| MORITO CO., LTD. (9837) |

|

||||||||

Company |

MORITO CO., LTD. |

||

Code No. |

9837 |

||

Exchange |

2nd section of Tokyo Stock Exchange |

||

President |

Takaki Ichitsubo |

||

Address |

4-2-4 Minami-honmachi, Chuo-ku, Osaka |

||

Business |

Wholesale of clothing materials, automobile interior parts, camera materials, etc. Planning and manufacturing of products. Production in China. Worldwide sales channels. |

||

Year-end |

Last day of November |

||

URL |

|||

*The share price means the closing price on Jan. 22. No. of shares issued taken from the latest brief financial report. (No. of treasury shares excluded.). ROE and BPS are the values as of the end of the previous term.

|

||||||||||||||||||||||||

|

|

*The values for the term ended Nov. 2014 were estimated by the company.

*The 2-for-1 share split was conducted on Jul. 1, 2014. We will briefly report the financial results for the term ending November 2016 and introduce the Seventh Mid-Term Management Plan, etc. of Morito Co., Ltd., which was listed in the second section of Tokyo Stock Exchange. |

|

| Key Points |

|

| Company Overview |

1.Founding Principle

The principle "Active and Steadfast" represents the spirit of Morito that has been fostered since its inauguration, and implies that "Success is ensured by proactively making a judgment and taking action." The backbone of Morita's business is the spirit of the founder Jukichi Morito: "To win over your competitors, you always need to come up with an innovative surprise. Always seek for new ideas while doing business."

Active and Steadfast 2.Management Philosophy

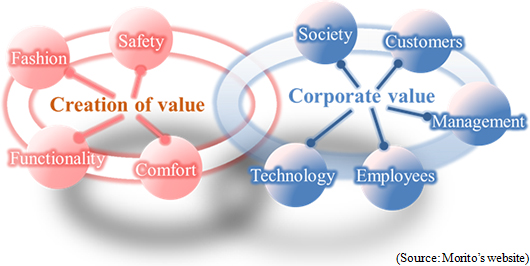

(1) To supply a variety of parts to the entire world, and pursue the development of a limitless market beyond genres.To connect with you via our parts, for the future (2) To give shape to customers' needs, and produce genuine items that would enrich people's lives. (3) To exert the ability to create value from the comprehensive perspective, including fashion, functionality, comfort, and safety, and create a future with all stakeholders.  3.Management Vision

Actualization of the new Morito Group that can create existence value 4.Principles of Corporate Activities  In both businesses, the company conducts the entire process of planning, development, manufacturing, distribution, and sale of products, according to markets and customers' needs, while considering fashion, functionality, comfort, safety, etc. The segments to be reported are the three segments: Japan, Asia, and Europe & the U.S.  Morito makes direct transactions with Fast Retailing, GAP, etc. Outside Japan, the popularity of Morito is high, and the company has been carrying out business with GAP, H&M, and ZARA for as long as 10 to 20 years.   As for the composition of sales, the transportation equipment business accounts for about 20%, the business of video equipment materials, including peripheral devices for PCs, makes up about 60%, and the foot-care business about 20%. As for the transportation equipment business, the automobile-related business accounts for about 90%. Toyota-related clients occupy 50% of them, Nissan-related ones 30%, and Honda-related ones 10%. As for the business of video equipment materials, the products for Canon account for 35%, and those for Nikon make up 30%. Other clients include Olympus and Kyocera. (1) Stable business performance

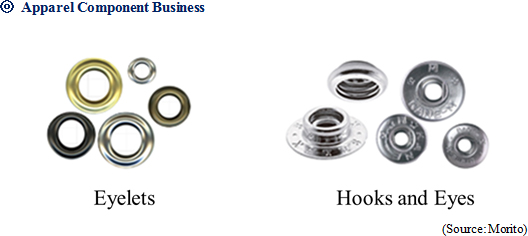

As described in the section of corporate history, Morito has been operating apparel component business since its inception, by handling eyelets, hooks and eyes, hook-and-loop fasteners®, etc. The company increased the purposes of use of general-purpose materials, and launched the product business, whose business scale is now nearly equal to that of the apparel component business. This business portfolio stabilizes the performance of Morito. The company has never fallen into the red, even during the two postwar oil shocks and the global economic crisis in the wake of the bankruptcy of Lehman Brothers. (2) High shares with a wide array of products

The company has high market share for various products, as tabulated below. Although some enterprises in emerging countries supply products at lower prices than Morito, Morito won the trust of clients with its capabilities of dealing with all processes, including planning, development, manufacturing, and distribution, and coping with various situations appropriately, and the quality of its products, including safety, which had been developed through its long history, achieving high market share. For example, Morito gives appropriate technical advice from the stage of producing samples for clients, repeatedly fine-tunes coloration to meet the needs of clients, and keeps checking products after the start of full-scale production. Namely, the company not merely sells products, but clears many hurdles before starting transactions, and provides clients with a system for all processes from upstream to downstream ones. The provision of such added value is highly evaluated by clients, mainly the famous brands outside Japan.   (3) Global Network

Planning and development are conducted mainly in Japan. The company owns many production and distribution facilities in Europe; North, Central, and South Americas; Asia-Pacific region, and Africa.

If this progresses as planed and its global network is fortified, the competitive advantage of the company will be enhanced further. In addition to the above three items, its unique positioning, too, can be said to characterize Morito. When considering just one among Morito's many products, there are always some competitors, but Morito is the only one company in the world that handles such a variety of products, deals with all processes, including planning, development, manufacturing, distribution, and sale, and has sales exceeding 30 billion yen.  In the Seventh Mid-Term Management Plan, a target value is not specified, but the company will keep efforts to increase ROE. The improvements in margin and asset efficiency will be essential. |

| Fiscal Year November 2015 Earnings Results |

Double-digit increases in sales and profit partly thanks to the contribution of Scovill

Sales were 43,293 million yen, up 20.7% from the previous term. The increase in sales was slight in Japan, but Scovill, which was obtained through M&A, contributed to the good performance in Asia, Europe, and the U.S. Operating income was 1,721 million yen, up 20.4% from the previous term. SG&A expenses augmented 20% due to the reorganization of Scovill and Matex into subsidiaries, but the growth of sales offset this augmentation. Since exchange gain decreased 111 million yen, the growth rate of ordinary income was low at single-digit levels. As the Chinese automobile interior parts factory run by a joint venture (Morito's ownership ratio: 51%) was transferred, a loss on liquidation of affiliated companies amounting to 458 million yen was recorded as an extraordinary loss, but there were the gains from the sale of noncurrent assets and investment securities amounting to 337 million yen and 699 million yen, respectively. Consequently, net income rose 12.7% from the previous term.  ◎ Japan

Sales grew 3.5% while profit declined 1.5% from the previous term. <Business related to clothing accessories> The sales of accessories for major mass retailers and sports apparel manufacturers in Japan, Europe, and the U.S. increased. <Business related to the materials for consumer goods> The sales of the accessories for stationery and teaching materials, including school bags, the OEM products of camera accessories, and shoes grew. ◎ Asia

Sales and profit grew 37.5% and 25.6%, respectively, from the previous term.<Business related to clothing materials> The sales toward European and U.S. manufacturers of babies' wear and casual outer clothes manufacturers in Hong Kong increased, and the performance for the needlework of sports shoes was healthy. <Business related to the materials for consumer goods> The sales of camera accessories in Hong Kong and Thailand, and the automobile interior parts for Japanese automobile manufacturers in Shanghai increased. The results of Scovill in Hong Kong and India have been newly included in consolidated results (Sales: 1.7 billion yen). ◎ Europe and the U.S.

Sales and profit grew 168.7% and 150.5%, respectively, from the previous term.<Business related to clothing accessories> The sales of medical clothing accessories in Europe and the U.S. grew, and the sales of the accessories for working wear in Europe increased. <Business related to the materials for consumer goods> The sales of automobile interior parts toward Japanese automobile manufacturers in the U.S. grew. In Europe, the sales of automobile interior parts toward European automobile manufacturers and camera accessories increased. The results of SCOVILL in the U.S. and the U.K. have been newly included in consolidated results. (Sales: 3.9 billion yen)  Due to the increase in corporate tax payable, etc., current liabilities augmented 400 million yen from the previous term, while noncurrent liabilities decreased 200 million yen because of the drop in long-term debts, etc. As a result, total liabilities augmented 100 million yen to 16.2 billion yen. Net assets increased 1.9 billion yen to 31.1 billion yen, because of the increases in retained earnings and foreign currency translation adjustment for the yen depreciation, etc. Consequently, equity ratio was 65.7%, up 1.0% from the end of the previous term.  Investing CF became positive, due to the sale of investment securities and property, plant and equipment, etc. Free CF, too, became positive. Financing CF became negative, as short-term debts augmented and there were no proceeds from long-term debts. Cash and cash equivalents increased 2.0 billion yen from the end of the previous term. (4) Topics

The synergy with Scovill, which was reorganized into a subsidiary through the first cross-border M&A for Morito, is emerging in the following three aspects.

◎ Synergy with Scovill ① Streamlining

The warehouse of Scovill UK was closed and integrated into the warehouse of Morito Europe. In the Seventh Mid-Term Management Plan, the two companies' business facilities are to be integrated in the U.S. and Hong Kong. These are expected to reduce costs steadily.

② Self-manufacturing the products whose manufacturing has been outsourced by Scovill

The metal and resin accessories that have been procured by Scovill through outsourcing will be produced in the Morito Group's factories or affiliated ones at lower costs. This is expected to boost operating income in the entire corporate group.

③ Top-line synergy

This will be started in full swing during this term. This is expected to increase sales and profit for the entire corporate group, mainly those of metal and resin accessories for European and U.S. apparel manufacturers. ◎ The company resolved to increase dividends

At the meeting of the board of directors on January 14, 2016, the company resolved to increase the term-end dividend for the term ended November 2015 from the earlier estimate of 7.00 yen/share to 7.50 yen/share. The estimated annual dividend has been increased from 14.00 yen/share to 14.50 yen/share. The estimated payout ratio is 29.3%. (These upward revisions are based on the assumption that the matters will be discussed and adopted at the 78th annual meeting of shareholders to be held in February 2016.) |

| Fiscal Year November 2016 Earnings Estimates |

Sales and operating income are estimated to increase for 4 consecutive terms

In this term, which corresponds to the first fiscal year of the Seventh Mid-Term Management Plan, the company will develop added value products originating from Japan, expand the revenue base through global business operation, challenge the uncultivated markets, maximize synergetic effects, etc. Sales are estimated to be 45 billion yen, up 3.9% from the previous term, and operating income is estimated to be 2 billion yen, up 16.2% from the previous term. As for dividends, interim, term-end, and annual dividends are estimated to be 8.00 yen/share, 8.00 yen/share, and 16.00 yen/share, respectively. The dividend will increase by 1.50 yen/share from the previous term. The estimated payout ratio is 30.7%. |

| The Seventh Mid-Term Management Plan |

|

(1) Review of the Sixth Mid-Term Management Plan

The Sixth Mid-Term Management Plan (from the term ended November 2011 to the term ended November 2015), whose basic policy is "to aim to grow as a global enterprise," resulted in the following.

(2) Regarding the Seventh Mid-Term Management Plan

(1) To expand and fortify the revenue base of the corporate group

(a) Sale

(b) Manufacturing, purchase, and inventory Ternary global management system of manufacture, purchase, and inventory based on sales strategies (c) New investment (2) Capital measures

(3) Strengthening of internal control systems

1. Apparel component business

Considering market trends and Morito's strengths, the company will select 14 target fields, prioritize these target fields, and implement group-wide strategies. The company thus far has had high market share in part of the "luxury" price range and the "middle high" price range. From now on, the company plans to maintain "middle high" as its most important price range, while at the same time increasing its share in the "luxury" and "middle low" price ranges, too, by adding targets, expanding the product lineup, and enhancing sales capabilities.

(1) Resetting of targets (2) Brands and products

While pursuing the quality of its core products, including hooks and eyes, eyelets, and hook-and-loop fasteners, the company will make efforts to increase highly functional products and develop new products. In addition, the company will review its brands from the global viewpoint, and consolidate them. (3) Systems for selling and after-sales services

The company will improve not only its products, but also its systems for providing them. Specifically, it will establish new bases, expand the human resources, strengthen the cooperation with Scovill, promote alliances and M&A, strengthen the activities with domestic enterprises that conduct global business operations, attend to inbound clients, and secure competitive advantages by improving after-sales services, etc. 2. Product Business

The primary measures are to expand the markets in China, North and Central Americas, improve the capability of global procurement and quality assurance, and strengthen quality, cost, delivery (QCD) competitiveness at priority bases, etc.

(1) Transportation Business (2) Consumer goods business

The company will set target fields to narrow down clients, and pursue added value by utilizing its own factories. It will also streamline its operations by concentrating its managerial resources.

(3) Distributed product business

As the company currently handles mainly men's shoe-related products, it will broaden its domain to handle women's products and high-priced sundries. Then, it will develop systems for responding to the purchase behaviors across the border between the Internet and the real world. In addition, the company will develop systems for overseas business operation mainly in China. |

| Conclusions |

|

The trust and achievements built by Morito in its long history of over 100 years are intangible yet important assets, and the company has never had a deficit. Therefore, the management considers that employees lack the ambition for changing themselves or the company. The management finds it the most necessary to raise the employees' awareness for creating new value on their own responsibility and for enabling the company to keep growing. These thoughts were put into the mottoes: "Make it happen. We will build our future on our own!!!" and "Actualization of the new 'Morito Group' that can create existence value." As concrete measures, the company plans to fine-tune personnel evaluation systems based on the awareness enhancement, send company-wide messages repeatedly, and introduce stock options for all employees. We would like to see what the awareness enhancement will bring. Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2016 Investment Bridge Co., Ltd. All Rights Reserved. |