Bridge Report:(1433)BESTERRA the first half of the fiscal year ending January 2021

President Akitatsu Yoshino | BESTERRA CO., LTD (1433) |

|

Company Information

Market | TSE 1st Section |

Industry | Construction business |

President | Akitatsu Yoshino |

HQ Address | Kiba Park Bldg, 3-2-6 Hirano, Koto-ku, Tokyo, Japan |

Year-end | End of January |

Homepage |

Stock Information

Share Price | Share Outstanding (exc. Treasury Stock) | Market Cap. | ROE (Act.) | Trading Unit | |

¥1,129 | 8,226,730 shares | ¥9,288million | 2.3% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥16.00 | 1.4% | ¥15.80 | 71.5x | ¥308.57 | 3.7x |

*The share price is the closing price on September 15. The number of shares issued was taken from the latest brief financial report excluding treasury stock. ROE and BPS are the values of the pervious term.

Consolidated Earnings

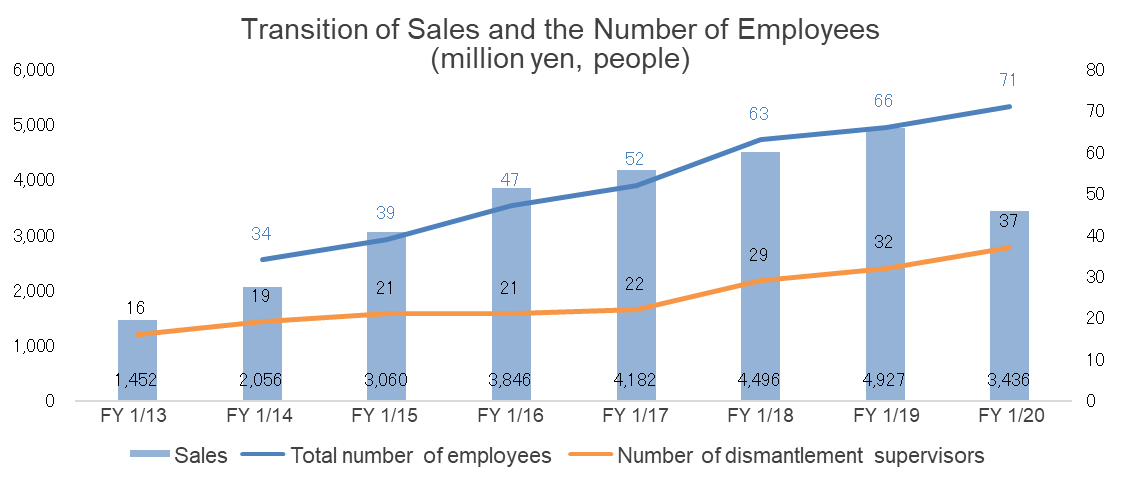

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Jan. 2017 (Actual) | 4,182 | 397 | 404 | 271 | 32.85 | 40.00 |

Jan. 2018 (Actual) | 4,496 | 386 | 373 | 263 | 31.69 | 15.00 |

Jan. 2019 (Actual) | 4,927 | 497 | 495 | 621 | 75.25 | 15.00 |

Jan. 2020 (Actual) | 3,436 | 93 | 97 | 59 | 7.29 | 16.00 |

Jan. 2021 (Forecast) | 3,800 | 120 | 200 | 130 | 15.80 | 16.00 |

*Forecast is from the Company’s financial report. unit: million yen, yen

This Bridge Report reviews on the outlook of BESTERRA CO., LTD’s earnings results for the first half of the fiscal year ending January 2021 and its forecast of the fiscal year ending January 2021.

Table of Contents

Key Points

1. Company Overview

2. First half of Fiscal Year ending January 2021 Earnings Results

3. Fiscal Year ending January 2021 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the first half of the term ending January 2021, sales and operating income fell 14.2% and 92.6%, respectively, year on year. While sales grew for the human resource service business, the start of some large-scale dismantling projects were pushed back until the second half due to the coronavirus pandemic, resulting in a decline in the amount of completed works. Meanwhile, amid a decline in gross profit caused by lower sales, an increase in SG&A costs due to higher personnel and other costs also worked as a drag on profit. With that said, orders received remained solid, growing 70% year on year. The order backlog at the end of the second quarter increased 2.8 times from the end of the same quarter of the previous year.

- For the term ending January 2021, sales and operating income are estimated to grow 10.6% and 28.8%, respectively, year on year. The plant dismantling industry is facing some restrictions, but is otherwise gradually returning to normal. For the company, self-imposed business restrictions at corporate customers have resulted in the start of dismantling work being delayed. However, it seems that there have been no major changes in plant dismantling demand. The company plans to move forward with operations while also paying utmost attention to the safety of workers carrying out sales activities and dismantling work. The annual dividend is to be 16 yen/share, including the dividend at the end of the second quarter and 10 yen/share at the end of the year.

- In the first half of the term, the company was damaged significantly by delays of the start of demolition work caused by the coronavirus pandemic, but the order backlog grew sharply, and it has apparently recently received many inquiries for potential new projects. This includes a large-scale dismantling project related to plant closures in the ironmaking industry, a project for a coal-fired thermal power plant that has a significant impact on the environment, and the replacement of a power-generating wind turbine. In addition, thanks to the success of sales activities geared toward obtaining primary contract orders, the company is seeing an increase of direct (primary contract) orders from major conglomerate chemical manufacturers in the petroleum and petrochemical fields. Amid solid orders for projects in the ironmaking and electric power industries, the petroleum and petrochemical industries are accounting for an increasingly higher percentage of orders received. There is also a possibility that changes in the manufacturing industry spurred by the coronavirus pandemic will lead to the acceleration of surplus facility disposal, etc. In view of this, earnings are anticipated to swiftly return to a growth trajectory.

1. Company Overview

As a specialist in plant dismantlement, BESTERRA manages the dismantlement of plants (metal structures) for iron-making, power generation, gas, petroleum, etc. Its core competence is “the method and technology for dismantling plants,” and it has many patented methods including international patents. The company concentrates its managerial resources on engineering (proposal, design, and work planning) and management (supervision and work management), and outsources actual dismantlement work to its affiliates, and so it does not own heavy machinery or construction teams (the risk of owning assets can be avoided), and it is unnecessary to procure materials, etc. and make transactions for material production (the inventory risk can be avoided).

The Group also has two consolidated subsidiaries, Hiro Engineering, which provides human resource services for design work, etc. and 3D Visual KK, which handles 3D scan modeling and design work.

The corporate name “BESTERRA” was coined by combining the English word “Best (the superlative of ‘good’)” and the Latin word “Terra (the earth),” and、infused with the ambition to “create the best earth.” By developing an integrated system for dismantling and recycling, the company aims to actualize an advanced recycling society and contribute to the earth environment.

Corporate ethos and the code of conduct

Under the corporate ethos “We will contribute to the earth environment with our flexible way of thinking, creativity, and technologies using these concepts,” the company enacted the following code of conduct.

Long-term vision (Ideal state of the company)

・ Plant Demolition Leader in Japan

・ Proposing Plant Disassembly Technologies to the World

1-1 Characteristics of the business

The company has a single segment consisting of the plant demolition business. For others, it engages in the human resource service business and the 3D scan, modeling and design business. In the term ended January 2020, the plant dismantling business accounted for 93.8% of total sales.

Plant dismantlement business

In the plant dismantlement business, the company works on all types of plants in the fields of ironmaking, electric power, gas, petroleum and petrochemicals, etc. The company offers services on overall engineering processes including proposals, designing, work planning, outsourcing/arrangement of equipment and materials, supervision, safety management, cost management, financial management, and handling of governmental procedures. It focuses on designing its unique demolition technologies and supervising demolition works based on demolition plans, and uses specialized subcontractors for demolition works.

The clients for plant dismantlement are leading companies that own plants for ironmaking, electric power, gas, petroleum, etc. In most cases, the equipment installation companies of the corporate groups of clients or leading general contractors are entrusted with dismantlement, and then BESTERRA serves as the primary or second-tier subcontractor.

Also, in the plant dismantlement business, BESTERRA receives valuable materials generated through dismantlement, such as scrap, and sells them to scrap handlers. Accordingly, the company estimates the value of valuable materials while comprehensively considering material, quantity, price (market price of each material, such as iron, stainless steel, and copper), etc. and negotiates with clients about the fee for dismantlement work. In accounting, the gain from sale of valuable materials is included in revenue from dismantlement work, and posted as part of sales from completed dismantlement work. In some cases, contractors (clients) dispose of (sell) scrap, etc. by themselves.

*Two standards for posting revenue and seasonality of revenue posting of the company

The standards for posting revenue from contracts can be classified into the completed contract method, in which revenue is posted when works are completed, and the percentage-of-completion method, in which revenue is posted according to the progress of works. In the case of plant dismantlement, where valuables, such as scrap, are collected, revenue cannot be confirmed until the sale of scrap. Therefore, the company basically applies the percentage-of-completion method to large-scale projects whose contract amount exceeds 50 million yen and whose period exceeds 3 months, from the term ended January 2018 (the completed contract method is applied to the projects that are not applicable to the above criteria). The timing of posting revenue (the completion of demolition work) from works for which the completed contract method is used is often affected by the capital investment plans of clients. In the case of BESTERRA, revenue tends to be posted in the first quarter (February to April) and the fourth quarter (November to January) (the seasonality of revenue posting). However, the variation in quarterly performance may mislead investors, so the company is expanding the scope of application of the percentage-of-completion method step by step, to equalize the timings of revenue posting.

Others

In response to the chronic shortage of skilled construction workers, the company began providing human resource services in January 2013, and in March 2018, it made Hiro Engineering, which handles human resource services such as design work, a subsidiary. In January 2015, the company began offering a 3D measurement service as well. It established 3D Visual KK in December 2019, and 3D scan modeling and design business was transferred from INTER ACTION Corporation (securities code: 7725) in February 2020.

1-2 Strengths: an excellent client base, efficient dismantlement management based on plenty of experience, and intellectual property, such as patented methods

The strengths of the company are excellent client assets, efficient dismantlement management based on plenty of experience, and intellectual property, such as patented methods. Because the clients are basically engineering subsidiary companies of leading companies in ironmaking, electric, gas, coal oil fields, and major general contractors, which are easily trustable excellent clients, and it is predicted that they will receive orders continuously. The clients of the leading companies highly evaluate its company’s total management (low cost and high efficiency) of plant dismantlement that it cultivated experiences for over 40 years, and it elect a barrier to entry.

Furthermore, a variety of technologies and know-how the company possesses, which have been accumulated through environmental work, etc. is also the strength of the company, including the recycling of waste materials which is a manifest and potential intellectual property.

Patented methods, etc.

“Apple peeling demolition method” and fusing robot “Ringo☆Star”

The “apple peeling demolition method” is a method of dismantling a large spherical tank, such as gas holders and oil tanks, by cutting it in spirals from the center of the ceiling of the enclosure part. The cut part spirals down to the ground gradually under the force of the earth’s gravity (natural energy). The method enjoys superiority in a work period, cost, and safety, and has considerable competitive advantages, realizing “greater promptness, higher cost efficiency, and added safety.” Furthermore, the company offers a robot for the fusing process, “Ringo☆Star,” which automates the “apple peeling demolition method.” (The company is also working to expand the range of applications for “Ringo☆Star” by developing a new attachment).

Environment-related methods

The company has cultivated experiences and business results of a multitude of environment-related demolition works, using the “fireless methods” which do not require the use of fire. For example, although polychlorinated biphenyls (PCBs) are considered as a toxic substance and therefore totally abolished today, it had been used for many years in transformers and condensers because of its excellent thermal stability and chemical stability (electric insulation characteristics). In many cases, transformers and condensers are disposed of in conjunction with plant demolition works; however, because PCBs gasify when they are treated at the high temperature, posing a risk of inhaling the gas so generated, any firearms (such as gas cutting machines) cannot be used in demolition and withdrawal involving PCBs. The company is skillful at fireless and quasi-fireless methods using saber saws (which cut off objects with their saw blades moving in a reciprocating manner) that can cut off objects thicker than the thickness, which, in the industry, had been considered impossible to cut, through numerous devices, including measures against seizure of motors and recycling of blades. BESTERRA has applied for joint patents with Hitachi Plant Construction, Ltd. for a transformer dismantling method, a transformer dismantling jig, and a cutting device for dismantling a transformer.

Windmill demolition works

The number of power-generating wind turbines continues to increase by about 20% annually worldwide, but the demand for dismantling is expected to increase in the future due to wear and tear and economic obsolescence. According to the material presented by the company, the wind power generation volume worldwide is 486,790 MW (by about 340,000 onshore power generation plants and about 4,000 offshore ones) with an annual growth rate of about 20%. In Japan, the number of wind power generation plants stood at 2,225 as of the end of 2017, expanding by about 90 every year. Meanwhile, as the useful life is approximately 15 to 20 years, and the windmills for power generation established in the early stage are reaching the application limit. Moreover, not a few plants need to be dismantled due to damage or fatal failure caused by thunderbolts or typhoons.

How to knock down a power-generating wind turbine (international patent application)

As some windmills have been built in mountain districts and on the sea, demolition of them is highly difficult. The company has devised a method for dismantling wind turbines that does not require scaffolds, and has already acquired a domestic patent for “Method of knocking down a power-generating wind turbine.” International patents are pending for “Method of knocking down towering structures using their bases” and “Method for dismantling tower-shaped equipment for wind power generation.” Safety of workers can be improved dramatically, and the work period can be shortened by using these patent-based methods.

Pursuit of the value of the 3D business

Using services such as layout simulation, strain/bending/torsion measurement, comparison of structures before and after improvement, and video walkthroughs, the company converts physical data taken when plants were established (more than 30 years ago) into the latest 3D data, and uses that to provide detailed information about the dismantling process. They also provide unique 3D measurement services for dismantling work using the latest measuring technology and simulation systems that are capable of drawing data as 2D diagrams, handling BIM/CIM modeling, Perfect 3D, and 3D printing, etc.

“Visualize” the dismantling process

Layout simulation | The equipment models produced with 3D CAD are placed in 3D data, and the replacement of equipment can be simulated. By moving the equipment models, it is possible to check how they interfere and collide with one another. |

Strain, bending, and torsion measurements | It is possible to measure changes in shapes. This is useful for diagnosing frameworks tentatively, to check whether a building got distorted due to an earthquake, deterioration, etc. |

Comparison of structures before and after installation

| The shapes of equipment that changes due to heat and vibration, such as pipes, conveyors, and furnaces, at the time of installation and after operation are compared. With 3D data, it is possible to grasp overall changes intuitively. |

Video walkthroughs

| Walk-through videos are produced by using synthesized point cloud data. These videos can be utilized for presentations and publicity videos regarding dismantlement plans and real estate information. |

Unique 3D measurement service

Draws a two-dimensional diagram | The 3D CAD models based on point cloud data are converted into drawings. It is also possible to produce drawings directly from point cloud data in a simple manner. |

Handles BIM/CIM modeling | Modeling is conducted with 3D CAD based on point cloud data. It is possible to produce models of the parts that require construction or renovation as BIM (building information modeling) data. |

Perfect 3D | This is a large-scale 3D data measurement service combining automobile-based MMS (mobile mapping system), airborne laser measurement, water area measurement, etc. |

3D printing | After modeling with point cloud data, data are processed and deformed so that they can be shaped with a 3D printer. It can produce fine structures with a lamination pitch of 15 μm. |

2. First half of Fiscal Year ending January 2021 Earnings Results

2-1 Consolidated results for the first half

| 1H of FY 1/20 | Ratio to sales | 1H of FY 1/21 | Ratio to sales | YoY |

Sales | 1,907 | 100.0% | 1,636 | 100.0% | -14.2% |

Gross profit | 434 | 22.8% | 303 | 18.5% | -30.2% |

SG&A expenses | 280 | 14.7% | 291 | 17.8% | +4.0% |

Operating income | 153 | 8.1% | 11 | 0.7% | -92.6% |

Ordinary income | 153 | 8.0% | 17 | 1.1% | -88.4% |

Profit attributable to owners of the parent | 101 | 5.3% | 6 | 0.4% | -93.8% |

*unit: million yen

Sales and operating income decreased 14.2% and 92.6%, respectively, year on year

Sales fell 14.2% year on year to 1.63 billion yen. While sales for the "other" business increased 36.9% year on year due to the growth in employee dispatch operations (human resource service business), sales for the plant dismantling business declined 17.1% to 1.49 billion yen, owing to the impact from the start of large-scale projects being pushed back until the second half of the year.

Operating income slumped 92.6% year on year to 11 million yen. This was attributable to (1) a decrease in sales, (2) a lower gross profit margin caused by a decrease of orders for relatively high-margin additional work, due partly to the coronavirus pandemic, and (3) a 4.0% year on year increase in SG&A costs (mainly personnel) to 290 million yen.

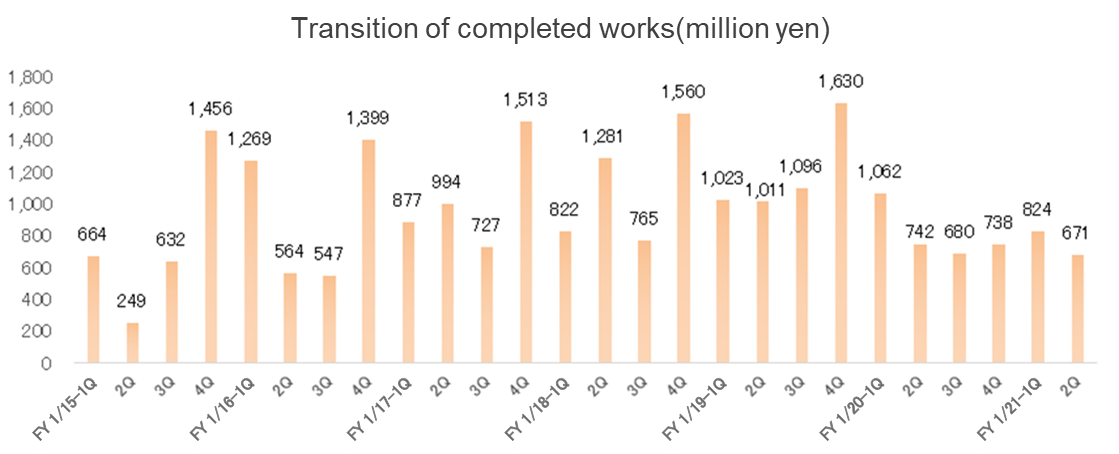

The number of completed works (rough estimates)

| 1H of FY 1/20 | Ratio to sales | 1H of FY 1/21 | Ratio to sales | YoY |

Electric power | 325 | 18% | 209 | 14% | -36% |

Steelmaking | 1,011 | 56% | 763 | 51% | -25% |

Petroleum/petrochemical | 289 | 16% | 389 | 26% | +35% |

Gas | 144 | 8% | 15 | 1% | -90% |

3D | - | - | 60 | 4% | - |

Other | 36 | 2% | 60 | 4% | +67% |

Total | 1,804 | 100% | 1,495 | 100% | -17% |

*unit: million yen

While the start of large-scale projects for the petroleum and petrochemical industries, for which the company is strengthening sales operations, has been pushed back until the second half of the fiscal year, the amount of completed works grew sharply, thanks to a steady inflow of orders. In the electric power industry, although the amount of completed works decreased year on year, reflecting the order backlog at the end of the previous fiscal year, orders received and the amount of completed works increased in the first half of the term thanks to the steady receipt of orders. Meanwhile, the amount of completed works and orders received from the ironmaking industry fell, owing partly to the recoil from the significant increase of orders received in the previous year.

Breakdown of SG&A

| 1H of FY 1/20 | Ratio to sales | 1H of FY 1/21 | Ratio to sales | Increase/ Decrease | Major change factors |

Personnel Cost | 132 | 6.9% | 161 | 9.8% | +22.0% | Increase in headcount and new provision of bonuses |

R&D Cost | 12 | 0.6% | 0 | 0.0% | -100.0% | Decreased Development of Robots |

Commissions and Remunerations Paid | 27 | 1.4% | 30 | 1.8% | +9.7% | New licensing fee |

Recruitment Cost | 8 | 0.4% | 11 | 0.7% | +33.6% | Advertising media, referral fee |

Advertisement | 7 | 0.4% | 2 | 0.1% | -69.5% | Decrease of exhibition |

Other | 92 | 4.8% | 86 | 5.3% | -6.3% |

|

Total SG&A expenses | 280 | 14.7% | 291 | 17.8% | +4.0% |

|

*unit: million yen

As for SG&A, personnel costs rose, due to the aggressive hiring of new personnel, as well as 15 million yen in allowances for employee bonuses (also booked as cost of sales), which were previously booked in the fourth quarter on a one-time basis, being booked in the first half of the term as part of efforts to level out quarterly profit.

The company is continually hiring for more construction supervisors as this is essential for its sustainable growth. The number of supervisors at the end of the first half of the fiscal year was 41, up 4 from the same period last year.

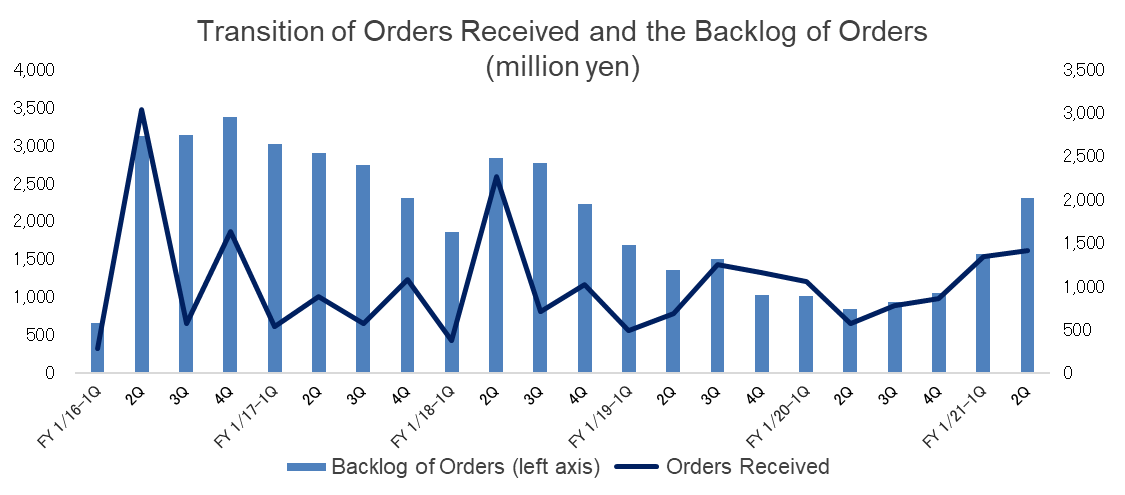

2-2 Orders received and the backlog of orders

| 1H of FY 1/20 | 1H of FY 1/21 | YoY |

The backlog of orders at the beginning of the term | 1,021 | 1,046 | +2.5% |

The amount of works received | 1,615 | 2,746 | +70.0% |

The amount of completed works | 1,804 | 1,495 | -17.1% |

The backlog of orders at the end of the term | 832 | 2,298 | +175.9% |

*unit: million yen

The order backlog at the end of the second quarter increased 2.8 times year on year. This owed to orders received soaring 70% year on year in the first half of the year, centered on orders from the electric power industry, which saw an increase in the dismantling of thermal power plants, and the petroleum and petrochemical industries, from which the company successfully received orders for large-scale chemical plant dismantling projects. The demand for dismantling is favorable in all industries.

Orders received by sector (Amounts are approximate.)

| 1H of FY 1/20 | Ratio | 1H of FY 1/21 | Ratio | YoY |

Electric power | 74 | 4.6% | 1,055 | 38.4% | +1326% |

Steelmaking | 1,115 | 69.0% | 450 | 16.4% | -60% |

Petroleum/petrochemical | 248 | 15.4% | 934 | 34.0% | +277% |

Gas | 142 | 8.8% | 83 | 3.0% | -42% |

3D | - | - | 60 | 2.2% | - |

Other | 37 | 2.3% | 164 | 6.0% | +343% |

Total Orders Received | 1,615 | 100.0% | 2,746 | 100.0% | +70% |

*unit: million yen

The backlog of orders by sector (Amounts are approximate.)

| 1H of FY 1/20 | Ratio | 1H of FY 1/21 | Ratio | YoY |

Electric power | 24 | 3% | 919 | 40% | +3729% |

Steelmaking | 533 | 64% | 252 | 11% | -53% |

Petroleum/petrochemical | 183 | 22% | 942 | 41% | +415% |

Gas | 49 | 6% | 68 | 3% | +39% |

Other | 41 | 5% | 114 | 5% | +178% |

Total Backlog of Orders | 832 | 100% | 2,298 | 100% | +176% |

*unit: million yen

2-3 Financial condition and cash flow(CF)

Financial condition

| January 2020 | July 2020 |

| January 2020 | July 2020 |

Cash | 938 | 1,461 | Payables | 347 | 355 |

Notes receivable, accounts receivable from completed construction contracts and other | 708 | 1,010 | Borrowings and Bonds | 1,747 | 2,641 |

Current Assets | 1,965 | 2,684 | Liabilities | 2,400 | 3,241 |

Investments, Others | 2,680 | 1,776 | Net Assets | 2,540 | 1,518 |

Noncurrent Assets | 2,975 | 2,074 | Total Liabilities, Net Assets | 4,941 | 4,759 |

*unit: million yen

The total assets as of the end of the second quarter stood at 4.75 billion yen, down 180 million yen from the end of the previous term. An increase in long-term borrowings with the aim of securing a stable source of working capital pushed up cash and deposits. Accounts receivable also increased. Meanwhile, investment securities decreased due to revaluation (specifically, the value of REVER Holdings shares, etc. dropped from 2,580 million yen to 1,680 million yen). On the credit side, long-term borrowings rose, while the deficit of valuation difference on available-for-sale securities augmented (from a loss of 10 million yen to a loss of 960 million yen) due to revaluation. Equity ratio was 31.8% (51.4% at the end of the previous fiscal year).

Cash Flow(CF)

| 1H of FY 1/20 | 1H of FY 1/21 | YoY | |

Operating Cash Flow(A) | -539 | -236 | +302 | - |

Investing Cash Flow(B) | -132 | -50 | +81 | - |

Free Cash Flows (A + B) | -671 | -286 | +384 | - |

Financing Cash Flow | -81 | 809 | +891 | - |

Cash and Equivalents at Term End | 1,277 | 1,461 | +183 | +14.4% |

*unit: million yen

3. Fiscal Year ending January 2021 Earnings Forecasts

3-1 Consolidated Earnings

| FY 1/20 | Ratio to sales | FY 1/21(forecast) | Ratio to sales | YoY |

Sales | 3,436 | 100.0% | 3,800 | 100.0% | +10.6% |

Operating income | 93 | 2.7% | 120 | 3.2% | +28.8% |

Ordinary income | 97 | 2.8% | 200 | 5.3% | +105.7% |

Profit attributable to owners of the parent | 59 | 1.7% | 130 | 3.4% | +116.8% |

*unit: million yen

Sales and operating income projected to grow 10.6% and 28.8%, respectively, year on year

The company unveiled its earnings forecast for the full fiscal year, which it had initially set as undecided. The plant dismantling industry is facing some restrictions, but is otherwise gradually returning to normal. For the company, self-imposed business restrictions at corporate customers have resulted in the start of dismantling works being delayed. However, plant dismantling demand appears to have remained largely intact, and the company has apparently seen a steady inflow of orders and inquiries. The company plans to move forward with operations while also paying utmost attention to the safety of workers carrying out sales activities and dismantling work.

The annual dividend is to be 16 yen/share, including the dividend at the end of the second quarter and 10 yen/share at the end of the year.

3-2. REVER Holdings becomes an equity-method affiliate

Following the approval given at the General Meeting of Shareholders in September 2020, REVER Holdings Corporation, with which BESTERRA has a capital alliance, became an equity-method affiliate. The two companies plan to join forces in order to realize an advanced recycling-orientated society by creating a platform for Japan's venous industry.

The conversion to an equity-method affiliate was conducted, as BESTERRA's Representative Director and Chairman Yoshihide Yoshino was appointed as an outside director for REVER Holdings at the board meeting of REVER Holdings held in August 2020, while BESTERRA holds shares of REVER Holdings, whose voting rights account for 15.01% (i.e., REVER Holdings automatically becoming an equity-method affiliate due to capital and human relationships). The executives of BESTERRA are to be dispatched to REVER Holdings as part of efforts to deepen cooperation between the two companies via the mutual dispatching of executives. The dispatch of executives from REVER Holdings to BESTERRA is to be implemented in the near future.

4. Conclusions

In the first half of the fiscal year, the company was damaged significantly by delays of the start of demolition work, and also saw a negative impact in terms of sales activities and meetings with clients due to the coronavirus pandemic. At the same time, operations at work sites continued, and there were no major coronavirus infections. There was a sharp increase in orders received, particularly from the electric power and the petroleum and petrochemical industries, areas of focus for the company. There has also been a strong influx of inquiries recently, including those for a large-scale dismantling project related to plant closures in the ironmaking industry, a project for a coal-fired thermal power plant that has a significant impact on the environment, and the replacement of a power-generating wind turbine. In addition, thanks to the success of sales activities geared toward obtaining primary contract orders, the company is seeing an increase in direct (primary contract) orders in the petroleum and petrochemical fields from major conglomerate chemical manufacturers. Amid solid orders for projects in the ironmaking and electric power industries, the petroleum and petrochemical industries are accounting for an increasingly higher percentage of orders received. There is also a possibility that changes in the manufacturing industry spurred by the coronavirus pandemic will lead to the acceleration of surplus facility disposal and other moves. In view of this, earnings are anticipated to swiftly return to a growth trajectory.

One key issue is personnel. Given the company's fairly substantial order backlog, it seems that it has had to limit the number of orders received in view of capacity constraints from the standpoint of maintaining work quality. At the end of the second quarter, the number of supervisors increased by 4 from the beginning of the fiscal year to 41. The focus is on the extent to which the company can make headcount additions by the end of the term.

<Reference: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with a board of company auditors |

Directors | 9 directors, including 2 outside ones |

Auditors | 3 auditors, including 3 outside ones |

◎ Corporate Governance Report Update date: April 24, 2020

Basic policy

In order to promote sound business administration and win social trust sufficiently, our company recognizes corporate governance as the most important issue, puts importance on the improvement of the soundness, transparency, and fairness of business administration, and complies with laws and regulations thoroughly, and all executives operate business while keeping in mind that “the violation of laws or regulations would lead to management responsibility.” In detail, our company disseminates and executes business pursuant to laws, regulations, and in-company rules thoroughly, by developing appropriate systems for making decisions about business administration, fulfilling duties, supervising work, conducting internal control, etc.

It is also important to reform management systems for “achieving appropriate share price” and “increasing share price sustainably” to emphasize shareholders and strengthen the function to check business administration, to establish global-level corporate governance. The results of such efforts would win the trust of society, increase corporate value, and satisfy shareholders.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary principle 4-3-3】

Our company has not established a clear procedure ensuring objectivity, timeliness and transparency for dismissal of the president or CEO, but we strive to realize a mutual assessment by involving outside directors in the process of evaluation of nomination and remuneration of the Board of Directors, in order to carry out the assessment of effectiveness of the Board of Directors appropriately.

【Principle 4-11】

The Board of Directors consists of directors and others with thorough knowledge of each of our business lines, and outside directors who are company managers. While we consider the size of the board appropriate, we cannot say the same with regard to gender and ethnic diversity. As such, we will strive to place importance on diversity when appointing directors going forward. In addition, the Board of Directors, joined by outside directors, shall periodically meet to discuss the structure and management of the board in order to improve its capabilities and effectiveness. Our Board of Auditors comprises three independent auditors, including tax accounts and persons with experience in corporate management, with expert knowledge and experience in management, finance, accounting, sales, auditing, etc.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4 Strategically held shares】

From the viewpoint of business expansion based on maintaining and strengthening long-term, stable partnerships with business partners, etc., we will acquire and hold the shares of business partners, etc., if we judge that this will contribute to the improvement of our mid/long-term corporate value. For equity investments premised on forming business alliances, the management meets with and receives explanations of the operating environment, business strategy, and purposes of the capital alliance from representatives of the other party. Based on this, the Board of Directors comprehensively evaluates the appropriateness of the stock valuation report and judges whether the deal should take place. For strategically held shares, the Board of Directors constantly checks whether the holding of such shares will contribute to the improvement of our corporate value, and confirms the purpose and rationality of said holding based on that check. Our company will appropriately buy/sell shares and exercise voting rights in accordance with relevant regulations, based on a comprehensive evaluation from the viewpoint of improving our corporate value.

【Principle 5-1 Policy on constructive dialogue with shareholders】

Regarding requests from shareholders for dialogue (interviews), our company believes that we should express a positive attitude within a reasonable scope in order to contribute to sustainable growth and medium- and long-term improvement of the corporate value of our company. Aiming to promote constructive dialogue with shareholders, with the planning department designated as a department in charge of IR activities, our company holds financial results briefings targeted at financial institutions and investors semiannually and discloses corporate information as needed on our website and through the system of optional disclosure offered by Tokyo Stock Exchange.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |