Bridge Report:(9698)CREO the Second quarter of fiscal year ending March 2021

President and Representative Director Junichi Kakizaki | CREO CO., LTD. (9698) |

|

Company Information

Market | JASDAQ |

Industry | Information and telecommunications |

President | Junichi Kakizaki |

HQ Address | Sumitomo Fudosan Shinagawa Building 4-10-27 Higashi-shinagawa, Shinagawa-Ku, Tokyo |

Year-end | March |

HOMEPAGE |

Stock Information

Share price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥1,265 | 8,185,753 thousand shares | ¥10,355 million | 12.2% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥36.00 | 2.8% | ¥89.79 | 14.1x | ¥750.33 | 1.7x |

*The share price is the closing price on November 9th 2020. The number of issued shares is obtained by subtracting the number of treasury shares from the number of shares issued as of the end of the latest quarter. ROE and BPS were the previous term result.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating income | Ordinary income | Net income | EPS | DPS |

Mar. 2017 (Actual) | 11,559 | 296 | 333 | 267 | 31.11 | 13.00 |

Mar. 2018 (Actual) | 12,268 | 410 | 457 | 305 | 36.79 | 15.00 |

Mar. 2019 (Actual) | 13,526 | 670 | 706 | 664 | 80.05 | 25.00 |

Mar. 2020 (Actual) | 14,624 | 1,044 | 1,095 | 731 | 88.49 | 35.00 |

Mar. 2021 (Forecast) | 15,500 | 1,100 | 1,130 | 735 | 89.79 | 36.00 |

*The forecasted values are from the Company. Unit: million yen, yen

This Bridge Report overviews the business performance for the Second quarter of fiscal year ending March 2021 and describes the earnings forecast for the term ending March 2021 for CREO Co., Ltd.

Table of Contents

Key Points

1. Company Overview

2. The Second quarter of Fiscal Year ending March 2021 Earnings Results

3. Fiscal Year ending March 2021 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the first half of the fiscal year ending March 2021, sales and operating income fell 1.2% and 6.2%, respectively, year on year. Sales grew in the Solutions Service Business, which continued to receive orders for large-scale projects related to comprehensive solutions, but this was outweighed by the decline in sales of the System Operation and Services Business, impacted by orders that were put on hold as part of measures to prevent the spread of COVID-19. Although profit was weighed down by the augmentation of SG&A costs, due partly to investments in developing a telecommuting environment and R&D, profitability improved across all businesses, resulting in operating income, ordinary income and net income beating the company’s initial forecasts.

- Sales and operating income are estimated to rise 6.0% and 5.3%, respectively, year on year in the fiscal year ending March 2021. While profit exceeded the company’s estimates for the first half of the term, there are a large number of orders scheduled for acceptance inspection in the fourth quarter (Jan. to Mar.), so the company has left its earnings forecast unchanged for now, citing the need to monitor performance at the end of the third quarter. There is actually ample room for an overshoot versus the company’s forecasts, but even if earnings do end up in line with its expectations, CREO will still post a record profit for the second consecutive year. The dividend is to be 36 yen/share, up 1 yen/share (estimated dividend payout rati 40.1%).

- In April 2019, the Act on the Arrangement of Related Acts to Promote Work Style Reform came into effect, meaning that some major companies were required to digitalize the submission of various internal documents as part of these reforms, increasing the workload for employees involved in human resources (HR) and labor matters. However, the fact that the digitalization of such HR/labor-related work has been slow is also said to be a contributing factor to the increased workload of these employees. If digitalization enables the automatic generation of documents, as well as the online submission of applications to government offices, this will significantly increase efficiency and lighten the workload of works. Business opportunities for the company are increasing. We look for the company to benefit from developments on this front.

1. Company Overview

CREO is a system integrator that offers a variety of solutions. The company offers business solutions, including “ZeeM Series,” a business package software used by over 2,000 enterprises (Enterprise Resource Planning (ERP) for human resources, accounting, asset management, etc.) and “BIZ PLATFORM,” for business process management (BPM), which contributes to the streamlining of business operation and cost reduction, develops systems for governmental offices, municipalities, public-interest corporations, and large companies, produces and operates web systems for leading portal site operators in Japan, provides loyal clients with call-center services, and so on.

The corporate group is composed of CREO, and four consolidated subsidiaries: CoCoTo Co., Ltd., CREATE LAB Co., Ltd., ITI Co., Ltd., and Adams Communications Co., Ltd. Amano (6436) and Z Holdings Corporation (4689) holds 32.31% and 13.44% of shares of CREO, respectively. CREO is an equity-method affiliate of Amano Corporation.

[Three thoughts in the logo]

| To create an “impression” The exclamation mark in the logo represents the stance of surpassing expectations and impressing clients. To continue “creation” The sphere is CREO itself, and represents the environment in which human resources, products, and services are born and grow. To cuddle up to “eternity” This logo denotes CREO, which is represented by the sphere, cuddling up to clients, society, and shareholders. |

1-1. Business Segments

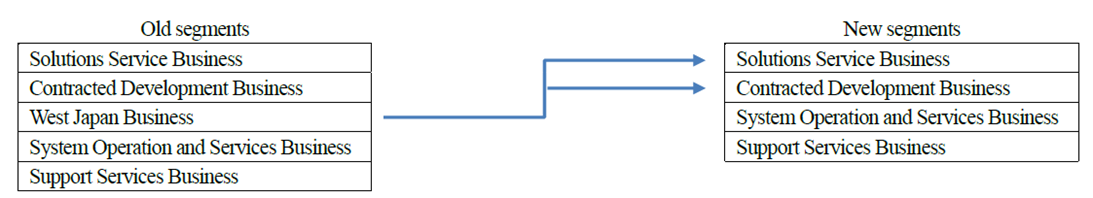

In executing the mid-term management plan, which begins in the fiscal year ending March 2021, certain business segments that were previously identical to the organizational segments were reclassified. Specifically, the sales and profit of the West Japan Company, which had been treated as the West Japan Business, were divided into two business segments depending on business details. The two business segments are the Solutions Service Business and the Contracted Development Business. Therefore, the company changed its five reporting segments to four reporting segments and enhance business management further in order to maximize profitability.

Solutions Service Business

The company offers and customizes package software such as “ZeeM Series,” an ERP for human resources, payroll, accounting, and asset management used by over 2,000 companies, and “BIZ PLATFORM,” a BPM that contributes to the streamlining of business operation and cost reduction, develops software and cloud services provided by client companies to corporate clients and consumers (as development is carried out together with client companies, the business is called “co-creation contracted business” or “co-creation development” within the company), the RPA solution for actualizing business processes that use manpower and robots by combining the know-how of ERP and BPM and the robotic process automation (RPA) technology for automating the routine tasks of white-collar workers, and so on.

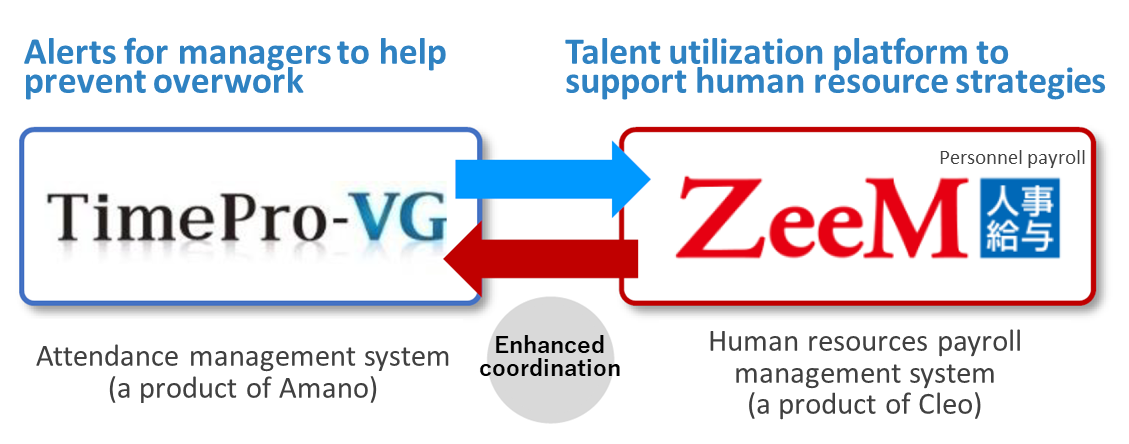

In recent years, the company has succeeded in capturing demand related to Work Style Reform by linking “ZeeM,” a software package for human resource and payroll, and “TimePro,” an attendance management solution of Amano Corporation, and the scale of the projects has been growing.

Business entities in charge: Solution Services Company, Solution Development Center (newly established in 2020), West Japan Company (product sale)

Contracted Development Business

The company undertakes the development of systems for large companies, governmental offices, and municipalities, typesetting systems for newspaper publishers, odds systems for professional sports organized by the government, etc., which require reliability and experience. As a characteristic, the transactions made via Fujitsu are dominant, and so stable growth can be expected, although there are some short-term fluctuations. It is essential to secure “manpower,” including subcontractors.

Business entities in charge: Next Solution Company, West Japan Company (contracted development)

Systems Operation and Services Business

The company offers operation services, including the development, maintenance, and anti-hacking operation of server systems for portal sites and web services, to mainly the leading Japanese portal-site operator and its group companies. Previously, this business was operated by several group companies under the holding company, but they were integrated into CoCoTo Co., Ltd., which was established in Apr. 2016. This way, it became possible to exert the capability of the corporate group in marketing and development, and the company is making transactions with the group companies of portal-site operator. The company plans to boost sales from portal-site operator and approach its group companies, to expand its business.

Business entities in charge: CoCoTo Co., Ltd

Support Services Business

The company offers support services, including help desk and technical support services, and call-center services (making and receiving calls), including election exit polls, social surveys, and market research. A strength of this business is that the company offers technical services to loyal clients, including those related to Fujitsu and NEC, with a good balance. This business can be expected to grow stably, but it is necessary to secure “human resources.” Accordingly, the company makes efforts to recruit foreign workers, too.

Business entities in charge: CREATE LAB Co., Ltd., ITI Co., Ltd., Adams Communications Co., Ltd.

ITI Co., Ltd. and Adams Communications Co., Ltd. are subsidiaries of CREATE LAB Co., Ltd.

1-2. Mid-term Management Plan (FY 3/21 to FY 3/23)

CREO Group, which will celebrate its 50th anniversary in 2024, conducts its business operations from a medium/long-term perspective, striving to become a “100-year-old company” that will remain attractive to all stakeholders for the next 50 years. As part of such efforts, the company started a mid-term management plan in the fiscal year ending March 2021, when it commemorated its 45th anniversary, with “creating mechanisms” that achieve sustainable growth and improve corporate value as its main theme.

The Mid-term Management Plan’s Vision and 3 Key Initiatives

Based on the ongoing challenges from the previous mid-term management plan and future changes in the external environment, the group set the vision of the new mid-term management plan as “creating a framework for sustainable growth and increasing corporate value.” Under this vision, CREO will work on “business structure and business portfolio transformation,” “human resources development and utilization for sustainable growth,” and “transformation into a flexible organization and business process capable of responding to changes and risks.” The company will place particular importance on the operating income rate as a management index. As a result of the company’s efforts over the past three years, orders and sales are expanding. However, it is difficult to accurately predict how much the impact of the spread of the coronavirus will offset. Even if the sales growth rate slows down to some extent, the company will achieve profit growth by improving productivity and profitability (operating income rate).

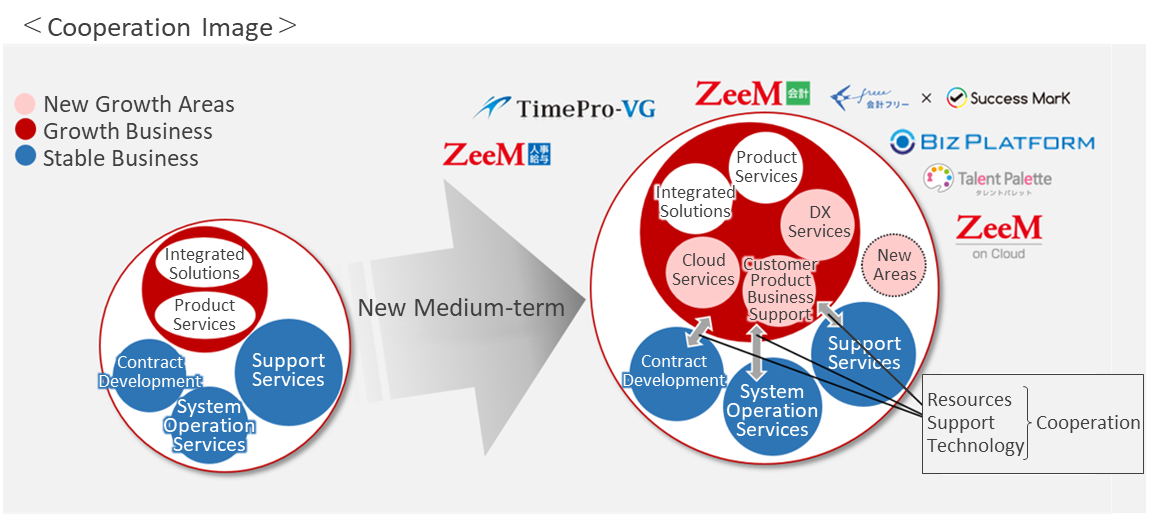

“Business Structure and Business Portfolio Transformation”:

The Solutions Service Business earns 50% of CREO Group’s total operating income, but due to a shortage of engineers, it could not establish a sufficient order-receiving system to fulfill demand. As such, the company will increase the mobility of its workforce within the Group (collaboration across business segments and the reshuffling of human resources) and utilize offshore and nearshore bases to concentrate its management resources on the Solutions Service Business. Also, by adopting HR solutions at the same time, CREO plans to move forward with the automation of system configuration and other processes (i.e., initiatives to reduce manpower).

“Human Resources Development and Utilization for Sustainable Growth”

CREO will develop human resources focusing on the themes of training future generation leaders, cultivating global human resources, and improving the skill level of engineers. For these initiatives to be successful, increasing employees’ motivation is key. The company therefore rates and rewards multitalented employees that display distinct strengths and skills in various fields. As it also needs to have HR systems that tolerate diversity, it is working to reform existing systems and establish new ones. “Training future generation leaders” will continue permanently. On the other hand, regarding cultivating global human resources, the company will provide motivated young employees with opportunities to gain experience overseas, and then they will gradually spread a global perspective and awareness throughout the group. CREO will work on improving the skill level of engineers, but rather than blindly pursuing multiple new technologies, it will identify areas where it can exert its strengths and specialize in it.

“Transformation into a Flexible Organization and Business Process Capable of Responding to Changes and Risks”

While moving forward with the second stage of group restructuring, CREO will carry out a business process reform that considers both improving productivity and its Business Continuity Plan (BCP). For the second stage of group restructuring, the company began to implement measures that shift human resources to more profitable business in the previous fiscal year. It will not simply shift its workforce, but it will put in place a framework that allows it to flexibly and swiftly allocate personnel within the Group and transform their skills. As for business process reforms, the company started developing and operating the infrastructure for telecommuting. This will enable it to maintain high productivity even if another crisis like the coronavirus pandemic occurs and working styles change dramatically.

Investments

CREO established a new investment committee. The committee does not only evaluate and approve the investment plans from each business, but will also seek investment opportunities and encourage its implementation. The members of the committee have their respective areas of responsibility and will promote investment while primarily focusing on new business investment, development investment, human capital investment, and capital investment. CREO sets a guideline for the scale of investment amount of the entire group to be around 500 million yen during the current mid-term management plan, and it will make decisions flexibly based on the investment opportunities and results.

Management Goals

The targets for the end of the current mid-term management plan, which is at the end of March 2023, are sales of 18 billion yen (annual growth rate: 7.2%, previous mid-term growth rate: 8.1%) and an operating income of 1.8 billion yen (annual growth rate: 19.9%, previous mid-term growth rate: 39.0%). The pace of increase in sales and profits is slightly slower than that of the previous term. This is due to the conservative estimation based on the influence of the coronavirus and strengthening various investments. Also, as CREO prioritizes quality transformation through the creation of various mechanisms in the current mid-term management plan, it uses operating income rate as an indicator of this transition, and is aiming to raise operating income rate to at least 10%.

Financial/Capital Policy and Profit-sharing Policy

There are no changes from the previous mid-term management plan, and there is an optimal balance of the three points: shareholder return, financial stability, and investments. Although CREO will expand its investments to achieve permanent growth more than before, this will not impair the rules of financial stability as the company will continue to generate investment resources through business activities by improving the operating income rate. As for the profit-sharing policy, CREO will continue to aim for a consolidated payout ratio of 40%.

2. The Second quarter of Fiscal Year ending March 2021 Earnings Results

2-1. First half Earnings Overview

| FY 3/20 1H | Ratio to sales | FY 3/21 1H | Ratio to sales | YoY Change | Full year Forecast | Divergence |

Sales | 6,832 | 100.0% | 6,748 | 100.0% | -1.2% | 6,900 | -2.2% |

Gross Profit | 1,539 | 22.5% | 1,574 | 23.3% | +2.3% | - | - |

SG & A | 1,098 | 16.1% | 1,161 | 17.2% | +5.7% | - | - |

Operating Income | 440 | 6.4% | 413 | 6.1% | -6.2% | 300 | +37.7% |

Ordinary Income | 474 | 6.9% | 459 | 6.8% | -3.1% | 320 | +43.5% |

Profit attributable to owners of parent | 306 | 4.5% | 264 | 3.9% | -13.8% | 170 | +55.4% |

*Unit: Million yen

Mainstay Solutions Service Business continued to receive orders for large-scale projects

Sales fell 1.2% year on year to 6,748 million yen. In the System Operation and Services Business, sales declined 9.2% year on year, because projects were put on hold as part of measures to prevent the spread of COVID-19. Sales also edged down in the Contracted Development Business and Support Services Business. Meanwhile, sales for the Solutions Service Business grew 4.1% year on year, continuing to receive orders for large-scale projects related to comprehensive solutions.

Operating income decreased 6.2% year on year to 413 million yen. Although the company successfully curbed nonessential costs, this was not enough to offset drags including costs associated with developing a telecommuting environment, R&D for new businesses, expanding office space for a large-scale project, and stock option expensing. While non-operating income/losses improved, with the company booking 110 million yen in compensation income associated with projects put on hold, net income fell 13.8% year on year to 264 million yen due to higher tax expenses.

Operating income, ordinary income and net income exceeded the company’s initial forecasts, due to better-than-expected profitability improvement across all businesses and success with efforts to curb nonessential costs.

2-2. Trends in each segment

| FY 3/20 1H | Ratio to sales・Profit margin | FY 3/21 1H | Ratio to sales・Profit margin | YoY | plans | Compared with the plans |

Solutions Service | 2,249 | 32.9% | 2,341 | 34.7% | +4.1% | 2,330 | +0.5% |

Contracted Development | 1,202 | 17.6% | 1,158 | 17.2% | -3.7% | 1,220 | -5.0% |

Systems Operation and Services | 1,065 | 15.6% | 967 | 14.3% | -9.2% | 1,030 | -6.0% |

Support Services | 2,314 | 33.9% | 2,280 | 33.8% | -1.5% | 2,320 | -1.7% |

Consolidated sales | 6,832 | 100.0% | 6,748 | 100.0% | -1.2% | 6,900 | -2.2% |

Solutions Service | 436 | 19.4% | 459 | 19.6% | +5.4% | 450 | +2.0% |

Contracted Development | 173 | 14.4% | 171 | 14.8% | -0.7% | 160 | +7.5% |

Systems Operation and Services | 44 | 4.1% | 84 | 8.7% | +87.5% | 45 | +86.7% |

Support Services | 175 | 7.6% | 169 | 7.4% | -3.6% | 135 | +25.6% |

Adjustment | -389 | - | -471 | - | - | -490 | - |

Consolidated operating income | 440 | 6.4% | 413 | 6.1% | -6.2% | 300 | +37.7% |

*Unit: Million yen

*Due to a change in internal administrative categories, the reporting segments were changed, and comparisons with the same period of the previous year are based on the figures calculated based on the new categories.

Solutions Service Business

Sales came to 2,341 million yen (up 4.1% year on year) and operating income to 459 million yen (up 5.4% year on year). This business, which offers solution services including ZeeM, a system for personnel affairs, payroll, and accounting, reported sales growth owing partly to the receipt of large-scale orders for personnel affairs solutions, and improved profitability.

Contracted Development Business

Sales were 1,158 million yen (down 3.7% year on year) and operating income was 171 million yen (down 0.7% year on year). This business, which offers contracted development services for systems to leading companies, including the Fujitsu Group and Amano Corporation, saw sales decline due to a decrease of orders from the manufacturing industry in western Japan due to the COVID-19 pandemic. Meanwhile, it secured profit largely in line with the year-earlier level, with operating income margin improving from 14.4% to 14.8% on the back of improved profitability.

System Operations and Service Business

Sales came to 967 million yen (down 9.2% year on year) and operating income came to 84 million yen (up 87.5% year on year). This business, which offers services of developing, maintaining, and operating systems mainly to leading Japanese portal sites providers, suffered a decrease in sales caused by projects being put on hold in the first quarter as part of measures to prevent the spread of the coronavirus. However, operating income grew sharply year on year, thanks to improvement in profit margins of projects.

Support Services Business

Sales were 2,280 million yen (down 1.5% year on year) and operating income was 169 million yen (down 3.6%). This business, which offers support and services centered on help desks and technical support as well as call center services for social/market surveys, and so on, reported a decline in sales and profit owing partly to the decrease of orders for call center services.

The increase in “Adjustment” from 389 million yen to 471 million yen reflects the booking of costs associated with developing a telecommuting environment, R&D for new businesses, rent related to the expansion of office space for a large-scale project, stock option expensing, etc.

2-3. Financial Position and Cash Flows (CF)

Financial Position

| Mar. 2020 | Sep. 2020 |

| Mar. 2020 | Sep 2020 |

Cash | 4,128 | 3,892 | Accounts payable | 665 | 567 |

Receivables | 2,950 | 2,300 | Accounts payable | 258 | 172 |

Current Assets | 7,558 | 7,004 | Taxes Payable | 293 | 186 |

Tangible Assets | 289 | 328 | Advance Payment | 215 | 393 |

Intangible Assets | 390 | 496 | Liabilities | 2,810 | 2,423 |

Investments and Others | 730 | 730 | Net Assets | 6,158 | 6,136 |

Noncurrent Assets | 1,409 | 1,555 | Total Liabilities and Net Assets | 8,968 | 8,559 |

*Unit: million yen

The total assets at the end of the second quarter stood at 8,559 million yen, down 409 million yen from the end of the same period in the previous term. While cash and deposits decreased due to the payment of dividends, income tax, etc., the ratio of liquidity on hand (based on sales estimates for the second half of the year) was as healthy as 3.0 months. Advances received also increased, reflecting solid orders. Capital-to-asset ratio was 71.5% (68.5% at the end of the previous term).

Cash Flows (CF)

| FY 3/20 1H | FY 3/21 1H | YoY | |

Operating cash flow(A) | 339 | 270 | -69 | -20.4% |

Investing cash flow (B) | -76 | -213 | -137 | - |

Free Cash flow (A+B) | 263 | 57 | -206 | -78.3% |

Financing cash flow | -214 | -292 | -78 | - |

Cash and Equivalents at the end of term | 4,061 | 3,892 | -169 | -4.2% |

*Unit: Million yen

The company secured an operating cash flow (CF) of 270 million yen, as pretax profit was 450 million yen (470 million yen in the same period of the previous term), depreciation was 68 million yen (85 million yen in the same period of the previous term), and income tax and other payments amounted to 290 million yen (95 million yen in the same period of the previous year). Investing CF is mainly attributable to the acquisition of intangible assets, and financing CF is mainly due to the payment of dividends. Following the adoption of a Board Benefit Trust (BBT) and Employee Stock Ownership Plan (J-ESOP), the company purchased treasury stock (480 million yen) and disposed of treasury stock (480 million yen) via third-party allotment.

3. Fiscal Year ending March 2021 Earnings Forecasts

3-1. Earnings Estimates

| FY3/20 Act. | Ratio to sales | FY3/21 Est. | Ratio to sales | YoY |

Sales | 14,624 | 100.0% | 15,500 | 100.0% | +6.0% |

Operating Income | 1,044 | 7.1% | 1,100 | 7.1% | +5.3% |

Ordinary Income | 1,095 | 7.5% | 1,130 | 7.3% | +3.2% |

Profit attributable to owners of parent | 731 | 5.0% | 735 | 4.7% | +0.5% |

*Unit: Million yen

No changes to full-year forecasts. Sales and operating income estimated to rise 6.0% and 5.3%, respectively, year on year

The progress rate toward the full-year forecast is 43.5% for sales (46.7% of the FY3/20 sales result achieved in the first half of the previous year), 37.6% for operating income (42.1%), 40.6% for ordinary income (43.3%), and 35.9% for net income (41.9%). While profit exceeded the estimate for the first half, progress toward the full-year forecast is below that achieved in the previous term. This is attributable to the large number of orders scheduled for acceptance inspection in the fourth quarter, and is also the reason why the company left its current earnings unchanged. CREO expects earnings to be in line with its forecast from the third quarter onward, but also sees a need to monitor the state of orders at the end of the third quarter. It aims to achieve its earnings forecast by focusing on project management.

The dividend is to be 36 yen/share, up 1 yen/share (estimated dividend payout rati 40.1%).

3-2. Changes in Customers’ Business Environments, Recognized Issues, and Measures to Solve Them

Changes in Customers’ Business Environments

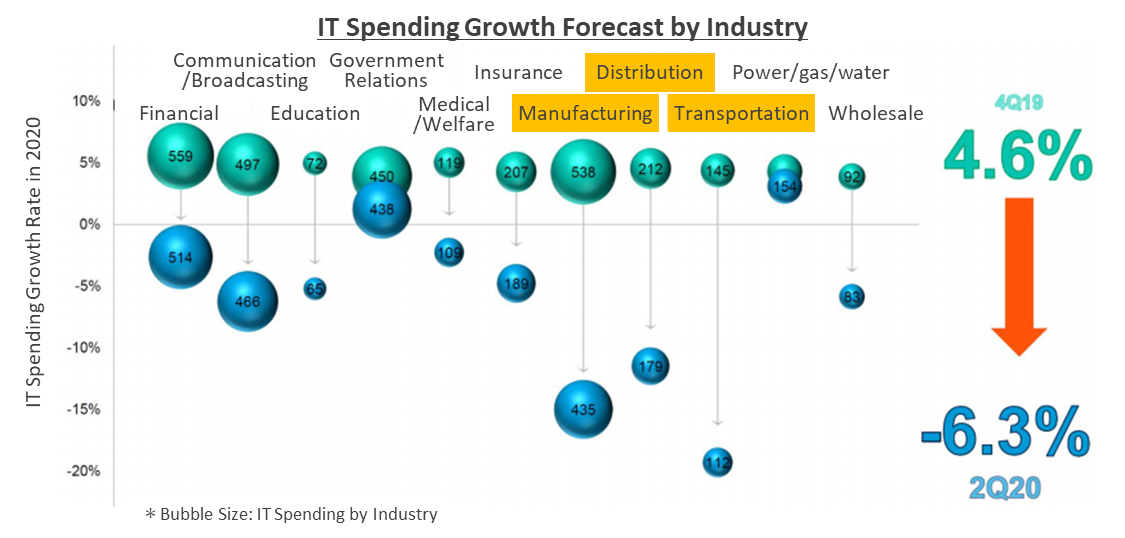

According to the reference material of the company, research companies have lowered their initial outlook for IT investments in 2020 from a 4.6% increase to a 6.3% decrease. For CREO, the number of orders received is robust in the Tokyo Metropolitan Area, which are mainly telecommunications/broadcasting and government-related orders, but that in the Kansai region, which are mainly for the manufacturing, distribution, and transport industries, is sluggish.

However, the COVID-19 pandemic made us realize the importance of digitalization and digital transformation (DX) again. Due to this, demand for enterprise resource planning (ERP; system that manages a company’s core processes), an area of strength for CREO, is strong. The company plans to provide services that accelerate the digital transformation process to capture such demand.

(From company documents)

Impact of and Measures Against the Spread of COVID-19

At this stage, the impact from the COVID-19 pandemic on the company’s earnings has been smaller than expected, and demand has also remained solid. However, as the ITC service market tends to be impacted by the economic performance at a roughly six-month time lag, the company will continue to collect relevant information and analyze the impact in order to flexibly respond to changes in the business environment.

Major risk factors include (1) suspension of business operations and decline in efficiency due to employees/associates being infected by the coronavirus, (2) decreased capacity to provide products and services due to prolonged self-restraint (lower quality of support for customers, difficulty in securing personnel for the company and partner companies), and (3) the possibility of medium/long-term changes in the IT market (reduced IT investment due to changes in customers’ earnings).

(1) As a measure to prevent the suspension of business operations and the decline in efficiency due to employees/associates being infected by the coronavirus, the company has established a teleworking environment for employees and executives in order to reduce the risk of contracting the virus, and has also made all meetings, interviews, and training online. As such, just under 40% of employees are currently working in the office.

(2) As a measure to prevent the decrease of the capacity to provide products and services due to prolonged self-restraint (lower quality of support for customers, difficulty in securing personnel for the company and partner companies), the company is working to maintain quality (including that at partner companies) by adopting a hybrid working model that combines telework and office working.

(3) As a measure to prevent the possibility of medium/long-term changes in the IT market (reduced IT investment due to changes in customers’ earnings), the company will expand orders by contributing to the digital transformation of its customers with an eye to the “new normal” accelerated by the COVID-19 pandemic.

Recognized Issues and Measures to Solve Them

In addition to the COVID-19 pandemic, CREO faces issues including measures to deal with a lack of manpower, enhancing large-scale project management, and its business partnership with Amano Corporation.

To solve the lack of manpower, the company is pushing forward with measures outlined in its mid-term management plan. As a short-term measure, it is optimizing installation work for its products and services (reducing manpower by using a template for standardized work). Over the medium/long term, it is utilizing human resources through group-wide collaboration (expanding service rendering capabilities through provision of work support by subsidiaries) and using the offshore bases in Vietnam for service development.

In order to enhance large-scale project management, the company is working to reduce the emergence of loss-making projects by ensuring that project progress is properly managed. As a medium/long-term measure, it is training up leaders that can efficiently manage large-scale projects.

As for the business partnership with Amano Corporation, the company is strengthening sales coordination between Amano’s attendance management solution and CREO’s HR and payroll system. Over the medium/long term, it plans to create and enhance a framework for system engineer and support collaboration.

(From company documents)

3-3. Progress of the Mid-term Management Plan

Under its key initiative: “business structure and business portfolio transformation,” the company will increase the mobility of its workforce within the Group (collaboration across business segments and the reshuffling of human resources) and utilize offshore and nearshore bases to concentrate its management resources on the Solutions Service Business, which earns 50% of CREO group’s total operating income.

In particular, amid difficulties in securing human resources, from the second half of the previous fiscal year, the company has undertaken measures such as transferring engineers belonging to the Contracted Development Business to projects that deal with large-scale orders received in the Solutions Service Business in order to further stabilize growth of the Solutions Service Business, which is the key earnings driver for the company. It has also achieved automation of system configuration and other processes (initiatives to reduce manpower) by introducing HR solutions.

The company has recently stepped up collaboration between group companies that mainly handle operations for the Solutions Service Business. In the second quarter, it established the Solutions Service Development Center, which is involved in development for both the Solutions Service Business and Contracted Development Business. Through this move, it has enabled the Contracted Development, which has been hit with a slowdown in orders due to the COVID-19 pandemic, and the Solutions Service Business, which has insufficient labor resources, to share projects. In addition, the company is also working to cement cooperation between the Solutions Service Business and the Support Services Business for customer support services.

(From company documents)

4. Conclusions

In April 2019, the Act on the Arrangement of Related Acts to Promote Work Style Reform came into effect. This meant that some major companies were required to digitalize the submission of various internal documents as part of these reforms, increasing the workload for employees involved in human resources (HR) and labor matters. However, the fact that the digitalization of such HR/labor-related work has been slow is also said to be a contributing factor to the increased workload of these employees. If digitalization enables the automation of tasks such as generation of documents, as well as the online submission of applications to government offices, this will significantly increase efficiency. Furthermore, more people are working remotely due to the COVID-19 pandemic and working styles are changing drastically, increasing business opportunities for CREO, which provides comprehensive solutions on this front.

Establishment of Japan Digital Agency, which is a key pledge of the Suga administration, will also provide a tailwind for the company. The government announced the establishment of a Working Group that will seek to pass a bill to establish Japan Digital Agency, update the conventional basic law on information technology, and also reform the Personal Information Protection Law and the Act on the Use of Numbers to Identify a Specific Individual in Administrative Procedures (My Number Act). Said group has been progressing with setting forth concrete measures at a rapid clip, such as the establishment of a task force in charge of formulating data strategies. CREO has an abundant track record in handling basic resident register system- and My Number-related projects for government agencies and local government bodies. It plans to leverage these strengths to enhance marketing aimed at undertaking projects related to Japan Digital Agency.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 6 directors, including 3 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report: Updated on Jun. 25, 2020

Basic policy

Our company believes that establishing appropriate corporate governance systems and striving to improve them constantly would improve the transparency and fairness of our business administration, and our corporate value. While considering that the observance of the corporate governance code would contribute to the establishment of our better governance, we will adopt the supplementary principles and the principles other than the basic 5 principles, too, one after another. The details of the already adopted principles are written in this report.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

As a company listed in JASDAQ, our company follows all of the basic principles of the corporate governance code. As for supplementary principles and the principles other than the basic ones that need to be disclosed and that are already followed by our company, they are outlined in the “Disclosure Based on the Principles of the Corporate Governance Code” below.

<The main principles of disclosure>

<Principle 1-4 Disclosure of policies for strategically held shares>

Our company does not hold shares that fall under strategically held shares.

【Supplementary Principle 4-1-(1) Roles and responsibilities of the board of directors】

The scope of matters to be resolved and the respective responsibilities of the Board of Directors and the Management Committee, to which the Board of Directors delegates some decision-making and business execution matters (referred to internally as the “Management Strategy Committee”), are set based on the rules of the Board of Directors and the Management Committee, as outlined below.

・Board of Directors

Decisions are made concerning matters to be resolved at Board of Directors meeting prescribed by laws and regulations, and other matters, predominantly those outlined below, based on the rules of the Board of Directors.

1) Matters involving outlays of over 100 million yen and investments, financing, the conclusion of contracts, etc., considered essential to business operations.

2) Matters involving the company’s capital policy

3) Appointment and dismissal of executive officers

4) Decisions related to the mid-term management plan

5) Decisions related to business plans for a single fiscal year

・Management Committee

Decisions are made concerning matters set forth in the rules of the Management Committee and the Administrative Authority Criteria Table, predominantly those outlined below.

1) Formulating the mid-term management plan and business plans for a single fiscal year

2) Decisions related to human resources, the company organization, hiring, etc.

3) Other matters, prior deliberations on matters to be discussed in the meetings of the Board of Directors

【Principle 5-1 Policy for constructive dialogue with shareholders】

Our company aims to improve shareholder value in cooperation with shareholders, through the constructive dialogue with them.

To do so, we have established the following system and implemented some measures.

Mainly the IR section deals with dialogue with shareholders. Executives, including the representative director and president, participate in, give explanations and answer questions at briefing sessions for financial results and individual investors, small meetings, etc. Like this, we prepare opportunities for direct dialogue between shareholders and the management.The IR section of our company forwards opinions given during the dialogue with shareholders to the management, to utilize them for discussing mid/long-term management policies.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co.,Ltd. All Rights Reserved. |

The back issues of the Bridge Report (CREO: 9698) and the contents of the Bridge Salon (IR Seminar) can be found at :www.bridge-salon.jp/ for more information.