Bridge Report:(9698)CREO the second quarter of fiscal year ending March 2023

President and Representative Director Junichi Kakizaki | CREO CO., LTD. (9698) |

|

Company Information

Market | TSE Standard Market |

Industry | Information and telecommunications |

President | Junichi Kakizaki |

HQ Address | Sumitomo Fudosan Shinagawa Building 4-10-27 Higashi-shinagawa, Shinagawa-Ku, Tokyo |

Year-end | March |

HOMEPAGE |

Stock Information

Share price | Number of shares issued (end of period) | Total market cap | ROE (Act.) | Trading Unit | |

¥837 | 7,943,488 shares | ¥6,648 million | 9.6% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥40.00 | 4.8% | ¥100.12 | 8.4x | ¥854.65 | 1.0x |

*The share price is the closing price on November 7th 2022. The number of issued shares is obtained by subtracting the number of treasury shares from the number of shares issued as of the end of the latest quarter.

* BPS and ROE are the results for the fiscal year ended March 2022. The figures are rounded off.

* DPS and EPS are the company's forecasts for the fiscal year ending March 2023.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating income | Ordinary income | Net income | EPS | DPS |

Mar. 2019 (Actual) | 13,526 | 670 | 706 | 664 | 80.05 | 25.00 |

Mar. 2020 (Actual) | 14,624 | 1,044 | 1,095 | 731 | 88.49 | 35.00 |

Mar. 2021 (Actual) | 14,745 | 1,131 | 1,195 | 776 | 94.90 | 38.00 |

Mar. 2022 (Actual) | 14,784 | 1,060 | 1,107 | 657 | 80.28 | 39.00 |

Mar. 2023 (Forecast) | 15,350 | 1,230 | 1,260 | 800 | 100.12 | 40.00 |

*The forecasted values are from the Company. Unit: million yen, yen

*Net income is the profit attributable to owners of parent. The same applies below.

This Bridge Report overviews the business performance for the second quarter of fiscal year ending March 2023 and describes the earnings forecast for the term ending March 2023 for CREO Co., Ltd.

Table of Contents

Key Points

1. Company Overview

2. The second quarter of Fiscal Year ending March 2023 Earnings Results

3. Fiscal Year ending March 2023 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year ended March 2022, sales increased 0.1% year on year to 7,173 million yen, due to the growth of businesses other than the Solutions Service Business. On the other hand, operating income declined 22.9% year on year to 366 million yen, as the performance of the strategic order receipt project in the Solutions Service Business fell below the forecast significantly. While the Solutions Service Business saw year-on-year declines in sales and profit, all of the other segments witnessed year-on-year increases in sales and profit.

- After the second quarter, the corporate forecast for the fiscal year ending March 2023 has not been revised, and it is projected that sales will grow 3.8% from the previous term to 15,350 million yen and operating income will rise 16.0% from the previous term to 1,230 million yen. Sales are expected to grow, as the demand for investment in systems is healthy because enterprises engage in workstyle reform, productivity improvement, etc. Profit is forecast to increase, as the company will finish the high-cost project of the Solutions Service Business and enhance marketing activities for increasing new customers. The dividend plan has not been revised, and they plan to pay a dividend of 40 yen/share, up 1 yen/share from the previous term.

- Since a high-cost project emerged in the Solutions Service Business, the sales and operating income in the first half of the term were 156 million yen and 53 million yen, respectively, smaller than the corporate forecast. Under such circumstances, the company thinks that it is possible to catch up by finishing the high-cost project in the Solutions Service Business early and resuming the normal allocation of resources. Their performance in the third quarter is noteworthy, to see how much they can get closer to the full-year forecast by catching up on the delay in the first half through their multifaceted measures, including the enhancement of PMO (project management support inside an organization) and quality improvement.

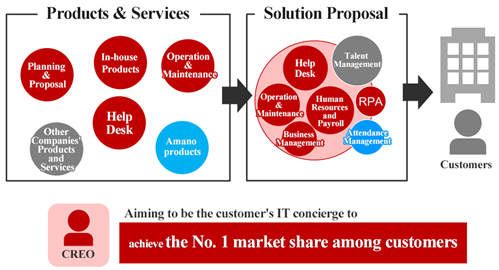

1. Company Overview

CREO is a system integrator that offers a variety of solutions. The company offers business solutions, including “ZeeM Series,” a business package software used by over 2,000 enterprises (Enterprise Resource Planning (ERP) for human resources, accounting, asset management, etc.) and “BIZ PLATFORM,” for business process management (BPM), which contributes to the streamlining of business operation and cost reduction, develops systems for governmental offices, municipalities, public-interest corporations, and large companies, produces and operates web systems for leading portal site operators in Japan, provides loyal clients with call-center services, and so on.

The corporate group is composed of CREO, and three consolidated subsidiaries: CoCoTo Co., Ltd., Brigh-E Co., Ltd. and Adams Communications Co., Ltd. Amano (6436) and Z Holdings Corporation (4689) holds 30.6% and 12.7% of shares of CREO, respectively. CREO is an equity-method affiliate of Amano Corporation.

[Three thoughts in the logo]

| To create an “impression” The exclamation mark in the logo represents the stance of surpassing expectations and impressing clients. To continue “creation” The sphere is CREO itself, and represents the environment in which human resources, products, and services are born and grow. To cuddle up to “eternity” This logo denotes CREO, which is represented by the sphere, cuddling up to clients, society, and shareholders. |

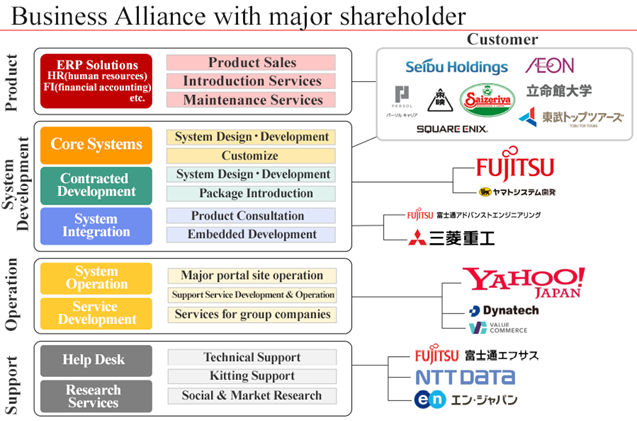

[Business tie-ups with major shareholders]

The major shareholders of CREO are Amano Corporation, which is attracting attention with the reform of workstyles, and Z Holdings (the former Yahoo!). The company formed a capital tie-up with Amano in March 2013 and a business tie-up in April 2015, to cooperate in sale of products, support the development of parking lot systems, etc., and collaborate in support. In addition, the company formed capital and business tie-ups with Z Holdings in January 2005, to develop and offer collaborative services and operate service systems.

(From the company’s briefing material for individual investors)

[Company strength]

The company's strength lies in its long history and experience of continuing two businesses with different characteristics, the product business and the contracting business, as a few companies in the domestic SI industry operate both businesses in a well-balanced manner. Another strength is that the company's main business, the Solutions Service Business, includes both a product business and a co-creation type contracting business. The company flexibly meets package customization demands in the co-creation type contracted development, as well as horizontally deploying its original product development know-how to contracted development of other companies' products.The company differentiates itself from competitors that only do either of these or companies that can only do one. In addition to the sale of products, the company offers services for solving corporate issues, linking dots (products) with lines, to offer comprehensive services.

(From the company’s briefing material for individual investors)

[Robust customer base]

The clients of CREO include top enterprises in various fields. The major clients in the Solutions Service Business include Seibu Holdings, SoftBank, Saizeriya, Tokyu Railways, companies affiliated with Toyota, Sammy Networks, Chateraise, Aioi Nissay Dowa, Ritsumeikan University, and Doshisha University. The major clients in the Contracted Development Business include the Fujitsu Group, the Amano Group, and Yamato System Development. The major clients in the System Operations and Service Business include Yahoo!, GYAO!, ValueCommerce, and Senshu University. The major clients in the Support Services Business include Fujitsu Fsas, NEC Group, Lenovo Japan, and en Japan.CREO was founded in 1974, and has been making transactions with Fujitsu, NEC, SoftBank, Saizeriya, Nishikawa Sangyo, and Ito-pan for many years since the 1990s or earlier.

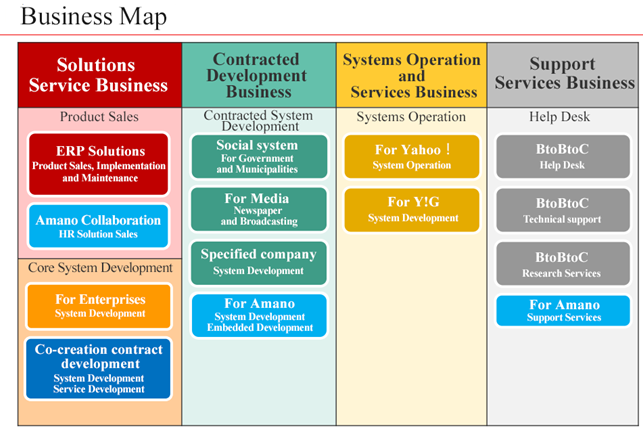

1-1. Business segments

The company changed its organizational structure in April 2021 from a company system to a business department system. As a result, in the fiscal year ended March 2021, the Solution Service Company, West Japan Company, and Next Solution Company were restructured into Enterprise Digital Transformation Dept., Business Acceleration Dept., Business Strategy Dept., and Social System Dept. There are no changes to the four reporting segments, which are the disclosure segments.

Solutions Service Business (accounting for 31.5% of total sales in the second quarter of fiscal year ending March 2023)

The company offers and customizes package software such as “ZeeM Series,” an ERP for human resources, payroll, accounting, and asset management used by over 2,000 companies, and “BIZ PLATFORM,” a BPM that contributes to the streamlining of business operation and cost reduction, develops software and cloud services provided by client companies to corporate clients and consumers (as development is carried out together with client companies, the business is called “co-creation contracted business” or “co-creation development” within the company), the RPA solution for actualizing business processes that use manpower and robots by combining the know-how of ERP and BPM and the robotic process automation (RPA) technology for automating the routine tasks of white-collar workers, and so on.

In recent years, the company has succeeded in capturing demand related to Work Style Reform by linking “ZeeM,” a software package for human resource and payroll, and “TimePro,” an attendance management solution of Amano Corporation, and the scale of the projects has been growing.

Business entities in charge: Enterprise Digital Transformation Dept., Business Acceleration Dept. (since the fiscal year ending March 2022)

Contracted Development Business (accounting for 19.2% of total sales in the second quarter of fiscal year ending March 2023)

The company undertakes the development of systems for large companies, governmental offices, and municipalities, typesetting systems for newspaper publishers, odds systems for professional sports organized by the government, etc., which require reliability and experience. As a characteristic, the transactions made via Fujitsu are dominant, and so stable growth can be expected, although there are some short-term fluctuations. It is essential to secure “manpower,” including subcontractors.

Business entities in charge: Social System Dept.

In addition, Business Strategy Dept., which was newly established in the fiscal year ending March 2022, is a joint department of the Solutions Service Business and the Contracted Development Business.

Systems Operation and Services Business (accounting for 18.1% of total sales in the second quarter of fiscal year ending March 2023)

The company offers operation services, including the development, maintenance, and anti-hacking operation of server systems for portal sites and web services, to mainly the leading Japanese portal-site operator and its group companies. Previously, this business was operated by several group companies under the holding company, but they were integrated into CoCoTo Co., Ltd., which was established in Apr. 2016. This way, it became possible to exert the capability of the corporate group in marketing and development, and the company is making transactions with the group companies of portal-site operator. The company plans to boost sales from portal-site operator and approach its group companies, to expand its business.

Business entities in charge: CoCoTo Co. Ltd

Support Services Business (accounting for 31.2% of total sales in the second quarter of fiscal year ending March 2023)

The company offers support services, including help desk and technical support services, and call-center services (making and receiving calls), including election exit polls, social surveys, and market research. A strength of this business is that the company offers technical services to loyal clients, including those related to Fujitsu and NEC, with a good balance. This business can be expected to grow stably, but it is necessary to secure “human resources.” Accordingly, the company makes efforts to recruit foreign workers, too.

Business entities in charge: Brigh-E Co., Ltd. (the corporate name changed from the fiscal year ending March 2022 due to a merger), and Adams Communication Co., Ltd.

(From the company’s briefing material for individual investors)

(From the company’s briefing material for individual investors)

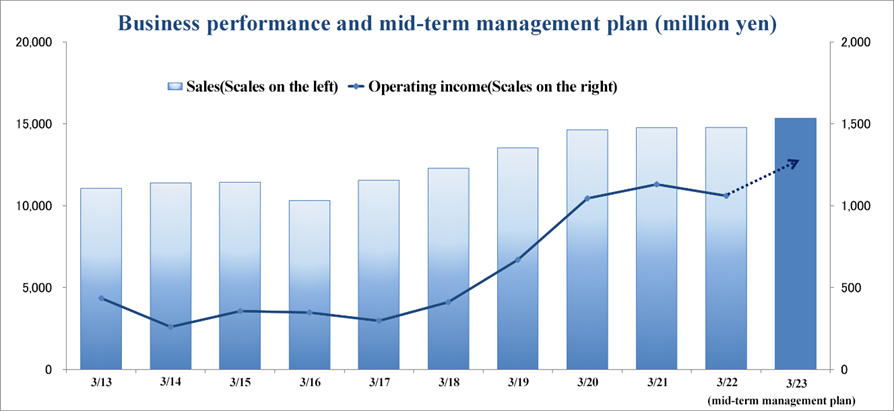

1-2. Mid-term Management Plan (FY 3/21 to FY 3/23)

CREO Group, which will celebrate its 50th anniversary in 2024, conducts its business operations from a medium/long-term perspective, striving to become a “100-year-old company” that will remain attractive to all stakeholders for the next 50 years. As part of such efforts, the company started a mid-term management plan in the fiscal year ended March 2021, when it commemorated its 45th anniversary, with “creating mechanisms” that achieve sustainable growth and improve corporate value as its main theme.The Mid-term Management Plan’s Vision and 3 Key Initiatives

Based on the ongoing challenges from the previous mid-term management plan and future changes in the external environment, the group set the vision of the new mid-term management plan as “creating a framework for sustainable growth and increasing corporate value.” Under this vision, CREO will work on “business structure and business portfolio transformation,” “human resources development and utilization for sustainable growth,” and “transformation into a flexible organization and business process capable of responding to changes and risks.” The company will place particular importance on the operating income rate as a management index. As a result of the company’s efforts over the past three years, orders and sales are expanding. However, it is difficult to accurately predict how much the impact of the spread of the coronavirus will offset. Even if the sales growth rate slows down to some extent, the company will achieve profit growth by improving productivity and profitability (operating income rate).

“Business Structure and Business Portfolio Transformation”

The company aims to expand promising domains, such as cloud services (ZeeM series for payroll and accounting, BP, and SMK), digital transformation services, and customer products business support (development and installation support) by combining the group's strengths. The company will also concentrate its management resources on the Solutions Service Business to maintain and expand existing businesses.

Strategy of Solutions Service Business

The company will expand the co-creation type contracted development to improve sales. The company will also enhance the planning, development, and operation of systems and services that support the maintenance and expansion of customers' market competitiveness and improve the development and operation of core systems and products that support the sustainable stabilization of customers' management bases.

From short and medium-term perspectives, the company will strengthen integrated HR solutions by improving collaboration with Amano Corporation, upgrading products, expanding the HR product lineup, and automating installation settings to enhance profits. In addition, from a medium/long-term perspective, the company will launch digital transformation services to improve accounting data analysis (data utilization) and operational efficiency. The company will also accelerate cloud services by increasing order receiving opportunities and improving stock rates.

“Business Structure and Business Portfolio Transformation”

CREO will develop human resources focusing on the themes of training future generation leaders, cultivating global human resources, and improving the skill level of engineers. For these initiatives to be successful, increasing employees’ motivation is key. The company therefore rates and rewards multitalented employees that display distinct strengths and skills in various fields. As it also needs to have HR systems that tolerate diversity, it is working to reform existing systems and establish new ones.

The keyword for "developing leaders for future generations" is nurturing them by entrusting them. Starting from executive candidates to department leaders, the company will improve the level of non-technical "business" and "management" skills to enable sustainable business succession and expansion. The keyword for "cultivating global human resources" is nurturing them by letting them travel. The company will promote human resources exchanges with overseas partners to develop human resources that can absorb differences in the environment and culture and accept diversity. As for "upgrading the level of engineers," the keyword is nurturing them by allowing them to specialize. The company will secure and train human resources who can utilize new technologies such as AI, IoT, and 5G, and digital transformation development methods including Agile and DevOps.

“Transformation into a Flexible Organization and Business Process Capable of Responding to Changes and Risks”

While moving forward with the second stage of group restructuring, CREO will carry out a business process reform that considers both improving productivity and its Business Continuity Plan (BCP). For the second stage of group restructuring, the company began to implement measures that shift human resources to more profitable business in the previous fiscal year. It will not simply shift its workforce, but it will put in place a framework that allows it to flexibly and swiftly allocate personnel within the Group and transform their skills. As for business process reforms, the company started developing and operating the infrastructure for telecommuting. This will enable it to maintain high productivity even if another crisis like the coronavirus pandemic occurs and working styles change dramatically.

Investments

CREO established a new investment committee. The committee does not only evaluate and approve the investment plans from each business, but will also seek investment opportunities and encourage its implementation. The members of the committee have their respective areas of responsibility and will promote investment while primarily focusing on new business investment, development investment, human capital investment, and capital investment. CREO sets a guideline for the scale of investment amount of the entire group to be around 500 million yen during the current mid-term management plan, and it will make decisions flexibly based on the investment opportunities and results.

Management Goals

In the fiscal year ending March 2023, which is the final fiscal year of the mid-term management plan, it is difficult to hire engineers who can immediately deal with actual tasks, due to the intensification of competition for recruiting personnel amid the uncertain social situation and the expansion of the ICT service market. In addition, the company will fortify the quality control system for preventing the reemergence of unprofitable projects in the Solutions Service Business, pursue quality improvement rather than quantitative expansion and secure a foothold, and actively invest in human resources, products, and services for accelerating sustainable growth. Considering these points, the company has downwardly revised the forecasts in the mid-term management plan.

Meanwhile, the number of orders received in the Solutions Service Business, which remains on a growth track, is healthy, and the company has been undertaking projects that span several years.

| FY3/21 (Actual) | FY3/22 (Actual) | FY3/23 (Before Revision) | FY3/23 (After Revision) | ||||

Amount | YoY | Amount | YoY | Amount | YoY | Amount | YoY | |

Sales | 14,745 | +0.8% | 14,784 | +0.3% | 18,000 | +21.8% | 15,350 | +3.8% |

Operating Income | 1,131 | +8.3% | 1,060 | -6.3% | 1,800 | +69.7% | 1,230 | +16.0% |

Ratio of Operating Income | 7.7% | - | 7.2% | - | 10.0% | - | 8.0% | - |

Ordinary Income | 1,195 | +9.2% | 1,107 | -7.4% | - | - | 1,260 | +13.8% |

Profit attributable to owners of parent | 776 | +6.3% | 657 | -15.4% | - | - | 800 | +21.7% |

*Unit: Million yen

Reasons for the revision |

◆The company cannot supply sufficient products to meet the market demand, and the expansion of resources, including personnel and partners, is delayed. ◆Installation efficiency improvement is not enough. ◆The company is losing business opportunities, because it is busy with handling unprofitable projects. ◆The number of new orders received is stagnant, because major clients are promoting in-house production. ◆The company will invest in human resources, products, and services more actively for accelerating sustainable growth. ◆The company will create new services and markets. |

Future measures and outlook |

◆To strengthen the quality system for preventing the reemergence of unprofitable projects. ◆To improve profitability and productivity by standardizing and automating the installation process. ◆To concentrate on the following activities in the investment phase for further growth. ① To accelerate the shift to cloud services (strengthening cloud services for connecting) ② To strengthen products and services for major target clients of TimePro of Amano ③ To secure personnel and improve productivity by actively utilizing offshore facilities (Vietnam) ◆To shift to more profitable businesses. ◆To develop personnel with high added value (advancing the education of human resources, developing digital personnel, etc.). |

Financial/Capital Policy and Profit-sharing Policy

There are no changes from the previous mid-term management plan, and there is an optimal balance of the three points: shareholder return, financial stability, and investments. Although CREO will expand its investments to achieve permanent growth more than before, this will not impair the rules of financial stability as the company will continue to generate investment resources through business activities by improving the operating income rate. As for the profit-sharing policy, CREO will continue to aim for a consolidated payout ratio of 40%.

1-3 Initiatives for sustainability and ESG

Six Important Issues

Important issue | Outline | 17 SDGs |

Creation of a new industry through DX | To create value while grasping the trend of the times, such as the fourth industrial revolution and digital transformation (DX), and offer new excitement. | 4. Quality education 9. Industry, innovation and infrastructure 17. Partnerships for the goals |

Application of a new business model with digital technologies | To offer unprecedented business models by using digital technologies, and support customers in maintaining and enhancing competitiveness. | 3. Good health and well-being 4. Quality education 17. Partnerships for the goals |

Provision of safe and convenient infrastructure | To offer safe, convenient solutions for social infrastructure and corporate activities based on the experience and technologies accumulated for many years. | 3. Good health and well-being 4. Quality education 8. Decent work and economic growth 9. Industry, innovation and infrastructure 10. Reduced inequalities |

Cooperation with stakeholders (sustainable growth) | To create value together with various stakeholders, including shareholders, employees, customers, business partners, the social environment, and local communities to improve each other’s attractiveness. | 4. Quality education 11. Sustainable cities and communities 15. Life on land 17. Partnerships for the goals |

Advancing corporate governance | To develop a governance system for swiftly adapting to the business environment and improving management transparency. | 10. Reduced inequalities 16. Peace, justice and strong institutions |

Efforts to realize well-being | To practice sustainable lifestyles with the aim of maintaining good conditions of people and the environment. | 3. Good health and well-being 5. To realize gender equality 8. Decent work and economic growth |

Sustainability Data

Data | FY3/20 | FY3/21 | FY3/22 |

No. of employees | 1,139 | 1,220 | 1,224 |

No. of non-regular workers | 80 | 99 | 103 |

Training cost per employee | 60,546 | 59,085 | In the middle of the fiscal year |

Turnover rate of employees | 11.2 | 8.1 | In the middle of the fiscal year |

Ratio of female employees | 28.10% | 29.80% | 30.90% |

Ratio of female managers | 6.40% | 6.40% | 6.90% |

Ratio of female employees fresh out of college | 43.90% | 38.80% | 54.90% |

Ratio of employees with disabilities | 1.30% | 1.64% | 1.65% |

Ratio of mid-career workers | 57.7% | 44.7% | In the middle of the fiscal year |

Ratio of non-Japanese workers | 1.11% | 0.92% | 1.33% |

Sustainability Data

| [Business activities] ◎Acceleration of training of digital personnel | Corporate activities ◎Development of an environment where employees can keep exerting their abilities |

| Conclusion of a cooperation agreement with Shiga University ◆Increase of digital personnel ◆Training of digital personnel using corporate information ◆Collaborative research utilizing analytics | Good health business superior corporation 2022 ◆Certified continuously since 2019 ◆Promotion of health-oriented management for supporting the stable activities of personnel ◆Improvement of an environment for well-being of employees |

2. The second quarter of Fiscal Year ending March 2023 Earnings Results

2-1. Consolidated earnings results for the second quarter of Fiscal Year ending March 2023

| FY 3/22 2Q | Ratio to sales | FY 3/23 2Q | Ratio to sales | YoY | Company Forecast | Forecast Ratio |

Sales | 7,163 | 100.0% | 7,173 | 100.0% | +0.1% | 7,330 | -2.1% |

Gross Profit | 1,677 | 23.4% | 1,512 | 21.1% | -9.8% | - | - |

SG & A | 1,201 | 16.8% | 1,146 | 16.0% | -4.6% | - | - |

Operating Income | 475 | 6.6% | 366 | 5.1% | -22.9% | 420 | -12.6% |

Ordinary Income | 494 | 6.9% | 363 | 5.1% | -26.5% | 425 | -14.3% |

Profit attributable to owners of parent | 255 | 3.6% | 219 | 3.1% | -14.0% | 245 | -10.2% |

*Unit: Million yen

* The figures include the figures calculated by Investment Bridge Co., Ltd. as reference values and may differ from the actual figures. The same applies below.

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

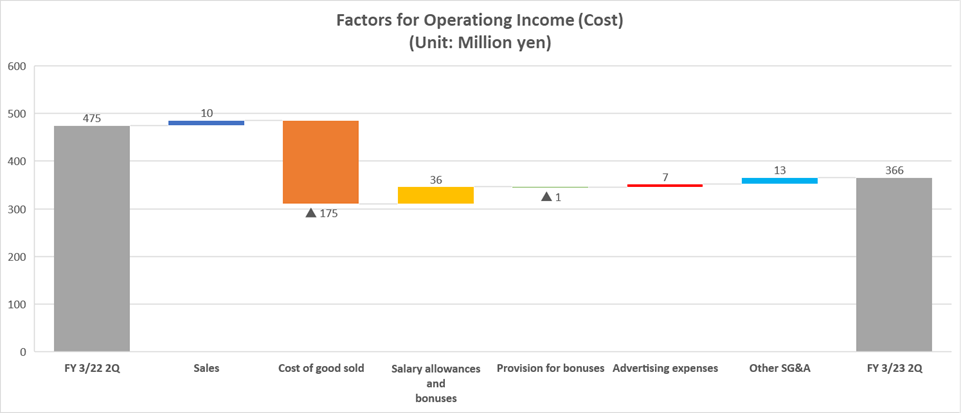

*▲ represents a rise in expenses.

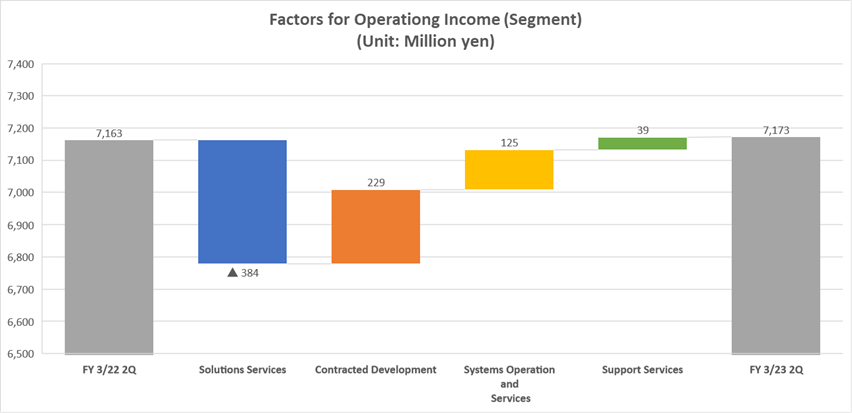

Sales increased 0.1%, while operating income dropped 22.9% year on year.

In the ICT service market, in which the Creo Group operates business, the demand from client companies and others remained strong due to the trend of workstyle reform. Sales grew 0.1% year on year to 7,173 million yen, and operating income dropped 22.9% year on year to 366 million yen. In the Solutions Service Business, sales and profit declined year on year, but all of the other segments saw year-on-year increases in sales and profit. Since the demand for investment in IT kept growing, the number of orders received was healthy, but operating income fell below the forecast considerably in the strategic order receipt project.

Gross profit margin declined 2.3 points year on year to 21.1%. While sales increased slightly, the company reduced SGA, and the ratio of SGA to sales decreased 0.8 points to 16.0%, but operating income margin dropped 1.5 points to 5.1%. Due to the decrease in revenues from subsidies, etc., ordinary income dropped 26.5% year on year, showing a higher decrease rate than operating income, while due to the decreases in expenses for office relocation, the loss from software evaluation, etc., profit attributable to owners of parent declined 14.0% year on year, showing a lower decrease rate than operating income.

Sales and operating income were 2.1% and 12.6%, respectively, smaller than the initial forecast for the first half of the term.

Situation of the high-cost project in the Solutions Service Business

In the Solutions Service Business, the company had a high-cost project in FY 3/2022 and another one in FY 3/2023. In the high-cost project in the previous term, the company undertook the collaborative development of packaged products to be sold by the client. On the other hand, in the high-cost project this term, the company redevelops the system so that a client can replace the old version of ZeeM, which is a core product of CREO. This project earns a revenue of several billions of yen. CREO has been making transactions for 20 years with the two client companies of the high-cost projects in the previous term and this term, so CREO undertook the projects for the loyal customers who are expected to make transactions with CREO in the long term. The company aims to finish the project that is affecting the performance this term by the end of this term, and its response will reach a peak in the third quarter. Currently, they are making company-wide efforts to deliver products to clients while taking multifaceted measures, including the enhancement of PMO (project management support inside an organization) and quality improvement.

2-2. Trends in each segment

Sales and operating income for each segment

| FY 3/22 2Q | Ratio to sales・Profit margin | FY 3/23 2Q | Ratio to sales・Profit margin | YoY |

Solutions Services | 2,640 | 36.9% | 2,256 | 31.5% | -14.5% |

Contracted Development | 1,150 | 16.1% | 1,379 | 19.2% | 19.9% |

Systems Operation and Services | 1,174 | 16.4% | 1,299 | 18.1% | 10.6% |

Support Services | 2,198 | 30.7% | 2,237 | 31.2% | 1.8% |

Consolidated sales | 7,163 | 100.00% | 7,173 | 100.00% | 0.1% |

Solutions Service | 449 | 17.0% | 227 | 10.1% | -49.4% |

Contracted Development | 183 | 15.9% | 241 | 17.5% | 31.8% |

Systems Operation and Services | 142 | 12.1% | 182 | 14.0% | 28.0% |

Support Services | 154 | 7.0% | 183 | 8.2% | 18.8% |

Head Office Expenses and Income | -453 | - | -467 | - | - |

Consolidated Operating Income | 475 | 6.6% | 366 | 5.1% | -22.9% |

*Unit: Million yen

*In the two businesses other than the System Operation and Services Business and the Support Services Business operated by consolidated subsidiaries, the head office expenses are not allocated when calculating operating income.

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

Solutions Service Business

◎It mainly offers solutions and services, including “ZeeM,” a solution for personnel affairs, salaries, and accounting.

Sales were 2,256 million yen, down 14.5% year on year, and operating income was 227 million yen, down 49.4% year on year. The number of orders was healthy, but the performance of the strategic order receipt project fell below the forecast significantly, so sales dropped 383 million yen year on year, and operating income declined 221 million yen year on year. The profit margin in this segment decreased 6.9 points year on year. Sales and operating income were 243 million yen and 182 million yen, respectively, smaller than the initial forecast for the first half of the term.

Contracted Development Business

◎The company mainly undertakes system development for major companies such as the Fujitsu Group and Amano Corporation.

Sales were 1,379 million yen, up 19.9% year on year, and operating income was 241 million yen, up 31.8% year on year. Thanks to the increase of orders from major clients, etc., sales and operating income increased 228 million yen and 58 million yen, respectively, year on year. The profit margin in this segment rose 1.6 points year on year.

Sales and operating income were 59 million yen and 31 million yen, respectively, larger than the initial forecast for the first half of the term.

System Operations and Service Business

◎The company mainly provides system development, maintenance, and operation services to major domestic portal site operators.

Sales were 1,299 million yen, up 10.6% year on year, and operating income was 182 million yen, up 28.0% year on year. Thanks to the healthy trend of projects for major clients, etc., sales and operating income rose 124 million yen and 39 million yen, respectively, year on year. The profit margin in this segment rose 1.9 points year on year.

Sales were 10 million yen smaller than the initial forecast for the first half of the term, while operating income was 22 million yen higher than the initial forecast.

Support Services Business

◎The company mainly provides support and services centered on help desks and technical support and call center services for purposes, such as social research and market research.

Sales were 2,237 million yen, up 1.8% year on year, and operating income was 183 million yen, up 18.8% year on year. Due to the rebound from the temporary decline in the number of orders in the same period of the previous year, sales grew 39 million yen year on year and operating income rose 28 million yen year on year. The profit margin in this segment increased 1.2 points year on year.

Sales were 212 million yen smaller than the initial forecast for the first half of the term, while operating income was 13 million yen higher than the initial forecast.

2-3. Variations in quarterly results

In the second quarter of FY 3/23 (July-September), sales and profits declined YoY, but sales and operating income were higher level than in the past.

2-4. Financial Position and Cash Flows

Financial Position

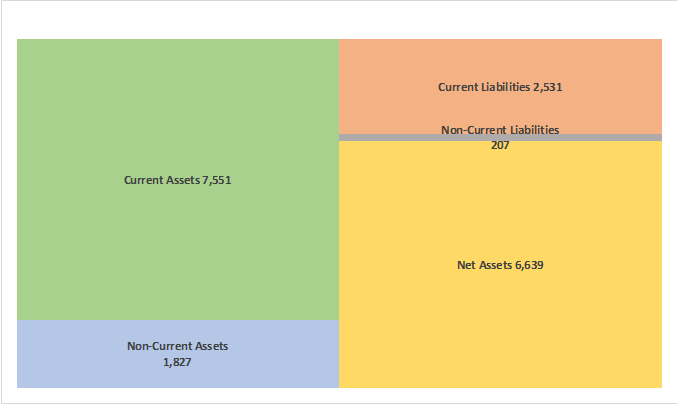

| Mar. 2022 | Sep. 2022 |

| Mar. 2022 | Sep. 2022 |

Cash | 4,317 | 3,875 | Accounts payable | 668 | 537 |

Receivables | 3,228 | 3,055 | Reserves for bonuses | 556 | 549 |

Inventories | 272 | 415 | Current Liabilities | 2,575 | 2,531 |

Current Assets | 8,017 | 7,551 | Noncurrent Liabilities | 204 | 207 |

Tangible Assets | 295 | 286 | Liabilities | 2,780 | 2,738 |

Intangible Assets | 695 | 720 | Net Assets | 6,997 | 6,639 |

Investments and Others | 767 | 819 | Total Liabilities and Net Assets | 9,777 | 9,378 |

Noncurrent Assets | 1,759 | 1,827 | Total Debt with Interest | 0 | 0 |

*Unit: Million yen

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

The total assets as of the end of September 2022 stood at 9,378 million yen, down 399 million yen from the end of the previous term. In the assets side, temporary account for software, investment securities, etc. increased, but cash & deposits, accounts receivable, etc. decreased. In the side of liabilities and net assets, provision for loss from projects, advances received, etc. increased, but the payment of dividends, the acquisition of treasury shares, etc. affected the performance. The liquidity of assets is high, as current assets account for 80.5% of total assets. Capital-to-asset ratio was as high as 70.8%.

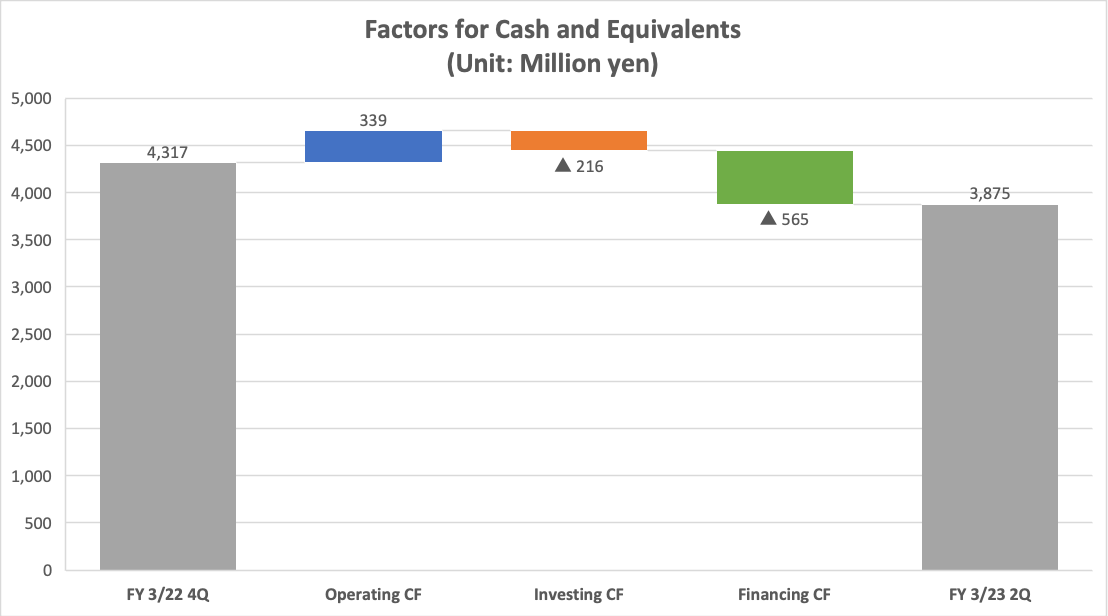

Cash Flows

| FY3/22 2Q | FY 3/23 2Q | YoY | |

Operating cash flow | 605 | 339 | -266 | -44.0% |

Investing cash flow | -210 | -216 | -6 | - |

Free Cash flow | 395 | 123 | -272 | -68.9% |

Financing cash flow | -328 | -565 | -237 | - |

Cash and Equivalents at the end of term | 3,993 | 3,875 | -118 | -3.0% |

*Unit: Million yen

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

In terms of cash flows, the cash inflow from operating activities shrank due to the drop in decreases in net income before taxes and other adjustments, accounts receivable, and contract assets, the augmentation of payments of income taxes, etc. In addition, the cash outflow from investing activities increased through the expenditure for acquiring investment securities, etc., and the surplus of free cash flow shrank. The cash outflow from financing activities expanded, due to the expenditure for acquiring treasury shares, the augmentation of dividend payments, etc. Consequently, the cash position as of the end of September 2023 was down 3.0% from the previous term.

2-5. Topics

◎Acquisition and retirement of treasury shares

After having discussions from the three viewpoints: (1) return to shareholders, (2) securing of funds for investment, and (3) maintenance of financial stability, which are our capital policies, we acquired and retired treasury shares.

<Results of acquisition of treasury shares>

Type of shares acquired | Common shares |

Total number of shares acquired | 250,000 (accounting for 3.14% of the total number of outstanding shares, excluding treasury shares) |

Total price for acquiring the shares | 236,416,500 yen |

Acquisition period | May 11 to July 21, 2022 |

Acquisition method | Buying in the market with the trust method |

<Results of retirement of treasury shares>

Type of shares to be retired | Common shares |

Total number of shares to be retired | 64,681 (accounting for 0.75% of the total number of outstanding shares, excluding treasury shares) |

Scheduled retirement date | July 1, 2022 |

◎Capital and business alliance with Individual Systems Co., Ltd. in Vietnam

On May 10, 2022, CREO concluded a basic agreement with Individual Systems Co., Ltd. (hereinafter called “IVS”), a Japanese-affiliated software developer in Vietnam, for investing in IVS under the condition that they will obtain permits, approvals, etc. from the local authorities in Vietnam. Since the start of its business in 2002, IVS has trained engineers in Vietnam and engaged in offshore development for Japan, and developed a 300-employee organization, one of the largest among Japanese-affiliated IT enterprises. In addition, it occupied the largest share in the local SI market targeting Japanese enterprises in Vietnam, so it is growing rapidly. This capital and business alliance is aimed at offering systems and services while utilizing its cost advantage, by cooperating with a development company in Vietnam and establishing a development system to meet the requests from clients.

From now on, it is expected that (1) its production capacity will be improved by securing ICT personnel, (2) their in-house development function will be enhanced by establishing a laboratory and conducting global cooperation, and (3) the training of global personnel and the cultivation of markets will be accelerated.

◎Conclusion of a “basic agreement for industry-academia collaboration” with Shiga University

On May 23, 2022, CREO concluded a “basic agreement for industry-academia collaboration” with Shiga University for the purpose of developing personnel in the data science field and facilitating the collaboration between the industrial and academic sectors. The company will cooperate with Shiga University broadly in conducting collaborative research for solving issues in the business field by utilizing big data and open data, developing personnel in the data science field, accepting interns, and recruiting personnel, in order to compensate for the recent shortage of personnel versed in digital technologies and DX and acquiring personnel who can accelerate business in the data and AI fields. From now on, the company plans to implement measures for creating new value by mutually utilizing resources, including the development of personnel in the field of data science, utilization of big data, and collaborative research for solving issues in the business field.

3. Fiscal Year ending March 2023 Earnings Forecasts

3-1. Consolidated earnings forecasts for Fiscal Year ending March 2023

| FY3/22 | Ratio to sales | FY3/23 Est. | Ratio to sales | YoY |

Sales | 14,784 | 100.0% | 15,350 | 100.0% | +3.8% |

Operating Income | 1,060 | 7.2% | 1,230 | 8.0% | +16.0% |

Ordinary Income | 1,107 | 7.5% | 1,260 | 8.2% | +13.8% |

Profit attributable to owners of parent | 657 | 4.4% | 800 | 5.2% | +21.7% |

*Unit: Million yen

Sales and operating income are projected to rise 3.8% and 16.0%, respectively, year on year.

After the second quarter, the corporate forecast for the fiscal year ending March 2023 has not been revised, and it is projected that sales will grow 3.8% from the previous term to 15,350 million yen and operating income will rise 16.0% from the previous term to 1,230 million yen.

Sales are expected to grow in all of the Solutions Service, Contracted Development, System Operation and Services, and Support Services Businesses, as the demand for investment in systems is healthy because enterprises engage in workstyle reform, productivity improvement, etc. Profit is forecast to increase, as the company will finish the high-cost project of the Solutions Service Business and enhance marketing activities for increasing new customers. In the other businesses: Contracted Development, System Operation and Services, and Support Services Businesses, too, profit is projected to rise. Operating income margin is expected to increase 0.8 points to 8.0%, due to the improvement in the profit margin of projects, etc.

The dividend plan has not been revised, and they plan to pay a dividend of 40 yen/share, up 1 yen/share from the previous term. The company aims to keep payout ratio at the target 40%.

In many business segments of the CREO Group, sales and profit tend to be larger in the second and fourth quarters. If the sales and profit in these quarters are not in line with the forecast, results may be significantly different from the consolidated earnings forecast. In the Solutions Service Business, projects tend to become larger, so there is a possibility that results will be significantly different from the forecast, if the receipt of orders or acceptance inspection is delayed or if a project becomes unprofitable. In the Contracted Development Business, acceptance inspection tends to be conducted in the fourth quarter due to the characteristics of the business, so there is a possibility that sales will be posted in the following term according to the progress of acceptance inspection. Furthermore, if leading IT vendors, which are their major clients, fail to receive orders from governmental offices, enterprises, etc., which are system users, as planned, they will not place orders with CREO, and business results may be considerably different from the forecast.

Sales and operating income for each segment of FY 3/23 (Company’s plan)

| FY3/22 Act. | Ratio to sales・Profit margin | FY3/23 Est. | Ratio to sales・Profit margin | YoY |

Solutions Service | 5,306 | 35.9% | 5,320 | 34.7% | +0.3% |

Contracted Development | 2,518 | 17.0% | 2,840 | 18.5% | +12.8% |

Systems Operation and Services | 2,479 | 16.8% | 2,630 | 17.1% | +6.1% |

Support Services | 4,478 | 30.3% | 5,080 | 33.1% | +13.4% |

Consolidated sales | 14,784 | 100.00% | 15,350 | 100.00% | +3.8% |

Solutions Service | 780 | 14.7% | 1,060 | 19.9% | +35.9% |

Contracted Development | 467 | 18.5% | 510 | 18.0% | +9.2% |

Systems Operation and Services | 325 | 13.1% | 360 | 13.7% | +10.8% |

Support Services | 351 | 7.8% | 370 | 7.3% | +5.4% |

Head Office Expenses and Income | -863 | - | -1,070 | - | - |

Consolidated operating income | 1,060 | 7.2% | 1,230 | 8.0% | +16.0% |

*Unit: Million yen

*Sales figures represent values prior to deletion of inter-segment sales or transfer amounts.

3-2 Key measures for the fiscal year ending March 2023

◎ Large-scale project management

◆ Enhancement of the process for checking order receipt judgments and conditions

◆ Visualization and analysis of projects

◆ Supervision of projects, and enhancement of risk management

◎ Shift to highly profitable models

◆ Improvement in productivity through the standardization and sharing of the produces for introducing products

◆ Selection and concentration of commissioned development projects (in continuing and promising fields)

◆ Streamlining of system operation services

◆ Expansion of the scope of cooperative business with Amano

◎ Support for DX and the shift to cloud services

◆ Improvement of solution services of HR Tech

◆ Promotion of co-creation of cloud vendors and fortification of the DX base

◆ Creation of digital business

◎ Investment in human resources

◆ Enhancement of offshore development based on the collaboration with IVS this term

◆ Development of global personnel

◆ Training and reskilling of DX personnel

◆ To adapt to diverse workstyles

3-3 Growth strategies

[Expansion of the cloud services that connect information and services]

(From the company’s briefing material for individual investors)

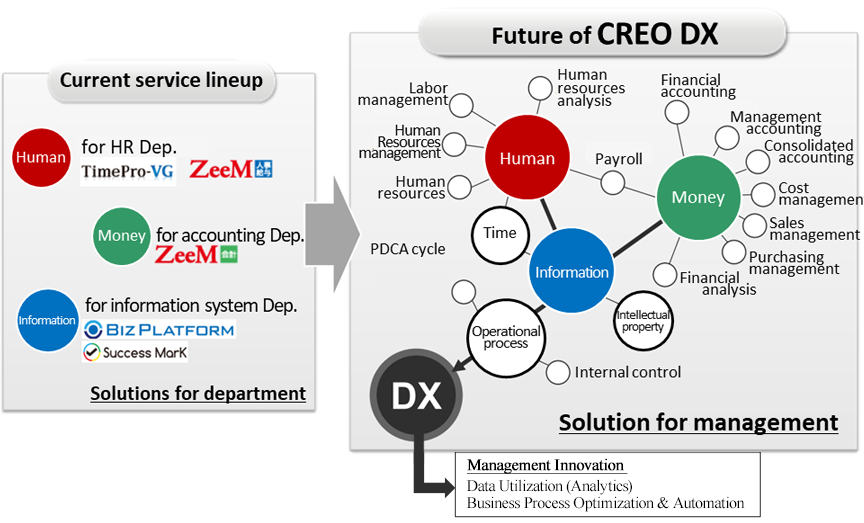

The company will redefine the products it offers in the Solutions Service Business as not only tools for the human resources, accounting, and information systems departments, but also as solutions for management, and proactively propose them to customers.

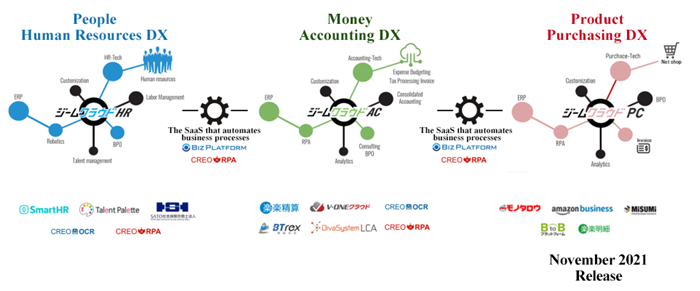

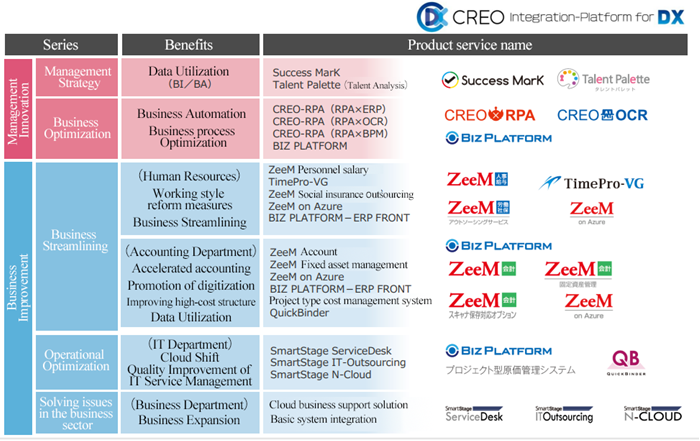

Cloud Products

(From the company’s briefing material for individual investors)

As a framework for promoting Enterprise DX for “Connecting,” they established a management base that connects management resources such as people, goods, and money, which brings continuity to digital innovation.

Product/Service Lineup

(From the company’s briefing material for individual investors)

3-4 Progress rate

[Consolidated results]

| Results in the first half of FY 3/2023 | Corporate forecast for FY 3/2023 | Progress rate |

Sales | 7,173 | 15,350 | 46.7% |

Operating Income | 366 | 1,230 | 29.8% |

Ordinary Income | 363 | 1,260 | 28.8% |

Net Income | 219 | 800 | 27.4% |

*Unit: Million yen

[Profit of each segment]

| Results in the first half of FY 3/2023 | Corporate forecast for FY 3/2023 | Progress rate |

Solutions Service | 227 | 1,060 | 21.4% |

Contracted Development | 241 | 510 | 47.3% |

Systems Operation and Services | 182 | 360 | 50.6% |

Support Services | 183 | 370 | 49.5% |

Head Office Expenses and Income | -467 | -1,070 | - |

Consolidated operating income | 366 | 1,230 | 29.8% |

*Unit: Million yen

CREO conducts business administration with the aim of leveling off its performance throughout each term, but it is forecast that its performance will be better in the second half. The sales and operating income in the first half of the term were 156 million yen and 53 million yen smaller than the forecast, but they aim to catch up by normalizing resources while finishing the high-cost project in the Solutions Service Business early in the second half. In addition, they will meet the demand for their products and cloud services, including ZeeM, by cementing the cooperation with Amano and selling licenses mainly in the fourth quarter. Furthermore, they aim to increase sales further in the other segments, which are currently healthy.

4. Conclusions

In the second quarter of the fiscal year ending March 2023, sales grew 0.1% and operating income dropped 22.9% year on year. In the ICT service market, in which the Creo Group operates business, the demand from client companies and others remained strong due to the trend of workstyle reform. Under these circumstances, sales and profit increased year on year in all segments other than the Solutions Service Business. In the Solutions Service Business, sales and profit declined year on year, due to the high-cost project. Consequently, the sales and operating income in the first half of the term were 156 million yen and 53 million yen smaller than the initial forecast. The company thinks that it is possible to catch up by finishing the high-cost project in the Solutions Service Business early and normalizing resources in the second half. The outcomes of ongoing multifaceted measures, including the enhancement of PMO (project management support inside an organization) and quality improvement, are noteworthy. The company aims to cement the cooperation with Amano to sell licenses mainly in the fourth quarter, meet the demand for their products and cloud services, including ZeeM, and increase sales in the other segments, which are performing well. Their business performance in the third quarter is noteworthy to see whether or not they can catch up on the delay in the first half and approach their full-year forecast with the above measures.

In addition, the company is actively carrying out investment for securing personnel and improving productivity, by accelerating the shift to cloud services (improvement of connectable cloud services), improving products and services targeted at the major customers of TimePro of Amano, and actively utilizing offshore resources (in Vietnam). In the mid/long term, we would like to keep an eye on when the outcomes of their strategic investment will become evident.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 6 directors, including 3 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎Corporate Governance Report: Updated on June 23, 2022

Basic policyBased on CREO Group’s corporate philosophy, the company fulfills the responsibilities to their stakeholders including shareholders, customers, employees, and business partners, with an honest and sincere attitude, and conducts highly transparent management. In accordance with the purpose of the Corporate Governance Code, we strive to achieve CREO Group’s sustainable growth and further improve its medium- and long-term corporate value by improving efficiency and transparency of business management, and by further strengthening the function to oversee business operations.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reason for not Following the Principles |

【Principle 1-2 (4) English translation of convocation notices, and the use of an electronic voting platform】 | Our company has not adopted the electronic exercise of voting rights or English translations of convocation notices because our company does not have a high proportion of institutional investors and overseas investors. If the proportion of institutional investors and overseas investors of our company exceeds 20%, we will consider whether or not to translate the convocation notices into English and whether to implement the electronic exercise of voting rights, taking into consideration the costs and other factors. |

【Principle 4-8 Effective use of independent outside directors】 | Our company has appointed one independent outside director with affluent experience and broad knowledge who is fully independent from our company’s major shareholders. The independent outside director sufficiently fulfills the roles and responsibilities required by the Board of Director, however, our company continues to discuss establishing a proper structure, including increasing the number of independent outside directors according to the needs, to further strengthen the governance structure in the future. |

【Supplementary Principle 4-10 (1) Establishment of a discretionary advisory committee】 | Currently, our company does not have an independent Nomination Advisory Committee or a Remuneration Committee, however, we will continue to discuss establishing a Nomination Advisory Committee and a Remuneration Committee under the Board of Directors, which primarily consists of independent outside directors, in order to strengthen the independence, objectivity, and accountability of the Board of Director’s functions related to nominations of senior executives and director (including succession planning) and remuneration. |

【Principle 5-2 Formulation and publication of management strategy and management plan】 | Our company has disclosed their goals for consolidated net sales, consolidated operating income, and consolidated operating margin in the three-year medium-term management plan, which ends in the fiscal year ending March 31, 2023, however, after taking into consideration the change in the market environment and the progress of the medium-term management plan, our company will consider the review of the business structure and allocation of management resources based on the cost of capital. In terms of investment, our company considers investment in human capital is the most important, and strives to strengthen recruitment and enhance the development of human assets through training and other means. In addition, our company considers the appropriate allocation of management resources by taking into account the risks associate with investment in facilities, research and development, and other investment, and examining whether or not such investment is consistent with the companywide business strategy. |

<The main principles of disclosure>

Principles | Disclosure Contents |

【Principle 2-4 (1) Ensuring diversity in appointment of core personnel, etc.】 | Our company regards human assets are the most important asset, endeavors to support the human resources so that a wide array of human assets can flourish in the medium/long term, and appoint management positions based on comprehensive consideration of their abilities and qualification regardless of gender, nationality, whether they are mid-career hires or recruitment of new graduates. With regard to foreign nationals and mid-career hires, our company hires personnel for positions required for its business strategy based on their experience, ability, etc., regardless of nationality, and recognizes that we are not in a situation to set goals specifically for promotion to management positions. Regarding female managers, the “ratio of female managers” was 6.9% as of FY 2021, however, our company is aiming to increase it to 10% or higher in the future. Our company will continue to actively appoint human assets who will contribute to the enhancement of corporate value in a broad range of areas, regardless of their nationality, or whether they are mid-career hires or new graduates. |

【Principle 3-1 Enhancement of information disclosure】 | (i) Our company’s goals (management philosophy, etc.), management strategies, and the management plan are posted on our company’s website (https://www.creo.co.jp/). Management Philosophy and the Code of Conduct https://www.creo.co.jp/corporate/concept/ The Medium-Term Business Plan (FY 2020-FY 2022) https://www.creo.co.jp/news/p20200521-6/ (ii) Basic approach and basic policy on corporate governance based on the respective principles in this code Our company’s basic policy on corporate governance is described in “I. 1. Basic Approach” of this report. (iii) Policies and procedures for the Board of Directors to determine remuneration for senior executives and directors Policies and procedures in determining remuneration for our company’s directors are posted in “II. 1. 【Remuneration for Directors】 Disclosure Contents of Policies for Determining the Amount of Remuneration or the Calculation Method” of this report. (iv) Policies and procedures for the Board of Directors’ election and dismissal of senior executives and nomination of candidates for directors and corporate auditors In electing and removing senior executives and nominating candidates for directors and corporate auditors, our company’s policy is to consider the balance and diversity of knowledge, experience, and abilities, taking into consideration the expertise, diverse experience, and advanced skills in the respective field required to supervise business execution and make important decisions. Based on this policy, candidates for directors are determined by the Board of Directors, and candidates for corporate auditors are resolved by the Board of Directors after obtaining the consent of the Board of Corporate Auditors. In the event of misconduct or serious violation of laws and regulations, or the Articles of Incorporation, in the execution of duties by a director, the Board of Directors will deliberate and decide on the dismissal or other disciplinary action of such director, or the submission of a proposal for dismissal to the General Meeting of Shareholders. (v) Explanation of individual election, dismissal, and nomination The reason for election and dismissal of individual directors is disclosed in the reference documents for the General Meeting of Shareholders. |

【Supplementary Principle 3-1 (3) Sustainability initiatives】 | Our company has organized sustainability policies and information on ESG since 2021 to identify important issues (materiality) that should be prioritized in the business management, and linked them to the services and activities we provide. Moving forward, our company will promote initiatives such as setting specific goals through analysis of each service and activity, as well as strengthening their governance structure. Regarding investment in human capital, our company has been working on strengthening recruitment and developing human assets through training and other programs. In addition, our company strives to make appropriate investment by examining the risks associated with investment in facilities, research and development, and other investment, to ensure that they are in line with the corporate business strategy. The latest information will be disclosed on the following website. Sustainability Policies and ESG Information Website |

【Principle 5-1 Policy on constructive communication with shareholders】 | Our company has established a basic policy on the development of systems and initiatives to promote constructive dialogue with shareholders from a viewpoint of ensuring appropriate information disclosure and transparency, to the extent and by the methods deemed appropriate by our company, and will engage in constructive dialogue with shareholders. To achieve this, our company will carry out the following steps. (1) For overall dialogue with shareholders, the executives of the Administrative Division will be responsible for the enhancement of contents and opportunities through various initiatives including financial results briefings. (2) The department responsible for IR that supports dialogue will actively engage in IR activities to enhance dialogue with shareholders by coordinating with relevant departments that have detailed information according to the IR activities, including adequately exchanging information in advance with these departments. (3) Our company will actively promote the provision of information on its business and strategies, etc., by holding or participating in Financial Results Briefings and other investor meetings as necessary. (4) An executive in charge will deliver feedback to the management meeting and the Board of Directors on opinions, requests, etc. obtained from shareholders and other stakeholders through IR activities. (5) With regard to insider information, our company pursues thorough information management in accordance with the internal insider regulations. (6) Upon holding dialogue with shareholders and investors, our company strictly follows the Fair Disclosure Rules to avoid any selective disclosure of critical information to any specific persons, and ensures thorough management of critical information. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |