Bridge Report:(9698)CREO First Half of the Fiscal Year March 2020

President and Representative Director Junichi Kakizaki | CREO CO., LTD. (9698) |

|

Company Information

Market | JASDAQ |

Industry | Information and telecommunications |

President | Junichi Kakizaki |

HQ Address | Sumitomo Fudosan Shinagawa Building 4-10-27 Higashi-shinagawa, Shinagawa-Ku, Tokyo |

Year-end | March |

HOMEPAGE |

Stock Information

Share price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥1,646 | 8,299,086 shares | ¥13,660 million | 12.0% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥34.00 | 2.1% | ¥81.94 | 20.1 x | ¥701.42 | 2.3 x |

*The share price is the closing price on November 11th 2019. The number of issued shares is obtained by subtracting the number of treasury shares from the number of shares issued as of the end of the latest quarter. ROE and BPS are the values as of the end of the previous term.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating income | Ordinary income | Net income | EPS | DPS |

Mar. 2016 (Actual) | 10,305 | 348 | 368 | 413 | 47.79 | 15.00 |

Mar. 2017 (Actual) | 11,559 | 296 | 333 | 267 | 31.11 | 13.00 |

Mar. 2018 (Actual) | 12,268 | 410 | 457 | 305 | 36.79 | 15.00 |

Mar. 2019 (Actual) | 13,526 | 670 | 706 | 664 | 80.05 | 25.00 |

Mar. 2020 (Forecast) | 15,000 | 1,000 | 1,030 | 680 | 81.94 | 34.00 |

*The forecasted values are from the Company.

*Unit: Million yen, yen

This Bridge Report overviews the business performance for the First Half of term ending March 2020 and describes the earnings forecast for the term ending March 2020, for CREO Co., Ltd

Table of Contents

Key Points

1. Company Overview

2. First Half of Fiscal Year ending March 2020 Earnings Results

3. Fiscal Year ending March 2020 Earnings Forecasts

4. Conclusions

< Reference: CSR activities>

<Reference:Regarding Corporate Governance>

Key Points

- For the first half of the fiscal year ending Mar. 2020, sales and operating income grew 10.5% and 188.0%, respectively, year on year. As the company met the demand related to Work Style Reform, etc., the Solutions Service Business and the West Japan Business grew considerably, and the Contracted Development Business and the Support Services Business were healthy. Gross profit rate increased, as the ratio of engineers in service improved and outsourcing cost was reduced by utilizing Vietnamese business partners. On the other hand, the augmentation of SGA was insignificant thanks to the curtailment of personnel expenses for overtime work, etc. Accordingly, operating income rate increased 3.9 points to 6.4%.

- As for the full-year forecast, sales are estimated to be 15 billion yen (up 10.9% year on year), which is a goal in the mid-term management plan, and operating income is projected to reach 1 billion yen (up 49.1% year on year), hitting a record high. Mainly the Solutions Service Business and the West Japan Business, which have plentiful backlogs of orders, are expected to see the growth in sales and profit. The dividend is to be 34 yen/share, up 9 yen/share (with a payout ratio estimated to be 41.5%). Taking into account the acquisition of treasury shares, total return ratio is estimated to be 60%.

- In the first half, the business model shift through the restructuring of the corporate group in April 2017 bore fruit. As for marketing, the company received more orders for comprehensive solutions that combine the products of Amano Corporation and other business partners, meeting the needs that had not been met. As for development, the cooperation between business divisions and between groups and the utilization of offshore bases in Vietnam got on track, improving profitability. There are few concerns about the achievement of the mid-term management plan, unless there is the carry-over of inspection or the like. In the new mid-term management plan, which will begin next term, the company will shift to services with the aim of achieving an operating income rate of 10%.

1. Company Overview

CREO is a system integrator that offers a variety of solutions. The company offers business solutions, including “ZeeM Series,” a business package software used by over 2,000 enterprises (Enterprise Resource Planning (ERP) for human resources, accounting, asset management, etc.) and “BIZ PLATFORM,” for business process management (BPM), which contributes to the streamlining of business operation and cost reduction, develops systems for governmental offices, municipalities, public-interest corporations, and large companies, produces and operates web systems for leading portal site operators in Japan, provides loyal clients with call-center services, and so on.

The corporate group is composed of CREO, and four consolidated subsidiaries: CoCoTo Co., Ltd., CREATE LAB Co., Ltd., ITI Co., Ltd., and Adams Communications Co., Ltd. Amano (6436) and Yahoo Japan (4689) holds 30.57% and 12.71% of shares of CREO, respectively. CREO is an equity-method affiliate of Amano Corporation (the voting rati 31.89%). In the fiscal year ended Mar. 2019, the sales toward Fujitsu Fsas Inc., accounted for 12.1% of consolidated sales, while the sales toward Yahoo Japan made up 14.3%.

Corporate ethos

We aim to trigger changes that would “impress people” and actualize an affluent society, by combining “human imagination” and “technologies around the world.”

[Three thoughts in the logo]

| To create an “impression” The exclamation mark in the logo represents the stance of surpassing expectations and impressing clients. To continue “creation” The sphere is CREO itself, and represents the environment in which human resources, products, and services are born and grow. To cuddle up to “eternity” This logo denotes CREO, which is represented by the sphere, cuddling up to clients, society, and shareholders. |

1-1. Business details

Its business is classified into Solutions Service Business, Contracted Development Business, West Japan Business, and subsidiaries’ business domains: Systems Operation and Services Business and Support Services Business.

Solutions Service Business

The company offers “ZeeM Series,” a business package software used by over 2,000 medium-sized enterprises (enterprise resource planning (ERP) for human resources, accounting, and asset management), “BIZ PLATFORM,” for business process management (BPM), which contributes to the streamlining of business operation and cost reduction, the RPA solution for actualizing business processes that use manpower and robots by combining the know-how of ERP and BPM and the robotic process automation (RPA) technology for automating the routine tasks of white-collar workers, and so on.

Contracted Development Business

The company undertakes the development of systems for large companies, governmental offices, and municipalities, typesetting systems for newspaper publishers, odds systems for professional sports organized by the government, etc., which require reliability and experience. As a characteristic, the transactions made via Fujitsu are dominant, and so stable growth can be expected, although there are some short-term fluctuations. It is essential to secure “manpower,” including subcontractors.

West Japan Business

This is a mini-CREO business that offers Solution Services and Contracted Development Services to clients in Nagoya and regions to the west of it. Stable growth can be expected.

Systems Operation and Services Business

This is the business domain of the consolidated subsidiary CoCoTo Co., Ltd. The company offers operation services, including the development, maintenance, and anti-hacking operation of server systems for portal sites and web services, to mainly the leading Japanese portal-site operator Yahoo Japan (4689) and its group companies. Previously, this business was operated by several group companies under the holding company, but they were integrated into CoCoTo Co., Ltd., which was established in Apr. 2016. Then, it became possible to exert the capability of the corporate group in marketing and development, and the company is making transactions with the group companies of Yahoo Japan. The company plans to boost sales from Yahoo Japan and approach its group companies, to expand its business.

Support Services Business

The company offers support services, including help desk and technical support services, and call-center services (making and receiving calls), including election exit polls, social surveys, and market research. A strength of this business is that the company offers technical services to loyal clients, including those related to Fujitsu and NEC, with a good balance. This business can be expected to grow stably, but it is necessary to secure “human resources.” Accordingly, the company makes efforts to recruit foreign workers, too.

1-2. Group Companies

Group company | Business details | Voting right |

CoCoTo Co., Ltd. | Systems Operation and Services Business, including the development of systems and networks, the support for development and operation of business apps, and clerical tasks for system operation | 100.0% |

CREATE LAB Co., Ltd. | Support Services Business (mainly help desk services), including support services, such as technical support regarding computers and help desk services, the development of systems, and support for sale | 97.5% |

ITI Co., Ltd. | Support Services Business (mainly the development, operation, and maintenance of systems), including the development, operation, management, and maintenance of computer systems, and the design, building, operation, and maintenance of network systems | 90.0% |

Adams Communications Co., Ltd. | Support Services Business (mainly marketing research and call center services), including the planning, implementation, summarization, and analysis of surveys on public opinion, society, and markets, and the provision of inside sales and call center services | 100.0% |

* For CREATE LAB Co., Ltd., the employee shareholding association holds 2.5% of voting rights. ITI Co., Ltd. and Adams Communications Co., Ltd. are subsidiaries of CREATE LAB Co., Ltd

1-3.Mid-term Business Plan (FY 3/18 to FY 3/20)

【Basic policy】

Recognizable growth potential | Targets for the term ending Mar. 2020 are sales of 15 billion yen and an operating income of 1 billion yen (operating income rate: 6.7%). Operating income is to exceed a record high (880 million yen after the release of Windows 95, which is attributable to “Fudemame”). |

Comprehensive capability of the corporate group | Enhance cross-selling, strengthen cooperation between departments, and create new business. |

Stable return to shareholders | Acquire treasury shares with an excess amount over 70% of capital-to-asset ratio as capital, maintaining a payout ratio of 40% |

Enhancement of corporate governance | Strengthen dialogue with shareholders, revise systems for executives’ remunerations, and appoint independent executives (outside directors or auditors). |

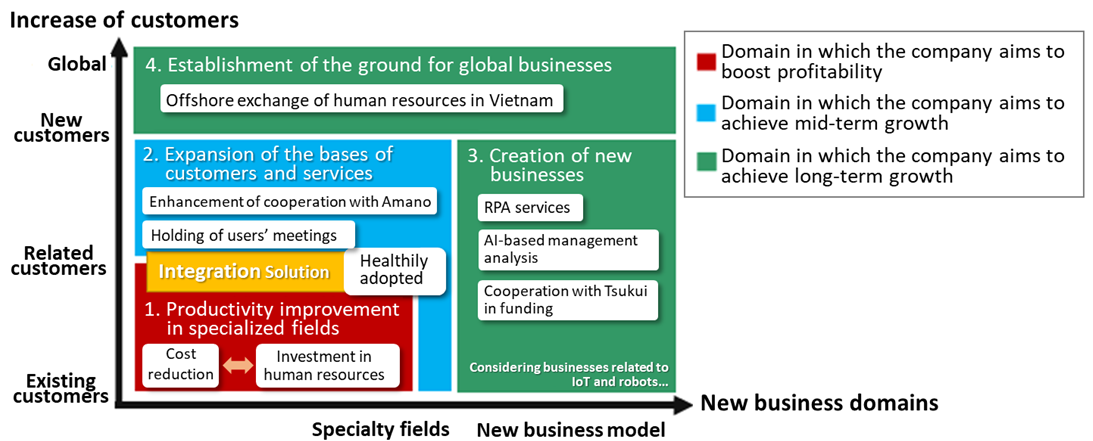

【Schematic diagram of growth strategies】

(Taken from the reference material of the company)

CREO aims to grow by increasing clients and expanding its business domain. The company will fortify its business base by increasing the loyalty of existing clients by offering integrated solutions that combine ZeeM for personnel affairs, payroll, accounting, fixed asset management, and the attendance management systems of Amano Corporation, etc. In addition, the company will broaden the base of clients and services by enhancing the cooperation with Amano Corporation and users’ associations. In the long term, the company will conduct global business by utilizing offshore bases in Vietnam and expand its business domain by offering RPA services, carrying out AI-based business analysis, and creating business in the nursing-care business in cooperation with the fund of the Tsukui Group, which leads the nursing-care field.

【Numerical goals and results】

| FY3/18 Act.(Plan) | FY3/19 Act.(Plan) | FY3/20 Plan | Ratio to sales | YoY |

Theme | Resetting issues | Period of change | Proof of ability | - | - |

Sales | 12,268(12,500) | 13,526(13,100) | 15,000 | 100.0% | +10.9% |

Operating Income | 410(400) | 670(570) | 1,000 | 6.7% | +49.1% |

Profit attributable to owners of parent | 305(280) | 664(400) | 680 | 4.5% | +2.3% |

*Unit: Million yen

For the first half of the fiscal year ending March 2020, which is the final fiscal year of the plan, sales and operating income grew 10.5% and 188.0%, respectively, year on year. Sales were almost in line with the initial estimate, while operating income was 91.5% larger than the initial estimate. The progress rate toward the full-year forecast is 45.5% for sales (the progress rate toward the actual result in the same period of the previous yea 45.7%), and 44.0% for operating income (the progress rate toward the actual result in the same period of the previous yea 22.7%). This progress can be said to be very healthy, considering that business performance of the company is highest in the fourth quarter.

In terms of sales, it is collaborating with Amano to propose sales of systems that integrate Amano’s attendance management system, etc. into the company’s packages, such as ERP package “ZeeM” and business process management system “BIZ PLATFORM.” It has succeeded in capturing the IT investment of the companies that are dealing with the shortage of workforce and laws related to Work Style Reform. In terms of profit, conventionally, the company’s engineers were specialized in each work for each package type. In case of ERP package “ZeeM,” for example, engineers were specialized in work such as personnel salary, accounting, and asset management. The company retrained the engineers for multitasking (supporting multiple tasks), and this effort improved the productivity of engineers. Furthermore, the offshore development in Vietnam is taking off, which is resulting in the improvement of the operating income margin.

2. First Half of Fiscal Year ending March 2020 Earnings Results

2-1. Earnings Overview

| 1H FY 3/19 | Ratio to sales | 1H FY 3/20 | Ratio to sales | YoY Change | Initial Est. | Divergence |

Sales | 6,181 | 100.0% | 6,832 | 100.0% | +10.5% | 6,750 | +1.2% |

Gross Profit | 1,235 | 20.0% | 1,539 | 22.5% | +24.6% | - | - |

SG & A | 1,082 | 17.5% | 1,098 | 16.1% | +1.5% | - | - |

Operating Income | 152 | 2.5% | 440 | 6.4% | +188.0% | 230 | +91.6% |

Ordinary Income | 184 | 3.0% | 474 | 6.9% | +156.7% | 250 | +89.6% |

Profit attributable to owners of parent | 129 | 2.1% | 306 | 4.5% | +136.2% | 150 | +104.3% |

*Unit: Million yen

Sales and operating income grew 10.5% and 188.0%, respectively, year on year.

Sales were 6,832 million yen, up 10.5% year on year. The performance of system operation services declined due to the recoil from large-scale projects in the previous term, but the company met the demand related to Work Style Reform, etc., so the Solutions Service Business and the West Japan Business grew considerably, and the Contracted Development Business and the Support Services Business were healthy.

Operating income was 440 million yen, up 188.0% year on year. Gross profit rate increased 2.5 points to 22.5%, due to the improvement in the ratio of engineers in service and the reduction of outsourcing cost through the utilization of business partners in Vietnam. On the other hand, the augmentation of SGA was insignificant (up 1.5% year on year) thanks to the curtailment of personnel expenses for overtime work, etc. Accordingly, operating income rate increased 3.9 points to 6.4%.

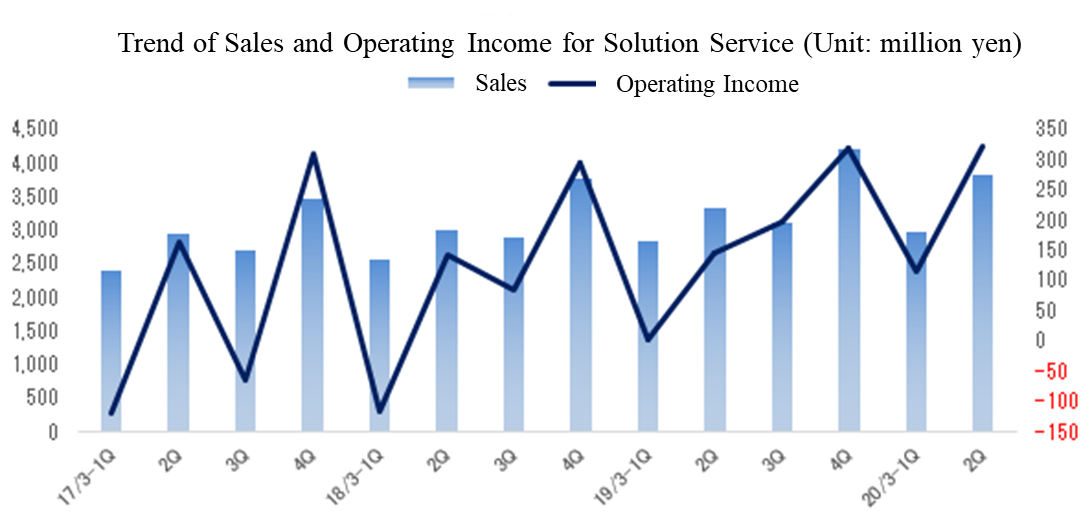

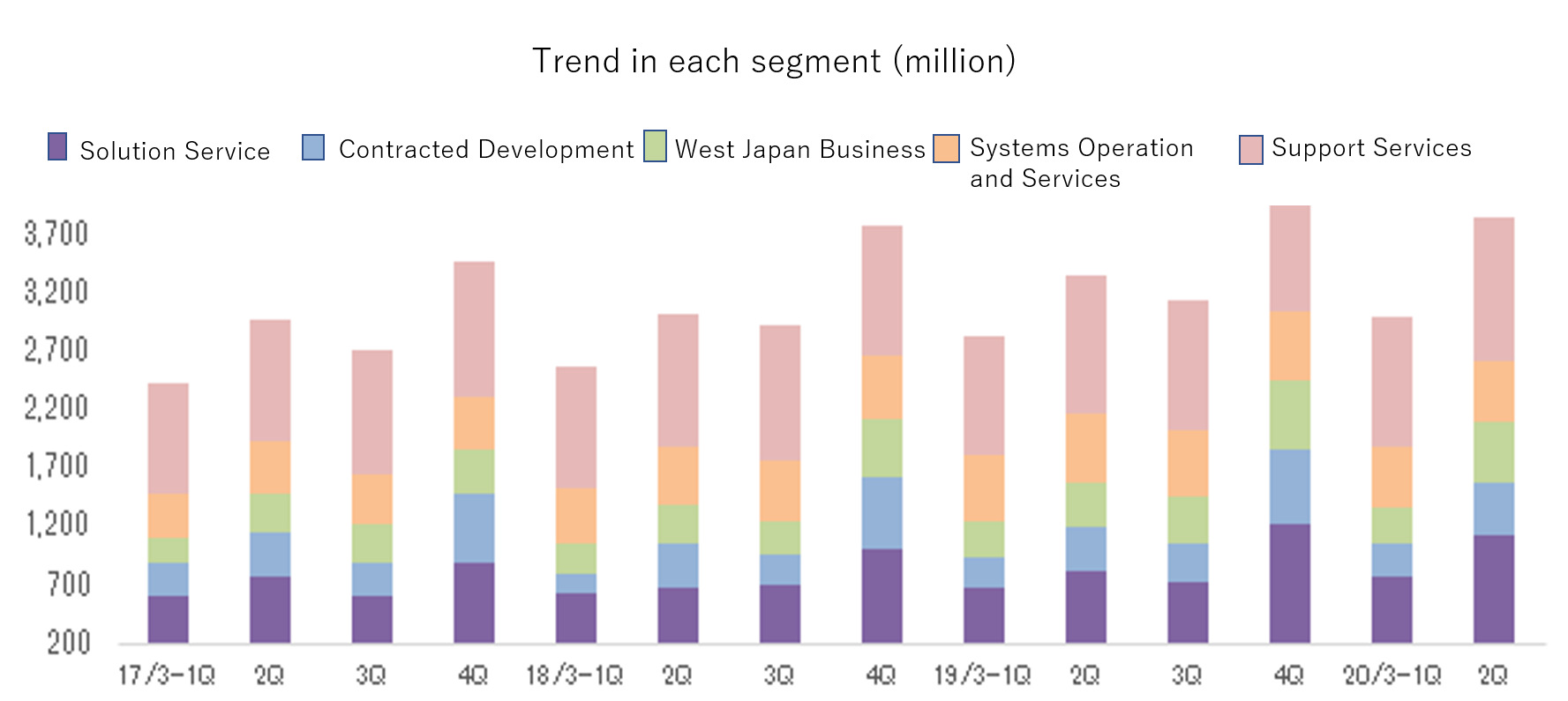

2-2. Trend in each segment

| 1H FY 3/19 | Ratio to sales・ Profit margin | 1H FY 3/20 | Ratio to sales・ Profit margin | YoY

| Plan | Compared with plan |

Solutions Service | 1,510 | 24.4% | 1,923 | 28.1% | +27.4% | 1,776 | +8.3% |

Contracted Development | 654 | 10.6% | 716 | 10.5% | +9.5% | 803 | -10.8% |

West Japan Business | 665 | 10.8% | 830 | 12.1% | +24.7% | 715 | +16.1% |

Systems Operation and Services | 1,169 | 18.9% | 1,065 | 15.6% | -8.8% | 1,231 | -13.5% |

Support Services | 2,276 | 36.8% | 2,429 | 35.6% | +6.7% | 2,366 | +2.7% |

adjustment | -96 | - | -134 | -2.0% | - | -141 |

|

Consolidated sales | 6,181 | 100.0% | 6,832 | 100.0% | +10.5% | 6,750 | +1.2% |

Solutions Service | 183 | 12.1% | 354 | 18.4% | +93.6% | 225 | +57.6% |

Contracted Development | 114 | 17.4% | 126 | 17.6% | +10.6% | 132 | -3.8% |

West Japan Business | 56 | 8.4% | 127 | 15.3% | +127.3% | 75 | +70.1% |

Systems Operation and Services | 78 | 6.7% | 44 | 4.1% | -43.2% | 70 | -36.0% |

Support Services | 99 | 4.3% | 175 | 7.2% | +77.5% | 125 | +40.8% |

Adjustment | -379 | - | -389 | +2.6% | - | -397 | - |

Consolidated operating income | 152 | 2.5% | 440 | 6.5% | +188.0% | 230 | +91.6% |

*Unit: Million yen

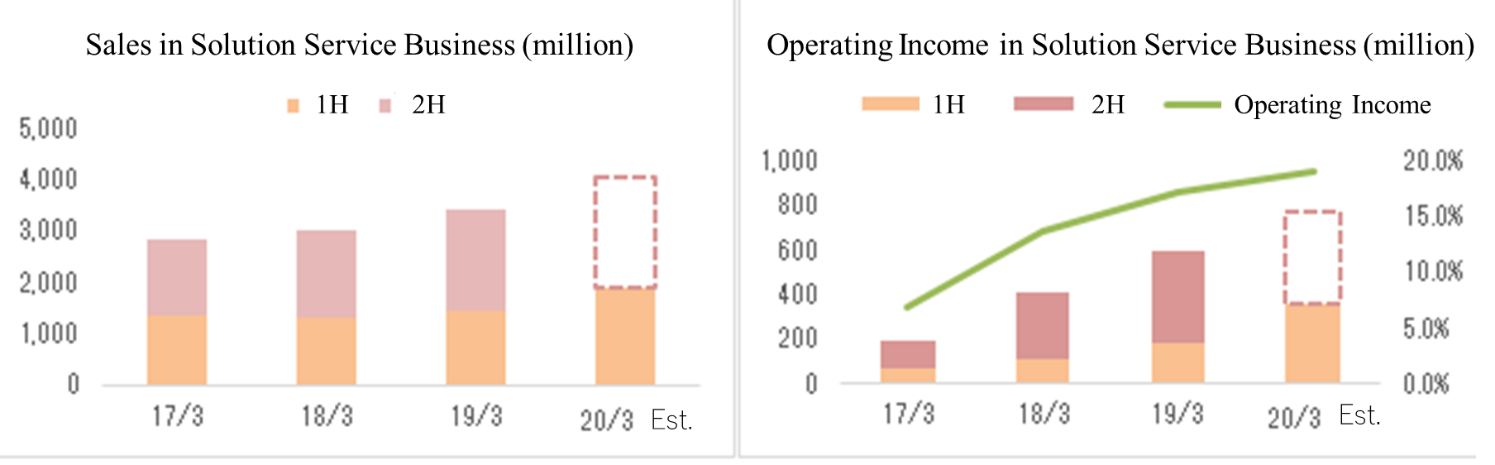

Solutions Service Business

Sales (including internal sales) were 1,923 million yen, up 27.4% year on year, and operating income was 354 million yen, up 93.6% year on year. This business offers solution services, including ZeeM, a system for personnel affairs, payroll, and accounting. In the first half, sales increased, as the company received several orders for comprehensive solutions related to Work Style Reform and large-scale projects for developing systems related to “intra-mart” (an integrated framework for system development of NTT DATA Intramart Corporation). Operating income rate rose from 12.1% to 18.4%, thanks to the improvement in productivity of engineers and the curtailment of outsourcing expenses through the utilization of offshore bases in Vietnam.

Contracted Development Business

Sales were 716 million yen, up 9.5% year on year, and operating income was 126 million yen, up 10.6% year on year. This business offers system development services to leading companies, including the Fujitsu Group and Amano Corporation. In the first half, the number of orders and sales mainly from existing major clients increased.

West Japan Business

Sales were 830 million yen, up 24.7% year on year, and operating income was 127 million yen, up 127.3% year on year. This business sells original products and services, and offers development services to clients to the west of Nagoya. In the first half, solution services contributed to sales growth. As for profit, profitability improved considerably, thanks to the improvement in the ratio of engineers in service due to the favorable number of orders received, the effects of the curtailment of outsourcing expenses through the utilization of offshore bases in Vietnam, etc.

System Operations and Service Business

Sales were 1,065 million yen, down 8.8% year on year, and operating income was 44 million yen, down 43.2% year on year. This business offers services of developing, maintaining, and operating systems to mainly leading portal site providers in Japan. In the first half, sales and profit declined, due to the recoil from large-scale projects in the same period of the previous year, the termination of some contracts at the end of the previous term, etc.

Support Services Business

Sales were 2,429 million yen, up 6.7% year on year, and operating income was 175 million yen, up 77.5% year on year. This business offers support and services, including help desk and technical support, and call center services for social and market surveys, and so on. As the rate of utilization has been improving since the second half of the previous term, transactions for surveys related to the 25th election of the House of Councillors contributed in the first half of this term. As for profit, profitability improved, because cost reduction efforts bore fruit.

2-3. Financial Position and Cash Flows (CF)

Financial Position

| Mar. 2019 | Sep. 2019 |

| Mar. 2019 | Sep. 2019 |

Cash | 4,012 | 4,061 | Accounts payable | 671 | 565 |

Receivables | 2,761 | 2,365 | Accounts payable | 304 | 206 |

Inventories | 240 | 471 | Taxes Payable | 178 | 174 |

Current Assets | 7,192 | 7,107 | Advance Payment | 180 | 363 |

Tangible Assets | 303 | 309 | Bonus reserves | 566 | 547 |

Intangible Assets | 276 | 265 | Liabilities | 2,571 | 2,373 |

Investments and Others | 660 | 654 | Net Assets | 5,861 | 5,963 |

Noncurrent Assets | 1,240 | 1,229 | Total Liabilities and Net Assets | 8,433 | 8,336 |

*Unit: million yen

The total assets as of the end of the second quarter were 8,336 million yen, down 97 million yen from the end of the previous term. Inventory assets and advances received increased thanks to the favorable number of orders received, while accounts receivable and accounts payable decreased. Capital-to-asset ratio was 71.0% (69.0% as of the end of the previous term).

Acquisition of treasury shares

From November 18, 2019 to January 31, 2020, the company will acquire up to 140,000 shares (which account for 1.7% of the total number of outstanding shares excluding treasury shares) worth up to 200,000,000 yen.

This is in line with the basic policy regarding the acquisition of treasury shares announced in Oct. 2016: “To set the ideal capital-to-asset ratio for maintaining financial stability at 70% and allocate equity capital above this to the acquisition of treasury shares.” As of the end of the second quarter of the fiscal year ending March 2020, capital-to-asset ratio was 71.0%, which indicates that the sufficient amount of funds for acquiring treasury shares has been secured.

As for dividends, the company plans to pay a term-end dividend of 34 yen/share, up 9 yen/share (with a payout ratio of 41.5%), and taking into account the acquisition of treasury shares, total return ratio is estimated to be 60%.

Cash Flows (CF)

| 1H FY 3/19 | 1H FY 3/20 | YoY | |

Operating cash flow(A) | 623 | 339 | -284 | -45.6% |

Investing cash flow (B) | -97 | -76 | +21 | - |

Free Cash flow (A+B) | 526 | 263 | -263 | -50.0% |

Financing cash flow | -130 | -214 | -84 | - |

Cash and Equivalents at the end of term | 3,879 | 4,061 | +182 | +4.7% |

*Unit: Million yen

The company secured an operating CF of 339 million yen, as pretax profit was 473 million yen (184 million yen in the same period of the previous year), depreciation was 85 million yen (121 million yen in the same period of the previous year), the decrease in accounts receivable was 396 million yen (543 million yen in the same period of the previous year), the increase in inventory assets was negative 231 million yen (negative 209 million yen in the same period of the previous year), and the payment of income tax, etc. was negative 95 million yen (89 million yen in the same period of the previous term), and so on.

Investing CF is attributable to the acquisition of tangible and intangible assets. Financing CF is due to the payment of dividends.

3. Fiscal Year ending March 2020 Earnings Forecasts

3-1Earnings Estimates

| FY3/19 Act. | Ratio to sales | FY3/20 Est. | Ratio to sales | YoY |

Sales | 13,526 | 100.0% | 15,000 | 100.0% | +10.9% |

Operating Income | 670 | 5.0% | 1,000 | 6.7% | +49.1% |

Ordinary Income | 706 | 5.2% | 1,030 | 6.9% | +45.7% |

Profit attributable to owners of parent | 664 | 4.9% | 680 | 4.5% | +2.3% |

*Unit: Million yen

There is no revision to the forecast for the full year, in which the company aims to achieve the goals set in the mid-term management plan, and it is estimated that sales and operating income will grow 10.9% and 49.1%, respectively, year on year.

The actual profit in the first half exceeded the initial estimate considerably, and the progress rate toward the full-year forecast is 45.5% for sales (the progress rate toward the actual result: 45.7%), 44.0% for operating income (the progress rate toward the actual result: 22.7%), 46.0% for ordinary income (the progress rate toward the actual result: 26.1%), and 45.0% for net income (the progress rate toward the actual result: 19.4%), much higher than the rates in the same period of the previous year. However, the full-year forecast has not been revised, because the business performance of the company is highest in the fourth quarter and there remain uncertainties and the risk of postponement of inspection, as large-scale projects are increasing although there are plentiful backlogs of orders. After seeing the number of orders received, the progress of projects under development, etc. as of the end of the third quarter, the company will examine it again.

Segments Estimates

| FY 3/19 Act. | Ratio to sales・ Profit margin | FY 3/20 Est. | Ratio to sales・ Profit margin | YoY |

Solutions Service | 3,510 | 26.0% | 4,061 | 27.1% | +15.7% |

Contracted Development | 1,609 | 11.9% | 1,900 | 12.7% | +18.1% |

West Japan Business | 1,638 | 12.1% | 1,650 | 11.0% | +0.7% |

Systems Operation and Services | 2,355 | 17.4% | 2,687 | 17.9% | +14.1% |

Support Services | 4,638 | 34.3% | 4,800 | 32.0% | +3.5% |

Adjustment | -226 | -1.7% | -98 | -0.7% | - |

Consolidated Sales | 13,526 | 100.0% | 15,000 | 100.0% | +10.9% |

Solutions Service | 593 | 16.9% | 770 | 19.0% | +29.8% |

Contracted Development | 332 | 20.6% | 350 | 18.4% | +5.4% |

West Japan Business | 170 | 10.4% | 190 | 11.5% | +11.8% |

Systems Operation and Services | 160 | 6.8% | 210 | 7.8% | +31.3% |

Support Services | 217 | 4.7% | 250 | 5.2% | +15.2% |

Adjustment | -804 | - | -770 | - | - |

Consolidated Operating Income | 670 | 5.0% | 1,000 | 6.7% | +49.3% |

*Unit: Million yen

3-2. Business Strategies (future policies)

Company-wide policy

As the company-wide policy for the fiscal year ending March 2020, the company upholds “the hybrid business administration for stability and growth.” In detail, considering the “cliff in 2025” described in DX Report of the Ministry of Economy, Trade and Industry, the company will conduct the hybrid business administration for the growth with value-creating digital business with the revenue base being the business of solving problems with existing conventional systems.

Client’s environment

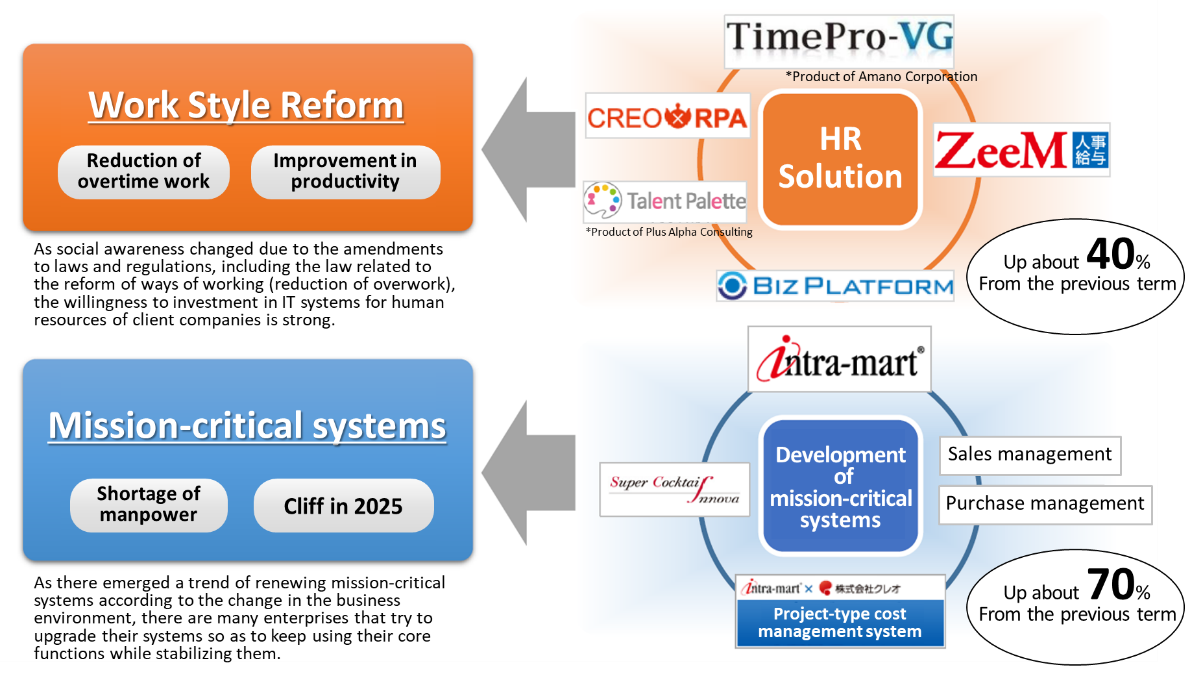

In the first half, the Solutions Service Business and the West Japan Business grew, thanks to Work Style Reform (reduction of overtime work and improvement in productivity) and the renewal and upgrade of mission-critical systems (to cope with the shortage of manpower and the cliff in 2025).

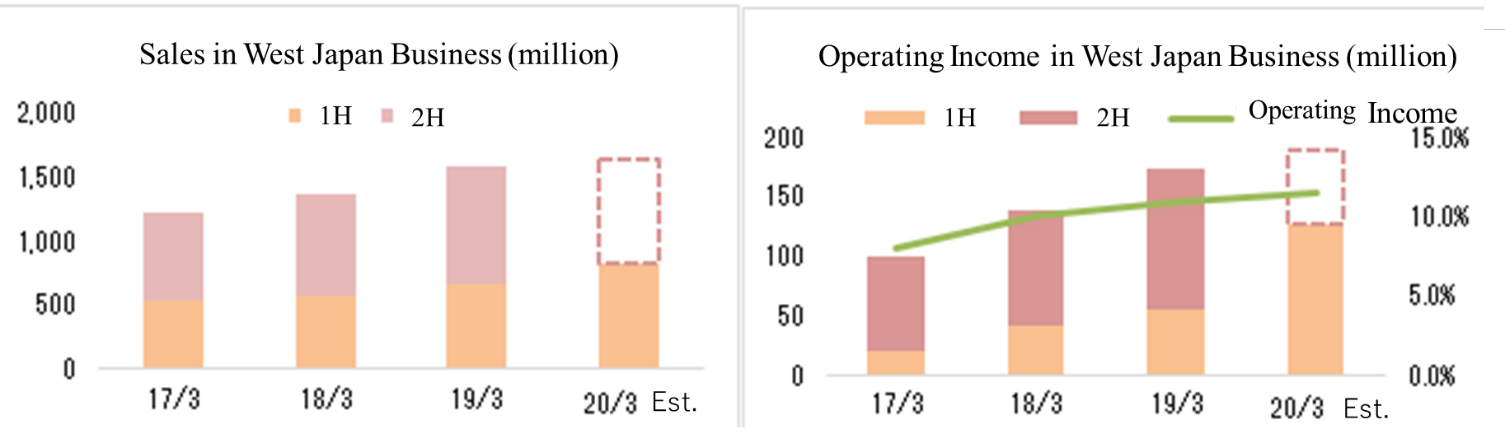

As social awareness changed due to the amendments to laws and regulations, including the law related to Work Style Reform (reduction of overwork), the willingness to invest in IT systems related to human resources of client companies is strong. The company saw about-40% year-on-year increase in sales of integrated solutions that combine ZeeM, a system for personnel affairs, payroll, and accounting; CREO RPA; BIZ PLATFORM, a BPM (Business Process Management), which contributes to the streamlining of business operation and the reduction of cost, TimePro-VG, an attendance management system of Amano Corporation, and Talent Palette, a talent management system of Plus Alpha Consulting Co., Ltd. (Minato-ku, Tokyo; representative director and president: Katsuya Mimuro).

In addition, there is a growing trend of renewing mission-critical systems according to the changes in the business environment, and many enterprises try to upgrade their systems so as to keep using their core functions while stabilizing them. The company increased sales related to the update of the mission-critical systems by about 70%, as the version of Intra-mart, a web application platform, which is developed and sold by NTT Data Intramart, was upgraded.

(Taken from the reference material of the company)

The product lineup of Intra-mart is composed of Intra-mart, which is a system base provided by NTT Data Intramart, and a variety of applications that work with that system base. CREO Co., Ltd. deals with tasks ranging from sale to development of software licenses as a distributor of Intra-mart, and offers major applications: Cost Control System, Expenditure Calculation, and Man-hour and Attendance Management. In addition, CREO sells, installs, and customizes Super Cocktail Innova, an ERP system based on Intra-mart, as a solution & sales partner of Uchida Yoko.

Results in the first half, and full-year forecast

In the first half, the Solutions Service Business and the West Japan Business met the demand for development related to “Work Style Reform” and “the renewal and upgrade of mission-critical systems.” The company recognizes the fiscal year ending March 2020, which is the final fiscal year of the mid-term management plan, as the period for “proving themselves.” The company aims to achieve sales of 15 billion yen, an operating income of 1 billion yen, and an operating income rate of 6.7% (6.4% in the first half), and their progress is steady as explained above.

Issues and countermeasures

Issues to be solved are the shortage of manpower and the management of large-scale projects, and it is necessary to enhance collaboration with Amano Corporation.

In order to cope with the shortage of human resources, the company is optimizing installation services, utilizing human resources in cooperation with group companies, and utilizing offshore bases in Vietnam. For the optimization of installation services, labor saving is progressing through the development of templates for standard services. For the utilization of human resources in cooperation with group companies, the company is making efforts to improve installation services by enlisting support from CreateLab and its group companies, and its business is getting on track in parallel with the use of offshore bases in Vietnam.

Recently, the marketing activities based on a proposal for an integrated solution have borne fruit, increasing orders for large-scale projects, so it is necessary to improve the capacity management. The company thoroughly manages progress for projects not to fall into the red, and in the first half, each project progressed healthily. The company also strives to raise leaders for managing large-scale projects (project managers).

Together with Amano Corporation, the company is promoting the integrated solution that combines TimePro-VG, an attendance management system of Amano Corporation, and ZeeM, a system for personnel affairs, payroll, and accounting of CREO, receiving orders for large-scale projects. In order to increase orders further, the company is enhancing collaborative marketing while developing and strengthening systems for cooperation in SE and support.

(Taken from the reference material of the company)

Concept of the new mid-term management plan

The company is currently designing mid-term goals. In the ongoing mid-term management plan, the core business grew through new combination and profitability improved. The theme of the new mid-term management plan, which will begin in the fiscal year ending March 2021 and end in the fiscal year ending March 2023, is “transition for sustainability.” In the fiscal year ending March 2024, the company will commemorate the 50th anniversary of establishment, and work on the development of a long-term base for growth while looking ahead to a company surviving for 100 years. The company plans to announce the details in around May, 2020.

(Taken from the reference material of the company)

4. Conclusions

In the first half, the business model shift through the restructuring of the corporate group in April 2017 bore fruit. As for marketing, the company diversified its proposals based on the joint promotion of the products of CREO and Amano and the integrated solution that combines the products of other business partners, and became able to meet the needs that had not been met. The projects ordered are becoming larger, and they said that the company received several orders for large-scale projects worth 30 million yen to over 100 million yen in the first half.

As for development, the cooperation between business divisions and between groups and the utilization of offshore bases in Vietnam got on track. Operating income rate increased considerably, as the ratio of engineers in service increased in the corporate group and outsourcing cost was reduced. The volume of transactions among group companies reportedly increased over 50% year on year. In Vietnam, a total of 25 workers from 3 business partners are engaged in development, and CREO aims to increase the number of orders to offshore bases two or three times.

There are few concerns about the achievement of the mid-term management plan, unless there is the carry-over of inspection or the like. In the plan, the company aims to “prove themselves” in the fiscal year ending March 2020, and the financial results are expected to achieve this goal. In the new mid-term management plan, which will begin next term, the company will shift to services to achieve an operating income rate of 10%.

< Reference: CSR activities>

The CREO group engages in various activities to realize a company that is friendly to people and the environment.

To sponsor IT Charity Ekiden (Long-distance Relay Race)

NIPPON IT Charity Ekiden is a charity event in which mainly IT enterprises participate, for supporting those who are suffering from depression and withdrew from social life. The CREO group sponsors this event as a Special Zeichen Sponsor, while agreeing with its objective “to support youngsters in helping, encouraging, supporting, and forging connections with one another for achieving a shared goal and overcoming current hardships through the sport called ekiden (long-distance relay race).”

(Taken from the reference material of the company)

Kofu Project

“Let’s develop a place where employees and their family members can enjoyably interact with nature.”

“We wish to grow up through agricultural experience.”

“As a healing spot”

“We wish to learn the blessings of living organisms and the preciousness of nature, through the interaction with nature.”

For these multifarious purposes, CreateLab, which is a subsidiary of CREO, launched this project. In April 2012, it started under the title “Shingen Project (a project for utilizing fallow fields)” and is still ongoing under the title “Kofu Project.” Based on a renovated old folk house and fields, they hold events for interacting with local people, harvest festivals inviting employees’ family members, in-company training, etc., expanding communication.

(Taken from the reference material of the company)

Efforts for healthy business administration and work-life balance

Considering that human resources are “human assets” and employees are the most important assets of CREO, the company engages in various activities so that they can enjoy their jobs with their mental and physical conditions being healthy. One of them is “Walk Race,” in which pedometers are distributed to all employees of the CREO group and group companies compete in the average number of steps. In addition, the company holds a group-wide overtime work reduction contest, etc. so that employees will better their lives with the time saved by reducing overtime work, and create new value with their broadened perspectives and enhanced creativity.

Utilization of local human assets

In February 2016, Karatsu Office of CoCoTo Co., Ltd. was opened. After opening the office, the company utilizes local human assets for the purposes of securing employment, helping develop local industries, and vitalizing local communities.

<Reference:Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory board |

Directors | 7 directors, including 3 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report: Updated on Jun. 28, 2018

Basic policy

Our company believes that establishing appropriate corporate governance systems and striving to improve them constantly would improve the transparency and fairness of our business administration, and our corporate value. While considering that the observance of the corporate governance code would contribute to the establishment of our better governance, we will adopt the supplementary principles and the principles other than the basic 5 principles, too, one after another. The details of the already adopted principles are written in this report.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

As a company listed in JASDAQ, our company follows all of the basic principles of the corporate governance code. As for supplementary principles and the principles other than the basic ones that need to be disclosed and that are already followed by our company, they are outlined in the “Disclosure Based on the Principles of the Corporate Governance Code” below.

<Principle 1-4 Disclosure of policies for strategically held shares>

Our company does not hold shares that fall under strategically held shares.

<Principle 3-1 Enrichment of information disclosure>

Out of the items to be disclosed specified in this principle, “(i) Corporate vision (ethos, etc.), management strategies, and plans” are disclosed as follows.

Corporate ethos and guidelines for action

https://www.creo.co.jp/corporate/concept/

Mid-term business plan (FY 2017 to FY 2019)

https://www.creo.co.jp/ir/plan/

【Principle 5-1 Policy for constructive dialogue with shareholders】

Our company aims to improve shareholder value in cooperation with shareholders, through the constructive dialogue with them.

To do so, we have established the following system and implemented some measures.

1) Mainly the IR section deals with dialogue with shareholders. Executives, including the representative director and president, participate in, give explanations and answer questions at briefing sessions for financial results and individual investors, small meetings, etc. Like this, we prepare opportunities for direct dialogue between shareholders and the management.

2) The IR section of our company forwards opinions given during the dialogue with shareholders to the management, to utilize them for discussing mid/long-term management policies.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co.,Ltd. All Rights Reserved. |