Bridge Report:(9837)MORITO the Fiscal Year November 2019

President Takaki Ichitsubo | MORITO CO.,LTD. (9837) |

|

Company Information

Exchange | 1st section of Tokyo Stock Exchange |

Industry | Wholesale (commerce) |

President | Takaki Ichitsubo |

Address | 4-2-4 Minami-honmachi, Chuo-ku, Osaka |

Year-end | Last day of November |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥726 | 30,800,000 shares | ¥22,360 million | 4.3% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥26.50 | 3.7% | ¥52.96 | 13.7 x | ¥1,193.13 | 0.6 x |

*The share price means the closing price on March 3. The number of shares issued, ROE, DPS, EPS, and BPS are taken from the brief financial report for the term ended November 2019.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

November 2016 (Actual) | 40,086 | 1,767 | 1,647 | 1,181 | 41.48 | 17.00 |

November 2017 (Actual) | 41,388 | 1,707 | 1,703 | 3,305 | 119.29 | 28.00 |

November 2018 (Actual) | 43,943 | 1,725 | 1,790 | 1,257 | 45.71 | 25.00 |

November 2019 (Actual) | 45,987 | 1,734 | 1,779 | 1,402 | 51.17 | 26.00 |

November 2020 (Forecast) | 47,000 | 1,900 | 1,900 | 1,450 | 52.96 | 26.50 |

* The forecasted values were provided by the company. Unit: million yen or yen.

We briefly report the financial results for the term ended November 2019 of Morito Co., Ltd.

Table of Contents

Key Points

1.Company Overview

2. Fiscal Year ended November 2019 Earnings Results

3. Fiscal Year ending November 2020 Earnings Forecast

4. The 8th Mid-Term Management Plan

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- Sales were 45,987 million yen, up 4.7% year on year. It increased in Japan and Asia while it decreased in the U.S. and Europe. The new consolidated subsidiaries contributed to the increase in sales. The sales of protecting-against-cold products for retailers didn’t grow in the 4th quarter (September to November) due to the effect of unseasonable weather such as a warm winter. Products for the automotive industry have performed well in all regions. Operating income was 1,734 million yen, up 0.5% year on year. Gross profit rate was 27.3%, up 0.4 points from the end of the previous term. However, selling, general and administrative (SG&A) expenses have increased due to the increase in transportation expenses, the transient expenses surge associated with operating new distribution bases, and the new subsidiaries of MANEUVERLINE CO., LTD. Further, ordinary income was 1,779 million yen, down 0.6% year on year. While foreign exchange losses increased for non-operating income/loss. Net income was 1,402 million yen, up 11.6% year on year. The posted extraordinary income included 325 million yen as gain on sales of fixed assets.

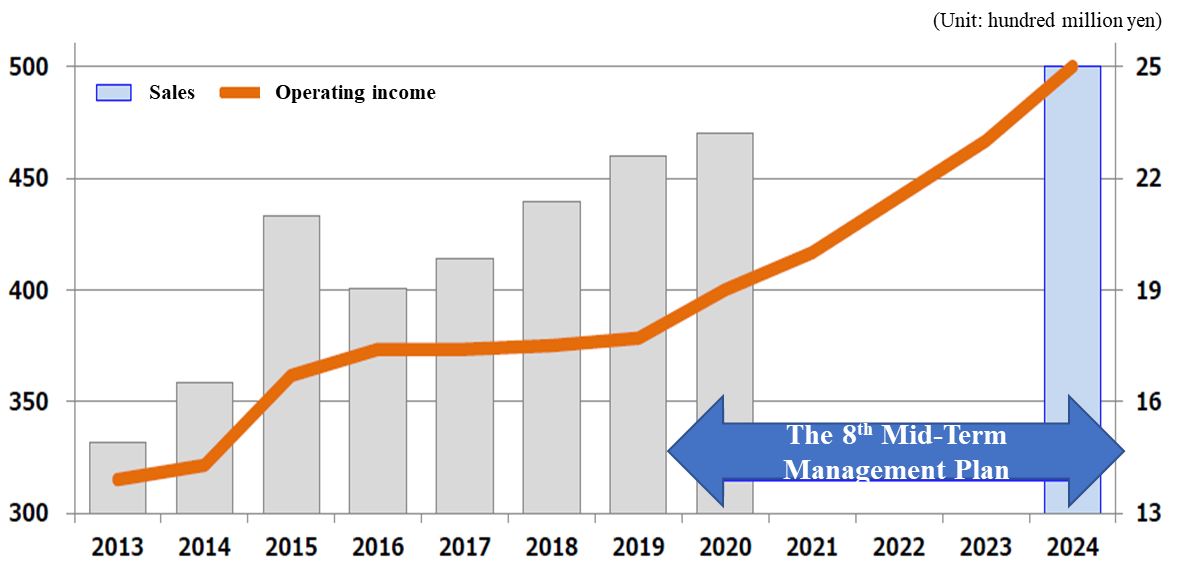

- For the term ending November 2020, it is estimated that sales will grow 2.2% year on year to 47 billion yen and operating income will rise 9.6% year on year to 1.9 billion yen. The company promotes the management vision of its “8th mid-term management plan (from FY 11/2020 to FY 11/2024), “Create Morito’s existence value, and realize ‘New Morito Group’” and proactively works to expand the business. The total annual dividend is projected to be 26.50 yen per share; the estimated payout ratio is 50.0%. Moreover, the 8th Mid-Term Management Plan aims to achieve 50 billion yen in sales, 2.5 billion yen in operating income (5% in operating profit rate), by the term ending November 2024.

- The performance of protecting-against-cold products decelerated during the 4th quarter (September to November), which is considered as its busiest season, however, the company managed to increase sales and operating income, raising the dividends. A new mid-term management plan will be kick-started; President Ichitsubo asserts that this mid-term management plan focuses on profit. In fact, gross profit rate is improving, and cutting the distribution center’s expenses, etc. can be expected to make progress. We have expectations from switching to a holding company structure, strengthening the functions of management strategies, and maximizing the Group synergy, which accelerated the management decision-making. The price book-value ratio (PBR) is as low as 0.7, which appears to be comparatively low for Morito, which has a defensive stock.

1. Company Overview

Morito is a specialized trading company that engages in the entire process of planning, developing, manufacturing, wholesaling, and distributing automobile interior parts and clothing accessories, including hooks and eyes, hook-and-loop fasteners, and “eyelets,” which are metal rings for lining a hole for laces on shoes, clothes, etc. Through its history of over 100 years, the company has developed the deep trust of customers, high market share with a wide array of products, global networks, etc. As of the end of November 2019 there are a total of 21 consolidated subsidiaries, 7 domestic and 14 overseas, and 1 affiliated company accounted for using the equity method in Japan. It has been a holding company since June 2019.

【Corporate history】

The founder Jukichi Morito, who had worked for a draper’s shop in Osaka as an employee, started a one-man company called “Morito Shoten” in 1908, brokering the trade of eyelets, hooks and eyes. In the Taisho period, the western fashion spread, boosting the demand for shoes and allowing the company to grow rapidly. In 1937, the company internationalized its business by exporting hook-and-loop fasteners to Sumatra and Java, and shoelaces to Johannesburg in South Africa and the U.K. After the Pacific War, the company started selling colored nylon fasteners and hook-and-loop fasteners. In the 1990s, the company launched the business related to consumer goods, such as automobile interior parts and camera straps, with the aim of promoting general-purpose materials, and expanded its business domain. The company also conducted overseas business actively. In 1989, the company was listed in the second section of Osaka Securities Exchange, and in July 2013, it was registered in the second section of Tokyo Stock Exchange, as Tokyo Stock Exchange and Osaka Securities Exchange merged. Morito changed to the first section of Tokyo Stock Exchange on December 2016.

1908 | Opened Morito Shoten (started selling eyelets, hooks and eyes, and shoelaces) |

1935 | Established Morito Shoten Co., Ltd. |

1958 | Started selling colored nylon fasteners. |

1960 | Started selling hook-and-loop fasteners. |

1976 | Renamed the company Morito Co., Ltd. |

1977 | Established Morito Industrial Co., (H.K.) Ltd. in China. (Currently, MORITO SCOVILL HONGKONG COMPANY LIMITED) |

1983 | Established KANE-M, Inc. in the U.S. |

1985 | Established a consolidated subsidiary named Morito (Europe) B.V. in the Netherlands. |

1987 | Ace Industrial Machinery Co., Ltd. was founded (Japan) |

1988 | Established Taiwan Morito Co., Ltd. in Taiwan. |

1989 | Listed in the 2nd section of Osaka Securities Exchange |

1997 | Opened Zama Logistics Center. |

2001 | Acquired Wah Kin Metal Products Mfg. Co., Ltd. and Morito (Shenzhen) Co., Ltd. in China as the subsidiaries of Morito Industrial Co., (H.K.) Ltd. through M&As. |

2003 | Established Kane-M Shanghai Co., Ltd. in China. Acquired Three Runners Co., Ltd. through M&A in Japan. |

2005 | Relocated and expanded the scales of Bao'an Factory of Morito Industrial Co., (H.K.) Ltd. and Morito (Shenzhen) Co., Ltd. in China. |

2007 | Morito Industrial Co., (H.K.) Ltd. acquired Wah Kin Metal Products Mfg. Co., Ltd. through absorption-type merger in China. |

2008 | Formed business and capital tie-ups with the Kuraray Group and reorganized Kuraray Fastening Co., Ltd. into an equity-method affiliate. |

2009 | Built Dalian Office of Kane-M Shanghai Co., Ltd. in China. |

2010 | Established Kane-M Danang Co., Ltd. in Vietnam. |

2011 | Established Kane-M (Thailand) Co., Ltd. in Thailand. |

2012 | Opened a representative office in Myanmar (Currently, The Representative Office Of Morito Japan Co., Ltd. in Myanmar). Established Michigan Branch of Kane-M Inc. in the U.S. Started operating Kane-M Danang. |

2013 | Listed in the 2nd section of Tokyo Stock Exchange. |

2014 | Acquired Scovill, a U.S. company that manufactures and sells clothing materials in Japan. Kane-M, Inc. Tennessee Branch opened in the U.S Acquired MATEX INC. through M&A (Currently, MORITO SCOVILL AMERICAS,LLC). |

2016 | Listed in the 1st section of Tokyo Stock Exchange. |

2017 | Established Morito Scovill Mexico (Mexico). Established 52DESIGN CO., LTD (Japan). |

2018 | Morito Kanto Logistics Center opened Acquired MANEUVERLINE CO., LTD. through M&A in Japan. Morito Japan Co., Ltd., a wholly-owned subsidiary of Morito Co., Ltd., established as a preparation company |

2019 | Company split between Morito Co., Ltd. as the splitting company and Morito Japan Co,. Ltd, as the succeeding company, in accordance with transition to a holding company structure. |

【Vision, etc.】

1.Founding Principle

Active and Steadfast

The principle “Active and Steadfast” represents the spirit of Morito that has been fostered since its inauguration, and implies that “Success is ensured by proactively making a judgment and taking action.” The backbone of Morita’s business is the spirit of the founder Jukichi Morit “To win over your competitors, you always need to come up with an innovative surprise. Always seek for new ideas while doing business.”

2.Corporate Principle

DESIGN YOUR BRIGHT FUTURE WITH OUR VARIOUS PARTS, WE DO IT!

(1) We make available a broad array of parts throughout the world, pursuing a boundless market that transcends product genres.

(2) We give shape to the needs of our customers, exercising authentic craftsmanship and thereby enriching people’s lives.

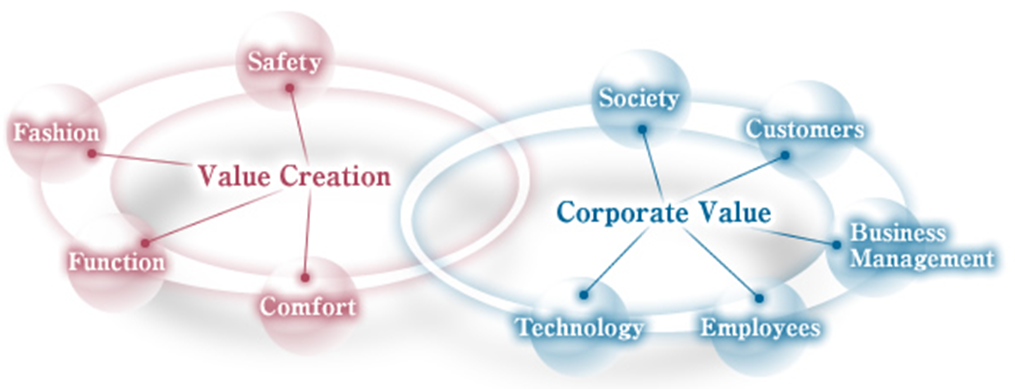

(3) We demonstrate value-creating expertise from a comprehensive point of view (i.e., in terms of fashion, function, comfort, safety), contributing to the creation of a better tomorrow in one with all our stakeholders.

(Source:Morito)

3.Corporate Vision

Create Morito’s existence value, Realize “New Morito Group”

4.Action Principles

For Customer From the drawing board to consumption, our emphasis on product quality and safety throughout the entire production process enables us to earn the customer’s satisfaction and help contribute to society. |

For Shareholder Our continued growth and the improvement of our corporate value will return profits to our shareholders. |

For Employees Working in an environment which promotes individualism yet also encourages teamwork will give employees at Morito a feeling of pride. |

For Society As a good corporate citizen, we will contribute to the progress of the society while practicing strict observance of the law and environmental regulations. |

【Business description】

The business of Morita can be classified into three realms: 1) The “apparel business,” which handles clothing accessories, such as eyelets, hooks and eyes, buckles, and fasteners, 2) The “product business,” which handles the straps for cameras and mobile terminals, and foot-care products, such as the secondary materials and insoles of shoes, and 3)The “transportation equipment business”, which treats automobile interior parts, such as mat emblems and door grips,.

In each business, the company conducts the entire process of planning, development, manufacturing, distribution, and sale of products, according to markets and customers’ needs, while considering fashion, functionality, comfort, safety, etc.

The segments to be reported are the three segments: Japan, Asia, and Europe & the U.S.

◎ Apparel Business

(Source: Morito)

Sales composition ratio is 41% as of FY November 2019.

Morito delivers the accessories of clothes and footwear, including eyelets, hooks and eyes, buckles, fasteners, and rivets, to apparel manufacturers, etc. inside and outside Japan, which are end clients of Morito, mainly via wholesalers, trading companies, and distributors.

◎ Product Business

(Source: Morito)

Sales composition ratio is 43% as of FY November 2019.

Morito delivers straps for camera cases and lens cases etc. to video equipments manufacturers. Moreover, the company sells foot-care products, such as secondary materials, insoles of shoes, and shoe cream, as its original brands.

◎ Transportation Equipment Business

(Source: Morito)

Sales composition ratio is 16% as of FY November 2019.

Morito handles automobile interior parts, such as mat emblems, door grips and arm rests.

The automobile-related business accounts for about 90%. The major clients are supplier companies of Japanese leading automobile manufacturers.

【Features and Strengths】

(1) Stable business performance

As described in the section of corporate history, Morito has been operating apparel business since its inception, by handling eyelets, hooks and eyes, hook-and-loop fasteners, etc. The company increased the purposes of use of general-purpose materials, and launched the product business including the transportation equipment business.

At the present, sales composition ratio is slightly over 40 % of the apparel business and the product business and nearly 20% of the transportation equipment business.

This business portfolio stabilizes the performance of Morito. The company has never fallen into the red, even during the two postwar oil shocks and the global economic crisis in the wake of the bankruptcy of Lehman Brothers.

(2) High shares with a wide array of products

The company has high market share for various products, as tabulated below.

Although some enterprises in emerging countries supply products at lower prices than Morito, it won the trust of clients with its capabilities of dealing with all processes, including planning, development, manufacturing, and distribution, and coping with various situations appropriately, and the quality of its products, including safety, which had been developed through its long history, achieving high market share.

For example, Morito gives appropriate technical advice from the stage of producing samples for clients, repeatedly fine-tunes coloration to meet the needs of clients, and keeps checking products after the start of full-scale production. Namely, the company not merely sells products, but clears many hurdles before starting transactions, and provides clients with a system for all processes from upstream to downstream ones. The provision of such added value is highly evaluated by clients, mainly the famous brands outside Japan.

<Major Items and Share>

Item | Share |

Metal hooks and eyes (babies’ wear) | 35%: the 2nd largest in the world |

Eyelets, hooks and eyes | 55%: the largest in Japan |

Hook-and-loop fasteners | 60%: the largest in Japan |

Insoles | 25%: the largest in Japan |

Mat emblems for automobiles | 70%: the largest in Japan |

Camera accessories | 40%: the largest in Japan |

(Surveyed by Morito)

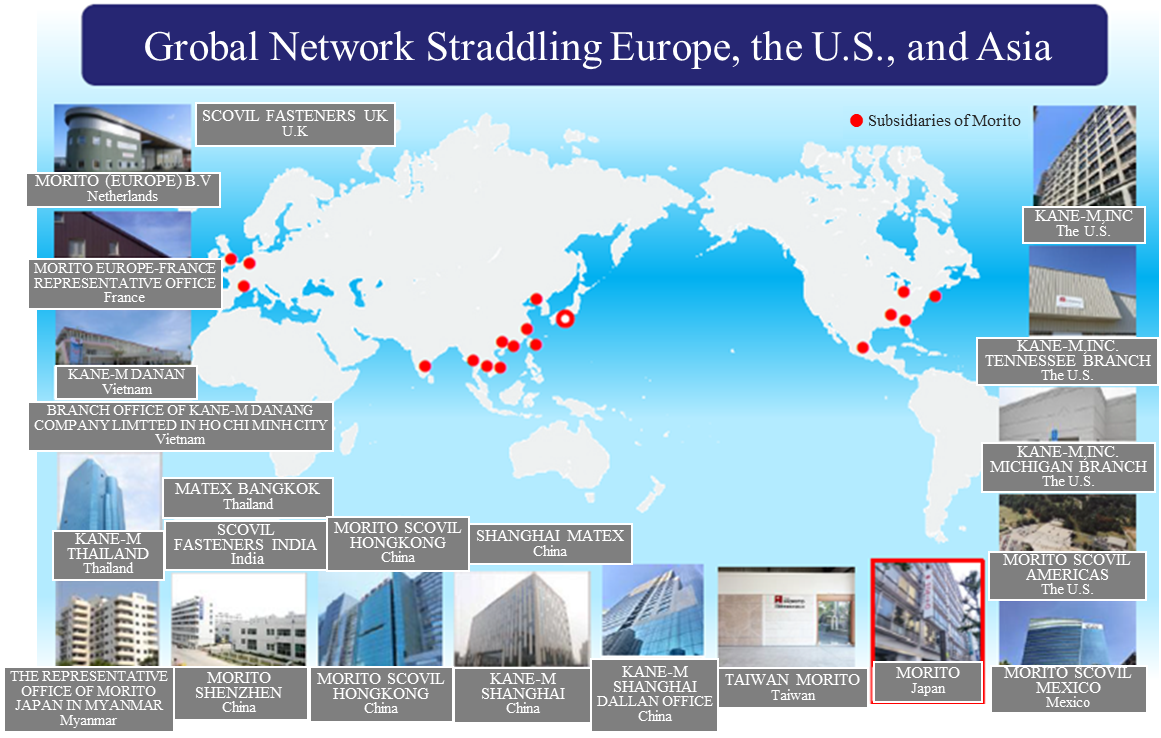

(3) Global Network

Planning and development are conducted mainly in Japan. The company owns production and distribution facilities in Europe; North Americas; Asia-Pacific region, and Africa.

(Source:Morito)

With the aim of growing as a global company, Morito is enriching international production sites and sales networks, and developing internal systems to underpin global business administration.

If this progresses as planed and its global network is fortified, the competitive advantage of the company will be enhanced further.

In addition to the above three items, its unique positioning, too, can be said to characterize Morito.

When considering just one among Morito’s many products, there are always some competitors, but Morito is the only one company in the world that handles such a variety of products, deals with all processes, including planning, development, manufacturing, distribution, and sale, and has sales exceeding 40 billion yen.

【ROE analysis】

| Term ended Nov. 2013 | Term ended Nov. 2014 | Term ended Nov. 2015 | Term ended Nov. 2016 | Term ended Nov. 2017 | Term ended Nov. 2018 | Term ended Nov. 2019 |

ROE (%) | 4.1 | 4.5 | 4.7 | 3.9 | 10.7 | 3.8 | 4.3 |

Net income ratio to sales [%] | 3.26 | 3.54 | 3.31 | 2.95 | 7.99 | 2.86 | 3.05 |

Total asset turnover | 0.97 | 0.88 | 0.93 | 0.91 | 0.98 | 0.96 | 0.97 |

Leverage [times] | 1.31 | 1.43 | 1.53 | 1.46 | 1.36 | 1.40 | 1.45 |

For the term ended November 2017, ROE rose drastically due to increase in net income, which is attributed to increase in extraordinary income after the sale of land.

In the term ended November 2019, gain on sales of fixed assets and gain on sales of securities have continued to push up net income.

For the term ending November 2020, net income ratio to sales is estimated 3.09%.

2. Fiscal Year ended November 2019 Earnings Results

(1) Overview of consolidated results

| FY Nov. 2018 | Ratio to sales | FY Nov. 2019 | Ratio to sales | YoY change | Initial forecast | Compared with the initial forecast |

Sales | 43,943 | 100.0% | 45,987 | 100.0% | +4.7% | 47,000 | -2.2% |

Gross margin | 11,807 | 26.9% | 12,543 | 27.3% | +6.2% | - | - |

SG&A expenses | 10,082 | 22.9% | 10,808 | 23.5% | +7.2% | - | - |

Operating income | 1,725 | 3.9% | 1,734 | 3.8% | +0.5% | 1,900 | -8.7% |

Ordinary income | 1,790 | 4.1% | 1,779 | 3.9% | -0.6% | 1,900 | -6.4% |

Net income | 1,257 | 2.9% | 1,402 | 3.1% | +11.0% | 1,400 | +0.1% |

*Unit: million yen. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

Ordinary income was on a plateau due to the increase in sales and the increase in transportation expenses

Sales were 45,987 million yen, up 4.7% year on year. It increased in Japan and Asia while it decreased in the U.S. and Europe. The new consolidated subsidiaries contributed to the increase in sales. The sales of protecting-against-cold products for retailers didn’t grow in the 4th quarter (September to November) due to the effect of unseasonable weather such as a warm winter. Products for the automotive industry have performed well in all regions. Operating income was 1,734 million yen, up 0.5% year on year. Gross profit increased 6.2% year on year while gross profit rate was 27.3%, up 0.4 points from the end of the previous term. However, SG&A expenses have increased by 7.2% due to the increase in transportation expenses including the increase in shipping prices, the transient expenses surge associated with operating new distribution bases, and the new subsidiaries of MANEUVERLINE CO., LTD. Ordinary income was 1,779 million yen, down 0.6% year on year. As for non-operating income/loss, foreign exchange losses increased from 19 million yen to 40 million yen. Net income was 1,402 million yen, up 11.6% year on year. The posted extraordinary income included 325 million yen as gain on sales of fixed assets and 85 million yen of gain on sale of securities.

(2) Trend by segment

| FY Nov. 2018 | Composition ratio | FY Nov. 2019 | Composition ratio | YoY change |

Sales |

|

|

|

|

|

Japan | 31,326 | 71.3% | 33,262 | 72.3% | +6.2% |

Asia | 6,484 | 14.8% | 6,963 | 15.1% | +7.4% |

Europe and the U.S. | 6,132 | 14.0% | 5,762 | 12.5% | -6.0% |

Total | 43,943 | 100.0% | 45,987 | 100.0% | +4.7% |

Profit in the segment |

|

|

|

|

|

Japan | 1,361 | 4.3% | 1,509 | 4.5% | +10.9% |

Asia | 469 | 7.2% | 524 | 7.5% | +11.7% |

Europe and the U.S. | 305 | 5.0% | 13 | 0.2% | -95.7% |

Adjustment amount | -411 | - | -312 | - | - |

Total | 1,725 | 3.9% | 1,734 | 3.8% | +0.5% |

*Unit: million yen

*Sales are for external clients. The composition ratio of profit means the ratio of profit to sales.

◎ Japan

Sales and profit grew 6.2% and 10.9%, respectively, year on year.

In the apparel components business, sales of accessories for uniforms and working wear increased.

In the products business, sales of products for uniform-price stores and automobile interior parts has increased.

Furthermore, the business results of MANEUVERLINE CO., LTD., which has engaged in the import and sale of items related to marine leisure and snowboarding and was acquired by Morito as a consolidated subsidiary in April 2018, were incorporated in Morito’s business results, bringing Morito a net increase in revenues by the amount of the sales from Maneuverline’s business.

◎ Asia

Sales and profit grew 7.4% and 11.7%, respectively, year on year.

In the apparel components business, sales of accessories targeted at Japanese apparel manufacturers decreased in Shanghai, sales of accessories for European and American apparel manufacturers dropped in Hong Kong.

In the products business, sales of automobile interior parts for Japanese automobile manufacturers in Shanghai and Thailand has increased.

◎ Europe and the U.S.

Sales and profit decreased 6.0% and 95.7%, respectively, year on year.

The apparel components business showed a sales drop in accessories targeted at apparel manufactures in the United States.

In the products business, automobile interior parts for Japanese automobile manufacturers were on the rise in Europe and the United States.

(3) Financial Situation and Cash Flow

◎ Main BS

| End of Nov. 2018 | End of Nov. 2019 |

| End of Nov. 2018 | End of Nov. 2019 |

Current assets | 27,579 | 27,657 | Current liabilities | 7,926 | 8,892 |

Cash and deposits | 9,343 | 9,716 | Trade payables | 4,500 | 4,859 |

Trade receivables | 12,008 | 11,773 | Short-term debts s | 1,349 | 956 |

Inventories | 5,406 | 5,083 | Noncurrent liabilities | 7,126 | 5,568 |

Noncurrent assets | 20,422 | 19,522 | Long-term debts s | 4,267 | 2,874 |

Property, plant and equipment | 10,146 | 9,810 | Total liabilities | 15,052 | 14,460 |

Intangible assets | 4,352 | 3,993 | Shareholders’ Equity | 30,189 | 30,885 |

Investments, others | 5,922 | 5,717 | Retained earnings | 25,277 | 26,072 |

Total assets | 48,011 | 47,185 | Equity | -2,118 | -2,222 |

|

|

| Net assets | 32,959 | 32,725 |

|

|

| Total liabilities, net assets | 48,011 | 47,185 |

|

|

| Equity ratio (%) | 68.5% | 69.2% |

*Unit: million yen

Total assets were 47,185 million yen, down 826 million yen from the end of the previous term.

Current assets were 27,657 million yen, up 77 million yen from the end of the previous year. This is mainly attributable the cash and bank deposits increased by 373 million yen and the notes and accounts receivable-trade decreased by 235 million yen.

Fixed assets were 19,522 million yen, down 900 million yen from the end of the previous year. This is mainly attributable to the decrease in land by 257 million yen, goodwill by 357 million yen, and investment securities by 330 million yen.

Current liabilities were 8,892 million yen, up 965 million yen from the end of the previous year. This is mainly attributable to the increase in notes payable-trade and accounts payable-trade by 358 million yen, accrued tax payable by 312 million yen, and accounts payable by 367 million yen.

Fixed liabilities were 5,568 million yen, down 1,558 million yen from the end of the previous year, primarily because long-term loans payable decreased by 992 million yen and corporate bonds shrank by 400 million yen. Net assets were 32,725 million yen, down 233 million yen from the end of the previous year. Capital adequacy ratio increased by 0.7 points from 68.5% at the end of the previous term to 69.2%.

◎ Cash flow

| FY Nov. 2018 | FY Nov. 2019 | Increase/decrease |

Operating CF | 626 | 3,614 | 2,987 |

Investing CF | -5,171 | 110 | 5,282 |

Free CF | -4,544 | 3,725 | 8,269 |

Financing CF | 2,303 | -2,694 | -4,998 |

Cash and Equivalents | 8,525 | 9,442 | 916 |

*Unit: million yen

Operating CF was 3,614 million yen in surplus (which stood at 626 million yen in the previous year), which is mainly due to the posting of net income before taxes and depreciation expenses.

Investing CF was 110 million yen in surplus (which had a deficit of 5,171 million yen in the previous year), owing primarily to the acquisition and sale of tangible fixed assets, and withdrawal of time deposits.

Financing CF was 2,694 million yen in deficit (which was at a surplus of 2,303 million yen in the previous year), mainly because of the repayments of long-term loans payable and the payment of dividends.

As a result, the balance of cash and cash equivalents at the end of the term ended November 2019 increased 916 million yen from the end of the previous term to 9,442 million yen.

(4) Topics

◎Implementing organizational changes

On December 1, 2019, the following organizational changes were made.

(1) The Corporate Planning Division was discontinued and the president's office was established to collect information and achievements from each department, swiftly reflect the Group’s management strategy, and spread policies throughout the entire Group.

(2) Aiming to maximize the Group’s profit, the Global Business Development Department was abolished and a new Strategic Business Unit was established to formulate global strategies and implement it on a global scale according to the actual conditions of the operations.

(3) Established a new “Operation Management Division” to strengthen the operation management structure by suggesting the management issues and proposed solutions based on the results of analyzing the numbers and data from mainly the finance and IT departments.

(4) Established “the Administrative Division” to strengthen the operation management structure by reducing management risks as well as responding to the various issues based on the quantitative information and qualitative analysis.

(5) Reflecting on the 7th mid-term management plan

The term ended November 2018 was the last fiscal year of the mid-term management plan. The following goals were raised, where investments and returns to stockholders were achieved while the profit was unachieved. The main reason the targeted sales were unachieved is 4 billion yen from not performing M&A, while the main reason the operating income was unachieved is 200 million yen from not performing M&A and 150 million from the delay in reducing the distribution center expenses. The payout ratio substantially increased from the conventional 30% or so to 50% or more.

The aim of management

Sales and profit | 48 billion yen in sales * | ⇒ | Unachieved | 44 billion yen |

Operating income of 2 billion yen | Unachieved | 1,730 million yen | ||

Improving ROE | Unachieved | From 4.7% in FY 11/2015 to 3.8% in FY 11/2018 | ||

Investment | Maximizing the synergy effect of current investments | Achieved | Completed integration with the Scovill Group | |

Continued M&A | Achieved | Acquired the Maneuverline Group | ||

Returns to stockholders | Implementing stable returns to stockholders | Achieved | 14.5 yen per share in FY 11/2015 25 yen per share in FY 11/2018 |

(*) after excluding external factors (foreign exchange effect, the price surge of raw materials, the surge in shipping expenses, etc.)

3. Fiscal Year ending November 2020 Earnings Forecast

(1) Consolidated earnings forecast

| FY Nov. 2019 | Ratio to sales | FY Nov. 2020 (Forecast.) | Ratio to sales | YoY change |

Sales | 45,987 | 100.0% | 47,000 | 100.0% | +2.2% |

Operating income | 1,734 | 3.8% | 1,900 | 4.0% | +9.6% |

Ordinary income | 1,779 | 3.9% | 1,900 | 4.0% | +6.8% |

Net income | 1,402 | 3.1% | 1,450 | 3.1% | +3.4% |

*Unit: million yen

*The estimated values were those announced by the company. *Net income means the profit attributable to owners of the parent.

Sales and profit are estimated to increase in the term ending November 2020

For the term ending November 2020, it is estimated that sales will grow 2.2% year on year to 47 billion yen and operating income will rise 9.6% year on year to 1.9 billion yen. The company promotes the management vision of its “8th mid-term management plan (from FY 11/2020 to FY 11/2024, details are mentioned below), “Create Morito’s existence value, and realize ‘New Morito Group’,” and proactively works to expand the business.

Under the basic policy of “Maintain a payout ratio of 50% or higher (ordinary annual dividend) and a DOE of 1.5%,” the total annual dividend in the term ending November 2020 is estimated at 26.50 yen per share. The estimated payout ratio is 50.0%.

4. The 8th Mid-Term Management Plan

The term ended November 2018 was the last fiscal year of the seventh mid-term management plan while the term ended November 2019 was considered a year of structural reform and started the 8th mid-term management plan in the term ending November 2020.

The management principles

1. Founding philosophy

Active and Steadfast

The principle “Active and Steadfast” represents the spirit of Morito that has been fostered within employees since its inauguration, and represents taking the initiative in exercising good judgment and putting it into appropriate actions to ensure consistent results.

2. Corporate philosophy

Design your bright future with our various parts

・ We make available a broad array of parts throughout the world, pursuing a boundless market that transcends product genres.

・ We give shape to the needs of our customers, exercising authentic craftsmanship and thereby enriching people’s lives.

・ We demonstrate value-creating expertise from a comprehensive point of view (i.e., in terms of fashion, function, comfort, safety), contributing to the creation of a better tomorrow together with all our stakeholders as one.

3. Corporate Vision

Create Morito’s existence value, and realize “New Morito Group”

We will aim to be a company that will continue to grow by creating an environment where every one of our employees can unleash their capabilities so that they add new value to our existence, which goes beyond the added values of our products.

4. MORITO Value

Win the deep trust of customers and partners

・ Continuously put out information and ideas that have value to our customers and partners

・ Provide higher-than-expected satisfaction levels by responding to the needs of our customers and partners faster and more accurately.

Perform own responsibilities

・ Understand one’s responsibilities and perform them thoroughly.

・ Raise higher goals and ambitiously continue personal growth.

Understand the other party and collaborate

・Respect diversity and opinions of others

・Collaborate with various people and make bigger achievements.

Release imagination

・ Sharpen the senses and dive into new challenges with intellectual curiosity.

・ Sense and respond to changes with broad perspective and flexibility.

Integrity

・ Always be respectful to others and act with sincerity.

・ Hold a strong sense of ethics and strictly comply with laws, principles of society, and rules.

・ Members of Morito employees shall fulfill their responsibility to society with pride through business activities.

What Morito Group aspires to be

“Employees who realize their dream” X “a company that supports dreams”

Global Niche Top

Continue to change the world with our small parts

The direction of the 8th Mid-Term Management Plan

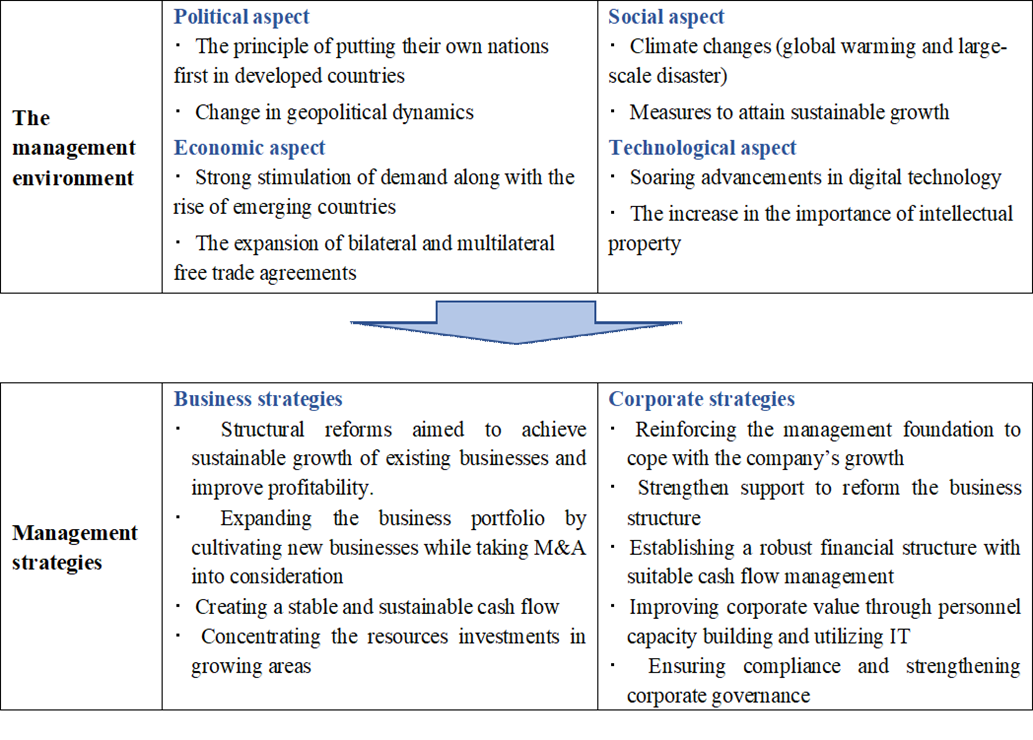

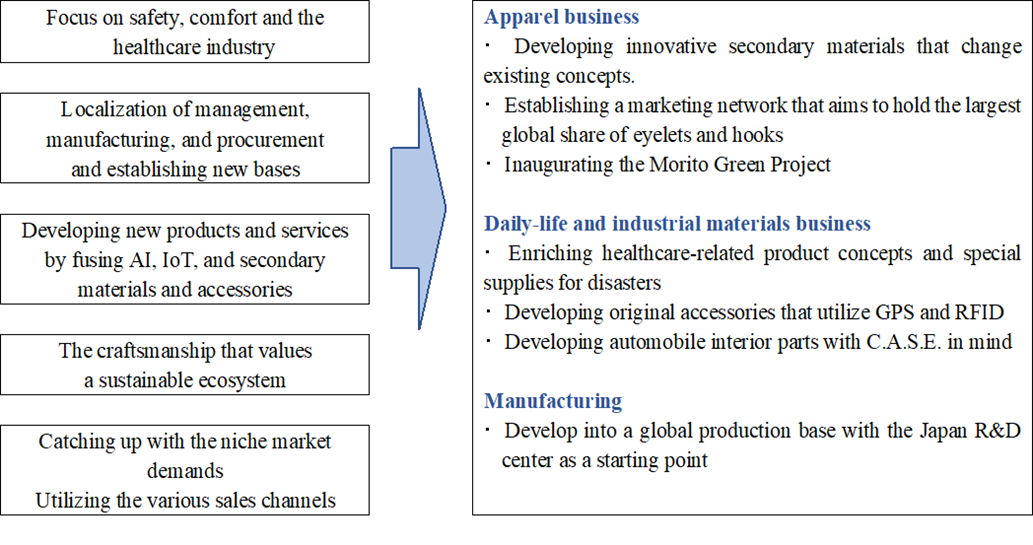

Business strategies

Corporate strategies

Human resource strategy

・ Work towards acquiring human resources who can contribute to implementing the management strategies, train them, assign the right talent in the right place, effectively utilize human resources throughout the group, and increase the value of the human resources asset.

Personnel-related issues and measures |

| Goals for the end of FY 2024 |

|

|

|

・ Acquiring, maintaining, and training human resources who can realize MORITO value ・ Creating a working environment where various employees can stay healthy, safe, and each can perform their jobs vigorously. |

| ・ Assigning the right talent in the right place and career reconstruction - Human resources communication inside the Group - Expanding the human resources pool ・ Constructing and implementing the most suitable and diverse human resources system for each company in the Group ⇒ Increase engagement |

Financial strategies

・ With the utilization of the financial bases the company has been promoting and further expanding them, the company aims to increase funding efficiency in the Group, strengthen risk management, and improve the financial structure.

Issues and measures for the financial field |

| Goals for the end of FY 2024 |

|

|

|

・ Improve the Group’s funding management by making effective investments and procurement ・ Improve capital efficiency by reinvesting in further growing fields |

| ・ Increase the operating CF along with improving the profit ratio - Improving the profit ratio and reducing the working capital ・ Downsizing the balance sheet - Asset liquidation, sale of cross-shareholdings, etc. ⇒ Improve profitability and efficiency |

IT strategies

・ Aim to promote utilization of management information, achieve speedy management, and increase business efficiency by applying the current IT infrastructure for the 3 fields (management, business, infrastructure) and invest in and utilize the optimum IT technology.

Issues and measures for the IT field |

| Goals for the end of FY 2024 |

|

|

|

・ Effective utilization of IT (Effective adoption of technology) - Improving IT functions for management information - Improving business IT functions - Improving the basement IT functions |

| ・ Establishing a system for effectively providing and managing the Groups’ management information to achieve speedy management. ・ Digitizing manufacturing, marketing, distribution, and administration activities and strengthen the support to marketing activities ・ Applying an IT infrastructure including the network ⇒Improving efficiency will improve competitiveness |

Measures to attain sustainable growth

・ The sustainable development goals (SDGs) were adopted in the United Nations Summit in September 2015 and consist of 17 international goals that aim to realize a sustainable, diverse, and an inclusive society

・ Our company as well aims to realize a society where people around the world would live happily and in prosperity, and we will work to contribute to achieving the SDGs.

Numerical targets

FY 11/2024 (expected foreign exchange rate: 110 Yen/US Dollar)

・ 50 billion yen in sales

・ Operating income of 2.5 billion yen (operating income rate: 5%)

(Source:Morito)

Investment

・ Pursue synergy between existing businesses

・ Proactively invest in new businesses

・ Continue M&A

Returns to stockholders

・ Dividend payout ratio is 50% or higher

・ DOE is 1.5%

5. Conclusions

The performance of protecting-against-cold products decelerated during the 4th quarter (September to November), which is considered as its busiest season, however, the company managed to increase sales and operating income, raising the dividends. A new mid-term management plan will be kick-started; President Ichitsubo asserts that this mid-term management plan focuses on profit. In fact, gross profit rate is improving, and cutting the distribution center’s expenses, etc. can be expected to make progress. We have expectations from switching to a holding company structure, strengthening the functions of management strategies, and maximizing the Group synergy, which accelerated the management decision-making. The price book-value ratio (PBR) is as low as 0.7, which appears to be comparatively low for Morito, which has a defensive stock.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 5 directors, including 2 external ones |

Auditors | 3 auditors, including 2 external ones |

◎ Corporate Governance Report

Updated on March 2, 2020

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

【Supplementary principles 1-2-(4) Exercise of rights at a general meeting of shareholders】 | Our company has adopted a system for exercising voting rights through the Internet. We will translate convocation notices into English when we have judged that doing so is necessary after taking the proportion of overseas investors into account |

【Supplementary Principle 4-3-(1), Principle 4-10, Supplementary Principle 4-10-(1) Making Use of Independent Outside Directors】 | Our company has currently appointed 2 independent outside directors. At this moment, the independent external directors fully express their opinions at board meetings, and discussion over candidates for directors is thoroughly held among board members. Our company, however, has not set up any advisory committee. Through extensive discussion with independent outside directors, we will consider how independent external directors should be involved and how the Board of Directors should serve, including establishment of an advisory committee. |

【Supplementary principle 4-3-(2), supplementary principle 4-3-(3) Procedures for the appointment or dismissal of a CEO】 | We do not form an advisory committee to nominate directors. In fact, selecting a CEO is the most important strategic decision to make for the company, thus we are considering taking the opinions of outside directors, etc. into consideration for the procedures of selecting a CEO in an objective, timely, and transparent manner. Moreover, similarly, when dismissing a CEO, we will consider taking the opinions of outside directors, etc. into consideration for the procedures of dismissing the CEO in an objective, timely, and transparent manner according to the appropriate evaluation criteria. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Principle 1-4 So-called strategically held shares】 | Our company will acquire and hold shares of listed companies only when we have judged that doing so is strategically necessary after taking into account the importance as a business strategy and the partnership with each partner company in terms of sale, manufacturing, and fundraising, in addition to potential acquisition of dividends and capital gains. Furthermore, we will strive to cut down on the number of strategically held shares when the significance of holding them is deemed to be no longer profound. In light of the aforementioned, we regularly verify at board meetings whether or not we should continue holding shares of a listed company by taking our revenue targets, actual return, and transaction status into consideration.

Regarding the listed companies whose shares our company holds in large numbers out of the listed companies whose shares we have decided to hold continuously based on the verification, we will disclose the number of shares held and the purpose of continuing to hold them through securities reports. Our company properly exercises our voting rights on the strategically held shares through comprehensive judgment by taking into account whether or not strategically holding shares contributes to improvement in shareholder value, and how that impacts our company. |

【Principle 5-1 Policy for constructive dialogue with shareholders】 | Our company has provided opportunities for dialogue with shareholders for the purpose of contributing to our company’s sustainable growth and medium- and long-term improvement of the corporate value. ① Status of system development Our company has appointed a person responsible for IR activities in order to realize constructive dialogue with shareholders. In addition, with the department in charge of IR activities taking the lead, related departments cooperate with each other, establishing a system that offers appropriate information to shareholders. ② Policies on efforts Our company hosts a variety of events on a regular basis, including financial results briefings that are designed for analysts and institutional investors and held semiannually by a person in charge of IR activities, individual interviews held quarterly, and company information sessions held 3 – 4 times a year for individual investors. Information is shared among the top executives in the hope of utilizing information obtained through such events in corporate management. Furthermore, our company properly grasps insider information in accordance with the regulations on management of insider trading, and exercises utmost caution when we hold dialogue with shareholders. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on Morito Co., Ltd (9837) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/.