Bridge Report:(9837)MORITO the term ended November 2022

President Takaki Ichitsubo | MORITO CO.,LTD. (9837) |

|

Company Information

Exchange | TSE Prime Market |

Industry | Wholesale (commerce) |

President | Takaki Ichitsubo |

Address | 4-2-4 Minami-honmachi, Chuo-ku, Osaka |

Year-end | Last day of November |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥962 | 30,000,000 shares | ¥28,860million | 4.8% | 100shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥54.00 | 5.6% | ¥67.40 | 14.3 x | ¥1,371.63 | 0.7 x |

*The share price means the closing price on February 10. Shares Outstanding, ROE and BPS are based on FY 11/22 earnings results. DPS and EPS are based on FY 11/23 earnings estimates.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

November 2018 (Actual) | 43,943 | 1,725 | 1,790 | 1,257 | 45.71 | 25.00 |

November 2019 (Actual) | 45,987 | 1,734 | 1,779 | 1,402 | 51.17 | 26.00 |

November 2020 (Actual) | 40,727 | 856 | 928 | 470 | 17.17 | 18.00 |

November 2021 (Actual) | 43,636 | 1,619 | 1,834 | 1,407 | 51.41 | 26.00 |

November 2022 (Actual) | 48,478 | 2,116 | 2,342 | 1,674 | 62.23 | 32.00 |

November 2023 (Forecast) | 50,000 | 2,300 | 2,450 | 1,800 | 67.40 | 54.00 |

* The forecasted values were provided by the company. Unit: million yen or yen.

We briefly report the financial results for the term ended November 2022 of Morito Co., Ltd.

Table of Contents

Key Points

1.Company Overview

2. Fiscal Year ended November 2022 Earnings Results

3. Fiscal Year ending November 2023 Earnings Forecast

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- Sales and ordinary income increased 11.1% and 27.7% year on year, respectively, in the term ended November 2022. Although there was a decrease in production by automobile manufacturers, accessories and products with excellent functionality, especially sports and medical equipment-related products, performed well. Sales increased in Japan, Asia, Europe, and the United States. In terms of profit, many factors pushed down profit, such as soaring prices of raw materials for mainstay products and difficulty in procurement. However, the company continued to optimize expenses such as transportation costs. Thus, operating income margin improved, mainly due to a decline in the ratio of SG&A expenses. Profit in Japan, Asia, Europe, and the United States all increased significantly, and the company has also achieved record-high sales and ordinary income. The term-end dividend is 18.50 yen, up 3.00 yen from the previous forecast. The annual dividend is 32.00 yen.

- In the term ending November 2023, it is expected that sales will grow 3.1% and ordinary income will rise 4.6% year on year. As the future of the global economy is uncertain due to such factors as violent exchange rate fluctuations and rising prices, the company will focus on selling value-added products that focus on functionality, sustainability, and being green, in addition to core products. Morito will also continue to improve profit margin as a company-wide policy. In addition, the company plans to continue reforms for unprofitable businesses, products, and distribution channels. It reviewed part of the medium-term plan. Based on the new shareholder return policy, the company plans to increase the dividend by 22.00 yen from the previous term to 54.00 yen (including 27.00 yen in the first half).

- Despite soaring raw material prices and transportation costs, stagnant automobile production, the turmoil in the distribution network, and rapid exchange rate fluctuations, sales and profit increased by double digits in the term ended November 2022. Sales growth in the apparel business is on track, and sales in Europe and the United States are growing every quarter. Regarding the 8th medium-term plan, the achievement of the plan in the term ending November 2023 ahead of schedule is in sight. The main focus of this mid-term plan revision is likely to be the DOE target of 4%. We feel that the company is strongly determined to achieve its long-term target of an ROE of 8%. Regarding stock price, the PBR is well below 1, and we believe there is room for further improvement.

1. Company Overview

Morito is a specialized trading company that engages in the entire process of planning, developing, manufacturing, wholesaling, and distributing automotive interior parts and clothing accessories, including hooks and eyes, hook-and-loop fasteners, and “eyelets,” which are metal rings for lining a hole for laces on shoes, clothes, etc. Through its history of over 100 years, the company has developed the deep trust of customers, high market share with a wide array of products, global networks, etc. As of the end of November 2022 there are a total of 22 consolidated subsidiaries, 8 domestic and 14 overseas, and 1 affiliated company accounted for using the equity method in Japan. It has been a holding company structure since June 2019.

【Corporate history】

The founder Jukichi Moritou, who had worked for a draper’s shop in Osaka as an employee, started a one-man company called “Moritou Shoten” in 1908, brokering the trade of eyelets, hooks and eyes. In the Taisho period, the western fashion spread, boosting the demand for shoes and allowing the company to grow rapidly. In 1937, the company internationalized its business by exporting hook-and-loop fasteners to Sumatra and Java, and shoelaces to Johannesburg in South Africa and the U.K. After the Pacific War, the company started selling colored nylon fasteners and hook-and-loop fasteners. In the 1990s, the company launched the business related to consumer goods, such as automotive interior parts and camera straps, with the aim of promoting general-purpose materials, and expanded its business domain. The company also conducted overseas business actively. In 1989, the company was listed in the second section of Osaka Securities Exchange, and in July 2013, it was registered in the second section of Tokyo Stock Exchange, as Tokyo Stock Exchange and Osaka Securities Exchange merged. Morito promoted to the first section of Tokyo Stock Exchange in December 2016.

The company was listed on the Prime Market in April 2022.

1908 | Opened Moritou Shoten (started selling eyelets, hooks and eyes, and shoelaces) |

1935 | Established Moritou Shoten Co., Ltd. |

1958 | Started selling colored nylon fasteners. |

1960 | Started selling hook-and-loop fasteners. |

1976 | Renamed the company Morito Co., Ltd. |

1977 | Established Morito Industrial Co., (H.K.) Ltd. in China. (Currently, MORITO SCOVILL HONGKONG COMPANY LIMITED) |

1983 | Established KANE-M, Inc. in the U.S. (Current, MORITO NORTH AMERICA, INC.) |

1985 | Established a consolidated subsidiary named Morito (Europe) B.V. in the Netherlands. |

1987 | Ace Industrial Machinery Co., Ltd. was founded (Japan) |

1989 | Listed in the 2nd section of Osaka Securities Exchange |

2001 | Acquired Wah Kin Metal Products Mfg. Co., Ltd. and Morito (Shenzhen) Co., Ltd. in China as the subsidiaries of Morito Industrial Co., (H.K.) Ltd. through M&As. |

2003 | Established Kane-M Shanghai Co., Ltd. in China. (Current, MORITO SHANGHAI CO.,LTD.) |

2005 | Relocated and expanded the scales of Bao'an Factory of Morito Industrial Co., (H.K.) Ltd. and Morito (Shenzhen) Co., Ltd. in China. |

2007 | Morito Industrial Co., (H.K.) Ltd. acquired Wah Kin Metal Products Mfg. Co., Ltd. through absorption-type merger in China. |

2008 | Formed business and capital tie-ups with the Kuraray Group and reorganized Kuraray Fastening Co., Ltd. into an equity-method affiliate. |

2010 | Established Kane-M Danang Co., Ltd. in Vietnam. (Current, MORITO DANANG CO.,LTD) |

2011 | Established Kane-M (Thailand) Co., Ltd. in Thailand. (Current, MORITO TRADING (THAILAND) CO.,LTD) |

2012 | Opened a representative office in Myanmar (Currently, The Representative Office Of MORITO APPAREL CO., LTD. in Myanmar). Established Michigan Branch of Kane-M Inc. in the U.S. (Current, MORITO NORTH AMERICA, INC.) |

2013 | Listed in the 2nd section of Tokyo Stock Exchange. |

2014 | Acquired MATEX INC. through M&A (Japan). Acquired Scovill, a U.S. company that manufactures and sells clothing materials. (Current, MORITO SCOVILL AMERICAS,LLC). |

2016 | Listed in the 1st section of Tokyo Stock Exchange. |

2017 | Established MORITO SCOVILL Mexico S.A. DE C.V. (Mexico). |

2018 | Morito Kanto Logistics Center opened Acquired MANEUVERLINE CO., LTD. through M&A in Japan. MORITO JAPAN CO., LTD., a wholly-owned subsidiary of MORITO CO., LTD., established as a preparation company |

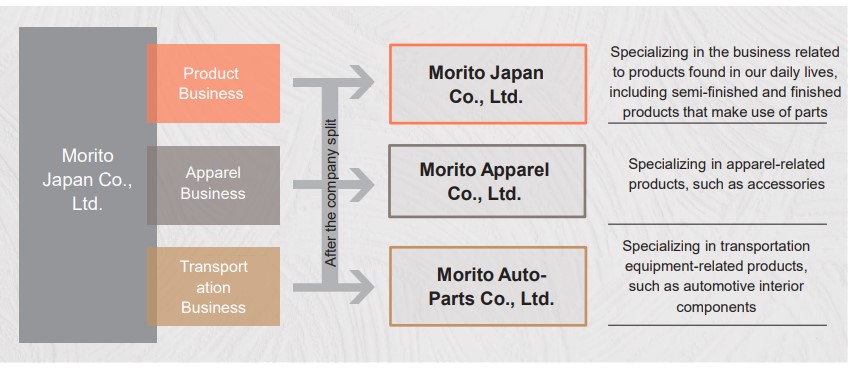

2019 | Company split between MORITO CO., LTD. as the splitting company and MORITO JAPAN CO,. LTD, as the succeeding company, in accordance with transition to a holding company structure. |

2022 | Listed on the Tokyo Stock Exchange Prime Market MORITO JAPAN CO., LTD. as the splitting company, with rights and obligations related to apparel-related business transferred to MORITO APPAREL CO., LTD, and rights and obligations related to transportation-related business transferred to MORITO AUTO-PARTS CO,.LTD. |

【Vision, etc.】

1.Founding Principle

Active and Steadfast

The principle “Active and Steadfast” represents the spirit of Morito that has been fostered since its inauguration, and implies that “Success is ensured by proactively making a judgment and taking action.”

"Active and steadfast" has always been the basic attitude in Morito's activities, and this attitude has been behind the development of today's business. Morito will continue adopting this founding philosophy without change and aim for further growth.

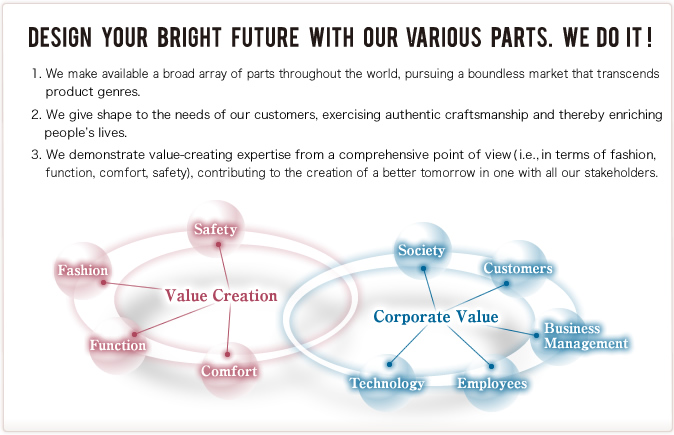

2.Corporate Principle

DESIGN YOUR BRIGHT FUTURE WITH OUR VARIOUS PARTS, WE DO IT!

(1) We make available a broad array of parts throughout the world, pursuing a boundless market that transcends product genres.

(2) We give shape to the needs of our customers, exercising authentic craftsmanship and thereby enriching people’s lives.

(3) We demonstrate value-creating expertise from a comprehensive point of view (i.e., in terms of fashion, function, comfort, safety), contributing to the creation of a better tomorrow in one with all our stakeholders.

(Source:Morito)

3.Corporate Vision

Create Morito’s existence value, Realize “New Morito Group”

By creating an environment where each and every employee can demonstrate their strengths, the company will create new existence value for the Morito Group that goes beyond the added value of its products and will aspire to be a company that continues to grow.

4.Action Principles

Fulfilling our responsibility to our customers |

Fulfilling our responsibility to our business partners |

Fulfilling our responsibility to shareholders |

Fulfilling our responsibility to Society |

Fulfilling our responsibility to each other |

5.MORITO VALUE

"MORITO Values" are the values, ways of thinking, and behaviors rooted in Morito's employees as tacit knowledge. By clarifying and permeating them as action guidelines and judgment standards, the company will increase the sense of unity and solidarity of the Morito Group in Japan and overseas.

(Source:Morito)

【Update of the corporate brand】

(Background)

Morito Japan, the largest operating company of the Morito Group, was split.

→ To respond to all environmental changes and manage the company in line with the needs in each market.

(Source:Morito)

Established a new tagline and changed the corporate logo

With the rebirth of the Morito Group under a new structure, the company established a new tagline and changed the corporate logo.

The company has also conducted PR activities using the new logo and tagline, which are scheduled to continue.

The new tagline, "Where innovation is the norm," shows that it is the norm for the company to pursue the user-friendliness of Morito's parts, which seem ordinary at first glance, and continue to develop and propose new products that meet that purpose.

The corporate logo expresses the vibration when encountering newness in the letter M, which resembles a wave pattern. The bottom of the typeface is slightly hidden to indicate the awareness of the company's supporting role in various industries and express its strength which resembles the rising sun.

(Source:Morito)

Morito became an official sponsor of the Chiba Lotte Marines and posted advertisements at ZOZO Marine Stadium.

|

|

(Source:Morito)

【Business description】

The business of Morito can be classified into three realms: 1) The “apparel related business,” which handles clothing accessories, such as eyelets, hooks and eyes, buckles, and fasteners, 2) The “product related business,” which handles the PC related cases and mobile terminals, and foot-care products, such as the secondary materials and insoles of shoes, and 3)The “transportation equipment related business”, which treats automotive interior parts, such as mat emblems and door grips. In each business, the company conducts the entire process of planning, development, manufacturing, distribution, and sale of products, according to markets and customers’ needs, while considering fashion, functionality, comfort, safety, etc. The segments to be reported are the three segments: Japan, Asia, and Europe & the U.S.

◎ Apparel related Business

<Examples of products>

| <Usage example>

Casual wear and shoes

Sportswear and shoes

Work clothes and shoes

Medical clothes and baby clothes

Formal wear, shoes, and bags |

(Source:Morito)

Sales composition ratio is 47% as of FY November 2022.

Morito delivers the accessories of clothes and footwear, including eyelets, hooks and eyes, buckles, fasteners, and rivets, to apparel manufacturers, etc. inside and outside Japan, which are end clients of Morito, mainly via wholesalers, trading companies, and distributors.

◎ Product related Business

<Examples of products>

| <Usage example> Insoles and shoe care products Video equipment-related products, such as cameras and PC cases Supports, safety-related products, educational materials, and stationery Skateboarding, surfing, etc. Active sports-related products |

(Source:Morito)

Sales composition ratio is 37% as of FY November 2022.

Besides providing accessories and semi-finished products to the industrial materials field, the company sells original products under its own brand, focusing on shoe care products such as shoe insoles and shoe creams.

◎ Transportation Equipment related Business

<Examples of products>

| <Usage example>

Interior parts of automobiles Interior parts of trains and shinkansen (bullet trains) Interior parts of aircraft

|

(Source: Morito)

Sales composition ratio is 16% as of FY November 2022.

Morito handles automotive interior parts, such as mat emblems, door grips and arm rests.

The automobile-related business accounts for about 90%. The major clients are supplier companies of Japanese leading automotive manufacturers.

【Features and Strengths】

(1) Stable performance with the three business pillars

Sales composition ratio is slightly over 40 % of the apparel related business and slightly under 40% of the product related business and nearly 20% of the transportation equipment related business.

This business portfolio stabilizes the performance of Morito. The company has never fallen into the red, even during the two postwar oil shocks, the global economic crisis in the wake of the bankruptcy of Lehman Brothers, and the novel corona virus crisis.

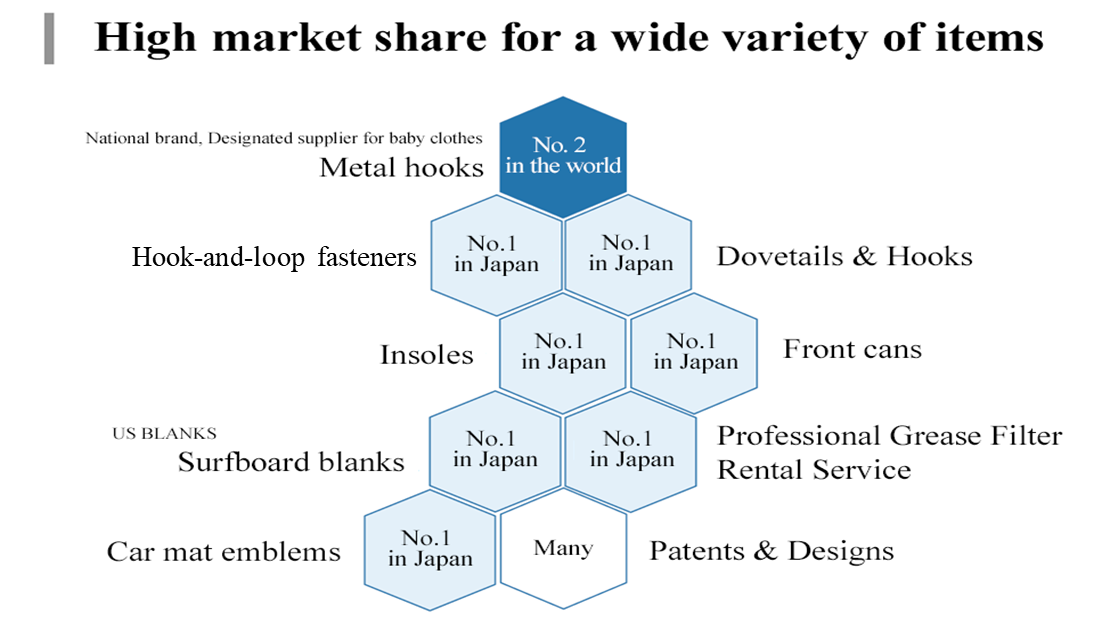

(2) Large market share for various products

The company has high market share for various products, as tabulated.

Although some enterprises in emerging countries supply products at lower prices than Morito, it won the trust of clients with its capabilities of dealing with all processes, including planning, development, manufacturing, and distribution, and coping with various situations appropriately, and the quality of its products, including safety, which had been developed through its long history, achieving high market share.

For example, Morito gives appropriate technical advice from the stage of producing samples for clients, repeatedly fine-tunes coloration to meet the needs of clients, and keeps checking products after the start of full-scale production. Namely, the company not merely sells products, but clears many hurdles before starting transactions, and provides clients with a system for all processes from upstream to downstream ones. The provision of such added value is highly evaluated by clients, mainly the famous brands outside Japan.

<Major Items and Share>

(Surveyed by Morito)

(3) Global network spreading all over the world

Planning and development are conducted mainly in Japan. The company owns production and distribution facilities in Europe; North Americas; Asia-Pacific region, and Africa.

(Source:Morito)

With the aim of growing as a global company, Morito is enriching international production sites and sales networks, and developing internal systems to underpin global business administration.

If this progresses as planed and its global network is fortified, the competitive advantage of the company will be enhanced further.

In addition to the above three items, its unique positioning, too, can be said to characterize Morito.

When considering just one among Morito’s many products, there are always some competitors, but Morito is the only one company in the world that handles such a variety of products, deals with all processes, including planning, development, manufacturing, distribution, and sale, and has sales exceeding 40 billion yen.

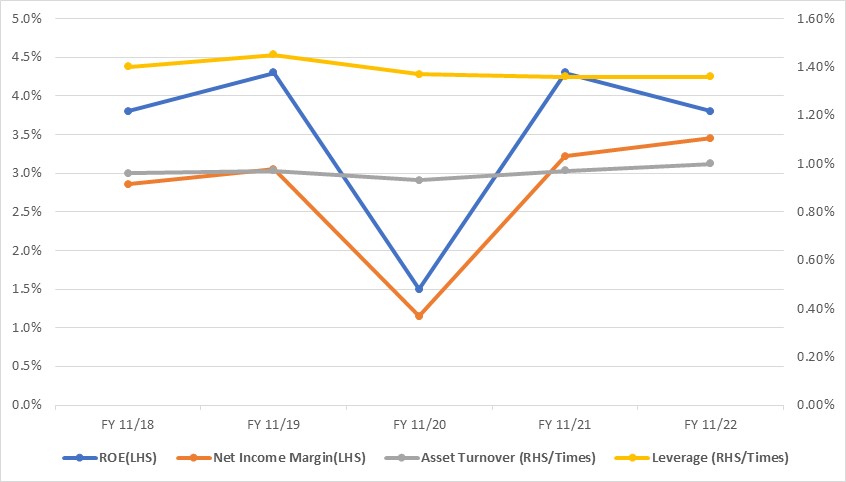

【ROE analysis】

| Term ended Nov. 2016 | Term ended Nov. 2017 | Term ended Nov. 2018 | Term ended Nov. 2019 | Term ended Nov. 2020 | Term ended Nov. 2021 | Term ended Nov. 2022 |

ROE (%) | 3.9 | 10.7 | 3.8 | 4.3 | 1.5 | 4.3 | 4.8 |

Net income ratio to sales [%] | 2.95 | 7.99 | 2.86 | 3.05 | 1.15 | 3.22 | 3.45 |

Total asset turnover | 0.91 | 0.98 | 0.96 | 0.97 | 0.93 | 0.97 | 1.00 |

Leverage [times] | 1.46 | 1.36 | 1.40 | 1.45 | 1.37 | 1.36 | 1.36 |

*Created by Investment Bridge based on disclosed material of the company.

For the term ended November 2017, ROE rose drastically due to increase in net income, which is attributed to increase in extraordinary income after the sale of land.

In the term ended November 2019, gain on sales of fixed assets and gain on sales of securities have continued to push up net income. In the term ended November 2020, net income margin declined due to the impact of the novel corona virus.

In the term ended November 2021, net income margin improved significantly. The ROE of the term ended November 2022 also improved, reaching a record high, excluding it in the term ended November 2017, which had special factors. The net income ratio to sales for the term ending November 2023 is expected to improve further to 3.60%.

2. Fiscal Year ended November 2022 Earnings Results

(1) Overview of consolidated results

| FY Nov. 2021 | Ratio to sales | FY Nov. 2022 | Ratio to sales | YoY change | Company forecast | Compared with the company forecast |

Sales | 43,636 | 100.0% | 48,478 | 100.0% | +11.1% | 46,000 | +5.4% |

Gross margin | 11,401 | 26.1% | 12,487 | 25.8% | +9.5% | - | - |

SG&A expenses | 9,781 | 22.4% | 10,370 | 21.4% | +6.0% | - | - |

Operating income | 1,619 | 3.7% | 2,116 | 4.4% | +30.7% | 2,000 | +4.8% |

Ordinary income | 1,834 | 4.2% | 2,342 | 4.8% | +27.7% | 2,100 | +11.6% |

Net income | 1,407 | 3.2% | 1,674 | 3.5% | +19.0% | 1,550 | +8.0% |

*Unit: million yen. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

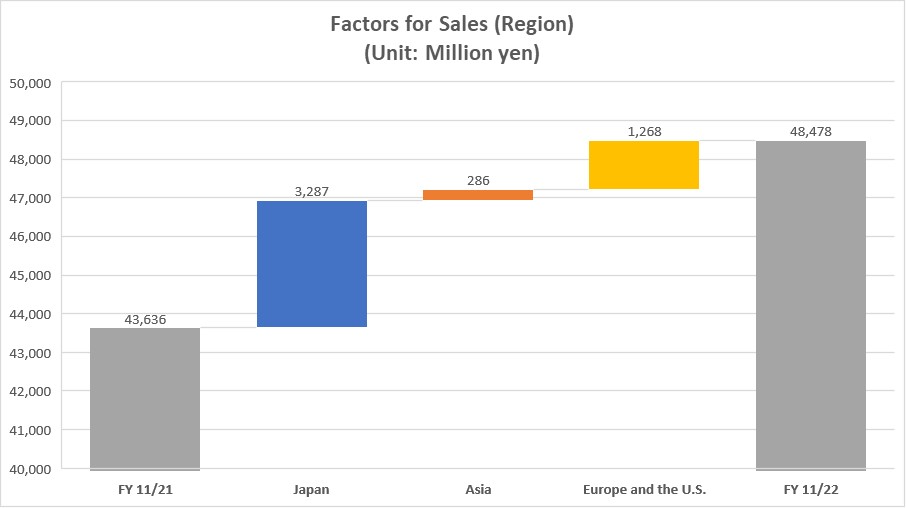

Sales increased 11.1%, and ordinary income rose 27.7% due to cost optimization.

Sales increased 11.1% year on year to 48,478 million yen. There were production cuts and suspensions by automobile manufacturers due to the shortage of semiconductors and delays in marine transportation. On the other hand, accessories and products with excellent functionality, mainly medical wear, work clothes, sports-related products such as yoga and fishing products, and medical equipment-related products, which are not affected by trends, performed well. In addition, the company focused on acquiring new businesses by promoting the development and sales of eco-friendly products that use scraps from discarded fishing nets and garment factories. Sales increased in Japan, Asia, Europe, and the United States.

Operating income increased 30.7% year on year to 2,116 million yen. Many factors pushed down profit, such as soaring raw material prices and procurement difficulties for mainstay products, production cuts or suspensions by automobile manufacturers, delays in marine transportation, and soaring transportation costs. Nonetheless, the company continued to optimize expenses such as transportation costs. Gross profit margin remained unchanged from the previous term due to an increase in purchase prices caused by the yen depreciation. However, operating income margin improved from 3.7% in the same period of the previous year to 4.4% due to a decrease in SG&A ratio. Profits in Japan, Asia, Europe, and the United States all increased significantly. In non-operating areas, there was a decrease in employment adjustment subsidies, and ordinary income increased 27.7% year on year to 2,342 million yen. Gains on the sale of investment securities as extraordinary income decreased, and net income increased 19.0% year on year to 1,674 million yen.

Sales and ordinary income reached record highs. From the beginning of the first quarter, the company has applied the Accounting Standard for Revenue Recognition (Accounting Standards Board of Japan No. 29, March 31, 2020). Thus, sales decreased 427 million yen, and operating income declined 46 million yen. Ordinary income and net income increased 6 million yen each.

The term-end dividend is 18.50 yen, up 3.00 yen from the previous forecast. The annual dividend is 32.00 yen.

(2) Trend by segment

Trend by area

| FY Nov. 2021 | Composition ratio | FY Nov. 2022 | Composition ratio | YoY |

Sales |

|

|

|

|

|

Japan | 30,229 | 69.3% | 33,516 | 69.1% | +10.9% |

Asia | 8,054 | 18.5% | 8,340 | 17.2% | +3.5% |

Europe and the U.S. | 5,353 | 12.3% | 6,621 | 13.7% | +23.7% |

Total | 43,636 | 100.0% | 48,478 | 100.0% | +11.1% |

Profit in the segment |

|

|

|

|

|

Japan | 1,375 | 4.6% | 1,618 | 4.8% | +17.7% |

Asia | 401 | 5.0% | 696 | 8.4% | +73.7% |

Europe and the U.S. | 56 | 1.1% | 104 | 1.6% | +82.7%- |

Adjustment amount | -213 | - | -146 | - | - |

Total | 1,619 | 3.7% | 2,116 | 4.4% | +30.7% |

*Unit: million yen

*Sales are for external clients. The composition ratio of profit means the ratio of profit to sales.

*Created by Investment Bridge based on disclosed material of the company.

Sales by Business Segment

| Apparel related | Product related | Transportation Equipment related | Total |

Japan | 11,528 | 17,315 | 4,673 | 33,516 |

Asia | 5,763 | 711 | 1,865 | 8,340 |

Europe and the U.S. | 5,503 | 33 | 1,084 | 6,621 |

Total | 22,795 | 18,060 | 7,622 | 48,478 |

*Unit: million yen

*Not disclosed for the previous period.

◎Japan

Sales were up 10.9%, and profit increased 17.7% year on year.

Sales in the apparel business remained firm. While the impact of semiconductor shortages continued, sales of interior parts for minor change models of Japanese automobile manufacturers were strong in the transportation equipment business.

In the apparel business, the sales of accessories for work clothes and medical wear, accessories for casual wear, and accessories for sportswear in Europe and the United States increased. In the product business, sales increased for medical equipment-related products, products for flat-price retailers, safety-related products for construction sites, and snowboarding, surfing, and outdoor-related products. In the transportation equipment business, the sales of automotive interior parts increased.

◎Asia

Sales increased 3.5%, and profit rose 73.7% year on year.

The apparel business in China and Hong Kong continued to perform well. Sales in the transportation equipment business decreased due to adjustments resulting from the transfer of production between manufacturers' factories.

In the apparel business, the sales of accessories related to work clothes and accessories for casual wear manufactured in China and Hong Kong to be sold in Europe and the United States increased. Regarding the product business, sales of accessories for sports shoes increased in Vietnam. In transportation equipment business, sales of automotive interior parts manufactured in China to be sold to Japanese automobile manufacturers decreased.

◎Europe and the U..S.

Sales increased 23.7%, and profit rose 82.7% year on year.

Apparel sales, centered on work clothes and casual wear, remained firm. Regarding the transportation equipment business, the impact of semiconductor shortages continues.

In the apparel business, the sales of accessories for work clothes, casual wear, and luxury down wear increased. In transportation equipment business, sales of automobile interior parts to Japanese automobile manufacturers decreased.

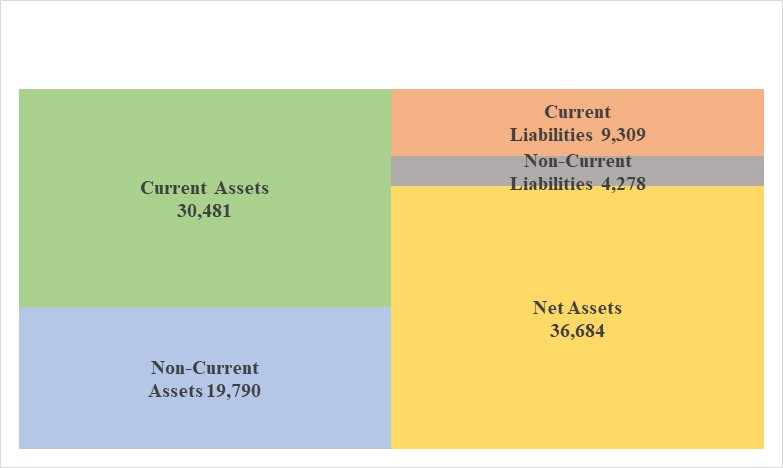

(3) Financial Situation and Cash Flow

◎ Main BS

| End of Nov. 2021 | End of Nov. 2022 |

| End of Nov. 2021 | End of Nov. 2022 |

Current assets | 26,957 | 30,481 | Current liabilities | 7,507 | 9,309 |

Cash and deposits | 11,103 | 10,399 | Trade payables | 4,453 | 5,625 |

Trade receivables | 10,649 | 12,103 | Short-term debts s | 444 | 330 |

Inventories | 4,540 | 6,953 | Noncurrent liabilities | 4,515 | 4,278 |

Noncurrent assets | 18,980 | 19,790 | Long-term debts s | 1,703 | 1,423 |

Property, plant and equipment | 9,876 | 10,166 | Total liabilities | 12,023 | 13,587 |

Intangible assets | 3,469 | 3,866 | Shareholders’ Equity | 31,477 | 31,860 |

Investments, others | 5,633 | 5,757 | Retained earnings | 26,726 | 27,539 |

Total assets | 45,938 | 50,271 | Treasury stock | -2,289 | -2,174 |

|

| Net assets | 33,914 | 36,684 | |

Total liabilities, net assets | 45,938 | 50,271 | |||

Equity ratio (%) | 73.7% | 72.9% | |||

*Unit: million yen

*Created by Investment Bridge based on disclosed material of the company.

Total assets were 50,271 million yen, up 4,333 million yen from the end of the previous term.

Current assets increased 3,523 million yen from the end of the previous term to 30,481 million yen. This was mainly due to an increase of 2,413 million yen in inventories and 1,453 million yen in accounts receivable, and a decrease of 703 million yen in cash and deposits.

Fixed assets increased 801 million yen from the end of the previous term to 19,709 million yen. This was mainly due to increases in the goodwill of 280 million yen, machinery and equipment of 168 million yen, and trademark rights of 137 million yen.

Current liabilities augmented 1,801 million yen to 9,309 million yen. This was mainly due to an increase of 1,171 million yen in trade payables, 259 million yen in liabilities related to paid payments, 113 million yen in accrued expenses, and 106 million yen in provision for bonuses, as well as a 114 million yen decrease in short-term interest-bearing debt.

Fixed liabilities decreased 237 million yen from the end of the previous term to 4,278 million yen. This was mainly due to a 280 million yen decrease in long-term interest-bearing debt.

Net assets increased 2,769 million yen to 36,684 million yen.

Equity ratio decreased 0.8 points from 73.7% at the end of the previous term to 72.9%.

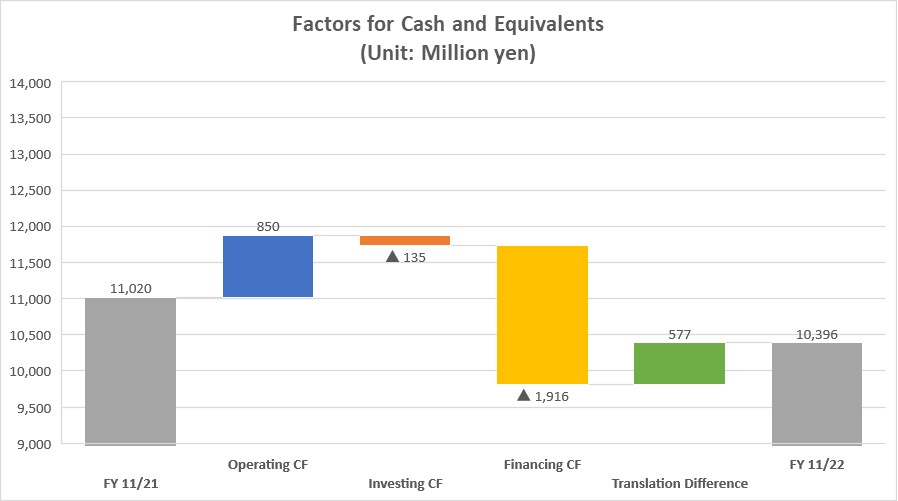

◎ Cash flow

| FY Nov. 2021 | FY Nov. 2022 | Increase/decrease |

Operating CF | 2,644 | 850 | -1,793 |

Investing CF | -401 | -135 | 266 |

Free CF | 2,242 | 715 | -1,526 |

Financing CF | -1,380 | -1,916 | -536 |

Cash and Equivalents | 11,020 | 10,396 | -623 |

*Unit: million yen

*Created by Investment Bridge based on disclosed material of the company.

The balance of cash and cash equivalents as of the end of November 2022 stood at 10,396 million yen, down 623 million yen from the end of the previous term.

A cash inflow of 850 million yen from operating activities was posted (a cash inflow of 2,644 million yen in the previous term). This is mainly because funds increased through the earning of quarterly net income before taxes and other adjustments and the posting of depreciation while funds decreased through the increase in inventories and income taxes paid. A cash outflow of 135 million yen from investing activities was posted (a cash outflow of 41 million yen in the previous term). This is mainly because funds decreased through the acquisition of property, plant and equipment while funds increased through the sale of investment securities.

A cash outflow of 1,916 million yen from financing activities was posted (a cash outflow of 1,380 million yen in the previous term). This is mainly because funds decreased due to the expenditure for repaying long-term debts, paying dividends, and acquisition of treasury stock.

(4) Business Overview and Topics

◎Efforts Around Environment, Rideeco

"Rideeco" stands for RIDE FOR ECO, and RIDE is an acronym that expresses Morito Group's attitude. The company is implementing initiatives to realize a sustainable society by cooperating with various industries and sectors. The company has accomplished many unprecedented achievements, such as using eco-friendly fabrics for the award pins for the Good Design Award ceremony.

Relation: Build relationships and collaborate with various businesses and industries to create new value,

Initiative: Take action to build a sustainable society instead of being a bystander,

Devote: Devote our wisdom not only to the pursuit of short-term profits but also to the future of society,

Energy: And act with perseverance and energy.

(Source:Morito)

Sustainability Site:

https://www.morito.co.jp/sustainability_en/

The company held a large-scale exhibition at Sustainable Fashion EXPO Autumn in October 2022. Many Rideeco products, such as items jointly developed with the Tokyo Verdy women's hockey team, were on display.

For details, please visit https://www.morito.co.jp/event/ecofes/

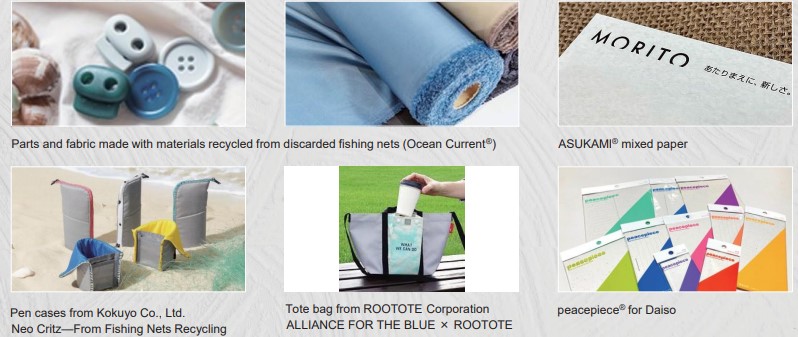

◎ Environmental initiatives- Product

The number of applications and sales of materials using discarded fishing nets, which have been implemented for some time, increased. The company also launched a composite paper that utilizes new chemical fibers and products made from origami cranes that are sent to Hiroshima Peace Memorial Park.

(Source:Morito)

◎ Initiatives for sports and outdoor environments- Product

The Morito Group has been highly evaluated for its product functionality and quality, delivery time, and global planning ability. Thus, it has received orders for accessories and finished products from major sports brands in Japan and overseas.

In addition, sales of snowboard-related products were strong due to the Beijing Olympics. Sales of POLeR®, a brand centered on outdoor-related products, also grew.

(Source:Morito)

◎ Growth of the base in Mexico

Sales to American brands are expanding through Morito Scovill Mexico, which was established in 2017 as a procurement and sales base. Demand is increasing due to the advantages of stable delivery times and reduced transportation costs through land transportation.

In the transportation equipment business, the number of products and orders for automotive interior parts increased. In the apparel business, new orders were received for baby clothes and casual wear, and further expansion is expected.

3. Fiscal Year ending November 2023 Earnings Forecast

(1) Consolidated earnings forecast

| FY Nov. 2022 | Ratio to sales | FY Nov. 2023 (Forecast.) | Ratio to sales | YoY change |

Sales | 48,478 | 100.0% | 50,000 | 100.0% | +3.1% |

Operating income | 2,116 | 4.4% | 2,300 | 4.6% | +8.6% |

Ordinary income | 2,342 | 4.8% | 2,450 | 4.9% | +4.6% |

Net income | 1,674 | 3.5% | 1,800 | 3.6% | +7.5% |

*Unit: million yen

*The estimated values were those announced by the company. Net income means the profit attributable to owners of the parent.

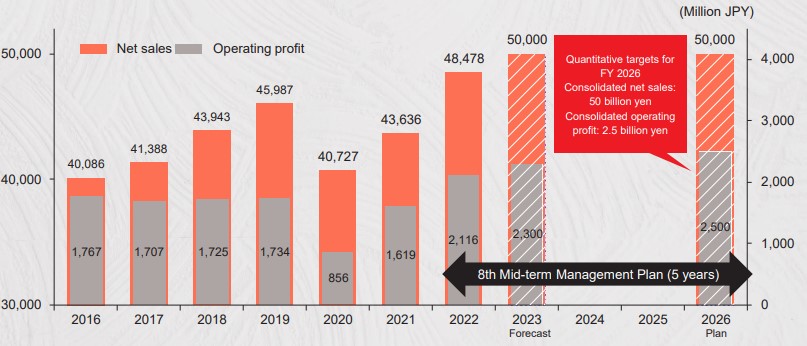

Sales and profit are expected to increase in the term ending November 2023 as well.

In the term ending November 2023, the company is expected to increase sales by 3.1% year on year to 50 billion yen, operating income by 8.6% to 2.3 billion yen, ordinary income by 4.6% to 2.450 billion yen, and net income by 7.5% to 1.8 billion yen. As the future of the global economy is uncertain due to factors such as violent exchange rate fluctuations and rising prices, the company will focus on selling value-added products that focus on functionality, sustainability, and being green in addition to core products. Morito will also continue improving profit margin as a company-wide policy. In addition, the company plans to continue reforms for unprofitable businesses, products, and distribution channels.

Based on the new shareholder return policy (mentioned later), the company intends to increase the dividend by 22.00 yen from the previous term to 54.00 yen (including 27.00 yen in the first half).

(2) Basic policy on profit sharing

●Achieving stable and continuous dividends

●To aim at a dividend payout ratio of 50% or higher

●To aim at a Ratio of dividends to shareholders equity (DOE) of 4.0%

However, the impact of any significant fluctuation in net income due to special factors such as extraordinary gains and losses will be taken into consideration.

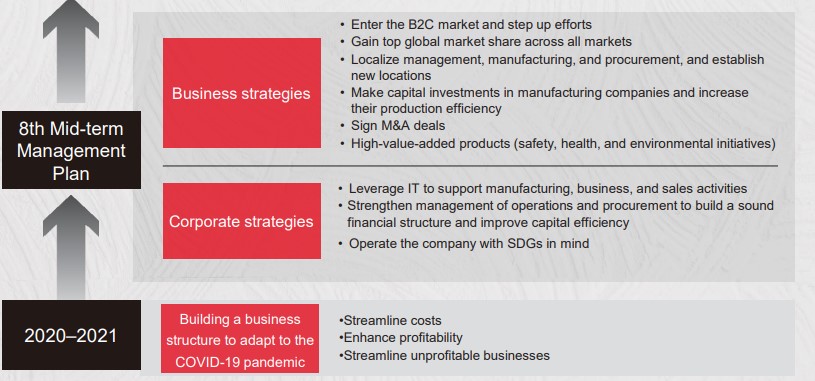

(3) Partial change of the 8th mid-term management plan

【Background】

June 2019: Transition to a holding company structure

June 2022: Morito Japan, the largest operating company, was split.

⇒ Completed organizational restructuring

⇒The holding company (Morito Co., Ltd.) will take the lead in maximizing group synergy value, developing a sustainable management system, and strengthening the management system.

The company has revised its medium-term management plan by establishing these systems.

【Main changes】

1) Formulation of Sustainability Policy

2) Changing the capital policy

In order to stably and efficiently procure and manage the funds necessary for corporate activities from a long-term perspective, the company will build a stable financial capital structure that is not biased.

<Measures>

(1) Improving medium- to long-term capital efficiency (ROE) → Practicing efficient management

(2) Add stability to the performance-based capital return to shareholders → Distribute profits appropriately

(3) Improve asset efficiency → Streamline the balance sheet, create cash flows, and actively invest funds

(4) Optimize the capital structure → Utilize financial leverage

3) Changing the shareholder return policy

It is determined based on the 2) Basic policy on profit distribution (from FY 11/23) mentioned above. The company changed DOE from 1.5% to target 4.0%.

【Quantitative target】

The investment period is set to be from the term ended November 2022 to the term ending November 2026, with quantitative targets of 50 billion yen in sales and 2.5 billion yen in operating income.

However, if sales and operating income targets are achieved early, the company will revise its goals.

4) Medium- to long-term policy- Morito's vision

Become a global niche top company that keeps making a big difference in the world with small parts

(Source:Morito)

4. Conclusions

In the term ended November 2022, despite soaring raw material prices and transportation costs, stagnant automobile production, the turmoil in the distribution network, and rapid exchange rate fluctuations, the company overcame these external factors, and sales and profit increased by double digits after the upward revision to the forecasts announced at the time of the first half's earnings results. Sales growth in the apparel business, which is relatively stable, is on track, and sales in Europe and the United States are growing every quarter. Regarding the 8th medium-term plan, the achievement of the plan in the term ending November 2023 ahead of schedule is in sight. The main focus of this mid-term plan revision is likely to be the DOE target of 4%. If ROE is 8%, the payout ratio will be 50%, and DOE will be 4.0% which is the reason behind the change. In other words, we feel that the company is strongly determined to achieve its long-term target of an ROE of 8%.

The stock price was improved after the announcement of financial results. Still, PBR is well below 1. We believe there is room for further improvement if the medium-term plan is achieved ahead of schedule and the company is close to achieving an ROE of 8%.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 5 directors, including 2 external ones |

Auditors | 3 auditors, including 2 external ones |

Morito has set up an arbitrary nomination and remuneration committee for which an outside director serves as chair. The committee consists of three members, two of whom are outside directors.

◎ Corporate Governance Report

Updated on February 28, 2022

<Basic Views>

Pursuant to our corporate principle and our action principles that stipulate the acts that should be carried out by all our officers and employees, from the standpoint of our stakeholders, our company considers reinforcement and enrichment of our corporate governance framework to be the most important business issue for long-term and continuous improvement of our corporate value. For our stakeholders, we believe that we need sincere and timely disclosure, speedy decision-making through clarification of roles and responsibilities, and strengthening of objective check functions.

Considering that supervision of the business execution of the Board of Directors by the outside directors and audits by the auditors including the outside auditors are effective as a business monitoring function, we have operated as a company with an audit and supervisory committee.

Our Board of Directors is composed of three internal directors and two outside directors, holds meetings every month, makes decisions about matters stipulated by the law and important matters related to our company’s business strategies, and supervises business execution by the directors. In addition, we have set up a compliance committee to instill and maintain a compliance structure and meet requirements for an internal control system.

Regarding the two outside directors, we have appointed them as independent officers in accordance with the regulations of the Tokyo Stock Exchange and notified the stock exchange of the appointment.

Our Audit and Supervisory Committee consists of three members including two outside auditors and conducts audits in a fair and objective manner from a basic audit perspective of establishment of a corporate governance system.

Regarding the two outside auditors, we have appointed them as independent officers in accordance with the regulations of the Tokyo Stock Exchange and notified the stock exchange of the appointment.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

【The Corporate Governance Code to Follow】

The following information is based on the Corporate Governance Code revised in June 2021.

Principles | Reasons for not implementing the principles |

【Supplementary Principle 2-4-1 Ensuring diversity in the promotion to core human resources】 | Our company promotes our employees to middle managerial positions through fair evaluation of their abilities, insights, personality, and other relevant elements regardless of such factors as gender and nationality; therefore, we have not set any numerical targets, but our corporate group has already promoted local and female employees to the positions of director and administrator at our overseas bases, through which we ensure diversity. We will continue discussing such matters as setting of numerical goals. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Principle 1-4 So-called strategically held shares】 | (1) Policy on strategically held shares Our company holds shares of other listed companies only when we have determined that doing so contributes to raising our corporate value and is necessary for our business after considering such factors as the importance for our business strategies and necessity of business relationships with our business partners in the course of sales, production, and financing. (2) Matters discussed regarding strategically held shares Our company comprehensively judges whether we should continue to hold shares in other listed companies after the Board of Directors has annually verified the benefits of holding the shares, such as the amount of dividends and transaction volumes, purposes of holding the shares, and the future outlook of transactions. We will sell shares in other listed companies appropriately when we judge that the significance of holding the shares is not enough as a result of the board’s verification. Even when the validity of holding the shares is confirmed through the verification, we may sell them by taking into consideration the market environment, business and financial strategies, and other relevant factors. In addition, regarding the shares that we have held in large numbers out of the shares that we have decided to continue holding, we disclose the number of shares that we hold and the purpose of holding them in our securities reports. (3) Criteria for exercising the voting rights attached to strategically held shares Our company appropriately exercises the voting rights attached to strategically held shares after comprehensive judgment from the perspectives of whether doing so contributes to improving the shareholder value and impacts of doing so on our company. |

[Principle 3-1 (ii) Basic approach to corporate governance] | We believe that maintaining and strengthening the corporate governance system is an important management issue in order to build a crisis management system and actively execute management strategies. This is stated in "I.1 Basic concept" of this report. |

【Supplementary Principle 3-1-3- Initiatives 【on sustainability】 | <Initiatives on sustainability> Our company has posted our attitude, policies, and efforts towards sustainability on our website: https://www.morito.co.jp/ir_en/management/risk.html

https://www.morito.co.jp/sustainability_en/

https://www.morito.co.jp/rideeco_en/

<Investment in human capital and intellectual property> Our company offers opportunities of capacity development to human resources with capacities and aspirations that allow outstanding achievements under our education policy of self-development and self-growth in accordance with Morito Group’s Human Resources Management Policy. We strive to enhance our human capital by regularly providing such programs as training sessions designed for each employee level, career design sessions, and support for self-enlightenment. We also make investment in intellectual property by filing patents for products related to sustainability under our unified brand name, and applying for patents and design for products. |

【Principle 5-1 Policy for constructive dialogue with shareholders】 | Our company has provided opportunities for dialogue with shareholders for the purpose of contributing to our company’s sustainable growth and medium- and long-term improvement of the corporate value. ① Status of system development Our company has appointed a person responsible for IR activities in order to realize constructive dialogue with shareholders. In addition, with the department in charge of IR activities taking the lead, related departments cooperate with each other, establishing a system that offers appropriate information to shareholders. ② Policies on efforts Our company hosts a variety of events on a regular basis, including financial results briefings that are designed for analysts and institutional investors and held semiannually by a person in charge of IR activities, individual interviews held quarterly, and company information sessions held 3 – 4 times a year for individual investors. Information is shared among the top executives in the hope of utilizing information obtained through such events in corporate management. Furthermore, our company properly grasps insider information in accordance with the regulations on management of insider trading, and exercises utmost caution when we hold dialogue with shareholders. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved |

For back numbers of Bridge Reports on Morito Co., Ltd (9837) and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp/.