Bridge Report:(9837)MORITO the term ended November 2021

President Takaki Ichitsubo | MORITO CO.,LTD. (9837) |

|

Company Information

Exchange | 1st section of Tokyo Stock Exchange |

Industry | Wholesale (commerce) |

President | Takaki Ichitsubo |

Address | 4-2-4 Minami-honmachi, Chuo-ku, Osaka |

Year-end | Last day of November |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥730 | 30,800,000 shares | ¥22,484million | 4.3% | 100shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥27.00 | 3.7% | ¥53.13 | 13.7 x | ¥1,240.70 | 0.6 x |

*The share price means the closing price on February 2. Each number is taken from the brief financial report for the term ended November 2021.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

November 2018 (Actual) | 43,943 | 1,725 | 1,790 | 1,257 | 45.71 | 25.00 |

November 2019 (Actual) | 45,987 | 1,734 | 1,779 | 1,402 | 51.17 | 26.00 |

November 2020 (Actual) | 40,727 | 856 | 928 | 470 | 17.17 | 18.00 |

November 2021 (Actual) | 43,636 | 1,619 | 1,834 | 1,407 | 51.41 | 26.00 |

November 2022 (Forecast) | 45,000 | 1,800 | 1,850 | 1,450 | 53.13 | 27.00 |

* The forecasted values were provided by the company. Unit: million yen or yen.

We briefly report the financial results for the term ended November 2021 of Morito Co., Ltd.

Table of Contents

Key Points

1.Company Overview

2. Fiscal Year ended November 2021 Earnings Results

3. Fiscal Year ending November 2022 Earnings Forecast

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the term ended November 2021, sales grew 7.1% and ordinary income rose 97.6% from the previous term. The external environment was very harsh for the core business of Morito, due to the spread of the COVID-19, the skyrocketing of material prices and transportation costs, and so on. On the other hand, the apparel business performed stably and healthily, as mainly all-season products sold well. In addition, the sales of sports and leisure goods increased. Regarding profit, the company made continuous efforts to reduce expenses by reconsidering the costs for unprofitable businesses, using its own warehouses for distribution, etc. As a result, the ratio of SG&A expenses decreased, and operating income margin rose significantly year on year from 2.1% to 3.7%. The company paid an interim dividend of 9.00 yen/share and a term-end dividend of 17.00 yen/share for a total of 26.00 yen/share, up 8.00 yen/share from the previous term.

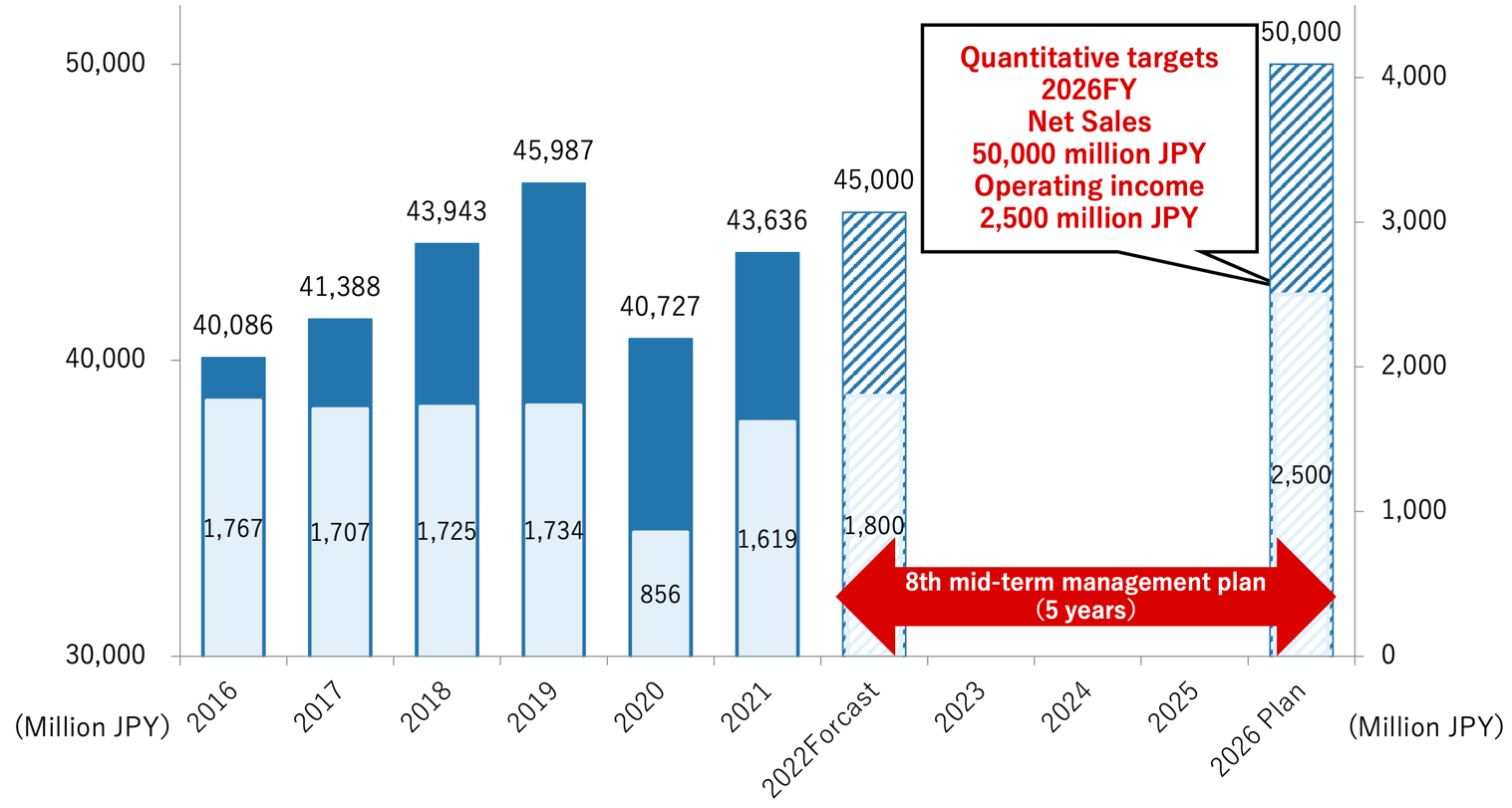

- For the term ending November 2022, sales are projected to grow 3.1% from the previous term to 45 billion yen and ordinary income is forecasted to increase 0.9% from the previous term to 1,850 million yen. The impact of the COVID-19 is lingering, so economic activities are restricted to some degree, but the company plans to implement various measures for adapting to rapidly changing markets and new lifestyles, with the aim of achieving consolidated sales of 50 billion yen and a consolidated operating income of 2.5 billion yen in the term ending November 2026, which were set in the 8th mid-term management plan. The expected dividend is 27.00 yen/share (the interim dividend: 13.50 yen/share), up 1.00 yen/share from the previous term.

- In the term ended November 2021, which the company considered to be a period of building up a business structure in the 8th mid-term management plan, the results exceeded the projections significantly. In the term ending November 2022, although the current spread of the COVID-19 is a concern, the impact will not be significant to the company because it has taken measures. Soaring costs of raw materials are another issue, but the company plans to cope with it by raising prices and reducing costs. In addition, the company is working on initiatives for future business, including the development of environmentally friendly products and the release of new products. Price book-value ratio (PBR) is as low as 0.6. There is significant room for reconsidering share price, while considering the profit level assuming the completion of the mid-term plan.

1. Company Overview

Morito is a specialized trading company that engages in the entire process of planning, developing, manufacturing, wholesaling, and distributing automotive interior parts and clothing accessories, including hooks and eyes, hook-and-loop fasteners, and “eyelets,” which are metal rings for lining a hole for laces on shoes, clothes, etc. Through its history of over 100 years, the company has developed the deep trust of customers, high market share with a wide array of products, global networks, etc. As of the end of November 2021 there are a total of 20 consolidated subsidiaries, 6 domestic and 14 overseas, and 1 affiliated company accounted for using the equity method in Japan. It has been a holding company structure since June 2019.

【Corporate history】

The founder Jukichi Moritou, who had worked for a draper’s shop in Osaka as an employee, started a one-man company called “Moritou Shoten” in 1908, brokering the trade of eyelets, hooks and eyes. In the Taisho period, the western fashion spread, boosting the demand for shoes and allowing the company to grow rapidly. In 1937, the company internationalized its business by exporting hook-and-loop fasteners to Sumatra and Java, and shoelaces to Johannesburg in South Africa and the U.K. After the Pacific War, the company started selling colored nylon fasteners and hook-and-loop fasteners. In the 1990s, the company launched the business related to consumer goods, such as automotive interior parts and camera straps, with the aim of promoting general-purpose materials, and expanded its business domain. The company also conducted overseas business actively. In 1989, the company was listed in the second section of Osaka Securities Exchange, and in July 2013, it was registered in the second section of Tokyo Stock Exchange, as Tokyo Stock Exchange and Osaka Securities Exchange merged. Morito promoted to the first section of Tokyo Stock Exchange on December 2016.

1908 | Opened Moritou Shoten (started selling eyelets, hooks and eyes, and shoelaces) |

1935 | Established Moritou Shoten Co., Ltd. |

1958 | Started selling colored nylon fasteners. |

1960 | Started selling hook-and-loop fasteners. |

1976 | Renamed the company Morito Co., Ltd. |

1977 | Established Morito Industrial Co., (H.K.) Ltd. in China. (Currently, MORITO SCOVILL HONGKONG COMPANY LIMITED) |

1983 | Established KANE-M, Inc. in the U.S. |

1985 | Established a consolidated subsidiary named Morito (Europe) B.V. in the Netherlands. |

1987 | Ace Industrial Machinery Co., Ltd. was founded (Japan) |

1988 | Established Taiwan Morito Co., Ltd. in Taiwan. |

1989 | Listed in the 2nd section of Osaka Securities Exchange |

2001 | Acquired Wah Kin Metal Products Mfg. Co., Ltd. and Morito (Shenzhen) Co., Ltd. in China as the subsidiaries of Morito Industrial Co., (H.K.) Ltd. through M&As. |

2003 | Established Kane-M Shanghai Co., Ltd. in China. |

2005 | Relocated and expanded the scales of Bao'an Factory of Morito Industrial Co., (H.K.) Ltd. and Morito (Shenzhen) Co., Ltd. in China. |

2007 | Morito Industrial Co., (H.K.) Ltd. acquired Wah Kin Metal Products Mfg. Co., Ltd. through absorption-type merger in China. |

2008 | Formed business and capital tie-ups with the Kuraray Group and reorganized Kuraray Fastening Co., Ltd. into an equity-method affiliate. |

2010 | Established Kane-M Danang Co., Ltd. in Vietnam. |

2011 | Established Kane-M (Thailand) Co., Ltd. in Thailand. |

2012 | Opened a representative office in Myanmar (Currently, The Representative Office Of Morito Japan Co., Ltd. in Myanmar). Established Michigan Branch of Kane-M Inc. in the U.S. Started operating Kane-M Danang. |

2013 | Listed in the 2nd section of Tokyo Stock Exchange. |

2014 | Acquired Scovill, a U.S. company that manufactures and sells clothing materials. (Currently, MORITO SCOVILL AMERICAS,LLC). Kane-M, Inc. Tennessee Branch opened in the U.S Acquired MATEX INC. through M&A (Japan). |

2016 | Listed in the 1st section of Tokyo Stock Exchange. |

2017 | Established Morito Scovill Mexico (Mexico). Established 52DESIGN CO., LTD (Japan). |

2018 | Morito Kanto Logistics Center opened Acquired MANEUVERLINE CO., LTD. through M&A in Japan. Morito Japan Co., Ltd., a wholly-owned subsidiary of Morito Co., Ltd., established as a preparation company |

2019 | Company split between Morito Co., Ltd. as the splitting company and Morito Japan Co,. Ltd, as the succeeding company, in accordance with transition to a holding company structure. |

【Vision, etc.】

1.Founding Principle

Active and Steadfast

The principle “Active and Steadfast” represents the spirit of Morito that has been fostered since its inauguration, and implies that “Success is ensured by proactively making a judgment and taking action.” The backbone of Morita’s business is the spirit of the founder Jukichi Moritou: “To win over your competitors, you always need to come up with an innovative surprise. Always seek for new ideas while doing business.”

2.Corporate Principle

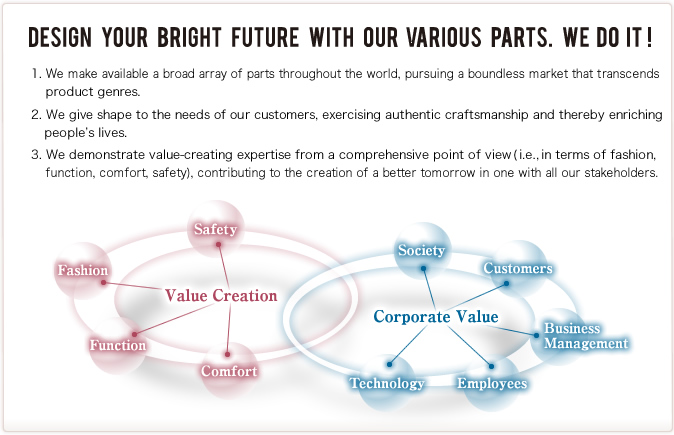

DESIGN YOUR BRIGHT FUTURE WITH OUR VARIOUS PARTS, WE DO IT!

(1) We make available a broad array of parts throughout the world, pursuing a boundless market that transcends product genres.

(2) We give shape to the needs of our customers, exercising authentic craftsmanship and thereby enriching people’s lives.

(3) We demonstrate value-creating expertise from a comprehensive point of view (i.e., in terms of fashion, function, comfort, safety), contributing to the creation of a better tomorrow in one with all our stakeholders.

(Source:Morito)

3.Corporate Vision

Create Morito’s existence value, Realize “New Morito Group”

4.Action Principles

For Customer From the drawing board to consumption, our emphasis on product quality and safety throughout the entire production process enables us to earn the customer’s satisfaction and help contribute to society. |

For Shareholder Our continued growth and the improvement of our corporate value will return profits to our shareholders. |

For Employees Working in an environment which promotes individualism yet also encourages teamwork will give employees at Morito a feeling of pride. |

For Society As a good corporate citizen, we will contribute to the progress of the society while practicing strict observance of the law and environmental regulations. |

【Business description】

The business of Morito can be classified into three realms: 1) The “apparel business,” which handles clothing accessories, such as eyelets, hooks and eyes, buckles, and fasteners, 2) The “product business,” which handles the straps for cameras and mobile terminals, and foot-care products, such as the secondary materials and insoles of shoes, and 3)The “transportation equipment business”, which treats automotive interior parts, such as mat emblems and door grips. In each business, the company conducts the entire process of planning, development, manufacturing, distribution, and sale of products, according to markets and customers’ needs, while considering fashion, functionality, comfort, safety, etc. The segments to be reported are the three segments: Japan, Asia, and Europe & the U.S.

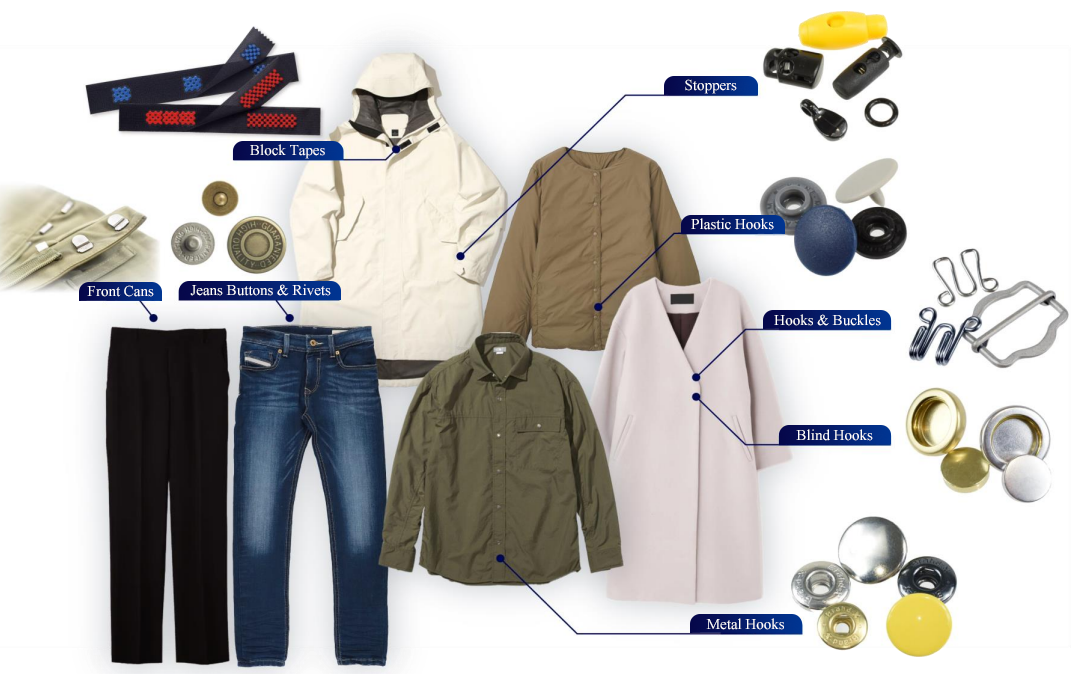

◎ Apparel Business

(Source: Morito)

Sales composition ratio is 46% as of FY November 2021.

Morito delivers the accessories of clothes and footwear, including eyelets, hooks and eyes, buckles, fasteners, and rivets, to apparel manufacturers, etc. inside and outside Japan, which are end clients of Morito, mainly via wholesalers, trading companies, and distributors.

◎ Product Business

Insole |

Shoe cream |

Deodorant spray |

Waterproof material bag |

(Source: Morito)

Marine leisure brands

| Snowboards and skateboards brands  |

(Source: Morito)

Sales composition ratio is 36% as of FY November 2021.

Besides providing accessories and semi-finished products to the industrial materials field, the company sells original products under its own brand, focusing on shoe care products such as shoe insoles and shoe creams.

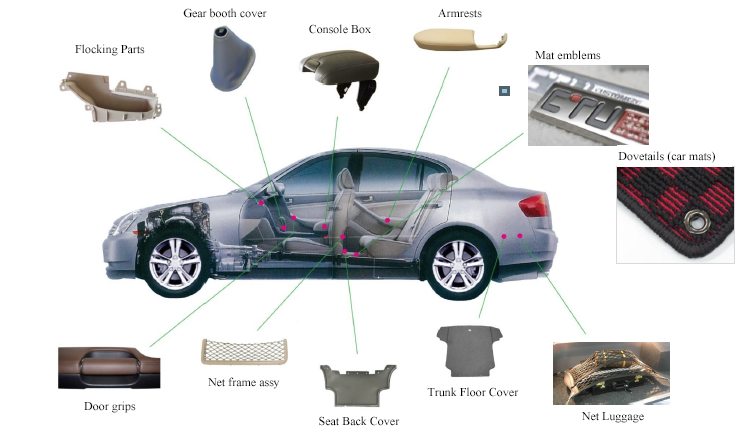

◎ Transportation Equipment Business

(Source: Morito)

Sales composition ratio is 18% as of FY November 2021.

Morito handles automotive interior parts, such as mat emblems, door grips and arm rests.

The automobile-related business accounts for about 90%. The major clients are supplier companies of Japanese leading automotive manufacturers.

【Features and Strengths】

(1) Stable business performance

As described in the section of corporate history, Morito has been operating apparel business since its inception, by handling eyelets, hooks and eyes, hook-and-loop fasteners, etc. The company increased the purposes of use of general-purpose materials, and launched the product business including the transportation equipment business.

At the present, sales composition ratio is slightly over 40 % of the apparel business and slightly under 40% of the product business and nearly 20% of the transportation equipment business.

This business portfolio stabilizes the performance of Morito. The company has never fallen into the red, even during the two postwar oil shocks, the global economic crisis in the wake of the bankruptcy of Lehman Brothers, and the novel corona virus crisis.

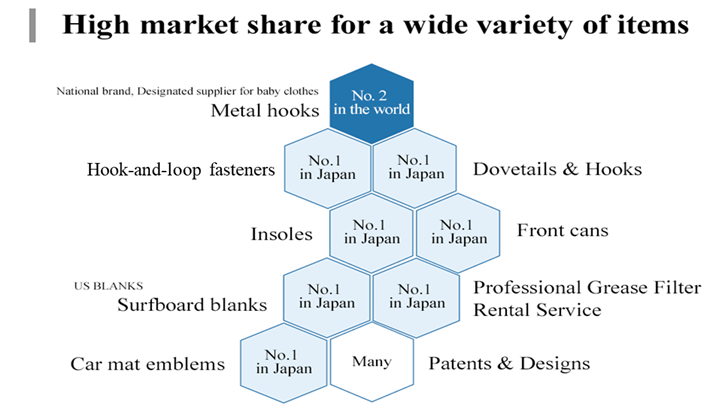

(2) High shares with a wide array of products

The company has high market share for various products, as tabulated.

Although some enterprises in emerging countries supply products at lower prices than Morito, it won the trust of clients with its capabilities of dealing with all processes, including planning, development, manufacturing, and distribution, and coping with various situations appropriately, and the quality of its products, including safety, which had been developed through its long history, achieving high market share.

For example, Morito gives appropriate technical advice from the stage of producing samples for clients, repeatedly fine-tunes coloration to meet the needs of clients, and keeps checking products after the start of full-scale production. Namely, the company not merely sells products, but clears many hurdles before starting transactions, and provides clients with a system for all processes from upstream to downstream ones. The provision of such added value is highly evaluated by clients, mainly the famous brands outside Japan.

<Major Items and Share>

(Surveyed by Morito)

(3) Global Network

Planning and development are conducted mainly in Japan. The company owns production and distribution facilities in Europe; North Americas; Asia-Pacific region, and Africa.

(Source:Morito)

With the aim of growing as a global company, Morito is enriching international production sites and sales networks, and developing internal systems to underpin global business administration.

If this progresses as planed and its global network is fortified, the competitive advantage of the company will be enhanced further.

In addition to the above three items, its unique positioning, too, can be said to characterize Morito.

When considering just one among Morito’s many products, there are always some competitors, but Morito is the only one company in the world that handles such a variety of products, deals with all processes, including planning, development, manufacturing, distribution, and sale, and has sales exceeding 40 billion yen.

【ROE analysis】

| Term ended Nov. 2015 | Term ended Nov. 2016 | Term ended Nov. 2017 | Term ended Nov. 2018 | Term ended Nov. 2019 | Term ended Nov. 2020 | Term ended Nov. 2021 |

ROE (%) | 4.7 | 3.9 | 10.7 | 3.8 | 4.3 | 1.5 | 4.3 |

Net income ratio to sales [%] | 3.31 | 2.95 | 7.99 | 2.86 | 3.05 | 1.15 | 3.22 |

Total asset turnover | 0.93 | 0.91 | 0.98 | 0.96 | 0.97 | 0.93 | 0.97 |

Leverage [times] | 1.53 | 1.46 | 1.36 | 1.40 | 1.45 | 1.37 | 1.36 |

For the term ended November 2017, ROE rose drastically due to increase in net income, which is attributed to increase in extraordinary income after the sale of land.

In the term ended November 2019, gain on sales of fixed assets and gain on sales of securities have continued to push up net income. In the term ended November 2020, net income margin declined due to the impact of the novel corona virus.

In the term ended November 2021, net income margin improved significantly. The net income margin for the term ending November 2022 is expected to be 3.22%.

2. Fiscal Year ended November 2021 Earnings Results

(1) Overview of consolidated results

| FY Nov. 2020 | Ratio to sales | FY Nov. 2021 | Ratio to sales | YoY change | Company forecast | Compared with the company forecast |

Sales | 40,727 | 100.0% | 43,636 | 100.0% | +7.1% | 43,000 | +1.5% |

Gross margin | 10,573 | 26.0% | 11,401 | 26.1% | +7.8% | - | - |

SG&A expenses | 9,717 | 23.9% | 9,781 | 22.4% | +0.7% | - | - |

Operating income | 856 | 2.1% | 1,619 | 3.7% | +89.1% | 1,550 | +4.5% |

Ordinary income | 928 | 2.3% | 1,834 | 4.2% | +97.6% | 1,700 | +7.9% |

Net income | 470 | 1.2% | 1,407 | 3.2% | +199.3% | 1,050 | +34.0% |

*Unit: million yen. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

Sales grew 7.1%, and ordinary income rose 97.6%, thanks to the curtailment of SG&A expenses, etc.

Sales were 43,636 million yen, up 7.1% from the previous term. The performance was affected by the spread of the COVID-19. Makers adjusted their production amounts in response to the temporary closure of department stores, the production amounts of automobiles decreased due to the shortage of semiconductors, and the prices of raw materials for eyelets and hooks, which are their core products, including metals, such as copper, and resign, skyrocketed. In addition, the external environment surrounding the core business of Morito was very harsh, due to the shortage of containers for maritime transportation, the considerable delay in the entry or departure of ships at the time of customs clearance for import or export, the skyrocketing of transportation costs, etc. On the other hand, the performance of the apparel business was stable and healthy, as all-season baby clothes, medical wear, working uniforms, etc. sold well. In addition, the sales of sports and leisure goods for skateboarding, yoga, fishing, camping, etc. increased. The sales in the fourth quarter (Sep-Nov) exceeded the sales in the fourth quarter of the term ended November 2019 which is before the outbreak of the COVID-19, showing the recovery of economic activities and the number of orders received.

Operating income was 1,619 million yen, up 89.1% from the previous term. Gross profit margin was 26.1%, showing a slight increase. The company has been reducing expenses since last year, by reconsidering the expenses for unprofitable businesses, using their own warehouses for distribution, etc. As these efforts paid off, the ratio of SG&A expenses dropped and operating income margin increased significantly from 2.1% in the previous term to 3.7%. Regarding non-operating income, exchange loss decreased from the previous year and the subsidy for employment adjustment to cope with the COVID-19 increased, so ordinary income grew 97.6% from the previous term to 1,834 million yen. Net income increased 199.3% from the previous term to 1,407 million yen, as the company reconsidered strategically held shares and posted the gain on sale of investment securities as an extraordinary gain.

The company paid an interim dividend of 9.00 yen/share and a term-end dividend of 17.00 yen/share for a total of 26.00 yen/share per year, up 8.00 yen/share from the previous term.

(2) Trend by segment

Trend by area

| FY Nov. 2020 | Composition ratio | FY Nov. 2021 | Composition ratio | YoY change |

Sales |

|

|

|

|

|

Japan | 28,810 | 70.7% | 30,229 | 69.3% | +4.9% |

Asia | 7,225 | 17.7% | 8,054 | 18.5% | +11.5% |

Europe and the U.S. | 4,691 | 11.5% | 5,353 | 12.3% | +14.1% |

Total | 40,727 | 100.0% | 43,636 | 100.0% | +7.1% |

Profit in the segment |

|

|

|

|

|

Japan | 868 | 3.0% | 1,375 | 4.6% | +58.4% |

Asia | 255 | 3.5% | 401 | 5.0% | +56.7% |

Europe and the U.S. | -63 | - | 56 | 1.1% | - |

Adjustment amount | -205 | - | -213 | - | - |

Total | 856 | 2.1% | 1,619 | 3.7% | +89.1% |

*Unit: million yen

*Sales are for external clients. The composition ratio of profit means the ratio of profit to sales.

◎ Japan

Sales and profit grew 4.9% and 58.4%, respectively, from the previous term.

The sales of accessories for bags and shoes decreased about 200 million yen. The sales of accessories for sports and outdoor goods increased about 400 million yen. The sales of camping goods and their accessories, accessories for yoga wear, waterproof fishing boxes, and drying agents for shoes for sports goods makers were healthy. In addition, the sales of interior parts of automobiles for the next minor changes in Japanese automotivemakers increased 400 million yen. The sales of goods for surfing and skateboarding, which attracted public attention in the Tokyo Olympic Games, increased about 300 million yen.

◎ Asia

Sales and profit increased 11.5% and 56.7%, respectively, from the previous term.

The sales of interior parts of automobiles for Japanese automotive makers in China decreased about 300 million yen, because of the relocation of their factories from Tianjin to Chengdu and the adjustment for it. On the other hand, the sales of accessories for working uniforms and baby clothes for Europe and the U.S. in China and Hong Kong increased. This is mainly because working uniforms and baby clothes remain in demand even amid the COVID-19 pandemic, so base sales increased and the company acquired new customers.

◎ Europe and the U.S.

Sales grew 14.1% from the previous term, and a profit of 56 million yen was posted (a loss of 63 million yen in the previous term).

The sales of accessories for working uniforms and leisure goods for campers and boats increased. The production output of automotive makers decreased due to the shortage of semiconductors mainly in North America and the U.K., but the company received new orders. As a result, the sales of interior parts of automobiles for Japanese automotive makers increased about 200 million yen.

(3) Financial Situation and Cash Flow

◎ Main BS

| End of Nov. 2020 | End of Nov. 2021 |

| End of Nov. 2020 | End of Nov. 2021 |

Current assets | 25,496 | 26,957 | Current liabilities | 6,927 | 7,507 |

Cash and deposits | 10,125 | 11,103 | Trade payables | 4,255 | 4,453 |

Trade receivables | 9,957 | 10,649 | Short-term debts s | 780 | 444 |

Inventories | 4,721 | 4,540 | Noncurrent liabilities | 4,756 | 4,515 |

Noncurrent assets | 18,201 | 18,980 | Long-term debts s | 2,097 | 1,703 |

Property, plant and equipment | 9,565 | 9,876 | Total liabilities | 11,684 | 12,023 |

Intangible assets | 3,651 | 3,469 | Shareholders’ Equity | 30,516 | 31,477 |

Investments, others | 4,984 | 5,633 | Retained earnings | 25,703 | 26,726 |

Total assets | 43,699 | 45,938 | Treasury stock | -2,227 | -2,289 |

|

| Net assets | Net assets | 33,914 | |

Total liabilities, net assets | Total liabilities, net assets | 45,938 | |||

Equity ratio (%) | Equity ratio (%) | 73.7% | |||

*Unit: million yen

Total assets stood at 45,938 million yen, up 2,238 million yen from the end of the previous term.

Current assets increased 1,461 million yen from the end of the previous term to 26,957 million yen. This is mainly because cash and deposits grew 978 million yen, trade notes and accounts receivable increased 692 million yen, raw materials and supplies (some of inventories) rose 141 million yen, and merchandise and finished goods (some of inventories) decreased 348 million yen.

Noncurrent assets grew 778 million yen from the end of the previous term to 18,980 million yen. This is mainly because investment securities rose 544 million yen, land increased 517 million yen, and goodwill decreased 129 million yen.

Current liabilities augmented 580 million yen from the end of the previous term to 7,507 million yen. This is mainly because income taxes payable increased 385 million yen and trade notes and accounts payable rose 197 million yen.

Noncurrent liabilities decreased 241 million yen from the end of the previous term to 4,515 million yen. This is mainly because long-term debts decreased 394 million yen and deferred tax liabilities increased 209 million yen.

Net assets increased 1,899 million yen from the end of the previous term to 33,914 million yen.

Equity ratio rose 0.6 points from 73.1% at the end of the previous term to 73.7%.

◎ Cash flow

| FY Nov. 2020 | FY Nov. 2021 | Increase/decrease |

Operating CF | 2,462 | 2,644 | +181 |

Investing CF | -16 | -401 | -384 |

Free CF | 2,445 | 2,242 | -203 |

Financing CF | -1,878 | -1,380 | +497 |

Cash and Equivalents | 10,052 | 11,020 | +968 |

*Unit: million yen

The balance of cash and cash equivalents as of the end of November 2022 stood at 11,020 million yen, up 968 million yen from the end of the previous term.

A cash inflow of 2,644 million yen from operating activities was posted (a cash inflow of 2,462 million yen in the previous term). This is mainly because funds increased through the earning of net income before taxes and other adjustments and the posting of depreciation while funds decreased through the increase of trade receivables.

A cash outflow of 401 million yen from investing activities was posted (a cash outflow of 16 million yen in the previous term). This is mainly because funds decreased through the acquisition of property, plant and equipment while funds increased through the sale of investment securities.

A cash outflow of 1,380 million yen from financing activities was posted (a cash outflow of 1,878 million yen in the previous term). This is mainly because funds decreased due to the expenditure for repaying long-term debts, paying dividends, and redeeming corporate bonds.

(4) Business Overview and Topics

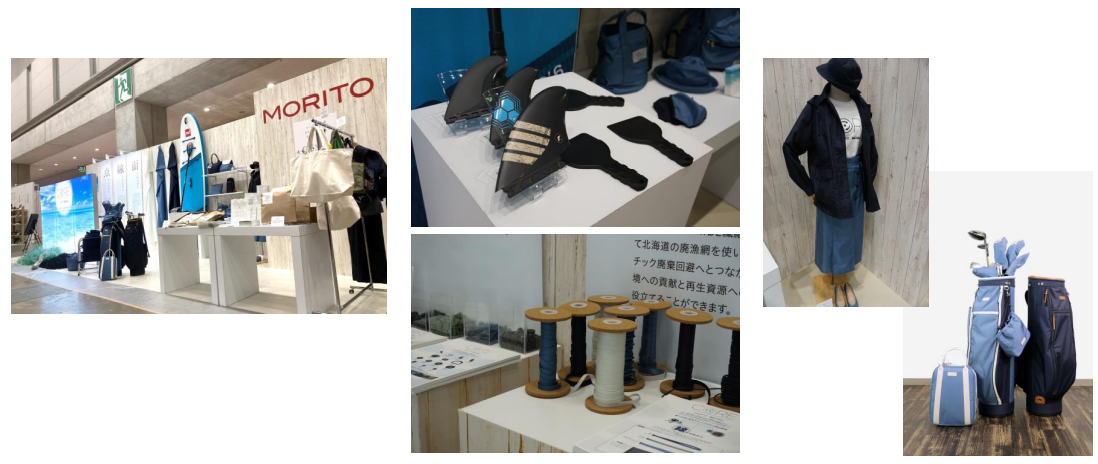

◎ <Apparel/Product Businesses> Efforts Around Environmentally Friendly Product Development, C.O.R.E.

C.O.R.E. stands for Committed to Our Resource and Environment. It means efforts such as environmentally friendly product development, and Morito Group’s commitment to the environment. C.O.R.E. is a comprehensive approach to protecting the beautiful Earth and limited resources for the future, and the Group’s unique project to adopt eco-friendly manufacturing processes, and develop and sell new environmentally conscious products.

Under the theme of the ocean, air, and forest, the company is pushing ahead with development of materials mainly for the apparel industry, such as resin parts, tapes, and fabrics made using a nylon resin, REAMIDE®, which is produced by recycling waste fishing nets that reportedly account for about 40% of marine plastic waste.

Materials that Morito has developed are growing in number, including such parts as buttons that fasten things as points, tapes that connect things as lines, and fabrics that decorate things along the surface, and can be used for a multitude of uses and in many different industries. Morito’s materials have been adopted by various leading brands, and the company will extend this approach in the term ending November 2022.

Examples of materials made from recycling waste fishing nets

(Source: Morito)

Using the materials developed through C.O.R.E., including the fabrics and tapes, Morito is developing bags in collaboration with Toyooka Kaban®, a regional brand in Hyogo Prefecture. This is not mere reuse of materials, but an approach called upcycle that generates things of a higher level and value than original items.

These bags are sold via the brick-and-mortar shops and online shops (https://shop.artisan-atelier.net) of Toyooka Kaban®. Morito will plan new projects to extend the approach of C.O.R.E., such as hosting events with the municipality with the aim of local production for local consumption. As a starting point, the company continues to clean Imagoura Beach in Hyogo Prefecture, to which marine debris are reportedly carried in due to the tidal current. Actual visits to the beach enable the company not only to help the local people with the garbage problems, but also to think up ideas that it should push forward from now on.

Toyooka Kaban®

(Source:Morito)

Like last year, Morito plans to exhibit products on a large scale at Sustainable Fashion EXPO held at Tokyo Big Sight in October this year. The company made a myriad of proposals, including clothes, hats, and shoes, last year. The highlight of Morito’s exhibition this year will be C.O.R.E..

(Source:Morito)

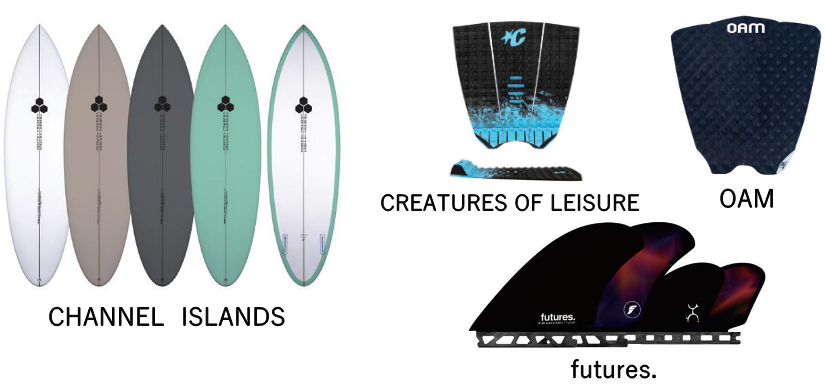

◎ <Product Business> The skateboard and surfing-related products are promising.

Skateboarding and surfing related products are attracting attention, partly because of the medals won by Japanese athletes at the Tokyo Olympics in 2021. Sales of skateboarding and surfing-related products have been growing as outdoor sports that can be enjoyed without dense traffic in the Corona disaster area, and the Olympics have provided a tailwind. Sales have also been strong in preparation for the 2024 Olympics in Paris.

(Skateboard-related brands to keep an eye on)

(Source:Morito)

(Surfing-related brands to keep an eye on)

Morito started to deal with items of a brand named NEILPRYDE that offers products related to windsurfing. In addition, the company serves as an import agency of a brand, CHANNEL ISLANDS, whose products have been used by a number of world-famous surfers. Morito will open a store that exclusively sells products of these brands, and it expects sales expansion.

(Source:Morito)

In the snowboard-related field, the NITRO brand, which is handled by the company's subsidiary, Maneuverline, has become popular.

In the outdoor-related field, the company exhibited at two solo exhibitions and outdoor shows in January 2022. The company has received almost double the inquiries and orders than the previous year.

◎ <Japan Apparel Business>

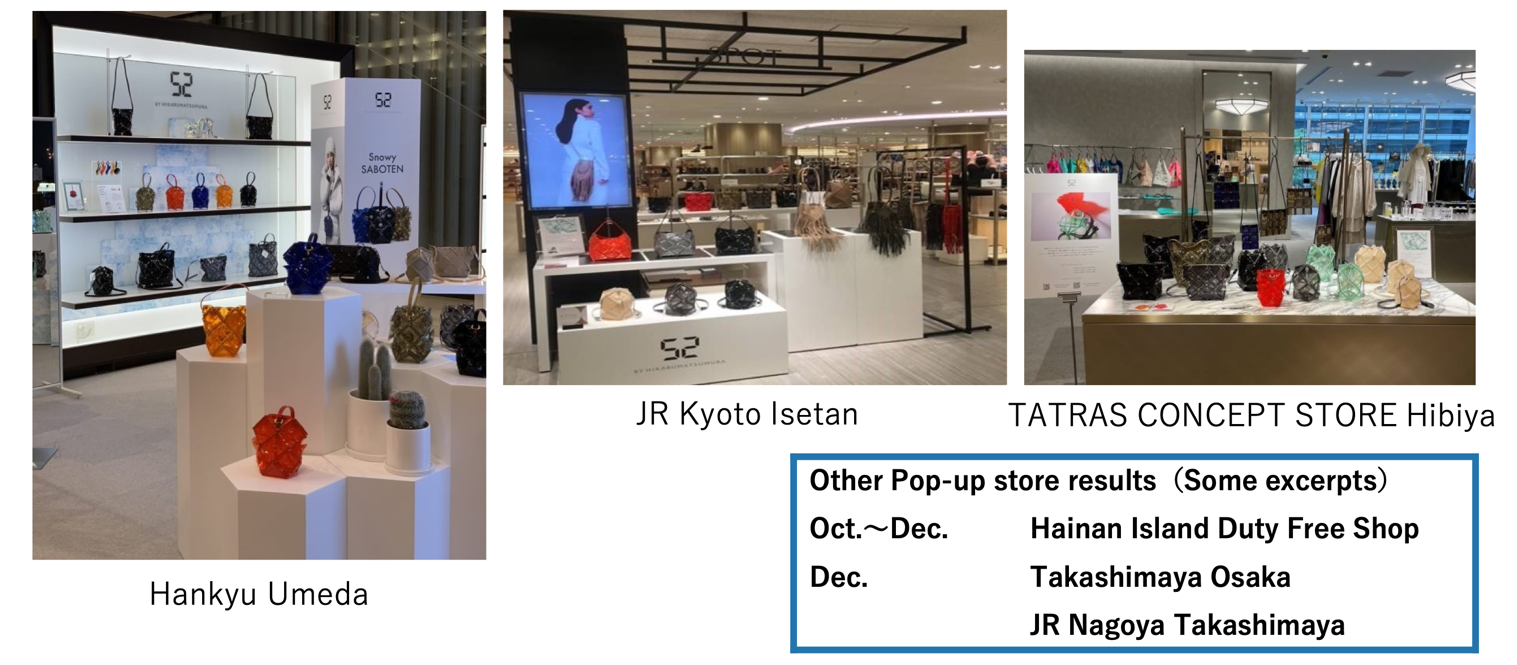

Development of BtoC business 52design

52DESIGN, established in 2017, is developing a BtoC business. The company was established in collaboration with Hikaru Matsumura, who was involved in the development of the "BAO" bags at ISSEY MIYAKE. The company focuses on sales of bags in the high price range.

The company plans to continue actively developing POP-UP stores at department stores and select stores around the country. The number of wholesalers in Japan and overseas is also on the rise, and inquiries and purchases from select stores in China are increasing in particular. The company is also holding a POP-UP STORE in Hainan Island, China, and will strengthen sales mainly in Asia. In the future, there are plans to collaborate with famous overseas brands and to develop products in new fields other than just bags, which looks promising.

(Source:Morito)

◎ <Product Business> Expansion of the Product Lineup for Uniform-price Retail Stores

While Morito’s main product has been insoles of shoes, it began selling products related to computers, such as mousepads developed utilizing materials used in its insoles. As an increasing number of people who work from home due to the COVID-19 pandemic are fueling demand, the company will continue strengthening such products.

Furthermore, this fiscal year, it began to deal with products related to face masks and products related to handicrafts and craftworks, some of which are items that the company started to sell on a full scale in the term ending November 2022, and it is expected to generate sales continuously.

In the term ending November 2022, Morito intends to focus on added value and business expansion amid the COVID-19 crisis, and it will continue reform of low gross profit and unprofitable businesses.

(Source:Morito)

3. Fiscal Year ending November 2022 Earnings Forecast

(1) Consolidated earnings forecast

| FY Nov. 2021 | Ratio to sales | FY Nov. 2022 (Forecast.) | Ratio to sales | YoY change |

Sales | 43,636 | 100.0% | 45,000 | 100.0% | +3.1% |

Operating income | 1,619 | 3.7% | 1,800 | 4.0% | +11.1% |

Ordinary income | 1,834 | 4.2% | 1,850 | 4.1% | +0.9% |

Net income | 1,407 | 3.2% | 1,450 | 3.2% | +3.0% |

*Unit: million yen

*The estimated values were those announced by the company. Net income means the profit attributable to owners of the parent.

Sales and profit are expected to grow in the term ending November 2022.

In the term ending November 2022, the company projects that sales will increase 3.1% year on year to 45 billion yen, operating income will grow 11.1% year on year to 1.8 billion yen, ordinary income will rise 0.9% year on year to 1,850 million yen, and net income will go up 3.0% year on year to 1,450 million yen. The COVID-19 infection has a prolonged impact and has imposed restrictions on economic activities to a certain extent; however, Morito will carry out multifarious policies to cope with rapidly changing markets and a new normal with the aim of achieving consolidated sales of 50 billion yen and a consolidated operating income of 2.5 billion yen in the term ending November 2026 as set in its 8th mid-term management plan (see below for details).

Although the future of the global economy is uncertain due to such factors as the COVID-19 that is spreading again and the U.S.-China trade war, the company will aim to increase sales and profit by focusing on sale of functional, sustainable, and eco-friendly products with value added, besides its key products.

The amount of dividends is to be 27.00 yen (including 13.50 yen for the first half), up 1.00 yen from the previous term.

(2) Basic policy on profit sharing

● To realize continuous dividend payment

● To aim at a dividend payout ratio of 50% or higher (when net income fluctuates considerably, the impact will be considered)

● To maintain a DOE of 1.5%

*The company will continue discussing acquisition and retirement of treasury shares flexibly by taking into consideration various factors, such as the financial situation and the current level of the share price, from the perspective of further enriching shareholder returns.

(3) Start of the 8th mid-term management plan

The original period of the mid-term management plan was five years starting in the term ended November 2020, but Morito revised the plan so that it starts in the term ending November 2022 due to the impact of the spread of the COVID-19.

During the terms ended November 2020 and 2021 which the company considered as a period for building a business structure, Morito improved its profit structure, coped with its employees and businesses amid the COVID-19 crisis, prepared itself for a post-pandemic world, and developed new products. It will endeavor to attain sales of 50 billion yen and an operating income of 2.5 billion yen, the quantitative targets for the five years starting in the term ending November 2022 and ending in the term ending November 2026, ahead of schedule.

(Source:Morito)

4. Conclusions

Sales and operating income for the term ended November 2021, which the company considered to be a period of building up a business structure in the 8th mid-term management plan, were initially projected to be 43 billion yen and 1.3 billion yen, respectively, but the actual sales and operating income exceeded the projections significantly. In the term ending November 2022, although the current spread of the COVID-19 is a concern, the impact will not be significant to the company because it has taken measures. Soaring costs of raw materials are another issue. In particular, the prices of brass and copper, which are used in hooks, are shooting up. While Morito has raised its selling prices and already been reviewing unprofitable businesses, it will cut down on costs to address the issue. Regarding overseas markets, the earnings level remains low in Europe and the United States, and Morito would like to pass on the rising costs to sales prices. It is not only striving to turn around the existing business domains, but making steady efforts to expand the top line towards the future, such as development of environmentally friendly products and release of new products.

Concerning the share price, PBR is as low as 0.6. There is ample room for reconsideration because earnings per share (EPS) is expected to be around 70 yen if the company achieves the targets of the mid-term management plan.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 5 directors, including 2 external ones |

Auditors | 3 auditors, including 2 external ones |

Morito has set up an arbitrary nomination and remuneration committee for which an outside director serves as chair. The committee consists of three members, two of whom are outside directors.

◎ Corporate Governance Report

Updated on December 17, 2021

<Basic Views>

Pursuant to our corporate principle and our action principles that stipulate the acts that should be carried out by all our officers and employees, from the standpoint of our stakeholders, our company considers reinforcement and enrichment of our corporate governance framework to be the most important business issue for long-term and continuous improvement of our corporate value. For our stakeholders, we believe that we need sincere and timely disclosure, speedy decision-making through clarification of roles and responsibilities, and strengthening of objective check functions.

Considering that supervision of the business execution of the Board of Directors by the outside directors and audits by the auditors including the outside auditors are effective as a business monitoring function, we have operated as a company with an audit and supervisory committee.

Our Board of Directors is composed of three internal directors and two outside directors, holds meetings every month, makes decisions about matters stipulated by the law and important matters related to our company’s business strategies, and supervises business execution by the directors. In addition, we have set up a compliance committee to instill and maintain a compliance structure and meet requirements for an internal control system.

Regarding the two outside directors, we have appointed them as independent officers in accordance with the regulations of the Tokyo Stock Exchange and notified the stock exchange of the appointment.

Our Audit and Supervisory Committee consists of three members including two outside auditors and conducts audits in a fair and objective manner from a basic audit perspective of establishment of a corporate governance system.

Regarding the two outside auditors, we have appointed them as independent officers in accordance with the regulations of the Tokyo Stock Exchange and notified the stock exchange of the appointment.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

【The Corporate Governance Code to Follow】

The following information is based on the Corporate Governance Code revised in June 2021.

Principles | Reasons for not implementing the principles |

【Supplementary Principle 2-4-1 Ensuring diversity in the promotion to core human resources】 | Our company promotes our employees to middle managerial positions through fair evaluation of their abilities, insights, personality, and other relevant elements regardless of such factors as gender and nationality; therefore, we have not set any numerical targets, but our corporate group has already promoted local and female employees to the positions of director and administrator at our overseas bases, through which we ensure diversity. We will continue discussing such matters as setting of numerical goals. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Principle 1-4 So-called strategically held shares】 | (1) Policy on strategically held shares Our company holds shares of other listed companies only when we have determined that doing so contributes to raising our corporate value and is necessary for our business after considering such factors as the importance for our business strategies and necessity of business relationships with our business partners in the course of sales, production, and financing. (2) Matters discussed regarding strategically held shares Our company comprehensively judges whether we should continue to hold shares in other listed companies after the Board of Directors has annually verified the benefits of holding the shares, such as the amount of dividends and transaction volumes, purposes of holding the shares, and the future outlook of transactions. We will sell shares in other listed companies appropriately when we judge that the significance of holding the shares is not enough as a result of the board’s verification. Even when the validity of holding the shares is confirmed through the verification, we may sell them by taking into consideration the market environment, business and financial strategies, and other relevant factors. In addition, regarding the shares that we have held in large numbers out of the shares that we have decided to continue holding, we disclose the number of shares that we hold and the purpose of holding them in our securities reports. (3) Criteria for exercising the voting rights attached to strategically held shares Our company appropriately exercises the voting rights attached to strategically held shares after comprehensive judgment from the perspectives of whether doing so contributes to improving the shareholder value and impacts of doing so on our company. |

【Supplementary Principle 2-4-1 Ensuring diversity in the promotion to core human resources】 | Our company has established Morito Group’s Human Resources Management Policy in which we aim to realize personnel management that protects diversity in our employees. We promote our employees to middle managerial positions through fair evaluation of their abilities, insights, personality, and other relevant elements regardless of such factors as gender and nationality; therefore, we have not set any numerical goals, but our corporate group has already promoted local and female employees to the positions of director and administrator at our overseas bases, through which we ensure diversity. Furthermore, regarding mid-career hires, the ratio of mid-career hires who have been promoted to administrative positions has already exceeded 50% in our company. We will continue to ensure diversity pursuant to Morito Group’s Human Resources Management Policy. Morito Group’s Human Resources Management Policy and various pieces of data are posted on our website: http://www.morito.co.jp/csr/ |

【Supplementary Principle 3-1-3- Initiatives on sustainability】 | <Initiatives on sustainability> Our company has posted our attitude, policies, and efforts towards sustainability on our website: http://www.morito.co.jp/ir/management/risk.html http://www.morito.co.jp/core/ http://www.morito.co.jp/csr/03_society/index.html <Investment in human capital and intellectual property> Our company offers opportunities of capacity development to human resources with capacities and aspirations that allow outstanding achievements under our education policy of self-development and self-growth in accordance with Morito Group’s Human Resources Management Policy. We strive to enhance our human capital by regularly providing such programs as training sessions designed for each employee level, career design sessions, and support for self-enlightenment. We also make investment in intellectual property by filing patents for products related to sustainability under our unified brand name, and applying for patents and design for products. |

【Principle 5-1 Policy for constructive dialogue with shareholders】 | Our company has provided opportunities for dialogue with shareholders for the purpose of contributing to our company’s sustainable growth and medium- and long-term improvement of the corporate value. ① Status of system development Our company has appointed a person responsible for IR activities in order to realize constructive dialogue with shareholders. In addition, with the department in charge of IR activities taking the lead, related departments cooperate with each other, establishing a system that offers appropriate information to shareholders. ② Policies on efforts Our company hosts a variety of events on a regular basis, including financial results briefings that are designed for analysts and institutional investors and held semiannually by a person in charge of IR activities, individual interviews held quarterly, and company information sessions held 3 – 4 times a year for individual investors. Information is shared among the top executives in the hope of utilizing information obtained through such events in corporate management. Furthermore, our company properly grasps insider information in accordance with the regulations on management of insider trading, and exercises utmost caution when we hold dialogue with shareholders. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on Morito Co., Ltd (9837) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/.