Bridge Report:(9698)CREO fiscal year ended March 2023

President and Representative Director Junichi Kakizaki | CREO CO., LTD. (9698) |

|

Company Information

Market | TSE Standard Market |

Industry | Information and Communications |

President | Junichi Kakizaki |

HQ Address | Sumitomo Fudosan Shinagawa Building 4-10-27 Higashi-shinagawa, Shinagawa-Ku, Tokyo |

Year-end | March |

HOMEPAGE |

Stock Information

Share price | Number of shares issued (end of period) | Total market cap | ROE (Act.) | Trading Unit | |

¥886 | 7,944,688 shares | ¥7,038 million | 7.0% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥40.00 | 4.5% | ¥90.63 | 9.8x | ¥869.04 | 1.02x |

*The share price is the closing price on May 12th 2023. The number of issued shares is obtained by subtracting the number of treasury shares from the number of shares issued as of the fiscal year ended March 2023.

* BPS and ROE are the results for the fiscal year ended March 2023. The figures are rounded off.

* DPS and EPS are the company's forecasts for the fiscal year ending March 2024.

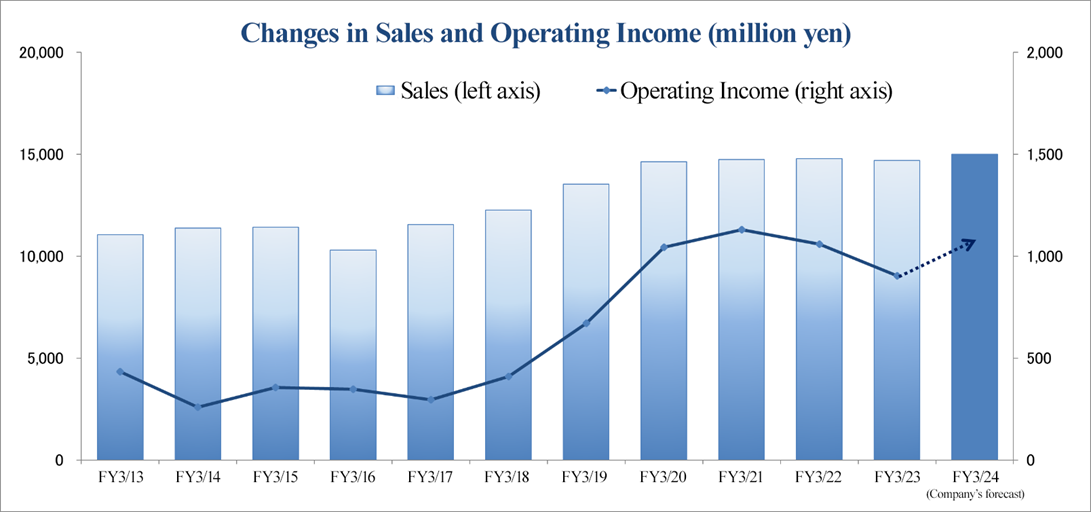

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating income | Ordinary income | Net income | EPS | DPS |

Mar. 2020 (Actual) | 14,624 | 1,044 | 1,095 | 731 | 88.49 | 35.00 |

Mar. 2021 (Actual) | 14,745 | 1,131 | 1,195 | 776 | 94.90 | 38.00 |

Mar. 2022 (Actual) | 14,784 | 1,060 | 1,107 | 657 | 80.28 | 39.00 |

Mar. 2023 (Actual) | 14,689 | 904 | 911 | 487 | 60.99 | 40.00 |

Mar. 2024 (Forecast) | 15,000 | 1,070 | 1,080 | 720 | 90.63 | 40.00 |

*The forecasted values are from the company. Unit: million yen, yen

*Net income is the profit attributable to owners of parent. The same applies below.

This Bridge Report overviews the business performance for the fiscal year ended March 2023 and describes the earnings forecast for the term ending March 2024 for CREO Co., Ltd.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2023 Earnings Results

3. Fiscal Year ending March 2024 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year ended March 2023, sales declined 0.6% year on year to 14,689 million yen, and operating income fell 14.7% year on year to 904 million yen, as both sales and profit declined year on year in the Solution Services business due to opportunity losses on projects with strategic orders along with the impact of higher costs.

- For its business plan for the fiscal year ending March 2024, the company forecasts a 2.1% year-on-year increase in sales to 15 billion yen and an 18.3% year-on-year increase in operating income to 1,070 million yen, with a recovery in the Solution Services business leading to higher sales and profit once the impact of opportunity losses on strategic orders and cost increases that affected the fiscal year ended March 2023 has subsided. The dividend is expected to be 40 yen/share, unchanged from the previous fiscal year.

- Key measures for future growth are (1) business expansion through HR tech collaboration with Amano Corporation, (2) shift of resources to businesses with high potential and profitability, (3) creation of cloud services, and (4) strengthening initiatives in new businesses. We would like to pay close attention to the results of this year's growth strategy, which will serve as a hint for the next medium-term management plan.

1. Company Overview

CREO is a system integrator that offers a variety of solutions. The company offers business solutions, including “ZeeM Series,” a business package software used by over 2,000 enterprises (Enterprise Resource Planning (ERP) for human resources, accounting, asset management, etc.) and “BIZ PLATFORM,” for business process management (BPM), which contributes to the streamlining of business operation and cost reduction, develops systems for governmental offices, municipalities, public-interest corporations, and large companies, produces and operates web systems for leading portal site operators in Japan, provides loyal clients with call-center services, and so on.

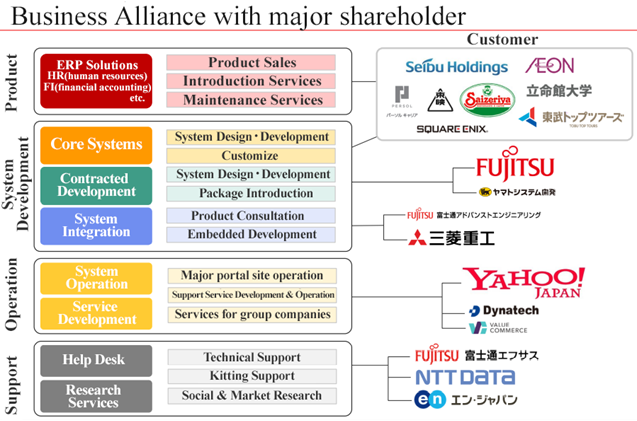

The corporate group is composed of CREO, and three consolidated subsidiaries: CoCoTo Co., Ltd., Brigh-E Co., Ltd. and Adams Communications Co., Ltd. Amano (6436) and Z Holdings Corporation (4689) holds 30.8% and 12.8% of shares of CREO, respectively. CREO is an equity-method affiliate of Amano Corporation. (All figures are from the Securities Report for the fiscal year ended March 2022)

[Three thoughts in the logo]

| To create an “impression” The exclamation mark in the logo represents the stance of surpassing expectations and impressing clients. To continue “creation” The sphere is CREO itself, and represents the environment in which human resources, products, and services are born and grow. To cuddle up to “eternity” This logo denotes CREO, which is represented by the sphere, cuddling up to clients, society, and shareholders.

|

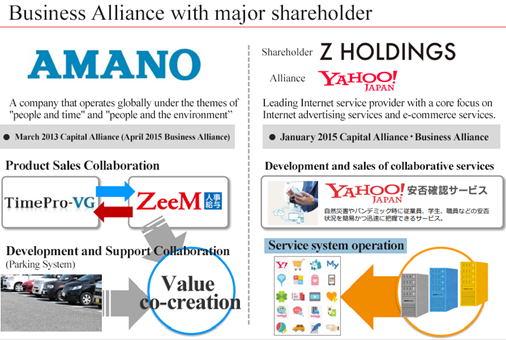

The major shareholders of CREO are Amano Corporation, which is attracting attention with the reform of workstyles, and Z Holdings (the former Yahoo!). The company formed a capital tie-up with Amano in March 2013 and a business tie-up in May 2014, to cooperate in sale of products, support the development of parking lot systems, etc., and collaborate in support. In addition, the company formed capital and business tie-ups with Z Holdings in January 2005, to develop and offer collaborative services and operate service systems.

(From the company’s briefing material for individual investors)

[Company strength]

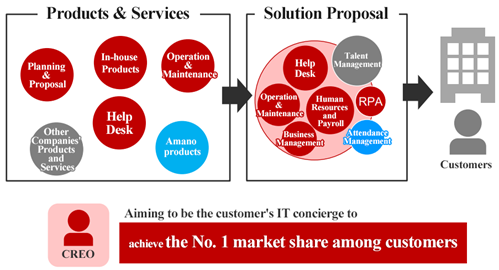

The company's strength lies in its long history and experience of continuing two businesses with different characteristics, the product business and the contracting business, as a few companies in the domestic SI industry operate both businesses in a well-balanced manner. Another strength is that the company's main business, the Solutions Service Business, includes both a product business and a co-creation type contracting business. The company flexibly meets package customization demands in the co-creation type contracted development, as well as horizontally deploying its original product development know-how to contracted development of other companies' products. The company differentiates itself from competitors that only do either of these or companies that can only do one. In addition to the sale of products, the company offers services for solving corporate issues, linking dots (products) with lines, to offer comprehensive services.

(From the company’s briefing material for individual investors)

[Robust customer base]

The clients of CREO include top enterprises in various fields. The major clients in the Solutions Service Business include Seibu Holdings, SoftBank, Saizeriya, Tokyu Railways, companies affiliated with Toyota, Sammy Networks, Chateraise, Aioi Nissay Dowa, Ritsumeikan University, and Doshisha University. The major clients in the Contracted Development Business include the Fujitsu Group, the Amano Group, and Yamato System Development. The major clients in the System Operations and Service Business include Yahoo!, GYAO!, ValueCommerce, and Senshu University. The major clients in the Support Services Business include Fujitsu Fsas, NEC Group, Lenovo Japan, and en Japan. CREO was founded in 1974, and has been making transactions with Fujitsu, NEC, SoftBank, Saizeriya, Nishikawa Sangyo, and Ito-pan for many years since the 1990s or earlier.

1-1. Business segments

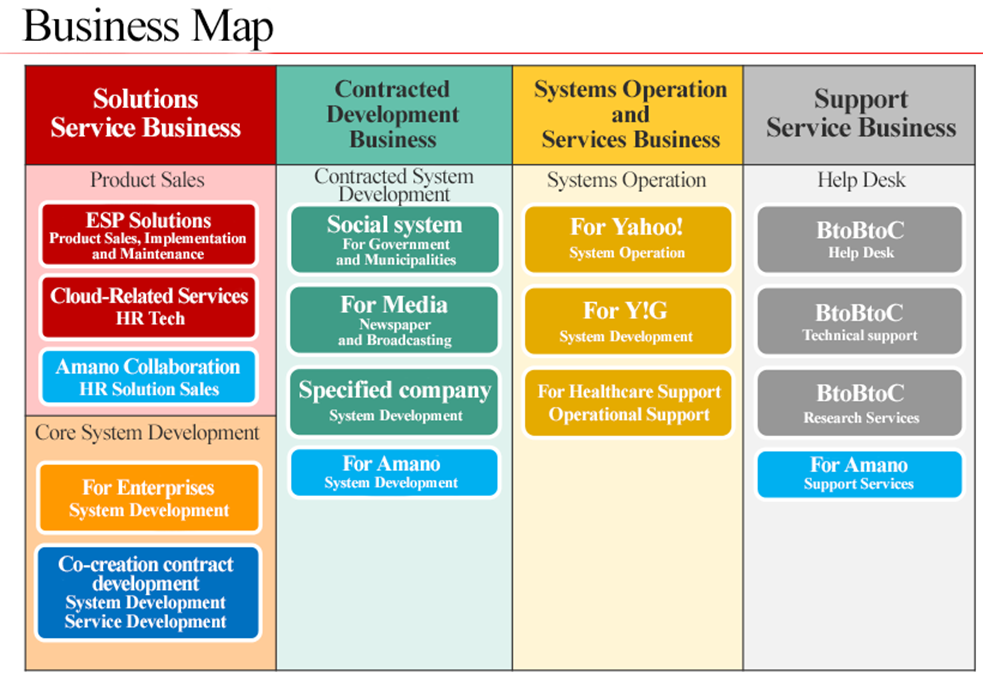

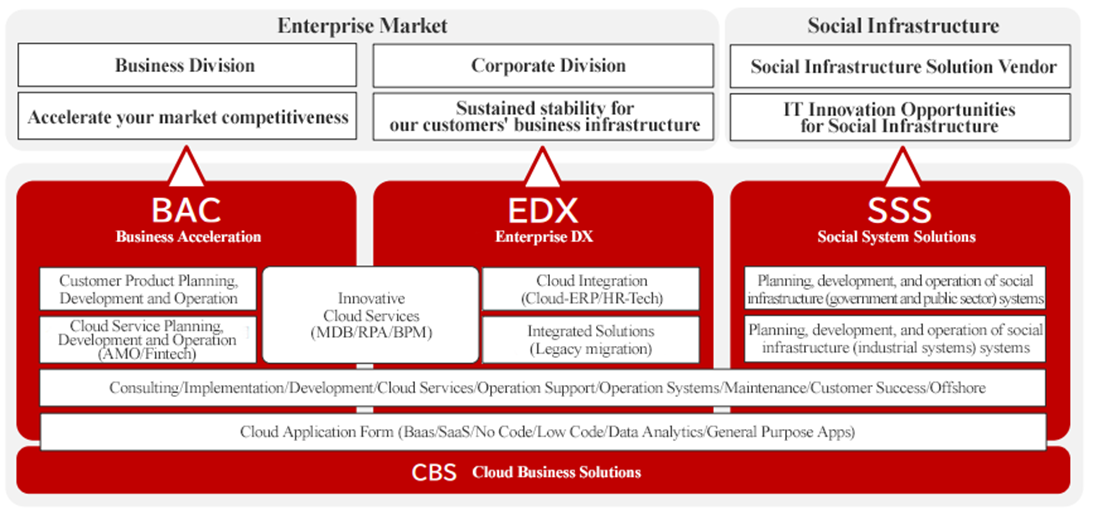

The company changed its organizational structure in April 2021 from a company system to a business department system. As a result, in the fiscal year ended March 2021, the Solution Service Company, West Japan Company, and Next Solution Company were restructured into Enterprise Digital Transformation Dept., Business Acceleration Dept., Business Strategy Dept., and Social System Dept. There are no changes to the four reporting segments, which are the disclosure segments.

Solutions Service Business (accounting for 30.7% of total sales in the fiscal year ended March 2023)

The company offers and customizes package software such as “ZeeM Series,” an ERP for human resources, payroll, accounting, and asset management used by over 2,000 companies, and “BIZ PLATFORM,” a BPM that contributes to the streamlining of business operation and cost reduction, develops software and cloud services provided by client companies to corporate clients and consumers (as development is carried out together with client companies, the business is called “co-creation contracted business” or “co-creation development” within the company), the RPA solution for actualizing business processes that use manpower and robots by combining the know-how of ERP and BPM and the robotic process automation (RPA) technology for automating the routine tasks of white-collar workers, and so on.

In recent years, the company has succeeded in capturing demand related to Work Style Reform by linking “ZeeM,” a software package for human resource and payroll, and “TimePro,” an attendance management solution of Amano Corporation, and the scale of the projects has been growing.

Business entities in charge: Enterprise Digital Transformation Dept., Business Acceleration Dept. (since the fiscal year ending March 2022)

Contracted Development Business (accounting for 21.1% of total sales in the fiscal year ended March 2023)

The company undertakes the development of systems for large companies, governmental offices, and municipalities, typesetting systems for newspaper publishers, odds systems for professional sports organized by the government, etc., which require reliability and experience. As a characteristic, the transactions made via Fujitsu are dominant, and so stable growth can be expected, although there are some short-term fluctuations. It is essential to secure “manpower,” including subcontractors. Business entities in charge: Social System Dept.

In addition, Business Strategy Dept., which was newly established in the fiscal year ending March 2022, is a joint department of the Solutions Service Business and the Contracted Development Business.

Systems Operation and Services Business (accounting for 17.6% of total sales in the fiscal year ended March 2023)

The company offers operation services, including the development, maintenance, and anti-hacking operation of server systems for portal sites and web services, to mainly the leading Japanese portal-site operator and its group companies. Previously, this business was operated by several group companies under the holding company, but they were integrated into CoCoTo Co., Ltd., which was established in Apr. 2016. This way, it became possible to exert the capability of the corporate group in marketing and development, and the company is making transactions with the group companies of portal-site operator. The company plans to boost sales from portal-site operator and approach its group companies, to expand its business.

Business entities in charge: CoCoTo Co. Ltd

Support Services Business (accounting for 30.6% of total sales in the fiscal year ended March 2023)

The company offers support services, including help desk and technical support services, and call-center services (making and receiving calls), including election exit polls, social surveys, and market research. A strength of this business is that the company offers technical services to loyal clients, including those related to Fujitsu and NEC, with a good balance. This business can be expected to grow stably, but it is necessary to secure “human resources.” Accordingly, the company makes efforts to recruit foreign workers, too.

Business entities in charge: Brigh-E Co., Ltd. (the corporate name changed from the fiscal year ending March 2022 due to a merger), and Adams Communication Co., Ltd.

(From the company’s briefing material for individual investors)

(From the company’s briefing material for individual investors)

1-2. Mid-term Management Plan (FY 3/21 to FY 3/23)

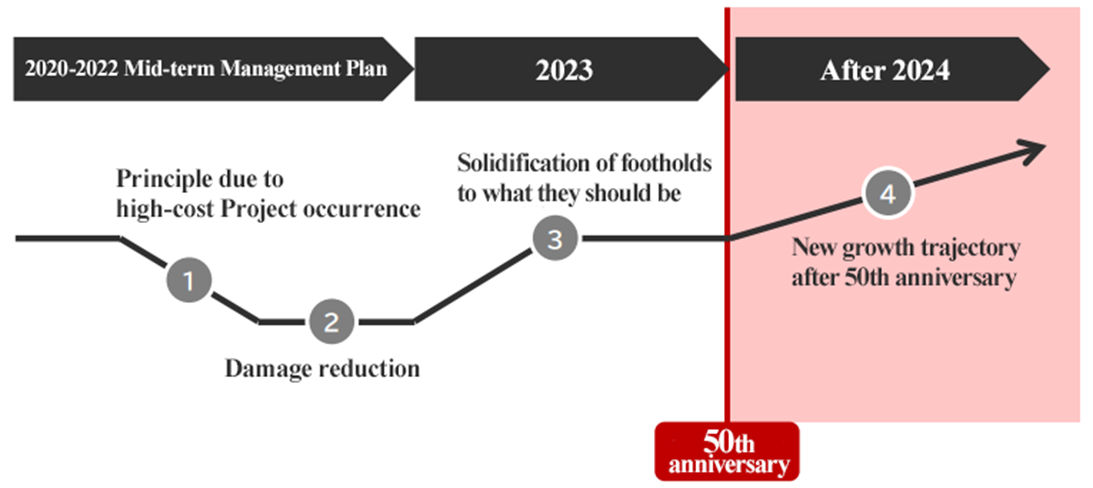

In the fiscal year ended March 2023, the company completed its medium-term management plan for the fiscal year ended March 2021 to the fiscal year ended March 2023, but it has postponed the formulation of a new medium-term management plan for the fiscal year ending March 2024 to the fiscal year ending March 2026. This is because the company will celebrate its 50th anniversary on March 22, 2024, and will take a year to solidify its foothold and announce a new medium/long-term management policy next year, for the next stage of its growth. The company plans to maintain its current dividend policy with a "payout ratio of 40%."

(From the financial results briefing material for the fiscal year ended March 2023)

1-3 Initiatives for sustainability and ESG

【Human Capital and Sustainability Initiatives】

The company has identified six material issues based on the sustainability policies: "Contribute to the settlement of social issues through business activities," "Work toward sustainable harmony between the environment and the economy," and "Aim to develop a management foundation that can flexibly respond to change." In addition, the company has initiated efforts to achieve zero carbon emissions as part of its initiatives for the "Environment."

Field | Major Issues and Initiatives | |

Environment | → Preparing for calculation and visualization of GHG emissions | ◆Collaborating with each stakeholder Co-creating value that mutually enhances attractiveness |

Social Capital | ◆Providing safe and convenient social infrastructure → Providing solutions for social infrastructure and corporate activities | |

Human Capital | ◆Initiatives to achieve well-being → Supporting sustainable lifestyles for employees | |

Business Model and Innovation | ◆Creating new industries through DX ◆Developing new business models through digital technology → Pursuing value creation using IT and digital technology in a new era | |

Leadership and Governance | ◆Enhancing Corporate Governance → Creating a transparent governance structure | |

(From the financial results briefing material for the fiscal year ended March 2023)

【Sustainability data】

Data | FY3/21 | FY3/22 | FY3/23 |

Number of employees | 1,220 | 1,224 | 1,241 |

Number of non-permanent employees | 99 | 103 | 192 |

Training costs per employee | 59,085 | 55,443 | 60,906 |

Employee turnover rate | 8.1% | 8.2% | 9.5% |

Ratio of female employees | 28.9% | 29.5% | 36.2% |

Ratio of female managers | 6.4% | 7.6% | 8.0% |

Ratio of female hired by new graduates | 38.8% | 54.9% | 45.7% |

Ratio of employees with disabilities | 1.64% | 1.65% | 1.42% |

Ratio of mid-career hires | 44.7% | 23.4% | 37.4% |

Ratio of non-Japanese employees | 0.92% | 1.33% | 0.93% |

(From the company’s website)

【Efforts to Improve Corporate Governance】

The company was listed on the Standard Market on April 4, 2022. Amid the demand for tighter governance, the company is strengthening its governance to enhance its corporate value. Of all the principles required by the Corporate Governance Code, the sufficiency rate of our company at the moment is 95.1%, showing a significant improvement of 27.2 points from the level prior to the market change in April 2022.

Status of Compliance with Corporate Governance Code | |||

Before the market change in April 2022 | Total: 78 Principles | Sufficiency of the company: 53 Principles | Sufficiency rate: 67.9% |

After the market change in April 2022 | Total: 83 Principles | Sufficiency of the company: 79 Principles | Sufficiency rate: 95.1% |

2. Fiscal Year ended March 2023 Earnings Results

2-1. Consolidated earnings results for the Fiscal Year ended March 2023

| FY 3/22 | Ratio to sales | FY 3/23 | Ratio to sales | YoY |

Sales | 14,784 | 100.0% | 14,689 | 100.0% | -0.6% |

Gross Profit | 3,406 | 23.0% | 3,248 | 22.1% | -4.6% |

SG & A | 2,345 | 15.9% | 2,344 | 16.0% | -0.0% |

Operating Income | 1,060 | 7.2% | 904 | 6.2% | -14.7% |

Ordinary Income | 1,107 | 7.5% | 911 | 6.2% | -17.7% |

Profit attributable to owners of parent | 657 | 4.4% | 487 | 3.3% | -25.9% |

*Unit: Million yen

* The figures include the figures calculated by Investment Bridge Co., Ltd. as reference values and may differ from the actual figures. The same applies below.

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

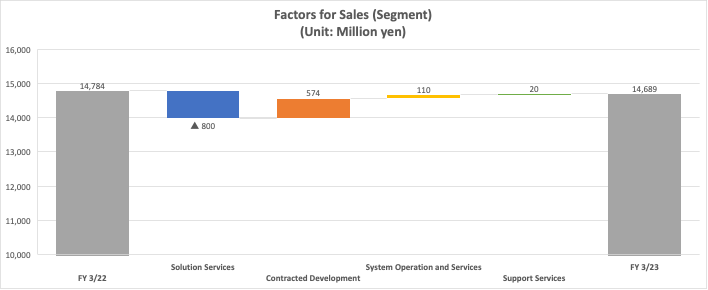

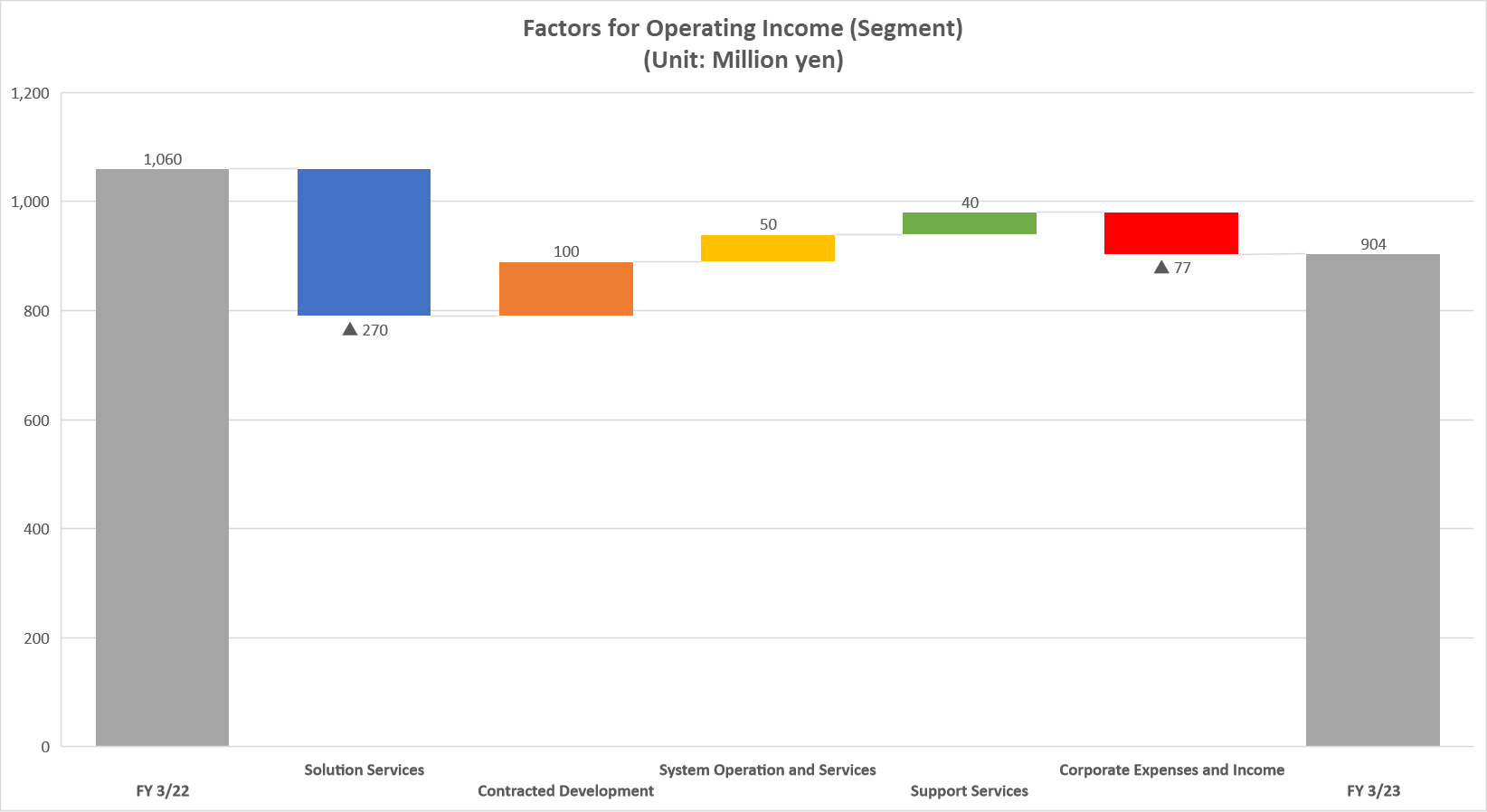

*▲ represents a rise in expenses.

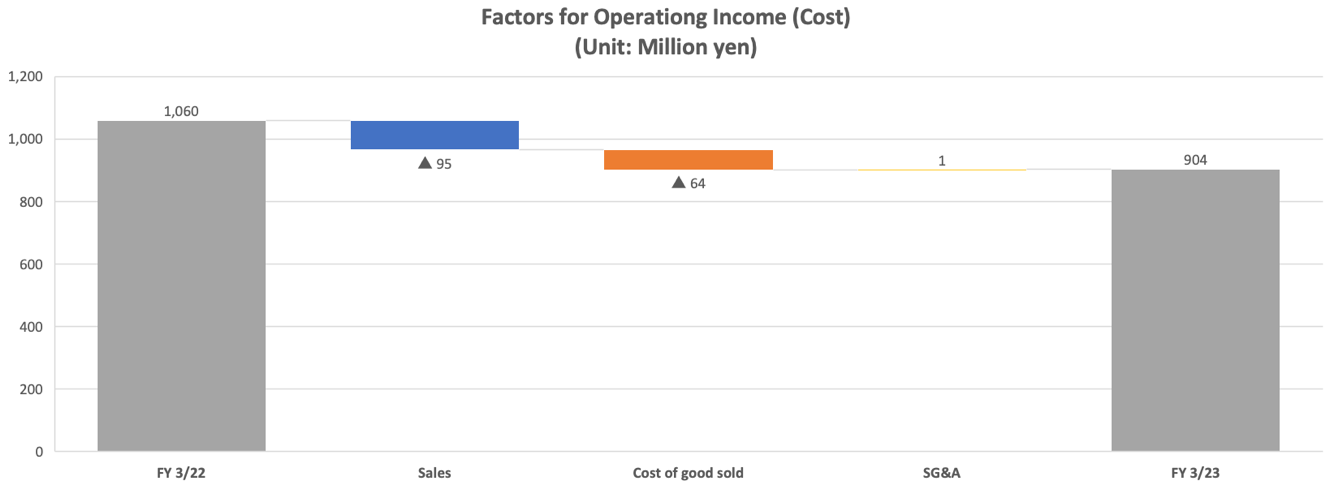

Sales decreased 0.6% year on year, and operating income dropped 14.7% year on year.

Sales declined 0.6% year on year to 14,689 million yen, and operating income fell 14.7% to 904 million yen. The ICT services market, in which the corporate group operates business, continued to see strong demand from client companies amid changing workstyles in society. Despite this environment, the Solution Services business recorded lower sales and profit year on year due to lost opportunities in projects with strategic orders and higher costs. On the other hand, all other segments saw year-on-year increases in both sales and profit.

Gross profit margin was 22.1%, down 0.9 points from the previous term. SG&A expenses were largely unchanged from the previous term, and the ratio of SG&A to net sales rose 0.1 points year on year to 16.0%, while operating profit margin declined 1.0 point year on year to 6.2%. Other factors, including a decrease in subsidiary income, caused ordinary income to decline 17.7% year on year, which exceeded the rate of decline of operating income. Profit attributable to owners of parent declined 25.9% year on year due to an increase in total income taxes, despite a decrease in office relocation expenses and software valuation losses.

2-2. Trends in each segment

Sales and operating income for each segment

| FY 3/22 | Ratio to sales・Profit margin | FY 3/23 | Ratio to sales・Profit margin | YoY |

Solutions Services | 5,306 | 35.9% | 4,506 | 30.7% | -15.1% |

Contracted Development | 2,518 | 17.0% | 3,093 | 21.1% | +22.8% |

Systems Operation and Services | 2,479 | 16.8% | 2,590 | 17.6% | +4.5% |

Support Services | 4,478 | 30.3% | 4,499 | 30.6% | +0.5% |

Consolidated sales | 14,784 | 100.00% | 14,689 | 100.00% | -0.6% |

Solutions Service | 780 | 14.7% | 510 | 11.3% | -34.6% |

Contracted Development | 467 | 18.5% | 567 | 18.4% | +21.6% |

Systems Operation and Services | 325 | 13.1% | 375 | 14.5% | +15.5% |

Support Services | 351 | 7.8% | 391 | 8.7% | +11.6% |

Head Office Expenses and Income | -863 | - | -940 | - | - |

Consolidated Operating Income | 1,060 | 7.2% | 904 | 6.2% | -14.7% |

* For two businesses other than the "System Operation and Services business" and the "Support Services business" operated by consolidated subsidiaries, no allocation of head office expenses, etc., is made when calculating operating income.

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

Solutions Service Business

◎It mainly offers solutions and services, including “ZeeM,” a solution for personnel affairs, salaries, and accounting.

Sales were 4,506 million yen (down 15.1% year on year), and operating income was 510 million yen (down 34.6% year on year). The high cost of projects with strategic orders resulted in the increase in development costs and lost opportunities for personnel as the projects concluded, and the cloud shift from a license format to a usage fee format accelerated in product services. As a result, sales declined 800 million yen year on year and operating income decreased 270 million yen year on year. Segment profit margin declined 3.4 points year on year.

Contracted Development Business

◎The company mainly undertakes system development for major companies such as the Fujitsu Group and Amano Corporation.

Sales were 3,093 million yen (up 22.8% year on year), and operating income was 567 million yen (up 21.6% year on year). Sales increased 574 million yen year on year and operating income rose 100 million yen year on year, mainly due to the healthy increase of projects for major clients. Profit increased due to improved personnel adjustments, and the company was also successful with major system integration projects due to specializing in areas in which it excelled. Segment profit margin declined 0.1 points year on year.

System Operations and Service Business

◎The company mainly provides system development, maintenance, and operation services to major domestic portal site operators.

Sales were 2,590 million yen (up 4.5% year on year), and operating income was 375 million yen (up 15.5% year on year). Sales increased 110 million yen year on year and operating income grew 50 million yen, mainly due to increased orders from major clients. In addition to the expansion of the major portal site business in Japan, higher unit prices also contributed to the increase. In addition, there were continued orders for medical services from the second half of the fiscal year ended March 2022. Segment profit margin rose 1.4 points year on year.

Support Services Business

◎The company mainly provides support and services centered on help desks and technical support and call center services for purposes, such as social research and market research.

Sales were 4,499 million yen (up 0.5% year on year), and operating income was 391 million yen (up 11.6% year on year). Sales increased 20 million yen year on year and operating income rose 40 million yen year on year, mainly due to an increase in orders received through cooperation among group companies. While the research service was scaled back, help desk and technical support services, which are the mainstay, remained strong. Segment profit margin rose 0.9 points year on year.

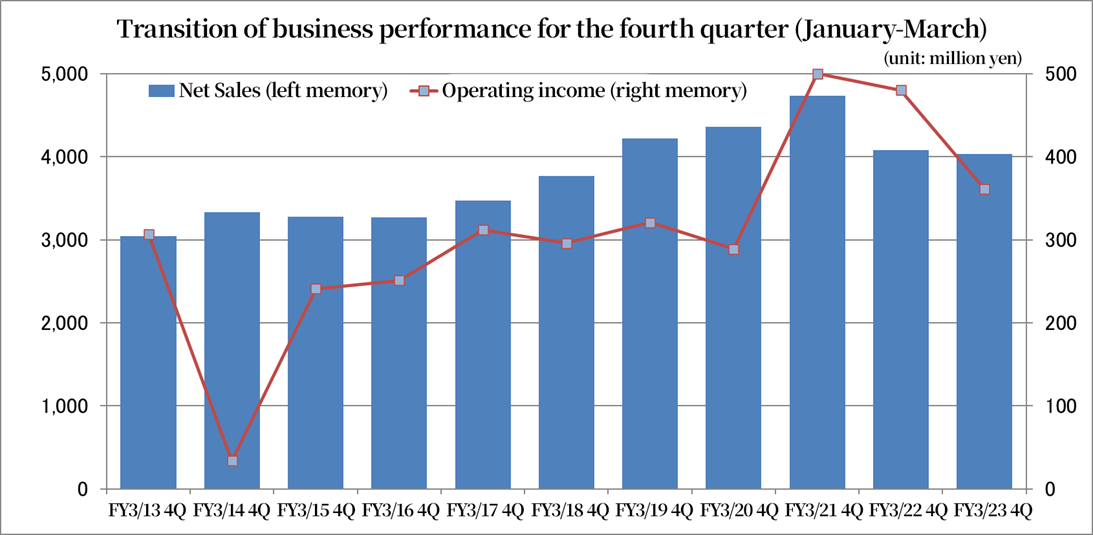

2-3. Variations in quarterly results

Transition of Consolidated Net Sales and Operating Income for the fourth Quarter (Jan-Mar)

In the fourth quarter of FY 3/23 (Jan-Mar), sales and profits declined YoY, but sales and operating income were higher level than in the past.

2-4. Financial Position and Cash Flows

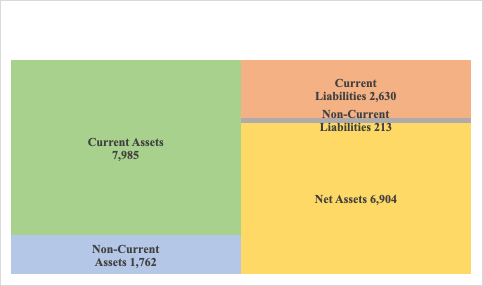

| Mar. 2022 | Mar. 2023 |

| Mar. 2022 | Mar. 2023 |

Cash | 4,317 | 3,910 | Accounts payable | 668 | 608 |

Receivables | 3,228 | 3,567 | Reserves for bonuses | 556 | 598 |

Inventories | 272 | 306 | Current Liabilities | 2,575 | 2,630 |

Current Assets | 8,017 | 7,985 | Non-current Liabilities | 204 | 213 |

Tangible Assets | 295 | 267 | Liabilities | 2,780 | 2,844 |

Intangible Assets | 695 | 722 | Net Assets | 6,997 | 6,904 |

Investments and Others | 767 | 773 | Total Liabilities and Net Assets | 9,777 | 9,748 |

Non-current Assets | 1,759 | 1,762 | Total Debt with Interest | 0 | 0 |

*Unit: Million yen

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

The total assets as of the end of March 2023 stood at 9,748 million yen, down 29 million yen from the end of the previous term. In the assets side, receivables, temporary account for software, investment securities, etc. increased, but cash & deposits, software in progress, etc. decreased. In the side of liabilities and net assets, other account payable, provision for loss from projects, retained earnings, etc. increased, however, not only trade account payable and income taxes payable decreased, but also the acquisition of treasury shares affected the performance. The liquidity of assets is high, as current assets account for 81.9% of total assets. Capital-to-asset ratio was as high as 70.8%.

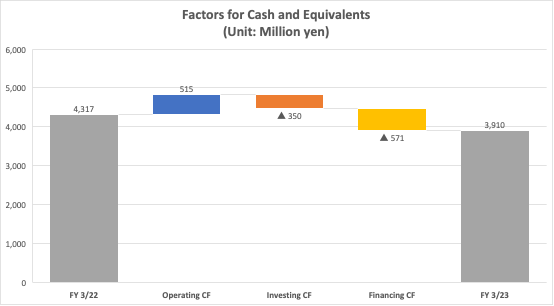

Cash Flows

| FY3/22 | FY 3/23 | YoY | |

Operating cash flow | 1,110 | 515 | -595 | -53.6% |

Investing cash flow | -389 | -350 | 39 | - |

Free Cash flow | 721 | 165 | -556 | -77.1% |

Financing cash flow | -330 | -571 | -241 | - |

Cash and Equivalents at the end of term | 4,317 | 3,910 | -407 | -9.4% |

*Unit: Million yen

*Produced by Investment Bridge Co., Ltd. with reference to the material of the company.

In terms of cash flows, the cash inflow from operating activities shrank due to the drop in decreases in profit before taxes and other adjustments, the augmentation of accounts receivable, contract assets, payments of income taxes, etc. Although, the cash outflow from investing activities decreased through the expenditure for acquiring intangible asset, etc., the surplus of free cash flow also shrank due to the above-mentioned shrank of the cash inflow from operating activities. The cash outflow from financing activities expanded, due to the expenditure for acquiring treasury shares, the augmentation of dividend payments, etc. Consequently, the cash position as of the end of March 2023 was down 9.4% from the previous term.

2-5. Topics

April 4, 2022 | Listed on the Standard Market |

May 10, 2022 | Share buyback (up to 250,000 shares repurchased / repurchase completed on July 21) |

May 10, 2022 | Capital alliance with Individual Systems Co., Ltd. (offshore collaboration) |

May 24, 2022 | Signed "Basic Agreement on Industry-Academia Collaboration" with Shiga University (data scientist training) |

March 14, 2023 | Recognized by the Ministry of Economy, Trade and Industry as a “Corporation with Excellent Health-oriented Management 2023” |

(From the financial results briefing material for the fiscal year ended March 2023)

3. Fiscal Year ending March 2024 Earnings Forecasts

3-1. Consolidated earnings forecasts for Fiscal Year ending March 2024

| FY3/23 | Ratio to sales | FY3/24 Est. | Ratio to sales | YoY |

Sales | 14,689 | 100.0% | 15,000 | 100.0% | +2.1% |

Operating Income | 904 | 6.2% | 1,070 | 7.1% | +18.3% |

Ordinary Income | 911 | 6.2% | 1,080 | 7.2% | +18.5% |

Profit attributable to owners of parent | 487 | 3.3% | 720 | 4.8% | +47.8% |

*Unit: Million yen

Sales are expected to grow 2.1% and operating income is projected to rise 18.3% year on year.

For the fiscal year ending March 2024, the company is expecting a 2.1% year-on-year increase in sales to 15,000 million yen and an 18.3% year-on-year increase in operating income to 1,070 million yen.

Although the outlook for the global and domestic economies is becoming increasingly uncertain due to soaring raw material prices and global inflationary trends, the company will continue to promote the management of resources and capital through the use of ICT and adapt to cloud computing technologies, etc. in the ICT services market, in which the company operates business, specifically in the area of management of corporate resource and human capital management. The company expects to increase its investment in the expansion of its management base necessary for the digital society in the future. The company intends to build a new business model and provide services for the new normal.

Under these circumstances, a recovery in the Solution Services business is expected to contribute to higher sales and profit, once the impact of opportunity losses from strategic orders and cost increases, which affected the company in the fiscal year ended March 2023, has subsided. The contracted development business is also expected to continue its trend of higher sales and profits due to steady growth in projects for major clients. In addition, operating profit margin is expected to improve 0.9 points year on year to 7.1%, mainly due to an improvement in project profit margin.

The company plans to pay a dividend of 40 yen per share, like in the previous year. The company intends to maintain its dividend payout ratio target of 40%.

Sales and operating income for each segment of FY 3/24 (Company’s plan)

| FY3/23 Act. | Ratio to sales・Profit margin | FY3/24 Est. | Ratio to sales・Profit margin | YoY |

Solutions Service | 4,506 | 30.7% | 4,720 | 31.5% | +4.7% |

Contracted Development | 3,093 | 21.1% | 3,130 | 20.9% | +1.1% |

Systems Operation and Services | 2,590 | 17.6% | 2,570 | 17.1% | -0.7% |

Support Services | 4,499 | 30.6% | 4,580 | 30.5% | +1.7% |

Consolidated sales | 14,689 | 100.00% | 15,000 | 100.00% | +2.1% |

Solutions Service | 510 | 11.3% | 715 | 15.1% | +40.1% |

Contracted Development | 567 | 18.3% | 600 | 19.2% | +5.6% |

Systems Operation and Services | 375 | 14.5% | 350 | 13.6% | -6.8% |

Support Services | 391 | 8.7% | 380 | 8.3% | -3.0% |

Head Office Expenses and Income | -940 | - | -975 | - | - |

Consolidated operating income | 904 | 6.2% | 1,070 | 7.1% | +18.3% |

3-2. Initiatives for business growth

The market environment for IT investment remains relatively favorable. The ERP market continues to see demand for renewal of old-fashioned ERPs, and there are signs of an increase in demand for cloud computing and ERP for data-driven management. In such an environment, the battle for hiring IT engineers is becoming more intense than ever, and the multiple subcontracting structure of system integrators may soon become unsustainable due to labor shortage, making it necessary to recruit and retain human resources that can survive in this era of rapid change.

The company will promote the following initiatives for growth in each of its business segments.

【Growing Businesses】

◎Solution Services Business

Market trends (Major clients’ trends) | The transition to the next generation model for public cloud for SMEs is expected to accelerate quickly after 2026, in conjunction with DX. |

Business model/service transformation | ◆Shift in demand from one-time purchase of licenses to monthly subscription ◆Service model renewal to adapt to the business model shift |

Maintenance and improvement of service quality | ◆Improving productivity through higher efficiency of installation work ◆Improving customer sales system → Higher customer satisfaction ◆Enhancing the product improvement functionality in line with the diversity of services |

Points to strengthen IT personnel development | ◆Development of personnel for installing products ◆Cloud personnel development ◆Offshore utilization |

【Stable Businesses】

◎Contracted Development Business

Market trends (Major clients’ trends) | IT investment trends in public offices and local governments are strong, with a 104% growth forecast for 2026 compared to 2021. |

Business model/service transformation | ◆Shifting product development resources while maintaining and expanding key customers ◆Undertaking more product service development projects for Amano Corporation |

Maintenance and improvement of service quality | ◆Improving project management ◆Specialization and differentiation of businesses and industries |

Points to strengthen IT personnel development | ◆Project manager training ◆Cloud personnel development |

◎System operation and services business

Market trends (Major clients’ trends) | "Line Yahoo Japan Corporation": Yahoo! Japan Corporation, Z Holdings Corporation and LINE Corporation will merge in October 2023. Selection and focus are expected to accelerate. |

Business model/service transformation | ◆Expanding the number of new customers by utilizing the skills and expertise cultivated in the operation centers ◆Utilizing the group's near-shore bases ◆Strategically investing in new businesses |

Maintenance and improvement of service quality | ◆Making efforts to gain new transactions by enhancing customer satisfaction amid the ongoing corporate mergers of clients |

Points to strengthen IT personnel development | ◆Enhancing the utilization of near-shore base (Karatsu) ◆Training technical personnel |

◎Support Service Business

Market trends (Major clients’ trends) | Spot demand boosted the market amid the COVID-19 pandemic, but the markets are expected to swing back from FY 2023 onward. |

Business model/service transformation | ◆Cultivating new business channels while maintaining high-quality customers ◆Increasing orders received and proficiency for cloud infrastructure-related projects |

Maintenance and improvement of service quality | ◆Learning trendy technologies and enhancing responsiveness to the upstream phase |

Points to strengthen IT personnel development | ◆Strengthening next generation personnel development (promoting organizational rejuvenation) |

3-3. Priority measures

◎ Growth Strategy

◆Expanding business through HR tech collaboration with Amano Corporation

◆Shifting resources to businesses with high potential and profitability

◆Creating cloud services

◆Strengthening initiatives for new businesses

◎ Sales Strategy

◆Securing an order receiving system by improving cooperation among group companies and external parties

◆Improving the quality of business negotiations by improving order risk management

◆Improving customer contact

◎ Organizational Strategy

◆Streamlining the organization by improving efficiency and controlling costs through organizational elimination and consolidation

◆Improving productivity and creativity by improving work comfort and job satisfaction and personnel training curriculum

◆Fostering engagement

3-4. Solution Map for Growing Businesses

(From the financial results briefing material for the fiscal year ended March 2023)

4. Conclusions

The company's results for the fiscal year ended March 2023 showed declines in both sales and profit, with a 0.6% decrease in sales and a 14.7% drop in operating income year on year. Although sales and profit increased in businesses other than the Solution Services segment which was a growing business, it affected the results by recording lower sales and profit year on year due to higher development costs at project closures and lost personnel opportunities for projects with strategic orders. Although it was unfortunate that the Solution Services business experienced high-cost projects for the second consecutive fiscal year, the high-cost projects that impacted the results for the fiscal year ended March 2023 have already been concluded, and the company expects the Solution Services business to lead the recovery and expand earnings moving forward. For the fiscal year ending March 2024, the company forecasts a 4.7% increase in sales and a 40.1% increase in operating income year on year in the Solution Services business. Considering the cost increases and opportunity losses incurred from high-cost projects over the past two years, it seems that this plan is conservative. We will pay close attention to the performance of the Solution Services segment to see how sales and profitability will recover in the future, while ensuring thorough project management.

In addition, the company has decided not to prepare a new medium-term management plan. This is because the company will celebrate its 50th anniversary on March 22, 2024, and will take a year to solidify its foothold and announce a new medium-to-long-term management policy for the next stage of growth next year. The company's growth strategy for the current fiscal year to establish a firm foothold is: (1) expanding business through the HR Tech collaboration with Amano Corporation, (2) shifting resources to businesses with high potential and profitability, (3) creating cloud services, and (4) improving initiatives in new businesses. We will pay close attention to the progress on this year's growth strategy, which will serve as a guidepost for the next mid-term management plan.

Furthermore, the company plans to launch a new DX solution in the future. These include "Toramiru," a cloud solution for purchasing process management, and a corporate performance management service that supports data-driven management. The sales of these new DX solutions will be closely watched with high expectations.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 6 directors, including 3 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎Corporate Governance Report: Updated on June 23, 2022

Basic policy Based on CREO Group’s corporate philosophy, the company fulfills the responsibilities to their stakeholders including shareholders, customers, employees, and business partners, with an honest and sincere attitude, and conducts highly transparent management. In accordance with the purpose of the Corporate Governance Code, we strive to achieve CREO Group’s sustainable growth and further improve its medium- and long-term corporate value by improving efficiency and transparency of business management, and by further strengthening the function to oversee business operations.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reason for not Following the Principles |

【Principle 1-2 (4) English translation of convocation notices, and the use of an electronic voting platform】 | Our company has not adopted the electronic exercise of voting rights or English translations of convocation notices because our company does not have a high proportion of institutional investors and overseas investors. If the proportion of institutional investors and overseas investors of our company exceeds 20%, we will consider whether or not to translate the convocation notices into English and whether to implement the electronic exercise of voting rights, taking into consideration the costs and other factors. |

【Principle 4-8 Effective use of independent outside directors】 | Our company has appointed one independent outside director with affluent experience and broad knowledge who is fully independent from our company’s major shareholders. The independent outside director sufficiently fulfills the roles and responsibilities required by the Board of Director, however, our company continues to discuss establishing a proper structure, including increasing the number of independent outside directors according to the needs, to further strengthen the governance structure in the future. |

【Supplementary Principle 4-10 (1) Establishment of a discretionary advisory committee】 | Currently, our company does not have an independent Nomination Advisory Committee or a Remuneration Committee, however, we will continue to discuss establishing a Nomination Advisory Committee and a Remuneration Committee under the Board of Directors, which primarily consists of independent outside directors, in order to strengthen the independence, objectivity, and accountability of the Board of Director’s functions related to nominations of senior executives and director (including succession planning) and remuneration. |

【Principle 5-2 Formulation and publication of management strategy and management plan】 | Our company has disclosed their goals for consolidated net sales, consolidated operating income, and consolidated operating margin in the three-year medium-term management plan, which ends in the fiscal year ending March 31, 2023, however, after taking into consideration the change in the market environment and the progress of the medium-term management plan, our company will consider the review of the business structure and allocation of management resources based on the cost of capital. In terms of investment, our company considers investment in human capital is the most important, and strives to strengthen recruitment and enhance the development of human assets through training and other means. In addition, our company considers the appropriate allocation of management resources by taking into account the risks associate with investment in facilities, research and development, and other investment, and examining whether or not such investment is consistent with the companywide business strategy. |

<The main principles of disclosure>

Principles | Disclosure Contents |

【Principle 2-4 (1) Ensuring diversity in appointment of core personnel, etc.】 | Our company regards human assets are the most important asset, endeavors to support the human resources so that a wide array of human assets can flourish in the medium/long term, and appoint management positions based on comprehensive consideration of their abilities and qualification regardless of gender, nationality, whether they are mid-career hires or recruitment of new graduates. With regard to foreign nationals and mid-career hires, our company hires personnel for positions required for its business strategy based on their experience, ability, etc., regardless of nationality, and recognizes that we are not in a situation to set goals specifically for promotion to management positions. Regarding female managers, the “ratio of female managers” was 6.9% as of FY 2021, however, our company is aiming to increase it to 10% or higher in the future. Our company will continue to actively appoint human assets who will contribute to the enhancement of corporate value in a broad range of areas, regardless of their nationality, or whether they are mid-career hires or new graduates. |

【Principle 3-1 Enhancement of information disclosure】 | (i) Our company’s goals (management philosophy, etc.), management strategies, and the management plan are posted on our company’s website (https://www.creo.co.jp/). Management Philosophy and the Code of Conduct https://www.creo.co.jp/corporate/concept/ The Medium-Term Business Plan (FY 2020-FY 2022) https://www.creo.co.jp/news/p20200521-6/ (ii) Basic approach and basic policy on corporate governance based on the respective principles in this code Our company’s basic policy on corporate governance is described in “I. 1. Basic Approach” of this report. (iii) Policies and procedures for the Board of Directors to determine remuneration for senior executives and directors Policies and procedures in determining remuneration for our company’s directors are posted in “II. 1. 【Remuneration for Directors】 Disclosure Contents of Policies for Determining the Amount of Remuneration or the Calculation Method” of this report. (iv) Policies and procedures for the Board of Directors’ election and dismissal of senior executives and nomination of candidates for directors and corporate auditors In electing and removing senior executives and nominating candidates for directors and corporate auditors, our company’s policy is to consider the balance and diversity of knowledge, experience, and abilities, taking into consideration the expertise, diverse experience, and advanced skills in the respective field required to supervise business execution and make important decisions. Based on this policy, candidates for directors are determined by the Board of Directors, and candidates for corporate auditors are resolved by the Board of Directors after obtaining the consent of the Board of Corporate Auditors. In the event of misconduct or serious violation of laws and regulations, or the Articles of Incorporation, in the execution of duties by a director, the Board of Directors will deliberate and decide on the dismissal or other disciplinary action of such director, or the submission of a proposal for dismissal to the General Meeting of Shareholders. (v) Explanation of individual election, dismissal, and nomination The reason for election and dismissal of individual directors is disclosed in the reference documents for the General Meeting of Shareholders. |

【Supplementary Principle 3-1 (3) Sustainability initiatives】 | Our company has organized sustainability policies and information on ESG since 2021 to identify important issues (materiality) that should be prioritized in the business management, and linked them to the services and activities we provide. Moving forward, our company will promote initiatives such as setting specific goals through analysis of each service and activity, as well as strengthening their governance structure. Regarding investment in human capital, our company has been working on strengthening recruitment and developing human assets through training and other programs. In addition, our company strives to make appropriate investment by examining the risks associated with investment in facilities, research and development, and other investment, to ensure that they are in line with the corporate business strategy. The latest information will be disclosed on the following website. Sustainability Policies and ESG Information Website |

【Principle 5-1 Policy on constructive communication with shareholders】 | Our company has established a basic policy on the development of systems and initiatives to promote constructive dialogue with shareholders from a viewpoint of ensuring appropriate information disclosure and transparency, to the extent and by the methods deemed appropriate by our company, and will engage in constructive dialogue with shareholders. To achieve this, our company will carry out the following steps. (1) For overall dialogue with shareholders, the executives of the Administrative Division will be responsible for the enhancement of contents and opportunities through various initiatives including financial results briefings. (2) The department responsible for IR that supports dialogue will actively engage in IR activities to enhance dialogue with shareholders by coordinating with relevant departments that have detailed information according to the IR activities, including adequately exchanging information in advance with these departments. (3) Our company will actively promote the provision of information on its business and strategies, etc., by holding or participating in Financial Results Briefings and other investor meetings as necessary. (4) An executive in charge will deliver feedback to the management meeting and the Board of Directors on opinions, requests, etc. obtained from shareholders and other stakeholders through IR activities. (5) With regard to insider information, our company pursues thorough information management in accordance with the internal insider regulations. (6) Upon holding dialogue with shareholders and investors, our company strictly follows the Fair Disclosure Rules to avoid any selective disclosure of critical information to any specific persons, and ensures thorough management of critical information. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |