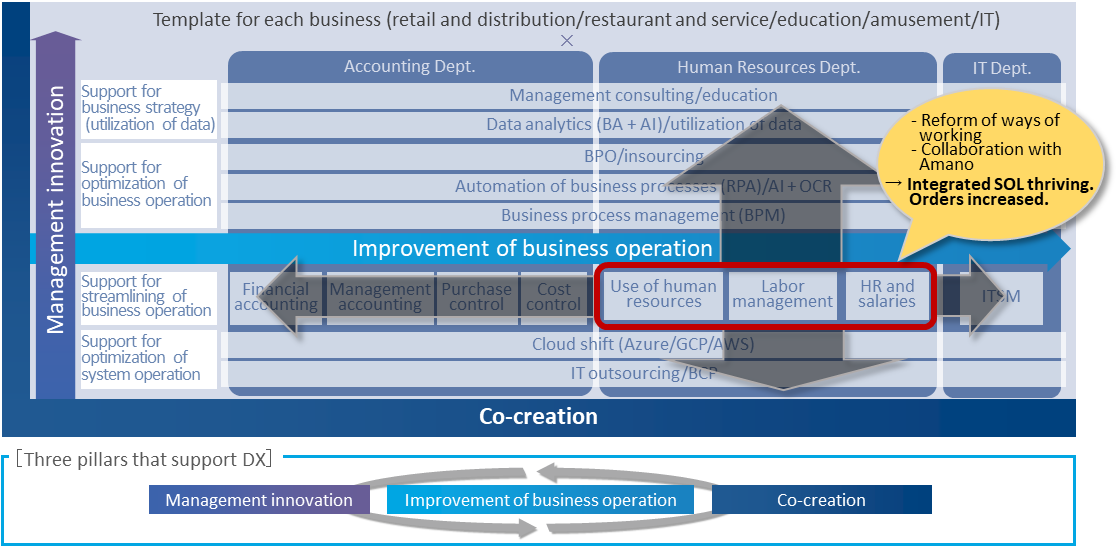

【Schematic diagram of growth strategies】

(Taken from the reference material of the company)

The company aims for growth through expansion of customers and business areas. It will strengthen its business foundation by developing solutions that integrate ZeeM Personnel Affairs and Salaries, ZeeM Accounting, ZeeM Fixed Asset Management, and Amano’s attendance management system to intensify connections with the existing customers. Based on that business foundation, it will expand the customer and service bases through collaboration with Amano and user associations. In the long run, it will establish a foundation for global development by making use of offshore bases in Vietnam. In addition, it will increase its business domains by developing RPA services and AI-type business analysis, or by creating businesses for the nursing care industry by linking with the funds of the Tsukui Group, which is a leading corporate group in the nursing care industry.

【Numerical goals and results】

Unit: million yen | FY3/18 Act.(Plan) | FY3/19 Act.(Plan) | FY3/20 Plan | Ratio to sales | YoY |

Sales | 12,268(12,500) | 13,526(13,100) | 15,000 | 100.0% | +10.9% |

Operating Income | 410(400) | 670(570) | 1,000 | 6.7% | +49.1% |

Ordinary Income | 457(410) | 706(590) | 1,030 | 6.9% | +45.7% |

Profit attributable to owners of parent | 305(280) | 664(400) | 680 | 4.5% | +2.3% |

Both sales and operating income exceeded the forecast in the fiscal year ended Mar. 2019, which is the second year of the mid-term business plan. All business segments are performing well by bringing out the Group’s comprehensive strength through Group reorganization. The Solutions Service Business is making a particularly significant contribution to profits. Sales increased about 20% from 2,866 million yen to 3,452 million yen compared with the fiscal year ended Mar. 2016, and operating income margin improved 10.3 points from 6.9% to 17.2% during the same period.

In terms of sales, it is collaborating with Amano to propose sales of systems that integrate Amano’s attendance management system, etc. into the company’s packages, such as ERP package “ZeeM” and business process management system “BIZ PLATFORM.” It has succeeded in capturing the IT investment of the companies that are dealing with the shortage of workforce and laws related to reform of work styles. In terms of profit, conventionally, the company’s engineers were specialized in each work for each package type. In case of ERP package “ZeeM,” for example, engineers were specialized in work such as personnel salary, accounting, and asset management. The company retrained the engineers for multitasking (supporting multiple tasks), and this effort improved the productivity of engineers. Furthermore, the offshore development in Vietnam is taking off, which is resulting in the improvement of the operating income margin.

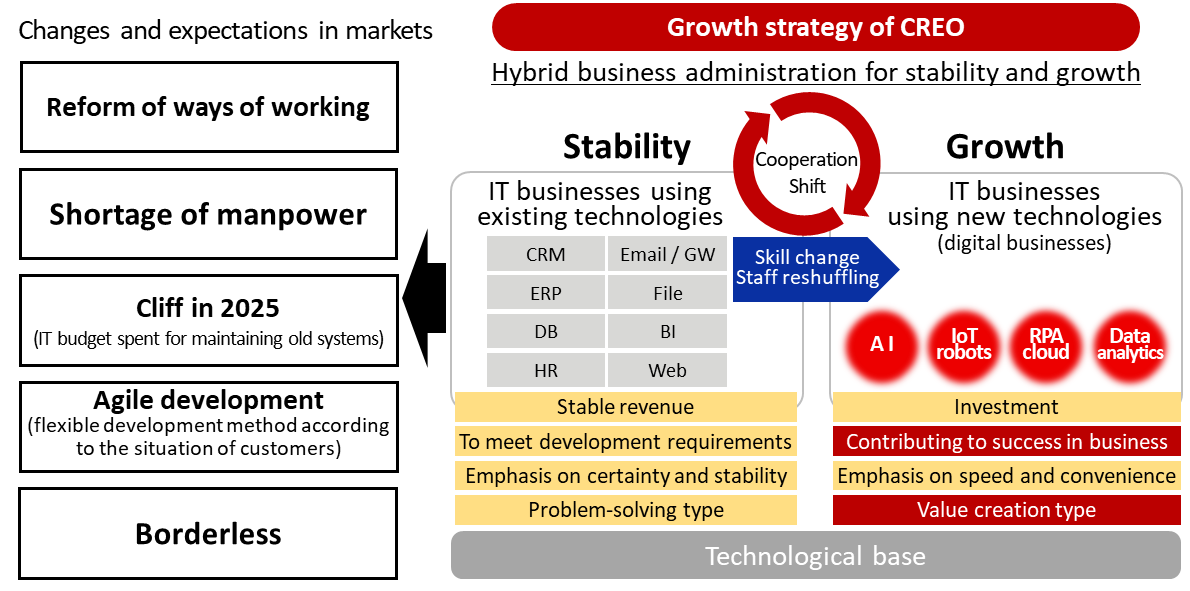

Towards the long-term vision “100-year-corporation”

Many business owners understand the need for the digital transformation (DX) to create and modify new business models with new digital technologies for growth and competitiveness. However, DX is not well implemented for reasons such as “data cannot be utilized across the whole company since the existing systems are built for each business unit” and “DX cannot be done as the existing systems are too complicated or black-boxed due to excessive customization etc.” In the DX report released in September 2018, however, the Ministry of Economy, Trade and Industry warned corporations as “If they leave legacy systems, they will miss the wave of the digital age” and encouraged them to renew their systems.

In the field of DX, the core of IT investment will shift from the maintenance of existing systems with the aim of improving business efficiency and cost reduction to management innovation to create and establish competitive advantage by utilizing new technologies such as cloud, social, big data and mobility and creating new values. It will use its existing technology-based IT investments as stable revenue sources and use IT business, which applies new technologies such as AI, IoT, robots, RPA, cloud and data analytics, as a growth driver.

The company will work on collaboration across business types, discover new values, and co-create value with partners including users. At the same time, it will not only strengthen its recruitment activities (healthy management excellent corporation (white 500), internship, local recruitment) but also grow human resources who can respond to the change of system development methods such as agile development (a development method that replaces traditional waterfall development. It is said that it can respond flexibly to meet customer needs.) and design thinking (a way of thinking not based on product but based on user understanding). Furthermore, it will also work on skill set conversion (digital innovator).

“CREO Integration-Platform for DX”

The service platform for DX is “CREO Integration-Platform for DX.” Specifically, the company will develop solutions for business strategies that use RPA for business optimization and data utilization for existing customers.

Next Mid-Term Business Plan

In the fiscal year ending Mar. 2020, which is the final year of the current mid-term business plan, the entire company will work to achieve the goals. The next mid-term management plan will be formulated around May 2020, with the next stage in mind, as a foundation for growth after the 50th anniversary (established in Mar. 1974).

4. Fiscal Year March 2020 Earnings Estimates

| FY3/19 Act. | Ratio to sales | FY3/20 Est. | Ratio to sales | YoY |

Sales | 13,526 | 100.0% | 15,000 | 100.0% | +10.9% |

Operating Income | 670 | 5.0% | 1,000 | 6.7% | +49.1% |

Ordinary Income | 706 | 5.2% | 1,030 | 6.9% | +45.7% |

Profit attributable to owners of parent | 664 | 4.9% | 680 | 4.5% | +2.3% |

Unit: million yen

Aiming to achieve the goals of the mid-term business plan. The operating income will mark a record high.

Sales and profit will grow in all business segments led by the Solutions Service Business, which has abundant backlogged orders including the integrated solution projects in collaboration with Amano, which is its major shareholder. Risk factors include the opportunity loss due to the shortage of IT human resources and the complexity of project management (such as occurrence of trouble projects) due to growing scale of projects.The dividend is planned to increase 9 yen to 34 yen at the end of the fiscal year (the estimated payout ratio is 40%).

| FY 3/19 Act. | Ratio to sales・Profit margin | FY 3/20 Est. | Ratio to sales・Profit margin | YoY |

Solutions Service | 3,510 | 26.0% | 4,061 | 27.1% | +15.7% |

Contracted Development | 1,609 | 11.9% | 1,900 | 12.7% | +18.1% |

West Japan Business | 1,638 | 12.1% | 1,650 | 11.0% | +0.7% |

Systems Operation and Services | 2,355 | 17.4% | 2,687 | 17.9% | +14.1% |

Support Services | 4,638 | 34.3% | 4,800 | 32.1% | +3.5% |

Adjustment | -226 | -1.7% | -98 | -0.7% | - |

Consolidated Sales | 13,526 | 100.0% | 15,000 | 100.0% | +10.9% |

Solutions Service | 593 | 16.9% | 770 | 19.0% | +29.9% |

Contracted Development | 332 | 20.6% | 350 | 18.4% | +5.4% |

West Japan Business | 170 | 10.4% | 190 | 11.5% | +11.3% |

Systems Operation and Services | 160 | 6.8% | 210 | 7.8% | +30.8% |

Support Services | 217 | 4.7% | 250 | 5.2% | +15.5% |

Adjustment | -804 | - | -770 | - | - |

Consolidated Operating Income | 670 | 5.0% | 1,000 | 6.7% | +49.1% |

5. Conclusions

Sales were 11,500 million yen and operating income was 290 million yen in the fiscal year ended Mar. 2017, a year before the start of the mid-term business plan. At that time, the goals to achieve sales of 15,000 million yen and operating income of 1,000 million yen within 3 years seemed to be “challenging.” However, given the performance momentum, the probability of achievement is high. Through group reorganization, collaboration with Amano, as well as awareness reform, it has succeeded in capturing the IT investment demand of corporations against the backdrop of shortage of workforce and “reform of work styles.” Although not disclosed, the Solutions Service Business seems to have abundant backlog of orders mainly on integrated solution projects, and at the results briefing session, President Kakizaki showed confidence in achieving the goals set in the plan.

However, utilization of Amano’s client assets is still in the early stages. Even if the numerical targets of the mid-term business plan are achieved, operating income margin will remain at 6.7%, leaving room for improvement. Therefore, there is still large room for the growth in both sales and profit. It is also interesting to foster IT business using new technology utilizing existing sales channels, such as DX support for corporations. Although the fiscal year ending Mar. 2020 has just begun, expectations are already high for the new mid-term business plan, which will start in the next fiscal year.

Reference: Regarding Corporate Governance

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory board |

Directors | 7 directors, including 3 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report: Updated on Jun. 28, 2018

Basic policy

Our company believes that establishing appropriate corporate governance systems and striving to improve them constantly would improve the transparency and fairness of our business administration, and our corporate value. While considering that the observance of the corporate governance code would contribute to the establishment of our better governance, we will adopt the supplementary principles and the principles other than the basic 5 principles, too, one after another. The details of the already adopted principles are written in this report.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

As a company listed in JASDAQ, our company follows all of the basic principles of the corporate governance code. As for supplementary principles and the principles other than the basic ones that need to be disclosed and that are already followed by our company, they are outlined in the “Disclosure Based on the Principles of the Corporate Governance Code” below.

<Principle 1-4 Disclosure of policies for strategically held shares>

As for strategically held shares, we set policies for shareholding and exercising voting rights, and disclose them through the timely disclosure below. In principle, we will not hold new shares, and plan to reduce currently held shares step by step.

Notification on the basic policy regarding strategically held shares and the state of shareholding

https://www.creo.co.jp/news/n160729-2/

<Principle 3-1 Enrichment of information disclosure>

Out of the items to be disclosed specified in this principle, “(i) Corporate vision (ethos, etc.), management strategies, and plans” are disclosed as follows.

Corporate ethos and guidelines for action

https://www.creo.co.jp/corporate/concept/

Mid-term business plan (FY 2017 to FY 2019)

https://www.creo.co.jp/ir/plan/

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co.,Ltd. All Rights Reserved. |