Bridge Report:(9997)Belluna Second Quarter of Fiscal Year ending March 2022

President & CEO Kiyoshi Yasuno | Belluna Co., Ltd. (9997) |

|

Company Information

Market | TSE 1st Section |

Industry | Retail (commerce) |

President & CEO | Kiyoshi Yasuno |

HQ Address | 4-2 Miyamoto-cho, Ageo-shi, Saitama |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Number of Shares Issued | Total Market Cap | ROE (Actual) | Trading Unit | |

¥708 | 97,244,472 shares | ¥68,849 million | 10.3% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥19.00 | 2.7% | ¥129.30 | 5.5x | ¥1,164.97 | 0.6x |

*The share price is the closing price on January 4. Shares outstanding, DPS and EPS are from the financial report of second quarter of FY 3/22. ROE and BPS are from the financial report of the previous term.

Earning trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2018 (Actual) | 161,673 | 13,008 | 13,248 | 9,665 | 99.41 | 12.50 |

March 2019 (Actual) | 177,648 | 12,005 | 15,309 | 10,343 | 106.39 | 15.00 |

March 2020 (Actual) | 179,948 | 10,311 | 10,365 | 5,862 | 60.62 | 16.00 |

March 2021 (Actual) | 206,499 | 15,734 | 16,872 | 11,036 | 114.17 | 16.50 |

March 2022 (Forecast) | 246,000 | 17,500 | 18,200 | 12,500 | 129.30 | 19.00 |

* Unit: Million yen, yen.

*Net income is profit attributable to owners of parent. Hereinafter the same shall apply.

This report outlines Belluna, the financial results for the second quarter of fiscal year ending March 2022 etc.

Table of Contents

Key Points

1. Company Overview

2. The Second Quarter of Fiscal Year ending March 2022 Earnings Results

3. Fiscal Year ending March 2022 Earnings Estimates

4. Management Policy and Activities

5. Conclusions

<Reference: Regarding corporate governance>

Key Points

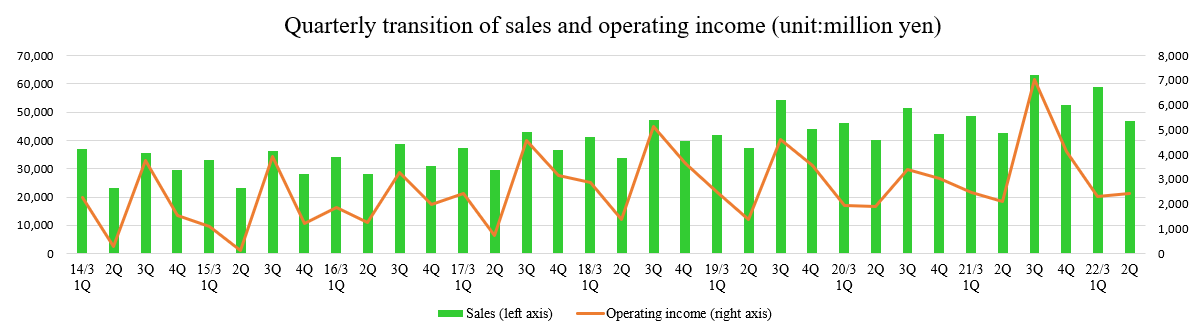

- The sales in the second quarter of the term ending March 2022 were 105.8 billion yen, up 16.1% year on year. Sales grew in the General Mail Order Business, the Gourmet Food Business, the Nurse-related Business, etc. Sales declined in the Cosmetics and Health Foods Business and Other Business. Gross profit rose 14.2% year on year. Operating income grew 4.2% year on year to 4.7 billion yen, as SG&A, including media and distribution costs, augmented 15.2% year on year, but it was offset. Ordinary income declined 0.5% year on year to 5.1 billion yen, due to the rise in commission fee. Sales and profit fell below the initial forecasts.

- There is no change in the earnings forecasts. In the term ending March 2022, sales are projected to rise 19.1% year on year to 246 billion yen and operating income is forecast to grow 11.2% year on year to 17.5 billion yen. The mail-order industry is expected to see the continuous growth of demand due to the changes in consumers’ lifestyles and purchase behavior amid the COVID-19 pandemic. The General Mail Order Business is expected to see a significant sales growth this term, too. The kimono-related business and the property business are projected to recover. The company plans to pay a dividend of 19.00 yen/share, up 2.5 yen from the previous term, showing an increase for the fourth consecutive term. The expected payout ratio is 14.7%. The current term is the final fiscal year of the fourth management plan, and the company will establish a foothold for the fifth management plan.

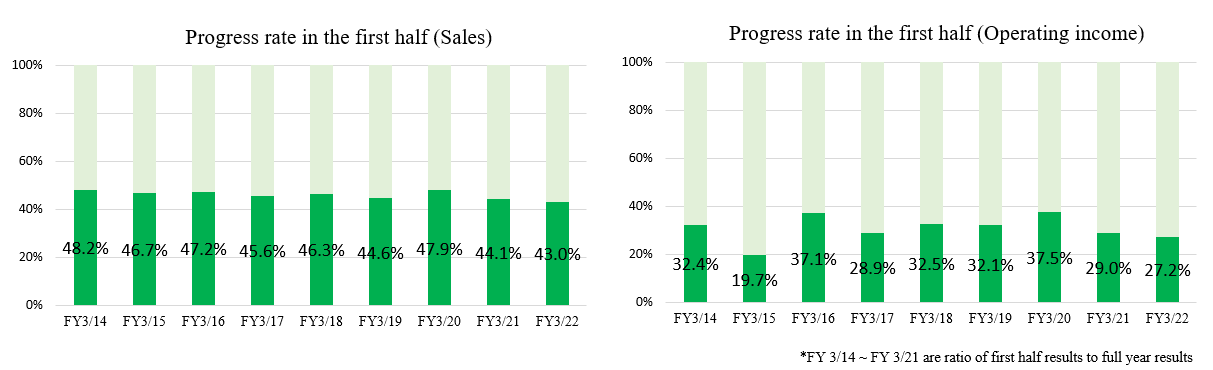

- The progress rate for the first half was 43.0% for net sales and 27.2% for operating income. Both rates are slightly lower than the previous several fiscal years. While there is a rebound from the nest egg demand, the mutant stock Omicron has started to expand, and the business environment is still uncertain. In this circumstance, we are looking forward to the increase of sales and profits in the third and fourth quarters as the company continues to establish a foothold for the fifth management plan.

- In the kimono store sales business, which is expected to see high growth in the future, structural reforms will be completed this fiscal year. We will keep a close eye on the speed at which this business will start up in the next fiscal year.

1.Company Overview

Belluna is a leading general catalog retailer. In addition to the mail-order business specializing in some genres, this company operates the Retail Store Sales Business, the Solution Business for providing corporations with its know-how and infrastructure that have been nurtured through its mail-order business, and so on. Its strengths and characteristics include a database of customers who are mainly married women, and stable profitability and growth potential based on portfolio management. It also conducts M&A actively.

1-1 Corporate History

In 1968, Mr. Kiyoshi Yasuno, who is currently the representative director and president of the company, started the business of selling seals door-to-door under the name of “Yukado.” Then, starting with the mail-order sale of clothes, the company started dealing in food products, cosmetics, etc. While operating the Specialty Mail Order Business, the company has enriched its business portfolio, including the Finance Business, Property Business, Retail Store Sales Business, Solution Business, etc. targeted at mail-order customers. In March 2000, the company was listed on the first section of the Tokyo Stock Exchange. Belluna actively conducts M&As to fortify the business base.

1-2 Management Philosophy

◎Management Philosophy

Origin of our business | To contribute to our customers’ lifestyle and happiness, by taking an international perspective to be the first company to provide a wide range of customers across the nation with an abundance of food, clothing, lifestyle and recreational products and services, with superior systems and planning for improved convenience, economy, fashion and assortment. |

Ideal employees of our company | Our employees approach challenges with a cheerful and positive attitude, to do whatever possible to proactively improve customer satisfaction and broaden their abilities, in order to always maintain the confidence of our customers. |

Ideal state of our company | We aim to develop overwhelming superiority as we compete with other companies in the areas of food, clothing, lifestyle and recreational goods and services, and with an image of stability, growth, continuity, and profitability to become an excellent company that attracts capable personnel and makes a contribution to society. |

In addition, Belluna set “Basic Mind,” which describes the mindset of Belluna’s employees, and “Basic Action. “Basic Mind” is composed of “the awareness as a party involved,” “the awareness of profit,” “a sense of playing a game,” “positive thinking,” and “the willingness to grow,” while “Basic Action” is composed of “1. Collecting information,” “2. Case studies,” “3. Utilizing data,” “4. Testing theories,” “5. Use of others,” “6. Intellectual understanding,” “7. Discussion” and “8. Reporting, contacting, and consulting.” These are what the employees of Belluna should return to when facing a challenging problem.

In addition, the company considered “CCBSKKKS” (C: Change, C: Challenge, B: Brushing up, S: Speed, K: (Kizuki) Awareness, K: (Kaizen) Improvement, K: (Kyakushikou / Kyakumichaku) Customers’ perspective and getting closer to customers, S: Case studies of SA class corporations) as a common factor in growing corporations and recognizes it as a milestone for its own growth.

1-3 Market Environment・Competitors in the same business

Compared with Scroll and Senshukai, which are competitors in the general mail-order field, Belluna has large sales and market cap, and high profit ratio.

Promoting further understanding of the growth strategy will be necessary for an increase in PER and PBR.

◎Comparison of major mail-order companies

Code | Corporate name | Sales | Sales growth rate | Operating income | Profit growth rate | Operating income ratio | ROE | Market cap | PER | PBR |

3092 | ZOZO | 162,600 | +10.3 | 47,800 | +8.3% | 29.4% | 68.8% | 1,101,662 | 32.4 | 19.5 |

4921 | Fancl | 106,500 | -7.3% | 12,000 | +3.7% | 11.3% | 11.7% | 458,843 | 52.4 | 6.0 |

4927 | Pola Orbis HLD | 190,000 | +7.8% | 19,000 | +38.2% | 10.0% | 2.6% | 451,856 | 38.6 | 2.6 |

8005 | Scroll | 80,000 | - | 5,900 | - | 7.4% | 21.6% | 26,887 | 6.4 | 1.0 |

8165 | Senshukai | 76,000 | -8.7% | 1,000 | - | 1.3% | -10.6% | 20,354 | 15.8 | 0.6 |

9997 | Belluna | 246,000 | +19.1% | 17,500 | +11.2% | 7.1% | 10.3% | 66,515 | 5.3 | 0.6 |

* Unit: Million-yen, yen, x.

*Sales and operating income are the values estimated by the company for this term.

*ROE is the actual result of the previous term.

*Market Cap, PER and PBR are the values calculated from the closing prices on December 2, 2021.

1-4 Business Contents

(1) Segments

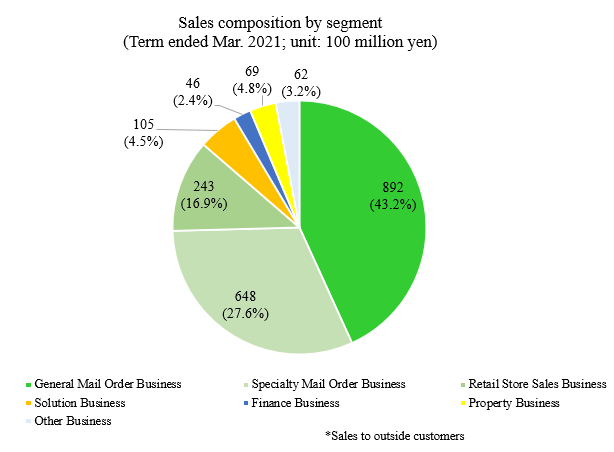

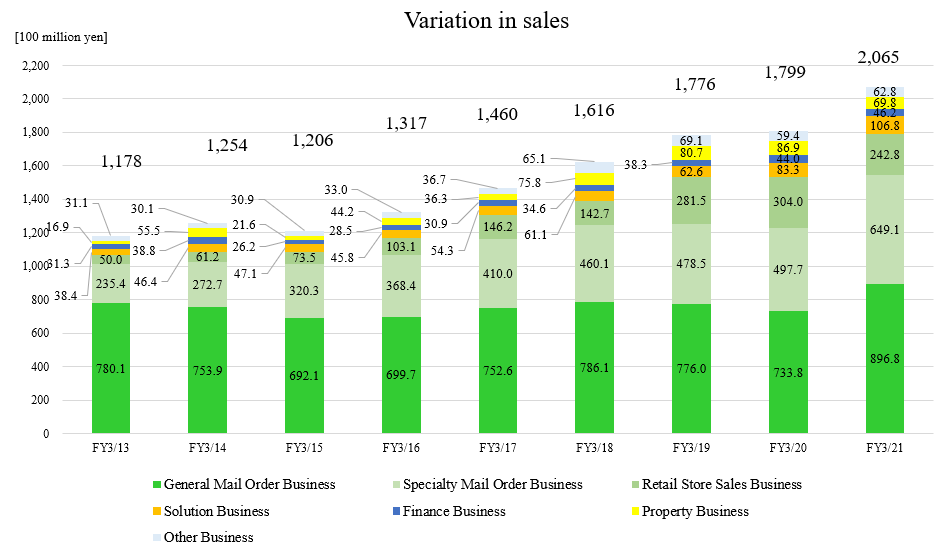

Belluna operates seven business segments: General Mail Order Business, which is its core business, Specialty Mail Order Business, Retail Store Sales Business, Solution Business, Finance Business, Property Business, and Other Business. The General Mail Order and Specialty Mail Order businesses account for about 70% of total sales.

In order to further clarify business content, Belluna has classified its business into eight segments: General Mail Order Business, Cosmetics and Health Foods Business, Gourmet Business (including wine and Japanese sake), NursesBusiness, Database Use Business, Kimono-related Business, Property Business, and Other Business in the fiscal year ending March 2022.

(Produced by Investment Bridge with reference to the material of Belluna.)

(Produced by Investment Bridge with reference to the material of Belluna.)

①General Mail Order Business

◎Outline

The company receives orders and sells apparel goods, fashion goods, interior accessories, etc. mainly via e-commerce (via PCs and smartphones), catalogues and flyers.

(E-commerce, smartphone application)

|

|

(Major catalogs)

(Taken from the website of Belluna)

◎Attributes of subscribers

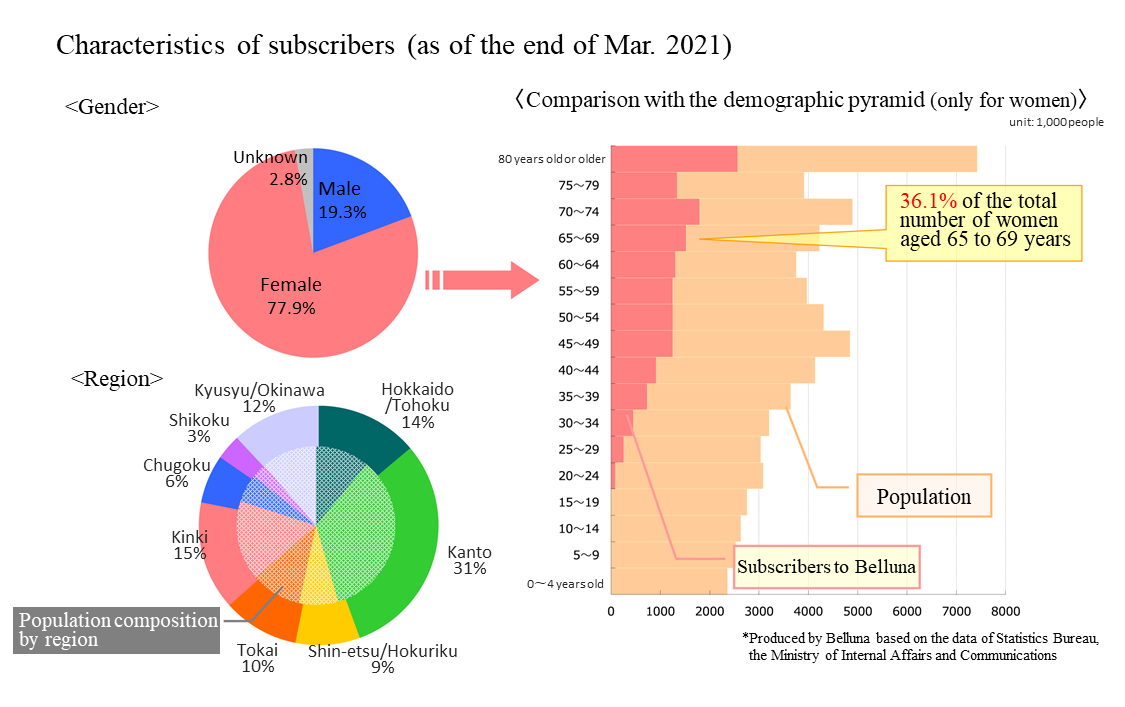

As of the end of March 2021, the number of subscribers is about 21.4 million, and married women in their 40s or older account for about 80% of them.

The subscribers aged 65 to 69 years, who are major married women, make up 36.1 % of the population of this age group in Japan, indicating an overwhelming market share.

(Taken from the reference material of the company)

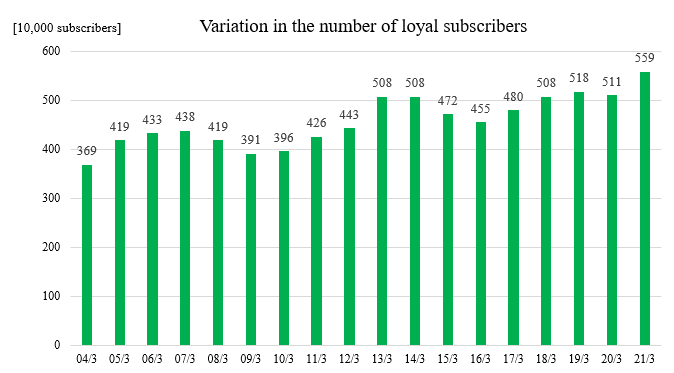

The number of loyal subscribers, who are defined as subscribers who have purchased products within 2 years after registration, was 5.59 million in the term ended March 2021.

It is steadily increasing.

(Produced by Investment Bridge with reference to the material of Belluna)

Belluna employs about 70 merchandisers, and offers more fashionable products than leading supermarkets and women’s apparel shops. Particularly, designs focusing on hiding Mrs’s figures which change with age are well-received by its user.

In addition, the company offers a variety of unrivaled catalogs targeted at customers in their 50s to 70s. Accordingly, it won overwhelming support from married women.

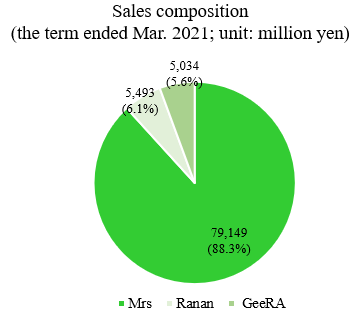

◎Customer segments

Female customer segments are divided into three ones: “Mrs” for customers in their 50s or older, “ Ranan” for customers in their 40s, and “ GeeRA(former Ryu-Ryu)” for customers in their 30s. The company offers products tailored for the preferences and needs of each age group.

(Produced by Investment Bridge with reference to the material of Belluna.)

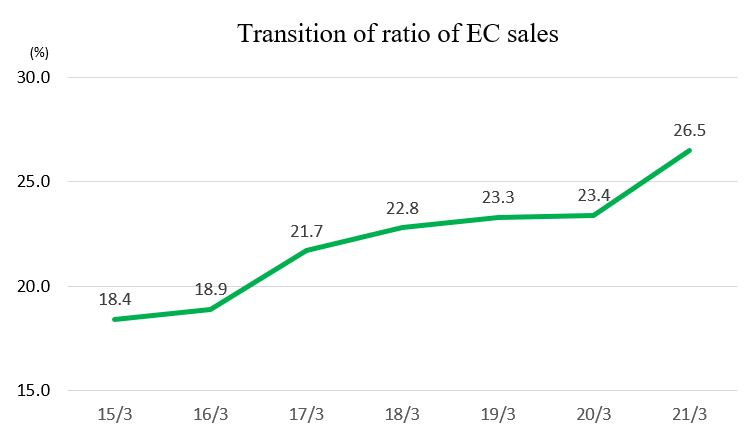

◎Efforts for developing e-commerce

As a result of the efforts, online shopping has become the main driving force in attracting new customers.

In the term ended March 2021, the ratio of e-commerce increased significantly, meeting the demand from housebound consumers amid the spread of COVID-19.

(Produced by Investment Bridge with reference to the material of Belluna)

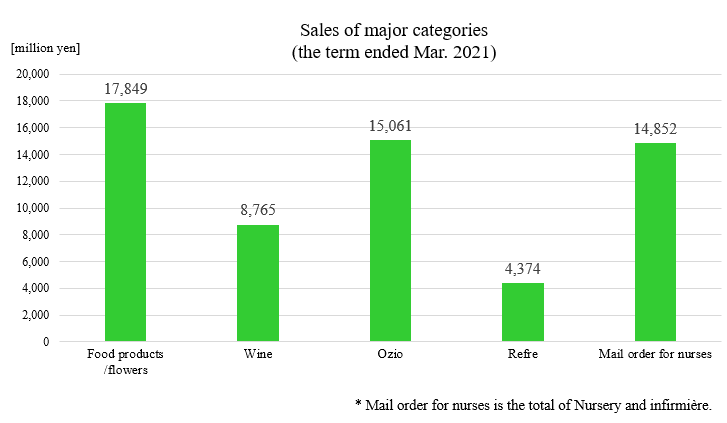

②Specialty Mail Order Business

By specializing in specific genres, the company adds characteristics to its product lineup, prices, and services. Therefore, the company can retain customers easily, and receive orders from repeat customers.

Main genre | Catalog/website | Outline |

Food products, flowers, and wine | Belluna Gourmet | Belluna handles food products and flowers. In addition to the sale of individual products, it offers a “periodic distribution service” for delivering products to subscribers every month, a “gift service” for mid-summer gifts, and so on. |

My Wine CLUB | Belluna directly imports wines that are rare in Japan, and won the largest share in the mail-order market for wine in Japan for 13 consecutive years (fiscal 2008 to fiscal 2020). | |

Cosmetics | Ozio | Belluna deals in cosmetics and supplements, such as facial washes, skin lotions, and milks, for which safety is pursued. It is composed of 18 different types of amino acids, collagen, hyaluronic acid, etc. "Eggshell Membrane Beauty Serum: Beauty Opener," which is made from an eggshell membrane that provides firmness, gloss, elasticity, and moisture, is the number one domestic seller. |

Nachu life | All-in-one cosmetics are mainly handled. Especially, the company offers products composed of mainly skin-friendly plant ingredients. As for the all-in-one cosmetic product "Royal Jelly Mocchiri Gel" for the mature skin, the company has sold over 12 million products. Together with Ozio, the company is also working on developing overseas markets such as Taiwan. | |

Supplements | Refre | Belluna deals in healthy food products and supplements made from ingredients selected rigorously The company is working to develop products suitable for senior customers to enhance lives of married women in a healthy and enjoyable way. The company also focuses on securing the safety of food and the quality of products, preventing health hazards, and so on. |

Mail order for nurses | Nursery infirmière | Belluna operates “Nursery,” which offers products at reasonable prices, and “infirmière,” whose attractive features are its rich product lineup and collaborative products with other brands. It has an overwhelming share in the mail-order market for nurses. |

(Produced by Investment Bridge with reference to the material of Belluna)

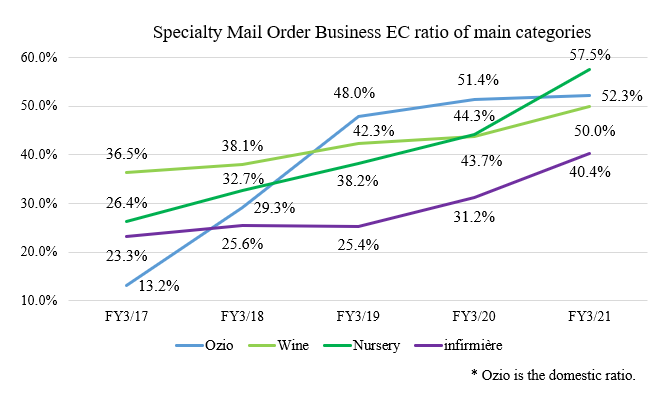

◎ Efforts for the shift to e-commerce

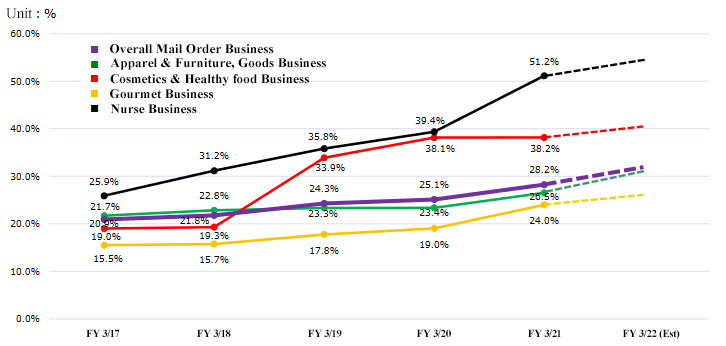

In each category, e-commerce ratio has increased remarkably. The majority of new customers were acquired through online shopping.

(Produced by Investment Bridge with reference to the material of Belluna)

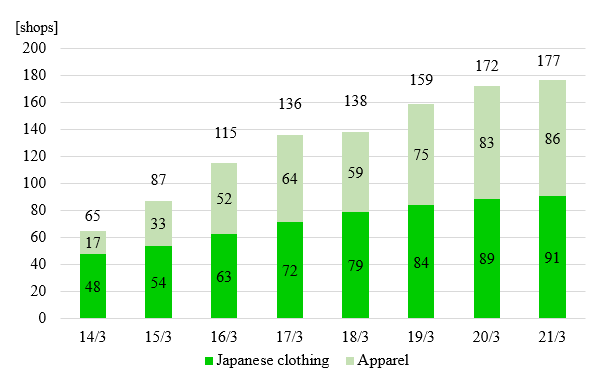

➂Retail Store Sales Business

Aiming for a synergistic effect between the mail-order, online, and physical store sales channels, the company is targeting customers who are unreachable by mail-order by placing kimono and apparel stores in shopping centers and shopping malls.

In Japanese clothing field, the company operates “BANKAN” and “Wamonoya,” which sell kimono and Japanese clothing-related products. In addition to them, Sagami Group Holdings Co., Ltd. was reorganized into a consolidated subsidiary in Jun. 2018.

Sagami Group Holdings runs stores under the two brand names “Sagami" and “Tokyo Masuiwaya.” They possess abundant knowledge and know-how about kimono culture and how to handle kimono, and excel in helping customers get dressed

The traditional Japanese apparel stores "BANKAN" and "Wamonoya," which has a high average spending per customer, can be characterized by high profitability they have improved, and presently, the company is working to permeate the market with their “Sagami” brand. It is also endeavoring to cultivate future customers among young women who do not currently own kimonos through promotional campaigns.

Apparel stores BELLUNA offer casual clothes at low prices, targeted mainly at women in their 40s and 50s.

As of the end of March 2021, there are 91 Japanese clothing stores ("BANKAN" and "Wamonoya,") and 86 apparel stores. The total number of stores is 177.

(Produced by Investment Bridge with reference to the material of Belluna)

④Solution Business

By utilizing the know-how and infrastructure that have been nurtured through the mail-order business for many years, Belluna offers the “service of enclosing promotional flyers” and the “mail-order agency service” to corporations.

In the service of enclosing promotional flyers, the company encloses the flyers, product samples, etc. of client companies with products and catalogs and ships them to customers, by utilizing its enormous customer database. It is possible to narrow down target customers according to the needs of client companies. Accordingly, client companies can expect effective sales promotion.

“The mail-order agency service” is to offer a series of functions, including the infrastructure and know-how of Belluna, to enterprises that sell products by mail order. Belluna comprehensively undertakes the tasks of receiving, shipping, and storing products at distribution centers and operating call centers (managing both inbound and outbound calls).

Even enterprises that are starting the mail-order business do not need to prepare their own infrastructure, and they can offer products and services swiftly at low prices.

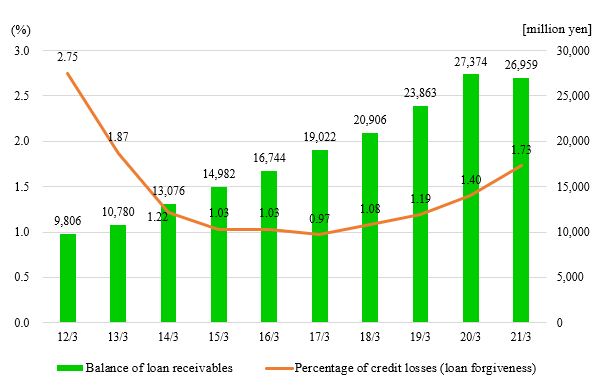

⑤Finance Business

It is a consumer finance business utilizing the database developed through the mail-order business.

The company mainly introduces loans to mail-order customers by enclosing flyers, etc. Since the company possesses the data of the past purchases and payments by customers, credibility is high and the balance of loan receivables is expanding steadily, while the percentage of credit losses is low compared with other companies.

Its profitability is high, partially because the cost for reeling in borrowers is low as mail-order customers are targeted.

(Produced by Investment Bridge with reference to the material of Belluna)

⑥Property Business

The company leases real estate, such as office buildings, operates hotels, and so on.

⑦Other Business

The company operates the wholesale business targeted at department stores and co-op shops, and the insurance business.

1-5 Characteristics and Strengths

➀Customer database and know-how mainly for married women, which have been nurtured through the mail-order business for about 40 years

As mentioned in the section of business contents, about 80% of over 20 million subscribers of Belluna are married women in their 40s or older.

Belluna’s female subscribers aged 65 to 69 years, who are dominant among married women, account for 36.1% of the population, 1 in 3 people of this age group in Japan.

The competitive customer database and know-how, which have been developed through the mail-order business for about 40 years, are significant features that contribute to the creation of corporate value. In the mail-order sale business, which is its mainstay, Belluna won strong support from married women by proposing products that can meet their needs based on the requests from customers, etc. grasped through sales and purchase activities and questionnaire surveys.

In the finance business, the company earn sales and profit stably by utilizing its database. In the solution business, the company creates new business opportunities by offering its customer database, know-how, and infrastructure.

②Building a new successful business model and challenges

Within a corporate culture that values endeavors, Belluna is working to construct a new successful business model and establishing a track record rather than maintaining the status quo.

In the General Mail Order Business, the fashion e-commerce mall "RyuRyumall" targeted at young people launched in 2018 continues to grow in terms of order receipt and total distribution amount. In the Specialty Mail Order Business, the "Eggshell Membrane Beauty Serum: Beauty Opener" has grown to achieve the largest domestic sales, beginning to contribute to the profit of new products.

In addition to strengthening the mail order business targeted at men and handling more champagne, Belluna will begin focusing on the online sales of products targeted at nurses and caregivers, which is a large market.

Moreover, the company will actively engage in M&A to further strengthen online sales.

③Stable profitability and growth potential based on portfolio management

Another characteristic of Belluna is the business model called “portfolio management,” which actualizes stable growth potential and profitability by conducting business in a multifaceted manner while utilizing its managerial resources nurtured through the mail-order business.

Based on this business model, the company disperses the risks of changes in social situations and economic trends, allows each business to exert its strengths as a mainstay, brings out the synergy among businesses, and actualizes stable profitability and growth potential.

1-6 Shareholder Return

Belluna determines dividends while considering its business performance and strategic investments for mid-term growth. This term(FY3/22), the company plans to pay 19 yen/share, up 2.5yen/share from the previous year.

The company has been Implementing a shareholders’ benefit plan, and gives benefits twice a year to shareholders who hold 100 or more shares as of the end of March and the end of September every year. For the purposes of expressing gratitude to shareholders and deepening shareholders’ understanding, the company announced the enrichment of the shareholders’ benefit plan in November 2017, adding complimentary coupons that can be used in Belluna Net. There is no revision to the criteria for receiving shareholders’ benefits, the date of issuance of coupons, or their effective periods.

| 100 to 499 shares | 500 to 999 shares | 1,000 or more shares |

Shareholders can choose any of the following: “General mail-order coupon,” “Coupon exclusively for online shopping,” and “Belluna’s product (food product/wine)” | Worth 1,000 yen | Worth 3,000 yen | Worth 5,000 yen |

Accommodation coupon of Urabandai Lake Resort | 1 coupon | 2 coupons | 4 coupons |

Accommodation coupon of Le Grand Kyu Karuizawa | 1 coupon | 1 coupon | 1 coupon |

*The accommodation coupon of Le Grand Kyu Karuizawa is distributed once a year (issued in early December).

1-7 ROE analysis

| FY3/14 | FY3/15 | FY3/16 | FY3/17 | FY3/18 | FY3/19 | FY3/20 | FY3/21 |

ROE (%) | 10.0 | 8.4 | 4.4 | 7.0 | 10.9 | 10.8 | 5.8 | 10.3 |

Net Income Margin (%) | 5.59 | 5.30 | 2.69 | 3.97 | 5.98 | 5.82 | 3.26 | 5.34 |

Total Asset Turnover (times) | 1.02 | 0.85 | 0.84 | 0.86 | 0.86 | 0.87 | 0.81 | 0.87 |

Leverage (times) | 1.75 | 1.85 | 1.97 | 2.06 | 2.12 | 2.13 | 2.22 | 2.21 |

In the term ended March 2021, due to the increase of net income margin, ROE recovered to the double-digit level. The goal of the fourth management plan is to achieve ROE of 10.5% by the end of the final year of the plan in the term ending March 2022. If the company can improve total asset turnover rate, it will be able to achieve a higher ROE.

2. The Second Quarter of Fiscal Year ending March 2022 Earnings Results

2-1 Consolidated Business Results

| FY3/21 2Q | Ratio to sales | FY3/22 2Q | Ratio to sales | YoY | Compared to initial plan |

Sales | 91,139 | 100.0% | 105,808 | 100.0% | +16.1% | -2.0% |

Gross profit | 53,769 | 59.0% | 61,419 | 58.0% | +14.2% | - |

SG&A expenses | 49,186 | 54.0% | 56,663 | 53.6% | +15.2% | - |

Operating income | 4,565 | 5.0% | 4,756 | 4.5% | +4.2% | -12.7% |

Ordinary income | 5,124 | 5.6% | 5,100 | 4.8% | -0.5% | -12.1% |

Quarterly net income | 2,923 | 3.2% | 3,210 | 3.0% | +9.8% | -19.8% |

*Unit: Million yen. Gross profit is gross profit - net. Quarterly net income is quarterly net income attributable to owners of parent.

Sales and Profit increased. But both sales and profit fall below the initial plan.

The sales in the second quarter of the term ending March 2022 were 105.8 billion yen, up 16.1% year on year. Sales grew in the General Mail Order Business, the Gourmet Food Business, the Nurse-related Business, etc. Sales declined in the Cosmetics and Health Foods Business and Other Business. Gross profit rose 14.2% year on year. Operating income grew 4.2% year on year to 4.7 billion yen, as SG&A, including media and distribution costs, augmented 15.2% year on year, but it was offset. Ordinary income declined 0.5% year on year to 5.1 billion yen, due to the rise in commission fee. Sales and profit fell below the initial forecasts.

2-2 Trend of each segment

| FY3/21 2Q | Composition Ratio | FY3/22 2Q | Composition Ratio | YoY |

Sales |

|

|

|

|

|

General Mail Order Business | 44,975 | 49.3% | 47,044 | 44.5% | +4.6% |

Cosmetics & Healthy food Business | 9,000 | 9.9% | 8,138 | 7.7% | -9.6% |

Gourmet Business | 9,798 | 10.8% | 11,913 | 11.3% | +21.6% |

Nurse Business | 7,891 | 8.7% | 8,765 | 8.3% | +11.1% |

Database Business | 6,774 | 7.4% | 7,553 | 7.1% | +11.5% |

Kimono store sales Business | 8,256 | 9.1% | 10,189 | 9.6% | +23.4% |

Property Business | 3,110 | 3.4% | 10,775 | 10.2% | +246.8% |

Other Business | 1,982 | 2.2% | 1,937 | 1.8% | -2.2% |

Adjustment | -651 |

| -509 |

|

|

Total | 91,139 | 100.0% | 105,858 | 100.0% | +16.1% |

Operating income |

|

|

|

|

|

General Mail Order Business | 1,729 | 3.8% | -525 | - | - |

Cosmetics & Healthy food Business | 728 | 8.1% | 1,193 | 14.7% | +63.9% |

Gourmet Business | 575 | 5.9% | 539 | 4.5% | -6.3% |

Nurse Business | 1,045 | 13.2% | 772 | 8.8% | -26.1% |

Database Business | 2,598 | 38.4% | 2,886 | 38.2% | +11.1% |

Kimono store sales Business | -1,711 | - | -834 | - | - |

Property Business | -46 | - | 973 | 9.0% | - |

Other Business | -159 | - | -51 | - | - |

Adjustments | -195 | - | -198 | - | - |

Total | 4,565 | 5.0% | 4,756 | 4.5% | +4.2% |

*Unit: Million yen. The composition ratio of income means the ratio of income to sales.

◎ General Mail Order Business

Sales grew, but an operating loss was posted.

As the number of mail-order customers increased, the company advertised its products actively like in the previous term. Meanwhile, the demand from housebound consumers due to the spread of COVID-19 subsided, so the response from existing customers weakened from the same period of the previous year. The ratios of media, distribution costs, and personnel expenses rose.

◎ Cosmetics & Healthy Food Business

Sales declined, but profit grew.

Sales declined, because the cosmetics sale business saw the sluggish overseas business performance of OZIO Inc. due to the spread of COVID-19 in Taiwan and the health food mail-order business saw a decline in response from new customers of Refre Co., Ltd.

On the other hand, the advertisement cost for increasing new customers shrank, resulting in a rise in profit.

◎ Gourmet Business

Sales grew, but profit declined.

As the number of mail-order customers increased, the company advertised its products actively like in the previous term. Meanwhile, the demand from housebound consumers due to the spread of COVID-19 subsided, so the response from existing customers weakened from the same period of the previous year.

◎ Nurse Business

Sales grew, but profit declined.

While the company advertised its products actively through TV commercials, etc., the demand from housebound consumers due to the spread of COVID-19 subsided. The demand for medical goods and supplies, including face masks and pulse oxymeters, which was in high demand in the same period of the previous year, weakened.

◎ Database Business

Sales and profit grew.

Sales of mail-order agency services and enclosing and package delivery services were strong.

◎ Kimono store sales Business

Sales grew, but an operating loss was posted.

The company shortened business hours and temporarily closed shops, following the policies of developers of department stores including the shops to prevent the spread of COVID-19, but their impact was weaker than that in the same period of the previous year.

◎ Property Business

Sales grew, and the business moved into the black.

The hotel business was affected by the restrictions on travel and foreign people’s entry to Japan imposed by the Japanese government to prevent the spread of COVID-19, but their impact was weaker than that in the same period of the previous year, and overseas real estate was sold.

◎ Other Business

Sales declined, and an operating loss was posted.

Due to the spread of COVID-19, the restaurant business, the accommodation booking business, etc. struggled, but the impact of COVID-19 weakened from the same period of the previous year.

2-3 Financial Condition and Cash Flows

◎Main BS

| End of March 2021 | End of September 2021 | Increase/ Decrease |

| End of March 2021 | End of September 2021 | Increase/ Decrease |

Current assets | 115,534 | 113,905 | -1,629 | Current liabilities | 55,645 | 58,748 | +3,103 |

Cash and deposits | 30,778 | 27,545 | -3,233 | Trade payables | 22,250 | 23,645 | +1,395 |

Trade receivable | 10,242 | 10,099 | -143 | Short-term interest-bearing debts | 5,909 | 10,946 | +5,037 |

Inventories | 23,416 | 27,894 | +4,478 | Noncurrent liabilities | 71,334 | 73,829 | +2,495 |

Noncurrent assets | 124,677 | 135,226 | +10,549 | Long-term interest-bearing debts | 66,797 | 69,117 | +2,320 |

Property, plant and equipment | 92,558 | 100,985 | +8,427 | Total liabilities | 126,980 | 132,578 | +5,598 |

Intangible assets | 10,904 | 11,487 | +583 | Net assets | 113,231 | 116,553 | +3,322 |

Investments and other assets | 21,213 | 22,753 | +1,540 | Retained earnings | 94,667 | 97,055 | +2,388 |

Total assets | 240,211 | 249,131 | +8,920 | Total liabilities and net assets | 240,211 | 249,131 | +8,920 |

*Unit: Million yen

Total assets increased 8.9 billion yen year on year to 249.1 billion yen, as cash and deposits declined, but inventory assets and tangible fixed assets rose. Total liabilities rose 5.5 billion yen to 132.5 billion yen due to the increase in trade payables, short and long-term interest-bearing debts and etc. As retained earnings grew etc., net assets increased 3.3 billion yen to 116.5 billion yen. As a result, capital-to-asset ratio decreased 0.4 points from the end of the previous term to 46.5%.

◎Cash Flows

| FY3/21 2Q | FY3/22 2Q | Increase/Decrease |

Operating CF | 5,991 | 2,658 | -3,333 |

Investing CF | -4,407 | -12,204 | -7,797 |

Free CF | -1,584 | -9,546 | -11,130 |

Financing CF | -3,508 | 6,214 | +9,722 |

Balance of cash equivalents | 20,413 | 27,728 | +7,315 |

*Unit: Million yen

Operating CF decreased due to the increases in inventory assets and payment of income taxes, etc. The deficits of investing CF and free CF augmented due to the rise in purchase of property, plant and equipment, etc.

Financing CF turned positive due to the increase in short and long-term debts, etc. The cash position improved.

3.Fiscal Year ending March 2022 Earnings Estimates

3-1 Full-year Earnings Estimates

| FY 3/21 | Ratio to sales | FY 3/22 (Est.) | Ratio to sales | YOY | Progress rate |

Sales | 206,499 | 100.0% | 246,000 | 100.0% | +19.1% | 43.0% |

Operating income | 15,734 | 7.6% | 17,500 | 7.1% | +11.2% | 27.2% |

Ordinary income | 16,872 | 8.2% | 18,200 | 7.4% | +7.9% | 28.0% |

Net income | 11,036 | 5.3% | 12,500 | 5.1% | +13.3% | 25.7% |

*Unit: Million yen. The estimated values are those announced by the Company. Net income is profit attributable to owners of parent

No change in the earnings forecasts. Sales and profit are estimated to increase

There is no change in the earnings forecasts. Sales are projected to rise 19.1% year on year to 246 billion yen and operating income is forecast to grow 11.2% year on year to 17.5 billion yen. The mail-order industry is expected to see the continuous growth of demand due to the changes in consumers’ lifestyles and purchase behavior amid the COVID-19 pandemic. The General Mail Order Business is expected to see a significant sales growth this term, too. The kimono store sales business and the property business are projected to recover. The company plans to pay a dividend of 19.00 yen/share, up 2.5 yen from the previous term, showing an increase for the fourth consecutive term. The expected payout ratio is 14.7%. The current term is the final fiscal year of the fourth management plan, and the company will establish a foothold for the fifth management plan.

3-2 Trends of each segment

| FY 3/21 | FY 3/22 (Est.) | YOY | Progress rate |

Sales |

|

|

|

|

General Mail Order Business | 996.3 | 1,199.8 | +20.4% | 39.2% |

Cosmetics & Healthy Food Business | 182.9 | 186.0 | +1.7% | 43.8% |

Gourmet Business (including wine and Japanese sake) | 271.5 | 280.0 | +3.1% | 42.5% |

Nurse Business | 159.4 | 157.5 | -1.2% | 55.7% |

Database Business | 141.8 | 143.2 | +1.0% | 52.7% |

Kimono store sales Business | 214.4 | 256.8 | +19.7% | 39.7% |

Property Business | 69.8 | 212.5 | +204.2% | 50.7% |

Operating income |

|

|

|

|

General Mail Order Business | 52.6 | 57.6 | +9.5% | - |

Cosmetics & Healthy Food Business | 26.4 | 19.3 | -26.9% | 61.8% |

Gourmet Business (including wine and Japanese sake) | 21.5 | 19.8 | -7.9% | 27.2% |

Nurse Business | 17.7 | 14.9 | -15.8% | 51.8% |

Database Business | 55.0 | 49.4 | -10.2% | 58.4% |

Kimono store sale Business | -10.6 | 3.5 | - | - |

Property Business | 0.1 | 16.5 | - | 59.0% |

*Unit: 100 million yen. The composition ratio of income means the ratio of income to sales.

The kimono store sales and property businesses are expected to contribute to profit growth. The progress rate of operating income is low, but the company plans to operate business while putting importance on profit in the second half.

4. Management Policy and Activities

Belluna’s mid/long-term policy is to aim for the maturation as a general trading company for online shops with 300 billion yen in sales and 30 billion yen in operating income as a benchmark.

【4-1 Regarding the business environment】

The company will pay attention to “the intensification of competition,” “lingering deflationary mindsets,” “weakening of demand from housebound consumers,” “growth of the Internet,” and “diversification of consumption” in the external environment and “business administration in response to the change of the times,” “mature organizational structures,” and “initiatives for new business” in the internal environment, and cope with changes.

【4-2 Fifth Management Plan】

The company’s goals for the final fiscal year of its Fifth Management Plan for three years from the fiscal year ending March 2023 to the fiscal year ending March 2025 are as follows.

Goal of fiscal year ending March 2025

Sales | 310 billion yen | CAGR 9.2% |

Operating income | 28 billion yen | CAGR 18.3% |

ROE | Over 10% | - |

In order to establish a foothold for the Fifth Management Plan, Belluna intends to meet this fiscal year's budget, which is the final year of the Fourth Management Plan.

(1) The current term and Fifth Management Plan

Business Description | FY3/22 | FY3/23 | FY3/24 | FY3/25 | ||||

Sales | Operating income | Sales | Operating income | Sales | Operating income | Sales | Operating income | |

Mail Order Business | 1966.6 | 161.0 | 2160.9 | 177.0 | 2345.1 | 193.9 | 2527.6 | 214.3 |

Apparel & Furniture, Goods Business | 1,199.8 | 57.6 | 1,331.3 | 67.2 | 1,417.5 | 73.2 | 1,514.7 | 81.2 |

Cosmetics & Healthy Food Business | 186.0 | 19.3 | 206.3 | 21.4 | 230.3 | 23.4 | 256.3 | 26.0 |

Gourmet Business (including wine and Japanese sake) | 280.0 | 19.8 | 303.8 | 21.1 | 347.0 | 23.3 | 369.8 | 26.5 |

Nurse Business | 157.5 | 14.9 | 169.4 | 17.6 | 181.7 | 19.8 | 197.0 | 22.0 |

Database Business | 143.2 | 49.4 | 150.2 | 49.8 | 168.7 | 54.1 | 189.8 | 58.6 |

Kimono store sales Business | 256.8 | 3.5 | 277.2 | 12.0 | 303.7 | 17.4 | 335.1 | 21.2 |

Property Business | 212.5 | 16.5 | 157.1 | 13.5 | 215.8 | 36.7 | 219.1 | 40.2 |

Other Business + Adjustments | 22.2 | -6.4 | 4.7 | -2.4 | 35.5 | 2.0 | 18.3 | 4.3 |

Total | 2,460.0 | 175.0 | 2,600.0 | 200.0 | 2,900.0 | 250.0 | 3,100.0 | 280.0 |

*Unit: 100 million yen.

In the term ending March 2023, the company plans to reorganize the 8 business segments into 4 segments: the mail order business, the kimono-related business, the property business, and other business. The mail order business will be composed of 5 sub-segments: mail order business for apparel and miscellaneous goods (former title: general mail order), cosmetics and health foods, gourmet food, nurse-related, and database-related businesses. The company will provide investors with more understandable information on business segments.

(2) Concept of the Fifth Management Plan

The company will focus on the following five points.

1. Achieving each segment goal

2. Implementation of e-commercialization (including SNS)

3. Maturation of the portfolio (by widening and strengthening business pillars)

4. Training and enhancing practical human resources

5. Promoting M&A aimed at synergy effect

【4-3 Activities in each business segment】

(1) Mail Order Business

①Overall Mail Order Business

| FY 3/21 | FY 3/22 | ||||

Sales | Operating income | Sales | Increase/Decrease | Operating income | Increase/Decrease | |

Apparel & Furniture, Goods Business | 997.5 | 53.0 | 1,199.8 | +202.3 | +57.6 | +4.6 |

Apparel & Furniture, Goods | 869.9 | 52.6 | 1,042.1 | +172.2 | 51.2 | -1.4 |

Minn, IC-Net, Marucho | 78.6 | 4.2 | 89.6 | +11.0 | 4.9 | +0.7 |

Apparel stores | 49.1 | -3.8 | 68.2 | +19.1 | 1.5 | +5.3 |

Cosmetics & Healthy food Business | 194.3 | 26.5 | 186.0 | -8.3 | 19.3 | -7.2 |

Cosmetics | 150.6 | 20.8 | 150.0 | -0.6 | 15.0 | -5.8 |

Healthy food | 43.7 | 5.7 | 36.0 | -7.7 | 4.3 | -1.4 |

Gourmet Business | 266.2 | 21.8 | 280.0 | +13.8 | 19.8 | -2.0 |

Wine | 87.7 | 10.5 | 100.0 | +12.3 | 9.8 | -0.7 |

Japanese sake | 44.5 | 3.0 | 52.0 | +7.5 | 3.3 | +0.3 |

Gourmet | 134.0 | 8.3 | 128.0 | -6.0 | 6.7 | -1.6 |

Nurse Business | 159.5 | 18.2 | 157.5 | -2.0 | 14.9 | -3.3 |

Nursery | 61.4 | 6.9 | 65.5 | +4.1 | 6.0 | -0.9 |

Infirmiere | 87.1 | 11.5 | 75.8 | -11.3 | 8.5 | -3.0 |

Nurse Career Next | 1.5 | -1.5 | 2.9 | +1.4 | -0.7 | +0.8 |

JOB STUDIO | 9.5 | 1.3 | 13.3 | +3.8 | 1.1 | -0.2 |

Database Business | 141.8 | 55.0 | 143.2 | +1.4 | 49.4 | -5.6 |

合計 | 1,759.3 | 174.5 | 1,966.5 | +207.2 | 161.0 | -13.5 |

*Unit: 100 million yen.

(Recent situation, outlook for the current term, and measures)

☆ | Despite many negative factors, the company maintained its growth and increase profit from the term ended March 2021. |

☆ | The number of mail-order customers had been stagnant, due to the augmentation of delivery costs, etc., but it got on a growth track, thanks to measures for attracting new customers. |

☆ | Average spending per order is stagnant and declining, as the company strives to increase new customers and spending is decreasing. |

☆ | The budget for the current term is focused on growth potential, as the company will invest a lot in advertisement, while gross profit is expected to grow. In the second half, the company will adjust the operating income balance by controlling mainly media costs. |

As shown in the graph, the ratio of e-commerce is increasing in each business. The shift to e-commerce is progressing in all kinds of businesses for all generations.

(Taken from the reference material of the company)

② Apparel & Furniture, Goods Business (previous General Mail Order Business)

Business Description | FY3/21(Act.) | FY3/22 (Est.) | ||

Sales | Operating income | Sales | Operating income | |

General Mail Order Business -Selling products via catalogs and the Internet mainly to madams -The company started selling products at shopping malls for young customers in 2018 -Also sells men’s goods and hardware through mail order | 869.9 | 52.6 | 1,042.1 | 51.2 |

Min Co., Ltd.・ICnet Co., Ltd.・Maruchou Co., Ltd. (Internet-specialized mail order) -min: an online shop handling big-size apparel -IC Net: an online shop handing high-end products -Marucho: an online shop handling miscellaneous goods | 78.6 | 4.2 | 89.6 | 4.9 |

Apparel stores -Operating shops nationwide under the Belluna brand (83 shops as of March 2020) | 49.1 | -3.8 | 68.2 | 1.5 |

Total | 996.3 | 52.6 | 1,199.8 | 57.6 |

*Unit: 100 million yen.

(Recent situation, outlook for the current term, and measures)

☆ | The company will enhance and promote brand development, and pursue “uniqueness” under each brand concept. |

③ Cosmetics & Healthy Food Business

Business Description | FY3/21(Act.) | FY3/22 (Est.) | ||

Sales | Operating income | Sales | Operating income | |

Cosmetics Business -Operating mail order cosmetic products business -Cross-border EC in Asia -Growth drivers are online and overseas businesses | 150.6 | 20.8 | 150.0 | 15.0 |

Health Foods Business -Business operation under the Refre brand ・Gussurizum received the Golden Award of the Monde Selection for the 4th consecutive year | 43.7 | 5.7 | 36.0 | 4.3 |

Total | 182.9 | 26.4 | 186.0 | 19.3 |

*Unit: 100 million yen.

(Recent situation, outlook for the current term, and measures)

☆ | Belluna’s domestic e-commerce growth and strong cosmetics business expansion in Asia led to a significant increase in its business performance in the previous term. |

☆ | This fiscal year, sales are expected to level off due to the influence of domestic online advertising regulations. |

☆ | In October 2021, the company started commercials for men’s cosmetics. As the restriction on online ads was imposed, the company will concentrate on the strategy for developing its product brands. |

④ Gourmet Business (including wine and sake)

Business Description | FY3/21(Act.) | FY3/22 (Est.) | ||

Sales | Operating income | Sales | Operating income | |

Wine mail order businesses My Wine Club recorded the largest online sales of wine for 13 consecutive years | 87.7 | 10.5 | 100.0 | 9.8 |

Mail order of Sake Belluna Gourmet recorded the largest online sales of sake for four consecutive years | 44.5 | 3.0 | 52.0 | 3.3 |

Gourmet food business -Sells boxed meals, year-end gifts, New Year’s food, etc. through mail order -The total sales volume of Belluna Gourmet’s New Year’s food, Yui, is over 400,000 | 134.0 | 8.3 | 128.0 | 6.7 |

Total | 271.5 | 21.5 | 280.0 | 19.8 |

*Unit: 100 million yen.

(Recent situation, outlook for the current term, and measures)

☆ | The mail-order sales of wine have been the largest for 13 consecutive years, and a set of globally selected 11 bottles of wine marked the largest sales volume in the wine set section in Japan in 2020. Sales are growing as the company increases new customers efficiently and a high ratio of customers become repeat customers. The factors in favorable performance are the continuous development and improvement of attractive products. |

☆ | The mail-order sales of sake have been the largest for 5 consecutive years. The number of bottles sold exceeded 2 million in the term ended March 2021. This term, it is expected to reach 2.9 million, up 45% from the previous term. |

☆ | The number of boxes of New Year’s Food “Yui” sold was 112,000 in the term ended March 2021, and is expected to be 155,000 in this term, up 38% from the previous term. |

⑤ Nurse Business

Business Description | FY3/21(Act.) | FY3/22 (Est.) | ||

Sales | Operating income | Sales | Operating income | |

Nursery (the 2nd largest in the mail-order field for nurses) | 61.4 | 6.9 | 65.5 | 6.0 |

infirmière (the largest in the mail-order field for nurses) | 87.1 | 11.5 | 75.8 | 8.5 |

Nurse Career Next (business of nurse staff agency) | 1.5 | -1.5 | 2.9 | -0.7 |

JOBSTUDIO (business of staff agency in Singapore) | 9.5 | 1.3 | 13.3 | 1.1 |

Total | 159.4 | 17.7 | 157.5 | 14.9 |

*Unit: 100 million yen.

(Recent situation, outlook for the current term, and measures)

☆ | Healthcare professionals tend to become repeat customers, so the company expects to see a continuation of this trend in the next term and beyond. |

☆ | The company aims to meet the demand for corporations, by strengthening the BtoB business for hospitals and clinics based on online and offline systems. |

☆ | The company will enter healthcare-related markets targeting nurses, dental clinics, beauty clinics, etc. by utilizing the forte as an SPA (Speciality store retailer of Private label Apparel). |

⑥ Kimono store sales Business

Business Description | FY3/21(Act.) | FY3/22 (Est.) | ||

Sales | Operating income | Sales | Operating income | |

BANKAN, Wamonoya (Japanese clothing sales business launched by the company in 2007) | 90.4 | 3.9 | 98.8 | 6.2 |

Sagami Group Holdings Co., Ltd. (Acquired in 2018. Business of selling mid-priced kimono) | 73.3 | -12.1 | 88.4 | -6.1 |

Tokyo Masuiwaya (Acquired in parallel with the acquisition of Sagami. Business of selling high-priced kimono) | 30.9 | -3.8 | 42.0 | 0.7 |

Maimu Co., LTD. (Rental of hakama, a traditional Japanese kimono-skirt, for university graduation ceremonies) | 20.8 | 1.7 | 27.5 | 2.7 |

Total | 214.4 | -10.6 | 256.8 | 3.5 |

*Unit: 100 million yen.

(Recent situation, outlook for the current term, and measures)

☆ | Sales and profit declined in BANKAN and Wamonoya amid the coronavirus pandemic, but they remained in the black. The number of stores is increasing. |

☆ | This fiscal year, the company will promote the building of a foundation for Sagami to become profitable. |

Regarding Sagami, the company strives to “enrich products” for increasing new customers, holds sessions for wearing kimono and teaching how to get on kimono for increasing repeat customers, and is shifting from large-scale events to in-store events for reducing the ratio of costs.

In addition, the company educates sales staff for selling products at stores, closes unprofitable stores, and takes comprehensive measures for cost reduction. The company aims to raise the earning ratio per store from 2-3% to 10%.

Structural reform will be completed this term, and the business is expected to move into the black next term. The company aims to earn sales of 33.5 billion yen and a profit of 2.1 billion yen in the fifth management plan (the end of the term ending March 2025) and occupy a 20% share of the kimono market (with a scale of 230 billion yen), becoming the largest company in this market, in the sixth management plan (the end of the term ending March 2028).

⑦ Property Business

Business Description | FY3/21(Est.) | FY3/22 (Fourth Business plan) | ||

Sales | Operating income | Sales | Operating income | |

Income gain Rental of real estate owned (offices, stores, solar power facilities, etc.) for rental income | 25.6 | 11.8 | 22.0 | 12.4 |

Capital gain Development and sales of real estate | 0.0 | 0.0 | 95.9 | 21.4 |

Hotel business Operation of 4 hotels in Japan and 3 hotels overseas | 39.6 | -13.7 | 84.6 | -19.3 |

Other | 10.0 | 1.9 | 10.0 | 2.0 |

Total | 69.8 | 0.1 | 212.5 | 16.5 |

*Unit: 100 million yen.

(Recent situation, outlook for the current term, and measures)

☆ | As of now, the company owns 27 pieces of real estate for rental, mainly urban offices, and 3 solar power generation facilities. These have stable occupancy/utilization rates and yield (6.6%). |

☆ | The large-scale development of complex facilities (total investment amount: 24.5 billion yen, assumed yield: over 6%) is progressing in Ginza 7-chome. Significant profit growth is expected in the term ending March 24 or later. |

☆ | Regarding hotels, the company operates 7 owned hotels and 6 rental hotels, that is, a total of 13 hotels, as of October 2021. This term, the company acquired Jozankei View Hotel and opened 4 new hotels, so it is expected that sales will grow, but costs for opening them will augment. |

☆ | The occupancy rates and average spending per room of domestic hotels in the term ending March 2022 are projected to fall below those in the previous term. On the other hand, the performance of overseas hotels is recovering, and they are expected to earn profit in the next term. |

☆ | In the next term or later, the company plans to open 1 overseas hotel and 2 domestic hotels. If the pandemic subsides and the number of foreign visitors to Japan recovers and then the business gets on track, the company is expected to earn sales of 25 billion yen and an operating income of over 5 billion yen. |

5.Conclusions

The progress rate for the first half was 43.0% for sales and 27.2% for operating income. Both rates are slightly lower than the previous several fiscal years. While there is a rebound from the nest egg demand, the mutant stock Omicron has started to expand, and the business environment is still uncertain. In this circumstance, we are looking forward to the increase of sales and profits in the third and fourth quarters as the company continues to establish a foothold for the fifth management plan.

In the kimono-related business, which is expected to see high growth in the future, structural reforms will be completed this fiscal year. We will keep a close eye on the speed at which this business will start up in the next fiscal year.

<Reference: Regarding corporate governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 11 directors, including 2 external ones |

◎Corporate Governance Report

Last Update: June 30, 2021.

<Basic policy>

Our basic policy for corporate governance is to streamline business operation by allowing operating officers to have the authority and responsibility for their businesses under the policy determined by the board of directors, and establish compliance systems and effective management systems by enhancing the fairness and transparency of business administration. In addition, we organized a compliance committee inviting outside intellectuals, granting it authority, so that a third party’s viewpoint would be reflected in management decisions.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

<Supplementary Principle 1-2-(4)> | Taking shareholder composition into account, we post English convocation notices on our website to make it easier for shareholders to examine items on the agenda, whether they are from Japan or overseas. We will consider using an electronic voting platform in the future. |

<Supplementary Principle 4-10-(1)> | We currently have two independent outside directors. The independent outside directors express their opinions and provide advice as necessary to both individual directors and the Board of Directors, utilizing their specialized knowledge and extensive experience. From now on, we will consider setting up a voluntary organization whose main members consist of independent outside directors if necessary. |

<Supplementary Principle 4-11-(3)> | As for the analysis and evaluation of the effectiveness of the board of directors, we will keep discussing concrete evaluation methods, etc. from the viewpoint of upgrading the functions of the board of directors. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

We disclose the compliance with each principle of the corporate governance code under “Our Efforts Towards the Corporate Governance Code” at the following company website (corporate governance).

Principles | Disclosure contents |

【Principle 1-4】 | In order to foster good business relations with business partners and carry out business smoothly, we may hold their shares as requested by them. We judge whether or not to invest while comprehensively considering the benefits to our corporate group due to the strengthening of business relations, investment amounts, etc. As for the exercise of voting rights, we check whether proposed bills would degrade shareholder value, and consider the situations of target companies for investment, etc. |

【Basic principle 5】 | In order to contribute to sustainable growth and the mid/long-term improvement of corporate value, we recognize that we should have constructive dialogues with shareholders also outside general meetings of shareholders and explain our management policy to shareholders clearly and understandably, to win the understanding of shareholders. Therefore, we strive to proactively have dialogues with investors by developing IR systems and holding individual IR meetings and sessions for briefing our company to individual investors in addition to the results briefing session held twice a year, so that they will understand our company more deeply. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |