| BESTERRA CO., LTD (1433) |

|

||||||||

Company |

BESTERRA CO., LTD |

||

Code No. |

1433 |

||

Exchange |

TSE Mothers |

||

Industry |

Construction business |

||

President |

Yoshihide Yoshino |

||

Address |

4-24-3 Kotobashi, Sumida-ku, Tokyo |

||

Year-end |

January |

||

URL |

|||

* The share price is the closing price on March 17. The number of shares issued was obtained by subtracting the number of treasury shares from the number of outstanding shares as of the end of the latest quarter. ROE and BPS are the values as of the end of the previous term.

|

||||||||||||||||||||||||

|

|

*The forecasted values were provided by the company. The term ended Jan. 2014 is 9 months, because the accounting period has been changed.

*The company split its stock 4 for 1 in May 2015, 2 for 1 in Feb. 2016, and 3 for 1 in Feb. 2017 (EPS has been revised retroactively). This document reports on the performance of BESTERRA for the term ended Jan. 2017 and the outlook for the term ending Jan. 2018. |

| Key Points |

|

| Company Overview |

|

Code of conduct

We will fulfill our responsibilities as professionals. We constantly develop new technologies, "put a higher priority on safety than anything else," and offer our services to clients while increasing assurance under the motto "Swifter, more affordable, and safer."   * Regarding seasonal variations (amount of completed dismantlement work)

The sales (amount of completed dismantlement work) of the company vary with season according to equipment investment plans of clients, and tend to be larger in the first quarter (Feb. to Apr.) and the fourth quarter (Nov. to Jan.). The progress standard is adopted for dismantlement work transactions whose fee is over 50 million yen, period is over 3 months, and estimated selling price of scrap is not over 10% of the dismantlement fee. For plant dismantlement work, through which the company would receive valuable items, such as scrap, the revenue from the work cannot be confirmed until the sale of scrap. Accordingly, the completion standard is adopted regardless of the fee for dismantlement work and construction period. Since there is a possibility that the variation in quarterly performance will mislead investors, the company has discussions with an audit corporation for applying the progress standard more.

* Regarding two revenue posting standards

|

| Fiscal Year January 2017 Earnings Results |

As the backlog of orders was handled steadily, sales and operating income grew 8.3% and 30.8%, respectively, year on year.

In the 4th quarter (Nov. to Jan.), the backlog of orders was handled steadily, and the number of completed dismantlement projects increased. Accordingly, sales grew 8.3% year on year. Since plant dismantlement processes were streamlined and the profitability of sale of scrap, etc. improved, gross profit margin rose 1.9 points year on year to 24.1%. It offset the augmentation of SG&A due to the upfront investment, including the increase of manpower, and operating income increased 30.8% year on year to 217 million yen.

Sales grew 8.7%, while operating income dropped 11.1% year on year.

Sales increased 8.7% year on year to 4,182 million yen. As the backlog of orders was handled, sales grew from the previous term, but did not reach the initial estimate, because the sales from a dismantlement project for which the progress standard was adopted and another project for which the completion standard was adopted were posted in another term. In the dismantlement project for which the progress standard was adopted, the additional fee for additional work that emerged in large scale project due to the revision to specifications was not determined by the end of the term, and so sales of 140 million yen estimated were posted for the term ending Jan. 2018. In the project for which the completion standard was adopted, the completion of work for which sales of 500 million are estimated to be posted was delayed till the term ending Jan. 2018 (the sales are forecasted to be posted in the first half of the term ending Jan. 2018). The total sales from other dismantlement projects were 122 million yen larger than the initial estimate, but could not offset the above-mentioned effect. As for profits, gross profit rate dropped 1.5 points to 21.0%, as sales were smaller than the estimate for the above-mentioned reasons and expenses included the existing cost for the dismantlement project for which the progress standard was adopted and whose sales were posted in the term ending Jan. 2018. On the other hand, SG&A augmented 14.8% year on year to 481 million yen, because the company conducted upfront investment in personnel recruitment, advertisement, equipment for 3D measurement business, etc. as planned. The number of employees increased by 5 from 47 at the end of the previous term to 52 at the end of the current term. The impact of the posting of the above sales in the next term on operating income is minus 61 million yen for the project for which the progress standard was adopted and minus 100 million yen for the project for which the completion standard was adopted.   For the term ending Jan. 2018, the ratios of sales (to full-year sales) posted in the 2nd and 4th quarters are estimated to be relatively high.  On the other hand, the amount of completed projects grew 8.8% year on year to 4,112 million yen, although the amount of 640 million yen was posted in the following term. As the dismantlement work in the 4th quarter progressed steadily, the term-end amount of order received dropped 31.5% from the end of the previous term to 2,303 million yen. While a large-scale project is ongoing, the company curbs the number of orders received to prioritize dismantlement work, and so the amount of orders received and the backlog of orders decrease. As the large-scale project is scheduled to be completed in the first half of the term ending Jan. 2018, the company is currently enhancing efforts to receive orders for work from the middle of the term ending Jan. 2018.  Current ratio is 190.9% (271.8% in the previous term), fixed ratio 18.8% (20.4% in the previous term), equity ratio 51.7% (63.6% in the end of the previous term), and rate of return on invested capital 10.7% (16.7% in the previous term; reason why the enrichment of equity capital by IPO decreased).   |

| Fiscal Year January 2018 Earnings Estimates |

Sales and operating income are estimated to grow 36.3% and 41.9%, respectively, year on year.

Sales are projected to rise 36.3% year on year to 5.7 billion yen. Out of the initial backlog of orders of 2,303 million yen, 2,120 million yen (including the large-scale project worth 1,380 million yen) was posted in sales. The forecast takes into account "prospective transactions" worth 2.5 billion yen, for which quotes have been submitted and the company will certainly receive orders, and "expected transactions" worth 1,080 million yen, for which the company is most likely to receive orders, considering the past records.Operating income is projected to grow 41.9% year on year to 564 million yen. As for profits, the augmentation of SG&A, including personnel cost (term-end number of employees: 57 → 79), R&D cost (7.6 million yen → 39 million yen), and recruitment/employment cost (11 million yen → 26.5 million yen), was offset by the increases in sales and gross profit rate due to the advantage of scale and the improvement in productivity. Difference from the previous mid-term goal

Sales are equal to the target value set in the previous mid-term plan. The sales of 640 million yen from the project in the previous term will be posted, but the company curbed the number of new transactions as affiliates and their employees need to deal with the ongoing projects, and so the sales from staffing services, which were first estimated to be 400 million yen, were forecasted to be 100 million yen. As for profits, the profit of 161 million yen from the project in the previous term will be posted, but the costs for personnel, R&D, recruitment, and employment will augment, and so the increase in profit is estimated to be a modest 40 million yen.

(2) Profit distribution policy and return to shareholders

As for profit distribution, the company conducts mainly the following three: (1) investment in future growth, (2) internal reserve for fortifying its business base, and (3) return of 40% of total profit to shareholders (dividends). As for growth investment, the company will invest in equipment (robots and 3D measurement equipment), technological development (dismantlement methods and robots), systems (3D systems, BIM, and CIM), and strategic business (M&A, etc.) in a rational manner.In addition, as shareholders' benefits, the company will give Quo cards (prepaid cards that can be used at many kinds of shops, restaurants, etc. in Japan) to shareholders according to the number of shares held on the date of right allotment (the end of Jan.) from the term ending Jan. 2018, as follows. The company carried out a 3-for-1 share split on Feb. 1, 2017 (second share split after the 2-for-1 share split on Feb. 1, 2016 since the company was listed on the stock market).  (3) Capital policy

On Apr. 4, 2017, the company will issue paid stock options, and sell 100,000 shares through off-floor trading for 11 days from Apr. 6.

Paid stock options will be issued for executives and employees for the purpose of enhancing their motivation, morale, and unity further as the company aims to improve its performance and corporate value in the medium to long term. The sale through off-floor trading is aimed at improving the distribution and liquidity of shares. The company is preparing for the application for the listing in Main Markets (first or second section) of the Tokyo Stock Exchange.

|

| Medium-term management plan 2019 (from the term ending January 2018 to the term ending January 2020) |

The government propels reorganization and reconstruction of the plant industry, aiming for high efficiency.

Various policies, including enforcement of the Act on Strengthening Industrial Competitiveness and the Act on Sophisticated Methods of Energy Supply Structures, increase in the energy use rationalization business support subsidy, and establishment of a new construction business license, "demolition business," have been adopted to boost the dismantling and renewal of plants.

Industrial trend for each client (based on the company's own research)

The plant stock of the power industry is about 13.6 trillion yen (calculated by the company and the same shall apply hereinafter). The number of licensed or registered thermal power plants (whose generating power is greater than 1,000 kW) is 185 with the total generating power of 143,286,000 kW. The number of nuclear power plants is 59 (including disused ones and ones under demolition) with the total generating power of 51,103,000 kW. In addition, the total generating power of hydroelectric power plants, wind farms, photovoltaic power plants, and the like is 46,233,000 kW. Aging of thermal power plants is considerable, from which increase in dismantling of oil-fired power plants is forecasted (the number of boilers, smokestacks, and oil tanks to be dismantled will grow) particularly from the perspectives of "environmental problems (CO2 emissions)" and "power generation efficiency (high cost)." Furthermore, from the viewpoint of "power generation efficiency," cogeneration, use of renewable energy, and the like will be encouraged and thus the demand for replacement of thermal, hydroelectric, and wind power plants and the like is expected, and it is also anticipated that the number of demolition work of nuclear power plants that will be abolished due to aging will grow.The capital stock of the steel industry is about 1.7 trillion yen with 32 blast furnaces and crude steel production of 90.4 million tons. The number of electric furnaces is 44, the production volume of ordinary electric furnaces is 8.8 million tons, and 4.2 million tons of special steel is produced. The steel industry is undergoing various changes such as merger and reorganization due to transfer of the manufacturing business to overseas, resulting in a shift of the investment purpose from "strengthening of production capabilities" to "optimization of redundant facilities." The capital stock of the petrochemical industry is about 28.5 trillion yen with 23 refineries and the refining capacity of 5,792 (thousand barrels/day). The number of petrochemical complexes is 14 and the ethylene production capacity is 7,210,000 tons (plants that manufacture industrial goods whose raw material is not ethylene are not included in the calculation). Advancement of the energy efficient approaches has been conducive to a decrease of domestic demand, contributing to cutbacks by oil companies in their refining capacities. Moreover, optimization of energy supply capabilities is also propelled under the Act on the Sophistication of Energy Supply Structures. Besides the foregoing, transfer of business to overseas, and merger and reorganization to strengthen competitiveness is being promoted in each field of the manufacturing industry. In the paper industry, Oji Holdings Corporation (established through the merger between Oji Paper Co., Ltd., Honshu Paper Co., Ltd., and Kanzaki Paper Mfg. Co., Ltd.) came into the world, and the second largest paper company in Japan, Nippon Paper Industries, Co., Ltd., merged with Daishowa Paper Mfg. Co., Ltd. In the shipbuilding industry, Universal Shipbuilding Corporation and IHI Marine United Inc. Japan merged, establishing Marine United Corporation. In the cement industry, the merger between Chichibu Onoda Cement Corporation and Nihon Cement Co., Ltd. set up Taiheiyo Cement Corporation. In the electrical industry, in addition to the establishment of Mitsubishi Hitachi Power Systems, Ltd. through the integration of the business of Mitsubishi Heavy Industries, Ltd. and that of Hitachi, Ltd., rationalization of the home appliance business was propelled in Sharp Corporation, Toshiba Corporation, and the like.  Enrichment of methods (plant demolition strategy)

Besides the "apple peeling demolition method" which is its major patented technique and is being put to practical use, the company has a number of patented methods including the "method for disassembling a boiler." It has a plan to commercialize dismantling methods using such patented techniques by making a proposal to various companies who own plants. Furthermore, the company will exert itself to develop new robots through industry-academia collaboration with the aim of improving the safety and efficiency of robotic methods and, taking advantage of its environment-related methods, to receive more orders for work where hazardous substances, such as PCB (polychlorinated biphenyl), dioxins, and asbestos, are involved and demand is forecasted to increase in the future.As for the environment-related techniques, the company will promote fireless and quasi-fireless methods that can be carried out both indoors and outdoors. Although PCB is currently deemed as a toxic substance and therefore totally abolished, it had been used for many years in transformers and condensers because of its superior thermal stability and chemical stability (electric insulation characteristics). In dismantling plants, transformers and condensers are often disposed of, but any firearms (such as gas cutting machines) cannot be used in demolition and removal because PCB is gasified when treated at high temperature, posing a risk of inhaling the hazardous gas. The company is skillful at work with fireless and quasi-fireless methods using saber saws (which cut off objects with the reciprocating blade) and the like (through numerous devices including measures against seizure of motors and recycling of blades, the company's saber saws can cut off thickness which everyone in the industry believes is impossible to cut). Establishment of 3 main business fields (demolition work, 3D technologies, and human resources)

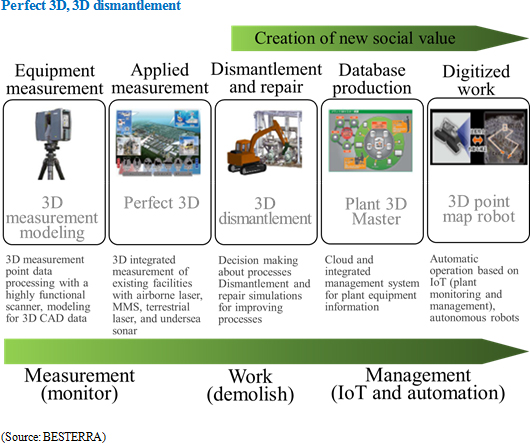

The company enhances its total plant demolition management (strategic asset management) by expanding services in the areas related to plant dismantling, including human resource services, 3D measurement BIM, and CIM.

In the long term, the company will endeavor to create new social value mainly with the plant 3D master where a system will be established for cloud migration of the perfect 3D technologies (3D point cloud data and 3D CAD data), various drawings and specifications, 2D CAD data, pictures, videos, and the like as well as GIS (Geographic Information System) and for their uniform management. Management of general data of plants in cloud allows sharing of data between each work site and the headquarters, process control via tablet-type devices, and the like, serving as a database for project management. Furthermore, the company will develop self-behaving robots by using data of the plant 3D master and the perfect 3D technologies and adding the SLAM (Simultaneous Localization and Mapping) technology. Establishment of a large-scale work execution system

The company is specialized in the management of demolition work, which means that staffing of the supervisor who manages the process of work field, safety, administrative action, and the like is required for each and every work. In the current situation, because the cost of each work is greater, the company has succeeded in maintaining the trend of sales growth without expanding the number of workers; however, it is inevitable to augment the number of employees in order to fulfill the "medium-term management plan 2019" and realize the long-term vision. Therefore, the company as a whole will make proactive efforts at recruitment activities.

Promoting alliances, such as M&A

Aiming to generate a variety of synergy such as new businesses where its plant lifecycle management and know-how on 3D measurement will be utilized, and development of start-up businesses overseas, the company will take concrete partnership approaches including M&A, starting from the term ending January 2018. While regarding design companies, engineering companies, survey companies, and the like as its partners, the company will take careful action on M&A. According to the company, it plans to expand business by itself without depending on M&A until it achieves sales of about 10 billion yen.

|

| Conclusions |

|

The scale of transactions is getting larger. As the company needs to assign supervisors for all dismantlement tasks, a large-scale project would improve labor productivity and profitability. The experience of large-scale dismantlement work would lead to the receipt of an order for a larger project, and it would be significant assets. In the case where the company directly receives an order for large-scale dismantlement work, which is increasing, its profitability is high, but if there is a change to specifications or additional work emerges, the company will be directly affected. Specifications changes and additional work are unavoidable for construction and dismantlement companies, but by expanding its business content, the company will be able to absorb the impact on business performance. The company is steadily expanding its business content, but it is still midway. For the foreseeable future, there will be the risk that the company will need to revise its earnings forecast downwardly due to specifications change or additional work like in the term ended Jan. 2017. This is an issue for growing companies, but the plants constructed since the rapid growth period in the 1960s have been deteriorating, it is becoming necessary to dismantle and renew them. Therefore, the business environment is expected to remain favorable for a long period of time, and the company, which is No.1 in this field, will no doubt receive benefits from this situation. It is essential to consider long-term trends, rather than fretting over short-term sales, profit, the number of orders, and the backlog of orders. |

| <Reference: Regarding corporate governance> |

◎ Corporate Governance Report

Update date: Apr. 25, 2016

Basic Policy

In order to promote sound business administration and win social trust sufficiently, our company recognizes corporate governance as the most important issue, puts importance on the improvement of the soundness, transparency, and fairness of business administration, and complies with laws and regulations thoroughly, and all executives operate business while keeping in mind that "the violation of laws or regulations would lead to management responsibility." In detail, our company disseminates and executes business pursuant to laws, regulations, and in-company rules thoroughly, by developing appropriate systems for making decisions about business administration, fulfilling duties, supervising work, conducting internal control, etc. It is also important to reform management systems for "achieving appropriate share price" and "increasing share price sustainably" to emphasize shareholders and strengthen the function to check business administration, to establish global-level corporate governance. The results of such efforts would win the trust of society, increase corporate value, and satisfy shareholders. <Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Our company implements each basic principle of the corporate governance code.

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2017 Investment Bridge Co., Ltd. All Rights Reserved. |