Bridge Report:(9837)MORITO the term ended November 2020

President Takaki Ichitsubo | MORITO CO.,LTD. (9837) |

|

Company Information

Exchange | 1st section of Tokyo Stock Exchange |

Industry | Wholesale (commerce) |

President | Takaki Ichitsubo |

Address | 4-2-4 Minami-honmachi, Chuo-ku, Osaka |

Year-end | Last day of November |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥608 | 30,800,000 shares | ¥18,726million | 1.5% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥18.00 | 3.0% | ¥25.57 | 23.8 x | ¥1,167.21 | 0.5 x |

*The share price means the closing price on February 26. The number of ROE and BPS are taken from the brief financial report for the term ended November 2020. The number of shares issued, DPS, and EPS are taken from the brief financial report for the term ended November 2020.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

November 2016 (Actual) | 40,086 | 1,767 | 1,647 | 1,181 | 41.48 | 17.00 |

November 2017 (Actual) | 41,388 | 1,707 | 1,703 | 3,305 | 119.29 | 28.00 |

November 2018 (Actual) | 43,943 | 1,725 | 1,790 | 1,257 | 45.71 | 25.00 |

November 2019 (Actual) | 45,987 | 1,734 | 1,779 | 1,402 | 51.17 | 26.00 |

November 2020 (Actual) | 40,727 | 856 | 928 | 470 | 17.17 | 18.00 |

November 2021 (Forecast) | 43,000 | 1,300 | 1,300 | 700 | 25.57 | 18.00 |

* The forecasted values were provided by the company. Unit: million yen or yen.

We briefly report the financial results for the term ended November 2020 of Morito Co., Ltd.

Table of Contents

Key Points

1.Company Overview

2. Fiscal Year ended November 2020 Earnings Results

3. Fiscal Year ending November 2021 Earnings Forecast

4. The 8th Mid-Term Management Plan

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the term ended November 2020, sales and ordinary income decreased 11.4% and 47.8%, year on year, respectively. Business performance was sluggish due to the impact of department stores and mass merchandisers around the world voluntarily suspending operations and automobile-related factories in Japan and overseas closing for some time. Under these challenging circumstances, the company focused on developing and selling value-added products that are safe, secure, healthy, and environmentally friendly. Morito has been making efforts to continue its business in order to contribute to society through its core products. For example, in the United States, the company continues producing hooks used for medical equipment. In terms of profits, gross profit margin declined due to the effects of the warm winter on the sales of the product mix. Although the company curtailed its SG&A, profits declined. The year-end dividend was 4.75 yen, and the annual dividend, including 13.25 yen at the end of the first half, was 18.00 yen.

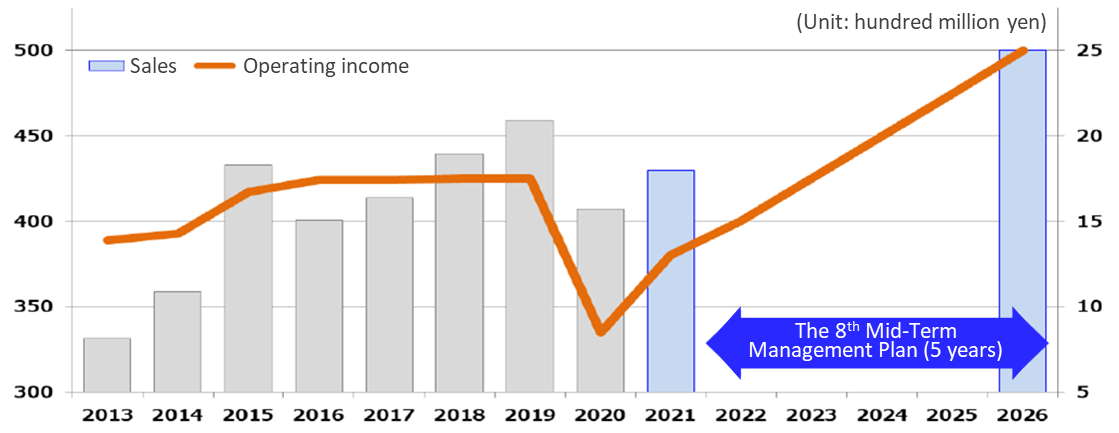

- In the term ending November 2021, sales and operating income are expected to increase 5.6% and 51.8%, year on year, respectively. Although the outlook for the global economy is uncertain due to the spread of the novel coronavirus and the US-China trade conflict, the company will focus on selling value-added products needed under all circumstances. The company revised the 8th Medium-Term Plan and decided to implement it from the term ending November 2022 to the term ending November 2026. As for the term ended November 2020 and the term ending November 2021, the company views them as a phase to build the business structure during the novel coronavirus crisis. The dividend is expected to be 18.00 yen (9.00 yen at the end of the first half and 9.00 yen at the end of the year), which is the same amount as in the term ended November 2020.

- For a company like Morito, which has transactions with a wide range of industries, it was unavoidable that it got affected by the novel coronavirus. However, its business performance is on a recovery trend after bottoming out in the third quarter of the term ended November 2020. Furthermore, the company handles many products that are indispensable in daily life and the medical field. Thus, the novel coronavirus's impact on its business performance was minimal. It is expected that in the term ending November 2021, sales will improve regardless of the status of the spread of the novel coronavirus and the distribution of vaccines. Stock prices will remain weak. The price-book value ratio (PBR) will be as low as 0.5. Assuming that the company will achieve the medium-term plan, earnings per share (EPS) are estimated to exceed 50 yen. Thus, there is a good chance that the stock price might go up.

1. Company Overview

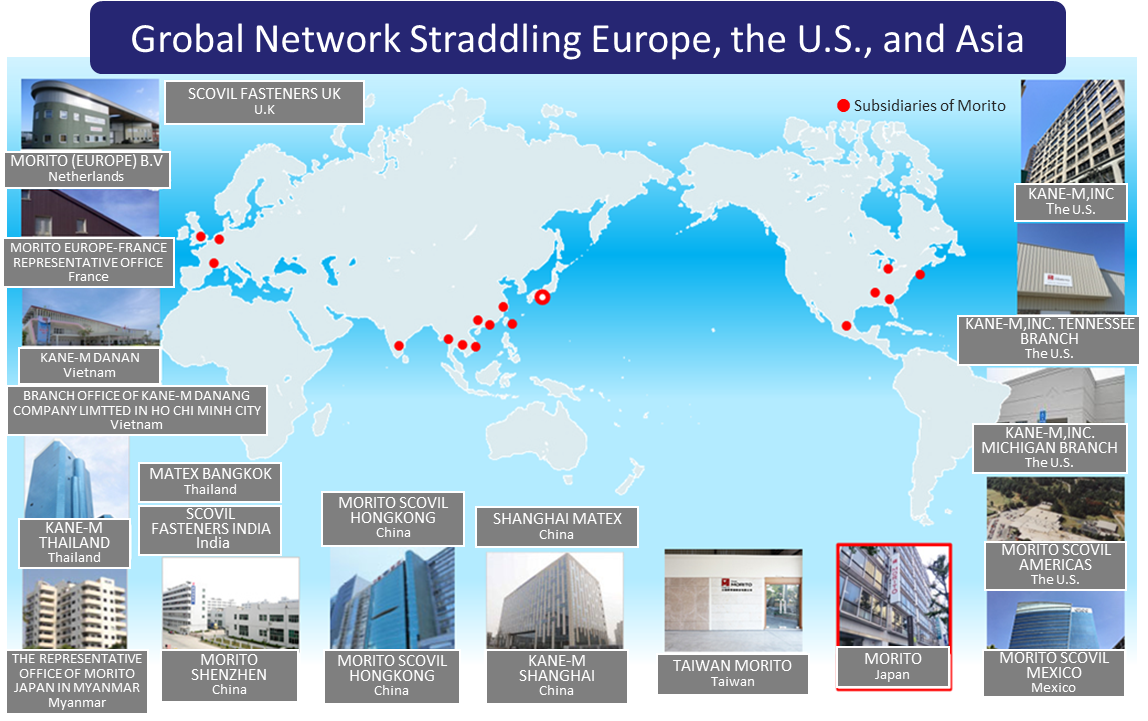

Morito is a specialized trading company that engages in the entire process of planning, developing, manufacturing, wholesaling, and distributing automobile interior parts and clothing accessories, including hooks and eyes, hook-and-loop fasteners, and “eyelets,” which are metal rings for lining a hole for laces on shoes, clothes, etc. Through its history of over 100 years, the company has developed the deep trust of customers, high market share with a wide array of products, global networks, etc. As of the end of November 2020 there are a total of 20 consolidated subsidiaries, 6 domestic and 14 overseas, and 1 affiliated company accounted for using the equity method in Japan. It has been a holding company structure since June 2019.

【Corporate history】

The founder Jukichi Morito, who had worked for a draper’s shop in Osaka as an employee, started a one-man company called “Morito Shoten” in 1908, brokering the trade of eyelets, hooks and eyes. In the Taisho period, the western fashion spread, boosting the demand for shoes and allowing the company to grow rapidly. In 1937, the company internationalized its business by exporting hook-and-loop fasteners to Sumatra and Java, and shoelaces to Johannesburg in South Africa and the U.K. After the Pacific War, the company started selling colored nylon fasteners and hook-and-loop fasteners. In the 1990s, the company launched the business related to consumer goods, such as automobile interior parts and camera straps, with the aim of promoting general-purpose materials, and expanded its business domain. The company also conducted overseas business actively. In 1989, the company was listed in the second section of Osaka Securities Exchange, and in July 2013, it was registered in the second section of Tokyo Stock Exchange, as Tokyo Stock Exchange and Osaka Securities Exchange merged. Morito promoted to the first section of Tokyo Stock Exchange on December 2016.

1908 | Opened Morito Shoten (started selling eyelets, hooks and eyes, and shoelaces) |

1935 | Established Morito Shoten Co., Ltd. |

1958 | Started selling colored nylon fasteners. |

1960 | Started selling hook-and-loop fasteners. |

1976 | Renamed the company Morito Co., Ltd. |

1977 | Established Morito Industrial Co., (H.K.) Ltd. in China. (Currently, MORITO SCOVILL HONGKONG COMPANY LIMITED) |

1983 | Established KANE-M, Inc. in the U.S. |

1985 | Established a consolidated subsidiary named Morito (Europe) B.V. in the Netherlands. |

1987 | Ace Industrial Machinery Co., Ltd. was founded (Japan) |

1988 | Established Taiwan Morito Co., Ltd. in Taiwan. |

1989 | Listed in the 2nd section of Osaka Securities Exchange |

2001 | Acquired Wah Kin Metal Products Mfg. Co., Ltd. and Morito (Shenzhen) Co., Ltd. in China as the subsidiaries of Morito Industrial Co., (H.K.) Ltd. through M&As. |

2003 | Established Kane-M Shanghai Co., Ltd. in China. |

2005 | Relocated and expanded the scales of Bao'an Factory of Morito Industrial Co., (H.K.) Ltd. and Morito (Shenzhen) Co., Ltd. in China. |

2007 | Morito Industrial Co., (H.K.) Ltd. acquired Wah Kin Metal Products Mfg. Co., Ltd. through absorption-type merger in China. |

2008 | Formed business and capital tie-ups with the Kuraray Group and reorganized Kuraray Fastening Co., Ltd. into an equity-method affiliate. |

2010 | Established Kane-M Danang Co., Ltd. in Vietnam. |

2011 | Established Kane-M (Thailand) Co., Ltd. in Thailand. |

2012 | Opened a representative office in Myanmar (Currently, The Representative Office Of Morito Japan Co., Ltd. in Myanmar). Established Michigan Branch of Kane-M Inc. in the U.S. Started operating Kane-M Danang. |

2013 | Listed in the 2nd section of Tokyo Stock Exchange. |

2014 | Acquired Scovill, a U.S. company that manufactures and sells clothing materials in Japan. Kane-M, Inc. Tennessee Branch opened in the U.S Acquired MATEX INC. through M&A (Currently, MORITO SCOVILL AMERICAS,LLC). |

2016 | Listed in the 1st section of Tokyo Stock Exchange. |

2017 | Established Morito Scovill Mexico (Mexico). Established 52DESIGN CO., LTD (Japan). |

2018 | Morito Kanto Logistics Center opened Acquired MANEUVERLINE CO., LTD. through M&A in Japan. Morito Japan Co., Ltd., a wholly-owned subsidiary of Morito Co., Ltd., established as a preparation company |

2019 | Company split between Morito Co., Ltd. as the splitting company and Morito Japan Co,. Ltd, as the succeeding company, in accordance with transition to a holding company structure. |

【Vision, etc.】

1.Founding Principle

Active and Steadfast

The principle “Active and Steadfast” represents the spirit of Morito that has been fostered since its inauguration, and implies that “Success is ensured by proactively making a judgment and taking action.” The backbone of Morita’s business is the spirit of the founder Jukichi Morito: “To win over your competitors, you always need to come up with an innovative surprise. Always seek for new ideas while doing business.”

2.Corporate Principle

DESIGN YOUR BRIGHT FUTURE WITH OUR VARIOUS PARTS, WE DO IT!

(1) We make available a broad array of parts throughout the world, pursuing a boundless market that transcends product genres.

(2) We give shape to the needs of our customers, exercising authentic craftsmanship and thereby enriching people’s lives.

(3) We demonstrate value-creating expertise from a comprehensive point of view (i.e., in terms of fashion, function, comfort, safety), contributing to the creation of a better tomorrow in one with all our stakeholders.

(Source:Morito)

3.Corporate Vision

Create Morito’s existence value, Realize “New Morito Group”

4.Action Principles

For Customer From the drawing board to consumption, our emphasis on product quality and safety throughout the entire production process enables us to earn the customer’s satisfaction and help contribute to society. |

For Shareholder Our continued growth and the improvement of our corporate value will return profits to our shareholders. |

For Employees Working in an environment which promotes individualism yet also encourages teamwork will give employees at Morito a feeling of pride. |

For Society As a good corporate citizen, we will contribute to the progress of the society while practicing strict observance of the law and environmental regulations. |

【Business description】

The business of Morito can be classified into three realms: 1) The “apparel business,” which handles clothing accessories, such as eyelets, hooks and eyes, buckles, and fasteners, 2) The “product business,” which handles the straps for cameras and mobile terminals, and foot-care products, such as the secondary materials and insoles of shoes, and 3)The “transportation equipment business”, which treats automobile interior parts, such as mat emblems and door grips,.

In each business, the company conducts the entire process of planning, development, manufacturing, distribution, and sale of products, according to markets and customers’ needs, while considering fashion, functionality, comfort, safety, etc.

The segments to be reported are the three segments: Japan, Asia, and Europe & the U.S.

◎ Apparel Business

(Source: Morito)

Sales composition ratio is 43% as of FY November 2020.

Morito delivers the accessories of clothes and footwear, including eyelets, hooks and eyes, buckles, fasteners, and rivets, to apparel manufacturers, etc. inside and outside Japan, which are end clients of Morito, mainly via wholesalers, trading companies, and distributors.

◎ Product Business

|

|

(Source: Morito)

Sales composition ratio is 38% as of FY November 2020.

Besides providing accessories and semi-finished products to the industrial materials field, the company sells original products under its own brand, focusing on shoe care products such as shoe insoles and shoe creams.

◎ Transportation Equipment Business

(Source: Morito)

Sales composition ratio is 19% as of FY November 2020.

Morito handles automobile interior parts, such as mat emblems, door grips and arm rests.

The automobile-related business accounts for about 90%. The major clients are supplier companies of Japanese leading automobile manufacturers.

【Features and Strengths】

(1) Stable business performance

As described in the section of corporate history, Morito has been operating apparel business since its inception, by handling eyelets, hooks and eyes, hook-and-loop fasteners, etc. The company increased the purposes of use of general-purpose materials, and launched the product business including the transportation equipment business.

At the present, sales composition ratio is slightly over 40 % of the apparel business and slightly under 40% of the product business and nearly 20% of the transportation equipment business.

This business portfolio stabilizes the performance of Morito. The company has never fallen into the red, even during the two postwar oil shocks, the global economic crisis in the wake of the bankruptcy of Lehman Brothers, and the novel corona virus crisis.

(2) High shares with a wide array of products

The company has high market share for various products, as tabulated below.

Although some enterprises in emerging countries supply products at lower prices than Morito, it won the trust of clients with its capabilities of dealing with all processes, including planning, development, manufacturing, and distribution, and coping with various situations appropriately, and the quality of its products, including safety, which had been developed through its long history, achieving high market share.

For example, Morito gives appropriate technical advice from the stage of producing samples for clients, repeatedly fine-tunes coloration to meet the needs of clients, and keeps checking products after the start of full-scale production. Namely, the company not merely sells products, but clears many hurdles before starting transactions, and provides clients with a system for all processes from upstream to downstream ones. The provision of such added value is highly evaluated by clients, mainly the famous brands outside Japan.

<Major Items and Share>

Item | Share |

Metal hooks and eyes (babies’ wear) | 35%: the 2nd largest in the world |

Eyelets, hooks and eyes | 55%: the largest in Japan |

Hook-and-loop fasteners | 60%: the largest in Japan |

Insoles | 25%: the largest in Japan |

Mat emblems for automobiles | 70%: the largest in Japan |

Camera accessories | 40%: the largest in Japan |

(Surveyed by Morito)

|

|

|

(3) Global Network

Planning and development are conducted mainly in Japan. The company owns production and distribution facilities in Europe; North Americas; Asia-Pacific region, and Africa.

(Source:Morito)

With the aim of growing as a global company, Morito is enriching international production sites and sales networks, and developing internal systems to underpin global business administration.

If this progresses as planed and its global network is fortified, the competitive advantage of the company will be enhanced further.

In addition to the above three items, its unique positioning, too, can be said to characterize Morito.

When considering just one among Morito’s many products, there are always some competitors, but Morito is the only one company in the world that handles such a variety of products, deals with all processes, including planning, development, manufacturing, distribution, and sale, and has sales exceeding 40 billion yen.

【ROE analysis】

| Term ended Nov. 2014 | Term ended Nov. 2015 | Term ended Nov. 2016 | Term ended Nov. 2017 | Term ended Nov. 2018 | Term ended Nov. 2019 | Term ended Nov. 2020 |

ROE (%) | 4.5 | 4.7 | 3.9 | 10.7 | 3.8 | 4.3 | 1.5 |

Net income ratio to sales [%] | 3.54 | 3.31 | 2.95 | 7.99 | 2.86 | 3.05 | 1.15 |

Total asset turnover | 0.88 | 0.93 | 0.91 | 0.98 | 0.96 | 0.97 | 0.93 |

Leverage [times] | 1.43 | 1.53 | 1.46 | 1.36 | 1.40 | 1.45 | 1.37 |

For the term ended November 2017, ROE rose drastically due to increase in net income, which is attributed to increase in extraordinary income after the sale of land.

In the term ended November 2019, gain on sales of fixed assets and gain on sales of securities have continued to push up net income.

In the term ended November 2020, net income margin declined due to the impact of the novel coronavirus. The net income margin for the term ending November 2021 is expected to be 1.63%.

2. Fiscal Year ended November 2020 Earnings Results

(1) Overview of consolidated results

| FY Nov. 2019 | Ratio to sales | FY Nov. 2020 | Ratio to sales | YoY change | Company forecast | Compared with the company forecast |

Sales | 45,987 | 100.0% | 40,727 | 100.0% | -11.4% | 40,000 | +1.8% |

Gross margin | 12,543 | 27.3% | 10,573 | 26.0% | -15.7% | - | - |

SG&A expenses | 10,808 | 23.5% | 9,717 | 23.9% | -10.1% | - | - |

Operating income | 1,734 | 3.8% | 856 | 2.1% | -50.6% | 600 | +42.7% |

Ordinary income | 1,779 | 3.9% | 928 | 2.3% | -47.8% | 600 | +54.7% |

Net income | 1,402 | 3.1% | 470 | 1.2% | -66.5% | 300 | +56.7% |

*Unit: million yen. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

11.4% decreased in sales and 47.8% declined in ordinary income due to the influence of the novel coronavirus

Sales were 40,727 million yen, down 11.4% year on year. Sales increased in Asia, but decreased in Japan, Europe and the United States. Business performance was sluggish, due to the impact of department stores and mass merchandisers around the world voluntarily suspending operations and automobile-related factories in Japan and overseas closing for some time. Under these challenging circumstances, the company focused on developing and selling value-added products that are safe, secure, healthy, and environmentally friendly. While businesses continue to suspend operations due to lockdowns worldwide, Morito has been making efforts to continue its business in order to contribute to society through its core products. For example, in the United States, the company continues producing hooks used for medical equipment.

Operating income decreased 50.6% year on year to 856 million yen. Gross profit margin fell from 27.3% in the same period of the previous year to 26.0% due to the influence of the warm winter on the sales of the product mix. The company reduced its SG&A expenses by 10.1%, but it was not enough to offset the 15.7% decrease in gross profit, and a profit decreased. Ordinary income dropped 47.8% year on year to 928 million yen. Aside from its operations, there was a decline in equity method investment income and an increase in the foreign exchange losses. However, the company received employment adjustment subsidies. Net income decreased 66.5% year on year to 470 million yen. Tax burdens decreased, but the company had some additional taxes due to the income from the sales of fixed assets in the previous fiscal year.

Despite the decline in sales and profits, both sales and profits far exceeded the company's forecast disclosed in October.

The year-end dividend was 4.75 yen, and the annual dividend, including 13.25 yen at the end of the first half, was 18.00 yen.

(2) Trend by segment

Trend by area

| FY Nov. 2019 | Composition ratio | FY Nov. 2020 | Composition ratio | YoY change |

Sales |

|

|

|

|

|

Japan | 33,262 | 72.3% | 28,810 | 70.7% | -13.4% |

Asia | 6,963 | 15.1% | 7,225 | 17.7% | +3.8% |

Europe and the U.S. | 5,762 | 12.5% | 4,691 | 11.5% | -18.6% |

Total | 45,987 | 100.0% | 40,727 | 100.0% | -11.4% |

Profit in the segment |

|

|

|

|

|

Japan | 1,509 | 4.5% | 868 | 3.0% | -42.5% |

Asia | 524 | 7.5% | 255 | 3.5% | -51.2% |

Europe and the U.S. | 13 | 0.2% | -63 | - | - |

Adjustment amount | -312 | - | -205 | - | - |

Total | 1,734 | 3.8% | 856 | 2.1% | -50.6% |

*Unit: million yen

*Sales are for external clients. The composition ratio of profit means the ratio of profit to sales.

◎ Japan

Sales decreased 13.4%, and profit declined 42.5% from the previous year.

New demand for mask-related items increased.

Sales of accessories for casual wear, workwear, and men's heavy clothing decreased.

Sales of sports-related products such as skateboards and products for flat-price retailers rose.

Sales of automobile interior parts fell.

◎ Asia

Sales increased 3.8%, and profit decreased 51.2% from the previous year.

Sales of accessories for apparel declined.

Sales of interior parts for Japanese automobiles in China increased.

◎ Europe and the U.S.

Sales decreased 18.6% year on year, resulting in a loss of 63 million yen (13 million yen in profit in the same period of the previous year).

Sales of accessories for the medical industry increased.

Sales of accessories for the apparel industry declined.

Sales of automobile interior parts for Japanese automobile manufacturers in Europe and the United States decreased.

(3) Financial Situation and Cash Flow

◎ Main BS

| End of Nov. 2019 | End of Nov. 2020 |

| End of Nov. 2019 | End of Nov. 2020 |

Current assets | 27,657 | 25,496 | Current liabilities | 8,892 | 6,927 |

Cash and deposits | 9,716 | 10,125 | Trade payables | 4,859 | 4,255 |

Trade receivables | 11,773 | 9,957 | Short-term debts s | 956 | 780 |

Inventories | 5,083 | 4,721 | Noncurrent liabilities | 5,568 | 4,756 |

Noncurrent assets | 19,522 | 18,201 | Long-term debts s | 2,874 | 2,097 |

Property, plant and equipment | 9,810 | 9,565 | Total liabilities | 14,460 | 11,684 |

Intangible assets | 3,993 | 3,651 | Shareholders’ Equity | 30,885 | 30,516 |

Investments, others | 5,717 | 4,984 | Retained earnings | 26,072 | 25,703 |

Total assets | 47,185 | 43,699 | Treasury stock | -2,222 | -2,227 |

|

|

| Net assets | 32,725 | 32,015 |

|

|

| Total liabilities, net assets | 47,185 | 43,699 |

|

|

| Equity ratio (%) | 69.2% | 73.1% |

*Unit: million yen

Total assets were 43,699 million yen, down 3,486 million yen from the end of the previous fiscal year.

Current assets decreased 2,161 million yen from the end of the previous fiscal year to 25,496 million yen. This was mainly because notes and accounts receivable (trade receivables) decreased 1,816 million yen, and commodities and products (part of inventories) declined 390 million yen.

Fixed assets decreased 1,320 million yen from the end of the previous fiscal year to 18,201 million yen. This was primarily because investment securities declined 455 million yen, and goodwill decreased 277 million yen.

Current liabilities decreased 1,964 million yen from the end of the previous fiscal year to 6,927 million yen. This was mainly attributable to notes payable-trade and accounts payable-trade decreasing 603 million yen, accrued tax payable going down 343 million yen, and accounts payable-other shrinking 660 million yen.

Fixed liabilities dropped 811 million yen from the end of the previous fiscal year to 4,756 million yen. This was mainly due to long-term debt and deferred tax assets shrinking 576 million yen and 209 million yen, respectively.

Net assets dropped 710 million yen from the end of the previous fiscal year to 32,015 million yen. Equity ratio increased 3.9 points from 69.2% at the end of the previous fiscal year to 73.1%.

◎ Cash flow

| FY Nov. 2019 | FY Nov. 2020 | Increase/decrease |

Operating CF | 3,614 | 2,462 | -1,151 |

Investing CF | 110 | -16 | -127 |

Free CF | 3,725 | 2,445 | -1,279 |

Financing CF | -2,694 | -1,878 | +816 |

Cash and Equivalents | 9,442 | 10,052 | +609 |

*Unit: million yen

Operating CF was 2,462 million yen (which stood at 3,614 million yen in the previous fiscal year). This was mainly due to a decrease in funds due to the payment of corporate taxes. On the other hand, there was an increase in funds due to a decrease in accounts receivable and posting depreciation expenses and net income before income taxes.

Investing CF was negative 16 million yen (which was at a surplus of 110 million yen in the previous year). This was primarily due to a decrease in funds because of the acquisition of tangible fixed assets. On the other hand, there was an increase in funds because of the withdrawal of time deposits.

Financing CF was negative 1,878 million yen (which was at a deficit of 2,694 million yen in the previous year). This was mainly due to a decrease in funds due to dividend payments, long-term debt repayment, and corporate bond redemption.

As a result, the balance of cash and cash equivalents at the end of the term ended November 2020 was 10,052 million yen, down 609 million from the end of the previous fiscal year.

(4) Business Overview and Topics

◎ <Japan Product Business> The skateboard and surfing markets are booming.

| The demand for these sports is increasing as they have attracted attention during the novel coronavirus crisis since they are sports that you do not need to be in a closed or crowded place to enjoy. Sales of Maneuverline, a group company that handles related products, increased. (Source: Morito) |

◎ <Europe and the U.S. Apparel Business> Demand for hooks (Genko shape) for electrocardiograms is increasing

Due to the spread of novel coronavirus, the number of electrocardiogram tests in the United States has increased rapidly. Morito Scovill Americas produces the metal parts in the patches used in electrocardiography. The company continued operating even during the lockdown as it is a life-saving business. |

(Source: Morito) |

◎ <Japan Apparel Business> ALL WEATHER HIGH SPEC WEAR

The company launched a website for the brand, ALL WEATHER HIGH SPEC WEAR, which was highly recognized by the crowdfunding site, Makuake. https://allweatherhighspecwear.com The brand started by selling functional masks with carefully chosen parts. It also has a lineup of products that respond to environmental changes.

|

(Source: Morito) |

◎ <Japan Product Business> BEVOR High-Performance Mask

(Source: Morito)

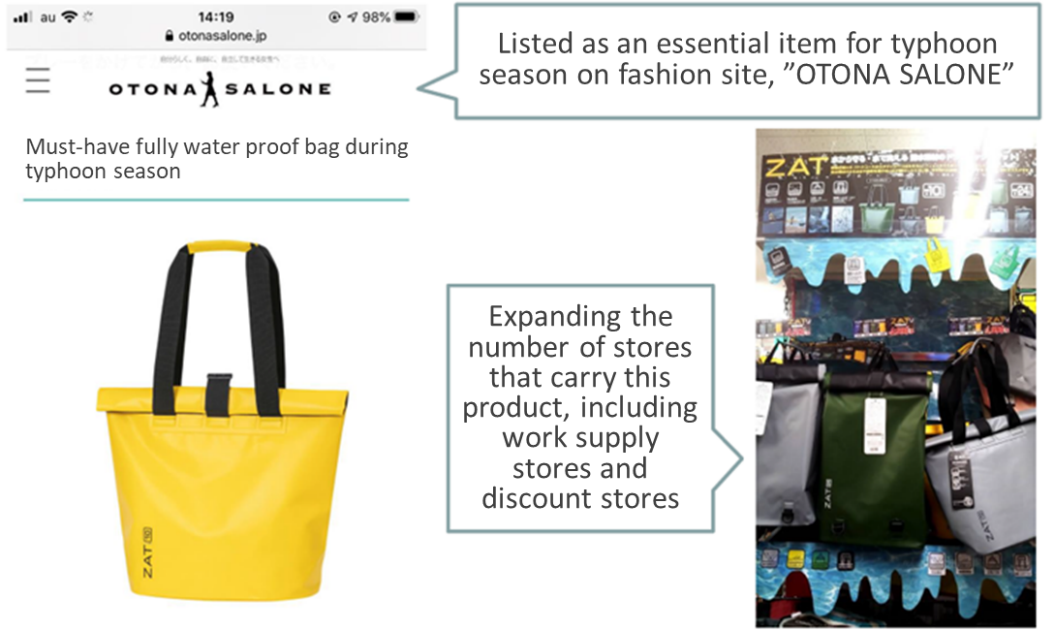

◎ <Japan Product Business> Sales of the new model of the Waterproof bag "ZAT" are strong.

(Source: Morito)

◎ <Japan Product Business> The new model of the waterproof bag "ZAB" launched in March

The company transformed the popular waterproof bag into a casual style bag, ideal for gardening, etc.

(Source: Morito)

◎ <Japan Product Business> Launching the Morito Japan Online Store

The company launched an official online store selling products that include insoles, waterproof sprays, and "ZAT."

You can search for and purchase Morito products from your home or smartphone. https://shopping.geocities.jp/morito/

(Source: Morito)

◎ <Japan Apparel Business> 52design pop-up stores are a great success

The company is actively opening pop-up stores and continuously launching new products.

(Source: Morito)

◎ <Japan Apparel Business> The company's hooks were featured on the TV program "Gacchiri Monday" (TBS)

The company is actively opening pop-up stores and continuously launching new products.

(Source: Morito)

◎ <Japan Internal System> Acquisition of the "Kurumin Certification"

The company acquired the certification by formulating an action plan and achieving its goals, which included:

・ Thorough time management and reduction of total working hours

・ To achieve 50% of the targeted paid leave acquisition rate

・ Extension of the period where employees are allowed shortened working hours for childcare

・ Adopting a remote work system.

◎ <Company-wide> Launching "C.O.R.E.," an initiative for eco-friendly product development etc.

"C.O.R.E." is a comprehensive approach to preserve our beautiful planet and limited resources. C.O.R.E. stands for Morito Group's "Commitment to Our Resources and Environment." In recent years, the company has been proposing eco-friendly products to the apparel industry, which has a high awareness of environmental issues and the entire society. By doing so, Morito helps promote the industry's positive movement as a whole and contributes to the realization of a sustainable society.

|

(Source: Morito) |

◎ <Company-wide> Announcement of clothing parts made from recycled materials of waste fishing nets

As the first step of the C.O.R.E. initiative, Morito is collaborating with Refinverse Inc. (Chuo-ku, Tokyo), a resource recycling business, to develop applications for materials to be adopted in the apparel industry, such as buttons made of the nylon resin REAMIDE produced from recycled waste fishing nets.

Morito plans to develop various products that respond to clients' needs while pursuing its quest to manufacture unique products.

(Source: Morito)

3. Fiscal Year ending November 2021 Earnings Forecast

(1) Consolidated earnings forecast

| FY Nov. 2020 | Ratio to sales | FY Nov. 2021 (Forecast.) | Ratio to sales | YoY change |

Sales | 40,727 | 100.0% | 43,000 | 100.0% | +5.6% |

Operating income | 856 | 2.1% | 1,300 | 3.0% | +51.8% |

Ordinary income | 928 | 2.3% | 1,300 | 3.0% | +40.1% |

Net income | 470 | 1.2% | 700 | 1.6% | +48.9% |

*Unit: million yen

*The estimated values were those announced by the company. *Net income means the profit attributable to owners of the parent.

A significant increase in sales and profits for the term ending November 2021 is expected.

In the term ending November 2021, sales are expected to be 43 billion yen, up 5.6%. Operating income is also projected to increase 51.8% to 1.3 billion yen. Although the outlook for the global economy is uncertain due to the spread of the novel coronavirus and the US-China trade conflict, the company will focus on selling value-added products that are needed under all circumstances.

The 8th Medium-Term Plan was revised to take place from the term ending November 2022 to the term ending November 2026 instead of being implemented from the term ended November 2020 to the term ending November 2024. As for the term ended November 2020 and the term ending November 2021, the company views them as a phase to build the business structure during the novel coronavirus crisis.

The dividend is expected to be 18.00 yen (9.00 yen at the end of the first half and 9.00 yen at the end of the year), which is the same amount as in the term ended November 2020.

4. The 8th Mid-Term Management Plan

The management principles

1. Founding philosophy

Active and Steadfast

The principle “Active and Steadfast” represents the spirit of Morito that has been fostered within employees since its inauguration, and represents taking the initiative in exercising good judgment and putting it into appropriate actions to ensure consistent results.

2. Corporate philosophy

Design your bright future with our various parts

・ We make available a broad array of parts throughout the world, pursuing a boundless market that transcends product genres.

・ We give shape to the needs of our customers, exercising authentic craftsmanship and thereby enriching people’s lives.

・ We demonstrate value-creating expertise from a comprehensive point of view (i.e., in terms of fashion, function, comfort, safety), contributing to the creation of a better tomorrow together with all our stakeholders as one.

3. Corporate Vision

Create Morito’s existence value, and realize “New Morito Group”

We will aim to be a company that will continue to grow by creating an environment where every one of our employees can unleash their capabilities so that they add new value to our existence, which goes beyond the added values of our products.

4. MORITO Value

Win the deep trust of customers and partners

・ Continuously put out information and ideas that have value to our customers and partners

・ Provide higher-than-expected satisfaction levels by responding to the needs of our customers and partners faster and more accurately.

Perform own responsibilities

・ Understand one’s responsibilities and perform them thoroughly.

・ Raise higher goals and ambitiously continue personal growth.

Understand the other party and collaborate

・Respect diversity and opinions of others

・Collaborate with various people and make bigger achievements.

Release imagination

・ Sharpen the senses and dive into new challenges with intellectual curiosity.

・ Sense and respond to changes with broad perspective and flexibility.

Integrity

・ Always be respectful to others and act with sincerity.

・ Hold a strong sense of ethics and strictly comply with laws, principles of society, and rules.

・ Members of Morito employees shall fulfill their responsibility to society with pride through business activities.

What Morito Group aspires to be

“Employees who realize their dream” X “a company that supports dreams”

Global Niche Top

Continue to change the world with our small parts

The direction of the 8th Mid-Term Management Plan

The management environment | Political aspect ・ The principle of putting their own nations first in developed countries ・ Change in geopolitical dynamics Economic aspect ・ Strong stimulation of demand along with the rise of emerging countries ・ The expansion of bilateral and multilateral free trade agreements | Social aspect ・ Climate changes (global warming and large-scale disaster) ・ Measures to attain sustainable growth Technological aspect ・ Soaring advancements in digital technology ・ The increase in the importance of intellectual property |

| ||

Management strategies | Business strategies ・ Structural reforms aimed to achieve sustainable growth of existing businesses and improve profitability. ・ Expanding the business portfolio by cultivating new businesses while taking M&A into consideration ・ Creating a stable and sustainable cash flow ・ Concentrating the resources investments in growing areas | Corporate strategies ・ Reinforcing the management foundation to cope with the company’s growth ・ Strengthen support to reform the business structure ・ Establishing a robust financial structure with suitable cash flow management ・ Improving corporate value through personnel capacity building and utilizing IT ・ Ensuring compliance and strengthening corporate governance |

Business strategies

Focus on safety, comfort and the healthcare industry |

| Apparel business ・ Developing innovative secondary materials that change existing concepts. ・ Establishing a marketing network that aims to hold the largest global share of eyelets and hooks ・ Inaugurating the Morito Green Project

Daily-life and industrial materials business ・ Enriching healthcare-related product concepts and special supplies for disasters ・ Developing original accessories that utilize GPS and RFID ・ Developing automobile interior parts with C.A.S.E. in mind

Manufacturing ・ Develop into a global production base with the Japan R&D center as a starting point |

|

| |

Localization of management, manufacturing, and procurement and establishing new bases |

| |

|

| |

Developing new products and services by fusing AI, IoT, and secondary materials and accessories |

| |

|

| |

The craftsmanship that values a sustainable ecosystem |

| |

|

| |

Catching up with the niche market demands Utilizing the various sales channels |

|

Corporate strategies

Human resource strategy

・ Work towards acquiring human resources who can contribute to implementing the management strategies, train them, assign the right talent in the right place, effectively utilize human resources throughout the group, and increase the value of the human resources asset.

Personnel-related issues and measures |

| Goals for the end of FY 2026 |

|

|

|

・ Acquiring, maintaining, and training human resources who can realize MORITO value ・ Creating a working environment where various employees can stay healthy, safe, and each can perform their jobs vigorously. |

| ・ Assigning the right talent in the right place and career reconstruction - Human resources communication inside the Group - Expanding the human resources pool ・ Constructing and implementing the most suitable and diverse human resources system for each company in the Group ⇒ Increase engagement |

Financial strategies

・ With the utilization of the financial bases the company has been promoting and further expanding them, the company aims to increase funding efficiency in the Group, strengthen risk management, and improve the financial structure.

Issues and measures for the financial field |

| Goals for the end of FY 2026 |

|

|

|

・ Improve the Group’s funding management by making effective investments and procurement ・ Improve capital efficiency by reinvesting in further growing fields |

| ・ Increase the operating CF along with improving the profit ratio - Improving the profit ratio and reducing the working capital ・ Downsizing the balance sheet - Asset liquidation, sale of cross-shareholdings, etc. ⇒ Improve profitability and efficiency |

IT strategies

・ Aim to promote utilization of management information, achieve speedy management, and increase business efficiency by applying the current IT infrastructure for the 3 fields (management, business, infrastructure) and invest in and utilize the optimum IT technology.

Issues and measures for the IT field |

| Goals for the end of FY 2026 |

|

|

|

・ Effective utilization of IT (Effective adoption of technology) - Improving IT functions for management information - Improving business IT functions - Improving the basement IT functions |

| ・ Establishing a system for effectively providing and managing the Groups’ management information to achieve speedy management ・ Digitizing manufacturing, marketing, distribution, and administration activities and strengthen the support to marketing activities ・ Applying an IT infrastructure including the network ⇒Improving efficiency will improve competitiveness |

Measures to attain sustainable growth

・ The sustainable development goals (SDGs) were adopted in the United Nations Summit in September 2015 and consist of 17 international goals that aim to realize a sustainable, diverse, and an inclusive society.

・ Our company as well aims to realize a society where people around the world would live happily and in prosperity, and we will work to contribute to achieving the SDGs.

Numerical targets

FY 11/2026

・ 50 billion yen in sales

・ Operating income of 2.5 billion yen (operating income rate: 5%)

(Source:Morito)

Investment ・ Pursuit of existing business synergies ・ Aggressive investment in new businesses ・ Continuation of M & A | Shareholder return ・ Dividend payout ratio of 50% or higher ・ DOE: 1.5% |

5. Conclusions

For a company like Morito, which has transactions with a wide range of industries, it was unavoidable that it got affected by the novel coronavirus. However, its business performance is on a recovery trend after bottoming out in the third quarter of the term ended November 2020. Furthermore, the company handles many products that are indispensable in daily life and the medical field. Thus, the impact of the novel coronavirus on its business performance was relatively minimal. In a way, the novel coronavirus helped demonstrate the company's stability. The term ending November 2021 is positioned as a year to build the business structure for the medium-term plan, but it is expected that sales will gradually improve regardless of the status of the spread of the novel coronavirus and the distribution of vaccines. The stock price remained weak. The price-book value ratio (PBR) was as low as 0.5. Even with the novel coronavirus crisis, the company was able to secure a profit in the term ended November 2020. Assuming that the company will achieve its medium-term plan, earnings per share (EPS) are estimated to exceed 50 yen. Thus, there is a good chance that the stock price might go up.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 5 directors, including 2 external ones |

Auditors | 3 auditors, including 2 external ones |

◎ Corporate Governance Report

Updated on March 3, 2020

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

【Supplementary principles 1-2-(4) Exercise of rights at a general meeting of shareholders】 | Our company has adopted a system for exercising voting rights through the Internet. We will translate convocation notices into English when we have judged that doing so is necessary after taking the proportion of overseas investors into account. |

【Supplementary Principle 4-3-(1), Principle 4-10, Supplementary Principle 4-10-(1) Making Use of Independent Outside Directors】 | Our company has currently appointed 2 independent outside directors. At this moment, the independent external directors fully express their opinions at board meetings, and discussion over candidates for directors is thoroughly held among board members. Our company, however, has not set up any advisory committee. Through extensive discussion with independent outside directors, we will consider how independent external directors should be involved and how the Board of Directors should serve, including establishment of an advisory committee. |

【Supplementary principle 4-3-(2), supplementary principle 4-3-(3) Procedures for the appointment or dismissal of a CEO】 | We do not form an advisory committee to nominate directors. In fact, selecting a CEO is the most important strategic decision to make for the company, thus we are considering taking the opinions of outside directors, etc. into consideration for the procedures of selecting a CEO in an objective, timely, and transparent manner. Moreover, similarly, when dismissing a CEO, we will consider taking the opinions of outside directors, etc. into consideration for the procedures of dismissing the CEO in an objective, timely, and transparent manner according to the appropriate evaluation criteria. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Principle 1-4 So-called strategically held shares】 | Our company will acquire and hold shares of listed companies only when we have judged that doing so is strategically necessary after taking into account the importance as a business strategy and the partnership with each partner company in terms of sale, manufacturing, and fundraising, in addition to potential acquisition of dividends and capital gains. Furthermore, we will strive to cut down on the number of strategically held shares when the significance of holding them is deemed to be no longer profound. In light of the aforementioned, we regularly verify at board meetings whether or not we should continue holding shares of a listed company by taking our revenue targets, actual return, and transaction status into consideration.

Regarding the listed companies whose shares our company holds in large numbers out of the listed companies whose shares we have decided to hold continuously based on the verification, we will disclose the number of shares held and the purpose of continuing to hold them through securities reports. Our company properly exercises our voting rights on the strategically held shares through comprehensive judgment by taking into account whether or not strategically holding shares contributes to improvement in shareholder value, and how that impacts our company. |

【Principle 5-1 Policy for constructive dialogue with shareholders】 | Our company has provided opportunities for dialogue with shareholders for the purpose of contributing to our company’s sustainable growth and medium- and long-term improvement of the corporate value. ① Status of system development Our company has appointed a person responsible for IR activities in order to realize constructive dialogue with shareholders. In addition, with the department in charge of IR activities taking the lead, related departments cooperate with each other, establishing a system that offers appropriate information to shareholders. ② Policies on efforts Our company hosts a variety of events on a regular basis, including financial results briefings that are designed for analysts and institutional investors and held semiannually by a person in charge of IR activities, individual interviews held quarterly, and company information sessions held 3 – 4 times a year for individual investors. Information is shared among the top executives in the hope of utilizing information obtained through such events in corporate management. Furthermore, our company properly grasps insider information in accordance with the regulations on management of insider trading, and exercises utmost caution when we hold dialogue with shareholders. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2021 Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on Morito Co., Ltd (9837) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/.