Bridge Report:(9698)CREO second quarter of fiscal year ending March 2022

President and Representative Director Junichi Kakizaki | CREO CO., LTD. (9698) |

|

Company Information

Market | JASDAQ |

Industry | Information and telecommunications |

President | Junichi Kakizaki |

HQ Address | Sumitomo Fudosan Shinagawa Building 4-10-27 Higashi-shinagawa, Shinagawa-Ku, Tokyo |

Year-end | March |

HOMEPAGE |

Stock Information

Share price | Number of shares issued (end of period) | Total market cap | ROE (Act.) | Trading Unit | |

¥1,052 | 8,185,988 shares | ¥8,611 million | 12.2% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥39.00 | 3.7% | ¥97.73 | 10.8x | ¥811.44 | 1.3x |

*The share price is the closing price on November 5th 2021. The number of issued shares is obtained by subtracting the number of treasury shares from the number of shares issued as of the end of the latest quarter.

* BPS and ROE are the results for the fiscal year ended March 2021. The figures are rounded off.

* DPS and EPS are the company's forecasts for the fiscal year ending March 2022.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating income | Ordinary income | Net income | EPS | DPS |

Mar. 2018 (Actual) | 12,268 | 410 | 457 | 305 | 36.79 | 15.00 |

Mar. 2019 (Actual) | 13,526 | 670 | 706 | 664 | 80.05 | 25.00 |

Mar. 2020 (Actual) | 14,624 | 1,044 | 1,095 | 731 | 88.49 | 35.00 |

Mar. 2021 (Actual) | 14,745 | 1,131 | 1,195 | 776 | 94.90 | 38.00 |

Mar. 2022 (Forecast) | 15,500 | 1,260 | 1,275 | 800 | 97.73 | 39.00 |

*The forecasted values are from the Company. Unit: million yen, yen

*Net income is the profit attributable to owners of parent. The same applies below.

This Bridge Report overviews the business performance for the second quarter of fiscal year ending March 2022 and describes the earnings forecast for the term ending March 2022 for CREO Co., Ltd.

Table of Contents

Key Points

1. Company Overview

2. Second quarter of Fiscal Year ending March 2022 Earnings Results

3. Fiscal Year ending March 2022 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the second quarter of the fiscal year ending March 2022, sales were 7,163 million yen and operating income was 475 million yen, up 6.1% and 15.2% year on year, respectively. Although sales dropped slightly in the Contracted Development Business and the Support Services Business, the impact of the new revenue recognition standard adopted and the healthy business performance in the Solutions Service Business and the Systems Operation and Services Business contributed to the sales increase. The major factor behind the growth of operating income was the sales rise in the Systems Operation and Services Business.

- The second quarter ended, and the full-year earnings forecasts remain unchanged. Sales and operating income are forecasted to be 15.5 billion yen and 1,260 million yen, respectively, for the fiscal year ending March 2022. The order receipt environment continues to be stable. Under these circumstances, the company aims to expand its business with a focus on products that replace the legacy system (for HR and payrolls) and product development for business transformation (co-creation-type contracted development). Sales and operating income are expected to grow year on year in the Solutions Service Business and all the other business segments. The amount of dividends also remains unchanged from the initial forecast of 39 yen per share, up 1 yen per share from the previous fiscal year.

- The company is releasing more cloud-compatible products that contribute to digital transformation (DX) of companies. It plans to launch a cloud-compatible product for procurement and purchase in November 2021 on the “connecting” platform that is based on collaboration with other vendors. We would like to keep an eye on how well the company sells its own cloud-compatible products because sales expansion of in-house cloud products often results in significant improvement in profitability.

1. Company Overview

CREO is a system integrator that offers a variety of solutions. The company offers business solutions, including “ZeeM Series,” a business package software used by over 2,000 enterprises (Enterprise Resource Planning (ERP) for human resources, accounting, asset management, etc.) and “BIZ PLATFORM,” for business process management (BPM), which contributes to the streamlining of business operation and cost reduction, develops systems for governmental offices, municipalities, public-interest corporations, and large companies, produces and operates web systems for leading portal site operators in Japan, provides loyal clients with call-center services, and so on.

The corporate group is composed of CREO, and three consolidated subsidiaries: CoCoTo Co., Ltd., Brigh-E Co., Ltd. and Adams Communications Co., Ltd. Amano (6436) and Z Holdings Corporation (4689) holds 30.6% and 12.7% of shares of CREO, respectively. CREO is an equity-method affiliate of Amano Corporation.

[Three thoughts in the logo]

| To create an “impression” The exclamation mark in the logo represents the stance of surpassing expectations and impressing clients. To continue “creation” The sphere is CREO itself, and represents the environment in which human resources, products, and services are born and grow. To cuddle up to “eternity” This logo denotes CREO, which is represented by the sphere, cuddling up to clients, society, and shareholders. |

[Company strength]

The company's strength lies in its long history and experience of continuing two businesses with different characteristics, the product business and the contracting business, as a few companies in the domestic SI industry operate both businesses in a well-balanced manner. Another strength is that the company's main business, the Solutions Service Business, includes both a product business and a co-creation type contracting business. The company flexibly meets package customization demands in the co-creation type contracted development, as well as horizontally deploying its original product development know-how to contracted development of other companies' products. The company differentiates itself from competitors that only do either of these or companies that can only do one.

1-1. Business segments

The company changed its organizational structure in April 2021 from a company system to a business department system. As a result, in the fiscal year ended March 2021, the Solution Service Company, West Japan Company, and Next Solution Company were restructured into Enterprise Digital Transformation Dept., Business Acceleration Dept., Business Strategy Dept., and Social System Dept. There are no changes to the four reporting segments, which are the disclosure segments.

Solutions Service Business (accounting for 36.9% of total sales in the first half of fiscal year ending March 2022)

The company offers and customizes package software such as “ZeeM Series,” an ERP for human resources, payroll, accounting, and asset management used by over 2,000 companies, and “BIZ PLATFORM,” a BPM that contributes to the streamlining of business operation and cost reduction, develops software and cloud services provided by client companies to corporate clients and consumers (as development is carried out together with client companies, the business is called “co-creation contracted business” or “co-creation development” within the company), the RPA solution for actualizing business processes that use manpower and robots by combining the know-how of ERP and BPM and the robotic process automation (RPA) technology for automating the routine tasks of white-collar workers, and so on.

In recent years, the company has succeeded in capturing demand related to Work Style Reform by linking “ZeeM,” a software package for human resource and payroll, and “TimePro,” an attendance management solution of Amano Corporation, and the scale of the projects has been growing.

Business entities in charge: Enterprise Digital Transformation Dept., Business Acceleration Dept. (since the fiscal year ending March 2022)

Contracted Development Business (accounting for 16.0% of total sales in the first half of fiscal year ending March 2022)

The company undertakes the development of systems for large companies, governmental offices, and municipalities, typesetting systems for newspaper publishers, odds systems for professional sports organized by the government, etc., which require reliability and experience. As a characteristic, the transactions made via Fujitsu are dominant, and so stable growth can be expected, although there are some short-term fluctuations. It is essential to secure “manpower,” including subcontractors.

Business entities in charge: Social System Dept.

In addition, Business Strategy Dept., which was newly established in the fiscal year ending March 2022, is a joint department of the Solutions Service Business and the Contracted Development Business.

Systems Operation and Services Business (accounting for 16.4% of total sales in the first half of fiscal year ending March 2022)

The company offers operation services, including the development, maintenance, and anti-hacking operation of server systems for portal sites and web services, to mainly the leading Japanese portal-site operator and its group companies. Previously, this business was operated by several group companies under the holding company, but they were integrated into CoCoTo Co., Ltd., which was established in Apr. 2016. This way, it became possible to exert the capability of the corporate group in marketing and development, and the company is making transactions with the group companies of portal-site operator. The company plans to boost sales from portal-site operator and approach its group companies, to expand its business.

Business entities in charge: CoCoTo Co. Ltd

Support Services Business (accounting for 30.7% of total sales in the first half of fiscal year ending March 2022)

The company offers support services, including help desk and technical support services, and call-center services (making and receiving calls), including election exit polls, social surveys, and market research. A strength of this business is that the company offers technical services to loyal clients, including those related to Fujitsu and NEC, with a good balance. This business can be expected to grow stably, but it is necessary to secure “human resources.” Accordingly, the company makes efforts to recruit foreign workers, too.

Business entities in charge: Brigh-E Co., Ltd. (the corporate name changed from the fiscal year ending March 2022 due to a merger), and Adams Communication Co., Ltd.

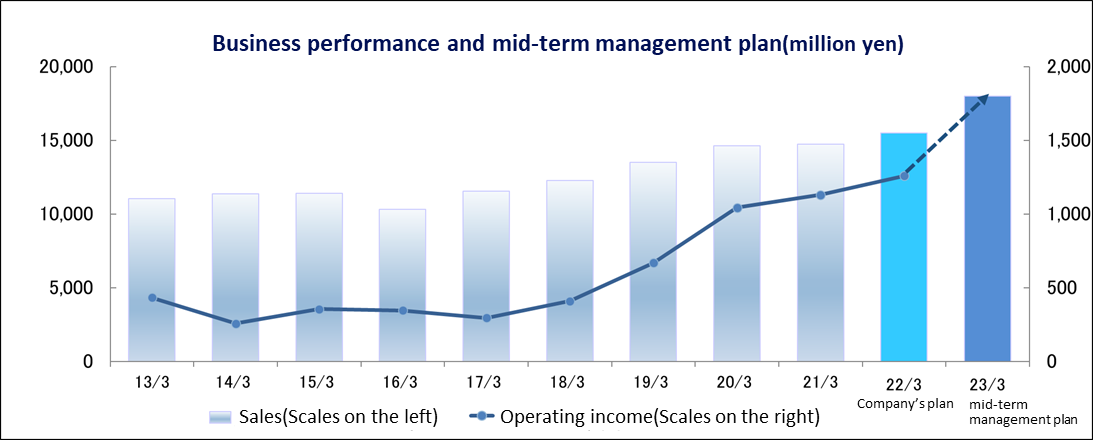

1-2. Mid-term Management Plan (FY 3/21 to FY 3/23)

CREO Group, which will celebrate its 50th anniversary in 2024, conducts its business operations from a medium/long-term perspective, striving to become a “100-year-old company” that will remain attractive to all stakeholders for the next 50 years. As part of such efforts, the company started a mid-term management plan in the fiscal year ended March 2021, when it commemorated its 45th anniversary, with “creating mechanisms” that achieve sustainable growth and improve corporate value as its main theme.

The Mid-term Management Plan’s Vision and 3 Key Initiatives

Based on the ongoing challenges from the previous mid-term management plan and future changes in the external environment, the group set the vision of the new mid-term management plan as “creating a framework for sustainable growth and increasing corporate value.” Under this vision, CREO will work on “business structure and business portfolio transformation,” “human resources development and utilization for sustainable growth,” and “transformation into a flexible organization and business process capable of responding to changes and risks.” The company will place particular importance on the operating income rate as a management index. As a result of the company’s efforts over the past three years, orders and sales are expanding. However, it is difficult to accurately predict how much the impact of the spread of the coronavirus will offset. Even if the sales growth rate slows down to some extent, the company will achieve profit growth by improving productivity and profitability (operating income rate).

“Business Structure and Business Portfolio Transformation”

The company aims to expand promising domains, such as cloud services (ZeeM series for payroll and accounting, BP, and SMK), digital transformation services, and customer products business support (development and installation support) by combining the group's strengths. The company will also concentrate its management resources on the Solutions Service Business to maintain and expand existing businesses.

Strategy of Solutions Service Business

The company will expand the co-creation type contracted development to improve sales. The company will also enhance the planning, development, and operation of systems and services that support the maintenance and expansion of customers' market competitiveness and improve the development and operation of core systems and products that support the sustainable stabilization of customers' management bases.

From short and medium-term perspectives, the company will strengthen integrated HR solutions by improving collaboration with Amano Corporation, upgrading products, expanding the HR product lineup, and automating installation settings to enhance profits. In addition, from a medium/long-term perspective, the company will launch digital transformation services to improve accounting data analysis (data utilization) and operational efficiency. The company will also accelerate cloud services by increasing order receiving opportunities and improving stock rates.

“Business Structure and Business Portfolio Transformation”

CREO will develop human resources focusing on the themes of training future generation leaders, cultivating global human resources, and improving the skill level of engineers. For these initiatives to be successful, increasing employees’ motivation is key. The company therefore rates and rewards multitalented employees that display distinct strengths and skills in various fields. As it also needs to have HR systems that tolerate diversity, it is working to reform existing systems and establish new ones.

The keyword for "developing leaders for future generations" is nurturing them by entrusting them. Starting from executive candidates to department leaders, the company will improve the level of non-technical "business" and "management" skills to enable sustainable business succession and expansion. The keyword for "cultivating global human resources" is nurturing them by letting them travel. The company will promote human resources exchanges with overseas partners to develop human resources that can absorb differences in the environment and culture and accept diversity. As for "upgrading the level of engineers," the keyword is nurturing them by allowing them to specialize. The company will secure and train human resources who can utilize new technologies such as AI, IoT, and 5G, and digital transformation development methods including Agile and DevOps.

“Transformation into a Flexible Organization and Business Process Capable of Responding to Changes and Risks”

While moving forward with the second stage of group restructuring, CREO will carry out a business process reform that considers both improving productivity and its Business Continuity Plan (BCP). For the second stage of group restructuring, the company began to implement measures that shift human resources to more profitable business in the previous fiscal year. It will not simply shift its workforce, but it will put in place a framework that allows it to flexibly and swiftly allocate personnel within the Group and transform their skills. As for business process reforms, the company started developing and operating the infrastructure for telecommuting. This will enable it to maintain high productivity even if another crisis like the coronavirus pandemic occurs and working styles change dramatically.

Investments

CREO established a new investment committee. The committee does not only evaluate and approve the investment plans from each business, but will also seek investment opportunities and encourage its implementation. The members of the committee have their respective areas of responsibility and will promote investment while primarily focusing on new business investment, development investment, human capital investment, and capital investment. CREO sets a guideline for the scale of investment amount of the entire group to be around 500 million yen during the current mid-term management plan, and it will make decisions flexibly based on the investment opportunities and results.

Management Goals

The targets for the end of the current mid-term management plan, which is at the end of March 2023, are sales of 18 billion yen (annual growth rate: 7.2%, previous mid-term growth rate: 8.1%) and an operating income of 1.8 billion yen (annual growth rate: 19.9%, previous mid-term growth rate: 39.0%). The pace of increase in sales and profits is slightly slower than that of the previous term. This is due to the conservative estimation based on the influence of the coronavirus and strengthening various investments. Also, as CREO prioritizes quality transformation through the creation of various mechanisms in the current mid-term management plan, it uses operating income rate as an indicator of this transition, and is aiming to raise operating income rate to at least 10%.

Financial/Capital Policy and Profit-sharing Policy

There are no changes from the previous mid-term management plan, and there is an optimal balance of the three points: shareholder return, financial stability, and investments. Although CREO will expand its investments to achieve permanent growth more than before, this will not impair the rules of financial stability as the company will continue to generate investment resources through business activities by improving the operating income rate. As for the profit-sharing policy, CREO will continue to aim for a consolidated payout ratio of 40%.

2. Second quarter of Fiscal Year ending March 2022 Earnings Results

2-1. Consolidated earnings results for the second quarter of Fiscal Year ending March 2022

| 2Q of FY 3/21 | Ratio to sales | 2Q of FY 3/22 | Ratio to sales | YoY |

Sales | 6,748 | 100.0% | 7,163 | 100.0% | +6.1% |

Gross Profit | 1,574 | 23.3% | 1,677 | 23.4% | +6.5% |

SG & A | 1,161 | 17.2% | 1,201 | 16.8% | +3.4% |

Operating Income | 413 | 6.1% | 475 | 6.6% | +15.2% |

Ordinary Income | 459 | 6.8% | 494 | 6.9% | +7.7% |

Profit attributable to owners of parent | 264 | 3.9% | 255 | 3.6% | -3.2% |

*Unit: Million yen

* The figures include the figures calculated by Investment Bridge Co., Ltd. as reference values and may differ from the actual figures. The same applies below.

Sales and operating income increased 6.1% and 15.2% year on year, respectively.

In the second quarter of the fiscal year ending March 2022, sales went up 6.1% year on year to 7,163 million yen. Although sales dropped slightly in the Contracted Development Business and the Support Services Business, the impact of the new revenue recognition standard adopted and the healthy business performance in the Solutions Service Business and the Systems Operation and Services Business led to the year-on-year sales increase of 414 million yen.

Operating income stood at 475 million yen, up 15.2% year on year. The sales growth in the Systems Operation and Services Business allowed operating income to increase 62 million yen year on year, while it fell short of the previous year in the Solutions Service Business and the Support Services Business. Gross profit margin increased 0.1 points year on year to 23.4% and the ratio of selling, general and administrative (SG&A) expenses to sales shrank 0.4 points year on year to 16.8%, raising operating income margin by 0.5 points year on year to 6.6%. In addition, while ordinary income went up 7.7% year on year because of a decline in compensation received, profit attributable to owners of parent dropped 3.2% year on year in reaction to the office relocation cost and the loss on valuation of software recorded.

Sales were 36 million yen less than the initial forecast, while operating income was 25 million yen higher than the forecast.

2-2. Trends in each segment

Sales and operating income for each segment

| 2Q of FY 3/21 | Ratio to sales・Profit margin | 2Q of FY 3/22 | Ratio to sales・Profit margin | YoY |

Solutions Services | 2,341 | 34.7% | 2,640 | 36.9% | +12.7% |

Contracted Development | 1,158 | 17.2% | 1,150 | 16.0% | -0.7% |

Systems Operation and Services | 967 | 14.3% | 1,174 | 16.4% | +21.3% |

Support Services | 2,280 | 33.8% | 2,198 | 30.7% | -3.6% |

Consolidated sales | 6,748 | 100.00% | 7,163 | 100.00% | +6.1% |

Solutions Service | 459 | 19.6% | 449 | 17.0% | -2.2% |

Contracted Development | 171 | 14.8% | 183 | 15.9% | +6.7% |

Systems Operation and Services | 84 | 8.7% | 142 | 12.1% | +69.4% |

Support Services | 169 | 7.4% | 154 | 7.0% | -8.9% |

Head Office Expenses and Income | -471 | - | -453 | - | - |

Consolidated Operating Income | 413 | 6.1% | 475 | 6.6% | +15.2% |

*Unit: Million yen

*In the two businesses other than the System Operation and Services Business and the Support Services Business operated by consolidated subsidiaries, the head office expenses are not allocated when calculating operating income.

Solutions Service Business

The company mainly provides solution services such as "ZeeM," a system for HR, payroll, and accounting solutions.

Sales stood at 2,640 million yen, up 12.7% year on year, and operating income was 449 million yen, down 2.2% year on year. Sales went up 298 million yen year on year owing to a steady growth in the number of orders received for solution services including HR and payroll solutions, and an impact of the new revenue recognition standard adopted. Meanwhile, operating income shrank 10 million yen year on year due to product development and investment in public relations activities for cloud-compatible services, and some unprofitable projects.

Contracted Development Business

The company mainly undertakes system development for major companies such as the Fujitsu Group and Amano Corporation.

Sales were 1,150 million yen, down 0.7% year on year, and operating income was 183 million yen, up 6.7% year on year. While the company strived to improve the business performance by offsetting the impact of a decrease in orders received in western Japan with the number of orders received in the region around Tokyo, sales went down 7 million yen year on year and operating income rose 11 million yen year on year.

System Operations and Service Business

The company mainly provides system development, maintenance, and operation services to major domestic portal site operators.

Sales were 1,174 million yen, up 21.3% year on year, and operating income stood at 142 million yen, up 69.4% year on year. The growing number of orders received for projects for major customers increased sales and operating income by 206 million yen and 58 million yen year on year, respectively.

Support Services Business

The company mainly provides support and services centered on help desks and technical support and call center services for purposes, such as social research and market research.

Sales were 2,198 million yen, down 3.6% year on year, and operating income was 154 million yen, down 8.9% year on year. Sales and operating income shrank 82 million yen and 15 million yen year on year, respectively, due to a smaller-than-expected number of orders received for research-related services.

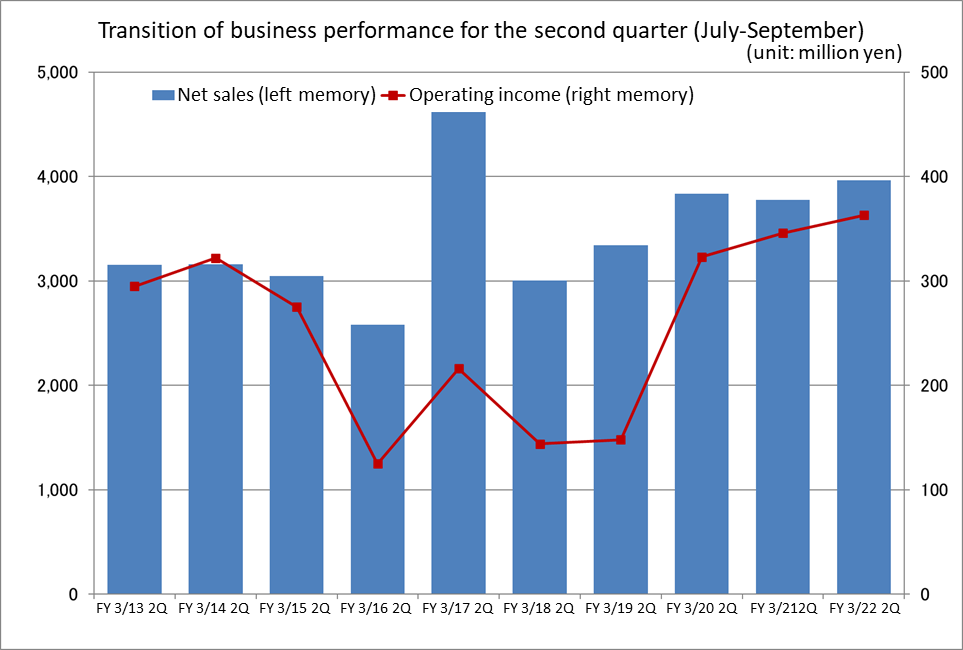

2-3. Variations in quarterly results

Variations in consolidated sales and operating income for the second quarter (July-September)

Sales and operating income are on an upward trend in the second quarter (July-September) almost every fiscal year. In the context of this trend, operating income in the second quarter (July-September) of the fiscal year ending March 2022 reached a level higher than those in the past several years.

2-4. Financial Position and Cash Flows (CF)

Financial Position

| Mar. 2021 | Sep. 2021 |

| Mar. 2021 | Sep. 2021 |

Cash | 3,927 | 3,993 | Accounts payable | 693 | 613 |

Receivables | 3,203 | 2,975 | Reserves for bonuses | 577 | 557 |

Inventories | 365 | 262 | Current Liabilities | 2,541 | 2,400 |

Current Assets | 7,697 | 7,467 | Noncurrent Liabilities | 153 | 200 |

Tangible Assets | 314 | 322 | Liabilities | 2,694 | 2,601 |

Intangible Assets | 609 | 671 | Net Assets | 6,642 | 6,575 |

Investments and Others | 714 | 716 | Total Liabilities and Net Assets | 9,336 | 9,176 |

Noncurrent Assets | 1,638 | 1,709 | Total Debt with Interest | 0 | 0 |

*Unit: million yen

Total assets at the end of September 2021 stood at 9,176 million yen, down 160 million yen from the end of the previous fiscal year. In terms of assets, cash increased, but such accounts as trade receivables and inventories declined. In terms of liabilities and net assets, accounts payable, other accounts payable, and dividends paid were the major factors behind the decreases. Their assets were highly liquid, as current assets accounted for about 81% of the total assets. Equity ratio also remained high at 71.6%.

Cash Flows

| 2Q of 3/21 | 2Q of FY 3/22 | YoY | |

Operating cash flow | 270 | 605 | +335 | +124.1% |

Investing cash flow | -213 | -210 | +3 | - |

Free Cash flow | 57 | 395 | +338 | +593.0% |

Financing cash flow | -292 | -328 | -36 | - |

Cash and Equivalents at the end of term | 3,892 | 3,993 | +101 | +2.6% |

*Unit: Million yen

In terms of CFs, the cash inflow from operating activities expanded because the amount of decline in reserves for bonuses, the amount of increase in inventories, and the amount of income taxes paid decreased. The cash outflow from investing activities was almost the same as that in the previous fiscal year, and the surplus of the free CF rose. In addition, an increase in dividends paid increased the cash outflow from financing activities. As a result, the cash position at the end of the second quarter improved.

3. Fiscal Year ending March 2022 Earnings Forecasts

3-1. Consolidated earnings estimates for Fiscal Year ending March 2022

| FY3/21 | Ratio to sales | FY3/22 Est. | Ratio to sales | YoY |

Sales | 14,745 | 100.0% | 15,500 | 100.0% | - |

Operating Income | 1,131 | 7.7% | 1,260 | 8.1% | - |

Ordinary Income | 1,195 | 8.1% | 1,275 | 8.2% | - |

Profit attributable to owners of parent | 776 | 5.3% | 800 | 5.2% | - |

*Unit: Million yen

*From the beginning of the FY 3/22, “The accounting standard for recognition of revenue” (No.29 of corporate accounting standard), and so on are applied, the forecasts above are following those standards. Therefore, the changes year on year are not noted.

In the fiscal year ending March 2022, sales and operating income are expected to be 15.5 billion yen and 1,260 million yen, respectively.

The second quarter ended, and the earnings forecasts for fiscal year March 2022 remains unchanged from the initial forecasts with sales and operating income being projected to be 15.5 billion yen and 1,260 million yen, respectively.

In the field of administrating corporate management resources in the ICT service market to which the company belongs, further investment in the management base, which is necessary for the future digital era, such as promotion of business management by continuing to utilize ICT, and expansion of using cloud technology, is expected to be strong. Under these circumstances, in the ERP (core information system), which CREO is focusing on, the company is promoting business expansion in terms of both product development to create new products to replace the legacy (HR and payroll) and for business transformation (co-creation type contracted development). In addition, the company will capture the on-premise demand of medium-sized and larger companies, which is the company's primary target. It will also expand sales of cloud products to medium-sized and smaller companies. As a result, in the fiscal year ending March 2022, sales and profits are estimated to increase year on year in all businesses: the Solutions Service Business, the Contracted Development Business, the System Operation and Services Business, and the Support Services Business. Furthermore, due to improvements in the project profit margin, operating income margin is expected to be 8.1%, up 0.4 points from the previous fiscal year.

The dividend per share remains unchanged at 39 yen, increasing by 1 yen from the end of the previous fiscal year. The company intends to maintain its dividend payout ratio of 40%.

Sales and operating income for each segment of FY 3/22 (Company’s plan)

| FY3/21 Act. | Ratio to sales・Profit margin | FY3/22 Est. | Ratio to sales・Profit margin | YoY |

Solutions Service | 5,617 | 38.1% | 5,950 | 38.4% | +5.9% |

Contracted Development | 2,525 | 17.1% | 2,580 | 16.6% | +2.2% |

Systems Operation and Services | 2,041 | 13.9% | 2,220 | 14.3% | +8.8% |

Support Services | 4,561 | 30.9% | 4,750 | 30.6% | +4.1% |

Consolidated sales | 14,745 | 100.0% | 15,500 | 100.0% | +5.1% |

Solutions Service | 1,128 | 20.1% | 1,305 | 21.9% | +15.7% |

Contracted Development | 426 | 16.9% | 460 | 17.8% | +8.0% |

Systems Operation and Services | 216 | 10.6% | 260 | 11.7% | +20.4% |

Support Services | 320 | 7.0% | 340 | 7.2% | +6.3% |

Head Office Expenses and Income | -959 | - | -1,105 | - | - |

Consolidated operating income | 1,131 | 7.7% | 1,260 | 8.1% | +11.4% |

*Unit: Million yen

Progress rate against full-year company plan

| FY 3/22 Full-year company plan | FY 3/22 2Q results | Progress rate | |

Solutions Service | 5,950 | 2,640 | 44.4% |

|

Contracted Development | 2,580 | 1,150 | 44.6% | |

Systems Operation and Services | 2,220 | 1,174 | 52.9% | |

Support Services | 4,750 | 2,198 | 46.3% | |

Consolidated sales | 15,500 | 7,163 | 46.2% | |

Solutions Service | 1,305 | 449 | 34.4% | |

Contracted Development | 460 | 183 | 39.9% | |

Systems Operation and Services | 260 | 142 | 54.7% | |

Support Services | 340 | 154 | 45.4% | |

Head Office Expenses and Income | 1,260 | 475 | 37.8% |

*Unit: Million yen

Although the company is propelling business management forward with the aim of leveling its business performance, it is influenced by the industry’s characteristics, that is, better performance in the second half than in the first half of each fiscal year. The company is seemingly moving things forward on a steady basis to reach its earnings forecasts for this fiscal year.

3-2. Changes in customer environment and recognition of issues

Solutions Service Business | -Orders received for the mainstay products related to HR and payrolls are steadily growing in number. -The company will increase the turnover of product installation and secure resources. -The company will continue to strengthen the project management office (PMO) (proactive management, project manager development). -The company will boost the appeal of its connecting cloud services. |

Contracted Development Business | -The company will facilitate cooperation between enterprises in the Kansai and Kanto regions to share projects and help improve its development capabilities. -The company will strive to expand transactions with its major customers (social infrastructure systems). |

Systems Operation and Services Business | -Orders for the existing services are steadily growing in number. -The company is endeavoring to find new customers in such fields as healthcare. |

Support Services Business | -The company will maintain and continue the existing business. -The company will allow its employees engaging in the call center services to work from home. |

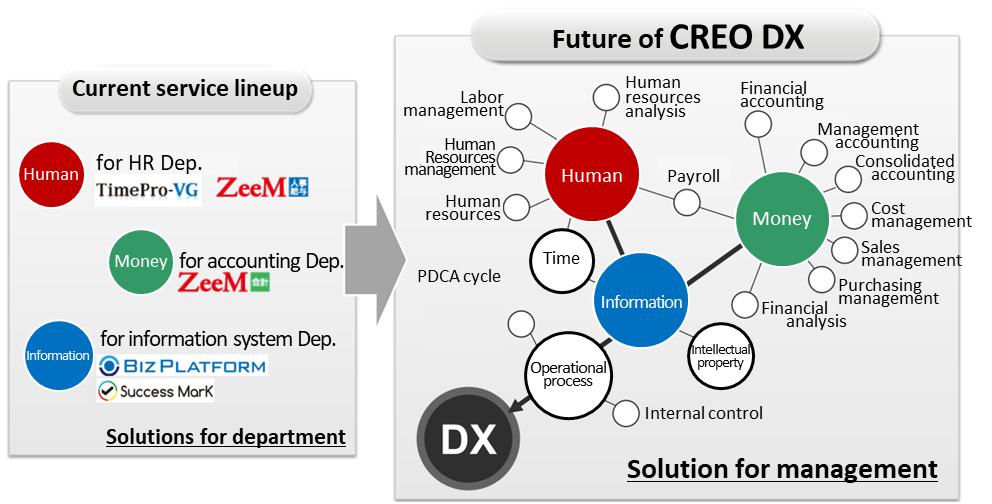

Growth strategies [Expansion of the cloud services that connect information and services]

(From the company's financial results briefing material for the second quarter of fiscal year ending March 2022)

The company will redefine the products it offers in the Solutions Service Business as not only tools for the human resources, accounting, and information systems departments, but also as solutions for management, and proactively propose them to customers.

3-3 Implementation of work style reform

The company has presented a summary of its mid-term management plan as “creating a framework for sustainable growth and improving corporate value.” To fulfill this vision, it is increasing investments in (1) business structure and business portfolio transformation, (2) human resources development and utilization for sustainable growth, and (3) transformation into a flexible organization and business process capable of responding to changes and risks. What is essential for achieving these is work style reform.

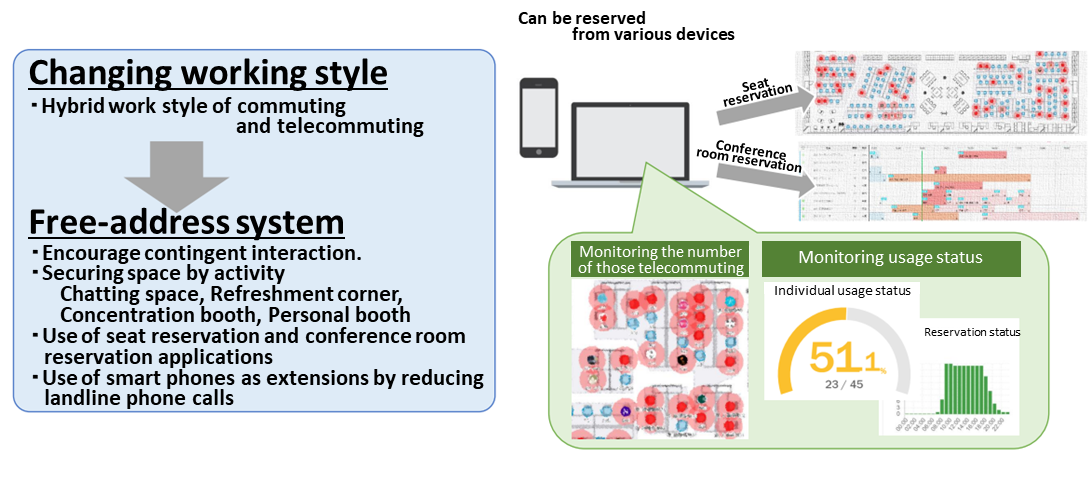

The company is among the first to reform the corporate culture through (1) smart work realized by continuous measures against the novel coronavirus infection and promoting telecommuting, (2) office reform by creating a safe and rewarding work environment based on the concept of hot desking, and (3) multi-stratified communication, establishment of in-house venture programs, and improvement of engagement. The company’s work style reform is aimed at fostering a working environment where each one of its employees can balance their private life with work, engage in fulfilling work in good health, and continue to thrive, and it is expected to contribute to developing employees who come up with ideas to raise added value to stakeholders within a limited amount of time.

Example of structure building for new working style

(From the company's financial results briefing material for the second quarter of fiscal year ending March 2022)

4. Conclusions

Both sales and operating income in the second quarter (July-September) of the fiscal year ending March 2022 reached a level higher than those in the past several years. A steady increase in the number of orders received for the mainstay products for HR and payrolls was seen in the Solutions Service Business. In addition, in the Systems Operation and Services Business, it was found that orders for the existing services grew strongly and the company is making steady progress in finding new customers in such fields as healthcare. We can say that these results heightened our expectations about the company’s achievement of the full-year earnings forecasts. The best time for CREO to make a profit is the fourth quarter (January-March), and we would like to pay attention to the trend of its business performance in the coming third quarter (October-December) regarding how much the company will be able to get closer to the earnings forecasts in the second half.

Furthermore, CREO has set a goal in its mid-term management plan, which is an operating income margin of 10% in the next fiscal year. We have to say that it is a little difficult for the company to reach the goal with its current profitability; however, it is releasing more cloud-compatible products that contribute to DX of companies. It plans to launch a cloud product for procurement and purchase in November 2021 on the “connecting” platform that is based on cooperation with other vendors. We would like to keep an eye on how well the company sells its own cloud-compatible products because sales expansion of in-house cloud products results in significant improvement in profitability. We would like to expectantly pay attention whether the company can expand sales of its new cloud product for procurement and purchase to a level above the market expectations, or how well the sales expansion of such new products contributes to improvement in profitability.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 6 directors, including 3 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report: Updated on June 23, 2021

Basic policy

Our company believes that establishing appropriate corporate governance systems and striving to improve them constantly would improve the transparency and fairness of our business administration, and our corporate value. While considering that the observance of the corporate governance code would contribute to the establishment of our better governance, we will adopt the supplementary principles and the principles other than the basic 5 principles, too, one after another. The details of the already adopted principles are written in this report.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

As a company listed in JASDAQ, our company follows all of the basic principles of the corporate governance code. As for supplementary principles and the principles other than the basic ones that need to be disclosed and that are already followed by our company, they are outlined in the “Disclosure Based on the Principles of the Corporate Governance Code” below.

<The main principles of disclosure>

<Principle 1-4 Disclosure of policies for strategically held shares>

Our company does not hold shares that fall under strategically held shares.

【Supplementary Principle 4-1-(1) Roles and responsibilities of the board of directors】

The scope of matters to be resolved and the respective responsibilities of the Board of Directors and the Management Committee, to which the Board of Directors delegates some decision-making and business execution matters (referred to internally as the “Management Strategy Committee”), are set based on the rules of the Board of Directors and the Management Committee, as outlined below.

・Board of Directors

Decisions are made concerning matters to be resolved at Board of Directors meeting prescribed by laws and regulations, and other matters, predominantly those outlined below, based on the rules of the Board of Directors.

1) Matters involving outlays of over 100 million yen and investments, financing, the conclusion of contracts, etc., considered essential to business operations.

2) Matters involving the company’s capital policy

3) Appointment and dismissal of executive officers

4) Decisions related to the mid-term management plan

5) Decisions related to business plans for a single fiscal year

・Management Committee

Decisions are made concerning matters set forth in the rules of the Management Committee and the Administrative Authority Criteria Table, predominantly those outlined below.

1) Formulating the mid-term management plan and business plans for a single fiscal year

2) Decisions related to human resources, the company organization, hiring, etc.

3) Other matters, prior deliberations on matters to be discussed in the meetings of the Board of Directors

【Principle 5-1 Policy for constructive dialogue with shareholders】

Our company aims to improve shareholder value in cooperation with shareholders, through the constructive dialogue with them.

To do so, we have established the following system and implemented some measures.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |

The back issues of the Bridge Report (CREO: 9698) and the contents of the Bridge Salon (IR Seminar) can be found at :www.bridge-salon.jp/ for more information.